Abstract

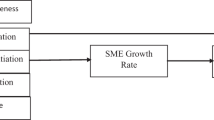

This research explored the effects of the legal system on SMEs operations in the Nigerian economy. The study aimed to address the gap in literature discussing the legal system and SMEs’ operations in Nigeria. It focused on learning about the current level of support of the legal system for SME operations and as well as suggesting an approach to enhance effective SMEs’ operations in Nigeria further. The current study applied a conceptual review, relying on extant literature relating to the antecedence of the Nigeria legal system, focusing on the critical factors affecting SME practices in Nigeria. A key finding is the importance of the legal system functions to SMEs practice in Nigeria. It also highlighted the weaknesses of the legal system in providing the needed backing and conducive business environment for SMEs in Nigeria. A model was proposed, depicting the need for restructuring of the legal system, improvised support of other government functionaries and other relevant stakeholders, to facilitate SMEs’ operations and enhance their contributions to the Nigerian economy. The research ends with the suggestion for further research to consider other research methodological approaches, the development of alternative dispute revolutionary measures, as well as a comparative study involving two or more economies in order to project further learning on the legal system and SMEs’ operations.

Similar content being viewed by others

Introduction

In every society, business activities depend on the functioning of the legal system for back up and to regulate interactions between business entities and the environment. This ensures that business activities, ranging from negotiations and agreement, promises and fulfilment are made against the backdrop of the functional legal system which therefore acts as an umpire to ensure fairness and legalities in these activities (Abereijo and Fayomi, 2005; Kadiri, 2012). While these operational activities among small and medium enterprises (SMEs) call for caution and alignment with the legal system, the attention of SMEs practitioners is drawn to factors, such as the extent to which the Nigeria legal system can offer SMEs the needed legal provisions. These can support their operations and obligations in the Nigerian economy (Gorondutse and Hilman, 2013; Ogundele et al., 2013).

This paper is focused on the effectiveness of the Nigerian legal system in supporting the operations of SMEs in the Nigerian economy. This is measured based on the various gaps found in literature, about the flaws in the legal system. These are largely due to the failure of the law to ensure efficiency and to provide the needed supports and conducive environment required for SMEs businesses to thrive in Nigeria due to numerous numbers of SMEs corporate failures, winding up or liquidations in the country. The study pays attention to the relationship between the Nigerian legal system in its functionalities towards the operations of SMEs. A critical question raised in this research is how much can the SMEs rely on the legal system for backing in the Nigerian economy? The current study is based on extant literature on the subject of the effectiveness of the Nigerian legal system, the relevance, current situations, critical issues and the prospects for the future in offering guidance to business activities among SMEs in the Nigerian economy. The paper also aims to unpack the possibility of learning about the responsibilities of practicing SMEs in the strive for a just business society that can project fair prosperity for the state and the other key stakeholders. The focus would be on the level of SMEs’ interest and freedom to use the legal system in their operations.

The current research adopts a conceptual review to explore the antecedence and effects of the legal system on SME practice in Nigeria. The study pays due attention to current issues affecting the Nigeria SMEs’ operations from the perspective of the legal system from extant literature, over the last 10 years. This provides a reliable view of the documented existing relationship between the legal system and SME businesses in Nigeria. The research assumes the following structure. The next section provides a brief overview of the methodology applied, followed by a literature review on SME practice in the Nigerian economy. This is followed by the role of the Nigerian legal system and SME and further discussion on SME operations and the legal system function in Nigeria. The research ends with the proposed model, conclusion and recommendations for further research.

Methodology

The study applies a conceptual review. The research depends on extant literature relating to the antecedence of the Nigeria legal system, focusing on the critical factors affecting SMEs practice in the country. The research also aims to view the topic from different perspectives based on extant literature, covering the legal system and SMEs’ operations in Nigeria’s economy (Saunders et al., 2014). The study relies primarily on reports from extant literature, ranging from primary, secondary and tertiary data sources such as the newspapers, the internet and website sources (Levy and Ellis, 2006; Eaton, 2018).

SMEs practice in the Nigerian economy

SMEs are enterprises with a maximum asset base of 500 million Naira excluding land and working capital, and with a staff strength of not less than ten (10) and not more than 300 workers. On a broad note, SMEs operating in the Nigerian economy are mandated to operate under the legal system that regulates their operations (Adelowo et al., 2012). They can be referred to as enterprises with a total capital base of over 1.5 million Naira but not more than 500 million Naira including working capital but excluding the cost of land and a labour size of 11–100 workers. While a medium scale enterprises are enterprises with a total capital base of over 50 million Naira but not more than 500 million Naira including working capital, but excluding the cost of land and/or a labour size of 101–300 workers (Essien, 2001; Ajayi, 2002; Gberevbie and Isiavwe-Ogbari, 2007; Ihua, 2009; Alaye-Ogan, 2012). Any connotation of SMEs sector must take into consideration street traders to be fully included. Otherwise, it is not complete; the broader definition of this group invariably encompasses this category of entrepreneurs. It is interesting to note that in some towns, both the hawkers as well as the small/medium scale enterprises operate from the same areas (Mbogua, 2003; Gberevbie andIsiavwe-Ogbari, 2007; Matanda, 2012).

