Abstract

Solid-state lithium metal batteries show substantial promise for overcoming theoretical limitations of Li-ion batteries to enable gravimetric and volumetric energy densities upwards of 500 Wh kg−1 and 1,000 Wh l−1, respectively. While zero-lithium-excess configurations are particularly attractive, inhomogeneous lithium plating on charge results in active lithium loss and a subsequent coulombic efficiency penalty. Excess lithium is therefore currently needed; however, this negatively impacts energy density and thus limiting its thickness is essential. Here we discuss the viability of various technologies for realizing thin lithium films that can be scaled up to the volumes required for gigafactory production. We identify thermal evaporation as a potentially cost-effective route to address these challenges and provide a techno-economic assessment of the projected costs associated with the fabrication of thin, dense lithium metal foils using this process. Finally, we estimate solid-state pack costs made using thermally evaporated lithium foils.

Similar content being viewed by others

Main

Lithium metal batteries (LMBs) offer enhanced volumetric and gravimetric energy densities compared with Li-ion batteries (LIBs), owing to lithium’s higher specific capacity than graphite1. Dendritic lithium deposition and cell shorting are problematic in the liquid state2, whereas solid electrolytes (SEs) can in theory suppress dendrite formation to allow LMBs to achieve the high C-rates and volumetric energy density (1,000 Wh l−1) desired by the automotive industry3,4.

To become a reality, solid-state battery (SSB) production costs must be competitive with LIBs. The USABC’s target cost for high-performance electric vehicle (EV) batteries is US$125 kWh−1 (ref. 5). Cathode production costs for lithium SSBs are not envisaged to be substantially different from liquid-state LIBs, as cathode active materials (CAMs) are interchangeable between liquid and solid states. SEs are yet to be finalized, with various electrolytes and production techniques being investigated6, but the most promising utilize Earth-abundant materials, so their cost at scale should not prove to be prohibitive to SSB adoption7.

Anode production methods have been discussed in the literature8,9, yet their ability to be commercialized for SSBs and the cost of production are yet to be analysed. A recent Benchmark solid-state and LMB report concluded that the lithium metal industry is underprepared for widespread development of LMBs10, projecting that battery-grade lithium metal supply will fall short of demand in 2024.

Herein we calculate the volumetric energy density as a function of anode thickness to determine the maximum permissible thickness of lithium metal anodes able to achieve an energy density of 1,000 Wh l−1. We then analyse lithium production techniques to identify the most promising candidate for mass-scale production and conduct a techno-economic assessment to estimate the associated production costs. Finally, we discuss the critical scientific and technological challenges in implementing mass production.

Lithium anode requirements

To achieve the high energy density battery desired by the automotive industry, one could use high areal capacities (Fig. 1d). Higher areal capacities, however, limit the charge/discharge rate owing to limitations of ion transport within the composite cathode11. A teardown of Tesla’s latest Li-ion 4680 cylindrical cell revealed an areal capacity of 4.9 mAh cm−2 (ref. 12), while Samsung has reported good cyclability of a lithium metal SSB with an areal capacity of 5.4 mAh cm−2 (ref. 4). This work will therefore take an areal capacity of 5.4 mAh cm−2 as an achievable target for commercialized SSBs.

a–c, Schematics of SSBs with varying anode thicknesses: zero lithium excess (a), 17 µm (b) and 100 µm (c). d, Volumetric energy density as a function of anode thickness (dashed lines represent the maximum permitted anode thickness to achieve 1,000 Wh l−1, when an areal capacity of 5.4 mAh cm−2 is used). e, CE required to maintain 75% capacity after 1,250 cycles (dashed lines represent the minimum required CE to maintain 75% capacity after 1,250 cycles when an areal capacity of 5.4 mAh cm−2 and a starting volumetric energy density of 1,000 Wh l−1 are used).

SSB energy density is maximized in the zero-lithium-excess architecture (Fig. 1a), where on cell assembly fully lithiated CAM is used in the composite cathode while the anode simply consists of a current collector (CC). Upon charging, lithium plates on the CC forming the anode. This zero-lithium-excess configuration with an areal capacity of 5.4 mAh cm−2 leads to a cell energy density of 1,100 Wh l−1 (Fig. 1d; calculation details are shown in Methods and cell geometry in Supplementary Figs. 1 and 2)4. To achieve 75% capacity retention (CR) after a target number of cycles (n) of 1,250 (as EV health guarantees require)13, an average coulombic efficiency (CE) target of ≥99.964% per cycle is required in the zero-lithium-excess configuration (as shown by the y-intercept in Fig. 1e), where CE is defined as the proportion of the cyclable lithium inventory retained each cycle14.

While ideally SEs would suppress dendritic growth and prevent lithium loss from reducing the CE, zero-lithium-excess SSBs currently suffer from inhomogeneous lithium deposition on the first charge15,16. In addition, there is considerable solid electrolyte interphase (SEI) formation17,18, further reducing the CE.

This highlights the need for a lithium excess layer, as inhomogeneous lithium plating can be subdued by providing a lithium seed layer for lithium to plate onto15. The seed layer also acts as a reservoir to replace any lithium lost to irreversible processes during charge/discharge (for example, SEI formation), and could also allow for the use of passivation layers, which are known to have an impact on SEI formation and CE19,20. This seed layer ultimately lowers the energy density, as can be seen in Fig. 1d. To meet the volumetric energy density target of ≥1,000 Wh l−1, a maximum excess of 17 µm (Fig. 1b) is permitted. To achieve 75% capacity retention after 1,250 cycles with this lithium excess, an average CE of ≥99.929% is required (shown by dashed lines in Fig. 1e; Supplementary Table 1). This CE is not substantially higher than has already been published in the literature (>99.8% over 1,000 cycles)4, and thus should be viewed as an achievable target for the automotive industry.

Manufacturing thin lithium metal anodes

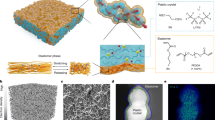

There are several ways of producing lithium metal anodes; however, the technology must be mature, cost competitive and the production rate compatible with gigafactory outputs (35 GWh yr−1 equates to 197 Mm2 yr−1; see ‘Gigafactory calculation’ in Methods). Acebedo et al. categorize the commercially most feasible techniques into four groups8: extrusion, liquid-based, electrodeposition and vapour-based (Fig. 2).

The current commercial standard method of manufacturing thin lithium foils is through a combination of extrusion and calendering (Fig. 2a). Calendering can produce ~50 µm films in a reliable and reproducible manner1. This, however, is still notably too thick to achieve a volumetric energy density of 1,000 Wh l−1. The highly adhesive nature of lithium makes damage-free calendering to below 50 µm extremely challenging9,21, so 20 µm lithium foils are only commercially available with a high cost of ~US$6,000 m−2 (ref. 22).

