Abstract

China’s transition from fossil fuels to clean energy to attain environmental and economic co-sustainability necessitates changes in its energy policy landscape. Such policy shifts impact the confidence of both businesses and consumers. Building on this argument, this research article investigates the response of China’s business and consumer confidence towards energy-related uncertainty for the period February 2000 to October 2022. Utilizing a novel energy-related uncertainty measure and the quantile-on-quantile regression approach, the empirical analysis underscores that China’s business confidence is hostile towards energy-related uncertainty across all quantiles. The quantiles of consumer confidence mirror the outcomes of business confidence, recording the negative impact of energy-related uncertainty, except for a few quantiles. The empirical outcomes indicate that to augment business and consumer confidence, Chinese policymakers should strive to minimize energy-related uncertainty through transparent communication with stakeholders and a gradual shift from fossil fuels to clean energy sources.

Similar content being viewed by others

Introduction

China’s aim of achieving economic and environmental co-sustainability through the transition from dirty to clean energy sources is commendable, despite noteworthy challenges of infrastructure investment, technological advancement, and so forth. However, the policy stances of becoming a low-carbon economy, particularly the evolving regulatory frameworks pertaining to the energy mix give rise to energy-related uncertainty. Policy uncertainty is a phenomenon in which government prospective actions are ambiguous, propelling market volatility and making individuals and businesses postpone their spending and investing patterns for a period of time until the uncertainty somehow (Bernanke 1983a; Jurado et al. 2015; Baker et al. 2016; Younis et al. 2024). Policy shifts alters the dynamics of renewable energy sources and compel businesses to reconsider their decisions in the sector. Footnote 1 Ambiguous energy policies make businesses adopt wait and see strategy are refrain to opt for investing in long-term capital-intensive and innovative projects, owing to the risks of cost of capital (Eryilmaz and Homans 2013). The risk of renewable energy augments with frequent policy changes and hence alters both the demand and supply for energy (Omri and Nguyen 2014; Sharif et al. 2020). The energy sector is highly responsive to policy uncertainty and the energy production, distribution, and consumption are highly regulatory dependent. Environmental regulations changes, tax breaks for the renewable energy sector, and geopolitical factors are prime factors propelling uncertainty within the energy sector, altering investments, and overall dynamics of the markets (Adedoyin and Zakari 2020). A volatile policy environment also disturbs supply chains and propels operational costs, which pass on and burden consumers. Consumers suffer from the uncertainty in the shape of higher prices, ultimately decreasing their purchasing power, negatively affecting both consumer spending and overall economic vitality. High policy uncertainty tends to reduce consumer spending and make households cognizant about their future financial prospects (Bloom 2014; Basu and Bundick 2017). Against this backdrop, this research work aims to answer the question; how does energy-related uncertainty affect business and consumer confidence in China?

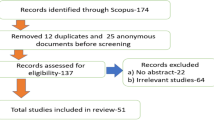

This study attempts to expand the existing literature in the following manner. First, A plethora of literature has addressed the economic and financial consequences of economic policy uncertainty (inter ali, Bloom et al. 2007; Baker et al. 2016; Arbatli et al. 2017; Bonaime et al. 2018; Carrière-Swallow and Céspedes 2013; Gulen and Ion 2015; Jurado et al. 2015; Walkup 2016; Plakandaras et al. 2019; Duong et al. 2020; Lam et al. 2020; Sha et al. 2020; Xu 2020; Hammer et al. 2023; Gyamerah and Asare 2024). Limited attempts linked business confidence with economic policy uncertainty (Adekoya and Oliyide 2021; Montes and Nogueira 2022). However, to the best of our knowledge, the existing literature lacks evidence to either support or negate the postulation of how energy-related uncertainty influences business and consumer confidence in China. Ullah et al. (2025) studied the relationship of business and consumer confidence and economic policy uncertainty (EPU). The prime difference between the current and Ullah et al. (2025) study is that unlike the broad economic uncertainty measure used in their study, we aim to study whether business and consumer confidence exhibit vulnerability towards energy-related uncertainty. The postulation is worth studying owing to regulatory changes introduced by Chinese government to address the pressing issue of climate change. Consequently, this shift from dirty to clean energy sources pertaining to technology, investment and policy frameworks, affecting energy production and consumption, influencing businesses and consumers sentiments. The economic dynamics of a country stipulate to business and consumer confidence (Montes and Nogueira 2022; Gholipour et al. 2023). Second, we utilize a novel energy-related uncertainty recently introduced by (Dang et al. 2023). This index is constructed from the uncertainty espoused by both economic and energy facets. The authors replicated the economic uncertainty facets following the work of Ahir et al. (2022). To extract energy facets, the authors extended the Afkhami et al. (2017). Dang et al. (2023) used 87 exact words along with 15 additional words to gauge shocks and crises in energy sectors. Since the uncertainty indices are mainly newspaper search-based indices (Alexopoulos and Cohen 2015; Baker et al. 2016). Nonetheless, like Ahir et al. (2022), while constructing the energy uncertainty index, the author(s) adopted another approach for text searches and used monthly country reports from the EIU (Economist Intelligence Unit) by taking insights from Ahir et al. (2022) study. EIU has a standard coverage strategy in producing its monthly reports for a country, which covers unexpected concerns regarding ideological bias, consistency, and accuracy (Ahir et al. 2022).

