Abstract

The co-fluctuation of two time series has often been studied by analysing the correlation coefficient over a selected period. However, in both domestic and global financial markets, there are more than two active time series that fluctuate constantly as a result of various factors, including geographic locations, information communications and so on. In addition to correlation relationships over longer periods, daily co-fluctuation relationships and their transmission features are also important, since they can present the co-movement patterns of multi-time series in detail. To capture and analyse the features of the daily co-movements of multiple financial time series and their transmission characteristics, we propose a new term—“the co-fluctuation relation matrix”—which can reveal the co-fluctuation relationships of multi-time series directly. Here, based on complex network theory, we construct a multi-time series co-fluctuation relation matrix transmission network for financial markets by taking each matrix as a node and the succeeding time sequence as an edge. To reveal the process more clearly, we utilize daily time series data for four well-known stock indices—the NASDAQ Composite (COMP), the S&P 500 Index, the Dow Jones Industrial Average and the Russell 1000 Index—from 22 January 2003 to 21 January 2015, to examine the concentration of the transmission networks and the roles of each matrix—in addition to the transmission relationships between the matrices—based on a variety of coefficients. We then compare our results with the statistical features of the stock indices and find that there are not many discernible patterns of co-fluctuation matrices over the 12-year period, and few of these play important roles in the transmission network. However, the conductibility of the few dominant nodes is different and reveals certain novel features that cannot be obtained by traditional statistical analysis, such as the “all positive co-fluctuation matrix”, which is the most important node, although one stock index has negative correlation with the other three. This research therefore provides a novel method for analysing the co-movement behaviour of multiple financial time series, which can help researchers obtain the roles and relations of co-fluctuation patterns both over short and long terms. The findings also provide an important basis for further investigations into financial market simulations and the fluctuation of multiple financial time series.

Similar content being viewed by others

Introduction

The financial markets constitute an important component of both domestic economies and the global economy. It is important to study the fluctuations of financial time series to understand financial market performance and economic stability. Typically, scholars examine the fluctuation and stability of financial time series by analysing the statistical features of single time series—such as the means or standard deviations of stock returns, futures and options prices and stock indices (Kumar et al., 2012)—and the correlations between two different time series over a selected period of time (Sadorsky, 2012), for example, 1 year, one decade and so on. However, there are hundreds of different time series that exhibit different fluctuations simultaneously; thus, to study the inner relationships of multiple financial time series, it is also important to study how these multiple time series interact with one another over both the short and the long term, in addition to examining the role that each interactive pattern plays and what relationships can be discerned among the interactive patterns.

Stock indices are important tools for measuring the fluctuation and performance of both stock markets and financial markets. Calculated from selected stock prices, stock indices are also important to the financial futures markets, which are used to hedge risk in stock markets (Yang et al., 2012; Chen et al., 2013). Stock indices constantly fluctuate based on a variety of factors, including investor sentiment and customer satisfaction (Peng et al., 2015), the exchange market (Cao et al., 2012), crude oil prices and world oil spot markets (Filis et al., 2011; Soytas and Oran, 2011; Chang et al., 2013), and internet usage data (Preis et al., 2012). Typically, scholars use volatility and correlation coefficients to measure the variations in a single stock index (Schwert, 2011) and the strength of the linear relationship between two or multiple cross-stock indices (Wang et al., 2011) during a given period, respectively. Some scholars use artificial neural networks (Kara et al., 2011; Ticknor, 2013), wavelet analysis (Akoum et al., 2012; Reboredo and Rivera-Castro, 2014) and certain hybrid models (Wei et al., 2011; Liu and Wang, 2012; Wang et al., 2012; Kao et al., 2013) to forecast the fluctuation of stock indices and the interactions between stock indices and other time series. However, few scholars use autoregressive sub-patterns to study the transmission of a single stock index (Gao et al., 2014).

There are many different stock indices associated with the global financial markets that are characterized by more or less interactive relationships due to myriad factors, such as the common listed companies they consider, the stock markets they analyse, the similarity of the economic environments in which they operate and so on. To study the interactive relationships of stock indices more deeply, it is important to capture the co-fluctuation relations of multi-stock index time series and to determine what the roles of each co-fluctuation relationship are over both the long and short terms. Indeed, the co-fluctuation relations of multiple stock indices (assuming that the quantity of stock indices is n) over the short term (such as one day) can be represented by an n×n symmetric matrix that captures the fluctuation relationship between any of the two indices. These n×n symmetric matrices that are based on the n time series can form a new time series for the matrices, and we can map these time series into complex networks employing different methods (Zhang and Small, 2006; Lacasa et al., 2008; Xu et al., 2008; Yang and Yang, 2008; Donner et al., 2010). With the help of a complex network, we can then analyse the roles of each co-fluctuation pattern over the short term and its relationships with other patterns in the network over the long term.

