Abstract

Is there a cost to our well-being from increased affluence? Drawing upon responses from 2.05 million U.S. adults from the Gallup Daily Poll from 2008 to 2017 we find that with household income above ~$63,000 respondents are more likely to experience stress. This contrasts with the trend below this threshold, where at higher income the prevalence of stress decreases. Such a turning point for stress was also found for population sub-groups, divided by gender, race, and political affiliation. Further, we find that respondents who report prior-day stress have lower life satisfaction for all income and sub-group categories compared to the respondents who do not report prior-day stress. We find suggestive evidence that among the more satisfied, healthier, socially connected, and those not suffering basic needs deprivations, this turn-around in stress prevalence starts at lower values of income and stress. We hypothesize that stress at higher income values relates to lifestyle factors associated with affluence, rather than from known well-being deprivations related to good health and social conditions, which may arise even at lower income values if conventional needs are met.

Similar content being viewed by others

Introduction

Human well-being and its relationship with income is a hotly debated area of research, as higher income can provide means to better living conditions1,2, and satisfy psychological needs3, but with potentially diminishing returns4,5. Past research in the U.S. examines the relationship between self-evaluated life satisfaction or experienced emotions, such as happiness, stress, or anger, against income. Overall, with few exceptions, the literature shows that higher incomes are related to higher well-being (more life satisfaction, more happiness, less anger) even though there is mixed evidence on the strength of the relationship at high incomes. Most studies find that higher life satisfaction is associated with higher income well beyond the annual household income of $200,0006,7,8,9, although one study finds that increases in life satisfaction slow down and reverse with personal income growth past $105,00010.

Contradictions have also been reported for the relationship between emotional (or experienced) well-being and high income. Typically, positive-affect emotions such as happiness, enjoyment, or smiling and negative affect emotions such as stress, worry, and sadness are aggregated before analysis11,12,13. Kahneman and Deaton report plateauing (satiation) of emotional well-being at an annual household income of ~$75,0006 while others report a monotonic relationship for different elements of experienced well-being (less sadness and anger, more feeling good) with household income up to $625,0009. This difference has been attributed to the different extents of satiation experienced by people at different levels of well-being among high-income earners14.

Stress stands out among experienced well-being dimensions for potentially having a unique relationship with income: stress has been found to decrease with income up to $60,000–90,0006,8, but then slightly increase at higher incomes. Such a turn-around with income has also been found for aggregated negative-affect emotions (including stress), but it is unclear what specific elements may be driving this trend10. However, Killingworth found no significant correlation for stress (P = 0.0476) with household income9. Given that stress is a complex multidimensional construct15, these seemingly contradictory conclusions may reflect different manifestations of stress for different lived experiences. For example, for one component of stress related to time scarcity, it has been reported that stress increases with income16, especially when the value of time is perceived to be monetary at workplaces17,18. For another component of stress associated with financial worries, it has been reported that higher income is associated with lower distress19. Motivated by the lack of attention to different underlying lived experiences, in this study we examine the phenomenon of turning points in stress more deeply. Who experiences stress, how does its prevalence vary at different income values, and how does it influence life satisfaction? How do these relationships vary across the population sub-groups? We examine the population characteristics that influence the turning point from lower stress prevalence with rising income to growing prevalence, the income value at which the turning point occurs, and how fast the prevalence increases.

Why is it important to examine stress? Increased stress has been linked to increased cortisol levels that are associated with heart-ailments, anxiety, depression, and/or a strain on personal relationships20. There have been several attempts to mitigate such negative consequences of increased stress using environmental and lifestyle changes. In some cases, moderate stress at work has been shown to increase work productivity and help respondents achieve their goals21,22. Holistic stress models suggest that a respondent’s response to stress can be positive (eustress) or negative (distress), and both distress and eustress can be experienced at the same time23. However, there have only been a few studies probing the factors that may relate stress to life satisfaction and affluence.

We hypothesize that the relationship between income and stress differs for different ranges of household incomes, leading to a turning point (increase or U-shaped trend). Previous studies have shown that the turning point in aggregated negative-affect emotions, including stress, varies by demographics such as gender, education, and geography10. We test whether this turn-around is observed in the stress income relationship when the population is divided by gender, race, and political affiliation. As the underlying lifestyle factors that govern the turning point in stress remain unclear across these population demographics, we probe how the turning point for stress versus household income depends on previously reported correlates of stress such as health, smoking habits, basic needs, social, educational, marital, economic, and work factors, and life satisfaction. Lastly, we investigate the lifestyle correlates of stress for the high-income and high-life satisfaction respondents for whom stress might be desirable.

Methods

Data

Data from 2008 to 2017 was analyzed together to estimate the turning/satiation point. The study was not pre-registered. All data analysis was conducted after filtering out entries with key variables such as no household income, age, stress, life satisfaction, and other well-being metrics reported. Household income variable has the highest number of missing values (516,501) followed by life satisfaction (102,230). We report both respondent-level and aggregate-level models. The non-parametric methods used in this study do not rely on any distributional assumptions about the data. The distributions for the key variables of age, life satisfaction, and household income are shown in Supplementary Figs. 1a–c, respectively.

Sample

Data came from the Gallup Daily tracking24 conducted by asking 1000 U.S adults a day questions about political, economic, and well-being questions for the years 2008–2017. The respondents span the 50 U.S. states with standard demographics of race, gender, political affiliation, and occupation, and the weights have been designed to match targets reported by the U.S. Census Bureau. The survey uses a random-digit (RDD) list-assisted landline sample and random-digit-dialing (RDD) wireless phone sampling provided by Survey Sampling International (SS1). The contact rate is 37% for the well-being track and 38% for the Politics and Economics track with a response rate of 9% and 12%, respectively. The completion rate was 86% for the well-being track and 93% for the Economics and Political track. Complete details can be obtained from the Gallup Daily Methodology document from Gallup.

All methods were carried out following relevant guidelines and regulations. The surveys were conducted by Gallup, who obtained informed consent from all the respondents. No participation compensation was provided. The datasets used were anonymized by removing all identifying information on respondents before being made available. Ethics approval was waived by Yale University as the research did not meet the definition of human subjects research, and no Yale University Institutional Review Board review was required per United States federal policy.

Variable definitions

Definitions of measures reported in this study are mentioned below. We separate variables into Native and Derived categories to distinguish variables that were used from Gallup as is from those variables where changes were made before analysis.

Native variables

Life satisfaction

Life satisfaction is reported based on the Cantril ladder question, “Please imagine a ladder with steps numbered from zero at the bottom to ten at the top. The top of the ladder represents the best possible life for you and the bottom of the ladder represents the worst possible life for you. On which step of the ladder would you say you personally feel you stand at this time?” Predicted non-ordinal values of life satisfaction are provided for certain respondents in 2008 for whom the response to this question was compromised. Full details are available in the Gallup Methodology document.

Stress

‘Did you experience the following feelings during A LOT OF THE DAY yesterday? How about stress?’ (Yes/No)

Gender

Gender is based on the response to the question, ‘I am required to ask, are you male or female’. Of those that answered as refused, Gallup codes gender as male or female. (Male/Female)

Race

The combined self-identified race and ethnicity variable made available in the Gallup dataset is used here. (White/Black/Hispanic)

Anger

‘Did you experience the following feelings during A LOT OF THE DAY yesterday? How about anger’? This variable is not available for 2014-2015. (Yes/No)

Worry

‘Did you experience the following feelings during A LOT OF THE DAY yesterday? How about worry?’. This variable is not available for 2017. (Yes/No)

Sadness

Did you experience the following feelings during A LOT OF THE DAY yesterday? How about sadness? (Yes/No)

Enjoyment

‘Did you experience the following feelings during A LOT OF THE DAY yesterday? How about enjoyment?’. (Yes/No)

Happiness

‘Did you experience the following feelings during A LOT OF THE DAY yesterday? How about happiness? (Yes/No)

Smiling

‘Did you experience the following feelings during A LOT OF THE DAY yesterday? How about smiling? (Yes/No) This variable is not available for 2017.

