Abstract

The purpose of this study is to examine how economic development and stability are affected by carbon trading pilot programs. Using panel data from 31 Chinese provinces and autonomous regions between 2005 and 2021, two hypotheses were tested using the DID model. The findings indicate that (1) the carbon trading market pilot program has an immediate effect on economic stability. (2) High-quality economic development is positively and significantly impacted by the carbon trading market pilot program. Regional heterogeneity exists in the effects of carbon trading pilot programs on high-quality development and economic stability. The relationship between carbon trading pilot programs and economic development is not conclusive, despite the growing number of these policies. Given this, additional investigation into this connection is required. Understanding the results of carbon trading pilot programs can be used to gauge how successful these initiatives are. This research adds to the body of knowledge regarding the impact of the carbon trading pilot programs. It then makes policy recommendations that may serve as a guide for future “double carbon” research.

Similar content being viewed by others

Introduction

People all over the world have been affected by climate change (Liu et al. 2017). Global climate change caused by greenhouse gas (GHG) emissions, especially CO2, is the greatest risk of the twenty-first century (Wang et al. 2022). China’s fast economic growth since the reform and opening-up has been accompanied by environmental pollution because of the country’s transition from a planned to a market economy (Xie et al. 2022). China is the world’s largest carbon emitter, with total emissions reaching 9.76 billion tons (ibid). China has actively worked to lower greenhouse gas emissions and improve its capacity for climate change adaptation. China indicated in 2009 that by 2020, it would reduce its carbon dioxide emissions per GDP unit by 40–45% compared to 2005 levels (ibid). The carbon emissions trading market (CETM) is an essential market-based incentive environmental regulatory policy tool for promoting low-carbon development and the reduction of greenhouse gas emissions (Xie et al. 2022). By employing a market mechanism, the Emissions Trading Scheme (ETS) is a useful tool for reducing greenhouse gas (GHG) emissions (Huang 2021). Governments from various countries can assist one another in lowering their greenhouse gas emissions while still fulfilling their emission targets. Carbon emission trading is the most effective way to reduce greenhouse gas emissions and meet these targets at a lower cost to society (Wang et al. 2022).

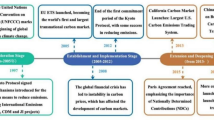

China, the top carbon emitter in the world, has taken an active role in lowering its emissions. The 20th Party Congress report from October 2022 suggested that carbon peaking and carbon neutrality be “actively and steadily promoted”. Enhance the carbon emission rights market trading system, as well as the accounting and statistics on carbon emissions “(Xi 2022). China committed to achieving “peak carbon” by 2030 and “carbon neutral” by 2060—a “double carbon” goal—when it ratified the Paris Climate Agreement in 2016. The National Development and Reform Commission published the “Notice on the Pilot Project of Carbon Emission Trading” as early as 2011 to implement carbon emission trading pilot projects in Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen to reduce carbon emissions through market mechanisms. Eight major industries were involved: electricity, non-ferrous metals, building materials, chemicals, iron and steel, petrochemicals, paper manufacturing, and aviation (Huang 2021). In addition, to the extensive work on dual carbon, China’s macro economy has demonstrated strong resilience under the dual pressure of rising international uncertainties and domestic reforms to address challenges. The current objective for China’s economy is to establish a foundation for high-quality economic development and sustain long-term stability in the wake of shocks. Building a comprehensive socialist modern state is the main challenge and the path to modernization for China. In December 2022, the Report on the First Compliance Cycle of the National Carbon Emissions Trading Market was released. It stated that although the average trading price of each pilot carbon market increased by more than 15%, the development of the national carbon trading market continued to progress steadily in 2022, with a turnover of 50.89 million tons of carbon emission allowances—a decrease of 18% from 2021—and a turnover of 2.8 billion yuan. China is the first developing nation to impose cap-and-trade regulations on carbon dioxide emissions (Liu et al. 2017). China’s carbon emissions pricing plan began somewhat late and on a lesser scale than other ETS markets across the world, but it has grown quickly (Zhang et al. 2021). With a turnover of 2.15 billion CNY, China’s trading volume in 2020 amounted to 75.25 million tons. After operating for ten years, the national carbon emission trading market (ETM) formally started trading on July 16, 2021 (Wang et al. 2022).

However, the development of the national carbon market is still in its early stages, and long-term planning, data quality, and market functions all still need improvement. After the establishment of its national carbon market, China will overtake the ETS in the European Union to take the lead in the global carbon market (Liu et al. 2017). The development of a global carbon market will be influenced by China’s experience and the lessons it learned from its pilot ETSs, which may also help other developing countries build their ETSs. Unlike the developed countries where the institutions are strong and the ETS market is mature, in China, the immature and soaring market for the ETS, and recently supporting policies, it is essential to quantify and investigate the outcomes of pilot ETSs, particularly on the economy and environment, as this will serve as the foundation for making scientific judgments about the implementation of a national ETS (ibid). Due to the significant difference between institutional factors and market system, the effect of carbon trading schemes on economic stability and high-quality development could be different as the smooth operations of the carbon market mechanism require support from a mature market system and other institutional infrastructure (Jin et al. 2022). Understanding the effect alone can serve as a benchmark for the effectiveness of the national market. An essential problem that needs to be resolved in the “double carbon” environment is how to balance the relationship between steady economic growth and carbon emission reduction. For China, the largest developing nation, economic development is crucial. Furthermore, it serves as the cornerstone for securing the livelihoods of the populace, preserving national stability, and elevating the country’s standing abroad. It is also essential that urgent action be taken to reduce CO2 emissions given the rising pressure from stakeholders. Targets for carbon intensity and economic growth should both be considered simultaneously (Zhu et al. 2015). The main concern around emission trading is whether it will impede economic growth while reducing carbon emissions. Extant literature has extensively addressed the effect of carbon trading pilot policies on carbon emission reduction (e.g., Yi et al. 2020; Li et al. 2021; Liu et al. 2020; Huang et al. 2022; Zhou et al. 2022; Ma et al. 2023; Wu et al. 2023; Qian et al. 2023, Li et al. 2023). Furthering this debate, some studies have addressed the influence of carbon trading pilot policies on green innovation (e.g., Qi et al., 2021; Li et al., 2022; Liu et al., 2022). Zhou and Zhou (2021) demonstrated the positive effect of carbon trading policies on the technical specification of exports in China. Meanwhile, several studies (e.g., Qi et al., 2021; Shen et al., 2021; Chai et al. 2022; Wu et al. 2023) address the influence of carbon emission trading policies on economic development with varied results. For example, most studies (e.g., Zhang et al. 2020; Qi et al. 2021; Shen et al. 2021; Chai et al. 2022; Wu et al. 2023) report positive effects, while some studies (e.g., Zheng et al., 2020; Li and Li, 2018; Lin and Jia 2018) demonstrates negative effects on economic development. Zheng et al. (2020) suggest that distinct regions should impose varying emission restrictions to ensure economic stability pointing to the reality that the effect of carbon trading policies on economic development and stability could vary. Overall, the link between carbon emission trading policies and economic development is inconclusive. Given the mixed results, the link between carbon emission trading policies and economic development and stability is crucial and needs further research.

Given the above discussion, this study investigates the impact of carbon trading pilot policies on both economic stability and high-quality development As the Chinese Government is taking initiatives to shift its high-speed economic development model to a high-quality model, considering the influence of carbon trading policies on both economic development models is inevitable. Our study is different from the previous studies that address only the influence of carbon trading policies on economic growth. This study contributes to the existing literature regarding outcomes of carbon emission trading policies in terms of economic stability and high-quality development and the heterogeneity of these relationships in various regions. Moreover, this research provides practical implications for policymakers. This research is conducted in the following ways. First, a review of relevant studies on the carbon emissions trading mechanism and its impact mechanism on economic stability and high-quality development is conducted leading to the introduction of hypotheses. Second, based on the theoretical analysis, a quasi-natural experiment with a double difference model is conducted to explore the specific impact of carbon trading market policies, and conclusions are drawn based on the empirical results to propose policy recommendations. This research enriches the theoretical literature and empirical evidence on the impact mechanism of carbon trading on macroeconomics and provides a reference for further work on the “double carbon” target. This article has the following structure: Section I presents the introduction; Section II shows the literature review; Section III demonstrates the theoretical analysis; Section IV presents the empirical research design, including variable selection, model construction, and data processing; Section V shows the analysis of empirical results, and finally Section VI concludes the paper with policy recommendations.

