Abstract

The role of green banking (GB) in the green supply chain (CSC) is a relevant issue for green growth. The literature has pointed to some barriers identified as obstacles to the development of GSC. Since the publish of the framework of OECD for green growth, which is a reference for most of the countries, empirical research on GB has proliferated. Despite this, the barriers to the development of GSC have not yet been linked to empirical research on GB.Through a literature review of the empirical research on GB, this paper identifies by scientific impact the banking role, and we contribute with a mapping of the relationship among barriers to the development of GSC and conclusions of empirical research regarding GB, also considering the link with main topics of GB research. Additionally, it displays the main vectors related to area, year and methodology for each barrier and topic of empirical research on GB.

Similar content being viewed by others

Introduction

In 2009, a group of 34 countries signed a declaration of Green Growth, recognizing that “growth” and “green” can go hand in hand in order to add value to the sustainable development, resulting so the green growth strategies (OEDC, 2011). The green development links the growth of green businesses and innovation processes within green supply chain (GSC). The transition towards the GSC entails many difficulties (Zhu et al., 2005), that supposes the existence of barriers to GSC development. Despite the relevant role of the green banking (GB) for green growth, the seemingly abundant literature draws few conclusions about the contributions of GB to the GSC, and consequently, to the social value of the GB is not being sufficiently endorsed.

We have conducted a literature review to identify barriers to the development of CSG in the literature on GB, and draw qualitative conclusions about the evolution of research, since as Andrew Booth et al. (2012) indicate, a review of the literature must obtain qualitative conclusions.

Our work displays two types of contributions to green values. First, we contribute to cataloging of findings of empirical research on GB but associating them with the barriers to the development of GSC. Second, we contribute with an analysis of literature on empirical research on GB according to its scientific impact. Consequently, we map the barriers to CSG according to the scientific impact and relating it to the cataloging of topics on GB. Therefore, we can offer a perspective on the gaps and future lines in research on GB as a key agent in the development of GSC.

Our findings display relevant conclusions on how the empirical research on GB makes a proactive role or not for the development of GSC. Furthermore, we identify key differences on the research published by analyzing principal vectors in several dimensions of investigation.

After this section, the rest of the paper is structured as follows: Background, Method, Scientific production: sample and descriptives, Barriers to GSC identified in empirical research on GB, Mapping of scientific impact of empirical research on GB, and Conclusions, and suggestions.

Background

The concept of GSC is also linked to the impact that supply chain causes on the environment (Beamon, 1999), that involves a set of processes (e.g., purchasing, manufacturing, marketing, logistics, etc.) in order to integrate customers satisfaction, efficiency, quality, and responsiveness (Zelbst et al., 2010). Thus, sustainability has been incorporated as an indispensable concept in supply chain (Seuring and Müller, 2008) to make socially and environmentally responsible business, that considers sustainable development, corporate social responsibility (CSR), stakeholder concerns, and corporate accountability (Council of Supply Chain Management Professionals, 2013). To achieve this goal, everyone plays their role, involving all economic agents in the sustainability of economic processes, that supposes the environmental sustainability as key concept to growth (Green et al., 2012; Seuring and Müller, 2008). The concepts of “sustainability” and “green going” are linked to the supply chain management (Srivastava, 2007), emerging the approach of GSC as a manner of integration of environment, sustainability, and performance in the supply chain. The integration of green initiatives implies the assumption of complete responsibility for the impacts of the different members of the chain (Kaur et al., 2018). Thus, each agent apport a value to contribute to the sustainable GSC, being necessary the understanding of business (Beltramello et al., 2013) and the different stakeholders´ roles (Meherishi et al., 2019).

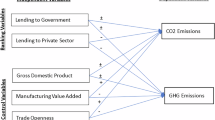

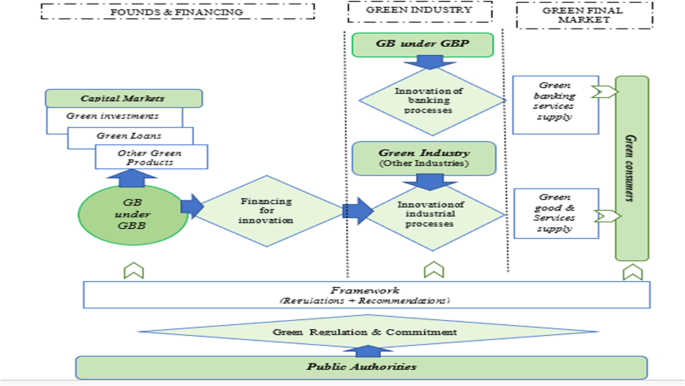

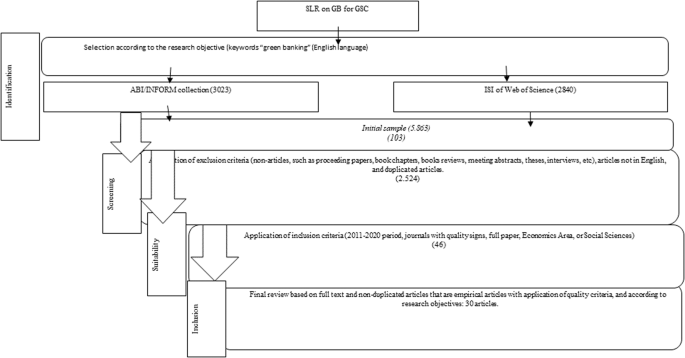

Considering GSC as the framework for sustainable development, on the one hand, GB can be considered as the company who implements pollution-free banking processes (GBP), that is, when a bank company works using less-polluting banking services. On the other hand, GB also can be considered as the bank company who makes green banking business (GBB), such as green investments or green credit, as a manner of providing the necessary financing for the GSC. Under this second approach, the term GB will include those bank companies with a business approach of financial products for the environmental sustainability. In this second one, the final objective of the green process is focused on the supporting of other members of GSC, being GB a mediator or driver of the green growth (see Fig. 1). This growth is associated with terms of sustainability and social ethics (Rao et al., 2015). Thus, banking can apport a determinant value for the eco-innovative business model (Beltramello et al., 2013). The absence of green financing causes that the managers must solve financial constrictions (Yang et al., 2019). Financial problems for green innovation are consider as a barrier for green growth (OEDC, 2011; Kaur et al., 2018; Sun et al., 2020), due to bank loans continue being the main sources of financing for some green companies (Belltramello et al., 3013), but the problems to access to this type of financing causes financial constrains (Kaur et al., 2018). It leads us to consider the analysis of GB as driver of green economy.

Oher problem is the disclosure about sustainability in GB (Dissanayake et al., 2016), that could be linked to the problems of lack of environmental knowledge and environmental awareness (Kaur et al., 2018). Likewise, the lack of knowledge about the benefits of green business is associated with the lack of green commitment of some members of the GSC, such as bank companies or governments (Belltramello et al., 2013).

Thus, three groups of barriers have been identified, (1) those related to environmental knowledge, (2) the scarce of green awareness (linked to the lack of CSR), and (3) the problems to green production (Kaur et al., 2018) due to financial problems. Financial difficulties for green innovation are a real barrier (OECD, 2011), due to the financial risk that green investments entail (Sun et al., 2020; Wu et al., 2019; Yang et al., 2019) and consequently with effect on the real capacity to make green products.

According to the usual barriers to development of GCS and the key role of GB, we consider the following research questions (RQ):

-

RQ1: Can barriers to GSC development be identified in the empirical literature on GB?

-

RQ2: Can we identify which barriers to GSC development have received the most attention in research?