Complex networks have been used effectively to simulate and facilitate the analysis of economic problems (FAGIOLO, 2009), particularly in the stock market. Typically, scholars take single homogeneous elements—including listed companies, stock prices and shareholders—as nodes and use their cross-shareholding relationships (Li et al., 2014), fluctuation correlations (Chi et al., 2010) and so on, as edges to construct complex networks to analyse their topological features and dynamic evolution. Moreover, certain “new frontiers”, such as networks of networks (Gao et al., 2011) and heterogeneous networks (Li et al., 2014) (two-mode and multi-mode networks) are used to simulate empirical economic agents and their relationships more precisely. In previous studies, in particular, we have examined the stock market from a two-mode perspective (Li et al., 2014) and have analysed a network of co-holding networks (Li et al., 2014), in addition to studying the transmission of a single stock index time series (Gao et al., 2014).

In this paper, with the aim of analysing the transmission issues surrounding the co-fluctuations of multiple time series and the roles of each co-fluctuation pattern, we use four well-known stock indices as empirical data and combine the ideas from the fields of network of networks and heterogeneous networks to construct a multi-stock index co-fluctuation relations matrix using the coarse-grained method (Hyeon and Thirumalai, 2011) and a time series transmission network with co-fluctuation relations matrices as nodes. We then examine the statistical features of each stock index as well as any of the two indices and analyse the concentration features of the entire transmission network by two defined coefficients. Finally, we analyse the roles of the co-fluctuation relation matrices and the relationships among them from various perspectives, including degree, weighting and certain conductibility coefficients, such as Eigenvector Centrality, Closeness Centrality, Betweenness Centrality and the Self-Conductibility Coefficient. This paper proposes a novel method for studying the co-fluctuation behaviour of multiple time series in the financial markets over both the long and short term; moreover, this method is also important for deeper understanding regarding the simulation and predictability of the financial markets.

Data and methodology

Data

To exploit the trading sessions, we use the daily time series data of four well-known stock indices, the NASDAQ Composite (COMP), the S&P 500 Index, the Dow Jones Industrial Average and the Russell 1000 Index. The NASDAQ Composite is an American stock index that is calculated based on all the American and foreign common stocks as well as similar securities listed on the NASDAQ stock market; typically, it is heavily weighted towards listed companies in the IT field. The S&P 500 Index is an American stock market index that is calculated based on the Top 500 common stocks listed on the New York stock exchange and NASDAQ stock market based on market capitalization. The Dow Jones Industrial Average is an American stock index that is calculated based on 30 American large publicly owned companies. These three stock indices are the three most-followed American stock market indices. Meanwhile, there is another well-known stock index, the Russell 1000 Index, that reflects the performance of small companies. The Russell 1000 Index is calculated based on the Top 1,000 stocks in the Russell 3000 Index, which consists of the Top 3,000 publicly held American companies as measured by total market capitalization. As shown above, both the constituencies and the weighting methodologies of the four stock indices are diverse. Here, we use the terms NASDAQ, S&P 500, Dow Jones and Russell 1,000 to represent the four stock indices. We include 3,022 trading days from 21 January 2003 to 21 January 2015 in our sample; thus, we arrive at 3,021 values for the index daily fluctuation rate (fluctuation rate for short) since 22 January 2003, based on the following:

where Fi(t) is the fluctuation rate of stock index i from trading day t-1 to trading day t, Ii(t) is the index value of stock index i at trading day t and Ii(t−1) is the index value of stock index i at trading day t-1. In this paper, stock indices’ fluctuation rates were acquired from the Global Stock Markets on the Quandl Data Platform (https://www.quandl.com). The datasets analysed during the current study are available in the Dataverse repository (Li, 2015).

Definition of co-fluctuation patterns

We use the coarse-grained method (Hyeon and Thirumalai, 2011) to simulate the co-fluctuation of any two stock indices. For each stock index, there are three possible fluctuation choices from trading day t−1 to t: increase (Fi(t)>0), decrease (Fi(t)<0), and remain unchanged (Fi(t)=0). For any two stock indices, we define six co-fluctuation patterns to represent their changing directions as follows:

Definition of multi-stock index co-fluctuation relation matrix

After we define the co-fluctuation patterns of any two stock indices, we can then obtain the short-term multi-stock index co-fluctuation pattern of each, which is calculated by combining the co-fluctuation patterns of any two of the stock indices and can be presented by the n×n relation matrix (M(t)) as follows:

where n is the quantity of stock indices. Here n=4, so M(t) is shown in Table 1.

Because it is a symmetric matrix (xij=xji), the values of the green parts can be obtained when the values of the yellow parts are obtained, we must know only 10 values of the green parts and yellow parts to represent the entire matrix. In this instance, we use a string—N(t)={x11(t), x12(t), x13(t), x14(t), x22(t), x23(t), x24(t), x33(t), x34(t), x44(t)}—to represent the matrix (see Fig. 1). As discussed above, N(t) and M(t) actually represent the same matrix.

The 10-digit string representing the 4×4 symmetric co-fluctuation relation matrix.

Note: The green parts are the values from the diagonal line of the co-fluctuation relation matrix which represent the co-fluctuation relations between the stock indices and themselves, and yellow parts are the co-fluctuation relations between any two different stock indices.

