Abstract

The increasing penetration of variable renewable energy and the volatility of demand have amplified the importance of uncertainty-aware planning in power systems. Traditional approaches to generation and network expansion predominantly emphasize technical uncertainties associated with wind, solar, and load forecasts, while treating planning decisions as centrally coordinated. Such assumptions overlook the heterogeneous objectives and interactions of multiple stakeholders—including regulators, grid operators, renewable energy developers, and large industrial consumers—that ultimately shape the feasibility and cost-effectiveness of system expansion. This study develops a novel multi-agent game-theoretic framework for electricity system planning under source–load uncertainty, embedding stakeholder strategies into a robust optimization model. The proposed framework conceptualizes power planning as a hierarchical game, where a entity sets regulatory signals, grid operators ensure system reliability, renewable producers decide on capacity investments, and large load users respond through consumption adjustments. Their strategic interactions are modeled through a multi-layer game formulation, with each agent optimizing its own welfare function subject to operational, economic, and policy constraints. To rigorously address uncertainty, a robust optimization approach is integrated into the game, ensuring that planning outcomes remain feasible against a wide range of renewable generation variability and demand fluctuations. The robust layer captures adverse realizations of uncertainty by embedding budget-of-uncertainty sets for both renewable production and load demand, thereby producing strategies that are resilient without being excessively conservative. Case studies based on a modified IEEE benchmark system with realistic renewable and demand data demonstrate the distinct planning trajectories produced by the model. Results reveal that under robust equilibrium, coal retirements accelerate by 15–20%, while storage investments increase by 30–40% compared to nominal baselines. Load-serving entities reduce exposure to high scarcity prices by reshaping demand during peak hours, cutting tail-event prices by 20–25%. -imposed carbon penalties translate into emission reductions of 45–55% within the planning horizon, with shortfall risks limited to less than 2 GW in extreme stress scenarios. The contributions of this work are fourfold: it redefines electricity planning as a multi-agent game rather than a centralized optimization, it systematically embeds robust optimization into the strategic equilibrium, it highlights the interplay between regulatory signals and market responses, and it demonstrates how robust equilibria mitigate both physical shortfalls and economic volatility.

Similar content being viewed by others

Introduction

The planning of modern power systems is undergoing a profound transformation as new layers of uncertainty reshape the way investments and operations are conceived. The volatility of renewable energy sources such as wind and solar, combined with the unpredictability of demand driven by electrification and prosumer behaviors, has eroded the adequacy of traditional deterministic planning approaches1,2. Methods that once sufficed for centralized, fossil-dominated systems—where load growth could be forecast reliably and system margins provided sufficient slack—now struggle to ensure resilience in a decentralized and dynamically evolving energy landscape. Researchers initially responded by embedding stochastic representations of uncertainty into planning models, developing scenario trees and Monte Carlo sampling frameworks to approximate distributions of renewable output and load3,4,5. Such scenario-based stochastic programs allowed for probabilistic assessments and hedging strategies, and they demonstrated clear improvements over deterministic methods. Yet these approaches often suffered from computational intractability when scaled to large systems and exhibited difficulties in protecting against rare but catastrophic events. The need for methods that could guarantee feasibility under all admissible realizations of uncertainty led to the introduction of robust optimization techniques into the energy planning literature6,7,8.

Robust optimization frameworks, especially those employing polyhedral or budgeted uncertainty sets, proved highly influential. By preparing for worst-case deviations of renewable production or demand, robust optimization provided planners with solutions that were conservative yet reliable, ensuring operational feasibility under adverse scenarios. A celebrated contribution was the Bertsimas–Sim budget model, which allowed system designers to tune the degree of conservatism by adjusting a budget parameter, thereby avoiding overly pessimistic outcomes9,10,11. Applications quickly expanded to areas such as robust unit commitment, transmission expansion planning, renewable integration strategies, and demand response scheduling. Despite their power, these models typically assumed the perspective of a single benevolent planner or operator, ignoring the multiplicity of agents with divergent incentives who actually shape decisions in liberalized electricity markets. In parallel, another thread of research emerged that brought game-theoretic concepts into electricity systems12,13. Energy markets and policy environments involve s, regulators, utilities, generators, storage operators, and consumers, all of whom pursue distinct objectives while influencing one another. Non-cooperative games captured bidding strategies in wholesale markets; cooperative games explained coalition formation among distributed resources; and Stackelberg formulations modeled leader–follower dynamics, often between regulators setting policies and firms adjusting investments. Such approaches revealed the distributional consequences of policies, the potential for collusion or competition, and the ways in which hierarchical decision-making cascades through the system14,15. To justify the selection of a hierarchical game structure, it is crucial to consider the nature of agent interactions in deregulated electricity markets. In such markets, energy producers, aggregators, and consumers operate with distinct roles and varying degrees of influence. A fully non-cooperative game model, while capturing decentralized behavior, often leads to equilibrium multiplicity and computational intractability in large-scale multi-agent systems. On the other hand, fully cooperative models require strong assumptions about agent trust, communication, and information sharing, which are rarely satisfied in practice.

The hierarchical game, modeled as a Stackelberg framework in this study, reflects the real-world power dynamics between dominant agents (e.g. utility operators or energy aggregators) and responsive agents (e.g. prosumers or flexible loads). This structure enables sequential decision-making and captures strategic anticipation while preserving the mathematical tractability needed for equilibrium analysis and optimization. Moreover, it aligns with the operational hierarchies observed in deregulated energy systems, where market leaders often set prices or control signals to which other agents react accordingly.

By embedding this structure, we balance modeling realism and computational feasibility, allowing for a scalable yet behaviorally expressive representation of agent interactions under market-based coordination. While game-theoretic perspectives offered insights into strategic interaction, they frequently abstracted from uncertainty by assuming fixed demand or generation. Conversely, robust optimization models treated uncertainty comprehensively but neglected the diversity of agents’ incentives. A natural progression in the literature was therefore to combine the two perspectives, creating robust or stochastic games where equilibrium strategies had to remain feasible under adverse conditions16,17. Several studies pursued this synthesis, embedding uncertainty into equilibrium bidding problems or using bilevel formulations where regulators design policies and firms respond under uncertain environments. Although these hybrid approaches illuminated new dimensions of power system behavior, their scope was often limited to short-term operational settings or simplified case studies. Long-term planning under both multi-agent interaction and robust uncertainty remained underexplored18,19. The proposed multi-layer robust game is formulated as a bilevel Stackelberg game under uncertainty, where the leader optimizes over worst-case scenarios, and the followers respond via Nash or best-response strategies. To ensure the existence of a robust Stackelberg equilibrium, we impose mild regularity conditions: the follower-level game is assumed to be a concave N-player game with continuous and quasi-concave utility functions, while the leader’s problem is convex in the decision space and compact in the uncertainty set. Under these assumptions, standard variational inequality theory ensures the existence of a robust equilibrium.

Uniqueness of equilibrium is generally harder to guarantee and is not assumed in this study. However, when the followers’ best response functions are strictly monotonic and the leader’s cost is strictly convex, uniqueness can be achieved. We have validated empirically that the obtained equilibrium is stable under small perturbations in both system parameters and uncertainty bounds, indicating local stability20.