Smoking

‘Do you smoke’ (Smoking/Non-Smoking)

Political affiliation

‘In politics, as of today, do you consider yourself a Republican, a Democrat, or an Independent?’ (Republican/Democrat/Independent)

Strength

‘At work, do you get to use your strengths to do what you do best every day, or not? (Yes/No)

Insurance

‘Do you have health insurance coverage?’ (Insured/Uninsured)

Spouse relation

Your relationship with your spouse, partner, or closest friend is stronger than ever (1: Strongly Disagree, 5: Strongly Agree)

Family/friend time

You always make time for regular trips or vacations with friends and family (1: Strongly Disagree, 5: Strongly Agree)

Goals

In the past 12 months, I have reached most of my goals (1: Strongly Disagree, 5: Strongly Agree)

Standard of living

Compared to the people I spend time with, I am satisfied with my standard of living (1: Strongly Disagree, 5: Strongly Agree)

Community

You can’t imagine living in a better community than the one you live in today. (1: Strongly Disagree, 5: Strongly Agree)

Like what I do

I like what I do every day (1: Strongly Disagree, 5: Strongly Agree)

Derived

Household income

Annual household income is reported using the income summary variable, which bins the household income into categories: “Under $720”, $720 to $5,999”, “$6,000 to $11,999”, “$12,000 to $23,999”, “$24,000 to $35,999”, “$36,000 to $47,999”, “$48,000 to $59,999”, “$60,000 to $89,999”, “$90,000 to $119,999”, “$120,000 and over”. We designated the first three categories as $6,000, and the further ones as $18,000, $30,000, $42,000, $54,000, $75,000, and $10,500 based on the mid-point of the income bracket. For the >$120,000 income category, we estimate the endpoint of the last bin using interpolated cumulative distributive functions using a distribution mean ($68,424) obtained from the Current Population Survey (2008) and then use the harmonic mean of the bin endpoints25,26 to estimate the highest income category as ~$160,000 which is slightly lower compared to the value of $187,500 reported by Tan et al.27. No income correction for inflation for used as inflation remained relatively low during 2008–201728.

Job categories

‘Could you tell me the general category of work you do in your primary job?’ For the unemployed category, we used the variable available from 2010 onwards. The responses were recoded into five groups: Clerical, Sales/Professional, Manager, Business/Service, Construction, Transportation, Repair, Manufacturing, /Farming/Unemployed.

Children

‘How many children, under the Age of 18, are living in your household?” Non-zero responses were coded as having children. (w/Child and w/o Child)

Health

‘Have you ever been told by a physician or nurse that you have any of the following, or not? How about: High blood pressure, High cholesterol, Diabetes, Depression, Cancer, and Obesity (Based on BMI)’. Respondents were classified as ‘Unhealthy’ if they answered Yes to at least one of the above prompts. (Healthy/Unhealthy)

Social

This variable is constructed using the Social Well Being Index score available for 2014–2017 based on whether the Social Well Being Index score was above 60 for social and less than 60 for not social category (out of 100). Social Well Being Index is composed of four questions, your relationship with your spouse, partner, or closest friend is stronger than ever, you always make time for regular trips or vacations with friends and family, someone in your life always encourages you to be healthy, your friends and family give you positive energy every day. (Social/Non-Social)

Education

‘What is the highest level of school you have completed or the highest degree you have received? Respondents with at least a college degree were classified as ‘Graduate’ if they were a ‘College graduate’, or were involved in ‘Post graduate work or degree’ and as ‘Non-Graduate’ if they were involved in any other type of schooling. (Graduate/Non-Graduate).

Divorce

‘What is your current marital status?’ Respondents were classified as ‘Divorced’ if they responded as being divorced and ‘Non-Divorced’ if they responded as being ‘Single/Never been married’, ‘Separated’, ‘Widowed’, or ‘Domestic partnership/living with partner’. (Divorced/Non-Divorced)

Economy

How would you rate economic conditions in this country today - - as excellent, good, only fair, or poor? The excellent/good responses are merged into ‘Positive Economy’ while ‘Fair/Poor’ responses are categorized as ‘Moderate Economy’. (Positive Economy/Moderate Economy).

Needs-Met

‘Have there been times in the past twelve months when you did not have enough money: To buy shelter/food/healthcare that you or your family needed’. Respondents were classified as Needs-Unmet if they responded ‘Yes’ to atleast one of the above prompts. (Needs-Met/Needs-Unmet)

Trust

“Trusting, Open Work Environment”. (Yes/No)

Thriving

Thriving: Current life satisfaction is 7,8,9,10 and expected life is 5 years is 8,9,10. Suffering: Current life satisfaction is 0,1,2,3,4 and expected life is 5 years is 0,1,2,3. Struggling: Not thriving or suffering. (Thriving/Suffering/Struggling)

Working hours

‘In a typical week (7 days), how many hours do you work for an employer.’ The Unemployment variable was combined with the working hours variable to recode the categories as Unemployed, 0–15 h, 15–30 h, and >30 h.

Year-wise descriptive statistics and breakdown of gender, race, and political affiliation sub-groups across other conditional factors are reported in Supplementary Table 1 and Supplementary Table 2, respectively. We also report sub-group sample size, effect sizes (d,h), and statistical power noting that we have enough statistical power to predict effect sizes as low as 0.01 with >97% statistical power (95% C.I.), except for the education sub-group where we found no difference in the average stress proportions (Supplementary Table 1).

The following R packages were used in this study: ggplot229, binsmooth30, tidyverse31, mgcv32, marginaleffects33, modelsummary34, npreg35, BayesFactor36, pwr37, esvis38, performance39.

Statistics and reproducibility

Respondent model

Linear models have been previously used to model well-being-income relationships, but linear models require identification of the breakpoint in the income stress relationship40, and can also result in abrupt shifts in slopes that may not be reflective of the underlying relationship. We, therefore, investigated the non-linear association between stress and income at the respondent level using cubic spline regression models for each of the sub-groups separately (gender, race, political affiliation, health, social, work, economic, education, and life satisfaction quantile) to probe the conditional role of these sub-group factors in altering the location of the turning point. We also investigated the relationship between life satisfaction versus income at different stress values to probe the conditional role of stress.

We analyze these sub-groups separately due to the complex nature of the stress-income relationship for each sub-group. This requires the fitting of penalized cubic spline models with the varied number of knots independently instead of running one large logistic regression model, which could fail to capture the complexities of the turning point and the conditional factors41. For all the models, we controlled for survey year and age (age2 for life satisfaction and income relationship)42 along with the relevant sub-group variables and splines. Additionally, for robustness, we have included gender, employment, and presence of children as co-variates in selected cases. To identify the turning/satiation point for the predicted stress versus household income relationships, we fit penalized cubic splines using the mgcv package in R32 with 3–7 knots for the sub-groups and identified the turning/satiation point by calculating the first derivative of the conditional prediction. For cases where the slope is statistically not different from zero, we assign a satiation point, and for slopes statistically greater than zero (less than zero for positive-affect emotions), we assign a turning point. We report estimated P-values for satiation (two-tailed) and turning (one-tailed) points. In cases where both satiation and turning point are observed, we designate the satiation point as the turning point. For the turning/satiation point estimation using the stress-household income relationship, a log of the income was used, similar to previous studies6,9,10. For the life satisfaction-income relationship, we fit separate spline terms for the respondents who experienced prior-day (ES) and those who did not experience prior-day stress (DES) respondents to model the buffering effect of stress on life satisfaction43,44 with income conditional on each factor using interaction terms. Among the investigated interaction models, we report all model summaries in the Supplementary Information file and only discuss the model with the lowest Akaike information criterion (AIC).

Turning/Satiation points/P-values for sub-groups are reported in Supplementary Tables 3–6 while model summaries are reported in Supplementary Summary Table 1–41 of the Supplementary Information file. A cutoff of <10 was implemented for the Variance Inflation Factor (VIF, for the splines terms concurvity was converted to VIF for easier interpretation) for all the regression models. However, no variables were dropped in any analysis.

Aggregate-model

We also investigated the association between life satisfaction and income and stress and income at an aggregate level for each income category as an auxiliary model to the respondent-model. To identify the turning/satiation point for the stress versus household income relationships and stress versus life satisfaction relationships, we fit cubic splines with 3–6 knots for the sub-groups and identified the turning/satiation point by calculating the first derivative of the fitted curve. For the turning/satiation point estimate using the stress-household income relationship, a log of the income was used similar to previous studies6,9,10, R2 and P-values for the fitted cubic spline models are reported in Supplementary Tables 7–9. We calculated the Bayes factor with Jeffreys–Zellner–Soiw prior with a default scale on medium effect size of 0.70745 similar to Jebb et al.9 to establish whether the reported well-being metrics have a turning point (one-sided test) or decrease (alternate hypothesis of the one-sided test) after the predicted satiation/turning point46,47 using the cubic spline fits. Bayes factor provides not only the strength of the evidence of the turning point (1–3: Weak, 3–10: Moderate, 1–30: Strong, and >30: Very Strong)48,49, but also gives us insights into the strength of the alternate hypothesis by comparing the Bayes Factor for both the alternate and null hypotheses (whether subjective well-being metric increases, remains same, or decreases after the predicted turning point). We find that the choice of prior does not affect the strength of evidence of the turning point for the population overall, with strong evidence observed for wide and ultrawide priors as well. We report Bayes Factors as auxiliary for the satiation/turning point along with the P-values from the respondent-model. For cases, where the respondent and aggregate-models do not agree on the presence of turning/satiation point (For example, Female respondents), we rely on the Bayes Factor to judge the strength of the evidence. For the differences in life satisfaction between the respondents who experienced prior-day (ES) and those who did not experience prior-day stress (DES), we report the 95% confidence intervals and P-values obtained from a t-test for each income level in Supplementary Table 10.

