Abstract

This study presents a comprehensive systematic literature review (SLR) of research on the relationship between financial technology (fintech) and bank risk. A total of 1837 articles were reviewed in WOS and Scopus from 2019–2023. The Reporting Standards for Systematic Synthesis of Evidence (ROSES) were used to identify 28 high-quality articles that robustly analyse the relationship between fintech and bank risk. This study categorizes fintech measures into bank-level (financial innovation, use of online channels), country-level (digital finance index, commercial bank digital transformation index), and fintech keywords (social media platforms, documents). It identifies four main bank risk themes: insolvency, credit, market, and liquidity risk. The review also highlights mediating variables such as operational efficiency, the capital adequacy ratio, and the net interest margin and moderating variables such as digital transformation, financial regulation, and economic uncertainty. Our findings highlight three key insights. First, most research does not mention theory, which suggests an integrated multitheoretical approach. Second, there is a notable gap in cross-country research on this topic. We recommend that future studies focus on comparative cross-country analysis to provide broader insights into the fintech–bank risk nexus. Third, the relationship between fintech and bank risk has received increasing academic interest, with more scholars utilizing interdisciplinary methods, expanding the geographical scope, and addressing emerging risks. This SLR provides valuable insights for researchers, policymakers, and industry practitioners to equip them with the knowledge to improve financial stability and strengthen risk management strategies in the evolving banking sector.

Similar content being viewed by others

Introduction

In recent years, the rapid increase in financial technology (fintech) has significantly transformed the financial services landscape and received substantial interest from a diverse spectrum of stakeholders, including scholars, industry practitioners, and regulatory bodies (Haddad and Hornuf, 2023). Fintech now spans a wide array of entities, from dynamic startups that provide revolutionary financial software solutions to more established institutions that leverage new technologies to offer enhanced services (Li et al. 2023). This systemic transformation is further underscored by global governmental initiatives that exploit fintech capabilities to promote environmental sustainability through the dematerialization of production and consumption processes, effectively curtailing the depletion of natural resources (Abdul-Rahim et al. 2022).

As the fintech landscape expands, it requires a robust framework for international cooperation, especially in domains that are critical to maintaining the integrity and efficiency of the global financial system, such as cybersecurity, anti-money laundering, combating the financing of terrorism, and improving payment and securities settlement systems (Vučinić, 2020). This burgeoning domain requires all market participants—commercial banks, investment banks, insurance providers, mutual funds, pension funds, and venture capital firms—to continuously innovate and increase their competitive strategies to remain relevant and efficient (Jović and Nikolić, 2022). However, banks are unique because of their systemic importance in credit intermediation, monetary policy transmission, and financial stability. Unlike other financial institutions, banks operate under strict regulatory frameworks and are uniquely exposed to fintech-driven risks, such as cyber threats, regulatory challenges, and disruptions to traditional banking models. Banks face direct pressure to innovate while managing these risks as primary financial intermediaries, making their fintech adaptation crucial for economic stability. While fintech’s influence extends across the financial sector, understanding its implications for banks is essential for policymakers and regulators given their central role in the financial system.

The main risks of commercial banks include credit, market, liquidity, interest rate, exchange rate, and compliance risks (Ni et al. 2023). The development of fintech improves banks’ competitiveness by driving innovation and strengthening risk control. Banks integrate fintech solutions to gather comprehensive customer data via digital channels such as online and mobile banking utilizing advanced analytical tools such as data mining, deep learning, and quantum algorithms to precisely cater to individual customers’ needs and preferences (Yao and Song, 2023). Banks can enhance their traditional business models, reduce operating costs, improve service efficiency, and strengthen risk control capabilities to ultimately create more attractive and competitive financial services (Wang et al. 2021). Automation, AI and data analytics can be used to improve credit risk assessment, fraud detection and compliance. Blockchain and smart contracts increase the security of transactions, whereas digital banking and personalized services increase efficiency and customer engagement. Additionally, big data analysis and algorithmic trading contribute to market risk management, and advanced cybersecurity measures ensure financial stability. However, while fintech offers significant advantages, it also introduces new technical risks, such as data security vulnerabilities, privacy concerns, transaction security challenges, and identity authentication issues (Cheng and Qu, 2020). These issues require robust cybersecurity measures and regulatory compliance strategies. In addition, fintech encourages banks to take on greater risks while expanding credit access and providing improved risk diversification services to enterprises (Chipeta and Muthinja, 2018). Consequently, as fintech continues to evolve, the complexity of the risks faced by banks also increases. This study aims to explore this dynamic relationship by examining how fintech impacts various dimensions of bank risk.

Although the literature is extensive, only one systematic literature review (SLR), conducted by Jain et al. (2023), has explicitly examined the relationship between fintech and bank risk, which aligns closely with the focus of this study. This ground-breaking work provides a valuable macro level perspective on the broader implications of fintech for financial stability and systemic risk. The authors focus on the systemic risk and potential destabilizing effects of fintech through increased interconnectedness and complexity. Unlike Jain et al. (2023), this study presents a deeper examination of insolvency, credit, market, and liquidity risks while incorporating mediating (e.g., operational efficiency, capital adequacy ratio) and moderating (e.g., financial regulation, digital transformation) variables. In addition to Jain et al. (2023), other SLRs have explored specific risks but have not provided a comprehensive analysis of the fintech-bank risk relationship. Zhao et al. (2024) conducted an SLR on default risk and examined the interplay between liquidity, information efficiency, and default risk using bibliographic mapping. Similarly, Suryono et al. (2019) focused on peer-to-peer (P2P) lending and identified challenges and potential solutions using a structured methodology that included planning, implementation, and reporting. While these studies offer valuable insights, they do not assess the broader impact of fintech across multiple dimensions of bank risk, which is the core contribution of this study.

With respect to research methods, our study employs the ROSES (RepOrting Standards for Systematic Evidence Syntheses) technique, a structured approach for conducting systematic literature reviews (SLR) that ensures a transparent and replicable synthesis of existing research on fintech and bank risk. Additionally, we utilize the Theoretical, Context, Characteristics, and Methodology (TCCM) framework to systematically organize and structure recommendations for future research and to highlight key gaps and potential directions in the field. This dual approach allows for a rigorous literature analysis while providing a roadmap for advancing scholarly enquiry in this domain.Moreover, we emphasize fintech sentiment using a keyword index to assess its impact on bank risk. This approach comprehensively explains how market perceptions and technological trends influence banking operations and risk management. Our study explicitly examines key bank risks, including credit, operational, market, and liquidity risks, and details how fintech innovations can mitigate and introduce new vulnerabilities.

Furthermore, most studies have not adopted a theoretical framework, have focused on single-country analyses, and have increasingly incorporated interdisciplinary perspectives to examine the relationship between fintech and bank risk. By addressing these gaps and integrating methodological innovations, our study contributes to a better understanding of the fintech–bank risk nexus. Our use of the ROSES technique for systematic review and the TCCM framework for structuring future research directions distinguishes this research and allows us to provide a comprehensive and actionable analysis of how fintech innovations shape banking risk. This study complements previous research and lays the foundation for future investigations into the evolving interplay between fintech and banking risk management.

Our study uses a rigorous research methodology that is systematically divided into three main parts, examining the literature, extracting data and performing thematic analysis, to assess the impact of fintech on bank risk. Section "Methodology" details the methodology and outlines a systematic literature review process that includes data collection and comprehensive analysis methods. Section 'Discussion' presents the discussion and summarizes the detailed findings and recommendations for future directions and limitations. Section 'Results' presents the results, including those that contrast with the previous literature. Section 'Recommendations for Future Research' identifies knowledge gaps and outlines future research directions by highlighting areas that are ripe for further academic exploration and areas with significant potential to shape the future of fintech and banking. Finally, Section 'Conclusions' concludes the study by synthesizing key insights and underscoring the significance of continued research in the evolving field of fintech and its implications for banking. This structure ensures a robust examination of the subject and facilitates a clear understanding of current trends and future opportunities in fintech-related financial risk management.