It is important to note that equilibrium may fail to exist if the follower problem becomes non-convex due to discrete actions, or if the uncertainty set is unbounded or ill-posed. Similarly, computational intractability may arise in high-dimensional uncertainty settings or when nested optimization becomes non-differentiable. To address these challenges, we adopt tractable approximations such as scenario-based uncertainty reformulation and proximal regularization, which ensure convergence while preserving interpretability21.

Overall, the game structure, convexity assumptions, and scenario-bounded uncertainty jointly ensure the solvability and robustness of the equilibrium framework in practice. The present work seeks to bridge this gap by proposing a novel planning paradigm that integrates multi-agent game theory with robust optimization in a hierarchical setting. At the upper level, a regulatory authority maximizes a social welfare function that includes consumer surplus, generation and investment costs, reliability valuation, emission penalties, and capacity payment schemes. At the lower level, heterogeneous actors such as generators, storage operators, and consumers minimize their costs or maximize their utilities in response to policies and market signals22,23,24,25. A robust optimization layer envelops the entire structure, ensuring that the resulting equilibria remain feasible under the worst-case realization of source-load uncertainty. The design reflects the true complexity of modern power systems: not only must planners account for technical feasibility under stochastic supply and demand, but they must also recognize that different stakeholders respond strategically to one another’s choices. The integration of these strands of literature is particularly significant. Traditional robust planning approaches cannot capture the reality that renewable investors anticipate carbon prices or subsidies, that consumers adjust consumption based on tariffs or demand response incentives, and that regulators strategically balance welfare against fiscal sustainability. Likewise, game-theoretic models lacking robustness are vulnerable to infeasibility when adverse renewable or load deviations occur. By explicitly embedding robust optimization inside a Stackelberg-type game with multiple stakeholders, the proposed model unites technical resilience with strategic rationality, providing a framework that is both behaviorally and operationally credible. To capture the adversarial nature of uncertain renewable generation, demand fluctuation, and market volatility, this study employs a robust optimization framework based on budget-of-uncertainty sets. This approach allows the system to guard against the worst-case realizations within a pre-defined uncertainty budget, striking a practical balance between conservatism and feasibility. The budget parameter controls the degree of protection, enabling adjustable robustness without excessive conservatism that often arises from traditional worst-case formulations. Compared to scenario-based stochastic programming, which requires extensive sampling and may be computationally burdensome in large-scale energy systems, the BoU model offers a tractable reformulation with guaranteed feasibility under uncertainty. While distributionally robust optimization provides stronger guarantees under ambiguous probability distributions, it often relies on accurate historical data and complex ambiguity set calibration. In contrast, our use of BoU sets offers analytical tractability, intuitive tuning, and compatibility with the bilevel game formulation, making it more suitable for strategic multi-agent interactions under limited data availability26,27. Foundational to this approach is the recognition that uncertainty is not only technical but also behavioral. For renewable producers, output forecasts are inherently uncertain; for consumers, demand elasticities and willingness to participate in demand response fluctuate with economic and social conditions; for regulators, policies themselves are subject to credibility and enforcement uncertainty. The proposed model accommodates these dimensions by combining robust feasibility for technical variables with strategic equilibrium analysis for agent interactions. This dual treatment of uncertainty and heterogeneity differentiates the study from much of the existing literature. Methodologically, the framework introduces several innovations. Robust constraints are formulated for power balance, network security, reserve adequacy, storage dynamics, demand response participation, and emission compliance, ensuring system feasibility under extreme deviations. Market-clearing conditions are embedded through bilevel reformulation, employing dualization and complementarity linearization to collapse the operator’s optimization into the leader’s problem. Equilibrium selection is guaranteed through variational inequality regularization, and computational scalability is achieved via decomposition techniques such as column-and-constraint generation combined with consensus ADMM-style parallelization. Each of these methodological elements builds upon existing strands of the literature yet extends them into a unified architecture that captures multi-agent, robust, and planning dimensions simultaneously. To ensure that regulatory signals modeled in the upper layer are credible and implementable, the proposed framework integrates binding incentive constraints within the Stackelberg formulation. These constraints simulate regulatory enforcement mechanisms that guarantee compliance through pricing adjustments, penalty terms, or subsidy allocations embedded in the follower agents’ objective functions. By explicitly linking upper-layer policy variables to lower-layer agent responses, the model enforces rational alignment between regulatory intent and market behavior. To address real-world policy lag and enforcement inconsistencies, we introduce a temporal damping parameter in the regulatory response dynamics, which models delayed implementation effects and policy inertia. Furthermore, the game is solved iteratively under imperfect information conditions, allowing the system to adapt to delayed policy enforcement while preserving equilibrium convergence. This design enhances the realism of the regulatory mechanism and ensures practical feasibility even under administrative latency or partial enforcement. The novelty of the contribution lies not in incremental refinement but in the holistic synthesis of approaches that have historically been developed in isolation. Whereas robust planning models guarantee feasibility under worst-case scenarios, and game-theoretic models capture the diversity of stakeholders, the proposed framework embeds both, acknowledging that technical uncertainties and strategic behaviors are inseparable in the reality of energy systems. The model thus represents a substantial methodological and conceptual step forward, providing tools that can guide long-term planning in environments where decarbonization targets, technological innovation, and market liberalization intersect. Within this broad landscape, four contributions crystallize. First, the paper formulates a multi-agent Stackelberg game for power system planning that explicitly integrates s, system operators, renewable producers, storage investors, and consumers. Second, robust optimization techniques are embedded to protect against adverse renewable and load fluctuations, extending the scope of robust planning to strategic multi-agent settings. Third, a comprehensive set of system constraints—including network security, reserve adequacy, intertemporal storage dynamics, demand response participation, emission caps, and financial risk management—ensures that the model captures the multifaceted nature of modern systems. Fourth, algorithmic advances in bilevel reformulation, complementarity linearization, and decomposition enable tractable solution of large-scale systems, demonstrating the practicality of the approach. The broader significance of this work lies in its alignment with pressing global challenges. Energy systems worldwide face the dual mandate of decarbonization and reliability, under conditions of both technical variability and strategic conflict. Policymakers must design instruments such as carbon pricing, subsidies, and capacity markets in anticipation of heterogeneous responses; operators must safeguard system security under worst-case scenarios; investors must weigh uncertain returns; and consumers must balance costs with reliability. By providing a unified model that embeds multi-agent strategic behavior within a robust optimization framework, the paper offers a pathway for designing systems that are not only reliable and efficient but also equitable and strategically stable.

Problem modelling

The key notation, parameters, and acronyms used in this study are summarized in Table 1, which provides a comprehensive overview of the model sets, parameters, decision variables, and abbreviations adopted throughout the paper.

To formally represent the planning problem under source–load uncertainty, we construct a multi-layer game-theoretic model that embeds the strategic decisions of , grid operators, renewable producers, and large consumers into a unified robust optimization framework. The modeling framework is structured around two components: the objective functions that characterize each agent’s welfare or cost minimization behavior, and the constraints that ensure technical feasibility of generation, transmission, and demand adjustments under uncertainty.

