Abstract

This paper examines the impact of internal audit (IA) practices on the performance of commercial banks. Six factors were investigated, including the application of international IA standards, the independence and objectivity of the IA, the quality and professionalism of IA members, gender diversity within the IA department, the size and frequency of meetings, and management support for IA. Using questionnaires, data were collected from 34 commercial banks in five Arab countries: Saudi Arabia, Yemen, Sudan, Somalia, and Djibouti. Structural equation modeling (SEM) was performed using SmartPLS 3.3.3. The results demonstrate the significant and direct influence of the examined factors on the performance of commercial banks, except for the professional competence of internal auditors. Additionally, the study reveals that the performance of internal auditors, as a mediating variable, does not significantly affect the relationship between the internal audit system (IAS) and bank performance. This paper makes a significant contribution to the field of auditing as it is the first study to examine IA in Arab countries using multiple factors. The findings of this study can be utilized by regulators, such as the Institute of Internal Auditors (IIA), bank owners and managers, government agencies, and central banks.

Similar content being viewed by others

Introduction

When it comes to improving performance, internal audit (IA) is one of the most critical functions that banks rely on. IA significantly affects the design, development, and implementation of internal control systems, as well as the measurement and evaluation of resource use efficiency. The Institute of Internal Auditors (IIA) (2016)” believes that “IA is an objective and independent activity aimed to improving the quality of an organization’s operations and adding value.” IA helps organizations, including commercial banks, in their efforts to implement their business strategies by taking corrective and reinforcing actions. It involves discovering the threats and obstacles they face, working to resolve them, and successfully achieving their goals (Misganaw, 2016). The IA department is one of the organization’s important internal departments. It includes many important functions, such as monitoring, consulting, and obtaining feedback information, to improve work and achieve organizational goals (Oussii and Boulila Taktak, 2018; Hazaea et al. 2023).

Compared to external audit, IA is a new function, and its development is primarily linked to the United States’ economic crisis in 1929 (Parker and Johnson, 2017). Due to the large size of organizations and the complexity of their work, as well as the separation of organizational ownership and management, society has created a need for IA. IA is considered in organizational governance an open system that collaborates with multiple departments to achieve its goals (Hazaea and Zhu, 2022). The primary reason for the need for IA is the separation of organizational ownership from management. Therefore, internal auditors report their opinions on the quality and reliability of financial statements through inspection and control procedures (CIIA, 2017). IA plays an important role in an organization’s administrative and operational aspects (Hazaea et al, 2021). In addition, IA is an important tool in enabling organizations to achieve maximum business results and ensure sustainability (Amoako et al. 2023; Khan and Liu, 2023).

IA is the primary guardian of an organization’s financial information (Ondieki, 2013). By ensuring the preparation of sound financial reports, IA can contribute positively to improving the performance of organizations and adding value (Postula et al. 2020; Alzeban, 2023). Internal control systems, including IA, are important tools for improving banks’ performance (Gras-Gil et al. 2012; Hazaea et al. 2020). The internal audit system (IAS) has made a positive and effective contribution to enhancing the financial stability of banks (Lambekova et al. 2020).

Using IA to evaluate an organization’s performance contributes to achieving accountability(Hazaea et al. 2021). IA plays a vital role in risk management and the provision of management consulting and advisory services (Abuazza et al. 2015; Weekes‐Marshall, 2020; Handoyo, 2024). Based on BCBS (2012), which confirms that there are various important factors that explain the work of IA in banks. IA is a well-defined function that works in conjunction with other functions in the success of the business. Therefore, there must be an IA in every bank who possesses unlimited powers, holds a high position and authority, and enjoys independence and access to higher authorities. It is essential for IA members to have a high level of professional competence. On the other hand, IA must provide impartial and independent assurance to the bank’s senior management to ensure effective risk management and protect the bank’s reputation. Therefore, the practice of IA as a fundamental tool of corporate governance varies across regions due to various factors, including political, economic, and cultural influences, as well as stakeholder acceptance and their perception of the role of internal audit functions (IAFs) in enhancing performance (Hazaea et al. 2023).

The Arab countries are one of those regions that are culturally and religiously different from other regions. Therefore, studying this topic from another perspective relevant to the Arab countries may help the understanding of the factors that influence performance and discover the findings that pose challenges and prevent the IAFs from performing as required. According to the IIA, Middle Eastern countries, including the Arab countries, have seen considerable development in regulatory procedures related to the practice of IA, which will help improve the performance of IA (Al-Akra et al. 2016). Despite the importance of IA, little is known about its role and functions. Some studies describe the role of IA as an underexplored “black box” (Lenz et al. 2018; Prasad et al. 2021). By exploring unfamiliar territory by running a variety of investigative methods, the black-box concept is gradually explained, aiming to provide new insights into the role of IA in commercial institutions, including commercial banks. For a more in-depth study and investigation of the impact and importance of IA, the current understanding of its role and assessment needs to be considered. The IIA believes that the IA function is a crucial pillar of a high-quality governance model (IIA, 2016).

This study contributes to conceptualizing and developing a new framework that related banks, companies, and stakeholders should embed. This paper also contributes to expanding knowledge in several aspects. First, this study presents a detailed analysis of the role IA plays in enhancing and improving the banks’ performance in the Arab region. It is the first study to address this issue using data collected from five Arab countries. Second, the availability of extensive information enables stakeholders, members of bank management and organizations, including the IIA, and those interested in Arab countries to identify the factors for enhancing the IA and implement them to improve the performance of institutions, including banks. Third, this study contributes to providing a clear vision and valuable results about the importance of gender diversity in audit departments, especially in light of the religiously and culturally conservative system that affects females at work. Fourth, this study may contribute to stakeholders by clarifying and enhancing compatibility between Islamic standards and international standards, as well as promoting gender diversity. Finally, this study also contributes to expanding knowledge about the peculiarities of internal control in banks.

The rest of this study is structured into 5 sections as follows: “Section 2 presents the literature review and hypotheses development.” Section 3 presents the methodology. Section 4 presents the results of SEM and discussion. In Section 5, the conclusion and limitations are presented and Section 6 presents the implications of the study.

Theoretical background, literature review, and hypotheses development

Theoretical background

Based on the main objective of the study, which is to investigate the various factors that can contribute to enhancing the effectiveness of IA and its impact on banks’ performance. This study relies mainly on the resource-based theory. This theory assumes that each organization is viewed as a diverse and distinctive mix of capabilities. It posits that bolstering strengthening and growing these organizations over time requires reinforcing them with various tangible and intangible assets (Ahmed and Che-Ahmad, 2016). Considering that the IA department is one of the departments of any organization, it naturally requires resources to ensure its strengthening and qualification in a way that assures the implementation of its work and the presentation of its outputs in an appropriate manner (Kruger et al. 2002). It should be noted that resources include many organizational characteristics, knowledge, competencies, organizations, independence, and general qualifications (Barney et al. 2001; Alqudah et al. 2023). Through it, the organization can implement its plans efficiently and effectively and implement the necessary strategies to enhance its sustainability (Khanam, 2024). Therefore, this study investigates the important role of internal resources within the organization and their impact on enhancing the effectiveness and efficiency of the IAF as well as their relationship to enhancing the performance of banks.

Literature review, and hypotheses development

IA standards

According to Ali et al. (2013) institutional theory provides a sufficient explanation of the effect of companies’ commitment to following international standards for practicing the IA profession as well as the impact of this on enhancing the effectiveness of IA and its positive impact on performance. In this regard, applying international IA standards is one of the elements that can improve the performance of financial institutions (Hazaea et al. 2020). Improving the audit function’s performance requires compliance with auditing standards (Bame-Aldred et al. 2013). Indeed, it can be said that improving organizational performance in banks is positively affected by the independence of internal auditors, the frequency of meetings between the members of the IA department with the relevant parties, and the qualifications of internal auditors to keep up with the updates issued in terms of standards, regulations, and procedures (Hazaea et al. 2020; Hazaea et al. 2021). The commitment of internal auditors to adhere to the standards and regulations that govern the practice of IAFs contributes positively to enhancing performance (Arena et al. 2006; Getie Mihret et al. 2010). Adhering to specific standards, regulations, and laws is essential for an IAS. Compliance with these regulations and rules can enhance the performance of banks (Asiligwa and Rennox, 2017).