Methods

We use a systematic literature review (SLR), because according to Pierre Pluye et al. (2016) this research approach allows the categorization of qualitative-quantitative contributions to identify items and deficiencies in emerging issues of the economy (see see Masi et al., 2017; Meherishi et al., 2019, and Munaro et al., 2020) for circular economy; Rashid and Ratten (2020) for entrepreneurship and innovation; or Gollapudi et al. (2019) and Queiroz et al. (2019) for financial technology and digital economy.

Nevertheless, this approach has not been applied to map the contributions of GB to the green growth as relevant value in the GSC.

To define stable thematic categories on the role of GB in green businesses, the present SLR was designed by considering the approach of Booth et al. (2012) and the Cochrane review protocol (Higgins and Green, 2011). Thus, various sequential phases were applied for the SLR (see Grant and Booth, 2009): selection and qualitative assessment of articles (phase 1), data systematization (phase 2), and data analysis (phase 3).

Selection and quality assessment of articles (phase 1)

We emphasize that according to the main objective of this work, which is the qualitative analysis of the empirical research on GB to identify barriers to the development of CSG, only the papers associated with the research terms “green” and “banking” are analyzed. For the inclusion we only selected those in which we could identify possible barriers to the development of CSG.

In the present SLR were included articles from ABI/INFORM and IsI Web of Science—Core collection (Thomson Reuters) and Scopus (Elsevier) databases—only published papers in English between 2011 and 2020 were included.

2011 was chosen as starting point because the OECD published in this year the document entitled “Towards green growth: A summary for policy makers” (2011). This document is considered as a real starting point for the development of the green economy under the current conception of sustainable economy (Bina, 2013). The disruption caused by the COVID-19 pandemic has affected research objectives in all fields, including in the field of Economics, and specifically also in green banking. Therefore, the COVID-19 and post-COVID-19 period would not be comparable with the data series analyzed, which is why half of 2020 was taken as the end point of the paper series to be analyzed. On the other hand, there is not yet a sufficient post-COVID-19 data series to make a pre- and post-COVID-19 comparison in the green banking literature, from the approach of barriers to development of the GSC.

According to the research objective, in this phase, we applied a usual protocol for literature reviews. To perform a data quality screening, several actions were carried out to obtain a reliable database. In four steps: (1) Identification, (2) Screening, (3) Suitability, and (4) Inclusion (see Fig. 2).

For the step 1 (Identification) tow searches were made in databases, one in ABI/INFORM collection and other in Web of Science (WoS). The search path was in ABI/INFORM: /green AND banking/ abstract or title/English/article/Scientific reviews/peer review/2011–2020/full paper. The search in WoS was done in a similar way. Both according to Fig. 1, ending the search on July 21, 2020. After identification and screening steps according to Fig. 2, the data were tabulated and submitted to the check list. Thus, in the step 3 (suitability) articles that without an adequate indication on methodology, objectives, conclusions, and other relevant dimensions were eliminated. For this qualitative selection process, a triple-blind review of the 46 articles was carried out by each author. As result, in the step 4 (Inclusion) a whole of 30 articles met the requirements (see Supplementary Appendix I). They provided conclusions on the relationship between green banking as part of GSC for green growth.

After step 3 (suitability), only 46 papers associated “green” and “banking” also considering the usual eligibility criteria (journals with quality signs, full paper, Economics Area, or Social Sciences). And more specifically the sample is specified in 30 works in step 4 (inclusion), considering furthermore only those that fall within the scope of the research objective (identification of barriers to the development of CSG in the conclusions of empirical research on GB). At this point, one might ask why it is interesting for the scientific community to review the literature within such specific parameters. It is precisely that we observe that the GB contributions to the GSC have not been associated to the research term “GB” yet. This is diminishing the visible value of the GB for the GSC, what’s both a limitation as a goal in terms of identifying research gaps. As in other reviews of the specialized literature whose objective is qualitative and not strictly bibliometric, the final sample is reduced to a small number of articles (Queiroz et al., 2019; Tseng et al., 2019).

Thus, our research is framed in the field of social sciences under the approach of Spash (2020), and it seeks to improve knowledge about GB-GSC in order to contribute to the social change of the economy, improving social welfare. In line with Bardsley (2020), we consider that social and ecological stimuli can redirect credit towards green infrastructure. This must be done from the different positions of each agent in the GSC, where undoubtedly the bank companies must develop a more proactive role. This in the long term must contribute to mitigating greenhouse gas emissions.

Data systematization (phase 2)

A coding template was designed in Microsoft Excel to provide an adequate coding for data treatment. This template included a whole of 19 fields. A questionnaire run play on 20% of the initially selected articles to verify the reliability of the template in a triple review (one by researcher) (see Supplementary Appendix I). After filtering the results, the final coding template included 17 fields: Article ID (numbering assigned by researchers), paper´s name, year, authors, country authors, continent authors, country of empirical analysis, Continent of empirical analysis (GB location), research topic, GB approach within GSC, research objective, analysis methodology, type of data, identification of specific conclusions on green banking, conclusions on green banking research, journal, and database. Most of the fields were synthesized using numerical coding, but some of them required a summary narrative approach for the qualitative treatment of mapping of conclusions (Queiroz et al., 2019; Rumrill and Fitzgerald, 2001). To avoid bias, each author revised the coding made by the other authors.

Data analysis (phase 3)

For the qualitative analysis some fields were considered as primary fields, due to the objective of the research is to identify the real contributions of GB empirical research and making a map of the current research situation. Thus, the primary fields were research topic, country, methodology, year, and conclusion, following Masi et al. (2017) and Queiroz et al. (2019).

First, we analyze the relationships between several fields of the coding template by using the specific statistical analysis software (Statistical Package for Social Sciences Software—SPSS—-version 20.0) plus Excel for graphs. Second, we identified the similarities and differences in the conclusions related to GB regarding the barriers to GSC, by using a specific software for qualitative analysis (Atas.ti software). Thus, the research paper follows cross-sectional qualitative research with descriptive outcomes.

Limitations

This study performs the search by combining two databases (ABI/INFORM and WoS), selecting only bibliography in English, and in scientific quality journals (peer-reviewed), which guarantees the initial inclusion of relevant literature. However, as indicated by other authors, a limitation of this work could be the framework of the study (Roy et al., 2022), which is delimited by the GSC, which makes the analysis of empirical research on GB focus exclusively on papers whose conclusions of GB can be associated with some of the barriers to the development of CSG. This affects the number of articles finally selected for analysis. However, this objective is simultaneously an opportunity to develop research about relationship between the theoretical knowledge about CSG and the empirical knowledge about GB. The fact of use a small sample (with a small number of articles) does not affect the qualitative conclusions of the study, since it does not seek to carry out statistical inference. Even in quantitative analyses for modeling, a small sample size would not be sufficient to discard the results, as they could be showing valuable latent patterns (Everitt, 1975). In spite that the use of a sample size of 30 or more observations ensures a normal distribution of the sample in statistical terms, as it happens in our sample; some authors also indicate that the sample size cannot be considered strictly in statistical terms, since in exploratory phases it cannot be considered as a limitation to the approach of an investigation (Sapnas and Zeller, 2002; Mundfrom et al., 2005), even less so, when the literature review focuses on the narrative in order to obtain a qualitative synthesis of results. Despite the application of a protocol to systematize the study, it is not uncommon for different studies to obtain different results (Rodrigo, 2012). Therefore, the sample size of our study does not compromise our findings, taking into account that the sample selection was carried out following an internationally accepted systematization protocol. Nevertheless, the results must be interpreted with caution, within the theoretical framework of the work, which must be taken into account for its interpretation.

