Abstract

In the current complex economic environment, entrepreneurial enterprises, as a crucial force in China’s economic transformation, have vital survival and development strategies. This study is grounded in resource-based theory, integrating strategic management and contingency theories. It establishes a theoretical model based on the influence pathway of “entrepreneurial orientation—market orientation—entrepreneurial performance”, incorporating environmental uncertainty as a moderating variable. The research focuses on entrepreneurial enterprises in the industrial, agricultural, and service sectors, specifically those established within the last 8 years. Through empirical analysis of 303 samples from Hubei Province, China, it is found that entrepreneurial orientation actively promotes market orientation and positively impacts entrepreneurial performance through market orientation. Environmental uncertainty plays a dual role in this process by enhancing the positive effects of entrepreneurial orientation on market orientation and entrepreneurial performance, while weakening the direct effect of market orientation on entrepreneurial performance. This suggests that in uncertain environments, entrepreneurial enterprises need to strengthen entrepreneurial orientation to adapt flexibly to market changes, while considering various strategic factors to enhance performance. This study provides theoretical support and practical guidance for entrepreneurial enterprises in turbulent markets in strategic decision-making.

Similar content being viewed by others

Introduction

Entrepreneurial firms, as entities that develop and capitalize on opportunities, contribute significantly to technological innovation, job creation, and economic development through their unique innovation and flexibility. They have become vital drivers of economic growth and social stability in contemporary China, closely linked to major developmental goals such as advancing industrial upgrading, deepening supply-side structural reforms, and building an innovative nation. In the Context of China’s Economic Transformation Era, the High Uncertainty in Business Environment Raises Questions on How Strategic Orientation of Enterprises Influences Strategic Choices and Firm Performance, Garnering Attention from Scholars and Managers. Atuahene-Gima et al.1 define strategic orientation as a combination of entrepreneurial orientation and market orientation. Kumar et al.2 point out in their study that a singular focus on one strategic orientation often leads to challenges in maintaining long-term competitive advantages, highlighting the importance of leveraging multiple strategic orientations for sustained success. Consequently, an increasing number of studies are focusing on the combined impact of market orientation and entrepreneurial orientation on firm performance3. As research progresses, scholars are increasingly recognizing environmental uncertainty as a central driver of strategic innovation in enterprises, closely intertwined with organizational strategic factors. Strategic orientation forms the foundation for enterprises to flexibly allocate internal resources based on external environmental changes, guiding companies to respond to market conditions in diverse ways, fostering varied entrepreneurial practices4. Only by precisely understanding the pulse of the environment can enterprises implement appropriate strategic adjustments and effectively drive entrepreneurial processes. It is noteworthy that the dual interaction between the choice of corporate strategy and environmental uncertainty is crucial for firm performance, with their alignment being a key determinant of performance quality5.

Resource-based theory posits that the primary reasons for performance disparities among firms lie in their possession of heterogeneous resources that are valuable, rare, difficult to imitate, and non-substitutable. Strategic management theory, on the other hand, emphasizes that strategic orientation, as a form of managerial resource, is a crucial factor in achieving superior performance. Scholars in this field have explored the necessity of strategic planning and classified corporate strategies, clarifying the impact of heterogeneous strategic choices on organizational performance6. Building on these two theoretical foundations, researchers in entrepreneurship studies introduced the concept of “entrepreneurial orientation”7, defined as a strategic decision-making perspective characterized by innovation, proactivity, and risk-taking ability8. Some scholars argue that entrepreneurial orientation serves as a heterogeneous strategic resource, with new ventures that adopt an entrepreneurial orientation exhibiting superior performance compared to other startups9,10,11. Moreover, some studies have indicated that the relationship between entrepreneurial orientation and firm performance is not linear, but rather follows an inverted U-shaped curve, suggesting that optimal performance is achieved only at moderate levels of entrepreneurial orientation12. Based on these theories and related research, it becomes evident that an in-depth investigation of the dimensions of entrepreneurial orientation within new ventures and their subsequent effects is necessary to analyze performance issues13. This raises the question: how does entrepreneurial orientation indirectly affect entrepreneurial performance? According to organizational imprinting theory, a new venture’s initial strategy tends to remain consistent for several years post-establishment and continues to influence its development14. New ventures typically exhibit higher degrees of innovativeness, risk-taking, and proactivity, largely influenced by the entrepreneurs’ backgrounds and specific socio-political contexts. Consequently, these enterprises often adopt entrepreneurial orientation as their initial and core strategy. Research indicates that as new ventures evolve, they adapt their strategies to respond to environmental changes; however, findings show that the core initial strategy remains unchanged, with only the non-core strategies and related actions undergoing modifications15. Hence, the centrality of the initial entrepreneurial orientation strategy remains robust, thereby constraining and influencing the subsequent growth of these ventures16. From this perspective, in dynamic environments, entrepreneurial firms influence their alignment with the environment and, consequently, their growth by adjusting non-core strategies and related actions under the guidance of their core entrepreneurial orientation strategy17. However, empirical studies on the impact of entrepreneurial orientation on organizational performance have yielded mixed results. While many studies confirm a significant positive relationship between the two18,19, some research has found only a weak correlation20, and other studies have reported no significant effects21. As a result, some scholars have begun to incorporate mediating variables into their research to explain these inconsistencies, such as organizational learning orientation22, strategic technology choices23, market orientation24, and capability factors25.

Moreover, research indicates that other strategies may mediate the relationship between entrepreneurial orientation and entrepreneurial performance, with a particularly strong emphasis on market orientation10,26. However, studies examining the conditional applicability of market orientation’s impact on performance within entrepreneurial ventures remain scarce, and existing conclusions are inconsistent27. Concurrently, much of the current research focuses on the boundary conditions that determine the positive effects of entrepreneurial and market orientations on performance, primarily concentrating on internal variables such as resource integration capacity, technological capability, absorptive capacity, information and communication technology capability, and learning ability28,29. In contrast, there has been relatively less attention given to external variables; considering environmental uncertainty as an external variable is particularly relevant for understanding the moderating effects between strategic orientations and performance. In the operational context of entrepreneurial firms, mediating and moderating variables often coexist and interact, each serving distinct roles. However, existing research predominantly approaches the relationship between entrepreneurial orientation and organizational performance from a singular perspective—either as a mediation or as a moderation—resulting in an incomplete understanding of the underlying mechanisms in entrepreneurial practice30. This narrow focus can lead to confusion regarding the roles of mediation and moderation, potentially yielding erroneous conclusions31. Contingency theory posits that the strategies adopted by firms should align with their environment to enhance performance. Therefore, exploring the applicable conditions under which entrepreneurial firms adopt market orientation from the perspective of environmental uncertainty is particularly important. Nonetheless, studies examining the moderating role of environmental uncertainty among entrepreneurial orientation, market orientation, and performance remain insufficient. Thus, a thorough investigation into the existence and differentiated effects of multiple variables in the relationship between entrepreneurial orientation and firm performance presents a significant area of focus.

