Abstract

The adoption of financial technology (fintech) has emerged as a significant phenomenon in the banking industry, driven by technological advancements that have transformed the financial sector. However, previous studies indicate that Saudi banks are in the initial stages of fintech adoption. Therefore, there is an urgent need to explore the critical factors driving its adoption in Saudi Arabia. This study proposes a theoretical model to investigate the relationships between the key factors influencing fintech adoption among Saudi banks. The technology–organisation–environment (TOE) framework is employed to illustrate these relationships, encompassing technological factors, including relative advantage, compatibility, simplicity, and observability; organisational factors, including top management support, infrastructure maturity, and financial readiness; and environmental factors, including competitive pressure, government regulation support, and customer pressure. This study offers significant contributions to the literature by applying the TOE framework to fintech adoption in Saudi banks, with a particular focus on regulatory influences and the maturity of digital infrastructure. Thereby expanding our understanding of the literature on fintech adoption in the banking sector. By integrating insights from Saudi Arabia’s financial sector, this study provides practical recommendations for policymakers and banking executives to enhance fintech adoption in alignment with the digital transformation goals of Vision 2030. Moreover, this study provides valuable insights for policymakers, managers, and stakeholders by highlighting the factors that enhance the adoption of fintech in Saudi banks.

Similar content being viewed by others

Introduction

The banking sector is globally recognised as a pivotal economic sphere, serving as a paramount source of financing for individuals as well as small, medium, and large enterprises (Tang et al., 2024; Tarawneh et al., 2024; Broby, 2021). Consequently, banks play a crucial role in both the economic and social domains by fulfilling essential lending requirements (Tang et al., 2024; Gupta et al., 2023). Developmental shifts, competitive advantages, and the challenges of sophisticated technological innovations have significantly impacted the banking sector (Al-Dmour et al., 2023). Therefore, the banking industry urgently needs to reconfigure its resources, specifically focusing on technology, enhancing efficiency, reducing costs, enabling effective communication with customers, and obtaining accurate results from customer data (Tang et al., 2024; Elsaman et al., 2024; Al-Dmour et al., 2023; Ebrahim et al., 2021). Additionally, the phenomenon of financial technology (fintech) has emerged as a critical issue in the financial sector, particularly in developing countries (Ebrahim et al., 2021; Kharrat et al., 2024). In addition, technological innovation has significantly increased in the banking sector, as exemplified by innovations such as blockchain, Industry 4.0, and decentralised finance (Abdul-Rahim et al., 2022; Kharrat et al., 2024). This surge poses a substantial challenge to the banking environment, which requires adaptation to effectively navigate and address these changes. This leads banks to leverage technology to improve their services, quality, profitability, and diversification, which allows them to face challenges effectively (Maniam, 2024).

Technological innovation is a basic component of the banking industry for traditional banks. Innovation produces tools that assist banks in delivering services and products to customers, including automated teller machines, point of sale, mobile banking, and Internet banking (Alnemer, 2022; Bu et al., 2022; Abdul-Rahim et al., 2022; Ebrahim et al., 2021). However, the sophisticated technological innovation of Industry 4.0 has increased rapidly, as peer-to-peer (P2P), digital payment, artificial intelligence, learning machines, blockchain, big data, fintech, virtual reality, digital advisory, and cryptocurrencies have all played a key role in the transformation of the financial sector into a new financial model (Maniam, 2024; Alafeef et al., 2024; Bu et al., 2022; Indriasari et al., 2022; Khan and Al-harby, 2022; Abdul-Rahim et al., 2022; Kjellman et al., 2019). This has prompted banking and other business sectors to consider technological innovation as a solution to support the ecosystem and sustain the financial system (Subanidja et al., 2023). Therefore, advanced technology is becoming a critical factor affecting competitiveness in the global financial sector (Al-Dmour et al., 2023; Abdul-Rahim et al., 2022). Despite innovations in traditional technology, fintech has become critical in reducing bank operational expenses, enhancing the value of banking, improving communication channels, and ensuring quality.

A successful fintech innovation outcome leads to positive banking performance (Kayed et al., 2025; Ebrahim et al., 2021). Technology and innovation can help achieve corporate and global sustainability. Furthermore, during the 2008 global financial crisis, the banking industry experienced significant losses in investments, leading to bank failures, bankruptcy, and severe damage to its reputation (Bu et al., 2022; Sidaoui et al., 2022, Broby, 2021; Loiacono and Rulli, 2022). Subsequently, banks endeavoured to restore their credibility and regain customer trust by adopting sustainable business practices and new business models. The 2008 global fiscal crisis compelled the banking sector to reconfigure its resources and create new financial instruments and investment strategies through technological innovation (Tarawneh et al., 2024; Khan and Al-harby, 2022; Lee et al., 2021; Naveed et al., 2024). Furthermore, the COVID-19 pandemic, which affected businesses worldwide, has had a significant impact on the banking industry and disrupted customer access to banking services and products (Naveed et al., 2024; Tang et al., 2024). However, technological innovation, specifically fintech, provides banks with a solution to deliver services to all customers and open new paths in the markets to reconfigure the services and products, allowing banks to reach new markets through new high-quality and low-cost channels (Alnemer, 2022). Hence, the COVID-19 pandemic has thereby changed the behaviour of customers and businesses, leading to a shift towards the digitalisation of services and products (Khan and Al-harby, 2022; Naveed et al., 2024). Consequently, the banking sector has made significant investments in technology to enhance the adaptability of the banking environment, ensuring flexibility in coping with emerging technologies that pose threats and changes in customer behaviour (Alarifi and Husain, 2023; Kayed et al., 2025). Moreover, there is widespread acknowledgement that financial innovation has undergone significant acceleration in recent decades (Maniam, 2024). The impact of financial innovation has been extensively debated since the global fiscal crisis of 2007–2009, and the events surrounding the COVID-19 pandemic have intensified these discussions (Tarawneh et al., 2024; Khan and Al-harby, 2022; Naveed et al., 2024; Tang et al., 2024). Additionally, the factors facilitating this innovation encompass heightened awareness among top management, driven by technological advancements and customer demands that reshape the business model and economic landscape.

In Saudi Arabia, the banking sector has undergone significant changes driven by competitive advantages resulting from sophisticated technology (Alnemer, 2022). New models have been introduced, including shadow banking, crowdfunding, digital banking, P2P, and digital financing firms (Alafeef et al., 2024; Khan and Al-harby, 2022). Khan and Al-harby (2022) argued that fintech innovation worsens banking stability in the Gulf Cooperation Council (GCC) countries. Furthermore, there is a high demand from customers for digital financial services and products (Megahed et al., 2021; KPMG Report, 2023). Addressing customer needs is a top priority for management, with a prioritisation rate of 92% in their strategies to endorse customer demand for digitisation services (KPMG Report, 2023). Hence, the Saudi Central Bank (SAMA) provides regulatory support to enhance digitisation within the financial sector (Sarabdeen, 2023). This initiative aims to create an investor-friendly environment, especially for firms seeking to strengthen their financial resources. Bank functions facilitate the provision of funds to both firms and individuals with funding demands aligned with regulations to keep pace with technological advancements. The overarching goal is to enable the banking sector to decrease operational costs, reduce risk, and achieve optimal communication with customers to enhance profitability (Oweis and Alghaswyneh, 2019).

The banking sector integrates technological innovation into its operational processes, strategies, and development (Khan and Al-harby, 2022; Tang et al., 2024). The technology–organisation–environment (TOE) theory explains the link between these key factors that significantly drive fintech adoption among financial firms (Horani et al., 2023; Maroufkhani et al., 2020; Megahed et al., 2021).

