Abstract

Aggregates (sand, gravel, crushed stone) make up half of all globally extracted materials and present substantial environmental challenges. China, which consumes half of the world’s aggregates, is undergoing profound shifts in both supply and demand. Our scenario-based model tracks aggregate flows and stocks across 30 end-uses in Chinese provinces from 1978 to 2050. We find that China’s aggregate demand peaked around 2015, accompanied by a gradual and continuous shift from natural to manufactured aggregates. Total demand after 2030 is projected to decline to ~50% of 2020 levels in circular economy scenarios. Per capita stocks tend to saturate by 2040, although saturation timing varies across provinces. Stock saturation may lead to increased availability of recycled aggregates, which could become a primary supply source. We highlight the critical need for stricter policies and regulations for the aggregate industry, offering insights for other economies facing similar challenges.

Similar content being viewed by others

Introduction

Earth’s crust consists of a solid lithosphere layer, varying between 60 and 120 kilometers thick, where rocks weather into sand, gravel, and stone. These substances, known as aggregates, are used extensively in construction and are the most extracted materials worldwide1. In 2019, global material extraction reached about 95.2 billion tons (Gt), with aggregates making up over half2,3. Around 1.1 trillion tons of non-metallic minerals were extracted globally for construction between 1970 and 2019. That is equivalent to stripping a 3–4 mm layer from Earth’s entire land surface (see Supplementary Notes for calculation).

In recent years, particularly after 2010, China consumed around half of the total extracted global aggregates. Each cubic meter of concrete used in China typically contains 1.8 tons of aggregates4. Building one square meter of a building requires 1.2 tons of aggregates4. For roads, between 4000 and 30,000 tons are needed per kilometer, and for high-speed rail, about 70,000–120,000 tons per kilometer4. Aggregates are the backbone of buildings and infrastructure, and as cities expand and global infrastructure grows, our dependence on these materials has reached unprecedented levels5.

Aggregates are essential for most contemporary construction. While materials like straw, wood, and clay can be used in specific cases, the heavy reliance on concrete-based construction has led to an enormous demand for aggregates. Globally, resource exhaustion poses little risk; however, high transport costs and rising local prices may constrain demand. A 50–150 km radius4,6 is typically the limit for local resource extraction and utilization. Thus, local analyses at finer scales, including down to the municipal level1,7 are vital for addressing these specific challenges.

In many regions, overexploitation has caused sand shortages and environmental damage8,9,10,11, especially from riverbed extraction, which harms both ecosystems and river channels10,12,13. This pattern often reflects the location of towns near rivers, where natural sand and gravel provide ideal construction materials. Local shortages drive up prices, fueling illegal extraction and exacerbating environmental and social impacts1. Because of their perceived abundance, sand and gravel issues have historically been overlooked, degrading these common-pool resources in many regions14. Some argue this trend has escalated into a sand crisis9,15,16,17.

Supply-side changes will be important in addressing some of these problems. Many investigations explore alternative resources with potentially lower environmental impacts, including crushed rocks from quarries and secondary aggregates derived from construction and demolition waste (CDW) and ore-sand, a by-product of mineral processing18. However, crushed rock and secondary aggregates still carry environmental impacts19,20. These alternatives require strict management but allow easier regulation compared to natural sand and gravel, which often face illegal extraction.

While a supply-side circular-economy focus on recycling is important, the use of recycled aggregates is currently very limited4,21. Even in high-income countries, recycled aggregates mostly go to lower-grade uses (e.g., road subbase) rather than high-quality concrete or structural components21. A holistic approach for addressing the sand crisis involves embracing circular economy principles15,22,23,24 that not only consider supply-side changes but have a demand-side focus on enhancing the material efficiency of buildings and infrastructure23,25,26,27 (see Table S1 for detailed terminology and classification of aggregate final uses).

China’s rapid economic growth was fueled by a four-decade construction boom5,28,29. This expansion involved systemic feedback in China’s export-led model, generating capital for more investment and infrastructure30, causing a sharp rise in aggregate consumption31. This period of growth was marked by massive projects such as extensive rail networks32, skyscrapers33, and other urban infrastructure24,34. By 2023, China accounted for nearly half of global aggregate usage35. Studies indicate a potential peak and subsequent decline in China’s resource consumption around 202024, alongside structural changes in its greenhouse gas emissions36. Aggregate consumption mirrors China’s construction scale and serves as a proxy for its urbanization, economic transformation, and regional development37.

These consumption dynamics underscore the global importance of construction material flows, supported by historical and projected data35. Research on China’s future aggregate demand and supply is limited, despite the country accounting for half of the global aggregate extraction7. A notable gap remains in assessing its recycling potential4,24. Given that aggregates are mostly mined and used locally35, detailed subnational analysis is vital.

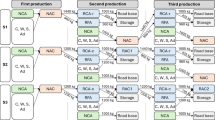

To address these gaps, we developed the China Aggregate Metabolism Provincial Scenarios (CHAMPS) model (Figs. S3–S5), a dynamic scenario-based metabolism framework for aggregate resources that tracks material flows across 31 provinces in mainland China from 1978 to 2050 (see Fig. S2). CHAMPS provides a comprehensive view of aggregate supply and usage, mapping processing stages to end uses for 30 distinct end uses grouped into eight categories, while integrating circular economy measures with Shared Socioeconomic Pathway (SSP)-based socioeconomic data to project future scenarios.

We assembled a comprehensive dataset of thousands of input parameters, validated through stakeholder consultations, thereby achieving a high-level granularity for China’s aggregate industry. Our projections extend to 2050 under six scenarios and explore effective circular economy approaches. We begin with a Baseline (BL) scenario reflecting China’s current state and future path based on Shared Socioeconomic Pathway 238 (SSP2), representing a middle-of-the-road pathway. Building on this, we then assess four strategies—Intensive Use (IU), Lightweight Design (LD), Lifetime Extension (LE), and Improved Recycling (IR)—plus an integrated All Measures (AM) approach. These strategies incorporate 3R (Reduce, Reuse, Recycle) principles39 to enhance the sustainability of resource use and the ecological environment (see Table 1 and Supplementary Notes 2.4). The modeling explicitly includes downcycling and recycling; further details are provided in Supplementary Notes Section 2.3. By filling a knowledge gap in China’s aggregate demand and supply dynamics, we hope to contribute to broader discussions on sustainable resource management in developing regions and offer a fresh perspective on achieving more efficient resource use while mitigating environmental impacts.

Results

Peaking and declining demand, with rising future waste

China’s aggregate demand peaked in 2015 at 18.8 Gt·year−1 (Fig. 1A) and is expected to decline markedly post-2020, stabilizing around 2030 with demand projected between 9.5 and 11.1 Gt·year−1. This decrease is attributed to factors such as the slowdown in China’s construction industry40 and changing demographics41. By 2050, the expected demand ranges between 9.2 and 12.4 Gt·year−1 across scenarios, marking a 50% reduction from peak levels, dropping to 2004 demand levels.

A China’s aggregate demand. B Aggregate stocks. C Aggregate waste generation, with aggregate demand projections under the All Measures scenario. D Growth rates of aggregate demand (blue), cement consumption (yellow), fixed asset investment (gray), and GDP (red). The growth rate data in (D) is plotted using a 3-year moving average. A–C share the legend shown in (B). Dark purple indicates aggregates used in historical buildings, dark gray for historical infrastructure, light purple for future buildings under the All Measures scenario, and light gray for future infrastructure under the same scenario. Different colors in (A, B, C) correspond to historical data and future scenarios: blue represents historical data, orange the Baseline scenario, green the Intensive Use intervention, pink the Lightweight Design intervention, brown the Lifetime Extension intervention, and red the All Measures scenario.