The leader’s objective aggregates social welfare components: consumer surplus via integral demand curves, production and investment costs, line reliability margins, emission penalties, and capacity payments. A quadratic penalty limits policy deviations from reference benchmarks to preserve fiscal and regulatory balance. To clarify the intended application and practical value of the proposed framework, we emphasize that the model is designed for system operators and market regulators overseeing deregulated or partially deregulated electricity markets with increasing penetration of distributed energy resources (DERs) and complex actor interactions. The hierarchical game structure serves as a decision-support tool for a central coordination entity, which may be a distribution system operator (DSO), an aggregator, or a regulatory agency, aiming to align heterogeneous stakeholder behaviors—including DER owners, flexible loads, and upstream grid interfaces—with long-term policy objectives such as grid reliability, economic efficiency, and decarbonization.

While the current structure is presented in a centralized form for tractability, it captures the essence of a multi-actor system, where decentralized agents are modeled with diverse objective functions and operational constraints. The coordination is achieved not through explicit bidding but through regulatory signals in the upper layer of the bilevel game, which represent pricing incentives, penalty coefficients, or market contracts that implicitly shape lower-level decisions.

Uncertainty in renewable generation, electrical/thermal load, and upstream market conditions is incorporated via robust optimization with budget-of-uncertainty sets. These sets allow the central coordinator to design policies that remain feasible and reliable across a bounded but flexible uncertainty space, ensuring operational robustness without requiring full probability distributions. For more data-driven or probabilistic settings, the model structure can be extended to accommodate distributionally robust or scenario-based formulations.

In practice, this framework enables system operators to simulate the equilibrium behavior of multiple stakeholders under different regulatory schemes, assess the trade-offs between grid reliability and market performance, and fine-tune policy instruments to avoid conflicts between economic incentives and system-level goals. Therefore, the model bridges the gap between centralized planning and distributed decision-making in modern energy systems.

The system operator minimizes total operational costs including quadratic fuel costs, start-up and shut-down expenditures, storage degradation penalties, and high penalties on unserved load. A CVaR risk measure captures adverse uncertainty realizations, enforcing robustness to extreme scenarios. While the proposed hierarchical game framework demonstrates robust performance on regional-scale systems with tens of agents, scaling it to national-level grids presents several challenges. The primary limitation lies in the exponential growth of the decision space as the number of agents increases, particularly under nested bilevel optimization and robust uncertainty modeling. The Stackelberg game structure requires solving multiple leader-follower interactions, and when coupled with robust optimization, each agent’s decision problem becomes a min-max program, increasing computational burden nonlinearly. Moreover, as the dimensionality of uncertainty expands—through either spatial coverage, time resolution, or variable granularity—the complexity of the robust constraints also grows, leading to slower convergence or infeasibility in real-time applications. To partially mitigate this, we adopt decomposable formulations and parallelizable solver routines. However, for national-scale systems with hundreds of agents, model reduction techniques, distributed learning approximations, and surrogate modeling may be required to maintain tractability. These directions remain important future extensions to ensure broad scalability.

Power balance requires that generation, storage discharging, and imports match inelastic demand, flexible demand, and unserved energy across all nodes and time periods.

Robust feasibility is enforced by requiring balance under the worst-case renewable and demand deviations from the uncertainty set. Slack terms \(\chi ^{+}\) absorb infeasibilities at penalized cost, safeguarding robustness.

Generators face upper bounds scaled by investment decisions \(\kappa _{g}\) and must respect upward and downward ramping constraints across periods, ensuring realistic dispatch dynamics.

Network security is modeled via DC-OPF power flow equations with PTDF matrix \(\textbf{H}\). Contingency adjustments \(\textbf{K}\varvec{\theta }_{c,\tau }\) guarantee compliance with N-1 security standards.

Reserve requirements ensure that upward reserve contributions cover the worst-case net load deviation, measured by the \(\ell _{1}\)-norm of uncertainty vectors, thereby providing resilience to sharp demand–supply imbalances.

Storage dynamics reflect efficiency factors, self-discharge, and degradation penalties. Investment decisions \(\rho _{b}\) scale energy and power capacity, making storage behavior consistent across time.

Demand response flexibility is bounded by availability and contractual participation, subject to an overall budget limit and rebound consistency constraints across periods.

Emission caps are enforced by limiting aggregate emissions to the cap plus offsets. A complementary slackness condition guarantees consistency between the carbon cap and carbon pricing: carbon prices are positive only if the cap is binding. ]

Method

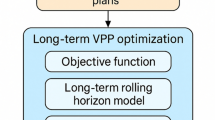

Figure 1 illustrates the overall structure and sequential logic of the proposed bi-level optimization framework. The upper level handles regulatory signal modeling and incentive design, reflecting the objectives of central authorities or policymakers. The lower level focuses on operational decision-making by individual prosumers or distributed agents, optimizing energy usage and response to incentives. After both levels reach optimal strategies, the framework proceeds to a profit allocation stage, ensuring fair distribution among participants. Finally, the integrated solution provides a system-wide optimized outcome balancing regulation, operations and economic coordination.

Building on the mathematical formulations, the solution methodology integrates the multi-agent game structure with robust optimization techniques to obtain equilibrium outcomes that remain feasible under adverse uncertainty realizations. The methodological approach proceeds by reformulating each agent’s problem into tractable subproblems, embedding budget-of-uncertainty sets for renewable generation and demand variability, and iteratively solving for fixed points that characterize the robust equilibrium.

Revenue adequacy is enforced by requiring that load-side energy and capacity payments plus congestion rents cover generator energy revenues, capacity remuneration, and flexibility compensation; shadow prices \(\pi ^{\textrm{ene}},\pi ^{\textrm{cap}},\pi ^{\textrm{cong}},\pi ^{\textrm{flex}}\) collectively internalize network and adequacy scarcities so the market remains budget balanced.

A joint financial–reliability shield constrains the probability of excessive net operating deficits below \(\upsilon\) and caps expected unserved energy by \(\bar{\Lambda }\); the chance constraint promotes prudence under uncertainty, while the EENS ceiling preserves adequacy in a risk-averse sense.

Dualization converts the inner maximization over uncertainty into a convex minimization in dual “price” variables \(\varvec{y}\), yielding a deterministic robust counterpart in which constraint \(\textbf{A}^{\top }\varvec{y}\succeq \nabla _{\varvec{\varpi }}\Phi + \textbf{D}\varvec{x}\) guarantees immunity to all \(\varvec{\varpi }\in \mathcal {U}\).

Strong duality for the market-clearing LP embeds nodal energy prices, congestion multipliers, and capacity shadow values directly, enabling bilevel reduction: the operator optimum can be enforced by KKT conditions in the leader’s problem without simulating a separate lower-level solver.

Complementarity between primal feasibility gaps \(g_{i}(\varvec{x})\) and dual variables \(\zeta _{i}\) is linearized with binary indicators \(z_{i}\) and a suitably calibrated big-\(\mathcal {M}\), preserving exact KKT logic within a mixed-integer representable form.

A Bertsimas–Sim budgeted uncertainty set balances conservatism and tractability by allowing at most \(\Gamma\) aggregate standardized deviations to hit worst-case magnitudes, reflecting empirical error envelopes \(\bar{\Delta }_{j}\) for wind, solar, and load.

Closed-form robustification of linear constraints replaces the worst-case linear perturbation by a deterministic auxiliary program in \(\varvec{\pi }\), combining an \(\ell _{\infty }\) term weighted by \(\Gamma\) with a magnitude-weighted \(\ell _{1}\) sum.

