Abstract

Artificial intelligence (AI) is transforming accounting through automating processes, enhancing operational efficiency, and increased accuracy in financial reporting, fraud prevention, and regulatory compliance execution. This paper explores the opportunities and challenges of AI adoption landscape in Saudi-Arabian accounting practices, aligned with the technology-driven objectives of Vision-2030. Using structured surveys and composite-based structural equation modeling (SEM) with the ADANCO approach, the research evaluates accounting academics’ knowledge, attitudes, and practices (KAP) regarding-AI. The study shows AI’s potential to streamline operations, perform knowledge-intensive tasks, and combat fraudulent activities. Implementation success depends on directed education programs and robust regulations and ethical assessment to handle risks such as algorithmic biases, workforce displacement and integrity concerns. The study reveals a direct link between educational perspectives on AI and its practical application, emphasizing the role of knowledgeable professionals in driving positive industrial developments. We recommended to fostering AI literacy, promoting socio-economic equality in adoption, and creating sustainable learning environments. These insights offer actionable guidance for academics, professionals, organizations, and policymakers to navigate AI’s evolving role while maintaining ethical standards. The implementation of enhanced AI integration in accounting will enable Saudi-Arabia to fulfill Vision-2030 goals while becoming a benchmark for sustainable, human-centric technological development in the field.

Similar content being viewed by others

Introduction

AI transforms global accounting procedures through automated operations while improving accuracy and detecting complex fraud patterns yet academic studies predominantly focus on developed economic systems without considering main distinctions between developing territorial entities such as Saudi-Arabia within strategic business settings especially since the nation uses its Vision-2030 economic transformation vision to boost technology leadership and shift beyond its dependence on crude oil sources. The Saudi-Arabian government delivers AI through Vision-2030 as a strategy to develop its intellectual economy and create digital leadership away from its oil-dependent economy. AI-based financial technology requires capital investment in artificial intelligence technology to fulfill all legal requirements with necessary ethical standards. This research fills vital knowledge gaps regarding AI’s implementation barriers and economic effects as well as national goal compatibility through three main investigation points: (1) AI’s impact on Saudi accounting efficiency and fraud detection accuracy and reduced errors. (2) What challenges prevent the integration of AI technology between different organizational structures and regulatory frameworks? (3) How can AI-driven innovations align with Vision-2030’s goals? Grounded in the Technological-Organizational-Environmental (TOE) framework and the Unified Theory of Acceptance and Use of Technology (UTAUT), we extend these models by linking AI-specific variables (e.g., algorithmic bias, workforce readiness) to financial outcomes, employing a robust composite-based structural equation model (SEM) to analyze data from Saudi accounting professionals. According to Aghion et al. (2018), AI-driven transformations will necessitate new expertise, including data analytics, algorithmic decision-making, and ethical AI governance. This shift aligns with Vision-2030’s objective to develop a highly skilled workforce capable of leveraging advanced technologies for financial management.

Businesses achieve better efficiency through AI-driven ERP systems because these systems automate workflows and strengthen financial regulations while meeting international industry requirements (Han et al. 2023; Hassani and Silva 2023). ERP systems should be considered for contemporary Saudi businesses because they align with their financial upgrade needs in their digital transformation project. AI’s fast infiltration creates difficulties such as financial disparities alongside the risk of workers becoming unemployed and system-based biases (Norori et al. 2021; Mislavskaya 2021). AI developers must resolve these issues because this work directly supports the Vision-2030 plan to achieve social equity throughout Saudi Arabia. Ensuring workforce upskilling and ethical AI development will be essential in maximizing AI’s benefits while mitigating unintended consequences. By addressing regional underrepresentation, theoretical fragmentation, and practical barriers such as implementation costs and ethical risks, this study offers a pioneering roadmap for policymakers and firms to optimize AI adoption while advancing scholarly discourse through context-sensitive frameworks that balance innovation with equitable socio-economic growth.

Scientific evidence defines artificial AI as a “general-purpose technology” (GPT) because it has the ability to modify economic outcomes and employee management strategies (Brynjolfsson and McAfee 2017; Baldwin-Morgan 1995). AI technology will elevate global GDP by 1.2% per year and deliver $13 trillion economic growth to the world economy until 2030 reported the McKinsey Global Institute in 2018 according to Szczepanski (2019). The manner AI reshapes financial operations and business processes becomes more substantial due to its economic impacts. AI operates at the core of industrial transformation for accounting operations by combining task automation with professional evolution according to Dong et al. (2023), Shihab et al. (2023) and Stancu and Dutescu (2021). Accounting history demonstrates that financial transaction precision stands parallel to standard compliance as foundational elements. Financial processes benefit from AI implementations because the technology efficiently automates tax preparation work and auditing tasks and financial reporting processes along with providing superior fraud detection capabilities through machine learning systems (Ng and Alarcon 2020; Zhou 2021; Vrontis et al. 2023). AI stands incomplete in its potential discoveries because Saudi-Arabia and other developing nations require research closure despite their focus on technological advancement through Vision-2030 (Wassie and Lakatos 2024; Seethamraju and Hecimovic 2022).

The profession embraces transformative capabilities from AI that ask accountants to nurture new abilities as well as transform their professional accountabilities. The combination of intelligent automation and labor augmentation with innovation diffusion will result in at least two times growth of economic expansion rates according to Accenture’s predictions for developed economies from 2035 through 2035 (Aghion et al. 2018). Recent economic growth from AI usage faces multiple challenges that include job loss through automation plus prejudiced algorithmic systems and moral challenges that lead to increased wealth disparities (Norori et al. 2021; Mislavskaya 2021; Muspratt 2018). The Kingdom of Saudi-Arabia places AI at its core for both reducing its dependency on oil resources and improving productivity through Vision-2030 according to Duan et al. (2019), Luo et al. (2018) and Alharasis (2024). Small businesses achieve operational excellence and financial management improvement together with international standard compliance through ERP systems integrated with AI technology (Han et al. 2023; Hassani and Silva 2023; Zhou 2021). Several implementation barriers including high costs and cybersecurity threats and regulatory uncertainties prevent wide adoption of artificial intelligence (Lehner et al. 2023; Erb 2018; Seethamraju and Hecimovic 2022).

This study completely examines how AI technology influences Saudi accounting practices while directly supporting Vision-2030 goals and international developments. The research conducts an analysis of AI adoption elements using structural equation modeling and ADANCO modeling to study usage frequency (Q10AI-Rep-Use) and familiarity (Q7AI-UnLev) combined with perceived opportunities (Q8AI-Pors) and challenges (Q9AI-Cons). The research depends on Wassie and Lakatos (2024) together with Silva et al. (2022). Age data (Q1Ege) and gender (Q2Gender) and education (Q3Educa) and experience act as demographic variables which affect AI engagement and accounting results according to Hamza et al. (2024) and Aljaaidi et al. (2023). The research examines Q17AI-Trust measure for AI system trust while evaluating operational effectiveness through Q12AI-Eff-ACCT-Prosdu alongside investigating how AI improves financial analysis through Q14AIEncUndFinacil and Q15AI-Enc-Analaysis (Adeyelu et al. 2024; Hussin et al. 2024; Odonkor et al. 2024). Researchers engaged Saudi academic experts and professionals to gather essential insights about AI utilization in local markets alongside ethical aspects that match educational reforms (Alharasis 2024; Alkhwaldi 2024; Ali et al. 2022; Ballantine et al. 2024).

AI demonstrates capability to boost operational automation and precision operations and fraud detection per Puthukulam et al. (2021) and Ghanoum and Alaba (2020) even though workforce transformations and skill gaps become barriers to implementation according to Silva et al. (2022), Das (2021) and Hamza et al. (2024). The preparation of accountants for technical roles depends heavily on AI-integrated educational reforms together with focused ethical training according to Alshdaifat et al. (2024), Alkhwaldi (2024) and Topol (2019). The study suggests accounting professionals follow CACS (Commitment, Accessibility, Capability, Skill Development) by MetricStream (2020) as a framework to implement responsible AI adoption and recommends policy solutions to confront regulatory, cybersecurity and bias risks defined by Norori et al. (2021), Schweitzer (2024) and Lee et al. (2018).

