Abstract

This paper analyzes the time-varying herding behavior in the non-fungible token (NFTs) and cryptocurrency markets and investigates their interrelationship. Using the daily market data from January 1st, 2020 to April 30th, 2023, our study covers the period characterized by Covid and post-Covid-19 induced global financial market volatility, capturing the dynamics in the global macroeconomic system and the Federal Reserve’s interest rate policy. Based on the rolling window method, our findings show the presence of herding behavior in both markets, where herding behavior in these markets may be influenced by the major events announcements particularly those related to the Federal Reserve's interest rate policy. Vector error correction model (VECM) indicates that the NFT market impacts the price of Ethereum, thereby influencing the broader cryptocurrency market. Such finding contributes to a deeper understanding of the market dynamics. By examining herding behavior, our findings indicate that the NFT market demonstrates relative independence from the volatile prices of the cryptocurrency market, suggesting the potential diversification benefits of incorporating NFTs for investors’ portfolio construction and risk management.

Similar content being viewed by others

Introduction

Based on blockchain technology, in contrast to traditional currencies, cryptocurrencies operate in a decentralized manner, eliminating the need for intermediaries to address trust-related concerns (Ballis and Drakos, 2020). Similarly, non-fungible tokens (NFTs), which are a type of digital asset that represent ownership or proof of authenticity of a unique item or piece of content, such as art, music, photos, or even land (Ante, 2022b; Dowling, 2022a; Yousaf and Yarovaya, 2022a), also rely on blockchain technology and smart contracts as their digital infrastructure.

NFTs open up new possibilities for digitizing and trading unique values on the Internet. According to the report by Nonfungible (2022), NFT sales skyrocketed to $17.6 billion in 2021, marking a staggering increase of approximately 210 times compared to the $82 million recorded in 2020. The year 2022 also witnessed an increasing trend in NFT sales, reaching 23.74 billion. Moreover, the substantial increase in the number of NFT transactions, soaring from 54 million in 2022 to 90 million in 2023, provides strong evidence of growing participation in NFT trading (Moen, 2024). Data from CryptoSlam further reveals a growing interest in NFTs, as evidenced by over 800,000 unique buyers tracked for three consecutive months, starting from January 2022 (Keller, 2022). This growth underscores the increasing appeal and resilience of the NFT market within the fintech and cryptocurrency ecosystem.

The objectives of our study are twofold. First, we analyze the presence of herding behavior in the NFT market and the cryptocurrency market during periods of market volatility. Second, we investigate the relationship and cross-market herding behavior between the cryptocurrency market and the NFT market during periods of cryptocurrency herding. Both cryptocurrencies and NFTs are frequently regarded as speculative and risky assets due to their high price fluctuations and high probability of cyber threats. This phenomenon can be explained by Network Externalities and Diffusion of Innovation Theory, which illustrates how the value and adoption of NFTs are influenced by the interconnectedness of market participants and the rapid diffusion of new technologies. Coupled with inadequate, commonly accepted regulation or information (Makarov and Schoar, 2020; Corbet et al., 2019), market volatility and signals may influence investors' portfolio rebalancing decisions when allocating funds to the non-fungible token (NFT) and cryptocurrency markets, potentially resulting in herding behavior (Wilson et al., 2022). Herding behavior may be exacerbated during periods of extreme fear in a crisis when investors suppress their rational thinking and follow the market's reaction due to a lack of information or fear of loss, rather than relying upon their analysis (Bikhchandani and Sharma, 2000; Christie and Huang, 1995; Galariotis et al., 2015). Thus, severe herd behavior emerges, resulting in highly volatile, explosive, or distressed markets (Bouri et al., 2019). Considering the non-fungibility feature of NFTs, which provides investors with additional value beyond price appreciation (Bikhchandani and Sharma, 2000), we argue that the NFT market can exhibit greater stability during periods of market volatility, with less herding behavior compared to the cryptocurrency market. Hence, we extend previous studies by examining the herding frequency in both markets during periods of high fluctuation and frequent interest rate hikes. Moreover, we investigate the relationship between investors' herding behaviors and major event announcements during this special period.

Additionally, it is imperative to acknowledge cross-market herding behaviors in the cryptocurrency and NFT markets. Major NFT platforms like OpenSea and Rarible accept cryptocurrencies as a means of transaction, enabling users to exchange cryptocurrencies for NFTs (Ante, 2022b; Osivand and Abolhasani 2021). Dowling (2022a) also find that participants in the NFT market recognize a significant overlap between the two markets because they understand that accessing and using cryptocurrencies can pose challenges and that those who already possess cryptocurrencies are more likely to invest in the NFT market. The interconnectedness of these markets implies that herding behavior observed in the cryptocurrency market may spill over and influence investor behavior in the NFT market.

While some previous studies have explored the interaction of pricing efficiency between these two markets (Kong & Lin, 2021; Dowling, 2022a), limited emphasis has been placed on understanding how herding behavior in the cryptocurrency market impacts herding behavior in the NFT market. For instance, Ante (2022b) does not specifically address investor behavior in the cryptocurrency market and instead generalizes the relationship between the two markets. Investigating the effects of herding behavior in the cryptocurrency market on the NFT market is crucial, especially considering the potential for NFTs to exhibit relative resilience to shocks originating from other asset classes (Umar et al., 2022a; Umar et al., 2022b). However, it is worth noting that currently, there is a lack of studies examining the relationship between investor behavior and sales volume in the NFT market with cryptocurrency price fluctuations, particularly considering the role of cryptocurrency herding behavior in linking these two markets. Thus, our study bridges this gap by providing a deeper understanding of the cross-market herding dynamics between these two interconnected markets. We introduce the dates of herding presence in the cryptocurrency market as a dummy variable in our model to investigate the causal relationships between the NFT and cryptocurrency markets. Our study contributes to understanding whether NFTs represent an independent asset class and how they potentially contribute to the growth of cryptocurrency markets. Should NFTs display a propensity for absorbing risk and remain unaffected by the herding behaviors observed in the cryptocurrency markets, they could serve as a valuable tool for diversifying investments and spreading risk, thereby contributing to the overall stability of financial markets.

Our study encompasses the period from 2020−2023, characterized by heightened volatility in the global financial market due to the Covid-19 pandemic. This study period captures the highly dynamic global macroeconomic environment and interest rate policies that triggered investor panic and influenced investor behavior in financial markets. The period also observes significant growth in the cryptocurrency market in 2020 and the NFT market in 2021, as investors explored new investment alternatives in light of concerns about macroeconomic instability and low-interest rates. Both the cryptocurrency and NFT markets experienced significant volatility and uncertainty during the pandemic, amplifying the possibility of more pronounced herding behavior in these markets. Furthermore, in 2022, as the world transitioned into the post-pandemic era, the Federal Reserve announced a substantial increase in interest rates, marking the largest rate hike in nearly three decades (Tepper, 2023). This development adds to the interest of investigating herding behaviors in the cryptocurrency and NFT markets. Our paper thus provides insights into herd behavior during periods of heightened volatility, in comparison to previous studies such as Yousaf and Yarovaya (2022a) and Amirat and Alwafi (2020), which examine herd behavior in relatively steady markets.

Our study contributes to the literature in several ways. Firstly, we adopt a rolling window method, following the approach of Yousaf and Yarovaya (2022b), which distinguishes our study from most previous research that uses the static model of Cross-Sectional Absolute Deviation (CSAD). The static method is sensitive to the sample period selection and may fail to capture the system's dynamics during structural breaks (Bouri et al., 2019). In contrast, the rolling window method accounts for changes over time, making it more suitable for analyzing behaviors during crises, such as the COVID-19 pandemic. However, we extend the study period beyond Yousaf and Yarovaya (2022b) to include the post-pandemic phase, where we discover the presence of herding behavior. Furthermore, this study innovatively links herding behavior to the macro-environment by discussing how it responds to major event announcements, including the US Federal Open Market Committee (FOMC) interest rate hikes.