Following IA standards can greatly improve performance as it enables organizations to identify risks in a timely manner, thereby increasing transparency and accountability (Kasiva, 2012; Hazaea et al. 2021). A positive correlation exists between compliance with IA standards and performance in Iraqi commercial banks. Compliance with standards set by the IIA can enhance IA practices and strengthen its role in improving the performance of commercial banks (Fatah, 2021). It must be noted that the practice of IA in Islamic banks differs from banks in other countries in that it does not deal with usury, which is a major challenge for these institutions when applying the principles of IA issued by the IIA. This requires compatibility between IIA standards and Islamic standards to ensure the achievement of goals. In addition, there is another challenge represented by depositors bearing losses and not just sharing in profits in light of the application of Islamic standards. This requires the bank’s management to undertake additional work that contributes to achieving compatibility with international standards, such as establishing Sharia risk management committees (Kaaroud et al. 2020). Finally, globalization has led to the expansion of the boundaries of companies’ work between countries. This has created a major challenge in the practice of IA as it requires internal auditors to enhance their skills and understanding of international standards for IA to ensure effective implementation (Handoyo, 2024). In this context, further investigation into the importance of implementing international standards for IA, which differ culturally and organizationally diverse countries, effectively contributes to enhancing the knowledge and understanding of all stakeholders. It emphasizes the significance of adhering to standards as an essential factor in improving the practice and efficiency of IA. Therefore, this study predicts that following international standards for IA will enhance its effectiveness, which will have a positive impact on enhancing the performance of banks.

From above the first Hypothesis is:-

H1: The implementation of IA standards has a positive impact on the performance of commercial banks

Independence of IA

“IA is an independent, objective assurance and advisory activity designed to add value and improve the operations of institutions (banks)”(IIA, 2017). Independence is the spirit of IA, so improving the independence of IA is not only to protect corporate funds from fraud but also a key element in achieving high-quality corporate performance (Hazaea and Zhu, 2022; Shuwaili et al. 2023). The independence of internal auditors has significantly contributed to improving organizations’ performance (Ofoeda et al. 2020; Rahman and Ali, 2022). The independence of the IA members represents the first factor in enhancing and improving the performance of banks (Mustari et al. 2020). The independence and efficiency of internal auditors are among the most important elements for ensuring the effectiveness of an IAS (Abbott et al. 2015). Similarly, Khanam, (2024) confirms that the independence of internal auditors greatly enhances the positive role that IA plays in banks. From an administrative and financial perspective, the IA department’s independence and its members’ efficiency have implications for improving the performance of banks. There is a significant relationship between the elements of IA, including independence, and organizational performance (Hazaea et al. 2020). Anderson et al. (2004) found that the independence of audit members can reduce the cost of debt, so the overall performance of organizations will be in good shape.

However, the independence of members of the audit department is directly proportional to the quality of the organization and the company’s profitability. Therefore, members of the audit department should not be members of the audit committee due to their negative impact on the performance and quality of the audit organization’s profits (Al-Absy et al. 2020). Fin (2020) argues that IA independence largely affects organizational performance improvement. Biason (2020) studied the effect of IA on the efficiency of performance in Nigerian higher education organizations, which showed that the role of IA in improving performance was not very important due to the lack of internal auditors’ independence from senior management. In addition, independence is a necessary condition and a prerequisite for the smooth development of IA work. It is also an important guarantee for realizing the value of the audit function(Hazaea et al. 2020; Hazaea et al. 2021). These results are consistent with the view of the resource-based theory that posits that any organization is a collection of resources that contribute to enhancing the strategies of these organizations in a way that ensures their effectiveness and achieves their goals (Grant, 1991; Bryson and Ackermann, 2007). Therefore, the independence of the work of internal auditors is a resource that contributes to enhancing the effectiveness of IA (Alqudah et al. 2019). It must be noted that independence can be achieved through the presence of clear laws and regulations applied in all institutions, without interference from any party. This includes avoiding favoritism, the influence of a political party, any relationship between the bank’s management and the audit committees, or irregular state interventions. In addition to the type of ownership of banks and the intervention of their owners in imposing procedures on the audit department, these represent challenges faced by IA in Arab countries (Hazaea et al. 2023). Evidence from previous literature indicates that the lack of IA independence represents a significant challenge and obstacle that hinders the effectiveness of IA practice. Therefore, we believe that conducting studies using a sample of developing countries, especially Arab countries that face challenges such as nepotism and family ownership, will enhance the clarification of the importance of auditors’ independence in enhancing performance. Hypothesis two is:-

H2. The independence and objectivity of the IA members have a positive impact on the performance of commercial banks

The professional competence of internal auditors

Oyewumi et al. (2023) indicate that skill and experience are important indicators and positively affect the efficiency and performance of IA. There is a strong relationship between the degree to which audit members have financial and accounting expertise and an organization’s performance. An organization can achieve optimal performance and desired outcomes only if the audit members are highly competent in executing the audit engagements (Bouaziz, 2012; Oyewumi et al. 2023). Dianita (2015) reported that the role of internal auditors in improving organizational performance did not have a positive influence on performance. This was attributed to the inefficiency of internal auditors and the limited number of internal auditors, which prevented them from maximizing banking performance. Newman and Comfort (2018) showed that auditors’ financial and accounting expertise positively correlates with improving and enhancing organizational performance. The results also demonstrate a strong correlation between the two variables and demonstrate that they are associated with improved performance capacity. Ahmeti et al. (2022) confirmed that professional competence significantly impacts organizational performance. IA quality plays a significant role in protecting a company from the risk of collapse, a goal that all organizations strive for. At the same time, this means that the organizations audited by qualified and professional auditors are exposed to less risk (Chae et al. 2020). The results of Al-Sorihi and Al-Salafi (2019) show that the effectiveness and efficiency of IA play an important role in improving the performance of banks. Abd et al. (2021) investigate the role of IA and its practices in 13 commercial banks using 57 questionnaires. The findings suggest that commercial bank management must select auditors with experience and qualifications, which may have a positive response to improved performance. In this regard, agency theory assumes that company owners may mistrust the practices of managers as a result of opportunism and information asymmetry (Adams, 1994). The stimulation of the development of the IAF according to the agency theory came through what is called the asymmetry of information between the owners of companies and their managers (Jensen and Meckling, 1976). Therefore, IIA stressed the need for audit members to have sufficient levels of skills, experience, and knowledge, in addition to the need for them to enjoy independence to enable them to carry out their tasks effectively (Erasmus and Coetzee, 2018). In line with the above discussion, the third hypothesis is formulated as follows:

H3. The professional competence of the internal auditors has a positive impact on the performance of commercial banks

Female representatives in the IA department

According to Chijoke-Mgbame et al. (2020): and CIA (2021), female representation in IA departments (women in charge of the department) and representation on boards positively impact these organizations, leading to improved performance. According to social classification theory, there are differences between males and females in terms of ethical behavior, belonging, and cooperation. These differences can potentially contribute to improved organizational management and performance (Akaah, 1989; Dawson, 1997). In addition to being able to influence performance financially, women serving as members of IA departments also play a positive role in ensuring performance (Green and Homroy, 2018; Lee and Thong, 2023). Females with unique characteristics may positively affect firms’ performance (Grant, 1988; Ferrary and Déo, 2023). Ittonen et al. (2010) and Luh (2024) argues that having female representation on audit committees and in IA departments improves the integrity of financial reporting, improves internal control activities, and fosters effective communication with internal and external auditors. In addition, the difference between genders enhances the effectiveness of audit activities. The presence of female auditors has significantly enhanced the quality of audits. That’s because females may enjoy more independence than men, which allows female auditors to perform their work effectively by establishing important contacts with key clients and relevant departments to reduce the risk of wrong business (Hardies et al. 2016).