Among modeled interventions, Lifetime Extension (LE) sees the largest decrease in demand, with a 20% reduction from the Baseline (BL), while Intensive Use (IU) and Lightweight Design (LD) scenarios see 2% and 7% reductions, respectively. Substantial demand declines are anticipated for both buildings and infrastructure by 2050 under the All Measures (AM) scenario. Demand for building aggregates is expected to reduce by 4.9 Gt·year−1 (a 47% decrease from 2020 levels), and infrastructure aggregate demand is projected to drop by 4.1 Gt·year−1 (a 53% decrease).

Aggregate stocks are expected to stabilize by 2050 across scenarios, ranging between 402.9 and 420.2 Gt (Fig. 1B). Under an All Measures scenario, buildings and infrastructure aggregate stocks could level off at around 273.5 Gt and 129.4 Gt by 2050, respectively. This stabilization corresponds with the gradual decline in growth rates of China’s GDP and fixed asset investment, transitioning from a high-growth model to a focus on quality-driven development31. For example, GDP and fixed asset investment growth rates have decreased from 11% and 20% in 2010 to 3% and 5% in 202242, respectively (Fig. 1D). China has also seen a 12% reduction in cement consumption from 2021 to 202243 and a further 5% decrease over 2023, which further indicates a declining trajectory in aggregate demand.

With the saturation of China’s construction industry and the ensuing asset retirements, demolition waste is expected to accelerate in the near future44,45. Projections under the Baseline scenario indicate an increase in outflows from 4.95 Gt in 2021 (4.87–4.95 Gt across scenarios) to an estimated 12.3 Gt by 2050 (9.6–12.3 Gt across scenarios). Outflows are expected to exceed inflows by 2046 in the Lightweight Design scenario, reaching 11.8 Gt (Fig. 1C). Building-related outflows, especially from residential structures, are set to account for 61% of the total by 2050 in the Baseline scenario. Infrastructure (predominantly road-related) is expected to contribute 39% of the total outflows. This considerable outflow of waste presents environmental and spatial challenges due to the extensive land and resources required for disposal46,47. Nevertheless, recycling CDW from these aggregates offers a pathway to alleviate the environmental impacts of primary aggregate extraction and reduce the reliance on extraction47,48.

Recycled aggregates can bridge the circularity gap

There has been a large transformation in aggregate supply patterns in China over time, moving from a traditional reliance on natural sand and gravel (of over 80% of total aggregates before 2005)—primarily sourced from rivers and other natural water bodies10—to an increased emphasis on crushed stone (now comprising 80% of total aggregates). The transition from natural aggregates to manufactured aggregates (crushed stone) is particularly noticeable over the past two decades (Fig. 2A, B) and reflects an increasing interest in sustainable mining practices, which has included new policies regulating the aggregate industry between 2012 and 201849,50. This shift has yielded notable benefits, including enhanced industry standardization and reduced illegal mining51. Centralized environmental inspections of practices from 2016 onwards accelerated improvements52. While this transformation mitigates environmental and social concerns related to water-based sand mining, it introduces new challenges, primarily from the ecological impacts of mountain quarrying on nearby ecosystems, with relatively minor impacts from processing stages7,53.

A Percentage of aggregate supply (1978–2020: historical data; 2021–2050: the All Measures scenario). B Analysis of aggregate resource supply shifts from 2000, 2020, to 2050 (the All Measures scenario). Data for the intermediate years can be found in Fig. S27. C Estimations of primary aggregate demand in China in 2050 under various circular economy (CE) interventions. D An overview of aggregate resource material flows in China in 2050 (the All Measures scenario).

As the construction industry in China approaches saturation, the circular use of outflows is attracting increased policy attention. Scenario analysis indicates that Improved Recycling (IR) interventions can substantially increase recycled aggregate supply from 2021 to 2050, positioning it alongside crushed stone as a dominant source of aggregate supply. The concept of “closing the recycling gap” describes the potential to decrease the reliance on primary resources by enhancing the recycling or repurposing of waste materials, thereby contributing to a circular economy24. Detailed results, derived from our high-resolution model (CHAMPS), account for various usage categories and regional differences and enable a comprehensive exploration of recycling pathways (see the modeling details in Supplementary Figs. S5–S8).

Recycling of aggregate waste in China is expected to rise from 733.7 Mt in 2021 to 4.5 Gt by 2050 under the All Measures scenario, increasing its share from 13% to 46% of total CDW generation (Fig. 2D). Simultaneously, use for fillings is estimated to grow from 362.4 Mt to 2.4 Gt, raising its share from 7% to 24% of outflows. The combined recycling and filling rate is anticipated to increase from 20% to 70%. For buildings specifically, the proportion of waste recycled and the share used for fillings are projected to rise from 12% to 66%. In future scenarios, the amount of CDW generation will grow, and with higher recycling rates, both the recycled volume and the amount utilized for fillings will increase accordingly.

On the supply side, recycled aggregates are projected to increase from 4% in 2021 to 48% by 2050 under the All Measures scenario, overtaking manufactured aggregates around 2046 (Fig. 2A). This marked shift is likely to dramatically reduce environmental impacts7,11,54. Recycled aggregates used in buildings are expected to rise from 1% in 2021 to 26% by 2050, and more markedly in infrastructure, from 9% to 83%. This highlights a major trend towards using recycled materials for both building and infrastructure needs.

Primary aggregate extraction is projected to decrease by 55% under the All Measures scenario by 2050, equivalent to a reduction of 6.0 Gt compared to the Baseline (Fig. 2C). This reduction is driven by strategies focusing on Intensive Use, Lightweight Design, Lifetime Extension, and Improved Recycling. With the current recycling rate below 20%, substantial potential for improvement remains. By fully implementing 3R measures, the share of recycled aggregates is expected to rise to 48% of total demand by 2050 under the All Measures scenario, with the volume reaching 4.5 Gt.

Subnational disparities and shared saturation trends

The distribution of aggregate stocks and flows across China’s provinces highlights the economic diversity and development of each region, primarily reflected by their stage of development, construction demand, development plans, and resource endowments55. Given the typical transport range of only 50–150 km4,6, aggregates are often produced and used locally. The potential for increasing the circularity of aggregates will depend, in large part, on the availability of local outflows or outflows within neighboring regions, which in turn rely on the socioeconomics in those regions.

Investment-driven aggregate consumption surged across most provinces post-2010, due to China’s 2008 economic stimulus and rapid urbanization, largely driven by real estate expansion (reflected in red lines of buildings in Fig. 3). Meanwhile, growth driven by infrastructure needs remained relatively stable (green lines in Fig. 3), as such projects typically align with long-term development plans. The demand for aggregates for infrastructure is also relatively modest compared to real estate. In contrast, the real estate sector is more market-driven. Certain periods in China (e.g., post-2007) have seen the government directly or indirectly encouraging real estate development56.

Representative provinces from China’s four major regions are displayed: Beijing, Jiangsu, and Guangdong from the East; Anhui and Liaoning from the Central and Northeast regions, respectively; Xizang (Tibet), Qinghai, and Guizhou from the West. The lines represent per capita aggregate use: buildings (red), infrastructure (green), and overall (blue), while per capita GDP is shown in gray. Details on all 31 provinces are in Supplementary Fig. S23. See Figs. S24 and S25 for the normalized results showing decoupling trends.