The literature reviewed indicates that the mechanisms through which entrepreneurial orientation, market orientation, and environmental uncertainty affect entrepreneurial performance are still not fully understood32, leaving several research gaps. Firstly, current literature often focuses separately on the impact of entrepreneurial orientation, market orientation, and environmental uncertainty on entrepreneurial performance, lacking a comprehensive consideration of the complex relationships among these factors33. There is still room for exploring the multiple-factor combination studies on how entrepreneurial orientation influences entrepreneurial performance. Secondly, there must be intermediate mechanisms between entrepreneurial orientation and performance; studying how entrepreneurial orientation influences entrepreneurial performance through what pathways is crucial, rather than solely considering the direct impact relationship between the two34. Additionally, while some studies suggest that environmental uncertainty may moderate the relationship between entrepreneurial orientation and entrepreneurial performance, further validation is needed for the relationship between these two factors in different environments, requiring additional exploration of the pathways through which environmental uncertainty affects entrepreneurial performance under varying conditions. Lastly, current research on the relationship between entrepreneurial orientation, market orientation, environmental uncertainty, and entrepreneurial performance tends to concentrate within a single theoretical perspective, such as resource-based theory or resource management theory. However, the lack of integration of different theoretical frameworks to systematically construct a more complete and comprehensive theoretical model restricts a deeper understanding of this field.

Based on the aforementioned theoretical background, this study aims to explore the entrepreneurial performance of startups, examining the mechanisms by which entrepreneurial orientation influences firm performance. Specifically, it will focus on the indirect pathways through which entrepreneurial orientation affects performance, as well as the contextual conditions under which these pathways apply. In summary, the research questions this study seeks to address include: Firstly, how entrepreneurial orientation internally affects the entrepreneurial performance of new ventures. Entrepreneurship process theory suggests that entrepreneurial performance results from the combined matching of multiple internal and external factors. Therefore, different stages of development, industries, and environments lead to different strategic choices. New ventures often struggle with imprecise market demands. By investigating the mediating effect of market orientation in the impact process of entrepreneurial orientation on the entrepreneurial performance of new ventures, this study seeks to explore the internal operational mechanisms through which entrepreneurial orientation enhances entrepreneurial performance in new ventures. Secondly, how environmental uncertainty moderates the impact of entrepreneurial orientation on the entrepreneurial performance of new ventures. The contingency theory suggests that strategies adopted by businesses should align with the environment to improve performance. Environmental uncertainty reflects the unpredictable state of the environment for businesses. By introducing environmental uncertainty as a moderating variable in the internal operational mechanisms of the impact of entrepreneurial orientation on the entrepreneurial performance of new ventures, this study examines the influence of contingencies on their relationship. This exploration aims to guide businesses on how to leverage environmental changes to seek development effectively in practice.

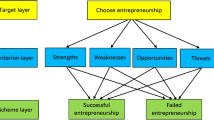

To date, existing research has not reached a systematic theoretical framework regarding the relationship among market orientation, entrepreneurial orientation, environmental uncertainty, and entrepreneurial performance. Current studies examining the interplay between these two strategic orientations and environmental variables, particularly in relation to mixed performance outcomes, remain insufficient. The lack of a systematic theoretical framework poses a risk in this field: scholars may invest considerable effort from their individual perspectives yet arrive at a multitude of conflicting empirical conclusions, with no cohesive method to integrate these findings. Consequently, relevant suggestions and insights often leave practitioners bewildered in their innovation practices. To mitigate this risk, prior to further investigations into strategic orientation, variable uncertainty, and entrepreneurial performance, it becomes crucial and meaningful to construct a scientific and systematic theoretical analysis framework that elucidates the interactions among market orientation, entrepreneurial orientation, environmental uncertainty, and innovation performance, followed by empirical validation. To systematically articulate this complex mechanism, this study centers on resource-based theory, integrating strategic management theory, contingency theory, and organizational imprinting to develop a comprehensive theoretical model—specifically, a mediation model that includes moderating effects (see Fig. 1). Within this model, the effectiveness of implementing entrepreneurial orientation is identified as a key determinant of performance variance among startups. Firstly, grounded in resource-based theory, this research derives the contributions of entrepreneurial orientation implementation to firm performance, underscoring its significance in helping firms navigate high-uncertainty environments and avoid market obsolescence. By incorporating insights from strategic management theory and organizational imprinting, the study further explores the specific pathways through which entrepreneurial orientation is implemented within organizational operations, identifying which mediating pathways are most effective in translating entrepreneurial orientation into improved firm performance. Secondly, the foundational logic of the model adheres to organizational imprinting theory35, positing market orientation as a strategic complement to entrepreneurial orientation. It delves into the mediating mechanisms by which market orientation influences the relationship between entrepreneurial orientation and firm performance. Finally, in line with contingency theory, the model considers potential contingency effects, primarily analyzing external variables such as environmental uncertainty, to elucidate the applicable conditions for various implementation pathways, thereby offering appropriate guidance for entrepreneurial activities in practice. This model aims to comprehensively reveal how strategic orientation influences enterprise behavioral strategies, subsequently impacting entrepreneurial performance, and how environmental uncertainty, as a moderating variable, significantly influences and adjusts these relationships. Through this model, we aim to deepen the understanding of the dynamic interactions between strategic orientation, environmental uncertainty, and entrepreneurial performance.

Literature hypotheses

Entrepreneurial orientation and entrepreneurial performance

Building on resource-based theory, strategic management theory conceptualizes market orientation as a managerial heterogeneous resource that can lead to variations in entrepreneurial performance among new ventures. In the realm of entrepreneurship research, entrepreneurial orientation is widely regarded as a key driver for companies to keenly identify and actively pursue new opportunities, aiming to foster new products, markets, and innovative business models. Wiklund et al.20 points out that for small enterprises, a high level of entrepreneurial orientation can prompt them to swiftly seize new opportunities, establish a first-mover advantage, and continually strengthen their market position over time. This is due to their ability to more precisely target high-quality niche markets compared to competitors, set more competitive pricing strategies, and effectively translate new opportunities into tangible returns20. Wales et al.36 further emphasizes that entrepreneurial orientation motivates small businesses to actively integrate internal and external knowledge resources, explore unknown territories, adopt proactive strategies, take risks, and engage in innovative activities to maximize the value creation of existing products and services. The positive impact of entrepreneurial orientation is also reflected in the overall enhancement of managerial effectiveness within organizations, including optimizing resource allocation, enhancing organizational flexibility, improving internal communication efficiency, and stimulating innovation potential. These positive effects collectively contribute to enhancing the overall performance of new ventures37. Multiple empirical studies support this theoretical perspective, Taan et al.38 conducted a study on small and medium enterprises in the manufacturing sector in Gorontalo Province, Indonesia, with results indicating that entrepreneurial orientation significantly promotes improved entrepreneurial performance. Similarly, the research conducted by Saleh et al.39 in small businesses across the five major provinces of Lebanon also confirmed the direct positive influence of entrepreneurial orientation on new venture performance. Makhloufi40 conducted an analysis of data from middle to upper-level managers in small and medium-sized enterprises in Algeria, revealing that entrepreneurial orientation positively influences entrepreneurial performance. Additionally, Yi et al.’s41 in-depth analysis using structural equation modeling on technology-based micro and small enterprises in Changsha, Hunan, also supported a positive correlation between entrepreneurial orientation and firm performance. Liu et al.42, focusing on new ventures in various entrepreneurial spaces in Zhejiang Province, explored how entrepreneurial orientation and entrepreneurial opportunity development synergistically impact the performance of new ventures, with research findings indicating a direct positive promotion effect of entrepreneurial orientation on new venture performance. Based on the above, this study proposes the hypothesis:

H1

Entrepreneurial orientation is positively related to entrepreneurial performance.

Entrepreneurial orientation, market orientation, and entrepreneurial performance

Resource-based theory posits that a firm’s heterogeneous resources are the sources of its competitive advantage and superior performance. Strategic management theory views corporate strategy as a form of managerial heterogeneous resource, where entrepreneurial orientation—characterized by innovation, risk-taking, and a forward-looking approach—plays a crucial role in influencing variations in firm performance; the greater the level of implementation, the better the firm’s performance. Additionally, market orientation, as another strategic approach, encompasses customer orientation, competitor orientation, and internal coordination. It serves as a vital cultural resource that guides firms in creating customer value, effectively fulfilling customer needs and driving sustained superior performance.