However, some research also suggests that women’s participation may not improve performance. For example, Ahern and Dittmar (2012) reported that an increase in female representation in the corporate sector might adversely affect an organization’s economic performance. They create more personal conflicts between them, which can lead to instability in management, ultimately negatively affecting performance. According to Darmadi (2013) there is no positive relationship between the presence of women and organizational performance in Indonesian banks. In business management, social categorization based on gender may have a negative impact on an organization’s performance (Jehn et al. 1999). The findings of a study by Dinu and Bunea (2018) concluded that the presence of women in Romanian banks is not very important for improving the performance. In light of these contradictions in the literature and the lack of consensus among them, we present the fourth hypothesis as follows:-

H4. Female representation in the IA department positively affects the performance of commercial banks

Size of IA and frequency meetings

Size of IA

Grima et al. (2023) indicates that the larger size of the IA, the more it contributes to increasing its effectiveness positively. The presence of a large number of auditors compared to the work to be carried out may be one of the reasons for not implementing the work with high quality. This can also lead to a lack of positive cooperation among members of the IA (Drakos and Bekiris, 2010). A sufficient number of internal auditors in an organization can enhance audit performance and effectiveness (Chang et al. 2019). Ujunwa (2012) argues that having the appropriate members in the IA department can benefit both in terms of appropriate knowledge, perspectives, and advice from different organizational investments, thereby substantially benefiting the organization. These results are consistent with the principles of resource dependence theory. Rahman and Ali (2022) discussed the degree of influence of audit characteristics on a company’s performance. It was found that the size of IA was positively related to performance. Because the size of IA will undoubtedly include members with various professional experiences, these members may help solve problems such as difficulties and challenges faced by organizations, thereby improving organizational performance. If the size of the auditor staff IA is large, there will be less interest in their work, and their knowledge and skills will remain unused (Dharmadasa et al. 2014).

The size of the IA (membership of the IA, frequency of meetings) has a positive but not significant effect on performance. Since the impact is normal, this does not significantly improve financial performance (Ojeka et al. 2014). Aridaha et al. (2021) investigated the role of audit committees in improving the IA function in Jordan. The findings revealed that the presence of audit committees has a positive impact on enhancing the role of IA in improving performance by promoting accountability. In addition, it may lead to support for the independence of IA members and monitor the extent to which IA members adhere to the standards and procedures that govern the work of the IAFs.

Frequency meetings

According to Vadasi et al. (2021) the practice of auditing is positively affected by the frequency of meetings. Likewise, Joshi, (2021) shows that repeated meetings between IA members, as well as repeated meetings with members of the audit committee, contribute positively to enhancing the efficiency and effectiveness of IA. Zaman and Sarens, (2013) showed that frequent meetings, whether regular or irregular, would improve the practice of IA. In contrast, Hazaea et al. (2020) showed that the meetings of the IA members and the IA committee do not have a significant impact on enhancing the performance of banks. In light of the lack of agreement between the results of the literature on the effect of the size and meetings of IA committees on enhancing the effectiveness of IA and the impact of this on enhancing the performance of banks.

The fifth hypothesis is:

H5. “The size of the IA and the frequency of meetings have a positive impact on the performance of commercial banks.”

Management support for IA

In addition to the stability of personnel in the audit process, the quality of the audit process and the continuous follow-up of the audit executives by the higher-level audit department are also key elements in improving performance (Hlaciuc, 2016). The support that the IA department receives from senior management contributes to the activation of the IAFs (D’Onza et al. 2020; Bataineh and Alrjoub, 2023). Singh et al. (2021) indicate that the support of top management for the IA department is one of the most crucial factors in enhancing the effectiveness of its practice and implementation. Likewise, Bani Ahmad et al. (2023) shows that management support has a positive effect in enhancing the effectiveness of IA. Improving business performance and financial reporting is closely related to the independence and efficiency of business leaders (Alazzabi et al. 2020; Gamayuni, 2018). The efficient implementation of internal evaluation can improve the comprehensive level of the enterprise and promote the long-term stable development of the enterprise (Alzeban and Gwilliam, 2014; Endaya and Hanefah, 2016). Tamimi (2021) suggests that top management plays an important role in supporting the IAFs to reduce the risks faced by the bank, thereby improving performance. Finally, senior management has a significant influence in activating the work of internal auditors, which contributes to enhanced performance (Madawaki et al. 2022; Alqudah et al. 2023). On the contrary, some studies such as Khanam, (2024) indicate that management support is not important in enhancing the effectiveness of IA. In light of the lack of absolute agreement regarding the effect of senior management support on IA effectiveness, this study presents the following hypothesis.

The sixth hypothesis is:-

H6. “The IA department’s top management support has a positive impact on the performance of commercial banks,”

IA performance

In addition to the direct hypotheses above, we have formulated new hypotheses to investigate the correlation between the IAS and bank performance. We have also considered the role of the moderating variable, which is represented by the performance of the internal auditors.

H7.The IAS has a positive significance on internal auditors’ performance.

H8.The IAS has a direct and positive significance on banks’ performance.

H9.There is a mediation effect of the role of effective internal auditor performance between IAS and banks’ performance.

The framework of the study is presented in Fig. 1.

Materials and Methods

Measurement

Based on the available literature, all items of this study were adapted, and some minor modifications were made to the questionnaire (Appendix 1 shows the questionnaire items and sources). The Five-Point Likert scale was used to analyze this study, which assigns the lowest value at number 1 and indicates “strongly disagree.” In contrast, the number 5 is assigned as the highest value, which indicates “strongly agree”. The study includes five questions related to demographic aspects, namely gender, education, type of job, experience, and the duration of employment in the bank. Researchers and academics can learn about the characteristics of the respondents through these questions (Al-Hattami and Kabra, 2022). These questions provide a clear context for the information obtained through the questionnaire (Allen, 2017).

Data collection

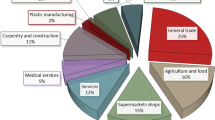

This paper is a quantitative study using a closed-ended questionnaire to collect data (Al-Hattami and Kabra, 2022). Only closed-ended questions were used to facilitate the analysis process and save time for the respondents (Mooi et al. 2018). This study focused on 34 commercial banks in 5 Arab countries. After reviewing various literature (Al-Twaijry et al. 2002; Alawaqleh, 2021; Hazaea and Zhu, 2022; Kassar et al. 2014), a total of 242 questionnaires were distributed to 170 branches of the commercial banks, and 172 responses were received. The questionnaire was distributed automatically through the Google platform, and the researchers also contacted the targeted banks by telephone. The obtained sample size is considered sufficient for the use of PLS-SEM and is expected to yield high statistical power (Henseler, 2010; Homaid, 2021). The adequacy of the collected sample was confirmed by referring to Churchill (2010) who stated that obtaining 50 to 100 responses is sufficient to estimate the results using SEM. One of the most important strengths of using PLS-SEM is its ability to produce high statistical power, even with a small sample size (Awuah et al. 2022). The use of PLS-SEM significantly contributes to the development of exploratory research and theories by providing a mechanism to predict the variation in the dependent variable (Hair et al. 2020). It is possible to estimate the PLS by ten times the maximum representative of the internal structural pathways in the underlying structure, which enables a representative sample size to be known (Gefen and Straub, 2005). Hence, the sample size employed in this paper is deemed sufficient to meet the requirements for implementing and conducting statistical tests using PLS.

Descriptive statistics

In Table 1, we examine the characteristics of the sample of respondents used in this study. The results showed that the percentage of male respondents reached (n = 131, 76.16%), while female respondents reached (n = 41. 23.84%). In terms of academic qualification, the number of questionnaires received from holders of a bachelor’s degree reached (n = 128, 74.42%), and the percentage of respondents who have a postgraduate degree reached (n = 28, 16.28%), and respondents who have a diploma qualification has reached (n = 16, 9.30%). To obtain accurate and more useful answers, the questionnaires were distributed to four specific categories (n = 98, 56.98%), responded by auditors, (n = 24, 13.95%) by accountants, finance employees (n = 44, 25.58%) and regulators (n = 6, 3.49%). In terms of measuring the experience of the respondents, the results showed that less than 3 years reached (n = 21, 12.21%), the percentage of respondents who have experienced between 3 and 6 years (n = 116, 67.44%), respondents who have experienced between 7 and 9 years (n = 20, 11.63%), and those with more than 9 years of experience (n = 15, 8.72%). In terms of years of working in the bank, the percentage of respondents who work in these banks for 3–6 years is (n = 131, 76.20%), respondents who work in these banks between 7 and 9 years (n = 13, 7.60%), respondents who work in these banks between 9 and 13 years is (n = 9, 5.20%), and respondents who work in these banks for more than 13 years is (n = 19, 11.04%). Analyzing the basic and demographic information of the respondents contributes to enhancing confidence in the data and obtaining acceptable results.

Results and discussion

Measurement model

After removing the clutter items, the measurement model is shown in Table 2. We tested the convergent validity and internal reliability of this model and it can be seen that the external loading values are between (0.459 and 0.843), as shown by the average variance extraction (AVE) value. The critical value of 0.50 has been exceeded, which confirms the validity of the internal consistency of the questionnaire. The composite reliability (CR) is certified because it takes into account that the indicators have different loadings, and its value ranges from 0.749 to 0.870. Cronbach’s alpha (CA) value of 0.6 or greater is considered acceptable in social science studies (Hazaea et al. 2021). Similarly, a CR value of 0.7 or greater is acceptable (ul Haque et al. 2019). This shows that the present model meets the conditions of convergent validity and internal reliability.