Third, taking insight from the literature that economic and financial variables often exhibit non-linear characteristics (Baruník et al. 2017; Bigerna 2023; Huynh et al. 2023; Jithin 2025), the study utilizes the novel quantile-on-quantile (henceforth, QQ) regression approach of Sim and Zhou (2015), to model the relationship between energy-related uncertainty and business/consumer confidence in China. The selection of the QQ is endorsed by Broock et al. (1996), BDS non-linearity test which affirms the postulation of data non-normality for the selected variables. Kruse. The prime advantage of the QQ approach is unlike the conventional quantile regression (QR), this approach determines the association between the dependent variable (Y) and independent variable (X) across different quantiles of Y and X, which enables us to identify the homogenous/heterogenous associations in quantile across the whole distribution of Y and X. This study takes the uniques case of China, as the country is the world’s largest consumer in terms of energy and changes in its energy policy have substantial implications for climate goals and global markets.

The rest of the paper unfolds as follows. The section “Literature review” outlines pertinent literature. The section “Data and estimation framework” relates to the data and estimation framework. The sections “Results and discussion” and “Robustness analysis for the QQ approach” outline empirical outcomes-cum-discussion and robustness checks, respectively. The section “Concluding remarks” reports concluding remarks along with the study limitations and future research directions.

Literature review

Bernanke (1983b) postulated real option theory stating that owing to uncertainty, investors’ demand decreases, as they develop negative sentiments. In such situation, they prefer to hold investments and go for viable prospective investments amid uncertainty. Inadequate energy sources decrease the pace of industrialization, ultimately retarding the wheel of economic growth (Fattouh and El-Katiri 2013). Economic policy uncertainty (EPU) influences asset prices as it alters the investment decisions of economic agents and firms. These decisions pertain to employment, savings, and consumption (Gulen and Ion 2016). EPU also influences supply and demand, thereby leading to economic contraction (You et al. 2017). EPU has a hostile impact on a firm’s operations, consumer behavior, innovation, and economic activity (Caldara et al. 2016; Bhattacharya et al. 2017). An adequate energy supply lubricates various aspects of an economy such as industry and infrastructure development, tourism, and information technology (Sun et al. 2024). Nonetheless, the prevailing environmental concerns have compelled governments, including China to adopt sustainable practices and move from non-renewable energy sources generating carbon emissions to clean and environmentally friendly resources. Elevated energy prices render low-profit margins for businesses and compel form to reassess their operational strategies. Corporations which are dependent on energy are more vulnerable to increases in energy costs as they tend to scale back investments, ultimately affecting their confidence.

Consumers require oil to fulfill their basic needs including food, accommodation and transportation (Hong et al. 2022). Economic uncertainty defined by fluctuations in energy prices is a prime determinant of consumer confidence. When consumers are confronted by uncertainty in the economy owing to volatility in energy prices, consumer confidence diminishes as majority of the consumers adopt a cautious spending strategy (Ghosh 2022). Xu et al. (2022) demonstrated that the tendency of affordability of higher oil prices is relatively higher in younger and well-educated consumers as they can afford it through annual flows of stable income, hence, consumer confidence does not diminish with an increase in oil prices. Knez et al. (2022) correlated energy price changes to economic well-being, showing that there is a significant impact of energy price changes on developing countries. They concluded that as energy costs increase, the households shift their priorities from sustainable to unsustainable energy practices, thereby confining novel energy sustainable economic development. Barsky and Sims (2012) associated consumer confidence with macroeconomic dynamics. They obtained that consumer sentiment is one of the prime predictors of business cycles. The confidence of consumers declines with an increase in energy prices because of consumers tend to curtail spending on goods and services which are non-essential. This reduction on behalf of consumers negatively affects both businesses and economic growth. Volatility in oil price has negative and significant impact on consumer sentiment in G7 economies (Azad and Serletis 2024).