The work provides concrete implementation methods for government agents along with organizations and teaching institutions to achieve both economic diversification and technological excellence in line with Vision-2030 objectives. AI adoption studies in other Gulf nations now have this study as a template because it demonstrates how innovation interacts with governance and human capital development (Mgammal 2024; Lemishovska and Mazur 2022).

The remainder of this paper is structured as follows. Section “Literature Review” literature review. Section “Methods” research design and data analysis. Discussions is presented in Section “Results”. Finally, Section “Discussion” provides the general conclusion of the study, highlighting the key outcomes, and includes considerations on the study’s limitations and recommendations for future research.

Literature review

The field of accounting has undergone a transformation through AI technology because this system delivers enhanced accuracy along with automated task performance while providing efficient tools for handling large datasets (Dong et al. 2023). AI is a sub-discipline of computer science that explores and builds the ability of computers to replicate some cognitive abilities of the human brain, such as learning, reasoning, problem-solving, and decision-making (Baldwin-Morgan 1995). All facets of accounting, including taxes, financial accounting, management accounting, auditing, and government reporting, are seeing an increase in the integration of AI (Aiguo et al. 2022). The joined forces between these technologies accelerate data processing operations while ensuring compliance and strengthen both financial analysis capabilities and risk evaluation operations and fraud detection operations (Ng and Alarcon 2020). ChatGPT enables better financial reports along with more precise forecasts and reduced human mistakes in the financial sector (Shihab et al. 2023; Vrontis et al. 2023). AI systems simplify operations involving financial report preparation, transaction reconciliation and compliance oversight functions (Zhou 2021; Ghanoum and Alaba 2020). Organizations can create dependable financial reports through their integration of AI systems and automated technology which decreases human error rates (Puthukulam et al. 2021; Ng and Alarcon 2020; Wassie and Lakatos 2024).

The research focus on AI adoption in accounting shows mismatched progress because academics examine advanced countries such as Australia along with China and Oman but miss the impacts on accounting development in Saudi-Arabia (Wassie and Lakatos 2024). The research on technology adoption uses the Technological-Organizational-Environmental (TOE) framework although it does not offer direct analytical connections between AI developments and financial reporting quality and accounting efficiency according to Seethamraju and Hecimovic (2022). AI’s strategic integration into financial systems becomes essential because emerging issues including computational prejudice, system transparency problems and ethical finance-related decisions create stronger demands for extensive regulatory oversight (Norori et al. 2021; Seethamraju and Hecimovic 2022).

Wassie and Lakatos (2024) examined 62 research articles published between 2019 and 2023 and discovered that while Saudi Arabia in the Middle East displays minimal interest in AI accounting, Asia and Europe provide the majority of these studies. While AI will undoubtedly play a role in accounting in the future, its implementation poses questions about skill adaptability and workforce transformation (Silva et al. 2022). Even if AI boosts productivity, accounting professionals must shift from routine tasks to strategic decision-making and consulting roles (Liu et al. 2022; Sudhamathi 2022). Data analysts, forensic accountants, and AI compliance specialists are examples of emerging professions that need technical proficiency in AI, machine learning, and data analytics (Stancu and Dutescu 2021). Quantitative survey data analysis and statistical assessment represent the majority of research studies but such investigations rarely use qualitative case study methods. Research must examine Saudi firms that adopt AI in accounting as a way to fill the current knowledge gap since it should investigate how AI affects financial reporting and compliance and taxation and fraud detection under Saudi-Arabian market conditions (Wassie and Lakatos 2024).

AI provides Saudi Arabia with unparalleled financial data analysis capabilities, leading to novel accounting solutions that support Vision-2030’s economic diversification objectives (Duan et al. 2019; Luo et al. 2018). Through machine learning algorithms alongside anomaly detection techniques artificial intelligence (AI) effectively supports fraud detection efforts (Perols 2011). AI-powered solutions provide superior high-risk action detection than conventional fraud detection methods because they analyze massive datasets instantly (KPMG 2016). Neural networks with predictive analytics functions help businesses reduce their financial risks through the discovery of concealed fraud patterns (Ranjith et al. 2021). The Saudi Arabian Vision-2030 program supports financial transparency and governance goals and enables AI applications in fraud detection according to Brynjolfsson and McAfee (2017). Accounting professionals dedicate their expertise to client advisory services when they utilize AI systems to perform automated tasks including data entry as well as invoice processing. AI enables quick data processing for better decision-support and streamlines administrative duties that include data input (Han et al. 2023; Hassani and Silva 2023). Companies using AI-powered solutions can enhance their customer relationships through real-time support while monitoring ongoing transactions helps businesses meet international regulatory standards (Teubner et al. 2023; Zhou 2021).

Many important challenges exist across Saudi Arabia regarding the implementation of AI technology. The use of artificial intelligence raises ethical problems and legal challenges composed of algorithmic bias and workforce replacement and corporate accountability concerns (Mislavskaya 2021). FinTech systems now require rapid data protection compliance because AI incorporation has become quick which stops unauthorized data exposure. The continuous need for oversight and fairness testing emerges from AI’s ability to insert bias into programs for financial reporting and fraud detection (Brynjolfsson and McAfee 2017). The accounting sector of Saudi-Arabia needs evolving regulatory frameworks to implement ethical AI systems according to Lee et al. (2018). Saudi Arabian organizations face a combination of challenges because they need to invest heavily in employee education along with digital systems and safe procedures to secure financial data (Lehner et al. 2023; Erb 2018).

The emerging automated technologies endanger traditional accounting operations therefore requiring professional training initiatives to overcome anxiety-related workforce challenges (Muspratt 2018; Stancu Dutescu 2021). The implementation of digital tools faces obstacles from confusing legal structures (Seethamraju and Hecimovic, 2022) although data bias in algorithms sustains financial and gender biases that exist within datasets (Norori et al. 2021). The implementation of investigation into ethical dilemmas involving workforce discrimination and privacy breaches is necessary because Brynjolfsson and McAfee (2017) and Mislavskaya (2021) state so. The guidance from experts includes developing AI7825 education for accountants and establishing specific legal structures for secure operations together with government funding to enhance digitization (Wassie and Lakatos 2024; Seethamraju and Hecimovic 2022; Lehner et al. 2023). The ethical deployment of AI requires organizations to use ethical bias rules while maintaining transparent data management systems according to Norori et al. (2021).

To include AI into accounting practice, teaching methodologies must be transformed. Accounting Information Systems (AIS) are crucial for enhancing the quality of data, which Saudi education requires for AI-integrated learning initiatives, claims Alharasis (2024). According to Alkhwaldi (2024) the social sustainability of Metaverse models requires student-perceived alignment for successful AI integration. The educational community advocates for programs that unite technical competence development with moral instruction according to Ali et al. (2022) and Alshdaifat et al. (2024). According to Ballantine et al. (2024) AI serves both as a threat and possibility because programs should transition past simple automation to promote stronger analytical abilities. Performance expectancy along with effort expectancy and user satisfaction play crucial roles in technology adoption according to both the Unified Theory of Acceptance and Use of Technology (UTAUT) and Information System Success (ISS) model and researchers (Alkhwaldi 2024; Alharasis 2024, 2025) explain this finding by supporting the need to develop AI educational tools based on student expectations. Research beginning with Baldwin-Morgan’s (1995) expert system proposal shows that AI education remains relevant today due to digitalization trends mentioned in Shi’s work (2020) and three more investigations (Aiguo et al. 2022; Lemishovska and Mazur 2022; Liu et al. 2022; Sudhamathi 2022). Accountants display reluctance toward AI implementation primarily because they worry about losing jobs together with advancing ethical concerns (Silva et al. 2022).

