Abstract

Corporate tax avoidance is a significant international issue, resulting in annual losses of USD 100–240 billion for governments globally. Understanding the relationship between firms’ corporate social responsibility (CSR) and tax avoidance activities is crucial to uncovering their motivations for tax avoidance. However, this relationship remains unclear. This study investigates firms’ tax payment motivations from environmental, social, and governance (ESG) perspectives by examining samples of firms with high, low, and no ESG-related reputational risk. We utilize the ESG index, which offers a broader scope than conventional CSR measures. Our empirical analysis includes 3981 firm-year observations from 31 OECD countries between 2017 and 2019. To determine the relationship between ESG and tax avoidance, we develop a reputation-based ESG risk dataset that addresses the endogeneity associated with managerial decisions and simultaneity bias. This study is among the few that explore the international relationship between ESG performance and tax avoidance, contributing to the shift from CSR to ESG in discussions of tax avoidance. Our findings reveal that companies’ tax payment behavior varies based on their ESG reputational risk. Specifically, firms with high ESG risk pay more taxes when their ESG risk is elevated, whereas firms with low ESG risk do not alter their tax payments based on ESG risk. Additionally, firms without any ESG risk tend to pay more taxes as their ESG scores increase.

Similar content being viewed by others

Introduction

The OECD notes that corporate tax avoidance, such as tax base erosion and profit shifting (BEPS), has become a major international issue, resulting in USD 100–240 billion in annual losses for governments and equivalent to 4–10% of global corporate income tax revenue (OECD Publishing, 2013). Corporate taxes are a fundamental source of government revenue in all countries, and reliance on corporate taxes is higher in developing countries. Previous studies have estimated that global government revenue loss due to tax avoidance strategies is USD 500–650 billion annually and that this loss is higher in developing countries based on empirical analysis of high-quality revenue data (Cobham and Jansky, 2018, Ernesto Crivelli et al., 2016). BEPS is a tax planning strategy in which companies artificially shift profits to low- or no-tax countries with few or no business activities to reduce profits in the place where their income is earned. In 2015, the OECD launched the OECD/G20 BEPS Project and set 15 actions, called the BEPS package, to tackle tax avoidance by improving international tax rules and ensuring a more transparent tax environment. In the beginning, 60 countries signed the BEPS package, and more than 135 countries implemented the BEPS package in 2023. Some people have claimed that tax payments can negatively affect social welfare because paying taxes reduces the amount of free cash flow available for innovation, production, job creation, etc. (Djankov et al., 2010). On the other hand, in general, aggressive corporate tax activities can be considered socially irresponsible activities because they result in potential losses to society.

Recently, people have started focusing on environmental, social, and governance (ESG), which has a broader scope for evaluating companies’ long-term value and risk than does corporate social responsibility (CSR), which has historically been used. CSR represents a company’s voluntary initiatives to contribute to society, whereas ESG is a framework for evaluating a company’s overall sustainability and ethical practices, including its ESG performance. A transition has occurred toward an economic system that promotes sustainable development by emphasizing environmental conservation, particularly actions addressing climate change (WBCSD, 2022). Firms’ ESG performance is becoming increasingly important for companies since investors have been increasing their consideration of environmental and ethical consciousness. The Global Sustainable Investment Alliance claims that global ESG (sustainable) investments—investment strategies that consider ESG—reached $35.3 trillion in 2020 (GSIA, 2021), representing a 15% and 55% increase from the values in 2018 and 2016, respectively. Thus, unlike CSR, ESG performance is not only a measure used to evaluate firms’ voluntary motivation toward society but also an essential measure for companies to receive investments.

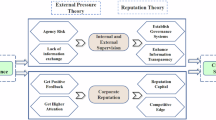

There has been a profound increase in interest in both CSR and corporate tax avoidance (Alsaadi, 2020), Gandullia and Pisera, 2020). Fundamentally, companies’ purpose should be to maximize their monetary revenue. Prior studies have examined whether companies spend resources on visible (CSR) or invisible (tax avoidance) costs (Kenny et al., 2017, Mashiyat Tasnia et al., 2020). To answer this question, many studies have focused on the relationship between firms’ CSR evaluations and aggressive tax activities (Lanis and Richardson, 2012, 2015, Davis et al., 2016, Watson, 2015, Hoi et al., 2013). However, the relationship between CSR and tax avoidance is uncertain because these studies have provided mixed results on their relationship. Furthermore, few studies have examined the relationship between companies’ ESG and tax payment activities (Du and Li, 2023, Yoon et al., 2021). Since the global economy has started to shift toward ESG performance from CSR, we need to understand better the connections among ESG performance, new sustainability measures of firms, and tax avoidance. To fill this knowledge gap, instead of considering CSR, we study the relationship between ESG performance and corporate tax avoidance to determine the tax payment motivation from the viewpoint of ESGFootnote 1,Footnote 2. Much of the current research has used biased data on ESG and CSR, such as the data provided by the firms themselves. This research helps provide new findings in the areas of CSR and tax avoidance research by adding a new factor—firms’ ESG reputational risk—which comprises unbiased data on ESG data given by a third party that can moderate this relationship.

We investigate the relationship between reputational ESG risk and tax avoidance activities by using a new dataset related to ESG measures. If they have a clear relationship, we can use ESG measures as a proxy for tax avoidance activities, which are challenging to identify from the accounting information provided by corporations. In this study, to measure ESG performance, we use RepRisk, which is more objective than other CSR and ESG measures used in the previous literature that has examined the relationship between CSR and tax payments. In addition, RepRisk addresses endogeneity by eliminating ESG-related information published by companies themselves.