Compared to the developed world, elevated energy prices are bearing more negative influence on the developing world, especially the third world countries. Okushima (2017) observed that income disparities and limited access to essential energy services add to energy poverty, leaving households vulnerable to energy price fluctuations, thereby negatively influencing the economic conditions of developing countries. Streimikiene and Kyriakopoulos (2023) asserted that recent major global crises, such as geopolitical tensions between Russia and Ukrainian and the COVID-19 pandemic, have soared energy prices, which has disturbed the financial condition of households in the developing regions. Huynh (2016) asserted that energy price shocks influence business cycles, and have significant ramifications for economic stability. Energy supply shocks defined by global oil prices elevate uncertainty, which increases business costs and disturbs prospective planning of businesses, as they adopt conservative approach; to tackle the risk of fluctuating energy prices, all of which have negative consequences for both business and consumer confidence. Shayaa et al. (2018) ascertained that consumer confidence mostly revolves around the stability of personal finances and the economic condition of the country. Heightened energy prices add to the inflation, making consumers hesitant to spend and households prioritize essential discretionary spending over the non-essential ones, which leads to economic decline. Elevated energy price leads to adverse economic conditions and cultivate risk-averse attitude among businesses (Jude et al. 2023; Razi et al. 2024).

Chen et al. (2020) suggest that renewable energy investment ensures higher economic stability, as such sources tend to have predictable pricing structures, unlike fossil fuels. Bolstering renewable energy consumption does not only affect energy costs but also strategically enhances overall economic resilience. Heightened uncertainty related to oil prices paves the way for renewable energy sources as businesses perceive the latter to be more sustainable in the long run (Lin and Wang 2023). Zhang et al. (2023) highlighted those geopolitical tensions directly influence the dynamics of energy supply, which alter strategic decision-making of the businesses. Energy-related uncertainty (EUI) stifles economic activities at (both country and industry levels), and this phenomenon has been observed to be more pronounced during the global financial crisis, and the recent COVID-19 pandemic (Dang et al. 2023). Chen et al. (2024) investigated whether volatility in oil prices and economic policy uncertainties influence global corporate investment. They obtained that both oil price volatility and economic policy uncertainties have detrimental impact on global corporate investment. Dagar et al. (2024) explored that global energy security receives negative spillovers from economic policy uncertainty (EPU), as it decreases the range of alternative energy sources, therefor policymakers shall focus on carbon-free energy security to ensure energy stability and diversification. Energy uncertainties prompt manufacturing industries to pour in more investment in innovation and technology domains for the transition from conventional energy sources. The conducive environment in the shape of digitalization and institutional quality support this strategic investment decision of the manufacturing industries (Anh et al. 2024). In a nutshell, the extant literature provides evidence that energy-related uncertainty and volatility in energy prices have marked influence on economic activities. It worthy to mention that the transition of striking a balance between existing and new energy sources is not straightforward and somehow challenging, particularly in the context of China, which is transitioning from dirty to new energy sources, creating uncertainty in China’s energy-mix, which in turn, influences both businesses and consumers confidence. This study aims to assess the influence of varying levels of energy-related uncertainty on varying levels businesses and consumers confidence in the context of China.

Data and estimation framework

The data for business and consumer confidence indices is retrieved from the CIEC database and energy-related uncertainty data is taken from the website (www.policyuncertainty.com). The energy-related index is a text based indexed recently constructed by Dang et al. (2023). This index captures uncertainty pertaining to the energy-related factors in the energy market. The business confidence (BC) and Consumer confidence (CC) are survey-based indices measuring optimism and pessimism about businesses and consumers. The data span of this research from February 2000 to October 2022. This data span is stipulated to the availability of the data. For empirical analysis, the data has been transformed to logarithmic form. Owing to asymmetric characteristics, the recent literature utilizes nonlinear approaches in various domains of economics and finance. In this respect, we resort to the Quantile-on-Quantile (QQ) endorsed by Sim and Zhou (2015). Although the conventional quantiles regression (QR) covers the heterogeneity characteristics, it does delineate entire distributional association between independent and dependent variables (Wan et al. 2024). The QQ regression approach has given preference over conventional quantile regression (QR) as the latter only determines the mean influences of the dependent variable and ignores its entire distribution. The QQ estimation envelopes the benefits of both quantile regression and non-parametric estimations. The QQR approach not only integrates the nuances of the conventional QR and non-parametric estimation but also tackles the endogeneity issue (Wang, 2024). The determination of association across the entire distribution between the explanatory and explained variable enables us to know if the variables have homogenous/heterogenous or neutral associations in the lower, medium, or high quantiles.