Scientific production: sample and descriptives

The GB research is considered as an interesting field (Queiroz et al., 2019) because it offers a way to analysis. However, green banking has not reached an equal level of technological processes even within the same country, so there is still a long way to go to achieve a development of environmental sustainability through green banking (Deka, 2015), highlighting its social responsibility in reducing environmental damage (Kondyukova et al., 2018). Thus, the company location is considered a key variable in economic research (Herrador-Alcaide and Hernandez-Solis, 2019), also for literature review in most of the research fields (e.g., Masi et al., 2017; Queiroz et al., 2019; Rumrill and Fitzgerald, 2001), and even more when the analysis is focused to identify differences, gaps and opportunities. As it is usual, we used location, year, and topic to frame the main descriptives of scientific production about empirical research on GB.

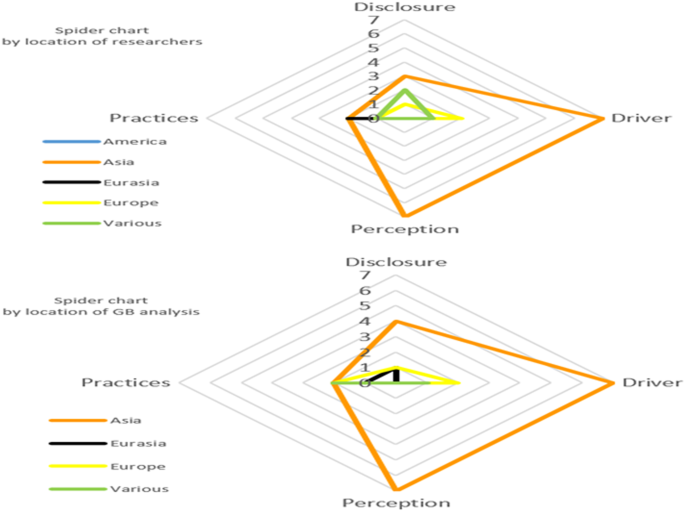

Figure 3 displays location of GB research by considering each research topic.

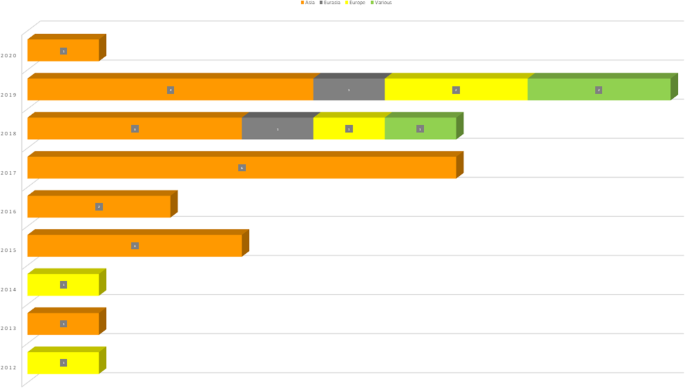

By considering the year, the largest scientific production is concentrated in 2019, and secondly in 2017 and 2018 (sea Fig. 4).

Additionally, we use methodology as other complementary vector to classify the status of scientific production, due to some methodologies as the descriptive statistic normally with secondary data (Masud et al., 2017) could be considered as first steps in research (Shampa and Jobaid, 2017), opposite to others as Structural Equation Modeling (SEM), that could be linked to a more advanced research phase (Tarka, 2018). Our sample displays majorly the use of descriptive methodology (the 46.66% of papers apply descriptive methodology) and only in the topic of GB disclosure the most used methodology is the regression analysis.

All the above shows the descriptive of the scientific production on GB of our sample, strictly considering the number of articles published in each topic, using as descriptives the geographical area (continent), the year of publication and the methodology. However, these descriptives based on the number of articles do not display the scientific impact of the publications, for which we have considered the citation criterion (see section on mapping by impact).

Barriers to GSC identified in empirical research on GB

The qualitative analysis of the research on GB was focused to the identification of the research lines by topic and their relationships with GSC barriers. This section shows our primer contribution through the identification of relationships between the GB and GSC. Furthermore, we identified also how GB could be or not a barrier for GSC. The analysis of relationships has been carried out by using the software, Atlas.ti. The findings are commented according to previous literature. It should be noted that for the qualitative analysis we have considered the location where the empirical analysis on GB has been performed, not the location per researcher (author), because our analysis focuses on discerning the barriers to the development of the GSC originated in the development of GB. Therefore, it does not make sense to link the results of the research to the location of the researcher, but to that of the continent on which the analysis has been carried out.

Barriers for GSC development in research on GB disclosure

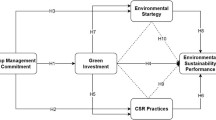

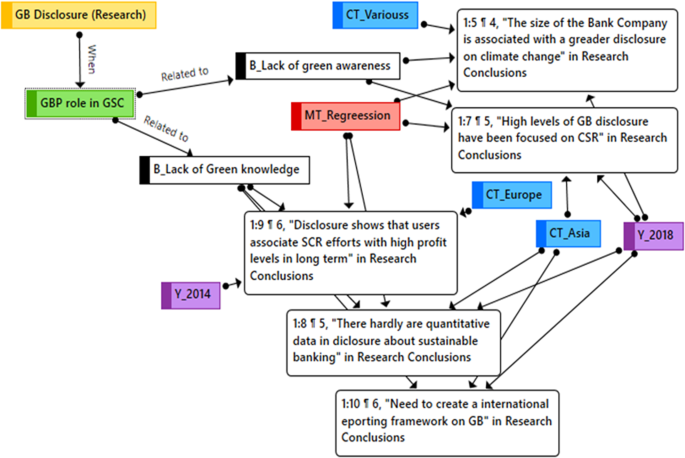

The literature on GB disclosure is mainly focused on GBP role. Thus, the value apported by GB to GSC is oriented to the banking process (see Fig. 5), being green disclosure associated to GB (Masud et al., 2017).

Attending to the literature map on Gb disclosure (research conclusions)-GSC (barriers for) shown in the Fig. 5, we identified the following qualitative connexions:

-

Some conclusions point out the lack of green awareness. The main line of conclusions relates the size of the bank company with levels of GB disclosure on climate change (Kılıç and Kuzey, 2019), but the reduction of carbon footprint and the saving of energy are hardly linked to the GB disclosure. The information is concentrated on board and ownership (Bose et al., 2018) and consequently on CSR. This line can be linked to the research carried out in 2018 in multiple countries.

-

Other conclusions point out the lack of green knowledge. When bank companies adopt voluntary guidelines for environmental performance, they disclose green qualitative information, but not quantitative data about sustainability (Kumar and Prakash, 2018). An international reporting framework (Masud et al., 2018) and the awareness of e-banking users (Lekakos et al., 2014) are necessary for the contribution of GB to the sustainable growth.

These barriers suppose that GB disclosure may be at an early stage, more focused on corporate image than a real accountability. Despite GB is starting to reduce this barrier through disclosure information on CSR for green management, however, the absence of quantitative data and heterogeneity in the content of the disclosure do not allow GB to show itself as a green member of the GSC.