On the basis of the definition of the co-fluctuation patterns, the values of the green variables, that is, x11(t), x22(t), x33(t) and x44(t), have only three possible choices depending on whether they are positive (P), negative (Q) or zero (O). Each of the other yellow variables has six different options, P, Q, N, O, p, q. Thus, in theory, if all the variables are independent, the diversity of the 4×4 symmetric co-fluctuation relation matrices is: 3×6×6×6×3×6×6×3×6×3=3,779,136. However, all the values of the yellow variables depend on the values of the green variables, so the feasible diversity (ND) of the 4×4 symmetric co-fluctuation relation matrices is 34=81.

Mapping the co-fluctuation relation matrix time series into the transmission network

On the basis of the four groups of time series data regarding stock indices’ fluctuation rates, we obtain the co-fluctuation relation matrix (CFM) for each trading day (M(t)). To map the transmission network, we take the CFMs as nodes and the succeeding sequence relations between the CFMs as edges. We can then obtain the weighted directed transmission network of the multiple stock index co-fluctuation relation matrices. The transmission time range in this paper is 12 years—from 22 January 2003 to 21 January 2015. For example, from trading day 1 to trading day 5, the strings of the CFMs are “QQQQQQQQQQ”, “PNPPQNNPPP”, “QNQQPNNQQQ”, “QQQQQQQQQQ”, “PNPPQNNPPP”, respectively. Moreover, using the method discussed above, we know that these strings connect with one another by successive relations: “QQQQQQQQQQ⇒PNPPQNNPPP⇒QNQQPNNQQQ⇒QQQQQQQQQQ⇒PNPPQNNPPP”, “QQQQQQQQQQ⇒PNPPQNNPPP” repeated twice during the first 5 trading days, so the weight of the edge between the two strings is 2, and we can obtain the transmission network of the 5 trading days as shown in Fig. 2. Meanwhile, we can use the same method to map the CFMs of the next 3,016 trading days into the transmission network iteratively. Thus, the heavier the weight of the edge, the higher the possibility that there will be transmission relations between two co-fluctuation matrices.

The CFMs’ transmission network for the 5 trading days.

Note: The strings which represent the co-fluctuation relation matrices (CFMs) of trading day 1 to trading day 5 are “QQQQQQQQQQ”, “PNPPQNNPPP”, “QNQQPNNQQQ”, “QQQQQQQQQQ”, “PNPPQNNPPP”, respectively. Then, we can get the co-fluctuation relation matrices transmission network of the first 5 days by successive relations.

Statistical features

To measure the fluctuation of a single stock index, we first calculate the average value (mean) μi of Fi(t), followed by the standard deviation σi according to Formula (4) (Here, N=3,021).

After analysing the fluctuations of each of the four stock indices, we next examine the co-fluctuation of any of the two stock indices using the Pearson correlation coefficient (Pearson, 1895; Preis et al., 2012):

Where ρij is the correlation coefficient of the daily fluctuation rate of stock index i and stock index j, and Cov(Fi(t), Fj(t)) is the covariance of the daily fluctuation rate of stock index i and stock index j.

Concentration of the transmission network

To analyse the existing forms of CFMs and their transmission relations, we define the concentration coefficient of the transmission network using two different aspects, that is, the concentration of nodes (see Formula (6)) and the concentration of edges (see Formula (7)).

where CN is the nodes concentration coefficient of the CFMs’ transmission network, NM is the quantity of CFMs (nodes) appearing in the network, and ND is the quantity of potential feasible diversity of the CFMs. Here, ND is 81.

where CE is the edges’ concentration coefficient of the CFMs’ matrix transmission network, EA is the quantity of apparent different adjacent relationships between any of the two CFMs (edges) in the network and ED is the quantity of potential feasible diversity of the adjacent relationships among the visible CFMs.

The roles and relationships of the nodes (CFMs) in the transmission network

There are two basic features that can show the role of the nodes and the relationship between any of the two nodes: degree and weight. The transmission network in our paper is directed and weighted. Therefore, “in-degree” indicates the different nodes that are directed to the given node, and “out-degree” denotes the different nodes to which the given node is directed. “Weighted in-degree” and “Weighted out-degree” consider not only the nodes directed to the given node or to which the given node is directed but also the weights of the directed edges between the nodes.

To further examine the roles of the CFMs, we also examine the conductibility of the nodes. In complex network theory, there are many different topological characteristics and methods for analysing the conductibility of the nodes. In this paper, we mainly rely on three widely used algorithms, Eigenvector Centrality, Closeness Centrality and Betweenness Centrality. On the basis of the self-transmission character of our network, we also define a Self-Conductibility Coefficient to analyse the self-transmission ability of the CFMs.

Eigenvector Centrality refers to the importance and influence of a node in the network, with the idea that higher score nodes contribute more and lower score nodes contribute less to the linked node. The node score is calculated using the adjacency matrix (Newman, 2008):

where xm is the centrality score of node m, X(m) is the set of neighbor-nodes of m, λ is a constant, M is the transmission network and am,s belongs to the adjacency matrix A, which equals 1 when there is link between node m and s and otherwise is 0.

