Abstract

FinTech innovations offer immense potential for enhancing financial inclusion among vulnerable populations, particularly older adults. Existing research on FinTech adoption in this demographic remains fragmented and limited. Hence, this study presents a detailed understanding on the distribution of the scientific manuscripts across geographies, the primary enablers and barriers influencing FinTech adoption among older adults. The review also attempted to critically integrate thematic content analysis and cluster analysis to identify dominant research themes in its pursuit of enhancing the understanding of FinTech adoption among older adults. A tri-method review approach was used, integrating systematic, bibliometric and content analysis. A total of 204 Scopus-indexed publications from 2001 to 2025 were reviewed using the PRISMA 2020 protocol. The fifty-five most-cited studies were subjected to in-depth content analysis to extract dominant research themes and methodological trends. Most impactful research themes are identified through tree map visualizations and keyword thematic mapping in the literature on FinTech adoption among older adults. Findings show that United States leads in publication output and PLOS ONE emerges as the most influential journal. Five thematic clusters were identified: (1) Digital Financial Inclusion and ICT adoption; (2) Cognitive perspectives on internet use; (3) Healthcare financing and economic challenges; (4) Psychological and organizational dimensions in elder caregiving: health, motivation and crisis responses; (5) Digital finance, social isolation, and financial well-being. Despite growing academic interest since 2021 in the area of FinTech adoption among older adults, studies from developing societies remains limited. The overall findings from this study highlight that socio-economic conditions significantly influence cognitive and technological engagement among older adults, while helping in achieving social and financial inclusion. However, there is need for context-specific policy interventions and inclusive FinTech product designs that cater to underprivileged populations. Further research needs to develop understanding of regional socio-cultural dynamics in FinTech adoption among older adults.

Similar content being viewed by others

Introduction

The FinTech landscape has evolved rapidly in recent years enhancing the security, efficiency and speed of financial transactions (Hazar & Babuşcu, 2023). This evolution has been further accelerated by the COVID-19 pandemic (Tut, 2023), which expedited the transition to digital payments and enhanced global access to formal financial services (World Bank 2022). Although the adoption of digital finance is often associated with developed economies (Kasri et al. 2022), recent studies indicate that digital finance also plays a critical role in fostering economic growth of developing economies (Yaqin & Safuan, 2023). Nevertheless, the progress of digital financial inclusion remains uneven, particularly among vulnerable demographic groups and across diverse global contexts (Ozili, 2024). This uneven progress raises critical questions on impactful applications of FinTech revolution across different socio-demographic and geographic groups (Tan, 2022; Vijayagopal et al., 2024).

Geographical location, race, gender, personal limitations, poverty, education, and age are the main sources of vulnerability (Pérez-Escolar & Canet, 2023). Certain groups including ethnic minorities, older adults, individuals with disabilities, women, children, immigrants, and the homeless, collectively known as the digitally vulnerable, face considerable barriers in accessing digital financial services. To understand this disparity, demographic factors are essential while analysing technological behaviour, particularly in the context of new user adoption (Venkatesh et al. 2003). One of the primary demographic groups which are digitally excluded, is older adults. An earlier research reporting an inverse relationship between age and digital financial inclusion (Ali & Ghiladiyal, 2023). Older adults encounter unique challenges related to physical, cognitive, emotional and socio-demographic characteristics that shape their ability to engage with FinTech solutions (Ge et al., 2025). Hence, it is crucial to gain an understanding of the age-specific barriers and enablers to FinTech adoption in order to inform inclusive digital financial policies (Yang et al., 2025). Given the ongoing advancements in Financial Technology (FinTech) and its potential impact on ensuring financial inclusion, it is imperative to formulate strategies that empower older adults to actively participate in digital finance platforms and benefit from these innovations, thereby preventing digital marginalization (Mei, 2024). Addressing this challenge is not only vital for promoting social equity, but also crucial for achieving the Sustainable Development Goals (SDGs), especially in the context of rapidly ageing societies (UNDP, 2021).

The UN’s most recent estimates indicate that by 2050, the global population aged 65 and above will reach 1.6 billion, comprising about 16% of the projected world population (United Nations, 2023). This significant demographic shift emphasizes the importance of digital inclusion for older adults, driven by advancements in healthcare, lower fertility rates and improved access to education (Chen et al., 2025). The population structure of the ASEAN has exhibited a growing trend. (Thanh Trong et al., 2024). An analysis based on the data from the UN world population prospects (2024) further illustrates a significant demographic shift projecting that the global population aged 65 and above will rise from 830 million in 2024 to 1.7 billion by 2054, with Asia accounting for the majority of this growth, while African nations will observe a faster rise than that of Europe, underscoring region-specific aging dynamics and associated policy challenges (Our World Data 2024). These statistics highlights the urgency of developing financial ecosystems, especially in societies with nascent technological penetration, that can effectively accommodate the needs of ageing populations (International Telecommunication Union, 2022; Bui & Luong, 2023).

Older adults represent a distinct demographic with specific needs and exhibit unique behavioural patterns in their acceptance of technology compared to other user groups. Their adoption of advanced technologies is influenced by cognitive abilities, as well as differences in attitudes, perceptions and motivations (Chen & Chan, 2011). In many societies, financial inclusivity among older adults has remained an area of concern. Technology adoption challenges may further exacerbate financial exclusion for this demographic within the evolving FinTech environment (Msweli & Mawela, 2021). These challenges highlight the need for a deeper, global, and research-based understanding of how older adults interact with technology, while managing their sensitive financial resources (Dai & McGrenere, 2025).

While previous research has examined FinTech adoption across generational cohorts and countries, studies specifically focusing on older adults remain limited. A background review suggests that most research studying adoption of digital finance have been concentrating mainly on developed economies with higher technology adoption and awareness, and larger share of older population. Despite a growing interest in understanding older adults’ interaction with FinTech, existing literature remains fragmented across conceptual, contextual, methodological, and geographical dimensions of its drivers and barriers. Older adults may be characteristically similar; yet the behavioural attributes of technology adoption may considerably vary across socio-demographic differences.

Therefore, this study aims to generate a comprehensive understanding on FinTech adoption among older adults, identifying key influencing factors, barriers, trends, and future research directions by employing a triangulated methodological (tri-method) approach based on studies published during the twenty-first century. The tri-method approach integrates systematic literature review (SLR), bibliometric analysis and content analysis of most influential papers with a mix of seminal manuscripts and recent observations. This multifaceted approach not only traces the research trends but also enables thematic mapping and cluster analysis that reveal underlying intellectual structures and emergent themes. By analysing highly cited publications, the study uncovers research gaps and deepens understanding of older adults’ engagement with digital financial tools, offering critical insights for future research. By triangulating these three review methods, this study offers a strategic roadmap for researchers, practitioners, and policymakers seeking to enhance financial inclusion among older adults in the digital era.

To guide this investigation, this study is framed by following research questions:

RQ1. What are the primary enablers and barriers influencing FinTech adoption among older adults?

RQ2. How has scientific output evolved over time in the field of FinTech adoption among older adults, and which countries and publication sources have contributed most prominently?

RQ3. What dominant research themes are revealed through tree map visualizations and keyword thematic mapping in the literature on FinTech adoption among older adults?

RQ4. How does the integration of thematic content analysis and cluster analysis enhance the understanding of FinTech adoption among older adults?

The structure of the paper is organized as follows: Section “Methodology and materials” describes the research methodology and materials used for this study; Section “Analysis and results” provides a synthesis of the systematic literature review and presents the results of both bibliometric and content analyses; Section “Discussion and conclusion” synthesizes the main findings in the form of a discussion and conclusion; Section “Theoretical implications” outlines the theoretical implications derived from the review findings; Section “Research implications” discusses the broader research implications; and Section “Managerial and policy implications” elaborates on the managerial and policy implications arising from the study. Finally, Section “Limitations and future recommendations” addresses the study’s limitations. Figure 1 provides a simple overview of the three key stages used in our review process.

