Abstract

Ambidextrous search behaviors that jointly looking for technological and market knowledge gain attention in the innovation management literature. This study treats the ambidextrous search behaviors as a technology-market search paradox and examines the effect of organizational slack on the paradox and further explore whether this paradox has synergistic effects on performance in high-tech small medium-sized enterprises (SMEs). Besides, by integrating the literature of ambidextrous search and strategic management, we seek to understand the roles of strategic orientations, including growth-oriented and profit-oriented, in SMEs’ technology-market search paradox. Based on panel data of 547 high-tech SMEs, we find that organizational slack promotes both technology and market search, and ambidextrous search separately enhance high-tech SMEs’ performance, while the interaction of technology search and market search is negatively related to performance. Further, a growth-oriented strategy positively moderates the link between organizational slack and ambidextrous search and a profit-oriented strategy reinforces the relationship between organizational slack and technology search. We further enrich search-related and strategic literature.

Similar content being viewed by others

Introduction

Rapid technological progress and changing market need prompt firms to innovate by searching for and integrating both technological knowledge and market knowledge (Zhang, Zhao, Wang, Wang, & Li, 2019). Acquiring new knowledge from both technology and market domains through a learning process is called ambidextrous search, which includes both technology search and market search behaviors (Vissa, Greve, & Chen, 2010; Zhang et al., 2019). On the one hand, the searched technological knowledge and market knowledge complement each other and could generate positive synergistic effects on firm performance (Su, Peng, Shen, & Xiao, 2013); on the other hand, the tension between market and technology search activities can also produce negative synergistic effects due to their competition for scarce financial and human resources to initiate ambidextrous behaviors and the potential coordination and integration problems (Zhang et al., 2019). This interdependent and contradictory relationship between technology search and market search can be viewed as a technology-market search paradox, as a paradox is defined as the persistent contradiction between interdependent elements (Schad, Lewis, Raisch, & Smith, 2016). It is vital to understand the role of technology search and market search to figure out the balance between the two search behaviors for improving firm performance (Zhang et al., 2019).

Previous studies on ambidextrous search mainly can be classified into two streams. One stream focuses on the antecedents of ambidextrous search and previous studies explore how resources, problems, and cognition trigger firms’ search behavior (Guo, Zou, Zhang, Bo, & Li, 2020b; Kiss, Libaers, Barr, Wang, & Zachary, 2020; Ye, Yu, & Nason, 2020; Zhong, Ma, Tong, Zhang, & Xie, 2020). From a strategic management perspective, resources and strategic orientations are critically important, because they are closely related to enterprises’ search direction, development goals, and innovation performance(Zhou & Park, 2020). However, organizational slack, as firms’ discretionary resources, can support search activities (Guo et al., 2020b), but agency theorists argue that slack, as a liability, could bring low efficiency (Vanacker, Collewaert, & Zahra, 2017). These conflicting results require further exploration of the role of slack to better understand the impacts of slack in ambidextrous search.

In addition, strategic choice, closely related to a firm’s development, growth, and survival, could influence the firm’s resource allocation, and innovation behaviors (Lee, Hoehn-Weiss, & Karim, 2021; Zhou & Park, 2020). Strategy research has studied that Porter’s three strategies, including low-cost, differentiation, and focus, benefit firms to strengthen competitive advantages (Lee et al., 2021). Growth and profit are two significant goals for firms to achieve competitive advantages, but they are commonly adopted as performance measurements, and few studies view them as strategic orientations, determining firms’ strategic development (Pe’er, Vertinsky, & Keil, 2016; Zhang et al., 2019). The effects of growth-oriented and profit-oriented strategies that firms adopted on their search activities have been ignored (Zhou & Park, 2020). Therefore, organizational slack and strategic orientations deserve further investigation along with the paradoxical view of technology search and market search.

The other stream focuses on outcomes of the ambidextrous search, and prior research mainly investigates how technology search and market search separately affect firm performance, and only a few studies explore the interaction of technology search and market search on firms’ innovation performance in manufacturing firms (Guo et al., 2020b; Zhang et al., 2019). Consequently, these studies have ignored to consider ambidextrous search as a paradox based on their interdependent and contradictory relation and to investigate the effects of paradox in high-tech small and medium-sized enterprises (SMEs). Indeed, the trade-off or tension between technology search and market search is more critical for high-tech SMEs, due to their resources or capabilities constraints, innovation-oriented focus, and high reliance on external knowledge for innovation (Boh, Huang, & Wu, 2020; Guo, Bo, Tong, & Zhang, 2020a; Parida, Westerberg, & Frishammar, 2012). Therefore, in this study, to fill the gap and enrich the literature about the antecedents and outcomes of ambidextrous search, we explore the direct effects of organizational slack as well as the moderating effects of strategic orientations on ambidextrous search, and further investigate the influence of technology-market search paradox on high-tech SMEs’ performance.

We argue that organizational slack can provide resource commitment and risk buffers for high-tech SMEs’ search of technology and market search activities (Guo et al., 2020b; Teirlinck, 2020). Meanwhile, a firm’s strategic orientations could influence its redeployment of slack to ambidextrous search. Specifically, a growth-oriented strategy emphasizes the pursuit of firm’s growth and establishment of core capabilities and implies more risk preference and willingness for exploration (Nunes, Serrasqueiro, & Leitao, 2012; Zhou & Park, 2020), so that growth-oriented SMEs are more likely to allocate slack to more technology search and market search. Conversely, a profit-oriented strategy focuses more on firms’ profits rather than their long-term growth (Zhou & Park, 2020). Profit-oriented SMEs tend to exploit existing resources or to imitate leader firms for lowering cost and uncertainty and obtaining quick returns (Lee et al., 2021; Wu, Harrigan, Ang, & Wu, 2019; Zhou & Park, 2020); in this vein, these SMEs are more likely to utilize slack efficiently to market search rather than to technology search. In addition, technology search enables firms to establish core technology and enhance innovation capability (Guo et al., 2020a; Wu et al., 2019), while market search help firms to capture market trends and promote market penetration, thereby improving firm performance (Ren, Eisingerich, & Tsai, 2015; Vissa et al., 2010; Zhang et al., 2019). Furthermore, due to resource competition in technology and market domains in ambidextrous search activities, and high-tech SMEs’ characteristics of constraint resources, weak integrative and absorptive capabilities, we argue that these firms can hardly realize the positive synergies of ambidextrous search on their performance.