In addition to the measures mentioned above, we also calculated discriminant validity, which refers to the extent to which one construct differs from others. Hair et al. (2010) propose associating squared correlation estimates with AVE values for any two structures. Moreover, the AVE value should be higher than the squared correlation estimate. We analyzed the validity indicated by the diagonal lines in Table 3, using the cross-loading matrix and the Fornell-Larker criterion as well as Heterotrait-monotrait ratio (HTMT) (Appendix, 3), for discriminant validity. The discriminant validity assessed with the Fornell-Larcker criterion test shows that each indicator is strongly related to its associated construct. This indicates that each indicator relies more on its own underlying structure than the other indicators, as indicated by (Hilkenmeier et al. 2020).

According to cross-loading discriminant validity (see, Appendix, 2), each indicator loads greater than all of its cross-loads, indicating that each indicator is well associated with the construct it is linked to.

To measure the reliability of differences we followed the suggestion of Henseler et al. (2015), which is the use of HTMT as shown in (Appendix, 3). Results show that all values are less than the critical value of 0.90. In summary, all measures used in this paper demonstrated satisfactory validity and reliability.

Structural model

This study uses the recommended Variance Inflation Factor (VIF) value recommended by (Diamantopoulos and Siguaw, 2006; Hair et al. 2014). The results showed that the VIF values were all less than 3.3, and some other research results indicated values less than 3 (Al-Adwan et al. 2021; Legate et al. 2021). Therefore, it can be concluded that no multicollinearity occurred in the conceptual model of this study.

Furthermore, correlation analysis provides information on both the magnitude and direction of the relationship. Values of correlation coefficients above 0.80 between two or more independent variables indicate a multicollinearity problem. As a rule of thumb, multicollinearity problems may exist when the correlation values between different variables exceed 0.80. Therefore, based on the results presented in Table 4, all independent variables had low correlation, not exceeding 0.80, which indicated no multicollinearity problem in this study.

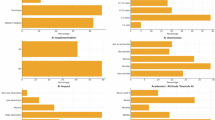

Hypotheses testing

Hypothesis 1

The results in Table 5 show that the independent variable, as determined by the SEM, has a direct effect on the coefficient of the dependent variable’s business. The results of the hypothesis test indicate that the path from the implementation of IA standards to the performance of commercial banks is positive and significant (β = 0.176, t = 2.755, P value = 0.006 < 0.05), which indicates that the implementation of IA standards significantly affects the performance of commercial banks. Therefore, H1 is accepted. We conclude that compliance with international auditing standards is one of the factors that enhances audit quality and thus positively affects the performance of commercial banks. So commercial banks that have special business needs to follow special regulations must also not exceed international IA standards.

Hypothesis 2

The results in Table 5 show that the path from the independence and objectivity of the IAFs to the performance of commercial banks is positive and significant (β = 0.164, t = 2.325, P value = 0.020 < 0. The independence and objectivity of the IAFs have a significant impact on the performance of commercial banks. Therefore, H2 is accepted. The findings confirm the importance of internal auditors’ independence and objectivity in practicing tasks related to the performance of the IAFs, which may contribute to improving the quality of IA, thereby enhancing the business and the overall performance of banks. So, the management of commercial banks should strive to support the independence of the department and not interfere with its work.

Hypothesis 3

Table 5 shows (β = 0.036, t = 0.489, P value = 0.625 > 0.05), that the path from the professional ability of IA to the performance of commercial banks is positive but not significant. There is no significant impact on the performance of commercial banks. Therefore H 3 is not acceptable. This refers to what was discussed in the previous section, which sheds light on IA practices in Arab countries’ overall lack of development. This may be due to the family ownership of the firms, the interference of the political system in the agency’s work of regulating practice, and the reluctance of the owners’ stakeholders to spend money on the audit function because they believe accountants can perform the duties of internal auditors. Additionally, a lack of understanding of the importance of the IAFs also played a role in respondents not accepting this hypothesis. These results are consistent with some recently published studies, such as (Alzeban and Gwilliam, 2014; Hazaea and Zhu, 2022; Thomran, 2020).

Hypothesis 4

Table 5 shows that the path from female representation in the IA department to the performance of commercial banks is positive and significant (β = 0.298, t = 5.166, P value = 0.000 < 0.05). This indicates that the IA department’s female representatives significantly impact the performance of commercial banks. Therefore, H4 is accepted. The presence of a female in banks’ IA department and finance department has a positive and effective effect on improving performance. So, the results of this study can remove the ambiguity of inconsistency between some previous research results. We conclude that commercial banks in Arab countries should work to develop regulations that regulate women’s work as auditors or in finance departments, which will help improve performance.

Hypothesis 5

Table 5 shows that the path from the size and meeting frequency of the IA department to the performance of commercial banks is positive and significant (β = 0.139, t = 2.044, P value = 0.041 < 0.05). This indicates that the IA department size and frequency of meetings significantly impact the performance of commercial banks. Therefore, H5 is accepted. In addition, the frequency of meetings is also one of the factors that can help strengthen and improve the performance of the IA department, which can help improve the performance of commercial banks.

Hypothesis 6

Table 5 shows that the path from top management support of the IA department to the performance of commercial banks is positive and significant (β = 0.205, t = 2.424, P value = 0.015 < 0.05). This indicates that top management’s support of the IA department has a significant impact on the performance of commercial banks. Therefore, H6 is accepted. As a result, commercial banks’ management must ensure the provision of all ethical elements for the IA department. Additionally, the management of commercial banks should work towards enhancing the independence of the IA department and offering auditors various training courses. These measures will help improve audit performance and ultimately enhance the overall performance of commercial banks (Fig. 2).

From the above path coefficient analysis, it can be seen that except for the path from the professional ability of internal auditors to the performance of commercial banks, which is positive but not significant, all the paths from independent variables to dependent variables are positive and significant. The independent factors explain 47% of the dependent variable commercial bank performance, which is considered an average explanation according to the R2 value of 0.477(Chin et al. 1998; Nakagawa and Schielzeth, 2013).

Goodness of Fit (GoF) evaluation

There is no global fit metric in PLS, but researchers propose a global GoF, defined as the geometric mean of the endogenously constructed AVE mean and R2 mean (Datsiou and Overend, 2018; Tenenhaus et al. 2005), based on the calculation formula

This study adopted the criteria of Wetzels et al. (2009) which point out three boundaries of GoF, that is, “0.1” means “small GoF”; “0.25” means “medium GoF”; and “0.36” means “big GoF”. According to the above formula, the GoF is calculated as a GoF of 0.507.

This value belongs to the GoF (higher). Therefore, it can be concluded that the applicability of this model is properly established.

The moderating effect of IA performance

Moderation models refer to mechanisms that attempt to identify and explain the observed relationship between two variables by adding a third variable, a so-called moderating variable. This model assumes that the independent variable affects the moderating variable, and the moderating variable affects the dependent variable. it aims to understand the known relationship by exploring the basic mechanism or process through which variable X influences variable Y (Ballen and Salehi, 2021).

There are several common methods for testing and analyzing moderation, the most important of which is the moderation analysis method proposed by (Baron and Kenny, 1986) known as the causal step method. Additionally, there is the approach of Preacher and Hayes (2008) which is a simple approach that relies on two preconditions for moderation. The first precondition is that the indirect effect of priming is significant (which was not achieved in this study). The second precondition is the use of bootstrapped intervals (lower and upper bounds). Hubona and Belkhamza (2021) review previous research on conditioning analysis and provide corresponding guidelines for future research. The authors describe two non-regulatory types (Hair et al. 2014).

The direct effect is significant, but the moderating variable is not significant. The direct effect is significant, but the indirect effect is not significant. No effect: Neither the direct nor indirect effects are significant (Normal). In addition, they identified three types of conditioning (Hair et al. 2014; Hair, 2017). i.e., “Complementary regulation: both the indirect and direct effects are significant and point in the same direction as competitive regulation. Both the indirect and direct effects are significant and point in opposite directions. Only indirect moderation: the indirect effect is significant, but the direct effect is not”. From the adjustment results below, it can be seen that there is no adjustment in the studied model. Its type is direct only non-adjustment. The direct effect is significant, but the indirect effect is not significant(see. Figure 3).