Methodology and materials

Rationale for the Tri-method review design

In order to achieve a holistic overview based on observations obtained from different perspectives of a thorough literature review, our effort adopted the tri-method review approach, combining a Systematic Literature Review (SLR), bibliometric analysis, and citation-based content analysis. A rigorous process of SLR systematically synthesizes the body of knowledge around a specific research topic, identifies the research gaps or conflicting observations, builds thorough methodological understanding, and helps to develop conceptual insights and theoretical frameworks in a transparent and reproducible manner. In addition, a bibliometric analysis maps the publication and citation trends and patterns, thematic clusters, and intellectual structures. Finally, the citation-based content analysis interprets the findings from the most influential publications to extract meanings and theories, and highlighting dominant themes, methodologies, and research gaps.

Recognising the fact that variety of factors may act as barriers and enablers towards FinTech adoption among older adults, a Systematic Literature Review (SLR) is conducted to identify, screen, and synthesize relevant studies using PRISMA- based protocol. Following the PRISMA 2020 guidelines, the systematic literature review (SLR), employed a systematic, structured and transparent approach to identify relevant publications from the Scopus database. This component primarily focused on identifying the key enablers and barriers and culminated in the development of conceptual framework. It provides a detail of convergence of ideas, and the existing gaps regarding only barriers and enablers of FinTech adoption among the population of interest, guiding to further research areas.

Complementing this, bibliometric analysis served as a powerful tool for examining metadata patterns and provides a descriptive understanding of annual trends in scientific output, country-wise publication distribution, source relevance, keyword dynamics and thematic clustering. This approach enabled us to evaluate scientific output across various dimensions e.g., articles, authors, keywords, journals, and countries and to trace the evolution of a field’s intellectual, social, and conceptual evolution of the field through the relationships and interactions among these elements over time (Donthu et al. 2021). Thematic clustering, which helps to transit the character of the analysis from descriptive to a critical assessment, has also been formed by this bibliometric analysis.

Finally, a citation-based content analysis was conducted on a focused subset of most-cited articles within this dataset. These articles were selected not solely based on their citation counts, but also for their thematic alignment with the study’s objectives. This analysis offered a critical understanding to identify the dominant research themes, methodologies and further scopes that are revealed by the most influential articles in the field. The purpose of the SLR and content analysis is to ensure analytical precision.

Literature search strategy and article selection process

The systematic literature review is conducted in three stages. First, relevant articles are gathered using a comprehensive set of keywords within the scholarly database, Scopus covering a period of 25 years, specifically from January 1st, 2001 to March 27th, 2025. The keywords were selected through iterative refinement, drawing from preliminary searches from broad literature scanning. The authors identified the keywords independently, and later cross-validated with each other to ensure comprehensive and thematically relevant coverage of the literature. The selected database was chosen because of its extensive coverage (Joshi, 2016) as well as robust search functionality, and streamlined access for extracting scholarly data for bibliometric study (Alshater et al., 2021).

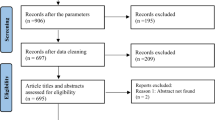

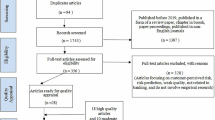

The literature search was conducted in the Scopus database using a set of Boolean operators and combining key concepts of financial technology and older adults. The search terms were limited to the “title, abstract, and keywords” fields. The search and screening process is illustrated in Fig. 2, which also presents specific search strings. Results from all three queries were downloaded as CSV files, merged and duplicates were removed before applying the inclusion and exclusion criteria during the screening process. We included only those articles that are published between January 1st, 2001 to March 27th, 2025 under the subject areas Economics, Social Sciences, Business Management & Accounting, Econometrics & Finance, Arts & Humanities, Multidisciplinary, and Decision Sciences. Exclusion criteria removed articles published before 2001, non-English papers, duplicates, and manuscripts that are not published in peer-reviewed SCOPUS indexed journals (excluding conference papers, book chapters, books, reviews, and editorials). The complete selection process is illustrated in Fig. 3.

After initial screening, 204 documents were retrieved from the database for the timespan 2001–2025, consisting solely of articles. Second, bibliometric analysis is performed using software tools such as VOSviewer and Biblioshiny. Minimum number of documents published from a country is 5 and minimum number of citations of a country has been set at zero as the thresholds for publications from a country. Out of 61 publishing countries, 10 met the threshold. However, for keyword occurrence analysis, minimum number of occurrences of a keyword has been set at 5, and out of 1546 keywords, 77 met the threshold. For the publication source based analysis, there should be at least two manuscripts published in a scientific journal, while citation was not considered to be mandatory for our analysis. Out of 153 journal sources, 25 met the threshold.

Finally, an in-depth examination is conducted through a content analysis of the 55 most influential articles. These were selected primarily based on their citation counts as indexed in Scopus. A careful consideration was applied to eliminate bias against recent publications. Citation counts for each article have been mentioned in Table 4. In addition, articles were also screened for thematic alignment with the study’s objectives through a TCM- ADO framework (Theory–Context–Method; Antecedents–Decisions–Outcomes) (Please refer to Table 4).

The review spans the period from 2001 to 2025, a timeframe selected to capture the emergence and evolution of digital financial technologies in the post millennium era. The early 2000 marked a pivotal point in the global expansion of internet and mobile infrastructures, which laid the ground work for the rapid growth of FinTech innovations, including online banking, mobile payments and AI driven financial services. This period also aligns with significant shifts in financial regulation especially after 2008 crisis, digital inclusion policies and demographic aging. By including publications up to 2025 ensures the review incorporates the most current developments in this rapidly evolving field.

Table 1 maps the research questions with the methods adopted while addressing them and the tabular and visual representations portraying their results.

Review process

The four-stage review process undertaken to systematically curate the data is depicted by Fig. 2.

Figure 3 illustrates the PRISMA 2020 protocol employed for data curation, and the number of manuscripts identified and screened at different stages, following clearly defined inclusion and exclusion criteria. According to Page et al. (2021) PRISMA utilizes a systematic approach and a comprehensive checklist guided by inclusion and exclusion criteria which enhances the quality and rigour of bibliometric analysis. The PRISMA statement aims to assist authors in improving the quality and transparency of reporting in systematic reviews and meta- analyses. The inclusion criteria specify which studies should be incorporated into the review, while the exclusion criteria outline the factors that make a study ineligible.

Analysis and results

Synthesis of the systematic literature review

Financial inclusion and the digital divide among older adults

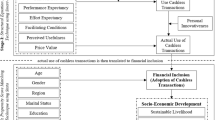

Technological factors such as facilitating conditions, performance expectancy and effort expectancy have consistently emerged as key enablers of intention and use (Venkatesh et al., 2012). Despite the immense potential of communication technologies and advanced internet services, older adults continue to be marginalized in the digital financial ecosystem (Ge et al., 2025). FinTech presents a promising solution to bridge this gap by delivering cutting-edge, user-friendly, and accessible FinTech solutions (Roh et al., 2024, Noreen et al., 2022). However, even with the rising ownership of technology among this demographic, their engagement with the digital financial services remains limited (Choi et al., 2024). This suggests that beyond access, psychological, cognitive, and social enablers must be considered to understand actual usage (Zaid et al., 2023). To better understand this limited participation, it is crucial to examine the specific underlying drivers and barriers that influence FinTech adoption among older adults (Tomczyk et al., 2023).

Operational definitions

‘Older adults’ are defined as individuals aged 60 years or older, in accordance with the UNHCR emergency handbook (UNHCR, 2025). However, we acknowledge that this demographic is not homogenous (Tomczyk et al., 2023). ‘FinTech’ as an umbrella term, refers to technology- driven financial services and platforms designed to enhance user experience by offering more user-friendly, transparent, efficient, and automated solutions for managing, accessing or transacting financial products (Dorfleitner et al., 2017).