High income-high life satisfaction model

To investigate the lifestyle correlates of stress for those with high life satisfaction and high income, we modeled the relationship using a logistic regression model controlling for the survey year.

In all the Gallup surveys we examine from 2008 to 2017, stress, anger, sadness, worry, happiness, smiling, and enjoyment are binary responses (Yes/No), indicative of respondents’ experiences the previous day, while life satisfaction is a score (0–10) reported on a Cantril ladder50 (Table 1 for variable name, brief description, and range). At the respondent-level, we report predicted life satisfaction and predicted probability of experiencing stress and other emotional well-being metrics the previous day after controlling for survey and age unadjusted for income inflation, and at the aggregate-level, we report average life satisfaction and stress prevalence as population shares for each household income level similar to Kahneman and Deaton5. Henceforth, for convenience, we sometimes refer to stress and other emotional well-being metrics as a descriptor rather than the probability at the respondent level or share of a population at the aggregate-level. Both the respondent-level and aggregate-level analyses yield similar results, as discussed below.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Results

We start by showing how life satisfaction trends with rising income vary across population groups using cubic spline regression models. We then present results on the effect of stress on life satisfaction, followed by a detailed look at the turning points and their drivers.

Higher life satisfaction is associated with higher income but varies by social group

Higher life satisfaction is associated with higher household income (trend in Supplementary Fig. 2a, as evidenced by the statistically significant non-negative slope of the stress and income relationship. The slope was considered significantly different from zero when the 95% C.I. did not overlap with the zero-line in Supplementary Fig. 2b) consistent with previous studies6,9 that show increasing yet diminishing returns for life satisfaction at higher household income (N = 2,038,169). We observe similar trends of higher life satisfaction associated with higher household income for both the respondents who experienced prior-day (ES) and those who did not experience prior-day stress (DES) (trends in Fig. 1a, evidenced by statistically non-negative slope in Supplementary Fig. 3a) as well as population divided by gender (Supplementary Fig. 4a, statistically non-negative slope in inset of Supplementary Fig. 4a), race (Supplementary Fig. 4b, statistically non-negative slope in inset of Supplementary Fig. 4b), and political affiliation (Supplementary Fig. 4c, statistically non-negative slope in inset of Supplementary Fig. 4c). Female respondents (N = 993,908) report higher life satisfaction for all income values compared to male respondents (N = 1,044,259) as evidenced by the statistically positive difference in life satisfaction between the two sub-groups in Supplementary Fig. 4d, in agreement with previous studies8,10. In terms of race, Hispanic respondents (N = 157,446) reported higher or similar life satisfaction for all income values when compared to White (N = 1,602,799) and Black respondents (N = 162,877) except for high-income values where Hispanic respondents reported similar life satisfaction compared to the White respondents (statistically positive and no difference, respectively, in Supplementary Fig. 4d). Divided by political affiliation, respondents identifying as Independent (N = 552,089) reported lower satisfaction for all income values when compared to the Republican (N = 496,289) and Democratic respondents (N = 544,552) (statistically negative differences in Supplementary Fig. 4d). Next, we assess the conditional role of stress in the trends of life satisfaction with income for different population sub-groups using cubic spline regressions.

Trends against annual household income of (a) predicted life satisfaction (95% confidence interval) for the respondents (NOverall = 2,038,169) who experienced prior-day (ES) and those who did not experience prior-day stress (DES) and (b) the predicted probability of experiencing prior-day stress for 2008–2017, showing the estimated turning point, derived from the statistically non-negative region of the slope of the stress against household income ($, logarithmic) relationship.

Higher stress is associated with reduced life satisfaction

For all the investigated population sub-groups, respondents who experienced prior-day stress (ES) report lower satisfaction compared to those who did not experience prior-day stress (DES) for all income values and demographic sub-groups (Fig. 1a, Fig. 2a–c, as evidenced by the statistically positive differences in Supplementary Fig. 5a–d, Supplementary Fig. 6a–c and statistically positive differences in Supplementary Table 10 for aggregate-model). Higher life satisfaction is still associated with higher income for both types of respondents for all sub-groups, as evidenced by the statistically non-negative slopes in Supplementary Figs. 3b–d. To probe whether there are certain job types where experiencing prior-day stress is associated with higher life satisfaction, we investigated trends of life satisfaction with income for respondents across different job categories. We observe that respondents who experienced prior-day stress (ES) report lower life satisfaction than the corresponding respondents who did not experience prior-day stress (DES) across all job categories (statistically positive differences in Supplementary Fig. 7). However, the causes of stress and its impact on life satisfaction likely differ at different income values. This is partly evidenced by the differing relationship between stress and rising income at different income values. We discuss this next.

Predicted life satisfaction (95% confidence interval) against household income ($, logarithmic scale) for respondents who experienced prior-day stress (ES, full) and those who did not experience prior-day stress (DES, dashed) when divided by (a) gender (Male (NMale = 1,044,259), Female (NFemale = 993,908)), b race (White (NWhite = 1,602,799), Black (NBlack = 162,877), Hispanic (NHispanic = 157,446)), and (c) political affiliation (Republican (NRepublican = 496,289), Democrat (NDemocrat = 544,552), Independent (NIndependent = 552,089)), for the years 2008–2017.

Stress, unlike other emotions, decreases, then increases, with rising income

The association of stress with income shows a turning point, unlike other positive and negative-affect emotions, which either show a weak turning point or monotonic trends with income. This turning point was found at an annual household income of ~$63,000 for the overall population (Fig. 1b and Supplementary Table 3) by examining the 95% C.I. of the slope of the stress-income relationship ([95% C.I.sat = −0.0058, 0.0030], P = 0.536 (satiation), P < 0.001 (turning)). The slope was considered significantly different from zero when the 95% C.I. did not overlap the zero-line in Supplementary Fig. 8a, aggregate-model trends are shown in Supplementary Fig. 9a and the corresponding Bayes Factor (B.F.) = 2218 for an increase in stress after the turning point in Supplementary Table 7). For robustness, we introduced additional controls of gender, presence of children, marital status, and employment as fixed effects in modeling the association between stress and income and found a statistically significant turning point in all cases within a range of ~$4000 (Supplementary Fig. 10a and the corresponding slopes are shown in the inset of Supplementary Fig. 10a). The presence of a turning point for stress is unique when compared to the other emotional well-being metrics (Supplementary Table 4). Well-being metrics of negative-affect emotions such as worry show satiation only at higher income (~$114,000, [95% C.I.sat = -0.0066, 0.0002], P = 0.065 (satiation), Supplementary Fig. 11a) while anger (Supplementary Fig. 11b) and sadness (Supplementary Fig. 11c) show no evidence for satiation at higher income (Supplementary Fig. 12a–c for predicted slopes and B.F. = 3.09 for worry in Supplementary Table 8). Positive-affect emotions such as enjoyment and smiling show no evidence for satiation (Supplementary Fig. 11d, f) while happiness (~$131,000, [95% C.I.sat = −0.0006, 0.0061], P = 0.111 (satiation), Supplementary Fig. 11e) show satiation at higher household income. (Supplementary Fig. 12d–f for non-zero predicted slopes and aggregate-model in Supplementary Fig. 13a–f). This suggests that for household income above $63,000, higher income is associated with higher reported stress, but not with higher negative emotions of anger and sadness that are typically associated with stress nor with any decreased positive-affect emotions. This brings into question whether stress is perceived as a burden or a motivator. We next explore how the turning point varies for different demographic sub-groups.