Some of the prior literature has shown that the link between CSR and tax avoidance activities varies according to the degree of companies’ CSR (Muller and Kolk, 2010, Kiesewetter and Manthey, 2017). Therefore, the relationship between CSR and tax avoidance might differ based on companies’ reputations from third parties. For instance, companies considered socially irresponsible may pay more taxes to improve their reputations. On the other hand, firms with good ESG reputations might be more likely to avoid paying taxes because they do not have to pay taxes to improve their reputations. To test our hypothesis, we use ESG measures that evaluate companies’ ESG reputational risk from third parties and classify our sample into three groups according to firms’ degree of ESG-related reputational risk: firms with low-risk exposure, firms with high-risk exposure, and firms with no reputational risk. The analysis for each subgroup enables us to investigate whether firms viewed as socially responsible by other organizations pay corporate taxes properly. Additionally, we can determine whether companies considered socially irresponsible truly engage in greater tax avoidance. Our results show that, among firms with high ESG reputational risk exposure, socially irresponsible firms are less likely to engage in tax avoidance activities. We also find that ESG-related reputational risk and tax avoidance have no relationship to firms with low ESG risk exposure. Furthermore, our results suggest that among firms with no ESG reputational risk exposure, socially responsible firms are less likely to engage in tax avoidance activities.

Through this study, we make four contributions to the literature. First, in a cross-country study, our sample consists of 31 OECD countries. Although much of the literature has examined the relationship between CSR and tax payments, most of these studies have focused on one specific country, such as the U.S. or Australia (Stephenson and Vracheva, 2015, Davis et al., 2016, Lanis and Richardson, 2012). They have obtained different results, perhaps because of institutional discrepancies and/or differences in the social environment, which can affect CSR and tax payments (Stephenson and Vracheva, 2015). Since BEPS is a common issue for multinational corporations, observing this issue on a global scale is needed. Considering institutional differences when investigating international trends in tax protection activities would be difficult because each country has a different corporate tax system and rate. To overcome this issue, we include the World Government Indicators published by the World Bank and the statutory corporate tax rate (SCTR) in our regression to control for the legal and institutional environments in each country. Second, we use a unique ESG measurement based only on information in the media, overcoming endogeneity and helping firms transition from CSR to ESG. Most studies have used indices that evaluate CSR activities and their impacts on society based on both firms’ self-reported information and reputations. To our knowledge, few empirical studies have used an index based only on firms’ reputations in the media. Third, we compare fixed effect model and pooled regression analysis. Most previous studies have used pooled regression to investigate how CSR relates to tax payments. Nonetheless, these studies could have suffered from omitted variable bias because their models did not capture the effect of variations in time series. Although some studies have used panel data (Hoi et al., 2013; Davis et al., 2016; Timbate, 2021), how time series variations affect a firm’s perspectives toward tax payments is not clear. To address this gap in the literature, we use fixed effects model analysis in addition to pooled ordinary least-squared analysis. Finally, we divide the observations into high, low, and no ESG-related reputational risk firms to drill down on the prior mixed results. We split our sample into three groups according to ESG-related reputational risk to determine whether socially responsible companies pay corporate taxes fairly.

Literature review

The relationship between CSR and tax payments

During the past few years, many researchers have shown interest in the relationship between CSR and tax payments. However, existing theory and empirical studies have found different results.

Several prior studies have shown a negative connection between CSR and aggressive tax activities. Therefore, socially responsible companies are less likely to engage in tax avoidance activities (Laguir and Elbaz, 2015, He Huang and Yu, 2017, Mgbame et al., 2017, Lanis and Richardson, 2012, 2015). Margolis and Walsh (2003) present the theory that firms must consider stakeholders to maximize their value. According to this theory, firms engage in CSR activities even if they reduce those existing profits as long as they benefit stakeholders (Mackey et al., 2007). These results are consistent with the theory suggested by Carroll (1979), suggesting that firms that find value in CSR activities devote their resources and human effort to CSR activities. However, these activities do not always create financial benefits for firms. In fact, Hoi et al. (2013) argue that firms that expend effort on CSR activities are less likely to engage in tax avoidance because those that positively engage in CSR activities also consider tax payments as a part of their CSR.

In contrast, some studies have shown that CSR is positively correlated with tax avoidance, suggesting that socially responsible firms are more likely to avoid tax payments and that socially irresponsible firms are less likely to engage in tax avoidance (Gulzar et al., 2018, Salhi et al., 2020, Fallan and Fallan, 2019). Two hypotheses support this relationship: efficient management of resources and the insurance effects of CSR activities. McGee (2010) claims that it is more beneficial for society to keep resources in the private sector than in the government sector because the private sector utilizes resources more efficiently. Porter and Kramer (2006) argue that since firms are not responsible for all of the problems in the world, each firm can efficiently identify and solve particular problems in their field, which can have a more significant impact on society than any other organization. This argument indicates that even some socially responsible firms do not consider tax payments to be the best way to carry out their social responsibilities, although they allocate resources to CSR activities. Godfrey (2005) and Gardberg and Fombrun (2006) note the insurance effects of CSR activities and that certain types of CSR activities have a risk-management effect. They claim that when negative events occur, some types of CSR activities preserve shareholder value because they act as “insurance-like” protections because CSR activities create a form of goodwill or moral capital for firms, meaning that some firms engage in CSR activities to protect themselves from the reputational risk that arises from tax aggressiveness practices.

In alignment with these theories, some studies have claimed that CSR is positively related to tax aggressiveness. One such example is Godfrey et al. (2009), who posit a theory about the risk management of CSR activity using an event study of 178 legal or regulatory actions against firms from 1993 to 2003. They find that CSR activities create shareholder value when firms face a particular adverse event. Davis et al. (2016) also find that CSR activities have a negative relationship with tax payments. They examine the five-year cash effective tax rates for a total of 5,588 firms in the U.S. from 2006 through 2011. This result indicates that socially responsible firms do not pay more corporate taxes than other firms do, implying that CSR and tax payments act as substitutes. In addition to these studies, others have shown no relationship between CSR and tax avoidance (Amidu et al., 2016, Mashiyat Tasnia et al., 2020). Overall, many studies have attempted to reveal the link between CSR and tax avoidance activities; however, they still need to provide a consistent and clear answer.