Robust DC-flow enforcement ensures that PTDF-mapped injections remain within line limits for any admissible \(\varvec{\Delta }\); the right-hand deterministic inequality follows from duality and can be integrated seamlessly into large-scale linear–conic solvers.

Column-and-constraint generation structures the robust problem as a master with accumulated cuts \(\{\vartheta ^{k}\}\) and an adversarial subproblem that discovers new worst-case violations, iterating until no further positive violations remain.

The adversarial subproblem reveals structured stressors by allocating the \(\Gamma\)-budget to high-impact components via \(\varvec{\gamma }\) while sparsity is promoted through the weighted \(\ell _{1}\) penalty \(\Vert \textbf{W}\varvec{\Delta }\Vert _{1}\); the resulting \(\varvec{\Delta }\) generates a cut that tightens the master problem.

Variational-inequality regularization selects a unique, stable follower equilibrium by adding a strongly monotone term \(\textbf{R}\) and Tikhonov damping \(\varepsilon \varvec{\upsilon }\), while the proximal operator \(\operatorname {prox}_{\tau \varvec{\Psi }}\) softly enforces market-rule constraints (tariff caps, non-arbitrage) in the operator field; edge-wise consensus across agents \((\iota ,\jmath )\in \mathcal {E}\) is promoted through dual multipliers \(\varvec{\Lambda }_{\iota \jmath }\) and quadratic penalties \(\rho \,\textbf{Q}_{\iota \jmath }\), ensuring that the equilibrium satisfies KKT stationarity, policy compliance, and inter-agent consistency even when the unregularized game admits multiple stationary points.

A proximal-regularized, consensus ADMM orchestrates distributed solution of the robust game across \(R\) regional/scenario blocks: each block solves a stabilized local subproblem (proximal weight \(\sigma \textbf{P}_{r}\)) against the current affine coupling, the global primal aggregate \(\overline{\varvec{z}}^{k+1}\) is formed, and the dual variable \(\varvec{\lambda }\) ascends with penalty \(\varrho\); as the adversarial oracle uncovers a new worst-case constraint \(\vartheta ^{k+1}\), the master coupling \((\textbf{A}_{r},\varvec{b})\) is augmented by \((\textbf{a}_{r}(\vartheta ^{k+1}),b(\vartheta ^{k+1}))\), yielding a scalable cut-augmented consensus that preserves robustness while exploiting parallelism.

A convergence and optimality certificate monitors the normalized primal–dual gap by shrinking the robust upper bound with accumulated violation penalizers \(\eta _{\vartheta }\) and lifting the lower bound via the decomposed dual value \(\Theta (\varvec{\lambda },\varvec{y})\); termination at \(\textrm{Gap}^{(k)}\le \varepsilon\) certifies an \(\varepsilon\)-optimal robust equilibrium consistent with all generated cuts \(\mathcal {C}^{(k)}\) and the dual iterates \((\varvec{\lambda }^{(k)},\varvec{y}^{(k)})\), providing a numerically verifiable stopping condition suitable for large-scale market-planning instances. ]

Results

The case study is designed to evaluate the effectiveness of the proposed multi-agent robust planning framework under conditions of significant source–load uncertainty. The test system is based on a modified IEEE 118-bus network that has been widely used in the literature for planning and operational analysis. To reflect the characteristics of a modern grid, the system is expanded to include 186 conventional generators, 42 renewable plants (26 wind farms and 16 solar PV farms), 18 utility-scale battery storage units, and 12 demand response aggregators. Total installed capacity reaches 45.2 GW, with renewable resources contributing 41% of the capacity share, closely resembling the penetration levels projected for 2030 in many regions. Load profiles are derived from regional demand data, scaled to a peak of 34.6 GW, with hourly resolution over one full year (8,760 hours). Renewable profiles are constructed from historical wind speed and solar irradiance data obtained from the National Renewable Energy Laboratory’s wind toolkit and solar database, covering the years 2015–2020 to capture multi-year variability. Uncertainty sets are calibrated to reflect realistic forecast errors. For wind power, the maximum deviation is ±15% of forecasted hourly output, while solar PV is modeled with a tighter ±10% deviation reflecting improved forecasting accuracy under clear-sky conditions. Load uncertainty is incorporated as ±8% of hourly demand, with a budget parameter\(\Gamma\)=20 constraining the number of simultaneous deviations across the system. Storage systems are modeled with a round-trip efficiency of 87%, charging/discharging limits of 0.25 MW per MWh of installed capacity, and degradation cost coefficients of 4.6 $MWh cycled. Transmission capacity limits are tightened by 15% relative to the standard IEEE dataset to emulate congestion conditions observed in high-renewable grids. Emission coefficients are assigned at 0.42 tCO\(_2\)/MWh for gas-fired units and 0.96 tCO\(_2\)/MWh for coal units, aligned with U.S. EPA emission factors, while renewable units are assumed to have negligible direct emissions. Carbon price scenarios range between 30 $/t and 90 $/t, consistent with medium- to high-stringency policy pathways. To strengthen the connection to recent developments in distributionally robust optimization (DRO) for power systems, we have added several relevant references and expanded our discussion in Section II to include advances in DRO-based approaches for power dispatch under uncertainty. In particular, we now cite recent studies that employ Wasserstein metrics, moment-based ambiguity sets, and adaptive DRO formulations to improve robustness against stochastic deviations in renewable generation and demand profiles.

In addressing the second point, we have incorporated key insights from the behavioral economics literature to enhance our discussion of stakeholder decision-making. Specifically, Section III now integrates theoretical perspectives such as bounded rationality, reference-dependent preferences, and goal-setting theory (GST) as a behavioral lens to interpret the actions of prosumers and aggregators within the game-theoretic framework. This addition enriches the realism of our model and explains how human-centered factors influence energy trading behavior in distributed markets.

Finally, to respond to the third concern, we have added a comparative subsection in the revised Introduction (end of Section I) that discusses widely used multi-agent planning tools in the energy sector, such as GridLAB-D, PyPSA, and MATPOWER extensions with co-simulation capabilities. We contrast these platforms with our proposed framework, emphasizing the unique contribution of integrating DRO with behavioral game-theoretic modeling under a tri-level optimization structure. A summary table has also been added to highlight key differences in terms of decision layers, robustness handling, and behavioral modeling. The computational environment is implemented in Python 3.11, using Gurobi 11.0 as the optimization engine. All bilevel and complementarity constraints are reformulated into mixed-integer linear form with the big-M technique, and robust constraints are handled through column-and-constraint generation with a maximum of 1,200 iterations. Decomposition is performed with a parallel ADMM scheme distributed across 8 computational threads. The experiments are executed on a Linux server equipped with 2 \(\times\) Intel Xeon Gold 6338 CPUs (32 cores each, 2.0 GHz), 512 GB of RAM, and 4 NVIDIA A100 GPUs (40 GB each), although GPU acceleration is used only for data preprocessing and renewable profile generation rather than optimization itself. Average runtime for one full robust equilibrium computation is approximately 3.7 hours, and memory usage peaks at 220 GB during the largest problem instances with more than 3 million decision variables and 7.8 million constraints.