In this paper, small-scale enterprise (SSE) will be defined as an enterprise that operates with total share capital (including working capital and rent) of between 5, million and 50 million Naira, and a workforce of not more than five people. Medium-scale enterprise (MSE) on the other hand as an enterprise that operates with a total capital (including working capital and rent) of between 51 million Naira and 500 million Naira and a workforce of between 10 and 50 people (Motilewa et al., 2015; Ihua, 2009; Central Bank of Nigeria, 2010; Alaye-Ogan, 2012).

SMEs have contributed to the growth and development of the industrialised economies of the world and over time has proved to be one of the most potent forces for the emancipation and growth in any economy (Lawal et al., 2016). The SMEs survival is based on the extent to which any economy maximises them, and their inputs much depends on the enabling and prevailing environment generated through the availability of necessary infrastructural facilities, tax incentives, business-friendly regulatory measures and essential structural services such as the provisions of the legal system. These comprise good transportation network, stable electrical power supply, strong telecommunication network, sound legislative structure, provision of credible credit facilities and policy (Ogundele, 2007; Okeke et al., 2013; Schlaeppi, 2014).

In Nigeria, SMEs constitute more than 80% of the business sector, and the failure rate is high due to economic shocks nevertheless, on average, 50% of SMEs that are started eventually fail due to factors such as legal breaches of their statutory obligations. In the past, the Nigerian government did not give enough backing to the SMEs sector. It seemed that large business typically received more supports than SMEs in Nigeria. There has been a drift in this trend since 1990, where the government has introduced enhanced SMEs’ support measures aimed at developing and promoting the SMEs (Akinbola et al., 2014).

However, despite the importance of SME contribution to economic growth, SMEs across the nation, they are still faced with numerous challenges that inhibit business growth and contribution to the Nigerian economy (Ogechukwu, 2010; Obi, 2015). Apart from SME funding and seamless access to finance, SMEs also suffer from poor management skills which is a result of lack of adequate training and education. This results in high rates of business failure (Mohd, 2005; Mwobobia, 2012). Similarly, the support of the legal system, which can provide the needed confidence for effective practice, tends to be an issue of constant concern among SMEs in Nigeria. This is the main focus of this research.

Towards understanding the role of the legal system on SMEs’ operations in Nigeria

The Nigerian, legal system operates as an aspect of the governance that provides the laws that govern the operations of business activities, such as the SMEs focused on the current research. The repealed Companies and Allied Matters Act (CAMA), Cap 20, Laws of the Federation of Nigeria, 2004 and newly assented CAMA, Laws of the Federation of Nigeria on August 7, 2020 which is a progressive development in the Nigerian commercial legal framework towards an easy way of doing business by small and medium enterprises and other investments in the country.

Part A of the Act provides for registration of all SMEs in Nigeria before they can carry out their businesses. Part B provides for registration of business names, the categories most SMEs plunges. Section 1 of the Act established the Corporate Affairs Commission (CAC) with the responsibility of registering and regulating companies, business names as stated under section 7 of the Act with the capability to directly probe into the affairs of SMEs especially where the investment of the populace is at stake. Moreover, to undertake other activities that are expedient for effective implementation of the Act by the commission to protect and enhance SMEs business operations through the ease of doing business reforms or platform of the Federal Government of Nigeria.

Another fundamental law regulating SMEs’ operation in Nigeria is the Investment and Securities Act, 2007. The Act establishes the Investment and Securities Tribunal as a special court to handle matters related capital market, securities, to determine any question of law or disputes on capital markets. SMEs operators, clients, commission, processes of mutual investment systems and investors but lack of sufficient funds has been the major challenge of the tribunal to discharge its duties efficiently in aiding SMEs operations through the speedy dispensation of commercial disputes. The Act also establishes the Securities and Exchange Commission (SEC) as a statutory body regulating the SMEs whose shares are listed in the Nigerian Capital Market. Sections 54–59 of the Act provide for compulsory registration of securities and investments of SMEs that are registered as public companies. It regulates their investments, securities commodity exchanges and offer of securities by SMEs to safeguard investors’ interest (Olujobi and Olusola-Olujobi, 2020).