Market orientation focuses on the core of customers, emphasizing the adjustment of product and service strategies based on in-depth insights into market needs and competitive dynamics to precisely meet market value demands. It not only provides abundant resources for organizational learning, but also accelerates the integration of internal and external knowledge and information within the firm. This process fosters the development of new knowledge, technologies, and products, thereby driving the continuous growth of the firm’s performance43. Meanwhile, Entrepreneurial orientation, as a key driving force that inspires entrepreneurial spirit and practice in enterprises44, prompts entrepreneurial organizations to innovate boldly, adopt preemptive strategies at the forefront of competition, face risks and uncertainties courageously, thereby enhancing the likelihood of entrepreneurial success45. Although new ventures are often constrained by the “liability of newness”, struggling to swiftly integrate market information and align precisely with customer needs46, some enterprises, through market-oriented strategies, closely monitor market dynamics, centering on customer needs, successfully establish a solid customer base, and demonstrate significant competitiveness. Empirical studies have shown a positive interactive relationship between entrepreneurial orientation and market orientation. Hossein’s research reveals the bridging role of market orientation between internal marketing and entrepreneurial orientation in private sports clubs47; Mudjijah et al.’s48 analysis based on Indonesian entrepreneurs’ data directly confirms the positive impact of entrepreneurial orientation on market orientation; Research by Karimi et al.49, Solano Acosta et al.50, and Wijayanti et al.51 also indicates that entrepreneurial orientation not only enhances company performance but also strengthens market-oriented behaviors. Based on the above, this study proposes the hypothesis:

H2

Entrepreneurial orientation is positively related to market orientation.

The profound impact of market orientation on entrepreneurial performance has long been a focal point in academia. Research indicates that efficient implementation of market-oriented strategies by enterprises significantly promotes the development of competitive advantages and long-term success52,53,54. Narver et al.55 assert that market orientation is rooted in the philosophy of “market pull”, enabling companies to keenly capture new market opportunities and swiftly respond to customer demands. This approach fosters continuous innovation of products and services, enhancing customer recognition and acceptance of new offerings56. Empirical research widely confirms the positive correlation between market orientation and organizational performance. Studies by Yao et al.30 and other scholars reveal the significant positive impact of responsive and proactive market orientation on organizational performance; Xue et al.57, through case analysis, indicates that proactive market orientation plays a more prominent role than reactive market orientation in performance improvement and long-term development; The studies conducted by Ma et al.58 and Fang et al.59 further substantiate the positive impact of entrepreneurial orientation and market orientation on firm performance. Based on the above, this study proposes the hypothesis:

H3

Market orientation is positively related to entrepreneurial performance.

Market orientation and entrepreneurial orientation play complementary roles in enterprise management. Market orientation focuses on the customer, continuously striving to meet both current and potential needs. In contrast, entrepreneurial orientation represents a forward-thinking mindset, characterized by a willingness to explore and innovate in response to customer demands. Resource-based theory provides a theoretical foundation for the integration of these two orientations, highlighting the alignment between market orientation’s customer-centric philosophy and the innovation characteristics of entrepreneurial orientation Market orientation, by continuously monitoring market trends and competitive landscapes, provides valuable information for entrepreneurial decision-making, helping entrepreneurs seize opportunities. Simultaneously, market orientation strengthens customer loyalty and fosters an innovative atmosphere, injecting long-term stable growth momentum into entrepreneurial performance. Research indicates that market orientation is regarded as a market-driven behavior, while entrepreneurial orientation serves as a driving force for the market60. When firms integrate entrepreneurial orientation with appropriate organizational design and structure, they are better positioned to comprehensively achieve market orientation objectives61. Additionally, companies with higher levels of market orientation tend to exhibit superior performance, as they are more adept at securing market success by effectively meeting customer values62. Existing research highlights the significant role of market orientation as a mediating variable. Based on empirical data, Yao et al.30 and others found that market orientation plays a significant mediating effect between entrepreneurial orientation and performance. Studies by scholars like Xia et al.26 and Liu et al.63 have also confirmed the mediating role of market orientation in the relationship between entrepreneurial orientation and innovative performance in different contexts (such as the new normal background, green entrepreneurial orientation, etc.). Furthermore, research by Lumpkin et al.56, Barrett et al.64, and other scholars equally support the mediating role of market orientation in the relationship between entrepreneurial orientation and performance. Based on the above, this study proposes the hypothesis:

H4

Market orientation positively mediates the relationship between entrepreneurial orientation and entrepreneurial performance.

Entrepreneurial orientation, market orientation, environmental uncertainty and entrepreneurial performance

Based on contingency theory, environmental uncertainty is considered a critical factor impacting corporate strategic choices and performance. In examining the relationships among entrepreneurial orientation, market orientation, and entrepreneurial performance, environmental uncertainty plays a significant moderating and influencing role. In highly uncertain environments, entrepreneurial orientation enables firms to innovate proactively and seek new opportunities, thereby enhancing adaptability. Meanwhile, market orientation allows companies to keenly understand customer needs and competitive dynamics, optimizing resource allocation. In this context, a flexible approach to both entrepreneurial and market orientation can effectively enhance corporate performance. Therefore, businesses should adjust their strategies in response to environmental changes to achieve optimal entrepreneurial performance.

With the deepening of economic globalization and the increasing market competition, the external environment in which enterprises operate is undergoing unprecedented dynamic changes, with industries facing high levels of environmental uncertainty. In this context, Freel points out that in order to solidify their market positions, enterprises often tend to adopt proactive competitive strategies, with entrepreneurial orientation being one of the most commonly used effective means65. Wiersema et al.66 further elaborate that the intensification of environmental uncertainty increases the difficulty of identifying potential market needs, compelling enterprises, especially those with entrepreneurial orientation, to adopt more flexible and exploratory strategies, such as launching new products, technological innovations, or establishing strategic alliances, to rapidly adapt to market changes and turn challenges into opportunities. Therefore, for startups, strengthening their entrepreneurial orientation capabilities becomes key to coping with environmental uncertainty. These enterprises should actively leverage market-oriented principles, keenly identify and effectively utilize emerging business opportunities, and continuously enhance their competitiveness. Tan et al.’s67 empirical research on private enterprises indicates that in situations of scarce resources and intense external competition, the importance of entrepreneurial orientation is particularly pronounced. Enterprises with high entrepreneurial orientation can proactively gather and use information, strengthen the practice of market orientation through innovation, foresight, and risk-taking, thereby driving business growth and enhancing profitability68. Furthermore, Zhu et al.’s69 study also found that the entrepreneurial environment plays a positive moderating role in the relationship between entrepreneurial orientation and organizational performance. A heightened awareness of environmental uncertainty by enterprises can stimulate their entrepreneurial orientation to keenly capture market opportunities70. Based on the above, this study proposes the hypothesis:

H5

Environmental uncertainty positively moderates the relationship between entrepreneurial orientation and market orientation.