This study takes 547 high-tech SMEs in China as the research object and uses a fixed-effect model to test the hypotheses. Empirical results demonstrate that organizational slack is conducive to ambidextrous search. The growth-oriented strategy could strengthen the positive effects of slack on ambidextrous search, whereas the profit-oriented strategy could only enhance the impacts of slack on technology search. Additionally, the ambidextrous search could lead to higher firm performance; however, the technology-market search paradox inhabits high-tech SMEs’ performance.

This research contributes to the current literature in several aspects. Firstly, this study contributes to ambidextrous search-related literature by extending our understanding of the paradox in technology and market search in high-tech SMEs and revealing their negative synergistic effects on high-tech SMEs’ performance. Secondly, this study contributes to search-related literature by uncovering and integrating the antecedents of organizational slack and consequences of the technology-market search paradox in high-tech SMEs. Thirdly, we enrich the strategic management literature by combining strategic orientations with ambidextrous search and uncovering the moderating roles of growth-oriented and profit-oriented strategies. Furthermore, we strengthen the understanding of context of emerging markets.

Theory and hypotheses

Ambidextrous search

Search behavior, referring to firms’ learning process of acquiring, integrating, and absorbing heterogeneous knowledge from various sources, can be classified into technology search and market search based on the type of knowledge, and the two types of search are also called ambidextrous search (Rosenkopf & Nerkar, 2001; Vissa et al., 2010; Zhang et al., 2019). Search in a technology domain (technology search) is related to the search of technological knowledge for a firm’s innovation improvement and is reflected by R&D investment activities, whereas search behavior in a market domain (market search) refers to efforts devoted to discovering more potential customers for a deeper market penetration or to add products for gaining a wider market position (Vissa et al., 2010; Zhang et al., 2019). However, technology search and market search activities are both interdependent and contradictory. In terms of interdependence, technological knowledge and market knowledge are complementary and have positive synergistic effects on innovation (Su et al., 2013). As for contradictions, two kinds of knowledge search behaviors will compete for resources commitment and managers’ attention (Zhang et al., 2019). Therefore, in the management literature, the pair of market search and technology search can be considered as a paradox based on their interdependent and contradictive relations (Schad et al., 2016).

The paradox is more evident in high-tech SMEs. On the one hand, ambidextrous search requires high-quality resources investment and managers’ attention (Su et al., 2013; Zhang et al., 2019), but SMEs are constrained by resources and well-trained management talents (Parida et al., 2012; Zhou & Park, 2020), which exacerbates the tension. On the other hand, due to the characteristics of high-tech industries, such as faster technology updating, shorter product life cycles (Boh et al., 2020), the higher demand for the novelty of products and more common radical innovation (Simms & Frishammar, 2024), thereby increasing the frequency of the balance or tradeoff. However, recent studies on search-related literature have neglected to explore the technology-market search paradox in high-tech SMEs.

In addition, from a resource-based view, resource allocation and utilization are critical to the success and performance of firms (Carnes, Xu, Sirmon, & Karadag, 2019; Greve, 2021). Organizational slack can foster innovation and competitive action, while it can also cause inefficient resource utilization (Carnes et al., 2019; Teirlinck, 2020). In this sense, it is important to explore or test the effects of slack on high-tech SMEs’ ambidextrous search, so that these firms can adjust their search strategies to improve the efficiency of slack utilization. Therefore, we study the direct impact of organizational slack on ambidextrous search, and then take the ambidextrous search behavior as a paradox, and further explore the influence of the paradox on high-tech SMEs’ performance.

Growth-oriented and profit-oriented strategies

Strategy literature pays more attention to Porter’s three business strategies, including low-cost, differentiation, and focused strategies, or imitation strategy and innovation strategy, and explores how these strategies contribute to firms’ competitive advantages (Ali, 2021; Lee et al., 2021). Growth and profit are two significant goals for firms’ development (Nunes et al., 2012; Zhou & Park, 2020). The majority of researchers consider growth and profit as outcomes or performance measurements, but few researchers view them as strategy choices (Pe’er et al., 2016; Zhou & Park, 2020). Indeed, two different strategic orientations (profit or growth) can be adopted by firms to reinforce their competitive advantages (Pe’er et al., 2016; Zhou & Park, 2020), since these strategies influence firms’ search directions and areas. The growth-oriented strategy is defined as the firm pursuing high growth at expense of its profit, while a profit-oriented strategy emphasizes more on profit than growth (Zhou & Park, 2020). Some high-tech SMEs adopt the growth-oriented strategy to strengthen their core competitiveness and to expand market shares (Nunes et al., 2012), but some firms utilize the profit-oriented strategy of creative imitation to leading firms in order to achieve high returns with lower cost (Wu et al., 2019).

Zhou and Park (2020) have proposed that growth-oriented and profit-oriented strategic orientations in emerging markets deserve separate exploration and investigation because these markets are experiencing economic transition and numerous opportunities urge firms to balance or tradeoff between growth and profit. However, these studies mainly link growth-oriented or profit-oriented strategic orientations with firms’ survival (Pe’er et al., 2016; Zhou & Park, 2020), but ignore the interaction effects between these strategies and search behaviors. Enterprises’ strategic choice could influence their resource allocation, and then affect firms’ search behaviors (Lee et al., 2021; Leiponen & Helfat, 2010). Therefore, we incorporate growth-oriented and profit-oriented strategic orientations and explore how these strategies moderate the relationship between slack and high-tech SMEs’ ambidextrous search.

Organizational slack and ambidextrous search

Organizational slack is defined as a firm’s stock of disposable resources (Carnes et al., 2019). We predict that organizational slack could provide flexible resources and buffers for high-tech SMEs’ ambidextrous search activities. From a resource-based view, organizational slack, as substantial uncommitted resources, can support firms’ technological investment activities to explore new ideas or technologies (Carnes et al., 2019). Technology search, reflected by R&D investment activities, is characterized by large investment and a long return cycle (Coad & Rao, 2008; Yu, Minniti, & Nason, 2019; Zhang et al., 2019), while the available slack allows firms to engage in more technology search. Meanwhile, slack can provide a cushion or buffer for firms to experiment for technology since technological search activities are associated with risk and uncertainty (Carnes et al., 2019; Zhang et al., 2019). Thus, technology search activities can be promoted by organizational slack.