Interestingly, we found large differences among seemingly similar provinces, especially in the wealthy coastal provinces (see Fig. S11 for an overview of aggregate stock and GDP). Zhejiang and Jiangsu, densely populated coastal provinces with strong economies, account for 18% of China’s aggregate demand in 2020 despite comprising only 11% of the population (Fig. S12). Their per capita consumption was high, averaging 23.5 t/cap and 23.8 t/cap during 2016–2020, respectively. In contrast, Guangdong, a province with a population similar to Japan’s and the highest GDP of any Chinese province, roughly equivalent to Canada, exhibited a different trend. Despite its large GDP, its aggregate demand averaged only 8.3 t/cap from 2016 to 2020, about half of Zhejiang and Jiangsu (Figs. S13 and S14). This disparity is primarily due to differences in building rather than infrastructure demand. For example, from 2016 to 2020, Guangdong’s infrastructure-driven demand was around 3.2 t/cap, comparable to 2.7–4.2 t/cap in Zhejiang and Jiangsu, but its building-driven demand was only 16–43% (3.8–6.8 t/cap) of that in Zhejiang and Jiangsu (15.0–24.1 t/cap). Despite Guangdong’s progress in infrastructure and buildings, its per capita aggregate demand remained steady at 7–8 t/cap from 2008 to 2020, reflecting an economic structure less reliant on construction, consistent with previous work5,28,31.

Less-developed regions also had high per capita aggregate demand between 2016 and 2020. Xizang (Tibet), for instance, exceeded 23 t/cap, driven by strong development needs for infrastructure and buildings, coupled with lower population density in 2020 (Fig. 4D). Other less developed but rapidly growing provinces, like Guizhou, Yunnan, and Shaanxi, which had not yet peaked by 2020, saw high demand ranging from 12 to 18 t/cap (12 provinces in this range). The remaining 16 provinces, including other relatively wealthy regions and those with long-standing stock accumulations such as Northeastern China, had moderate demands ranging from 7 to 12 t/cap. Overall, aggregate demand in 25 of the 31 provinces peaked before 2020, excluding several less-developed western regions and Guangdong, where consumption-driven economic development and substantial internal imbalances contribute to continued growth (see Supplementary Notes Section 3.6 for an extended discussion).

A Percentage change in aggregate consumption in 2050 relative to 2020. B Per capita aggregate demand (inflow) distribution across 31 provinces for 2020 and projected for 2050. C Provincial per capita aggregate stocks in 2020. D Provincial per capita aggregate inflows in 2020. E The provincial ratio of recycled aggregates to total aggregate demand in 2050, utilizing the All Measures scenario. F The provincial ratio of aggregate waste generation to demand in 2050, utilizing the All Measures scenario. The map is produced based on the standard map (Approval No. GS(2024)0650) downloaded from the Standard Map Service website of the China National Administration of Surveying, Mapping and Geoinformation, with no modification to the base map.

Per capita aggregate stocks ranged from 147.4 to 360.1 t/cap across China’s provinces (Figs. 4C and S13). High per capita stocks were observed in both developed regions, like Jiangsu and Zhejiang (350–360 t/cap), and less-developed areas like Xizang and Qinghai (240–322 t/cap), illustrating that low population densities and infrastructural challenges also can contribute to higher per capita stocks5,28. Conversely, developed areas with high population density, like Guangdong, Tianjin, and Shanghai, showed the lowest per capita stocks (147.4–163.7 t/cap). Apart from Hainan, these regions are well-developed areas or municipalities, where the scale and intensification of infrastructure and construction have contributed to moderate per capita stock levels. Hainan has seen a partial surge in real estate activity aimed at resort development, but recent environmental considerations have limited its long-term development and overall aggregate stock.

We can see the decoupling of aggregate demand from GDP (Figs. S23–S25), showing that: (i) aggregate stock is crucial in supporting economic development and essential services (like hospitals and health outcomes), and (ii) the economy now relies more on the value of existing infrastructure rather than rapid stock growth. From 2016 to 2020, we observed a decoupling between GDP growth and aggregate demand (inflows), as GDP increased while aggregate demand decreased in most provinces (Figs. S23–S25). The All Measures scenario for 2050 sees an even more pronounced decline in aggregate demand (Fig. 4A), with Jiangsu’s demand expected to drop by 62%. This reduction is more pronounced in wealthier provinces, with over 90% of wealthy provinces seeing per capita demand fall below 10 tons (Fig. 4B), indicating a trend toward per capita stock saturation.

Under various scenarios between 2021 and 2025, the growth rate of stocks in most provinces was projected to be around 2%, a decline from the nearly 6% observed during the peak consumption period around 2015. By 2035, the stock growth rate is expected to approach zero, with some provinces, such as Heilongjiang and Jilin, potentially experiencing slight negative growth. The All Measures scenario suggests that starting in 2038, the aggregate stock growth rate in all provinces would be less than 1%, and by 2050, 22 provinces would have experienced a decline. Under this scenario, by 2050, China’s per capita stock ranges between 179.6 t/cap (Hainan) and 564.8 t/cap (Jiangsu). The total stock of aggregates in the scenario is expected to saturate at around 400 Gt after 2040, with a very slight increase in the per capita level from 277.9 t/cap to 288.8 t/cap from 2040 to 2050.

Efforts to reduce demand and adopt circular economy strategies could see recycling rates among provinces ranging from 35% to 65% (Fig. 4E) in 2025, with Jiangsu, Zhejiang, and Shanghai (the Yangtze River Delta urban belts). This may mean they could meet their entire infrastructure aggregate needs through recycling (Fig. S36B). This could negate the need for new primary resources and generate a surplus of 70.3 Mt·year−1 of aggregates for use in surrounding regions, suggesting the emergence of a nearby interprovincial recycling system, especially among the Yangtze River Delta urban belts. Waste generation is expected to exceed aggregate demand in 22 provinces by 2050 under the All Measures scenario, particularly in the saturated construction markets of the east and northeast. Interregional redistribution of surplus waste aggregates is feasible but depends on transport infrastructure, costs, and policy enforcement. China’s “shift from road to waterway and railway transportation” policy57,58 and the Yangtze River’s transport network59 support efficient redistribution60. However, high transport costs, uneven logistics infrastructure, and local resistance may limit scalability. The remaining nine provinces are anticipated to show smaller circularity gaps, with waste-to-demand ratios above 0.8 (Fig. 4F), underlining the move towards a recycling-driven, closed-loop aggregate industry across China.

Discussion

China’s aggregate consumption accounts for half of global use, reflecting its rapid economic growth. To explore this trend, we developed the CHAMPS model to analyze past and future aggregate demand across China’s provinces. We show that total demand likely peaked in 2015 and is expected to decline post-2020 due to market saturation. By 2030, demand may stabilize at half the 2020 level, driven by a slowdown in construction, a cooling real estate market, and other socioeconomic factors such as demographic shifts. Considerable regional variation exists: affluent coastal areas, historically leading in demand, are nearing saturation, while less affluent inland regions are also approaching peak demand, though at comparatively lower levels. Given these disparities, it will be important to avoid overcapacity as demand declines.

China has transitioned from natural to manufactured aggregates to meet growing demand and address environmental concerns, supported by policies since 20104,61. As buildings and infrastructure age, the increase in waste at the end of their lifecycle makes recycling CDW critical for resource circularity62. However, challenges remain, including a lack of detailed data63,64 and limited use of recycled materials in high-quality and load-bearing structures65,66. From a technical perspective, the key difference between recycled aggregates (RA) and primary aggregates is the residual cement mortar that remains attached to the RA surface. This attached mortar leads to inherent defects in RA, including high porosity, high water absorption, and a weakened interface. These defects can adversely affect the performance of recycled aggregate concrete (RAC), influencing its compatibility, mechanical properties, and durability in fresh mixtures67 (and see more details in the Supplementary Notes Section 3.10).

