Abstract

Governments in many European countries have high hopes for cheap green hydrogen (H2) from Africa to decarbonize hard-to-abate sectors. Using geospatial levelized cost models, this study evaluates the economic feasibility of exporting green H2 in the form of ammonia from Africa to Europe under four realistic financing scenarios by 2030. Our findings suggest that without European policy interventions, green H2 from Africa remains prohibitively expensive with least costs from €4.2 kgH2−1 to €4.9 kgH2−1 depending on the interest rate environment. Using de-risking policy, we identify 214 locations in six African countries that may be competitive in the current interest rate environment, yet many of these face a challenging security situation casting doubt on long-term investments. Under optimal policy and interest rate scenarios, we find a least cost of €3.2 kgH2−1 in Mauritania by 2030. Overall, de-risking and strategic location selection are key to make African green H2 exports competitive on the global stage.

Similar content being viewed by others

Main

In 2022, 99% of hydrogen (H2) was produced using fossil fuels1. This ‘grey’ H2 mainly serves demand from the refining and industrial sectors. Achieving net zero requires a change to ‘green’ H2 using renewable energy to meet current demand at low emissions and to decarbonize further hard-to-abate sectors, such as steel production1. Decarbonizing such hard-to-abate sectors is projected to cause an almost sixfold increase in global H2 demand by 20501.

However, deploying green H2 at scale will require market-competitive costs. As of 2022, green H2 constituted a mere 0.1% of global H2 production1, with costs 2–3 times higher than grey H2 (refs. 2,3). To become competitive, technical and operational cost reductions could be pursued, projected at up to 85% through lower-cost renewable electricity, reduced electrolyser costs, enhanced electrolyser efficiency and optimized operating hours2. Additionally, shifting green H2 production to more cost-efficient locations with better availability of renewable energy, including overseas4,5, could increase its competitiveness against other types of hydrogen production.

The European Union explicitly supports the creation of green H2 export markets and aims to import 10 megatons (MT) of green H2 to support decarbonization6. Over 70 potential supply regions, many in Africa7 due to often abundant renewable energy, have been identified, and bilateral agreements have already been signed, for example, between the European Union and Namibia8. African countries have started implementing domestic H2 policies too, with countries such as Namibia, South Africa, Morocco and Kenya developing strategies focused on export9.

Geospatial modelling including variable capital expenditure (CAPEX) or energy cost10 is commonly used to inform policymakers on the economic viability of different green H2 (ref. 11) production locations. We complement the available green H2 cost estimates for the African continent, such as H2Atlas Africa12, in at least three substantive ways. We provide spatially more comprehensive and more precise results for 10,300 locations across the entire continent. We base these on realistic demand scenarios, and we do so in a transparent and replicable way. Yet, irrespective of the granularity, these models typically use a uniform financing cost or cost of capital (COC) set to 4–8% (refs. 10,13,14), which is problematic as energy infrastructure research indicates large variations in COC across Africa15. The few studies that account for these variations leverage data from the oil and gas sector16 or country-specific ratings17,18,19, which do not adequately represent the specific risks associated with green H2 investments and lack empirical calibration. Consequently, current modelling risks producing overly optimistic green H2 levelized cost of hydrogen (LCOH) estimates for export from African countries due to inaccurate representation of their investment and policy environments20. Given the existing north–south disparities regarding decisionmaking power and future visions for the sector21, this is ever more concerning because it could result in unviable infrastructure investments and stranded assets without development benefits in African countries.

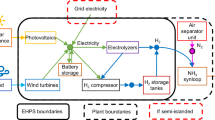

To tackle this issue, here we estimate COC across potential green H2 exporters in Africa for four realistic financing scenarios and use these to calculate LCOH. Differentiating COC by country, financing structure and interest rate environment—verified through expert interviews—we optimize green H2 production locations using GeoH2 (refs. 13,14), a geospatial least-cost model that optimizes production, transport, storage and conversion using granular spatial data. On the basis of an overview of currently planned projects, we model the case of ammonia production, which is shipped and reconverted to H2 in Europe. For simplicity, we choose Rotterdam as the entry port, and we exclude the possibility of pipeline construction or refurbishment for transport to Europe as we analyse the cost of projects to be operational in 2030. A flowchart in Supplementary Fig. 9 depicts the process, which is described in Methods.

Planned green H2 capacity

To understand the status of green H2 development throughout the African continent, we identified all projects planned to be operational by 2030. We restricted the analysis to African countries with port access, as landlocked countries would need to negotiate agreements to secure transportation to ports, introducing further complexity and uncertainty. Somalia and Libya are excluded due to political instability, and small island states are excluded due to infrastructure and space constraints, resulting in a sample of 31 countries (Methods). Thirty-four projects are found across seven countries (Fig. 1), 89% of which are either at concept or feasibility stages. Two of the projects have reached a financial investment decision and are under construction, and only one small-scale project (that is, 3.5 MW) in South Africa is operational. Planned project sizes vary from 3.5 MW to 6.9 GW. Whereas Egypt and South Africa have numerous smaller projects planned, Mauritania has three large projects planned, totalling 7 GW of capacity. This includes giga-scale projects Nour and Aman, two of the largest green H2 export projects planned globally22,23.

a, Number of projects by project status (bars) and the sum of planned capacity by country (bar labels). b, Share of planned standardized electrolyser capacity. Only projects planned to go online by 2030 are included. Projects can have more than one end use; hence, shares in b add up to 112%. Information on local versus export end use is unavailable. Note that capacity figures were not available for two planned projects in Mauritania and Morocco. Methods provide data sources and details on sample selection. Data as of December 2023. FID, final investment decision.

Figure 1 shows that 74% of planned electrolyser capacity is intended for ammonia (NH3) production. NH3 offers advantages as a H2 carrier for long-distance transport, including higher volumetric energy density compared to gaseous or liquid H2, and avoiding the boil-off rate of liquefied H2 (refs. 24,25). Moreover, unlike gaseous or liquid H2, international trade networks for NH3 are well established, so existing port facilities and trade routes can be utilized for shipping. Finally, the 2024 H2Global auction for African green H2 to be exported to Europe has resulted in a winning bid from an Egyptian project shipping NH3 to Rotterdam, illustrating the practical relevance of the case. For the remainder of this Article, we therefore analyse the economic viability of exporting green H2 by producing NH3, maintaining this state for transport and shipping and converting NH3 to H2 upon import. This excludes the consideration of other shipping carriers, such as liquid organic hydrogen carriers or methanol (CH4), as the intent of this work is not a comprehensive cost modelling of different theoretical options but providing guidance on the expected cost competitiveness of green H2 exported from African countries to Europe by 2030.