Measurement of ESG performance

We contribute to the shift from the concept of CSR to the use of ESG practices in discussing corporate tax avoidance and corporate responsibility. Different companies present several ESG measures that have been used in prior studies, such as the ESG scores provided by Refinitiv Eikon based on companies’ annual reports (Xie et al., 2023). Unlike many of the current studies, we use the RepRisk index, which is a unique index that reflects a firm’s ESG risk exposure, whereas other measurements of ESG performance estimate the extent of a firm’s ESG activities. Given its uniqueness, RepRisk has attracted attention from the fields of business, management, accounting, and finance (Gaganis et al., 2021, Li et al., 2017). Even though the data from the RepRisk index are available in broad applications, a limited number of prior studies have used RepRisk because it contains relatively new data (it began as a service in 2007). Some prior research has used RepRisk as the degree to which negative ESG incidents are reported because RepRisk captures only negative ESG-related information in the media (Li and Wu, 2020, Gloßner, 2019, Maung et al., 2020). The RepRisk index has also been used for negative media coverage of ESG (Berkan et al., 2021, Burke, 2021, Carnahan et al., 2010). In addition, Cui et al. (2018) treat RepRisk as a measurement of CSR to examine the association between CSR and information asymmetry.

Although several studies have used the index to determine the correlation between ESG performance and corporate finance, to our knowledge, we are the first to employ the ESG-related reputational risk index to examine the relationship between ESG performance and corporate tax payments. Therefore, we provide new perspectives on ESG-related reputational risk to the consecutive literature investigating the association between CSR and corporate tax avoidance.

Sample and data

We use financial and nonfinancial data to study the ESG-tax payment relationship. We rely on the Orbis data from the Bureau van Dijk. We collect all financial data with a unit of 1000USD. Orbis is used in many academic studies and covers close to 400 million companies. We collect data on 3926 companies from 2017 to 2019 that meet the criteria (details of the criteria are presented in Table 1). After collecting the dataset, we remove observations with negative taxable income and those missing data for any of our regression variables. Our final sample comprises balanced panel data, which consist of 3981 firm-year observations from 31 countries. The observations include 1327 individual firms from 2017 to 2019.

Measurement of tax payments

Tax avoidance activities can be captured in several ways. Each measure has its own limitations. Thus, we use two different measures to capture tax avoidance activities to compensate for these limitations. Measures of corporate tax payments were determined in the following two ways in previous studies (Manzon and Plesko, 2002, Desai and Dharmapala, 2006).

The first measure is the Manzon–Plesko book-tax difference (MP_BTD), which is book income less taxable income scaled by lagged total assets (Eq. (1)). Taxable income is calculated by corporate tax payments divided by the SCTR (Eq. (2)). Many studies have used this measurement to capture tax avoidance (Kim et al., 2011, Wilson, 2009, Hanlon and Heitzman 2010). Wilson (2009) finds that firms with larger book-tax differences (BTDs) tend to engage in more tax shelters. Lev and Nissim (2004) and Hanlon (2005) indicate that BTD identifies aggressive tax reporting.

where \(i\) and \(t\) represent individual firms and years, respectively.

The second measure is the Desai-Dharmapala discretionary book-tax difference (DD_BTD), which is the residual from an ordinary least squares regression of MP_BTD on total accruals (Desai and Dharmapala, 2006) (Eqs. (4) and (5)). Desai and Dharmapala (2006) document that MP_BTD can be increased or decreased by earnings management (controlling accounting income or reducing taxable income to archive several aims). DD_BTD is a measurement that excludes the effect of earnings management from MP_BTD. According to the Dechow et al. (1995) method, we calculate accruals using the following equations (Eq. (3)):

where

AC = total accruals

ΔCA = change in current assets;

ΔLOAN = change in short-term financial debts;

ΔCASH = change in cash and cash equivalent;

Dep = depreciation and amortization;

A = total assets

ESG (CSR) index

RepRisk

We focus on how firms change their tax planning in response to a negative reputation in the media regarding ESG issues, which requires data capturing negative ESG events. The ESG data are collected from RepRisk, a dataset that has been updated daily since 2007. RepRisk is an indicator of ESG-related reputational risk and covers more than 100,000 listed and nonlisted firms exposed to ESG risks, plus projects from all countries and sectors, including emerging and frontier markets. RepRisk systematically screens and analyzes negative ESG and business conduct information, which can affect firms’ reputations and finances.

Using advanced machine learning, RepRisk covers more than 80,000 media outlets, stakeholders, and other third-party sources in 20 languages. Then, human analysts analyze each risk incident according to the company’s methodology. The collected data are classified into 28 core issue categories. These 28 issues can be mapped to the ten principles of the UN Global Compact, which determine people’s and firms’ basic responsibility for adopting sustainable and socially responsible policies. RepRisk also includes 50 additional topic tags labeled “hot topics” or extensions of RepRisk’s core ESG issues. Topic tags are specific and thematic; each tag can be linked to multiple ESG issues.

The RepRisk Index (RRI) is constructed through the above process, making it easy to understand entities’ exposure to ESG-related risk. The RRI is calculated on a scale between 0 and 100. Since the RRI captures and quantifies reputational risk exposure related to ESG issues, a firm with a low RRI has been exposed to less ESG-related risk, and an RRI score of zero indicates that a firm has no ESG-related reputational risk. According to RepRisk’s documentation, an RRI score between 0 and 25 indicates low-risk exposure, 26 and 49 indicates medium-risk exposure, 50 and 59 indicates high-risk exposure, 60 and 74 indicates very high-risk exposure, and 75 and 100 indicates extremely high-risk exposure. We consider firms with high RRIs to be socially irresponsible and firms with low RRIs to be socially responsible.