Literature review

Carbon trading pilot policies

The need for the existence of a carbon trading market

The development of a carbon emission trading market is theoretically supported by externality theory. Externality theory developed as result of significant contributions from Marshall, Pigou, and Coase (Huang 2021). Pigou expanded on Marshall’s theory, which holds that when marginal social cost and marginal private cost diverge, government action is required. To address the issue of economic externality, Coase uses the theory of property rights. According to this theory, the economic purpose of property rights is to tackle externality and lower social costs to ensure effective use of resources. A major issue on a global scale is the interplay between economic growth and environmental pollution (Zang et al. 2020). China has continuously placed a higher priority on economic development through carbon emission reduction. As a key measure of energy saving and emission reduction within the context of the Kyoto Protocol, carbon trading pilot policies were created. China is attempting to create its own carbon trading market in response to the ongoing growth of the global carbon trading market over the last ten years in order to support energy efficiency and emission reduction (Weng and Xu 2018). The implementation of carbon emissions trading system will directly affect the economic benefits of enterprises, achieve the purpose of optimal allocation of resources and coordinated development among regions by influencing the location selection and development strategy of high-emission enterprises in different places, and solve externalities (Sun et al. 2021; Qi et al. 2023). The goal of the carbon emissions trading system, as a flexible market mechanism based on total amount control, is to lower carbon emissions and energy consumption while achieving economic development (Pan et al. 2021). It is widely acknowledged by countries around the world that the use of carbon emissions trading systems facilitates the development of a low-carbon economy. Because reducing carbon emissions will only have a limited impact, businesses will benefit from government oversight as they comply with the carbon emission trading system, which is in line with the goal of local economic growth. Thus, in line with lower carbon emissions, the government should provide a solid guarantee, create a framework that lasts, and combine the market and the government (Qi et al. 2023; Gao 2023).

Pilot carbon trading program implementation

Because of the epidemic’s effects, carbon prices are highly volatile, and economic development level and carbon prices have a short-term inverse relationship (Dong et al. 2022). China’s carbon trading pilot policy is effective, but there are flaws in the way the internal and external markets function, such as a lack of a signal function for the carbon price, a lack of compliance incentives, a lack of market liquidity, and a high degree of market fragmentation. Although still in its early stages of development, the carbon trading market has reduced carbon emissions in a favorable way. However, it also exhibits number of other features (Zhou et al. 2020). From the current pilot areas in China, the price and volume of carbon trading are characterized by sharp and long fluctuations duration. Beijing’s carbon market is second among the seven pilot markets and has high comprehensive capabilities among them. Beijing’s carbon market is relatively young, despite strong administration, and needs to increase its economic benefits due to a lack of market liquidity (Hu et al. 2017). China can encourage the growth of the green economy in addition to reducing carbon emissions by implementing a carbon emissions trading scheme. However, there are still some issues that will negatively impact the nation’s economy (Luo and Shi 2017). China’s carbon market is still a regional market driven by government policies, and the international carbon market and energy market (especially crude oil market) have upward risk spillover effect on it, which indicates that there is asymmetric risk spillover between influencing factors and carbon market (Zhang et al. 2022).

Carbon trading pilot policy and economic development

High-quality development effect of carbon trading pilot policy

According to Zhang et al. (2020), the carbon trading pilot program did not facilitate the short-term decoupling of economic output and carbon emissions in industrial subsectors. It has the potential to significantly lower societal costs while enhancing welfare and production factor allocation efficiency, which will help to close the regional economic divide and advance coordinated regional development (Fan et al. 2016). The economic dividend produced by the total industrial output value has increased in all seven carbon trading pilots because of the pilot program’s implementation; additionally, the average DEA efficiency of China’s seven carbon trading pilot policy areas has increased annually (Zhang et al., 2020).

The carbon trading market pilot program has a long-term positive impact on the superior growth of the local economy, as evidenced by the following:

-

(1)

Green effect. Carbon trading pilot policy is a market-oriented means to overcome the challenge of increasing carbon dioxide in China. Simultaneously, this policy’s implementation has reduced air pollution emissions in a coordinated manner (Munnings et al. 2016), and it may have a significant positive impact on air quality overall (Weng et al. 2022). Energy efficiency, energy structure optimization, and consumption reduction are the primary methods used to achieve it (Li et al. 2021; Chen et al. 2022).

-

(2)

Economic growth effect. In a huge economy with many non-market endowments, China’s carbon trading pilot policy has been successful in strengthening the socialist market economic system (Zhou et al. 2020). Furthermore, Zhou and Zhou (2021) demonstrated the positive effect of these policies on the technical specification of exports in China. Carbon trading pilot policy is positively related to the environmental and economic performance of enterprises (Ren et al. 2022). It expands the employment scale, which will be especially notable in eastern provinces, provinces with high average wages, and provinces with high levels of education (Liu et al. 2022). In provinces with high education level, provinces with high average wages and eastern provinces, this promotion will be more significant (Liu et al. 2023; Yang et al. 2020). According to Chai et al. (2022), the region’s GDP has greatly benefited from the greenness of economic growth, and the carbon trading policy has reduced emissions during the implementation phase. Yang et al. (2020) shows that carbon trading mechanism reduces carbon emissions and expands the employment level. Qi et al. (2021) demonstrates that China’s carbon market pilot policies have had a positive environmental impact, i.e., they have reduced carbon emissions while without compromising the country’s economic growth. According to Liu et al. (2017), the Hubei Pilot ETS has greatly decreased carbon emissions while having a negligible negative effect on the economy. According to Shen et al. (2021), regulating the intensity of environmental governance fosters carbon productivity, and the adoption of carbon trading is beneficial to regional sustainable development. However, Babiker et al. (2004) pointed out that the global carbon trading market was not always beneficial and that it might lower national welfare due to factors such as “immiserizing” growth. Lokhov and Welsch (2008) reported that the carbon trading market link between Russia and the European Union, in addition to being advantageous for the EU countries, meant a big increase in Russia’s GDP and welfare, along with a sizable reduction in Russia’s output. In their simulation of the EU ETS’s economic effects, Klepper and Peterson (2004) reported a 0.3% decrease in output compared to the business-as-usual assumption, with industrial sectors experiencing more severe decreases. China’s real GDP is predicted to decrease by 0.08–0.52% (Li and Li, 2018) or 0.19–1.44% (Lin and Jia 2018) as result of CETS by 2030. Similarly, Zheng et al. (2020) showed the negative effect of carbon trading pilot policies on economic development. Thus, emission trading scheme policies can have favorable and unfavorable effect on economic growth. Zheng et al. (2020) suggest that distinct regions should impose varying emission restrictions to ensure economic stability. Given the mixed results, the link between carbon emission trading policies and economic development is crucial and needs further research.

-

(3)

Synergy between economic and environmental policies. The carbon emissions trading pilot program has greatly raised the bar for environmentally conscious balanced development, encouraged the alignment of environmentally conscious economic growth with environmental justice, and offered a practical route forward for green development that balances efficiency and equity (Wang et al. 2022).