However, discussions with industry experts often suggest that market factors may be more important. To foster the recycled aggregate market, economic incentives such as subsidies or tax reductions for recycled products, incorporating recycled materials in procurement requirements, and promoting the standardization of reusable concrete components may be necessary68. China’s “green mine” policy, which encourages intelligent operations, environmental protection, and high-quality production, aligns with this transition. Innovation recognition programs and targeted incentives further support these objectives69. Our study indicates that with targeted support, recycled aggregate production could meet a sizeable share of future demand at reasonable recycling rates.

China’s shift in aggregate sources—from natural aggregates to crushed stone—is contributing to a global trend in which worldwide crushed stone production may peak between 2020 and 20301. Post 2030, China is expected to increase its use of recycled aggregates, reducing the demand for natural sand, gravel, and crushed stone. However, global peak1 aggregate demand is projected for 2060-2070, driven by population stabilization, after which China may no longer be the leading consumer. Given the challenges in aggregate supply—such as the social and environmental impacts of natural aggregate extraction and rising demand—it is essential to evaluate how urban development and the need for sustainable aggregates will evolve in regions like the Middle East, Africa, South Asia, and South America, which may become the primary markets for aggregates in the future.

In response to the potential shifts in both aggregate demand and CDW generation, economies undergoing industrial transition must coordinate supply–demand dynamics and prepare for corresponding changes in logistics, facility upgrades, and technology deployment. Policy support is essential for optimizing the aggregate industry’s value chain. For instance, implementing tax incentives for all stages of recycled aggregate production (e.g., collection, processing, and transportation), along with subsidies for procurement, could enhance economic viability70,71. Recent studies indicate that recycled aggregate concrete can reduce the Global Warming Potential by more than 30% compared to concrete made with natural aggregates72; however, the net benefit depends strongly on transport distances, production technology, and mixture design. Given the anticipated large-scale expansion of recycled aggregate use, the total energy consumption and carbon emissions associated with its production and consumption remain substantial. Although the aggregate industry is not considered energy-intensive, with lifecycle carbon footprints ranging from 3.67 to 38.2 kg CO₂-eq per ton, its combined production and transport emissions account for about 1% of global carbon emissions73,74,75. In China, a carbon intensity target of 5 kg CO₂-eq per ton has been proposed in policy documents as a guiding benchmark for aggregate production57. Among these, transportation contributes a disproportionately large share, exceeding 30%76, and the variability in distance and mode introduces further uncertainties in both energy use and emissions. Therefore, optimizing transportation logistics, shortening transport distances, and shifting long-distance haulage from road to rail or waterborne transport can substantially contribute to decarbonization and sustainability in the aggregate sector. In the longer term, deploying electric or low-emission vehicle fleets could further reduce sectoral energy and climate impacts.

Regional differences will require tailored approaches. China’s successful transition from natural to manufactured aggregates through strong policies has shown how targeted regulations can work to mitigate impacts61,77. This may offer a potential model for other regions, yet its universal applicability is uncertain. For example, the availability of sufficient quarries in each region remains unclear, and transporting aggregates or rocks (whether recycled or extracted) over long distances may be costly, posing logistical challenges. In addition, international trade in aggregates accounts for only a small portion of total consumption53. However, localized analyses remain necessary for island regions such as Singapore, the United Arab Emirates, and Hong Kong SAR, where cross-border aggregate trade plays a more prominent role.

Material flow analysis is essential for understanding resource stocks, flows, and the extraction-processing-use patterns. When combined with lifecycle assessment78, it provides a deeper evaluation of environmental and social impacts. Integrating MFA with Geographic Information Systems (GIS) helps identify local usage patterns relevant to policymakers. For instance, using CHAMPS and GIS, we explored the Jing-Jin-Ji (Beijing-Tianjin-Hebei) region (Fig. S34) to locate aggregate consumption and stocks. Future studies focusing on specific regions can refine site-level data on extraction, use, decommissioning, and recycling, thereby improving the practical applicability of the model.

Additionally, ore-sand (from tailings and waste rock) is considered a subset of manufactured aggregates79. However, the share of ore-sand in aggregate production in China remains relatively low (less than 2%), primarily due to concerns about pollution, excessive density, and the preference for prioritizing metal extraction from tailings. While the stockpile of tailings and waste rock in China has reached 60 billion tons80, which could potentially serve as an alternative source for primary aggregates, the energy consumption required to transform these materials into usable aggregates, as well as the risks of leachate contamination affecting infrastructure, must be carefully considered. Statistics and research on tailings ponds are generally lacking81, and whether or how to use these materials in a sustainable way still requires work. Future research can also assess any potential burden-shifting impacts from recycling strategies (see Supplementary Notes 3.9 for an extended discussion).

While our analysis focuses on the material flows associated with aggregate production and use, it does not explicitly account for the physical and financial risks that climate-related impacts may pose to coastal infrastructure. This is particularly relevant for China, where highly urbanized and economically vital coastal regions could face substantial damage due to sea level rise and extreme weather events. For example, a study estimated that $3.4 trillion of annual sea flood costs would take in China by 2100 under the SSP2, 1.5° scenario82. This may increase future aggregate demand beyond our current estimates. We acknowledge this as a limitation of the model and highlight the need for future research to integrate climate exposure, spatial risk distribution, and post-disaster reconstruction dynamics.

Finally, we emphasize that the sand crisis is not a global issue but a local one, making regional and localized studies essential. The crisis stems from local imbalances between demand and resource availability, leading to environmental impacts on water bodies, biodiversity, and socioeconomic issues, including illegal extraction22,83. It is crucial to note that framing this crisis may oversimplify its complex political, social, and environmental dynamics, potentially missing key perspectives and solutions17. Therefore, policymakers should engage in evidence-based modeling to evaluate these factors comprehensively. Finally, we conclude that strong, evidence-based policy support and local supply–demand planning are essential to address sustainability challenges, including sand crisis and supply shortages of the aggregate industry, particularly in rapidly growing economies.

Methods

Definition of aggregates

There is still no unified global definition of aggregate resources. In our model, we adopted a definition of aggregate resources that aligns with both China’s industry standards84,85 and internationally recognized reports86, ensuring that the terminology is accessible and understandable to a global audience. For a detailed definition of aggregate resources, please refer to Supplementary Fig. S1.

Primary aggregate resources encompass natural sand and gravel as well as raw rock, the latter of which is processed into crushed stone. This form of aggregate is particularly prevalent in China’s aggregate industry as of 2025. Secondary aggregates mainly consist of recycled aggregates, processed from CDW, and can serve as substitutes for primary aggregates. The quality of recycled aggregate, potentially matching that of virgin aggregates, depends on the source material (CDW) and the processing technology used87,88,89. Additionally, tailings and waste rock can also be processed into a form similar to crushed stone, akin to raw rock. In some cases in China, these materials are considered by-products of other ore extraction processes80,90. Aggregates are roughly classified in three different ways:

-

(1)

Natural aggregates comprise river sand, lake sand, desalinated sea sand, mountain sand, pit sand, and pebbles. These materials are naturally occurring rock particles, extracted and screened using manual labor or excavation equipment.

-

(2)

Manufactured aggregates include artificial sand and crushed stone. They are processed from raw rock, tailings, and waste rock through processes such as soil removal, mechanical crushing, and screening.