Closeness Centrality refers to the speed of the nodes relative to the other nodes. A lower Closeness Centrality is associated with a smaller total distance from all other nodes and is calculated by the sum of all the shortest paths to any other nodes in the network, according to (Dangalchev, 2006):

where Cc(m) is the s∈M\m of the nodes in network M that node m can reach directly by another bridge node (s). Further, dM(m, s) is the shortest path between node m and node s, and NM is the quantity of nodes in the transmission network.

Betweenness Centrality indicates the control of a CFM regarding transmissions between other CFMs in the network and is calculated based on the number of times a node acts as a bridge node on the shortest paths between any two other nodes (Brandes, 2011):

where CB(m) is the normalized Betweenness Centrality coefficient of CFM (node) m, σst is the quantity of short paths between s and t, σst(m) is the quantity of those short paths that pass through m, and NM is the quantity of nodes in the transmission network.

As required in the construction of the network, there will be some self-transmission nodes. Some of these may have strong self-transmission phenomena, but all the centrality coefficient methods discussed above only consider the conductibility of the node to other nodes in the transmission network; however, in this paper, we defined a the following Self-Conductibility Coefficient to analyse the self-transmission phenomenon of the nodes:

where Cs(m) is the normalized Self-Conductibility Coefficient; WOD′(m) is the sum of the weights of the edges between node m and all the other nodes to which node m is directed in the transmission network, except m; WID(m) is the sum of all the weights of the edges between all the nodes that are directed to m and m (including m directed to m); Wm,v represents the weights of the edge between node m and node v; m is the start of the directed edge; v is the end of the directed edge; and wm,m refers to the weights of the self-transmission edge of m.

Results

Statistical features of the fluctuation rates of the four stock indices

To study the fluctuation of the stock indices in both the traditional statistics perspective and transmission network perspective, we first used some common analytical methods from statistics to investigate the fluctuation of a single variable and the correlation coefficient of two variables, according to Formulas (4) and (5). All the average values of the standard deviation are all of the same order of magnitude (×10−4), and the standard deviation of the fluctuation rate of the NASDAQ is much larger than that of the other three stock indices, which indicates that the NASDAQ has a stronger fluctuation than the other three stock indices (Table 2). The NASDAQ and the Dow Jones, the NASDAQ and the Russell 1000 and the Dow Jones and the Russell 1000 exhibit more similar and consistent characteristics with one another (Fig. 3). The scatter plots of the NASDAQ and the S&P 500, the S&P 500 and the Dow Jones, and the S&P 500 and the Russell 1000 are more similar to one another. Each of these index groupings contains the S&P 500 stock index, so we can assume that the S&P 500 is the common factor involved in the distribution characteristics of the scatter plots. Table 3 provides further proof for consumption by showing that the Pearson correlation coefficient between the S&P 500 and any other stock index is significantly negative due to its diverse constituency and weighting methodology (as well as based on some other reasons, such as the business scope of the listed companies and so on). However, the Pearson correlation coefficients between any of the two stock index groupings involving the NASDAQ, the Dow Jones and the Russell 100 are significantly positive and relatively high (from 0.899 to 0.976), although they also have diverse constituencies and weighting methodologies. These findings form the basis of the following analysis regarding the concentration and conductibility of the CFMs of multiple stock indices.

The concentration features of a multi-stock index co-fluctuation relation matrix transmission network

As discussed above, any of the two-stock-index fluctuation rates have significant correlation coefficients, but we still cannot identify in much detail how the multi-fluctuation rate time series relate to one another both over the short term and from a holistic perspective. After mapping the CFMs’ time series into a transmission network based on the method discussed above, we identify 19 different nodes and 158 different edges (see Fig 4) and can therefore obtain the nodes’ concentration coefficient of the CFMs’ transmission network, which is 0.7654. Because the CFMs’ transmission network is directed and because the matrices can self-link, the potential feasible diversity of the adjacent relationships among the CFMs is 19×19=361. Following this determination, we can obtain the edges’ concentration coefficient of the CFMs’ transmission network, which is 0.5623. On the basis of the definitions and the values of both the nodes’ concentration coefficient and the edges’ concentration coefficient, we can conclude that the multiple co-fluctuation relations for the four stock indices studied in this paper are highly concentrated in a few forms and that the transmission relationships of these forms are concentrated as well.

The multi-stock index co-fluctuation relation matrix transmission network.

Note: This is the co-fluctuation relation matrix transmission network of the four stock indices from trading day 1 to trading day 3021. The size of the node depends on the occurrence number of the co-fluctuation relation matrix.