The low melting temperature of lithium lends itself to liquid-based processing (Fig. 2b). The highly reactive nature of lithium and its adhesion to tooling and equipment surfaces, however, limits the use of melt-processing techniques in obtaining scalable lithium films having sub-50 µm thicknesses in a reliable and reproducible manner.

Electrodeposition (Fig. 2c) can in theory be used to fabricate films of a set thickness. The use of liquid electrolyte is problematic, however, as concurrent lithium electrodeposition and SEI formation results in high-surface-area filamentary growth2,23, often forming lithium with a porous, ‘mossy’ morphology that would be unsuitable for use in SSBs. Salt concentration gradient formation in liquid electrolytes may further impose a limit on electrodeposition rate24. Liquid electrolytes are also often flammable and highly fluorinated25,26, raising both safety and environmental concerns.

There are several vapour-based techniques (Fig. 2d), which can be broadly divided into chemical and physical processes. The former includes processes such as chemical vapour deposition and its subsection atomic layer deposition (ALD) that are generally difficult to scale and have low throughput rates27. The latter are broadly called physical vapour deposition, encompassing techniques such as pulsed laser deposition (PLD), sputtering (magnetron and ion-beam) and thermal evaporation (TE).

PLD has been shown to make 3 µm thick lithium films28; however, the deposition time was long (4 h, ~8 nm s−1) and the substrate area was small (2 cm2). While PLD thin lithium metal films can be purchased from a Finnish company (Pulsedeon, https://www.pulsedeon.com/), the slow deposition rate of PLD so far makes the processes economically unviable for mass-produced 17 µm films. Sputtering is a widely used and industrially recognized technique for large-area deposition; however, the low melting point of lithium (180.5 °C) and lack of adhesion to metals such as Cu used as target backing plates make it unsuitable for large-scale lithium processing.

TE can exploit the low melting temperature and high vapour pressure of lithium at low temperatures. The viability of TE for processing lithium has been shown in the literature29,30. Deposition rates >100 nm s−1 are feasible and the technique is well established in industrial roll-to-roll (R2R) processes31,32,33. Compared with their calendered counterparts, lithium films produced using TE possess good homogeneity and surface conformality and are largely defect-free34. Pilot and commercial line level equipment for realizing evaporation of metals including lithium in R2R processes is already commercially available from various manufacturers31,32,33,35. Furthermore, Li Metal Corp. recently announced the successful production of battery anodes using TE-processed ultra-thin lithium metal, and expects to commission a commercial scale TE machine capable of coating 1–2 Mm2 of anode material by the middle of 202436. TE can utilize either the CC or SE as the substrate.

Herein TE is therefore considered the most suitable technique so far for producing thin films with controlled thickness, high quality and reproducibility, and at industrial scale37.

Techno-economic assessment of evaporated lithium metal foils

While thinner lithium metal anodes would result in lower production costs when produced by TE, here, unless otherwise stated, the costs are assessed for 17 µm lithium metal anodes. This represents the upper boundary thickness to achieve a volumetric energy density of 1,000 Wh l−1 (Fig. 1d).

Li-ion cell costs have substantially decreased over the past decade, costing US$120 kWh−1 in 2022 (compared with US$502 kWh−1 in 2013)38,39. Anode active materials in LIBs only account for about 10% of the overall manufacturing costs40. Taking a 5.4 mAh cm−2 cathode loading, an average cell voltage as 3.8 V and assuming reasonable scrapping rates (see ‘Scrap rate’ in Methods), the lithium anode would need to cost US$2.08 m−2 to match graphite anode costs in current commercial LIBs (compared with US$8.69 m−2 in 2013). An average gigafactory has an output rate of 35 GWh yr−1 (ref. 41), which leads to a requirement of 197 Mm2 yr−1 of lithium foil to produce SSBs at that rate (see ‘Gigafactory calculation’ in Methods).

The lithium deposition rate achieved by TE has been demonstrated to be 140 nm s−1 (Methods), and Emerson and Renwick Limited makes 1.2 m drum width R2R high-throughput vacuum coating platforms capable of depositing for 85% of the time and working continuously for 7 years, with an active coating length of 1 m (active coating area 1.2 m2). This leads to the production rates seen in Fig. 3a and reveals a production rate of 30.24 m2 h−1 (0.265 Mm2 yr−1) for 17 µm lithium; thus, an average output gigafactory (35 GWh yr−1) would require 744 thermal evaporators of this specification. We estimate that this would require a capital expenditure of US$1.30 billion (Supplementary Methods ‘Machine costing’), which may prove to be prohibitive as this would be a substantial fraction of average gigafactory initial capital expenditure41,42 (Fig. 3b).

a, Production rates. The vertical dashed line indicates the maximum permitted Li excess to achieve 1,000 W h−1, while the horizonal dashed lines reveal the production costs for this excess. b, Thermal evaporator capital expenditure requirements for 17 µm lithium anodes compared with average (35 GWh yr−1) gigafactory total capital expenditure94,95. c, Breakdown of key production metrics for 17 µm lithium anodes with pie area proportional to anode production costs.

The thermal evaporator could be scaled up to 3.0 m without adding notable extra costs. Above 3.0 m, thicker, heavier rollers (to prevent roller deflection) and larger motors and drives would be required, increasing costs substantially. We estimate that scaling to 3.0 m would add 30% to the machine cost, but increase the production rate by a factor of 2.5 (Fig. 3a) while simultaneously increasing lithium utilization (see Supplementary Fig. 3 and ‘Lithium utilization’ in Supplementary Information). This would substantially reduce the number of thermal evaporators required from 744 to 298, thus reducing initial capital expenditure from US$1.30 billion to US$0.68 billion (Fig. 3b). Electricity, overheads and administration costs would also reduce per unit area owing to the economies of scale of the larger machine. The differences in capital expenditure, output rate and production costs are illustrated in Fig. 3c. The rest of the techno-economic assessment, therefore, will focus on a 3.0 m wide deposition substrate (active coating area 3.0 m2).

The production costs of the thermally evaporated lithium metal anodes can be broken down into nine categories: Li2CO3, processing Li2CO3, labour, depreciation, variable overhead, general, sales and administration, financing and other manufacturing costs (see Supplementary Methods ‘Production costs’ for further details).