Methodology

The Review Protocol (ROSES)

This study utilized the ROSES standards, which offer two distinct advantages. First, ROSES enhances the techniques of SLR, particularly for methodology-based articles in the social sciences (Shaffril et al. 2021b). Second, ROSES is explicitly designed for systematic review and mapping to ensure that correct and detailed material is presented, consistent terminology is used, and critical methodological guidance is provided, which offers valuable support for research endeavours (Haddaway et al. 2018). The ROSES process includes the following steps: formulating the research question; implementing a systematic search strategy (identification, screening, and eligibility); and conducting a quality assessment of the selected articles followed by data extraction and analysis.

Formulation of research questions

The research questions for this study were formulated using the PICO framework, which stands for population, intervention, comparator, and outcome. PICO is a tool used by researchers to develop relevant and focused research questions (Lockwood et al. 2015). Consequently, our review included three essential elements: banks (representing the population), fintech indicators, and various risks (insolvency risk, credit risk, liquidity risk, and market risk). Importantly, the context of fintech measures is based on their application within banks and at different levels, including the bank level, the country level, and relevant fintech keywords. These three components guided us in developing the central research question: What are the determinants of bank risk in the context of the most commonly used fintech indicators?

Systematic search strategies

The systematic search strategy process included three main steps: identification, screening, and eligibility.

Identification

The main keywords used in this research search were “fintech,” “banking,” and “risk” and synonyms, related terms, and changes in the main keywords. This study utilized the keyword identification method outlined by Okoli (2015) and fintech keywords from Tarawneh et al. (2024). Unlike Tarawneh et al. (2024), who investigated the profitability implications of fintech in banking, our study broadened the scope to examine various bank risks in the context of fintech indicators. The identification process in this study involved an online thesaurus, keywords from previous studies, keywords proposed by Scopus, and keywords proposed by experts. We upgraded existing keywords from WoS and Scopus and developed a search string (using techniques such as Boolean operators, phrase search, truncation, wildcards, and field code functions), as shown in Table 1. We successfully retrieved 1837 articles (892 WoS; 945 Scopus).

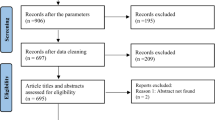

Screening

We used Mendeley software to download the identified papers and exported them to Excel software. We screened all 1837 articles using automatic criteria selection on the basis of the database sorting function (Okoli, 2015). To establish the review period, we chose January 2019 as the starting point, a period of significant financial technology advancement and integration into the banking sector. The five-year period from January 2019 to December 2023 was considered sufficient to capture significant research trends and related publications on fintech and banking risk (Shaffril et al. 2021a). To avoid ambiguity, this review included only specific articles published in English. During the review process, 94 duplicate entries and 1387 articles that did not meet the inclusion criteria were eliminated (Table 2). The remaining 356 articles were subsequently subjected to the third step of eligibility determination.

Eligibility

In the eligibility review step, we manually checked the retrieved articles to ensure that the filtered articles met the necessary criteria. Manual inspection was performed by reviewing the titles and abstracts of the remaining articles. During the review process, 282 articles were excluded because they focused mainly on customer-perceived risk, risk prediction, and the evaluation of perceived risk related to fintech adoption and fintech company performance. In addition, 46 articles that did not involve empirical research were excluded. The articles had to be consistent with our research objectives. Ultimately, only 28 studies were used in this review.

Quality appraisal

The 28 selected articles were submitted to three experts in fintech, banking, and banking risk for a quality assessment of the article content. Article quality was divided into high, medium, and low. Experts use four standard criteria to classify the quality of qualitative research: dependability, credibility, transferability, and confirmability (Stenfors et al. 2020). Dependability ensures that research can be replicated under the same conditions; it is therefore appropriate to assess research replication standards. Credibility ensures that research findings are plausible and reliable using real-time citation tracking and peer-reviewed impact metrics. Transferability determines whether findings can be generalized across different contexts, such as between sectors or across countries. Finally, confirmability ensures that research findings are derived directly from the data and are not influenced by personal biases. This is achieved by establishing a clear relationship between the data and the conclusions. In addition, researchers show how they produced their findings through detailed descriptions and the use of quotations. When an article meets all of these criteria, it is deemed high quality; if it meets only half of the criteria, it is deemed moderate quality. Only high- and moderate-level articles can be reviewed provided that all authors mutually agree (Jafri et al. 2024). Using this process, we rated 18 articles as high and 10 as moderate. Therefore, all 28 articles were eligible for review.

Data extraction

As illustrated in Fig. 1, we carefully examined 28 selected articles to extract relevant data. Our review process was thorough and involved a detailed analysis of each section of the articles’ abstracts, findings, and discussions. The extracted data were meticulously aligned with our research questions to ensure the relevance and significance of our findings and were then compiled into a comprehensive table. To facilitate a deeper understanding of the data, we conducted a thematic analysis guided by the methodology outlined by Braun and Clarke (2006), which involved pattern recognition and grouping similar data to identify prominent themes and subthemes. This structured approach allowed us to gain meaningful insights and ensure the robustness of our analysis.

Discussion

Our literature review identified and categorized fintech-related keywords, as shown in Table 3. Using VOSviewer software, we produced a visualization map of this keyword network, which is presented in Fig. 2. In this visualization, the colour of the connecting line, the size of the circle, the font size, and the line thickness represent the relationships between keywords (Hassan et al. 2023). This graphical representation helps to illustrate the interconnectedness and importance of various keywords in the fintech domain.

Table 3 presents all the fintech keywords extracted from the literature. According to the dimension classification, they are divided into three main parts: underlying technology (technology applications, technology foundation, artificial intelligence, block-chain related, cloud technology, data technology, internet technology, basic technology, technical base, new technology adoption, market facilities technology, infrastructure), innovation output (payment and settlement, resource allocation, information transmission, information transfer, clearing and payment, new business models, new products and services, capital raising, investment management), and risk (risk management, digital risk control). The relevant fintech keywords are presented according to each dimension. To further study the fintech keywords, we use VOSviewer software to visualize the keyword network (see Fig. 2). In this visualization, the core areas of the keywords are blockchain, big data, artificial intelligence, and third-party payment. The main application areas are internet finance, internet insurance, cloud computing, and digital currency. The leading interdisciplinary and technical fields are the Internet of Things, biometrics, crowdfunding, and P2P. The main cross-technical fields are quantum computing and risk control models. Overall, most of the nodes in Fig. 2 are interconnected, and the figure shows how various emerging technologies and applications in the fintech field are intertwined to promote the joint innovation and development of fintech. In addition, the results reveal that the financial industry is increasingly paying attention to digitalization, intelligence, and security in fintech.

The literature review shows that previous studies have adopted various theoretical frameworks to examine the impact of fintech on bank risk, as detailed in Table 4. Notably, technology spillover theory has emerged as the most frequently utilized framework in this context. Technology spillover theory holds that the innovation effect of fintech, the competition reversal effect, and the talent turnover effect prompt commercial banks to upgrade technology, innovate businesses and optimize services, thereby increasing productivity and profits and reducing the motivation to take risks (Wang et al. 2021). The second most commonly used theory is Schumpeter’s innovation theory. According to this theory, technological innovations introduced by fintech firms disrupt traditional banking models by offering more efficient and customer-centric solutions. This disruption forces traditional banks to innovate and adopt new technologies to remain competitive, with a strong emphasis on meeting customer needs. While these innovations can improve operational efficiency and customer experience, they also introduce new risks, such as cybersecurity threats, regulatory challenges, and implementation costs. As a result, the pace of fintech innovation can increase both market and operational risks for banks, and robust risk management strategies are needed to mitigate potential adverse effects.