In the current academic consensus, amidst the escalating environmental uncertainty, the proactive initiatives of entrepreneurial enterprises have become particularly crucial71. Confronted with the myriad challenges posed by the environment, adopting an entrepreneurial orientation in strategic decision-making is seen as the optimal path for enterprises to mitigate risks and maintain competitiveness. Consequently, startup enterprises that can actively adjust their mindsets to embrace challenges are more likely to achieve a significant improvement in performance72. The development activities of enterprises are profoundly influenced by external environmental factors. Hamel points out that environmental uncertainty is accelerating the shortening of product lifecycles, rendering future returns from existing businesses fraught with unknowns. Therefore, enterprises must continuously explore new opportunities, gain competitive advantages through innovation, rapid responsiveness, and the risk-taking entrepreneurial orientation activities73. Environmental uncertainty serves not only as a key driver for the flourishing of entrepreneurial activities but also as a significant source of complexity in entrepreneurial endeavors. As articulated by Thompson et al.74, an uncertain environment profoundly impacts organizational equilibrium and performance, serving as an indispensable variable to understand these phenomena. Multiple studies further confirm the moderating role of environmental uncertainty between entrepreneurial orientation and entrepreneurial performance. For instance, in the banking sector, and colleagues examined the influence of national governance environments on corporate governance responsibilities and sustainability goals, with specific attention to the potential impact of domestic political risk and global economic policy uncertainty on bank profitability. Additionally, scholars directly consider environmental uncertainty as a moderating variable, studying its role in the relationship between entrepreneurial orientation and firm performance. Covin et al.’s44 research indicates that in competitive markets, firms adopting entrepreneurial orientations often excel and achieve outstanding performance. Yoo et al.’s75 study on South Korean technology firms also highlights the necessity for firms to fully consider the dynamism and richness of the environment when formulating strategies to maximize the positive effects of entrepreneurial orientation on firm development. Utomo et al.’s76 analysis of small and medium enterprises similarly confirms the significant strengthening effect of environmental uncertainty on the relationship between entrepreneurial orientation and firm development. Based on the above, this study proposes the hypothesis:

H6

Environmental uncertainty positively moderates the relationship between entrepreneurial orientation and entrepreneurial performance.

When companies face environmental changes triggered by fluctuations in market information and shifts in customer demands, they must swiftly adjust their strategic deployment and resource allocation strategies to effectively counter the challenges brought about by environmental uncertainty, ensuring the stability and continuity of their competitive advantage. In this process, environmental uncertainty actually accelerates the market acumen and response speed of market-oriented enterprises, prompting them to precisely grasp market dynamics, customer demands, and competitive situations, thereby flexibly reallocating resources to maximize customer value77. Specifically, companies with strong market orientation demonstrate a high sensitivity to customer needs and establish efficient response mechanisms internally to ensure the immediate capture of market information, its rapid dissemination, and its effective translation into actionable strategies78. Furthermore, market orientation drives companies to be customer-centric, continuously optimize products and services to meet and exceed customer expectations, thereby enhancing customer satisfaction and loyalty, building long-term stable customer relationships, and laying a solid foundation for the company’s sustainable development79,80. According to social embeddedness theory, the market environment holds immeasurable value for startups. Only by deeply understanding and actively adapting to environmental changes can companies develop precise and effective market strategies, smoothly advance the entrepreneurial process, and ultimately enhance entrepreneurial performance81. Within this theoretical framework, environmental conditions are considered critical moderating variables between market orientation and firm performance, whose influence cannot be overlooked. Empirical research also supports the above views. Li et al.82, using sample data from equipment manufacturing enterprises in Jiangsu, Zhejiang, and Shanghai regions, verified the positive effect of market orientation on firm performance and revealed the moderating role of environmental uncertainty in this relationship. Zhang et al.83, based on research data from enterprises in the Yangtze River Delta region, further pointed out that in environments with high technological uncertainty, the promoting effect of market orientation on organizational performance is more significant. Additionally, research by Fu et al.84 also emphasizes the crucial moderating role of environmental uncertainty in the process of translating dynamic capabilities and absorptive capacity of enterprises into performance. Therefore, against the backdrop of increasing environmental uncertainty, companies, for survival and growth, often increase investments in marketing and research and development, closely monitor market demands and technological trends85. Based on the above, this study proposes the hypothesis:

H7

Environmental uncertainty positively moderates the relationship between market orientation and entrepreneurial performance.

Market orientation and entrepreneurial orientation, as two complementary strategic orientations, each exhibit different emphases in constructing organizational advantages. Environmental variables, as moderators, profoundly influence the contributions of these two strategic orientations to organizational performance. In turbulent market environments, companies face an urgent need to implement strategies that combine entrepreneurial and market orientations to adapt to rapidly changing market conditions. Faced with intense competition and threats to their competitive advantages due to market turbulence, companies must have a high degree of flexibility and adaptability, actively absorb new knowledge, information, and resources, swiftly adjust or even reshape their organizational resources and capabilities, to address challenges and seize unique competitive advantages in dynamic environments86. Environmental uncertainty not only broadens a company’s strategic horizons but also stimulates extensive experimentation and deep exploration in entrepreneurial and market orientations, prompting flexible adjustments in strategies and organizational structures, breaking inherent inertia, fostering innovative thinking, and ultimately driving a significant improvement in performance87. Prior research extensively confirms that environmental uncertainty, as a critical contextual factor, significantly moderates strategic choices of companies88. Wang et al.89 further point out that in high uncertainty environments, the effectiveness and efficiency of strategic choices improve, aiding companies in better coping with uncertainty and accelerating their growth pace. Specifically, as environmental uncertainty intensifies, the rapid changes in market demand and structure provide abundant opportunities for innovation for companies. In such environments, companies with entrepreneurial orientation are more likely to leverage market orientation to swiftly transform new ideas, products, or technologies into competitive advantages in the market, achieving high performance objectives90. Entrepreneurial orientation plays a bridging role in this process, encouraging companies to actively adopt market-oriented strategies in uncertainty, swiftly seize market opportunities, enhance performance, and ultimately realize entrepreneurial visions91. In conclusion, this study proposes the hypothesis:

H8

Environmental Uncertainty positively moderates the mediating role of entrepreneurial orientation acting on entrepreneurial performance through market orientation.

Research methodology

Sample collection

This study focuses on entrepreneurial firms established for no more than 8 years, with a sample drawn from entrepreneurial teams in Hubei, China, across various industries, including automotive, catering, education, and services. Given the multifaceted nature of the research, the survey participants were selected from founders who possess insights into the entrepreneurial enterprises, using a combination of questionnaire-based surveys and face-to-face interviews. To ensure the scientific rigor of the research findings, a stratified random sampling approach was employed. This method guarantees that every unit in the population has a non-zero probability of being selected, thereby upholding the principle of randomness and eliminating subjective bias. The total sample was derived from a list of entrepreneurial alumni provided by alumni associations from 25 universities in Hubei Province. The sampling process involved strict controls in two areas: the selection of universities for distributing the questionnaires and the selection of interviewees. The universities were initially stratified into 25 distinct layers, with each school’s entrepreneurial firms being assigned a code. A random number generator was then used to select a starting point, and firms were chosen at regular intervals. This procedure allowed us to select four entrepreneurial firms from each university, resulting in a total sample of 100 firms targeted for the questionnaire distribution. To enhance the reliability of the measurements and the efficiency of the survey, we focused on entrepreneurial teams comprising five or more members. Following this procedure, we excluded 28 entrepreneurial firms, resulting in 72 remaining sampled firms. Each firm’s founder was then coded, with five individuals randomly selected from each firm as survey participants, thereby maximizing the credibility of the conclusions. Prior to the questionnaire survey, we conducted semi-structured interviews with the founders to ensure their ability to accomplish the survey tasks. After providing focused training, they participated in the survey. Furthermore, post-survey, we conducted open-ended interviews with the founders to verify the authenticity of the questionnaire results.