The banking sector in Saudi Arabia needs a comprehensive study to clarify the significant factors that drive the adoption of fintech. Furthermore, there is a need to study how fintech adoption can enhance the performance of Saudi banks that are integrating technological innovation into their strategies and operational processes to transition to digitalisation (Almubarak and Aljughaiman, 2024; Oweis and Alghaswyneh, 2019). Vision 2030 has introduced various initiatives to support the increase in financial digitisation, aiming to reduce cash transactions and enhance sustainability by replacing traditional models with technology (Sarabdeen, 2023). For instance, banks have launched a multitude of mobile applications and other digitalisation services, leading to a reduction in physical banking branches. Additionally, research has indicated that excessive costs incurred by banks are associated with maintaining physical branches compared to digital services (Oweis and Alghaswyneh, 2019). Vision 2030 emphasises the pivotal role of digital transformation in achieving the objectives outlined in the Kingdom’s Vision 2030, aiming for sustainable economic and social development (Khan et al., 2021, Khan and Al-harby, 2022). Despite these commendable efforts, challenges and opportunities persist in ecosystem implementation (Ebrahim et al., 2021). Additionally, emerging markets are significantly influenced by the economic environment and competition, particularly in terms of developing technologies that simplify the entry of new firms, thereby reducing barriers to new entrants (Alafeef et al., 2024; Tang et al., 2024). This has led the financial sector to adopt optimal strategies for incorporating technological innovation to enhance financial performance, market share, and gain a competitive advantage.

The global financial landscape has undergone significant changes due to uncertain economic events, including the financial crisis of 2008, the COVID-19 pandemic, and disruptive technological innovations such as blockchain, AI, and Industry 4.0, in the business environment (Maniam, 2024; Tarawneh et al., 2024; Ebrahim et al., 2021; Khan and Al-harby, 2022; Tang et al., 2024). Consequently, these circumstances have altered the behaviour of both customers and businesses, leading them to actively seek the adoption of fintech and recover resources to identify opportunities for business restoration (Kayed et al., 2025). These changes have significantly transformed the financial sector’s landscape, facilitating the entry of new financial firms to engage in banking functions, even without accepting deposits. Additionally, the global financial sector has continued to change significantly, owing to the emergence of sophisticated technology (Sidaoui et al., 2022). Consequently, this has transformed the structure, models, customer expectations, and competitive landscape of Saudi banks. Hence, the existing banking model faces challenges in adapting to evolving customer expectations and new business models (Elsaman et al., 2024). Banks are also confronted with driving economic growth, stabilising the financial system, and aligning themselves with digital advancements. Hence, it is essential to enhance overall costs and value (Kayed et al., 2025).

Currently, Saudi Arabia is an emerging market that requires intensive development of regulation strategies and environmental factors to enhance market power and position the region among the top developing economies by implementing technological innovation to gain advantages that add to the financial sector (, Khan and Al-harby, 2022). Consequently, this study explores a fundamental framework based on TOE theoretical concepts to illustrate how technology, organisational, and environmental factors play a significant role in driving fintech adoption in Saudi banking. The research objectives were as follows.

-

i.

To explore the relationship between technological context, including relative advantage, compatibility, simplification, observability, and fintech adoption among Saudi banks.

-

ii.

To study the relationship between organisational context, management support, infrastructure maturity, financial readiness, and fintech adoption among Saudi banks.

-

iii.

To investigate the relationship between external environmental context, including competitor pressure, government regulation support, and customer pressure, and fintech adoption among Saudi banks.

This study adds new knowledge to the existing academic literature on fintech adoption in Saudi Arabia by introducing the TOE model within the Saudi banking sector. It offers both theoretical insights and practical implications, potentially informing decision-making processes and strategic initiatives in the banking industry while contributing to academic studies on fintech adoption dynamics. This study provides insights into the key factors driving fintech innovation adoption and their critical role in enhancing the economic value and growth of the banking sector. Additionally, this research will equip decision-makers, banking managers, and stakeholders with a comprehensive understanding of the significant factors influencing the process of FinTech adoption. This knowledge will support future technological innovations and prepare the banking industry for future technological advancements. While previous studies have extensively explored fintech adoption in the global banking sector, limited research has examined how regulatory policies, infrastructure maturity, and competitive pressures influence fintech adoption in Saudi Arabia (Hasan et al., 2024; Alarifi and Husain, 2023; Sarabdeen, 2023; Alshari and Lokhande, 2023; Bu et al., 2022). This study fills this gap by proposing a conceptual framework tailored to the Saudi banking sector, integrating unique variables, such as government regulation, financial readiness, and fintech-driven cost reduction strategies.

Theoretical underpinning

Numerous theories are concerned with technological adoption in the financial sector. However, most theories focus on the individual level, and studies on technology adoption at the organisational level within the banking sector in emerging markets, specific to Saudi Arabia, are limited (Hasan et al., 2024; Maniam, 2024). Therefore, this study integrated ideal theory to elucidate the factors leading to the increased adoption of financial technology. Furthermore, the study, based on TOE theory, formulates a model that endorses both the internal and external resources of organisations, offering frameworks covering several practical and theoretical aspects to enhance financial technology adoption within the banking sector.

Technology–organisation–environment (TOE) theory

Tornatzky and Fleischer, in formulating the TOE theory in the early 1990s, aimed to provide a holistic understanding of the decision-making process regarding the adoption of new technological innovations in a firm (Al-Dmour et al., 2023; Ahad and Busch, 2024; Horani et al., 2023). This theory complements the diffusion of innovation theory (Baig et al., 2019). Although the diffusion of innovation theory emphasises technological factors and considers the characteristics of adopters and organisational behaviour, it leaves gaps regarding organisational and external environmental contexts, which allows TOE theory to fill this gap by providing a holistic framework applicable to any industry intending to adopt new technology (Ahad and Busch, 2024; Maroufkhani et al., 2020). TOE theory illustrates that the technology context represents a new idea that enhances the adoption of new technology within the firm, whereas the organisational context refers to the readiness of the firm’s infrastructure and its ability to utilise its internal resources to implement the new technology (Malik et al., 2021; Maroufkhani et al., 2020). The organisational factors examined in this study are represented by top management, infrastructure maturity, and financial readiness. External environmental factors include pressures from competitors, customers, and government regulatory support that threaten the firm (Malik et al., 2021). TOE is comprehensive and provides an ideal framework at the organisational level to implement new technological innovations, considering all influencing factors that play critical roles in adopting innovative technology in the firm (Ahad and Busch, 2024; Malik et al., 2021; Maroufkhani et al., 2020). TOE theory is a comprehensive theoretical framework that illustrates the process of adopting innovative technology, enhancing adoption, and giving decision-makers the ability to understand the weaknesses and strengths of the factors that affect the adoption process in their firm.

Literature review

Fintech adoption

Fintech refers to the integration of technology into financial services and innovation (Kharrat et al., 2023). Furthermore, it is defined as a new channel that employs technological innovation to create new models for delivering financial services and products, effectively simplifying services at low cost (Mbaidin et al., 2024; Tang et al., 2024). Fintech adoption merges technology into banking operations to reduce operational costs, enhance quality, open communication channels, and introduce new financial instruments to develop the financial market based on technological innovation advantages (Oweis and Alghaswyneh, 2019; Lee et al., 2021). Moreover, Kharrat et al. (2024) found that fintech adoption enhances banking performance, including profitability, stability, and efficiency. Fintech adoption enhances both sustainability and banking performance (Siddik et al., 2024; Kaddumi et al., 2023). Lee et al. (2021) concluded that the adoption of fintech enhances banking efficiency and the effective use of technology in the banking sector in China. Thus, fintech adoption is becoming increasingly important in the financial sector, driven by development and strategies to enhance performance and competitive advantages.