To model the studied variables, we begin with the framework of QQ estimation:

Where \({{``} {\rm{CON}}}_{{{t}}}\mbox{''}\) stands for business/consumer confidence at period t, EU denotes energy-related uncertainty, \({\rm{\theta }}\) indicates the \({{\rm{\theta }}}^{{\rm{th}}}\) quantile of energy-related uncertainty and \({{\rm{\gamma }}}^{{\rm{\theta }}}\) is yet to be determined owing to the unlimited knowledge on the nexus between business confidence and energy-related uncertainty and the quantile disturbance term is denoted by \({{\rm{u}}}_{{\rm{t}}}^{{\rm{\theta }}}\). Next, we linearize the function \({{\rm{\gamma }}}^{{\rm{\theta }}}\) (.) around the quantile of \({{\rm{EU}}}^{{\rm{\tau }}}\) by taking insights from the “local linear technique” of Cleveland (1979) as follows:

The sign \({\gamma \; \theta }{\prime}\) signifies the partial derivative of\(\,{\gamma }^{\theta }\left({{{\rm{EU}}}}_{t}\right)\) pertaining to \({{EU}}_{t}\), also known the marginal effect. Following Sim and Zhou (2015) work, we redefine \(\gamma\)θ(\({{EU}}^{\tau }\)) and \(\gamma\)θ′ (\({{EU}}^{\tau }\)) as \({\gamma }_{0}\) = (θ,τ) and \({\gamma }_{1}\) = (θ,τ) and re-frame Eq. (2) in the following manner:

To replicate the QQ estimation process pioneered by Sim and Zhou (2015), Eq. (3) is substituted into Eq. (2) to get a new equation as given below:

In Eq. (4), (∗) refers to the conditional quantile of BC. Moreover, Eq. (4) affirms the association between the relationship between the quantile business confidence (\({\theta }^{{th}}\)) and the quantile of energy-related uncertainty (\({\tau }^{{th}}\)) of parameters \({\gamma }_{0}\) and \({\gamma }_{1}\). Following the ordinary least square (OLS) approach, Eq. (5) is obtained through a simple minimization, which, in turn, determines the impact of energy-related uncertainty on business/consumer confidence.

Note, \(\rho \theta\) represents quantile loss function and K(.). K\(\left(* \right){\rm{is}}\) the kernel density function and \(h\) is the bandwidth parameter. Where K\((.)\) measures the observation of \({{\rm{EU}}}\) while minimal weights are inversely assigned to the distribution function of \(\hat{{{{\rm{EU}}}}_{t}}\) and \(\hat{{{{\rm{EU}}}}^{\tau }}\) as:

Sim and Zhou (2015) asserted that non-parametric analysis predicates the bandwidth selection, as it determines the neighborhood close to the target point, and therefore controls the smoothness of the measurement. In this respect, we have employed a bandwidth parameter h = 0.05 in the study.

Results and discussion

Correlation analysis

Figure 1 provides preliminary information regarding the correlation of the variables. The correlation matrix shows that business and consumer confidence is negatively correlated to energy-related uncertainty. The corresponding values of each variable in the matric are in the acceptable range, suggesting that the model is free from multicollinearity issues.

Descriptive statistics

Table 1 reports the stochastic properties of variables, the mean values of all variables are positive. The data for energy-related uncertainty and business confidence is negatively skewed. Consumer confidence has the highest standard deviation followed by business confidence. The values of kurtosis for all the variables are greater than three and the probability values corresponding the Jarque-Bera statistics are significant at 5 and 10% levels, respectively; which entails that our model is exhibiting nonlinear characteristics. These outcomes infer to utilize asymmetric approach such as the QQ approach.

The time-series models usually exhibit non-normality owing to financial or social events. To further ascertain nonlinearity in the model, we apply the BDS test by Broock et al. (1996). The results of the BDS test, suggest that energy-related uncertainty and business/consumer confidence are showing nonlinear properties as all the values corresponding to the variables included in the model are significant at each embedding dimension. Table 2 summarizes the outcomes of the BDS test.

Kruse nonlinear unit root test

To further validate the stationarity and nonlinear characteristics of the model, the Kruse (2011) nonlinear unit root test is employed on the data series. This test not only assesses the stationarity issues but also determines if the data series exhibit nonlinearity at various specifications such as with constant, without constant and with constant and trend. The obtained results in Table 3 entail that unit root properties in energy uncertainty, business confidence, and consumer confidence are rejected as their corresponding probabilities are less than 1% and 10%, respectively. These inferences suggest that the model is exhibiting a non-linear stationary process.