AI is central to Saudi Arabia’s Vision 2030, enhancing transparency, accountability, and investor trust through advanced analytics (Brynjolfsson and McAfee 2017; Schweitzer 2024). Its integration in SMEs and startups drives entrepreneurship, job creation, and economic growth via automation and AI-driven tools (Luo et al. 2018; Han et al. 2023). However, challenges such as employee resistance to change and a shortage of skilled personnel hinder AI adoption in financial analysis, audit quality, and risk management (Hamza et al. 2024; Aljaaidi et al. 2023). Addressing these requires government-led educational reforms and regulations ensuring data privacy and algorithmic fairness (Topol 2019; Mgammal 2024; Lee et al. 2018; Schweitzer 2024).

In accounting, AI improves efficiency, transparency, and strategic planning, particularly for SMEs, by reducing costs and optimizing operations (Luo et al. 2018; Lee et al. 2018). Despite upfront costs in infrastructure, training, and security (Hashem and Alqatamin 2021), long-term gains like 80% faster processing, lower costs, and improved accuracy justify investments (Acemoglu and Restrepo 2018; Rampton 2017), aligning with Vision 2030’s sustainability goals (Schweitzer 2024). Organizations need both workforce training and a plan to overcome resistance to change before they can reach AI’s maximum potential (Hamza et al. 2024; Aljaaidi et al. 2023). Future research should analyze CACS as a framework for integrating AI in accounting processes (MetricStream 2020) alongside education efforts to provide students ethical and technical training for finance tasks in AI environments (Ali et al. 2022; Ballantine et al. 2024). Saudi Arabia should implement proper governance measures to support innovative AI-enhanced accounting solutions which will drive economic transformation and technological superiority within Vision 2030.

The modern accounting discipline transforms through AI advancement that boosts precision while it performs standardization and supports detailed examination of extensive datasets (Dong et al. 2023). ChatGPT joins other AI technologies which improve financial trend prediction while enhancing reports quality and decreasing human mistakes (Shihab et al. 2023; Vrontis et al. 2023). Experimental research has unveiled major AI potential areas in accounting through predictive data analysis which automates accounting processes including financial auditing and fraud detection (Albayati 2024; BaiDoo-Anu and Owusu Ansah 2023). AI provides rapid accurate data analysis capabilities which enhances business financial decision-making processes (Deike 2024). The technology enhances customer service operations through its capability to deliver quick support and handle difficult accounting challenges in an efficient manner (Teubner et al. 2023).

Implementing AI technology in accounting practices has several upcoming obstacles to overcome. Privacy along with security risks develop because of processing sensitive financial information which creates opportunities for cyber-attacks (Gordijn and Have 2023). The implementation of human bias in AI-driven decisions becomes possible when machine learning algorithms process unbalanced data which produces improper outcomes (Dwivedi et al. 2023). AI creates job displacement fears that account for decreased demand in traditional accounting work which requires current employees to train themselves for advancing skills (Khennouche et al. 2024). Accounting professionals adopt AI from the perspective of the Technology Acceptance Model (TAM) that links their usage to perceived ease of use and benefits according to Rahman et al. (2023). The Diffusion of Innovation Theory (DOI) demonstrates implementation ease and compatibility as key drivers for AI adoption according to Salloum et al. (2024). AI technology acceptance in accounting depends on risk perceptions according to the Perceived Risk Theory (PRT) analysis by Cotton et al. (2024). The successful implementation of AI-based accounting requires three specific measures according to Gordijn and Have (2023) and Dwivedi et al. (2023). First, AI decision transparency must be improved. Second, targeted training must develop accounting skills. Finally, strong governance systems need to prevent errors and biases. Despite its unmatched ability to enhance accounting processes AI technologies create difficulty regarding security controls as well as workforce adjustment and fairness concerns. A combination of regulated supervision with training programs and responsible AI application will allow accounting professionals to maximize their AI potential and build seamless partnerships with artificial intelligence systems.

AI serves as an essential tool for accounting enhancements through automation of monotonous tasks as well as large data analytics and strong financial auditing capabilities. AI technologies have advanced to include Large Language Models which now present new challenges in gender-based classification of accounting professions within business environments (Leong and Sung 2024). The research shows that AI technology presents major advantages for accounting practice because it speeds up big accounting data analysis which leads to better financial decision-making (Leong and Sung 2024). Financial process automation with AI technology provides reporting and auditing capabilities by decreasing human involvement that leads to lower errors (Shihab et al. 2023). The combination of AI helps increase transparency and compliance through its precise financial transaction review system which detects abnormal activities (Teubner et al. 2023).

Accounting practices face multiple challenges during the implementation of AI technologies. Decision-making processes may introduce biases because LLMs demonstrate gender-oriented patterns when sorting accounting roles between masculine and feminine roles per the training data (Leong and Sung 2024). Accounting job roles considered masculine earn greater salaries than those classified feminine which confirms the socioeconomic impact of gender-based discrimination through AI technology (Leong and Sung 2024). Clear regulatory standards need adoption because ethical and legal problems demand them to stop existing market bias intensification (Ferrara 2023). An empirical research study using LLMs conducted the gender-based classification of accounting roles through the Chi-squared Test which showed substantial discrepancies between the classification results of various models (Leong and Sung 2024). The authors advocate for better governance and regulation through policy development to support fair workplace conditions as a strategy to minimize AI biases while extracting its maximum benefits in accounting operations. The authors suggest developers maintain high training data standards while educating users and accountants about AI bugs in order to enable them to select technologies properly (Leong and Sung 2024). The substantial advantages of AI in accounting transformations need to be combined with an integrated strategy that addresses ethical concerns alongside economic and social implications of LLM bias incorporation. The adoption of AI by accounting practices requires both regulatory standards and training methods that guarantee fair and inclusive implementation.

AI stands as a transformative technology that dominates business economics because it transforms accounting procedures by incorporating automated systems and large-scale data processing. Organizations face crucial hurdles associated with ethical dilemmas as well as privacy concerns and regulatory obstacles after implementing this technology (Wach et al. 2023). The latest research findings show AI technology enables various advantages for accounting such as decreasing human workloads while reducing errors and enhancing overall operational performance (Radford et al. 2019). Businesses can exploit their extensive accounting data through AI to forecast financial patterns while making better business choices (Wach et al. 2023). AI detection tools raise transparency standards and compliance by spotting unauthorized financial operations and enforcing accounting law compliance (Robertson 2023). Multiple implementation issues confront accounting professionals who integrate AI systems. The absence of structured rules and oversight measures generates space within which organizations can exercise legal or ethical misconduct (Amariles and Baquero 2023). The growing automation in accounting practice requires accountants to undergo professional development for new skills to sustain their employment in a changing landscape according to Khogali and Mekid (2023). The utilization of AI in financial data analysis produces privacy and cybersecurity issues because insufficient protection measures exist (Teubner et al. 2023).

A major hazard exists when artificial intelligence systems include biases from training data which leads to improper financial outcomes (Norori et al. 2021). The research investigation of Wach et al. (2023) acknowledges seven essential risk fields from accounting AI applications including market regulatory requirements, data quality and misinformation challenges, automation-related job displacement and data privacy breaches, social manipulation of professional ethics along with employee technostress impacts and economic/social disparities. The study promotes the development of strong regulatory standards to safeguard AI uses in accounting by combining privacy security and fraud prevention measures (Amariles and Baquero 2023). Financial systems need accurate outcomes that require preventing bias in machine learning training datasets as a way to maintain fairness (Norori et al. 2021). Human resources departments should establish training programs which teach accounting employees how to work with new technology systems and effectively utilize AI-based tools (Khogali and Mekid 2023). The protection of accounting data through robust cybersecurity measures stands essential because it blocks fraudulent activities (Teubner et al. 2023). The adoption of AI in accounting requires establishment of clear regulations with ethics in mind along with innovative training programs and sustainability frameworks to secure the maximum benefits from this technology (Wach et al. 2023).