Fixing Li2CO3 at US$22 kg−1 (market price November 2023) and electricity at US$0.207 kWh−1 (2 year average of the United Kingdom, France and Germany, November 2021–2023)43,44 yields the production costs shown in Fig. 3c (US$4.30 m−2). The breakdown of the costs is shown by the pie charts in Fig. 3c and by the dashed lines in Fig. 4. This highlights that for the 17 µm lithium metal anode scenario, the three most important production costs are Li2CO3, processing Li2CO3 and electricity. Figure 4a–c fixes Li2CO3, processing Li2CO3 and electricity, respectively, to highlight their independent effect on the production costs in terms of US$ m−2 of anode and US$ kWh−1 of battery cost.

a, Li2CO3 (the grey area depicts the Li2CO3 price variation between February 2023 and February 2024, with dashed line price used in this techno-economic assessment)43,45. b, Processing Li2CO3 (the grey area depicts the projected processing Li2CO3 global price variation (see ‘Lithium cost’ in Methods), with the dashed line price used in this techno-economic assessment). c, Electricity prices (the grey area depicts the UK electricity price between November 2021 and 2023, while the dashed line represents the 2 year average of the United Kingdom, France and Germany)44. d, CO2 emissions of electricity supply if carbon emissions are going to be offset at a cost of €1,000 tonne−1 (the dashed line representing the UK CO2 emissions and the grey bands representing the extremes of national carbon intensity shown in Supplementary Fig. 8)46 for 17 µm lithium metal anodes.

Between February 2023 and February 2024, the price of Li2CO3 varied by ~500% between US$70.5 kg−1 and US$14.25 kg−1 (refs. 43,45). This is visualized by the grey area in Fig. 4a yielding a production cost between US$3.89 m−2 and US$6.85 m−2 (US$21.9 kWh−1 and US$38.6 kWh−1). UK electricity prices varied between US$0.075 kWh−1 and US$0.577 kWh−1 from November 2021 to 202344; this is visualized by the grey area in Fig. 4c yielding a production cost between US$3.84 m−2 and US$5.59 m−2 (US$21.6 kWh−1 and US$31.5 kWh−1). Taking the minima of both would yield a production cost of US$3.43 m−2 (US$19.3 kWh−1), which is still higher than the target of US$2.08 m−2 (US$11.7 kWh−1) to match LIB graphite anode costs.

Every US$0.01 kWh−1 increase in electricity cost adds US$0.035 m−2 (US$0.196 kWh−1) in production cost, while every US$1.00 kg−1 increase in Li2CO3 or processing Li2CO3 costs adds US$0.053 m−2 (US$0.296 kWh−1). Alternatively, if pure lithium was purchased, then every US$1.00 kg−1 increase in lithium price would add US$0.0098 m−2 (US$0.055 kWh−1) in production costs. Figure 5 shows the combinations of purified lithium and electricity costs necessary to achieve a production cost of 2.08 m−2.

US$2.08 m−2 represents the cost needed to match 2022 Li-ion anode costs, US$8.69 m−2 represents the cost needed to match 2013 Li-ion anode costs, and US$4.30 m−2 represents the cost calculated using average western European electricity prices and the projected cost to purify (in the United Kingdom) and purchase Li2CO3 at November 2023 market price.

These costs are calculated assuming that 17 µm lithium anodes are used and a deposition rate of 140 nm s−1. If a higher CE could be achieved, then thinner anodes could be used. The inverse correlation between thickness and cost is visualized in Supplementary Fig. 4, with the effect of Li2CO3 and electricity price also visualized. If only 10 µm of lithium excess was required, then the anode cost could be brought down to US$2.58 m−2 (US$14.5 kWh−1). Deposition rate is also seen to have a substantial impact on production cost (Supplementary Fig. 5), with Li2CO3 cost having a more substantial impact at higher deposition rates, while electricity has a more substantial impact at lower deposition rates. If the deposition rate could be improved from 140 nm s−1 to 1,000 nm s−1, then the anode production cost could be brought down to US$2.78 m−2 (US$15.6 kWh−1). These variables (deposition rate, anode thickness, Li2CO3 price and electricity price) and others (for example, staffing numbers, labour cost, depreciation time and machine utilization) can all be varied manually in the supporting document ‘Costs Calculator’ to generate anode production costs from any envisaged combination of these variables.

Up to this point, production costs have been calculated using western European costs. The main manufacturing cost is that of Li2CO3; while the price of this raw material may vary internationally, this data is not publicly available. Li2CO3 can, however, be sourced from international markets; therefore, no international variation in Li2CO3 purchase price is assumed. Electricity is observed to be the third biggest manufacturing cost (Fig. 4), which has a substantial global variation (Supplementary Fig. 6). Labour, processing Li2CO3, variable overheads and general, sales and administration costs can also vary internationally; these costs have been scaled by the average labour cost ratio (Supplementary Fig. 7 and Supplementary Table 2). The combination of these global effects is translated into production costs in Fig. 6a. These results show that Russia has the lowest production costs at US$2.31 m−2, while Switzerland is the most expensive at US$5.96 m−2.

a–c, Global production costs (a), carbon offset global production costs (b) and production costs at selected countries with carbon offset costs (c).

The major driving factor in adopting battery technology is the transition to a net zero society; therefore, one might want to consider the carbon offset cost. In Fig. 6b, the price to carbon offset the CO2 emissions from the 3.48 kWh m−2 of electricity consumed in production via direct carbon capture (€1,000 tonne−1) has also been included (the effect of carbon intensity on production costs can be seen in Fig. 4d)46. Owing to the variable carbon intensity of electricity globally (Supplementary Fig. 8), when carbon offset is taken into consideration, Colombia is observed to be the cheapest production location at US$3.06 m−2, while Singapore is the most expensive at US$6.32 m−2.

The cost breakdown for potential production locations is shown in Fig. 6c. China has the largest gigafactory output of any nation and through existing gigafactories and announced projects is predicted to have an annual output in excess of 2,200 GWh by the end of the decade47. Low labour costs and internationally competitive electricity prices make China an attractive production location at a cost of US$2.76 m−2. Increasing trade barriers between western nations and China48, coupled with the high carbon intensity of China’s electricity (534 gCO2 kWh−1), may make China less appealing as a production location (US$4.83 m−2 carbon offset).

Canada and Mexico’s free trade arrangements with the United States through the United States–Mexico–Canada Agreement49 make all three of these nations sensible to compare for the North American market. Indeed, the potential notable US tax breaks through the Inflation Reduction Act50 have led to a spike in North American anticipated gigafactory capacity51, as the United States has sought to bring gigafactory production to or near the United States (nearshoring). We estimate the average US production costs to be US$4.71 m−2 (US$6.13 m−2 carbon offset). Owing to lower labour costs and comparable electricity costs to the United States (Supplementary Figs. 6 and 7), one might consider placing gigafactory production in Mexico. Indeed, Tesla has announced that its sixth gigafactory will be in Mexico52. While from a purely economic point this makes sense, as from our calculations Mexico has the second cheapest lithium metal anode production costs globally (US$2.47 m−2), Mexico also has the highest carbon intensity electricity of the three nations at 424 gCO2 kWh−1 (Supplementary Fig. 8).