-

(3)

Recycled aggregates are produced from CDW and can substitute primary aggregates in various applications. However, due to specific material requirements and technical constraints, some recycled aggregates are not suitable for certain uses, such as in the construction of load-bearing structures, where primary aggregates are necessary.

It is important to note that primary aggregates include both natural and manufactured aggregates derived directly from raw materials. Secondary aggregates refer to recycled aggregates as well as manufactured aggregates sourced from tailings and waste rock. Given the low utilization rate of tailings and waste rock for aggregate production in China, secondary aggregate consumption primarily involves the use of recycled materials. Furthermore, when considering manufactured aggregates, tailings and waste rock form part of the overall mix, although they are not classified as separate categories (see Supplementary Notes).

China Aggregate Metabolism and Provincial Scenario Modeling (CHAMPS)

We build the CHAMPS based on the stock-driven and flow-driven dynamic material flow analysis model (see details in Supplementary Figs. S3–S8). The model includes eight categories (Building, Road, Rail, Pipeline, Rail transit, Building sublayers, Waterworks, Parks, etc.) and 30 subcategories of final uses.

The framework depicted in Supplementary Fig. S3 illustrates the lifecycle of aggregate resources, categorizing it into five main stages:

-

extraction, processing, and manufacturing;

-

international trade;

-

accumulation and metabolic transformation;

-

waste generation and management;

-

waste recycling and sustainable use.

Each stage is visually differentiated by colors for clarity: yellow denotes the initial stages of extraction, processing, and manufacturing; blue represents international trade; orange indicates the phase of accumulation and metabolic transformation; gray is for waste generation and management; and green highlights the stage of waste recycling and sustainable use.

The retrospective part of China Aggregate Metabolism and Provincial Scenario Modeling (CHAMPS), as shown in Supplementary Fig. S4, utilizes both economy-wide material flow analysis and dynamic material flow analysis. This approach starts with the extraction of resources through mining and other techniques, followed by the refinement of these raw materials and other secondary materials into construction-ready aggregates. These aggregates are subsequently used in construction, combined with binding agents, or traded on the international market in relatively small volumes. Once incorporated into structures, these materials eventually transform, culminating in their waste conversion, which is then managed through disposal or recycled for sustainable use. In analyzing some trends, we used a 5-year moving average to smooth fluctuations of inflows and applied a differential analysis to identify peaks (see “Methods” and Supplementary Information).

We develop several scenarios drawing on the SSP238,91, general scenarios which align with China’s current social metabolism, as depicted in Supplementary Figs. S5–S8. These scenarios incorporate additional circular economy measures and have been employed to create a detailed future scenario model for the social metabolism of aggregate resources at the provincial level in China, detailed in Table 1 and Section 2 of the Supplementary Notes.

We divided the model into stock-driven and flow-driven according to the statistical data of final uses. See Supplementary Notes Section 1 for details. Here we set a flow-driven model, for example.

The annual aggregate stock growth is the net inflow in the year, so the stock in year n equals the stock in year n−1 plus inflow in year n minus outflow in year \(n\) (Eq. 1). The inflows are obtained from statistical data and coefficients (see Supplementary Notes Section 1.2). The outflows are measured on lifetime distribution functions based on the regular patterns of social metabolism (Eq. 2). \(t\) represents time (year); μ and σ are the shape parameters of a log-normal distribution.

The lifetime distribution functions are based on the log-normal distribution function92 in Eq. 3.

We constructed the aggregate inflow, outflow, and stock of 31 provinces based on the model (see Supplementary Fig. S2 for grouping).

We have built a large-scale, province-level foundational database for aggregate resource calculations (Fig. S4), covering all years from 1978 to 2020, 31 provinces in mainland China, as well as the underlying data, intensity coefficients, and lifetime distribution functions for 30 subcategories of aggregate end uses. Through these calculations, we obtained the inflows, stocks, and outflows of aggregates for various end uses in each province. Data sources are detailed in Supplementary Notes Section 1.2.

This study crafts a future scenario model to explore the social metabolism of aggregate resources across China’s provinces, integrating trends in the industry, SSP, circular economy principles, and a tailored social metabolism model. Through a detailed framework, depicted in Supplementary Figs. S5–S8, it considers local resource characteristics and developmental differences across provinces, leveraging historical data to predict changes in stock and flow under various scenarios, including adjustments in the industrial structure on the supply side. The analysis employs a dynamic material flow model, incorporating circular economy strategies to project demand and supply dynamics for natural, manufactured, and recycled aggregates in the future, aiming to align with China’s developmental goals through 2050.

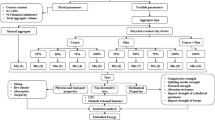

Demand side

We created a scenario analysis framework for examining future societal use of aggregate resources, focusing on the demand side (Supplementary Fig. S6). The methodology begins with calculating historical per capita stocks and densities (demographics and factors influencing demographics) across diverse applications (e.g., population density and built-up area density: urban road density is calculated as the total length of urban roads divided by the built-up area of the city), subsequently establishing future targets grounded in relevant plans and documents. The progression of stock is expected to adhere to an S-shaped curve aligned with economic growth93. This curve is derived through logistic regression analysis and connected to future per capita GDP to estimate future per capita stock. The calculation of future stock involves determining the future stock density and its foundational parameters. In this scenario analysis, leveraging the SSP2 scenario indicators, we constructed the distribution for various end uses. Lifetime distributions for these uses were devised based on local standards and insights from developed economies. The analysis encompasses nine major categories and 17 subcategories (Fig. S8), streamlining the parameters of 30 categories of final uses identified in the historical model into eight sets of scenario variables.

In the scenario settings presented in Supplementary Fig. S6, the study introduces demand-side strategies following the “3R” principle of the circular economy: Intensive Use and Lightweight Design to reduce aggregate demand, and a Lifetime Extension scenario to maximize utilization. All strategies are conducted based on the Baseline scenario. Intensive Use aims to limit the saturation stocks of buildings and infrastructure, major consumers of aggregates, by 20% for buildings, highways, and high-speed railways, and 10% for general-speed railways, encouraging the use of existing resources and contributing to energy conservation and emissions reduction. Lightweight Design initiatives seek to decrease per unit aggregate demand through design optimizations, reducing aggregate use with a projected decrease in the intensity coefficients of aggregates for buildings to 90% by 2050. The Lifetime Extension scenario, acknowledging the current 30–40-year lifespan of buildings falls well short of that in developed economies, proposes extending the service life of new housing from 2021 to 2050 by 90% and for houses built between 2000 and 2020 by 30%, and for infrastructure, considering for the future high-quality development, from 2021 to 2050 the lifespan of infrastructure will gradually increase by 60% compared to 2020. Details on specific parameter settings can be found in Supplementary Notes Section 2.4 and Supplementary Dataset.

Supply side

The framework for analyzing supply-side scenarios of aggregate resources in China is outlined in Supplementary Fig. S7. The structure for supplying aggregate resources within the country is divided into primary aggregates and recycled aggregates. Primary aggregates consist of both natural aggregates (like river sand and lake sand) and manufactured aggregates. Since the import and export of aggregates represent a very small portion of overall consumption and China’s aggregate mineral resource base is largely self-sufficient, the scenario analysis excludes the consideration of aggregate imports and exports.