The roles and relations of the multi-stock index co-fluctuation relation matrix in the transmission network

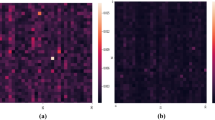

An analysis of the concentration coefficient reveals that the CFMs’ transmission network is relatively concentrated compared with the potential diversity of the network. Next, we must discover the roles of each CFM (node) in the transmission network. Table 4 shows that there are four CFMs with a high frequency in the transmission network, “PPPPPPPPPP”, “PNPPQNNPPP”, “QNQQPNNQQQ” and “QQQQQQQQQQ”. “PPPPPPPPPP” represents the entire positive CFM that we call the “all positive co-fluctuation matrix”, in which all four stock indices exhibit positive fluctuation (see Table 5). “PNPPQNNPPP” indicates that the S&P 500 has negative fluctuation while the other stock indices have positive fluctuations, which we call the “all positive but the S&P 500 co-fluctuation matrix” (see Table 6). “QNQQPNNQQQ” is the opposite of “PNPPQNNPPP”, that is, the S&P 500 has a positive fluctuation and the other indices have negative fluctuation, which we call the “all negative but the S&P 500 co-fluctuation matrix” (see Table 7). “QQQQQQQQQQ” represents the entire negative CFM that we call the “all negative co-fluctuation matrix”, in which all four stock indices exhibit negative fluctuation (see Table 8). Meanwhile, Fig 5(a) shows that these four CFMs account for more than 80% of all the weighted out-degrees of the network, which indicates that the four stock indices either co-move in the same direction or that the S&P 500 moves in one direction while the remaining three indices (co-)move together in a different direction. We can use the strong positive correlation coefficients between the NASDAQ, the Dow Jones and the Russell 1000 to explain their consistent co-fluctuation relations, a result that challenges the negative correlation coefficients between the S&P 500 and the other three stock indices. Although the S&P 500 is negatively correlated with the fluctuation rates of the NASDAQ, the Dow Jones and the Russell 1000, the “all positive but the S&P 500 co-fluctuation matrix” (PNPPQNNPPP) or the “all negative but the S&P 500 co-fluctuation matrix” (QNQQPNNQQQ) is not necessarily the top CFM (node) in the transmission network. It is clear that the “all positive co-fluctuation matrix” (PPPPPPPPPP) is the most constant co-fluctuation relation. Nonetheless, the sum of “PNPPQNNPPP” and “QNQQPNNQQQ” is slightly higher than the sum of “PPPPPPPPPP” and “QQQQQQQQQQ”, which supports the weak negative correlation between the S&P 500 and the other three stock indices.

Cumulative distribution and complementary cumulative distribution graph of the weighted out-degree and weights.

Note: Here there are eighteen nodes and one hundred and fifty eight egdes, and the nodes and edges are sequenced by “weighted out-degree” and “weights” from highest to lowest in the x-axis of a and b.

According to Fig. 5(b), although there are 158 different edges between the nodes, eight edges account for more than 60% of the total weights in the transmission network (see Table 4), which indicates that there are more transmission possibilities in the next period by these edges if we know the present CFM. Analysing these edges can be helpful in studying the relationships of different fluctuation scenarios and for more advanced simulations of stock indices fluctuation behaviour. According to Table 9, the top eight edges are all between the top four nodes discussed above, and when the co-fluctuation pattern of the four indices is the “all positive but the S&P 500 co-fluctuation matrix” (PNPPQNNPPP), they will have a greater likelihood of being in the opposite situation in the next period, i.e., the “all negative but the S&P 500 co-fluctuation matrix” (QNQQPNNQQQ) or the “all negative co-fluctuation matrix” (QQQQQQQQQQ). If the co-fluctuation pattern is the “all positive co-fluctuation matrix” (PPPPPPPPPP) at present, it will more likely transition to “all positive but the S&P 500 co-fluctuation matrix” (PNPPQNNPPP) or maintain the same pattern, that is, “PPPPPPPPPP”. When the S&P 500 fluctuates positively while the other three indices fluctuate negatively (QNQQPNNQQQ), it will also have a greater likelihood of transitioning into the opposite situation in the next period (“PNPPQNNPPP”) or “PPPPPPPPPP”. If its present scenario is the “all negative co-fluctuation matrix” (QQQQQQQQQQ), it will likely become “QNQQPNNQQQ” or “QQQQQQQQQQ” on the next trading day. Thus, we can conclude that if the CFM is “PNPPQNNPPP” or “QNQQPNNQQQ” in the CFMs” transmission network, it will likely change to the opposite scenario or make all the indices fluctuate in the same direction as the S&P 500, and if the CFM is either the “all positive co-fluctuation matrix” or the “all negative co-fluctuation matrix”, it will be likely that only the S&P 500 changes to the opposite direction in the next period or that all four stock indices remain the same.

The conductibility of the multi-stock index co-fluctuation relation matrix in the transmission network