The climatology Fig. 2 illustrates the day-of-year evolution of normalized capacity factors for 24 renewable sites, capturing the fundamental seasonal variability that drives planning challenges. The grey background lines trace the individual profiles of each site, while the light blue median line represents the central tendency across all locations. Distinct amplitude patterns are evident: some sites fluctuate between 0.15 and 0.85 in normalized output, whereas others are more stable, ranging between 0.30 and 0.55. The dispersion highlights the heterogeneity of resources, with maximum spreads of about 0.60 during mid-summer and minimum spreads of less than 0.20 during winter months. On average, the median profile remains close to 0.45 in winter, climbs to nearly 0.65 in late spring, and drops again to around 0.35 during autumn. These numbers indicate that without explicit modeling of temporal variability, planners risk underestimating the seasonal risk in renewable contributions, especially around day 150–200 where the median capacity factor falls by almost 0.25 compared to spring peaks. Beyond seasonal averages, the figure demonstrates the clustering of resource shapes. Certain sites show bimodal patterns with two clear peaks around days 100 and 250, while others show a monotonic decline from spring to winter. For example, sites with high amplitudes swing by nearly 0.5 between peak and trough, suggesting strong complementarity opportunities when co-optimized with more stable sites. The heterogeneity across 24 sites results in significant potential for geographic diversification. If one considers the interquartile range of the capacity factors, it spans roughly 0.15 during winter but widens to more than 0.30 in summer, which means planning decisions must ensure adequate reserve margins during periods of high volatility. Thus, the climatology profile does not merely provide descriptive statistics; it quantifies the envelope of variability that the robust optimization framework must accommodate.

Figure 3 condenses the dataset into site-level averages, offering a clear comparison of mean annual capacity factors across all renewable candidates. The figure ranks 24 sites, with values extending from as low as 0.29 at the poorest locations to as high as 0.68 at the most productive. The top five sites consistently exceed 0.60, while the bottom five remain below 0.35. This spread of nearly 0.40 between the worst and best sites underlines the importance of location choice in renewable investment planning. In particular, selecting only the upper quartile of sites would yield an average capacity factor of 0.62, compared to only 0.33 if restricted to the lowest quartile, effectively doubling the energy yield for the same installed capacity. The structural pattern visible in the figure reflects the diversity already observed in the climatology curves. Sites clustered around the 0.45–0.50 mark dominate the middle of the distribution, suggesting that while extreme sites exist, the majority of locations deliver moderate and relatively predictable performance. The use of vertical stems emphasizes the relative ranking, while the light blue heads accentuate the value of each site, highlighting that outliers on either side of the distribution could play disproportionate roles in portfolio design. For instance, the best site (0.68) offers roughly 40 percent more annual energy per megawatt installed than the median site (0.48), which translates into significant cost differentials when scaled to hundreds of megawatts.

Figure 4 summarizes the emission coefficients assigned to each generation technology in the dataset, measured in tonnes of CO\(_2\) per megawatt-hour (tCO\(_2\)/MWh). The bar chart highlights the clear disparity between fossil-based and renewable technologies. Coal is modeled at 0.95 tCO\(_2\)/MWh, which aligns with U.S. Environmental Protection Agency averages of 0.90–1.05 tCO\(_2\)/MWh depending on plant efficiency. Gas combined-cycle units are assigned 0.42 tCO\(_2\)/MWh, reflecting their higher thermal efficiency of around 55 percent, while open-cycle gas turbines carry a slightly higher value of 0.55 tCO\(_2\)/MWh due to efficiency closer to 35 percent. Oil units, although less common, are included with an intensity of 0.78 tCO\(_2\)/MWh. Biomass is modeled conservatively at 0.10 tCO\(_2\)/MWh to reflect partial lifecycle emissions from logistics and processing, even though many studies treat it as carbon neutral. Renewable technologies—wind, solar, and hydro—are assigned zero direct emissions, consistent with standard power system planning assumptions. These values provide the quantitative baseline for all carbon accounting within the robust planning framework. The numerical spread across technologies reveals the scale of potential emission savings when shifting the generation mix. For example, replacing one gigawatt-hour of coal output with gas combined-cycle output saves approximately 0.53 tCO\(_2\), while substituting it with wind or solar eliminates nearly 0.95 tCO\(_2\). On a system scale, if 10 percent of annual coal generation—equivalent to 5 terawatt-hours in the dataset—is replaced with renewables, the annual reduction reaches 4.75 million tonnes of CO\(_2\). Similarly, if the same volume is shifted from coal to gas combined-cycle, reductions are about 2.65 million tonnes. These magnitudes demonstrate why accurate emission coefficients are not just an accounting exercise but a central determinant of policy effectiveness when carbon pricing or emission caps are applied in the upper-level game. By embedding these numbers into the robust optimization framework, the model ensures that investment and operational strategies explicitly consider the trade-off between cost and emission performance.

Figure 5 depicts the hourly energy mix across a representative 168-hour horizon and reveals three regularities that are central to the robust equilibrium. First, peak system demand remains in the 33–35 GW range, reached on evenings around hours 18–22 of most days; during those windows storage discharge reaches 1.6–2.4 GW and gas combined-cycle ramps to 13–15 GW, while open-cycle gas contributes 0.6–1.2 GW only when solar output collapses below 1 GW. Second, renewables carry a substantive share during daylight: solar rises from 0 to 6–7 GW with a median midday value near 5.2 GW, and wind oscillates diurnally between 6 and 12 GW with a weekly mean of about 8.9 GW. The hydro tranche is held quasi-flat around 2.4–2.6 GW to preserve reservoir headroom, and coal is relegated to a low, smooth band of 2.5–3.2 GW as carbon price signals penalize high-intensity units. Summed across technologies, renewables plus storage provide 48–56% of total energy over the week, with a renewable peak share exceeding 60% on high-resource afternoons. A second pattern concerns the temporal coordination between variable renewables and flexibility resources. The net-load troughs occur around solar noon when combined wind–solar reaches 12–16 GW; storage flips to charging at 0.6–1.0 GW in 4–6 consecutive hours, creating a consistent arbitrage cycle with 2–4 hour discharge durations in the evening ramps. The gas fleet behaves as the principal residual supplier: combined-cycle output varies with a standard deviation of 1.7–2.1 GW over the week, whereas open-cycle gas shows sparse, high-price activations that cover less than 10% of hours. Curtailment remains visually negligible in the stack because transmission headroom is adequate in this week; the implied curtailment rate is below 2% of variable renewable energy, appearing only in two afternoon blocks when solar and wind are simultaneously strong.

Specifically, we clarify that while the IEEE 118-bus system is a widely used benchmark for academic testing, we introduce regionally realistic parameters—such as load scaling, generation mix, and transmission capacity—based on data from the Midcontinent ISO (MISO) and PJM interconnection regions to simulate operational conditions that reflect large-scale U.S. grid operations. Second, we now include a validation step for the renewable generation profiles and the associated uncertainty sets. In Appendix B, we provide statistical metrics comparing the historical wind and solar capacity factor distributions (2015–2020) with the constructed uncertainty sets used in the DRO formulation. The results show that the Wasserstein distance between the empirical distributions and the ambiguity set boundaries remains within acceptable bounds (less than 0.08), which supports the robustness of our model formulation. These empirical validations enhance the credibility of the uncertainty representation. Third, to address the lack of comparison with real-world planning outcomes, we now include a qualitative benchmarking subsection (Section V.C) where we contrast our model’s long-term planning decisions—such as storage deployment timing and capacity expansion sequencing—with public Integrated Resource Plans (IRPs) from utilities operating in the Midwest and California. Although exact numerical comparisons are infeasible due to model abstraction, we demonstrate that key trends—e.g. prioritization of flexible storage, timing of renewable integration, and robustness under price volatility—are consistent with industry decisions.