RepRisk is more suitable for our study than other ESG and CSR measures because our study focuses on the effect of reputation on tax plans. Using RepRisk, we can observe the net effect and overcome endogeneity. The other ESG and CSR measurements used in other studies were based mainly on self-reported information (Zeng, 2019, Garcia et al., 2017). RepRisk is a unique measurement based only on information in the media. We can explore how reputations related to ESG activities influence firms’ tax planning. Another measure we use in this study captures both positive and negative ESG information. Hence, we can observe the net effect, although RepRisk captures only negative information.

This study overcomes two endogeneity problems. The first is the issue between tax planning and ESG disclosure. Most of the ESG measures used in the literature have depended on information disclosed by each firm. However, managers’ decisions affect both tax planning and ESG disclosure, leading to omitted variable bias. On the other hand, the fluctuation of RepRisk is independent of managers’ decisions regarding ESG disclosure.

The second problem concerns CSR and tax planning, which has been commonly discussed in the literature. Previous studies have shown that firms that can afford to pay taxes properly engage more positively in CSR activity. This issue is unlikely to arise in our research because, regardless of companies’ efforts to improve ESG performance, RepRisk captures only negative information about ESG performance in the media.

MSCI ESG rating

Although RepRisk has several advantages over other ESG scores, it has several limitations. RepRisk cannot capture positive information related to ESG performance. For this reason, we cannot identify firms that do not engage in many CSR activities or those that vigorously engage in CSR activities when such firms have zero RRI, although they participate differently in CSR activities. To address this limitation, we use the MSCI for these firms to investigate the relationship between ESG performance and tax avoidance. We use the MSCI ESG rating for firms with zero RRI (firms with no reputational risk). These data are among the most commonly used in the previous literature to measure ESG performance. The MSCI information sources are specialized datasets provided by governments and nongovernmental organizations, company disclosures, and media sources. The most significant difference between the two ratings is that MSCI captures both negative and positive information about ESG. We use the final industry-adjusted score, which is calculated by normalizing each firm’s environmental, social, and governance scores on an industry basis. This score ranges from 0 to 10 according to ESG performance. Companies with a higher MSCI score have better reputations related to ESG.

Control variables

The descriptive statistics and Pearson correlation results are presented in Tables 2 and 3. We include several control variables that the previous literature has found to be critical in examining the relationship between ESG performance and tax payments. According to Liang and Renneboog (2017), we control for common law countries (COMs), measured as an indicator variable equal to 1 for common law countries and 0 for civil law countries, and for countries with worldwide tax systems (WWs), measured as an indicator variable equal to 1 for countries with worldwide tax systems and 0 for countries with territorial tax systems (Ernst & Young E&Y, 2020). We also add indicator variables (IFRS) to control for the adoption of International Financing Reporting Standards (IFRS), which are equal to 1 for countries requiring IFRS for domestic public companies and 0 otherwise.

We also include the government index from the World Government Indicators (WGI) proposed by Kaufmann et al. (2011) and published by the World Bank every year. In this study, we use four major indicators that the previous literature has shown to be relevant to the governance level: government effectiveness, regulatory quality, rule of law, and control of corruption. We identify a new variable, GOV, that is, the sum of these four indicators (Sáenz González and García-Meca, 2014, Zeng, 2019).

We control for intangible fixed assets (Intang), research and development costs (R&D), long-term debt (Leverage), costs of goods and other operating expenses (SG&A), and cash and cash equivalents (Cash). Most existing studies have included firm size (Size) and pretax returns on assets (PTROA) as control variables. We obtain all of these control variables yearly and divide Intang, R&D, Leverage, SG&A, and Cash by the companies’ total assets of the previous year. However, we find a strong correlation between the RRI and firm size (the correlation between RRIave and Size is 0.672). The RRI can be biased toward news from larger companies since such news is more likely to appear in the media than is news about smaller companies. Therefore, we exclude Size from our control variables. Additionally, MP BTD reflects PTROA because it includes pretax incomes and is scaled by total assets. Thus, we eliminate PTROA from our control variables to avoid this econometric problem.

Research design

We conduct fixed effects model analysis for these samples, in contrast to many previous studies that have used pooled regression analysis. We use fixed effects model regression to control for entity-specific fixed effects and time-variant factors. Fixed effects model data analysis is more suitable for our study. Fixed effects model data regression is selected over pooled regression analysis in this study because it better handles unobserved heterogeneity and the time-constant factors of companies. This is due to its capacity to account for individual-specific characteristics that remain constant over time, which might otherwise lead to biases in pooled regression analysis. By incorporating individual fixed effects, fixed effects model regression captures these unobserved, time-invariant traits, enhancing the reliability of the parameter estimates. It also allows for the exploration of effects that change over time and manages unobserved time-specific influences, making it a more effective approach for empirical research. We use a fixed effects model to control for unobserved firm heterogeneity because we assume that individual-specific characteristics, such as corporate culture are correlated with tax avoidance activities. Our results from the fixed effects model analysis explain the relationship between ESG performance and tax avoidance more precisely than do those of previous studies since we control for time-variant variables, such as cash and cash equivalents. When examining ESG and tax payments, ignoring corporate culture could lead to overestimating the effect of tax payments.

Although our primary analysis is a fixed effects model regression, we conduct a pooled regression analysis similar to that used in previous papers to compare our results with those of other studies. Conducting a pooled regression analysis reveals the importance of capturing time-series variation.

We examine the relationship between ESG performance and tax avoidance using the following regression model:

TA is one of two different variables:

DD_BTD = the residual from a regression of the Manzon–Plesko book-tax

differences in total accruals;

MP_BTD = book income less taxable income scaled by lagged total assets

ESG is one of four different variables:

RRIave = the average RRI value during the fiscal year for each firm;

RRImedian = the median RRI value during the fiscal year for each firm;

MSCIave = the average value of the MSCI industry-adjusted score during the fiscal year for each firm;

MSCImedian = the median value of the MSCI industry-adjusted score during the fiscal year for each firm.