Key factors driving the adoption of fintech among Saudi banks

Based on the existing literature, this study proposes that the factors driving fintech adoption in Saudi Arabia include understanding technological, organisational, and external environmental factors, all of which aim to gain competitive advantages and enhance the performance of banking.

Technological factors

The adoption of modern technology by firms through the diffusion of innovation theory reflects both the capability and willingness of technology adopters to drive innovation (Rogers et al., 2014). TOE aims to elucidate the essential factors that drive technological adoption. These factors include relative advantages, compatibility, simplification, and observability, all of which significantly influence the adoption process.

Relative advantage

Refers to the degree of benefits obtained from the adoption of an innovative technology that surpasses the value produced by the existing technology within the firm (Qatawneh, 2024). Numerous researchers agree that relative advantage is a crucial factor driving innovative technology adoption (Qatawneh, 2024; Baig et al., 2019; Nguyen et al., 2022). Thus, comparing the value of existing technology to that of innovative technology adoption determines whether it is worth adopting, based on the harmony among other factors within the firm (Baig et al., 2019). Relative advantages include both tangible and intangible benefits. For instance, the adoption of fintech in the banking sector enhances reputation, reduces costs, increases customer satisfaction, heightens banking efficiency, deepens the customer information database, furthers profitability, facilitates communication, lowers the number of branches, and fosters an ecosystem supportive of sustainability (Alam et al., 2022; Baabdullah et al., 2019; Lee et al., 2021). Consequently, those applying decision-making processes must thoroughly evaluate the value derived from the adoption of new technology, considering whether the aid is tangible or intangible. The task is to prioritise adoption and integrate it into the strategic vision to enhance the value of banking, maximise profits, and gain competitive advantages.

Compatibility

Refers to the ability to integrate innovative technologies with existing ones (Zhong and Moon, 2023). Compatibility is widely considered for adaptation and operational processing, skills, culture, employees, quality, knowledge, and capabilities, making new adoption compatible with the firm’s strategies and environmental changes within the firm (Maroufkhani et al., 2020; Megahed et al., 2021). A lack of compatibility leads to disruptive operational processes, reduced quality, increased expenses, and heightened wastage and errors. Conversely, compatibility fosters smoother operations, enhanced quality, cost reduction, minimised waste and errors, and supports the adoption process. Compatibility is a crucial factor that drives innovative technology adoption based on the TOE model to enhance the adoption process based on the capability of harmony with the existing technology and the expertise of the firm in adopting the recent technology.

Simplification

Refers to the degree of simplicity in adopting innovative technology and its use in operational processes (Kallmuenzer et al., 2024; Awa et al., 2017). This involves understanding how to use technology easily in a firm’s operations and ensuring logical comprehension through employee training (Baig et al., 2019). This facilitates employee engagement and efficiency in task completion, saves time, and reduces errors. This simplification gained from innovative technology leads to increased adoption (Zhong and Moon, 2023). Awa et al. (2017) noted that simplicity reduces uncertainty risk and simplifies communication to save time for employees, leading to enhanced efficiency and increased productivity. Hence, when there is high compatibility between innovative technology and existing technology, it leads to a prominent level of simplification (Zhong and Moon, 2023).

Observability

Refers to the extent to which the features and outcomes of implementing an innovative technology are apparent (seen) to others (Rogers et al., 2014). Another aspect of observability is when another firm implements innovative technological innovation and enhances its reputation and power in the market, leading other firms to adopt that technology, which means that it becomes visible to other firms (Baig et al., 2019). Thus, Abu Bakar et al. (2019) stated that observability is one of the crucial factors driving innovative technology; further, Maroufkhani et al. (2020) indicated that decision-makers adopt innovative technology based on others’ visible results. Likewise, Hirzallah and Alshurideh (2023) elaborated on observability as an advantage, whether tangible or intangible, gained by firms adopting innovative technology. This visibility of value addition in the adopted company motivates other firms to seek similar advantages in adopting innovative technology.

Organisation factors

The TOE theory considers organisational factors as significant drivers of innovative technology adoption in firms because they reflect the characteristics, facilities, and internal resources of banking regarding the willingness and capability of banking to implement fintech. Organisational factors include top management, infrastructure maturity, and financial readiness.

Top management

Refers to the extent to which managers understand and embrace the technological capabilities of innovative technology adoption (Al-Dmour et al., 2023; Maroufkhani et al., 2020; Megahed et al., 2021). This reflects the extent to which leadership embraces changes resulting from a new business model that has been transformed by advanced technological innovations aimed at improving efficiency and reducing operational costs. When managers have the ability to understand the role of technology in a firm’s operations, it fosters a higher rate of technological adoption. Thus, top management has the power to influence the behaviour of a firm by creating strategies, mission, and culture, and supporting employees to embrace adoption (Al-Dmour et al., 2023). This involves providing training and moral support to ensure readiness to implement innovative technologies within the firm. Top management is competent in understanding the required business environment and is interested in maximising a company’s profitability to ensure long-term sustainability (Urumsah et al., 2022). Furthermore, managers are seizing opportunities, such as fintech adoption, to enhance bank operations to achieve their goals and maintain a strong position in the market.

Infrastructure maturity

Refers to IT readiness, dependent on managers’ experience regarding technology systems and human skills, enabling the efficient implementation of innovative technology, which consequently increases a firm’s efficiency through the adoption of recent technology (Al-Dmour et al., 2023; Baig et al., 2019; Gökalp et al., 2022). Furthermore, Lai et al. (2018) clarified that infrastructure maturity includes tangible aspects, such as physical technology assets, and intangible aspects, such as experiences, skills, and knowledge. Thus, a well-prepared infrastructure enhances the willingness to adopt technology, enabling effective implementation based on the value it adds to the firm, whether tangible or intangible (Baig et al., 2019; Lai et al., 2018). However, infrastructure is a barrier that complicates the adoption of innovative technology owing to the lack of solid infrastructure resources (Megahed et al., 2021). The organisation’s technological maturity provides the firm with opportunities to cope with developing new sophisticated technological innovations and other aspects that make it more flexible in obtaining the advantages of technological innovations and positioning it as a leader in implementing innovations to open new communication channels, thereby enhancing its financial performance (Al-Dmour et al., 2023). Some researchers have called for future research on infrastructure maturity, particularly in emerging markets. Hence, infrastructure maturity is considered a key factor in the organisational context of the proposed model. (Jaradat et al., 2022).

Financial readiness

Refers to the adequacy of financial allocations to adopt technology, making a firm willing to implement innovative technology that consequently enhances the value of the firm’s operations, quality, and efficiency (Baig et al., 2019; Gökalp et al., 2022). Sufficient financial resources lead a firm to implement new technological innovations, thereby increasing its flexibility by changing technological opportunities (Gupta et al., 2022). Thus, successful firms invest in technology to seize new opportunities, endorse firms in new markets, and increase profitability (Alarifi and Husain, 2023; Al-Dmour et al., 2023). Furthermore, having sufficient financial resources enables firms to hire experts and consultants for innovation, enhancing their services and products (Lai et al., 2018; Megahed et al., 2021). This financial capacity covers all expenses related to the implementation and training of a firm’s employees, which enhances the implementation of innovative technology. Financial readiness is a key factor that enhances the adoption of recent technology because it gives a firm the willingness to implement innovative technology to enhance its competitive advantage and profitability (Gupta et al., 2022).