However, a curved or negative correlation may exist between organizational slack and technology search because slack can decrease efficiency (Carnes et al., 2019; Teirlinck, 2020). For high-tech SMEs, these kinds of relations may not exist. On the one hand, due to the constraints of scale and resources, SMEs have fewer opportunities to enter the external capital market for financing, so they are inclined to efficiently make full use of their slack or resources (Guo et al., 2020b; Kim & Hemmert, 2016; Nunes et al., 2012). On the other hand, high-tech industries operating in a relatively competitive environment, the speed of technological updating and obsolescence are much faster, which requires continuous R&D investment and technological innovation to maintain advantages (Boh et al., 2020; Guo et al., 2020b). Therefore, we propose the following hypothesis:

H1: Organizational slack is positively related to high-tech SMEs’ technology search

Organizational slack is also closely related to the market search. Market search refers to adding products to gain a wider market position or attracting more customers for deeper market penetration (Vissa et al., 2010). Similarly, organizational slack, as uncommitted resources, could provide abundant discretionary resources and opportunities for high-tech SMEs to establish deep relations with customers (Vissa et al., 2010; Zhang et al., 2019), thereby promoting high-tech SMEs’ market search. In addition, since the availability of organizational slack could help enterprises improve the controllability of uncertainty and risky behaviors, managers of resource-rich high-tech SMEs are more inclined to frame environment issues as potential opportunities and then actively exploit promising opportunities to open new product markets or to find new customer groups (Voss, Sirdeshmukh, & Voss, 2008; Zhang et al., 2019). In this vein, high-tech SMEs’ market search is promoted by organizational slack. Therefore, we hypothesize:

H2: Organizational slack is positively related to high-tech SMEs’ market search

Moderating effects of growth-oriented and profit-oriented strategies

The growth-oriented strategy emphasizes more on establishment and improvement of the core competencies to achieve long-term growth and it will improve the utilization efficiency of enterprises’ resources (Pe’er et al., 2016; Zhou & Park, 2020). We predict that firms with growth-oriented strategies have more motivation and possibilities to utilize slack efficiently in both technology search and market search. Technology search, reflected in R&D investment activities, is regarded as the fundamental factor for the success and growth of high-tech SMEs because such technological search activities enable firms to create new technologies or products, enhance their absorptive capability, and promote innovation capabilities (Nunes et al., 2012). In the context of a growth-oriented strategy, in order to achieve growth goal and build core competencies, SMEs are likely to improve the efficiency of slack utilization in R&D investment activities to explore or seize more potential growth opportunities (Nunes et al., 2012; Zhou & Park, 2020), thereby enhancing the impact of organizational slack on technology search. In addition, high-tech SMEs’ pursuit of growth strategy implies their preference for risk and exploration (Nunes et al., 2012; Zhou & Park, 2020), so that these SMEs may engage in technology search more frequently with the support of slack resources. Thus, a growth-oriented strategy reinforces the effect of organizational slack on technology search. Accordingly, we hypothesize:

H3: The growth-oriented strategy strengthens the positive relationship between organizational slack and high-tech SMEs’ technology search.

The growth-oriented strategy also influences the impacts of organizational slack on high-tech SMEs’ market search. High-tech SMEs with growth-oriented strategies are embodied in the pursuit of market knowledge to gain more new markets and market power (Buxton & Davidson, 1996; Zhou & Park, 2020). As such, it is necessary to establish relationships with more new customers or suppliers to enhance market penetration and position, which further require the firm to improve efficiency utilization of slack into more market search. In addition, firms with growth-oriented strategies are inclined to improve growth rates by developing new technologies or products (Buxton & Davidson, 1996; Liu et al., 2024a). These new technologies and products need to be marketed to attract more customers and to increase firms’ market share, which reflects that firms are likely to allocate financial slack to more market search. Thus, the positive effect of organizational slack on high-tech SMEs’ market search is reinforced. Therefore, we hypothesize:

H4: The growth-oriented strategy strengthens the positive relationship between organizational slack and high-tech SMEs’ market search.

Firms with profit-oriented strategy prioritize high profits rather than growth. These firms tend to adopt strategies of low-cost or imitation and to pursue quick market return (Vissa et al., 2010; Wu et al., 2019; Zhou & Park, 2020), so we predict that these SMEs are more willing to utilize their slack efficiently to more market search than to technology search. These profit-oriented SMEs are willing to adopt an incremental innovation strategy by exploiting existing knowledge and resources, or an imitation strategy by following first-movers’ technologies, rather than engaging in risky activities of exploration (Wu et al., 2019; Zhou & Park, 2020). In the context of a profit-oriented strategy, SMEs do not have much willingness and motivation to apply organizational slack to explore new ideas or opportunities through technology search due to the legitimacy of technology has been verified (Barreto & Baden-Fuller, 2006; Zhou & Park, 2020). In addition, profit-oriented firms have characteristics of risk aversion, but technology search activities require large long-term investment without certainty payoff (Blagoeva, Mom, Jansen, & George, 2020; Shaikh, O’Brien, & Peters, 2018). In this sense, these firms are unlikely to utilize organizational slack to conduct more technology search and the positive effect of organizational slack on technology search is reduced. Therefore, we propose the following hypothesis:

H5: The profit-oriented strategy weakens the positive relationship between organizational slack and high-tech SMEs’ technology search.

Previous studies have demonstrated that profit-oriented firms in emerging markets would strengthen their competitive advantages through strategies of low-cost or imitation (Porter, 1980; Zhou & Park, 2020). Imitation of first-movers enables firms to predict customers’ response or acceptance to new products (Wu et al., 2019; Zhou & Park, 2020), which further increases firms’ certainty to market search behaviors; in this context, high-tech SMEs have more willingness and motivation to allocate organizational slack to initiate more market search. In addition, a profit-oriented strategy focuses more on short and quick returns (Vissa et al., 2010; Zhou & Park, 2020); in this situation, the firm will focus on applying organizational slack to engage in market search more frequently due to the effects or returns of market search is much quicker. Therefore, a profit-oriented strategy intensifies the positive effect of organizational slack on market search. Accordingly, we hypothesize:

H6: The profit-oriented strategy strengthens the positive relationship between organizational slack and high-tech SMEs’ market search.