Table 6, tests the moderating effect of the role of effective IA performance between IAS and banks’ performance. The results show that the direct effect of the IAS on the moderating variable (IA performance) is positive and significant (β = 0.385, t = 4.642, P value = 0.000 < 0.05). The results also showed that the direct effect of the moderating variable (IA performance) on performance is negative but not significant (β = −0.024, t = 0.389, P = 0.697 > 0.05). The direct impact of IAS on banks’ performance is positive and significant (β = 0.671, t = 11.980, P value = 0.000 < 0.05). Additionally, the results show that in the presence of (IA performance), the indirect effect from IAS as independent variables on banks’ performance as dependent variables is negative and insignificant (β = −0.009, t = 0.369, P value = 0.712 > 0.05). From this result, it can be seen that the first intermediary condition is not satisfied, so the null hypothesis is accepted.

According to the R2 coefficient of determination value of 0.43, the adjustment model explains the variance of performance at 0.43, which is an average explanation (Chin et al. 1998). According to the value f2, it is clear that the contribution of the moderating variable to the coefficient of determination does not affect the explained variance. The contribution of the IAS to the value of the coefficient of determination is the highest (0.683). The Q2 value was 0.142, which was above the standard limit, indicating that the path model was adequate for predicting the relevance of the dependent variable. We note that by performing an SEM-based analysis, seven hypotheses were accepted, and two were rejected.

Conclusion and limitations

In recent years, the business environment has become highly competitive and fraught with risks due to the complex and unsimplified regulatory framework that all parties must adhere to. However, every organization faces some level of risk in its daily operations, while others stand out from their competitors by developing strategic plans that effectively address potential threats. Thus, IA is one of the main strategies for ensuring good governance and providing owners and stakeholders with accurate information about the institution’s status. This study aimed to investigate the influence of IAS on the performance of banks in 5 less developed Arab countries. Research and knowledge in this field are very limited. As a result of the limited literature available on this subject, especially in banks in developing countries, the findings of this paper are highly significant in addressing the research gap. The results of the study indicate that adherence to IA standards, the independence and objectivity of internal auditors, gender diversity, appropriate size and meeting frequency, and the support of senior management are crucial factors in improving the effectiveness of IAFs, and thus enhancing the performance of commercial banks. In addition, the results show that the qualifications of internal auditors do not affect the strengthening of the IAS. Moreover, the study results show that there is a significant direct effect between the IAS and the performance of banks. However, there is no effect on the performance of internal auditors as a moderating variable to enhance the relationship between the IAS and banks’ performance. Finally, the results show that the IAS directly affects the performance of the internal auditors.

This paper is limited to investigating the relationship between IAS and the performance of commercial banks. The data was collected through questionnaire surveys from only five Arab countries. Therefore, future research can be expanded by increasing the number of countries where studies can be conducted. Additionally, future research could incorporate additional factors. The effectiveness of practicing the IAFs can be measured through various factors, including the nature of the political system, cultural differences, and their impact on the effectiveness of practicing the IAFs. On the one hand, future studies can conduct investigations similar to ours and replicate the same procedures, but with a focus on collecting data from other regions such as Europe and Africa. This would allow for a comparison of results and an examination of the various factors (cultural, political, economic, and social) that influence the implementation of IAFs. Finally, commercial banks operating in the countries surveyed may be restricted. Future research could expand the inclusion of commercial companies and institutions of all kinds, which may expand the full understanding of the importance of the IAFs in improving performance.

Implications

Theoretical implications

This study has made several theoretical contributions, the most important of which is as follows: Firstly, this study enhances the existing IA literature and clarifies its role in improving performance based on data from organizational and cultural environments where the practice of IA is still in the emerging stage. This contributes to enhancing knowledge and understanding of the factors that can enhance the effectiveness of the IAF. Secondly, this study also contributes to the literature by clarifying the integration of all factors that can enhance IA effectiveness, including new drivers (such as the presence of females) and key factors such as independence and competence. Thirdly, the results of this study can provide a baseline for future literature as we have investigated multiple factors based on a set of theoretical foundations such as agency theory, resource-based theory, and social categorization theory which support gender diversity in organizations. Fourthly, It should be noted that this study is one of the few studies that use a sample from a group of different countries, given that most of the previous literature took samples from only one Arab country. It is expected that the results will serve as a factor in encouraging organizational commitment to international standards, promoting gender diversity, and strengthening the auditing profession through training auditors. Finally, the results can be applicable to various emerging contexts.

Practical implications

First, this paper has different implications for scholars who conduct theoretical research on improving the IAFs and their practice. Government agencies, stakeholders, and commercial banks interested in the IAFs of commercial banks can assess the current state of IA and the role of IA in Arab countries. Therefore, effective IAS should adhere to international standards that regulate IA practices, support the independence of internal auditors, and employ internal auditors who are proficient in modern systems and have professional accounting, and financial capabilities. Additionally, there should be gender diversity within the audit department. Furthermore, the number of members in the audit committee is appropriate, and the senior management of commercial banks supports the IA department. The presence of these elements helps activate the IAFs, thereby enhancing the performance of commercial banks. Second, this study has certain reference value for scholars, policymakers, government agencies, international investment institutions, and commercial bank management. It aims to strengthen the policies that all parties can follow in improving performance through the research presented in this paper and strengthen and clarify the importance of IAFs in improving the performance of commercial banks. The results of this paper are available for use by the IIA, which has published numerous reports on the practice of IAFs in Arab countries, as it is one of the locations that has made a significant contribution to the practice of IAFs in recent years. In addition, central banks can utilize the results of this paper to assess the reality of commercial banks’ IAFs practices and work towards developing policies and procedures to strengthen and activate IA, thereby contributing to the improvement of commercial banks’ performance. Third, this paper also presents the current state of IA in Arab countries, which may be beneficial for all stakeholders in strengthening procedures and regulations for the development and activation of IA practice.

Data availability

All data generated or analyzed during this study are included in this published article and its supporting information files.

References

Abbott LJ, Daugherty B, Parker S, Peters GF (2015) Internal Audit Quality and Financial Reporting Quality: The Joint Importance of Independence and Competence. J Account Res 54(1):3–40. https://doi.org/10.2139/ssrn.2673280

Abd M, Bandar A-H, Qasim Kuaiber M, Almaliki OJ (2021) The impact of the internal audit system on improving the quality of banking service in commericial banks. PalArch’s J Archaeol Egypt/Egyptol 18(1):1009–1023

Abuazza WO, Mihret DG, James K, Best P (2015) The perceived scope of internal audit function in libyan public enterprises. Manag Audit J 30(6–7):560–581. https://doi.org/10.1108/MAJ-10-2014-1109

Adams MB (1994) Agency Theory and the Internal Audit. Manag Audit J 9(8):8–12. https://doi.org/10.1108/02686909410071133

Ahern KR, Dittmar AK (2012) The changing of the boards: The impact on firm valuation of mandated female board representation. Q J Econ 127(1):137–197. https://doi.org/10.1093/qje/qjr049

Ahmed MI, Che-Ahmad A (2016) Effects of corporate governance characteristics on audit report lags. Int J Econ Financ Issues 6(7):159–164

Ahmeti A, Ahmeti S, Aliu M (2022) Effect of Internal Audit Quality on the Financial Performance of Insurance Companies: Evidence from Kosovo. Int J Appl Econ, Financ Account 12(2):63–68. https://doi.org/10.33094/ijaefa.v12i2.551

Akaah IP (1989) Differences in research ethics judgments between male and female marketing professionals. J Bus Ethics 8(5):375–381. https://doi.org/10.1007/BF00381729

Al-Absy MSM, Ismail KNIK, Chandren S, Al-Dubai SAA (2020) Involvement of board chairmen in audit committees and earnings management: Evidence from Malaysia. J Asian Financ, Econ Bus 7(8):233–246. https://doi.org/10.13106/JAFEB.2020.VOL7.NO8.233

Al-Adwan AS, Albelbisi NA, Hujran O, Al-Rahmi WM, Alkhalifah A (2021) Developing a Holistic Success Model for Sustainable E-Learning: A Structural Equation Modeling Approach. Sustainability 13(16):9453. https://doi.org/10.3390/su13169453

Al-Akra M, Abdel-Qader W, Billah M (2016) Internal auditing in the Middle East and North Africa: A literature review. J Int Account, Audit Tax 26:13–27. https://doi.org/10.1016/j.intaccaudtax.2016.02.004