Methods

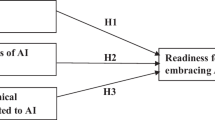

Theoretical framework and hypotheses development

The global accounting industry transforms with AI technology through efficient accuracy alongside automation benefits combined with fraud detection capabilities. Statistical evidence indicates developed economies have disproportionately adopted AI technology without fully understanding Saudi-Arabian markets affecting by the technology. An examination of AI technology showcases how it modifies financial processes and enhances accounting capabilities as well as raises fraud detection capacities and supports regulatory compliance measures while Saudi-Arabia executes Vision-2030 for its technological development. The paper offers workforce preparedness solutions alongside handling legal boundaries and moral issues. Saudi-Arabia’s distinctive characteristics receive complete analysis through the combination of TOE framework (Tornatzky and Klein 1982) and the KAP model. The TOE framework establishes a framework that integrates AI adoption through technological AI tool elements and anomaly detection algorithm implementation with organizational workforce training and organizational restructuring together with environmental regulatory policies and Vision-2030 objectives. The KAP model monitors how accountants’ AI knowledge together with their opinions about advantages and threats and their practical AI involvement determine the adoption results. The construct merges technological elements with human-focused components to bridge scholarly gaps about socio-technical complexities that generally remain unexamined in developing economies’ research.

The proposed hypotheses within this study adopt this theoretical framework to understand the effects these four elements have on AI adoption. The use of AI approximately twice per month enhances financial transaction operations by reducing human error rates and improving verification accuracy (H1) according to research found in invoice automation software examples (Zhou 2021). People who understand AI tools better will show increased capability in leveraging them (H2a) yet extensive automation dependence can cause workers to develop a sense of exhaustion (H2b) (Stancu and Dutescu 2021). Accounting professionals need systematic upskilling training programs because AI will play an essential role in their field (H3) according to Aljaaidi et al. (2023) and these established educational programs make workforce transitions more efficient. The implementation of AI technology requires additional interventions for effective improvements to take place. Transaction processing efficiency benefits from advanced automation technology only when supported by organizational policies and regulatory mechanisms (Wassie and Lakatos 2024; H4). AI delivers better accuracy and cost efficiency through proper strategic planning that connects technology applications to organizational targets (H5) (Seethamraju and Hecimovic 2022). Demographic attributes affect adoption patterns because women potentially experience different usability perceptions compared to men (H6) (Schweitzer 2024), professional workers with younger ages show higher engagement compared to their older colleagues (H7) (Abdullah and Almaqtari 2024) and professionals with higher education levels endorse AI integration (H8) (Teubner et al. 2023).

The implementation of organizational programs stands above AI use alone as the critical factor accounting professionals need for change readiness (H9) (Muspratt 2018). Professionals equipped with proper preparation create increased operational speed and lower operational costs together with heightened accuracy rates (H10) (Ballantine et al. 2024). Strong Results in fraud detection and enforcements require positive relationships between user engagement and outcomes to be successfully managed through AI awareness (H11) usage frequency (H12) and ethical governance (H13) according to Norori et al. (2021) and Alkhwaldi (2024). The study enhances AI adoption research by linking TOE and KAP frameworks to present a socio-technical viewpoint that rare in developing economies research. This theoretical contribution brings demographic factors (age, gender, education) as moderators with ethical concerns to enhance studies about equitable AI implementations. The analysis utilizes SEM provided by ADANCO for hypothesis validation while overcoming geographical sample bias challenges (Wassie and Lakatos 2024).

The successful deployment of Vision-2030 demands preparation of the workforce and explicit guidance linked to ethical management practices to accomplish AI adoption. In order to adopt AI successfully Saudi policymakers need to establish three fundamental strategies starting with training their citizens about AI fundamentals alongside offering platform incentives and regulating algorithmic discrimination and employment vulnerabilities (Lee et al. 2018; Schweitzer 2024). Organizations must make reskilling programs their highest priority through developing policies which will ensure innovation but maintain compliance regulations. The research develops a model to study AI adoption in developing economies by integrating global theoretical concepts with Saudi-Arabian context while illustrating how technology engages with human capital and government mechanisms. The national AI-driven accounting leadership aligns Saudi-Arabia to advance Vision-2030 sustainable economic transformation goals.

Research approach, sampling and data collection instrument

The research approach follows a quantitative method to study AI adoption in Saudi accounting practice while combining the TOE framework (Tornatzky and Klein, 1982) with the KAP model. Research adopts ADANCO as the structural equation modeling approach for analyzing survey data to perform hypothesis testing through composite-based analyses (Wassie and Lakatos 2024). The choice of ADANCO as modeling framework was motivated by its ability to handle formative constructs which includes AI engagement and regulatory influence thus being optimal for developing economy AI adoption research (Hair et al. 2021). The research methodology follows established standards of scientific rigor when used for SEM modeling in accounting and finance according to Silva et al. (2022) and Seethamraju and Hecimovic (2022).

A questionnaire survey targeting 101 Saudi accounting academics was conducted between February and March of 2024 through a university network and professional connections. Academics forming the majority of participants represent a workforce with extensive knowledge of accounting education and auditing and financial reporting hence their insights are suitable for examining both educational and industrial concerns (Alharasis 2024; Ballantine et al. 2024). Academic participants selected for this survey represent Saudi-Arabia’s technology-driven populace that directly supports Vision-2030’s human capital development goals as identified by Duan et al. (2019). Research indicates that survey participants included 65% males and 36% people aged 25–34 together with 47% holding doctoral degrees thus manifesting their preparedness for AI implementation in their academic domain. Saudi accounting scholars contribute essential analysis about academic concepts and practical issues in ambiguous regulations which addresses educational requirements and compliance standards (Hamza et al. 2024; Schweitzer 2024). The research used Mgammal (2024) questionnaire adaptation as a self-administered instrument to measure AI adoption in accounting per previous research by Bygren (2016), Li and Zheng (2018), Afroze and Aulad (2020), Rashwan and Alhelou (2020), Akinadewo (2021), Al-Rifai (2022), Assaf (2022), Qhabeel et al. (2022) and Aljaaidi et al. (2023). The initial five queries in the survey collected respondent data that included age, gender, education status along with professional accounting tenure and organizational affiliation type. The survey design incorporated representative sampling methods for various experience levels which generated extensive knowledge regarding Saudi-Arabia’s accounting profession’s AI adoption scope.

Supplementary Appendix 1 included a structured questionnaire that achieved both convergent validity with AVE above 0.5 as well as discriminant validity through Fornell-Larcker criterion. The study measured key variables which include frequency of AI system usage together with organizational familiarity about AI technologies and their financial transaction processes and their readiness for organizational changes. AI usage frequency assessment relies on tracking how often respondents use AI tools such as ChatGPT and fraud detection algorithms in their accounting workaday (Zhou 2021). AI familiarity functions as a tool to assess employee understanding about technologies that use AI capabilities alongside their perception of associated risks as described by Stancu and Dutescu (2021). Financial transaction processes concentrate on enhancing transaction precision as well as detecting fraudulent activities because they directly serve financial reporting compliance standards worldwide (Puthukulam et al. 2021). The measurement of change preparation emphasizes workplace readiness through technological programs because of existing research investigating accounting personnel adaptability (Aljaaidi et al. 2023 and Mgammal 2024).

The reliability test followed Cronbach’s alpha (>0.7) measurement while bootstrapping through 5,000 resample sets maintained the stability of parameter values (Hair et al. 2021). Each empirical construct received specific adaptation to fit Saudi-Arabia’s regulatory framework that supports both Vision-2030 AI governance policies and IFRS compliance (Zhou 2021; Wassie and Lakatos 2024).