The outcomes of the QQ approach are mainly pictorial. Figures 3 and 4 show the relationship between two variables i.e., energy-related uncertainty and business confidence at different points in their distributions. The results suggest that there is negative relationship between the quantiles of business confidence and the quantiles of energy-related uncertainty. In other words, business confidence tends to decrease as the level of energy-related uncertainty increases. Unclear energy policies with frequent regulatory changes make it difficult for businesses to predict future costs, resultantly they refrain or postpone from long-term planning such as opting for investment in the energy sector. Such scenario leads to low investment in the sector, affecting business confidence and economic activity. As energy uncertainty slows down economic activity, the level of economic uncertainty goes up. Economic uncertainty substantially impact various pillars of economic activity such as prices, consumption, and outputs, all of which create challenges for businesses and affect their performance (Adekoya and Oliyide 2021).

Figures 2 and 3 depict the QQ results of energy-related uncertainty (EU) and consumer confidence in China. The outcomes depicted by the color 2D and 3D graphs imply that the lower quantiles of EPU are negative affecting the lower to medium quantiles of CC. These results entail economic uncertainty personal investment and consumption decisions as the consumers keep themselves cognizant of fulfilling the necessities amid high uncertain period. High uncertainty espouses unemployment and alters personal investment and consumption choices (Al-Thaqeb et al. 2022). We also noticed that the lower quantiles of EPU positively affect the higher quantiles of CC. These outcomes suggest that the period of high uncertainty trims household expenditures but there is certain consumption on behalf of the household which are to be made and when the uncertainty is low the consumer spends more at that time to buy items for the future to remain well-off in the future when uncertainty will be high.

In Figs. 4 and 5, the association between energy-related uncertainty and consumer confidence is negative except for a few quantiles, which entails that consumer confidence tends to dissipate as energy uncertainty in the sector rises. Uncertainty in energy policy makes consumers wary of increasing energy costs in the future, which decreases their confidence and purchasing power, as they have to face the challenge of increased costs of goods and services and higher utility bills that rely on energy owing to the inflationary pressure. High energy uncertainty brings fluctuation in consumer confidence as they stipulate energy uncertainty to economic stability, which in turn, defines their perception of job security and financial well-being. Since domestic consumption most defined economic activity in China, losing consumer confidence owing to energy-related uncertainty may have considerable consequences. Decreased consumer confidence vis-a-vis uncertain energy policies highlight the interdependent nature of consumer sentiment, economic stability, and energy. To maintain consumer confidence, clear and consistent policies regarding energy hold prime significance for China as it will both businesses and consumers to opt for more renewable solutions.

Robustness analysis for the QQ approach

To validate the robustness QQ approach the average estimates are compared to the standard quantile regression (QR) estimates. Figures 6 and 7 showcasing these results infer that coefficient estimates of the QQR methodology are similar to estimates of the standard quantile regression (QR), as they are exhibiting almost identical trends. These results affirm that QQ estimations of the main models are robust.

Concluding remarks

This research evaluates the response of business and consumer confidence towards energy-related uncertainty in China for the period. Owing to the shock vulnerability, time series data often exhibit asymmetric behavior; hence we began with the BDS test, which deduced that the model displays nonlinearity. Therefore, utilize the novel QQ methodology to study the heterogenous/homogenous behavior of the model. The outcomes imply that business confidence decreases with high level of energy-related uncertainty across the entire distribution. Consumer confidence also tends to decrease vis-à-vis the high level of energy-related uncertainty for majority of the quantiles, except a few. Based on the empirical outcomes, we deduce that high level of energy uncertainty erodes the confidence of both businesses and consumers.

Policymakers should refrain from frequent regulatory changes in the energy market as high energy uncertainty about future costs causes both local and foreign firms to delay or cancel new projects that otherwise might have supported innovation and business expansion. Businesses opt out of investment, particularly in renewable energy infrastructure, where payback time is long, and ponder that policy landscape may change before they realize returns. The fluctuations in energy prices propels operational costs and hurt profitability. Owing to high energy uncertainty the notion of holding cash also increases as firms allocate more resources to monitor and adjust to policy shifts, ultimately increasing their cost of risk management. High risk in the energy sector tends to discourage both local and foreign investors from investing. The risk of high energy-related uncertainty also erodes consumer confidence as high energy costs translate to higher prices for goods and services, altering the dynamics of the cost of living, encouraging savings over spending, and reduce consumer spending.