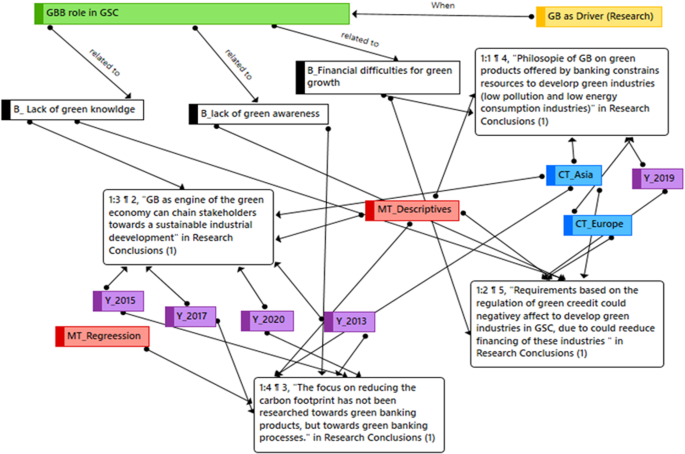

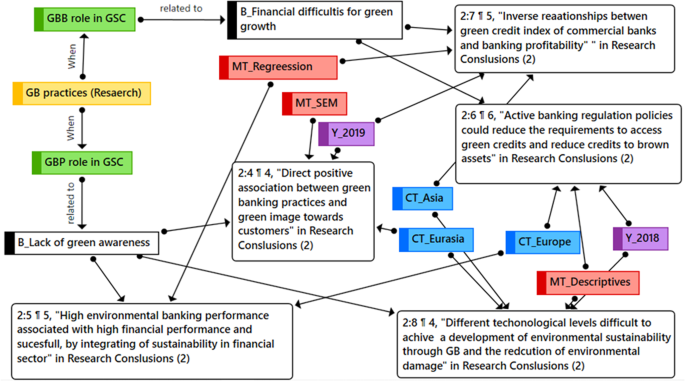

Barriers for GSC development in research on GB as driver of economy

We find that GB as driver of economy is focused mayorly on the GBB role. Thus, the GBB plays a key role for the development and sustainability (Manohar and Kumar, 2012; Ramila and Gurusamy, 2015; Islam et al., 2017; Miah et al., 2021), and reduction of pollution (Ramila and Gurusamy, 2015), but it is not free of barriers for de develop of GSC (Fig. 6). Green corporate performance, that it measured throughout CSR, is linked to green marketing strategies (Lymperopoulos et al., 2012).

Accordingly, we found three types of GSC barriers when GB literature is focus on GB as driver of economy:

-

Financial difficulties can cause a lower development of green growth (Miah et al., 2021; Radović-Marković and Živanović, 2019; Nieto, 2019; He et al., 2019; Julia and Kassim, 2019), because green regulation and financing policies maybe cause financial constraints in eco-industries. Regulation can hinder the distribution of bank credit for the green investment (He et al., 2019). This line of conclusions has been mainly analyzed in Asia and Europe, during 2019.

-

GSC barrier based on green unknowledge can be linked to two key conclusions. First conclusion shows that GBB can chain stakeholders towards sustainable industries (Manohar and Kumar, 2012; Miah et al., 2021), but other conclusion shows that a low GBB can be caused by the low knowledge of which must be the adequate green regulations to expand green growth. These barriers are concentrated in Asia, in a plurality of years, and they have been mainly identified by using descriptive analysis.

-

We can identify in the literature barriers based on lack of green awareness. Thus, literature shows that GBB research has not been able to associate reduction of pollution to GB products. The ecological offer of banking products is linked to banking philosophy of ethics and equity (Julia and Kassim, 2019), but transition to a low-carbon economy requires that banks integrate environmental risks into their governance systems (Nieto, 2019), being GB considered as a solution for the massive green infrastructure projects (Fashli et al., 2019). Also, green guidelines in countries and geopolitical context are necessaries (Julia and Kassim, 2019).

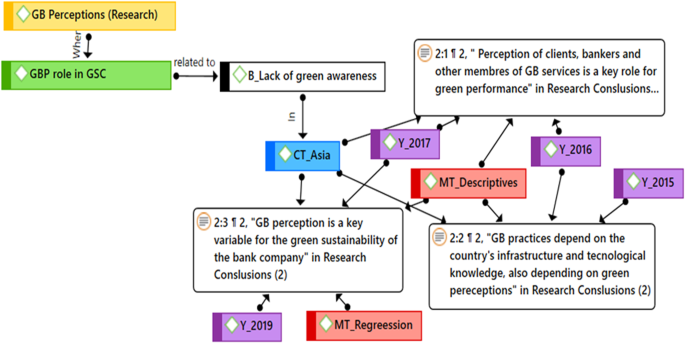

Barriers for GSC development in research on GB perceptions-

According to the map of qualitative conclusions of literature on GB perceptions (see Fig. 7), we found that the GB perceptions was researched under the approach of GBP.

We found that main lines about GB perception could be linked to barriers for GSC based on the lack of green awareness. These barriers are mainly investigated within perception of clients about the use of green banking processes (Jatana and Jain, 2016; Jayabal and Soudarya, 2017), and how the massive acceptance of the GB practices depend not only on infrastructure and technology (Girish, 2016; Subramanian, 2015). It depends on the green behavior of banking staff (Girish, 2016; Mehedi and Maniruzzaman, 2017). Motivation is an important personal predictor of green performance in banking (Iqbal et al., 2018). Likewise, stakeholder perceptions are essential for the bank company’s sustainable development (Linh and Anh, 2017).

Barriers for GSC development in research on GB practices

We found that this research line on GB practice has been developed in the two GB roles: GBB and GBP. GB practices in GBB role are linked to barriers cause by financial problems for the green growth (see Fig. 8). The environmental banking performance has been associated with a larger financial performance (Laguir et al., 2018). Regarding the causality of this association, it has been found that the integration of sustainability in the financial sector does not harm financial performance but rather increases it (Weber, 2017). However, it has also been found that the green credit index of commercial banks is associated with an inverse relationship with their profitability (Song et al., 2019). As solution for this problem, a more active banking regulation could reduce the requirements that affect the cost of capital of green projects (Thomä and Gibhardt, 2019).

GB practices on GBP role is linked to barriers by lack of green awareness. Several studies link GB practices with the sustainability of banking business, environmental commitment, social image, and manage of green practices. The location and temporal distribution of the studies, as well as the methodology used, is so diverse that we do not suggest possible associations. We must highlight that a direct and positive association was found between green banking practices and the green image (Ibe-enwo et al., 2019).

Considering previous maps with the qualitative identification of barriers considering these four topics on GB empirical research, the focus of GB concept is concentrated in GBP. According to this GB concept (GBP) and predominant topic of research on barriers to GSC (Lack of green awareness), we can point out that disclosure about GB has mainly focus on corporate image of banking and the capacity of disclosure in order to improve green knowledge of the agents within GSC.

These maps have implemented to define qualitative relationships among barriers to GSC and conclusions of empirical research on GB. Nevertheless, they should not be used to identify the priorities and gaps in the research, being necessary to carry out an analysis by scientific impact.

Mapping the scientific impact of empirical research on GB and barriers to GSC

The impact of research literature of each published article is commonly measured through the number of citations received by it. To collect appointments there are several search specialized engines. Among the most common are the Google Scholar (GS), the Web of Science (WoC) and Scopus (Sc). All of them collect automatically, reliably and systematically the citations received by the articles, papers and other research documents published although they measure the impact with different scope. While GS collects all citations received by publication in any database, WoC collects only those received in its database, and equally does Scopus. In order to measure the importance that research on GB has, all of the above are adequate. It could be interpreted that GS measures the impact for the generality, while WoC and Scopus measure a more relevant impact academically. To draw up our map of the state of empirical research on GB, we will use all three options.