Secondly, our study specifically considers the role of cryptocurrency herding behavior in linking the NFT and cryptocurrency markets within our model, thereby complementing the growing body of NFT literature. Notably, to our knowledge, our research is among the first to show that during the periods of market turbulence, the NFT market could potentially affect the larger cryptocurrency market by influencing the price of Ethereum. Additionally, we highlight the relative independence of the NFT market from the volatile prices of the broader cryptocurrency market. This may be attributed to investors making more rational investment decisions in the Ethereum-priced NFT market compared to the broader cryptocurrency market. These findings contribute to a deeper understanding of market dynamics and thus add to the current research realm by identifying the appropriate asset class for composing portfolios to mitigate the risks of a volatile macroeconomic environment. It holds significant implications for portfolio construction and risk hedging against market events.

The remainder of this paper is organized as follows: Section two reviews the literature. Section three presents data and methodology. Section four reports the empirical results. Section five discusses the results and concludes the paper.

Literature review

Herding behavior in the cryptocurrency market

According to Bouri et al. (2019), Ng et al. (2022), and Omane-Adjepong et al. (2021), a relatively immature and emerging financial market such as the cryptocurrency market may exhibit significant herding behaviors due to information asymmetry and uncertainty regarding returns. Extant studies about herding behavior in the cryptocurrency market mainly revolve around static herding and time-varying herding behavior.

Past studies such as Vidal-Tomás et al. (2019), Da Gama Silva et al. (2019), and Ballis and Drakos (2020) that rely on the CSAD and cross-sectional standard deviation (CSSD) of returns models find support for the static herding behavior in the cryptocurrency market. Their findings reveal a tendency for synchronized movements among the cryptocurrencies during both markets increases and declines. It is important that the herding behavior identified in the cryptocurrency market deviates from the fundamentals that usually drive the value of these digital assets. This suggests that other non-fundamental factors or market dynamics may be at play, influencing the herding behavior observed in the cryptocurrency market.

However, certain studies do not find evidence of static herding behavior when utilizing the CSAD model. Instead, they employ the rolling window method to demonstrate significant time-varying herding behavior (Bouri et al., 2019; Amirat & Alwafi, 2020; Kurt Gümüş et al., 2019; Yousaf & Yarovaya, 2022a). Bouri et al. (2019) suggests that applying a static CSAD model may not be suitable for detecting herding behavior due to the presence of structural breaks and nonlinearities in the cryptocurrency data series. With the rolling window method, their daily prices for six major cryptocurrencies from August 2015 to December 2018 with 1242 observations show that time-varying herding behavior tends to occur during periods of increased market uncertainty. Amirat and Alwafi (2020) support the notion that static herding behavior is not evident, instead they find evidence of time-varying herding. They collect daily closing prices for the 20 largest cryptocurrencies by market capitalization from January 2015 to January 2019, covering a period of 1492 trading days. Omane-Adjepong et al. (2021) also find the presence of time-varying herding behavior in the cryptocurrency market. They suggest that this behavior may be associated with significant economic events at the time. Their hypothesis is substantiated by the observation in that periods of herding, identified through the rolling window method, correspond with price surges in 2017 and the official recognition of cryptocurrencies as legal tender under Japan's Payment Services Law. Following the literature, we hypothesize that:

H1: There is time-varying herding behavior in cryptocurrency markets.

Apart from Omane-Adjepong et al. (2021), various studies including Bouri et al. (2019), Amirat & Alwafi (2020), Demir et al. (2018), and Corbet et al. (2017) also highlight that, cryptocurrency market, being a component of the broader financial market, is susceptible to significant economic events such as the interest rate policies implemented by the Federal Reserve. According to these studies, significant economic policies have the potential to trigger herding behavior among investors in the cryptocurrency market. Hence, as part of our H1, we attempt to explore the time-varying herding behavior in cryptocurrency markets during periods of uncertainty related to the Federal Reserve's interest rate policy. Besides policy announcements, media coverage also influences investors' behavior. This assertion aligns with the findings of Umar et al.(2021), which demonstrate the relationship between media coverage and cryptocurrency volatility using the time-varying parameter-VAR approach. Media coverage also includes key decisions by institutional investors or celebrities. For instance, Elon Musk's public support of Dogecoin on Twitter not only impacted the price of Dogecoin but also spurred investor attention and investment behavior towards other cryptocurrencies (Elsayed et al., 2024a; Elsayed et al., 2024b).

Herding behavior in the NFT market

Among existing empirical studies, the investigations of pricing efficiency and spillover effects in the NFT market are considered the two most representative directions, with most studies showing evidence of NFT market inefficiency. Specifically, Dowling (2022a) suggests that the rapidly expanding NFT market is in an early stage of searching for an appropriate pricing model. He collects data on all secondary market transactions of Decentraland tokens between March 2019 and March 2021 using automatic variance ratio (AVR) tests, automatic portmanteau (AP) tests, and Domínguez and Lobato (DL) consistency tests to validate the inefficiency of pricing in the NFT market, indicating that it is an unmatured and emerging market. Kong and Lin (2021) and Kampakis (2022) concentrate on a specific project, similar to Dowling (2022a) and use a hedonic regression model with a similar observed period to examine the pricing dynamics and return-risk trade-off of the CryptoPunks project, which is one of the most valuable NFTs. These studies investigate the extraordinary returns offered by NFTs compared to traditional assets, highlighting their association with high volatility. Kong and Lin (2021) further propose that the pricing of NFTs is predominantly influenced by factors such as token scarcity and investor preferences. Additionally, Vidal-Tomás (2022) explores the metaverse segment of NFTs and investigates their short- and long-term performance from October 2017 to October 2021. The study identifies the presence of market bubbles within this segment. Similarly, Borri et al. (2022) extend their analysis to the broader NFT market and find that volatility and the NFT valuation ratio are significant predictors of NFT market returns. These studies collectively provide compelling evidence supporting the findings of Dowling (2022a) that pricing inefficiencies exist in the NFT market.

The presence of herding behavior provides an additional perspective to comprehend the inefficiency within the NFT market, contributing to its remarkable returns and market instability (Bao et al., 2022). To delve deeper into the occurrence of herding, the researchers utilize the static CSAD model, analyzing a dataset spanning from November 2017 to April 2021. Their investigation reveals that herding behavior is more widespread during the launch of submarkets. Furthermore, they argue that herding behavior exhibits a correlation with investor attention, predominantly influenced by media coverage. Jiang and Xia (2023) provide support for the view that investor attention can significantly amplify the volatility of NFTs, as demonstrated by their autoregressive conditional heteroskedasticity-mixed-data sampling (G-M) model. De Silva et al.(2024) employ a time-varying method using three different-length windows within the CSAD model, also suggesting that herding behavior exists in the NFT market because of media movement. However, Yousaf and Yarovaya (2022b) present contrasting findings as they collect daily data from May 16, 2020, to May 15, 2021, using the same model as Bao et al. (2022). Their study reveals no evidence of static herding behavior in the short term for the NFT market. These conflicting conclusions may be due to the shorter duration of data examined in the study conducted by Yousaf and Yarovaya (2022b) or the limitations inherent in the classical CSAD model, as noted by Bouri et al. (2019).

NFTs, because of their scarcity and value distinguish them from cryptocurrencies, are seen as an important development direction of blockchain technology, and the existence of its market herd is controversial (Chohan, 2021). There has not been as much research on the NFT market herd as there has been on the cryptocurrency market. To assess the existence of herding behavior in the NFT market, we extend the dataset beyond previous studies to address model and data constraints. Accordingly, we hypothesize that:

H2: There is time-varying herding behavior in NFT markets.