These results of the study hold prime significance in the context of China, where the higher authorities are continually striving to enhance energy efficiency by reducing carbon emissions for realizing sustainable economic progression. Nonetheless, the challenge of implementing policies coming from central to local government persists, which mars business and consumer confidence and slows down national sustainable economic targets. These effects call for of consistent, conspicuous, and forward-looking policies pertaining to the energy sector to maintain both businesses and consumers’ confidence in China at par. In this regard, striking an equilibrium between economic and environmental targets is indispensable. A gradual policy shift from conventional energy sources to clean energy sources will not only minimize the burden on both businesses and consumers but boost their confidence, fostering a stable economic environment. The policy-makers need to have conspicuous communication regarding energy policy changes and shall consider all the stakeholders while devising policies for the energy mix. Such measures will not only maintain the confidence of businesses and consumers but will enable the Chinese government to realize the environmental targets and become a low-carbon economy. The current study only focuses on China, the world’s leading energy consuming country, and its pragmatic approach to tackle the global energy challenges such as renewable energy adoption, climate change and improved energy efficiency. Future studies can work on the postulation by extending it to other emerging and developing economies. Utilizing the multivariate quantile-on-quantile (m-QQR) approach will further allow researchers to add more pertinent variables in the existing QQR model, leading to improved policy inferences.

Data availability

The datasets used during the current study are available from the corresponding author upon reasonable request.

Notes

Harrabin, R. (2016). Investors deterred by EPU. BBC News, June 15, 2016.

References

Adedoyin FF, Zakari A (2020) Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140014

Adekoya OB, Oliyide JA (2021) Business confidence as a strong tracker of future growth: is it driven by economic policy uncertainty and oil price shocks in the OECD countries? Future Bus J 7(1):1–13

Afkhami M, Cormack L, Ghoddusi H (2017) Google search keywords that best predict energy price volatility. Energy Econ. https://doi.org/10.1016/j.eneco.2017.07.014

Ahir H, Bloom N, Furceri D (2022) The world uncertainty index. National Bureau of Economic Research

Al-Thaqeb SA, Algharabali BG, Alabdulghafour KT (2022) The pandemic and economic policy uncertainty. Int J Financ Econ. https://doi.org/10.1002/ijfe.2298

Alexopoulos M, Cohen J (2015) The power of print: uncertainty shocks, markets, and the economy. Int Rev Econ Financ 40:8–28. https://doi.org/10.1016/j.iref.2015.02.002

Anh DLT, Quang NTT, Anh NT (2024) Investment decision and efficiency: global insights on manufacturing firms amidst energy uncertainties. Energy Econ 137:107793

Arbatli E, Davis S, Ito A, Miake N, Saito I(2017) Policy uncertainty in Japan. IMF Working Paper 17(128):1. https://doi.org/10.5089/9781484300671.001

Azad NF, Serletis A (2024) Oil price uncertainty and consumer sentiment in advanced economies. Energy J 45(6):159–175

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ. https://doi.org/10.1093/qje/qjw024

Barsky RB, Sims ER (2012) Information, animal spirits, and the meaning of innovations in consumer confidence. Am Econ Rev 102(4):1343–1377

Baruník J, Kočenda E, Vácha L (2017) Asymmetric volatility connectedness on the forex market. J Int Money Finance. https://doi.org/10.1016/j.jimonfin.2017.06.003

Basu S, Bundick B (2017) Uncertainty shocks in a model of effective demand. Econometrica. https://doi.org/10.3982/ecta13960

Bernanke BS (1983a) Irreversibility, uncertainty, and cyclical investment. Q J Econ. https://doi.org/10.2307/1885568

Bernanke BS (1983b) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98(1):85. https://doi.org/10.2307/1885568

Bhattacharya U, Hsu PH, Tian X, Xu Y (2017) What affects innovation more: policy or policy uncertainty? J Financ Quant Anal. https://doi.org/10.1017/S0022109017000540

Bigerna S (2023) Energy price shocks, exchange rates and inflation nexus. Energy Econ. https://doi.org/10.1016/j.eneco.2023.107156

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect. https://doi.org/10.1257/jep.28.2.153

Bloom N, Bond S, Van Reenen J (2007) Uncertainty and investment dynamics. Rev Econ Stud 74(2):391–415. https://doi.org/10.1111/j.1467-937X.2007.00426.x

Bonaime A, Gulen H, Ion M (2018) Does policy uncertainty affect mergers and acquisitions? J Financ Econ. https://doi.org/10.1016/j.jfineco.2018.05.007

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Econom Rev. https://doi.org/10.1080/07474939608800353