Key drivers of FinTech adoption among the older population

Extant literature has explored the factors that affect FinTech adoption among older population. For instance, according to Arenas-Gaitán et al. (2015), the acceptance of internet banking among older adults is strongly influenced by performance expectancy, effort expectancy and price value. Their study concluded that older people’s actual behaviour is shaped by both behavioural intentions and habits. In this context, Graf-Vlachy and Buhtz, (2017) found that older adults’ FinTech adoption is significantly determined by the amount of time they spend using digital technologies, their digital experience and exposure. This aligns with the personal-cognitive domain, especially digital literacy and self-efficacy (Czaja et al., 2006; Jena & Paltasingh, 2025). Similarly, another study highlights that older adult’s positive attitudes toward mobile payment enhances their intention to use these technologies. This study found that perceived usefulness (PU), perceived ease of use (PEOU) and observability positively shape attitudes towards mobile payments (Yang et al., 2023).

Furthermore, Lee and Coughlin, (2015) identified ten core determinants for older adults’ adoption of technology. These includes usability, value, accessibility, affordability, social support, technical support, independence, emotion, confidence and experience. Many of these map directly to constructs such as hedonic motivation, trust, and attitude, categorized in the social and psychological factors of the conceptual model (Li & Kostka, 2024; Weck & Afanassieva, 2023). Adding to this, a study conducted in the United States by Wang and Pradhan, (2020) revealed that trust plays a significant role in influencing older adults’ willingness to use robo-advisors for their personal finances. Notably, trust operates both as a driver and, when absent, a barrier—this duality is acknowledged in our conceptual framework (Mei, 2024). While these factors explain adoption motivators, several barriers still hinder the actual usage of digital financial services among the older population.

Barriers to the adoption of digital financial technology among older adults

It is often claimed that human considerations are not adequately incorporated into product design and services. Even though older adults frequently lack awareness or knowledge of existing ICTs and related assistive technologies (Heinz et al., 2013, Kramer, 2014) there remains limited focus on innovative solutions to overcome barriers for this population (Wang & Pradhan, 2020). Moreover, older adults are typically conservative, cautious, sceptical, and risk-averse in adopting innovations, often preferring to observe their success among peers before engaging. Additional barriers identified within this cohort include cognitive, physical, attitudinal and socio-economic challenges (Wu et al., 2015). Key psychological and emotional barriers such as anxiety, security concerns, and perceived risk are consistently cited in the literature (Dizon & Ebardo, 2025).

This systematic review on barriers and enablers bring technological enablers alongside personal-cognitive factors in ensuring effective adoption of FinTech among older adults. However, the infrastructural differences and individual-level heterogeneity varies across countries, that may lead to diverse adoption and impact of digital finance among older adults. These findings necessitate development of a descriptive understanding of emerging trends of research manuscripts. The following section based on the bibliometric analysis demonstrate a temporal, geographical and academic source-based pattern of the research manuscripts.

Bibliometric analysis of scientific output and publication sources

Trend in annual scientific production of manuscripts

Figure 4 represents the trend in annual scientific production, showing the number of articles published each year. Prior to 2012, research on financial inclusion was limited (Allen et al., 2012), with foundational studies focusing more on access to health services rather than financial technology for older adults (Heart & Kalderon, 2013). Scholarly attention to senior citizen’s financial inclusion was hindered by digital gap (Yang et al., 2025). Research expanded during the second decade of twenty-first century, driven by the G-20 summit in Pittsburgh held in the year of 2009, highlighted universal financial access by 2020 with specific focus on policy-oriented studies. Although early studies did not emphasise older adults, they gradually began to highlight the distinct financial and technological challenges faced by this demographic. The growth between 2010-2019, was driven by factors such as rapid digitalization, mobile banking, and targeted financial literacy efforts for older adults. Research on FinTech adoption among older adults has increased, with 141 publications examining post-pandemic digital transformation and the usability of older population friendly banking between 2021 and 2025. Although financial inclusion policies after 2006 laid the groundwork for the research, older adults received limited attention until 2015 (Arun & Kamath, 2015). Since 2016, there has been a rising recognition of older peoples’ digital challenges and their limited FinTech footprints (Jena & Paltasingh, 2025). COVID-19 became a turning point (Sixsmith et al., 2022), shifting focus to digital banking access as a key priority (Vilhena & Navas, 2023). Research from 2021 to 2025 reflects a growing interdisciplinary focus on financial literacy, FinTech usability, and digital security challenges for older adults (Gumilar et al., 2024).

To quantify these patterns, a bi-variate linear regression model representing the changes in number of publications (y) over the years (x) is stated in equation-1.

In this case, the time variable accounts for about 54% of the observed variation, and the positive slope of the regression line (1.3983 with p < 0.05) highlights a long-term growth trajectory in annual publications, However, the moderate R2 value also indicates that a simple linear model does not fully capture the recent acceleration in scholarly output. To provide a clearer understanding on this regard, Fig. 4 demonstrates the change in the slope of the number of publications pre-COVID period (b = 0.374, R2 = 0.566) and post-COVID period (b = 10.2, R2 = 0.96). An interrupted time-series (ITS) analysis demonstrates that the gradient change (9.826 with Standard Error=0.725) in publications before and after 2020 has been statistically significant at p < 0.05.

Country-wise analysis of publication volume and citation impact

The country-wise analysis of publication volume and citation impact are presented in Table 2. The first panel presents the results obtained by VOSviewer from the analysis of 204 Scopus manuscripts, while the second panel shows the country-wise presentation based on the analysis of top 55 cited manuscripts obtained from Scopus database. The United States and China lead the list of the countries as the most productive ones, followed by United Kingdom and Australia. India, being the largest democracy and showing a rapid increase in older population, it is important to note the rise of studies in India, which can develop understanding for the emerging economies across the globe.

Most relevant sources

Figure 5 displays the top ten journals based on citations counts. The threshold was set at a minimum of one document and 100 citations per source. PLOS ONE emerges as the most significant source, with 8 documents, highlighting its prominence in contributing to the research domain. JMIR Aging stands out as the second-most relevant source, with 6 documents, followed by Educational Gerontology with 5 published documents, reflecting its relevance to studies on ageing and technology. Other significant contributors include Canadian Journal on Aging, Innovation in Aging, and Technology in Society, each contributing 4 documents.

Tree map of 50 prominent themes with paper counts and percentage

Figure 6 visualizes 50 prominent research themes displaying the number of manuscripts and relative percentage. A tree map was employed to analyse the primary topics based on the number of papers published. The topics discussed the most were aged (n = 81 manuscripts, 10%), followed by female (n = 62 manuscripts, 7%), male (n = 60 manuscripts, 7%), Human (n = 55 manuscripts, 6%), Humans (n = 44 manuscripts, 5%), adult (n = 42 manuscripts, 5%), middle-aged (n = 42 manuscripts, 5%).

Rationale for using both Bibliometric thematic mapping and keyword cluster analysis

We utilized bibliometric thematic mapping and keyword clustering with VOSviewer as part of the triangulation process to enhance rigour, validity, and richness to our bibliometric analysis through methodological triangulation. VOSviewer makes use of network visualization and clustering based on modularity to expose the structural relationships qualitatively, existing between research topics as addressed within extent literature. At the same time, Bibliometrix presents a broad depiction of the keywords, mapping themes based on the scale of centrality and density; thus classifying the constructs into core, niche, emerging, or underdeveloped areas (Arruda et al.; 2022).