Among the compiled articles, 22 studies were conducted in China, three involved cross-country research, one was conducted in Tunisia, one was conducted in Vietnam, and one was conducted in the U.S., as shown in Table 5. There are several possible reasons the majority of the reviewed studies were from China: (i) according to the global fintech adoption index 2019 report, China is a global leader in fintech adoption and innovation. Fintech adoption in China involves various purposes, such as banking and payments (92%), financial management (91%), financing (89%), and InsurTech (62%) (EY, 2019); (ii) China’s fintech industry is developing rapidly, and scholars are motivated to pay attention to and conduct research on fintech in China; (iii) the Chinese government’s policy support for fintech encourages academic research. For example, the Chinese government’s supportive regulatory framework and strategic initiatives, such as the “Internet Plus” strategy, have fostered a thriving fintech ecosystem, making it an ideal setting for empirical research; (iv) China’s unique economic environment, characterized by high levels of digitization and a significant unbanked population, presents unique challenges and opportunities for fintech and offers valuable insights into its influence on bank risk (Deng et al. 2021).

This study also examined the methods of analysis applied in research on fintech and bank risk. The most commonly used method of analysis is the panel fixed effects model (Table 6). The ordinary least squares method (OLS) and generalized method of moments (GMM) are two other commonly used methods of statistical analysis. Due to their limitations for categorical data, structural equation modelling (SEM), the panel-corrected standard error (PCSE) method, and hierarchical multiple regression analysis have been used by only a few studies.

Results

Table 7 presents a thematic analysis of fintech measures and the various types of bank risk examined in past studies. Fintech indicators are categorized into three main groups: bank-level, country-level, and fintech keywords. Bank risk studies are classified into four primary risk types: insolvency risk, credit risk, liquidity risk, and market risk. The following sections discuss the relevant themes and subthemes within these categories.

Fintech measures

Measuring fintech using bank-level data

Our findings provide a comprehensive understanding of fintech measures at the bank level with a focus on specific indicators such as financial innovation (FI) and online channel use (OCA). FI is a transformative force in the banking sector and is highlighted in three studies. It includes advances such as training and development (TD) (Tran et al. 2022), financial innovation (FI) (Zouari-Hadiji, 2023), and fintech-based financial inclusion (FFI) (Banna et al. 2021). TD is an essential component of FI as it aims to improve the capabilities and qualifications of employees as well as individual and organizational performance. Banks save money and time by running employee training programmes. Tran et al. (2022) used TD to measure the fintech index and reported that fintech has a positive and significant effect on bank risk. A study by Banna et al. (2021) constructed a comprehensive FFI index that considers the number of mobile money agents, mobile money accounts, nonbranch commercial bank agent branches, point-of-sale terminals, and mobile and internet banking transactions. Their study found that fintech had a negative and significant effect on bank risk and demonstrated the complex effects of different fintech measures.

OCA is another important indicator to predict fintech. Mobile banking and banking applications have attracted customer savings and deposits, highlighting the impact of OCA on the adoption of financial technology. Tran et al. (2022) chose mobile banking in OCA to measure the fintech index because of its strong appeal to customer savings and deposits. He et al. (2020) used a dummy variable to measure the use of online channels with a value of 1 for banks that used online channels and zero otherwise. Using a panel, they reported descriptive statistics between adopting and nonadopting banks to further illustrate the effect of OCA on bank performance.

Measuring fintech using country-level data

The most prominent fintech indicators at the national level are the digital finance index (DFI) and the commercial bank digital transformation index (Trans). Three studies use the DFI, compiled by Peking University’s Digital Finance Research Centre, as a proxy for fintech development (Deng et al. 2021; Hu et al. 2022; Wang et al. 2023). Similarly, three studies use the Commercial Bank Digital Transformation Index (Trans), compiled by the Institute of Digital Finance at Peking University, which includes cognitive, organizational, and product transformation dimensions (Cao et al. 2022; Chen and Shen, 2023; Liang et al. 2023). The index provides a macro-level view of fintech adoption to help policymakers and researchers assess digital transformation and technological advancements in the financial sector.

Other country-level indicators include macroeconomic uncertainty (EU), listed bank digital construction (Digital), the U.S. macroeconomic uncertainty index (USMU), the number of mobile phone users (Mobile) (Liang et al. 2023), noninterest income (NII) (Gao et al. 2023; Wan and Luo, 2023), the M2/M1 ratio (Khan et al. 2021), and patents (Dietzmann and Alt, 2019). Macroeconomic uncertainty (EU) represents a forecast of future uncertainty that increases the procyclicality of lending behaviour and hinders financial integration, with fintech developments helping to reduce information asymmetry. The digital construction of listed banks (digital) reflects the level of fintech development and is crucial for evaluating digital transformation. The USMU and the number of mobile phone users (Mobile) illustrate the correlation between U.S. economic policy and China, with mobile phones as the main channel for digital banking products. The interaction of these variables measures the fintech index, which has a significant positive effect on banks’ risk-taking (Liang et al. 2023). Noninterest income (NII) was chosen as a measure of fintech because of the shift from traditional interest income to noninterest income, which has a significant negative impact on bank risk (Wan and Luo, 2023). The M2/M1 ratio, which represents the ratio of broad money to narrow money, is used as a proxy for financial innovation and shows that increasing the money supply encourages fintech, which has a significant negative relationship with bank risk in ASEAN banks (Khan et al. 2021). Dietzmann and Alt (2019) suggest that patents are a suitable indicator for measuring innovation activities. The results show that patents have a negative and significant effect on bank risk. Therefore, financial innovation, especially information technology-related innovation, reduces banks’ risk-taking and risk-planning.

Measuring fintech using fintech keywords

As evidenced by eleven studies, social media platforms (SMPs) play an important role in the financial technology landscape. SMPs facilitate customer engagement, marketing, and service delivery and serve as powerful tools for fintech firms to engage with wider audiences, gather customer insights, and improve their service offerings. This research focuses on their role in shaping consumer behaviour and driving fintech adoption to influence the market. Many studies have adopted quantitative methods and fintech keywords to analyse the fintech index using text mining technology. In text mining, intelligent algorithms and data mining techniques are used to extract practical information from large text datasets, including frequency statistics, classification, and clustering (Cheng and Qu, 2020).

The process begins by classifying fintech into dimensions on the basis of its function in commercial banking applications and creating a keyword dictionary for each dimension. Crawler software is then used to conduct keyword frequency searches in search engines such as Baidu (Chen et al. 2022; He et al. 2023; Li, 2023; Li et al. 2022b; Zhang et al. 2023; Zhao et al. 2023). Since the data from the crawler cannot be directly analysed, some studies use the factor analysis method to calculate the fintech index (Chen et al. 2022; Chen and Shen, 2023; Wang et al. 2021; Yao and Song, 2021), whereas others calculate word frequency and then synthesize the fintech index (Li et al. 2022b; Zhao et al. 2023). Additionally, some scholars use text mining and principal component analysis to construct a fintech application index (Yao and Song, 2023).

In addition to using search engines, some studies measure the fintech index using documents such as annual reports, databases, and news information. For example, one study used text mining to analyse information in the annual reports of commercial banks and Python to crawl text data and calculate the frequency of keywords to build a bank fintech index (Wu et al. 2023). Another study used content analysis techniques by dividing fintech into five dimensions with specific keywords, coding each bank’s report by year, and building a fintech index based on the occurrence of keywords (Sajid et al. 2023). Another article exploited keywords through text mining techniques to capture text information from databases and calculate keyword occurrences to build a bank fintech index (Ni et al. 2023).

Fintech and bank risk research

The rise of fintech, driven by digital transformation and rapid technological advancements, has significantly influenced bank risk in multiple dimensions, including insolvency risk, credit risk, liquidity risk, and market risk. Understanding and adapting to these changes is crucial as financial institutions integrate digital innovations and navigate evolving risks shaped by shifting global market conditions and socioeconomic changes (Verhoef et al. 2021). Previous research on the interaction between fintech risk and banking risk has identified different types of risk, which can be further categorized into specific areas such as insolvency risk, credit risk, liquidity risk, and market risk.