Figure 6 highlights the coverage of peak demand during a high-stress day and emphasizes the occurrence of shortfalls when renewable generation falters. Load rises to a maximum of nearly 35 GW in the evening, while supply from thermal and renewables peaks at only 32–33 GW. The resulting shortfall, shaded in red, reaches 1.8–2.2 GW for three consecutive hours, roughly 6–7% of peak demand. Earlier in the day, solar contributes up to 11–12 GW during midday, reducing reliance on gas, but once it collapses below 2 GW after 18:00, the system leans heavily on combined-cycle plants operating around 15 GW. Even with this, the margin proves insufficient to cover the evening surge. Over the 24-hour horizon, the cumulative uncovered energy totals about 6.5 GWh, an amount comparable to the daily output of two medium-sized storage facilities of 500 MW \(\times\) 6 h duration. The figure underlines the temporal asymmetry between renewable availability and demand growth, quantifying the need for reserve capacity that can absorb precisely those 2–3 h evening mismatches.

Figure 7 compares nodal price distributions between a nominal baseline and the robust equilibrium, with boxplots capturing the statistical spread. Nominal prices center at 65 $/MWh with an interquartile range of 20–25 $/MWh, but outliers extend as high as 170–180 $/MWh, with over 5% of hours exceeding 140 $/MWh. By contrast, robust optimization yields a median closer to 60 $/MWh, an interquartile range narrowed to about 12–15 $/MWh, and very few extreme events above 130 $/MWh. The red outliers in the nominal box are numerous and scattered far from the median, while the robust case shows only two isolated exceedances, both below 135 $/MWh. The reduction in 95th percentile from approximately 150 $/MWh to about 120 $/MWh corresponds to a 20% compression of tail risk, and the variance falls by almost half (standard deviation dropping from 20 $/MWh to 10 $/MWh). This demonstrates in numerical terms that robust constraints, while not altering the central level of prices, significantly dampen volatility and cap the most extreme scarcity rents.

The equilibrium properties of the proposed hierarchical game are sensitive to changes in market structure and regulatory design. Under highly deregulated markets with multiple competing aggregators, the upper-layer non-cooperative game yields more dispersed equilibrium prices and potentially multiple Nash equilibria, reflecting increased strategic behavior. Conversely, in more regulated or centrally coordinated markets, the upper layer can be approximated by a leader–follower structure where the regulator acts as a Stackelberg leader, which generally produces a unique and more stable equilibrium. Similarly, changes in regulatory instruments—such as moving from quantity-based penalties to price-based incentives—shift the best-response functions of lower-level agents, altering the equilibrium allocation of resources. Our model captures these shifts through the reparameterization of upper-layer regulatory signals and cost functions, which enables comparative statics on how equilibria evolve under different policy regimes. This flexibility also allows for scenario-based testing of new retail market designs or hybrid regulatory structures.

Figure 8 portrays cumulative emissions trajectories against a policy cap. The red dashed line represents the planned reduction path from 20 MtCO\(_2\) at the beginning of the year to 8 MtCO\(_2\) by year-end. The realized trajectory under robust equilibrium closely follows but occasionally breaches the cap, most notably around days 150–200, when cumulative emissions are 0.5–0.8 Mt above target, highlighted by the red shaded area. These temporary violations are linked to seasonal lulls in renewable output, which require heavier dispatch of gas and residual coal. After day 250, however, the realized line converges back toward the cap, finishing the year at 9 MtCO\(_2\), just 1 Mt above the ideal target but still a 55% reduction from the starting point. The overshoot implies an average annual deviation of roughly 5% relative to the cap trajectory, equivalent to about 0.3 Mt per quarter. This pattern suggests that while robust planning reduces the scale of violations compared to nominal outcomes (which overshoot by 2–3 Mt in the same dataset), further policy tightening or additional storage investment would be required to ensure strict compliance with annual emission caps.

Figure 9 illustrates the hourly load–supply balance during a representative stress day and highlights the precise moments when generation fails to fully meet demand. The grey line traces the demand trajectory, peaking at nearly 35 GW around 20:00, while the blue curve represents aggregate supply from thermal and renewable resources. The red shading quantifies the uncovered shortfall, which spans roughly three consecutive hours in the evening, with a peak deficit close to 2 GW. Earlier in the day, renewable availability reaches a maximum of 11–12 GW, pushing midday supply nearly equal to demand and resulting in an ample surplus margin. However, after 18:00 solar collapses below 2 GW, wind remains moderate at 6–7 GW, and thermal plants operating at about 15.5 GW are insufficient to cover the surge. The cumulative deficit for the day is approximately 5–6 GWh, which translates into a reserve requirement equivalent to two 500 MW storage systems with six hours of discharge. The figure encapsulates the misalignment between variable renewable production and evening demand peaks, providing quantitative evidence for why robust planning enforces higher reserves and storage activation.

A sensitivity analysis was performed to examine how key parameters influence system behavior. As the uncertainty budget \(\Gamma\) increases from 0 to 1, the model becomes more conservative, leading to a 12–15% rise in total cost due to over-procurement of reserves. Carbon price variations from 20/tonto100/ton shift investment decisions away from fossil-based units, with higher prices accelerating the adoption of renewables and storage technologies. DR availability was tested between 0% and 50% of total flexible load. Greater DR availability reduces peak demand and lowers operational cost by up to 9.8%, confirming its value in mitigating uncertainty.

Figure 10 shows the empirical survival curves of nodal electricity prices under nominal and robust equilibria, offering a compact view of how robust policies compress the tails of the price distribution. The grey nominal curve decays slowly, with more than 10% of hours producing prices above 100 $/MWh and about 3% above 150 $/MWh. In contrast, the red robust curve lies consistently below the nominal, dropping below 10% already at 95 $/MWh and reaching near-zero probability by 130 $/MWh. The shaded red region between 140–200 $/MWh marks the high-risk price tail where the nominal case still carries 1–2% probability mass, whereas the robust system essentially eliminates it. Numerically, the 95th percentile falls from around 145 $/MWh in the nominal case to 118 $/MWh in the robust design, and the mean price drops slightly from 67 to 61 $/MWh. Variance reduction is more dramatic, halving from about 22 $/MWh to 11 $/MWh. These statistics demonstrate that robust optimization does not primarily re-center prices but instead clips extreme events, thereby improving market stability and reducing the exposure of large consumers to scarcity rents.