We classify our final sample into three groups: firms with low ESG-related reputational risk, firms with high ESG-related reputational risk, and firms with a good reputation for ESG. We classified our final samples into three groups according to their average RRI value (RRIave). Since the RRIave and RRImedian values among firms with some reputational risk are ~18, we define the group of firms with a 3-year peak RRI of 18 or less as low-risk firms. We characterize the firms with a three-year peak RRI greater than 18 as high-risk firms. Finally, we define firms with RRIs remaining at zero for three years as good ESG reputation firms. In our analysis, 468 firm-year observations were obtained for the firms in the low ESG-related reputational risk group from 23 OECD countries. The group of firms with high ESG-related reputational risk includes 387 firm-year observations from 15 OECD countries. The no ESG-related risk group comprises a sample of 472 firm-year observations from 20 OECD countries.

We use Eq. (6) for the fixed effects model regression analysis and (7) for the pooled regression analysis. A larger TA indicates more tax avoidance. The coefficient of ESG captures the relationship between ESG performance and tax avoidance. A positive coefficient for RRI implies that ESG measures and tax payments complement each other, indicating that socially responsible firms are more likely to pay more taxes because they consider tax payments part of their CSR activities. In contrast, a negative RRI coefficient implies that socially irresponsible firms tend to pay more taxes. In this case, ESG and taxes act as substitutes because firms might not view taxes as a CSR activity and/or might engage in CSR activities to protect their reputations from negative events. In addition, Eqs. (6) and (7) have year and industry fixed effects, respectively, where the industry is based on the U.S. SIC two-digit industry classification.

Results

Firms with reputational risk

Our results illustrate that the relationship between ESG risk and tax avoidance differs according to firms’ ESG-related reputation (Tables 4 and 5). We find that high-risk firms with high ESG-related reputations are less likely to engage in tax avoidance activities. On the other hand, there is no significant relationship between ESG performance and tax avoidance for companies with low reputation risk. Our fixed effects model analysis for high-risk firms shows that the coefficients of RRIave and RRImedian are significantly negative. The coefficient of the RRImedian is −0.0010, suggesting that a one-point increase in the RRI is associated with a 0.0010 percentage point decrease in DD_BTD. Furthermore, SCTR is significantly correlated with tax avoidance according to the same regression. A positive sign of SCTR indicates that those in countries with a higher SCTR are more likely to engage in tax avoidance activities among firms with high-risk exposure.

Overall, our results suggest that among firms with high ESG-related reputational risk, ESG and tax payments act as substitutes, whereas ESG and tax payments are not correlated within low-risk firms. We find that among companies with high-risk exposure, those with higher ESG-related reputational risk are less likely to engage in tax avoidance activities. These results support the theory suggested by Djankov et al. (2010) that high-risk firms do not consider paying taxes to be the best way to demonstrate their social responsibility because doing so degrades social welfare by reducing free cash flow for job creation, innovation, production, etc. The second interpretation of the results is that firms with high ESG-related risk paying more corporate taxes to protect shareholder value in preparation for negative events that might happen in the future. This finding is consistent with Godfrey (2005) and Gardberg and Fombrun (2006), who find that firms with high-risk exposure pay taxes hoping for a tax insurance effect.

Our findings indicate the limitations of previous studies that have used pooled regression. We find a significant correlation between ESG performance and tax avoidance when we analyze the data using fixed effects model regression. In contrast, when we use pooled regression regressions, we find no evidence that tax payments are correlated with ESG performance. This difference could be due to the lack of controlling for the effect of individual-specific characteristics, such as corporate culture.

Firms with good ESG

We estimate the relationship between firms’ ESG scores and tax avoidance for firms with no ESG-related reputational risk. This group consists only of firms with no ESG-related reputational risk that maintained an RRI score of zero from 2017 to 2019. The MSCI ESG scores for this group must capture only positive information since RepRisk captured no negative information. For these firms, we used the ESG score as our dependent variable, which is an MSCI index.

Our results suggest that among firms with no ESG-related reputational risk, those with higher ESG scores are less likely to engage in tax avoidance activities (Tables 6 and 7). We find that ESG measures and tax payments act as complements since the negative coefficients of MSCIave and MSCImedian from the fixed effects model regression are significant. This finding supports the theory presented by Carroll (1979) that firms that find value in CSR activities devote their resources and human efforts to CSR activities, although these activities do not always create financial benefits. Similarly, our results highlight the importance of fixed effects model analysis because we do not find a significant correlation between ESG measures and tax avoidance through pooled regression analysis.

Full sample results

We test how ESG performance is relevant to tax avoidance for all of our sample firm-year observations to determine the trends among all sample firms. We find a positive correlation between ESG-related risk and tax avoidance among all of the firms in our sample (Tables 8 and 9). The combined sample pooled regression analysis results provide evidence supporting the previous literature. This finding suggests that firms with higher ESG-related reputational risk are likely to engage in more tax avoidance. In other words, ESG measures and tax payments act as complements, and these results support the theory presented by Carroll (1979). The pooled regression analysis’s regression coefficients of RRIave and RRImedian are significantly positive. However, the fixed effects model analysis shows no statistically significant relationship between reputational risk and tax avoidance. This finding illustrates the importance of controlling for the effect of unobserved heterogeneity, as evidenced by the uncontrolled bias in the pooled regression analysis.

Robustness check

Heckman’s two-stage estimation

The empirical association between the ESG reputational risk index (RepRisk) and the measurement of tax avoidance could reflect sample selection bias. Therefore, we adopt Heckman’s (Heckman, 1979) two-stage procedure to treat this bias. We employ this method before selecting the samples for our main analysis; thus, the sample size is larger than our main sample size.