Interactions and spillover effects between NFT and cryptocurrency markets

The spillover effects of NFT are one of the most significant directions of empirical research, with various studies analyzing the interactions between NFT and other major asset classes. However, the interrelationship between NFT and major cryptocurrency markets remains debatable. We further investigate its relationship with the cryptocurrency market because both markets are based on blockchain technology (Dowling, 2022b; Ante, 2022b; Umar et al., 2022a; Umar et al., 2022c; Borri et al., 2022).

Numerous studies argue that NFT is relatively independent of other cryptocurrency markets (Karim et al., 2022; Aharon & Demir, 2022; Yousaf and Yarovaya, 2022a). Dowling (2022b) conducts wavelet coherence analysis and finds a weak correlation between the NFT market and the cryptocurrency market. The study incorporates data from the NFT secondary market trades and traditional cryptocurrency market data, covering the period from March 3, 2019, to March 2021, and aims to investigate the transmission of volatility between NFT pricing and traditional cryptocurrency pricing. The findings of the study indicate that there are insignificant spillovers between these two markets. This suggests that the volatility in one market does not spill over into the other market to a significant extent during the examined period. Karim et al. (2022) employ the quantile connectedness technique and demonstrate that NFT exhibits significant disconnection from other blockchain markets, offering potential diversification benefits and bearing significant risk. Aharon and Demir (2022) find that NFT is independent of shocks from other asset classes, exhibiting weak interaction and even absorbing risk during the COVID-19 period. Yousaf and Yarovaya (2022a) examine volatility transmission links between NFT and other cryptocurrencies, corroborating Dowling’s (2022b) conclusion regarding the decoupling of NFT from other markets.

On the other hand, several of the studies argue that there is a correlation between the NFT market and cryptocurrency markets (Umar et al., 2022a; Kong and Lin, 2021). Ante (2022b), and Osivand and Abolhasani (2021) analyze the interactions between these two markets, extracting the volume of all NFTs transactions and the number of wallets participating in the NFT market from January 2018 to April 2021, and demonstrate that the cryptocurrency market influences the growth and development of the NFT market. Kong and Lin (2021) provide support for the correlation between the NFT and cryptocurrency markets. They propose that during periods characterized by a surge in demand for alternative investments and the pursuit of higher returns in a low-interest rate environment, NFT prices experience significant increases due to investors' aesthetic preferences. Umar et al. (2022a) also support the view that global investments were transferred to the cryptocurrency market from other markets, causing spillover effects between markets, using the TVP-VAR connectedness approach. Additionally, Elsayed et al. (2024b) suggest that other cryptocurrencies (such as Bitcoin, Ethereum) are influenced by price fluctuations in non-traditional crypto assets, especially when the market size of these assets increases. This impact is particularly significant due to the speculative nature of NFTs, which are often characterized by high market volatility. However, they partially consider the spillover effects between markets but do not fully account for other factors influencing herding behavior in the cryptocurrency market, such as macroeconomic trends.

Ante (2022a) shows that sales and wallets in the NFT market are related to the pricing of Bitcoin and ETH through the vector error correction model. According to Wang et al. (2023), the trading volume of CryptoPunk in the short time before investors buy CryptoPunk has a negative relationship with the return of NFT, suggesting that investors interested in NFT should avoid joining the market when the market trading volume is at a high level. It indicates that NFT unique buyers are correlated with market volume. Furthermore, Ante (2022b), and Osivand and Abolhasani (2021) explore the interaction of NFT projects and adopt three variables: the number of transactions, trading volume, and the number of wallets. Their results show that there is a short-term causal relationship between NFT sub-markets. Umar et al.(2022a) also indicate that there are spillover effects among NFT segments by employing the TVP-VAR connectedness approach. Moreover, Apostu et al. (2022) adopt the NFT price as well as the price of Bitcoin and Ethereum and obtain the same conclusion as Ante (2022a).

Umar et al. (2022b) present separate findings based on different time intervals, revealing distinct relationships between NFT and other assets in various circumstances. They observe that NFT exhibits relative independence from other assets, but the linkages between NFT and other assets strengthen during periods of market volatility. The study divides the period from June 26, 2017, to October 29, 2021, into three subintervals and utilizes data from Bloomberg terminals, including NFT, Bitcoin price, MSCI World Equity Index, FTSE World Government Bond Index, gold, and crude oil, for empirical analysis. Employing the square wavelet coherence technique, the authors investigate the multiscale dependence of NFT on major asset classes, highlighting the increased coherence between NFT and other assets during the pandemic. Based on the previous literature, we hypothesize that:

H3: There is a relationship between the NFT and cryptocurrency markets.

Data and method

Data and variable selection

Our dataset comprises 1,216 daily observations, spanning from January 1st, 2020, to April 30th, 2023. It includes several variables such as the daily number of unique buyers and unique sellers in the NFT market, as well as the closing prices of two categories of cryptocurrencies: NFT and traditional cryptocurrencies. To expand upon the dataset used by previous studies and for the purpose of examining time varying herding, we collect data for the top 10 cryptocurrencies in each category based on market capitalization. The selected cryptocurrencies must have at least one year of available data. For NFT market data, we obtain information from Cryptoslam Corporation (https://www.cryptoslam.io). This dataset specifically covers NFT transactions on the Ethereum blockchain, which represents the majority of the NFT market. As for traditional cryptocurrencies, we collect daily closing prices from the cryptocurrency exchange platform (https://coinmarketcap.com).

Analysis method

Following the methodology employed by Yousaf and Yarovaya (2022a), we conduct an analysis of time-varying herding behavior in both the cryptocurrency market and NFT market. We calculate the Cross-Sectional Absolute Deviation (CSAD) value for each market and then utilize R to identify the specific dates on which herding behavior is observed. Subsequently, with the data on NFT market sales and the number of unique buyers and sellers, we proceed to investigate the presence of a Granger-causal relationship between the cryptocurrency market and the NFT market. Shih et al. (2012) and Ferreruela et al. (2022) also support the notion of cross-market herding behavior through Granger causality tests. According to Christie and Huang (1995), herding behavior in financial markets refers to investors' tendency to buy or sell an asset based on the perceived opinions or actions of others. Therefore, we include the number of unique sellers and unique buyers as variables to measure changes in the NFT market.

Our study opts to use the VECM model because it has the advantage of handling non-stationary time series with cointegration relationships, providing estimates of long-term equilibrium relationships, while connectivity methods focus primarily on detecting causal relationships between variables as applied by Elsayed et al.(2024a) and Umar et al. (2022a). Therefore, our study builds upon the work of Ante (2022b) and Osivand and Abolhasani (2021), aiming to enhance the understanding of the relationship between the cryptocurrency market and the smaller NFT market. Unlike Ante's (2022b) study, which does not distinguish between herding and stabilization scenarios in the cryptocurrency market, our research incorporates herding behavior in the cryptocurrency market as an exogenous dummy variable to account for the impact of herding. Various past studies also include exogenous dummy variables in their vector autoregressive models to account for various impacts such as financial crises (Jiang and Liu, 2011), airlines strike and war (Bonham et al., 2009), and Olympic Games (Yap and Allen, 2011) which enhance their analyses. Additionally, we differentiate between unique buyers and unique sellers by dividing the variable "wallets" in Osivand and Abolhasani (2021) and Ante's (2022b) studies into these two categories. Similarly, we utilize the variables NFT sales, bitcoin prices, and Ethereum prices, as employed in Ante's study, to investigate the impact of cryptocurrency market herding on the NFT market. By considering these factors, we aim to examine whether the herding behavior of the cryptocurrency market can affect the NFT market across markets.