Considering the total number of citations received in each of the bases, we build for each topic a relevance index of the topic by citations based on the following formulas:

Where GSCi, WoSIi,, and SCIi are the citation rates by base and topic, respectively. The numerator of each index represents the number of citations accumulated among all the papers published in a topic (i), while the denominator collects the total number of citations of all topics (all articles reviewed). In this way, the number of citations accumulated in each topic is relativized according to the total impact of the research analyzed. These indices are initially used to compare the scientific impact of the GB topics by comparing the three bases.

To determine a unique global impact that allows to relate barriers, topics and descriptive, we use an average index (AIi), which combines the different citation rates of each database, which ensures that we consider the impact in a broad sense. It is calculated as average of the citation indexes of each database. This average index allows us to apply a uniform measure to different aspects through the common measure of scientific impact per citation.

Correction of the time effect (age of publication) on the impact per citation

Table 1 shows the impact of each topic calculated based on citations. However, articles with a higher tenure (earliest date of publication) could have accumulated a greater number of citations just because of their longer publication time. In this way, if the effect of time on the AIi were not considered, a greater scientific interest could be attributed to older research whose greater volume of citations could be due more to the time effect than to a greater relevance for its interest to the scientific community. That is why we must consider the effect of time in the calculation of the impact per appointment. To do this, we built a correcting factor of the time effect. This correcting factor is based on the “Citation Rates” published in Field Baseline of InCitess Essential Science Indicators (Clarivate Analytics, 2023). From Clarivate’s Citation Rates we build an index to correct the AIi of each year, thus eliminating the effect of time on the citations received, which are placed in a homogeneous temporal context.

First, we construct a ratio that divides the Citation Rate (CRi) of each year by the Citation Rate of the base year (CR20). We take the last year of publication of the analyzed period (2020) as the base year for the conversion of the citations received by each paper to homogeneous values. Accordingly, the citation correction factor for the time elapsed since publication effect (TFCi) is constructed as: TFCi = CRi/CR20, where “i” corresponds to each year of the series. The CRi and CR20 corresponding to all the fields considered together are taken. TFCi allows the value of each AIi to be recalculated, transforming it into a homogeneous number in tenure to the average citations of the 2020 values, thus allowing the comparability of all the citations accumulated by the papers in the base year.

Second, the AIi-TFC is obtained as AIi-TFC = AIi/TFCi. In this way, the impact per appointment has been homogenized to average values of citations of 2020 (see Table 1).

Third, the sample rate (SR) is calculated, which is the proportion that each AIi-TFC represents over the 100% of the sample. The SR serves to compare the specific weight that the relevance by volume of citations (corrected for the time effect) has on the sample analyzed. In this way we can establish the appropriate priority among topics, barriers, and other vectors analyzed; neutralizing the effect of time on the scientific relevance attributed to the impact per citation.

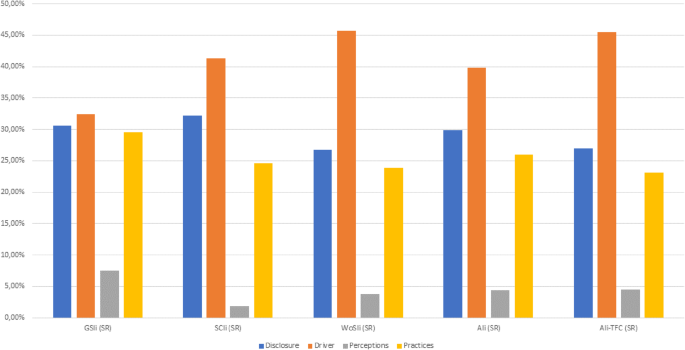

According of all above by considering the scientific impact measured by citations, Table 2 and Fig. 9 displays that GB as driver of economy is most relevant topic of the empirical research on GB in all indices. According to the average impact index of each topic (AIi), followed by the topic on GB disclosure, GB practices, GB perceptions.

When TFCi is applied to correct the time effect, the AIi-TFCi are 16.66%, 28.04%, 2.80%, and 14.24% for Disclosure, Driver, Perception, and Practices, respectively. This means that Disclosure, Driver, Perception and Practices have a specific relevance weight (SR) of 26.99, 45.42, 4.53, and 23.06% over 100% of the sample. It can be observed that by scientific impact by citation (isolated time effect) the order of most researched topics continues to be maintained as shown in Table 2 (Driver: 45.42%, Disclosure: 26.99%, Practices: 23.06%, and Perceptions: 4.53%).

It is observed that once the corrective factor of the time effect has been applied, the proportionality of the corrected cumulative citations does not affect the research preferences in terms of topics. This confirms that the method of analysis and the indices applied are a solvent tool for the measurement of scientific relevance calculated by citations, according to the objectives of the research.

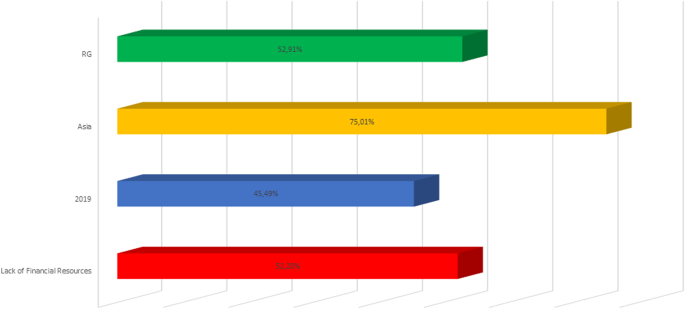

To identify the main vectors according to area, year, and methodology, we also use the SR (AIi-TFC) of each paper. According to Fig. 10, Asia receives the 75.01% of citations, and the main temporal vector indicates that the year 2019 concentrates the 45.49% of citations. The main vector by methodology indicates that the 52.91% of the citations are for methodology based on regression models. The Lack of Financial Resources is the main barrier to GSC with the 52.20% of citations.