This study employs ADANCO for composite-based SEM, rather than covariance-based SEM (CB-SEM), due to several methodological considerations. ADANCO demonstrates outstanding suitability for emerging technology analysis within developing economies because it supports both predictive studies and new technology trend examinations (Wassie and Lakatos 2024). ADANCO offers support for formative constructs with composite modeling since AI engagement and ethical governance constructs need approaches beyond reflective modeling of CB-SEM (Hair et al. 2021). ADANCO offers effective analysis of smaller dataset populations especially for Saudi accounting scholars whereas CB-SEM needs larger sample sizes according to Silva et al. (2022). The study investigates age and education variables as moderators because they integrate well with ADANCO’s sophisticated multi-level connection modeling capabilities (Norori et al. 2021). Meanwhile, AI awareness works as a mediator which ADANCO also supports through its advanced relationship modeling (Norori et al. 2021).

The use of covariance-based SEM mainly supports theory confirmation through assessment of goodness-of-fit indices like CFI and RMSEA. The model should be selected as the most suitable fit for research that needs to determine essential factors behind AI adoption since it maximizes variance explained through its R² values. The composite-based SEM analysis conducted by ADANCO demonstrates that accounting efficiency depends on 92.35% of variables (H10), thus confirming the significance of AI training and workforce preparation for AI adoption patterns (Ballantine et al. 2024). Researchers support AI literacy programs to prevent job loss and improve automated financial reporting according to Muspratt (2018) as well as Lee et al. (2018).

The methodology decisions from the study hold important practical consequences. The goal of maximizing variance explanation (R²) within ADANCO helps policymakers and business leaders create specific AI literacy programs and regulatory policies that produce better adoption results (Luo et al. 2018). The study confirms H6 and H7 to provide demographic evidence which benefits the creation of inclusive AI teaching plans (Schweitzer 2024; Abdullah and Almaqtari 2024). The study reveals that automation fatigue exists because excessive AI usage leads to disengagement according to the negative coefficient in H2b. AI governance frameworks must establish systems to manage technological progress against workforce health because Stancu and Dutescu (2021) highlight this need.

ADANCO’s composite-based SEM methodology enables this study to conduct a strong analysis of AI adoption in Saudi-Arabian accounting which complies with international best practices while supporting Vision-2030’s digital transformation initiatives. The research demonstrates that educational institutions serve as essential components for developing an AI-competent workforce and uncovers how AI boosts fraud identification together with financial effectiveness and automatization abilities in various industries (Zhou 2021; Teubner et al. 2023).

The study provides comprehensive findings about AI usage by Saudi-Arabian accounting academics but additional research should examine implementation strategies of AI technology in private sector companies with professionals. The research framework from this study provides a reference point for future developing economies AI adoption investigations because it demonstrates the three-point connection between technology, governance, and human capital (Mgammal 2024).

Diagnostic tests

Reliability

The measurement meant the use of numbers, percentages, means, and standard deviations for the closed-ended responses from the participants. Content analysis of the responses was also used to derive themes regarding the limitations of AI and areas of preparation. Cronbach’s alpha reliability coefficients were used to test the internal consistency of the Likert-scale measures. It also made it possible to consider whether the data obtained through the questionnaire could be credible for identifying accountants’ perceptions of the usefulness of AI within the profession. All reported items are presented in Supplementary Appendix 1.

Data collection method

The target population in this study was academics in the field of accounting in Saudi-Arabia, and the technique adopted for sample selection was snowball sampling. Google Forms was used to generate a link through which the respondents could access the surveys sent to them. Considering the target audience, the link to the survey was personally sent to the academics in the field of accounting by the researchers through their working email addresses and through the social media sites: WhatsApp groups, Instagram accounts, Snapchat, Facebook, and the ‘X’ platform where the researchers directly tagged the SOCPA account and appealed for the account followers to help the researchers in data collection. This survey was conducted between February and March 2024, and data collection was also conducted within this time frame. In total, 101 specialists completed the questionnaires.

Data analysis

To test the hypothesized research model, we employed ADANCO, an approach to CA-SEM. Based on Anderson and Gerbing’s (1988) recommended two-step approach, the first step involved the assessment of the measurement model for the construct under study; that is, employability skills using confirmatory factor analysis (CFA) to establish the validity and reliability of the construct. We then further evaluated the structural model employing the techniques provided by Hair et al. (2021) to analyze the hypothesized relationships among the constructs. A covariate multiple regression equation with OLS estimation was employed to estimate awareness, usage, engagement, and demographics as antecedents of financial processes, change preparedness, and accounting efficiency. Furthermore, a binary logistic regression test was performed to analyze the impact of the independent variables on the binary perceived positive impact of the AI-dependent variable. A set of CFA tests was employed to check the convergent and discriminant validity of the measurement models. While CFA was applied to estimate the measurement model, other hypotheses were tested using OLS regression, while binary outcome hypothesis testing was performed using logistic regression. In line with the two-step CFA procedure to validate the measures and structural modeling procedure for survey-based research models, the procedure meets the standards.

Models

We employed two types of regression models: simple linear regression, multiple regression, and logistic regression. OLS Regression is a linear regression technique that measures the relationship between dependent and independent variables and calculates the degree of variation between the dependent and independent variables’ predictions. It was used to determine the coefficient of the independent variables; awareness, usage, engagement, demographics and dependent variables such as ‘Financial Transaction Processes,’ ‘Preparation for Change,’ and ‘Accounting Efficiency, Accuracy and Costs.’ Logistic regression is used when the dependent variable is nominal, and it models the probability of a certain input point belonging to a certain category. This model was applied to determine the binary dependent variable of perceived AI impact, which was established based on the average of the questions regarding the effectiveness of the use of AI in the organization. Particularly, hypotheses numbers one through ten related to the use of the continuous dependent variable used the OLS Regression method, while the binary outcome analysis to categorize respondents’ perception about AI happened with the help of the Logistic Regression method.

Survey data analysis

In Fig. 1 and Table 1, we see that what came out from the data is an overview of a relatively large, mostly male (65%), fairly youthful (36% being 25–34 years of age), and educated group (47% with doctorate’s degree, 42% with master), which is reflective of a progressive and wise group. A majority of the respondents had been in the field for less than five years (39%). AI implementation is still growing, with 59 percent of entities reporting their implementation of AI applications; this combined with high levels of awareness, with 48% (19% + 29%) of the respondents being very familiar or familiar with AI. The daily usage of AI is moderately high (35%), signifying that the usage of AI technology in daily activities is on the rise, but the remaining 28% uses AI very sparingly. At 91%, the level of acceptability of AI’s influence indicates optimism; thus, the growth and development of AI is expected in the future. The variation in the training requirements, which extends to areas such as AI (38%) and skill upgrades (26%), shows an audience who is willing to learn more. Thus, further strengthening of AI’s presence, promotion of its application, and support of targeted training should be viewed as a continued enhancement of this promising groundwork toward developing more innovations with an emphasis on inclusiveness.

Age Group: Distribution of respondents by age categories. Gender: Gender distribution. Education Level: Distribution of respondents by level of education. Years of Experience: Distribution of respondents by experience. AI Implementation: Distribution of respondents by using of AI. AI Awareness: Distribution of respondents by Awareness levels of AI. AI Impact: Distribution of respondents by impact of AI. Academics' Attitude Towards AI: Distribution of respondents by Academics' Attitude. Concerns About AI: Distribution of respondents by level of Concerns About AI. Training Needs: Distribution of respondents by Needs of AI training.