A preliminary test is conducted to ensure the variables are suitable for our model. The Variance Inflation Factor (VIF) test results allow us to assess whether multicollinearity exists among the model variables. Generally, the VIF criteria are as follows: VIF < 10: No significant impact on the model, though some degree of multicollinearity may exist(O’brien, 2007). The VIF results as shown in Table 1 for all variables in the current model fall within an acceptable range, indicating that the model is suitable for use.

To conduct the Granger causality test, we adopt the methodology employed by Apostu et al. (2022) and Ante (2022b). In line with Dowling’s approach, we consider ETH (Ethereum) as the primary currency for issuing and trading NFTs, given its prominence and relevance in the NFT market. Additionally, BTC (Bitcoin) is selected as the largest and most significant cryptocurrency, serving as a reference market for our analysis. By incorporating these specific currencies and following Dowling’s methodology, we aim to gain insights into the dynamics and interactions between NFTs and cryptocurrencies within the context of our analysis.

The setting of the rolling window method

We first employ Chang's et al. (2000) model as the measure of dispersion to investigate herding behavior in the rolling window method. To quantify this, we utilize the cross-sectional absolute deviation (CSAD), which is defined by Eq. 1:

where N = the number of cryptocurrencies (NFTs). \({R}_{{mt}}\) = the daily returns of the market at time t \({R}_{{it}}\) = the daily returns of cryptocurrencies (NFTs) i at time t.

Chang et al. (2000) provide the following Eq. 2 for estimating market herding:

If the coefficient of \({({R}_{{mt}})}^{2}\) is negative and statistically significant, it implies that the connection between the distribution of individual cryptocurrencies (NFTs) returns and cryptocurrencies (NFTs) market returns is non-linear, indicating the presence of market herding.

As previously stated, the static model is sensitive to the chosen sample period, and it may not be suitable when there is a structural break in the data. Forecasting each series separately without considering the broken structure of the data often leads to undesirable outcomes (Zhang et al., 2017). Given that our selected sample period includes the Covid-19 crisis, which deviates from the conditions assumed by the static model, we have opted not to use it for examining herding behavior.

We employ a more robust rolling window approach to assess the stability of model parameters and detect potential time-varying parameters. In this analysis, we select a window length of 14 days to assess the stability of the (Rmt)2 coefficients in the CSAD model, as mentioned in Eq. 2. It is important to note that there is no definitive guideline for determining the optimal window length. However, in our case, we choose a relatively short window length to ensure an adequate number of windows, enabling us to detect trends and capture any potential instability in the parameters (Stavroyiannis & Babalos, 2017). Therefore, in our case, we choose a relatively short window based on the Relative Strength Index (RSI), traditionally using a 14 day period, which is a widely recognized technical indicator for evaluating overbought and oversold conditions. This period helps ensure an adequate number of windows, allowing us to detect trends and capture any potential instability in the parameters (Stavroyiannis and Babalos, 2017). It is considered optimal for capturing market dynamics without excessive noise or lag.

The setting of the VAR empirical model

The Vector Autoregressive (VAR) model helps to elucidate the complex interactions and relationships within the system by capturing the interdependencies and feedback mechanisms among variables. VAR model (Eq. 3) could be displayed as follows:

\({\alpha }_{0}\) is a vector of intercept terms, \({{\rm{Y}}}_{t}\) represents a matrix composed of endogenous variables, and A1 to \({A}_{p}\) are coefficients of a matrix.\({D}_{t}\) is an exogenous variable matrix consisting of dummy variables. ε represents the random disturbance term, which captures unmodeled factors. The parameter p denotes the lag order.

In this study, we consider the day of cryptocurrency market herding behavior as exogenous variables to account for their impact on the NFT sales, the number of unique buyers in the NFT market as well as the price of bitcoin and Ethereum. Hence, \({{\rm{Y}}}_{t}\) = (volume, unique buyer, bitcoin prices, Ethereum prices), and to incorporate cryptocurrency herding as an exogenous variable, we assign a value of 1 to \({D}_{t}\) to represent the day of herding and 0 otherwise. Our model's optimal lag length is determined based on the lowest Akaike information criterion (AIC) (Fransiska et al., 2018; Scott Hacker and Hatemi-J, 2008; Hatemi-J 2004; Hamilton, 1994). To mitigate the volatility of the data and address the presence of heteroscedasticity in the time series, a natural logarithm transformation is applied to the variables while preserving their relationships. The transformed variables are denoted as \(\mathrm{ln}{\_btc}\) \(\mathrm{ln}{\_eth}\), \(\mathrm{ln}{\_sales}\), \(\mathrm{ln}{\_buyer}\). Our VAR model (Eq. 4) is displayed as follows:

We then apply the Johansen test to check for any cointegration among the series. Such long-run connections make the VECM a suitable model to study any short-run deviations from the equilibrium relationship (Engle and Granger, 1987). Based on the Johansen cointegration test result (reported in section 4), we employ the vector error correction model (VECM) in our analysis. VECM is a combination of the vector autoregressive model and cointegration restrictions. Variables cointegrated to the order of one, I(1), indicates that they will tend to revert to the trend in the long run, even though they may deviate from each other in the short run. The general VECM can be represented by Eq. 5:

where \({Y}_{t}\) represents the independent I(1) variables being integrated to form an I(0) vector, C is the intercept, \(\delta\) is the matrix that reflects the short-run dynamic relationship between the elements of \({Y}_{t}\), and \({\in }_{t}\) is the residual. ∆ = (I–L), where L is the lag operator, k is the number of lags, and \(\beta\) is the matrix containing long-run equilibrium information. If the elements of \({Y}_{t}\) are I(1) variables and are cointegrated, then the rank of \(\beta\) can be rewritten as \(\delta\) = \(\alpha {{ect}}_{t-1}\); \({{ect}}_{t-1}\) is the error correction term, and \(\alpha\) is a loading matrix that defines the adjustment speed of the variables in \({Y}_{t}\) to the long-run equilibrium defined by the cointegrating relationships

The use of VAR or VECM models to study herding behavior is supported by information cascade theory. This theory explains how investors, in the face of uncertainty, are inclined to replicate the trades they observe, leading to herding behavior (Avery & Zemsky, 1998; Cipriani & Guarino, 2014). VAR models can capture the short-term dynamics of these cascades, while VECM model is suitable when long-run equilibrium relationships are expected, as often seen in interconnected markets (Park & Sabourian, 2011). These models allow us to study the observed trading actions on market behavior, particularly in highly fluctuating markets like cryptocurrency and NFT markets (Hirshleifer & Teoh, 2003). By modeling the dynamic interactions between observed actions and market outcomes, these models can shed light on how information cascades propagate herding behavior (Anderson & Holt, 1997).

Results

Description of historical trends in cryptocurrencies and NFT market

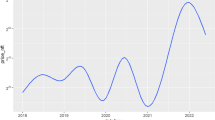

Figure 1a and Fig. 1b depict the historical prices of Bitcoin and Ethereum respectively. Based on the figures, the prices of Bitcoin and Ethereum underwent a rapid surge starting in 2020 and continuing until early 2021. To be more specific, Bitcoin reached its relatively high price levels earlier and sustained them for a longer period, fluctuating within the upper price range during the first quarter of 2021, whereas Ethereum's price only reached a relatively high level during the first month of the second quarter, and its duration was very short. Subsequently, the prices dropped substantially until July, marking a nearly 50% decrease from their peak levels. The prices then rebounded in the following two months, reaching a second peak in September 2021. However, from that point onwards, the prices experienced a steep decline, ultimately plummeting by a staggering 77% by 2023.

Figure 1c presents the historical sales volume of the NFT market. Based on the figure, the sales volume remained relatively low in 2020, gradually increased in early 2021, and experienced a significant surge in May. Throughout 2021, NFT sales volume exhibited rapid growth and substantial fluctuations, with sales increasing nearly 100 times compared to 2020. Notably, August 2021 witnessed an incredible surge in NFT sales volume, while the remaining months of 2021 experienced a decline. However, as we may note from Fig. 1c, starting from the first quarter of 2022, the sales volume increased and fluctuated. In April 2022, the sales volume reached its peak. Conversely, after May 2022, the sales volume experienced a significant decline, reaching a lower level, although it remained higher than the sales record in 2020.