The approach to calculating the supply of aggregate resources on the supply side includes: (1) Calculating the production of recycled aggregates is based on the outflow of aggregate waste generated from various stocks, as determined by the demand-side scenario analysis, and applying the set recycling rate80,94,95 (detailed in Supplementary Notes Section 2.3 and Supplementary Dataset). Assuming that the maximum recycling rate within a technically feasible range is reached in 2050. (2) Setting future extraction volumes for natural aggregates based on historical extraction data of natural sources like river sand and lake sand, as well as river sediment transport volumes96. (3) Determining the future supply of manufactured aggregates by assessing the aggregate inflow from the demand-side scenario analysis and using the principle of material conservation to subtract the quantities of recycled and natural aggregates supplied from the total required supply.

The supply-side scenario analysis in Supplementary Fig. S7 also introduces an Improved Recycling scenario, in line with the recycling in the “3R” principle, aiming to enhance the future recycling of aggregate waste and the supply of recycled aggregates. The scenario presents an increase in the recycling rates97 of aggregate waste from various end uses, with recycling rates of waste from buildings and infrastructure rising to high levels evenly from 2021 to 2030 and 2021 to 2035, respectively, before both gradually continue to climb at a steady pace until 2050. The specific recycling rate adjustments for aggregate waste from different end uses are detailed in Supplementary Notes Sections 2.4 and 3.10, and Supplementary Dataset.

Uncertainty analysis

This study integrates various parameters like material intensity coefficients and lifespans, drawn from literature, standards, and expert advice, into its model, acknowledging inherent uncertainties. To assess the impact of these uncertainties on model outcomes, a Monte Carlo simulation was used98,99 with 10,000 iterations and normally distributed parameter variations weighted according to the data availability and precision of each variable (see Table S15) at a 95.5% confidence level. This analysis focused on the model’s core—dynamic material flow analysis—particularly its stock linkage. The other parts of the model, based on conservation of mass, indicate a strong linear correlation between parameter variations and model outputs, so it is not necessary to include a further Monte Carlo simulation in other model segments. The simulation validated the core model’s reliability, with results (Supplementary Figs. S28–S33) showing most variations stay within ±30.9% of inflows, ±16.9% of stocks, and ±49.9% of outflows across provinces.

Data availability

The result data generated in this study are provided in the Supplementary Data file (Source data). The Underlying data and Parameters of the model are provided in the Supplementary Data file (Supplementary Data 1). The source of the data used in this study is available in the EPS database under accession code “https://www.epschinadata.com”. The minimum dataset to verify the research can be found in “https://doi.org/10.24433/CO.0218285.v1”. Source data are provided with this paper.

Code availability

The code can be used to reproduce the results of this study. The core code can be found in “https://doi.org/10.24433/CO.0218285.v1”.

References

Sverdrup, H. U., Koca, D. & Schlyter, P. A simple system dynamics model for the global production rate of sand, gravel, crushed rock and stone, market prices and long-term supply embedded into the WORLD6 Model. Biophys. Econ. Resour. Qual. 2, 8 (2017).

International Resource Panel. Global Resource Outlook 2019: Natural Resources for the Future We Want (United Nations Environment Programme, 2019).

UNEP IRP. Global Material Flows Database. https://www.resourcepanel.org/global-material-flows-database (accessed 26 November 2023) (2023).

Ren, Z. et al. Stocks and flows of sand, gravel, and crushed stone in China (1978–2018): evidence of the peaking and structural transformation of supply and demand. Resour. Conserv. Recycl. 180, 106173 (2022).

Jiang, M. et al. Additional north-south differences in China revealed by the Planetary Pressure-Adjusted Human Development Index. Resour. Conserv. Recycl. 198, 107191 (2023).

John, R. Sand geographies: disentangling the material foundations of the built environment. Geogr. Compass 15, https://doi.org/10.1111/gec3.12560 (2021).

UNEP. Sand and Sustainability: Finding New Solutions for Environmental Governance of Global Sand Resources (United Nations Environment Programme, 2019).

Torres, A., Brandt, J., Lear, K. & Liu, J. A looming tragedy of the sand commons. Science 357, 970–971 (2017).

Bendixen, M., Best, J., Hackney, C. & Iversen, L. L. Time is running out for sand. Nature 571, 29–31 (2019).

WWF. Impacts of Sand Mining on Ecosystem Structure, Process & Biodiversity in Rivers (WWF, 2018).

Peduzzi, P. Sand, rarer than one thinks. Environ. Dev. 11, 208–218 (2014).

Ashraf, M. A., Maah, M. J., Yusoff, I., Wajid, A. & Mahmood, K. Sand mining effects, causes and concerns: a case study from Bestari Jaya, Selangor, Peninsular Malaysia. Sci. Res. Essays 6, 1216–1231 (2011).

Rentier, E. S. & Cammeraat, L. H. The environmental impacts of river sand mining. Sci. Total Environ. 838, 155877 (2022).

Ostrom, E. Governing the Commons: The Evolution of Institutions for Collective Action (Cambridge University Press, 1990).

United Nations Development Programme. Sand and sustainability: finding new solutions for environmental governance of global sand resources. (GRID-Geneva, United Nations Environment Programme, 2019).

Watari, T., Cao, Z., Serrenho, A. C. & Cullen, J. Growing role of concrete in sand and climate crises. iScience 26, 106782 (2023).

Lamb, V. Constructing the global sand crisis: Four reasons to interrogate crisis and scarcity in narrating extraction. Extr. Ind. Soc. 15, 101282 (2023).

Wang, H. et al. Substantial increase in China’s manufactured sand supply since 2010. Nat. Geosci. 17, 833–836 (2024).

Braga, A. M., Silvestre, J. D. & de Brito, J. Compared environmental and economic impact from cradle to gate of concrete with natural and recycled coarse aggregates. J. Clean. Prod. 162, 529–543 (2017).

Hossain, M. U., Poon, C. S., Lo, I. M. C. & Cheng, J. C. P. Comparative environmental evaluation of aggregate production from recycled waste materials and virgin sources by LCA. Resour. Conserv. Recycl. 109, 67–77 (2016).

Mostert, C., Weber, C. & Bringezu, S. Modelling and simulation of building material flows: assessing the potential for concrete recycling in the German construction sector. Recycling 7, https://doi.org/10.3390/recycling7020013 (2022).

Mostert, C., Sameer, H., Glanz, D. & Bringezu, S. Climate and resource footprint assessment and visualization of recycled concrete for circular economy. Resour. Conserv. Recycl. 174, 105767 (2021).

Cao, Z. & Masanet, E. Material efficiency to tackle the sand crisis. Nat. Sustain. 5, 370–371 (2022).

Song, L. et al. China’s bulk material loops can be closed but deep decarbonization requires demand reduction. Nat. Clim. Change 13, 1136–1143 (2023).

Zhong, X., Deetman, S., Tukker, A. & Behrens, P. Increasing material efficiencies of buildings to address the global sand crisis. Nat. Sustain. 5, 389–392 (2022).

Pauliuk, S. et al. Global scenarios of resource and emission savings from material efficiency in residential buildings and cars. Nat. Commun. 12, 5097 (2021).

International Resource Panel. Resource efficiency and climate change: material efficiency strategies for a low-carbon future. (United Nations Environment Programme, 2020).

Jiang, M. et al. Different material footprint trends between China and the world in 2007-2012 explained by construction- and manufacturing-associated investment. One Earth 5, 109–119 (2022).

United Nations Development Programme; China Institute for Development Planning at Tsinghua University; State Information Center of China. China National Human Development Report Special Edition: In Pursuit of a More Sustainable Future for All: China’s Historic Transformation over Four Decades of Human Development (China Publishing Group Corporation, China Translation & Publishing House, 2019).