In the first stage, we run the probit model to determine whether RepRisk is more likely to capture ESG-related reputational risk for firms with more operating revenue, revenue, tangible assets, or capital markets. The first-stage model is formalized as follows:

where RRIdummy is a dummy variable equal to 0 if the three-year average RRI is zero and 0 otherwise. γ is the primary variable that is the logarithmic value of operating revenue, revenue, tangible assets, and capital marketsFootnote 3 The control variables are the same as those in Eq. (6).

We calculate the inverse Mills ratio (IMR), an adjustment term from the first-stage probit model, and include this variable in the second-stage regression. The second-stage regression, which adds IMR to Eq. (7), is as follows:

where TA is a measure of tax avoidance (DD BTD and MP BTD), and the variable ESG is the ESG reputational risk index (RRIave and RRImedian). The control variables are the same as in Eq. (7). We find our results to be robust. In all of the models, the coefficients of IMR are significantly negative, suggesting that sample selection bias is a potential issue when examining the association between ESG reputational risk and tax avoidance (Tables 10–13). Nevertheless, after controlling for sample selection bias, we find that the coefficients of the RRI retain the same sign and significance as our main results, thus supporting our main findings.

Our results show that RRI and tax avoidance have different trends for firms with low and high ESG reputational risk. Since our main analysis uses linear regression analysis, we analyze the data by using a nonlinear regression method to understand the trend more deeply. Tables 14 and 15 present the results of the polynomial regression analysis. The results indicate that tax avoidance and the RRI increase when it is lower than 12 but decrease when it is higher than 12. Thus, we conduct linear regression analysis for firms with RRIs lower than 12 to understand the trend for low-risk firms and find an increasing trend (Tables 16 and 17). These results support our main finding that different corporate tax payment behaviors can be explained by the degree of ESG reputational risk. Our results suggest that low-risk firms exhibit an increasing trend and that high-risk firms exhibit a decreasing trend.

Polynomial regression

Our results show that RRI and tax avoidance exhibit different trends for firms with low and high ESG reputational risk. Since our main analysis uses linear regression analysis, we analyze the data using a nonlinear regression method to understand the trend more deeply. To estimate the nonlinear relationship, we consider the following polynomial equations:

where Eq. (10) is used for the fixed effects model regression. and Eq. (11) is used for the pooled regression analysis.

Tables 14 and 15 present the results of the polynomial regression analysis. According to this fixed effects model regression result for RRIave in (1) of Table 14, the coefficients of the second-order term are −0.0001 and 0.0024 for the first-order term. The results indicate that tax avoidance and the RRI increase when the RRI is lower than 12 but decrease when the RRI is higher than 12.

Thus, we conduct linear regression analysis for firms with RRIs lower than 12 to understand the trend for low-risk firms and find an increasing trend (Tables 16 and 17). These results support our main finding that different corporate tax payment behaviors can be explained by the degree of ESG reputational risk. Our results suggest that low-risk firms exhibit an increasing trend and high-risk firms exhibit a decreasing trend.

Conclusion

We examine the relationship between ESG performance and corporate tax avoidance. Specifically, we explore how firms’ different degrees of ESG-related reputational risk from third parties influence the relationship between ESG measures and corporate tax avoidance. Most studies on CSR and tax payments have four limitations: they focus on a specific country, they use an ESG index biased toward positive information, they use either fixed effects model or pooled regression analysis, and they focus on all levels of ESG risk. Our research contributes to a better understanding of the relationship between CSR and tax avoidance and helps the shift to ESG from CSR. Our cross-country analysis suggests that the relationship between ESG performance and tax avoidance differs according to the degree of ESG-related reputational risk. Our results could be key to understanding why the results of previous research were mixed. We find that ESG-related reputational risk is negatively related to tax avoidance among firms with high ESG-related reputational risk. Additionally, the results show that corporate tax payments and ESG-related reputational risk have no relationship with firms with low ESG-related reputational risk. Moreover, ESG scores are negatively correlated with tax avoidance in the group of firms with no ESG-related reputational risk. These results imply that firms with high reputational risk might pay taxes in the hopes of compensating for the risk from their bad reputations. Furthermore, among firms with no reputational risk, socially responsible corporations are less likely to engage in tax avoidance.

Compared to other studies, there are essential differences in measuring the CSR index and analytical methods. First, we use the ESG index, which differs from the CSR indices used in other studies. The CSR indices used in previous studies have been biased toward positive information because they capture information provided in company disclosures. However, we use the ESG index, which captures only negative information from media reports. Moreover, we overcome two endogeneity issues—tax planning and ESG disclosure and tax planning and ESG—by using RepRisk. Second, we use fixed effects model regression analysis for our sample to capture unobserved heterogeneity. The distinct results observed in fixed effects model versus pooled regression analyses in our study primarily stem from the differing capabilities of these methods in handling unobserved heterogeneity and fixed effects, such as corporate culture, which significantly influence firms’ tax payment behaviors. Fixed effects model regression analysis excels in capturing these unobserved, time-invariant characteristics by considering data across multiple periods for the same firms, thereby isolating the effects of firm variables that change over time. In contrast, pooled regression analysis, which examines data at a single point in time across different firms, fails to effectively control for these fixed effects. This methodological divergence leads to different insights: while fixed effects model analysis reveals the nuanced impact of firm-specific attributes on tax behaviors, pooled regression analysis might miss these subtleties, potentially leading to nonsignificant or opposite findings. This contrast underscores the importance of choosing an appropriate analytical approach to accurately discern the influence of internal firm dynamics, such as corporate culture, on financial behaviors. We also classify our sample into three groups according to the degree of ESG-related reputational risk to determine how reputational risk influences tax planning in firms with different degrees of risk exposure.