Furthermore, other portfolio investments through national trust scheme, and this is to indemnify investors who have suffered injuries or damages that are not safeguarded adequately under the investor’s protection funds. It is managed by the Securities Exchange or Capital Trade Points. This will preserve unbiased and orderly markets for SMEs in Nigeria. The Act empowers the SEC to sanction any SMEs that doing an illegal capital market operations and freezing their assets or bank accounts for violation of the Act. It can also disqualify unfit persons from being employed in the security industry to enhance the confidence of investors in SMEs operations in the Nigerian economy.

The Factories Act Cap. F1, Laws of the Federation of Nigeria, 2004 require registration of premises to be used as factories by SMEs under section 2 of the Act and sections 7 and 8 provide for cleanliness, ventilation, lighting and healthy factories with sanitary conveniences. It requires fencing of factories and prohibits overcrowding in SMEs factories to reduce fatalities or accidents among SMEs’ factories workers to enhance good returns on investment by SMEs operations.

The Financial Reporting Council Act, No. 6, 2011 creates the Financial Reporting Council to enact and issue accounting reporting standards for SMEs. It also encourages strict adherence by all SMEs in the formulation of their financial statements to uphold transparency, credibility and reliability of their financial reports, to promote corporate disclosure by SMEs (Oyewunmi and Olujob 2016). Moreover, to protect investors by ensuring good corporate governance practice that will safeguard all stakeholders’ interest in their operations (Oyewunmi et al., 2017; Madawaki, 2012; Iyoha et al., 2017).

The Bank and Other Financial Institution Act (BOFIA) Cap B3 LFN 2004 is to regulate and to make the banking sector of the Nigerian economy accessible to SMEs for loans and other facilities to boost their operations. The Central Bank of Nigeria was instituted by the Central Bank Act, 1958 as the apex bank in Nigeria with the power to issue and revoke banking licenses of SMEs who engage in the fraudulent banking practices or business. Section 35 of the Act regulate the threshold of paid-up share capital of SMEs in the banking sector and to take off any director, manager or any official of a failing SMEs (Olujobi and Oyewunmi, 2017). The consent of the Governor of Central Bank is required for restructuring, merger and re-organisation of SMEs in the banking business in Nigeria as stated under section 7 of the Act to prevent frauds and to promote transparency and accountability in the sector.

The Standard Organisation of Nigeria (SON) Act, Cap. S.9, LFN 2004 established the SON to standardise methods and products manufactured, import and export by SMEs in Nigeria, to enhance quality products circulated in the Nigerian economy, and to eliminate counterfeit products by SMEs in Nigeria, this is to enhance healthy competition among SMEs to yield good returns on investments. The Ministry of Mines and Steel Development issue mining licenses, execute policies and laws regulating prospecting and excavating and mining of solid minerals in Nigeria to SMEs. Through its division, the Nigerian Geological Survey Agency is in charge of geological mapping and assessment of minerals with the aim of offering data on solid minerals for SMEs investment decisions and to promote economic stability.

The Federal High Court of Nigeria in accordance with the provision of section 251(1) (e) of the 1999 Constitution of the Federal Republic of Nigeria has original jurisdiction in civil matters arising from the operation of SMEs. The provisions of section 7 of the CAMA, Cap C. 20 Laws of the Federation of Nigeria, 2004 gives supervisory functions to the court under Nigeria’s legal system. The court can dissolve any SMEs and may declare the dissolution of SMEs void and may disqualify a person from being a director or taking part in the management of SMEs for a fixed period up to 10 years as provided in sections 254 CAMA. SMEs are also allowed to resolve their commercial disputes through alternative disputes resolutions mechanisms which are cheaper in contrast to protracted litigation which is expensive (Olujobi et al., 2018a).

The key players in the Nigerian legal system are judges who make decisions and dispense justice on economic issues involving SMEs operations. Equally important are the lawmakers and law officers these are officers in the Attorney General’s office who are charged with legal duties that will enhance the efficiency of SMEs through the enactment of business-friendly laws and policies, the Attorney General is the legal adviser to the government. Similarly, the Director of Public Prosecutions is to support the Attorney General’s office in the prosecution of criminal cases against SMEs and their directors in the event of the commission of frauds by lifting the veils of incorporation of such SMEs to promote accountability and transparency in Nigeria’s economy.

The basic challenges with legal framework discussed above are weak enforcement by the regulatory agencies, thereby giving room for inefficiencies and corruption by the SMEs, instead of boosting Nigeria’s economy (Olujobi, 2017). Therefore, there is the need for proper regulation and restructuring of the Nigerian legal system to promote efficiency and growth of the SMEs businesses in Nigeria to boost Nigeria’s economy and to ensure speedy recovery from economic shocks via a robust legal framework that eliminates onerous legal, regulatory and administrative bottlenecks which often impeded SMEs’ investments and operations in the country.