Turning point in stress varies with demographics

The turning points in the stress versus household income relationship vary across demographic sub-groups. Some sub-groups show only satiation, rather than a turn-around, in stress prevalence with rising income. We observed either turning or satiation points for stress with household income for the overall population (Fig. 1b) as well as the population divided by gender (Fig. 3a and statistically non-negative slope in Supplementary Fig. 8b), race (Fig. 3b and statistically non-negative slope in Supplementary Fig. 8c), and political affiliation (Fig. 3c and statistically non-negative slope in Supplementary Fig. 8d). Female respondents report higher stress compared to Male respondents at the satiation point (0.39 [95% C.I. = 0.39, 0.39] vs. 0.32 [95% C.I.sat = 0.33,0.33], respectively, in Supplementary Table 3) and the satiation point for stress (~$77,000, [95% C.I.sat = −0.0086, 0.0006], P = 0.09 (satiation)) for Female respondents was higher than the turning point for Male respondents (~$55,000 ([95% C.I.sat = −0.0022, 0.008], P = 0.271 (satiation), P < 0.001 (turning), B.F. = 3.22 and B.F. = 140,326, respectively, for trends in Supplementary Fig. 9b). Higher-income Black respondents reported lower stress than White and Hispanic respondents (Fig. 3b and statistically positive difference in Supplementary Fig. 14a), which is consistent with a previous study51. Hispanic respondents show a low turning point of ~$34,000 ([95% C.I. = −0.0064, 0.0041], P = 0.674 (satiation), P = 0.002 (turning)) while Black and White respondents had similar turning points of ~$77,000 ([95% C.I.sat = −0.0063, 0.003], P = 0.486 (satiation), P = 0.004 (turning) and ~$82,000 ([95% C.I. = −0.0034, 0.0005], P = 0.141 (satiation), P < 0.001 (turning)), respectively, Supplementary Fig. 8c, B.F. = 47, B.F. = 0.46, and B.F. = 81, respectively, for Supplementary Fig. 9c). Finally, when divided by political affiliation, the turning point for Republican, (~$77,000, 95% C.I.sat = [−0.0048, 0.0009], P = 0.182 (satiation), P = 0.019 (turning)), Democratic (~$72,000, 95% C.I.sat = −0.009, 0.0041], P = 0.218 (satiation), P < 0.001 (turning)), and Independent respondents (~$77,000, 95% C.I.sat = −0.0016, 0.0041], P = 0.394 (satiation), P < 0.001 (turning)) are comparable as seen in Fig. 3c, statistically non-negative slope in Supplementary Fig. 8d and B.F. = 14, B.F. = 6.33 and B.F. = 3.68, respectively, for Supplementary Fig. 9d. We next investigate whether the turning point in the income-stress relationship differs for population groups with differing underlying lifestyle factors.

Trends of stress, as the predicted probability of experiencing prior-day stress, against household income ($, logarithmic scale) by (a) gender (Male (NMale = 1,044,259, Female (NFemale = 993,908)), (b) race (White (NWhite = 1,602,799), Black (NBlack = 162,877), Hispanic (NHispanic =157,446)), and (c) political affiliation (Republican (NRepublican = 496,289), Democrat (NDemocrat = 544,552), Independent (NIndependent = 552,089)) for the years 2008–2017. The curve is a fitted cubic spline showing the 95% confidence interval. Satiation(turning point) is indicated by an empty (a full) circle, derived from the non-negative region of the slope of the stress versus income relationship.

Influence of lifestyle factors on stress

Lifestyle factors may contribute to stress, independent of income and demographic groups. We investigate using cubic spline regression models the difference in turning points and stress prevalence for groups differentiated by health, social conditions, basic needs, economic, work, and education factors—all of which are known correlates of stress from previous studies6,52. For health, we categorized respondents as Healthy and Unhealthy by modifying an existing grouping methodology6 based on whether they were diagnosed with cancer, cholesterol, or high blood pressure along with factors such as obesity53 and depression54, which have also been associated with increased stress. Additionally, we examined smoking status by comparing Smoking and Non-Smoking sub-groups as smoking has been previously linked with poor health55 although the relationship between smoking and stress is complex56. To study the role of social lifestyle factors, we divided respondents into Social/Non-Social categories based on the Social Well-being Index, whether they had children (w/Child, w/o Child), and if they were divorced (Divorced, Non-Divorced). Regarding basic needs, we analyzed sub-groups divided by whether basic needs are being met (Needs-Met, Needs-Unmet), inferred for those worrying about having enough money for shelter, food, and healthcare57. We also studied respondents having health insurance (Insured/Uninsured), as lack of health insurance was previously associated with increased stress58. Concerning economic conditions, we classified respondents as having a Positive or Moderate view of the economic status of the country. Finally, regarding work and education lifestyles, we grouped respondents based on their weekly working hours (0–15 h, 15–30 h, >30 h, and Unemployed) and whether they have a college degree, respectively (Graduate/Non-Graduate). Below, we present the trends in turning points and life satisfaction conditional on stress for each of these lifestyle groups.

The turning points for the Unhealthy and Smoking sub-groups are at higher income and higher stress compared to the Healthy and Non-Smoking sub-groups, respectfully. For the Unhealthy sub-group respondents (N = 1,328,988), stress is higher overall. It decreases more for the lower-income values compared to the healthy low-income values (Fig. 4a). Notably, the turning point is at a much lower income and lower stress for the Healthy sub-group (~$82,000 ([95% C.I.turn = 0.0009, 0.0057], P = 0.007 (turning)) vs. ~$23,000 ([95% C.I.sat = −0.003, 0.0002], P = 0.077 (satiation), P = 0.017 (turning)) in Supplementary Fig. 15a, B.F. = 165 and B.F. = 374 for trends in Supplementary Fig. 16a) and 0.38 [95% C.I. = 0.38, 0.38] vs 0.28 [95% C.I. = 0.28, 0.28], respectively). Moreover, respondents who experienced prior-day stress, regardless of whether they belonged to the Healthy or Unhealthy sub-groups, reported lower life satisfaction than the corresponding respondents who did not for all income values (Supplementary Fig. 17a, statistically positive differences in Supplementary Fig. 5e, and aggregate-model trends in Supplementary Fig. 18a). With respect to smoking habits, we find a turning point for the Non-Smoking sub-group and a satiation point for the Smoking sub-group. We find that fewer in the Non-Smoking sub-group (N = 1,690,769) report stress across all income values, not just the lower income values compared to the Smoking sub-group (N = 346,513) (Fig. 4b, statistically negative difference in Supplementary Fig. 14b, and Supplementary Fig. 16b for the aggregate-model) consistent with previous findings59. For example, for a $30,000 annual household income, stress prevalence is 0.45 [95% C.I. = 0.45, 0.45] for Smoking sub-group (vs. 0.36 [95% C.I. = 0.36, 0.36] for Non-Smoking) while for $160,000 income; stress prevalence is 0.41 [95% C.I. = 0.40, 0.41] for Smoking vs. 0.37 [95% C.I. = 0.37, 0.37] for Non-Smoking sub-group. Further, the turning point occurs at a lower income for the Non-smoking sub-group when compared to the satiation point for the Smoking sub-group (~$51,000 (95% [C.I.sat = −0.0037, 0.0032], P = 0.871 (satiation), P = 0.009 (turning)) vs. ~$94,000 ([95% C.I.sat = −0.0086, 0.0041], P = 0.481 (satiation)), respectively, in Supplementary Fig. 15b, B.F. = 61617 and B.F. = 3.47, respectively, for Supplementary Fig. 16b). Respondents who experienced prior-day stress belonging to both Smoking and Non-Smoking sub-groups report lower life satisfaction than the corresponding respondents who did not experience prior-day stress (Supplementary Fig. 17b, statistically positive difference in Supplementary Fig. 3f). Next, we investigate the role of social factors that are known to moderate the effect of stress by providing coping resources60.

Trends of stress, as the predicted probability of experiencing prior-day stress, against household income ($, logarithmic scale) by (a) health (Healthy (NHealthy = 685,182), Unhealthy (NUnhealthy = 1,328,988)), b smoking (Non-Smoking (NNon-Smoking = 1,690,769), Smoking (NSmoking = 346,513)), c being social (Non-Social (NNon-Social = 247,562), Social (NSocial = 330,108)), d basic needs met (Needs-Unmet (NNeeds-Unmet = 419,809, Needs-met (NNeeds-met = 1,524,920)), e view of the economy (Moderate Economy (NModerate = 1,120,182), Positive Economy (NPositive = 271,539)), and (f ) working hours sub-groups (0–15 h (N0-15 h = 43,979), 15–30 h (N15-30 h = 78,342), >30 h (N>30 h = 660,139), Unemployed (NUnemployed = 63,013)) for the years 2008–2017. The curve is a fitted cubic spline showing the 95% confidence interval. Satiation (turning point) is indicated by an empty (a full) circle, derived from the non-negative region of the slope of the stress versus household income ($, logarithmic) relationship.