Al-Hattami HM, Kabra JD (2022) The influence of accounting information system on management control effectiveness: The perspective of SMEs in Yemen. Inf Dev 40(1):75–93. https://doi.org/10.1177/02666669221087184

Al-Sorihi SAA, Al-Salafi HSAM (2019) Impact of Effectiveness and Efficiency of Internal Audit on Improving Financial Performance: A Field Study in Banks Operating in Yemen. J Soc Stud 25(4):57–82

Al-Twaijry AAM, Brierley JA, Gwilliam DR (2002) An examination of the role of audit committees in the Saudi Arabian corporate sector. Corp Gov 10(4):288–297. https://doi.org/10.1111/1467-8683.00293

Alawaqleh QA (2021) The Effect of Internal Control on Employee Performance of Small and Medium-Sized Enterprises in Jordan: The Role of Accounting Information System,. J Asian Financ, Econ Bus 8(3):855–863. https://doi.org/10.13106/jafeb.2021.vol8.no3.0855

Alazzabi WYE, Mustafa H, Karage AI (2020) Risk management, top management support, internal audit activities and fraud mitigation. J Financ Crime 30(2):569–582. https://doi.org/10.1108/JFC-11-2019-0147

Ali K, Mustafa E, Hanefah M (2013) Internal Audit Effectiveness: An Approach Proposition to Develop the Theoretical Framework. Res J Financ Account 4(10):92–103

Allen M (2017) The SAGE Encyclopedia of Communication Research Methods. SAGE Publications,, 2455 Teller Road, Thousand Oaks California 91320, 10.4135/9781483381411

Alqudah H, Amran NA, Hassan H, Lutfi A, Alessa N, Alrawad M, Almaiah MA (2023) Examining the critical factors of internal audit effectiveness from internal auditors’ perspective: Moderating role of extrinsic rewards. Heliyon 9(10):e20497. https://doi.org/10.1016/j.heliyon.2023.e20497

Alqudah HM, Amran NA, Hassan H (2019) Factors affecting the internal auditors’ effectiveness in the Jordanian public sector: The moderating effect of task complexity. EuroMed J Bus 14(3):251–273. https://doi.org/10.1108/EMJB-03-2019-0049

Alzeban A (2023) Internal audit findings, audit committees, and firm performance evidence from UK. Asia-Pac J Account Econ 30(4):868–889. https://doi.org/10.1080/16081625.2021.1908153

Alzeban A, Gwilliam D (2014) Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. J Int Account, Audit Tax 23(2):74–86. https://doi.org/10.1016/j.intaccaudtax.2014.06.001

Amoako GK, Bawuah J, Asafo-Adjei E, Ayimbire C (2023) Internal audit functions and sustainability audits: Insights from manufacturing firms. Cogent Bus Manag 10(1):2192313. https://doi.org/10.1080/23311975.2023.2192313

Anderson RC, Mansi SA, Reeb DM (2004) Board characteristics, accounting report integrity, and the cost of debt. J Account Econ 37(3):315–342. https://doi.org/10.1016/j.jacceco.2004.01.004

Arena M, Arnaboldi M, Azzone G (2006) Internal audit in Italian organizations. A multiple case study. Manag Audit J 21(3):275–292. https://doi.org/10.1108/02686900610653017

Aridaha MW, Kamila GA, Ahmad A (2021) How Audit Committees in Companies Improve Internal Audit and Its Reflection on Financial Reports. Account Manag Inf Syst 1(1):289–301

Asiligwa M, Rennox G (2017) The Effect of Internal Controls on the Financial Performance of Commercial Banks in Kenya. IOSR J Econ Financ 08(03):92–105. https://doi.org/10.9790/5933-08030492105

Awuah B, Onumah JM, Duho KCT (2022) Determinants of adoption of computer‐assisted audit tools and techniques among internal audit units in Ghana. Electron J Inf Syst Dev Ctries 88(2):e12203. https://doi.org/10.1002/isd2.12203

Ballen CJ, Salehi S (2021) Mediation Analysis in Discipline-Based Education Research Using Structural Equation Modeling: Beyond “What Works” to Understand How It Works, and for Whom. J Microbiol Biol Educ 22(2):1–6. https://doi.org/10.1128/jmbe.00108-21

Bame-Aldred CW, Brandon DM, Messier WF, Rittenberg LE, Stefaniak CM (2013) A summary of research on external auditor reliance on the internal audit function. Auditing 32(1):251–286. https://doi.org/10.2308/ajpt-50342

Bani Ahmad (Ayassrah) AYA, Bani Atta AAM, Alawawdeh HA, Aljundi NA, Morshed A, Dahbour SA, Alqaraleh MH (2023) The Effect of System Quality and User Quality of Information Technology on Internal Audit Effectiveness in Jordan, And the Moderating Effect of Management Support. Appl Math Inf Sci 17(5):859–866. https://doi.org/10.18576/AMIS/170512

Barney J, Wright M, Ketchen DJ (2001) The resource-based view of the firm: Ten years after 1991. J Manag 27(6):625–641. https://doi.org/10.1177/014920630102700601

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J Personal Soc Psychol 51(6):1173

Bataineh A, Alrjoub A (2023) Impact of ERP systems on the internal auditing effectiveness in light of governance mechanisms: evidence from Jordan. Int J Process Manag Benchmarking 13(4):571–585. https://doi.org/10.1504/IJPMB.2023.129823

BCBS B. C. on B. S. (2012) Bank for International Settlement: The internal audit function in banks. Bank for International Settlements, 1–23. https://www.bis.org/publ/bcbs230.pdf

Biason RS (2020) The effect of job satisfaction on employee retention. Int J Econ, Commer Manag 8(3):405–413

Bouaziz Z (2012) The Impact of the Presence of Audit Committees on the Financial Performance of Tunisian Companies. Int J Manag Bus Stud 2(4):57–64

Bryson JM, Ackermann F (2007) Putting the resource‐based view of strategy and distinctive competencies to work in public organizations. Public Adm Rev 67(4):702–717

Chae S-J, Nakano M, Fujitani R (2020) Financial Reporting Opacity, Audit Quality and Crash Risk: Evidence from Japan. J Asian Financ, Econ Bus 7(1):9–17. https://doi.org/10.13106/jafeb.2020.vol7.no1.9

Chang Y-T, Chen H, Cheng RK, Chi W (2019) The impact of internal audit attributes on the effectiveness of internal control over operations and compliance. J Contemp Account Econ 15(1):1–19. https://doi.org/10.1016/j.jcae.2018.11.002

Chijoke-Mgbame AM, Boateng A, Mgbame CO (2020) Board gender diversity, audit committee and financial performance: evidence from Nigeria. Account Forum 44(3):262–286. https://doi.org/10.1080/01559982.2020.1766280

Chin WW, Chinn WW, Chin WW (1998) The partial least squares approach to structural equation modelling. In Marcoulides GA (Ed.). Mod Methods Bus Res 295(2):295–336

Churchill GAID. (2010) Marketing research: Methodological foundations. Mason: South-Western Cengage Learning

CIA. (2021) Internal Audit and Diversity: Why Is It Important and How Can It Be Achieved? https://www.google.com/url?q=https://www.careersinaudit.com/article/internal-audit-anddiversity/&sa=U&ved=2ahUKEwi2gfqYkZ34AhVKEKYKHZwlBfA4ChAWegQIARAC&usg =AOvVaw3W6MHYdz4IsoF

CIIA. (2017) What is internal audit? Retrieved 16 October 2022 from https://na.theiia.org/about-us/about-ia/Pages/frequently-asked-questions.aspx.2017

D’Onza G, Sarens G, DeSimone S (2020) Factors that Influence the Internal Audit Function’s Maturity. Account Horiz 34(4):57–74. https://doi.org/10.2308/HORIZONS-18-127

Darmadi S (2013) Do women in top management affect firm performance? Evidence from Indonesia. Corp Gov: Int J Bus Soc 13(3):288–304. https://doi.org/10.1108/CG-12-2010-0096

Datsiou KC, Overend M (2018) Weibull parameter estimation and goodness-of-fit for glass strength data. Struct Saf 73:29–41. https://doi.org/10.1016/j.strusafe.2018.02.002

Dawson LM (1997) Ethical differences between men and women in the sales profession. J Bus Ethics 16(11):1143–1152. https://doi.org/10.1023/A:1005721916646