Insolvency risk

Fintech enables banks to enhance efficiency, reduce operational costs, and expand financial inclusion. However, the rapid digitalization of banking services and heightened competition from fintech firms and nonbank entities exert pressure on traditional banking models. Continuous and substantial technological investments and adaptation to disruptive innovations are more urgent than ever to maintain profitability, particularly for banks that are unable to compete effectively. Moreover, external shocks, such as pandemics and economic downturns, further increase the insolvency risk by disrupting traditional revenue streams and unpredictably accelerating digital transformation (Papadopoulos et al. 2021).

The primary subtheme within insolvency risk is the Z score, a prominent measure used in fourteen studies. The Z score comprehensively assesses a bank’s financial stability by combining various financial ratios to predict the likelihood of insolvency. It is an essential tool for evaluating the impact of fintech innovation on financial stability (Li, 2023; Wan and Luo, 2023) and has been widely adopted in the literature as a leading indicator of bank risk-taking, reflecting overall risks from both interest-based and noninterest business activities (Banna et al. 2021; Chen et al. 2022; Chen and Shen, 2023; Deng et al. 2021; Gao et al. 2023; He et al. 2020, 2023; Hu et al. 2022; Li et al. 2022b; Sajid et al. 2023; Wang et al. 2021; Wu et al. 2023; Zhao et al. 2023). Higher Z scores indicate less risk exposure and greater bank stability, whereas lower Z scores suggest greater risk-taking and lower stability (Banna et al. 2021; He et al. 2023).

Another subtheme of insolvency risk is economic capital (EC), which was used in two articles. EC directly reflects a bank’s overall risk and facilitates comprehensive risk management. When risk levels are high, the demand for economic capital increases; conversely, when risk levels decrease, the demand for economic capital decreases accordingly (Yao and Song, 2021, 2023). Additionally, the risk-weighted asset ratio (RWAR) was used in two studies to measure insolvency risk. RWAR assesses the proportion of high-risk assets held by banks and serves as a proxy for proactive risk-taking behaviour (Zhao et al. 2023). One study employed seven indicators to measure bank risk-taking, including RWAR, an indirect measure of RWAR (RWAR2), credit risk-weighted assets (CRWA), market risk-weighted assets (MRWA), operational risk-weighted assets (ORWA), transactional financial assets, and fixed assets. This comprehensive approach ensures robust results by calculating the indirect measure of RWAR as total equity/capital adequacy ratio/total assets, indicating that a higher RWAR signifies a greater degree of proactive risk-taking by commercial banks. Risk-weighted assets include credit, market, and operational risk-weighted assets, in addition to trading financial assets, loans, and fixed assets (Liang et al. 2023).

Credit Risk

The proliferation of fintech-driven credit assessment tools, powered by big data and artificial intelligence, has reshaped lending practices. While these innovations improve risk modelling and expand access to credit, they also introduce new vulnerabilities that should be approached with caution. The reliance on alternative data sources and automated decision-making may lead to an underestimation of borrower risk, particularly in volatile economic conditions. Additionally, digital lending platforms and peer-to-peer lending expose banks to counterparty risk, which increases the complexity of credit risk management (Kraus et al. 2022).

A significant subtheme in credit risk is the nonperforming loan (NPL) ratio, which was used to measure credit risk in fourteen studies (He et al. 2020). NPL is a category of borrowers who fail to make monthly principal and interest payments over time (Khan et al. 2021). The NPL ratio directly measures a bank’s loan portfolio quality and the level of credit risk. Since a bank’s credit business is directly related to its NPL, it is reasonable to use the NPL as a proxy variable to measure the risk of commercial banks (Ni et al. 2023). A greater NPL value indicates greater risk (Cheng and Qu, 2020). In addition, several studies have revealed a relationship between digital transformation and the NPL: for banks with a high level of digital transformation, there is a negative relationship between digital transformation and the NPL, whereas for banks with a low level of digital transformation, the relationship is positive (Cao et al. 2022). Therefore, the NPL ratio is a crucial indicator for evaluating the effectiveness of credit risk management, especially in relation to changes driven by financial technology in lending practices (Chen et al. 2022; Li et al. 2022b).

The loan loss reserve ratio (LLR) subtheme was mentioned four times. One article employed the LLR to measure credit risk and defined it as the ratio of loan loss reserves to total loans (Cheng and Qu, 2020). The LLR is calculated as the ratio of a bank’s loan loss reserve to net total loans, with a higher value indicating greater credit risk (Wang et al. 2021). Another article used the nonperforming loan provision coverage ratio (NPLP) as a robustness test for NPL (Zhang et al. 2023). The NPLP coverage ratio is crucial for assessing financial health and the effectiveness of credit risk management. It plays a significant role in enhancing investor confidence and facilitating the comparability of performance among banking institutions. Additionally, it ensures regulatory compliance and provides a secure framework for banking operations and adherence to industry standards.

Liquidity risk

The rise of digital banking and payment innovations has reshaped customer behaviour and accelerated the speed of fund movements. The convenience of digital transactions and mobile banking may lead to a surge in liquidity volatility as deposit withdrawals become more immediate and less predictable. Additionally, banks that are involved in fintech partnerships or digital asset trading may face heightened liquidity pressures, particularly during financial crises, when customers and investors react swiftly to perceived risk (Škare et al. 2021).

From a liquidity risk perspective, the liquidity ratio (LIQ) is a central theme that was highlighted in three studies (He et al. 2020; Tran et al. 2022; Wan and Luo, 2023). The liquidity ratio measures a bank’s ability to meet its short-term obligations without incurring significant losses, and its importance increases as fintech advances promote faster and more efficient transactions. Robust liquidity management ensures smooth operations and maintains customer trust (Khan et al. 2021). A higher liquidity ratio indicates lower liquidity risk, making it a crucial indicator of bank liquidity (Tran et al. 2022). Additionally, the loan-to-deposit ratio (LD) is another important measure of liquidity risk that was mentioned in two studies (Li et al. 2022a; Wu et al. 2023). The LD ratio is calculated as total deposits divided by total loans and provides insight into a bank’s liquidity management (Wu et al. 2023). A higher LD ratio indicates a bank’s reliance on stable funding sources, further highlighting its ability to manage liquidity risk effectively (Li et al. 2022a).

Market risk

Fintech innovations, such as algorithmic trading and blockchain-based financial instruments, are transforming financial markets. While these technologies improve efficiency and market access, they also introduce new systemic risks due to increased market interconnectivity and reliance on digital platforms. The resulting price fluctuations in fintech-driven financial products and macroeconomic uncertainties such as inflation and recession risk add complexity to market risk management. This complexity underscores the need for adaptability and continuous learning in risk management practices (Xie et al. 2022).

Two articles used annual value at risk (VaR) to measure market risk and bank risk management (Chen and Shen, 2023; Zouari-Hadiji, 2023). VaR utilizes financial market indicators, such as stock prices and returns, to assess the dependence between banks and markets and to identify systemically important banks. Additionally, two articles employed marginal expected shortfall (ES) to measure market risk (Chen and Shen, 2023; Li, 2023). ES is calculated using industry returns weighted by market capitalization and total market value and provides a detailed measure of potential losses under extreme market conditions (Li, 2023). ES and VaR are important for assessing potential losses due to market volatility and extreme events. These measures are particularly relevant in fintech as innovations often introduce new market dynamics and risks that require careful monitoring and management. Their ability to measure potential losses under different scenarios makes them indispensable for understanding and mitigating market risk in the rapidly evolving financial landscape (Deng et al. 2021; Wu et al. 2023).

In addition to the direct relationship studies between fintech and bank risk, a substantial body of research has examined the mediating and moderating mechanisms. Six studies focused on mediating mechanisms, six focused on moderating mechanisms, and two comprehensively covered both aspects (Table 8), providing a wealth of knowledge for our understanding of this complex relationship.