Market herding behavior analysis

Figure 2a, b present the time-varying herding behavior observed in the cryptocurrency market and the NFT market, respectively. The analysis utilizes a rolling window method with a length of 14 days, selected to effectively capture the underlying trends. In these figures, if the t-statistics fall below the negative 10% critical value line (indicating that negative γ2 becomes statistically significant), it indicates the presence of herding behavior.

a Time-varying Herding in the Cryptocurrency Market. b Time-varying Herding in the NFT market. In these figures, if the t-statistics fall below the negative 10% critical value line (indicating that negative \(\gamma 2\) becomes statistically significant), it indicates the presence of herding behavior.

From May 2020 to the beginning of 2021, the cryptocurrency market experienced multiple herding periods, as shown in Fig. 2(a). These periods could be attributed to macroeconomic uncertainty and the rapid growth of the cryptocurrency market. According to Sharma (2021), uncontrolled economic stimulus measures implemented during the economic slowdown, such as extensive money printing coupled with macroeconomic instability resulting from low-interest rates, led to the depreciation of the dollar, increased inflation rates, and raised investor concerns. However, the halving of Bitcoin in May 2020, which reduces the rate of Bitcoin inflation and emphasizes its scarcity, encouraged investors to shift their funds from dollars to cryptocurrencies (Copeland, 2020). In late 2020, the announcement of investments in cryptocurrencies and their trading ecosystems by institutional investors and banks had a significant impact, particularly benefiting Bitcoin and fueling investor frenzy (Sharma, 2021). These factors contributed to the herding behavior observed during this period in the cryptocurrency market as depicted in Fig. 2(a).

In 2021, the herding behavior observed in the cryptocurrency market aligns with a period characterized by cryptocurrency price volatility, often referred to as a bubble period. During this period, significant price fluctuations were witnessed in Bitcoin. For instance, from February to March, the price of Bitcoin surged to new highs before experiencing a minor decline. Subsequently, following a bottoming out in July, Bitcoin and other cryptocurrencies embarked on a solid recovery, partially driven by Elon Musk's engagement with leading Bitcoin mining companies to develop more sustainable and efficient mining practices (Ante, 2023). These specific timeframes in 2021 coincide with the bubble period, providing evidence of time-varying herding behavior in traditional cryptocurrencies. The herding behavior observed during this period reflects market participants' responses to the price volatility and rapid changes in the cryptocurrency market.

It is interesting to note that in 2022, the herding behaviors observed in the cryptocurrency market, as shown in Fig. 2a, coincided with the Federal Reserve's announcements of interest rate increases. This suggests that investor herding behavior is influenced by economic policy, which aligns with the conclusions drawn by Omane-Adjepong et al. (2021). Bitcoin, as the most prominent cryptocurrency, is often perceived as a hedge against risks associated with traditional currencies, such as the dollar. This perception is evident from the investor herding behavior observed in both 2020 and 2022. According to Corbet et al. (2019), monetary policy decisions made by the FOMC, particularly those concerning interest rates, exert a significant impact on Bitcoin prices. The herding behavior observed in 2020 can be attributed to low-interest rates and macroeconomic uncertainty, leading to a surge in cryptocurrency prices, as depicted in Fig. 1a, b. Conversely, as investors perceive the dollar as a stable currency with minimal risk of rapid depreciation, the Federal Reserve's decision to raise interest rates by 25 basis points in March, followed by an additional 50 basis points in May, culminating in a 75-basis point increase in June 2022, becomes even more appealing (see Table 2, Panel B). This prompts investors to shift their funds from risky cryptocurrency investments to dollar-denominated financial markets, resulting in a significant decline in cryptocurrency prices.

These findings consequently imply the potential utility of Bitcoin as a risk management tool, particularly in the face of unpredictable interest-rate risk shocks. They suggest that investors may consider incorporating Bitcoin into their portfolios as part of their risk analysis and management strategies.

To further analyze the linkage between events and herding behaviors, Table 2 shows the major event announcements related to the dates when herding behavior is observed. According to Table 2, Panel A, herding behavior occurs from 3 days before to 10 days after the announcement, except for the event on July 21, 2021. The herding behavior related to "The B Word" conference begins 10 days prior to the event, as the press had forecasted and informed the public in advance. Moreover, herding behavior is not persistent over time but it occurs periodically. Specifically, herding behaviors are observed prior to the announcement date; however, the public tends to appear calm as the actual event date approaches, including on the announcement date itself. After the announcement, the public's response can be either immediate or delayed, depending on whether the announcement meets their expectations. This is in line with the observation by Qiang (2023).

Table 2b presents the relationship between the Federal Open Market Committee (FOMC) meeting dates and the herding dates during 2022 and 2023. Investors tend to respond to the announcement more quickly than they do to a 50 bp hike, while no herding behavior is observed in response to a 25 bp hike except on March 22, 2023. The main reason for the herding behavior observed is attributed to the failure of Silicon Valley Bank (SVB) (Jin and Tian, 2024). Moreover, investors postponed their reaction during the herding period on October 12th, primarily because Bitcoin's value increased further as global markets improved, and traders were awaiting the release of US Consumer Price Index (CPI) data while also monitoring a significant upgrade to the Ether blockchain (Bloomberg, 2022; Qiang, 2023). The herding behavior predominantly occurred prior to the announcement, driven by investors' expectations.

Figure 2(b) specifically illustrates the presence of herding behavior in the NFT market, as evidenced by the consistently falling time-varying t-statistics below the critical value line. From February to August 2020, the presence of herding behavior in the NFT market can be attributed to market inefficiencies, aligning with the findings of Bao et al. (2022) and Dowling (2022a). The year 2021 witnessed the rise of NFTs, marked by a significant surge in NFT sales volumes occurring in May 2021, as depicted in Fig. 1(c). This surge in activity explains the occurrence of herding behavior during that period as depicted in Fig. 2(b). Furthermore, herding behavior can be observed in the NFT market from May to September 2022 and April 2023. Concurrently, the cryptocurrency market also exhibits herding behavior (see both Figs. 2a, b). Thus, our hypotheses H1 and H2 are both supported. Consequently, it is reasonable to speculate that there may be a causal relationship between the NFT and cryptocurrency markets.

Relationship between cryptocurrency and NFT markets

Table 3 presents the descriptive statistics for the variables under study. It is observed that all variables have mean values greater than their corresponding standard deviations, indicating an under-dispersed distribution. Additionally, the Jarque and Bera (1987) test results indicate that none of the variables follow a normal distribution. This suggests that Bitcoin prices, Ethereum prices, sales volume, and the number of unique buyers in the NFT market exhibit volatility and instability throughout the selected period.

Unit root test results (Augmented Dickey-Fuller (ADF)) are shown in Table 4, indicating that all the variables are stationary at their first difference level, which means that they are in the same order of integration, making VAR a suitable method. Yet, as shown in Table 5, on the basis of eigenvalues, Trace test and Maximum Eigenvalue test, our Johansen test of cointegration indicates one cointegration relationship, thus making the VECM as our model. Based on the AIC, we adopt the model with lag seven, following the approach of Ante (2022a) and Apostu et al (2022), to examine the linkage between the NFT and cryptocurrency markets.

After confirming the presence of a long-run association between our variables, we examine the long-run dynamics among these variables. Before establishing the VECM, we check for the presence of serial correlation in our model with the Lagrange Multiplier (LM) test. The results show that all the p-values (in Table 6) are greater than 5%, suggesting that there is no evidence of serial correlation in our model.