Legal procedure for formation of SMEs in Nigeria

Large numbers of SMEs in Nigeria registered as a business name because it is simple and convenient to register. It does not attract any stamp duty or share capital. The personal tax of the proprietor suffixes for the company as the proprietor and the company is seen as one. It eases the stress and other technicalities of forming a company by investors, especially for small businesses. A business organisation may be registered as a sole proprietorship or partnership. These organisations enjoy corporate names, but they are not legal entities. Their proprietors can be sued in their own names in any legal action, and their proprietors are usually described as “Trading under a name and style of…….”. The minimum statutory share capital of the company is N10,000.00. This type of company is also suitable for SMEs in Nigeria because it gives access to capitals or loans from banks or other financial institutions.

Now that the company has been formed, it becomes a legal entity, an artificial person that can sue and be sued its name, and it has perpetual succession. It can borrow money and acquired a moveable and immoveable property in Nigeria.

Further discussion on SME operations and the legal system functions in Nigeria

Almost all businesses, especially the SMEs, depending on the legal system to effectively function. As Atawodi and Ojeka (2012) observe, most Nigeria SMEs are expected to operate and remit taxes to the government, which adds to the revenue for the government. They, however, encourage the government to consider granting tax rebates to encourage voluntary compliance to tax obligations among Nigerian SMEs. While the legal system provides the requirement for tax payment, and their suggestion highlights the need for the government to create a working platform that can facilitate both compliance to the dictates of the legal system and the effective compliance to the laws among SMEs practitioners. This can become essential to establishing a complementary practice between the SMEs and the legal system functions.

However, the strength of the legal system has a strong effect on SMEs trust in business practices with partners. The level to which SMEs can trust partners in business relationships is; largely dependent on the strength of the legal system in providing the backing and source of redress if breaches of contractual trusts, such as threats, undue exploitation and outright business partners’ oppression occur (Ojukwu, 2016). For example, Ogundele et al. (2013) reckon that Nigeria has a critical amount of internet fraud and criminality, which affects businesses and individuals in the economy. While the Nigerian legal system has effectively guided practicing business on the need to engage in legal business practices, within the legal framework, the Nigerian SMEs operators tend to have a significantly low level of trust in the legal system. This is because of certain critical factors that are challenging their abilities to trust the legal system to support their business relationships reliably. For instance, Adeodu et al. (2015), explain that the high cost borne by these SMEs denies them of the opportunity to access specific business rights in their operational process. These include the cost of seeking redress in the court of law, creating the chances for business trust violators to go without and retribution, especially among SMEs, have limited funding and capital base. Oliyide (2012) reckons that as a result of poor funding issues confronting the SMEs in Nigeria, ranging from low access to credit facilities to exploitative business breaches. Some SMEs tend to assume low operational profiles, preferring to ignore the chance of seeking legal redress from the court (Mohd, 2005; Mwobobia, 2012).

A critical issue within the legal system that adversely affect SMEs is the perversion of justice. This tends to discourage SMEs practitioners from approaching the legal system redress in times of breaches of business trust in their operations. Olatunji and Yauri (2014) underline the adverse effect of corruption in the Nigerian which hinders individuals and business operators’ interest the entire ambience of the Nigerian public sector and the legal system (see Elijah, 2007; Amoako and Lyon, 2014). Many times, some corrupt personnel deliberately delay and paucity in the judicial process or intentionally pervert the court decisions due to incidences of corruption in the Nigerian legal system. It, therefore, seems that non-reliable systems for SMEs who tend to consider the process as wastage of time, as the fair judicial is not a tenable reality (Okpara, 2011; Dada, 2014; Amoako and Matlay, 2015).

The need for proper evaluation of the legal system seems has been un-met. This challenge tends to entail an unstoppable trend of challenges which require a critical effort to address. It would also position the legal system on a platform for effective functioning that can complement the operations of business entities, especially the SMEs in their operations and contributions to the national economy (Salihu and Gholami, 2018). This could be due to the critical issues within SMEs business environments such as stiff competition in some industrial sectors (Onugu, 2005; Ufua et al., 2020). The current research acknowledges the relevance of adequate legal backing for operational business practices that can facilitate sustainability. It is, therefore, argued that if proper attention is not given to keeping proper statistical records that can reveal erring operational practices in the legal system. There are chances that error such as corrupt judicial practices, perversion of justice and other legal services vices cannot be bated and that can drive the SMEs further away from the legal system in Nigeria. If the SMEs in Nigeria are far from the legal system, their development and contributions to the national economic growth could be hampered on the long run (see, Odia and Odia, 2013; Chimucheka and Mandipaka, 2015). It is, therefore, suggested for proper regulation and possibly restructuring of the concerned parts of the Nigerian legal system to create an affordable and accessible contact with the right advocates in the quest for justice among SMEs practitioners in Nigeria. The current research argues that if the costs of legal services are regulated, and the SMEs are well aware of this easy access to justice from the legal system it can help fortify business trust among business partners in the various sectors of the Nigerian economy.