Cost of capital

To date, only three green H2 deals have reached financial closure on the African continent, as shown in Fig. 1. Consequently, it is impossible to draw on empirical data regarding the COC for green H2 projects across African countries. Therefore, we developed four financing scenarios shown in Table 1, estimated the COC for each and triangulated the approach through 12 semi-structured expert interviews conducted in February–September 2023 (Methods). The scenarios are defined based on two dimensions: the general interest rate environment (reflecting the risk-free rate) and the policy environment. On interest rate, we depict an investment-friendly world with low interest rates reflective of the time after the financial crisis in 2008 (2009–2013) and a cash-constrained world with high interest rates reflective of the most recent full year of data available (August 2023–July 2024; Methods). For policy, we contrast a de-risked scenario, where European policymakers issue a complete price and off-taker guarantee to lower investment risk, with a commercial scenario, where investment risk lies entirely with the project sponsor. The COC in the de-risked scenario differs by country despite identical offtake guarantees because, based on expert interviews, we assume projects require insurance against expropriation and war by the World Bank Group (Methods provide operationalizing scenarios). As such, the COC can be understood as an aggregate financial metric, which includes underlying techno-economic and socio-political risks. Contrary to many existing reports12, which calculate the cost of green H2 first and then incorporate risk as a qualitative contextual factor, this approach allows us to consider these risks and their variance by country explicitly in the modelling of the cost of green H2 via the COC.

Figure 2 shows the calculated COC for green H2 projects by country, including investment into dedicated renewable generation and transport infrastructure, for scenarios 1 and 2. These are most representative of the current macroeconomic environment where interest rates are relatively high (Methods), and they illustrate the de-risking effect of offtake guarantees by European governments. Data on scenarios 3 and 4 are provided in Supplementary Fig. 1.

a, COC for a private commercial and a public de-risked scenario in a high general interest environment (scenarios 1 and 2). b, Average COC for all scenarios. Country COC for a low interest rate environment is provided in Supplementary Fig. 1. Country differences result from different investment risks based on default spreads, whereas differences between policy scenarios—commercial versus de-risked—are the result of different sources of capital and premia (Methods). Excludes landlocked countries and Libya and Somalia (Methods).

Figure 2 shows the large variance in commercial COC across the sampled countries, from 26.5% in Sudan to 10.6% in Morocco with an average of 15.5%. It also shows that de-risking projects has two effects. First, it lowers the COC for all countries to 9.0% on average (a 42% reduction). This improves the economic viability of green H2 substantially as shown in subsequent analyses (Figs. 3–5). Second, de-risking reduces the variance of COC across countries. Whereas in the commercial scenario, COC varies by 15.9 percentage points across countries, this variance reduces to 1.9 percentage points in a de-risked scenario. Hence, de-risking acts as a leveller, bringing green H2 costs across different countries much closer together.

Each violin plot shows the distribution of LCOH for imports from all modelled locations to Rotterdam. The width of the violin indicates the density of the distribution. Scenarios are defined as shown in Table 1. The orange line represents the cost of producing green H2 in Rotterdam by 2030 as described in Methods; the green line shows green H2 least cost realized in the European Hydrogen Bank auction closed in February 2024 with production scheduled to start in 2029 at the latest (Supplementary Table 6). Colours indicate the cost competitiveness with European green H2 projects, where blue is ‘in the money’ compared to the cost of green hydrogen produced in Rotterdam. Note that violin plots are fizzy at the end points, which exceed the minimum/maximum of the distribution. Supplementary Fig. 8 provides a boxplot for clear minimum/maximum values. The dotted line on the colour bar denotes the mean modelled cost of hydrogen produced in Rotterdam across the four scenarios. Dashed black lines within the violin plots indicate the median, and dotted black lines indicate the 25th and 75th percentiles. Supplementary Table 2 provides exact values. Excludes landlocked countries and Libya and Somalia (Methods).

a, LCOH for scenario 2, cash-constrained de-risked. b, LCOH for scenario 1, cash-constrained commercial. Countries are ordered by median LCOH in scenario 2. The orange line represents the cost of producing green H2 in Rotterdam by 2030 as described in Methods. Colours are on the same scale as in Fig. 3 and indicate the cost competitiveness with European green H2 projects, where blue is ‘in the money’ compared to the cost of hydrogen produced in Rotterdam, yellow is near the European cost and red is likely to be uncompetitive. Dashed black lines within the violin plots indicate the median and dotted black lines indicate the 25th and 75th percentiles. Supplementary Fig. 2 details scenarios 3 and 4. Excludes landlocked countries and Libya and Somalia (Methods).

a, LCOH for scenario 2, cash-constrained de-risked. b, LCOH for scenario 1, cash-constrained commercial. c–i, Detailed maps for Angola (c), Egypt (d), Kenya (e), Mauritania (f), Morocco (g), Namibia (h) and South Africa (i). The detailed map costs shown are for scenario 2, cash-constrained de-risked. Supplementary Fig. 4 details scenario 1. Supplementary Fig. 3 provides continent maps for scenarios 3 and 4. Countries are not shown to scale to improve readability; each hexagon is the same area across all sub-figures. Colours indicate the cost competitiveness with European green H2 projects, where blue is ‘in the money’ compared to the cost of hydrogen produced in Rotterdam, yellow is near the European cost and red is likely to be uncompetitive. The dotted line on the colour bar denotes the mean modelled cost of hydrogen produced in Rotterdam across the four scenarios. Stars denote planned projects, as listed in Fig. 1. Triangles denote the respective port of the country. Basemaps from GADM.

Finally, the absolute de-risking effect amounts to 6.5 percentage points, irrespective of the interest rate environment (Fig. 2b), which translates into a relative reduction of 42–52% depending on the interest rate scenario. Hence, the policy effect of 6.5 percentage points exceeds the difference between the two interest rate scenarios of 3 percentage points, and the combined difference of policy and interest rate environment amounts to a staggering 9.5 percentage points (average difference between scenarios 1 and 4).

Levelized cost of exported green H2

The GeoH2 model is employed to calculate the LCOH achievable in each country by optimizing location-specific production, transport, storage and conversion. The greenfield cost of NH3 production from renewable electricity is modelled for 10,300 hexagons (~1,770 km2 each) covering the 31 sample countries (Methods). A plant size of 300 MW, the median size of African projects with a planned operation by 2030, is modelled (Fig. 1). Hourly solar and wind data are used to optimize solar PV, onshore wind, battery storage, electrolysis, H2 storage and NH3 storage, subject to realistic technical constraints (Methods). As we consider plants to be operational by 2030, we focus on shipping to Europe (that is, Rotterdam) rather than pipeline transport, a potential option for North African countries. Given the recent results of H2Global auctions, shipping is confirmed to be the most realistic option for North African countries, such as Egypt, too. We assume the NH3 is transported from the production location to the closest domestic port and shipped to Rotterdam, where it is converted into green H2. Pipeline and trucking transport to the port are considered; the cheapest option is selected for each hexagon. Shipping costs to Rotterdam are calculated per distance based on the literature (Methods). LCOH is calculated for each hexagon using country-specific COC values (for example, as in Fig. 2) for the four scenarios in Table 1. The results are contrasted with a European green H2 cost estimate inferred from our model and triangulated with values from literature.

Figure 3 shows the resulting LCOH distribution across the sampled coastal African countries under each financing scenario. In a high interest environment (scenarios 1 and 2), least costs for green H2 exported from Africa are €4.9 kgH2−1 without policy support and €3.8 kgH2−1 when fully de-risked by European governments. In a low interest environment (scenarios 3 and 4), these costs come down to €4.2 kgH2−1 and €3.2 kgH2−1, respectively. Recent auction results from H2Global point to a price of green H2 around €4.5 kgH2−1 for de-risked delivery to Rotterdam from 2027 until 203326, well in line with our results. Our results also demonstrate the importance of de-risking, which reduces least costs by €1.1 kgH2−1 and median costs by €3.9 kgH2−1 (average between high- and low interest environment).