Ambidextrous search and high-tech SMEs’ performance

Ambidextrous search is closely related to high-tech SMEs’ performance. The searched technology and market knowledge could enrich firms’ knowledge base and bring more heterogeneous knowledge combinations, which further contribute to technological and product innovation (Leiponen & Helfat, 2010). More specifically, technology search activities could improve high-tech SMEs’ absorptive capabilities, innovation speed, and quality, and help firms to keep up with technology updating, thereby further enhancing their performance (Davcik, Cardinali, Sharma, & Cedrola, 2021; Guo et al., 2020a). Market search activities could not only facilitate imitation successes of competing products or leading products, but also enable firms to accurately capture or satisfy customers’ needs and preferences and further promote customer relationships building (Kohler, Sofka, & Grimpe, 2012; Zhang et al., 2019), which is beneficial to firms’ performance. Thus, we hypothesize:

H7: Technology search is positively related to high-tech SMEs’ performance.

H8: Market search is positively related to high-tech SMEs’ performance.

As mentioned in the above hypotheses, technology search and market search could respectively enhance SMEs’ performance. However, high-tech SMEs are unlikely to balance the tradeoff between technology and market search because of their resources and capacities constraints (Zhang & Li, 2023). First, synergistic effects require substantive financial and human resources support, but the resources that can be redeployed to search activities are often limited and more resources for technology search mean fewer resources are left for the firm’s market search, and vice versa (Zhang et al., 2019). For high-tech SMEs, the paradox is more obvious, because SMEs are constrained by their scale and complementary assets (Barrett, Dooley, & Bogue, 2021; Nunes et al., 2012), and these high-tech firms, operating in a highly competitive environment with characteristics of rapid technology upgrading and frequent emergence of market trends (Boh et al., 2020), needs more resource investment (Xie, Wu, & Martínez, 2023). Besides, the successful balance between technology and market search needs managerial attention and a different managerial mindset to both market and technological changes (Lee, Wu, & Pao, 2014; Zhang et al., 2019), as market search emphasizes more the speed of a product to market, while technology search focuses more on the quality of the technology or product (Mardani, Nikoosokhan, Moradi, & Doustar, 2018). However, in emerging markets, most firms suffer from a lack of well-trained qualified management talents (Zhou & Park, 2020), thereby intensifying the tension. Second, different characteristics and logic of market and technology knowledge increase difficulties of integration and absorption (Li, Zhang, & Lyles, 2013; Zhang et al., 2019), and SMEs lack absorptive capabilities compared with large firms (Ahokangas et al., 2021), which increases the difficulties of the tradeoff. Third, firms’ technology or market search activities are consciously self-reinforcing, reflecting that they would engage in their technology search along the same trajectory, namely path dependency, and the same applies to market search, thereby increasing firms’ tension between technology and market search (Zhang et al., 2019). Therefore, we put forward the following hypothesis:

H9: The interaction of technology search and market search is negatively related to high-tech SMEs’ performance.

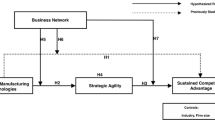

The research model is displayed in Fig. 1.

Methods

Sample and data

High-tech SMEs are important actors in the industry base, and largely contribute to technological innovation and economic development (Barrett et al., 2021). We test our hypotheses by relying on listed firms on Chinese Growth Enterprises Board, a stock market in China for helping high-tech SMEs to raise funds (Li & Hou, 2019). We select SMEs that belong to high-tech industries, including IT, materials, pharmaceutical, engineering industries (Ren et al., 2015), and get a sample of 606 firms. After deleting samples with missing observations in focal variables for three years in succession, we obtain a sample of 547 firms for the period from 2009 to 2018. We collect firm-level data, including technology search, market search, organizational slack, firm strategies, firm performance, intangible assets, firm size, age, cash strength ratio, profitability, performance feedback, and industrial level data, including industrial sale growth, industrial technology search, and industrial market search from Wind, a database of all public information, including basic information and financial data, disclosed by listed Chinese enterprises (Jia, Huang, & Zhang, 2019). The regional level data, including province GDP per capita and province R&D expenditure, is collected from China Statistical Yearbooks (Jia et al., 2019).

Measures

Dependent variables

Technology search, reflected by R&D investment, is measured by R&D expenses. More specifically, it is calculated by changes in R&D expenses from time t to time t-1, divided by R&D expenses at time t-1 (Blagoeva et al., 2020; Vissa et al., 2010; Yu et al., 2019). Market search can be measured by the sum of a firm’s advertising, marketing and distribution expenses (Vissa et al., 2010). Similarly, based on the measurement of technology search, market search can be calculated by changes in market expenses from time t to time t-1, divided by market expenses at time t-1. High-tech SMEs’ performance is measured by ROA (Yu et al., 2019).

Independent variables

Organizational slack, as available uncommitted resources, is calculated by the equity to debt ratio (Wan & Yiu, 2009). According to the research of Zhou and Park (2020), we use ROA and sales growth to measure a firm’s profit and growth. The growth-oriented strategy is a dummy variable that obtains a value of 1 if the firm’s sales growth is higher than the industry average level but profit is lower than the industry average level. Conversely, the profit-oriented strategy is also a dummy variable that has a value of 1 if the firm’s profit is higher than industry average profit but sales growth is lower than industry average level.