Besides, the provisions of the legal system set the platform for effective recognition of operational boundaries among business in the Nigerian economy (Ufua, 2019). As a result of this, practicing SMEs are to be aware and cautious about the end to end effects of their decisions and actions in the process of their operational practices in the sector (Turyakira, 2018). This draws the attention of practicing SMEs to ethical frames that covers their operational process (Ogundele et al., 2013). The current research, therefore, notes that it is pertinent for all stakeholders to the Nigerian legal system to create a fair playing platform that is well anchored on the legal system that could allow free ethical business practice among SMEs. The projection of ethical practices among SMEs in Nigeria could facilitate a resilient operational climate for SMEs and related businesses which could enable them to contribute optimally to the growth of the national economy (Apulu and Ige, 2011; Ufua et al., 2020), in ways such as fair employment generations, specialisation, and due compliance to obligations such as tax remittance to the national treasury. This is arguably predicated on the strength of the legal system to strive and enhance the balance between business practice and legal obligations among SMEs that will enhance trust and dependability among partners in the business environments (Tende and Abubakar, 2017).

On the other hand, researchers have observed that quite a good number of SMEs operators still lack primary education and most likely do not tend to see the values embedded in the legal system in providing the backing for SMEs in the Nigerian economy (Akanbi, 2016). This category of SMEs operators tends to rely more on traditional deities and superstitious beliefs in establishing trust in their business practices (Amoako and Matlay, 2015). However, they are more found in rural locations where business partnership and interactions are mostly among partners who tend to share these beliefs. The current research observes that if this is allowed to continue, there could be breaches of contracts as a result of lack of awareness among the less literate SME operators. This could expose them to business risks such as fraud, marginalisation, and other incidences of undue exploitation, by partners in their operational process. It, therefore, seems pertinent to suggest the need for the government to be more supportive to the less literate Nigerian SMEs operators, especially those who cannot afford the cost of hiring professional advocates (see, Olujobi and Olujobi, 2020). By creating this awareness about the strength of the legal system in protecting business operations among SMEs in Nigeria, through fair, transparent and accelerated hearing of commercial disputes cases involving SMEs in the country.

In summary, the stake of the current research is that SMEs can become more effective both in their operations and obligations in the Nigeria economy if the legal system is restructured to provide them with the required backing. It can create a more effective operational atmosphere that projects fair practices across cadres of SMEs’ operations in the Nigerian economy. This is coupled with the needed government and other stakeholders’ support (for instance, the regulatory agencies or institutions), that can enhance their contributions to the national economy. The current research argues that this can result to a complementary function among the Nigerian legal system, the SMEs’ operation and other stakeholders’ inputs, aimed to enhance a win–win performance situation (Ufua et al., 2018). There may also be the need for the use of legalalternative dispute resolution, such as contract renegociation, to address the inherent issue of delays and offer the needed support to SME operations in Nigeria. These are summarised in Fig. 1.

Discussion of findings

The study reveals that SMEs can become more effective both in their operations and statutory obligations towards the development of Nigeria’s economy. If the legal system is restructured to provide them with the required legal backing by creating a more effective operational atmosphere. A key finding is the importance of the legal system function to SMEs practice in Nigeria. The work also highlights the weaknesses of the legal system in providing the needed backing for SMEs in Nigeria with the legal panaceas.

The need for legislative reform of several obsolete statutes on SMEs operations which have hindered its growth. Nigeria’s, Investment and Securities Act and others corporate business laws and regulations with a conducive business environment with business-friendly regulatory framework. The reform should provide more opportunities for SMEs growth, development to safeguards it from winding up or liquidation by encouraging business turnaround or restructuring strategies, flexible negotiations creditors on loans payment plans and reduction of excessive taxes and other regulatory hurdles with adequate incentives to encourage investments in the country (Olujobi and Olusola-Olujobi, 2020). This can also support SMEs business recovery and turnaround strategies to save it from insolvency, to maintain jobs and to build economic resilience against economic crises or shocks in Nigeria (see Olujobi and Olusola-Olujobi, 2019).