Structural effect of carbon trading pilot policy

The structural effects of carbon trading pilot policies are manifested in industrial structure, energy structure and productivity structure. The carbon trading pilot policy has significantly improved the total factor productivity of the pilot areas through the industrial structure effect (Bai et al. 2023; Zhang et al. 2021; Zhang and Li 2021). Through resource synergy, ecological optimization, structural optimization, and upgrading, it increases the effectiveness of industrial ecologicalization and promotes regional energy conservation, emission reduction, and economic development (Fu et al. 2022). The carbon trading pilot policy produced spatial spillover effect, formed demonstration effect in neighboring areas, and promoted the subsequent improvement of Green Total factor productivity in neighboring areas (Wang et al. 2021). The implementation of a carbon trading pilot program has benefited China’s energy structure by directing funds, resources, and technological advancements toward sectors that support the use of clean energy and increase total factor productivity (Geng et al. 2022). The effect of improving energy efficiency of carbon emission trading system pilot varies among provinces due to some economic regional factors (Tan et al. 2022). The carbon trading pilot policy improves the high-quality development level by stimulating innovation. This incentive effect has a sustainable and growing trend, which indicates that the “Porter Hypothesis” holds true in the implementation of carbon trading pilot policies (Ren et al. 2022; Zhang et al. 2021; Ren and Liu 2023; Lim and Prakash 2023; Yang et al. 2020). Among them, the carbon trading pilot policy not only promotes the innovation capability of the region, but also has positive spillover effects on innovation capability and technological upgradation (Guo et al. 2023; Liu et al. 2022).

Heterogeneity of carbon trading pilot policy

Regional differences exist in how carbon trading pilot strategies support high-quality development. The promotion impact is more pronounced in the eastern region, which is related to the abundance of large cities and the high level of industry there (Cao et al. 2022; Zhai et al. 2023; Weng et al. 2022). In addition, the impact of carbon trading pilot policies on ecological efficiency is more prominent in non-resource-based cities (Wang et al., 2022). The pilot areas exhibited heterogeneity. In Hubei and Guangdong, for example, the carbon trading pilot policies have successfully stimulated local green innovation; in Tianjin, this positive effect is evident before the economic downturn, but it takes a few years for Shenzhen to show the same effect (Wang et al. 2022).

At the same time, the study shows that there is industrial heterogeneity in the impact of carbon trading pilot policies on high-quality development. Carbon trading price and market size are closely related to emission quota allocation schemes of various industries, coverage of participating industries, and development level of renewable energy, among others (Dai et al. 2018). The carbon trading pilot policy has improved the competitiveness of provincial high energy-consuming industries (Cao et al. 2022).

Conclusively, the carbon trading pilot policy is critical and has the potential to foster superior economic growth. The relationship between carbon trading pilot policy and economic growth is mixed with some studies reporting a positive relationship while others demonstrate a negative relationship. Thus, there is a need to examine further the link between carbon trading pilot policy and economic growth. There is inadequate evidence in the existing research to support the internal theoretical logic of the carbon trading pilot strategy on high-quality economic development. Therefore, it is crucial to investigate from both theoretical and empirical angles how carbon trading pilot policies affect both economic stability and high-quality development.

Theoretical model and research hypotheses

Theoretical model

Important components of the Chinese-style modernization process are the carbon trading pilot policy and high-quality economic growth. This paper uses a spider web model analysis tool to demonstrate the laws of economic fluctuation and high-quality development since the implementation of the carbon trading pilot policy.

The basic logic of the spider web model is that the current period’s output is determined by the previous period’s price, the current period’s price determines the current period’s demand, and when an equilibrium price changes, the price and output of its supply and demand produce a trend of change. The basic assumptions of the spider web model are 1. The supply function and demand function of goods are linear functions; 2. There is clearing of the market in each cycle. The basic settings of the model are as shown in Formula (1). \({D}_{t}\) indicates the demand in period t; \({S}_{t}\) indicates the supply in period t; \({P}_{t}\) indicates the price in period t; \(a\) indicates the price elasticity of demand for the product, \(c\) is the price elasticity of supply of the product; \(b\) indicates the demand in period t when the price is 0, which is a constant, and \(d\) is the same.

In this paper, the carbon emission trading market pilot policy trades carbon emission rights as a commodity. Due to the limited supply source, i.e., the government’s provision of carbon emission licenses, carbon emitting firms create a demand for carbon emission rights. For carbon emission rights, it is challenging to find an equilibrium point under the initial supply and demand circumstances. So far, a shift has been made from the demand side with the introduction of a carbon trading market. In the carbon trading market, enterprises can exchange carbon emission rights in the carbon trading market by their demand, and the market is inherently elastic to price as well as quantity and kind of carbon emissions. Therefore the carbon trading market can be considered to develop along a converging spider web trajectory of change.

In the converging spider web model, the absolute value of the slope of the supply curve is greater than the absolute value of the slope of the demand curve, i.e., the elasticity of supply is smaller than the elasticity of demand. When the market begins to deviate from the original equilibrium, prices and production fluctuate around the equilibrium level, and the fluctuations become smaller and smaller, and finally return to the original equilibrium point. As shown in Fig. 1a, the original equilibrium state is (Qe, Pe). In the first period, the equilibrium output is reduced from Qe to Q1, the price that consumers are willing and able to pay on the demand curve is P1, the second period output is reflected as Q2 on the supply curve, which is affected by the first period price, and then the price on the demand curve of the second period is reduced to P2 that urges the third period output to be adjusted to Q3, so the price will inevitably rise to P3. The change range of P and Q becomes smaller and smaller and finally returns to the original equilibrium state (Qe, Pe). Thus, as shown in Fig. 1a, when the elasticity of supply is less than the elasticity of demand, cobweb convergence is obtained, and a supply-demand equilibrium for carbon emission rights is formed.

With the deepening of the construction of carbon trading market, the supply of carbon emission rights of enterprises comes not only from government quotas but also from market supply; therefore, the supply elasticity becomes greater and the supply curve rotates clockwise. It takes a long time for enterprises participating in carbon trading to upgrade their equipment, and the innovation activities are gradually promoted, so the demand elasticity becomes smaller and the demand curve rotates clockwise. As shown in Fig. 1b, with the rotation of the supply and demand curve, the equilibrium point E0 moves to E1, and the trading volume in the carbon trading market will become larger. This is in line with China’s expectation to achieve the goal of “carbon peaking” in 2030. The supply and demand curves continue to rotate, as shown in Fig. 1c. Compared with E1, the price and transaction volume of the equilibrium point decrease, which provides strong support for China to achieve the goal of “carbon neutrality” in 2060. According to Fig. 1, the development of China’s carbon trading market always conforms to the convergent cobweb model and finally reaches the equilibrium state, providing a strong basis for superior development, guaranteeing the achievement of the “double carbon” goal, and supporting Chinese modernization.

Research hypotheses

Carbon trading pilot policy on economic stability

There are significant swings in the trading volume and price of China’s carbon trading market, according to an analysis of the trading and operation of the domestic carbon market (Zeng et al. 2023). The scale of carbon trading demonstrates the “tidal phenomenon”. There are significant disparities between pilot locations, and carbon trading prices are subject to extreme swings. The “tidal phenomenon” has exacerbated the volatility of carbon trading prices, with local and national carbon trading markets usually experiencing greater volatility during the centralized trading phase. Significant regional variations in carbon prices have also resulted from the fragmentation of local markets. For example, the carbon trading price in Guangdong was 76 Yuan/ton in December 2022, while in Fujian, it dropped to 29 Yuan/ton.

According to the cobweb model, the equilibrium point of the carbon trading market moves with the change in supply price elasticity and demand price elasticity. In the short term, while the carbon trading pilot policy has the effect of carbon emission reduction, the government has limited permission to supply carbon emission rights, which increases the carbon price and emission reduction cost, and has a certain impact on economic stability. In the long run, after the market role is brought into full play through the extensive use of clean energy and the investment in R&D by enterprises, supply and demand are closer to the equilibrium point, the market is more stable, and it promotes regional economic stability more effectively. Given this, we posit the following hypothesis:

H1: The impact of the carbon trading pilot on economic stability shows long- and short-term differences. In the short term, it is negatively correlated with economic stability, that is, it aggravates volatility. In the long run, it will help smooth economic fluctuations and promote stable fluctuations in economic growth.