The results of our VECM indicate a negative and significant sign of the error correction term, which implies the existence of a long-run relationship among the proposed variables. The long-run relationship among the proposed variables for one cointegrating vector is displayed below (standard errors are displayed in parenthesis).

In the following analysis, we present the Granger Causality Test results to interpret the VECM findings. Table 7 displays the short-run Granger causality test results, which assess whether a change in one variable precedes a change in other variables. These statistics are computed for each combination of our dependent and independent variables.

To illustrate, the first row of results shows whether all independent variables (ETH price, the number of unique buyers and Bitcoin price) significantly impact NFT sales. Since the estimates of these independent variables exceed the significance threshold of 10%, we cannot conclude that ETH price, Bitcoin price, and the number of unique buyers Granger-cause NFT sales. The third row shows the relationship between the number of unique buyers and the other variables. It demonstrates similar results, indicating that neither Bitcoin price, Ethereum price, nor NFT sales Granger cause the number of unique buyers. However, the second and fourth rows of results reveal that, there is a Granger-causal relationship between the price of Bitcoin and the price of Ethereum. Additionally, the number of unique buyers Granger causes the prices of both cryptocurrencies. The causality results remain unaltered with the herding dummy incorporated into the model.

Based on the Granger Causality Test results, we conclude that the prices of cryptocurrencies have a mutual influence on each other including during the period of cryptocurrency market herding, but the herding effect does not spill over into the NFT market. However, the number of investors participating in the NFT market can have an impact on the prices of cryptocurrencies, namely the prices of Bitcoin and Ethereum.

Robustness test

Robustness check with alternative variables

We conduct a further test by substituting variables. Specifically, we replace the number of unique buyers in the NFT market with the number of unique sellers. It is important to note that variables in the further test are stationary at I(1), and again the Johansen cointegration test confirms the existence of a long-term equilibrium relationship between them.

Table 8 presents the results of our robustness test, which reveal important insights. The number of unique sellers exhibits a Granger-causal relationship with NFT sales volume at the 1% significance level (see first row of Table 8). Conversely, NFT sales volume Granger-causes the number of unique sellers at the 10% significance level, as indicated in the third row. However, the null hypothesis that the prices of cryptocurrencies (Bitcoin and Ethereum) do not Granger-cause NFT market-related variables is accepted (see first and third rows of Table 8). Moreover, the price of Ethereum is influenced by both the number of unique sellers in the NFT market and the price of Bitcoin (see second row of Table 8). Combined with the result mentioned above, where the number of unique buyers Granger-causes Ethereum's price, this enhances our findings that investors in the NFT market have a significant impact on Ethereum's price. On the other hand, Bitcoin's price is influenced by Ethereum's price at the 5% significance level, indicating a Granger-causal relationship between these two cryptocurrencies during periods of market herding. However, NFT market-related variables do not significantly affect Bitcoin's price (see forth row of Table 8). Based on these results, we can infer that the NFT market may impact the cryptocurrency market by influencing the price of Ethereum. This suggests that changes and activities in the NFT market can potentially influence the dynamics of the broader cryptocurrency market. Thus, hypothesis H3 is supported.

Robustness check with impulse response functions

Our Granger causality results suggest that, the number of investors in the NFT market have cross-market influence in cryptocurrencies’ prices. To further analyze the dynamic mutual effects of cryptocurrency prices and the number of investors in the NFT market in the short run, impulse response functions are employed. Figure 3 shows the relevant impulse response function results. Specifically, it illustrates the response of cryptocurrency prices to a unit shock in the number of investors, including both unique sellers and buyers, and also shows the response of investors to a unit shock in cryptocurrencies prices.

Unlike VAR, impulse response functions of a VECM need not return to their mean value, as series are cointegrated in the long-run (Mills, 1998, Ante, 2022b). During the initial two periods, the response of cryptocurrency prices (as shown by the four diagrams in the left column of Fig. 3) to a unit shock in the number of investors (both unique buyers and unique sellers) in the NFT market is negative and exhibits a decreasing trend. Following slight fluctuations in the 3rd and 4th periods, there is a sharp increase in the response of cryptocurrency prices from the 5th period onwards that can be considered significant. However, as shown by the four diagrams in the right column of Fig. 3, the number of investors shows slight changes in response to the shock of cryptocurrencies and converges to zero as the effects of the shock die out. Comparing the left and right columns of Fig. 3, we observe that the shock from the number of investors lasts longer on cryptocurrency prices as expected. This indicates that the number of investors Granger-causes the prices of cryptocurrencies in the long run. In addition, long-term herding effects captured by the VECM model reflect more stable, equilibrium-driven behaviors that emerge over extended periods. The unique buyer would cause the increasing price of cryptocurrencies for both Bitcoin and Ethereum; however, the increasing price of cryptocurrencies would not cause an increase in the number of unique active wallets (both sellers and buyers) in NFT markets.

Overall, impulse response functions are helpful in mapping the short-run effects and thus complementing the results of the Granger causality tests. Specifically, the results show that the shock from the number of NFT investors (both buyers and sellers) on cryptocurrency prices lasts longer as expected, while the response of the number of investors in the short-run equilibrium adjustment process is rather fast.

Discussion and conclusion

Using the rolling window method to investigate the presence of time-varying herding behavior in both the cryptocurrency and NFT markets from January 2020 to April 2023, our findings indicate the existence of herding behavior in both markets. These findings align with previous studies such as Bao et al. (2022) and Jiang and Xia (2023). We argue that the herding behavior in these markets is influenced by the Federal Reserve's interest rate policy, corroborate with Omane-Adjepong et al. (2021) and Amirat and Alwafi’s (2020) view. Furthermore, we observed that the herding behaviors in our study are not persistent over time but happened periodically as they are related to the major event announcements, not only to the FOMC meeting announcements but also the influencers and institutional investors’ decisions. Our analysis also reveals more instances of herding behavior in the cryptocurrency market compared to the NFT market, implying that NFTs possess more characteristics of an asset than a liquid currency because the NFT market does not react quickly to changes in other markets. While herding behavior is present in the NFT market, it can be attributed to the market's initial inefficiency during its early development and the subsequent rapid growth in 2021. These findings are consistent with the explanations provided by Bao et al. (2022) and Dowling (2022a, 2022b).

Regarding the relationship between the cryptocurrency market and the NFT market, our findings indicate that the NFT market demonstrates relative independence from the volatile prices of the cryptocurrency market, aligning with the findings of Karim et al. (2022), Aharon and Demir (2022) and Yousaf and Yarovaya (2022a). However, the number of investors in the NFT market influences the price of Ethereum. These findings suggest a relationship between the two markets, where developments and activities in the smaller NFT market can potentially shape the dynamics of the larger cryptocurrency market, primarily through their effects on Ethereum's price. This emphasizes the potential diversification benefits of incorporating NFTs into investment portfolios (Xia et al., 2022; Ko et al., 2022). Therefore, our finding supports the conclusions of Zhang et al. (2022) and Umar et al. (2022c), suggesting that NFTs can be considered relatively independent assets for portfolio construction and risk hedging purposes, as argued by Kong and Lin (2021). It should be noted that in portfolio construction, it is the overall value of the entire NFT projects that is being considered, in which the NFT projects may consist of multiple unique NFTs. Finally, we identify a mutual Granger-causal relationship among cryptocurrencies. Notably, the number of investors in the NFT market influences the price of Ethereum. This finding indicates a relationship between the two markets, where developments and activities in the NFT market can potentially shape the dynamics of the cryptocurrency market, primarily through their effects on Ethereum's price.

Our study highlights the presence of herding behavior in both the cryptocurrency and NFT markets, suggesting important strategies for investors and policy implications. For investors, the findings suggest that investors need to be sensitive and cautious especially during major market events such as FOMC meetings and key decisions by institutional investors. Investors should diversify their portfolios to reduce the risks of these periodic herding behaviors, especially in the more volatile cryptocurrency market. As NFTs show relative independence from cryptocurrency market fluctuations, they offer an opportunity for risk hedging and diversification, which could help stabilize portfolios.