External environment

TOE theory considers external environmental factors as crucial variables that play an essential role in a firm’s competitiveness, profitability, and overall value. Thus, understanding the significance of the external environment is vital because of its dynamic and continuous change, which provides firms with new opportunities to exploit external resources. For instance, technology is one of the primary external environmental factors that enhances efficiency, profitability, and leverage to improve a firm’s financial performance. This dynamic nature of technology is based on technological innovation, reshaping regulations, government support, and customer interest and behaviour (Sarabdeen, 2023).

Competitors’ pressure

Refers to the influence exerted on the firm by other firms in the same sector, competing based on employing technology to make the firm unique and gain advantages such as customer satisfaction, new market share, efficiency, strong branding, reputation, effectiveness, high-quality, and cost reduction to establish market leadership (Al-Dmour et al., 2023; Urumsah et al., 2022). The firm implements tactics based on competitors in the market to create strategies that meet competitor standards and enhance unique services in the market by implementing new technological channels to reach customers (Gupta et al., 2022). Increasing technology adoption by competitors focuses on gaining a relative competitive advantage. Thus, the diffusion of innovation among competitors provides new communication channels and access to new markets, thereby enhancing a firm’s market share.

Customer pressure

Arises from the demand for products and services delivered through technological innovations, compelling firms to adopt innovative technologies to meet customer expectations and enhance satisfaction (Baig et al., 2019; Urumsah et al., 2022). Kumar and Krishnamoorthy (2020) highlighted that customer needs to expand with the adoption of innovative technology, emphasising that customer satisfaction is a top priority for firms. This drives technology to enhance customer experience, foster loyalty, and improve financial performance. The customer reshapes the firm’s resources to enhance technology adoption and, thus, the communication between the firm and customer via technological innovation (Urumsah et al., 2022; Broby, 2021). Therefore, customer pressure depends on industry characteristics. However, the banking sector is extremely sensitive to customer satisfaction because customers create deposits that banks transfer into assets to provide loans and generate profits (Broby, 2021; Khan et al., 2021; Megahed et al., 2021). Consequently, banks provide ideal services and financial products to enhance customer satisfaction, aiming to attract more customers and increase banking liquidity based on the volume of deposits, thereby increasing profitability (Alkhawaldeh et al., 2023).

Government regulation support

Refers to the policies established by the government as guidelines to define the rights of companies and customers while outlining firms’ responsibilities to comply with these regulations and avoid legal violations (Sarabdeen, 2023; Baig et al., 2019; Maroufkhani et al., 2020). This can either encourage or discourage the adoption of innovative technologies (Maroufkhani et al., 2020). Furthermore, the banking industry is highly regulated to safeguard customer rights and minimise the industry’s exposure to high risks. Therefore, some studies refer to the banking sector as a late-implementation technology compared to other sectors, based on strict regulations to prevent them from being implemented; however, the banking sector is eager to take advantage of the technology to reduce financial transaction costs and asymmetric information (Khalid and Kunhibava, 2021; Khan et al., 2021). Further, the government supports such as funding, training, and flexible regulation to encourage technological innovation and enhance the financial sector (Nguyen et al., 2022). According to Gupta et al. (2022), government regulatory support is one of the variables governing technology adoption in the financial sector. Government regulation is an essential factor in enhancing technology adoption because although a company may have all elements, including technological, organisational, and environmental factors pushing it to adopt technology, government regulation may prevent or disallow them, making it impossible for the company to adopt.

Barriers to fintech adoption in Saudi banks

Despite the numerous advantages of fintech adoption, banks in emerging markets face critical challenges, such as data security risks, limited IT infrastructure, and regulatory constraints. Cybersecurity concerns have slowed the adoption of fintech solutions because banks must ensure compliance with financial regulations while safeguarding customer data (Nguyen et al., 2022; Tang et al., 2024). Hence, Saudi banks face challenges in infrastructure readiness, including the ongoing technological revolution, compatibility of existing systems with innovative technologies and regulatory standards, and the transition from traditional banking to digitalisation (Sarabdeen, 2023). Furthermore, competitors pose significant threats to traditional banking by introducing new financial models, such as fintech startups, P2P lending, digital banking, and e-wallet services. The economic outlook suggests that leveraging technological innovations and resource optimisation will help Saudi banks raise SAR 4.553 billion in 2030. This advancement requires managers to have a deep understanding of the financial environment, particularly in developing countries where the banking sector is being transformed by the technology revolution.

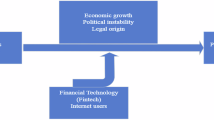

Conceptual framework enhancement

Figure 1 represents the conceptual model guiding this study, incorporating key determinants from the TOE theory. Saudi banks face several challenges, particularly because of the shift in customer preferences toward digitalisation. A report by KPMG indicates that 92% of Saudi customers prefer online banking services, reflecting a notable change in customer behaviour. Additionally, Saudi Vision 2030 has introduced comprehensive economic reforms and regulatory changes aimed at enhancing banking infrastructure and aligning it with advanced technological developments. As Saudi banks transition from traditional to modern banking models to support economic growth and increase the adoption rate of fintech, understanding the enabling factors has become critical. Therefore, this study proposes a comprehensive model to identify the key technological, organisational, and environmental factors that significantly drive fintech adoption in the Saudi banking sector. Technological factors, such as relative advantage and compatibility, determine the ease and help of fintech integration, while organisational factors, including top management support and infrastructure maturity, shape a bank’s internal capacity for adoption. Additionally, environmental factors, such as regulatory support and competitive pressure, highlight external forces that drive digital transformation in the Saudi banking sector.

The proposed research framework, which can help banking sector administration understand FinTech adoption, is presented in Fig. 1.

Hypothesis development

Technology factors

Technological factors, including relative advantage, compatibility, simplification, and observability, play a crucial role in driving fintech adoption. Based on Tornatzky and Fleischer’s TOE model, these factors illustrate how technology characteristics influence the fintech adoption process in Saudi Arabia’s banking sector.

Relative advantage and fintech adoption

Relative advantage reflects the economic benefits that firms gain from adopting new FinTech, such as improved quality, efficiency, effectiveness, and overall performance, surpassing those provided by existing technologies. Furthermore, Alshater et al. (2022) conducted a study indicating that fintech adoption has several advantages, including speed, effectiveness, and social benefits, thereby enhancing banking compared to traditional methods. Additionally, Dwivedi et al. (2021) find that fintech adoption in banking enhances competitive advantage and performance by reducing transaction costs, increasing efficiency, heightening profitability, enhancing customer satisfaction, reducing risk, and improving communication channels. Moreover, numerous studies (Maroufkhani et al., 2020; Marei et al., 2023; Lutfi et al., 2023) suggest that relative advantages significantly drive the adoption of new technological innovations, leading to the formulation of the following hypothesis:

H1: The relative advantages of fintech adoption have a positive and significant impact on fintech adoption among Saudi banks, as they enhance banking quality services, create new customer channels, break geographic barriers, match customer needs, and gain competitive advantages.