A key finding is that our results help us understand how ESG-related reputational risk affects corporate tax payments. Our findings offer several critical practical pieces of information for corporate managers and institutional investors. An essential practical contribution is that the current findings could improve our understanding of the relationship between ESG performance and corporate tax payments. One limitation of our study is the small coefficients observed in our analysis. While the results indicate a statistically significant correlation between tax payments and ESG-related reputational risk, we acknowledge that the strength of this correlation is relatively weak. However, the companies in our dataset are at least noteworthy enough to be in the news since ESG risk index is mainly provided for investors. These companies are ones that investors might consider as potential investment target. Therefore, our results can identify the possibility that ESG measurements can be used as a proxy for corporations’ tax avoidance activities for noteworthy companies.

Data availability

The datasets generated during and/or analyzed during the current study are not publicly available due to the data usage agreement with Bureau van Dijk and MSCI but are available from the corresponding author upon reasonable request.

Notes

We mainly focus on legal tax avoidance, although we cannot completely eliminate the impact of illegal tax avoidance commonly known as tax evasion, i.e., fraud, because legal tax avoidance could reduce government revenue and social welfare.

It is extremely difficult to distinguish legal tax avoidance from illegal tax avoidance using accounting information. Kanagaretnam et al. (2018) use a dataset from the World Bank Enterprise Surveys to measure tax evasion. Nevertheless, those data mainly include smaller, private firms from less developed countries.

We obtain revenue, tangible assets, and capital market data from Refinitiv Eikon.

References

Alsaadi A (2020) Financial-tax reporting conformity, tax avoidance and corporate social responsibility. J Financ Rep Acc 18(3):639–659

Amidu M, Yorke S, Harvey S (2016) The effects of financial reporting standards on tax avoidance and earnings quality: a case of an emerging economy. J Acc Financ 16(2):129–150

Berkan A, Leonardo B, Stefano M (2021) Media coverage, corporate social irresponsibility conduct, and financial analysts’ performance. Corp Soc Responsib Environ Manag 28(5):1456–1470

Burke JJ (2021) Do boards take environmental, social, and governance issues seriously? Evidence from media coverage and CEO dismissals. J Bus Ethics 176:647–671

Carnahan S, Agarwal R, Campbell B (2010) The effect of firm compensation structures on the mobility and entrepreneurship of extreme performers. Bus 2284(October):1–43

Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Acad Manag Rev 4(4):497–505

Cobham A, Jansky P (2018) Global distribution of revenue loss from corporate tax avoidance: re-estimation and country results. J Int Dev 30:206–232

Cui J, Jo H, Na H (2018) Does corporate social responsibility affect information asymmetry? J Bus Ethics 148(3):549–572

Davis AK, Guenther DA, Krull LK, Williams BM (2016) Do socially responsible firms pay more taxes? Acc Rev 91(1):47–68

Dechow PM, Sloan RG, Sweeney AP (1995) Detecting earnings management. Acc Rev 70(2):193–225

Desai MA, Dharmapala D (2006) Corporate tax avoidance and high-powered incentives. J Financ Econ 79(1):145–179

Djankov S, Ganser T, McLiesh C, Ramalho R, Shleifer A (2010) The effect of corporate taxes on investment and entrepreneurship. Am Econ J Macroecon 2(3):31–64

Du M, Li Y (2023) Tax avoidance, CSR performance and financial impacts: evidence from BRICS economies. Int J Emerg Markets

Ernesto Crivelli R, de Mooij M, Keen M (2016) Global distribution of revenue loss from corporate tax avoidance: re-estimation and country results. J Int Dev 72(3):268–301

Ernst & Young (E&Y) (2020) Worldwide corporate tax guide. Technical report

Fallan E, Fallan L (2019) Corporate tax behaviour and environmental disclosure: Strategic trade-offs across elements of CSR? Scand J Manag 35(3):101042

Gaganis C, Papadimitri P, Pasiouras F, Ventouri A (2021) Informal institutions and corporate reputational exposure: the role of public environmental perceptions. Br J Manag 32(4):1027–1061

Gandullia L, Pisera S (2020) Do income taxes affect corporate social responsibility? Evidence from European-listed companies. Corp Soc Responsib Environ Manag 27:1017–1027

Garcia AS, Mendes-Da-Silva W, Orsato R (2017) Sensitive industries produce better ESG performance: evidence from emerging markets. J Clean Prod 150:135–147. https://doi.org/10.1016/j.jclepro.2017.02.180

Gardberg NA, Fombrun CJ (2006) Corporate citizenship: creating intangible assets across institutional environments. Acad Manag Rev 31(2):329–346

Gloßner S (2019) Investor horizons, long-term blockholders, and corporate social responsibility. J Bank Financ 103:78–97

Godfrey PC (2005) The relationship between corporate philanthropy and shareholder wealth: a risk management perspective. Acad Manag Rev 30(4):777–798

Godfrey PC, Merrill CB, Hansen JM (2009) The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strateg Manag J 30(4):425–445

GSIA (2021) Global Sustainable Investment Review 2020

Gulzar MA, Cherian J, Sial SM, Badulescu A, Thu PA, Badulescu D, Khuong NV (2018) Does corporate social responsibility influence corporate tax avoidance of European listed companies? Sustainability 10(12):45–49

Hanlon M (2005) The persistence and pricing of earnings, accruals, and cash flows when firms have large book-tax differences. Acc Rev 80(1):137–166

Hanlon M, Heitzman S (2010) A review of tax research. J Acc Econ 50(2-3):127–178

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47(1):153–161

Henry He Huang LS, Yu TR (2017) Are socially responsible firms less likely to expatriate? An examination of corporate inversions. J Am Tax Assoc 39(2):43–62

Hoi CK, Wu Q, Zhang H (2013) Is corporate social responsibility (CSR) associated with tax avoidance? Evidence from irresponsible CSR activities. Acc Rev 88(6):2025–2059