Carbon trading pilot policy on high quality economic development

The pilot policy of the carbon trading market has a long-term significant promotion effect on the high-quality development of the regional economy, which is manifested in the green effect, economic growth effect, and synergistic effect with economic and environmental policies. To increase their earnings, businesses will upgrade the original production equipment, update the environmental protection equipment, increase investment in science and technology, introduce high-tech talents, and carry out technological innovation to improve the total factor productivity in the pilot areas and promote high-quality development of regional economy. With the implementation of the carbon trading pilot policy, high-pollution and high-emission enterprises gradually withdraw from production and turn to clean industries and emerging industries, encouraging the modernization and optimization of the regional industrial structure and supporting the superior growth of the regional economy. We formulate the following hypothesis.

H2: The implementation of the carbon trading pilot policy has a catalytic effect on high-quality development, significantly enhancing the level of regional high-quality development.

Empirical study design

Model

This paper aims to study the impact of the pilot carbon emission trading market on regional economic stability and high-quality economic development. This study considers the pilot carbon emission trading market policy as a quasi-natural experiment and also takes account into the impact of fixed assets, infrastructure, human capital, industrial enterprises, and employment status on economic fluctuations. Using panel data from 31 Chinese provinces, cities, and autonomous regions from 2005 to 2021, we built a double-difference model using the same control variables as the regression model. Here are the particular model settings:

Among them, \({{EF}}_{{it}}\) is the explanatory variable indicating economic fluctuations \({{HQD}}_{{it}}\) is also used as the explanatory variable indicating the level of high-quality economic development and did indicate the carbon emission trading market pilot policy as the core explanatory variable. \({X}_{{it}}\) denotes the various types of control variables and \({\varepsilon }_{{it}}\) is the random error term, while provincial and municipal fixed effects (\({\tau }_{i}\)) and year fixed effects (\({\gamma }_{t}\)) are also included.

Variables

Explanatory variables

Pilot regions of carbon emission trading market (did). In this paper, the pilot areas of the carbon emission trading market are used as the core explanatory variables. Since June 2013, Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen have successively implemented carbon trading pilot policies. As Shenzhen is a prefecture-level city, to unify the data index category, this paper merges Shenzhen into Guangdong Province.

The provinces of Guangdong, Tianjin, Shanghai, Chongqing, Hubei, and Beijing served as the experimental groups., and \({trea}{t}_{{it}}\) counts as 1; The rest of the provinces, cities, and autonomous regions, and \({trea}{t}_{{it}}\) counts as 0. Since the policy was implemented in 2013, the years before 2013 are designated as the non-pilot period, and \({tim}{e}_{{it}}\) taken as 0. The years after 2013 (including 2013) are designated as the pilot period and \({tim}{e}_{{it}}\) taken as 1. The two are multiplied to derive the core explanatory variables of this paper.

The explained variables

-

(1)

Economic Firm (EF). Drawing lessons from the construction methods of economic stability variables in the research of (Zhang et al. 2022; Zhan and Liu 2022), this paper adopts the measurement of China’s macroeconomic fluctuations and the three-year rolling standard deviation of the GDP growth rate of 31 provinces, cities and autonomous regions in China. Equation (5) provides the specific calculation formula.

$${{EF}}_{{it}}={{GDP}}_{g{\rm{\_}}{{sd}}_{{it}}}=\sqrt{\frac{1}{3}\mathop{\sum }\limits_{t=-1}^{t=1}{\left({{GDP}}_{{g}_{{it}}}-{\overline{{{GDP}}_{{g}_{{it}}}}}\right)}^{2}}$$(5)Where \({{GDP}}_{{g}_{{it}}}\) represents the GDP growth rate of each province, city, and autonomous region, and \(\bar{{{GDP}}_{{g}_{{it}}}}\) is the average of GDP growth rate from (t-1) to (t+1). EF indicator indicates the fluctuation of the GDP growth rate of 31 provinces, cities, and autonomous regions, which is inversely proportional to the economic stability, the larger the EF value, the more the economy is in a fluctuating non-stable state.

-

(2)

High-quality economic development (HQD). Promoting high-quality development in the present and future can be achieved by insisting on the implementation of the new development concept, which also offers action guidelines for grasping the new development stage and creating a new development pattern. This paper builds an indicator system for high-quality economic development based on the new development concepts of innovation, coordination, green, openness, and sharing. Table 1 displays the indicator system, which was created by selecting five representative primary indicators and eleven secondary indicators centered on high-quality development using the indicator construction techniques of Zeng et al. (2023), and other relevant studies.

Table 1 Index system of economic quality development.

This paper uses the entropy-weighted TOPSIS method to measure the level of high-quality economic development in 31 provinces, cities, and autonomous regions of China from 2005 to 2021, which effectively ensures the objectivity and validity of the measurement results.

The economic quality development index of each province, city, and autonomous region is obtained. After analyzing the data on the economic high-quality development of 31 provinces, cities, and autonomous regions in China in some years from 2005 to 2021, (see Table 7). The level of China’s high-quality economic development increased significantly between 2005 and 2021, and each province’s development index rose, with Beijing, Shanghai, and Jiangsu Province rising to the top. However, the central and western regions of China, where Qinghai Province, Guizhou Province and Tibet Autonomous Region are located, have developed more slowly than the eastern coastal provinces.

The control variables

This study chooses the following control variables to try to limit the factors influencing high-quality development and regional economic stability: (1) Investment in fixed assets: This study expresses the level of investment in the region using the growth rate of fixed asset investments in different provinces, municipalities, and autonomous regions; (2) Infrastructure: the per capita road area is calculated by the ratio of regional road area to regional resident population; (3) Human Capital: it is expressed by the proportion of the number of students in colleges and universities in the resident population; (4) Industrial Enterprise: The number of industrial enterprises above the designated size was treated logarithmically as the industrial development control variable; (5) Employment is determined by the unemployment rate in each province, city, and autonomous region.

Statistical characteristics of data

The data of all variables used in this study comes from the National Bureau of Statistics, China Statistical Yearbook, China Urban Statistical Yearbook, China Science and Technology Statistical Yearbook, and the statistical yearbooks of various provinces over the years. Hong Kong, Macao, and Taiwan are not included in the statistics in this article due to data availability. This study employs interpolation to fill in a few missing numbers and, in the end, obtains balance panel data for 31 Chinese provinces, cities, and autonomous regions from 2005 to 2021. The data frequency is yearly data. StataMP 17 is used for the empirical analysis in this research. The descriptive statistical findings for the aforementioned variables are shown in Table 2.

Analysis of empirical results

Carbon trading pilot policy and economic stability

Baseline regression

In our empirical analysis, we first conducted a baseline regression of the proposed model to scrutinize the influence of the carbon trading market pilot on regional economic stability. As detailed in Table 3, the benchmark regression results offer profound insights. Column (1) of the table presents the regression outcomes without the inclusion of any control variables, while columns (2) through (6) exhibit the refined results after systematically introducing various control variables into the model. The initial regression result in Column (1) reveals a statistically significant positive effect of the carbon trading market pilot on economic volatility (α1 = 1.0289; P = 0.005). This finding indicates that, in its unadjusted form, the pilot program is associated with an increase in economic fluctuations. To ensure the robustness of our findings, we subsequently included various control variables. Remarkably, the coefficients of the core explanatory variable remained significant and positive, even after accounting for these potential confounders. Specifically, upon introducing all control variables, the coefficient of the carbon trading market pilot continued to demonstrate a positive and statistically significant association with economic volatility (α1 = 1.1922; P = 0.005). This consistency underscores the robustness of our model and the reliability of our results. At a certain point, the adjusted R2 remains stable. In conclusion, our study provides empirical support for Hypothesis H1, which posits that in the short term, the carbon trading market pilot significantly contributes to economic volatility, thereby exacerbating economic fluctuations.

According to the control variable regression results, infrastructure has a significant and positive impact. Talent has a negative impact on economic volatility.