Keyword thematic map

In this section, detailed analysis was made on the topics that researchers have given significance to, or they have focused their research in recent years. The primary research themes and topics within a given field can be found using the keyword thematic map. It makes it possible to quickly review the most popular study topics and the way keywords are distributed among various thematic clusters. Figure 7 presents a thematic map that categorizes key themes based on their relevance and development within the research field. The keywords in this visualization ‘daily lives, electronic money, global system for mobile communications, mobile payment, banking, commerce, key factors, mobile banking, well-being, transportation planning, accessibility, aging societies’ are niche themes with low centrality and high density, indicating they are well- researched but hold limited significance in the study area. Whereas, the keywords namely, ‘behavioural research, decision making, economic development, elderly population, older adults, aging populations, information and communication technology, technology adoption’ represent a fundamental theme with low density and high centrality and are considered as important but remains underdeveloped within the research field. The group of keywords including ‘banking, financial systems, financial services’ evolved from emerging/declining themes to basic themes. The upper-right quadrant represents motor themes characterized by high density and centrality indicating that they are both well- researched and important. The keywords belong to this quadrant are ‘human, aged, humans, health care delivery, economics, income, COVID-19, pandemic, and health services’. Themes appearing in the lower- left quadrant are either emerging or declining with low centrality and density and are regarded as under-developed with limited significance. The set of keywords enveloping ‘banking, financial systems and financial services’ evolved from emerging/declining themes to basic themes.

Sensitivity analyses of bibliometric parameters

A minimum of five keyword occurrences was set as a threshold for thematic cluster analysis. In order to identify relevant sources, we set an eligibility criterion of at least one document and 100 citations per source. The network construction employed the association strength normalization technique, which is commonly used in bibliometric mapping to make items comparable. To test the stability of our results, we also varied the keyword thresholds (minimum = 3, 5 and 7 occurrences). The major keywords obtained from the five occurrences threshold criterion, such as ‘humans’, ‘aged’, ‘very elderly’, ‘aged 80 and over’, ‘older adults’, ‘ageing’, were consistently reproduced when we applied a lower (3) and a higher (7) occurrence thresholds. For three occurrences, 178 met the threshold out of 1546 keywords, and for seven, 45 keywords met the threshold. We similarly tested different source relevance thresholds considering 80, 100, and 120 citations, and alternative ways of normalizing the other metrics. The thematic clusters, leading sources, and country contributions remained largely the same across the two variations. These sensitivity analyses thus confirm the robustness of our bibliometric results.

Thematic cluster analysis

Despite the fact that Bibliometrix offers thirteen thematic cluster, and VOSviewer depicts five clusters, the in-depth thematic cluster analysis is done based on five clusters only. The patterns of networks connecting the keywords provide a better logical understanding on the dynamics of ongoing research. A minimum threshold of five keyword occurrences was applied. Figure 8 displays the keyword co-occurrence network, highlighting dominant research theme. The cluster analysis, presented in Table 3, demonstrating five distinct research clusters. The analysis has been conducted using VOSviewer with robust empirical referencing, and maps evolving intersections of digital financial inclusion, cognitive engagement, healthcare financing, caregiving psychology, and social well-being among older adults. Each cluster highlights a distinct yet interconnected area, illustrating the multidimensional nature of aging in an increasingly digital and socio-economically evolving environment.

Cluster 1: digital financial inclusion and ICT adoption

Cluster 1, represented by the colour red, captures the intricate relationship between digital financial inclusion, aging populations, and ICT adoption, with a strong geographical focus on India and China. Central keywords such as ‘Digital Inclusion, Older Adults, Financial Inclusion, ICT, and Mobile Banking’ indicate that research in this area primarily explores accessibility challenges, behavioural adoption patterns, and financial decision-making processes among older populations.

Recent empirical work by Jin and Fan (2022) underscores the significance of understanding older adults banking experiences in China to enhance accessibility of new digital banking platforms. In a complementary context, a study conducted in Taiwan found that attitude and behavioural intentions significantly influence mobile payment adoption among the older adults (Yang et al. 2023). Arenas-Gaitán et al. (2015) emphasized that enhancing older adult’s financial decision making necessitates improvements in web design, highlighting usability and aesthetic appeal as key facilitators of informed, confident choices in digital environments.

The results also reveal the presence of digital divide and variations in perception, where factors such as trust, financial literacy, and usability are particularly crucial for the uptake of FinTech products. Prior research highlights that the digital divide among older adults in China stems from low basic digital literacy, limited socio-economic resources, personal constraints, and privacy concerns. However, self-learning, intergenerational support and targeted digital training are found to be significantly improving older adults comfort levels with digital technologies (Xu, 2023).

Furthermore, the presence of Decision-Making and Behavioural Research keywords within this cluster highlights the significance of habit formation, risk perception and social influence in shaping older generations’ digital financial behaviours. Mei (2024) observes that older adults’ engagement with mobile banking platforms is notably shaped by peer interactions and word of mouth communication, which collectively influence their perceptions and willingness to adopt such technologies. Additionally, Arenas-Gaitán et al. (2015) demonstrates that behaviour intention and habit had an impact on the actual internet banking usage pattern. Trust emerges as a critical determinant of mobile payment utility and usability, exerting a substantial influence on behavioural intention to adopt such technologies (Yang et al. 2023). However, as Yang et al. (2023) further note, trust in the functionality and benefits of mobile payments tends to decline with heightened perceived risk. Moreover, the presence of keywords such as COVID-19, Health Services, and Sustainability within this cluster reflects increasing scholarly interest in how the pandemic accelerated mobile payment and digital banking adoption – especially for healthcare-related transactions. Empirical evidence suggests that older adults received increased support and encouragement to use digital payment methods in the context of the COVID-19 pandemic (Zhu et al. 2024). Notably, several studies within this cluster points to practical interventions such as structured digital literacy programmes, intergenerational interaction and individualized training as effective means to bridge the digital divide and empower older adults (Lee & Kim, 2019; Putrie, 2025).

Cluster 2: cognitive perspectives on internet use

As indicated in the VOSviewer analysis (green cluster), this thematic group emphasizes the cognitive, psychological, and social aspects of internet use among adults and older populations. A study conducted among Chinese adults found a strong positive correlation between internet use and cognitive function, suggesting that digital engagement can serve as a protective factor against cognitive decline (Jiao et al., 2025). Prominent keywords such as Cognition, Internet Use, and Social Support highlight the scholarly focus on the interplay between cognitive function, social relationships, and digital participation. A study by Wu et al. (2019) demonstrates that regular digital device usage is positively correlated with cognitive abilities. Older adults who did not use digital device daily exhibited lower cognitive skills compared to daily users. Similarly, Wang and Chen (2024) highlight that internet use among older adults significantly enhances social involvement, promoting both physical and mental well-being through stronger social networks.

Based on the research questions, researchers have employed diverse methods to understand the behavioural patterns and underlying factors associated with digital engagement in older age. The frequent appearance of terms such as Interviews, Qualitative Research, and Article, indicates a strong reliance on empirical, human-centred designs to explore behavioural trends and barriers to digital adoption. For instance, Jin and Fan (2022) provided a qualitative analysis of older adults’ use of physical and digital banking platforms in rapidly developing technological environments. Complementing these approaches, the presence of keywords such as Human Experiment, Major Clinical Study, and Controlled Study suggests that some research adopts rigorous experimental or intervention-based methodologies to evaluate cognitive outcomes, such as memory retention, attention, or executive functioning, that are associated with internet use among older adults.

Demographic terms such as Male, Female, Adult, Aged, and Age suggest a comparative research orientation, focusing on variations in digital literacy and behaviour across age groups and gender lines. According to Wu et al., (2019), the impact of age on financial behaviour and decision making remains a critical area of contemporary research. These demographic insights also have broader implications for technology adoption, particularly in FinTech. Compared to older adults, younger consumers typically exhibit greater interest and willingness to adopt FinTech. Supporting this trend, a study conducted in India regarding the e-banking adoption behaviour confirms that, except for marital status, all other demographic variables such as gender, age, monthly family income, educational qualification and internet usage experience had a significant influence (Chauhan et al., 2016). Further highlighting the demographic divide, a study in Indonesia shows that among the older demographic, the gender gap in digital literacy is noticeable, with men being more digitally literate than women (Long et al., 2023).