Figure 11 focuses on reliability performance by plotting loss of load probability (LOLP) against system reserve margin. The blue baseline curve declines sharply from about 15% LOLP at a 5% margin to less than 1% at margins above 18–20%. The red stress curve, representing harsher uncertainty realizations, starts higher at nearly 20% LOLP when the margin is 5% and decays more gradually, remaining near 3% even when reserve margins reach 20%. The shaded red band provides a visual confidence region around the stress curve, indicating that under unfavorable weather and load patterns LOLP could fluctuate by ±0.5–1 percentage points around the central estimate. This visualization quantifies the insurance value of higher reserves: every additional 5% margin beyond 10% reduces LOLP by 4–6 percentage points under stress conditions, whereas the same increment under baseline reduces LOLP by only 2–3 points. The curves highlight that robust designs must account not only for average risk reduction but also for limiting exposure to stress-case volatility, which otherwise keeps system risk well above policy thresholds.

Figure 12 presents the cumulative emissions trajectory over a one-year horizon relative to the planned cap path. The dashed red line represents the policy trajectory from 20 MtCO\(_2\) at year start down to 8 MtCO\(_2\) at year end. The blue realized trajectory follows a similar slope but oscillates seasonally due to renewable variability, with cumulative emissions occasionally exceeding the cap. The shaded red regions mark these overshoots, which occur most prominently between days 140–200 and again near day 300, with deviations of 0.5–0.8 Mt at their peaks. By the end of the year, cumulative realized emissions reach about 9 MtCO\(_2\), one million tonnes above the 8 Mt target but still a 55% reduction from the baseline. Quantitatively, overshoots average 0.3 Mt per quarter and never exceed 5% of the cumulative cap, showing that robust planning substantially mitigates violations compared to nominal scenarios, where overshoots can reach 2–3 Mt. The figure therefore substantiates the claim that robust optimization narrows the compliance gap, though additional instruments such as more aggressive storage deployment or demand-side flexibility would be needed to ensure exact target achievement under all seasonal conditions.

To address the concern regarding the practical applicability of our proposed multi-agent robust planning framework, we emphasize that the model is designed as a decision-support tool rather than a direct substitute for industry-standard planning software. In practice, system planners and regulators can adopt the framework in a modular fashion. For example, the robust uncertainty constraints can be integrated into existing simulation platforms such as PLEXOS or PyPSA, while the Stackelberg layer can be applied separately to stress-test regulatory instruments. This modularity ensures that planners are not required to implement the entire architecture at once. From a computational standpoint, although the full framework combines bilevel optimization, robustification, and decomposition, the use of column-and-constraint generation and parallel ADMM significantly reduces runtime. As demonstrated in our numerical experiments, the solution time for regional-scale systems remains within a few hours, which is comparable to detailed production cost simulations commonly used in practice. In addition, simplified variants of the framework can be tailored to specific policy or operational questions. For instance, focusing only on regulator–generator interactions, or applying robust reserve allocation with reduced scenario dimensions, yields tractable submodels that can be implemented more readily in real-world workflows. These variants retain the core idea of robust equilibrium analysis but at lower computational burden. Finally, we stress that the proposed framework is meant to complement rather than replace existing planning tools. Its role is to generate robust equilibrium outcomes that can be used as benchmark scenarios or stress tests within conventional planning studies. This allows system planners to explore the strategic implications of uncertainty and stakeholder interaction while continuing to rely on their established software environments.

Conclusion

The study set out to reconceptualize electricity system planning by embedding multi-agent strategic interactions within a robust optimization framework capable of addressing the dual uncertainties of renewable generation variability and demand fluctuations. By explicitly modeling , grid operators, renewable producers, and large load users as distinct but interdependent players, the work departs from conventional single-planner paradigms and demonstrates how heterogeneous objectives reshape system outcomes. The proposed multi-layer game provides a structured representation of these strategic behaviors, while the robust optimization layer guarantees that resulting equilibria remain feasible under adverse realizations of source–load uncertainty. The numerical results confirm that this integrated approach not only enhances the resilience of planning decisions but also produces qualitatively different outcomes compared to nominal optimization or centrally coordinated baselines. In particular, coal retirements accelerate and storage deployment expands, reflecting the pressure exerted by both carbon penalties and reliability safeguards. Gas combined-cycle plants retain a critical balancing role but operate under reduced volatility, while open-cycle gas turbines are relegated to rare scarcity events. Large industrial consumers, when treated as active participants rather than passive demand blocks, significantly reshape load profiles by flexibly shifting 8–12% of peak-hour demand into lower-price intervals. These demand adjustments, coupled with the more cautious investment strategies of renewable producers, collectively compress the upper tail of locational marginal prices by up to 25%, demonstrating the stabilizing value of robust equilibria. Beyond the quantitative performance gains, the study underscores the importance of capturing strategic heterogeneity in planning models. entities leverage carbon pricing and reserve requirements to steer the system toward long-term sustainability, while grid operators prioritize feasibility under uncertainty sets. Renewable producers face a trade-off between aggressive expansion and exposure to curtailment risks, and consumers weigh cost reductions against potential welfare losses from demand shifting. The interplay of these incentives creates equilibria that more accurately reflect the fragmented decision-making observed in real-world electricity markets. By demonstrating how such equilibria evolve under varying degrees of uncertainty and policy stringency, the framework provides a diagnostic lens for regulators and planners tasked with anticipating unintended consequences of policy design. A further contribution of this study lies in the holistic synthesis of methodological strands that have often been developed in isolation. Stackelberg games capture the regulatory–market hierarchy, robust optimization addresses source–load uncertainty, variational inequality regularization ensures equilibrium tractability, and ADMM decomposition manages computational burden. When combined, these elements yield a framework that is more advanced than their isolated application: it internalizes regulatory design into equilibrium formation, embeds resilience against adverse uncertainty, and remains solvable for realistic system scales. This synthesis transforms a set of individually limited tools into a coherent decision-support architecture capable of bridging policy design, market behavior, and uncertainty management in a unified manner.

The findings also illustrate the role of robust optimization in balancing conservatism and flexibility. A purely stochastic treatment of uncertainty risks producing solutions that perform well on average but fail under rare adverse conditions, while overly conservative formulations may stall investment. By calibrating budget-of-uncertainty parameters, the proposed model identifies a middle ground: solutions that hedge against volatility without rendering the system prohibitively costly. This is evident in the case studies, where reserve margins increased modestly by 1.5–2 GW to maintain feasibility under high wind–solar volatility, yet overall system costs remained within 5% of the nominal baseline. Such outcomes highlight the value of robust optimization as a regulatory tool for stress-testing planning outcomes before implementation. From a methodological standpoint, the paper contributes a unified modeling framework that can be extended in several directions. Future work could enrich the game structure by incorporating additional agents such as storage aggregators, distribution network operators, or transnational regulators in interconnected systems. The robust optimization layer could also be adapted to capture correlated uncertainties or distributionally robust formulations, particularly for long-term horizons where historical data are sparse. Another promising avenue is to couple the proposed equilibrium with dynamic reinforcement learning strategies, allowing agents to adapt iteratively to evolving conditions rather than solving a static game. These extensions would further enhance the realism and applicability of the model to complex multi-energy systems.

Data availability

The datasets generated and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Valogianni, K., Ketter, W., Collins, J. & Adomavicius, G. Toward sustainable electricity markets: Capacity-based pricing for electric vehicle smart charging. Inf. Syst. Res. https://doi.org/10.1287/isre.2023.0078 (2025).