From a policy perspective, our findings suggest that regulators should focus on mitigating the effects of herding behavior, particularly in the cryptocurrency market, where it is more prevalent. This could include implementing measures to monitor cryptocurrency exchanges and the substantial electricity fees associated with cryptocurrency mining to increase market transparency. Additionally, introducing policies to reduce the influence of speculative behaviors, such as increasing the value of collateral for NFT transactions to decrease the possibility of flash loans, could be beneficial. Policymakers should also monitor the NFT market's rapid growth and inefficiencies, ensuring that appropriate safeguards are in place to protect investors.

Limitations in our study should be acknowledged. First, the data used in our model are only relevant to the early stages of the rapid development of the cryptocurrency market and the NFT market. As the markets continue to mature and gain prominence, the relationship between them may evolve, and the efficiency of market pricing may improve. Moreover, due to the accessibility of off-chain NFT transactions, our study primarily relies on on-chain data, excluding a portion of the market conducted through private sales or via third-party platforms. These off-chain transactions can be significant and may influence overall market dynamics, particularly when capturing the full extent of herding behavior in the NFT market. Another limitation is the variation in NFT transactions across different blockchain platforms. Our study does not differentiate between NFTs built on various blockchains (e.g., Ethereum, Binance Smart Chain, Solana). Given that the majority of NFTs are built on Ethereum, we focused solely on data from this blockchain, which could potentially introduce biases in analyzing NFT market behavior. Second, we recognize that certain characteristics of NFTs as a unique asset are not fully explored in our research. For instance, the unique nature of NFTs may make them symbolic of social status, as observed when celebrities endorse and promote them on social media, leading to a surge in sales volume driven by influential individual purchasers rather than market dynamics. This characteristic of NFTs is not explicitly considered in our study. Finally, with regards to the issue of wash trading via flash loans, our study does not specifically control for such manipulative practices. Flash loans are used to artificially inflate trading volumes, which can distort market activity and affect price discovery in the NFT market. While our approach focuses on the broader relationship between NFTs and cryptocurrencies, it does not address these market distortions. This limitation presents an avenue for future research. For instance, future research could explore the application of machine learning techniques to identify and filter out wash trading activities.

Moreover, while our study relies on traditional econometric models, incorporating machine learning techniques in future studies could offer additional insights into the complexities of NFT and cryptocurrency markets. Methods like random forest, XGBoost, or neural networks could help in modeling nonlinear relationships, identifying patterns in large datasets, and improving prediction accuracy. This could also allow for real-time monitoring of market trends and herding behavior.

Data availability

The data that support the findings of this study were derived from the following resources available in the public domain: https://www.cryptoslam.io and https://coinmarketcap.com

References

Aharon DY, Demir E (2022) NFTs and asset class spillovers: lessons from the period around the COVID-19 pandemic. Finance Res Lett 47:102515

Amirat A, Alwafi W (2020) Does herding behavior exist in cryptocurrency market? Cogent Econ Finance 8:1735680

Anderson LR, Holt CA (1997) Information cascades in the laboratory. Am Econ Rev 87:846–862

Ante L (2022b) The non-fungible token (NFT) market and its relationship with bitcoin and ethereum. FinTech 1:216–224

Ante L (2023) How Elon Musk’s Twitter activity moves cryptocurrency markets. Technol Forecast Soc Change 186:122112

Ante, L (2022a). Non-fungible token (NFT) markets on the Ethereum blockchain: temporal development, cointegration and interrelations. Econ Innovation N Technol 32:1216–1234 https://doi.org/10.1080/10438599.2022.2119564

Apostu SA, Panait M, Vasa L, Mihaescu C, Dobrowolski Z (2022) NFTs and Cryptocurrencies—the metamorphosis of the economy under the sign of blockchain: a time series approach. Mathematics 10(17):3218

Avery C, Zemsky P (1998) Multidimensional uncertainty and herd behavior in financial markets. Am Econ Rev 88:724–748

Ballis A, Drakos K (2020) Testing for herding in the cryptocurrency market. Finance Res Lett 33:101210

Bao T, Ma M, Wen Y (2022) Herding in the non-fungible token (NFT) market. SSRN Electron J 39:100837 https://doi.org/10.2139/ssrn.4285007

Bikhchandani S, Sharma S (2000) Herd behavior in financial markets. IMF Staff Papers 47:279–310

Bonham C, Gangnes B, Zhou T (2009) Modeling tourism: a fully identified VECM approach. Int J Forecast 25:531–549

Borri N, Liu Y, Tsyvinski A (2022) The economics of non-fungible tokens. SSRN Electron J. https://doi.org/10.2139/ssrn.4052045

Bouri E, Gupta R, Roubaud D (2019) Herding behaviour in cryptocurrencies. Finance Res Lett 29:216–221

Chang EC, Cheng JW, Khorana A (2000) An examination of herd behavior in equity markets: an international perspective. J Bank Finance 24:1651–1679

Chohan UW (2021) Non-fungible tokens: blockchains, scarcity, and value. SSRN Electron J https://doi.org/10.2139/ssrn.3822743

Christie WG, Huang RD (1995) Following the pied piper: do individual returns herd around the market. Financ Anal J 51:31–37

Cipriani M, Guarino A (2014) Herd behavior in financial markets: New evidence. J Political Econ 122(1):27–66

Copeland T (2020) The Bitcoin Halving 2020 Just Happened: Here’s What You Missed. https://decrypt.co/28490/the-bitcoin-halving-2020-just-happened-heres-what-you-missed

Corbet S, McHugh G, Meegan A (2017) The influence of central bank monetary policy announcements on cryptocurrency return volatility. Invest Manag Financ Innovations 14:60–72

Corbet S, Lucey B, Urquhart A, Yarovaya L (2019) Cryptocurrencies as a financial asset: a systematic analysis. Int Rev Financ Anal 62:182–199

Da Gama Silva PVJ, Klotzle MC, Pinto ACF, Gomes LL (2019) Herding behavior and contagion in the cryptocurrency market. J Behav Exp Finance 22:41–50

De Silva EI, Kuruppu GN, Dassanayake S (2024) Time-varying window-based herding detection in the non-fungible token (NFT) marketplace. China Finance Rev Int 14:595–614

Demir E, Gozgor G, Lau CKM, Vigne SA (2018) Does economic policy uncertainty predict the bitcoin returns? an empirical investigation. Finance Res Lett 26:145–149

Dowling M (2022b) Is non-fungible token pricing driven by cryptocurrencies. Finance Res Lett 44:102097

Dowling M (2022a) Fertile LAND: pricing non-fungible tokens. Finance Res Lett 44:102096

Elsayed AH, Hoque ME, Billah M, Alam MK (2024b) Connectedness across meme assets and sectoral markets: determinants and portfolio management. Internat Rev Financ Anal 93:103177

Elsayed AH, Billah M, Goodell JW, Hadhri S (2024a) Examining connections between the fourth industrial revolution and energy markets. Energy Econ 133:107476

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251−276

Fransiska M, Sumani S, Stevanus P (2018) Herding behavior in Indonesian investors. Int Res J Business Stud 11.2:129–143

Galariotis EC, Rong W, Spyrou SI (2015) Herding on fundamental information: a comparative study. J Bank Finance 50:589–598

Hamilton JD (1994) Time series analysis. Princeton University Press, Princeton

Haque MDM, Kumer Paul S, Paul RR, Ekramul Hamid, Md, Fahim S, Islam S (2022) A comprehensive study on ethereum blockchain-based digital marketplace using NFT smart contract infrastructure. 2022 25th international conference on computer and information technology (ICCIT), Cox's Bazar, Bangladesh, pp. 348−353, 2022