With regard to insolvency risk, studies have highlighted the significant impact of fintech. Li et al. (2022b) tested the mediating effects of operating income (INC) and the capital adequacy ratio (CAR) on the relationship between fintech risk and insolvency risk and concluded that fintech reduces banks’ risk-taking by improving these financial metrics. This improvement provides banks with a buffer against potential financial shocks, thereby reducing insolvency risk. Additionally, Sajid et al. (2023) investigated operational efficiency (OE) as a mediating variable and reported that fintech innovations improve the operational efficiency of banks, which in turn reduces insolvency risk. These findings suggest that fintech products can drive growth in the banking industry by making banks more efficient and less prone to insolvency. Deng et al. (2021) used governance (Gov), bank competition intensity (HHI), and per capita savings (PCS) as mediating variables. Their findings indicated that fintech influences bank risk-taking by affecting market competition and residents’ willingness to save. Improved governance structures ensure better oversight and management of fintech initiatives, which reduces insolvency risk. Increased competition due to fintech can lead to more prudent risk management practices among banks. Furthermore, higher per capita savings driven by fintech-enhanced financial inclusion, can provide banks with a more stable deposit base, thereby reducing insolvency risk.

Gao et al. (2023) used the bank competition level (BCMP) as a moderating variable. Their results showed that a higher bank competition level (BCMP) motivated banks to prefer aggressive investment strategies, that off-balance-sheet business innovation (OBI) may hinder the transmission path of risk management changes and operating efficiency, and that bank competition may lead to further accumulation of banking risk, thereby reducing the inhibitory effect of off-balance-sheet business innovation (OBI) on bank risk-taking (BRT). In addition, Gao et al. (2023) used bank agency cost (BAC) as a mediating variable. Their results showed that lower BACs improved profitability. Reducing profitability pressure subsequently motivates banks to reduce transfer risk to depositors. With the support of emerging technologies, bank loan risk can be effectively identified and monitored, enabling banks to control BRT more effectively and reducing insolvency risk.

In the context of credit risk, several studies have examined ILR and NIM as mediating variables. Li et al. (2022b) explored the mediating role of the Loan impairment to total loan ratio (ILR) in the relationship between financial technology and credit risk. ILR measures the share of interest income compared to total loans and indicates the bank’s revenue efficiency from lending activities. Fintech innovations, such as enhanced data analysis and automated credit scoring, are revolutionizing the efficiency and accuracy of the loan approval process. This transformation is leading to a better loan portfolio and a better risk-return profile. As fintech empowers banks to evaluate and manage loans more effectively, ILR can increase, indicating higher interest income from loan portfolios, better lending efficiency and potentially lower credit risk. By examining ILR as a mediating variable, Li et al. (2022b) showed that fintech’s impact on credit risk is channelled partially through its impact on bank income from lending activities.

Deng et al. (2021) used the net interest margin (NIM) as a mediating variable to explore the relationship between fintech and credit risk. NIM, which represents the difference between the interest income generated by banks and the amount of interest paid out to their lenders relative to the amount of their interest-earning assets, serves as a critical measure of a bank’s profitability and efficiency in managing its assets and liabilities. Deng et al. (2021) posited that fintech innovations can enhance a bank’s operational efficiency and decision-making processes, thereby improving NIM. For example, fintech solutions such as advanced data analytics and automated credit assessment tools can lead to more accurate loan pricing and better management of interest rate spreads. An improved NIM suggests that the bank is generating higher interest income relative to its interest expenses, which reflects better financial health and reduced credit risk. By examining NIM as a mediating variable, Deng et al. (2021) demonstrated that fintech’s influence on credit risk is partially conveyed through its impact on NIM, which highlights how technological advancements can increase financial performance and stability by improving banks’ profitability metrics.

With regard to liquidity risk, Li et al. (2022a) examined the mediating effect of the capital adequacy ratio (CAR). They found that fintech innovation increases CAR and indirectly improves liquidity management. Fintech solutions, such as blockchain for transparent transactions and AI-driven predictive analytics, help banks optimize their capital allocation and maintain adequate capital buffers. For example, blockchain technology can streamline back-office operations and reduce transaction time and costs, whereas AI can predict cash flow needs to allow banks to allocate capital more efficiently. An enhanced CAR means that banks have a more substantial capital base to absorb potential losses and meet regulatory requirements. Efficient operations and robust capital buffers enable banks to meet short-term obligations without incurring significant losses, thereby maintaining liquidity. The robust findings of a study by Wu et al. (2024) strongly support the idea that fintech-driven increases in CAR lead to better liquidity management by ensuring that banks are well capitalized and can effectively deal with liquidity shocks. This shows how technological advances contribute to financial stability by strengthening key metrics that support effective liquidity management.

The analysis of the moderating variables reveals several insights into the relationship between fintech and different types of bank risk. With regard to market risk, Li (2023) concluded that banks’ digital transformation (DT) and the digital divide (DD) effectively moderate the impact of fintech. Banks with higher levels of digitalization can better manage the risks introduced by fintech, whereas those with lower levels of digitalization face increased market risk. This finding indicates that the digital divide within the banking industry can exacerbate market risk for less digitalized banks. Further research by Zhu and Jin (2023) supports the idea that digital transformation can significantly reduce the probability of bank failure by improving operational efficiency and risk management capabilities.

With respect to credit risk, Ni et al. (2023) examined financial regulation (FRI) as a moderating variable. Their findings suggest that financial regulation can effectively dampen the adverse effects of fintech on bank risk, thereby mitigating the exacerbating impacts of fintech on credit risk. Liang et al. (2023) explored the role of the capital adequacy ratio (CAR) and loan-to-asset ratio (LC) as moderating variables. Their study revealed that a robust CAR strengthens the fintech-credit risk relationship by ensuring that banks have enough capital to absorb potential losses from fintech-induced risk. Moreover, a stable LC helps manage credit risk by maintaining a balanced loan portfolio, which is crucial to mitigate the risks associated with fintech developments. According to Bouteska et al. (2022), stringent financial regulations can create a buffer that prevents excessive risk-taking by banks, which ensures more stable credit risk profiles in the face of fintech developments.

With regard to liquidity risk, Wang et al. (2023) investigated the role of economic uncertainty (EPU) as a moderating variable and reported that it plays a significant role in shaping the relationship between fintech risk and bank risk. Economic uncertainty can amplify the liquidity risks associated with fintech, highlighting the importance of considering broader economic conditions when assessing fintech’s impact on bank risk. Wu et al. (2024) suggested that banks with greater exposure to fintech during economic downturns may face greater liquidity pressures due to sudden shifts in consumer behaviour and market dynamics.

Understanding mediation and moderation mechanisms is crucial when analysing the relationship between fintech and different types of bank risk. The mediating mechanisms reveal that fintech innovations significantly impact the risk profile of the banking sector and bring potential benefits, such as improving operational efficiency, increasing operating income and capital adequacy, structuring liabilities, and shaping market competition and savings behaviour. For instance, fintech reduces banks’ risk-taking by increasing operating income (INC), which provides banks with a buffer against potential financial shocks. Operating efficiency (OE) as a mediating variable also increases the operational efficiency of banks, leading to reduced insolvency risk. This insight underscores the need to consider direct and indirect effects when assessing the influence of fintech on bank risk and offers promising prospects for the future of banking.

Moderating factors such as digital transformation (DT), the digital divide (DD), macroeconomic uncertainty (EPU), financial regulation (FRI), macroprudential policy (MP), and economic uncertainty also significantly influence the relationship between fintech and different types of bank risk. For market risk, banks with a higher level of digitization can better manage the risks introduced by fintech, whereas those with a lower level of digitization face increased market risk due to the digital divide. With respect to credit risk, the capital adequacy ratio (CAR) and loan-to-asset ratio (LC) reinforce the fintech credit risk relationship by ensuring that banks have sufficient capital to absorb potential losses and maintain a balanced loan portfolio, respectively. Economic uncertainty increases the liquidity risk associated with fintech, making it important to consider broader economic conditions when assessing the impact of fintech on bank risk. The findings suggest that understanding these moderating effects is vital for developing strategies to manage and mitigate the risks associated with fintech innovation. The importance and urgency of addressing this dynamic cannot be overstated, as it has significant implications for the future of banking and financial stability. Further research and policy interventions are necessary to achieve a balanced approach that promotes fintech growth while ensuring the stability of the banking sector. The emphasis on potential risks and the need for immediate action underscore the seriousness of the situation and the critical need for the involvement of all stakeholders.