Caldara D, Fuentes-Albero C, Gilchrist S, Zakrajšek E (2016) The macroeconomic impact of financial and uncertainty shocks. Eur Econ Rev. https://doi.org/10.1016/j.euroecorev.2016.02.020

Carrière-Swallow Y, Céspedes LF (2013) The impact of uncertainty shocks in emerging economies. J Int Econ 90(2):316–325. https://doi.org/10.1016/j.jinteco.2013.03.003

Chen C, Pinar M, Stengos T (2020) Renewable energy consumption and economic growth nexus: evidence from a threshold model. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111295

Chen Y, Dong S, Qian S, Chung K (2024) Impact of oil price volatility and economic policy uncertainty on business investment—insights from the energy sector. Heliyon. https://doi.org/10.1016/j.heliyon.2024.e26533

Dagar V, Dagher L, Rao A, Doytch N, Kagzi M (2024) Economic policy uncertainty: global energy security with diversification. Econ Anal Policy 82:248–263

Dang TH-N, Nguyen CP, Lee GS, Nguyen BQ, Le TT (2023) Measuring the energy-related uncertainty index. Energy Econ 124:106817. https://doi.org/10.1016/j.eneco.2023.106817

Duong HN, Nguyen JH, Nguyen M, Rhee SG (2020) Navigating through economic policy uncertainty: the role of corporate cash holdings. J Corp Financ. https://doi.org/10.1016/j.jcorpfin.2020.101607

Eryilmaz D, Homans F (2013) Uncertainty in renewable energy policy: how do renewable energy credit markets and production tax credits affect decisions to invest in renewable energy?

Fattouh B, El-Katiri L (2013) Energy subsidies in the middle East and North Africa. Energy Strategy Rev 2(1):108–115

Gholipour HF, Tajaddini R, Farzanegan MR (2023) Governments’ economic support for households during the COVID-19 pandemic and consumer confidence. Empir Econ 65(3):1253–1272. https://doi.org/10.1007/S00181-023-02367-0/TABLES/6

Ghosh S (2022) The impact of economic uncertainty and financial stress on consumer confidence: the case of Japan. J Asian Bus Econ Stud. https://doi.org/10.1108/JABES-04-2021-0044

Gulen H, Ion M (2015) Policy uncertainty and corporate investment. Rev Financ Stud hhv050. https://doi.org/10.1093/rfs/hhv050

Gulen H, Ion M (2016) Policy uncertainty and corporate investment. Rev Financ Stud. https://doi.org/10.1093/rfs/hhv050

Hammer B, Mettner S, Schweizer D, Wünsche N (2023) Management buyouts in times of economic policy uncertainty. Financ Res Lett. https://doi.org/10.1016/j.frl.2022.103499

Hong Y, Wang L, Liang C, Umar M (2022) Impact of financial instability on international crude oil volatility: new sight from a regime-switching framework. Resour Policy. https://doi.org/10.1016/j.resourpol.2022.102667

Huynh BT (2016) Macroeconomic effects of energy price shocks on the business cycle. Macroecon Dyn 20(3):623–642. https://doi.org/10.1017/S1365100514000455

Huynh TLD, Nasir MA, Nguyen DK (2023) Spillovers and connectedness in foreign exchange markets: the role of trade policy uncertainty. Q Rev Econ Financ. https://doi.org/10.1016/j.qref.2020.09.001

Jithin P (2025) Unveiling the asymmetric effects: global value chain participation and income inequality. Appl Econ 57(22):2853–2868

Jude O, Turgeman A, Boţoc C (2023) Recent examination of energy markets volatility. Stud Bus Econ. https://doi.org/10.2478/sbe-2023-0007

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev. https://doi.org/10.1257/aer.20131193

Knez S, Šimić G, Milovanović A, Starikova S, Županič FŽ (2022) Prices of conventional and renewable energy as determinants of sustainable and secure energy development: regression model analysis. Energy Sustain Soc. https://doi.org/10.1186/s13705-022-00333-9

Kruse R (2011) A new unit root test against ESTAR based on a class of modified statistics. Stat Pap. https://doi.org/10.1007/s00362-009-0204-1

Lam SS, Zhang H, Zhang W (2020) Does policy instability matter for international equity markets? Int Rev Financ 20(1):155–196. https://doi.org/10.1111/irfi.12222

Lin B, Wang S (2023) Mechanism analysis of the influence of oil price uncertainty on strategic investment of renewable energy enterprises. Int J Financ Econ. https://doi.org/10.1002/ijfe.2641