Conclusions

This research emphasised on the importance of the legal system functions to SMEs practice in the country. It investigated the effects of the legal system on SMEs operations in Nigeria’s economy. The work relied on extant literature to have a conceptual review on the topic. Part of the findings is recognition of the connectivity between the legal system and the effectiveness of SMEs’ operations in Nigeria. The research identified the critical challenges of the Nigerian legal system in offering the necessary legal backing to SMEs operations in Nigeria and proposed reforms. There is a need for the government to increase its supports for SMEs to guarantee low-interest credit and duty exemptions for essential machinery imports to boost supports for manufacturing to keep productive activities going in the country. There is also the need for overhauling of the legal system to encourage SMEs formation, sustenance through a conducive business environment and infrastructure development for SMEs businesses to thrive in the country and to boost the economy.

Recommendations

The study suggested the need for further improvement on the levels of supports to SMEs via the legal system. The government functionaries and other relevant stakeholders to facilitate the maximisation of effective SMEs practice. This can enhance a fair business atmosphere that can improve SMEs’ practice and contributions to the Nigeria economy.

While the current research is limited by the sole reliance on extant literature and the focus is on the Nigerian economy. While the current findings are adjudged useful, and it is suggested for further research to consider the topic from other research methodological approaches that can further unpack learning on the subject. Notably, the use of an action research approach, which is embedded in meaningful engagement with the stakeholders, is recommended. This could create a further knowledge about the requirement for better SME practice in Nigeria.

Based on the challenges highlighted in this study, it is suggested further researchers to focus on the possibility of developing a more acceptable alternative for dispute resolution, especially among SMEs and related stakeholders in the Nigerian economy. This can complement the performance of the current legal system in Nigeria, in supporting the operations of SMEs for a fair, speedy and effective commercial dispute resolutions mechanisms in Nigeria. There is the need for legislative reform of several obsolete statutes which have hindered economic growth of SMEs in Nigeria. The research proposed a model depicting the need for restructuring of the legal system, improvised supports of regulatory agencies in the country (Olujobi et al., 2018b). Finally, further research can consider a comparative study between two or more national locations, in order to explore the topic on a broader perspective that can inform more learning about the legal system practices and SMEs operations in Nigeria.

References

Abereijo IO, Fayomi AO (2005) Innovative approach to SME financing in Nigeria: a review of Small and Medium Industries Equity Investment Scheme (SMIEIS). J Soc Sci 11(3):219–227

Adelowo Caleb M, Olaopa RO, Siyanbola WO (2012) Technology business incubation as strategy for SME development: how far and how well in Nigeria. Sci Technol 2(6):172–181

Adeodu A, Daniyan I, Omohimoria C, Afolabi S (2015) Development of indigenous engineering and technology in Nigeria for sustainable development through promotion of smes (case of design of manually operated paper recycling plant). Int J Sci Technol Soc 3(4):124–131

Akanbi TA (2016) An investigative study of challenges facing Nigerian small and medium scale enterprises in adoption of E-commerce technology. Int J Adv Manag Econ 5(1):22–31

Ajayi OA (2002) An assessment of government incentives to SMES in a globalized world Africa Forum 6(1):67–68

Akinbola OA, Abiola OO, Ajonbadi HA (2014) Causes and symptoms of small and medium enterprises (SMEs) business failure in Nigeria. Rev Manag Econ Eng 13(1):263–282

Alaye-Ogan E (2012) A practical guide to running successful small businesses in Nigeria: challenges, peculiarities, and effective resolution support. Lambert Academic Publishing, Deutschland

Amoako IO, Lyon F (2014) ‘We don’t deal with courts’: cooperation and alternative institutions shaping exporting relationships of small and medium-sized enterprises in Ghana. Int Small Bus J 32(2):117–139

Amoako IO, Matlay H (2015) Norms and trust-shaping relationships among food-exporting SMEs in Ghana. Int J Entrep Innov 16(2):123–134

Apulu I, Ige EO (2011) Are Nigeria SMEs effectively utilizing ICT. Int J Bus Manag 6(6):207–214

Atawodi OW, Ojeka S (2012) Factors that affect tax compliance among small and medium enterprises (SMEs) in North Central Nigeria. Int J Bus Manag 7(12)

Central Bank of Nigeria (2010) Bank and Other Financial Institution Act (BOFIA) Cap B3 LFN 2004

Chimucheka T, Mandipaka F (2015) Challenges faced by small, medium and micro enterprises in the Nkonkobe municipality. Int Bus Econ Res J 14(2):309–316

Dada SO (2014) Forensic accounting technique: a means of successful eradication of corruption through fraud prevention, bribery prevention and embezzlement prevention in Nigeria. Kuwait Chapter Arabian J Bus Manag Rev 4(1):176

Eaton SE (2018) Educational research literature reviews: understanding the hierarchy of sources, Werklund School of Education Research & Publications, http://hdl.handle.net/1880/106406

Essien OE (2001) The role of development finance institutions in the financing of small-scale industries Bullion 25(3):3–6