Descriptive analysis

In Table 2, the data elicited provide insight into respondents’ attitudes and perceptions towards aspects of AI within the workplace. These demographic statistics reveal that the study participants’ age is relatively evenly spread with a mean age of 2.31 a standard deviation of 1.13, and that it can be slightly shifted to one side. Levels of education and experience are heterogeneous, with the median values of the tested variables being above average. Respondents’ perception and understanding of the usage of AI is positive, and the mean values show that they perceive the use of AI in their roles as helpful. However, the ranges defined by standard deviations speak of diversity and help measure differences in people’s experiences and attitudes. In this regard, the mean scores for AI efficiency, accuracy, and cost indicate a relatively positive attitude toward AI’s effects on professional productivity and financial knowledge, albeit with certain concerns. Another variable that has improved is trust in AI, where the trend is also on the rise, although the std reveals that there is a possibility of increasing confidence slightly. Accounting and the role of AI, as well as weaknesses and training needs, imply a closer look at the insights, which, on the one hand, reveal high regard for AI, and on the other, its further development and education. In conclusion, it can be said that people have a rather optimistic attitude towards AI, although it is accompanied by a desire for further development of knowledge and trust in the subject. This critical analysis also insists on the reduction of variability in the experiences of AI and the concentration on proper training of the AI system to achieve enhanced results.

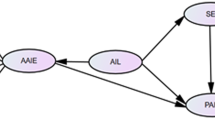

Measurement of the model

In Fig. 2 below, the SEM diagram represents the relationships between several key factors related to AI’s impact on accounting. It shows how demographics, AI awareness and usage, and AI engagement contribute to the impact of AI on accounting outcomes such as efficiency, accuracy, and costs. Path coefficients (like 0.559) indicate the strength of these relationships, with arrows showing the direction of influence. The central latent variable, AI Impact on Accounting, is influenced by factors like AI engagement and demographics, highlighting how various elements work together to affect accounting processes. The model helps visualize how these factors interconnect to shape the overall effect of AI in the accounting field.

Convergent validity analysis

Based on Table 3, which shows the AVE and CR values for each construct, the AVE values for all constructs are 1.0, but it makes sense because all convergent validity refers to the extent to which each construct accounts for the variance of its indicators, and in this case, they all account for 100% of the variance. The CR values varied between 0.882 and 0.995, which also indicates its high performance, where the minimum CR must be 0.7. This indicates that all the constructs have good-to-excellent internal consistency reliability, as depicted below. More specifically, CR values that indicated superb reliability were above 0.99 for the financial transaction processes, preparation for change, and accounting efficiency/accuracy/cost factors. - Among all the constructs, the lowest CR value was found in the AI Usage construct with a value of 0.882; however, it is relatively reliable, with values above the standard cut-off. In summary, both AVE and CR values reveal that the measurement model demonstrates high levels of convergent validity and internal consistency. The constructs are dependable and have validity with reference to their conceived ideas.

Discriminant validity analysis

Fornell, Larcker (1981)

The square root of the AVE for each construct in Table 4 is greater than the correlations with the other constructs, indicating good discriminant validity.

Table 5 results show that the items generally load higher on their respective constructs than on others, indicating good discriminant validity.

Correlation analysis

Table 6 shows that several multiple variables are evidently related in the given dataset. Looking at the correlation between age and experience it is apparent that the relationship between them is at 0.804 which can be regarded as rather high This means that the older people are, the more work experience they are expected to possess. Gender and AI usage are also closely related with a correlation value of 0.837, which implies a moderate level of relationship between the two. The results of correlation analysis show that there is a negative correlation between AI degree and repetitive AI control (−0.702); It indicates that greater application of AI is likely to mean that it is used less repetitively, possibly because it is used more effectively. Thus, perceived opportunities and constraints of AI (0.705) appear to have a positive linear relationship, meaning that as people’s perception of the opportunities created by AI expands, so does their estimate of the constraints. The perceived effectiveness and accuracy of AI are positively related to encouragement for analysis as well as usage in accounts (0.773, 0.719 respectively) suggesting that efficient AI tools encourage more analytical initiatives and gateways into proceedings in accounts. Respondents that were encouraged to understand the financials of a business were more inclined to be encouraged to perform an analysis as well as utilize AI in accounts hence the correlation coefficient of 0.733 for this statement and 0.754 for this statement. Also, trust in AI is strongly correlated with accounts’ AI usage (r = 0.826), which confirms the hypothesis that increased AI trust results in increased AI integration in accounts.

We use AI to produce the image

.Results

Regression analysis

In Table 7, H1: More frequent AI usage enhances general financial transaction processes, and there is a positive correlation between the frequency of AI usage and enhanced processes in the transaction. H2: There is a distinct positive correlation between familiarity with AI and actual AI application, as well as a distinct negative correlation between repetitive AI application and AI application, which may indicate that familiarity leads to increased utilization, and repetitive application may stem from inefficient processes. H3: Therefore, there is a positive correlation between the intensity of AI use and the need to prepare for change accountants, implying that a higher intensity translates to a higher need for preparation. H4-H5: While there is no impact on financial transaction processes or accounting efficiency, accuracy, or cost with the engagement of AI, there might be other factors that drive these impacts. H6: Gender differences may exist when it comes to experiences, attitudes, and perceptions of how AI influences the processes of financial transactions. H7 the level of AI engagement in the accountants’ organization is inversely proportional to the age of the Accountants’ Firm, meaning that the older the accountants, the less likely they will engage with AI. H8: The results of the regression analysis show that education level has a positive and significant impact on the need to prepare accountants for change, implying that education is key to preparing for the use of AI. H9: An increase or decrease in the extent of engagement with AI does not directly affect the extent of the need to prepare accountants for change, suggesting that there are other causes for the need to prepare accountants for change. H10: A relationship of significance and positive sign was obtained between preparatory need for accountants’ change and efficiency, accuracy, and cost of accounting, all of which point to the fact that preparation is key to reaping from AI advances.

Logistic regression analysis: impact of AI on accounting

This research seeks to establish the perceived effects of AI on accounting aspects and accountants’ roles by analyzing the demographic factors and factors related to the extent of engagement in the use of AI, with the help of logistic regression models to determine which of these factors are the predictors for each aspect. In Table 8, the analysis covers three primary categories: AI effectiveness examines how the use of AI enhances the performance of an organization in general; specifically, Procedural Impact captures how AI procedures affect members’ efficiency, and Training and Role explore training members for AI roles in an organization.

Model fit indices are crucial for evaluating the adequacy of a structural equation model (SEM). In the context of the research problem, the logistic regression model in Table 8 shows the factors that contribute to the perception of AI’s positive impacts on accounting processes. The pseudo R-squared value for this model was equal to 0.1797, indicating that approximately 17.97% of the variance in the dependent variable could be explained by the predictors. Key findings showed that Q10AI-Rep-Use (Frequency of AI usage) was statistically insignificant, as it had a very high p-value of 0.084, which is close to being non-significant at 0.01 significance level, suggests that grocery prices computed using the CPI may be misleading if used in further analysis. 05 level. This indicates that there could be a positive correlation between how often these tools are being used in organizations and the perception of their positive effects on the organization, which forms the basis for this research. The remaining predictors were age (Q1Ege), gender (Q2Gender), educational level (Q3Educa), years of experience (Q4Exper), current use of AI (Q6AI-ues); familiarity level with AI (Q7AI-UnLev), perception of the benefits arising from AI (Q8AI-Pors), and perception of the risks associated with AI (Q9AI-Cons).