Montes GC, da Silva Leite Nogueira F (2022) Effects of economic policy uncertainty and political uncertainty on business confidence and investment. J Econ Stud 49(4):577–602. https://doi.org/10.1108/JES-12-2020-0582/FULL/PDF

Okushima S (2017) Gauging energy poverty: a multidimensional approach. Energy. https://doi.org/10.1016/j.energy.2017.05.137

Omri A, Nguyen DK (2014) On the determinants of renewable energy consumption: international evidence. Energy. https://doi.org/10.1016/j.energy.2014.05.081

Razi U, Afshan S, Cheong CWH, Sharif A (2024) Dynamic connection between energy prices, Malaysia’s economic growth, and ecological footprint: an evidence from Morlet wavelet approach. Geol J 59(3):1000–1017

Sha Y, Kang C, Wang Z (2020) Economic policy uncertainty and mergers and acquisitions: evidence from China. Econ Model. https://doi.org/10.1016/j.econmod.2020.03.029

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain Cities Soc. https://doi.org/10.1016/j.scs.2020.102138

Shayaa S, Sulaiman A, Wai PS, Ashraf M, Jaafar NI, Zakaria SB (2018) Consumer confidence index predict behavioral intention to purchase. 758–767. https://doi.org/10.15405/epsbs.2018.07.02.80

Sim N, Zhou H (2015) Oil prices, US stock return, and the dependence between their quantiles. J Bank Finance. https://doi.org/10.1016/j.jbankfin.2015.01.013

Streimikiene D, Kyriakopoulos GL (2023) Energy poverty and low carbon energy transition. Energies 16(2):610. https://doi.org/10.3390/en16020610

Sun Y, Pal S, Mahalik MK, Gozgor G, Lau CKM (2024) Predicting energy source diversification in emerging Asia: the role of global supply chain pressure. Energy Econ 136:107735

Ullah A, Özmen İ, Bukhari AAA, Pervaiz A, Bukhari WAA, Shahzadi H (2025) The impact of economic policy uncertainty on China’s business and consumer confidence: a quantile-based analysis. J Know Econ 1–28

Walkup B (2016) The impact of uncertainty on payout policy. Manag Financ 42(11):1054–1072. https://doi.org/10.1108/MF-09-2015-0237

Wan L, Nazar R, Ali S, Anser MK (2024) Environmental consequences of trade-induced uncertainty: evidence from econometric estimation. Renew Sustain Energy Rev. https://doi.org/10.1016/j.rser.2023.114106

Wang K (2024) Economic policy uncertainty and green finance: evidence from frequency and quantile aspects. Econ Change Restruct. https://doi.org/10.1007/s10644-024-09579-z

Xu L, Chen J, Qu F, Wang J, Lu Y (2022) Queuing to refuel before price rise in China: how do gasoline price changes affect consumer responses and behaviours? Energy. https://doi.org/10.1016/j.energy.2022.124166

Xu Z (2020) Economic policy uncertainty, cost of capital, and corporate innovation. J Bank Financ 111:105698. https://doi.org/10.1016/j.jbankfin.2019.105698

You W, Guo Y, Zhu H, Tang Y (2017) Oil price shocks, economic policy uncertainty and industry stock returns in China: asymmetric effects with quantile regression. Energy Econ. https://doi.org/10.1016/j.eneco.2017.09.007

Younis I, Gupta H, Shah WU, Sharif A, Tang X (2024) The effects of economic uncertainty and trade policy uncertainty on industry-specific stock markets equity. Comput Econ 64(5):2909–2933

Zhang S, Yang Y, Ding C, Miao Z (2023) The impact of international relations patterns on China’s energy security supply, demand, and sustainable development: an exploration of oil demand and sustainability goals. Sustainability. https://doi.org/10.3390/su151712801

Acknowledgements

The second author (JC) thankfully acknowledges the financial support of the Hainan Provincial Key Laboratory of Ecological Civilization and Integrated Land-Sea Development, Haikou, China.

Author information

Authors and Affiliations

Contributions

AU: writing—conceptualization, writing original draft, formal analysis, review & editing, visualization. JC: writing original draft—supervision, review & editing. MS: writing original draft—literature review, supervision, writing, review & editing. AR: data curation, writing, figures—review and editing. MD: methodology, supervision, writing, review & editing. All authors have reviewed the revised manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Since this article does not contain any studies with human participants performed by any of the authors, therefore it does not require any informed consent.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Ullah, A., Chen, J., Sun, M. et al. Do business and consumer confidence in China respond to energy-related uncertainty? A quantile-based analysis. Humanit Soc Sci Commun 12, 1088 (2025). https://doi.org/10.1057/s41599-025-05300-1

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05300-1