Issam Laguir RS, Elbaz J (2015) Does corporate social responsibility affect corporate tax aggressiveness? J Clean Prod 107(16):662–675

Kanagaretnam K, Lee J, Lim CY, Lobo G (2018) Societal trust and corporate tax avoidance. Rev Acc Stud 23(4):1588–1628

Kaufmann D, Kraay A, Mastruzzi M (2011) The worldwide governance indicators: methodology and analytical issues. Hague J Rule Law 3(2):220–246

Kenny Z, Lin SC, Zhang F (2017) Corporate social responsibility, institutional environments, and tax avoidance: evidence from a subnational comparison in China. Int J Acc 52(4):303–318

Kiesewetter D, Manthey J (2017) Tax avoidance, value creation and CSR—a European perspective. Corp Gov 17(5):803–821

Kim JB, Li Y, Zhang L (2011) Corporate tax avoidance and stock price crash risk: firm-level analysis. J Financ Econ 100(3):639–662

Lanis R, Richardson G (2012) Corporate social responsibility and tax aggressiveness: an empirical analysis. J Acc Public Policy 31(1):86–108

Lanis R, Richardson G (2015) Is corporate social responsibility performance associated with tax avoidance? J Bus Ethics 127(2):439–457

Lev B, Nissim D (2004) Taxable income, future earnings, and equity values. Acc Rev 79(4):1039–1074

Li J, Wu D (2020) Do corporate social responsibility engagements lead to real environmental, social, and governance impact? Manag Sci 66(6):2564–2588

Li S, Ngniatedema T, Chen F (2017) Understanding the impact of green initiatives and green performance on financial performance in the US. Bus Strategy Environ 26(6):776–790

Liang H, Renneboog L (2017) On the foundations of corporate social responsibility. J Financ 72(2):853–910

Mackey A, Mackey TB, Barney JB (2007) Corporate social responsibility and firm performance: investor preferences and corporate strategies. Acad Manag Rev 32(3):817–835

Manzon Jr GB, Plesko GA (2002) The relation between financial and tax reporting measures of income. SSRN Electron J. https://doi.org/10.2139/ssrn.305620

Margolis JD, Walsh JP (2003) Misery loves companies: rethinking social initiatives by business. Admin Sci Q 48(2):268–305

Mashiyat Tasnia SMSJ, Abareshi A, Rosman R (2020) The impact of corporate social responsibility on stock price volatility of the US banks: a moderating role of tax. J Financ Rep. Acc 19(1):77–91

Maung M, Wilson C, Yu W (2020) Does reputation risk matter? Evidence from cross-border mergers and acquisitions. J Int Financ Mark Inst Money 66:101204

McGee RW (2010) Ethical issues in transfer pricing. Manch J Int Econ Law 7(2):24–41

Mgbame CO, Chijoke-Mgbame AM, Yaya S, Kemi YC (2017) Corporate social responsibility performance and tax aggressiveness. J Acc Tax 9(8):101–108

Muller A, Kolk A (2010) Responsible tax as corporate social responsibility: the case of multinational enterprises and effective tax in India. Bus Soc 54(4)

OECD Publishing (2013) Action plan on base erosion and profit shifting. http://www.oecd.org/tax/action-plan-on-base-erosion-and-profit-shifting-9789264202719-en.htm

Porter ME, Kramer MR (2006) Strategy & society: the link between competitive advantage and corporate social responsibility. Harv Bus Rev 84(12):78–92

Sáenz González J, García-Meca E (2014) Does corporate governance influence earnings management in Latin american markets? J Bus Ethics 121(3):419–440

Salhi B, Riguen R, Kachouri M, Jarboui A (2020) The mediating role of corporate social responsibility on the relationship between governance and tax avoidance: UK common law versus Europe civil law. Soc Responsib J 16(8):1149–1168

Stephenson D, Vracheva V (2015) Corporate social responsibility and tax avoidance: a literature review and directions for future research. SSRN. https://ssrn.com/abstract=2756640

Timbate L (2021) CSR and corporate taxes: substitutes or complements? Bus Res Q 26(4):327–346

Watson L (2015) Corporate social responsibility, tax avoidance, and earnings performance. J Am Tax Assoc 37(2):1–21

WBCSD (2022) Circular transition indicators v3.0 metrics for business, by business

Wilson RJ (2009) An examination of corporate tax shelter participants. Acc Rev 84(3):969–999

Xie J, Tanaka Y, Keeley AR, Fujii F, Managi S (2023) Corporate tax behaviour and environmental disclosure: strategic trade-offs across elements of CSR? Scand J Manag 1–29

Yoon B, Lee JH, Cho JH (2021) The effect of ESG performance on tax avoidance—evidence from Korea. Sustainability 13(12)

Zeng T (2019) Relationship between corporate social responsibility and tax avoidance: international evidence. Soc Responsib J 15(2):244–257

Acknowledgements

This work was supported by Kyushu University, Ryukoku University and JSPS KAKENHI Grant Number JP20H00648. We would like to express our very great appreciation to Yoshitaka Tanaka and Jun Xie for their valuable and constructive suggestions during the planning and development of this research work. Their willingness to give their time so generously has been very much appreciated.

Author information

Authors and Affiliations

Contributions

Akihiro Okuyama: Conceptualization, Methodology, Formal analysis and Writing (original draft, revision and editing); Shuichi Tsugawa: Conceptualization, Methodology, Formal analysis, Writing (revision) and Supervision; Chiaki Matsunaga: Conceptualization and Supervision; Shunsuke Managi: Resources and Supervision.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Not applicable.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Okuyama, A., Tsugawa, S., Matsunaga, C. et al. Companies adjust tax payments to offset changes in publicly perceived impact on environment, social, and governance factors. Humanit Soc Sci Commun 12, 115 (2025). https://doi.org/10.1057/s41599-024-04199-4

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-04199-4