Recommendations for future research

A wide range of theories, theoretical models, and constructs were assessed across the 28 articles, offering a comprehensive overview of various fintech measures and their influence on bank risk as well as bank risk types in the context of fintech over the past five years. This review provides directions for future research, which were formulated using the theory-context-characteristics-methodology (TCCM) framework.

Theory

Examining fintech and its impact on bank risk involves various theories, such as technology spillover theory, Schumpeter’s innovation theory, corporate governance theory, basic economic theory, real option theory, economy of scale and scope theory, and financial deepening theory. The most common concepts investigated in previous studies are derived from technology spillover theory and Schumpeter’s innovation theory. Jović and Nikolić (2022) suggest that fintech technologies help banks better understand customer needs and improve service quality, echoing the spillover effects that allow innovations to diffuse across firms and industries and enhance overall productivity. Yao and Song (2023) show that fintech improves the execution of payment instructions and speeds up currency circulation, thereby improving management efficiency and reducing risks. This finding aligns with Schumpeter’s innovation theory, which posits that innovation drives economic growth by introducing new products and processes. Al-Mamoorey and Al-Rubaye (2020) emphasize the importance of these improvements for maintaining competitiveness and suggest that banks must urgently adapt to dynamic financial ecosystems to stay ahead in the industry.

Technology spillover theory and Schumpeter’s innovation theory are relevant frameworks for understanding the impact of fintech on commercial banks. According to technology spillover theory, adopting fintech products can increase work efficiency, promote the development of innovative financial products, and significantly reduce costs (Sajid et al. 2023). Fintech companies’ external technical characteristics allow them to support commercial banks in information technology and prompt banks to adjust their business thinking, upgrade fintech, and improve their ability to respond to risks (Li et al. 2022a). Schumpeter’s innovation theory suggests that fintech can reduce operating costs, innovate business models, and expand access to banking services (Li et al. 2022b). This potential for cost reduction is a promising aspect of the role of fintech in the banking industry and offers an optimistic view of its benefits.

Future research should expand the theoretical frameworks used to examine fintech and its impact on bank risk. While technology spillover theory and Schumpeter’s innovation theory provide valuable insights, the incorporation of additional theories can offer a more comprehensive understanding of the complex dynamics at play. For example, corporate risk management theory can offer a more comprehensive understanding of how banks can mitigate the risks associated with fintech innovations. Studies can explore the effectiveness of different risk assessment models and tools in predicting and managing fintech-related risks (Stulz, 1996). Innovation diffusion theory provides a framework for understanding how fintech innovations spread within the banking industry and the factors that influence their adoption. Future research can examine the role of social networks, organizational culture, and technological compatibility in the diffusion of fintech innovations (Rogers, 2003). By adopting these theoretical frameworks, future research can provide a more dynamic and comprehensive understanding of how fintech impacts bank risk, which can advance academic knowledge and offer practical insights for policymakers and financial institutions.

Context

Most studies of the relationship between fintech and bank risk focus mainly on the impact of fintech on various types of bank risk. Specifically, 17 articles examine the impact of fintech on banks’ insolvency risk, 15 articles explore the impact of fintech on credit risk, 5 articles investigate the influence of fintech on liquidity risk, and 3 articles assess the impact of fintech on market risk. In this study, the Z score is usually used as the main predictive factor for insolvency risk, the nonperforming loan (NPL) ratio is used for credit risk, the liquidity ratio (LIQ) is used for liquidity risk, and the marginal expected shortfall (ES) and annualized value at risk (VaR) are used for market risk. While extensive research has been conducted on the impact of fintech on various types of bank risk, there is a pressing need for more extensive research on the steps banks should take to address fintech-related risks. Previous studies have focused mainly on the relationship between fintech and insolvency as well as credit, liquidity, and market risk. However, the speed of fintech innovation introduces new risks, such as strategic risks, operational risks, cyber risks, legal risks, outsourcing risks and systemic risks, due to the increase in fintech credit volumes (Abdul-Rahim et al. 2022; Jović and Nikolić, 2022; Vučinić, 2020). Future research should investigate these emerging risks and develop practical and effective strategies for banks to manage them.

Our analysis reveals that most studies of the impact of fintech on bank risk concentrate on individual countries, particularly in Asia and the Middle East, such as China, Tunisia, the U.S. and Vietnam. There is a noticeable lack of research on this topic in developed markets such as Europe. Among previous studies, only a few (three papers) adopt a cross-country approach. Future research should consider including developed European countries as well as countries in North America (e.g., Canada), Oceania (e.g., Australia, New Zealand), and Asia (e.g., Japan, South Korea, Singapore) to ensure a more comprehensive and globally representative understanding of the impact of fintech on banking risk. Furthermore, comparative studies between developed and developing countries can yield valuable insights into the differential impact of fintech on bank risk across various economic and regulatory environments. This comparative approach can significantly enhance our understanding of fintech’s influence on global banking stability.

In addition to banks, the impact of fintech extends to nonfinancial institutions and financial markets. While investment banks, insurance companies, mutual funds, and other financial institutions also leverage fintech for operational efficiency, risk management, and customer outreach, their risk profiles and regulatory frameworks differ significantly from those of commercial banks. Similarly, the growth of financial markets has allowed investors to diversify their assets and allowed businesses to raise cash by selling stocks, bonds, and foreign exchange through fintech. Future research can expand on this by incorporating comparative studies across different financial institutions or exploring fintech’s role in financial markets. This aligns with the findings of Kumar et al. (2024), who emphasized a positive relationship between digitalization and financial-economic development. However, they noted that this relationship is influenced by varying factors, including the digital divide and differences in financial literacy, which affect the extent and effectiveness of digital adoption across different populations.

Constructs

Financial innovation (FI) emerges as the most commonly used measure in our examination of bank-level fintech indicators. FI primarily includes training and development (TD) and fintech-based financial inclusion. These elements are crucial, as they represent the internal efforts of banks to enhance their technological capabilities and broaden financial access through innovative solutions. At the country level, the in-depth development of fintech leverages various cutting-edge digital technologies, including big data, cloud computing, artificial intelligence, and blockchain, to realize financial functions (Deng et al. 2021). Consequently, many scholars use the digital finance index and commercial bank digital transformation index to measure fintech. These indices, which capture the extent of digital transformation within the financial sector, are crucial in understanding the implications of fintech for banking stability and performance.

Future research should emphasize interdisciplinary cooperation that integrates finance and technology to conduct more in-depth studies on fintech. This approach can enhance understanding of fintech’s impact on banks and provide new ideas for promoting fintech products within banks. At the fintech keyword level, text mining methods provide advanced tools for measuring fintech and are widely utilized in scholarly articles. Text mining involves establishing specific keywords, using crawler software to locate these keywords in large datasets, and processing the collected data to calculate the fintech index. This process allows researchers to systematically analyse a large volume of textual data, such as academic papers or news articles, to identify trends and patterns in the use and impact of fintech. This quantitative research method enables comprehensive interdisciplinary studies on finance and technology and offers detailed insights into fintech trends and their effects (Cheng and Qu, 2020).