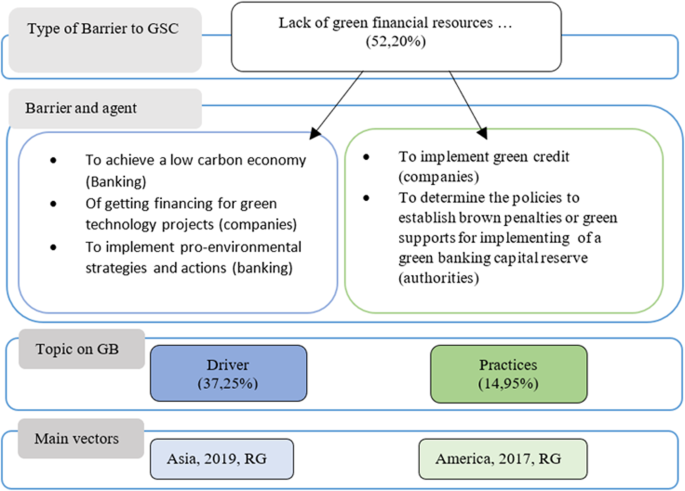

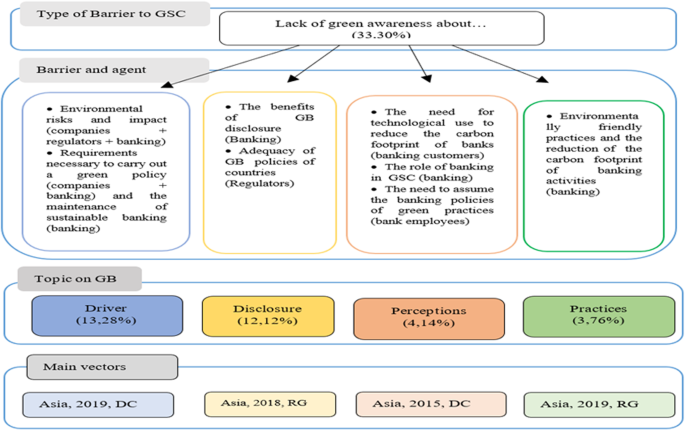

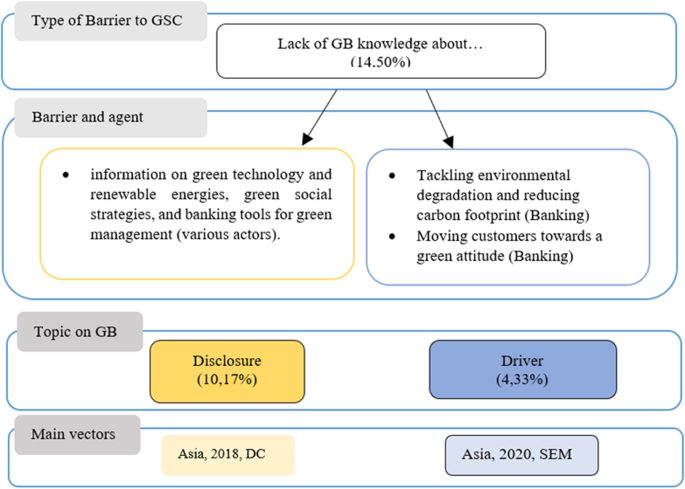

Mapping of barriers to GSC in empirical research on GB

The specific weights of each barrier considering the AIi are 51.33%, 31.99%, and 16.68%, for the barriers of Lack of Green Financial Resources, Lack of Green Awareness, and Lack of Green Knowledge, respectively. The specific weights of each of the three barriers indicated by applying the time correction factor (SR for each barrier) are 52.20%, 30.30%, and 14.50%, respectively. It is observed that the adjustment of the specific weight of each barrier due to the accumulation of citations that could be due to the time effect is scarce. As in the topics, we can affirm that the differences in the scientific attention paid to each of the barriers is not due to a greater accumulation of citations by the age of the publication. Thus, the most relevant barriers corrected for the time effect remain in the same descending order: Lack of Green Financial Resources, Lack of Green Awareness, and Lack of Green Knowledge.

The results of scientific impact of each barrier, breaking it down by GB topics and their impact by the different types of descriptives (area, year, and methodology), once considered the time effect (see Table 3). So, we can identify the priorities by Relating barriers, topics, and descriptive, by considering their relevancy by scientific impact.

Accordingly, the most relevancy by scientific impact is focused first on the lack of green financial resources (52.20%), second on the lack of green awareness (33.30%), and thirdly on the lack of green knowledge (14.40%).

For the lack of financial resources, the main topic is GB as driver of economy (37.25%) and its main descriptives vectors are Asia (31.58%) / 2019 (31.19%) / RG (19.21%). For the second barrier to GSC (lack of green awareness), the main topic is driver (13.28%) and its vectors are Asia/2019/DC. For the third barrier, the main topic is disclosure (10.17%) and its main vectors are Asia / 2018 / DC.

In addition, Fig. 11 shows the conclusions for the barrier related to the lack of green financial resources, but also associating barrier with conclusions, topic, and main vectors by topic.

The barrier to GSC associated with the lack of green financial resources analyzed through the results of empirical research on GB, shows that barrier can be mostly associated with limitations found in the role that GB should play as an engine for green development. The conclusions of empirical research suggest that banking fails to drive its function towards goals related to the carbon-free economy. The research also leads to the conclusion that companies operating within the GSC indicate that the role of the GB is not allowing them access to financing for green projects, possibly because banks have not yet found adequate pro-environmental strategies in the performance of their role as conduits of financial resources.

Figure 12 indicates that the barrier due to lack of green awareness for the development of GSC, considering the scientific impact of empirical research on GB, is shown to be relevantly associated with problems in driving financial resources to GSC. The conclusions of the empirical research analyzed lead to limit the lack of green awareness around three agents: banks, companies, and regulators.

For banks, the problem lies in how to insert environmental risk, so as to make it attractive to raise financial resources in the capital markets in order to direct them towards the needs of funds demanded by the companies that act in the GSC. As for regulators, the problem is how to make green policies that allow both establishing economic incentives for banks to attract resources and for companies to act in favor of green sustainability. For companies, the problem is limited access to green finance.

Figure 13 shows how in the empirical literature on GB the barriers to the development of GSC are relative to disclosure. Specifically, due to the lack of green knowledge associated with the absence of disclosure about technology to improve green production, the strategies for its implementation and banking management tools. This lack of disclosure that motivates ignorance would affect various economic agents, not only the banks themselves.

Conclusions and suggestions

The degree of commitment of all sectors with green growth means that most companies are increasingly involved in the transformation towards non-polluting processes. In this green transformation, the empirical research can shed light on how GB role is adding value to GSC. According to literature, GB is hardly starting to finance the green growth.

The empirical research on GB can be grouped around 4 topics: GB as driver of green economy, Disclosure on GB, Perceptions on GB, and Practices of GB (They were coded as GB driver, GB disclosure, GB perceptions, and GB practices, respectively). Considering the scientific attention received, measured by the scientific input (by citations), the most relevant topic has been GB driver (45.42%), but with a near attention received for the topics GB disclosure and GB practices (26.99% and 23.06%, respectively). Scientific attention on perceptions related to GB has had little scientific impact. Considering the differentiation between the role of the GB as GBP or GBB, some papers have focused on research on GB as green banking processes (GBP) but considering the scientific impact the research have been majorly focused on green banking business (GBB).

By considering the barriers to the development of CSG identified in empirical research on GB, applying the scientific impact of publications, the most relevant barrier is that related to the lack of access to green financing, which accounts for more than 52.20% of scientific attention; compared to just over 33.30% and 14.50% for barriers due to lack of green awareness and green knowledge, respectively.

Regarding the relationships between barriers and topics, we found that in the literature analyzed the most relevant topics are the following: Lack of green financial resources-GB driver, Lack of green awareness-GB driver, and Lack of green knowledge-GB disclosure. In this barrier-topic context, no geographical area reaches a scientific interest higher than 33%, although Asia are revealed as the areas of greatest interest for scientific research. Also, by scientific impact, the most relevant year has been 2019 and the methodology more applied was regression (modeling).

Since the OECD declaration—“Towards green growth: A summary for policy makers”—(2011), the findings about what is relevant to the development found within the conclusions of the empirical research on GB, allow us to point out an initial mapping on how the role of the GB could be holding back green development. Nevertheless, our findings must be interpreted with caution, and must be considered in the research framework that combines the empirical research published related to GB and the theorization about barriers to GSC, because only those papers that are in this intersection allow to draw valid conclusions according to the research objective. Consequently, and despite complying with the protocols that guarantee quality literature review process, this does not exempt from the existence of other publications not adjusted to the criteria established for the research objective that could contain interesting conclusions about GB, but they are framed within other approaches.

Considering, our contributions within the research framework of present work, we may remark the following conclusions and suggestions:

-

The research on GB that has attracted more attention considering impact per citation is not conditioned by the age of the publication. This indicates that the relevant topics of scientific interest related to GB within the GSC are not linked to a specific temporal space, being these topics of interest in all the periods analyzed.

-

It would be interesting the extension of research about GB towards the GBB approach to improve the knowledge about GB as key support for developing the GSC. Accordingly, the analysis of GB should be considered under the role of banking products to finance green business. On the contrary, the GBP approach implies that green transformation of the bank processes in green process does not differ from other companies do. The mere digitalization of the bank processes is a common adaptation to a global market, but it does not suppose that banking takes a key role to develop the GSC.