The lowest achievable costs in the sampled African countries are roughly in the range of estimates for European green H2 by 2030, around €3–5 kgH2−1 (Methods), demonstrating that achieving cost competitiveness with European green H2 will be challenging. In the current high interest macroeconomic environment, cost-competitive production (that is, below costs in Rotterdam estimated at €4.67–4.75 kgH2−1 with slight variations according to scenarios; Methods and Supplementary Table 2) is unattainable without de-risking. With de-risking, only 2.1% of all studied locations are economically competitive (Supplementary Table 2 and compare Fig. 4). These are situated in Algeria, Kenya, Mauritania, Morocco, Namibia and Sudan. In a low interest rate environment, the proportions of locations reaching cost competitiveness without de-risking remains minimal at 0.5% (11.0% with de-risking). We find no location competitive with the first round of auction results by the European Hydrogen Bank, which yielded a lowest bid of €2.8 kgH2−1 in Spain (Supplementary Table 6).

De-risking not only increases the number of cost-competitive African locations but also narrows the cost distribution substantially across countries. Costs range from €4.9–22.8 kgH2−1 without de-risking in the current macroeconomic environment but only from €3.8 to €12.0 kgH2−1 with de-risking. Irrespective of the interest rate environment, the lowest-cost locations for green H2 production without de-risking are mainly in Morocco and Algeria, due to their relatively good institutional quality, exceptional wind resources and relative proximity to Rotterdam. With de-risking, the lowest-cost locations shift to Mauritania with a few in Algeria and Namibia. Whereas Mauritania shares Morocco’s advantages in wind resources and proximity to Europe, it has lower institutional quality, reflected in its higher COC compared to Morocco (that is, 13.6% versus 10.6% without de-risking, 8.6% versus 8.1% with de-risking).

To further clarify spatial cost variance, Fig. 5a,b maps continent-wide LCOH for scenarios 1 and 2 alongside planned project locations (Supplementary Fig. 3 for scenarios 3 and 4). It also shows detailed LCOH for countries with planned projects above 1 MW for scenario 2 (Fig. 5c–i and Supplementary Fig. 4 for scenario 1). Most low-cost regions are north of the Equator, with some in the Southern Hemisphere. Equatorial costs are high due to moderate wind resources and consistent cloud cover, increasing renewable energy cost and thus LCOH. We identify least-cost green H2 production locations in the Western Sahara (modelled as part of Morocco, the authors make no statement about its political status), Mauritania, Central Algeria, at the Sudanese–Egyptian border and Lake Turkana’s shores at the Kenyan–Ethiopian border. Some coastal areas in Namibia and South Africa also exhibit low costs as shown in Fig. 5h,i.

To increase the number of cost-competitive African green H2 production locations, cost drivers and cost-reduction levers must be identified. To this end, a detailed cost breakdown for the least-cost green H2 location by country is provided in Fig. 6. This figure shows that the lowest LCOH is achieved by leveraging excellent onshore wind resources, which facilitate lower-cost green H2 production than solar photovoltaics (PV) systems due to their more consistent electricity output. Scrutinizing the temporal optimization results, we find that NH3 and compressed H2 storage are used to balance intermittent renewable energy generation and demand more cost competitively than battery storage in all examined countries’ least-cost production locations (Supplementary Fig. 5). Nevertheless, more consistent wind resources reduce the expenditure required for any form of storage, driving down costs.

Cost for the least-cost location in each country under scenario 2, cash-constrained de-risked. Supplementary Fig. 6 shows scenario 1. ‘Other’ contains costs for H2 compression and decompression, trucking transportation, battery interface, Haber–Bosch process, H2 fuel cell and a ramping penalty. Excludes landlocked countries and Libya and Somalia (Methods).

Figure 6 also shows that renewable energy investment constitutes the largest cost component for all countries. This points to two levers for cost reductions. First, lowering renewable energy costs would directly reduce the cost of green H2. This could potentially enhance the cost competitiveness of African green H2 exports, depending on concurrent impacts on European electricity prices, as these would probably move too if renewable energy costs shift drastically. Note that we currently consider a Rotterdam reference case using grid electricity. If contrasted with a newly built renewable energy production facility, wind energy cost changes would only affect the relative cost advantage to the extent that African projects face a higher COC and therefore benefit from a CAPEX reduction slightly more. Secondly, efficient de-risking (that is, maximally reducing the COC) can lower COC-intensive investments into renewables and consequently green H2 costs. Whereas movements in the general interest rate would affect the cost competitiveness of African projects compared to European ones only to the extent that African projects are more capital intensive because they require greenfield renewable energy, strong de-risking would improve the cost competitiveness of African projects directly. Finally, shipping costs are shown to have a marginal impact on LCOH. This suggests that potential economies of scale in NH3 shipping or repurposing existing pipelines from northern Africa to southern Europe may not notably enhance cost competitiveness of African green H2. On the upside, it indicates that uncertainties around NH3 shipping costs should not constitute a major impediment to planning green H2 export projects in African countries. We conduct a sensitivity analysis shown in Supplementary Fig. 7 where we vary the most important and most discussed input costs (that is, wind, solar PV and electrolyser CAPEX) by ± 20% for each financing scenario, indicating that a combination of wind and electrolyser CAPEX reductions could lower costs by roughly €0.5 kgH2−1 depending on the scenario. We note that battery storage costs may also decrease substantially making solar PV a more viable electricity source by powering the electrolyser at night (compared with Supplementary Fig. 5). However, for the purpose of this analysis, we subsume this effect into the modelled cost decrease of solar PV, which yielded minimal benefits as shown in Supplementary Fig. 7.

Discussion

Our findings indicate that using African green H2 to decarbonize hard-to-abate sectors in Europe might be unrealistic without de-risking from European countries, at least in the near-term. In a commercial scenario, green H2 from Africa is not cost competitive by 2030. With de-risking, several locations (2.1% of all studied) become cost competitive, yet questions around the economic feasibility of large infrastructure projects in many of these locations remain, as they face challenging localized security situations. Notwithstanding these challenges, de-risking is probably necessary to develop a market with a sufficient portfolio of potential locations, and future research is required to assess the potential for improved competitiveness beyond 2030.

Results also illuminate potential issues beyond cost that could hinder investment. First, many low-cost locations are in regions that are either politically contested or encounter relatively regular flares of armed conflict where the UK and German governments advise against travel. These include Western Sahara (partly), Central Algeria (border areas), the Sudanese–Egyptian border (entire Sudan) and the Kenyan–Ethiopian border (border areas in Ethiopia)27,28. Multilateral Investment Guarantee Agency (MIGA) or off-taker guarantees are probably unavailable in these areas, limiting de-risking potential. While beyond the scope of this paper, future analyses could consider investment risk variations within countries, including in specific regions with severe political instabilities. Second, the size of the planned investments relative to the GDP raises questions on feasibility. For example, as of 2021, the gross domestic product (GDP) of Mauritania is roughly US$10 billion; however, the planned green H2 project Aman is estimated to require an investment of US$40 billion, four times the country’s GDP29,30. This situation is concerning as many African countries face massive foreign debt burdens31. Third, whereas we find that wind resources are critical to low-cost green H2 production, local expertise to install this wind capacity may be insufficient. For context, there were 7.7 GW of installed wind capacity on the continent in 2022 (versus 12.5 GW of solar PV)15; meanwhile, wind plants on GW scale will be needed for each H2 production site (for example, up to 1.6 GW in Morocco), requiring massive upskilling efforts. Finally, some low-cost locations, such as those near the Red Sea or the river Nile in Egypt, may also face challenges of water insecurity potentially disrupting consistent production. Whereas water costs are considered in GeoH2, the potential for water depletion and associated conflict risks are not at present.