In addition to these fintech measures, 10 articles shed light on the mediating and moderating mechanisms between fintech and bank risk. With regard to the mediating variables, two studies concluded that operational efficiency (OE) effectively mediates the relationship between fintech and banks’ risk-taking (Li et al. 2022b; Sajid et al. 2023). This finding underscores the importance of OE in understanding how fintech affects bank risk and suggests that future research should further examine OE as a mediating variable. More in-depth studies on how fintech influences bank risk through OE can offer actionable suggestions for improving banks’ efficiency. In the analysis of the moderating variables, one study used financial regulation (FR) as the moderating variable to study the relationship between fintech and bank risk (Ni et al. 2023), while another study used macro prudential policy (MP) as a moderating variable (Zhao et al. 2023). These findings underscore the significant and reassuring role of financial regulatory policies in shaping the impact of fintech on bank risk. In future research, financial regulatory policies can be used as moderating variables for more comprehensive analyses to provide deeper insights into how these policies can mitigate the risks associated with fintech.

Method

Each article evaluated in this study used quantitative research methods to predict the relationship between fintech and banking risk. These methods include the panel fixed effects model, which was used in studies by Li (2023), Wan and Luo (2023), Cheng and Qu (2020), Li et al. (2022b), He et al. (2023), Ni et al. (2023), He et al. (2020), Liang et al. (2023), Dietzmann and Alt (2019), and Wang et al. (2021). Some studies have also used the ordinary least squares (OLS) method, as described by Li et al. (2022a), Banna et al. (2021), Zhao et al. (2023), Wu et al. (2023), Hu et al. (2022), and Tran et al. (2022). The generalized method of moments (GMM) is another commonly used method and was used in studies by Chen et al. (2022), Zhang et al. (2023), Yao and Song (2021, 2023), and Chen and Shen (2023). Additionally, the benchmark regression model was used by Deng et al. (2021), Wang et al. (2023), Gao et al. (2023), and Cao et al. (2022). Other methods include structural equation modelling (SEM), which was used by Sajid et al. (2023), the panel-corrected standard errors (PCSE) method, which was used by Khan et al. (2021), and hierarchical multiple regression analysis, which was used by Zouari-Hadiji (2023).

Previous studies have relied mainly on quantitative data collection methods and have not fully used qualitative research methods, such as questionnaires and interviews. Future research should consider the use of a mixed-methods approach to advance this field. Some scholars suggest expanding the horizons of research on the advancement of financial technology to highlight its complex effects on traditional commercial banks and add value to the literature (Chen et al. 2022). Zhao et al. (2023) recommend combining a theoretical framework that includes financial technology, regulatory agencies, and the banking system to provide a comprehensive view for future research. Additionally, text mining based on bank annual reports to construct fintech measures (Wang et al. 2021) as well as alternative modelling methods, such as structural equation modelling or decision trees, is suitable (Zouari-Hadiji, 2023). Further recommendations include using hierarchical multiple regression analysis and exploring mixed methods to provide a more complex understanding of fintech’s impact on bank risk. Researchers should also consider mechanisms related to the effects of mediation and moderation models to deepen the analysis. By expanding the methodological approach to include both quantitative and qualitative methods, future research can provide a more comprehensive and detailed understanding of fintech’s influence on bank risk and offer valuable insights to improve financial stability and performance.

Conclusions

An analysis of 28 papers obtained from the WoS and Scopus databases revealed that research on financial and banking risk has begun to attract considerable academic attention. The growing body of work in this field, particularly studies conducted between 2019 and 2023, has laid a solid scientific foundation for future research directions. This study covers various models and theoretical frameworks, explores the complex relationship between fintech and bank risk, and identifies seven main themes. Fintech measures are categorized into three main topics: bank level, country level, and fintech keywords. Bank-level measures include financial innovation and the use of online channels. At the country level, the digital finance index and the commercial bank digital transformation index are commonly used. Fintech keywords include social media platforms and documents. Bank risk research is divided into four themes: insolvency, credit, liquidity, and market risk. Specific measures of risk include the Z score, economic capital ratio, and risk-weighted asset ratio for insolvency risk; the loan loss reserve ratio and nonperforming loan ratio for credit risk; the liquidity ratio and loan-to-deposit ratio for liquidity risk; and the expected shortfalls and value at risk for market risk. The findings reveal that financial innovation is a commonly used measure at the bank level. The commercial bank digital transformation index and the digital finance index are prevalent at the country level. At the fintech keyword level, social media platforms are widely used. This study emphasizes the forms of bank risk, such as insolvency risk, credit risk, liquidity risk, and market risk, and provides a comprehensive view of the current state of research. These insights offer valuable guidance for researchers, identify research gaps, and provide recommendations for future studies on the basis of the theory-context-characteristics-method (TCCM) framework.

For policymakers, this research provides critical insights into the impact of fintech on bank risk. Many scholars have used text mining methods to measure fintech, achieve interdisciplinary collaboration between technology and finance, and accurately measure the fintech index. These developments represent significant advances in current research. As collaboration between banks and fintech companies grows, it becomes crucial for regulatory agencies to formulate timely and relevant policies. Our research equips policymakers with tools to leverage crawlers for a better understanding of fintech market dynamics and accurate identification of sources of bank risk. This knowledge can empower policymakers to strengthen supervision of the credit system and focus on establishing a comprehensive regulatory framework for holistic banking risk monitoring and analysis. In the future, we advocate for global cooperation to establish an international financial prevention system and improve anti-money laundering capabilities across countries. By continuously improving policies, we can ensure the overall stability of financial markets, protect consumer rights, promote sustainable economic growth, and instil a sense of hope and optimism in the audience.

This literature review highlights three insights and suggestions. (i) Regarding the theoretical framework, most previous research has not mentioned theory; some articles have adopted a single theoretical framework, and others have adopted a comprehensive multi-theoretical framework. It is recommended that scholars use theoretical foundations in future research and adopt a multi-theoretical framework. (ii) Previous studies have focused mainly on single countries. It is recommended that scholars expand the geographical scope of research in the future to focus on cross-country comparative analysis and study the relationship between fintech and risk more broadly. (iii) Interdisciplinary research studies fintech by combining finance and technology. Existing interdisciplinary research mainly utilizes unique search engines or professional databases and uses text analysis technology to measure fintech. Interdisciplinary research is mainly concentrated in China because China has unique search engine advantages, such as Baidu and professional news databases. It is recommended that scholars identify interdisciplinary research methods in other countries to conduct more comprehensive and accurate research on finance and technology. However, this study has limitations. The sample is mainly concentrated at the bank level, ignoring the research on fintech adoption at the individual level. Given the increasing role of consumer behaviour in fintech adoption, ignoring individual-level determinants such as financial literacy, trust in technology, risk tolerance, and digital accessibility limits the comprehensiveness of this review. Therefore, future research should consider adding individual-level influencing factors to more comprehensively study the relationship between fintech and bank risk.

Data availability

Data availability is not applicable to this article as no new data were created or analysed in this study.

Change history

04 June 2025

In the original version of this article, the authors’ faculty affiliations in the Affiliation information were omitted. This has now been corrected in both the PDF and HTML versions of the Article.