Finally, Social Support emerges as a critical enabler, illustrating how external networks—such as family, caregivers, and peer communities—shape the digital inclusion and internet accessibility of the ageing population. According to a study conducted in China found that cognitive ability, family support, activities of daily living, social capital, perceived importance, perceived risk appetite positively affected Internet usage among older adults (Shi et al., 2023). These insights collectively highlight the significance of both individual and environmental factors in shaping digital participation among older adults.

Cluster 3: healthcare financing and economic challenges

The colour blue represents Cluster 3. This cluster centres on the economic and financial aspects of healthcare delivery across various age groups, with particular emphasis on middle-aged and extremely older populations (those aged 80 +). According to a study by Sahoo et al. (2021), to achieve equitable healthcare delivery for the older adults in India, focused health finance policies must acknowledge the social, economic and medical determinants of health service utilization and healthcare costs. This cluster examines the financial burden of healthcare services, economic decision-making in medical treatment, and the sustainability of healthcare systems in ageing societies, as indicated by key terms such as health care delivery, health care cost, and financial management. Addressing the challenges faced by the older demographic, requires policymakers, households, governments, and other stakeholders to design a comprehensive health finance plan and demonstrate a commitment to achieving universal health coverage as part of SDG goal 2030 (Panda & Mohanty, 2022).

Cohort analysis within this cluster indicates a methodological emphasis on longitudinal studies tracking healthcare expenditure, utilisation trends, and financial planning across different age groups. According to a cross-sectional study in Sweden by Fledsberg et al. (2023), health care costs increase with age; however, the relationship between age and spending varies by gender and socio-economic categories. The presence of terms such as Clinical Article and Economics reflects the intersection of healthcare policies, economic constraints, and clinical outcomes, suggesting that studies in this cluster analyse how financial factors influence healthcare access and decision-making, particularly among older adults. A study by Glover et al. (2024) among older black adults found that a higher level of health and financial literacy acts as a driver of improved decision making.

The inclusion of adolescents alongside middle-aged and very older individuals suggests a comparative approach, exploring intergenerational differences in healthcare consumption, financial dependency and economic preparedness. As per Cecconi et al. (2025), medical requirements and health care usage vary across generations, with the silent generation uses healthcare more extensively than younger generations. This cluster underscores the pressing need to address escalating healthcare costs and develop viable financial strategies to support aging populations. It offers rich and valuable insights for policymakers, healthcare professionals, and financial advisers striving to optimise economic efficiency in health service delivery. These insights strongly support the design of inclusive healthcare financing models that complement with global policy frameworks such as Universal Health Coverage and SDG 3 (Good Health and Well-being), thereby ensuring equitable access to care for aging populations. Attaining financial inclusivity by innovation of older adult friendly FinTech products will help to achieve SDG 9 which advocates industry, innovation and infrastructure. At the same time, higher adoption of FinTech for the older adults from all spheres of life and across geographies will ensure achieving SDG 10 promoting reduction in inequalities in accessing resources.

In many developing economies healthcare financing has remained catastrophic and pose a serious concern, which can be addressed by proper digital finance mechanisms. Future studies should prioritise these regions to suggest evidenced-based inclusive health policies and interventions. Moreover, future research would also benefit from interdisciplinary integration, especially the application of behavioural economics to further enhance financial decision-making and gerontechnology to evaluate tech-driven healthcare solutions tailored for older adults.

Cluster 4: psychological and organizational dimensions in elder caregiving: health, motivation, and crisis responses

Cluster 4, represented in yellow, explores the intersection of psychology, caregiving practices, motivation, organizational management and health promotion within the context of the COVID -19 pandemic in the United States. COVID-19 radically altered the already vulnerable caregiving environment in the US; highlighting the critical need for systemic changes. This cluster emphasizes the psychological impacts on caregivers, including heightened stress, burnout, resilience and motivational dynamics, while emphasizing the crucial role of family support in both informal and professional caregiving. These results align with evidence suggesting that care givers experiencing care disruptions exhibited higher levels of anxiety, loneliness and depressive symptoms (Truskinovsky et al., 2022). The pandemic has significantly transformed caregiving practices, intensified emotional and physical burdens and hastened the adoption of telehealth and digital health solutions. Ensuring that older adults have access to appropriate technology can significantly reduce disparities in healthcare utilization and promote more equitable access to healthcare services across various age and income groups (Choi et al., 2022).

The organizational and management aspects are central to exploring policy interventions, institutional support systems, and workforce challenges that influence caregiver well-being and patient outcomes. A study by Norful et al. (2024) found that the well-being of healthcare assistants was strongly predicted by increased organizational support and a positive workplace culture. Moreover, health promotion initiatives aimed at caregivers play a crucial role in strengthening their resilience, mental well-being and overall caregiving efficiency. Findings from a review by Khiewchaum and Chase (2021) suggest that interventions such as psychoeducation, can improve caregiver well-being and health. The findings from this cluster offer valuable insights for policy decisions and strategies aimed at improving caregiving sustainability and economic efficiency within healthcare systems.

Technology should promote social networks in tandem with strong institutional frameworks, that are customised for specific community structure and conducive for older adults.

Cluster 5: digital finance, social isolation, and financial well-being

In the context of digital technology adoption, Cluster 5, symbolised by violet, explores the connection between digital financial inclusion, aging, economic factors, and social well-being. This cluster’s primary focus is on older adults’ interaction with digital financial services and the barriers they encounter. The rise of Digital Technology and Digital Inclusive Finance reflects an emphasis on technological advancements to bridge financial gaps for older individuals, particularly through mobile banking, online payment systems, and digital financial literacy initiatives.

Digital Inclusive Finance fosters an accessible, user-friendly and inclusive financial environment for the older generation by lowering barriers to financial service access, addressing personalized financial needs, enhancing financial literacy and promoting innovation in FinTech products. This, in turn, effectively stimulates their consumption potential (Fan et al., 2024). Income emerges as a key determinant, since financial disparities significantly influence access to and use of FinTech solutions. A study by Wang and Mao (2023) found that by eliminating credit restrictions and increasing family income, digital inclusive finance can mitigate the financial vulnerability of aging families. Affordability concerns, shortage of digital skills and technological scepticism further exacerbate exclusion risks among lower income older adults. Income inequality, particularly in developing countries, is identified as a major cause of the digital divide within the older demographic (Mubarak & Suomi, 2022).

Moreover, Social Isolation introduces a critical socio-psychological dimension; older adults with limited social interactions are less likely to interact with FinTech solutions, thereby heightening financial marginalization and economic vulnerability. Evidence suggests that social interactions can significantly boost technological engagement among the older people (Mei, 2024).

To promote equitable financial participation among older adults, this cluster emphasizes the need for tailored interventions, including community-based financial education, digital literacy programmes, and the development of user-friendly FinTech solutions. These insights are highly valuable for financial institutions, policymakers and technology developers aiming to enhance digital financial inclusivity and bridge digital divide among the older population.

Content analysis

Structured content analysis of highly cited articles using the TCM-ADO framework

Table 4 presents a content analysis of the top 55 publications ranked by citation count, highlighting the most influential studies. To provide an analytical depth, the TCM- ADO framework (Theory–Context–Method; Antecedents–Decisions–Outcomes) has been applied, presenting a structured synthesis of each study’s core theoretical base, research context, methodological design, key variables examined, and major findings.