Regarding socialization, the Social and Non-Social sub-groups show a larger difference in turning point compared to the groups divided by having children and being divorced. For the more Social sub-groups (N = 330,108), respondents are less likely to experience less prior-day stress at all income values (Fig. 4c, statistically positive differences in Supplementary Fig. 14c). The turning point is at a higher income (~$72,000 ([95% C.I. = −0.0048, 0.0027], P = 0.582 (satiation), P = 0.003 (turning)) for the Non-Social (N = 247,562) compared to the ~$45,000 ([95% C.I. = −0.00105, 0.0006], P = 0.083 (satiation), P = 0.004 (turning)) for the Social sub-group in Supplementary Fig. 15c and B.F. = 85 and B.F. = 66, respectively, for Supplementary Fig. 16c). Compared to health, smoking, social sub-groups, other social factors such as having children (Supplementary Fig. 19a and corresponding slopes in Supplementary Fig. 15d) and being divorced (Supplementary Fig. 19b and corresponding slopes in Supplementary Fig. 15e) do not influence the turning point. In the sub-group with no children (w/o Child, N = 1,437,953), life satisfaction for all the income values is lower or similar to the sub-group with children (w/ Child, N = 598,232) (statistically negative and non-zero differences in Supplementary Fig. 5h) while turning points are similar ([~$72,000, 95% C.Isat = [−0.0102, 0.0007], P = 0.084 (satiation), P = 0.004 (turning)) and ~$77,000, 95% C.I.sat = [−0.0095, 0.0007], P = 0.093 (satiation), P < 0.001 (turning), B.F. = 136 and B.F. = 3.61, respectively, for Supplementary Fig. 16d), respectively, for the w/o Child and w/Child sub-groups. Being divorced (N = 239,947) is associated with higher stress compared to the Non-Divorced sub-group (N = 1,805,545) for all household income values (statistically positive difference in Supplementary Fig. 14d) while the turning points are similar (Supplementary Fig. 15e, ([~$77,000, 95% C.I.sat = [−0.008, 0.0048], P = 0.614 (satiation), P = 0.001 (turning)) and ~$72,000, 95% C.I.sat = [−0.0002, 0.0025], P = 0.094 (satiation), P < 0.001 (turning), B.F. = 3.68 and B.F. = 17469 in Supplementary Fig. 16e), respectively, for the Divorced and Non-Divorced sub-groups.

Fulfillment of basic needs and having health insurance shifts the turning point to lower income with lower stress prevalence. Respondents who don’t worry about having money for basic needs (Need-met sub-group) are less likely to experience prior-day stress than those who don’t for all income values (Fig. 4d and statistically negative difference in Supplementary Fig. 14e). However, the Needs-Met sub-group (N = 1,524,920) shows a turning point at ~$19,000 ([95% C.I.sat = −0.0068, 0.003], P = 0.071 (satiation), P = 0.022 (turning)) in Supplementary Fig. 15f and B.F. = 67,702,785 in Supplementary Fig. 16f) while for the Needs-Unmet sub-group (N = 419,809), we find no evidence for satiation or turning point (Supplementary Fig. 15f). Next, we find a turning point in stress for those having health insurance (~$72,000 for the Insured (N = 1,819,481) ([95% C.I.sat = −0.0014, 0.0013], P = 0.943 (satiation), P < 0.001 (turning) in Supplementary Fig. 19c), B.F. = 34,352 for Supplementary Fig. 16g) while the Uninsured (N = 216,293) show only a satiation point in stress with income ((~$88,000 for the Insured ([95% C.I.sat = −0.0022, 0.0038], P = 0.165 (satiation) in Supplementary Fig. 15g and B.F. was not calculated due to insufficient data points in Supplementary Fig. 16g).

Next, respondents who have a positive view of the economy (N = 271,539) (Fig. 4e) have a lower turning point at ~$32,000 ([95% C.I.sat = −0.0058, 0.0018], P = 0.302 (satiation), P = 0.002 (turning)) compared to ~$72,000 ([95% C.I.turn = 0.003, 0.0051], P = 0.025 (turning) in Supplementary Fig. 15h, B.F. = 77 and B.F. = 2.93, respectively, for Supplementary Fig. 16h) for the ones with a moderate view (N = 1,120,182). Both sub-group respondents who did not experience prior-day stress also reported higher life satisfaction than the corresponding sub-group respondents who did. (Supplementary Fig. 17h, statistically positive differences in Supplementary Fig. 5k).

With respect to work conditions, those who worked for >30 h and those who were Unemployed show monotonic trends between stress against income without a turning point but in opposing directions. For respondents who work for more than 30 h (N = 660,139) weekly experiencing higher stress is associated with higher income compared to respondents who work for 15–30 h (N = 78,342), 0–15 h (N = 43,979), or are unemployed (N = 63,013) for whom experiencing lower stress is associated with higher income (Fig. 4f, non-positive slope in Supplementary Fig. 15i, and Supplementary Fig. 16i for aggregate-model). For the population divided by education, we observe that respondents with a college degree (N = 522,536) are more likely to have experienced prior-day stress than respondents without a college degree (N = 1,466,486) (Graduate vs. Non-Graduate in Supplementary Fig. 19d) for all household income values (non-negative difference in Supplementary Fig. 14f). However, both sub-groups have a similar turning point (~$82,000 ([95% C.I.sat = −0.0037, 0.0026], P = 0.733 (satiation), P = 0.002 (turning)) vs ~$82,000 ([95% C.I.sat = −0.0018, 0.0025], P = 0.754 (satiation), P < 0.001 (turning)) in Supplementary Fig. 15j and B.F. = 4.05, and B.F. = 73, respectively, in Supplementary Fig. 16j for aggregate-model).

Finally, we investigated the turning points for the population overall, considering only demographic and lifestyle groups. We did this because, at the sub-group level, the influence of missing values, bias due to omitted sub-group characteristics (e.g., other races), and variable-non-availability may be higher than for aggregated groups. We find that the turning points are statistically significant in all cases (Supplementary Fig. 10b and non-negative slope in the inset of Supplementary Fig. 10b).

Influence of life satisfaction and affluence on turning points

Respondents who experienced prior-day stress from all the health, social, education, basic needs, economic, work, and education sub-groups report lower life satisfaction than the corresponding respondents who experienced prior-day stress. (Supplementary Fig. 17a–j for trends, statistically positive difference in Supplementary Fig. 5e–n, and Supplementary Fig. 18a–j for aggregate-model trends). Higher life satisfaction is still associated with higher income for both types of respondents for all sub-groups, as evidenced by the statistically non-negative slopes in Supplementary Fig. 3e–n. The Healthier, Non-Smoking, Non-Divorced, socially connected, Basic Needs-Met, Positive economic outlook, and working sub-group respondents report higher life satisfaction than the other corresponding sub-group respondents, while the presence of children does not change life satisfaction (Supplementary Table 1). Moreover, sub-groups with higher life satisfaction also show an earlier turning point in income (except for the education sub-group in Supplementary Fig. 20a) and a larger increase in stress after the turning point (except for the divorced and working hour groups in Supplementary Fig. 20b). For sub-groups where we don’t find evidence for turning/satiation point, we observe comparatively lower life satisfaction (Supplementary Fig. 20a). We, therefore, investigated the conditional role of life satisfaction in the stress against income relationship.

We find that higher life satisfaction is associated with turning points at lower income and with lower stress prevalence. We grouped respondents based on life satisfaction (5th, 15th, 50th, 75th, and 95th quantiles of the life satisfaction distribution) and assessed the turning point in stress (Fig. 5a) for each of these quantiles separately. For those in the 5th quantile, we observe only satiation ($59,000, [95% C.I.sat = −0.0263, 0.0041], P = 0.152 (satiation), slope statistical not different from zero in Supplementary Fig. 21 and Supplementary Table 5). In contrast, for respondents in the 95th quantile, we observed that lower stress is associated with higher life satisfaction, and the turning point becomes significant ($37,000, [95% C.I.turn = −0.00107, 0.0022], P = 0.197 (satiation), P = 0.005 (turning)). We obtained similar results for the aggregate-model for the relationship between income and emotional well-being metrics for the different life satisfaction quantiles (B.F. = 0.30, 1.38, 1,744,033, 6,344,000, and 7977, respectively, for the 5th–95th quantiles in Supplementary Fig. 22 and Supplementary Table 9). We further categorized respondents as suffering, thriving, and struggling based on their current and expected life satisfaction (Supplementary Fig. 23a), and found that the thriving respondents, while having the highest life satisfaction, also have a larger increase in stress after the turning point (($28,000, [95% C.I.sat = −0.002, 0.0015], P = 0.783 (satiation), P < 0.001 (turning)) compared to the suffering respondents in Supplementary Fig. 23b ([$82,000, 95% C.I.sat = −0.0296, 0.0017], P = 0.08 (satiation), B.F. = 752,000, B.F. = 125, and B.F. = 0.36, respectively, in Supplementary Table 9).