References

Abdul-Rahim R, Bohari SA, Aman A, Awang Z (2022) Benefit–risk perceptions of fintech adoption for sustainability from bank consumers’ perspective: the moderating role of fear of COVID-19. Sustainability 14(14):8357

Al-Mamoorey MA, Al-Rubaye MMM (2020) The role of electronic payment systems in Iraq in reducing banking risks: an empirical research on private banks. Pol J Manag Stud 21(2):49–59

Banna H, Hassan MK, Rashid M (2021) Fintech-based financial inclusion and bank risk-taking: evidence from OIC countries. J Int Financ Mark Inst Money 75:101447

Braun V, Clarke V (2006) Using thematic analysis in psychology. Qual Res Psychol 3(2):77–101

Bouteska A, Büyükoğlu B, Ekşi̇ İH (2022) How effective are banking regulations on banking performance and risk? Evidence from selected European countries. Financ Res Lett 53:103604. https://doi.org/10.1016/j.frl.2022.103604

Cao X, Han B, Huang Y, Xie X (2022) Digital transformation and risk differentiation in the banking industry: evidence from Chinese commercial banks. Asian Econ Pap 21(3):1–21

Chen B, Yang X, Ma Z (2022) Fintech and financial risks of systemically important commercial banks in China: an inverted U-shaped relationship. Sustainability 14(10):5912

Chen Q, Shen C (2023) How fintech affects bank systemic risk: evidence from China. J Financ Serv Res 65(1):77–101

Cheng M, Qu Y (2020) Does bank fintech reduce credit risk? Evidence from China. Pac Basin Financ J 63:101398

Chipeta C, Muthinja MM (2018) Financial innovations and bank performance in Kenya: evidence from branchless banking models. S Afr J Econ Manag Sci 21(1):a1681

Deng L, Lv Y, Liu Y, Zhao Y (2021) Impact of fintech on bank risk-taking: evidence from China. Risks 9(5):99

Dietzmann C, Alt R (2019) How IT-related financial innovation influences bank risk-taking: results from an empirical analysis of patent applications. Paper presented at the 2019 IEEE 21st conference on business informatics (CBI), IEEE, Moscow, Russia, 15–17 July 2019

EY (2019) Global fintech adoption index 2019. https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/financial-services/ey-global-Fintech-adoption-index-2019.pdf. Accessed 3 June 2019

Gao S, Gu H, Buitrago GA, Halepoto H (2023) Will off-balance-sheet business innovation affect bank risk-taking under the background of financial technology? Sustainability 15(3):2634

Haddad C, Hornuf L (2023) How do fintech start-ups affect financial institutions’ performance and default risk? Eur J Financ 29(15):1761–1792

Haddaway NR, Macura B, Whaley P, Pullin AS (2018) ROSES RepOrting standards for systematic evidence syntheses: pro forma, flow-diagram and descriptive summary of the plan and conduct of environmental systematic reviews and systematic maps. Environ Evid 7(1):7

Hassan NC, Abdul-Rahman A, Amin SIM, Ab Hamid SN (2023) Investment intention and decision making: a systematic literature review and future research agenda. Sustainability 15(5):3949

He D, Ho CY, Xu L (2020) Risk and return of online channel adoption in the banking industry. Pac Basin Financ J 60:101268

He M, Song G, Chen Q (2023) Fintech adoption, internal control quality and bank risk taking: evidence from Chinese listed banks. Financ Res Lett 57:104235

Hu D, Zhao S, Yang F (2022) Will fintech development increase commercial banks risk-taking? Evidence from China. Electron Commer Res 24(1):37–67

Jafri JA, Amin SIM, Rahman AA, Nor SM (2024) A systematic literature review of the role of trust and security on fintech adoption in banking. Heliyon 10(1):e22980

Jain R, Kumar S, Sood K, Grima S, Rupeika-Apoga R (2023) A systematic literature review of the risk landscape in fintech. Risks 11(2):36

Jović Ž, Nikolić I (2022) The darker side of fintech: the emergence of new risks. Zagreb Int Rev Econ Bus 25(S1):45–63

Khan AB, Fareed M, Salameh AA, Hussain H (2021) Financial innovation, sustainable economic growth, and credit risk: a case of the ASEAN banking sector. Front Environ Sci 9:729922

Kraus S, Durst S, Ferreira JJ, Veiga P, Kailer N, Weinmann A (2022) Digital transformation in business and management research: an overview of the current status quo. Int J Inf Manag 63:102466

Kumar MVM, Almuraqab N, Moonesar IA, Braendle UC, Rao A (2024) How critical is SME financial literacy and digital financial access for financial and economic development in the expanded BRICS block? Front Big Data 7:1448571

Li C, He S, Tian Y, Sun S, Ning L (2022a) Does the bank’s fintech innovation reduce its risk-taking? Evidence from China’s banking industry. J Innov Knowl 7(3):100219

Li C, Khaliq N, Chinove L, Khaliq U, Oláh J (2023) Consumers’ perception of risk facets associated with fintech use: evidence from Pakistan. Sage Open 13(4):21582440231200199

Li G, Elahi E, Zhao L (2022b) Fintech, bank risk-taking, and risk-warning for commercial banks in the era of digital technology. Front Psychol 13:934053

Li X (2023) Impact of fintech on bank risks: the role of bank digital transformation. Appl Econ Lett 32(6):895–899

Liang F, Zhao P, Huang Z (2023) Financial technology, macroeconomic uncertainty, and commercial banks’ proactive risk-taking in China. China Econ Q Int 3(2):77–87

Lockwood C, Munn Z, Porritt K (2015) Qualitative research synthesis: methodological guidance for systematic reviewers utilizing meta-aggregation. Int J Evid Based Health 13(3):179–187

Ni Q, Zhang L, Wu C (2023) Fintech and commercial bank risks–the moderating effect of financial regulation. Financ Res Lett 58:104536

Okoli C (2015) A guide to conducting a standalone systematic literature review. Commun Assoc Inf Syst 37:879–910

Papadopoulos T, Baltas KN, Balta ME (2021) The use of digital technologies by small and medium enterprises during COVID-19: implications for theory and practice. Int J Inf Manag 55:102192

Rogers E (2003) Diffusion of Innovations. Fifth edition. Free Press: New York

Sajid R, Ayub H, Malik BF, Ellahi A (2023) The role of fintech on bank risk-taking: mediating role of bank’s operating efficiency. Hum Behav Emerg Technol 2023:1–11

Shaffril HAM, Samah AA, Kamarudin S (2021a) Speaking of the devil: a systematic literature review on community preparedness for earthquakes. Nat Hazards 108(3):2393–2419

Shaffril HAM, Samsuddin SF, Samah AA (2021b) The ABC of systematic literature review: the basic methodological guidance for beginners. Qual Quant 55(4):1319–1346

Škare M, Soriano DR, Porada-Rochoń M (2021) Impact of COVID-19 on the travel and tourism industry. Technol Forecast Soc Change 163:120469

Stenfors T, Kajamaa A, Bennett D (2020) How to … assess the quality of qualitative research. Clin Teach 17(6):596–599

Stulz RM (1996) Rethinking risk management. J Appl Corp Financ 9:8–25. https://doi.org/10.1111/j.1745-6622.1996.tb00295.x

Suryono RR, Purwandari B, Budi I (2019) Peer to peer (P2P) lending problems and potential solutions: a systematic literature review. Procedia Comput Sci 161:204–214

Tarawneh A, Abdul-Rahman A, Amin SIM, Ghazali MF (2024) A systematic review of fintech and banking profitability. Int J Financ Stud 12(1):3

Tran OKT, Duong KD, Nguyen NNT (2022) Innovations and liquidity risks: evidence from commercial banks in Vietnam. J Int Stud 15(3):145–157

Verhoef PC, Broekhuizen T, Bart Y, Bhattacharya A, Dong JQ, Fabian N, Haenlein M (2021) Digital transformation: a multidisciplinary reflection and research agenda. J Bus Res 122:889–901

Vučinić M (2020) Fintech and financial stability potential influence of fintech on financial stability, risks and benefits. J Cent Bank Theory Pr 9(2):43–66

Wan X, Luo S (2023) Research on risk management of commercial banks under financial innovation based on fixed effects model. Paper presented at the Proceedings of the 2023 8th International Conference on Intelligent Information Processing, Association for Computing Machinery, Bucharest, Romania, 21–22 November 2023

Wang J, Selamat AI, Ashhari ZM, Yahya MHH (2023) The inverted-u-shaped impact of fintech development on bank risk: a study of liability structure and economic uncertainty. Econ Financ Lett 10(4):268–285

Wang R, Liu J, Luo H (2021) Fintech development and bank risk taking in China. Eur J Financ 27(4-5):397–418

Wu X, Jin T, Yang K, Qi H (2023) The impact of bank fintech on commercial banks’ risk-taking in China. Int Rev Financ Anal 90:102944