The electricity market in North America varies substantially across its cities (Supplementary Fig. 9a). The cheapest known electricity price across the United States and Canada is in Québec (US$0.0413 kWh−1), which yields a production cost of US$4.09 m−2 (US$23.0 kWh−1). Owing to Canada’s higher labour cost than Mexico, this production cost is still higher despite the substantially lower electricity cost (Supplementary Fig. 9b). Québec, however, in conjunction with the lowest electricity price has one of the lowest carbon intensities in North America (Supplementary Fig. 9c). This makes the carbon offset production cost (Supplementary Fig. 9d) in Québec (US$4.15 m−2) comparable to that of Mexico’s (US$4.11 m−2).

In the EU, Germany is projected to have the largest gigafactory output by the end of the decade (>545 GWh)53, yet owing to Germany’s high electricity prices (Supplementary Fig. 6), lithium metal anode production costs are not favourable at US$4.24 m−2 (US$5.73 m−2 carbon offset production cost). Owing to Poland and Sweden’s low cost labour and electricity, respectively (Supplementary Figs. 6 and 7), lithium metal anode production costs are some of the lowest in Europe (US$2.98 m−2 and US$3.77 m−2, respectively). Indeed, by the end of 2025, in Poland, LG plans to have a gigafactory capacity of 115 GWh yr−1, and in Sweden, Northvolt plans to have gigafactory capacity >110 GWh yr−1 (ref. 53). Yet owing to Poland having one of the highest carbon intensities and Sweden one of the lowest (Supplementary Fig. 8), the difference in carbon offset production cost is stark (US$5.43 m−2 versus US$3.95 m−2).

While Australia shows an average production cost of US$4.32 m−2 (and one of the worst globally when carbon offset, US$6.26 m−2), owing to Australia being the largest producer of lithium by weight54, Australia may prove to have competitive production costs if lithium can be sourced at a lower cost in Australia compared with other international locations.

When the maximum permitted lithium anode thickness to achieve 1,000 Wh l−1 is required (17 µm), all global locations exhibit higher lithium metal anode production costs compared with current graphite anodes for traditional LIBs (~US$12 kWh−1), when compared on a US$ kWh−1 basis. The production costs, however, are still shown to be lower than graphite anode costs experienced in 2013 (~US$50 kWh−1), ranging between US$13 kWh−1 and 34 kWh−1 (US$17–36 kWh−1 carbon offset). If all other manufacturing costs were unchanged, the cell production costs would only rise by 1–18% (5–20% carbon offset) compared with Li-ion cells. Indeed, if the full 17 µm lithium excess is not required, then the graphite anode production cost (~US$12 kWh−1 equating to US$2.08 m−2) could be achieved with ≤7.9 µm lithium metal anodes (using western European production costs and Li2CO3 at US$22 kg−1).

While we have shown that anode costs alone may not prove to be prohibitive to SSB commercialization, this cost should be considered in parallel with SE costs to assess material costs (Fig. 7a,b). Thiophosphate SEs have so far shown the most promising performance in SSBs, owing to their high Li-ion conductivity55. Thiophosphate production at scale has been estimated to cost US$50 kg−1 (ref. 7). Using the cell design used in this work (Supplementary Figs. 1 and 2) leads to an SE material cost of US$24 kWh−1 (Fig. 7b). The SE replaces both the electrolyte and separator (combined cost of US$6 kWh−1)40 from the liquid state (Fig. 7a), yielding an increase of US$18 kWh−1, while Li2CO3’s higher material cost than materials for graphite anodes accounts for another US$5 kWh−1 in increased material costs. Other material costs are assumed to be consistent across both cell types.

a–d, Breakdown of raw material costs for liquid- (a) and solid-state (b) batteries, and pack costs for liquid- (c) and solid-state (d) batteries. Area is scaled to US$ kWh−1 and liquid-state data are taken from BatPac. All data assume a cell yield of 95% and a gigafactory output of 35 GWh yr−1. For solid-state materials, anode costs are replaced with lithium metal, while separator and electrolyte costs are replaced with SE costs (US$50 kg−1). The CAM is taken to be NCM811 in both cases, with an areal capacity of 5.4 mAh cm−2, a discharge capacity of 210 mAh g−1 and an average potential of 3.8 V. All pack costs are calculated with an energy cost of US$0.207 kWh−1 and a financing cost of 5%. Solid-state pack costs incorporate the calculated material costs and TE as the anode production cost, while other production costs are taken from the liquid state as a proxy.

Pack costs (Fig. 7c,d) incorporate the increased material costs while also considering increased manufacturing costs. SEs are likely to require isostatic pressing (ISP) during cell assembly to remove internal voids and defects, to yield the uniformity, density and particle contact required for prolonged pack cycling. A conservative estimate for ISP cost for cell integration has been reported to be negligible (US$0.02 kWh−1)56. The anode production costs for preparation and coating in the liquid state have been replaced in the solid state with 17 µm lithium metal anodes produced by TE. While the rest of the manufacturing process for liquid and solid states will ultimately diverge, there are no established production lines for the solid state; therefore, liquid-state costs are used as a proxy to compare pack costs. This results in a pack-level price increase of US$32 kWh−1 (25%) for solid-state cells, compared with the liquid state. Considering the enhanced safety, faster charge times and higher energy density of SSBs compared with traditional LIBs, this pack premium should not be considered a barrier to SSB commercialization.

Barriers to commercialization

SSB development challenges have recently been discussed in detail1,55. This analysis shows that, from an economic and throughput standpoint, TE is a viable way to produce lithium metal anodes. The implementation of these anodes and the production of machines the size required for gigafactories, however, lead to a number of scientific (lithium shelf life, cell life prediction and extending cycle life) and technological (increasing throughput, upscale production and quality control) challenges, respectively.

The chemical state and morphology of the lithium metal surface are critical to the performance of the cell for reversibility, rate performance and morphological stability57. A thin film produced by TE can alter the surface energy, topography and hence reactivity of the surface produced58,59. Even in controlled environments, lithium metal readily reacts to form oxides, hydroxides, carbonates, bicarbonates and so on60. The reactivity of a clean lithium metal surface produced by TE needs to be studied to estimate its ageing, allowing a projection of shelf life. One could manipulate the storage environment to control the passivation layer, which is known to affect the lithium metal anode interaction with the electrolyte19,20.