On the basis of the algorithms of Eigenvector Centrality (Formula (8)), Closeness Centrality (Formula (9)), and Betweenness Centrality (Formula (10)), we calculate the values of each node and obtain the hierarchical cluster of these values (see Fig. 6). We can see that the nodes can be divided into three different sets based on their centrality coefficients. Set A contains the high-centrality coefficients” nodes, that is, “QQQQQQQQQQ”, “QNQQPNNQQQ”, “PPPPPPPPPP” and “PNPPQNNPPP”. Set C is the low-centrality coefficients nodes, that is, “PPpPPpPOpP”, “PNPpQNqPpO” and “QqQQOqqQQQ”. Meanwhile, Set B corresponds to the medium-centrality coefficients” nodes with the left twelve nodes of the transmission network. The four nodes in Set A are also the four nodes with high degrees as analysed above, based on the values of the centrality coefficients (see Table 10), this indicates that different nodes have different roles and conductibility. For example, “PPPPPPPPPP” has the largest Eigenvector Centrality, which indicates that the “all positive co-fluctuation matrix” links to all the higher Eigenvector Centrality matrices in the network. “QQQQQQQQQQ” has the largest Betweenness Centrality, which signifies that the “all negative co-fluctuation matrix” has the best conductibility for transmitting to the other CFMs as the bridge node. Three nodes (CFMs) have substantial Closeness Centrality, which indicates that they can transmit to the other CFMs with very low short paths. In addition, each node in Set C appears only once in the transmission network (see Table 4), which indicates that there is little chance that the stock indices will remain unchanged between the successive periods.

Hierarchical cluster analysis based on the nodes’ Eigenvector Centrality, Closeness Centrality and Betweenness Centrality.

Note: Here, we get the values of Eigenvector Centrality (Formula (8)), Closeness Centrality (Formula (9)), and Betweenness Centrality (Formula (10)) of each node, and then we input all the values of each node into SPSS and use “hierarchical clustering” to get the result of Fig. 6, which is calculated by the distance of the three values of each node.

Figure 4 shows that certain nodes have the self-transmission phenomenon, that is, “PPPPPPPPPP”, “QQQQQQQQQQ”, “QNNNPPPPPP”, “PPNPPNPQNP”, “PNPPQNNPPP”, “QNQQPNNQQQ”, “PNNNQQQQQQ” and “PNNPQQNQNP”. According to Formula (11), their Self-Conductibility Coefficients are 0.3618, 0.3449, 0.0860, 0.0510, 0.0064, 0.0035, 0.0200 and 0.0212, respectively. These results indicate that when all four stock indices demonstrate positive fluctuation or negative fluctuation simultaneously, there is approximately a 35% chance that the same co-fluctuation will remain in the next period. If the co-fluctuation relation at present is one of the two high-frequency situations, that is, “PNPPQNNPPP” or “QNQQPNNQQQ”, there is much less of a chance for self-transmission. Except for the eight CFMs discussed above, there is no self-transmission phenomenon for the other eleven CFMs.

Discussion and conclusions

The main thrust of this paper is to propose a new method of analysing the co-fluctuation patterns of multiple financial time series over the short term and their roles and transmission relations over the long term. To determine how the co-fluctuation relations of multi-stock index time series are transmitted as time passes and what the roles of each co-fluctuation relation are over the long term, we construct a new matrix time series based on the fluctuation rates of the initial multi-stock index time series and the defined coarse-grained co-fluctuation patterns between any two of the stock indices examined. To avoid differences in trading days in the stock indices of different countries, we use four well-known stock indices as empirical data to construct the transmission network of the CFM time series (that is, CFMs’ transmission network).

After defining and analysing the concentration of the transmission network, we find that the co-fluctuation relation matrix transmission network shows a high concentration on the co-fluctuation relation matrix forms and their transmission relationships compared with the potential diversity of nodes and edges. The concentration coefficients of the nodes and edges are 0.7654 and 0.5623, respectively; thus, although the analysis covers 12 years and more than 3,000 trading days, only approximately 23% and 44% of the potential nodes and edges appear in the transmission network. This finding might help stock market investors and analysts focus on a smaller scope of fluctuation possibilities when making investment decisions.

Futhermore, although the statistical analysis indicate that one stock index had weak negative correlations with the remaining three, we find that analysing the degrees of the nodes and comparing the results to the correlation coefficient between stock indices demonstrate that the co-fluctuation patterns with the highest frequency are found in the “all positive co-fluctuation matrix”, that is, when all the stock indices have a positive fluctuation rate simultaneously. By analysing the weights between the nodes, we find strong transmission relations between the CFMs, which will help further investigation into simulating and predicting the stock indices for the next trading day after being given the current CFM. A review of the cumulative distribution graph of weighted out-degree and weights leads us to identify four dominant CFMs: the “all positive co-fluctuation matrix”, the “all positive but the S&P 500 co-fluctuation matrix”, the “all negative but the S&P 500 co-fluctuation matrix”, the “all negative co-fluctuation matrix” and the eight dominant transmission forms between the four CFMs. These results confirm and support our statistical findings and also reveal new findings regarding the transmission relations between different co-fluctuation patterns.

In addition, although all four dominant nodes discussed immediately above have high Eigenvector Centrality, Closeness Centrality, and Betweenness Centrality, our analysis of the conductibility of the nodes shows that they still differ in terms of their conductibility. For example, the “all positive co-fluctuation matrix” has more links to the high-score node, the “all negative co-fluctuation matrix” is the best bridge node in the transmission network, and most of the four nodes can transmit to the other nodes with the shortest path, among other differences. Moreover, by defining and analysing the Self-Conductibility Coefficient based on the self-transmission character of our network, we find that the “all positive co-fluctuation matrix” and the “all negative co-fluctuation matrix” have relatively high self-conductibility, which indicates that there is a strong chance for the stock indices to have the same co-fluctuation relations the next trading day if their co-fluctuation relations matrix is presently either the “all positive co-fluctuation matrix” or the “all negative co-fluctuation matrix”.