Compatibility and fintech adoption

Compatibility refers to the degree of harmony between a new fintech adoption and an organisation’s existing systems, encompassing integration with the organisation’s current values, culture, requirements, capabilities, employee skills, functions, basic technology, and standards (Maroufkhani et al., 2020; Megahed et al., 2021). Furthermore, an important level of compatibility between innovative technology and existing systems simplifies the adoption process, reduces costs, and ensures better cultural fit and adherence to standards. Consequently, this enhanced integration increases the potential for adoption (Al-Khatib, 2022; Kwabena et al., 2021; Aligarh et al., 2023; Baig et al., 2021). Hence, based on the arguments mentioned, it is proposed that:

H2: The compatibility of fintech solutions with existing banking infrastructure has a positive and significant impact on fintech adoption among Saudi banks, as it reduces implementation costs and facilitates integration with current operational systems.

Simplification and fintech adoption

Simplification is defined as the level of effort used to implement new technological innovations and how easily they can be understood and utilised in a firm’s operations and activities (Awa et al., 2017; Truong, 2022). Numerous researchers have conducted empirical studies that have shown that increasing simplification leads to wider adoption of new technology, indicating that simplification has a positive effect on the adoption of new technological innovation (Xicang et al., 2024; Awa et al., 2017; Baig et al., 2019; Geng et al., 2023; Rogers et al., 2014; Truong, 2022). Hence, it is proposed that:

H3: The simplification of processing of fintech adoption for understanding and easy processing has a positive and significant impact on fintech adoption among Saudi banks, which indicates that Saudi banks have enough capability to reduce the complexity of the processing of the adoption, which leads to an increase in the opportunity of adoption and motivates the decision to implement fintech.

Observability and fintech adoption

Observability refers to seeing and observing a firm in terms of the advantages of adopting technology from other adopters (Abu Bakar et al., 2019; Nguyen et al., 2022). Meanwhile, this observation indicates the recent technology that distinguishes the firm from others by the advantages obtained from it. Moreover, an increasing level of observability leads to greater opportunities to maximise profitability (Saygili and Ercan, 2021). Similarly, Nguyen et al. (2022), Abu Bakar et al. (2019), concluded that observability is an important factor that has a significantly positive effect on the adoption of recent technological innovation. Consequently, the following hypothesis is proposed:

H4: Observability has a positive and significant impact on fintech adoption among Saudi banks because it gives decision-makers the cognisance of the benefits earned from fintech adoption by rival and market conditions, which enables banks to drive fintech implementation and adapt to the evolving financial landscape shaped by the fintech phenomenon.

Organisation context

This reflects the internal resources that enable banking capabilities to adopt fintech. Based on Tornatzky and Fleischer’s TOE theory, the organisational context is represented by top management, infrastructure maturity, and financial readiness.

Top management and fintech adoption

Top management is one of the most important resources in the banking sector because it represents decision-making power in strategies that must align with the adoption of innovative technology within the firm (Al-Omoush et al., 2020; Megahed et al., 2021). Several studies indicate that top management significantly drives the adoption of fintech innovation in organisations. Examples include the works of Marei et al. (2023), Abu Bakar et al. (2019), Megahed et al. (2021), Lutfi et al. (2023), Lai et al. (2018), Nguyen et al. (2022), and Maroufkhani et al. (2020). The results of these studies show that top management significantly affects the adoption of new technological innovations. Hence, the following hypothesis is presented:

H5: Top management has a positive and significant impact on fintech adoption among Saudi banks, which reflects the motivation and knowledge of top management in understanding the importance of adoption when more benefits, high compatibility, and ease of implementation of fintech increase top-level management support for adoption.

Infrastructure maturity and fintech adoption

Infrastructure maturity indicates the level of readiness of a firm’s technical skills, IT resources, facilities, and employees to adopt new technological innovations (Hasan et al., 2024; Hasan et al., 2024; Gökalp et al., 2022). Numerous empirical studies have shown that infrastructure maturity plays a critical role in the adoption of new technology and significantly impacts the adoption of new technological innovation (Abed, 2020; Al-Khatib, 2022; Bag et al., 2023; Chittipaka et al., 2023; Hasan et al., 2024; Kajla et al., 2024; Lutfi et al., 2023; Nguyen et al., 2022). Consequently, the following hypothesis is proposed:

H6: Infrastructure maturity has a positive and significant impact on fintech adoption among Saudi banks, as it reflects the capability of the available Saudi banking resources to simplify the adoption of fintech when the high maturity of resources reduces the costs and efforts of digital transformation.

Financial readiness and fintech adoption

Henao‐Ramírez et al. (2022) defined financial readiness as allocating financial resources for adopting modern technological innovation, which emphasises that financial resources are one of the essential factors for giving the firm the capability to adopt innovative technology. In addition, according to Lutfi et al. (2023), Baig et al. (2021), and Nguyen et al. (2022), financial readiness significantly drives technological innovation adoption. Likewise, financial readiness indicates a firm’s financial capability to adopt modern technology. Similarly, Megahed et al. (2021) studied financial readiness for fintech adoption in retail banking by comparing Bahrain and Egypt, and their results indicate that financial readiness has a considerable influence on fintech adoption in the retail banking sector. Malik et al. (2021) referred to the importance of financial readiness in the adoption of modern technology. Further, sufficient allocation of funds motivates and encourages firms to adopt recent technologies. Based on these arguments, it is proposed that:

H7: Financial readiness has a positive and significant impact on fintech adoption among Saudi banks, as it reflects investments of Saudi banking in technology to keep up with the continuation of fintech adoption processing.

External environmental

The business environment is the external resource surrounding firms and is dynamic and changing based on developing technological innovations and uncertain economic circumstances, including macroeconomic factors. TOE theory illustrates the key factors that drive the adoption of innovative technology among firms. These are elucidated in TOE theory as mechanisms to explain the relationship among the external environment, represented by competitor pressure, government regulation support, customer pressure, and fintech adoption.

Competitor pressure and fintech adoption

Competitive pressure refers to the force that firms face from other businesses operating within the same sector by adopting new technological innovations to be unique and reduce the cost of providing high-quality financial services (Chittipaka et al., 2023). Thus, the banking sector is highly competitive and driven by customers’ evolving needs and expectations. Banks must differentiate themselves by offering unique and attractive services that effectively meet customer demands. Therefore, based on the transformation of the market and customers’ needs shifting towards digitalisation, the banking environment must implement technology to adapt to the evolving market. Numerous empirical studies have shown that infrastructure maturity plays a critical role in the adoption of new technology and significantly impacts the adoption of new technological innovation (Abed, 2020; Al-Khatib, 2022; Bag et al., 2023; Chittipaka et al., 2023; Hasan et al., 2024; Kajla et al., 2024; Lutfi et al., 2023; Nguyen et al., 2022). Hence, the following hypothesis is proposed:

H8: The competition pressure has a positive and significant impact on fintech adoption among Saudi banks, as the financial sector has changed its model to reduce costs and provide a new financial business model. Digital banking and fintech startups that threaten traditional banking implement fintech to reduce financial transactions and mitigate the threat of risk based on customers’ needs.

Government regulation support and fintech adoption

Government regulation support refers to policies, regulations, disclosures, and guidelines created by authorities to illustrate the adoption process and provide support for the adoption of innovative technology (Sarabdeen, 2023; Khalid and Kunhibava, 2021). Authorities will offer substantial support to increase innovative technology adoption, such as training, funding, and technical support (Nguyen et al., 2022). Furthermore, it asserts that when authorities encourage innovative technology adoption, they provide support to ensure compatibility with regulations and policies (Khalid and Kunhibava, 2021). However, discouragement poses an obstacle to the adoption of innovative technology when the government prohibits the adoption of recent technology. For example, sandbox support to enhance financial services through technological innovation enhances regulations to protect the rights of customers and financial institutions (Khalid and Kunhibava, 2021). Likewise, government regulatory support is a significant driver of fintech adoption among firms. Thus, it is proposed that:

H9: The Government regulatory support has a positive and significant impact on fintech adoption among Saudi banks, as the regulation is critical to developing fintech adoption, which is aligned with Saudi reformed regulation to support, such as lunch sandbox and police, that significantly impact fintech adoption in the banking sector to achieve Vision the 2030s aim of digitalisation transformation in the Saudi financial sector.