Distribution of research methods, data analysis techniques, and thematic focus among the top fifty cited papers

Analysis of the research methods

An analysis of top 55 articles reveals interesting trends in the research methodologies employed. It is found that 55% (30 studies) employed a quantitative method, 24% (13 studies) adopts a qualitative approach, 13% (7 studies) follows a Systematic Literature Review approach, while 5% (3 studies) of the studies accounted for mixed method approach.

Type of data analysis

The data analysis techniques adopted by the top 55 articles demonstrate a diverse methodological landscape. The most frequently used methods include Qualitative Data Analysis (31%), Structural Equation Modelling (SEM) (18%), Quantitative and Econometric Modelling Techniques (16%), Systematic Review Methods (13%), and Survey Method (11%).

Thematic focus, derivation, and reliability

Themes were derived using a structured content analysis, guided by the TCM–ADO framework. The framework is designed to guide the criticality of the analysis and ensure that the resulting themes are conceptually robust and connected to established scholarly dimensions. The process was primarily inductive, involved a detailed reading and interpretation of the texts in order to establish dominant themes. To enhance the results reliability, two researchers independently classified the studies into themes, and all discrepancies were resolved by achieving a consensus. This approach, integrated within our tri-method design (systematic review, bibliometric analysis, and structured content analysis), strengthens transparency and replicability of the critical observations obtained from the review. Definitions of the category are provided in Appendix C.

Figure 9 illustrates the distribution of research methods, data analysis techniques and thematic focus among the top 55 cited papers, offering insights into the methodological and topical trends in the existing literature. Exploration of the key themes and research topics of the most impactful articles on the FinTech adoption among older adults, highlight nine main research areas categorized into percentage groups. The thematic distribution is as follows: 18% (10 studies) focus on ‘Digital Inclusion, Literacy and Technology Acceptance’, while ‘Emerging Technologies and Health Tech for older adults’ and ‘Mobile and Digital Banking Adoption’ each account for 16% (9 studies) followed by ‘Healthcare, Aging and Well-being’ at 15% (8 studies). Themes related to ‘Digital Economy and Economic Inclusion’ and ‘Digital Financial Ecosystem and Policy Implications’ represent 11% (6 studies) and 9% (5 studies) of the studies considered for the content analysis. Further, Financial Services and Payment Technologies comprise 7% (4 studies), while Risk Management and Safety make up 5% (3 studies), and Cross-Cultural and Transnational Perspectives account for 4% (2 studies).

Discussion and conclusion

This study presents a comprehensive understanding of FinTech adoption among older adults across the globe using a novel tri-methodological synthesis, which integrates a systematic literature review, bibliometric analysis, and content analysis. By aligning macro-level bibliometric trends with thematic insights, this review offers a robust framework for examining the intersection of aging, technology, financial behaviour and socio-cultural attributes.

While summarizing the observations based on RQ1, one can observe that the socio-cultural variations across societies diversely influence technology adoption and financial inclusion. This variation arises because technology use among older adults is influenced by a combination of personal attributes and contextual factors, including cognitive and emotional aspects, demographic traits, and their technological and social surroundings (Chan et al., 2023). While existing studies offer valuable insights into the behavioural drivers or barriers of FinTech adoption among older adults in specific national or regional contexts and usage behaviour of older adults, these primarily empirical studies are limited in geographic scope. Such findings prompted a bibliometric analysis of research outcomes across the globe during the twenty-first century.

In response to RQ2, the bibliometric trends reveal a surge in research output over the past five years, particularly following COVID pandemic. According to Kamilova et al., 2022, Fintech adoption witnessed substantial growth during the COVID-19 era even in the developing countries. Yet, there is a lack of global efforts in understanding the FinTech adoption among older adults. Regions such as Africa, Latin America and several South and South-East Asian countries remain significantly underrepresented in this area of research. Out of the scanty empirics, a study conducted in South Africa by Slazus and Bick (2022) identifies the barriers that include age-related reluctance among older adults to adopt new technologies and limited internet access, especially in rural areas. Similarly, a study by Imam et al. (2022) focusing on south and south-east Asian countries analyzing the Global Findex database, 2017 by the World Bank found that older adults (those aged 55 and above) are underrepresented in these regions. However, a study conducted in Latin America by Sunkel and Ullmann (2019) found that although older adults use the internet less frequently than other age groups, they are the most likely to access it from the home. The RQ2 confirms that much of the existing literature generalizes findings based on developed countries or China, often overlooking the economic structures and unique demographic patterns present in low- and middle-income countries.

Nevertheless, adoption of the Tri-method approach provides broader thematic, methodological and geographic perspectives. Addressing RQ2 and RQ3, this study spots global research trends and emerging themes, besides providing managerial insights and policy relevance. Moreover, our synthesis brings to light interdisciplinary intersections encompassing the role of cognitive health, social isolation, and healthcare financing with the advent of digital financing mechanisms, that rarely explored collectively in prior research. Hence, the critical analysis of the research themes under RQ4, not only integrates fragmented knowledge but also establishes a foundation for inclusive digital finance and targeted interventions for the ageing population worldwide.

The content analysis of the top 55 articles indicates adoption of a range of methodologies while assessing the phenomena of adoption of FinTech among older adults. Both exploratory observations using qualitative methods, besides descriptive and predictive analysis utilising quantitative techniques are adopted to provide a holistic understanding. In-depth qualitative investigations will be beneficial for exploring these issues within emerging economies. However, quantitative studies remain essential for developing market strategies and policies, as they provide generalized insights and supports theory testing. Systematic literature reviews (SLRs) can be adopted to locate evidence-based researches and formulate in-depth understanding on specific areas of concern. Major research themes advocate digital literacy, technology adoption and inclusion, while older adults in developing societies often exhibit limited awareness and acceptance of technology.

Addressing RQ1 again from a practical standpoint, our findings suggest that FinTech adoption has the potential to improve the quality of life among older adults by enhancing their access to financial services, healthcare, and public transportation. These findings are consistent with those of Mei (2024), who emphasizes the importance of developing social strategies that support older adults in overcoming barriers to digital technology use, thereby improving their quality of life and social participation. Extending the applicability of FinTech to more vulnerable older adults in developing societies can generate significant social value.

The rigorous review has attempted to maintain transparency and replicability in its conduct and reporting. In conclusion, this tri-method review through a logical integration of methods, offers a timely contribution to the literature on digital financial inclusion among older adults. By covering broad literature landscape and diving deep into its contents it provides a latest pattern of scientific research, advances theoretical understanding, highlights practical and design-oriented considerations, and proposes a forward-looking research agenda aimed at reducing the digital divide for older populations in an increasingly digitalized financial ecosystem. This study offers a broad understanding on the literature gaps in terms of unearthing a regional lacuna of knowledge despite heavy surge on number of studies in recent years, and need for developing more empirical understanding that may potentially lead to further theoretical advancements primarily focusing on technologically challenged or financially vulnerable population.

Economies should strive to strengthen financial inclusion, digital infrastructure, and financial literacy to foster collaboration among FinTech companies, regulators and stakeholders (Vijayagopal et al., 2024). Effective FinTech adoption among older population can contribute to achieving Sustainable Development Goals (SDGs) 1, 5, and 10 which focus on ‘No Poverty’, ‘Gender Equality’ and ‘Reduced Inequalities’, respectively, through the promotion of inclusive financial systems.

Theoretical implications

The study provides significant theoretical insights to the growing body of literature among the older adult’s technology adoption and financial inclusion. Majority of the existing research on FinTech adoption employs theories such as Unified Theory of Acceptance and Use of Technology (UTAUT) (Venkatesh et al., 2003), UTAUT2 (Venkatesh et al., 2012) and Technology Acceptance Model (TAM) (Davis,1989). These frameworks are primarily grounded in empirical case studies situated within specific national or demographic contexts. This tri-method review offers an enriched understanding of how these theoretical frameworks can be expanded, challenged and contextualized to reflect the diverse realities of the older adults. The Senior Technology Acceptance Model (STAM) which offers aging- specific additions to TAM still remains underutilized in FinTech adoption studies (Renaud & Van Biljon, 2008). Future research could benefit from integrating STAM constructs to better account for cognitive, physical, and emotional aspects unique to older adults.

This review suggests to bring theoretical refinement and contextual expansion of the standard theoretical models (TAM and UTAUT2) by incorporating aging -specific concerns such as cognitive decline, digital mistrust and intergenerational factors. First, the findings go beyond TAM and UTAUT by highlighting the importance of context specific factors such as policy environments, healthcare access, digital infrastructure which significantly shape the effort expectancy and perceived usefulness among older adults. Adoption is embedded in socio-economic and institutional realities not solely driven by individual -level cognitive effort or intention. Second, the review draws attention to the emotional and cognitive dimensions such as psychological stress and fear of financial fraud associated with learning new technologies in later life and digital mistrust which are inadequately addressed by traditional technology adoption models. Third, the synthesis emphasizes the critical but under-theorized role of intergenerational social influence. Hence, the UTAUT construct of social influence can be expanded by incorporating family-based and caregiving contexts for the older adults. Fourth, clustering around the themes such as social isolation, digital finance, behavioural economics and financial well-being suggests that traditional models need to be interdisciplinary in scope.

Intersectional factors such as gender, disability, rural-urban location, education level and income significantly shape how older adults experience and engage with FinTech as illustrated in the conceptual framework (Chan et al., 2023). Henceforth, this review offers a conceptual framework through the Fig. 10 that synthesizes personal, technological, social, and demographic enablers, alongside barriers, to model their influence on behavioural intention, actual use, and eventual adoption outcomes among older adults.

Research implications

Keyword thematic mapping reveals that critical themes like behavioural research and technology adoption remain underexplored, pointing to key areas for future scholarly inquiry. Our findings identify a constellation of factors including digital literacy, trust, usability, social influence, and intergenerational engagement – that consistently shape adoption behaviours across varied contexts. Therefore, future studies should focus on the development and validation of context-specific behavioural adoption models tailored to older adults that incorporate sociocultural and infrastructural differences. Potential research questions include: How do social norms and intergenerational interactions influence trust in FinTech? How do usability and accessibility barriers vary across rural and urban contexts in various countries?

This study, by mapping the longitudinal bibliometric patterns and global disparities, this review adds a meta-theoretical contribution. It not only synthesizes what is known but also identifies why certain populations remain underexplored particularly in Africa, Latin America and Southeast Asia, offering a direction for future theory development and empirical validation in diverse, underrepresented contexts. Slow pace of technology adoption, precarious financial condition during oldage, and poor regulation and implementation has crippled the benefit of FinTech adoption in these countries. Shortage of data has also remained a point of botheration for the researchers. This study urge future researchers, policy makers and technology leaders to devise plans and generate evidences towards effective adoption of digital finance.

Cross-cultural disparities remain significant. While cognitive and behavioural traits associated with ageing are largely consistent, the socio-economic contexts in which older adults engage with FinTech vary substantially. This underscores the need for designing contextually relevant longitudinal and cross-cultural interventions, particularly those that address local socio-economic realities and digital infrastructure limitations. For example, although studies from China and India reflect rapid uptake of digital financial services among older adults, persistent inequalities in access and digital literacy, especially in rural and economically disadvantaged communities- need to be further highlighted.

Moreover, future research should also examine how intergenerational engagement and knowledge transfer can strengthen trust in FinTech, thereby improving its usability among older adults by using experimental and mixed-method designs. A region-specific lens is crucial to address the impacts of ageing in different economic contexts.

Managerial and policy implications

In terms of the practical implications, the study suggests product designers and policy makers to be more thoughtful in their design and policy action. From a designer’s perspective, designs of FinTech tools should be “age-friendly”, by including larger fonts, simple navigation, and voice assistance, all of which allow older adults to feel more competent and comfortable when engaging with technology. From a policy perspective, FinTech companies are encouraged to work with NGOs who work directly with older adults to design and test digital finance solutions for older adults. These partnerships could also introduce trusted, community-based support to the adoption process. The governments can create more awareness generation programmes and apply regulation mechanisms that reduce digital scams and increase trust among older adults to adopt FinTech for diverse purposes.

The intersection between cognitive health and digital engagement suggests a bidirectional relationship: digital participation may support cognitive well-being while cognitive limitations constrain FinTech use. Findings from a review study in the Indian context among older adults found that the ICT adoption is limited among this demographic due to insufficient digital literacy (Jena & Paltasingh, 2025). To address this, FinTech developers and public health agencies should also design and test personalized, cognitively adaptive FinTech tools tailored to the unique cognitive profiles of ageing users across different communities and socio-demographic profiles, to enhance accessibility and decision-making. Together, these insights suggest that inclusive digital finance is not merely a technical or infrastructural challenge, but a human-centred issue influenced by emotional, cognitive and social factors. Therefore, strategies should prioritize user-centric design, cognitive accessibility, and emotional usability in FinTech adoption frameworks.

In addition, the connection between healthcare financial burden and digital financial tools needs more market-specific strategic attention. Policy makers and industry stakeholders should collaboratively explore how digital financial platforms can help alleviate medical financial stress in ageing populations. This includes adapting tools to local health financing contexts and promoting awareness. Furthermore, digital finance tools like healthcare wallets, FinTech applications on insurances and health savings and robo-advisors, that can support older adults in managing medical expenses, enhancing insurance literacy, and aid emergency planning, warrant further exploration. Pilot programmes and field experiments could help assess real-world usability and financial outcomes for ageing users.

Particular attention should be given to evaluating the effectiveness of trust-building mechanisms, accessibility features, and intergenerational design elements in driving technology acceptance and sustained use. In this regard, Artificial Intelligence (particularly humanoids AI) can assist older adults by providing companionship, supporting daily activities and enhancing quality of life (Murugesan & Viswanathan, 2024). Future research could explore public-private partnerships to develop AI-enabled assistive services integrated with FinTech platforms.

Finally, policy makers in low- and middle-income countries need to emphasize digital financing mechanisms to enhance financial inclusion and reduce distress spending, with a special focus on older adults. They are required to implement strong regulatory frameworks that significantly reduces fraud events. Targeted national digital literacy campaigns, subsidy-linked onboarding for elder users, and community-led digital support systems may serve as actionable policy tools. This calls for inter-ministerial cooperation, usability testing, and regulatory guidelines that ensure financial clarity and transparency.

Limitations and future recommendations

This review study has a few limitations. First, the scope is restricted to publications indexed in the Scopus database, and the search terms used are limited, emphasizing the need for broader keyword enrichment. Future researchers are encouraged to incorporate additional databases such as Web of Science, IEEE Xplore, and Google Scholar. Secondly, the keyword selection should be refined to capture a broader range of relevant literature. Thirdly, the analysis excludes non-English publications; hence some observations reported in other languages, may have been missed. This language bias may create a Western-centric bias, missing out on important socio-cultural and market level experiences and insights from non-English sources.

In absence of a rigorous effort, tri-method approach can also lead to potential overlap in findings and hence, diluting the contribution. The selection of the top 55 most cited papers may also introduce bias, as it tends to favour high income country publications. This could lead to the underrepresentation of recent or low- and middle-income country research in the thematic insights. While the approach helps identify influential trends, it may limit the diversity and representativeness of the findings. The content analysis based on the top 55 manuscripts may also lead to underrepresentation of recent manuscripts. However, a closer look to reduce such bias has ensured justifiable referencing of manuscripts published during 2023 and 2024.

It is crucial to recognize the ethical dimensions in researching FinTech and older adults. Although this review is based on secondary data, future empirical studies must pay close attention to issues related with data security and privacy concerns of the older adult respondents and while procuring their informed consent. Older adults represent a vulnerable population, and studies related with their financial behaviours or digital interactions raise critical ethical concerns. For secondary analyses, researchers should ensure that datasets are ethically sourced, de-identified, and used in ways that respect consent obtained at the point of original data collection. Addressing these ethical dimensions is essential to build trust, safeguard participant rights, and ensure that FinTech solutions are both inclusive and respectful.

Finally, the study only included academic papers and excluded short notes, reports, and grey literature. The inclusion of grey literature such as industry reports, white papers, and policy briefs could provide practical insights and complement academic findings, especially in FinTech and digital inclusion which are rapidly changing domains.

Future studies might consider specific hypotheses like: “How does social isolation influence FinTech adoption among older adults?”, or, “To what extent do intergenerational interactions impact trust, and digital engagement in financial services?”. Formulating such targeted questions can help in bridging theoretical gaps, and in developing more context-specific interventions.

Data availability

The dataset used and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Ahlin T (2018) Only near is dear? Doing elderly care with everyday ICTs in Indian transnational families. Med Anthropol. Q 32(1):85–102. https://doi.org/10.1111/maq.12404

Allen F, Demirgüç-Kunt A, Klapper L, Peria MSM (2012) The foundations of financial inclusion: Understanding ownership and use of formal accounts. World Bank Policy Research Working Paper No. 6290. World Bank. https://doi.org/10.1596/1813-9450-6290

Ali J, Ghildiyal AK (2023) Socio-economic characteristics, mobile phone ownership and banking behaviour of individuals as determinants of digital financial inclusion in India. Int J. Soc. Econ. 50(10):1375–1392. https://doi.org/10.1108/IJSE-10-2022-0673

Alshater MM, Hassan MK, Khan A, Saba I (2021) Influential and intellectual structure of Islamic finance: A bibliometric review. Int J Islam Middle East Financ Manag 14(2):339–365. https://doi.org/10.1108/IMEFM-08-2020-0419

Amin I, Ingman S (2014) Eldercare in the transnational setting: Insights from Bangladeshi transnational families in the United States. J Cross Cult. Gerontol. 29:315–328. https://doi.org/10.1007/s10823-014-9236-7

Andalib Touchaei S, Hazarina Hashim N (2024) The antecedents of mobile banking adoption among senior citizens in Malaysia. Int J Hum. Comput. Interact. 40(9):2380–2397. https://doi.org/10.1080/10447318.2022.2161236

Arenas-Gaitán J, Peral-Peral B, Ramon-Jeronimo MA (2015) Elderly and internet banking: An application of UTAUT2. J Internet Bank Commer. 20(1):1–23. https://idus.us.es/server/api/core/bitstreams/60967bb2-02d3-4ac5-b5a2-0f93f1353da5/content

Arun T, Kamath R (2015) Financial inclusion: Policies and practices. IIMB Manag Rev 27(4):267–287. https://doi.org/10.1016/j.iimb.2015.09.004

Arruda H, Silva ER, Lessa M, Proença Jr D, Bartholo R (2022) VOSviewer and Bibliometrix. J Med Libr Assoc. 110(3):392. https://doi.org/10.5195/jmla.2022.1434

Bai X, Lai DW, Liu C (2020) Personal care expectations: Photovoices of Chinese ageing adults in Hong Kong. Health Soc Care Community 28(3):1071–1081. https://doi.org/10.1111/hsc.12940

Barik R, Sharma P (2019) Analyzing the progress and prospects of financial inclusion in India. J Public Aff 19(4):e1948. https://doi.org/10.1002/pa.1948

Bui MT, Luong TNO (2023) Financial inclusion for the elderly in Thailand and the role of information communication technology. Borsa Istanb Rev 23(4):818–833. https://doi.org/10.1016/j.bir.2023.02.003

Button M, Karagiannopoulos V, Lee J, Suh JB, Jung J (2024) Preventing fraud victimisation against older adults: Towards a holistic model for protection. Int J Law Crime. Justice 77:100672. https://doi.org/10.1016/j.ijlcj.2024.100672

Cecconi C, Adams R, Cardone A, Declaye J, Silva M, Vanlerberghe T, van Vugt J (2025) Generational differences in healthcare: The role of technology in the path forward. Front Public Health 13:1546317. https://doi.org/10.3389/fpubh.2025.1546317

Chan DYL, Lee SWH, Teh PL (2023) Factors influencing technology use among low-income older adults: A systematic review. Heliyon 9(9):e20111. https://doi.org/10.1016/j.heliyon.2023.e20111

Chaouali W, Souiden N (2019) The role of cognitive age in explaining mobile banking resistance among elderly people. J. Retail Consum Serv. 50:342–350. https://doi.org/10.1016/j.jretconser.2018.07.009

Chauhan V, Choudhary V, Mathur S (2016) Demographic influences on technology adoption behavior: A study of e-banking services in India. Prabandhan Indian J Manag 9(5):45–59. https://doi.org/10.17010/pijom/2016/v9i5/92571

Chen K, Chan AH (2011) A review of technology acceptance by older adults. Gerontechnology 10(1):1–12. https://doi.org/10.4017/gt.2011.10.01.006.00

Chen Y, Yin Q, Zhou T, Gu S, Xie L, Xiao M, Zhao Q (2025) Digital inclusion pathways and influencing factors among older adults in outpatient settings: A grounded theory study. Clin Inter Aging 20:701–716. https://doi.org/10.2147/CIA.S518045

Cheng X, Qiao L, Yang B, Li Z (2024) An investigation on the influencing factors of elderly people's intention to use financial AI customer service Internet Res 34(3):690–717. https://doi.org/10.1108/INTR-06-2022-0402

Choi NG, DiNitto DM, Marti CN, Choi BY (2022) Telehealth use among older adults during COVID-19: Associations with sociodemographic and health characteristics, technology device ownership, and technology learning. J Appl Gerontol. 41(3):600–609. https://doi.org/10.1177/07334648211047347

Choi Y, Han S, Lee C (2024) Exploring drivers of fintech adoption among elderly consumers. Technol Soc 78:102669. https://doi.org/10.1016/j.techsoc.2024.102669

Choudrie J, Junior CO, McKenna B, Richter S (2018) Understanding and conceptualizing the adoption, use, and diffusion of mobile banking in older adults: A research agenda and conceptual framework. J Bus Res 88:449–465. https://doi.org/10.1016/j.jbusres.2017.11.029

Cirella GT, Bąk M, Kozlak A, Pawłowska B, Borkowski P (2019) Transport innovations for elderly people. Res Transp Bus Manag 30:100381. https://doi.org/10.1016/j.rtbm.2019.100381

Czaja SJ, Charness N, Fisk AD, Hertzog C, Nair SN, Rogers WA, Sharit J (2006) Factors predicting the use of technology: Findings from the Center for Research and Education on Aging and Technology Enhancement (CREATE). Psychol Aging 21(2):333–352. https://doi.org/10.1037/0882-7974.21.2.333

Dai J, McGrenere J (2025) Envisioning financial technology support for older adults through cognitive and life transitions. In: Proc 2025 CHI Conf Hum Factors Comput Syst:1–24. https://doi.org/10.1145/3706598.3713427

Davis FD (1989) Technology Acceptance Model: TAM. In: Al-Suqri MN, Al-Aufi AS (eds) Information seeking behavior and technology adoption. IGI Global, pp 205–219. https://doi.org/10.4018/978-1-4666-8156-9.ch013

Dizon G, Ebardo R (2025) Barriers and motivations of older adults in digital banking adoption: Recent findings, gaps, and future directions. Int J Innov Res Sci Stud 8(3):1959–1970. https://doi.org/10.53894/ijirss.v8i3.6929