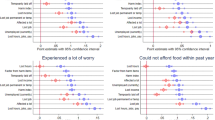

a Trends of stress, as the predicted probability of experiencing prior-day stress, against household income ($, logarithmic) for 5th (N5th = 164,449, 15th (N15th = 241,300), 50th (N50th = 667,520), 75th (N75th = 604,557) and 95th (N95th = 360,343) quantile sub-groups of the life satisfaction distribution for the years 2008–2017. The curve is a fitted cubic spline showing the 95% confidence interval. Satiation (turning point) is indicated by an empty (a full) circle, derived from the non-negative region of the slope of the stress versus household income ($, logarithmic) relationship. b Odds ratios (O.R.) with the 95% C.I. for experiencing prior-day stress using a logistic regression model for the highly satisfied (95th Quantile) and high-income (after the turning point) respondents.

That both higher income and high life satisfaction are associated with higher stress may indicate that other life domains are affected by their lifestyles15 or reflect mere complaints by affluent respondents16. To test the former hypothesis, we investigated the lifestyle correlates of the high life satisfaction (95th Quantile)-high income (after the turning point) respondents using logistic regression models.

We find several lifestyle factors associated with stress for the affluent respondents. Affluent respondents who report using their strengths at work (Odds ratio (O.R.) = 1.33, 95% C.I. = [1.12, 1.57], P < 0.001), have a college degree (O.R. = 1.60, 95% C.I. = [1.46, 1.75], P < 0.001), and work for >30 h (O.R. = 1.25, 95% C.I. = [1.02, 1.53], P < 0.001), are more likely to experience prior-day stress (Fig. 5b). Conversely, respondents who report the feeling of liking what they do every day and achieving their goals are less likely to have experienced prior-day stress (O.R. = 0.91, 95% C.I. = [0.87, 0.95], P < 0.001 and O.R. = 0.87, C.I. = [0.84, 0.92], P < 0.001, respectively, in Fig. 5b). For example, the lack of pro-social behavior, previously shown to be associated with stress61, inferred from having vacation time with friends and family, is linked to a lower likelihood of experiencing prior-day stress (O.R. = 0.82, 95% C.I. = [0.78, 0.85], P < 0.001 in Fig. 5b). Additionally, we find that affluent respondents who reached their goals in the past 12 months are less likely to experience prior-day stress (O.R. = 0.87, 95% C.I. = [0.83, 0.91], P < 0.001 in Fig. 5b). In summary, affluent respondents who work for longer hours and use their strength at work are more likely to experience prior-day stress while those who reached their goals, have vacation time for friends/family are less likely to experience prior day stress.

The demographic and lifestyle factors are also correlated with each other and, when considered together in the context of compounded identities, also influence the turning point. Considering those who are Healthy with basic needs-met (r = 0.08, P < 0.001, Supplementary Fig. 24), we observe vastly different behaviors for the stress against income relationships for the compounded identities (Supplementary Fig. 25a–e). For example, for Healthy respondents with Needs-Met, stress is much lower for low-income respondents (trend in Supplementary Fig. 25a, statistically positive difference in Supplementary Fig. 25b) compared to the Unhealthy and Needs-Unmet respondents). Further, for the Healthy respondents with Needs-Met respondents, higher stress is associated with higher income (statistically positive slope in Supplementary Fig. 25c) in contrast to the Unhealthy and Needs-Unmet respondents for whom lower stress is associated with higher income (statistically non-positive slope in Supplementary Fig. 25c). Next, to understand the lack of a turning point for Female respondents (Fig. 3a), we hypothesized the stress associated with smoking to affect the presence of a turning point as smoking was observed to have a large difference in stress and turning points (Fig. 4c). Therefore, we investigated turning points for female respondents with and without smoking habits reported (Supplementary Fig. 25d). We observe a turning point for female respondents who don’t smoke (~67,000, [95% C.I.sat = −0.0037, 0.0004], P = 0.118 (satiation), P = 0.02 (turning), slope in Supplementary Fig. 25e, B.F. = 63) compared to satiation for female respondents who smoke (~100,000, [95% C.I.sat = −0.0188, 0.0053], P = 0.271 (satiation), slope in Supplementary Fig. 25e, B.F. was not calculated due to insufficient data points). These results suggest the compounding effects of sub-group identities in affecting both stresses associated with low-income deprivations and high-income affluence factors. We next discuss possible hypotheses for the origin of stress across the income and life satisfaction distributions.

Discussion

We systematically described turning points in the stress-income relationship conditioned on life stressors such as poor health, poor social conditions, worrying about having basic needs, and life satisfaction. We confirm that there is a turn-around in the relationship between stress prevalence and income across the U.S. population. This result is consistent with previous results that showed an increase in stress at high income6,8. In specific cases for lifestyle factors such as smoking, unmet basic needs, and working longer hours, we didn’t find evidence for a turning point. These results can potentially explain why the turning point phenomenon was not observed in other studies9.

Although we cannot infer with certainty the causes of the turning point due to several data and methodological limitations discussed below, our detailed results raise some hypotheses that merit further exploration. One may expect that experienced stress is driven by the hardships of being poor that reduce at higher income, presumably because income offers opportunities to relieve or compensate for the sources of stress. This trend of lower stress associated with higher income for those whose basic needs are unmet is consistent with previous studies that unmet basic needs are associated with higher perceived stress15,62. The higher stress associated with higher income for respondents with basic needs met after the turning point suggests that there could be other affluent life circumstances associated with this stress. They are also consistent with past findings of higher well-being along other dimensions—less negative emotions such as anger, worry, and sadness, and higher life satisfaction—and logically consistent with them, given the known increase in cortisol levels with stress that increases the chance of congestive heart failure63. The secular difference in stress prevalence between the Unhealthy and Healthy sub-groups is also consistent with these findings. These results may suggest that poor health drives stress64, but also that respondents at lower income enjoy fewer coping mechanisms or compensating life circumstances65. Another possible explanation is that stress is job-related, where it has two competing effects. Stressful conditions at work can be linked to the risk of diabetes66, possible increased cardiovascular risk67, and common mental disorders68, which may not be reflected in any well-being measures since they are long-term, while also leading to increased productivity, which leads to higher income despite its negative consequences69. This is consistent with the observation that for respondents working for >30 h a week, higher stress is associated with higher income without a turning point, and we only observe the trends of lower stress associated with higher income for the unemployed. The puzzle, however, is why stress prevalence increases above a certain household income value for other sub-groups.

The consistency across various demographics (gender, race, and political affiliation) and lifestyles (health, socialization, education, basic needs, and work conditions) of a turning point in the income-stress relationship, differences in income value at which the turning points occur, and the extent of stress at different income values point to the likely heterogeneity in the perception of stress with life circumstances for different groups including access to basic needs15, time pressure16, income equality70. For example, the larger differences in the turning/satiation point when divided by race and gender compared to political affiliation could suggest that daily stressful circumstances are less influenced by political affiliation. Yet there is the possible universality of the impact of affluent lifestyles on stress that seems to dominate incomes after the turning point.

We see heterogeneity in the turning point within lifestyle sub-groups. For example, the higher income and higher stress at the satiation point for the Smoking sub-group may suggest that it takes more from life (what higher incomes can buy) for smokers to get to a point where stress starts to increase again, or that higher income compensates for the stressors associated with smoking. Also, the lower income and lower stress at the turning point for the Social sub-group suggest that a relatively lower income is needed to compensate for the low-income stressors associated with being social. Of most significance is the finding that higher life satisfaction is associated with a lower turning point income, and the more that this association strengthens with higher income. Comparing people with similar life satisfaction, by quantile, we see a stronger relationship between increased stress prevalence and income and starting at lower income for the highest life satisfaction quantile. Among those with the lowest life satisfaction, even at very high incomes, we do not see a higher stress prevalence associated with higher income. Perhaps this is a sign of people’s propensity to want more the more satisfied they are if stress is how they internalize this desire.

Our findings contribute to the existing literature on stress associated with affluent lifestyles and time scarcity. For the high life satisfied high-income respondents, experiencing stress is associated with not having enough time for friends and family, working for longer hours, and not reaching goals—Factors consistent with previously reported attributes of time scarcity and affluent lifestyle such as spending a large portion of time at work leaving no time for other activities15, or not having enough time to spend their money16. As the study here is not designed to measure the quality and intensity of stress that respondents report, future studies can focus on the nature of stress at various income values, especially among the affluent.

Overall, our results show that experiencing any kind of stress is associated with lower life satisfaction at all income values. While the decreasing difference in life satisfaction between respondents who experienced prior-day stress and those who did not at higher income could be attributed to the buffering nature of income against negative emotions43,44, significant differences in life satisfaction persist even at the highest income values. Our findings suggest that the life satisfaction of higher-income households could be even higher without the experience of stress. What remains to be answered is whether the higher stress associated with high-income lifestyles is desirable. Or if there are ways to avoid the feeling of experiencing prior-day stress. The exploratory nature of this work is aimed at establishing factors that could influence the turning point. As the data is cross-sectional, we are unable to make causal inferences or test hypotheses between the stress and the sub-group lifestyle factors. Instead, we lay down hypotheses about the possible causal mechanisms through an exploratory analysis of the sub-group factors. We suggest that more causal data be collected on the nature and causes of stress to understand how they contribute to overall well-being, especially at high incomes and factors that showed a larger influence on the turning point, such as health, social, basic needs fulfillment, and working hours.