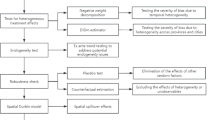

Robustness tests

-

(1)

Parallel trend tests. In this study, a rigorous analysis was conducted to examine the disparities between the experimental and control groups, utilizing the tvdiff command, with a focus on the timeframes spanning four years prior to and five years following the implementation of the carbon trading pilot policy. The findings reveal that the individual trend F value stands at 0.33, with a corresponding Prob > F value of 0.7174, indicating a non-significant effect. Similarly, the time trend F value is 0.26, with a Prob > F value of 0.6078, again suggesting a non-significant trend. These outcomes satisfy the parallel trend hypothesis test, thus validating the underlying assumption of this analytical framework. Consequently, it is evident that the parallel trend test hypothesis concerning the effect of the carbon trading market pilot policy on economic stability is upheld, lending credibility to the application of the double difference model in this context.

-

(2)

Placebo tests. Considering the effects of other policies or factors not to be taken into accounted, a random sample was taken for the placebo effect test in this paper, and a double difference model regression analysis was performed. The sampling process was repeated 500 times, and the kernel density plot of the placebo test was drawn (see Fig. 2.). The kernel density figure displays the range of possible outcome measure values on the x-axis and their estimated probability densities on the y-axis. The smooth curve approximates the data's empirical distribution, with peaks indicating higher observation densities. Most of the sampling results are concentrated on both sides of 0. The dashed line in the figure is the coefficient size of the core explanatory variables in the benchmark regression of this paper, which is significantly different from most of the repeated sampling results, excluding the influence of other unobservable factors, and the results of the benchmark regression of this paper are robust.

Heterogeneity analysis

Eastern, Central, and Western provinces and cities are included in the carbon market pilot program. Geographical location, environmental factors, the region’s economic foundation, and other factors all impact China’s large territory. Thus, the impact on economic stability after the carbon market pilot policy may also differ. Therefore, in this paper, the 31 provinces, cities, and autonomous regions are divided into three regions, East, Central, and West, according to the three major regions, as shown in Appendix Table 8, and regressed separately.

Table 4 presents the findings of the heterogeneity analysis conducted in this study. Specifically, column (7) reveals that in the eastern region, the carbon trading market pilot policy exhibits a statistically significant positive effect on economic volatility. This finding indicates that the implementation of such a policy in the eastern region tends to intensify economic fluctuations. Contrastingly, the results presented in column (8) for the central region indicate that while the coefficient of the core explanatory variable is positive, it is not statistically significant. This suggests that the carbon trading market pilot policy does not have a discernible impact on economic volatility in the central region. Finally, column (9) of Table 4 reports the regression results for the western region, demonstrating that the regression coefficient associated with the impact of the carbon trading market pilot policy on economic volatility is negative, albeit non-significant. This finding implies that, unlike the eastern region, the western region may experience a slight mitigating effect on economic volatility following the implementation of the carbon trading market pilot policy, albeit not to a statistically significant degree. In summary, the heterogeneity analysis reveals region-specific differences in the effect of the carbon trading market pilot policy on economic volatility.

The influence coefficients exhibited by the eastern, central, and western regions diverge significantly, primarily attributable to disparities in industrial structure, talent aggregation, and technological advancement. Notably, the carbon trading market pilots are predominantly concentrated in the eastern region, where the vast market potential has propelled ongoing efforts to enhance the carbon trading policy. Consequently, the market has displayed fluctuations in the post-implementation years, thereby inducing economic volatility. Conversely, the central and western regions possess a limited number of carbon trading market pilot areas, coupled with a relatively shallow degree of marketization in regional carbon trading and a slower pace of industrial structural upgrading. These factors contribute to the non-significant findings observed in the regression analysis.

The impact of carbon trading pilot policy on high-quality economic development

One key component of Chinese modernization is the advancement of high-quality economic development. To reach the “double carbon” target, China’s economic growth must steadily improve in quality in addition to achieving economic stability.

Baseline regression

The regression analysis presented in Table 5 examines the impact of the carbon trading market pilot policy on the standard of quality of economic development. To ensure the robustness of our findings, we employed a multi-faceted approach encompassing the ordinary least squares (OLS) regression, random effects model and fixed effects model. With the inclusion of all control variables, the coefficients of the core explanatory variables remained consistently positive and significant. Prior to the application of the two-way fixed effects model, all core explanatory variable coefficients were positive and surpassed the 1% significance threshold. Following the implementation of the two-way fixed effects model, the coefficient of the core explanatory variable in column (14) attained a level of significance at 5%, with a value of 1.0250. This finding provides empirical support for Hypothesis 2, indicating that the carbon trading market pilot policy significantly contributes to the advancement of the quality of regional economic development.

Robustness tests

-

(1)

Parallel trend tests. As above, the differences between the experimental and control groups before and after the policy pilot were analyzed according to the tvdiff command, and the time ranges of 4 years before and 5 years after the implementation of the carbon trading market pilot were selected respectively. The results showed that the individual trend F value was 2.53, Prob > F = 0. 0823; the time trend F value was 0.62, Prob > F = 0. 4321, all of which passed the parallel trend hypothesis test. It shows that the hypothesis of the parallel trend test of the carbon trading market pilot policy on economic quality development is valid, and the double difference model is also meaningful.

-

(2)

Placebo tests. In this paper, a random sample was taken for the placebo effect test, taking account into the effects of other policies or unconsidered factors. The sampling process was repeated 500 times, and the placebo test kernel density plot was drawn (as in Fig. 3, with the same layout and interpretation as Fig. 2). Most of the sampling results are concentrated on both sides of 0. The dashed line in the figure shows the coefficient of 1.0250 for the core explanatory variables in the baseline regression of this paper, which is significantly different from most of the repeated sampling results, excluding the influence of other unobservable factors, and the baseline regression results of this paper are robust.

Heterogeneity analysis

Similarly, in this paper, the results of the heterogeneity analysis of carbon trading market pilot policies on economic quality development are shown in Table 6, by dividing the 31 provinces and cities into three major zones according to the table.

Table 6, column (17) presents the regression results to the western region. The regression coefficient indicating the impact of the carbon market pilot policy on the level of high-quality economic development in the West is positive and significant at the 1% level. This suggests that the policy has a significant role in fostering high-quality regional economic development, whereas its effects in the Eastern and Central regions were not found to be significant. The eastern region has made great achievements in the process of economic development and urbanization, facing the contradiction and resistance of eliminating industries with high energy consumption/high pollution, and there is little room for high-quality development. Economic transformation and carbon emission reduction in the central region can help improve economic quality, but it is still necessary to strengthen the implementation of carbon trading pilot policies to better serve high-quality development. The level of industrialization and economic development in the western region is low, the development model and industrial system have not yet taken shape, and the resistance and cost of transforming to a low-carbon economy are small. The western region should give full play to the effect of the carbon trading pilot policy and empower high-quality development.

Discussion

As China is a large country, which substantially contributes to the World CO2 emissions, it is essential that urgent action be taken to reduce CO2 emissions. Carbon trading pilot programs is one of the effective and low-cost mechanism for reducing the carbon emission. Though the market for the carbon trading pilot programs is immature, its volume is increasing. Targets for both economic growth and carbon intensity should be considered jointly (Zhu et al., 2015) to ensure high-quality economic development. In effect, the carbon trading pilot program is essential and could contributes to the growth of an economy both positively and negatively. The question arises whether the carbon trading pilot programs hinder or support the economic development. Answering this question is vital to gain an insight into the effectiveness of the carbon trading pilot policies in the context of a developing country. Studies that address the effect of the carbon trading pilot programs on economic development have produced varied outcomes. Thus, there is a need to examine this relationship. This research examines the effect of carbon trading pilot policies on both economic stability and high-quality economic development to corroborate the Porter hypothesis. The study further tests the heterogeneity of the earlier mentioned link in various regions.