African countries will face global competition for cheap green H2 production from countries such as Chile32, Oman33 and Saudi Arabia1 with plans to expand production of H2 and downstream products (for example, iron). These countries have the domestic financial resources to fund infrastructure development, institutional frameworks to attract large international private investment and strategic locations along major international trading routes. European countries such as Spain also offer favourable H2 production costs, low COC and proximity to demand locations17. Tailored de-risking support from international organizations, such as the World Bank or the United Nations Development Program34,35, may therefore be necessary for African nations to compete. The use of such support tools should be contingent on the provision of benefits of green H2 production for local economies beyond export revenues only.

Similarly, African countries should consider such benefits in bilateral negotiations with prospective green H2 importers. Considering the prospects for local industrial use of green H2 (for example, in creating value-added downstream products) when designing policy support schemes may favour countries such as Morocco, Egypt, South Africa or Kenya, in contrast to Mauritania or Namibia, as the latter exhibit less fitting industrial pre-conditions, which are relevant for the successful implementation of green H2 production value chains36. African countries could also strike intra-continental agreements concerning the optimal production, use and trade of green H2, which may necessitate modelling costs for countries that are excluded in the present analysis. International organizations may consider de-risking local use in such cases. Whereas potentially more challenging, such multi-use projects may improve developmental impacts and avoid neo-colonial extractive patterns of excessively large, export-only projects—a risk evident in planned projects. Comprehensive plans for economic development around green H2 production will be crucial to ensure a beneficial industry for decarbonization in Europe and development in Africa alike.

Methods

Sample

As described in the flowchart in Supplementary Fig. 9, we start by describing the sample. We model the LCOH for all African countries with access to ports, excluding landlocked countries, due to the logistical and infrastructural complexities that hinder H2 export from these areas. Further, Somalia and Libya are excluded from our analysis given that in the past 5 years, both countries were in the bottom 5% of the World Bank Governance Indicators in terms of political stability37. It is therefore likely that investors would refrain from any project in these countries, irrespective of the theoretical COC. Finally, we exclude small island states such as Cape Verde or Mauritius from our analysis due to space and infrastructure constraints. This yields a list of 31 African countries for our sample, which constitutes 85% of total African GDP38.

To collect planned green H2 projects, we use the International Energy Agency’s (IEA) Hydrogen Database, which lists 1,991 H2 projects as of December 202322. Of these, 66 projects are located in our sample countries and plan to produce H2 from electrolysis using renewable electricity from either wind or solar. Note that our scope excludes two projects in Zimbabwe, one of which was decommissioned in 2015, and one project in Niger. We further restrict our sample to projects planned to go online by 2030 for two reasons. First, announced projects with live dates beyond 2030 are probably speculative, and it is difficult to assess the credibility of the plans. Second, the COC and several other cost factors, such as the cost of renewables or the cost of NH3 shipping are changing over time, making cost projections beyond 2030 difficult.

The final green H2 project sample consists of 34 projects, for which we include the project’s development status, planned first year of operation, designated end-use applications and size in standardized electrolysis capacity as calculated by the IEA in MW H2 output (LHV) for all Power-to-X projects (Supplementary Table 3)22. We use the median planned capacity of 60.6 kt H2 yr−1 as the green H2 demand for the LCOH modelling. Capacity affects the LCOH via economies of scale (for example, in the electrolyser) and space constraints as larger projects need more space, mainly for renewable energy build-out.

Estimating the cost of capital

Between February and August 2023, F. Schneider and F. Egli conducted 12 virtual exploratory expert interviews with 13 representatives to inform the financing scenarios shown in Table 1. Because green H2 projects at scale are currently hypothetical on the African continent, the interviews served to understand the planned financing structures. All interviews followed the same question guide provided in a slide deck to interviewees. Interviewees were sampled from organizations that would probably be involved in financing deals if de-risked by European policymakers. Early interviewees were contacted using the researchers’ network and subsequent ones via snowball sampling. Systematic sampling is impossible because few experts globally can comment on the planned financing structures. Note that interviews only served to triangulate our COC estimation approach, which is based on peer-reviewed literature. Hence, we are less concerned about potential sampling biases regarding gender or region. Interviews took place under Chatham House rules, and consent to use provided information in research was obtained at the beginning together with shared information on the research project in the form of a slide deck. No personal information beyond participants’ names and affiliations was obtained and interviewees are listed anonymously only. An overview of the interview sample is provided in Supplementary Table 4.

The COC is the price that a profit-maximizing capital provider demands for investing equity into a project or issuing debt (for example, loans) for a project. The COC increases with the risk for an investor of being unable to recoup their investment, for example, due to uncertain policy environments or novel risky technologies. In financial economics, it is common practice to decompose the COC into a risk-free rate (reflecting the time value of money) and a risk premium (reflecting the investment-specific risk). The latter typically differs between countries, technologies and over time39. A standard project-level specification of the COC is the weighted average cost of capital (WACC), where capital is sourced from equity and debt financing. The WACC reflects the costs of obtaining debt and equity financing, respectively, and the share of each type within the total capital budget. In line with the literature39, a standard notation ‘vanilla-WACC’ (no consideration of potential tax deductions for debt payments) can be defined as follows:

where \({K}_{{\mathrm{e}},{{i}}}\) and \({K}_{{\mathrm{d}},i}\) denote the cost of equity and the cost of debt, respectively, for investments in a specific country i. \(E\), \(D\) and \(V\) denote total equity, debt and capital; the debt share is denoted as \(\frac{D}{V}\). As we model the case of exporting green H2 from Africa to Europe, it is uncertain which entities would be liable to pay tax where and we do not consider a country-specific tax rate. We use the terms COC and WACC interchangeably in this paper, focusing on COC in the main text for simplicity. In the absence of a track record for the financing of green H2 projects globally and certainly in Africa, we define four financing scenarios to model the COC based on insights from the finance literature and expert interviews (Table 1, main text).