Morrison, W. M. China’s economic rise: History, trends, challenges, and implications for the United States. Curr. Polit. Econ. North. West. Asia 28, 189–242 (2019).

Jiang, M. et al. Provincial and sector-level material footprints in China. Proc. Natl. Acad. Sci. USA 116, 26484–26490 (2019).

Mao, R., Wu, Y., Chen, J., Chen, P. & Li, X. Development patterns, material metabolism, and greenhouse gas emissions of high-speed railway in China. Commun. Earth Environ. 4, 312 (2023).

Huang, B. et al. Building material use and associated environmental impacts in China 2000–2015. Environ. Sci. Technol. 52, 14006–14014 (2018).

Jiang, M. et al. Material and carbon footprints of machinery capital. Environ. Sci. Technol. 57, 21124–21135 (2023).

United Nations Environment Programme. Global Resources Outlook 2024: Bend the Trend—Pathways to a Liveable Planet as Resource Use Spikes Report No. 9280741284 (International Resource Panel, 2024).

Guan, D. et al. Structural decline in China’s CO2 emissions through transitions in industry and energy systems. Nat. Geosci. 11, 551–555 (2018).

Zhou, Y., He, F., Liu, J., Bai, J. & Duan, H. Analysis of Flow and Stock of Sand and Gravel in Shenzhen Buildings and Associated Environmental Impact. In Proc. of the 27th International Symposium on Advancement of Construction Management and Real Estate (eds Li, J. et al.) 85–95 (Springer Nature Singapore, 2022).

Chen, Y. et al. Provincial and gridded population projection for China under shared socioeconomic pathways from 2010 to 2100. Sci. Data 7, 83 (2020).

European Parliament. Circular economy: definition, importance and benefits. (European Parliament, Brussels, 2023).

South China Morning Post. China’s property, construction sectors contract as Evergrande crisis, tougher regulation hit home. South China Morning Post (2023).

Han, X., Wei, C. & Cao, G.-Y. Aging, generational shifts, and energy consumption in urban China. Proc. Natl. Acad. Sci. USA 119, e2210853119 (2022).

National Bureau of Statistics of China. National Data. http://www.stats.gov.cn/english/ (accessed 26 November 2023).

China Cement Association. China Cement Industry Economic Operation Report (2022) (in Chinese). http://www.ccawz.com/chinacca/wenjian/ (accessed 26 November 2024) (China Cement Association, 2023).

Krausmann, F., Lauk, C., Haas, W. & Wiedenhofer, D. From resource extraction to outflows of wastes and emissions: the socioeconomic metabolism of the global economy, 1900-2015. Glob. Environ. Change 52, 131–140 (2018).

Steffen, W. et al. Planetary boundaries: guiding human development on a changing planet. Science 347, 1259855 (2015).

Chen, K., Wang, J., Yu, B., Wu, H. & Zhang, J. Critical evaluation of construction and demolition waste and associated environmental impacts: a scientometric analysis. J. Clean. Prod. 287, 125071 (2021).

Zhang, M., Liu, X. & Kong, L. Evaluation of carbon and economic benefits of producing recycled aggregates from construction and demolition waste. J. Clean. Prod. 425, 138946 (2023).

Ghanbari, M., Abbasi, A. M. & Ravanshadnia, M. Production of natural and recycled aggregates: the environmental impacts of energy consumption and CO2 emissions. J. Mater. Cycles Waste Manag. 20, 810–822 (2018).

Li, S., Yu, L., Jiang, W., Yu, H. & Wang, X. The recent progress China has made in green mine construction, Part I: mining groundwater pollution and sustainable mining. Int. J. Environ. Res. Public Health 19, https://doi.org/10.3390/ijerph19095673 (2022).

Huang, J., Guo, D. & Hou, H. An Analysis of Progress and Models of Local Green Mining. In IOP Conference Series: Earth and Environmental Science. 558, 022022 (IOP Publishing, 2020).

HILLMAN, B. Law, order and social control in Xi’s China. Issues Stud. 57, 2150006 (2021).

Ministry of Ecology and Environment of China. The first batch of central environmental protection inspectors was launched in 2016. (Ministry of Ecology and Environment of China, 2016).

Bendixen, M. et al. Sand, gravel, and UN Sustainable Development Goals: conflicts, synergies, and pathways forward. One Earth 4, 1095–1111 (2021).

UNEP. Sand and Sustainability: 10 Strategic Recommendations to Avert a Crisis (United Nations Environment Programme, 2022).

Hu, Y. Recognizing aggregates products and the aggregates industry correctly. http://en.zgss.org.cn/industry/d_619c8fb50d3abc00a4143aa6.html (accessed 26 November 2023) (2021).

Wu, F. Commodification and housing market cycles in Chinese cities. Int. J. Hous. Policy 15, 6–26 (2015).

Ministry of Industry and Information Technology of the People’s Republic of China. Several opinions on promoting the high-quality development of the manufactured aggregate industry (in Chinese). https://wap.miit.gov.cn/zwgk/zcwj/wjfb/yclgy/art/2020/art_89b19870371149d8a2289a4ad1ebe829.html (accessed 6 April 2024) (2019).

National Development and Reform Commission of China. Guidelines on promoting the healthy and orderly development of aggregate industry. http://www.gov.cn/zhengce/zhengceku/2020-03/27/content_5496182.htm (accessed 10 September 2021) (2020).

Han, X. The "transportation transition from highway to water" turns out to be a new opportunity for cost reduction (in Chinese). In People’s Daily (People's Daily, Beijing, 2024).

Global Times. China rolls out plan for multimodal transport to boost connectivity. https://www.globaltimes.cn/page/202303/1287302.shtml (accessed 26 December 2024) (2023).

China Aggregates Association. China’s solution to achieve green and low-carbon transformation of aggregates industry. http://en.zgss.org.cn/industry/d_6232e1ef8e483f00933e91e1.html (accessed 26 November 2023) (2022).

Lu, Y., Schandl, H., Wang, H. & Zhu, J. China’s pathway towards a net zero and circular economy: a model-based scenario analysis. Resour. Conserv. Recycl. 204, 107514 (2024).

Hou, L. China eyes waste to solve shortage of sand, gravel. https://www.chinadaily.com.cn/a/202004/23/WS5ea0f301a3105d50a3d1838c.html (accessed 26 November 2023) (2020).

Huang, B. et al. Construction and demolition waste management in China through the 3R principle. Resour., Conserv. Recycl. 129, 36–44 (2018).

Di Maria, A., Eyckmans, J. & Van Acker, K. Downcycling versus recycling of construction and demolition waste: combining LCA and LCC to support sustainable policy making. Waste Manag. 75, 3–21 (2018).

Ghaffar, S. H., Burman, M. & Braimah, N. Pathways to circular construction: an integrated management of construction and demolition waste for resource recovery. J. Clean. Prod. 244, 118710 (2020).

Li, Z. et al. Sustainable building materials-recycled aggregate and concrete: a systematic review of properties, modification techniques, and environmental impacts. Environ. Sci. Pollut. Res. 31, 20814–20852 (2024).

Nicholson, V. & Miatto, A. Architects as catalysts of reuse in construction. Nat. Cities 1, 179–181 (2024).

Guo, D., Yang, F., Zhong, X. & Chuai, Y. Thoughts on green mine construction of sand and gravel industry in China. In Journal of Physics: Conference Series. 2682, 012007 (IOP Publishing, 2024).

Liu, J., Gong, E. & Wang, X. Economic benefits of construction waste recycling enterprises under tax incentive policies. Environ. Sci. Pollut. Res. 29, 12574–12588 (2022).