Control variables

We include firm, industrial and regional level control variables in our regression analysis because these factors can influence firms’ ambidextrous search behaviors (Blagoeva et al., 2020; Guo et al., 2020a; Yu et al., 2019). For firm-level variables, we control for firm size, which is measured by the natural logarithm of the firm’s total employees, because, even among SMEs, large firms have more resources than small firms to initiate search behaviors (Dutt & Mitchell, 2020). Firm age, measured by the number of years since the firm is established, is controlled for because older firms with a long history are more inclined to exploit existing technologies rather than explore new knowledge domains (Lee et al., 2023; Sørensen & Stuart, 2000). Intangible assets, calculated by the natural logarithm of the firm’s intangible assets, and cash strength ratio, measured by the ratio between cash net flow and total assets, are controlled because those factors can influence firms’ growth (Li & Hou, 2019; Liu et al., (2024b)). We control for profitability, measured by the natural logarithm of a firm’s net profit because enterprises with higher profits are more likely to enhance existing knowledge (Zhong et al., 2020). According to the behavioral theory, firms’ past performance triggers their innovation search behavior, such as R&D search, so that we control for the feedback (Posen, Keil, Kim, & Meissner, 2018). Performance feedback is measured by the differences between firms’ ROA and industrial average level of ROA (Yu et al., 2019). Industrial sales growth, measured by the growth in industrial sales from time t-1 to t, is controlled for because it can influence a firm’s R&D expenditure (Ye et al., 2020). Industrial technology search, calculated by the changes in industrial R&D expenditures, and industrial market search, measured by the changes in industrial market expenditures, are controlled for because industrial search behavior could influence a firm’s search preference (Vissa et al., 2010; Yu et al., 2019).

For regional variables, we introduce Province GDP per capita, measured by natural log, and Province R&D expenditure per capita to control for differences in economic development among provincial-level regions, since macroeconomic environment is closely related to firms’ behavior (Gao, Hu, Liu, & Zhang, 2021; Jia et al., 2019). In addition, Supplementary Table S1 lists the detailed measurements for all variables.

Estimation method

Following research of Yu et al. (2019), we test our nine hypotheses by using fixed effects regression with standard errors. We performed the Hausman test and the results showed that using random effects should be rejected (p > 001), so that the fixed effects estimation is adopted. To avoid potential problems of endogeneity, according to suggestions of Xu, Zhou, and Du (2019), first, we lagged our independent and control variables to reduce the possible reverse causality; second, we controlled for a set of firm, industrial, and regional level variables that may influence firms’ ambidextrous search behaviors; third, we include year and firm fixed effects in our regression process to account for within-group variation and reduce the potential bias caused by omitted variables. This empirical approach allows the predicted mean of the dependent variable to vary across groups, thereby controlling for unobserved heterogeneity (Gormley & Matsa, 2014; Xu et al., 2019).

Results

Regression analysis

Table 1 displays the descriptive statistics and correlation matrix for the main variables in this study. Overall, the correlation coefficients between variables are small, so the multicollinearity issue is not a concern in this paper. The average value of technology search and market search of enterprises are 0.331 and 0.337 respectively, indicating that those SMEs tend to engage in both types of search behaviors. Besides, since the results showed a positive and correlation between technology search and market search, to avoid the existence of multicollinearity, we separate the effects of organizational slack on ambidextrous search. Furthermore, the average value of growth-oriented strategy (0.299) is a little bit higher than the average level of profit-oriented strategy (0.243), reflecting a slight tendency for firms in our sample to adopt a growth-oriented strategy. A negative correlation between two strategical orientations may imply different effects on the relationship between organizational slack on ambidextrous search.

Tables 2 and 3 present the results of regressions. Model 1 and Model 4 in Table 2 shows the effects of control variables on ambidextrous search respectively. We regressed organizational slack (OS) on technology search (TS) and market search (MS) separately in Model 2 and Mode1 5 to test the main effects. The results indicate that organizational slack significantly and positively affects technology search (b = 0.004, p < 0.05) and market search (b = 0.004, p < 0.10). Therefore, both H1 and H2 are supported.

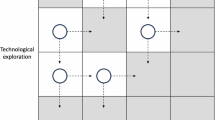

To test the moderating effects of strategic orientations, we added the interaction terms between organizational slack (OS) and strategic orientations (growth-oriented strategy (GOS) and profit-oriented strategy (POS)). The interaction effects (OS×GOS) in Model 3 and Model 6 shows that a growth-oriented strategy positively moderates the effect of organizational slack on technology search (b = 0.008, p < 0.10) and the effect of organizational slack on market search (b = 0.007, p < 0.10). The marginal effects of organizational slack on ambidextrous search with the moderating impacts of growth-oriented strategy are plotted and shown in Figs. 2 and 3. The results indicate that a growth-oriented strategy intensifies the positive effects of organizational slack on technology search and market search. Therefore, both H3 and H4 are supported. In addition, the coefficient of the interaction term between organizational slack and profit-oriented strategy (OS×POS) in Model 3 and Model 6 is insignificant (b = 0.008, p > 0.10; b = 0.003, p > 0.10); thus, H5 and H6 is not supported.

To empirically examine the outcomes of the technology-market search paradox in high-tech SMEs, we regressed technology search and market search on performance in Table 3. The results in Model 7 and Model 8 indicate that both market search (b = 0.625, p < 0.01) and technology search (b = 0.899, p < 0.01) significantly facilitate high-tech SMEs’ performance, thereby supporting H7 and H8. To test the synergistic effect of the paradox, we added the interaction term between technology search and market search (TS×MS) in the regression. The results in Model 9 show that the coefficient of the interaction term is negative and significant for high-tech SMEs’ performance (b = −0.020, p < 0.05). The results indicate a negative synergistic influence of the paradox on high-tech SMEs performance. Therefore, H9 is supported as well.

Robustness check

To verify the robustness check, firstly, we replace organizational slack with unabsorbed slack, which is measured by the ratio of current assets to current liabilities (Gambeta, Koka, & Hoskisson, 2019; Xu et al., 2019), to test the antecedent and outcome of ambidextrous in high-tech SMEs. The results show that unabsorbed slack can promote both technology search (b = 0.008, p < 0.01) and market search (b = 0.004, p < 0.05). Besides, technology search (b = 0.509, p < 0.01) and market search (b = 0.831, p < 0.01) positively influence high-tech SMEs’ performance, and the interaction term (TS×MS) (b = −0.020, p < 0.05) is negative and significant. Furthermore, the growth-oriented strategy could positively moderate the effects of organizational slack on both technology search (b = 0.010, p < 0.05) and market search (b = 0.008, p < 0.10). These results are consistent with the results of organizational slack, suggesting that our regression results are robust.