As SSBs approach lifetime targets, it will be necessary to introduce performance metrics to predict cell lifetime and compare cell stability without the need for lengthy cycling experiments. The CE fulfils this role for LIBs61, requiring high-precision coulometry62. However, meaningful CE measurement in SSBs is not straightforward. Excess lithium inflates the measured CE such that it no longer reflects the loss of active lithium per cycle14, prompting the use of lithium-free CCs for CE characterization in liquid-state LMBs. Unfortunately, poor mechanical and electrical contact in SSBs17, combined with inhomogeneous lithium plating on common CCs16,63, promotes capacity loss processes, giving a pessimistic CE estimate. The development of a standardized, accurate SSB CE testing protocol capable of predicting cell lifetime would, therefore, be of great importance.

One of the major active-lithium-loss processes in SSBs is SEI formation17, but the SEI and its role in controlling cell stability are still poorly understood. Recent evidence suggests that the SEI that forms between Li6PS5Cl and lithium can be several hundred nanometres in thickness18,64, which is notably larger than previously believed, and its properties depend on the temperature and current density during formation18,64,65. If thin lithium films are deposited directly onto the SE, then this could enable SEI properties to be tuned through control of TE parameters, although the impact on cell lifetime requires further study. The implementation of interlayers in SSBs has also been demonstrated to improve cycling stability by promoting more uniform lithium plating/stripping4,66, although this added mass will reduce the permitted lithium foil thickness. TE enables the possibility of depositing additional layers (multilayers and interlayers) on top of or beneath the coated lithium layer. These could promote uniform deposition or protect from degradation. Finally, the choice of CC should be made with care. Most reports use copper; however, ~5% capacity loss could occur over a cell lifetime owing to lithium diffusion into copper CCs18.

Upscaling machine production to ~700–750 machines as may be necessary for a gigafactory could be challenging; however, this could be avoided (and capital expenditure reduced) if substantial increases in throughput could be achieved. One way to do this would be by increasing deposition rates through higher operating temperatures. These would be challenging to implement59, but could result in an exponential increase in deposition rates67. Improvements achieved thus would need further investigation to assess the impact on film quality.

When considering quality control, impurities or uneven lithium films can result in increased localized current densities, which can trigger dendrite formation68. Thus, ensuring that the lithium films that are produced have a uniform thickness and are free of defects and impurities is a key challenge.

Conclusion

Calculations have revealed that to achieve an energy density of 1,000 Wh l−1 with an areal capacity of 5.4 mAh cm−1, a lithium excess of ≤17 µm is permitted, while maintaining 75% capacity after 1,250 cycles, a CE ≥99.929% is required. Although many techniques exist to make thin films of lithium, techniques such as extrusion plus calendering are unable to produce uniform films of the desired thicknesses, while techniques such as ALD would have prohibitive costs and throughput rates when required to make films several micrometres thick. The most promising technique, therefore, to manufacture ~17 µm lithium films is thermal evaporation. The techno-economic assessment reveals that lithium metal anodes of this thickness with western Europe energy prices could be manufactured at a cost of US$4.30 m−2, equating to an anode cost of US$24.2 kWh−1 (compared with ~US$12 kWh−1 for traditional graphite anodes). The cost could be further reduced by manufacturing in low energy and labour cost countries. Factoring in both SE and anode costs was shown to yield a pack cost of US$158 kWh−1, compared with US$126 kWh−1 for liquid-state cells. While this shows a cost premium to make solid-state cells, it can be argued that the potential benefits of fast charging, high energy density and improved safety justify the increased costs.

Methods

Cell modelling

The section details the calculations used to reveal both the excess of lithium permitted and the target efficiency requirements for solid-state cells.

Energy density calculation

For the energy density calculation, the outer cell geometry is based on the reported cell geometry for the Volkswagen ID.3 (refs. 69,70). The cell geometry is shown in Supplementary Fig. 1. The inner cell geometry used is shown in Supplementary Fig. 2. The CC was set to the same thickness as reported for the ID.3 cell (12 µm) and is coated on both sides. The thickness of the SE separator was set at 30 µm (ref. 4). The number of sheets was set to match the outer shape thickness.

The cathode composition used is taken from a previous publication4. In short, it consists of 81.3 wt% CAM, 2.9 wt% carbon, 14.1 wt% SE and 1.4 wt% PTFE and has a porosity of 12% by volume. The CAM is taken as NMC811. An irreversible capacity on first charge is considered for NMC811, with a charge capacity of 247 mAh g−1 and a discharge capacity of 210 mAh g−1 (refs. 71,72). While this capacity loss is viewed as irreversible, the 37 mAh g−1 is treated as Li that is left plated on the anode after first discharge. NMC811 is set to a density of 4.77 g cm−3 (ref. 73) and an average potential of 3.8 V (ref. 74).

Calculating target efficiency

For these calculations, all losses are assumed to come from the anode capacity (negative electrode, N) as lost Li; potential cathode capacity (positive electrode, P) is assumed to stay constant at the first discharge capacity. The average Li plating/stripping coulombic efficiency (CE) required to maintain a certain cell capacity retention (CR) after n cycles is therefore a function of the N:P ratio and is calculated using equation (1):

The additional supplementary file ‘Efficiency Calculator’ uses equation (1) to produce the target efficiency numbers seen in Supplementary Table 1.

Lithium excess thickness permitted

The maximum Li excess that can be added to the cell before first discharge to achieve an energy density of 1,000 Wh l−1 is shown in Supplementary Table 1. The target efficiency required to have 75% capacity after 1,250 cycles is also shown.

Techno-economic assessment

The section details the data and calculations used to determine the production cost of thermally evaporated lithium metal foils for solid-state cells.

Power consumption calculation

For detailed power consumption calculations, see Excel spreadsheet ‘Power Calculator’. In short, the 3 m gigafactory machine would consume an average of 263.3 kW, while the smaller 1.2 m machine would consume 118.7 kW on average.

Electricity cost

Unless otherwise stated, the electricity cost is set at US$0.207 kWh−1. This is the 2 year average of France, Germany and the United Kingdom (November 2021–2023)44. When comparing between countries, electricity prices were compared using an average electricity price between November 2021 and November 202344,75,76. These prices are shown in Supplementary Fig. 6.

Lithium cost

In this techno-economic assessment model, the Li source is taken as Li2CO3, which then has an associated cost to purify to Li before TE can be conducted. Alternatively, one could obtain LiOH to purify to Li. Traditionally, Li2CO3 is treated with HCl to produce LiCl, which is then subjected to an electrolytic reduction process to obtain Li metal11. Companies such as Li Metal, however, are innovating this process36.

Li input is treated as Li2CO3, with a purity of 99.5%.

The cost to convert to pure Li metal is taken from the spread between the price of Li metal and the lithium units obtained from Li2CO3. The prices of Li metal and 99.5% pure Li2CO3 were taken from Shanghai Metals Market on 24 May 202477,78. This value is then scaled by the labour scaling factor (Supplementary Table 2).