Impact of carbon trading pilot policy on economic stability

The findings demonstrate that the carbon trading pilot program has a significant and positive influence on economic fluctuations, indicating that the policy is short-term detrimental to economic stability. This aligns with the conclusions drawn by Luo and Shi (2017). Previously, Li (2023) mentioned that in the process of making low-carbon transition changes, there will be direct or indirect impacts on the financial system. Deng and Zhang (2019) pointed out that the current carbon trading pilots are in the groping stage, and all of them have certain flaws in the design process, which will have significant impacts on the carbon market and the macroeconomy. This result is also consistent with Zhou et al. (2020) who found that the price and volume of carbon trading fluctuate sharply and last for a long time given the five carbon trading pilots. Yet, it also highlights certain issues, including inadequate trading mechanisms, low market liquidity, high market fragmentation, lack of a signal function for the carbon price, and Liu et al. (2015). However, a major cause of economic volatility is the existence of inflation in the economic cycle (Xu et al. 2023). The analysis shows that the carbon emission trading market’s pilot policy, which trades carbon emission rights like commodities, develops along a convergence cobweb track. As a result, there are differences between the policy’s long- and short-term effects on economic stability, and more work needs to be done to maximize its economic benefits.

Among the control variables, infrastructure has a positive effect, such as the improvement of transportation infrastructure will stimulate China’s economic growth (Wang et al. 2020), and the increase of per capita road area is conducive to enhancing the tenacity of China’s economy; Moreover, it is able to determine the effectiveness of economic development (Gorokhova 2018). The development of China’s green economy is in partly dependent on the improvement of human capital stock (Wang et al. 2023). It provides support for economic stability. Human capital enhances economic stability. The increase of human capital is an important condition for a sustainable and stable economy and structural upgrading. Mihçi and Atilgan (2010) noted a negative correlation between the unemployment rate and economic growth. The rise of the unemployment rate means weak economic growth and insufficient employment demand of enterprises, which aggravate the degree of economic fluctuation and is unfavorable to long-term stable economic development.

Impact of carbon trading pilot policy on high-quality development

The results show that the carbon trading pilot policy has a positive and significant impact on high-quality development, which confirms the positive effect of the carbon trading pilot policy on high-quality development. This aligns with the conclusions of Zhang et al. (2022) and Chai et al. (2022). By creating a market for carbon trading, greenhouse gas emissions, like carbon dioxide emissions, will be included in the market mechanism. This will motivate businesses and other organizations to reduce their emissions in order to lower pollution levels and enhance economic development overall (Shi et al. 2022; Weng et al. 2022). Our results align with the research conducted by Geng et al. (2022), which demonstrated that carbon trading pilot programs modify the industrial structure, encourage the transition of conventional industries to low-carbon and clean energy sectors, and foster high-quality economic development. The results of Chai et al. (2022) also support those of our study, which discovered that the carbon trading policy has reduced emissions during the implementation phase and that the growth of the green economy significantly boosts regional GDP. Similarly, Shen et al. (2021) have confirmed in their research that the adoption of carbon trading facilitates regional sustainable development and that regulating the intensity of environmental governance enhances carbon productivity. According to Klepper and Peterson (2004), Babiker et al. (2004), Lokhov and Welsch (2008), Li and Li (2018), Lin and Jia (2018), and Zheng et al. (2020), the carbon trading pilot programs have a negative impact on economic growth. Our findings contradict their findings. According to these authors, cutting carbon emissions has a negative impact on economic expansion.

Heterogeneity of carbon trading pilot policy effect

Our results show heterogeneity regarding the effect of carbon trading pilot policy on economic growth in various regions. The impact of carbon trading pilot policy on economic stability in the eastern region is positive and significant that is, it intensifies economic fluctuations in the eastern region. Among the impacts on high-quality development, the pilot policy of carbon trading market has a positive and significant impact on the high-quality development level of western economy. Different regions have different levels of environmental efficiency and different impacts. The effect of carbon emission reduction is remarkable, which is one of the reasons why the policy reduces production emission in the eastern region and causes economic fluctuation (Weng et al. 2022). In the study, it is mentioned that the central and western regions have great influence. The reason may be that emissions trading promotes the green balance level in the eastern region less than that in the central and western regions (Wang and He 2022), and has a strong inhibitory effect on technological innovation (Zhang et al. 2022). The level of industrialization and economic development in the western region is low, the development model and industrial system have not yet taken shape, and the resistance and cost of transforming to a low-carbon economy are small. Given this, the western region ought to maximize the benefits of the carbon trading pilot program and support development of the highest caliber.

Conclusion and policy implications

Conclusion

As the largest developing country, the influence of emissions trading on industrial upgrading and energy saving in China has received attention worldwide since the launch of carbon emissions trading. In response to the question of whether these carbon trading policies promote or adversely affect economic development, few studies address the effect of carbon trading policies on economic development resulting in mixed findings suggesting further research in this area. This study contributes to the existing body of knowledge by investigating the effect of carbon trading policies on both economic growth and high-quality development.

This paper innovatively utilizes the cobweb model to analyze the dynamics of economic fluctuations and high-quality development under the carbon trading pilot policy. Our analysis highlights that the carbon trading market’s equilibrium shifts based on supply and demand price elasticities. While the policy achieves carbon reduction in the short term, it also impacts economic stability. However, its enforcement optimizes regional industrial structure, fostering long-term high-quality economic growth.

The empirical results show that the carbon trading pilot policy has a positive and significant effect on economic volatility. This demonstrates that in the short term, China is still in the stage where the carbon trading pilot has a shock to the economy and exacerbated economic volatility. The results are robust and credible through parallel trend tests and placebo tests. This is attributed to the dramatic fluctuations in the price and volume of carbon trading in China, which raises costs and reduces profits for companies while producing carbon reduction effects. Enterprises need to make long-term production equipment modifications and technological innovations to ensure rising profits and stabilize the economy. The heterogeneity analysis concludes that the impact of carbon trading pilot policies on increased economic volatility is evident in the East and not in the Central and West regions. Since the market potential is high and the East is still trying to improve the carbon trading pilot policy, the macro economy will show fluctuations in the years after the implementation of the carbon trading schemes.

Furthermore, this study developed an index system for high-quality economic development and produced high-quality development indices for 31 provinces, cities, and autonomous areas. From 2005 to 2021, China’s degree of high-quality economic development increased significantly. The carbon trading pilot policy has a positive and significant effect on the high-quality economic development, according to the empirical test, and the results are strong and reliable according to the replacement model, parallel trend test, and placebo test. The heterogeneity analysis shows that the carbon trading pilot policy in the West significantly boosts the high-quality development of the regional economy and that there is much more space and low cost for high-quality development in the West.

Policy implications

With the increasing severity of global climate change, low-carbon, green, and sustainable development have become a global consensus. This study examines the economic impact of carbon trading policies, aiming to facilitate the transition to a low-carbon economy and promote the achievement of sustainable development goals. It delves into the effects of carbon trading policies on economic stability and high-quality economic development, providing significant practical guidance for governments to formulate and refine relevant policies. Here are the policy implications of this paper.

Carbon emission reduction, stable growth, and high-quality development in synergy

Reducing carbon emissions while maintaining steady economic growth and promoting high-quality development are essential. We must regulate the rate and intensity of carbon emission reduction, set precedents, and accelerate the process of energy structure optimization We should reduce energy consumption and carbon emissions while hastening the development and acceptance of eco-friendly and low-carbon technology. Moreover, we should encourage major changes in the way that technology, energy, and industries are organized while promoting the greening and decarbonization of industries. Finally, to advance modernization in the Chinese way and to achieve stable economic growth and high-quality development, we must reach carbon peak and carbon neutrality.

Accelerate and improve the carbon emission market trading system

To overcome the fragmentation of the pilot regional markets, implement the centralization and unification of the carbon market, and control carbon trading activities, China needs to construct an integrated national carbon trading market. Further, there is a need to establish a system of reasonable and thorough laws and regulations, strengthen the management of carbon assets, advance technology for carbon reduction, create carbon trading information platforms and carbon consulting firms, and support third-party certification organizations. In order to better support the optimization of regional economic structure, encourage high-quality economic development, and bolster the role that high-quality development plays in supporting the national carbon trading market, the national carbon trading market’s price regulation mechanism, carbon quota allocation mechanism, and policy regulation system should all be improved.

Improve the enthusiasm of market players to participate in carbon trading

Diversification of market factor inputs, participating parties, advantages, and outputs are primarily included. Encourage businesses to take part in carbon trading and highlight their technical advancement and passion. Increase the amounts of paid quotas gradually, cover more industries, lower the barrier to investment, and increase the market’s liquidity for carbon trading. To achieve Chinese-style modernization, it is necessary to increase the variety of carbon trading products, investigate the viability of combining carbon trading with carbon tax project offset mechanisms, actively engage in carbon financial innovation, fully exploit the market’s ability to reduce carbon emissions, and more.