Here, we have provided a novel perspective and a tool for analysing the co-fluctuation of multiple financial time series. Thus, by constructing and analysing a multiple time series co-fluctuation relation transmission network, this research reveals not only the co-fluctuation patterns on the short term but also the inner transmission relationships and roles of the co-fluctuation patterns over the long term. However, there are issues and challenges that remain to be addressed and overcome in future studies, such as how to analyse the co-fluctuation relations among global stock indices with different transaction dates, why the correlation coefficients are different between the stock indices, and how the correlation coefficients of the stock indices affect the structure of the co-fluctuation relation transmission network quantitatively. Further, immediate study, will focus on how these findings can improve understanding of simulating and predicting the fluctuation of the stock indices.

Data availability

The datasets analysed during the current study are available in the Dataverse repository (Li, 2015):

http://dx.doi.org/10.7910/DVN/NRWQYU

These datasets were derived from the following public domain resources:

Quandl Data Platform (2015) and Yahoo Finance (2015a, 2015b, 2015c, 2015d).

Global Stock Markets on the Quandl Data Platform: https://www.quandl.com.

Yahoo Finance:

NASDAQ Composite (COMP):

http://finance.yahoo.com/q/hp?s=^IXIC+Historical+Prices

S&P 500 Index:

http://finance.yahoo.com/q/hp?s=%5EGSPC+Historical+Prices

Dow Jones Industrial Average:

http://finance.yahoo.com/q/hp?s=%5EDJI+Historical+Prices

Russell 1000 Index:

Additional information

How to cite this article: Li H et al. (2015) Characteristics of the co-fluctuation matrix transmission network based on financial multi-time series. Palgrave Communications. 1:15023 doi: 10.1057/palcomms.2015.23.

References

Akoum I, Graham M, Kivihaho J, Nikkinen J and Omran M (2012) Co-movement of oil and stock prices in the GCC region: A wavelet analysis. Quarterly Review of Economics and Finance; 52 (4): 385–394.

Brandes U (2011) A faster algorithm for betweenness centrality. Journal of Mathematical Sociology; 25 (2): 163–177.

Cao G, Xu L and Cao J (2012) Multifractal detrended cross-correlations between the Chinese exchange market and stock market. Physica A; 391 (20): 4855–4866.

Chang C L, McAleer M and Tansuchat R (2013) Conditional correlations and volatility spillovers between crude oil and stock index returns. North American Journal of Economics and Finance; 25: 116–138.

Chen H, Han Q, Li Y and Wu K (2013) Does index futures trading reduce volatility in the Chinese stock market? A panel data evaluation approach. Journal of Futures Markets; 33 (12): 1167–1190.

Chi K T, Liu J and Lau F C (2010) A network perspective of the stock market. Journal of Empirical Finance; 17 (4): 659–667.

Dangalchev C (2006) Residual closeness in networks. Physica A; 365 (2): 556–564.

Donner R V, Zou Y, Donges J F, Marwan N and Kurths J (2010) Recurrence networks—A novel paradigm for nonlinear time series analysis. New Journal of Physics; 12 (3): 033025.

Fagiolo G (2009) Economic networks: The new challenges. Science; 325 (5939): 422–425.

Filis G, Degiannakis S and Floros C (2011) Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis; 20 (3): 152–164.

Gao X, An H, Fang W, Huang X, Li H and Zhong W (2014) Characteristics of the transmission of autoregressive sub-patterns in financial time series. Scientific Reports; 4: 6290.

Gao J, Buldyrev S V, Havlin S and Stanley H E (2011) Robustness of a network of networks. Physical Review Letters; 107 (19): 195701.

Hyeon C and Thirumalai D (2011) Capturing the essence of folding and functions of biomolecules using coarse-grained models. Nature Communications; 2: 487.

Kao L J, Chiu C C, Lu C J and Chang C H (2013) A hybrid approach by integrating wavelet-based feature extraction with MARS and SVR for stock index forecasting. Decision Support Systems; 54 (3): 1228–1244.

Kara Y, Boyacioglu M A and Baykan Ö K (2011) Predicting direction of stock price index movement using artificial neural networks and support vector machines: The sample of the Istanbul Stock Exchange. Expert Systems with Applications; 38 (5): 5311–5319.

Kumar S, Managi S and Matsuda A (2012) Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Economics; 34 (1): 215–226.

Lacasa L, Luque B, Ballesteros F, Luque J and Nuño J C (2008) From time series to complex networks: The visibility graph. Proceedings of the National Academy of Sciences; 105 (13): 4972–4975.

Li H (2015) Fluctuation patterns of financial multi-time series. Dataverse. http://dx.doi.org/10.7910/DVN/NRWQYU.

Li H, An H, Gao X, Huang J and Xu Q (2014) On the topological properties of the cross-shareholding networks of listed companies in China: Taking shareholders’ cross-shareholding relationships into account. Physica A; 406: 80–88.