This calculation can be seen in the ‘Li2CO3 Processing Cost’ tab of the ‘Costs Calculator’.

Lithium utilization

TE can achieve high utilization rates and small thickness variations when line sources are used. The lithium utilization and film thickness variation that can be achieved using TE have been estimated in this work with a deposition model. To achieve no more than 4% thickness variation across the entire film, a line source with a width 0.24 m larger than the substrate is required.

With this set-up, deposition efficiencies greater than 82% can be achieved for 1.2 m substrates, which increases with increasing substrate width. For further details, see Supplementary Methods.

Machine costing

A 1.2 m machine is projected to cost US$1.75 million, while a 3.0 m machine is projected to cost US$2.275 million. For full details on machine costing, see Supplementary Methods.

Depreciation cost

This takes the cost of the machine and spreads it out over 7 years. The machine is assumed to be operating 85% of the time.

Labour cost

Six-person maintenance crews would be responsible for 4 machines, with the average person in crew being paid US$20 per hour. A more experienced crew could be responsible for 6 machines, with the average person in a more experienced crew being paid US$30 per hour.

International labour cost variations are scaled by the scaling factor shown in Supplementary Table 2 and Supplementary Fig. 7. The 2022 average salaries (with the exception of Chile, Colombia and Ukraine) for OECD countries are taken from OECD data79, while for Argentina, Bulgaria, China, Croatia, Nicaragua, Romania, Russia, Serbia, Singapore, Slovak Republic and Ukraine, they are taken from a governmental source from each nation80,81,82,83,84,85,86,87,88. These local currency average salaries are converted into USD using a 2022 conversation rate provided by the OECD89, with the exception of Ukraine and Nicaragua where a 2022 conversion average is taken from XE (https://www.xe.com/).

To get a labour scaling factor for Chile and Colombia, 2021 OECD data are used and compared with 2021 OECD UK data, as 2022 data for these countries have not yet been published. Ukraine pay data are taken from the month of January 2022 only and multiplied by 12 to get an annual salary as the data for the whole of 2022 are not provided.

General, sales and administration cost

Set at 1.39% of total production cost (excluding carbon offset cost), when electricity is set at US$0.207 kWh−1 (2 year average of France, Germany and the United Kingdom, November 2021–2023) and lithium carbonate is set at US$22 kg−1. This is the same percentage that BatPac uses (Supplementary Fig. 10).

This equates to US$0.06 m−2 of production costs. For global variation, this is scaled by the labour cost scaling factors shown in Supplementary Fig. 7 and Supplementary Table 2.

General, sales and administration is a cost taken from BatPac. BatPac defines this category as ‘Plant office, taxes on income and property, cost of sales and insurance expenses’.

Variable overhead cost

Set at 1.99% of total production cost (excluding carbon offset cost), when electricity is set at US$0.207 kWh−1 (2 year average of France, Germany and the United Kingdom, November 2021–2023) and lithium carbonate is set at US$22 kg−1. This is the same percentage that BatPac uses (Supplementary Fig. 10).

This equates to US$0.09 m−2 of production costs. For global variation, this is scaled by the labour cost scaling factors shown in Supplementary Fig. 7 and Supplementary Table 2.

Financing

For detailed financing calculations, see the ‘Financing Costs’ tab of the ‘Costs Calculator’ Excel spreadsheet. In short, the financing interest rate has been set at 5% (although this can be changed in the ‘Costs Calculator’), with the outstanding debt lowering by 1/‘depreciation time’ each year. The total finance cost over the entire depreciation time is then spread out as a financing cost.

Other manufacturing costs

Plant footprint costs for the evaporators: A plant area of 20,000 m2 was entered into BatPac after all anode production costs were removed. For 3.0 m machines, this yields enough space for over 5 m × 13 m for each machine, and for 1.2 m machines, this yields enough space for over 2 m × 13 m. This yields a cost of US$0.09 kWh−1.

BatPac yields a cost of vacuum drying graphite anodes at US$0.14 kWh−1 (see the ‘BatPac’ tab of the ‘Costs Calculator’). This process should not be needed for evaporated anodes, but storing in a dry room may be necessary if not used straight away. This number, therefore, is used as a proxy for dry-room and services cost, along with unforeseen handling costs.

BatPac yields a cost for notching graphite anodes at US$0.34 kWh−1 (see the ‘BatPac’ tab of the ‘Costs Calculator’); this is used as an approximation for the notching and handling costs of Li anodes.

All these costs are turned into a US$ m−2 cost by dividing by the cell energy density (0.2052 kWh m−2).

Scrap rate

For Li loss rate during TE, see ‘Lithium utilization’. All the unutilized Li is treated as scrap.

Post deposition, there are three scrap rates used: anode slitting, cell stacking and cell yield. The rates have been set as 8%, 1% and 5%, respectively (the rates of these can all be changed in the ‘Costs Calculator’ in the effective yields section). These scrap rates are used when converting production cost in US$ m−2 to production cost in US$ kWh−1, as shown by equation (2):

Carbon intensity of electricity generation

Global variation in carbon intensity of electricity generation at a national level is taken from Our World in Data90, with data provided for the year 2022 used only. This is visualized in Supplementary Fig. 8.

Variation in carbon intensity for Canadian states and provinces is taken from Canadian government data91, with the updated carbon intensity model of existing Canadian grid electricity used.

Variation in carbon intensity of the states of the United States is produced by taking total carbon emissions from electricity of all the states provided by the US Energy Information Administration92, and dividing it by the total electricity consumption of all the states provided by the US Energy Information Administration93. The numbers can be found in Supplementary Table 3.

The full variation in Canada and US emissions is visualized in Supplementary Fig. 11.

Deposition rate

The deposition rate in our techno-economic assessment is taken as 140 nm s−1. This is the average (to two significant figures) lithium deposition rate observed from multiple TE tests that used lithium discs (PI-KEM, 99.9% purity, 15.6 mm diameter × 0.45 mm thick) as the lithium source. The source temperature was ~670 °C, with a 17 cm source to substrate separation distance and a chamber volume of ~51.5 l. An induction power set point of 5% (500 W) was used and the crucible orifice size was 20 mm, with a 50 mm depth. The crucible was ~80% full before each evaporation run was conducted. The base pressure of the chamber was ~5 × 10−6 mbar. These results are summarized in Supplementary Table 4.

It should be noted that the evaporation rate likely slightly decreases as the crucible empties. The deposition rate in Supplementary Table 4, therefore, must be taken as an average between the full to minimum fill level of the crucible.

Deposition area and roll speed

The deposition area is taken to be the substrate width multiplied by 1 m. The 1 m comes from the thermal evaporator consisting of 5 evaporation sources being placed consecutively with each being able to deposit over a 20 cm length perpendicular to the width.