Elijah A (2007) Effects of corruption and economic reforms on economic growth and development: lessons from Nigeria. In: African economic conference

Gberevbie DEI, Isiavwe-Ogbari M (2007) Creating enabling environments for small and medium enterprises (SMEs) to contribute to Nigerian development. Ghana J Dev Stud 4(2):11–32

Gorondutse AH, Hilman H (2013) Business social responsibility (BSR) and small and medium enterprises (SMES) relations: evidence from Nigerian perspectives. Int J Manag Res Rev 3(2):2346

Ihua UB (2009) SMEs key failure-factors: a comparison between the United Kingdom and Nigeria. J Soc Sci 18(3):199–207

Iyoha OF, Olujobi JO, Oyewunmi OA (2017) Application of the laws of defamation and sedition in Nigeria’s jurisprudence: still relevant? J Adv Res Law Econ 8(1 23):59–68

Kadiri IB (2012) Small and medium scale enterprises and employment generation in nigeria: the role of finance. Kuwait Chapter Arab J Bus Manag Rev 33(845):1–15

Lawal FA, Worlu RE, Ayoade OE (2016) Critical success factors for sustainable entrepreneurship in SMEs: Nigerian perspective. Mediterr J Soc Sci 7(3 S1):338

Levy Y, Ellis TJ (2006) A systems approach to conduct an effective literature review in support of information systems research. Informing Sci 9

Madawaki A (2012) Adoption of international financial reporting standards in developing countries: the case of Nigeria. Int J Bus Manag 7(3):152

Matanda MJ (2012) Internationalization of established small manufacturers in a developing economy: a case study of Kenyan SMEs. Thunderbird Int Bus Rev 54(4):509–519

Mbogua JP (2003) Promotion of small and medium scale enterprises. Manag Nigeria—J Niger Inst Manag 39(1):26–28

Mohd KH (2005) Small and medium-sized enterprises in Malaysia-role in issues. UUM Press, Sintok

Motilewa DB, Ogbari ME, Aka D (2015) A review of the impacts SMEs as social agents of economic liberations in developing economies. Int Rev Manag Bus Res 4(3):903–914

Mwobobia FM (2012) Role of business management into the success and survival of small business: the Case of Star Learning Centre in Botswana. Int J Bus Adm 3(1):93–112

Obi JN (2015) The role of small-scale enterprises in the achievement of economic growth in Nigeria. Int J Soc Sci Humanit 3(1):1

Odia JO, Odia AA (2013) Developing entrepreneurial skills and transforming challenges into opportunities in Nigeria. J Educ Soc Res 3(3):289–289

Ogechukwu AD (2010) Entrepreneurial developments and small scale industry contribution to Nigerian national development—a marketing interface. Inf Manag Bus Rev 1(2):51–68

Ogundele OJ (2007) Introduction to entrepreneurship development, corporate government and small business management, 1st edn. Molofin Nominees, Lagos

Ogundele OJK, Hassan AR, Idris AA, Aliu AA (2013) Ethical problems affecting SMES In Nigeria, and their impact on E-business development. Int J Econ Manag Sci 2(10):1–15

Ojukwu D (2016) Redressing the lack of trust within SMEs engaging in E-commerce activities in developing countries: a Nigerian case study. Int J Sci Technol 4(1):51

Okeke AU, Ezenwafor JI, Femiwole RM (2013) Entrepreneurs’ reported challenges and opportunities of global financial crisis on small business operations in Anambra and Ekiti States, Nigeria. Paper presented at Global Awareness Society International 22nd Annual Conference, Rome, Italy, May 2013

Okpara JO (2011) Factors constraining the growth and survival of SMEs in Nigeria. Manag Res Rev 34(2):156–171

Olatunji H, Yauri UM (2014) Corruption, accountability and transparency in the present democratic era (1992 to date) in Nigeria’s public service. Int J Humanit Soc Sci Educ 1(8):109–114

Oliyide O (2012) Law, credit risk management and bank lending to SMEs in Nigeria. Commonw Law Bull 38(4):673–695

Olujobi OJ (2017) Legal framework for combating corruption in Nigeria—the upstream Petroleum Sector in perspective. J Adv Res Law Econ VIII 3(25)

Olujobi OJ, Adeniji AA, Oyewunmi OA, Oyewunmi AE (2018a) Commercial dispute resolution: has arbitration transformed Nigeria’s legal landscape? J Adv Res Law Econ 9(1 31):204–209

Olujobi OJ, Olujobi OM (2020) Comparative appraisal of Anti-Corruption Laws: lessons Nigeria can learn from Norway, United Kingdom and United States’ Anti-Corruption Strategies. Int J Manag 11:338–347