Dharmadasa P, Gamage P, Herath SK (2014) Corporate governance, board characteristics and firm performance: Evidence from Sri Lanka. South Asian J Manag 21(1):7–31

Diamantopoulos A, Siguaw JA (2006) Formative Versus Reflective Indicators in Organizational Measure Development: A Comparison and Empirical Illustration. Br J Manag 17(4):263–282. https://doi.org/10.1111/j.1467-8551.2006.00500.x

Dianita M (2015) Role of the Internal Auditor Influence and Good Corporate Governance in Banking Financial Performance Against State Owned Corporation. Int J Bus Adm Stud 1(4):176–179. https://doi.org/10.20469/ijbas.10006-4

Dinu V, Bunea M (2018) The Impact of the Gender Diversity on the Romanian Banking System Performance”,. Transform Bus Econ 17(2):42–59

Drakos AA, Bekiris FV (2010) Endogeneity and the relationship between board structure and firm performance: a simultaneous equation analysis for the Athens Stock Exchange. Manag Decis Econ 31(6):387–401. https://doi.org/10.1002/mde.1492

Endaya KA, Hanefah MM (2016) Internal auditor characteristics, internal audit effectiveness, and moderating effect of senior management. J Econ Adm Sci 32(2):160–176. https://doi.org/10.1108/JEAS-07-2015-0023

Erasmus L, Coetzee P (2018) Drivers of stakeholders’ view of internal audit effectiveness. Manag Audit J 33(1):90–114. https://doi.org/10.1108/MAJ-05-2017-1558

Fatah NA (2021) The Role of Internal Audit on Financial Performance Under IIA Standards: A Survey Study of Selected Iraqi Banks. Qalaai Zanist Sci J 6(2):1028–1048. https://doi.org/10.25212/lfu.qzj.6.2.38

Ferrary M, Déo S (2023) Gender diversity and firm performance: when diversity at middle management and staff levels matter. Int J Hum Resour Manag 34(14):2797–2831. https://doi.org/10.1080/09585192.2022.2093121

Fin AJMA (2020) Effect of audit quality on financial performance of listed manufacturing firms in Nigeria (2006–2016). Adv J Manag, Account Financ 5(1):1–12

Gamayuni RR (2018) The effect of internal auditor competence and objectivity, and management support on effectiveness of internal audit function and financial reporting quality implications at local government. Int J Economic Policy Emerg Economies 11(3):248–261. https://doi.org/10.1504/IJEPEE.2018.093951

Gefen D, Straub D (2005) A Practical Guide To Factorial Validity Using PLS-Graph: Tutorial And Annotated Example Commun Associat Inform Syst 16(1):91–109. https://doi.org/10.17705/1CAIS.01605

Getie Mihret D, James K, Mula JM (2010) Antecedents and organisational performance implications of internal audit effectiveness: Some propositions and research agenda. Pac Account Rev 22(3):224–252. https://doi.org/10.1108/01140581011091684

Grant J (1988) Women as managers: What they can offer to organizations. Organ Dyn 16(3):56–63. https://doi.org/10.1016/0090-2616(88)90036-8

Grant RM (1991) The resource-based theory of competitive advantage: implications for strategy formulation. Calif Manag Rev 33(3):114–135

Gras-Gil E, Marin-Hernandez S, de Lema DGP (2012) Internal audit and financial reporting in the Spanish banking industry. Manag Audit J 27(8):728–753. https://doi.org/10.1108/02686901211257028

Green CP, Homroy S(2018) Female directors, board committees and firm performance Eur Econ Rev 102(1):19–38.https://doi.org/10.1016/j.euroecorev.2017.12.003

Grima S, Baldacchino PJ, Grima S, Kizilkaya M, Tabone N, Ellul L (2023) Designing a Characteristics Effectiveness Model for Internal Audit. J Risk Financ Manag 16(2):56. https://doi.org/10.3390/jrfm16020056

Hair JF, Black WC, Babin BJ, A RE (2010) Multivariate Data Analysis: A Global Perspective. Prentice Hall, Upper Saddle River, NJ

Hair JF, Hult GTM, Ringle CM Sarstedt M (2014) A Primer on Partial Least Squares (PLS)Structural Equation Modeling, Sage, Los Angeles, CA

Hair JF, Howard MC, Nitzl C (2020) Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J Bus Res 109:101–110. https://doi.org/10.1016/j.jbusres.2019.11.069

Hair Jr, JF (2017) A primer on partial least squares structural equation modeling (PLS-SEM). Second Edition. Sage publications

Handoyo S (2024) Mapping the landscape of internal auditing effectiveness study: a bibliometric approach. Cogent Bus Manag 11(1):2289200. https://doi.org/10.1080/23311975.2023.2289200

Hardies K, Breesch D, Branson J (2016) Do (Fe)Male Auditors Impair Audit Quality? Evidence from Going-Concern Opinions. Eur Account Rev 25(1):7–34. https://doi.org/10.1080/09638180.2014.921445

Hazaea SA, Al-Matari EM, Khatib SFA, Albitar K, Zhu J (2023) Internal Auditing in the Arab World: A Systematic Literature Review and Directions for Future Research. SAGE Open 13(4):1–22. https://doi.org/10.1177/21582440231202332

Hazaea SA, Tabash MI, Khatib SFA, Zhu J, Al-kuhali AA (2020) The Impact of Internal Audit Quality on Financial Performance of Yemeni Commercial Banks: An Empirical Investigation. J Asian Financ, Econ Bus 7(11):867–875. https://doi.org/10.13106/jafeb.2020.vol7.no11.867

Hazaea SA, Tabash MI, Zhu J, Khatib SFA, Farhan NHS (2021) Internal audit and financial performance of Yemeni commercial banks: Empirical evidence. Banks Bank Syst 16(2):137–147. https://doi.org/10.21511/bbs.16(2).2021.13

Hazaea SA, Zhu J (2022) Internal audit system and financial corruption in public institutions: case study of Yemeni public telecommunication corporation. Int J Bus Excell 27(3):360–386. https://doi.org/10.1504/IJBEX.2022.124541

Henseler J (2010) On the convergence of the partial least squares path modeling algorithm. Computational Stat 25(1):107–120. https://doi.org/10.1007/s00180-009-0164-x

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43(1):115–135. https://doi.org/10.1007/s11747-014-0403-8

Hilkenmeier F, Bohndick C, Bohndick T, Hilkenmeier J (2020) Assessing Distinctiveness in Multidimensional Instruments Without Access to Raw Data – A Manifest Fornell-Larcker Criterion. Front Psychol 11:504969. https://doi.org/10.3389/fpsyg.2020.00223

Hlaciuc E (2016) The Challenges Of Corporate Governance And Audit In Relation To Financial Performance–Trends, Limitations And Directions To Follow. USV Ann Econ Public Adm 16(2):126–136

Homaid AA (2021) Information communication technology acceptance and usage in the microfinance sector: The perspective of least developed countries. Inf Dev 38(4):549–569. https://doi.org/10.1177/02666669211009932

Hubona G, Belkhamza Z (2021) Testing a moderated mediation in PLS-SEM: A full latent growth approach. Data Anal Perspect J 2(4):1–5

IIA. (2016) Definition of Internal Auditing. https://na.theiia.org/standards-guidance/mandatoryguidance/Pages/Definition-of-Internal-Auditing.aspx

IIA. (2017) International standards for the professional practice of internal auditing. Institute of Internal Auditors (IIA) Report. https://www.theiia.org/en/content/guidance/mandatory/standards/international-standards-for-the-professional-practice-of-internal-auditing/

Ittonen K, Miettinen J, Vähämaa S (2010) Does Female Representation in Audit Committees Affect Audit Fees? Q J Financ Account 49(3–4):113–139. https://doi.org/10.2307/23074633

Jehn KA, Northcraft GB, Neale MA (1999) Why differences make a difference: A field study of diversity, conflict, and performance in workgroups. Adm Sci Q 44(4):741–763. https://doi.org/10.2307/2667054

Jensen MC, Meckling WH (1976) Theory of the firm: Managerial behavior, agency costs and ownership structure. J Financial Econ 3(4):305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Joshi PL (2021) Determinants Affecting Internal Audit Effectiveness. EMAJ: Emerg Mark J 10(2):10–17. https://doi.org/10.5195/emaj.2020.208

Kaaroud MA, Mohd Ariffin N, Ahmad M (2020) The extent of audit report lag and governance mechanisms. J Islamic Account Bus Res 11(1):70–89. https://doi.org/10.1108/JIABR-05-2017-0069