Across all financing scenarios, we use a separate COC for the plant investment encompassing H2 production facilities (for example, the electrolyser), the renewable energy generation assets and the supporting infrastructure encompassing roads, pipelines and so on. The risk-free rate \({r}_\mathrm{f}\) is based on two indicators: a long-term risk-free bond, commonly depicted with the 10-year US treasury bond yield and an overnight interbank rate reflecting the current interest rate environment, commonly depicted with the Effective Federal Funds Rate (FFR). In line with previous work40, we estimate \({r}_\mathrm{f}\) for a high and a low interest rate scenario to account for the fact that the interest rate environment has a large impact on the cost of renewables. We set \({r}_{\mathrm{f}_{\mathrm{low}}}\) to 2%, which is reflective of the 5-year average of the 10-year treasury bond in the aftermath of the financial crisis of 2008 between 2009 and 2013 (2.68%), considering the FFR was substantially lower during that period (0.14%)41,42. Conversely, \({r}_{\mathrm{f}_{\mathrm{high}}}\) is set to 5%, which is representative of the high interest environment over the last year (August 2023–July 2024) at the time of writing. During this period, the average 10-year US treasury bond yield stood at 4.33% and the FFR at 5.33% (refs. 41,42). In this Article, we therefore consider the high interest rate environment (Table 1) to be representative of the status quo. The share of debt in total financing, \(\frac{D}{V}\), is assumed to be 75% across all scenarios18.

We model a commercial scenario in both interest rate environments (Table 1, main text). For these commercial scenarios 1 and 3, we define the cost of debt to reflect lending to a large infrastructure project in a specific country. Namely, we add a country default spread to reflect country risk43 (\({\mathrm{CDS}}_{{\mathrm{Host}}_{i}}\)) and a lender margin (\({L}_\mathrm{m}\)), which we set to 2% in line with the literature15,44,45, to reflect infrastructure risk. The country default spreads are reflective of country risk at the time of writing in 2023. The cost of debt for the plant is therefore given by:

Similar to the cost of debt, the cost of equity contains a country mark-up. Furthermore, we add an equity risk premium and a technology premium to reflect the additional risk of equity compared to debt and the risk of green H2 investments, as there is a very limited track record. The cost of equity for commercial scenarios was calculated as follows:

where ERP is the equity risk premium of a mature market, set to 5% in July 202343. \({\mathrm{CRP}}_{{\mathrm{Host}}_{i}}\) varies by country i and accounts for the return that investors require as compensation for the risk of an investment in a publicly listed company in each country. In addition, the technology premium (Tp) reflects that green H2 is a relatively immature technology with a limited track record of successfully constructing large-scale projects. Following a recent IRENA report15, Tp is set to 3.25%, reflecting an investment premium for novel technologies. Because ref. 43 does not provide \({\mathrm{CDS}}_{{\mathrm{Host}}_{i}}\) and \({\mathrm{CRP}}_{{\mathrm{Host}}_{i}}\) for Eritrea, Equatorial Guinea, Djibouti and Mauritania, \({\mathrm{CDS}}_{{\mathrm{Host}}_{i}}\) is obtained using Wikiratings as described in Supplementary Table 5. Thereafter, \({\mathrm{CRP}}_{{\mathrm{Host}}_{i}}\) is calculated following the approach suggested by ref. 43.

Finally, we assume that any supporting infrastructure will be financed by a project’s host government at its sovereign rate. Consequently, the COC for infrastructure is given by:

For the de-risked scenarios 2 and 4 (Table 1, main text), we model a situation where a green H2 project on the African continent benefits from access to below-market terms financing due to an offtake guarantee from a western European government entity. This assumption follows developments driven in particular by Germany, which has established diplomatic relations to support the transition of current fossil fuel exporting nations such as Angola or Nigeria to a decarbonized energy export industry by substituting fossil fuel exports at least partially by H2 (ref. 46). Moreover, Germany has recently announced a joint declaration of intent with the Netherlands to implement a joint tender under the H2Global Instrument, offering 10-year purchase agreements to suppliers to kick-start the emergent European green H2 import market47. Finally, Germany has signed further bilateral partnership agreements with countries such as South Africa48, Namibia49 and Kenya50.

In these scenarios, the cost of debt can be represented as follows:

where \({\mathrm{CDS}}_{\mathrm{WesternEU}}\) represents the average default spread of a western European country weighted by its GDP, where western Europe includes Andorra, Austria, Belgium, Cyprus, Denmark, Finland, France, Germany, Greece, Guernsey, Iceland, Ireland, Isle of Man, Italy, Jersey, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey and the United Kingdom43. In July 2023, this amounted to 0.96% (ref. 43). Despite the offtake guarantee, certain risks, such as the risk of expropriation or war, will remain. Consequently, we assume that in scenarios 2 and 4, investors will seek insurance against such political risks, which could disrupt operations or damage assets. Informed by the expert interviews and because private political risk insurance is not available in most countries in our sample, we assume political risk insurance by the World Bank Group’s Multilateral Investment Guarantee Agency (MIGA). \({\mathrm{MIGA}}_{{\mathrm{expr}}_{i}}\) and \({\mathrm{MIGA}}_{{\mathrm{war}}_{i}}\) represent the price for obtaining such coverage for war and expropriation risk. As the MIGA pricing is confidential, we develop a heuristic to approximate the pricing based on reports and the expert interviews. Reference 51 states that the price per MIGA risk ranges from 0.5% to 1.75% of the total sum insured, depending on the country and project risk. Assuming that in a de-risked scenario, only country risk will remain as the project is fully de-risked, the distribution of in-sample country risk, reflected by the credit default spread provided by ref. 43 can be mapped onto the pricing range indicated by ref. 51. Formally, the approach can be represented as follows:

where \(x\) is the percentile of the default spread of a country based on ref. 43, \(g\left(x\right)\) returns the percentile of the CDS in the sample distribution and f() maps the percentile to the corresponding percentile of the MIGA pricing range51.

The cost of equity was calculated as follows:

where \({\mathrm{CRP}}_{\mathrm{WesternEU}}\) reflects the average equity country risk premium in Western Europe weighted by GDP. In July 2023, this premium was 1.37% (ref. 43).

Finally, we assume that infrastructure in the de-risked scenarios is either financed by the host government, that is, as in the commercial scenarios or financed by the project sponsor backed with an offtake guarantee from a western European government. We therefore define the COC for infrastructure investments in the de-risked scenarios as the minimum of the host government’s sovereign rate \({\mathrm{WACC}}_{\mathrm{commercial},\mathrm{infra}}\) and the de-risked COC based on \({K}_{\mathrm{e},i,\mathrm{derisked},\mathrm{plant}}\) and \({K}_{\mathrm{d},i,\mathrm{derisked},\mathrm{plant}}\). A detailed breakdown of how the COC components were obtained and the corresponding data sources are provided in Supplementary Table 5.

Modelling the LCOH

The GeoH2 optimization model is used to calculate the lowest possible cost of H2 achievable throughout each country, assuming an electrolyser lifetime of 20 years. Electrolyser lifetimes are subject to some uncertainty, but do not have a major impact on LCOH52 and most importantly for this analysis, affect the LCOH in European and African countries alike except for a small penalty for Africa-based production due to higher financing costs on the CAPEX. The model tessellates the country into hexagons and calculates the costs to (1) produce the specified quantity of green H2 (or here green NH3) in each hexagon, (2) convert it to the required state for transport and (3) transport it to a specified demand location. In each hexagon, a cost-optimal off-grid H2 plant powered by PV and wind turbines is designed to meet the specified demand. The electrical infrastructure (that is, PV, turbines, battery storage) and plant infrastructure (that is, electrolyser, NH3 storage, compressed H2 storage) are sized for cost optimality using site-specific, hourly weather data from the European Centre for Medium-Range Weather Forecasts Reanalysis v5 dataset53. Here data for the duration of 2022 are used. The Corine Land Cover54 and OpenStreetMap55 datasets are used to constrain land availability in each hexagon, and country boundary base maps are from GADM, which allows free academic re-use. The costs to transport the H2 to port are calculated for both road transport (that is, trucking) and pipeline transport, including construction of necessary infrastructure. Water costs for either desalination or freshwater processing are included as applicable—however, no limit is placed on water consumption to avoid depletion in either case. Cost parameters used in the modelling are available in Supplementary Table 1 and harmonized to 2023 euros using average annual US$/€ exchange rates from the Economic Research Division of the Federal Reserve Bank of St. Louis and an annual average of the Harmonized Index of Consumer Prices from Eurostat. Further details on the GeoH2 model implementation are available in the model descriptor14.