Limitations

Some limitations must be considered in the interpretation of the results discussed in this study. The binary nature of the stress variable reported here does not allow us to infer whether self-reported stress is beneficial or not, the intensity of the experienced stress, and whether other avenues of well-being are correlated with stress. Therefore, we recommend that future data collection probe stress prevalence with higher time resolution and a richer set of well-being measures while testing the mechanisms proposed in this study. Household income is reported crudely, in bins, which could further bring uncertainty in the turning point estimation. For example, Kudrna and Kushlev have shown that moderate to null effects were observed for the relationship between happiness and income depending on whether income was treated as a continuous or a binned variable, respectively71. We also do not rule out that we do not have enough data for the high-income values to capture the turning point in life satisfaction and other positive/negative affect emotions reported previously10 where higher stress would again be associated with lower life satisfaction. We also note that the Bayes Factor for the aggregate-model was not calculable in some cases due to insufficient data points due to income aggregation of the stress variable. We also find some differences between the results from the respondent-level and the aggregate-model which could also be attributed to insufficient data points from income-aggregation. Further, income is reported for the entire household while other metrics are at the respondent level. Our findings assume that income is distributed evenly across various sub-groups in the household.

The range of income values for the turning points (~$19,000–~$100,000) observed amongst the various sub-groups suggest that several underlying mechanisms of economic valuation of time, social comparison72,73, and perception70 might be at play, which is beyond the scope of this study. While we have considered several sub-group factors based on insights from existing literature, the list of such factors is not exhaustive. For example, we have not considered factors such as having a high net worth74, or dual-income families with young children75 and other third variables that could influence the stress-income relationship due to the non-availability of such variables in the current dataset. We have not considered all possible confounders between demographic and sub-group factors that could influence the turning point. Comparison of life satisfaction between respondents has been criticized by Bond and Lang due to the lack of reliability between the reported integer and the internal mental state76. However, recent work has shown the predictive power of numerical scales over other socioeconomic parameters77. We also note that the reverse causality is possible due to the possible bi-directionality of the association between income, stress, and life satisfaction78,79,80 and this was not considered in this study.

Data availability

All data was obtained with permission from Gallup. The raw data (.dta) and the processed data can be made available upon request to the corresponding author (Karthik Akkiraju) after obtaining permission from Gallup. The datasets may also be directly obtained from Gallup. The data underlying the Figures is available at https://doi.org/10.5281/zenodo.14618513.

Code availability

All the processing, data analysis, and figure creation was conducted using RStudio 2023.06.2. The processing scripts (.R) for all the analyses are available at Zenodo81. This link to the Zenodo repository is https://doi.org/10.5281/zenodo.14618513.

References

Sacks, D. W., Stevenson, B. & Wolfers, J. Subjective Well-Being, Income, Economic Development and Growth (National Bureau of Economic Research, 2010).

Lucas, R. E. & Schimmack, U. Income and well-being: how big is the gap between the rich and the poor? J. Res. Personal. 43, 75–78 (2009).

Howell, R. T., Kurai, M. & Tam, L. Money buys financial security and psychological need satisfaction: testing need theory in affluence. Soc. Indic. Res. 110, 17–29 (2013).

Aknin, L. B., Norton, M. I. & Dunn, E. W. From wealth to well-being? Money matters, but less than people think. J. Posit. Psychol. 4, 523–527 (2009).

Diener, E. & Seligman, M. E. P. Beyond money: toward an economy of well-being. Psychol. Sci. Public Interest 5, 1–31 (2004).

Kahneman, D. & Deaton, A. High income improves evaluation of life but not emotional well-being. Proc. Natl. Acad. Sci. USA 107, 16489–16493 (2010).

Diener, E., Sandvik, E., Seidlitz, L. & Diener, M. The relationship between income and subjective well-being: relative or absolute? Soc. Indic. Res. 28, 195–223 (1993).

Klein Teeselink, B. & Zauberman, G. The Anna Karenina income effect: well-being inequality decreases with income. J. Econ. Behav. Organ. 212, 501–513 (2023).

Killingsworth, M. A. Experienced well-being rises with income, even above $75,000 per year. Proc. Natl. Acad. Sci. USA 118, e2016976118 (2021).

Jebb, A. T., Tay, L., Diener, E. & Oishi, S. Happiness, income satiation and turning points around the world. Nat. Hum. Behav. 2, 33–38 (2018).

Huppert, F. A. & Whittington, J. E. Evidence for the independence of positive and negative well-being: implications for quality of life assessment. Br. J. Health Psychol. 8, 107–122 (2003).

Headey, B. & Wooden, M. The effects of wealth and income on subjective well-being and ill-being. Econ. Rec. 80, S24–S33 (2004).

De Neve, J. E. & Oswald, A. J. Estimating the influence of life satisfaction and positive affect on later income using sibling fixed effects. Proc. Natl. Acad. Sci. USA 109, 19953–19958 (2012).

Killingsworth, M. A., Kahneman, D. & Mellers, B. Income and emotional well-being: a conflict resolved. Proc. Natl. Acad. Sci. USA 120, e2208661120 (2023).

Ng, W., Diener, E., Aurora, R. & Harter, J. Affluence, feelings of stress, and well-being. Soc. Indic. Res. 94, 257–271 (2009).

Hamermesh, D. S. & Jungmin, L. Stressed out on four continents: time crunch or yuppie kvetch? Rev. Econ. Stat. 89, 374–383 (2007).

DeVoe, S. E. & Pfeffer, J. Time is tight: how higher economic value of time increases feelings of time pressure. J. Appl. Psychol. 96, 665–676 (2011).

Pfeffer, J. & Carney, D. R. The economic evaluation of time can cause stress. Acad. Manag. Discov. 4, 74–93 (2018).

Ryu, S. & Fan, L. The relationship between financial worries and psychological distress among U.S. adults. J. Fam. Econ. Issues 44, 16–33 (2022).

Sher, L. Type D personality: the heart, stress, and cortisol. QJM Int. J. Med. 98, 323–329 (2005).

Crum, A. J., Salovey, P. & Achor, S. Rethinking stress: the role of mindsets in determining the stress response. J. Pers. Soc. Psychol. 104, 716–733 (2013).

Rudland, J. R., Golding, C. & Wilkinson, T. J. The stress paradox: how stress can be good for learning. Med. Educ. 54, 40–45 (2020).

Branson, V., Palmer, E., Dry, M. J. & Turnbull, D. A holistic understanding of the effect of stress on adolescent well-being: a conditional process analysis. Stress Health 35, 626–641 (2019).

Gallup Daily Poll. https://www.gallup.com/224855/gallup-poll-work.aspx.

Thiede, B. C., Butler, J. L. W., Brown, D. L. & Jensen, L. Income inequality across the rural-urban continuum in the United States, 1970–2016. Rural Sociol. 85, 899–937 (2020).

von Hippel, P. T., Hunter, D. J. & Drownb, M. Better estimates from binned income data: interpolated CDFs and mean-matching. Sociol. Sci. 4, 641–655 (2017).

Tan, J., Jachimowicz, J., Smerdon, D. & Hauser, O. Opposing effects of economic inequality concentrated at the top or bottom of the income distribution on subjective well-being. Preprint at https://doi.org/10.31234/OSF.IO/5RCMZ (2021).

Bureau of Labor Statistic (BLS) Website. https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm (Accessed Feb 10, 2025).

Wickham, H. Data Analysis 189–201 (2016).

Binsmooth R Package. https://doi.org/10.32614/CRAN.package.binsmooth (2022).

Wickham, H. et al. H. Welcome to the tidyverse. J. Open Source Softw. 4, 1686 (2019).

Wood, S. N. Fast stable restricted maximum likelihood and marginal likelihood estimation of semiparametric generalized linear models. J. R. Stat. Soc. Ser. B Stat. Methodol. 73, 3–36 (2011).

Arel-Bundock, V., Greifer, N. & Heiss, A. How to interpret statistical models using marginal effects for R and Python. J. Stat. Softw. 111, 1–32 (2024).

Arel-Bundock, V. Model summary: data and model summaries in R. J. Stat. Softw. 103, 1–23 (2022).

Helwig, N. E. Multiple and generalized nonparametric regression. SAGE Res. Methods Found. https://doi.org/10.4135/9781526421036885885 (2020).