Customer pressure and fintech adoption

Customers are the main target of any firm that marshals all their resources to provide services and products to increase customer satisfaction based on their needs and desires (wael AL-khatib, 2023). Studies indicate that customers are ready to use digitisation services in the banking sector (Megahed et al., 2021; Oppusunggu et al., 2024). Based on the results of previous studies and according to TOE theory, it can be concluded that customer pressure is one of the most crucial factors (Albastaki, 2021; Khalid and Kunhibava, 2021; Urumsah et al., 2022). Thus, the following hypothesis is proposed:

H10: Customer pressure has a positive and significant impact on fintech adoption among Saudi banks, as business and customer behaviours are shifting toward digitalisation due to the increasing use of the Internet. According to KPMG reports, 92% of customers have used digital banking services, highlighting fintech as a key solution for enhancing customer satisfaction. Additionally, customers are vital resources for banks, as their deposits contribute to shaping banking capital.

Proposed research methodology

This study aims to evaluate a comprehensive model that determines the factors that impact fintech adoption in Saudi banks using a quantitative cross-sectional design. The target population includes managers at all levels within Saudi banks to capture a comprehensive view of banking readiness for fintech adoption. A non-probability purposive sampling technique is best suited to ensure that participants are eligible to study subjects based on strategic knowledge and experience in the banking mission and vision. Data can be collected through an online questionnaire distributed via the HR, CSR departments and LinkedIn to maximise reach and engagement. The questionnaire will be developed using validated scales and pre-tested for reliability and content validity. Item measurements can be adapted from existing studies (Megahed et al., 2021; Awa et al., 2017; Gupta et al., 2022; Maroufkhani et al., 2020).

Conclusion and future research directions

The banking environment in Saudi Arabia has evolved significantly, owing to technological advancements, thereby posing a threat to traditional banking models. Consequently, this study aims to propose a model to demonstrate how the adaptation of fintech is influenced by technological, organisational, and external environmental factors. This study underscores the advantages of fintech adoption among Saudi banks and highlights its role in enhancing digital banking adoption, which in turn contributes to economic growth and societal development. As banking serves as the backbone of economic development by providing the financial support needed to drive economic progress, there is an urgent need to explore the fundamental factors that drive fintech adoption in this sector. As banks transition to fintech solutions, ethical considerations such as cybersecurity, customer data privacy, and fraud prevention become critical. Ensuring compliance with financial regulations and adopting robust cybersecurity measures are essential for maintaining customer trust and the integrity of digital financial services (Gupta et al., 2023).

A review of the academic literature highlights the importance of integrating fintech into banking functions and processes to improve operations, enhance service quality, and expand access to new market segments. Furthermore, this study contributes to the growing academic literature on fintech adoption among Saudi banks, encouraging scholars to examine significant changes in the banking environment, including the key drivers of fintech adoption. This study also contributes to the development of a flexible model for studying fintech adoption capable of incorporating additional variables to further enhance academic research in GCC countries. By reflecting on the significant factors driving fintech adoption, this study posits that fintech can provide banks with solutions to global challenges and help them gain a competitive advantage through fintech innovations.

Limitations and future research recommendations

A limitation of this study is that it has not included an empirical study to examine the significance of TOE factors on fintech adoption in Saudi banks. Furthermore, it has been considered only in the Saudi banking sector, which does not cover the financial industry, such as insurance firms and financial firms. Finally, this study is conducted on the Saudi banks, which have not expanded to GCC countries. Future studies should empirically validate this framework using surveys and case studies in Saudi banks. Additionally, research can explore the role of fintech in Islamic banking and its compatibility with Sharia-compliant financial practices. Moreover, future studies shall extend the model to address other perspectives, including ethical considerations, particularly in exploring risks and barriers to adoption in emerging economies. Additionally, future research can apply the TOE model in the GCC countries and make comparisons between their banks.

Theoretical contribution

This study developed a comprehensive framework by determining the significantly important barriers that challenge fintech adoption in the banking sector, such as infrastructural maturity, government regulations support, customer pressure, and competitor pressure in the Saudi banking context. Therefore, this study adds new knowledge to the existing academic landscape in Saudi Arabia by introducing a study of the TOE model in the Saudi banking sector. It offers both theoretical insights and practical implications, holding the potential to inform decision-making processes and strategic initiatives within the banking sector while contributing to academic studies on fintech adoption. This study provides insights into the crucial factors driving fintech innovation adoption in the banking sector and its critical role in enhancing overall economic value and growth. Additionally, it equips decision-makers, banking managers, and stakeholders with a comprehensive understanding of the significant factors driving fintech adoption, thereby supporting future technological innovations and preparing them for forthcoming technological revolutions in the banking industry.

Practical implications

This study offers policymakers and banking managers an overview of the key influences on the adoption process and the significance of these procedures. They also emphasise the need for banking managers to adopt this model to enhance fintech adoption to gain a competitive advantage in the financial market. In addition, this assists in understanding the importance of the role of fintech in banking in developing regulations and enhancing infrastructure to enable the incorporation of fintech in banking to align with Vision 2030. Furthermore, developing banking strategies and upgrading existing systems to align with fintech solutions and regulatory requirements are critical. Enhancing R&D will enable banks to adapt to the evolving financial landscape, optimise resources, and ensure the sustainability of Saudi Arabia’s financial system through fintech solutions. Furthermore, the proposed model can assist the banking sector by identifying financial solutions that align with the standards of Sharia-compliant financial practices.

Data availability

No datasets were generated or analysed during the current study.

References

Abdul-Rahim R, Bohari SA, Aman A, Awang Z (2022) Benefit–risk perceptions of FinTech adoption for sustainability from bank consumers’ perspective: the moderating role of fear of COVID-19. Sustainability 14(14):8357

Abed SS (2020) Social commerce adoption using TOE framework: An empirical investigation of Saudi Arabian SMEs. Int J Inf Manag 53(March):102118. https://doi.org/10.1016/j.ijinfomgt.2020.102118

Abu Bakar AR, Ahmad SZ, Ahmad N (2019) SME social media use: a study of predictive factors in the United Arab Emirates. Glob Bus Organ Excell 38(5):53–68

Ahad T, Busch P (2024) Exploring the factors influencing Mobile‐based Ubiquitous System adoption in the Bangladesh RMG sector: a view through DOI and TOE. Electron J Inf Syst Developing Ctries 90(1):e12291

Alafeef M, Kalyebara B, Kalbouneh N, Abuoliem N, Yousef A, Al-Afeef M (2024) The impact of FINTECH on banking performance: evidence from Middle Eastern countries. Int J Data Netw Sci 8(4):2219–2230

Alam AW, Banna H, Hassan MK (2022) ESG activities and bank efficiency: Are Islamic banks better. J Islam Monet Econ Finance 8(1):65–88. https://doi.org/10.21098/jimf.v8i1.1428

Alarifi AA, Husain KS (2023) The influence of Internet banking services quality on e-customers’ satisfaction of Saudi banks: comparison study before and during COVID-19. Int J Qual Reliab Manag 40(2):496–516