The survey was conducted from September 2022 to February 2023, during which we distributed a total of 360 questionnaires to 72 entrepreneurial firms. Of these, 321 respondents provided usable responses. To further ensure the reliability of the data, we excluded any firm that had fewer than two valid questionnaires. This procedure reduced the sample size to 66 entrepreneurial firms, yielding a total of 303 responses for final analysis. Among these, there were 137 enterprises under 3 years old, 101 enterprises aged between 3 and 5 years, and 65 enterprises aged between 5 and 8 years. Additionally, there were 123 enterprises with fewer than 50 employees, 74 enterprises with 50–100 employees, 47 enterprises with 100–200 employees, and 59 enterprises with over 200 employees. In terms of revenue, there were 122 enterprises with revenue below 10 million RMB, 117 enterprises with revenue between 10 and 20 million RMB, and 64 enterprises with revenue exceeding 20 million RMB. Furthermore, 83 enterprises were in the agricultural sector, 87 in the industrial sector, and 133 in the service sector.

Variable measurement

Unless otherwise specified, all variable measurements were conducted using a 5-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree). To ensure the equivalence of meaning, we followed the procedure outlined by Brislin to translate all measurement items of the variables into Chinese, excluding those originally in Chinese92.

Dependent variable

Entrepreneurial performance

Entrepreneurial performance is a comprehensive metric that assesses the outcomes and efficiency of entrepreneurial activities, reflecting the situation of new enterprise creation, growth, and competitive advantage acquisition. The measurement of entrepreneurial performance drew on scales developed by Chandler et al.93, modified specific items in conjunction with studies by Jiang et al.94, forming an 8-item scale tailored to the needs of this study. The measurement covers aspects such as “the enterprise maintains a high profit margin”, “the enterprise’s return on equity (ROE) is leading in the industry”, “the enterprise’s workforce has grown rapidly”, “the enterprise has developed new products or services at a fast pace”, “the enterprise’s sales have increased significantly”, “the enterprise’s market share of products has grown rapidly”, “the enterprise’s net income has grown substantially”, and “founding this enterprise has been a satisfying experience for me”.

Independent variables

Entrepreneurial orientation

Entrepreneurial orientation refers to a strategic tendency of enterprises actively pursuing innovation, taking risks, and proactively seeking growth opportunities to drive business development. The measurement of entrepreneurial orientation utilized a 9-item scale developed by Covin et al.44. The items include: “The enterprise places a high priority on research and development activities”, “Pursues technological or service leadership and innovation”, “Implements significant changes in its product or service lines to gain competitive advantage”, “Has a recent major goal of introducing new products or services”, “Typically initiates activities that competitors later follow”, “Leads competitors in introducing new products and ideas”, “Is often the first to adopt new production methods or management styles, pioneering new products or services”, “Takes bold and swift actions to achieve corporate goals”, “Displays a strong preference for high-risk, high-reward projects”, and “When confronted with an uncertain environment, takes bold actions to maximize opportunities”.

Market orientation

Market orientation is a business philosophy centered around customer needs, adjusting operational strategies flexibly by deeply understanding market trends and customer preferences to meet market demands. The measurement of market orientation employed an 8-item scale developed by Narver et al.92. The items encompass: “The primary objective of our production is to satisfy customers”, “Our competitive strategies are formulated based on customer needs”, “We frequently assess customer satisfaction”, “We pay closer attention to customers than our competitors”, “We continuously strive to uncover needs that customers may not be aware of themselves”, “We seek business opportunities in areas where customers struggle to articulate their needs”, “We are relentless in understanding how customers consume our products”, and “We anticipate mainstream trends to identify future customer needs”.

Environmental uncertainty

Environmental uncertainty refers to the complexity and variability of external environments that are difficult to predict and grasp. The measurement of environmental uncertainty utilized a 7-item scale developed by Jansen et al.95. The items encompass: “The degree of change in the external environment faced by the enterprise is very dramatic”, “Customers frequently present new demands for the enterprise’s products (services)”, “The external environment is constantly evolving”, “The number and variety of products (services) in the market where the enterprise operates are continually changing”, “The market in which the enterprise operates is highly competitive”, “Comparatively, the competitors faced by the enterprise are all very powerful”, and “The enterprise operates in a highly competitive market”.

Control variables

This study employed control variables to ensure result accuracy. Generally, entrepreneurial performance is influenced by fundamental characteristics of enterprises. Therefore, this study considered enterprise age, company size, sales volume, and industry as control variables to eliminate their potential influences on the research outcomes. This approach enables a more precise evaluation of the impact of other key factors on entrepreneurial performance.

Results

Reliability and validity testing

The reliability of all variables was tested through confirmatory factor analysis, a systematic approach that ensures the validity and stability of measurement variables by verifying constructs, evaluating factor loadings, examining convergent validity, and providing model fit indices. Table 1 presents the results of the confirmatory factor analysis. The factor loadings for each item range between 0.850 and 0.957, with composite reliabilities (CR) exceeding 0.9, indicating high reliability of the measurement scale in this study. The average variance extracted (AVE) is above 0.6 for all variables, demonstrating high convergent validity. The square root of the AVE for each variable is greater than its Pearson correlation coefficients with other latent variables, indicating good discriminant validity of the measurement scale in this study. These results suggest that the construct validity and reliability of latent variables in the measurement model of this study meet the evaluation standards proposed by Fornell and Larcker, making the sample data suitable as the empirical research foundation for this study. Additionally, Table 2 also provides the means (M) and standard deviations (SD) of the variables. The standard deviations for entrepreneurial orientation, market orientation, environmental uncertainty, and entrepreneurial performance are relatively small, with mean values of 3.525, 3.299, 3.634, and 3.520 respectively, indicating that respondents overall perceive the measurement items for each variable as “consistent”.

This study employed Amos 24.0 to conduct a confirmatory factor analysis to test the discriminant validity of the variables, with the results presented in Table 2. It is evident from the analysis that the four-factor model exhibits the best fit indices (χ2/df = 1.694, SRMR = 0.0258, RMSEA = 0.048, CFI = 0.977, TLI = 0.975), significantly outperforming other models, indicating a high level of discriminant validity among the variables. Furthermore, the fit indices for the one-factor model are notably poor (χ2/df = 9.574, SRMR = 0.082, RMSEA = 0.168, CFI = 0.713, TLI = 0.693), suggesting a lack of serious common method bias issues.