The model is applied to each country in the project sample. A demand of 60.6 ktH2 yr−1 is simulated at each country’s main port. This demand is assumed to be met in the form of green NH3 (that is, 341.4 ktNH3 yr−1) due to its cost advantages in shipping and to be temporally uniform (that is, evenly spaced truck pick-ups throughout the year or a consistent pipeline flow rate). As NH3 is utilized as a transport vector, we build on the ammonia trade literature. A first stream of this literature investigates green ammonia costs in/from specific countries56,57 and trading routes58 whereby a second stream of literature looks at global ammonia trade. Reference 59 applies a global optimization model to locate optimal ammonia production sites, however the site selection is based on a previous paper and planned projects, considering a total of 112 sites. Such models are great to assess the cost competitiveness of planned projects; however, they cannot compare these to alternative possibilities as we do for the African continent. Finally, ref. 60 applies a geospatial model in 28 countries with a less granular resolution within country and abstracting from water costs and transportation options to port (pipeline vs trucking), which are included in this paper. Hence, whereas the key contribution of this paper is the inclusion and comparison of different financing and policy scenarios and the explicit calculation of the cost differentials for the entire African continent, we also apply a state-of-the-art bottom-up model, which can serve to improve within-country cost comparisons.

Country-specific figures are used for energy prices, heat prices and interest rates. Level-four H3 hexagons61 are used to define the spatial resolution. Land availability is constrained such that H2 production and associated generation are not permitted to be built on wetland, built-up areas, water bodies or within 250 m of coastlines or protected areas. PV is additionally not permitted to be built on agricultural land. Whereas elevation is not considered as an exclusion criterion here due to data constraints, future work may also wish to exclude high elevations or steep slopes. All maps are based on the authors’ own analysis of publicly available input data. Note that this work leverages a model of the Haber–Bosch process in plant optimization in place of the H2 production process available in the standard GeoH2 model14. This variant of the codebase is made available on GitHub (Code Availability).

To account for shipping costs, the sea distance from each of the exporting ports to Rotterdam is first calculated using the ShipTraffic website62. Previous work has estimated the cost of shipping NH3 over a distance of approximately 13,800 km to be €0.39 kgH2−1 (ref. 13). Following ref. 24, shipping cost projections depend approximately linearly on transport distance. Consequently, we scale this estimate linearly to km, resulting in our cost parameter of €0.00003 kgNH3−1 km−1, which we multiplied with each of the obtained distances from the African port to Rotterdam. Implementing this approach yields a shipping cost range of €0.09 kgH2−1 (Morocco)–€0.44 kgH2−1 (Mozambique), in line with other estimates in the literature, according to which shipping could add up to €0.46 kgH2−1 by 203063.

The interest rates for Rotterdam are obtained following the same approach as for all other countries described in Methods and following previous work, heat costs of €0.06 kWh−1 are assumed for converting NH3 to H2 (ref. 13). Note that the cost of this process is subject to some uncertainty because it does not yet exist at scale. Electricity costs are assumed to be €0.1 kWh−1 and are calculated as the combination of the average price of Dutch Power Base futures64 and the price of a guarantee of origin for renewable electricity. At the time of writing, Dutch Power Base futures are available until October 2028, and the average price obtained is €0.097 kWh−1. Ideally, we would base our calculation on a Dutch Power Base future that matches our modelling period of 20 years. As this is not available, we took the longest available market-based future as input for our simplified model in Rotterdam using constant electricity prices. Moreover, future prices reflect the current interest rate environment; hence, we deem our Rotterdam costing most representative for scenarios 1 and 2, on which all results in the main text are based and suggest some caution when using it for scenarios 3 and 4. On the basis of grey literature65, an average price of a guarantee of origin of €0.055 kWh−1 by 2030 is assumed. Whereas Rotterdam serves as our comparison case, the resulting electricity cost is deemed representative of the European Union as a whole, given that historically, Dutch wholesale electricity prices were strongly correlated with German wholesale electricity prices, and the Dutch wholesale price roughly represents the average wholesale electricity price in Europe66.

Our modelling excludes two cost components: namely, (1) costs associated with upgrading ports to enable large-scale NH3 shipments and (2) costs for last-mile distribution in Europe. Both would require detailed information (that is, on port design and demand locations respectively), which is beyond the scope of this analysis. Furthermore, our model does not account for potential cost reductions in onshore wind, solar PV, electrolysers and battery storage that may occur by the year 2030. Such cost decreases will not only reduce the cost of green H2 projects in Africa but may also influence renewable deployment in Europe and, therefore, European wholesale electricity prices. As such, the net effect on the cost competitiveness of African green H2 exports vs European green H2 production remains inconclusive.

Finally, we calculate the LCOH in Rotterdam to create a European cost benchmark. We use the same assumptions for electricity and heat costs as mentioned above to model LCOH for green H2 produced in Rotterdam using grid electricity due to space constraints for renewable energy. Due to the absence of renewable energy investments, these projects are much less capital intensive, and variations in the COC, therefore, are less important for LCOH. Note that recent auctions by the European Hydrogen Bank have yielded winning projects using grid electricity and/or greenfield renewable energy. Here we consider the former case only, whereas future research could model European least costs more comprehensively by considering all locations in Europe with their respective transport costs to demand centres. We calculate an LCOH for production in Rotterdam for each financing scenario shown in Table 1 and obtain an LCOH of €4.74 kgH2−1 for scenario 1, €4.72 kgH2−1 for scenario 2, €4.69 kgH2−1 for scenario 3 and €4.67 kgH2−1 for scenario 4 (Supplementary Table 2). Because large green H2 production plants do not currently exist, cost estimates are not commonly available, but several reports have tried to estimate costs. These are broadly in line with our costs; for example, Aurora Energy Research estimates the least-cost LCOH in Germany by 2030 between €3.9 and €5 kgH2−1 (ref. 67). Other research reports even lower 2030 costs for Germany of US$3.1 kgH2−1 in a baseline scenario and US$2.7 kgH2−1 in an optimistic scenario68, which is roughly the range where the IEA Global Hydrogen Review places North-Western European green H2 costs by 2020 (€3.1 kgH2−1) (ref. 1). Other European locations, such as Spain, with more favourable renewable energy sources and similarly favourable financing costs, may reach even lower costs by 2030 at €2.7 kgH2−1 as estimated by the Hydrogen Council and McKinsey69. These costs have been confirmed by the results of the recent European Hydrogen Bank auction yielding a lowest bid in Spain at €2.8 kgH2−1. For the four other countries where least costs were disclosed, they ranged from €4.6 kgH2−1 in Norway to €7.6 kgH2−1 in the Netherlands (Supplementary Table 6). Note that we prefer comparing our results to realized costs as comparisons across studies with different methodological approaches, spatial resolutions, geographical and technological scopes and policy cases considered are difficult (Supplementary Table 7). A thorough comparison of different studies on the subject would require a separate review article with a methodological approach to render comparisons meaningful.