Albastaki YA (2021) When technology meets finance: a review approach to FinTech. In: Innovative strategies for implementing FinTech in banking. Hershey, PA, USA p 1–21

Al-Dmour H, Saad N, Basheer Amin E, Al-Dmour R, Al-Dmour A (2023) The influence of the practices of big data analytics applications on bank performance: filed study. VINE J Inf Knowl Manag Syst 53(1):119–141

Al-Khatib AW (2022) Intellectual capital and innovation performance: the moderating role of big data analytics: evidence from the banking sector in Jordan. EuroMed J Bus 17(3):391–423

Aligarh F, Sutopo B, Widarjo W (2023) The antecedents of cloud computing adoption and its consequences for MSME’ performance: A model based on the Technology-Organization-Environment (TOE) framework. Congt Bus Mang 10(2):2220190

Alkhawaldeh B, Alhawamdeh H, Al-Afeef M, Al-Smadi A, Almarshad M, Fraihat B, Alaa A (2023) The effect of financial technology on financial performance in Jordanian SMEs: the role of financial satisfaction. Uncertain Supply Chain Manag 11(3):1019–1030

Almubarak AI, Aljughaiman AA (2024) Corporate governance and FinTech innovation: evidence from Saudi banks. J Risk Financ Manag 17(2):48

Alnemer HA (2022) Determinants of digital banking adoption in the Kingdom of Saudi Arabia: a technology acceptance model approach. Digit Bus 2(2):100037

Al-Omoush KS, Al Attar MK, Saleh IH, Alsmadi AA (2020) The drivers of E-banking entrepreneurship: an empirical study. Int J Bank Mark 38(2):485–500

Alshari HA, Lokhande MA (2023) Analysis of constraints and their impact on adopting digital FinTech techniques in banks. Electron Commer Res 1–34. https://doi.org/10.1007/s10660-023-09782-6

Alshater MM, Saba I, Supriani I, Rabbani MR (2022) Fintech in islamic finance literature: a review. Heliyon 8(9): e10385. https://doi.org/10.1016/j.heliyon.2022.e10385

Awa HO, Ojiabo OU, Orokor LE (2017) Integrated technology-organization-environment (TOE) taxonomies for technology adoption. J Enterp Inf Manag 30(6):893–921

Baabdullah AM, Alalwan AA, Rana NP, Patil P, Dwivedi YK (2019) An integrated model for m-banking adoption in Saudi Arabia. Int J Bank Mark 37(2):452–478

Bag S, Rahman MS, Gupta S, Wood LC (2023) Understanding and predicting the determinants of blockchain technology adoption and SMEs’ performance. Int J Logist Manag 34(6):1781–1807

Baig MI, Shuib L, Yadegaridehkordi E (2019) Big data adoption: state of the art and research challenges. Inf Process Manag 56(6):102095

Baig MI, Shuib L, Yadegaridehkordi E (2021) A model for decision-makers’ adoption of big data in the education sector. Sustainability 13(24):13995

Broby D(2021) Financial technology and the future of banking. Financ Innov 7(1):1–19. https://doi.org/10.1186/s40854-021-00264-y

Bu Y, Li H, Wu X (2022) Effective regulations of FinTech innovations: the case of China. Econ Innov New Technol 31(8):751–769

Chittipaka V, Kumar S, Sivarajah U, Bowden JLH, Baral MM (2023) Blockchain Technology for Supply Chains operating in emerging markets: an empirical examination of technology-organization-environment (TOE) framework. Ann Oper Res 327(1):465–492

Dwivedi P, Alabdooli JI, Dwivedi R (2021) Role of FinTech adoption for competitiveness and performance of the bank: a study of banking industry in UAE. Int J Glob Bus Compet 16(2):130–138

Ebrahim R, Kumaraswamy S, Abdulla Y (2021) FinTech in banks: opportunities and challenges. In: Innovative strategies for implementing fintech in banking. Hershey, PA, USA p 100–109

Elsaman H, Dayanandan R, Dawood Z, Al Akrabi S (2024) Navigating fintech innovation: performance, trust, and risk factors in UAE’s banking sector. J East Eur Cent Asian Res 11(2):332–341

Geng L, Hui H, Liang X, Yan S, Xue Y (2023) Factors Affecting Intention Toward ICT Adoption in Rural Entrepreneurship: Understanding the Differences Between Business Types of Organizations and Previous Experience of Entrepreneurs. SAGE Open 13(3):21582440231197112

Gökalp E, Gökalp MO, Çoban S (2022) Blockchain-based supply chain management: understanding the determinants of adoption in the context of organizations. Inf Syst Manag 39(2):100–121

Gupta S, Ghardallou W, Pandey DK, Sahu GP (2022) Artificial intelligence adoption in the insurance industry: evidence using the technology–organization–environment framework. Res Int Bus Financ 63:101757

Gupta S, Pandey DK, El Ammari A, Sahu GP (2023) Do perceived risks and benefits impact trust and willingness to adopt CBDCs? Res Int Bus Financ 66:101993

Hasan A, Alenazy AA, Habib S, Husain S (2024) Examining the drivers and barriers to adoption of e-government services in Saudi Arabia. J Innov Digit Transform 1(2):139–157

Henao‐Ramírez AM, Lopez-Zapata E (2022) Analysis of the factors influencing adoption of 3D design digital technologies in Colombian firms. J Enterp Inf Manag 35(2):429–454

Hirzallah M, Alshurideh M (2023) The effects of the internal and the external factors affecting artificial intelligence (AI) adoption in e-innovation technology projects in the UAE? Applying both innovation and technology acceptance theories. Int J Data Netw Sci 7(3):1321–1332

Horani OM, Khatibi A, ALSoud AR, Tham J, Al-Adwan AS, Azam SF (2023) Antecedents of business analytics adoption and impacts on banks’ performance: the perspective of the TOE framework and resource-based view. Interdiscip J Inf Knowl Manag 18:609–643

Indriasari E, Prabowo H, Gaol FL, Purwandari B (2022) Intelligent digital banking technology and architecture: a systematic literature review. Int J Interact Mob Technol 16(19):98–117

Jaradat Z, Al-Dmour A, Alshurafat H, Al-Hazaima H, Al Shbail MO (2022) Factors influencing business intelligence adoption: evidence from Jordan. J Decis Syst 33(2):242–262. https://doi.org/10.1080/12460125.2022.2094531

Kaddumi TA, Baker H, Nassar MD, A-Kilani Q (2023) Does financial technology adoption influence bank’s financial performance: the case of Jordan. J Risk Financ Manag 16(9):413

Kajla T, Sood K, Gupta S, Raj S, Singh H (2024) Identification and prioritization of the factors influencing blockchain adoption in the banking sector: integrating fuzzy AHP with TOE framework. Int J Qual Reliab Manag 41(8):2004–2026

Kallmuenzer A, Mikhaylov A, Chelaru M, Czakon W (2024) Adoption and performance outcome of digitalization in small and medium-sized enterprises. Rev Manag Sci 19:2011–2038. https://doi.org/10.1007/s11846-024-00744-2

Kayed S, Alta’any M, Meqbel R, Khatatbeh IN, Mahafzah A (2025) Bank FinTech and bank performance: evidence from an emerging market. J Financ Report Account 23(2):518–535. https://doi.org/10.1108/JFRA-09-2023-0526

Khalid M, Kunhibava S (2021) Regulating FinTech through sandboxes: entering the UK and Malaysian regulatory sandbox. In: Innovative strategies for implementing FinTech in banking. IGI Global, Hershey PA, USA p 83–99