Morey, R. D.; Rouder, J. N. Bayesfactor: computation of Bayes factors for common designs. R package version 0.9.12-4.2. https://CRAN.R-project.org/package=BayesFactor (2025).

Champely, S., Ekstrom, C., Dalgaard, P., Gill, J., Weibelzahl, S., Anandkumar, A., Ford, C., Volcic, R. & Rosario, H. D. Pwr: Basic Functions for Power Analysis https://nyuscholars.nyu.edu/en/publications/pwr-basic-functions-for-power-analysis (2017).

Esvis R. Package. https://doi.org/10.32614/CRAN.package.esvis (2022).

Lüdecke, D., Ben-Shachar, M. S., Patil, I., Waggoner, P. & Makowski, D. Performance: an R package for assessment, comparison and testing of statistical models. J. Open Source Softw. 6, 3139 (2021).

Bennedsen, M. Income and emotional well-being: evidence for well-being plateauing around $200,000 per year. Econ. Lett. 238, 111730 (2024).

Lazarus, R. S., DeLongis, A., Folkman, S. & Gruen, R. Stress and adaptational outcomes. the problem of confounded measures. Am. Psychol. 40, 770–779 (1985).

Stone, A. A., Schwartz, J. E., Broderick, J. E. & Deaton, A. A snapshot of the age distribution of psychological well-being in the United States. Proc. Natl. Acad. Sci. USA 107, 9985–9990 (2010).

Hudson, N. W., Lucas, R. E., Donnellan, M. B. & Kushlev, K. Income reliably predicts daily sadness, but not happiness. Soc. Psychol. Personal. Sci. 7, 828–836 (2016).

Kushlev, K., Dunn, E. W. & Lucas, R. E. Higher income is associated with less daily sadness but not more daily happiness. Soc. Psychol. Personal. Sci. 6, 483–489 (2015).

Rouder, J. N., Speckman, P. L., Sun, D., Morey, R. D. & Iverson, G. Bayesian t tests for accepting and rejecting the null hypothesis. Psychon. Bull. Rev 16, 225–237 (2009).

Van Ravenzwaaij, D., Monden, R., Tendeiro, J. N. & Ioannidis, J. P. A. Bayes factors for superiority, non-inferiority, and equivalence designs. BMC Med. Res. Methodol. 19, 71 (2019).

Dienes, Z. How bayes factors change scientific practice. J. Math. Psychol. 72, 78–89 (2016).

Dienes, Z. Using bayes to get the most out of non-significant results. Front. Psychol. https://doi.org/10.3389/fpsyg.2014.00781 (2014).

Wetzels, R. et al. Statistical evidence in experimental psychology: an empirical comparison using 855 t tests. Perspect. Psychol. Sci. 6, 291–298 (2011).

Cantril, H. The Pattern of Human Concerns (Rutgers University Press, 1965).

Graham, C. & Pinto, S. Unequal hopes and lives in the USA: optimism, race, place, and premature mortality. J. Popul. Econ. 32, 665–733 (2019).

Nielsen, L., Curtis, T., Kristensen, T. S. & Rod Nielsen, N. What characterizes persons with high levels of perceived stress in Denmark? A national representative study. Scand. J. Public Health 36, 369–379 (2008).

Cuevas, A. G., Chen, R., Thurber, K. A., Slopen, N. & Williams, D. R. Psychosocial stress and overweight and obesity: findings from the Chicago community adult health study. Ann. Behav. Med. 53, NP–NP (2019).

Bayram, N. & Bilgel, N. The prevalence and socio-demographic correlations of depression, anxiety and stress among a group of university students. Soc. Psychiatry Psychiatr. Epidemiol. 43, 667–672 (2008).

Larsson, S. C. & Burgess, S. Appraising the causal role of smoking in multiple diseases: a systematic review and meta-analysis of Mendelian randomization studies. eBioMedicine. https://doi.org/10.1016/j.ebiom.2022.104154 (2022).

Kassel, J. D., Stroud, L. R. & Paronis, C. A. Smoking, stress, and negative affect: correlation, causation, and context across stages of smoking. Psychol. Bull. 129, 270–304 (2003).

Whelan, C. T. & Maître, B. Understanding material deprivation: a comparative European analysis. Res. Soc. Stratif. Mobil. 30, 489–503 (2012).

Alang, S. M., Mcalpine, D. D. & Henning Smith, C. E. Disability, health insurance, and psychological distress among US adults. Soc. Ment. Health 4, 164–178 (2014).

Richards, J. M. et al. Biological mechanisms underlying the relationship between stress and smoking: state of the science and directions for future work. Biol. Psychol. 88, 1–12 (2011).

Thoits, P. A. Stress, coping, and social support processes: where are we? What next? J. Health Soc. Behav, Spec No, 53–79 (1995).

Ng, W. & Diener, E. Stress’s association with subjective well-being around the globe, and buffering by affluence and prosocial behavior. J. Posit. Psychol. 17, 790–801 (2022).

Cappelletti, E. R., Kreuter, M. W., Boyum, S. & Thompson, T. Basic needs, stress and the effects of tailored health communication in vulnerable populations. Health Educ. Res. 30, 591–598 (2015).

York, K. M., Hassan, M. & Sheps, D. S. Psychobiology of depression/distress in congestive heart failure. Heart Fail. Rev. 14, 35–50 (2008).

Watson, J. M., Logan, H. L. & Tomar, S. L. The influence of active coping and perceived stress on health disparities in a multi-ethnic low income sample. BMC Public Health 8, 1–9 (2008).

Murphy, A., McGowan, C., McKee, M., Suhrcke, M. & Hanson, K. Coping with healthcare costs for chronic illness in low-income and middle-income countries: a systematic literature review. BMJ Glob. Health 4, e001475 (2019).

Heraclides, A., Chandola, T., Witte, D. R. & Brunner, E. J. Psychosocial stress at work doubles the risk of type 2 diabetes in middle-aged women: evidence from the Whitehall II study. Diabetes Care 32, 2230 (2009).

Szerencsi, K. et al. The association between study characteristics and outcome in the relation between job stress and cardiovascular disease—a multilevel meta-regression analysis. Scand. J. Work. Environ. Health 38, 489–502 (2012).

Clark, C. et al. The contribution of work and non-work stressors to common mental disorders in the 2007 adult psychiatric morbidity survey. Psychol. Med. 42, 829–842 (2012).

Hargrove, M. B., Becker, W. S. & Hargrove, D. F. The HRD eustress model: generating positive stress with challenging work. Hum. Resour. Dev. Rev. 14, 279–298 (2015).

Willis, G. B., García-Sánchez, E., Sánchez-Rodríguez, Á., García-Castro, J. D. & Rodríguez-Bailón, R. The psychosocial effects of economic inequality depend on its perception. Nat. Rev. Psychol 1, 301–309 (2022).

Kudrna, L. & Kushlev, K. Money does not always buy happiness, but are richer people less happy in their daily lives? It depends on how you analyze income. Front. Psychol. 13, 883137 (2022).

Clark, A. E. & Oswald, A. J. Satisfaction and comparison income. J. Public Econ. 61, 359–381 (1996).

Paul, S. & Guilbert, D. Income–happiness paradox in Australia: testing the theories of adaptation and social comparison. Econ. Model. 30, 900–910 (2013).

Donnelly, G. E., Zheng, T., Haisley, E. & Norton, M. I. The amount and source of millionaires’ wealth (moderately) predict their happiness. Pers. Soc. Psychol. Bull. 44, 684–699 (2018).

Goldin, C. The quiet revolution that transformed women’s employment, education, and family. Am. Econ. Rev. 96, 1–21 (2006).

Bond, T. N. & Lang, K. The sad truth about happiness scales. J. Polit. Econ. 127, 1629–1640 (2019).

Kaiser, C. & Oswald, A. J. The scientific value of numerical measures of human feelings. Proc. Natl. Acad. Sci. USA 119, e2210412119 (2022).

Jiménez-Solomon, O., Irwin, G., Melanie, W. & Christopher, W. When money and mental health problems pile up: the reciprocal relationship between income and psychological distress. SSM - Popul. Health 25, 101624 (2024).

Liu, X., Li, Y. & Cao, X. Bidirectional reduction effects of perceived stress and general self-efficacy among college students: a cross-lagged study. Humanit. Soc. Sci. Commun. 11, 1–8 (2024).

Zheng, Y., Zhou, Z., Liu, Q., Yang, X. & Fan, C. Perceived stress and life satisfaction: a multiple mediation model of self-control and rumination. J. Child Fam. Stud. 28, 3091–3097 (2019).

Zenodo Code Repository. (2024) https://doi.org/10.5281/zenodo.14618513 (Accessed Jan 8, 2025).

Acknowledgements