-

Most research topics on GB should focus on measuring the effect that green investment and loans could have on the advancement of a cleaner industry for the expansion of the GSC. Maybe the focus could be directed towards cataloging associations between research results and the term GB.

-

The relevancy of the topic related to GB driver as a main topic in two of the barriers to the development of the GSC, shows how society needs to improve different aspects of the role of green banking business to build a financial bridge between those who offer economic resources and those who demand them. The lack of disclosure, understood as lack of accountability towards society, may be hindering the development of CSG due to lack of knowledge. Consequently, the measuring of GB disclosure and its modeling could be considered a relevant goal for future research.

-

The concentration of publications in the topic of GB as driver of economy point out to consider this topic as the main issue in future lines on GB research. According to barriers, they have been majorly focused on the barriers to the development of GSC based on lack of green financial resources and green awareness. A key idea for next research is the need to increase research from the perspective of the value that GB plays for the development of sustainable green growth, that is, when GB plays the role of promoter of GSC (GBB role), and how it should be channeled the necessary financing for the renewal of business models towards green business models.

Data availability

A content analysis of the resulting papers was performed at the end of the structured literature search process. All the analyzed information is available in the article. Data on the sample of articles are provided as supplementary material.

References

Bardsley N (2020) Avoiding a great depression in the era of climate change. https://doi.org/10.30687/978-88-6969-442-4/020

Beamon BM (1999) Designing the green supply chain. Logist Inf Manag. https://doi.org/10.1108/09576059910284159

Beltramello A, Haie-Fayle L, Pilat D (2013) Why new business models matter for green growth. https://doi.org/10.1787/22260935

Bina O (2013) The green economy and sustainable development: an uneasy balance? Environ Plann C Gov Policy 31(6):1023–1047. https://doi.org/10.1068/c1310j

Booth A, Sutton A, Papaioannou D (2012) Systematic approaches to a successful literature review. SAGE Publications Ltd, London

Bose S, Khan HZ, Rashid A, Islam S (2018) What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pac J Manag 35(2):501–527. https://doi.org/10.1007/s10490-017-9528-x

Council of Supply Chain Management Professionals (2013) “CSCMP’s definition of supply chain management”. www.cscmp.org/CSCMP/Educate/SCM_Definitions_and_Glossary_of_Terms/CSCMP/Educate/SCM_Definitions_and_Glossary_of_Terms.aspx?hkey=60879588-f65f-4ab5-8c4b-6878815ef921 (accessed 18 Jan 2020)

Deka G (2015) Green Banking Practices: A Study on environmental strategies of banks with special reference to State bank of India. Indian J Commer Manag Stud 6(3):11–19

Dissanayake D, Tilt C, Xydias-Lobo M (2016) Sustainability reporting by publicly listed companies in Sri Lanka. J Clean Prod 129:169–182. https://doi.org/10.1016/j.jclepro.2016.04.086

Everitt BS (1975) Multivariate analysis: the need for data and other problems. Brit J Psychiat 126:237–240. https://doi.org/10.1192/bjp.126.3.237

Fashli A., Herdiansyah H., Handayani RD (2019) Application of green banking on financing infrastructure project industry: environmental perspective. J Phys Conf Ser (vol. 1175, No. 1, p. 012027). IOP Publishing

Girish S (2016) Evaluation of stakeholder perception on green banking practices in selected public and private sector banks in Kerala. J Intern Bank Commer 21(2):1

Gollapudi SPV, Choppella V, Sanagavarapu LM, Chimalakonda S, Reddy YR (2019) Promoting better financial inclusion through web page transformation—a systematic literature review. J Bank Financ Technol 3(2):131–147. https://doi.org/10.1007/s42786-019-00010-0

Grant MJ, Booth A (2009) A typology of reviews: an analysis of 14 review types and associated methodologies. Health Inf Libr J 26(2):91–108. https://doi.org/10.1111/j.1471-1842.2009.00848.x

Green KW, Zelbst PJ, Meacham J, Bhadauria VS (2012) Green supply chain management practices: impact on performance. Supply Chain Manag Int J. https://doi.org/10.1108/13598541211227126

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energ 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

Herrador-Alcaide T, Hernandez-Solis M (2019) Empirical study regarding non-financial disclosure for social conscious consumption in the Spanish E-credit market. Sustainability 11(3):866. https://doi.org/10.3390/su11030866

Higgins JPT, Green S (eds.) (2011) Cochrane handbook for systematic reviews of interventions version 5.1.0 [updated March 2011]. The Cochrane collaboration. https://doi.org/10.1002/jrsm.38

Ibe-enwo G, Igbudu N, Garanti Z, Popoola T (2019) Assessing the relevance of green banking practice on bank loyalty: the mediating effect of green image and bank trust. Sustainability 11(17):4651. https://doi.org/10.3390/su11174651

Iqbal Q, Hassan SH, Akhtar S, Khan S (2018) Employee’s green behavior for environmental sustainability: a case of banking sector in Pakistan. World J Sci Technol Sustain Dev. https://doi.org/10.1108/WJSTSD-08-2017-0025

Islam AM, Ali MM, Medhekar A (2017) Exploratory results of green production, sale, willing to pay and financing: case of Bangladesh. Environ Econ 8(Iss. 3):8–17

Jatana R, Jain H (2016) Green banking: a study of customers’ perspective in Rajasthan. Sumedha J Manag 5(4):4–13

Jayabal G, Soudarya M (2017) Customers satisfaction regarding green banking in public sector banks in Sivagangai district. Int J Manag Res Rev 7(8):822

Julia T, Kassim S (2019) Exploring green banking performance of Islamic banks vs conventional banks in Bangladesh based on Maqasid Shariah framework. J Islam Markethttps://doi.org/10.1108/JIMA-10-2017-0105

Kaur J, Sidhu R, Awasthi A, Chauhan S, Goyal S (2018) A DEMATEL based approach for investigating barriers in green supply chain management in Canadian manufacturing firms. Int J Prod Res 56(1-2):312–332. https://doi.org/10.1080/00207543.2017.1395522

Kılıç M, Kuzey C (2019) Determinants of climate change disclosures in the Turkish banking industry. Int J Bank Market. https://doi.org/10.1108/IJBM-08-2018-0206

Kondyukova ES, Shershneva EG, Savchenko NL (2018) Green banking as a progressive model of socially responsible business. Управленец 9(6):30–39

Kumar K, Prakash A (2018) Developing a framework for assessing sustainable banking performance of the Indian banking sector. Soc Responsib J 15(5):689–709. https://doi.org/10.1108/SRJ-07-2018-0162

Laguir I, Marais M, El Baz J, Stekelorum R (2018) Reversing the business rationale for environmental commitment in banking: Does financial performance lead to higher environmental performance?. Manag Decis. https://doi.org/10.1108/MD-12-2016-0890

Lekakos G, Vlachos P, Koritos C (2014) Green is good but is usability better? Consumer reactions to environmental initiatives in e-banking services. Ethics Inf Technol 16(2):103–117. https://doi.org/10.1007/s10676-014-9337-6

Linh DH, Anh TV (2017) Impact of stakeholders on the performance of green banking products and services: the case of Vietnamese banks. Econo Ann-XXI 165:143–151

Lymperopoulos C, Chaniotakis IE, Soureli M (2012) A model of green bank marketing. J Financ Serv Market 17(2):177–186. https://doi.org/10.1057/fsm.2012.10