Secondly, to solve the potential problems of partial coefficient distortion in the negative synergistic effect of the technology-market paradox on high-tech SMEs’ performance, we adopted the method of residual centering procedure (Heavey & Simsek, 2017). To test the interaction effects of technology search and market search on high-tech SMEs’ performance, we first regressed the interaction term (TS×MS) on the components (TS and MS) separately. We then used the interaction term of the resulting residuals to replace the prior interaction term (TS×MS). The regression result shows the residual of the interaction term is negative and significant to high-tech SMEs’ performance (b = −0.108, p < 0.05), thereby confirming the robustness of our results. Thirdly, to further enhance the robustness of our results, we use net profit as a measure of firm performance and the results showed a negative synergistic effect of the technology-market paradox on high-tech SMEs’ performance, thereby supporting H9.

Conclusion and discussion

Conclusion

This research aims to explore the antecedent and outcome of the technology-market search paradox in high-tech SMEs and consider the contingent effects of growth-oriented and profit-oriented strategies. Based on a sample of 547 high-tech SMEs in China, we find that organizational slack facilitates technology search and market search in high-tech SMEs; the growth-oriented strategy reinforces the effects of organizational slack on both technology search and market search; both technology and market search is beneficial for performance improvement, and the interaction between technology search and market search hinders high-tech SMEs in reaping performance. However, H5, referring that profit-oriented strategy weakens the relationship between organizational slack and technology search, is not supported. One possible explanation is that these high-tech SMEs pay more attention to their technological search because technology improvement and advance are the basis and key of their success and source of profit (Nunes et al., 2012). Although the profit-oriented strategy focus more on high profit, the imitation strategy also requires R&D resources investment, which can promote imitation frequency and speed (Wu et al., 2019). Thus, to achieve the profit goal, these high-tech SMEs have willingness to apply slack to technology search. H6, stating that profit-oriented strategy strengthens the positive relationship between organizational slack and high-tech SMEs’ market search, is not supported. One plausible explanation is that market search, with a certain degree of uncertainty, also requires financial resource investment and managers’ attention and accurate judgment on the market (Vissa et al., 2010; Zhang et al., 2019); in this vein, profit-oriented high-tech SMEs may not so willing to utilize slack to increase the frequency of market search activities based on consideration of cost evaluation and risk aversion.

Theoretical contribution

This study makes some contributions to the literature of ambidextrous search and strategic management. First, this study extends our understanding of the technology-market search paradox in ambidextrous search-related literature by revealing the impacts of this paradox on high-tech SMEs’ performance. The ambidextrous search of technology and market has been discussed in the academic literature, but little literature empirically investigates the technology-market search paradox in high-tech SMEs (Vissa et al., 2010; Zhang et al., 2019). In this study, we offer additional insights into ambidextrous search by uncovering that the interaction of market search and technology search could generate a negative synergistic effect on high-tech SMEs’ performance, due to SMEs’ resource and capabilities constraints and their integration problems (Ahokangas et al., 2021; Barrett et al., 2021; Zhang et al., 2019). These findings offer a novel perspective to understand the technology-market search paradox in high-tech SMEs’ operations.

Second, this study enriches ambidextrous search-related literature by integrating and theorizing a conceptual framework of antecedent and consequence of the technology-market search paradox in high-tech SMEs. Previous studies either focus on the antecedents of ambidextrous search (Kiss et al., 2020; Ye et al., 2020; Zhong et al., 2020) or focuses on the outcomes of ambidextrous (Guo et al., 2020a; Zhang et al., 2019), and the studies integrating this two streams are rare and insufficient in high-tech SMEs. This study considers ambidextrous search as a paradox and integrate the research on antecedents and outcomes in high-tech SMEs. Our study reveals the positive effect of organizational slack on technology search and market search in high-tech SMEs and provide empirical evidence to demonstrate that ambidextrous search is beneficial for high-tech SMEs’ performance. Previous literature has offered conflicting views regarding the slack that facilitates or inhabits firms’ innovation behaviors (Carnes et al., 2019; Teirlinck, 2020; Voss et al., 2008). The results of this research confirm that organizational slack in high-tech SMEs indeed could promote the ambidextrous search, due to its available resource commitment and buffer effects (Carnes et al., 2019; Guo et al., 2020b). Thus, our study further enriches search-related literature by uncovering the antecedent and outcome of technology-market search paradox.

Third, this study extends the literature of strategic management by combining strategic orientations with ambidextrous search. Prior studies mainly consider profit and growth as firms’ outcomes, but little literature considers them as strategic orientations (Buxton & Davidson, 1996; Pe’er et al., 2016; Zhou & Park, 2020). Zhou and Park (2020) propose that growth-oriented and profit-oriented strategies deserve further deep exploration and investigation in emerging markets as context. To echo the call, we uncover that the two strategic orientations, including growth-oriented and profit-oriented strategies, act as important moderators in influencing the relationship between organizational slack and ambidextrous search in high-tech SMEs in emerging markets, which further extends strategic management and search-related literature.

Managerial implications

We present two valuable practical implications. One the one hand, managers need to pay attention to ambidextrous search and balance the paradox. According to our findings, ambidextrous search contributes to performance and its interaction could generate negative synergy on high-tech SMEs’ performance. Thus, high-tech SMEs could facilitate their performance by actively engaging in more search activities in technological and market domains and pay attention to ease the tension. For example, the firms can make a reasonable resource allocation plan, cultivate specialized qualified management personnel and management team in technological and market domains, and strengthen communication and cooperation among different sectors within firms to improve firms’ coordination and integration capabilities. For example, enterprises can carry out innovative activities involving users, establish customer feedback platforms, and fully take into account the constructive opinions of customers. They can also establish cooperative relationships with scientific research institutions and universities to promote the updating of internal technical knowledge.

On the other hand, enterprises should carefully make the strategic assessment and strategic choice. As we know, different strategic orientation makes SMEs have different search preferences and previous literature has pointed out that strategic orientations have a close connection with firms’ survival (Pe’er et al., 2016; Zhou & Park, 2020). For instance, the top management team should carefully determine the SMEs’ development strategies, and they can adjust their growth-oriented or profit-oriented strategies based on their specific situations or continuous evaluations. For start-ups, the growth-oriented strategy should be fully considered; Perhaps for mature enterprises, they focus on profit orientation.