Research limitations

This paper tested the impact of carbon trading pilot policies on economic stability and high-quality development using the cobweb model. However, according to the cobweb model, we can continue to discuss the demand elasticity and supply elasticity of the carbon trading market theoretically and empirically in the future, and whether the new equilibrium point formed by the two is in line with China’s “double carbon” goal. Further studies can address this area in their research and contribute to the literature. Furthermore, further studies should conduct comparative studies between China and developed countries on the earlier mentioned associations to get insight how the effects of the carbon trading policies differ in China compared the developed countries.

Data availability

All data generated or analyzed during this study are included in this published article.

References

Bai C, Liu H, Zhang R, Feng C (2023) Blessing or curse? Market-driven environmental regulation and enterprises’ total factor productivity: Evidence from China’s carbon market pilots. Energy Econ 117. https://doi.org/10.1016/j.eneco.2022.106432

Babiker M, Reilly J, Viguier L (2004) Is international emissions trading always beneficial? Energy J 25(2):33–56. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol25-No2-2

Cao Q, Zhou S, Sajid MJ, Cao M (2022) The impact of China’s carbon-reduction policies on provincial industrial competitiveness. Energy Efficiency 15. https://doi.org/10.1007/s12053-022-10040-1

Chai S, Sun R, Zhang K, Ding Y, Wei W (2022) Is emissions trading scheme (ETS) an effective market-incentivized environmental regulation policy? Evidence from China’s Eight ETS Pilots. Int J Environ Res Public Health 19. https://doi.org/10.3390/ijerph19063177

Chen L, Wang D, Shi R (2022) Can China’s carbon emissions trading system achieve the synergistic effect of carbon reduction and pollution control? Int J Environ Res Public Health 19. https://doi.org/10.3390/ijerph19158932

Dai H, Xie Y, Liu Y, Masul T (2018) Aligning renewable energy targets with carbon emissions trading to achieve China’s INDCs: A general equilibrium assessment. Renew Sustain Energy Rev 82:4121–4131. https://doi.org/10.1016/j.rser.2017.10.061

Dong F, Gao Y, Li Y, Zhu J, Hu M, Zhang X (2022) Exploring volatility of carbon price in European Union due to COVID-19 pandemic. Environ Sci Pollut Res 29:8269–8280. https://doi.org/10.1007/s11356-021-16052-1

Deng M, Zhang W (2019) Recognition and analysis of potential risks in China’s carbon emission trading markets. Advances in Climate Change Research. https://doi.org/10.1016/j.accre.2019.03.004

Fan Y, Wu J, Xia Y, Liu J (2016) How will a nationwide carbon market affect regional economies and efficiency of CO2 emission reduction in China? China Economic Rev 38:151–166. https://doi.org/10.1016/j.chieco.2015.12.011

Fu C, Huang Y, Zheng Y, Luo C (2022) The influence and acting pattern of China’s national carbon emission trading scheme on regional ecologicalization efficiency of industry. Sci Rep 12. https://doi.org/10.1038/s41598-022-16185-4

Gao M (2023) The impacts of carbon trading policy on China’s low-carbon economy based on county-level perspectives. Energy Policy 175. https://doi.org/10.1016/j.enpol.2023.113494

Geng L, Hu J, Shen W (2022) The impact of carbon finance on energy consumption structure: evidence from China. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-022-24303-y

Guo BN, Feng Y, Hu F (2023) Have carbon emission trading pilot policy improved urban innovation capacity? Evidence from a quasi-natural experiment in China. Environ Sci Pollut Res https://doi.org/10.1007/s11356-023-25699-x

Gorokhova MY (2018) Resource potential of the knowledge economy. Upravlenets- Manager 9(3):20–25. https://webofscience-clarivate-cn-s.mssl.hznu.edu.cn/wos/woscc/full-record/WOS:000449068600004

Hu Y, Li X, Tang B (2017) Assessing the operational performance and maturity of the carbon trading pilot program: The case study of Beijing’s carbon market. J Clean Prod 161:1263–1274. https://doi.org/10.1016/j.jclepro.2017.03.205

Huang S (2021) Three theoretical pillars to support ESG. Financ Account Mon 19:3–10. https://doi.org/10.19641/j.cnki.42-1290/f.2021.19.001

Huang W, Wang Q, Li H, Fan H, Qian Y, Klemeš JJ (2022) Review of recent progress of emission trading policy in China. J Clean Prod 349:131480. 1016/j.jclepro.2022.131480

Jin C, Tsai FS, Gu Q, Wu B (2022) Does the Porter hypothesis work well in the emission trading schema pilot? Exploring moderating effects of institutional settings. Res Int Bus Financ 62:101732. https://doi.org/10.1016/j.ribaf.2022.101732

Klepper G, Peterson S (2004) The EU emissions trading scheme allowance prices, trade flows and competitiveness effects. Eur Environ 14(4):201–218. https://doi.org/10.1002/eet.356

Li F, Li G (2018) Agglomeration and spatial spillover effects of regional economic growth in China. Sustainability 10(12):4695. https://doi.org/10.3390/su10124695

Li K, Luo Z, Hong L, Wen J, Fang L (2024) The role of China’s carbon emission trading system in economic decarbonization: Evidence from Chinese prefecture-level cities. Heliyon 10(1). https://doi.org/10.1016/j.heliyon.2023.e23799

Li X, Guo D, Feng C (2022) The carbon emissions trading policy of China: Does it really promote the enterprises’ green technology innovations? Int J Environ Res Public Health 19(21):14325. https://doi.org/10.3390/ijerph192114325

Li G, Tian Z, Song Y (2023) Study on the influence of local government debt on the high-quality development of urban economy. J Cent Univ Financ Econ 425:3–14. https://doi.org/10.19681/j.cnki.jcufe.2023.01.006

Li X, Hu ZG, Cao J (2021) The impact of carbon market pilots on air pollution: evidence from China. Environ Sci Pollut Res 28:62274–62291. https://doi.org/10.1007/s11356-021-14995-z

Lim S, Prakash A (2023) Does carbon pricing spur climate innovation? A panel study, 1986-2019. Journal of Cleaner Production 395. https://doi.org/10.1016/j.jclepro.2023.136459

Lin B, Jia Z (2018) Impact of quota decline scheme of emission trading in China: A dynamic recursive CGE model. Energy 149:190–203. https://doi.org/10.1016/j.energy.2018.02.039

Liu Y, Tan X, Yu Y, Qi S (2017) Assessment of impacts of Hubei Pilot emission trading schemes in China–A CGE-analysis using Term CO2 model. Appl Energy 189:762–769. https://doi.org/10.1016/j.apenergy.2016.05.085

Liu M, Shan Y, Li Y (2022) Study on the effect of carbon trading regulation on green innovation and heterogeneity analysis from China. Energy Policy 171. https://doi.org/10.1016/j.enpol.2022.113290

Liu Y, Liu S, Shao X, He Y (2022) Policy spillover effect and action mechanism for environmental rights trading on green innovation: Evidence from China’s carbon emissions trading policy. Renew Sustain Energy Rev 153. https://doi.org/10.1016/j.rser.2021.111779

Liu C, Ma C, Xie R (2020) Structural, innovation and efficiency effects of environmental regulation: Evidence from China’s carbon emissions trading pilot. Environ Resour Econ 75:741–768. https://doi.org/10.1007/s10640-020-00406-3

Liu Y, Huang J, Dong H (2023) Achieving employment dividend in the post-Covid-19 Era: An exploration from china’s carbon market. Clim Change Econ 14(01). https://doi.org/10.1142/s2010007823400018

Lokhov R, Welsch H (2008) Emissions trading between Russia and the European Union: a CGE analysis of potentials and impacts. Environ Econ Policy Stud 9:1–23. https://doi.org/10.1007/BF03353972