The roll speed (Rs) is determined by dividing the deposition length (ϕl) by the deposition time (ϕt) required to deposit the desired thickness (d):

where deposition time (ϕt) is taken by dividing the desired deposition thickness (d) by the deposition rate (t):

Costs calculator

For details of how the above costs are converted into production costs, see spreadsheet ‘Costs Calculator’.

Power consumption, electricity cost, lithium cost, lithium utilization, machine costing, depreciation time, machine cost, labour cost, general, sales and administration cost, variable overhead cost, deposition rate, target thickness, staffing levels, carbon intensity and offset cost, machine utilization, finance %, effective yields and regional scaling factor can all be varied in the ‘Costs Calculator’ spreadsheet.

Gigafactory calculation

For the required number of thermal evaporators needed, see spreadsheet entitled ‘Gigafactory Calculation’.

Gigafactory capital expenditure

Capital expenditure per GWh annual output (CapEx/GWh): North American expenditure for a gigafactory is US$104.8 million per GWh of output production per annum, Europe US$111.5 million and Asia US$58.0 million94,95. Original source quotes costs in Euros, which have been converted to USD here using the OECD 2022 conversion rate89.

Average gigafactory output (Av Output): The average gigafactory output is taken as 35 GWh yr−1 (ref. 41). The initial capital expenditure (IntCapEx) is then deduced via equation (5):

Data availability

The authors declare that all data supporting the findings of this study along with the source data are included within the paper and its Supplementary Information. Source data are provided with this paper.

References

Schmaltz, T. et al. A roadmap for solid-state batteries. Adv. Energy Mater. 13, 2301886 (2023).

Bai, P., Li, J., Brushett, F. R. & Bazant, M. Z. Transition of lithium growth mechanisms in liquid electrolytes. Energy Environ. Sci. 9, 3221–3229 (2016).

Liu, H. et al. Controlling dendrite growth in solid-state electrolytes. ACS Energy Lett. 5, 833–843 (2020).

Lee, Y.-G. et al. High-energy long-cycling all-solid-state lithium metal batteries enabled by silver–carbon composite anodes. Nat. Energy 5, 299–308 (2020).

Goals for Advanced High-Performance Batteries for Electric Vehicle (EV) Applications (USABC, 2020); https://uscar.org/usabc/

Yang, X., Adair, K. R., Gao, X. & Sun, X. Recent advances and perspectives on thin electrolytes for high-energy-density solid-state lithium batteries. Energy Environ. Sci. 14, 643–671 (2021).

Schmuch, R., Wagner, R., Hörpel, G., Placke, T. & Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 3, 267–278 (2018).

Acebedo, B. et al. Current status and future perspective on lithium metal anode production methods. Adv. Energy Mater. 13, 2203744 (2023).

Schnell, J. et al. All-solid-state lithium-ion and lithium metal batteries—paving the way to large-scale production. J. Power Sources 382, 160–175 (2018).

Solid State and Lithium Metal Batteries Forecasts—Quarterly Update March (Benchmark Mineral Intelligence, 2024).

Heubner, C., Schneider, M. & Michaelis, A. Diffusion-limited C-rate: a fundamental principle quantifying the intrinsic limits of Li-ion batteries. Adv. Energy Mater. 10, 1902523 (2020).

Ank, M. et al. Lithium-ion cells in automotive applications: Tesla 4680 cylindrical cell teardown and characterization. J. Electrochem. Soc. 170, 120536 (2023).

Nissan warranty. Nissan Motor Co., Ltd https://www.nissan.co.uk/ownership/ownership/nissan-car-warranties.html?cid=psm_afts_cmid=19969256100_grid=146715054366_adid=660532205509&gclid=Cj0KCQjwk96lBhDHARIsAEKO4xbKrKp9V12dD6LwdkwmqQVTjoCZUalZ3ku3r65h_G0DzciEKKtFkaIaAuYBEALw_wcB&gclsrc=aw.ds (2023).

Xiao, J. et al. Understanding and applying coulombic efficiency in lithium metal batteries. Nat. Energy 5, 561–568 (2020).

Krauskopf, T. et al. Lithium-metal growth kinetics on LLZO garnet-type solid electrolytes. Joule 3, 2030–2049 (2019).

Kazyak, E. et al. Understanding the electro-chemo-mechanics of Li plating in anode-free solid-state batteries with operando 3D microscopy. Matter 5, 3912–3934 (2022).

Guo, R., Hobold, G. M. & Gallant, B. M. The ionic interphases of the lithium anode in solid state batteries. Curr. Opin. Solid State Mater. Sci. 26, 100973 (2022).

Aktekin, B. et al. SEI growth on lithium metal anodes in solid-state batteries quantified with coulometric titration time analysis. Nat. Commun. 14, 6946 (2023).

Riegger, L. M. et al. Evolution of the interphase between argyrodite-based solid electrolytes and the lithium metal anode—the kinetics of solid electrolyte interphase growth. Chem. Mater. 35, 5091–5099 (2023).

Hobold, G. M., Wang, C., Steinberg, K., Li, Y. & Gallant, B. M. High lithium oxide prevalence in the lithium solid–electrolyte interphase for high coulombic efficiency. Nat. Energy 9, 580–591 (2024).

Bouchard, P., Guerin, P.-E., St-Amant, G. & Laroche, G. Process for laminating a thin film of lithium by controlled detachment. US patent US5528920A (1996).

MSE PRO lithium (20 µm) copper (11 µm) single side laminated foil anode for lithium metal batteries, 100g/pack. MSE Supplies https://www.msesupplies.com/en-gb/products/mse-pro-lithium-20-um-copper-11-um-single-side-laminated-foil-anode-for-lithium-metal-batteries-100g-pack?variant=39439834972218 (2024).

Boyle, D. T. et al. Resolving current-dependent regimes of electroplating mechanisms for fast charging lithium metal anodes. Nano Lett. 22, 8224–8232 (2022).

Wu, W., Luo, W. & Huang, Y. Less is more: a perspective on thinning lithium metal towards high-energy-density rechargeable lithium batteries. Chem. Soc. Rev. 52, 2553–2572 (2023).

Wang, H. et al. Liquid electrolyte: the nexus of practical lithium metal batteries. Joule 6, 588–616 (2022).

Hernández, G., Mogensen, R., Younesi, R. & Mindemark, J. Fluorine-free electrolytes for lithium and sodium batteries. Batter. Supercaps 5, e202100373 (2022).

Wang, X. & Yushin, G. Chemical vapor deposition and atomic layer deposition for advanced lithium ion batteries and supercapacitors. Energy Environ. Sci. 8, 1889–1904 (2015).