Söderholm, P. Taxing virgin natural resources: lessons from aggregates taxation in Europe. Resour., Conserv. Recycl. 55, 911–922 (2011).

Hasheminezhad, A., King, D., Ceylan, H. & Kim, S. Comparative life cycle assessment of natural and recycled aggregate concrete: a review. Sci. Total Environ. 950, 175310 (2024).

UEPG—Aggregates Europe. Roadmap for climate neutrality in the aggregates industry. Neutral aggregates 2050. (UEPG—Aggregates Europe, 2023).

de Bortoli, A. Understanding the environmental impacts of virgin aggregates: critical literature review and primary comprehensive life cycle assessments. J. Clean. Prod. 415, 137629 (2023).

Rosado, L. P., Vitale, P., Penteado, C. S. G. & Arena, U. Life cycle assessment of natural and mixed recycled aggregate production in Brazil. J. Clean. Prod. 151, 634–642 (2017).

Zuo, C., Birkin, M., Clarke, G., McEvoy, F. & Bloodworth, A. Modelling the transportation of primary aggregates in England and Wales: exploring initiatives to reduce CO2 emissions. Land Use Policy 34, 112–124 (2013).

Hu, Y. Yesterday, today and tomorrow of the aggregate industry (in Chinese). China Concr. 2, 56–61 (2016).

de Bortoli, A., Bouhaya, L. & Feraille, A. A life cycle model for high-speed rail infrastructure: environmental inventories and assessment of the Tours-Bordeaux railway in France. Int. J. Life Cycle Assess. 25, 814–830 (2020).

Golev, A. et al. Ore-sand: a potential new solution to the mine tailings and global sand sustainability crises. https://doi.org/10.14264/503a3fd (accessed 26 November 2024) (2022).

National Development and Reform Commission of China. Annual Report on Comprehensive Utilization of Resources in China (2014) (in Chinese). https://www.ndrc.gov.cn/xwdt/xwfb/201410/t20141009_955923.html (accessed 26 November 2024) (National Development and Reform Commission of China, 2014).

Tang, L., Liu, X., Wang, X., Liu, S. & Deng, H. Statistical analysis of tailings ponds in China. J. Geochem. Explor. 216, https://doi.org/10.1016/j.gexplo.2020.106579 (2020).

Jevrejeva, S., Jackson, L., Grinsted, A., Lincke, D. & Marzeion, B. Flood damage costs under the sea level rise with warming of 1.5 C and 2 C. Environ. Res. Lett. 13, 074014 (2018).

Mostert, C., Bock, J., Sameer, H. & Bringezu, S. Environmental assessment of carbon concrete based on life-cycle wide climate, material, energy and water footprints. Materials 15, 4855 (2022).

General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China. Sand for construction (GB/T 14684-2022). (Standards Press of China, 2022).

General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China. Pepple and crushed stone for construction (GB/T 14685-2022). (Standards Press of China, 2022).

UNEP/GRID-Geneva. What is Sand? Result from a UNEP/GRID-Geneva Expert Discussion. https://archive-ouverte.unige.ch/unige:160291 (accessed 26 November 2024) (UNEP/GRID-Geneva, 2022).

Sanger, M., Natarajan, B. M., Wang, B., Edil, T. & Ginder-Vogel, M. Recycled concrete aggregate in base course applications: review of field and laboratory investigations of leachate pH. J. Hazard. Mater. 385, 121562 (2020).

Varshney, H., Ahmad Khan, R. & Khaleel Khan, I. Quality improvement techniques for recycled aggregates concrete incorporating fibers and Bacillus species bacteria—a review. Mater. Today Proc. https://doi.org/10.1016/j.matpr.2023.03.223 (2023).

Raman, J. V. M. & Ramasamy, V. Various treatment techniques involved to enhance the recycled coarse aggregate in concrete: a review. Mater. Today Proc. 45, 6356–6363 (2021).

National Development and Reform Commission of China. Development Plan for the Circular Economy in the 14th Five Year Plan Period. http://www.gov.cn/zhengce/zhengceku/2021-07/07/content_5623077.htm (accessed 10 September 2021).

O’Neill, B. C. et al. The roads ahead: Narratives for shared socioeconomic pathways describing world futures in the 21st century. Glob. Environ. Change 42, 169–180 (2017).

Miatto, A., Schandl, H. & Tanikawa, H. How important are realistic building lifespan assumptions for material stock and demolition waste accounts? Resour. Conserv Recycl. 122, 143–154 (2017).

Krausmann, F. et al. Global socioeconomic material stocks rise 23-fold over the 20th century and require half of annual resource use. Proc. Natl. Acad. Sci. USA 114, 1880–1885 (2017).

Xinhua News Agency. China advances the management and recycling utilization of construction waste. https://www.gov.cn/xinwen/2021-12/09/content_5659650.htm (accessed 26 November 2024) (2021).

Chen, J. Enhancing the comprehensive utilization of construction waste to alleviate the supply shortage of aggregates. http://www.chinajsb.cn/html/202004/08/9222.html (accessed 26 November 2024) (2020).

Ministry of Water Resources of P. R. China. Bulletin of sediment in Chinese rivers. http://www.mwr.gov.cn/sj/tjgb/zghlnsgb/ (accessed 26 December 2024) (2000–2023).

Panghal, H. & Kumar, A. Recycled coarse aggregates in concrete: a comprehensive study of mechanical and microstructural properties. Iran. J. Sci. Technol. Trans. Civ. Eng. https://doi.org/10.1007/s40996-024-01539-x (2024).

Liu, Q. et al. Product and metal stocks accumulation of China’s megacities: patterns, drivers, and implications. Environ. Sci. Technol. 53, 4128–4139 (2019).

Brunner, P. H. & Rechberger, H. Practical Handbook of Material Flow Analysis Vol. 9 (CRC Press, 2004).

Acknowledgements

The authors would like to acknowledge the support of the National Natural Science Foundation of China grant (no. 41661144023 (B.Z.)) and Horizon Europe Project CircoMod (no. 101056868 (E.H.)). The authors thank Prof. Youyi Hu, the President of the China Aggregates Association, for advice in synthesizing the research. The authors thank Xingyu Liu from the Department of Chemical Engineering of Tsinghua University for his input. P.B. is supported by a British Academy Global Professorship. The views presented in this publication are solely those of the authors and should not be interpreted as representing the views or positions of any organization.

Author information

Authors and Affiliations

Contributions

B.Z. and P.B. conceived the research. Z.R. developed the CHAMPS model. Z.R., M.J., D.C., W.Z., C.L., F.L., L.L., and B.Z. contributed to methodology development and data collection. Z.R., M.J., P.B., D.C., F.L., H.W., M.X., and B.Z. analyzed the results. Z.R., M.J., P.B., C.M., M.X., E.H., S.B., and B.Z. wrote the paper. All authors (Z.R., M.J., P.B., D.C., C.M., W.Z., C.L., F.L., L.L., H.W., M.X., E.H., S.B., and B.Z.) were involved in the discussions and approved the manuscript. Z.R. and M.J. contributed equally.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Communications thanks Juliana Segura-Salazar and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Source data

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Ren, Z., Jiang, M., Behrens, P. et al. Declining demand and circular transition possibilities of sand, gravel and crushed stone in China. Nat Commun 16, 9294 (2025). https://doi.org/10.1038/s41467-025-64349-3

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41467-025-64349-3

This article is cited by

-

Assessing construction material waste in Egypt through stakeholder Estimation

Discover Sustainability (2026)