Li H, Fang W, An H and Yan L (2014) The shareholding similarity of the shareholders of the worldwide listed energy companies based on a two-mode primitive network and a one-mode derivative holding-based network. Physica A; 415: 525–532.

Liu F and Wang J (2012) Fluctuation prediction of stock market index by Legendre neural network with random time strength function. Neurocomputing; 83: 12–21.

Newman M E (2008) The mathematics of networks. The New Palgrave Encyclopedia of Economics; 2: 1–12.

Pearson K (1895) Contributions to the mathematical theory of evolution. II. Skew variation in homogeneous material. Philosophical Transactions of the Royal Society A; 186: 343–414.

Peng C L E, Lai K L, Chen M L and Wei A P (2015) Investor sentiment, customer satisfaction and stock returns. European Journal of Marketing; 49 (5/6): 827–850.

Preis T, Kenett D Y, Stanley H E, Helbing D and Ben-Jacob E (2012) Quantifying the behavior of stock correlations under market stress. Scientific Reports; 2: 752.

Quandl Data Platform. (2015) Global Stock Markets, https://www.quandl.com, accessed 22 January 2015.

Reboredo J C and Rivera-Castro M A (2014) Wavelet-based evidence of the impact of oil prices on stock returns. International Review of Economics & Finance; 29: 145–176.

Sadorsky P (2012) Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Economics; 34 (1): 248–255.

Schwert G W (2011) Stock volatility during the recent financial crisis. Europ. Financial Management; 17 (5): 789–805.

Soytas U and Oran A (2011) Volatility spillover from world oil spot markets to aggregate and electricity stock index returns in Turkey. Applied Energy; 88 (1): 354–360.

Ticknor J L (2013) A Bayesian regularized artificial neural network for stock market forecasting. Expert Systems with Applications; 40 (14): 5501–5506.

Wang D, Podobnik B, Horvatić D and Stanley H E (2011) Quantifying and modeling long-range cross correlations in multiple time series with applications to world stock indices. Physical Review E; 83 (4): 046121.

Wang J J, Wang J Z, Zhang Z G and Guo S P (2012) Stock index forecasting based on a hybrid model. Omega; 40 (6): 758–766.

Wei L Y, Chen T L and Ho T H (2011) A hybrid model based on adaptive-network-based fuzzy inference system to forecast Taiwan stock market. Expert Systems with Applications; 38 (11): 13625–13631.

Xu X, Zhang J and Small M (2008) Superfamily phenomena and motifs of networks induced from time series. Proceedings of the National Academy of Sciences of the United States of America; 105 (50): 19601–19605.

Yang J, Yang Z and Zhou Y (2012) Intraday price discovery and volatility transmission in stock index and stock index futures markets: Evidence from China. Journal of Futures Markets; 32 (2): 99–121.

Yang Y and Yang H (2008) Complex network-based time series analysis. Physica A; 387 (5): 1381–1386.

Yahoo Finance. (2015a) NASDAQ Composite (COMP), http://finance.yahoo.com/q/hp?s=^IXIC+Historical+Prices, accessed 22 January 2015.

Yahoo Finance. (2015b) S&P 500 Index, http://finance.yahoo.com/q/hp?s=%5EGSPC+Historical+Prices, accessed 22 January 2015.

Yahoo Finance. (2015c) Dow Jones Industrial Average, http://finance.yahoo.com/q/hp?s=%5EDJI+Historical+Prices, accessed by 22 January 2015.

Yahoo Finance. (2015d) Russell 1000 Index, http://finance.yahoo.com/q/hp?s=%5ERUI+Historical+Prices, accessed 22 January 2015.

Zhang J and Small M (2006) Complex network from pseudoperiodic time series:Topology versus dynamics. Physical Review Letters; 96 (23): 238701.

Acknowledgements

This research is supported by grants from the National Natural Science Foundation of China (Grant No. 71173199), the China Scholarship Council (File No. 201406400004), the Humanities and Social Sciences Planning Funds Project under the Ministry of Education of the PRC (Grant No. 10YJA630001), and the Fundamental Research Funds for the Central Universities (Grant No. 2-9-2014-104).

Author information

Authors and Affiliations

Contributions

H. An and H. Li designed the structure of the research; H. Li performed the research; H. Li, X. Gao, and W. Fang contributed the data and tools; and H. Li and H. An analysed the data and wrote the paper. All co-authors of this paper reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that we have no competing interests as defined by the journal or any other interests that might be perceived to influence the results and/or discussion reported in this paper.

Rights and permissions

This work is licensed under a Creative Commons Attribution 3.0 International License. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in the credit line; if the material is not included under the Creative Commons license, users will need to obtain permission from the license holder to reproduce the material. To view a copy of this license, visit http://creativecommons.org/licenses/by/3.0/

About this article

Cite this article

Li, H., An, H., Gao, X. et al. Characteristics of the co-fluctuation matrix transmission network based on financial multi-time series. Palgrave Commun 1, 15023 (2015). https://doi.org/10.1057/palcomms.2015.23

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/palcomms.2015.23