Hence, positive perceptions of AI in relation to accounting are positively associated with the constant use of AI. Nonetheless, the insignificance of other predictors in these perceptions taps the likelihood that several other factors affect these perceptions, which requires further investigation. where it is used to indicate the extent to which the specified model emulates the actual data. The chi-square (χ²) in Table 9 holds the null hypothesis of a perfect one-to-one match between the model and the data in question, while the lower p-value of χ² signifies that it lies greater than 0. However, is sensitive to the sample size, and as such, reveals high statistical significance in large samples for models that could fit the data well; therefore, other indices of fit should be used. The Root Mean Square Error of Approximation (RMSEA) in Table 10 evaluates how well a hypothetical model that has the best possible, although unknown, estimator placed in the model would fit the population covariance matrix. According to the results achieved, the following information is presented: RMSEA values less than 0.0. Five suggested a good fit, whereas values below 0.05 and 0. Eight are considered to fit well, suggesting that D-STS 0.08 has a reasonable fit, whereas values between 0 and 0.08. Ten suggest a poor fit, while values below 0 suggest a good fit. 10 comprised poor fit. However, like other fit indices, it also considers the model’s complexity and comes with a confidence interval, and thus is a good measure of fit. The Comparative Fit Index (CFI) is the difference between the fit of the specified model and that of an independent (null) model. In Table 11 the CFI index has values between 0 and 1; higher values are more desirable, ranging from 0 to 1. Values above 0. Ninety are widely considered good, and scores above 0.95 suggest a very good fit. CFI is also less sensitive to sample size than the chi-square.” Consequently, the employment of these different indices gives a broad outlook on model fitness to make the right decisions on either improving the model further or accepting it as it is.

Results of hypothesis test

Diagnosis of the structural model hypothesis testing results was carried out in line with the guidelines of Hair et al. (2021), which demanded checking of R squared for endogenous resources (R2R^2R2), beta (β\betaβ), and the values of t against the bootstrapping procedure that was performed with 5000 resamples. In accordance with the reporting guidelines explained by Hahn and Ang (2017) for quantitative studies, the BI analysis included effect size and confidence interval, as shown in Table. Complimentary to the analysis above, our research is based on direct and indirect relations in the framework of the influence of AI on accounting practices. Thus, the research produced material results for the assessment of direct relationships.

For hypothesis H1, the significant predictor is Q10AI-Rep-Use that carries a path coefficient of 0.2095 and hence the p-value of 0.003. This means that the frequency of the usage of AI has a huge influence on the financial transaction processes. Statistically significant predictors for H2 are Q7AI-UnLev and Q10AI-Rep-Use with betas of 0.1016, p = 0.002 and −0.2210 (p < 0.0001), respectively. This means that the more familiar one gets with AI, then the higher the likelihood of using it while dynamic use lowers the chances of frequent usage of the same. H3 which involves the Q10AI-Rep-Use as a considerable predictor entails a path coefficient of 0.2387 and the p-value of 0.024, This will suggest that with the increase in the frequency of using AI, there will be a bigger issue of needing to prepare accountants for change.

Applied to Hypotheses H4 and H5 it resulted in absence of significant predictors N/A implying that the AI engagement by itself does not have an effect on the financial transaction processes or accounting efficiency, accuracy and costs. For the last hypothesis H6 the leading predictor is Q2Gender and its corresponding path coefficient is 0.3137 and an associated p-value of 0.033, which results imply that gender assumes a significant of on the management of the financial transaction. The path coefficient of the significant predictor, Q1Ege, for H7 is zero and a negative value of −0. The mean for the group is 0583 and the p-value of this study is 0.003, which means age influences the usage of AI in accountants’ practice.

In the case of model H8, the only significant predictor is Q3Educa and the path coefficient was estimated to be 0.2452 and a p-value of 0.032, it can be seen that educational level of professionals influences the extent that it is imperative to get accountants ready for change. There was no evidence in support of Hypothesis H9 as no significant predictors were found (N/A), which depicts that AI engagement level does not exert a significant effect on the concern of preparing accountants for change being a concern. As for the path coefficient of H10, Preparation for Change is identified as a significant predictor; thus, the path coefficient is equal to 0.9235 and the p-value is <0.0001. This study supports the notion that the importance of preparing accountants for change is a measure that affects efficiency of accounting, accuracy and costs.

When testing hypotheses H11, H12, and H13 concerning indirect relationships in the moderation analysis, the mediators were AI engagement and impact in accounting. Although H11, H12, and H13 were not applied in this research directly, the obtained simple direct relations pave the way towards understanding the mediating effects that were presupposed by these hypotheses. Combined, these outcomes contribute to the advancement of knowledge regarding the connections within the introduced model and help identify direct and indirect consequences. Concerning the research objectives, the results suggest that AI awareness and usage, AI engagement, and the effects of AI positively predict the comprehensiveness of AI to account for accounting.

Discussion

The research investigates CGI (AI) potential for accounting operations throughout Saudi-Arabia. This research attempts to expand respondent knowledge regarding AI implementations in accounting functions as well as their occupational behaviors toward these AI applications. These major findings based on the literature demonstrate the essential role of AI in accounting where it automates tasks while enhancing computation precision and resolving complex fraudulent activity (Zhou 2021; Ng and Alarcon 2020; Wassie and Lakatos 2024) and buttress the research conclusions. AI introduces automation, increases the accuracy of calculations, and addresses complicated fraud detection issues, which reaffirms the conclusions made in this study. Accenture’s prediction that AI will boost global economic development rates through 2035 proves compatible with Saudi Vision-2030’s guidelines regarding AI-based economic transformation (Aghion et al. 2018; Duan et al. 2019; Luo et al. 2018). Fragmented data from the McKinsey Global Institute supports that AI operates to boost worldwide GDP by 2% annually along with generating $13 trillion of economic value by 2030 (Bughin et al. 2018).

The evaluation method equipped with ADANCO and SEM mechanisms performs assessment on both demographic statistics and artificial intelligence perception and utility through structured questionnaires following the guidelines by Wassie and Lakatos (2024). This research met different types of validity and reliability requirements that matched academic investigations of the Technological-Organizational-Environmental (TOE) model as noted by Seethamraju and Hecimovic (2022). Seven hypotheses (H1, H2, H3, H6, H7, H8, H10) (disruptive potential of AI in accounting) receive direct and substantial validation throughout the structural model assessment. The nonsignificant results in H4 and H5 in the model can help explain the implementation issues mentioned in literature regarding algorithmic biases and workforce displacement concerns that show AI benefits depend on specific contexts (Norori et al. 2021; Muspratt 2018).

This study confirms AI literacy drives adoption (path coefficient: 0.2095) (Alharasis 2024; Alkhwaldi 2024), with AI awareness directly correlating to integration in workflows. However, excessive usage (−0.2210) triggers automation fatigue (Stancu and Dutescu 2021), necessitating strategic adoption plans to balance benefits and over-reliance. AI’s analytical capabilities strongly enhance accounting efficiency (0.9235) (Puthukulam et al. 2021; Zhou 2021), aiding fraud detection, compliance, and automation. Moderate adoption commitment (0.2387) reflects reskilling demands (Muspratt 2018; Hamza et al. 2024), aligning with Saudi Vision-2030’s inclusive tech framework (Schweitzer 2024), despite differing from Abdullah and Almaqtari (2024).

Moderation analysis using UTAUT (Alkhwaldi 2024) identifies AI engagement and perception as mediators, with H11–H13 validating independent efficiency gains (Teubner et al. 2023; Silva et al. 2022). Active AI engagement correlates with digital readiness, supporting McKinsey’s $13 trillion economic projection but requiring ethical oversight (Norori et al. 2021; Mislavskaya 2021). Theoretically, AI serves as both disruptor and enabler (Brynjolfsson and McAfee 2017), improving transparency and compliance while necessitating human oversight to mitigate fatigue. Practically, AI literacy programs (Alharasis 2024; Alkhwaldi 2024) and SME incentives (Han et al. 2023) are critical, with 38% of respondents demanding training (Aljaaidi et al., 2023). The study aligns with Vision-2030 and McKinsey’s $13 trillion GDP forecast (Szczepanski 2019) but highlights unresolved ethical gaps in privacy and fairness (Lee et al. 2018; Schweitzer 2024).