Data availability

Techno-economic modelling data and assumptions are included and referenced in the Supplementary materials. The full numeric results of the modelling can be made available upon request to A.L.

Code availability

The GeoH2 model is available via Github with a CC-BY-4.0 license at https://github.com/ClimateCompatibleGrowth/GeoH2. GeoNH3, the NH3 module used in this work, is also available via Github at https://github.com/ClimateCompatibleGrowth/GeoNH3.

References

Global Hydrogen Review 2023 (IEA, 2023).

Making the Breakthrough: Green Hydrogen Policies and Technology Costs (IRENA, 2021).

Global Hydrogen Review 2021 (IEA, 2021).

Geopolitics of the Energy Transformation: The Hydrogen Factor (IRENA, 2022).

Global Hydrogen Flows: Hydrogen Trade as a Key Enabler for Efficient Decarbonization (Hydrogen Council & McKinsey & Company, 2022).

Directorate-General for Energy. Hydrogen. European Commission https://energy.ec.europa.eu/topics/energy-systems-integration/hydrogen_en (2023).

Alsulaiman, A. Renewable Hydrogen Import Routes into the EU OEIS Paper: ET24 (Oxford Institute for Energy Studies, 2023).

EU and Namibia agree on next steps of strategic partnership on sustainable raw materials and green hydrogen. European Commission https://ec.europa.eu/commission/presscorner/detail/en/IP_23_5263 (2023).

Yohannes-Kassahun, B. Green hydrogen to fuel Africa’s rise—hard truths and key questions. UN Office of the Special Adviser on Africa https://www.un.org/osaa/news/green-hydrogen-fuel-africa%E2%80%99s-rise-%E2%80%93-hard-truths-and-key-questions#_ftnref1 (2023).

Genge, L., Scheller, F. & Müsgens, F. Supply costs of green chemical energy carriers at the European border: a meta-analysis. Int. J. Hydrogen Energy 48, 38766–38781 (2023).

Levelised Cost of Hydrogen. Making the Application of the LCOH Concept More Consistent and More Useful (Agora Industry & Umlaut, 2023).

H2 Atlas Africa. Forschungszentrum Jülich https://africa.h2atlas.de/ (2024).

Müller, L. A., Leonard, A., Trotter, P. A. & Hirmer, S. Green hydrogen production and use in low- and middle-income countries: a least-cost geospatial modelling approach applied to Kenya. Appl. Energy 343, 121219 (2023).

Halloran, C., Leonard, A., Salmon, N., Müller, L. & Hirmer, S. GeoH2 model: geospatial cost optimization of green hydrogen production including storage and transportation. MethodsX 12, 102660 (2024).

The Cost of Financing for Renewable Power (IRENA, 2023).

Moritz, M., Schönfisch, M. & Schulte, S. Estimating global production and supply costs for green hydrogen and hydrogen-based green energy commodities. Int. J. Hydrogen Energy 48, 9139–9154 (2023).

Hank, C. et al. Site-specific, comparative analysis for suitable power-to-X pathways and products in developing and emerging countries. Fraunhofer Institute for Solar Energy Systems ISE https://www.ise.fraunhofer.de/en/publications/studies/power-to-x-country-analyses.html (2023).

Green Hydrogen Opportunities for Emerging and Developing Economies: Identifying Success Factors for Market Development and Building Enabling Conditions Vol. 205 (OECD, 2022).

Global Hydrogen Trade to Meet the 1.5 °C Climate Goal: Green Hydrogen Cost and Potential (IRENA, 2022).

Egli, F., Steffen, B. & Schmidt, T. S. Bias in energy system models with uniform cost of capital assumption. Nat. Commun. 10, 4588 (2019).

Brauner, S., Lahnaoui, A., Agbo, S., Böschen, S. & Kuckshinrichs, W. Towards green hydrogen?—a comparison of German and African visions and expectations in the context of the H2Atlas-Africa project. Energy Strategy Rev. 50, 101204 (2023).

Hydrogen Production and Infrastructure Projects Database - Data product (IEA, 2023); https://www.iea.org/data-and-statistics/data-product/hydrogen-production-and-infrastructure-projects-database

GH2. GH2 country portal—Mauritania. Green Hydrogen Organisation http://gh2.org/countries/mauritania (2022).

Schuler, J., Ardone, A. & Fichtner, W. A review of shipping cost projections for hydrogen-based energy carriers. Int. J. Hydrogen Energy 49, 1497–1508 (2024).

Global Hydrogen Trade Outlook (IRENA, 2022).

Wichtiger Schritt für globalen Wasserstoffhochlauf – Deutschland importiert ab 2027 mit H2Global grüne Wasserstoffprodukte im großen Umfang. German Federal Ministry for Economic Affairs and Climate Action https://www.bmwk.de/Redaktion/DE/Pressemitteilungen/2024/07/20240711-h2global.html (2024).

Foreign travel advice. GOV.UK https://www.gov.uk/foreign-travel-advice (2023).

Federal Foreign Office. Reisehinweise. Auswärtiges Amt https://www.auswaertiges-amt.de/de/ReiseUndSicherheit/reise-und-sicherheitshinweise (2024).

Mauritania and CWP sign a framework agreement for the US$40 billion AMAN green hydrogen project. CWP Global https://cwp.global/mauritania-and-cwp-sign-a-framework-agreement-for-the-us-40-billion-aman-green-hydrogen-project/ (2022).

IMF data mapper—Mauritania datasets. International Monetary Fund https://www.imf.org/external/datamapper/profile (2023).

Africa faces a mounting debt crisis. The Economist (2023).

Bartlett, J. Chile’s bet on green hydrogen. IMF https://www.imf.org/en/Publications/fandd/issues/2022/12/country-case-chile-bet-on-green-hydrogen-Bartlett (2022).

Renewable Hydrogen from Oman–Analysis (IEA, 2023); https://www.iea.org/reports/renewable-hydrogen-from-oman

Scaling Hydrogen Financing for Development (ESMAP, OECD, GIF, & Hydrogen Council, 2023).

Derisking Renewable Energy Investment (UNDP, 2018).

Müller, V. P. & Eichhammer, W. Economic complexity of green hydrogen production technologies—a trade data-based analysis of country-specific industrial preconditions. Renewable Sustainable Energy Rev. 182, 113304 (2023).

Kaufmann, D. & Kraay, A. The Worldwide Governance Indicators: Methodology and 2024 Update Policy Research Working Paper 10952 (World Bank Group, 2024)

GDP (Current US$) (World Bank, 2022).

Steffen, B. Estimating the cost of capital for renewable energy projects. Energy Econ. 88, 104783 (2020).