Luo M, Shi C (2017) Study on the Impact of China ‘s Carbon Trading Mechanism Based on Multi - Agent Model. Agro Food Ind Hi-Tech 28(3):880–884

Li N (2023) Measuring the combining effects of financial stability and climate risk for green economic recovery. Economic Change and Restructuring. https://doi.org/10.1007/s10644-022-09466-5

Li N, Li N, Zhao Y, Zhao E (2015) China’s carbon-emissions trading: Overview, challenges and future. Renew Sustain Energy Rev 49:254–266. https://doi.org/10.1016/j.rser.2015.04.076

Ma G, Qin J, Zhang Y (2023) Does the carbon emissions trading system reduce carbon emissions by promoting two-way FDI in developing countries? Evidence from Chinese listed companies and cities. Energy Econ 120:106581. https://doi.org/10.1016/j.eneco.2023.106581

Munnings C, Morgenstern R, Wang Z, Liu X (2016) Assessing the design of three carbon trading pilot programs in China. Energy Policy 96:688–699. https://doi.org/10.1016/j.enpol.2016.06.015

Mihçi S, Atilgan E (2010) Unemployment and growth: Okun coefficients for Turkish economy. Iktisat Isletme Ve Flnans. https://doi.org/10.3848/iif.2010.296.2803

Ou J, Xu C, Liu Y (2020) Measurement of high-quality economic development level based on “five development concepts”-an empirical analysis of 21 prefecture-level cities in Guangdong Province. Econ Geogr 40:77–86. https://doi.org/10.15957/j.cnki.jjdl.2020.06.009

Pan X, Li M, Xu H, Guo S, Guo R, Lee C (2021) Simulation on the effectiveness of carbon emission trading policy: A system dynamics approach. J Oper Res Soc 72:1447–1460. https://doi.org/10.1080/01605682.2020.1740623

Qi S, Zhou C, Li K, Tang S (2021) Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Clim Policy 21(3):318–336. https://doi.org/10.1080/14693062.2020.1864268

Qi Y, Yuan M, Bai T (2023) Where will corporate capital flow to? Revisiting the impact of China’s pilot carbon emission trading system on investment. Journal of Environmental Management 336. https://doi.org/10.1016/j.jenvman.2023.117671

Qian L, Xu X, Zhou Y, Sun Y, Ma D (2023) Carbon Emission Reduction Effects of the Smart City Pilot Policy in China. Sustainability 15(6):5085. https://doi.org/10.3390/su15065085

Ren F, Liu XL (2023) Evaluation of carbon emission reduction effect and porter effect of China’s carbon trading policy. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-023-25593-6

Ren S, Yang X, Hu Y, Chevallier J (2022) Emission trading, induced innovation and firm performance. Energy Economics 112. https://doi.org/10.1016/j.eneco.2022.106157

Shen L, Wang X, Liu Q, Wang Y, Lv L, Tang R (2021) Carbon trading mechanism, low-carbon e-commerce supply chain and sustainable development. Mathematics 9(15):1717. https://doi.org/10.3390/math9151717

Shi X, Xu Y, Sun W (2022) Evaluating China’s pilot carbon Emission Trading Scheme: collaborative reduction of carbon and air pollutants. Environ Sci Pollut Res https://doi.org/10.1007/s11356-022-24685-z

Sun P, Hao X, Wang J, Shen D, Tian L (2021) Low-carbon economic operation for integrated energy system considering carbon trading mechanism. Energy Sci Eng 9:2064–2078. https://doi.org/10.1002/ese3.967

Tan X, Liu Y, Dong H, Zhang Z (2022) The effect of carbon emission trading scheme on energy efficiency: Evidence from China. Econ Anal Policy 75:506–517. https://doi.org/10.1016/j.eap.2022.06.012

Wang H, Shi W, He Y, Dong J (2022) Spill-over effect and efficiency of seven pilot carbon emissions trading exchanges in China. Sci Total Environ 838:156020. https://doi.org/10.1016/j.scitotenv.2022.156020

Wang N, Zhu Y, Yang T (2020) The impact of transportation infrastructure and industrial agglomeration on energy efficiency: Evidence from China’s industrial sectors. J Cleaner Prod https://doi.org/10.1016/j.jclepro.2019.118708

Wang S, Chen G, Han X (2021) An analysis of the impact of the emissions trading system on the green total factor productivity based on the spatial difference-in-differences approach: The case of China. Int J Environ Res Public Health 18. https://doi.org/10.3390/ijerph18179040

Wang X, Liu C, Wen Z, Long R, & He L (2022) Identifying and analyzing the regional heterogeneity in green innovation effect from China’s pilot carbon emissions trading scheme through a quasi-natural experiment. Comput Ind Eng 174. https://doi.org/10.1016/j.cie.2022.108757

Wang X, Wang Y, Zheng R, Wang J, Cheng Y (2023) Impact of human capital on the green economy: empirical evidence from 30 Chinese provinces. Environ Sci Pollut Res https://doi.org/10.1007/s11356-022-22986-x

Wang Y, He L (2022) Can China’s carbon emissions trading scheme promote balanced green development? A consideration of efficiency and fairness. J Cleaner Prod 367 https://doi.org/10.1016/j.jclepro.2022.132916

Wei M, Li S (2018) Study on the measurement of high-quality development level of China’s economy in the new era. Quant Econ Tech Econ Res 35:3–20. https://doi.org/10.13653/j.cnki.jqte.2018.11.001

Weng Q, Xu H (2018) A review of China’s carbon trading market. Renew Sustain Energy Rev 91:613–619. https://doi.org/10.1016/j.rser.2018.04.026

Weng Z, Liu T, Wu Y, Cheng C (2022) Air quality improvement effect and future contributions of carbon trading pilot programs in China. Energy Policy 170. https://doi.org/10.1016/j.enpol.2022.113264

Wu R, Tan Z, Lin B (2023) Does carbon emission trading scheme really improve the CO2 emission efficiency? Evidence from China’s iron and steel industry. Energy 277:127743. https://doi.org/10.1016/j.energy.2023.127743

Xi JP (2022) Xi emphasizes Chinese path to modernization as central task. Available online: https://www.chinadaily.com.cn/a/202210/16/WS634b6784a310fd2b29e7cb7d_1.html (accessed on 16 October 2023)

Xie L, Zhou Z, Hui S (2022) Does environmental regulation improve the structure of power generation technology? Evidence from China’s pilot policy on the carbon emissions trading market (CETM). Technological Forecasting and Social Change 176. https://doi.org/10.1016/j.techfore.2021.121428

Xu Y, Li X, Yuan P, Zhang Y (2023) Trade-off between environment and economy: The relationship between carbon and inflation. Frontiers in Environmental Science. https://doi.org/10.3389/fenvs.2023.1093528

Yang X, Jiang P, Pan Y (2020) Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 142. https://doi.org/10.1016/j.enpol.2020.111492

Yi L, Bai N, Yang L, Li Z, Wang F (2020) Evaluation on the effectiveness of China’s pilot carbon market policy. J Clean Prod 246:119039. https://doi.org/10.1016/j.jclepro.2019.119039

Zang J, Wan L, Li Z, Wang C, Wang S (2020) Does emission trading scheme have spillover effect on industrial structure upgrading? Evidence from the EU based on a PSM-DID approach. Environ Sci Pollut Res 27:12345–12357. https://doi.org/10.1007/s11356-020-07818-0

Zeng S, Fu Q, Yang D, Tian Y, Yu Y (2023) The Influencing Factors of the Carbon Trading Price: A Case of China against a “Double Carbon” Background. Sustainability 15(3). https://doi.org/10.3390/su15032203

Zeng S, Fu Q, Haleem F, Shen Y, Zhang J (2023) Carbon-reduction, green finance, and high-quality economic development: A case of China. Sustainability 15(18). https://doi.org/10.3390/su151813999

Zhai X, An Y, Shi X, Cui H (2023) Emissions trading scheme and green development in China: Impact of city heterogeneity. Sustainable Development. https://doi.org/10.1002/sd.2533