Hatemi-J A (2004) Multivariate tests for autocorrelation in the stable and unstable VAR models. Econ Model 21:661–683

Hirshleifer D, Teoh SH (2003) Limited attention, information disclosure, and financial reporting. J Account Econ 36:249–283

Jiang H, Liu C (2011) Forecasting construction demand: a vector error correction model with dummy variables. Construct Manag Econ 29:969–979

Jiang M, Xia Y (2023) What drives the volatility of non-fungible tokens (NFTs): macroeconomic fundamentals or investor attention? Appl Econ Lett 31:1439–1448

Jin C, Tian X (2024) Enhanced safe-haven status of bitcoin: evidence from the silicon valley bank collapse. Finance Res Lett 59:104689

Kampakis S (2022) Non-fungible tokens as an alternative investment – evidence from cryptopunks. J Br Blockchain Assoc 5:1–12

Karim S, Lucey BM, Naeem MA, Uddin GS (2022) Examining the interrelatedness of NFTs, DeFi tokens and cryptocurrencies. Finance Res Lett 47:102696

Keller L (2022) Number of unique NFT buyers soars to all-time high in January. https://forkast.news/number-unique-nft-buyers-soars-high-january/. Accessed 7 Feb 2022

Ko H, Son B, Lee Y, Jang H, Lee J (2022) The economic value of NFT: evidence from a portfolio analysis using mean–variance framework. Finance Res Lett 47:102784

Kong DR, Lin TC (2021) Alternative investments in the fintech era: the risk and return of non-fungible token (NFT). SSRN Electron J. https://doi.org/10.2139/ssrn.3914085

Kurt Gümüş G., Gümüş Y, Çimen A (2019) Herding behaviour in cryptocurrency market: CSSD and CSAD analysis. In: Hacioglu, U (ed) Blockchain economics and financial market innovation, Springer International, 2019

Makarov I, Schoar A (2020) Trading and arbitrage in cryptocurrency markets. J Financial Econ 135:293–319

Mills TC (1998) Recent developments in modelling nonstationary vector autoregressions. J Econ Surv 12:279–312

Mnif E, Mouakhar K, Jarboui A (2023) Energy-conserving cryptocurrency response during the COVID-19 pandemic and amid the Russia–Ukraine conflict. J Risk Finance 24:169–185

Moen, R (2024) NFT market declines in 2023, yet bitcoin and solana NFTs present significant opportunities. https://blockchain.news/analysis/nft-market-declines-in-2023-yet-bitcoin-and-solana-nfts-present-significant-opportunities#google_vignette. Accessed 3 Jan 2023

Ng S-H, Zhuang Z, Toh M-Y, Ong T-S, Teh B-H (2022) Exploring herding behavior in an innovative-oriented stock market: evidence from ChiNext. J Appl Econ 25:523–542

Omane-Adjepong M, Paul Alagidede I, Lyimo AG, Tweneboah G (2021) Herding behaviour in cryptocurrency and emerging financial markets. Cogent Econ Finance 9:1933681

Osivand S, Abolhasani H (2021) Effect of bitcoin and Etherium on non-fungible token (NFT). IOSR J Business Manag 23:49–51

Park IS, Sabourian H (2011) Information cascades with endogenous observation costs. Jf Econ Theory 146:1845–1882

Qiang X (2023) The impact of FED announcements on bitcoin price and on the bitcoin futures-spot spread. https://repositorio.ulisboa.pt/bitstream/10400.5/28175/1/DM-XQ-2023.pdf. Accessed June 2023

Scott Hacker R, Hatemi-J A (2008) Optimal lag-length choice in stable and unstable VAR models under situations of homoscedasticity and ARCH. J Appl Stat 35:601–615

Sharma R (2021) Bitcoin and cryptocurrency’s 2020 turnaround. https://www.investopedia.com/bitcoin-and-cryptocurrencys-2020-turnaround-5094080. Accessed 5 Jan 2021

Stavroyiannis S, Babalos V (2017) Herding, faith-based investments and the global financial crisis: empirical evidence from static and dynamic models. J Behav Finance 18:478–489

Tepper T (2023) Federal funds rate history 1990 to 2023. https://www.forbes.com/advisor/investing/fed-funds-rate-history/. Accessed 18 Sept 2023

Umar Z, Jareño F, de la O González M (2021) The impact of COVID-19-related media coverage on the return and volatility connectedness of cryptocurrencies and fiat currencies. Technol Forecasting Soc Change 172:121025

Umar Z, Alwahedi W, Zaremba A, Vo XV (2022a) Return and volatility connectedness of the non-fungible tokens segments. J Behav Exp Finance 35:100692

Umar Z, Gubareva M, Teplova T, Tran DK (2022b) Covid-19 impact on NFTs and major asset classes interrelations: Insights from the wavelet coherence analysis. Finance Res Lett 47:102725

Umar Z, Polat O, Choi SY, Teplova T (2022c) Dynamic connectedness between non-fungible tokens, decentralized finance, and conventional financial assets in a time-frequency framework. Pacific-Basin Finance J 76:101876

Vidal-Tomás D (2022) The new crypto niche: NFTs, play-to-earn, and metaverse tokens. Finance Res Lett 47:102742

Vidal-Tomás D, Ibáñez AM, Farinós JE (2019) Herding in the cryptocurrency market: CSSD and CSAD approaches. Finance Res Lett 30:181–186

Wang J-N, Lee Y-H, Liu H-C, Hsu Y-T (2023) Dissecting returns of non-fungible tokens (NFTs): evidence from CryptoPunks. N Am J Econ Finance 65:101892

Wilson KB, Karg A, Ghaderi H (2022) Prospecting non-fungible tokens in the digital economy: stakeholders and ecosystem, risk and opportunity. Business Horizons 65:657–670

Xia Y, Li J, Fu Y (2022) Are non-fungible tokens (NFTs) different asset classes? Evidence from quantile connectedness approach. Finance Res Lett 49:103156

Yap G, Allen D (2011) Investigating other leading indicators influencing Australian domestic tourism demand. Math Comput Simulation 81:1365–1374

Yousaf I, Yarovaya L (2022a) Herding behavior in conventional cryptocurrency market, non-fungible tokens, and DeFi assets. Finance Res Lett 50:103299

Yousaf I, Yarovaya L (2022b) Static and dynamic connectedness between NFTs, Defi and other assets: portfolio implication. Glob Finance J 53:100719

Zhang K, Gençay R, Ege Yazgan M (2017) Application of wavelet decomposition in time-series forecasting. Econ Lett 158:41–46

Zhang Z, Sun Q, Ma Y (2022) The hedge and safe haven properties of non-fungible tokens (NFTs): evidence from the nonlinear autoregressive distributed lag (NARDL) model. Finance Res Lett 50:103315

Acknowledgements

This work was supported by Xiamen University Malaysia under Grant XMUMRF/2024-C14/ISEM/0049.

Author information

Authors and Affiliations

Contributions

Conceptualization by Yu and Ng. Data curation by Yu.Methodology, formal analysis and investigation by Yu, Ng and Toh. Main manuscript written by Yu and Ng. Ng and Toh revised and edited the manuscript. Project administration and funding acquisition by Ng. All authors have reviewed, read and agreed to the submitted version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Competing interests

Moau-Yong Toh was a member of the Editorial Board of this journal at the time of acceptance for publication. The manuscript was assessed in line with the journal’s standard editorial processes, including its policy on competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Yu, X., Ng, SH. & Toh, MY. Exploring the herding behavior of investors in the Non-fungible Tokens (NFTs) and cryptocurrency markets. Humanit Soc Sci Commun 12, 1607 (2025). https://doi.org/10.1057/s41599-025-05730-x

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05730-x