This study employs SEM analysis via ADANCO (Wassie and Lakatos 2024; Silva et al. 2022) to ensure validity, with structural models reflecting AI’s varied accounting impacts (Shihab et al. 2023; Vrontis et al. 2023) and mediation analysis refining exposure-experience links (Van Horn 2021; Saleem et al. 2023). While affirming AI’s automation and fraud detection benefits, ethical gaps persist (Norori et al. 2021; Schweitzer 2024), urging future focus on bias, privacy, and workforce transitions (Lee et al. 2018; Topol 2019). Demographic factors (gender, age) minimally influenced adoption, aligning with Vision-2030’s inclusivity; longitudinal studies on employment and regulation are needed. Prioritizing ethical policy frameworks, integrating KSA insights with CACS (MetricStream 2020) promotes Vision-2030 and Gulf-AI-strategies (Mgammal 2024).

AI improves transaction correctness (mean 3.97) and compliance (Zhou 2021), according to empirical studies, and usage frequency is substantially correlated with efficiency (0.2095, p = 0.003) (Wassie and Lakatos 2024; Silva et al. 2022), validating H1/H2a and reducing errors (Stancu and Dutescu 2021). Future research must address employment and governance impacts. AI familiarity (Q7AI-UnLev) and workforce training (Q21AI-Training) predict adoption, per UTAUT (Alkhwaldi 2024), but excessive use reduces engagement (−0.2210, p < 0.0001), supporting H2b and automation fatigue risks (Stancu and Dutescu 2021; Hamza et al. 2024). Younger (36% aged 25–34), highly educated accountants (47% doctorates) adopt AI more readily (Mgammal 2024), while gender (65% male) shows limited influence in Saudi Arabia (Schweitzer 2024).

Theoretical and practical implications

By including the KAP model, this study theoretically expands the TOE framework and connects micro-level behavioral results (like AI literacy) with macro-level Vision-2030 policies (such investments in digital infrastructure). This synthesis fills in the gaps in the literature on AI adoption, which frequently ignores the socio-technical complexity of emerging nations (Seethamraju and Hecimovic 2022). Practically, the findings underscore the urgency of AI literacy programs tailored to accountants’ evolving roles. For instance, 38% of respondents demanded more AI training, echoing Aljaaidi et al.’s (2023) recommendations for curricula blending technical skills with ethical governance. Organizations must also mitigate algorithmic bias risks (Norori et al. 2021) by adopting frameworks like CACS (Commitment, Accessibility, Capability, Skill Development) to ensure responsible AI integration (MetricStream 2020).

Economically speaking, real-time compliance monitoring and AI-driven fraud detection (Q14AI-Enc-Und-Finacil) improve financial transparency and support Vision-2030’s objectives of drawing in foreign investment (Duan et al. 2019). Since 91% of respondents acknowledged AI’s revolutionary potential but mentioned a lack of skills, the study supports academically AI-integrated courses (Q20AI-Weakness). The goal to develop analytical capabilities instead of automated routines matches Ballantine et al. (2024) recommendation. The Saudi regulatory body needs to create precise AI governance procedures that handle data privacy issues (Q9AI-Cons) and protect against cyberattacks (Erb 2018). A program of tax relief for SMEs deploying AI systems shows potential to drive digitalization across the system according to Han et al. (2023).

AI serves both as an industry disruptor and system enabler within the Saudi accounting industry. The deployment of AI delivers two major benefits: improved operational efficiency with 92.35% outcome variability impact and advanced fraud prevention however organizations must address workforce preparedness deficits and automation fatigue symptoms which reduce H2b by −0.2210. Saudi-Arabia can lead Gulf region efforts towards equitable technological integration when it connects AI implementation to the socio-economic targets of Vision-2030. Research in the future needs to understand the long-term effects of AI technology on job responsibilities together with its ethical management to support sustainable accounting industry growth.

Conclusion

Research based on Saudi-Arabian accounting processes analyzes how AI transforms operational practices with solid empirical data on efficiency and accuracy improvement and fraud detection (Zhou 2021; Ng and Alarcon 2020; Wassie and Lakatos 2024). The research outcomes agree with worldwide scholarly works that demonstrate AI functions as an accelerator which transforms work assignments while performing patterned functions and increasing executive leadership abilities (Dong et al. 2023; Shihab et al. 2023). Academics and practitioners in Saudi-Arabia need to conduct ongoing research activities to handle creating biases in algorithms and workforce reorganization (Norori et al. 2021; Muspratt 2018) while exploiting AI capabilities that support the national goals of Vision-2030 through economic transformation and technology advancement (Duan et al. 2019; Luo et al. 2018).

The conducted research establishes fundamental knowledge to investigate Artificial Intelligence applications in accounting practice. The essential role of AI in economic development now makes it necessary for businesses and governments to utilize it for financial changes. The research delivers essential knowledge for Saudi Arabian scholars and practitioners as well as policymakers to help explore the changing role of AI in accounting literature. The research incorporates Saudi-specific information using TOE models (Seethamraju and Hecimovic 2022) alongside UTAUT (Alkhwaldi 2024) making its findings directly applicable to international knowledge. In order to prepare accountants for their changing duties the field requires pedagogical reforms that include teaching AI systems and teaching ethical principles (Alharasis 2024; Ballantine et al. 2024). Analysis using ADANCO-based structural equation modeling (SEM) in this study matches academic demands (Wassie and Lakatos 2024; Silva et al. 2022) for statistical sophistication in artificial intelligence-accounting research to achieve reliable and valid results while combating geographic insufficiency.

This research accomplishes three main implications. Organizations need to develop AI literacy programs with lifelong learning initiatives according to Alharasis (2024) and Ali et al. (2022) so they can achieve maximum AI benefits. AI education demand continues to grow because automation systems improve both accuracy and financial security detection capabilities. All organizations must adopt artificial intelligence training programs as part of their educational approach so professionals can extract the maximum value from AI systems. The implementation of teaching curricula with AI concentrations becomes necessary to handle the transformations accounting methods receive from AI technology. Accounting professionals need to establish learning habits that allow them to adapt their work practices because AI-based technologies continue transforming financial processes.

The development of specific policy guidelines by authorities must address fundamental issues regarding cybersecurity data privacy and algorithmic fairness as identified in Schweitzer (2024) and Lee et al. (2018). Ethical AI deployment depends on policies that promote responsible AI governance because they help businesses and accountants prevent risks from bias and privacy breaches along with fraud but also assist in risk mitigation. National economic development strategies must include AI implementation objectives to support a responsible expansion of AI at regional or nationwide levels.

Strategic investments in digital infrastructure and SME support need to be implemented to connect AI systems with Saudi Vision-2030’s economic mission (Han et al. 2023; Hassani and Silva 2023). Organizations need to understand the value of governance policies for ethical and practical AI utilization during financial reporting and auditing as AI usage continues to grow.

This study adds better clarity to AI operational processes through survey investigations but response bias could occur from this methodology. Future investigations should combine mixed methods because these surveys indicate a need. The research results are restricted by their potential lack of relevance toward various industries across distinct regional settings because AI acceptance differs substantially per cultural standards and economic systems and technological capabilities. Longitudinal studies will become necessary to understand AI evolution because researchers need to track its enduring effects on ethical challenges and social-economic developments such as algorithmic errors along with employee migration and employment elimination (Norori et al. 2021; Topol 2019). The industry needs ongoing oversight of the effects of AI on employment structures and occupational roles and financial standards to adapt to AI advancements in accounting practices.

This study introduces both ethical and socioeconomic implications yet the research does not provide complete analysis of these issues. Further research should study AI’s ethical troubles by assessing the factors of data protection and worker retraining and systems visibility in detail. Researchers must perform an extensive assessment of the economic and social consequences which result from using AI in accounting practice to understand its impact on job markets along with human control of decisions and financial controls.

The research shows that AI technology serves both disruptor and enabling capabilities to transform Saudi accounting practice through global best practices and local implementation strategies. The adoption of CACS (MetricStream 2020) and ethical governance procedures will enable Saudi-Arabia to use AI effectively in pursuing Vision-2030’s goals while managing its complex systems. The evolving nature of AI technology in accounting requires organizations to establish an integrated system which harmonizes technology with education and regulatory standards for enduring implementation.