Limitation and future directions

Several limitations emerge in our study. First, we conduct this research in the context of the emerging market in China, which may lack the generalizability of our empirical results. It is rational to use the different data sources to further test the results in the future. Second, we focus on high-tech SMEs because the tension between technology search and market search is much stronger, and whether these results are applicable to other situations also needs to be tested in the future. Third, we introduce strategic orientations as contingency factors in ambidextrous search activities, while other boundary factors, such as environmental and institutional changes, competitive intensity (Guo et al., 2020a), are also worthwhile considering and verifying in the future.

Data availability

The dataset of our study is generated by the secondary data, sourced from the Wind Database (https://www.wind.com.cn/) and China Statistical Yearbooks (https://www.stats.gov.cn/sj/ndsj/). Restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Interested parties can obtain these data with permission from the Wind Database.

Change history

16 September 2024

A Correction to this paper has been published: https://doi.org/10.1057/s41599-024-03717-8

References

Ahokangas P, Haapanen L, Golgeci I, Arslan A, Khan Z, Kontkanen M (2021) Knowledge sharing dynamics in international subcontracting arrangements: The case of Finnish high-tech SMEs. J Int Management 28(1):100888

Ali M (2021) Imitation or innovation: To what extent do exploitative learning and exploratory learning foster imitation strategy and innovation strategy for sustained competitive advantage? Technol Forecast Soc Change 165:120527

Barreto I, Baden-Fuller C (2006) To conform or to perform? Mimetic behaviour, legitimacy-based groups and performance consequences. J Manag Stud 43(7):1559–1581

Barrett G, Dooley L, Bogue J (2021) Open innovation within high-tech SMEs: A study of the entrepreneurial founder’s influence on open innovation practices. Technovation 103:102232

Blagoeva RR, Mom TJM, Jansen JJP, George G (2020) Problem-solving or self-enhancement? A power perspective on how CEOs affect R&D search in the face of inconsistent feedback. Acad Manag J 63(2):332–355

Boh WF, Huang CJ, Wu A (2020) Investor experience and innovation performance: The mediating role of external cooperation. Strategic Manag J 41(1):124–151

Buxton J, Davidson M (1996) Building a sustainable growth capability. Strateg Leadership 24(6):33–38

Carnes CM, Xu K, Sirmon DG, Karadag R (2019) How Competitive Action Mediates the Resource Slack–Performance Relationship: A Meta‐Analytic Approach. J Manag Stud 56(1):57–90

Coad A, Rao R (2008) Innovation and firm growth in high-tech sectors: A quantile regression approach. Res policy 37(4):633–648

Davcik NS, Cardinali S, Sharma P, Cedrola E (2021) Exploring the role of international R&D activities in the impact of technological and marketing capabilities on SMEs’ performance. J Bus Res 128:650–660

Dutt N, Mitchell W (2020) Searching for knowledge in response to proximate and remote problem sources: Evidence from the US renewable electricity industry. Strategic Manag J 41(8):1412–1449

Gambeta E, Koka BR, Hoskisson RE (2019) Being too good for your own good: A stakeholder perspective on the differential effect of firm-employee relationships on innovation search. Strategic Manag J 40(1):108–126

Gao YC, Hu YM, Liu XL, Zhang HR (2021) Can public R&D subsidy facilitate firms? exploratory innovation? The heterogeneous effects between central and local subsidy programs. Res Policy 50(4):104221

Gormley TA, Matsa DA (2014) Common Errors: How to (and Not to) Control for Unobserved Heterogeneity. Rev Financial Stud 27(2):617–661

Greve HR (2021) The Resource-Based View and Learning Theory: Overlaps, Differences, and a Shared Future. J Manag 47(7):1720–1733

Guo F, Bo QW, Tong X, Zhang XF (2020a) A paradoxical view of speed and quality on operational outcome: An empirical investigation of innovation in high-tech small and medium-sized enterprises. Int J Production Econ 229:107780

Guo F, Zou B, Zhang X, Bo Q, Li K (2020b) Financial slack and firm performance of SMMEs in China: Moderating effects of government subsidies and market-supporting institutions. Int J Production Econ 223:107530

Heavey C, Simsek Z (2017) Distributed Cognition in Top Management Teams and Organizational Ambidexterity: The Influence of Transactive Memory Systems. J Manag 43(3):919–945

Jia N, Huang KG, Zhang CM (2019) Public Governance, Corporate Governance, and Firm Innovation: An Examination of State-Owned Enterprises. Acad Manag J 62(1):220–247

Kim J-j, Hemmert M (2016) What drives the export performance of small and medium-sized subcontracting firms? A study of Korean manufacturers. Int Bus Rev 25(2):511–521

Kiss AN, Libaers D, Barr PS, Wang T, Zachary MA (2020) CEO cognitive flexibility, information search, and organizational ambidexterity. Strategic Manag J 41(12):2200–2233

Kohler C, Sofka W, Grimpe C (2012) Selective search, sectoral patterns, and the impact on product innovation performance. Res Policy 41(8):1344–1356

Lee C-H, Hoehn-Weiss MN, Karim S (2021) Competing both ways: How combining Porter’s low-cost and focus strategies hurts firm performance. Strategic Manag J 42(12):2218–2244

Lee CY, Wu HL, Pao HW (2014) How does R&D intensity influence firm explorativeness? Evidence of R&D active firms in four advanced countries. Technovation 34(10):582–593

Lee ES, Liu W, Yang JY (2023) Neither developed nor emerging: Dual paths for outward FDI and home country innovation in emerged market MNCs. Int Bus Rev 32(2):101925

Leiponen A, Helfat CE (2010) Innovation objectives, knowledge sources, and the benefits of breadth. Strategic Manag J 31(2):224–236

Li HY, Zhang Y, Lyles M (2013) Knowledge Spillovers, Search, and Creation in China’s Emerging Market. Manag Organ Rev 9(3):395–412

Li X, Hou KQ (2019) R&D based knowledge capital and future firm growth: Evidence from China’s Growth Enterprise Market firms. EconModel 83:287–298