Manohar B, Kumar CV (2012) GREEN BANKING:” bye-bye cheques, hello electronic payments”. Asia Pacific J Manag Entrep Res 1(3):60

Masi D, Day S, Godsell J (2017) Supply chain configurations in the circular economy: a systematic literature review. Sustainability 9(9):1602. https://doi.org/10.3390/su9091602

Masud MAK, Bae SM, Kim JD (2017) Analysis of environmental accounting and reporting practices of listed banking companies in Bangladesh. Sustainability 9(10):1717. https://doi.org/10.3390/su9101717

Masud MAK, Hossain MS, Kim JD (2018) Is green regulation effective or a failure: comparative analysis between Bangladesh Bank (BB) green guidelines and global reporting initiative guidelines. Sustainability 10(4):1267. https://doi.org/10.3390/su10041267

Mehedi S, Maniruzzaman MD (2017) The identification of Bankersâ   perception toward indicators for the adoption of green banking in Bangladeshi scheduled commercial banks. J Intern Bank Commer 22(2):1–18

Meherishi L, Narayana SA, Ranjani KS (2019) Sustainable packaging for supply chain management in the circular economy: a review. J Clean Prod 237:117582. https://doi.org/10.1016/j.jclepro.2019.07.057

Miah MD, Rahman SM, Mamoon M (2021) Green banking: the case of commercial banking sector in Oman. Environ Dev Sustain 23(2):2681–2697. https://doi.org/10.1007/s10668-020-00695-0

Munaro MR, Tavares SF, Bragança L (2020) Towards circular and more sustainable buildings: a systematic literature review on the circular economy in the built environment. J Clean Prod 260:121134. https://doi.org/10.1016/j.jclepro.2020.121134

Mundfrom DJ, Shaw DG, Ke TL (2005) Minimum sample size recommendations for conducting factor analyses. Int J Test 5:159–168. https://doi.org/10.1207/s15327574ijt0502_4

Nieto MJ (2019) Banks, climate risk and financial stability. J Financ Regul Compliance. https://doi.org/10.1108/JFRC-03-2018-0043

OECD (2011) Towards green growth. A summary for policy makers, ECD. May 2011

Pluye P, Hong QN, Bush PL, Vedel I (2016) Opening-up the definition of systematic literature review: the plurality of worldviews, methodologies and methods for reviews and syntheses. J Clin Epidemiol 73:2–5. https://doi.org/10.1016/j.jclinepi.2015.08.033

Queiroz MM, Telles R, Bonilla SH (2019) Blockchain and supply chain management integration: a systematic review of the literature. Supply Chain Manag Int J. https://doi.org/10.1108/SCM-03-2018-0143

Radović-Marković M, Živanović B (2019) Fostering green entrepreneurship and women’s empowerment through education and banks’ investments in tourism: evidence from Serbia. Sustainability 11(23):6826. https://doi.org/10.3390/su11236826

Ramila M, Gurusamy S (2015) Impact of green banking initiatives on the level of carbon foot print-an empirical study. Sumedha J Manag 4(1):59

Rao GP, Menezes S, Dhanush R (2015) Contemplating customers and bankers outlook on green banking. Int J Sci Res Technol 1(1):75–82

Rashid S, Ratten V (2020) A systematic literature review on women entrepreneurship in emerging economies while reflecting specifically on SAARC countries. In: Entrepreneurship and Organizational Change. 37–88. Springer, Cham

Rodrigo CP (2012) Las revisiones sistemáticas: declaración PRISMA. Rev Esp Nutr Comunitaria 18(1):57–58

Roy J, Prakash A, Some S, Singh C, Bezner Kerr R., Caretta MA, Tandon I (2022) Synergies and trade-offs between climate change adaptation options and gender equality: a review of the global literature. Humanit Soc Sci Commun 9(1). https://doi.org/10.1057/s41599-022-01266-6

Rumrill Jr PD, Fitzgerald SM (2001) Using narrative literature reviews to build a scientific knowledge base. Work 16(2):165–170

Sapnas KG, Zeller RA (2002) Minimizing sample size when using exploratory factor analysis for measurement. J Nurs Meas 10(2):135–154. https://doi.org/10.1891/jnum.10.2.135.52552

Seuring S, Müller M (2008) From a literature review to a conceptual framework for sustainable supply chain management. J Clean Prod 16(15):1699–1710. https://doi.org/10.1016/j.jclepro.2008.04.020

Shampa TS, Jobaid MI (2017) Factors influencing customers’ expectation towards green banking practices in Bangladesh. Eur J Bus Manag 9(12):140–152

Song X, Deng X, Wu R (2019) Comparing the influence of green credit on commercial bank profitability in china and abroad: empirical test based on a dynamic panel system using GMM. Int J Financ Stud 7(4):64. https://doi.org/10.3390/ijfs7040064

Spash CL (2020) A tale of three paradigms: realising the revolutionary potential of ecological economics. Ecol Econ 169:106518. https://doi.org/10.1016/j.ecolecon.2019.106518

Srivastava SK (2007) Green supply‐chain management: a state‐of‐the‐art literature review. Int J Manag Rev 9(1):53–80. https://doi.org/10.1111/j.1468-2370.2007.00202.x

Subramanian R (2015) Fostering technology adoption by customers: an innovative technology initiative of SBI. Gavesana J Manag 7(2):1

Sun Y, Bi K, Yin S (2020) Measuring and integrating risk management into green innovation practices for green manufacturing under the global value chain. Sustainability 12(2):545. https://doi.org/10.3390/su12020545

Tarka P (2018) An overview of structural equation modeling: its beginnings, historical development, usefulness and controversies in the social sciences. Qual Quan 52(1):313–354. https://doi.org/10.1007/s11135-017-0469-8

Thomä J, Gibhardt K (2019) Quantifying the potential impact of a green supporting factor or brown penalty on European banks and lending. J Financ Regul Compliance 27(3):380–394. https://doi.org/10.1108/JFRC-03-2018-0038

Tseng ML, Islam MS, Karia N, Fauzi FA, Afrin S (2019) A literature review on green supply chain management: Trends and future challenges. Resour Conserv Recycl 141:145–162. https://doi.org/10.1016/j.resconrec.2018.10.009

Weber O (2017) Corporate sustainability and financial performance of Chinese banks. Sustain Account Manag Policy J. https://doi.org/10.1108/SAMPJ-09-2016-0066

Wu DD, Yang L, Olson DL (2019) Green supply chain management under capital constraint. Int J Prod Econ 215:3–10. https://doi.org/10.1016/j.ijpe.2018.09.016

Yang H, Miao L, Zhao C (2019) The credit strategy of a green supply chain based on capital constraints. J Clean Prod 224:930–939. https://doi.org/10.1016/j.jclepro.2019.03.214

Zelbst PJ, Green KW, Abshire RD, Sower VE (2010) Relationships among market orientation, JIT, TQM, and agility. Ind Manag Data Syst. https://doi.org/10.1108/02635571011044704

Zhu Q, Sarkis J, Geng Y (2005) Green supply chain management in China: pressures, practices and performance. Int J Oper Prod Manag 25(5):449–468. https://doi.org/10.1108/01443570510593148

Author information

Authors and Affiliations

Contributions

All authors in the equal proportion collected and analyzed the data, designed the study, interpreted the results, carried out the implications, did the literature review, and wrote the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Herrador-Alcaide, T.C., Hernández-Solís, M. & Cortés Rodríguez, S. Mapping barriers to green supply chains in empirical research on green banking. Humanit Soc Sci Commun 10, 411 (2023). https://doi.org/10.1057/s41599-023-01900-x

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-023-01900-x