Schmidt, T. S. et al. Adverse effects of rising interest rates on sustainable energy transitions. Nat. Sustain 2, 879–885 (2019).

Market yield on U.S. Treasury securities at 10-year constant maturity, quoted on an investment basis. Board of Governors of the Federal Reserve System https://fred.stlouisfed.org/series/DGS10 (2024).

Federal funds effective rate. Board of Governors of the Federal Reserve System https://fred.stlouisfed.org/series/FEDFUNDS (2024).

Damodaran, A. Risk Premiums for Other Markets (NYU Stern School of Business, 2023); https://pages.stern.nyu.edu/~adamodar/New_Home_Page/dataarchived.html#discrate

Infrastructure Financing—An Overview (Schroders, 2017); https://mybrand.schroders.com/m/98f972a9379ca480/original/201704_Infrastructure_financing_an_overview.pdf

Amenc, N., Blanc-Brude, F. & Gupta, A. 2019 Global infrastructure investor survey–benchmarking. EDHEC Infra & Private Assets https://edhec.infrastructure.institute/paper/2019-global-infrastructure-investor-survey-benchmarking-trends-and-best-practices/ (2019).

German Federal Foreign Office & GIZ. H2 diplo. GIZ Website https://h2diplo.de/ (2022).

Pearce, O. ‘A common vision’: Germany forge new ties for hydrogen imports with the Netherlands, Africa. Ammonia Energy Association https://www.ammoniaenergy.org/articles/a-common-vision-germany-forge-new-ties-for-hydrogen-imports-with-the-netherlands-africa/ (2023).

Germany and South Africa sign cooperation agreement on green hydrogen. German Federal Foreign Office https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2023/06/20230627-germany-south-africa-cooperation-green-hydrogen.html (2023).

Federal Ministry of Education and Research. Karliczek: Germany and Namibia form partnership for green hydrogen—BMBF. Federal Ministry of Education and Research—BMBF https://www.bmbf.de/SharedDocs/Pressemitteilungen/DE/2021/08/172_namibia_eng.pdf?__blob=publicationFile&v=3 (2021).

Germany backs Kenya hydrogen in raft of African climate pledges. Bloomberg https://www.bloomberg.com/news/articles/2023-09-04/germany-backs-kenya-hydrogen-in-raft-of-african-climate-pledges (2023).

Gatti, S. in Project Finance in Theory and Practice 3rd edn (ed. Gatti, S.) 209–335 (Academic, 2018); https://doi.org/10.1016/B978-0-12-811401-8.00006-4

Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5C Climate Goal (IRENA, 2020).

Setchell, H. ECMWF reanalysis v5. ECMWF https://www.ecmwf.int/en/forecasts/dataset/ecmwf-reanalysis-v5 (2020).

Buchhorn, M. et al. Copernicus Global Land Service: land cover 100 m: collection 3: epoch 2019: globe. Zenodo https://doi.org/10.5281/zenodo.3939050 (2020).

OpenStreetMap Data Excerpts. Geofabrik GmbH & OpenStreetMap Contributors https://download.geofabrik.de/ (2018).

Galimova, T., Fasihi, M., Bogdanov, D. & Breyer, C. Feasibility of green ammonia trading via pipelines and shipping: cases of Europe, North Africa, and South America. J. Cleaner Prod. 427, 139212 (2023).

Egerer, J., Grimm, V., Niazmand, K. & Runge, P. The economics of global green ammonia trade—‘shipping Australian wind and sunshine to Germany’. Appl. Energy 334, 120662 (2023).

Wang, H., Daoutidis, P. & Zhang, Q. Ammonia-based green corridors for sustainable maritime transportation. Digital Chem. Eng. 6, 100082 (2023).

Salmon, N., Bañares-Alcántara, R. & Nayak-Luke, R. Optimization of green ammonia distribution systems for intercontinental energy transport. iScience 24, 102903 (2021).

Franzmann, D. et al. Green hydrogen cost-potentials for global trade. Int. J. Hydrogen Energy 48, 33062–33076 (2023).

H3: Hexagonal Hierarchical Geospatial Indexing System. Uber Technologies https://h3geo.org/ (2023).

Sea distance calculator. ShipTraffic.net http://www.shiptraffic.net/2001/05/sea-distances-calculator.html (2023).

Hydrogen Insights 2021 (Hydrogen Council & McKinsey and Company, 2021); https://hydrogencouncil.com/en/hydrogen-insights-2021/

Dutch power base prices and Dutch power base futures prices. Barchart.com https://www.barchart.com/futures/quotes/ZUZ23/futures-prices (2023).

A booming guarantees of origin market could drive record investments in renewable energy production in Europe. Echoz https://www.ecohz.com/press-releases/a-booming-guarantees-of-origin-market-could-drive-record-investments-in-renewable-energy-production-in-europe (2023).

European power price tracker. Ember https://ember-climate.org/data/data-tools/europe-power-prices/ (2023).

Tracey, M. Renewable hydrogen imports could compete with EU production by 2030. Aurora Energy Research https://auroraer.com/media/renewable-hydrogen-imports-could-compete-with-eu-production-by-2030/ (2023).

Brändle, G., Schönfisch, M. & Schulte, S. Estimating long-term global supply costs for low-carbon hydrogen. Appl. Energy 302, 117481 (2021).

Global Hydrogen Flows—2023 Update (Hydrogen Council & McKinsey and Company, 2023); https://hydrogencouncil.com/en/global-hydrogen-flows-2023-update/

Acknowledgements

A.L. and S.H. acknowledge support from the Climate Compatible Growth (CCG) programme. CCG is funded by UK aid from the UK government. However, the views expressed herein do not necessarily reflect the UK government’s official policies.

Funding

Open access funding provided by Technische Universität München.

Author information

Authors and Affiliations

Contributions

F.E. and S.H. conceived the research idea. F.E., F.S., S.H. and T.S. designed the research plan. F.S. collected the COC data and developed the scenarios and calculations with F.E. A.L. and C.H. curated the data for GeoH2, ran the model and plotted the results. N.S. contributed the NH3 module. F.E. wrote the original draft with input from F.S.; F.S., A.L., S.H., C.H., T.S. and N.S. reviewed and edited subsequent drafts. F.E. and S.H. supervised the research. S.H. acquired funding for Oxford.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Energy thanks Katundu Imasiku and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Figs. 1–9 and Tables 1–7.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Egli, F., Schneider, F., Leonard, A. et al. Mapping the cost competitiveness of African green hydrogen imports to Europe. Nat Energy 10, 750–761 (2025). https://doi.org/10.1038/s41560-025-01768-y

Received:

Accepted:

Published:

Version of record:

Issue date:

DOI: https://doi.org/10.1038/s41560-025-01768-y

This article is cited by

-

Mpox control, the future of green hydrogen in Africa, air pollution and heatwaves, mental health care

Nature Africa (2025)

-

Origines de l’Omicron, hydrogène vert, cultures sous-utilisées et dents des hominines

Nature Africa (2025)

-

Omicron origins, green hydrogen, underutilized crops, and hominin teeth

Nature Africa (2025)

-

Contrôle du mpox, avenir de l'hydrogène vert en Afrique, pollution de l'air et vagues de chaleur, soins de santé mentale

Nature Africa (2025)