Gireaud, L., Grugeon, S., Laruelle, S., Yrieix, B. & Tarascon, J. M. Lithium metal stripping/plating mechanisms studies: a metallurgical approach. Electrochem. Commun. 8, 1639–1649 (2006).

Bates, J. Thin-film lithium and lithium-ion batteries. Solid State Ion. 135, 33–45 (2000).

Adhitama, E. et al. Pre-lithiation of silicon anodes by thermal evaporation of lithium for boosting the energy density of lithium ion cells. Adv. Funct. Mater. 32, 2201455 (2022).

Taylor, D. M. Vacuum-thermal-evaporation: the route for roll-to-roll production of large-area organic electronic circuits. Semicond. Sci. Technol. 30, 054002 (2015).

Kim, S.-H. et al. A study on thin film uniformity in a roll-to-roll thermal evaporation system for flexible OLED applications. Int. J. Precis. Eng. Manuf. 18, 1111–1117 (2017).

Yokoyama, A. et al. Development of an Li metal anode using a vacuum evaporation process. ULVAC Tech. J. 83, 11–15 (2020).

Ho, A. S. et al. Comparing the purity of rolled versus evaporated lithium metal films using X-ray microtomography. ACS Energy Lett. 7, 1120–1124 (2022).

Effective Genesis vacuum roll-to-roll machine. Emerson and Renwick Ltd https://eandr.com/vacuum-machinery/genesis-vacuum/ (2024).

Li-Metal Produces Ultra-Thin Lithium on Polymer Anodes Using PVD Technology (Li Metal, 2023); https://investors.li-metal.com/news/news-details/2023/Li-Metal-Produces-Ultra-Thin-Lithium-on-Polymer-Anodes-Using-PVD-Technology/default.aspx

Anders, A. Plasma and ion sources in large area coating: a review. Surf. Coat. Technol. 200, 1893–1906 (2005).

Curry, C. Lithium-ion battery costs and market. Bloom. N. Energy Financ. 5, 43 (2017).

Top 10 Energy Storage Trends in 2023 (BNEF, 2023); https://about.bnef.com/blog/top-10-energy-storage-trends-in-2023/

Knehr, K. W., Kubal, J. J., Nelson, P. A. & Ahmed, S. Battery Performance and Cost Modeling for Electric-Drive Vehicles: A Manual for BatPaC v5.0 (Argonne National Laboratory, 2022).

Global EV Outlook 2022 (IEA, 2022); https://www.iea.org/reports/global-ev-outlook-2022

Gigafactory Cost Model (Benchmark Mineral Intelligence, 2024); https://www.benchmarkminerals.com/

About Lithium (LME, 2024); https://www.lme.com/en/Metals/EV/About-Lithium

Real-Time Electricity Tracker—Data Tools (IEA, 2024); https://www.iea.org/data-and-statistics/data-tools/real-time-electricity-tracker?tracker=true&from=2023-11-5&to=2023-11-3&category=price&compareCountry=true

Lithium Prices (Fastmarkets, 2024); https://www.fastmarkets.com/newgen/battery-materials/lithium/lithium-prices/

Dow, J. World’s Largest Direct Air Carbon Capture Facility ill Reduce CO2 by .0001% (Electrek, 2022) https://electrek.co/2022/06/28/worlds-largest-direct-air-carbon-capture-facility-will-reduce-co2-by-0001/

Batterieprojekte in Asien (Battery News, 2023); https://battery-news.de/batterieproduktion-asien/

The Impact of US-China Trade Tensions (The International Monetary Fund, 2019); https://www.imf.org/en/Blogs/Articles/2019/05/23/blog-the-impact-of-us-china-trade-tensions

Agreement Between the United States of America, the United Mexican States, and Canada 7/1/20 Text (Office of the United States Trade Representative, 2020); https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement/agreement-between

Inflation Reduction Act Guidebook (The White House, 2023); https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/

The Battery Report 2022 (Volta Foundation, 2023).

Tesla Confirms Its Next Gigafactory will be in Mexico (The Verge, 2023); https://www.theverge.com/2023/3/1/23571725/tesla-gigafactory-monterrey-mexico-announce-investor-day

Batterieproduktion in Europa (Battery News, 2024); https://battery-news.de/batterieproduktion/

World’s Biggest Lithium Producers (Reuters, 2023); https://www.reuters.com/markets/commodities/worlds-biggest-lithium-producers-2023-04-21/

Janek, J. & Zeier, W. G. Challenges in speeding up solid-state battery development. Nat. Energy 8, 230–240 (2023).

Dixit, M. et al. The role of isostatic pressing in large-scale production of solid-state batteries. ACS Energy Lett. 7, 3936–3946 (2022).

Otto, S.-K. et al. Storage of lithium metal: the role of the native passivation layer for the anode interface resistance in solid state batteries. ACS Appl. Energy Mater. 4, 12798–12807 (2021).

Wang, X., Liu, X. H., Zou, S. C., Martin, P. J. & Bendavid, A. Atomic force microscopy study on topography of films produced by ion-based techniques. J. Appl. Phys. 80, 2658–2664 (1996).

Grèzes-Besset, C., Chauveau, G. & Pinard, L. in Optical Thin Films and Coatings (eds Piegari, A. & Flory, F.) 697–718 (Elsevier, 2018).

Gibson, J. S. et al. Gently does it!: in situ preparation of alkali metal-solid electrolyte interfaces for photoelectron spectroscopy. Faraday Discuss. 236, 267–287 (2022).

Dahn, J. R., Burns, J. C. & Stevens, D. A. Importance of coulombic efficiency measurements in R&D efforts to obtain long-lived Li-ion batteries. Electrochem. Soc. Interface 25, 75–78 (2016).

Bond, T. M., Burns, J. C., Stevens, D. A., Dahn, H. M. & Dahn, J. R. Improving precision and accuracy in coulombic efficiency measurements of Li-ion batteries. J. Electrochem. Soc. 160, A521–A527 (2013).

Zor, C., Turrell, S. J., Uyanik, M. S. & Afyon, S. Lithium plating and stripping: toward anode-free solid-state batteries. Adv. Energy Sustain. Res. 5, 2300001 (2023).

Burton, M., Liang, Y., Aspinall, J., Jagger, B. & Pasta, M. The role of phosphorous in the solid electrolyte interphase of argyrodite solid electrolytes. Preprint at ChemRxiv https://doi.org/10.26434/chemrxiv-2024-1727n (2024).

Narayanan, S. et al. Effect of current density on the solid electrolyte interphase formation at the lithium∣Li6PS5Cl interface. Nat. Commun. 13, 7237 (2022).

Sandoval, S. E. et al. Structural and electrochemical evolution of alloy interfacial layers in anode-free solid-state batteries. