Abstract

This paper assesses the effect of board diversity on resilience with a mediating role of financial sustainability. The research sampled data from 166 Saudi companies from 2017 to 2023 and analysed it using a fixed effect framework. The findings showed that board nationality diversity and audit committee expertise may provide greater firm resilience. Firm size, leverage, board independence and government ownership were also significant determinants of firm resilience. Further, the analysis reveals that financial sustainability exerts a strong mediation effect. These results support the agency, resource dependence and signalling theories that predicted that boardroom diversity might promote monitoring, provide access to greater talent, enhance the company’s ability to navigate disruptions and maintain resilience in the face of adversity. The policy implication of the empirical findings is that companies can strengthen their ability to withstand and recover from disruptions by setting up diverse boards of directors. Also, policymakers and regulators can shape regulatory frameworks to encourage good governance practices through board diversity dynamics. Moreover, the study outcome provides a broader perspective that can guide stakeholders to make informed decisions that may strengthen organisational resilience and promote long-term corporate stability.

Similar content being viewed by others

Introduction

Today’s business environment is increasingly complex and volatile. As businesses globalise and internationalise their activities, crises appear to occur with greater frequency in the evolution of organisations (Cheng et al. 2023; Lu et al. 2022). Hence, effective risk management and sustaining growth during crises have emerged as critical concerns that decision-makers must address. Firm resilience has become a focal point of research due to its crucial role in enabling organisations to withstand disruptions, adapt to changing environments, and ensure long-term survival and success (Iftikhar et al. 2024; Lodorfos et al. 2023). Firm resilience is vital for the economy as it helps businesses navigate and recover from disruptions, maintain employment, and contribute to overall economic stability and growth (Cheong, 2021; Croci et al. 2024; Khatib et al. 2023). Therefore, firms need robust internal governance to mitigate shocks and other uncertainties that may negatively affect their sustainability.

The board of directors is a significant corporate governance mechanism. It provides oversight, strategic guidance, and accountability to ensure that the organisation’s management acts in the best interests of stakeholders and upholds ethical standards (Fama and Jensen 1983; Lee et al. 2024). One of the characteristics of the board that influences the decision-making process within boardrooms is board diversity (Aksoy and Yilmaz 2023; Sani 2021). Boardroom diversity encompasses the diversity among board members concerning gender, ethnicity, nationality, education, and experience. In the current business environment, firms must cultivate a more diverse boardroom as it brings forth various perspectives and insights (Khatib et al. 2021; Kirsch 2018). A diverse board is more effective in problem-solving and establishing network connections, thereby enhancing the firm’s overall image (Bazhair and Sulimany 2023; Li and Zhang 2019; Singh 2007). Different opinions and views due to board diversity may assist management in formulating sound financial policies that lead to better outcomes, including resilience (Al-Hakimi et al. 2022; Croci et al. 2024).

In particular, there is disagreement regarding which corporate governance proxies might significantly affect the firm’s financial volatility, which indicates varying and inconsistent results in the literature. Past studies have evaluated several proxies in different periods to observe any changes (increase/decrease) in firm resilience. Most of the work on the behaviour of firms’ financial volatility performance is carried out in developed countries, mainly the US and European markets (e.g. Cheng et al. 2023; Croci et al. 2024; DesJardine et al. 2019; Wang et al. 2023), indicating that the emerging and developing countries remain appealing to most academicians and researchers. Researchers have argued that a firm’s problems and challenges may be more severe in developing markets (Sani et al. 2020; Sulimany 2023). Developing economies’ political, social, and financial dynamics differ from those of advanced economies. In contrast to the developed markets, developing markets are less efficient, have weaker regulations, and are riskier and more volatile (Bazhair and Sulimany 2023; Kent et al. 2020). Hence, the first objective of this study is to examine how board diversity attributes affect firm resilience in the Saudi context.

Furthermore, studies have emphasised that financial sustainability is important for firm resilience because it provides the necessary resources and stability to withstand and recover from unexpected events or crises (Alshareef and Sulimany 2024; Ghardallou 2022). A financially sustainable firm can manage disruptions, absorb financial shocks, and maintain essential operations during challenging times (Alshareef 2024; Naciti 2019). It enables the firm to invest in risk mitigation measures, maintain sufficient liquidity, and adapt its strategies and operations. By maintaining a robust financial position, companies can invest in risk management measures to attract diverse personalities to their boards. This solid financial situation may pave the way for firms to withstand challenges, adapt to changes, and maintain long-term resilience (Lu et al. 2022; Wang et al. 2023). Thus, the second objective of this research is to explore the mediating role of financial sustainability on the relationship between board diversity and firm resilience.

The current study adds to the body of knowledge on corporate governance and firm resilience, thus contributing to corporate boards’ effectiveness in mitigating uncertainties. The outcome can advance literature and shape practice regarding board dynamics. The mediation analysis brings new insight into the literature by highlighting the role of financial sustainability in the relationship between board diversity and firm resilience. The analysis may assist companies in developing effective governance strategies that enhance their ability to withstand and recover from disruptions. Also, policymakers can shape regulatory frameworks that encourage good governance practices. This knowledge exchange facilitates learning, promotes industry standards, and contributes to the broader understanding of the role of governance in maintaining economic stability. By understanding the governance factors contributing to firm resilience, stakeholders can make informed decisions that strengthen organisational resilience, enhance regulatory frameworks, and promote long-term economic stability.

The rest of the article proceeds as follows: The second segment highlights the institutional background, followed by the literature review segment. The third section discusses the research method and the results. The last section gives the concluding remarks.

Saudi context

The corporate environment in Saudi suffers from ineffective institutional structures and a weak legal system that can invariably affect sound corporate governance practices (Alregab 2021; Sulimany 2023). The Saudi stock market exhibits several unique characteristics compared to other developing nations, particularly from a corporate governance perspective. For instance, the market has seen significant regulatory reforms to enhance corporate governance practices (Bazhair 2023; Ghardallou 2022). The introduction of the Corporate Governance Code in 2017 and subsequent updates have emphasised transparency, accountability, and protecting shareholder rights. This commitment to improving corporate governance standards sets the Saudi market apart. Moreover, the kingdom’s attention to sound corporate governance practices stems from trying to materialise its Vision 2030 (Alregab 2021; Alshareef and Sulimany 2024).

The Saudi stock market has been affected by many crises and times of uncertainty that have strongly impacted the market. In the 2006 financial crisis, the Saudi market suffered a drop of 25% in its value (Bazhair 2022; Boshnak et al. 2023). Several firms have failed to withstand this economic shock, resulting in bankruptcy. The recent COVID-19 outbreak is another example of such a crisis. Ghardallou (2022) reported that between December 2019 and July 2020 (the time of the outbreak), the Saudi market experienced a significant impact and disruption in 9 of its sectors. Times like these, when firms could not face these periodical and almost unavoidable adversities, show that firms’ resilience is vital for firms survival. Moreover, it has been argued that these economic shocks and the influence on the Saudi firms in the market have been connected with weak internal control mechanisms and inadequate risk management (Alregab 2021; Sulimany 2024).

Another unique characteristic is the presence of government ownership and influence. The Saudi government has substantial stakes in several major companies, and government-related entities play a significant role in the market (Boshnak 2023; Piesse et al. 2012). While this can provide stability and support during economic volatility, it can also create challenges in ensuring equal treatment of all shareholders and maintaining independent decision-making (Bajaher et al. 2021; Bazhair and Sulimany 2023). These specific features of the Saudi market have created a high agency cost, which may impede various organisational outcomes, including firm resilience. Therefore, the corporate governance of Saudi firms has remained an important issue that deserves empirical attention.

Literature review

Underpinning theories

Agency theory is one of the frameworks that underpin the nexus between board governance and firm resilience. This framework pays greater attention to the potential conflict of interest between managers and shareholders due to the separation between firms’ management and ownership (Jensen 1993; Jensen and Meckling 1976; Sulimany 2024). In addition, this theory suggests that a board of directors need to be in place to monitor management performance and mitigate agency conflicts for organisational survival (Sewpersadh 2019; Yakubu and Oumarou 2023). It has been emphasised that the board of directors is likely to execute this task when constituted with diverse personalities. According to this view, board diversity may result in lower agency costs due to effective monitoring of management policies (Jensen 1986; Mustapha and Ahmad 2011). The robust monitoring from diverse boards may mitigate agency costs and enhance stock market outcomes, influencing resilience in the face of challenges (Cheng et al. 2023; Iftikhar et al. 2024). Diverse opinions and views due to board diversity may assist management in formulating sound financial policies that lead to better outcomes, including resilience (Al-Hakimi et al. 2022; Croci et al. 2024). Therefore, this theory suggests a positive relationship between board diversity and firm resilience.

The resource dependency theory offers another perspective on how board governance mechanisms may impact organisational outcomes. This theory posits that boards of directors are for monitoring and as a crucial link for drawing resources from the external environment (Hillman et al. 2009; Pfeffer 1973; Yakubu and Oumarou 2023). The board of directors connects firms and external resources, manages external dependencies and reduces environmental uncertainties (Bhatt and Bhattacharya 2015; Pfeffer and Salancik 2003). Moreover, the resource dependency view provides a theoretical insight that could explain the importance of board diversity in fostering firm resilience. Diversity in gender, nationality and skills brings various perspectives and knowledge that can shape decision-making (Khatib and Al Amosh 2023; Wu et al. 2024). Diverse expertise and backgrounds can tap into various external resources, facilitating information sharing, collaboration, and strategic decision-making. By leveraging these resources, the board diversity may enhance the firm’s resilience by adapting to environmental changes, identifying strategic opportunities, and effectively managing risks.

Signalling theory explains the nexus between board governance and firm resilience. The theory posits that individuals and organisations engage in specific actions or behaviours to convey credible information to others (Miller and Triana 2009; Ross 1977). It suggests that firms engage in particular actions or make confident choices to signal their quality, competence, or prospects to external stakeholders such as investors, customers, or suppliers (Omran and Tahat 2020; Ozo and Arun 2019). These signals can include financial indicators, strategic decisions, investments in technology or research, or even hiring top talent. By sending positive signals, firms aim to attract investment, gain customer trust, establish credibility, and differentiate themselves from competitors (Arko et al. 2014; Muradoglu et al. 2024). According to the literature, a corporate board with more female and foreign directors may help firms minimise operational risk, reduce capital costs, and increase profitability (Aras and Crowther 2008; Maier and Yurtoglu 2022). According to the signalling theory, organisations with diverse personalities on their boards send a favourable message to the market (Akbar et al. 2016; Gwilym et al. 2010).

Empirical review and hypotheses development

Board gender diversity and firm resilience

Board gender diversity refers to the representation of men and women on a company’s board of directors. When a board is composed of individuals from diverse gender backgrounds, it brings a broader range of perspectives, experiences, and insights to the decision-making process (Aksoy and Yilmaz 2023; Bart and McQueen 2013). This diversity could ultimately influence firm resilience in several ways. For instance, gender-diverse boards tend to foster a more inclusive and equitable work environment, which promotes employee satisfaction and engagement (Donkor et al. 2023; Othuon et al. 2023). This, in turn, enhances the organisation’s productivity, creativity, and innovation, creating a higher market value and the ability to withstand long-term disruptions (Donkor et al. 2023; Triana et al. 2019).

Moreover, diverse boards are more likely to consider broader risks and opportunities, leading to better strategic decision-making and risk management. They are better equipped to anticipate and respond to market changes, adapt to evolving customer needs, and identify emerging trends (Khatib et al. 2021; Sani 2021). Additionally, gender diversity at the board level can improve stakeholder relations, reflecting a commitment to diversity, equality, and social responsibility. This can enhance the firm’s reputation, attract a diverse talent pool, and strengthen relationships with customers, suppliers, and investors, which are crucial for cultivating a resilient environment (Adams and Ferreira 2009; Aksoy and Yilmaz 2023).

In contrast, another stream of literature argues the opposite. Many scholars have argued that women have less confidence in decision-making and are more risk-averse (Hernandez-Nicolas et al. 2015; Naciti 2019). Therefore, it can be stated that the risk aversion of women directors may influence firm outcomes adversely. Donkor et al. (2023) illustrated that board gender diversity facilitates slower decision-making due to intra-group conflicts between male and female directors. This potential conflict may adversely influence the discussion in the boardroom (Sani 2021; Wu et al. 2024). Armeanu et al. (2017) found that the proportion of women directors on the corporate board is negatively related to firm risk and firm resilience.

The corporate governance code in Saudi Arabia does not mention any specifics regarding women’s representation in the boardroom (Bazhair 2023; Bazhair and Sulimany 2023). The country’s religious and cultural norms may be based on the lack of a regulation mandating gender diversity on the board (Al-Ghamdi and Rhodes 2015; Boshnak 2023). Considering the preceding explanation, the link between board gender diversity and firm resilience has been proven by both theoretical and practical research. Therefore, the current study proposes the following hypothesis:

H1 There is a significant relationship between the board gender diversity and firm resilience of the Saudi non-financial listed companies.

Board nationality diversity and firm resilience

Board nationality diversity refers to including individuals from different nationalities and backgrounds on a company’s board of directors. It is vital for firm resilience because it brings many perspectives, experiences, and cultural insights to decision-making (Estelyi and Nisar 2016; Fernandez-Temprano and Tejerina-Gaite 2020). A company can tap into a broader pool of knowledge and expertise by having board members with diverse national backgrounds. Greater expertise may enhance understanding of global markets, navigate cultural nuances, and make more informed and well-rounded decisions (Harjoto et al. 2019; Sani 2021). This diversity helps firms adapt to changing market conditions, identify emerging opportunities, mitigate risks, and foster innovation, leading to greater resilience and long-term success (Alshareef and Sulimany 2024; Hussain et al. 2024). These diverse connections provide the company with a broader range of resources and alternative sources of information, reducing its dependence on a single resource or market. By diversifying their resource base, firms become more adaptable and resilient to disruptions, market fluctuations, and geopolitical changes. Additionally, national diversity enhances the firm’s ability to understand and navigate different cultural and institutional contexts, thereby strengthening its resilience in diverse markets and promoting sustainable growth (Alshareef and Sulimany 2024; Croci et al. 2024)

On the other hand, some scholars have argued that foreign directors might have a negative effect on firms. Demographic differences lower social cohesion between groups, and these social barriers reduce the probability that minority viewpoints influence group decisions (Harjoto et al. 2019; Sani 2021). To that extent, some researchers have found that national diversity might affect corporations negatively (Kent et al. 2020; Ujunwa 2012; Zaid et al. 2020).

Although the literature is scarce in the Saudi context, the majority of prior studies aligned with the resource dependency theory, which suggests that national diversity has a strong impact on organisational outcomes corporations as it will bring a wide range of perspectives, experiences, and cultural insights to the decision-making process and eventually harness resilient environments for (Alshareef and Sulimany 2024; Alshareef and Sulimany 2024). Based on the discussion above, theoretical and practical research has proven the relationship between board national diversity and firm resilience. Therefore, the current study proposes the following hypothesis:

H2: There is a significant relationship between the board's national diversity and the firm resilience of the Saudi non-financial listed companies.

Audit committee expertise and firm resilience

Due to prior financial crises and past corporate scandals, the need for expertise on the audit committee was highlighted in the literature (Khan et al. 2017; Khatib et al. 2021). Audit committee financial qualification refers to the committee members’ expertise and knowledge in financial matters. It plays a vital role in influencing firm resilience by ensuring effective oversight and decision-making (Kallamu and Saat 2015; Sulimany 2024). Moreover, committee members with financial qualifications can critically evaluate financial statements and identify potential red flags or irregularities (Alqatamin 2018; Boshnak 2021). Their expertise allows them to provide valuable insights to enhance the accuracy and reliability of financial information (Al-ahdal and Hashim 2022; Klein 2002). Furthermore, with strong financial qualifications, committee members can effectively assess the company’s financial health, identify risks, and recommend appropriate measures to mitigate them (Alqatamin 2018; Alzeban 2020). This expertise contributes to firm resilience by promoting sound financial governance, effective risk management, and informed decision-making, ultimately strengthening the company’s ability to navigate challenges and adapt to changing market conditions.

Extant literature has looked into the qualifications of audit committee members and their impact on the firms from various angles. However, the results were inconsistent in many occurrences. Thus, most studies show a positive influence of audit committee financial qualification on long-term performance (Alzeban 2020; Bazhair 2022; Ben Barka and Legendre 2017; Davidson et al. 2004; Sarhan et al. 2019; Sulimany 2024). Given the prior discussion, most of the literature supports the significant relationship between audit committee financial qualifications and firm resilience, which aligns with the resource dependency theory. Therefore, the current study proposes the following hypothesis:

H3: There is a significant relationship between audit committee financial qualification and firm resilience of the Saudi non-financial listed companies.

Mediating effect of financial sustainability

The agency theory offers a solid theoretical foundation to suggest a mediation effect of financial sustainability on the relationship between board diversity and firm resilience. It has been argued that board diversity may shape firms’ decision-making capabilities, leading to sound financial policies and firm resilience (Cheong 2021; Lu et al. 2022). Better governance associated with a diverse board can reduce information asymmetry and align the interests of executives with those of firm owners and other stakeholders, thereby maximising a firm’s durability over the long term (Fama 1980; Khatib et al. 2021). Therefore, governance features gender diversity, board nationality, and audit committee effectiveness, which may guide businesses towards financial stability and, ultimately, better resiliency.

Signalling theory provides a helpful framework to evaluate the mediating effect of financial sustainability on the association between board diversity and firm resilience. According to this perspective, board diversity may help firms minimise operational risk, reduce capital costs, and increase profitability (Laskar and Maji 2018; Mubeen and Hanif 2017). This enhanced efficiency may lead to stable financial performance, boost long-term shareholder profits, and improve financial sustainability. Therefore, according to the signalling theory, organisations with good corporate governance send a favourable message to the market (Akbar et al. 2016; Iftikhar et al. 2024; Shakil et al. 2024). Given this review, the following hypotheses were developed:

H4: Financial sustainability mediates the relationship between board gender diversity and firm resilience of Saudi listed companies.

H5: Financial sustainability mediates the relationship between board nationality diversity and firm resilience of Saudi listed companies.

H6: Financial sustainability mediates the relationship between audit committee expertise and firm resilience of Saudi listed companies.

Method

Sampling and data

The research population comprises 213 firms operating in the Saudi stock market. 47 financial organisations and firms with substantial missing data were excluded from this study. The sample covers 166 non-financial listed firms in the Saudi Stock Exchange market. These firms operate in 17 sectors of the Saudi non-financial industry. The sample size is depicted in Fig. 1.

The selected sample period is from 2017 to 2023. This study covers this period because the governance code was amended and included risk management guidelines for the listed companies, effective from 2017 (Ebaid 2022; Sulimany 2024). Implementing risk management in the new Saudi Corporate Governance Code aims to enhance corporate transparency, accountability, and resilience. The code emphasises the role of the board of directors in overseeing and managing risks and requires companies to disclose their risk management policies and practices (Alshareef and Sulimany 2024; Boshnak 2023). Moreover, the period from 2017 to 2023 is a crucial timeframe for examining the resilience of Saudi firms because it encompasses the implementation of Saudi Arabia’s Vision 2030 plan, which seeks to diversify the economy. The archival data was retrieved from the official website of the Saudi Stock Exchange: https://www.tadawul.com.sa. In particular, data related to financial statements was collected using the Thomas Reuters Data Stream. Secondly, data on corporate governance was extracted from the annual reports of the selected firms. Most annual reports are available on the company website and the Saudi Stock Market Exchange (Tadawul).

Variables

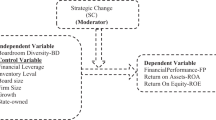

Dependent variable

The dependent variable is firm resilience, measured using long-term growth sales (LGS) and stock return volatility (SRV). LGS stands as a compelling indicator of a firm’s stability, reflecting its ability to consistently generate revenue and adapt to market dynamics over an extended period (Lv et al. 2019; Wang et al. 2023). A sustained upward trajectory in sales suggests that the firm has established a solid market presence, satisfied customer needs, and maintained competitive relevance. It underscores the effectiveness of the business model, strategic planning, and operational execution, signifying a resilient foundation (Lv et al. 2019; Sila et al. 2016). SRV is a valuable indicator of a firm’s flexibility, as it reflects the organisation’s adaptability to changing market conditions and its ability to adjust strategies in response to uncertainties. Stock return volatility is measured as the annualised monthly standard deviation of a firm’s return series (Brennan and Xia 2001; Sila et al. 2016). It can be a valuable indicator of firm resilience because it provides insight into how a company’s stock price reacts to market changes, which can reflect the company’s ability to weather different economic conditions.

Independent variable

The independent variable is board diversity, which includes board gender (BGD), board nationality (BND) and audit committee expertise (ACE). The justification for selecting these variables emanated from the agency theory, the resource dependency perspectives and the signalling theory. Through the lenses of these theories, past studies have investigated the role of the board of directors in increasing firm resilience (Al-Hakimi et al. 2022; Cheong 2021; Croci et al. 2024).

Mediating variable

This research used Higgins’ model (1977) to measure financial sustainability. The model focuses on strategies that firms should adopt to achieve synergy between growth objectives and financial policies for sustainable performance. This approach was widely used by prior studies in measuring firms’ financial sustainability (Alshareef 2024; Naciti 2019). The model is given as \({SGR}\left( \% \right)={PM}* {AT}* {FL}* {ERR}.\) Where SGR = sustainable growth rate, PM = profit margin (net income after tax/revenue), AT = assets turnover (revenue / total assets), FL = Financial leverage (total debt / total assets) and ERR = earnings retention rate (retained earnings / net income after tax).

Control variables

Additionally, this study employed firm size, firm age, leverage, profitability, board independence, family ownership and government ownership as control variables to mitigate specification bias. Past studies revealed that firm size can significantly affect firm resilience. Abor and Fiador (2013) depicted that bigger firms offer higher stock returns because they generate substantial cash flows. Hence, firm size can be positively related to stock return. Similarly, the literature demonstrates that older firms gain goodwill due to their track records, thus associating with higher stock prices (DesJardine et al. 2019; Kusi et al. 2018). Besides, profitable firms are more likely to design an optimum dividend policy, increasing their stock returns, signifying a positive link between profitability and firm resilience (Bokpin 2011; Iftikhar et al. 2024). As for the effect of leverage on stock returns, Lu et al. (2022) disclosed that leverage and dividends are regarded as agency mechanisms. In this way, firms with higher gearing ratios pay lower returns to shareholders. It has been argued that firms with more independent directors are more likely to obtain objective and unbiased judgment on strategic matters, executive performance evaluation, and risk oversight. Therefore, these firms will be better positioned to face disruptive events and build resilience (Cheng et al. 2023; Jackling and Johl 2009; Maier and Yurtoglu 2022).

Studies have shown that family ownership is essential for firm resilience because it fosters commitment, stability, and a long-term perspective that helps navigate challenges and maintain continuity (Alshareef 2024; Habbash 2016). On the other hand, many scholars have shown evidence that suggests a negative association between government ownership and organisational outcomes, including firm resilience (Alshareef and Sulimany 2024; Munisi et al. 2014; Rajverma et al. 2019). The measurements of the variables mentioned are contained in Table 1.

Analytical model

This study used a regression analysis to investigate the relationship between board diversity and firm resilience. Specifically, the panel data approach was employed due to the structure of the data collected, which involves time series and cross-sectional units from 2017 to 2023. The Panel data research method produces more efficient regression estimates because it offers large data points, reduces estimation bias and provides more freedom (Githaiga and Kosgei 2023; Hsiao 1985; Pesaran 2015). The panel data analytical frameworks widely employed in finance and accounting studies include the OLS, fixed and random effect models. The Hausman test results revealed that the fixed effects estimation technique is more suitable for this work. Fixed effects generate more efficient estimates because the model considers firms’ effects and captures unobserved differences between several firms (Gujarati 2003; Pesaran 2015). Thus, the study specified the following empirical models:

Mediation approach

A mediating variable (financial sustainability) is included in the relationship between board diversity and firm resilience. A mediation effect answers the question of why an independent variable is significantly associated with the dependent variable (Aguinis et al. 2017; MacKinnon 2011; Triana et al. 2019). The most common approach to mediation was derived from the seminal work of Baron and Kenny (1986). There are many methods available to verify the effect of mediation. As such, two methods were employed in this present study: The Baron and Kenny approach and the bootstrapping method developed by Hayes (2018). A few steps need to be taken to assess the effect of mediation. First, the independent variable must be significantly linked with the dependent variable. Second, the independent variable must be significantly related to the mediator. Third, the mediator must be strongly associated with the dependent variable. Fourth, the impact of the independent variable on the dependent variable should significantly decrease when the mediator is embedded into the equation.

Results

Descriptive analysis

The summary statistics of the variables under examination are shown in Table 2. The results reveal a slight variance among the sampled firms regarding long-term growth sales (LGS). However, the stock return volatility (SRV) exhibits a minimum and maximum ratio of −1.270 and 70.733, indicating a large dispersion across the companies regarding stock return movement. Gender diversity (BGD) shows a mean value of 0.051, demonstrating that within the period under review, 5.1% of the board members were females. The number of foreign directors (BND) shows that, on average, only 2% of the board members are non-Saudi nationals. According to the results, the average number of audit committee members with financial expertise (ACE) represents 6.85% of the total directors. Firm size (FS) exhibited a mean value of 9.491 and recorded a lower and higher ratio of 7.380 and 12.412, respectively.

Furthermore, the firm age (FA) variable records a wide dispersion among the firms with a maximum value of 51 years. Leverage (LEV) shows a mean value of 0.254, indicating that debt financing stood at 25.4% of the firms’ capital employed, and the remaining 74.61% represents equity funding. The profitability ratio (ROA) exhibits a 0.062 mean value, signifying that, on average, return on assets denotes 6.2%. Board independence (BI) suggests that, on average, 20.3% of the board members are outside directors. Family ownership (FO) and government shareholding (GO) variables record a mean value of 0.531 and 0.231, respectively. These results suggest that 53.1% and 23.1% of the firms’ shareholding represent family and government investments, respectively. The outcome supports the argument that family and government shareholdings are substantial in the Saudi corporate sector. Financial sustainability (FINS) demonstrates a wide margin across the firms and shows a minimum and maximum ratio of -0.372 and 42.219, respectively.

The correlations between the study variables are presented in Table 3. Based on the results, the correlation coefficients of the variables are generally lower than the 80% threshold. This outcome signifies the absence of multicollinearity among the variables. In addition, the Variance Inflation Indicator (VIF) values are not up to 10, further reinforcing the non-appearance of multicollinearity in the specified models.

Regression results

Direct effect

Diagnostic tests such as serial correlation, heteroscedasticity and variance inflation factor (VIF) tests were carried out to ensure the appropriateness of the specified models. Likewise, the Hausman specification test was conducted to determine the most suitable estimation technique between fixed effects and random effects. These results are shown in Table 4.

Based on the evidence in Table 4, the specified models are associated with serial correlation and heteroscedasticity because of the significant p-values. Hence, robust regression was applied to correct these statistical issues and generate more reliable empirical evidence. In addition, the outcome of the Hausman test revealed a significant P-value. This work adopts the fixed effect over the random effect model (Gujarati 2003; Hausman 1978).

The results of the fixed effects model are presented in Table 5, focusing on the impact of board diversity on firm resilience. The proxies for firm resilience used are long-term growth sales (LGS), Model 1, and stock return volatility (SRV), Model 2. The R-squared of Models 1 and 2 suggests that the explanatory variables influenced 35.93% and 39.14% of the variations in LGS and SRV. Likewise, the P-value of the F-statistics in both models appears significant, revealing the robustness of the specified models. According to the results in Table 5, the coefficient of board gender diversity seems insignificant. The outcome demonstrates that female presence on the board may not significantly influence firm resilience in Saudi. The finding lends no support to the argument that board gender diversity can enhance the firm’s reputation and may attract a diverse talent pool and resources, which are crucial elements for cultivating a resilient environment (Aksoy and Yilmaz 2023; Bart and McQueen 2013; Khatib et al. 2021). This may be unconnected with the corporate governance situation in Saudi, which does not consider any specifics about women’s representation in the boardroom (Alregab 2021; Sulimany 2024). However, board nationality diversity indicates a positive and significant coefficient with LGS and a negative one with SRV. This evidence implies that board nationality diversity may yield greater sales growth and lower stock volatility risk, leading to firm resilience. The economic implication of the findings is that a 1% increase in board nationality diversity may lead to an increase in long-term growth sales by 0.689% and may equally reduce stock return volatility by 44.271%. The finding supports agency theory, resource dependency view and signalling theory. These frameworks argue that board national diversity may enable firms to access broader knowledge and expertise, enhance understanding of global markets, mitigate risks, and foster innovation (Alshareef and Sulimany 2024; Hussain et al. 2024; Wu et al. 2024). Thus, leading to greater resilience and long-term success. The empirical results show that audit committee expertise has a significant positive relation with LGS and a strong negative relation with SRV. This outcome suggests that increasing the number of financial experts in the audit committee may result in greater sales growth and lower stock return risk. The economic interpretation of the results is that a 1% increase in audit committee diversity may lead to an increase in long-term growth sales by 0.114% and may equally reduce stock return volatility by 0.363%. This finding aligns with prior studies that emphasised the importance of financial qualification in enhancing the effectiveness of board committees (Alzeban 2020; Klein 2002). Therefore, the result supports the conclusion that audit committee expertise may contribute to firm resilience by promoting sound financial governance and effective risk management (Croci et al. 2024; Iftikhar et al. 2024; Lodorfos et al. 2023). This improved efficiency may strengthen the firm’s ability to navigate challenges and adapt to changing market conditions.

Regarding the control variables, it was found that firm age, profitability and family ownership appear insignificant in the specified models. However, the coefficient of the company size suggests a strong positive effect on LGS and a significant negative link with SRV. The evidence implies that larger companies may be associated with higher sales growth and lower stock return risk. This outcome supports the studies that reported that bigger firms gain goodwill due to their track records (Abor and Fiador 2013; Kusi et al. 2018). Thus, they may have higher sales growth and stable risk management. The results indicate that board independence may pave the way for firm resilience by providing more growth and flexibility for managing risk. The result confirms earlier studies that found that board independence may foster board oversight, mitigate operational risk, and make firms more capable of facing disruptive events and building resilience (Cheong 2021; Jackling and Johl 2009; Maier and Yurtoglu 2022). The coefficient of the government indicates that increasing government shareholding may generate lower sales growth and higher stock return risk. This finding supports the argument that firms with substantial government shareholding may be associated with high agency conflicts due to weaker corporate governance practices (Alshareef 2024; Habbash 2016; Munisi et al. 2014). This may hinder firms’ ability to withstand disruption or the degree of their recovery when faced with such events.

Mediation results

This section shows the empirical evidence concerning the mediation effect of financial sustainability on the relationship between board diversity and firm resilience. This study adopted the Baron and Kenny (1986) approach to perform the mediation analysis. Second, the bootstrapping procedure with 1000 bootstrap resamples and percentile confidence estimates was applied to explore the significance of the mediation (indirect effect). These results are presented in Table 6. The board gender variable was dropped in the mediation analysis because it failed to meet the first mediation condition (insignificant effect in the direct relationship in Table 5). We have only two independent variables: board nationality and audit committee experience. The path analysis to determine the mediation is shown in Table 6.

Based on the outcomes in Table 6, the path of BND – FINS displayed a significantly positive coefficient at a 1% level. Notably, the finding implies that Saudi firms with more foreign directors may be associated with greater financial sustainability. Next, the path FINS - LGS revealed that financial sustainability positively affects long-term growth sales (LGS) at a 5% significance level. Meanwhile, the indirect path of (BND – FINS - LGS) showed a significant positive coefficient (β = 0.1511, p-value = 0.000). The result signified that the coefficient of board nationality (BND) reduced (from 0.77891 to 0.1511) when financial sustainability was inserted into the model. Following Baron and Kenny’s (1986) framework, this study concludes that financial sustainability partially mediates the link between BND and LGS.

Given the outcomes in Table 6, the path of BND – FINS displayed a significantly positive coefficient at a 1% level. Next, the path FINS - SRV revealed that financial sustainability positively affects stock return volatility (SRV) at a 5% significance level. Meanwhile, the indirect path of (BND – FINS - SRV) showed a significant positive coefficient (β = 31.7128, p-value = 0.000). The result signified that the coefficient of board nationality (BND) reduced (from 44.2711 to 31.7128) when financial sustainability was inserted into the model. Following Baron and Kenny’s (1986) framework, this study concludes that financial sustainability partially mediates the link between BND and SRV.

However, the results revealed that the indirect effect coefficients for audit committee experience (ACE) in both models (LGS and SRV) appeared higher than that of the direct effect. Hence, based on the Baron and Kenny (1986) framework, the study concludes that financial sustainability does not mediate the impact of audit committee experience on firm resilience.

The bootstrapping analysis was conducted to assess the significance of the mediation results. The outcomes of this analysis are demonstrated in Table 7.

A bootstrapping procedure with 1000 resamples and percentile confidence estimates was executed to ascertain the significance of the mediation effects. Table 7 presents the results of this robustness test. The bootstrapping estimates for the indirect effects (BND – FINS - LGS) and (BND – FINS - SRV) assessed if financial sustainability significantly mediated the relationship between board nationality and firm resilience. Given that the confidence intervals were positive and statistically different from zero at 90% confidence, the indirect paths were significant. This finding signified that financial sustainability significantly and partially mediates the relationship between board nationality and firm resilience. The outcomes support prior studies and theoretical predictions that better governance associated with board nationality can reduce information asymmetry and align the interests of executives with those of firm owners and other stakeholders (Fama 1980; Khatib et al. 2021). Therefore, governance features such as board nationality may guide businesses towards financial stability and, ultimately, better resiliency (Akbar et al. 2016; Iftikhar et al. 2024; Shakil et al. 2024). The policy implication of the finding is that foreign directorship may serve as an essential mechanism in enhancing firm resilience in the Saudi context. This robust internal governance may enhance monitoring, mitigate agency costs, maximise shareholder value, and build resilience.

Conclusion

The Saudi stock market has been affected by many crises and times of uncertainty, that are strongly impacted. Several firms have failed to withstand this economic shock, resulting in bankruptcy. It has been argued that these economic shocks and their influence on Saudi firms in the market have been connected with weak internal control mechanisms and inadequate risk management. This paper assesses the effect of board diversity on resilience with a mediating role of financial sustainability. The research sampled 166 non-financial listed firms on the Saudi Stock Exchange market. The data covers 2017 to 2023 and was analysed using a fixed effect framework. The findings indicated that board nationality diversity and audit committee expertise may provide greater firm resilience. Firm size, leverage, board independence and government ownership were also significant determinants of firm resilience. In addition, the mediation analysis suggests that board nationality partially mediated the effect of board nationality on firm resilience.

These results support the agency, resource dependence and signalling theories that predicted that board diversity might promote monitoring, provide access to greater talent and enhance the company’s ability to navigate disruptions and maintain resilience in the face of adversity. The policy implication of the empirical evidence is that firms can improve their ability to withstand and recover from disruptions by constituting diverse boards of directors. Also, policymakers can shape regulatory frameworks that encourage good governance practices through board diversity dynamics. The study provides a broader perspective that guides stakeholders to make informed decisions that strengthen organisational resilience and promote long-term corporate stability.

This research must have acknowledged some limitations that may prevent generalising its findings. The study focuses on non-financial companies; other researchers may concentrate on financial companies from different viewpoints. The board diversity attributes used are board gender, board nationality and audit committee expertise. Thus, upcoming studies may exploit other diversity traits such as age, ethnicity, and academic qualifications for a broader analysis. The work focuses on the Saudi corporate sector, and future studies may use other African countries as a sample for comparison purposes.

Data availability

The data has been deposited at the Saudi stock (Tadawul) website: https://www.saudiexchange.sa/wps/portal/tadawul/home.

References

Abor J, Fiador V (2013) Does corporate governance explain dividend policy in Sub-Saharan Africa? Int J Law Manag 55(3):201–225

Adams RB, Ferreira D (2009) Women in the boardroom and their impact on governance and performance. J Financ Econ 94(2):291–309

Aguinis H, Edwards JR, Bradley KJ (2017) Improving our understanding of moderation and mediation in strategic management research. Organ Res Methods 20(4):665–685

Akbar S, Poletti-Hughes J, El-Faitouri R, Shah SZA (2016) More on the relationship between corporate governance and firm performance in the UK: evidence from the application of the generalised method of moments estimation. Res Int Bus Financ 38:417–429

Aksoy M, Yilmaz MK (2023) Does board diversity affect the cost of debt financing? Empirical evidence from Turkey. Gend Manag 38(4):504–524

Al-ahdal WM, Hashim HA (2022) Impact of audit committee characteristics and external audit quality on firm performance: Evidence from India. Corp Gov 22(2):424–445

Al-Ghamdi M, Rhodes M (2015) Family ownership, corporate governance and performance: evidence from Saudi Arabia. Int J Econ Financ 7(2):78–89

Al-Hakimi MA, Borade DB, Saleh MH (2022) The mediating role of innovation between entrepreneurial orientation and supply chain resilience. Asia-Pac J Bus Adm 14(4):592–616. https://doi.org/10.1108/APJBA-10-2020-0376

Alqatamin RM (2018) Audit committee effectiveness and company performance: evidence from Jordan. Acc Financ Res 7(2):48–60

Alregab H (2021) The role of corporate governance in attracting foreign investment: an empirical investigation of Saudi-listed firms in light of Vision 2030. Int J Financ Econ 3(2):1–11

Alshareef MN (2024) Ownership structure and financial sustainability of Saudi listed firms. Sustainability 16:3773. https://doi.org/10.3390/su16093773

Alshareef MN, Sulimany HGH (2024) Board financial expertise and financial sustainability: evidence from Saudi-listed firms. Sustainability 16:7100. https://doi.org/10.3390/su16167100

Alshareef NM, Sulimany HGH (2024) Effects of board gender and foreign directorship on the financial sustainability of Saudi listed firms: does family ownership matter? Heliyon 10(20):e39359. https://doi.org/10.1016/j.heliyon.2024.e39359

Alzeban A (2020) The relationship between the audit committee, internal audit and firm performance. J Appl Acc Res 21(3):437–454

Aras G, Crowther D (2008) Governance and sustainability: an investigation into the relationship between. Manag Decis 46(3):433–448

Arko AC, Abor J, Adjasi CKD, Amidu M (2014) What influence dividend decisions of firms in Sub-Saharan African? J Acc Emerg Econ 4(1):57–78

Armeanu DSŞ, Vintilă G, Gherghina ŞC, Petrache DC, Vintila G, Ghergtian SC, Gherghina SC, Petrache DC (2017) Approaches on correlation between board of directors and risk management in resilient economies. Sustainability 9(2):1–15. https://doi.org/10.3390/su9020173

Bajaher M, Habbash M, Alborr A (2021) Board governance, ownership structure and foreign investment in the Saudi capital market. J Financ Rep Acc 2(2):261–278

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychology research: conceptual, strategic and statistical considerations. J Pers Soc Psychol 51(6):1173–1182

Bart C, McQueen G (2013) Why women make better directors. Int J Bus Gov Ethics 8(1):93–99

Bazhair AH (2022) Audit committee attributes and financial performance of Saudi non-financial listed firms. Cogent Econ Financ 10(1):2127238. https://doi.org/10.1080/23322039.2022.2127238

Bazhair AH (2023) Board governance mechanisms and capital structure of Saudi non-financial listed firms: A dynamic panel analysis. SAGE Open 13(2):1–12. https://doi.org/10.1177/21582440231172959

Bazhair AH, Sulimany HGH (2023) Does family ownership moderate the relationship between board diversity and the financial performance of Saudi-listed firms? Int J Financ Stud. https://doi.org/10.3390/ijfs11040118

Ben Barka H, Legendre F (2017) Effect of the board of directors and the audit committee on firm performance: a panel data analysis. J Manag Gov 21(3):737–755

Bhatt RR, Bhattacharya S (2015) Do board characteristics impact firm performance? An agency and resource dependency theory perspective. Asia-Pac J Manag Res Innov 11(4):274–287

Bokpin GA (2011) Ownership structure, corporate governance and dividend performance on the Ghana stock exchange. J Appl Acc Res 12(1):61–73

Boshnak HA (2021) The impact of audit committee characteristics on audit quality: evidence from Saudi Arabia. Int Rev Manag Mark 11(4):1–12

Boshnak HA (2023) Ownership structure and firm performance: evidence from Saudi Arabia. J Financ Rep Acc. https://doi.org/10.1108/JFRA-11-2022-0422

Boshnak HA, Alsharif M, Alharthi M (2023) Corporate governance mechanisms and firm performance in Saudi Arabia before and during the COVID-19 outbreak performance in Saudi Arabia before and during. Cogent Bus Manag. https://doi.org/10.1080/23311975.2023.2195990

Brennan MJ, Xia Y (2001) Stock price volatility and equity premium. J Monet Econ 47:249–283

Cheng S, Hua X, Wang Q (2023) Corporate culture and firm resilience in China: evidence from the Sino-US trade war. Pac Basin Financ J 79:102039. https://doi.org/10.1016/j.pacfin.2023.102039

Cheong CWH (2021) Risk, resilience, and Shariah-compliance. Res Int Bus Financ 55:101313. https://doi.org/10.1016/j.ribaf.2020.101313

Croci E, Hertig G, Khoja L, Lan LL (2024) Board characteristics and firm resilience: evidence from disruptive events. Corp Gov Int Rev 32(1):2–32. https://doi.org/10.1111/corg.12518

Davidson WN, Xie B, Xu W (2004) Market reaction to voluntary announcements of audit committee appointments: the effect of financial expertise. J Account Public Policy 23(4):279–293

DesJardine M, Bansal P, Yang Y (2019) Bouncing back: building resilience through social and environmental practices in the context of the 2008 global financial crisis. J Manag 45(4):1434–1460. https://doi.org/10.1177/0149206317708854

Donkor A, Trireksani T, Djajadikerta HG (2023) Board diversity and corporate sustainability performance: do CEO power and firm environmental sensitivity matter? Sustainability 15(23):16142. https://doi.org/10.3390/su152316142

Ebaid IE-S (2022) Nexus between corporate characteristics and financial reporting timelines: evidence from the Saudi Stock Exchange. J Money Bus 2(1):43–56

Estelyi KS, Nisar TM (2016) Diverse boards: why do firms get foreign nationals on their boards? J Corp Financ 39:174–192

Fama EF (1980) Agency problems and the theory of the firm. J Political Econ 88(2):288–307

Fama EF, Jensen MC (1983) Separation of ownership and control. J Law Econ 26(2):301–325

Fernandez-Temprano MA, Tejerina-Gaite F (2020) Types of director, board diversity and firm performance. Corp Gov 20(2):324–342

Ghardallou W (2022) Corporate sustainability and firm performance: the moderating role of CEO education and tenure. Sustainability 14(6):3513. https://doi.org/10.3390/su14063513

Githaiga PN, Kosgei JK (2023) Board characteristics and sustainability reporting: a case of listed firms in East Africa. Corp Gov 23(1):3–17. https://doi.org/10.1108/CG-12-2021-0449

Gujarati DN (2003) Basic econometrics, 4th edn. McGraw-Hill Higher Education

Gwilym OP, Morgan G, Thomas S (2010) Dividend stability, dividend yield and stock returns: UK evidence. J Bus Financ Account 27(3):261–281. https://doi.org/10.1111/1468-5957.00313

Habbash M (2016) Corporate governance and corporate social responsibility disclosure: evidence from Saudi Arabia. Soc Responsib J 12(4):740–754

Harjoto MA, Laksmana I, Yang YW (2019) Board nationality and educational background diversity and corporate social performance. Corp Gov 19(2):217–239

Hausman JA (1978) Specification tests in econometrics. J Econom Soc 46(6):1251–1271

Hayes AF (2018) Introduction to mediation, moderation, and conditional process analysis - a regression-based approach, 2nd edn. Guilford Press, New York

Hernandez-Nicolas CM, Martín-Ugedo JF, Mínguez-Vera A (2015) The influence of gender on financial decisions: evidence from small start-up firms in Spain. Bus Adm Manag 18(4):93–107

Hillman AJ, Withers MC, Collins BJ (2009) Resource dependence theory: a review. J Manag 35(6):1404–1427

Hsiao C (1985) Benefits and limitations of panel data. Econom Rev 4(1):121–174

Hussain MJ, Nie D, Ashraf A (2024) The brain gain of corporate boards and green commitment: evidence from China boards. Medit Acc Res. https://doi.org/10.1108/MEDAR-02-2023-1924

Iftikhar A, Ali I, Arslan A, Tarba S (2024) Digital innovation, data analytics, and supply chain resiliency: a bibliometric-based systematic literature review. Ann Oper Res 333(2):825–848. https://doi.org/10.1007/s10479-022-04765-6

Jackling B, Johl S (2009) Board structure and firm performance: evidence from India’s top companies. Corp Gov Int Rev 17(4):492–509

Jensen MC (1986) Agency costs of free cash flow, corporate finance and takeovers. Am Econ Rev 76(2):323–329

Jensen MC (1993) The modern industrial revolution, exit, and the failure of internal control systems. J Financ 48(3):831–880

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behaviour, agency costs and ownership structure. J Financ Econ 3(4):305–360

Kallamu BS, Saat NAM (2015) Audit committee attributes and firm performance: evidence from Malaysian finance companies. Asian Rev Account 23(3):206–231

Kent BH, Pandey N, Kumar S, Haldar A (2020) A bibliometric analysis of board diversity: current status, development, and future research directions. J Bus Res 108:232–246

Khan MA, Khan MA, Liaqat I (2017) Role of corporate governance in shareholders value creation. Int J Strateg Decis Sci 8(2):70–82

Khatib SFA, Abdullah DF, Elamer AA, Abueid R (2021) Nudging toward diversity in the boardroom: a systematic literature review of board diversity of financial institutions. Bus Strategy Environ 30(2):985–1002

Khatib SFA, Al Amosh H (2023) Corporate governance, management environmental training, and carbon performance: the UK evidence. J Knowl Econ. https://doi.org/10.1007/s13132-023-01650-w

Khatib SFA, Ismail IHM, Salameh N, Abbas AF, Bazhair AH, Sulimany HGH (2023) Carbon emission and firm performance: the moderating role of management environmental training. Sustainability 15(10485):1–19

Kirsch A (2018) The gender composition of corporate boards: a review and research agenda. Leadersh Q 29(2):346–364

Klein A (2002) Audit committee, board of director characteristics, and earnings management. J Acc Econ 33:375–400

Kusi BA, Gyeke-dako A, Agbloyor EK, Darku AB (2018) Does corporate governance structures promote shareholders or stakeholders value maximisation? Evidence from African banks. Corp Gov 18(2):270–288

Laskar N, Maji SG (2018) Disclosure of corporate sustainability performance and firm performance in Asia. Asian Rev Acc 26(4):414–443

Lee CY, Wen CR, Thi-Thanh-Nguyen B (2024) Board expertise background and firm performance. Int J Financ Stud. https://doi.org/10.3390/ijfs12010017

Li Y, Zhang XY (2019) Impact of board gender composition on corporate debt maturity structures. Eur Financ Manag 25(5):1286–1320

Lodorfos G, Kostopoulos I, Konstantopoulou A, Shubita M (2023) Sustainable business resilience and development in the pandemic economy: Insights from organisational and consumer research. Int J Organ Anal 31(1):1–6. https://doi.org/10.1108/IJOA-02-2023-008

Lu J, Rodenburg K, Foti L, Pegoraro A (2022) Are firms with better sustainability performance more resilient during crises? Bus Strategy Environ 31(7):3354–3370. https://doi.org/10.1002/bse.3088

Lv W, Wei Y, Li X, Lin L (2019) What dimension of CSR matters to organisational resilience? Evidence from China. Sustainability 11:1561. https://doi.org/10.3390/su11061561

MacKinnon DP (2011) Integrating mediators and moderators in research design. Res Soc Work Pract 21(6):675–681. https://doi.org/10.1177/1049731511414148

Maier F, Yurtoglu BB (2022) Board characteristics and the insolvency risk of non-financial firms. J Risk Financ Manag. https://doi.org/10.3390/jrfm15070303

Miller T, Triana MDC (2009) Demographic diversity in the boardroom: mediators of the board diversity-firm performance relationship. J Manag Stud 46(5):755–786

Mubeen M, Hanif MN (2017) Sustainable growth of non-financial firms: microeconometric evidence from Pakistan. Pak Bus Rev 19(3):630–648

Munisi G, Hermes N, Randoy T (2014) Corporate boards and ownership structure: evidence from Sub-Saharan Africa. Int Bus Rev 23(4):785–796

Muradoglu G, Peng N, Qin H, Xia C(2024) Investor attention and market reactions to early announcements in mergers and acquisitions Int Rev Financ Anal 91:102993. https://doi.org/10.1016/j.irfa.2023.102993

Mustapha M, Ahmad AC (2011) Agency theory and managerial ownership: evidence from Malaysia. Manag Audit J 26(5):419–436

Naciti V (2019) Corporate governance and board of directors: the effect of a board composition on firm sustainability performance. J Clean Prod 237:117727

Omran M, Tahat YA (2020) Does institutional ownership affects the value relevance of accounting information? Int J Acc Inf Manag 28(2):323–342

Othuon DO, Kiende K, Musafiri CM, Ngetich FK (2023) Board diversity effects on the financial performance of small-holder coffee processors: evidence from Kenya. Soc Sci Humanit Open 8(1):100568. https://doi.org/10.1016/j.ssaho.2023.100568

Ozo FK, Arun TG (2019) Stock market reaction to cash dividends: evidence from the Nigerian stock market. Manag Financ 45(3):366–380

Pesaran MH (2015) Time series and panel data econometrics, 1st edn. Oxford University Press

Pfeffer J (1973) Size, composition, and function of hospital boards of directors: a study of organisation-environment linkage. Adm Sci Q 18(3):349–364

Pfeffer J, Salancik GR (2003) The external control of organisations: a resource dependence approach. Stanford University Press

Piesse J, Strange R, Toonsi F (2012) Is there a distinctive MENA model of corporate governance? J Manag Gov 16(4):645–681

Rajverma AK, Arrawatia R, Misra AK, Chandra A (2019) Ownership structure influencing the joint determination of dividend, leverage, and cost of capital. Cogent Econ Financ 7(1):1–25

Ross SA (1977) The determination of financial structure: the incentive-signalling approach. Bell J Econ 8(1):23–40

Sani A (2021) Board diversity and financial performance of the Nigerian listed firms: a dynamic panel analysis. J Acc Bus Educ 6(1):1–13

Sani A, Alifiah MN, Dikko UM (2020) The dynamic relationship between board composition and capital structure of the Nigerian listed firms. J Crit Rev 7(11):621–626

Sarhan AA, Ntim CG, Al-najjar B (2019) Antecedents of audit quality in MENA countries: the effect of firm- and country-level governance quality. J Int Acc Audit Tax 35:85–107

Sewpersadh NS (2019) A theoretical and econometric evaluation of corporate governance and capital structure in JSE-listed companies. Corp Gov 19(5):1063–1081

Shakil MH, Munim ZH, Zamore S, Zamore S (2024) Sustainability and financial performance of transport and logistics firms: does board gender diversity matter? J Sustain Financ Invest 14(1):100–115. https://doi.org/10.1080/20430795.2022.2039998

Sila V, Gonzalez A, Hagendorff J (2016) Women on board: does boardroom gender diversity affect firm risk? J Corp Financ 36:26–53

Singh V (2007) Ethnic diversity on top corporate boards: a resource dependency perspective. Int J Hum Resour Manag 18(12):2128–2146

Sulimany HGH (2023) Ownership structure and audit report lag of Saudi listed firms: a dynamic panel analysis. Cogent Bus Manag. https://doi.org/10.1080/23311975.2023.2229105

Sulimany HGH (2024) Does institutional ownership moderate the relationship between audit committee composition and audit report lag: evidence from Saudi. SAGE Open 14(2):1–14. https://doi.org/10.1177/21582440241241171

Triana M, del C, Richard OC, Su W (2019) Gender diversity in senior management, strategic change, and firm performance: examining the mediating nature of strategic change in high tech firms. Res Policy 48:1681–1693

Ujunwa A (2012) Board characteristics and the financial performance of Nigerian quoted firms. Corp Gov 12(5):656–674

Wang N, Cui D, Jin C (2023) The value of internal control during a crisis: evidence from enterprise resilience. Sustainability 15(513):1–18

Wu Z, Gao J, Luo C, Xu H, Shi G (2024) How does boardroom diversity influence the relationship between ESG and firm financial performance? Int Rev Econ Financ 89:713–730. https://doi.org/10.1016/j.iref.2023.10.045

Yakubu IN, Oumarou S (2023) Boardroom dynamics: the power of board composition and gender diversity in shaping capital structure. Cogent Bus Manag. https://doi.org/10.1080/23311975.2023.2236836

Zaid MAA, Wang M, Adib M, Sahyouni A, Abuhijleh STF (2020) Boardroom nationality and gender diversity: implications for corporate sustainability performance. J Clean Prod 251:119652

Acknowledgements

The authors thank Taif University, Saudi Arabia, for supporting this work through project number (TU- DSPP-2024-303). This research was funded by Taif University, Saudi Arabia, Project No. (TU-DSPP-2024- 303).

Author information

Authors and Affiliations

Contributions

Abdulaziz Ahmed Aljammaz – conceptualisation, writing original, validation, project administration; Suresh Ramakrishnan – supervision, review and editing, conceptualisation; Hamid Ghazi H Sulimany – supervision, visualisation, methodology, formal analysis; Saleh F.A. Khatib – supervision, review and editing; Adnan Ali – review and editing, methodology, formal analysis; Ehsan Almoataz – software, funding, data collection, resources; Abdulrhman Atllah Alharbi – software, data collection, investigation.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

AI Usage disclosure

AI tools were not used in writing this manuscript.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Aljammaz, A.A., Ramakrishnan, S., Sulimany, H.G.H. et al. Mediating role of financial sustainability between board diversity and firms’ resilience: evidence from Saudi listed firms. Humanit Soc Sci Commun 12, 1946 (2025). https://doi.org/10.1057/s41599-025-06195-8

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-06195-8