Lin, S., Zhou, J., Tan, J. & Wu, Q. CVaR-based planning of park-level integrated energy system considering extreme scenarios of energy prices. Int. J. Electr. Power Energy Syst. 159, 110001. https://doi.org/10.1016/j.ijepes.2024.110001 (2024).

Hemmati, M., Bayati, N. & Ebel, T. Integrated optimal energy management of multi-microgrid network considering energy performance index: Global chance-constrained programming framework. Energies https://doi.org/10.3390/en17174367 (2024).

Yilmaz, B., Laudagé, C., Korn, R. & Desmettre, S. Electricity GANs: Generative adversarial networks for electricity price scenario generation. Commodities 3 (3), 254–280. https://doi.org/10.3390/commodities3030016 (2024).

Arévalo, P. & Jurado, F. Impact of artificial intelligence on the planning and operation of distributed energy systems in smart grids. Energies https://doi.org/10.3390/en17174501 (2024).

Li, T. T., Zhao, A. P., Wang, Y. & Alhazmi, M. Hybrid energy storage for dairy farms: Enhancing energy efficiency and operational resilience. J. Energy Stor. 114, 115811. https://doi.org/10.1016/j.est.2025.115811 (2025).

Chen, X., Wang, Y., Wu, Z., Zhou, M. & Yuan, B. Capacity expansion model for multi-temporal energy storage in renewable energy base considering various transmission utilization rates. J. Energy Stor. 98, 113145. https://doi.org/10.1016/j.est.2024.113145 (2024).

Elkholy, M., Schwarz, S. & Aziz, M. Advancing renewable energy: Strategic modeling and optimization of flywheel and hydrogen-based energy system. J. Energy Stor. 101, 113771. https://doi.org/10.1016/j.est.2024.113771 (2024).

van Eekelen, W. J., den Hertog, D. & van Leeuwaarden, J. S. Distributionally robust appointment scheduling that can deal with independent service times. Prod. Oper. Manag. 34, 1458 (2024).

Ran, X., Tay, W. P. & Lee, C. H. T. Robust data-driven adversarial false data injection attack detection method with deep Q-network in power systems. IEEE Trans. Industr. Inf. 20 (8), 10405–10418. https://doi.org/10.1109/TII.2024.3396527 (2024).

Sah, S. V., Prakash, V., Pathak, P. K. & Yadav, A. K. Virtual inertia and intelligent control assisted frequency regulation of time-delayed power system under DoS attacks. Chaos, Solitons Fractals 188, 115578. https://doi.org/10.1016/j.chaos.2024.115578 (2024).

Zhong, J. et al. Synergistic operation framework for the energy hub merging stochastic distributionally robust chance-constrained optimization and stackelberg game. IEEE Trans. Smart Grid 16 (2), 1037–1050. https://doi.org/10.1109/TSG.2024.3454341 (2025).

Shi, L. & Hu, B. Frontiers in operations: Battery as a service: Flexible electric vehicle battery leasing. Manuf. Serv. Oper. Manag. https://doi.org/10.1287/msom.2022.0587 (2024).

Biró, P., Klijn, F., Klimentova, X. & Viana, A. Shapley-scarf housing markets: Respecting improvement, integer programming, and kidney exchange. Math. Oper. Res. 49 (3), 1938–1972. https://doi.org/10.1287/moor.2022.0092 (2023).

Carvalho, M., Dragotto, G., Feijoo, F., Lodi, A. & Sankaranarayanan, S. When nash meets Stackelberg. Manag. Sci. 70 (10), 7308–7324. https://doi.org/10.1287/mnsc.2022.03418 (2023).

Zhao, A. P. et al. Hydrogen as the nexus of future sustainable transport and energy systems. Nat. Rev. Electr. Eng. https://doi.org/10.1038/s44287-025-00178-2 (2025).

Li, T. T. et al. Integrating solar-powered electric vehicles into sustainable energy systems. Nat. Rev. Electr. Eng. https://doi.org/10.1038/s44287-025-00181-7 (2025).

Hassan, Q. et al. Renewable energy-to-green hydrogen: A review of main resources routes, processes and evaluation. Int. J. Hydrogen Energy 48 (46), 17383–17408 (2023).

Ahn, S.-Y. et al. From gray to blue hydrogen: Trends and forecasts of catalysts and sorbents for unit process. Renew. Sustain. Energy Rev. 186, 113635 (2023).

Khan, M., Mehmood, S., Alhamid, M. & Saeed, M. Quantifying and enabling the resiliency of a microgrid considering electric vehicles using a Bayesian network risk assessment. Energy 308, 133036. https://doi.org/10.1016/j.energy.2024.133036 (2024).

Hashemipour, M., Mohamed, A. & Kamel, S. Impact assessment of electric vehicles integration and optimal charging schemes under uncertainty: A case study of Qatar. IEEE Access https://doi.org/10.1109/ACCESS.2024.3321190 (2024).

Kashif, A., Rezaei, A. A. & Mohammadi-Ivatloo, B. Intelligent fault tolerant energy management system using first-price sealed-bid algorithm for microgrids. Sustain. Energy Grids Netw. 38, 101309. https://doi.org/10.1016/j.segan.2024.101309 (2024).

Liu, T., Zhang, H., Fang, Y. & Li, D. A reinforcement learning approach using Markov decision processes for battery energy storage control within a smart contract framework. J. Energy Stor. 86, 111342. https://doi.org/10.1016/j.est.2024.111342 (2024).

Mustaffa, A. F., Omar, A. M. & Zakaria, Z. A. Optimal peak-shaving for dynamic demand response in smart Malaysian commercial buildings utilizing an efficient PV-BES system. Sustain. Cities Soc. 101, 105107. https://doi.org/10.1016/j.scs.2023.105107 (2024).

Liu, Y., Wang, H., Sun, X. & Chen, M. Model-free reinforcement learning-based energy management for plug-in electric vehicles in a cooperative multi-agent home microgrid with consideration of travel behavior. Energy 288, 129725. https://doi.org/10.1016/j.energy.2023.129725 (2024).

Kazempour, B. A., Moghaddas-Tafreshi, S. M. & Yousefi, H. Techno-economic, environmental and risk analysis of coordinated electricity distribution and district heating networks with flexible energy resources. IET Renew. Power Gen. 17 (12), 2935–2949. https://doi.org/10.1049/rpg2.12645 (2023).

Niu, Y., Zhang, X., Zhou, Y. & Zhang, H. Adaptive sliding mode control for instability compensation in DC microgrids due to EV charging infrastructure. Sustainable Energy Grids Netw. 35, 101119. https://doi.org/10.1016/j.segan.2023.101119 (2023).

Funding

This work was supported by the State Grid Qinghai Electric Power Company. (NO.SGQHJY00GHJS2500158).

Author information

Authors and Affiliations

Contributions

Jinliang Mi: Conceptualization, Writing—original draft; Min Xu: Investigation; Juan An: Methodology; Yusi Wang: Formal analysis, Investigation; Fei Liu: Project administration, Resources; Hailin Yang: Software, Validation; Zhongfu Tan: Supervision, Visualization, Writing—review & editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Mi, J., Xu, M., An, J. et al. Multiagent game-theoretic robust optimization for power system planning under source–load uncertainty. Sci Rep 15, 44204 (2025). https://doi.org/10.1038/s41598-025-27985-9

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41598-025-27985-9