Olujobi OJ, Olusola-Olujobi Y (2020) Comparative appraisals of legal and institutional framework governing gas flaring in Nigeria’s upstream petroleum sector: how satisfactory? Environ Qual Manag 1–14

Olujobi OJ, Oyewunmi AO, Oyewunmi AE (2018b) Oil spillage in Nigeria’s upstream petroleum sector: beyond the legal frameworks. Int J Energy Econ Policy 8:220–260

Olujobi OJ, Olusola-Olujobi T (2019) Insolvency law and business recovery practices in Nigeria’s upstream petroleum sector: the need for a paradigm shift. Int J Mech Eng Technol 10(1):1609–1628

Olujobi OJ, Oyewunmi OA (2017) Annulment of oil licenses in Nigeria’s upstream petroleum sector: a legal critique of the costs and benefits. Int J Energy Econ Policy 7:364

Onugu BAN (2005) Small and medium enterprises (SMEs) in Nigeria: problems and Prospects. Unpublished Dissertation for a Doctor of Philosophy in Management Award, St. Clements University, Nigeria

Oyewunmi OA, Olujob OJ (2016) Transparency in Nigeria’s oil and gas industry: is policy re-engineering the way out? Int J Energy Econ Policy 6(3):630–636

Oyewunmi OA, Osibanjo OA, Falola HO, Olujobi OJ (2017) Optimization by integration: a corporate governance and human resource management dimension. Int Rev Manag Mark 7(1):265–272

Salihu HA, Gholami H (2018) Mob justice, corrupt and unproductive justice system in Nigeria: an empirical analysis. Int J Law Crime Justice 55:40–51

Saunders M, Lewis P, Thornhill A (2014) Research methods for business students, 3rd Edn. Pearson Education Ltd, England

Schlaeppi F (2014) 5 Reasons for success and failure of SMEs in export markets. TRSM—Novertur Blog.html retrieved 10/02/2015 at 9.50 p.m. http://therightsocialmedia.novertur.com/international-trade-2/5-reasons-success-export-markets/. Accessed 8 Feb 2015

Tende SB, Abubakar HL (2017) Achieving maximum performance through the practice of entrepreneurial ethics: evidence from SMEs in Nigeria. Int J Econ Manag Eng 11(4):1079–1082

Turyakira PK (2018) Ethical practices of small and medium-sized enterprises in developing countries: literature analysis. South Afr J Econ Manag Sci 21(1):1–7

Ufua DE (2019) Exploring the effectiveness of boundary critique in an intervention: a case in the Niger Delta Region, Nigeria. Syst Pract Action Res 1–15

Ufua DE, Papadopoulos T, Midgley G (2018) Systemic lean intervention: enhancing lean with community operational research. Eur J Oper Res 268(3):1134–1148

Ufua DE, Salau OP, Dada JA, Adeyeye MO (2020) Application of systems approach to achieving cleaner and sustainable environment: a study of waste dumping issue on Idiroko Road, Ota, Ogun State, Nigeria. Int J Environ Sci Technol 33:485–499. https://doi.org/10.1007/s13762-020-02665-5

Ufua DE, Salau OP, Ikpefan O, Dirisu JI, Okoh EE (2020) Addressing operational complexities through re-inventing leadership style: a systemic leadership intervention. Heliyon 6(7):e04270

Acknowledgements

The authors wish to commend the management of Covenant University, Ota, Nigeria, for providing support for this research. The authors also acknowledge the Centre for Economic Policy and Development Research (CEPDeR) and Covenant University Centre for Research Information and Discovery (CUCRID), both in Covenant University, Ota, Nigeria, for supporting this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ufua, D.E., Olujobi, O.J., Ogbari, M.E. et al. Operations of small and medium enterprises and the legal system in Nigeria. Humanit Soc Sci Commun 7, 94 (2020). https://doi.org/10.1057/s41599-020-00583-y

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-020-00583-y

This article is cited by

-

Household food waste management among working class and the drive for achieving SDG2 in Nigeria

Discover Sustainability (2025)

-

Managing Health Challenges Among Media Entertainment Practitioners in Nigeria: A Systems Dynamics Conceptual Model

Systemic Practice and Action Research (2025)

-

Lean Entrepreneurship and SME Practice in a Post COVID-19 Pandemic Era: A Conceptual Discourse from Nigeria

Global Journal of Flexible Systems Management (2022)

-

Intrinsic Conflict Among Nigerian Public Security Forces: A Systems Model for Compliant Security Service Delivery in Nigeria

Systemic Practice and Action Research (2022)

-

Carbon emission, solid waste management, and electricity generation: a legal and empirical perspective for renewable energy in Nigeria

International Environmental Agreements: Politics, Law and Economics (2022)