Kasiva, MV (2012). The impact of risk-based audit on financial performance in commercial banks in Kenya. University of Nairobi

Kassar ANEl, Elgammal W, Bayoud MM (2014) Effect of internal audit function on corporate governance quality: evidence from Lebanon. Int J Corp Gov 5(1/2):103–117. https://doi.org/10.1504/ijcg.2014.062349

Khan U, Liu W (2023) The role of internal auditing on corporate governance: its effects of economic and environmental performance. Environ Sci Pollut Res 30(52):112877–112891. https://doi.org/10.1007/s11356-023-30363-5

Khanam Z (2024) Effectiveness of internal auditing from the lens of internal audit factors: empirical findings from the banking sector of Bangladesh. J. Financial Crime. Vol. ahead-of-print No. ahead-of-print, https://doi.org/10.1108/JFC-11-2023-0299

Kruger HA, Steyn PJ, Kearney W (2002) Determinants of internal audit efficiency. South Afr J Bus Manag 33(3):53–62. https://doi.org/10.4102/sajbm.v33i3.705

Lambekova AN, Temirbekova LA, Syzdykova EZ (2020) Internal audit of banks: methodological model for reducing credit risk (Logit model). Bull Karaganda Univ Econ Ser 97(1):66–74

Lee KW, Thong TY (2023) Board gender diversity, firm performance and corporate financial distress risk: international evidence from tourism industry. Equality Diver Incl: Int J 42(4):530–550. https://doi.org/10.1108/EDI-11-2021-0283

Legate AE, Hair JF, Chretien JL, Risher JJ (2021) PLS‐SEM: Prediction‐oriented solutions for HRD researchers. Hum Resour Dev Q 34(1):91–109. https://doi.org/10.1002/hrdq.21466

Lenz R, Sarens G, Jeppesen KK (2018) In search of a measure of effectiveness for internal audit functions: An institutional perspective. Edpacs 58(2):1–36. https://doi.org/10.1080/07366981.2018.1511324

Luh PK (2024) Gender of firm leadership, audit committee gender diversity and audit quality through the lens of audit fee: a Ghanaian insight. Gend Manag: Int J 39(3):388–408. https://doi.org/10.1108/GM-06-2022-0215

Madawaki A, Ahmi A, Ahmad HN (2022) Internal audit functions, financial reporting quality and moderating effect of senior management support. Meditari Account Res 30(2):342–372. https://doi.org/10.1108/MEDAR-04-2020-0852

Misganaw T (2016) Factors Determining Effectiveness of Internal Audit in Ethiopian Commercial Banks. Addis Ababa University, Addis Ababa, Ethiopia

Mooi E, Sarstedt M, Mooi-Reci I (2018) Market Research: The Process, Data, and Methods Using Stata. Springer Nature, Singapore

Mustari K, Rusibana C, Nzamalu A (2020) Internal Audit Profession And Financial Performance In Commercial Banks In Rwanda. J Adv Res Bus Manag Account (ISSN: 2456-3544) 6(10):12–20. https://doi.org/10.53555/nnbma.v6i10.924

Nakagawa S, Schielzeth H (2013) A general and simple method for obtaining R 2 from generalized linear mixed-effects models. Methods Ecol Evol 4(2):133–142. https://doi.org/10.1111/j.2041-210x.2012.00261.x

Newman W, Comfort M (2018) Investigating the value creation of internal audit and its impact on company performance. Acad Entrepreneurship J 24(3):1–21

Ofoeda I, Commey J, Osabutey W, Afoley L (2020) Effects of Internal Audit Committee Size on Profitability. Int J Acad Res Bus Soc Sci 10(5):221–228. https://doi.org/10.6007/IJARBSS/v10-i5/7189

Ojeka S, Iyoha FO, Obigbemi IF (2014) Effectiveness of audit committee and firm financial performance in Nigeria: an empirical analysis. J Account Audit 1(1):1–11

Oussii AA, Boulila Taktak N (2018) The impact of internal audit function characteristics on internal control quality. Manag Audit J 33(5):450–469. https://doi.org/10.1108/MAJ-06-2017-1579

Oyewumi HK, Ayoib CAB, Popoola OMJ (2023) Internal auditors without proficiency: a giraffe without a neck. Int J Account Audit Perform Eval 19(1):1–21. https://doi.org/10.1504/IJAAPE.2023.130526

Parker S, Johnson LA (2017) The Development of Internal Auditing as a Profession in the U.S. During the Twentieth Century. Account Historians J 44(2):47–67. https://doi.org/10.2308/aahj-10549

Postula M, Irodenko O, Dubel P (2020) Internal Audit as a Tool to Improve the Efficiency of Public Service. Eur Res Stud J XXIII(Issue 3):699–715. https://doi.org/10.35808/ersj/1663

Prasad N, Hay D, Chen L (2021) Internal audit use, earnings quality and external audit fees. Pac Account Rev 33(4):474–504. https://doi.org/10.1108/PAR-04-2020-0050

Preacher KJ, Hayes AF (2008) Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav Res Methods 40(3):879–891. https://doi.org/10.3758/BRM.40.3.879

Rahman HU, Ali A (2022) Revisiting the role of audit and compensation ‘committees’ characteristics in the financial performance of the non-financial sector through the lens of the difference generalised method of moments. Cogent Business & Management, 9(1). https://doi.org/10.1080/23311975.2022.2085365

Shuwaili AMJ, Hesarzadeh R, Bagherpour Velashani MA (2023) Designing an internal audit effectiveness model for public sector: qualitative and quantitative evidence from a developing country. J Facilit Manage Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JFM-07-2022-0077

Singh KSD, Ravindran S, Ganesan Y, Abbasi GA, Haron H (2021) Antecedents and internal audit quality implications of internal audit effectiveness. Int J Bus Sci Appl Manag 16(2):1–21

Tamimi O (2021) The Role of Internal Audit in Risk Management from the Perspective of Risk Managers in the Banking Sector. Australas Bus, Account Financ J 15(2):114–129. https://doi.org/10.14453/aabfj.v15i2.8

Tenenhaus M, Vinzi VE, Chatelin Y-M, Lauro C (2005) PLS path modeling. Computational Stat Data Anal 48(1):159–205. https://doi.org/10.1016/j.csda.2004.03.005

Thomran M (2020) Challenges faced the internal audit profession in Yemen. Int J Manag 11(9):1018–1026. https://doi.org/10.34218/IJM.11.9.2020.096

Ujunwa A (2012) Board characteristics and the financial performance of Nigerian quoted firms. Corp Gov: Int J Bus Soc 12(5):656–674. https://doi.org/10.1108/14720701211275587

ul Haque A, Nair SLS, Kucukaltan B (2019) Management and administrative insight for the universities : High stress low satisfaction and commitment. Pol J Manag Stud 20(2):236–255. https://doi.org/10.17512/pjms.2019.20.2.20

Vadasi C, Bekiaris M, Koutoupis AG (2021) The impact of audit committee characteristics on internal audit professionalization: empirical evidence from Greece. Account Res J 34(5):447–470. https://doi.org/10.1108/ARJ-05-2020-0091

Weekes‐Marshall D (2020) The role of internal audit in the risk management process: A developing economy perspective. J Corp Account Financ 31(4):154–165. https://doi.org/10.1002/jcaf.22471

Wetzels, Odekerken-Schröder, van Oppen (2009) Using PLS Path Modeling for Assessing Hierarchical Construct Models: Guidelines and Empirical Illustration. MIS Q 33(1):177–195. https://doi.org/10.2307/20650284

Zaman M, Sarens G (2013) Informal interactions between audit committees and internal audit functions: Exploratory evidence and directions for future research. Manag Auditing J 28(6):495–515. https://doi.org/10.1108/02686901311329892

Acknowledgements

The authors extend their appreciation to the Deanship of Scientific Research at King Khalid University for funding this work through a large-group Research Project under grant number (RGP.2/131/45).

Author information

Authors and Affiliations

Contributions

Conceptualization, SAH, EMA-M, and AMO; methodology, SAH and NHSF; software, SAH and EMA-M; validation, JZ and AMO; formal analysis, SAH and NHSF investigation, EMA-M and AMO; resources, SAH and EMA-M; data curation, SAH and JZ; writing—original draft preparation, SAH.; writing—review and editing, EMA-M and JZ.; visualization, SAH and NHSF; supervision, JZ.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interest.

Ethical approval