Direct effects testing

This study employs a multiple linear regression analysis approach to rigorously examine the direct, indirect, and mediation effects. Specifically, it utilizes the Process program developed by Hayes96, which is based on the principles of ordinary least squares regression, to estimate and interpret these effects. For detailed instructions on the utilization of the Process program, readers are advised to refer to the website accessible via the URL: https://www.processmacro.org/index.html. For the examination of direct and mediating effects, the study utilized Model 4 of the mediation analysis in the SPSS 26.0 software with the Process tool, running 5000 bootstrap samples to investigate direct and mediating effects after controlling for firm age, company size, sales volume, and industry. The direct and mediating effects testing results are presented in Tables 4 and 5, respectively. In the subsequent analysis, the variables Entrepreneurial Orientation (EO), Market Orientation (MO), Environmental Uncertainty (EU), and Entrepreneurial Performance (EP) were denoted. Additionally, the control variables Firm Age (EA), Company Size (ES), Sales Volume (SS), and Industry (IN) were represented. Analyzing the direct effects using Table 3, the results of Model 1 indicate a significant positive influence of Entrepreneurial Orientation on Entrepreneurial Performance (β = 0.889; CI [0.789, 0.989]), validating hypothesis H1. This finding aligns with previous research by Rauch et al.97, suggesting a significant relationship between entrepreneurial orientation and organizational performance. A higher entrepreneurial orientation plays a crucial role in enhancing entrepreneurial performance by motivating firms to actively seek market opportunities, innovate new products and services, and achieve higher customer satisfaction. Furthermore, Model 2 demonstrates that Entrepreneurial Orientation has a significant positive impact on Market Orientation (β = 0.860; CI [0.801, 0.919]), supporting hypothesis H2. This implies that a higher entrepreneurial orientation facilitates new ventures in focusing on both explicit and latent customer needs, utilizing unique market insights, strengthening market orientation, and establishing competitive advantages that competitors cannot easily replicate. Lastly, Model 3 reveals that Market Orientation has a significant positive impact on Entrepreneurial Performance (β = 0.595; CI [0.414, 0.777]), confirming hypothesis H3. A higher market orientation plays a critical role in enhancing entrepreneurial performance by helping firms win customers, outperform competitors, foster internal cooperation, and secure a competitive position in intense markets.

Mediation effects testing

According to the results of Model 1 and Model 3, it is evident that even after the inclusion of Market Orientation, Entrepreneurial Orientation still exerts a positive impact on Entrepreneurial Performance (β = 0.377; CI [0.195, 0.559]). However, the regression coefficient decreases from 0.889 to 0.377, indicating a significant weakening of the effect. Combining the test results of hypotheses H1, H2, and H3, it can be concluded that Market Orientation plays a significant mediating role between Entrepreneurial Orientation and Entrepreneurial Performance, supporting hypothesis H4. This suggests that entrepreneurial-oriented firms actively gather customer demand information to adapt to market trends, collect competitor attack information to respond and counterattack promptly55, and fully harness their creativity to develop new products and services, meeting customer needs98, combating market competition, and fostering internal coordination efficiency, thereby enhancing performance through their efforts99. Further analysis of the mediating effects through Table 4 reveals that Entrepreneurial Orientation has a significant total effect on Entrepreneurial Intent (0.889, CI [0.789, 0.989]), with a significant direct effect (0.377, CI [0.195, 0.559]) and a significant indirect effect (0.512, CI [0.362, 0.667]). The indirect effect accounts for 57.69% of the total effect, while the direct effect represents 42.40%.

Moderation effects testing

In conducting the moderation effects test, the Process program developed by Andrew F. Hayes was utilized. The Process 3 program within SPSS 26.0 software was employed to analyze the moderating effect after incorporating Market Orientation through 5000 bootstrap samples. After controlling for firm age, company size, sales volume, and industry, the moderation effects testing results are presented in Tables 5 and 6, with moderated mediating effects shown in Table 7. From the results in Model 4 as shown in Table 5, it is evident that the interaction term between Entrepreneurial Orientation and environmental uncertainty has a significant positive impact on Market Orientation (β = 0.096; CI [0.048, 0.143]). This positive moderation by environmental uncertainty enhances the influence of Entrepreneurial Orientation on Market Orientation, validating hypothesis H5. This suggests that under higher environmental uncertainty, Entrepreneurial Orientation enables firms to foresee future customer demands with foresight, gather competitor intelligence effectively, and promptly develop creatively new products that deliver superior customer value, enabling them to compete more effectively in existing and emerging markets. Based on the results from Model 5, the interaction term between Entrepreneurial Orientation and environmental uncertainty has a significant positive impact on Entrepreneurial Performance (β = 0.236; CI [0.032, 0.439]). This positive moderation by environmental uncertainty enhances the impact of Entrepreneurial Orientation on Entrepreneurial Performance, confirming hypothesis H6. However, the interaction term between Market Orientation and environmental uncertainty has a significant negative impact on Entrepreneurial Performance (β = − 0.299; CI [− 0.510, − 0.087]), contradicting hypothesis H7. Additionally, through Model 5, it is observed that after incorporating environmental uncertainty, the impact of Market Orientation on Entrepreneurial Performance becomes insignificant (β = 0.200; CI [− 0.021, 0.422]). This suggests that under higher environmental uncertainty, Entrepreneurial Orientation facilitates firms in identifying the necessary resources and capabilities for future growth effectively, leveraging internal coordination and cooperation advantages to enhance profitability and growth100,101. Nevertheless, in times of extreme environmental uncertainty when markets are highly volatile, predicting market trends becomes challenging, leading firms to avoid risky, aggressive behaviors. Market Orientation encourages firms to monitor future market trends vigilantly, awaiting market stability, thereby restraining the growth of firm performance.

This study conducted a simple slope analysis for moderation effects using the mean (M) of environmental uncertainty and one standard (SD) deviation above and below it as benchmarks. The results are presented in Table 6. When EU = M − 1SD, the interaction between environmental uncertainty and Entrepreneurial Orientation significantly positively influences Market Orientation (Effect = 0.466, CI [0.390, 0.543]); when EU = M, this interaction has a significant positive effect on Market Orientation (Effect = 0.553, CI [0.487, 0.619]); when EU = M + 1SD, the interaction has a significant positive impact on Market Orientation (Effect = 0.640, CI [0.559, 0.721]). It can also be inferred that as environmental uncertainty increases, the impact of Entrepreneurial Orientation on Market Orientation decreases. When EU = M − 1SD, the interaction between environmental uncertainty and Entrepreneurial Orientation does not significantly affect Entrepreneurial Performance (Effect = 0.097, CI [− 0.168, 0.361]); when EU = M, this interaction has a significant positive effect on Entrepreneurial Performance (Effect = 0.311, CI [0.140, 0.481]); when EU = M + 1SD, the interaction has a significant positive impact on Entrepreneurial Performance (Effect = 0.524, CI [0.287, 0.762]). Similarly, with increasing environmental uncertainty, the influence of Entrepreneurial Orientation on Entrepreneurial Performance increases. When EU = M − 1SD, the interaction between environmental uncertainty and Market Orientation significantly positively affects Entrepreneurial Performance (Effect = 0.471, CI [0.133, 0.809]); when EU = M, this interaction does not significantly affect Entrepreneurial Performance (Effect = 0.200, CI [− 0.021, 0.422]); when EU = M + 1SD, the interaction has a significant positive impact on Entrepreneurial Performance (Effect = − 0.070, CI [− 0.311, 0.170]). It can also be deduced that as environmental uncertainty rises, the impact of Market Orientation on Entrepreneurial Performance decreases.

To clearly illustrate the moderating effect of environmental uncertainty, based on the analysis in Table 7, this study plotted moderation effect graphs using one standard deviation above and below the mean of Entrepreneurial Attitude as benchmarks. The results, as shown in Figs. 2, 3 and 4, align with the conclusions drawn from the above analysis.