Liu W, Cao M, Zheng J, Zhang JZ (2024a) Independence or interdependence: The role of artificial intelligence in corporate entry mode for overseas energy investments. J Innov Knowl 9(3):100518

Liu W, Li WH, Yang JY, Zheng LJ (2024b) Geographical proximity, foreign presence and domestic firm innovation: the micro-level evidence. Regional Stud 58(4):787–804

Mardani A, Nikoosokhan S, Moradi M, Doustar M (2018) The relationship between knowledge management and innovation performance. J High Technol Manag Res 29(1):12–26

Nunes PM, Serrasqueiro Z, Leitao J (2012) Is there a linear relationship between R&D intensity and growth? Empirical evidence of non-high-tech vs. high-tech SMEs. Res Policy 41(1):36–53

Parida V, Westerberg M, Frishammar J (2012) Inbound Open Innovation Activities in High-Tech SMEs: The Impact on Innovation Performance. J Small Bus Manag 50(2):283–309

Pe’er A, Vertinsky I, Keil T (2016) Growth and survival: The moderating effects of local agglomeration and local market structure. Strategic Manag J 37(3):541–564

Porter M (1980) Competitive Strategy. Free Press, New York

Posen HE, Keil T, Kim S, Meissner FD (2018) Renewing Research on Problemistic Search—A Review and Research Agenda. Acad Manag Ann 12(1):208–251

Ren S, Eisingerich AB, Tsai H-T (2015) How do marketing, research and development capabilities, and degree of internationalization synergistically affect the innovation performance of small and medium-sized enterprises (SMEs)? A panel data study of Chinese SMEs. Int Bus Rev 24(4):642–651

Rosenkopf L, Nerkar A (2001) Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strategic Manag J 22(4):287–306

Schad J, Lewis MW, Raisch S, Smith WK (2016) Paradox Research in Management Science: Looking Back to Move Forward. Acad Manag Ann 10(1):5–64

Shaikh IA, O’Brien JP, Peters L (2018) Inside directors and the underinvestment of financial slack towards R & D-intensity in high-technology firms. J Bus Res 82:192–201

Simms C, Frishammar J (2024) Technology transfer challenges in asymmetric alliances between high-technology and low-technology firms. Res Policy 53(3):104937

Sørensen JB, & Stuart TEJASQ (2000) Aging, obsolescence, and organizational innovation. 45(1): 81–112

Su Z, Peng J, Shen H, Xiao T (2013) Technological capability, marketing capability, and firm performance in turbulent conditions. Manag Organ Rev 9(1):115–137

Teirlinck P (2020) Engaging in new and more research-oriented R&D projects: Interplay between level of new slack, business strategy and slack absorption. J Bus Res 120:181–194

Vanacker T, Collewaert V, Zahra SA (2017) Slack resources, firm performance, and the institutional context: evidence from privately held European firms. Strategic Manag J 38(6):1305–1326

Vissa B, Greve HR, Chen WR (2010) Business Group Affiliation and Firm Search Behavior in India: Responsiveness and Focus of Attention. Organ Sci 21(3):696–712

Voss GB, Sirdeshmukh D, Voss ZG (2008) The effects of slack resources and environmentalthreat on product exploration and exploitation. Acad Manag J 51(1):147–164

Wan WP, Yiu DW (2009) From crisis to opportunity: environmental jolt, corporate acquisitions, and firm performance. Strategic Manag J 30(7):791–801

Wu J, Harrigan KR, Ang SH, Wu ZF (2019) The impact of imitation strategy and R&D resources on incremental and radical innovation: evidence from Chinese manufacturing firms. J Technol Transf 44(1):210–230

Xie XM, Wu YH, Martínez JMG (2023) More is not always better: Reconciling the dilemma of R&D collaboration in high-tech industries in transition economies. Techno Forecast Soc Change 190:122422

Xu D, Zhou KZ, Du F (2019) Deviant versus aspirational risk taking: The effects of performance feedback on bribery expenditure and R&D intensity. Acad Manag J 62(4):1226–1251

Ye Y, Yu W, Nason R (2020) Performance Feedback Persistence: Comparative Effects of Historical Versus Peer Performance Feedback on Innovative Search. J Manag 47(4):1053–1081

Yu W, Minniti M, Nason R (2019) Underperformance duration and innovative search: Evidence from the high‐tech manufacturing industry. Strategic Manag J 40(5):836–861

Zhang W, Zhao Y, Wang D, Wang H, Li J (2019) Ambidextrous search and product innovation: moderating effects of resource and structural attributes. J Technol Transf 44(4):1007–1028

Zhang X, Li H (2023) Reputation incentive model of open innovation of scientific and technological-based SMEs considering fairness preference. Humanit Soc Sci Commun 10(1):1–11

Zhong W, Ma Z, Tong TW, Zhang Y, Xie L (2020) Customer Concentration, Executive Attention, and Firm Search Behavior. Acad Manag J 64(5):1625–1647

Zhou N, Park SH (2020) Growth or profit? Strategic orientations and long-term performance in China. Strategic Manag J 41(11):2050–2071

Acknowledgements

This work was supported by the Shandong Provincial Natural Science Foundation for Excellent Young Scholars (Grant No. 2023HWYQ-090), Taishan Scholars Project Funding (tsqn202312167), Science and Technology Support Plan for Youth Innovation of Colleges and Universities of Shandong Province of China (No. 2022RW033), and Shandong Provincial Natural Science Foundation (Grant numbers ZR2023QG059), and the Fundamental Research Funds of Shandong University.

Author information

Authors and Affiliations

Contributions

Qingwen Bo: Conceptualization, Data curation, Methodology, Investigation, Formal analysis, Visualization, Writing-original draft; Mengxiao Cao: Methodology, Writing-original draft; Yan Wang: Validation, Writing-original draft; Yuhuan Xia: Investigation; Writing-review & editing; Wei Liu: Conceptualization, Funding acquisition, Supervision, Writing-review & editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Bo, Q., Cao, M., Wang, Y. et al. Organizational slack, ambidextrous search and high-tech SMEs’ performance: do strategic orientations matter?. Humanit Soc Sci Commun 11, 1057 (2024). https://doi.org/10.1057/s41599-024-03588-z

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03588-z