Khan S, Bashir U, Islam MS (2021) Determinants of capital structure of banks: evidence from the Kingdom of Saudi Arabia. Int J Islam Middle East Financ Manag 14(2):268–285

Khan S, Al-harby ASA (2022) The use of fintech and its impact on financial intermediation–a comparison of Saudi Arabia with other GCC economies. Intelekt Ekon 16(2):26–43

Kharrat H, Trichilli Y, Abbes B (2024) Relationship between FinTech index and bank’s performance: a comparative study between Islamic and conventional banks in the MENA region. J Islam Account Bus Res 15(1):172–195

Kjellman A, Bj€orkroth T, Kangas T, Tainio R, Westerholm T (2019) Disruptive innovations and the challenges for banking. Int J Financ Innov Bank 2:232–249

KPMG Report (2023) https://kpmg.com/xx/en/home/insights/2023/09/the-future-of-fintech.html

Kumar A, Krishnamoorthy B (2020) Business analytics adoption in firms: a qualitative study elaborating TOE framework in India. Int J Glob Bus Compet 15(2):80–93

Kwabena GY, Mei Q, Ghumro TH, Li W, Erusalkina D (2021), “Effects of a technological–organizational–environmentalfactor on the adoption of the mobile payment system”, J Asian Finance Econ Bus, 8(2):329–338

Lai Y, Sun H, Ren J (2018) Understanding the determinants of big data analytics (BDA) adoption in logistics and supply chain management: an empirical investigation. Int J Logist Manag 29(2):676–703

Lee CC, Li X, Yu CH, Zhao J (2021) Does fintech innovation improve bank efficiency? Evidence from China’s banking industry. Int Rev Econ Financ 74:468–483

Loiacono G, Rulli E (2022) ResTech: innovative technologies for crisis resolution. J Bank Regul 23(3):227–243

Lutfi A, Alrawad M, Alsyouf A, Almaiah MA, Al-Khasawneh A, Al-Khasawneh AL, Ibrahim N (2023) Drivers and impactof big data analytic adoption in the retail industry: a quantitative investigation applying structural equation modeling. J Retail Consum Serv 70:103129

Malik S, Chadhar M, Vatanasakdakul S, Chetty M (2021) Factors affecting the organizational adoption of blockchain technology: extending the technology–organization–environment (TOE) framework in the Australian context. Sustainability 13(16):9404

Maniam S (2024) Determinants of Islamic fintech adoption: a systematic literature review. J Islam Mark 15(11):2916–2936. https://doi.org/10.1108/JIMA-11-2023-0373

Marei A, Mustafa JA, Othman M, Daoud L, Lutfi A, Al-Amarneh A (2023) The moderation of organizational readiness on the relationship between toe factors and FinTech adoption and financial performance. J Law Sustain Dev 11(3):e730. https://doi.org/10.55908/sdgs.v11i3.730

Maroufkhani P, Tseng ML, Iranmanesh M, Ismail WKW, Khalid H (2020) Big data analytics adoption: determinants and performances among small to medium-sized enterprises. Int J Inf Manag 54:102190

Mbaidin H, Sbaee N, AlMubydeen I, Alomari K (2024) Key success drivers for implementation blockchain technology in UAE Islamic banking. Uncertain Supply Chain Manag 12(2):1175–1188

Megahed N, Al-Kayaly D, Al-Hadad A (2021) Relevance of DOI and TOE for assessing FinTech adoption by banks: comparative analysis between Egypt and Bahrain. J Glob Bus Adv 14(6):768–803

Naveed M, Ali S, Gubareva M, Omri A (2024) When giants fall: tracing the ripple effects of Silicon Valley Bank (SVB) collapse on global financial markets. Res Int Bus Financ 67:102160

Nguyen TH, Le XC, Vu THL (2022) An extended technology-organization-environment (TOE) framework for online retailing utilization in digital transformation: empirical evidence from Vietnam. J Open Innov Technol Mark Complex 8(4):200

Oweis KA, Alghaswyneh OF (2019) The antecedents of electronic banking adoption in Saudi Arabia: using diffusion of innovation theory. Mark. menedž. ìnnov 4:160–171. https://doi.org/10.21272/mmi.2019.4-13

Oppusunggu L, Suwarno S, Lisdiono P, Djanegara M (2024) Quantitative analysis of the impact of electronic banking on the financial performance of rural banks in Indonesia. Int J Data Netw Sci 8(2):1179–1186

Qatawneh N (2024) Empirical insights into business intelligence adoption and decision-making performance during the digital transformation era: extending the TOE model in the Jordanian banking sector. J Open Innov Technol Mark Complex 10(4):100401

Rogers EM, Singhal A, Quinlan MM (2014) Diffusion of innovations. In: An integrated approach to communication theory and research. New York NY: Routledge, p 432–448

Sarabdeen J (2023) Laws on regulatory technology (RegTech) in Saudi Arabia: Are they adequate? Int J Law Manag 65(6):523–537

Saygili EE, Ercan T (2021) An overview of international fintech instruments using innovation diffusion theory adoption strategies. In: Innovative strategies for implementing FinTech in banking. Hershey PA, USA. p 46–66

Sidaoui M, Ben Bouheni F, Arslankhuyag Z, Mian S (2022) Fintech and Islamic banking growth: new evidence. J Risk Financ 23(5):535–557

Siddik AB, Yong L, Sharif A (2024) Do sustainable banking practices enhance the sustainability performance of banking institutions? Direct and indirect effects. Int J Bank Mark 42(4) 672–691

Subanidja S, Sorongan FA, Legowo MB (2023) Bridging sustainable bank performance through fintech and enacted norms. Emerg Sci J 7(6):2156–2164

Tang M, Hu Y, Corbet S, Hou YG, Oxley L (2024) Fintech, bank diversification and liquidity: evidence from China. Res Int Bus Financ 67:102082

Tarawneh A, Abdul-Rahman A, Mohd Amin SI, Ghazali MF (2024) A systematic review of fintech and banking profitability. Int J Financ Stud 12(1):3

Truong NX (2022) Factors affecting big data adoption: an empirical study in small and medium enterprises in Vietnam. Int J Asian Bus Inf Manag (IJABIM) 13(1):1–21. https://doi.org/10.4018/ijabim.315825

Urumsah D, Ispridevi RF, Nurherwening A, Hardinto W (2022) Fintech adoption: its determinants and organizational benefits in Indonesia. J Akunt Audit Indones 26(1):88–101

wael AL-khatib A (2023) Drivers of generative artificial intelligence to fostering exploitative and exploratory innovation: a TOE framework. Technol Soc 75:102403

Xicang Z, Bilal M, Jiying W, Sohu JM, Akhtar S, Itzaz Ul Hassan M (2024) Unraveling the factors influencing digital transformation and technology adoption in high-tech firms: the moderating role of digital literacy. SAGE Open 14(4):21582440241300189

Zhong Y, Moon HC (2023) Investigating the impact of Industry 4.0 technology through a TOE-based innovation model. Systems 11(6):277

Author information

Authors and Affiliations

Contributions

Ali Alrsheedi wrote the entire final manuscript. Yulita Hanum P Iskandar supervised and guided the development of the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Not required as this study did not involve human participants.

Informed consent

Not applicable as the study did not involve human participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Alrsheedi, A., P. Iskandar, Y.H. Key factors influencing fintech adoption among Saudi banks: a conceptual framework. Humanit Soc Sci Commun 12, 1194 (2025). https://doi.org/10.1057/s41599-025-05532-1

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05532-1