Examination of moderated mediation effects

This study proceeded to analyze the moderated mediation effects, conducting tests at the mean (M) of environmental uncertainty and one standard (SD) deviation above and below this mean, as shown in Table 7. The findings revealed that when EU equals its mean, the moderating effect of environmental uncertainty on the mediation between entrepreneurial orientation and entrepreneurial performance through market orientation is insignificant (Effect = 0.111, CI − 0.011, 0.243), thereby not supporting Hypothesis H8. When EU is below its mean by one standard deviation (M − 1SD), environmental uncertainty positively moderates the effect of entrepreneurial orientation on entrepreneurial performance through market orientation (Effect = 0.220, CI 0.045, 0.402). Conversely, when EU is above its mean by one standard deviation (M + 1SD), environmental uncertainty does not moderate the effect of entrepreneurial orientation on entrepreneurial performance through market orientation (Effect = − 0.045, CI − 0.175, 0.084). This suggests that as environmental uncertainty increases, the impact of entrepreneurial orientation on entrepreneurial performance through market orientation diminishes. Comparing the effects in different levels of environmental uncertainty, it is evident that when comparing Effect2 to Effect1, Effect2 is significantly lower (Effect2–Effect1 = − 0.109, CI − 0.192, − 0.025). Similarly, when Effect3 is compared to Effect1, Effect3 is significantly lower (Effect3–Effect1 = − 0.265, CI − 0.474, − 0.061). And when Effect3 is compared to Effect2, Effect3 is significantly lower (Effect3–Effect2 = − 0.156, CI − 0.284, − 0.037). These findings indicate that the moderating effect of environmental uncertainty varies at different levels. Moderate environmental uncertainty can stimulate entrepreneurial firms to anticipate environmental and market changes, actively seek valuable information and insights, particularly relating to customer needs and competitor intelligence102. By various means, this information is disseminated, shared, analyzed, and transformed into organizational memory, becoming the basis for strategic decision-making. These actions are likely to result in superior long-term performance for the firm103. However, when environmental uncertainty becomes too high, the complexity of market information makes it difficult to distinguish real from false information, hindering the firm’s ability to capture valuable insights from the market. In such circumstances, the role of market orientation becomes significantly weakened, having a negligible effect on enhancing entrepreneurial performance.

Robustness test

In this study, a robustness check was conducted on the constructed model to further validate our primary findings. Since Beijing and Shanghai serve as China’s political and economic centers, companies registered in these two regions do not represent the general population. Therefore, samples registered in these regions were excluded, leaving 239 samples for the robustness analysis, accounting for approximately 80% of the original sample. The robustness results, as presented in Tables 8, 9, 10, and 11, indicate that hypotheses H7 and H8 were not supported, while hypotheses H1 to H6 were all supported. Consequently, we found that the results of this robustness test align with the earlier findings, thus strongly supporting our main conclusions.

Hypothesis testing results

This study establishes a unique moderated mediation model by linking entrepreneurial orientation, market orientation, and entrepreneurial performance through the moderation of environmental uncertainty. The findings reveal that hypotheses H1 to H6 are supported, while hypotheses H7 and H8 are not. Specifically, entrepreneurial orientation exerts a significant positive influence on entrepreneurial performance and market orientation, supporting hypotheses H1 and H2. Market orientation has a significant positive impact on entrepreneurial performance, validating hypothesis H3. Furthermore, the mediating effect between entrepreneurial orientation and entrepreneurial performance is positively significant, supporting hypothesis H4. Environmental uncertainty significantly moderates the impact of entrepreneurial orientation on market orientation and entrepreneurial performance positively, confirming hypotheses H5 and H6. However, the negative moderation effect of environmental uncertainty on the relationship between market orientation and entrepreneurial performance (H7) and the non-significant moderation effect on the impact of entrepreneurial orientation on entrepreneurial performance through market orientation (H8) are not supported. Out of the eight hypotheses proposed in this study, six are validated while two are not, with the unverified hypotheses primarily focused on the moderating role of environmental uncertainty on market orientation and entrepreneurial performance. A summary of the conclusions derived from the data analysis and the status of hypothesis validation is presented in Table 12.

Discussion

The examination of hypotheses H1, H2, H3, and H4 indicate that entrepreneurial orientation not only significantly and positively influences market orientation and entrepreneurial performance but also exerts an indirect positive effect on entrepreneurial performance through market orientation. Furthermore, market orientation itself has a notable positive impact on entrepreneurial performance. This conclusion unequivocally underscores entrepreneurial orientation as a pivotal source of superior performance in enterprises, positively influencing entrepreneurial performance in two distinct ways. Firstly, from the perspective of the resource-based theory, the direct effect of entrepreneurial orientation is substantial, aligning with the findings of Yao et al.30, Zahra et al.72, as well as Du et al.88. It also reinforces the conclusions drawn by Wiklund et al. through longitudinal data analysis104, indicating that entrepreneurial orientation, as a core resource, motivates enterprises to pursue innovation, thereby directly enhancing their performance. Secondly, the mediating role of market orientation underscores the significance of entrepreneurial orientation in enabling firms to discern new market opportunities, strengthen innovation capabilities, and elevate proactiveness and risk-taking abilities. Strategic management theory highlights the customer-centric approach of market orientation, which is congruent with the objectives of entrepreneurial orientation. By emphasizing the understanding and fulfillment of customers’ latent needs, entrepreneurial orientation exerts a positive indirect effect on firm performance through market orientation. This discovery echoes the research of Chou et al.105, who emphasize market orientation as a critical strategic component embodying firms’ unique, hard-to-imitate skills and processes in competition. Empirical results further suggest that startups with entrepreneurial orientation tend to adopt market orientation to mitigate risks in uncertain environments, thereby enhancing entrepreneurial performance103. Entrepreneurial orientation’s influence on market orientation primarily manifests in how it shapes startups’ information usage, processing, and interpretation50, a process intimately linked to contingency theory, which emphasizes strategy adaptation to external changes to manage uncertainty. Moreover, market orientation fosters EP by enhancing customer satisfaction and value106, thereby increasing market share and propelling growth and sustained performance. From an RBV standpoint, market orientation serves as a vital mechanism transforming entrepreneurial orientation into tangible outcomes. It also strengthens internal coordination, reduces communication costs107, enables swift responses to competitors’ actions, and ultimately enhances competitive advantage and profitability.

The examination results of Hypotheses H5 and H6 indicate that environmental uncertainty positively moderates the influence of entrepreneurial orientation on both market orientation and entrepreneurial performance. This finding corroborates the conclusions drawn by Guo et al.108, thereby reinforcing the perspective of contingency theory. From the lens of contingency theory, environmental uncertainty serves as a vital impetus for corporate innovation and creativity. In uncertain environments, entrepreneurial-oriented enterprises are more likely to proactively explore and exploit new opportunities while fostering robust relationships with stakeholders, such as customers, partners, and investors. This proactive interaction facilitates information flow, enhancing the effectiveness of market orientation. Furthermore, entrepreneurial-oriented enterprises tend to outpace their competitors by swiftly introducing novel products and services to the market. They expedite their market entry by updating their opportunity recognition, flexibly adjusting strategic decisions, and allocating resources, thereby seizing market opportunities promptly and enhancing entrepreneurial performance. This phenomenon is intimately tied to contingency theory, which underscores the importance of enterprises’ agility in responding to external environmental changes and swiftly adapting their strategies to better align with market demands. Environmental uncertainty not only provides a more conducive environment for the relationship between entrepreneurial orientation and market orientation but also strengthens enterprises’ innovation capabilities, adaptability, and relationships with stakeholders, thereby further propelling entrepreneurial development. Consequently, the positive moderation between environmental uncertainty and entrepreneurial orientation underscores the significance of adapting to dynamic environments for fostering growth and success.

The examination results of Hypothesis H7 indicate that environmental uncertainty negatively moderates the impact of market orientation on entrepreneurial performance. This conclusion contrasts with previous findings by Jaworski et al.53, Slater et al.109, and Qu et al.110, who consistently demonstrated that the positive influence of market orientation on entrepreneurial performance remains unaffected by environmental variables. The emergence of this discrepancy primarily stems from the fact that those studies failed to incorporate any antecedent variables, instead solely examining the direct effects of market orientation on entrepreneurial performance without delving into the nuanced breakdown of its influence. In the present study, we introduce entrepreneurial orientation as an antecedent variable into the model, a transformative design that enables a more holistic understanding of how environmental uncertainty negatively moderates the impact of market orientation on entrepreneurial performance. This significant discovery deepens our comprehension of the underlying mechanisms at play between market orientation and entrepreneurial performance, elucidating how market orientation differentially impacts firm performance under varying environmental conditions. From a contingency theory perspective, environmental uncertainty exerts markedly different influences on market orientation depending on its degree. In a low-uncertainty environment, where firms operate within a relatively stable context, market orientation effectively captures customer needs, thereby enhancing performance. Conversely, in a high-uncertainty environment characterized by tumultuous changes in markets and technologies, the resources invested by firms in pursuing market orientation may inadvertently lead to strategic rigidity. In such scenarios, the absence of strategic flexibility hampers firms’ ability to adapt swiftly to environmental shifts, inevitably leading to a decline in performance. This revelation not only provides fresh empirical support for the relationship between market orientation and entrepreneurial performance but also broadens the application scope of contingency theory. It underscores the importance for firms to agilely adjust their market orientation strategies in response to shifting external conditions, thereby safeguarding their performance from adverse impacts. Thus, this study presents a novel perspective for both theory and practice, empowering firms to effectively manage market orientation amidst environmental uncertainty and elevate their entrepreneurial performance.

The examination results of Hypothesis H8 indicate that environmental uncertainty does not significantly moderate the mediating effect of entrepreneurial orientation on entrepreneurial performance through market orientation. Within the contingency theory framework, environmental uncertainty is recognized as a pivotal factor influencing firms’ strategic choices, necessitating agile strategies to adapt to external changes across varying conditions. Consequently, the role of environmental uncertainty in modulating the impact of entrepreneurial orientation on entrepreneurial performance via market orientation may not be as pronounced as traditionally assumed. Firstly, contingency theory underscores the importance of considering external environmental shifts when formulating corporate strategies. While market orientation aims to facilitate the understanding and fulfillment of customer needs, heightened environmental uncertainty exposes firms to complex and ambiguous market signals. This implies that, even though market orientation can enhance entrepreneurial performance, the rapidly evolving external environment may hinder firms from accurately capturing customer demands, thereby diminishing the effectiveness of performance enhancement109. Secondly, environmental uncertainty can instill hesitancy in firms when implementing market-oriented strategies, impeding the execution of effective market orientation tactics. In high-uncertainty environments, firms may be more inclined to maintain existing strategies and operational models to mitigate risks associated with uncertainty. This strategic rigidity constrains firms’ innovation capabilities and flexibility, further compromising the positive outcomes of entrepreneurial orientation. Thus, from a contingency theory perspective, environmental uncertainty fails to effectively moderate the mediating role of entrepreneurial orientation on entrepreneurial performance through market orientation. This theoretical lens offers fresh insights into firms’ strategic choices under different environmental conditions, emphasizing the significance of resource management and capability building. It guides firms in achieving sustained entrepreneurial performance enhancement amidst uncertainty by fostering adaptability and resilience.

Implications for theory

This study makes theoretical contributions in the following ways: First, Previous literature has extensively explored the relationships among entrepreneurial orientation, market orientation, entrepreneurial performance, and environmental uncertainty individually. However, studies that integrate these four factors into a single research framework are relatively scarce. By explicitly outlining the relationships among entrepreneurial orientation, market orientation, entrepreneurial performance, and environmental uncertainty, this research enriches the findings in the field of entrepreneurship. From a strategic management theory perspective, integrating these variables aids in identifying the basis upon which enterprises can select appropriate strategies under varying environmental conditions, thereby enhancing their competitiveness109. Second, It enhances the theoretical understanding of environmental uncertainty. Market uncertainty, in certain circumstances, can negatively moderate the impact of market orientation on entrepreneurial performance. Companies, in implementing market orientation, need to constantly monitor external environmental changes, promptly and effectively adjust their market orientation based on these changes, thereby maximizing entrepreneurial performance70. This perspective aligns with the resource-based theory, suggesting that firms should leverage both internal and external resources effectively to better navigate market changes. Third, Entrepreneurial orientation, as a complex mindset and behavioral approach to coping with environmental uncertainty, is beneficial for a company’s survival and growth in turbulent environments. Market orientation implies a company’s focus on understanding and responding to its customers’ needs. Entrepreneurial orientation serves as the driving force, while market orientation acts as the conduit linking external customers and competition. By leveraging market orientation, entrepreneurial orientation can adeptly navigate changes in the external environment. The integration of these two orientations represents a crucial element in enabling enterprises to create sustainable competitive advantages111, echoing the contingency theory’s emphasis on dynamically adjusting strategies in response to external environmental dynamics.

Implications for practice

This study contributes to practice in the following ways: First, Entrepreneurial Orientation for Startups. Entrepreneurial ventures should recognize the significance of entrepreneurial orientation. Due to factors such as smaller scale and limited resource endowment, startups inherently possess greater flexibility. This flexibility enables them to act ahead of competitors. For new ventures, rapid growth and capturing larger market shares are essential for sustained development45. Second, Enhancing Market Orientation. Fostering a strong market orientation within organizations is crucial. Companies should strive to better understand market motivations, expand their market networks, seek assistance from market participants, and establish mutually beneficial relationships with them. As emphasized by contingency theory, enterprises must flexibly adjust their market strategies in response to changes in the external environment, thereby enhancing their market adaptability and responsiveness. Third, Developing Entrepreneurial Resilience. It is vital to enhance the entrepreneurial resilience and psychological endurance of entrepreneurs. Even in highly dynamic market and technological environments, entrepreneurs should proactively adapt, leverage the flexibility inherent in entrepreneurial ventures, consciously adjust their strategies, and drive improvements in entrepreneurial performance. Lastly, Policy Implications. Policymakers need to recognize the significant roles of entrepreneurial and market orientations in enhancing entrepreneurial performance. They should strive to create favorable entrepreneurial and market environments, provide platforms for experience sharing and information exchange, and promote market orientation among businesses to address challenges related to entrepreneurial performance.

Limitations and future directions

This study, while contributing to the discourse on entrepreneurial orientation, market orientation, and environmental uncertainty, does not come without its limitations. First, we acknowledge that the empirical analysis is based solely on a sample of entrepreneurial firms within Hubei province, which restricts the generalizability of our findings. The narrow geographical scope of the sample raises concerns regarding the representativeness of our data, suggesting a need for future research to expand the sampling boundary to cover a wider regional or national area, taking into account the regional heterogeneity of entrepreneurial resources that may influence the relationships we have explored. Second, the applicability of the insights gained from this study beyond Hubei province and even at the national level is uncertain. The findings may not uniformly hold across different economic environments, regulatory frameworks, and cultural contexts. To address this limitation, future studies should replicate the analysis in broader regions or countries to validate our results and enhance the generalizability of our conclusions. Lastly, the current study focuses solely on the moderating role of environmental uncertainty as an exogenous variable in the relationship between entrepreneurial orientation, market orientation, and entrepreneurial performance. However, the influence of endogenous variables within the organization, such as corporate culture and organizational structure, on this relationship has not been explored. Future research could extend the framework by incorporating these internal moderators to provide a more comprehensive understanding of the dynamic interplay between internal organizational factors and external environmental influences. Addressing these limitations in future research will not only enhance the robustness and reliability of our findings but also contribute to a more nuanced and holistic perspective on the factors that influence entrepreneurial success in varying contexts.

Conclusion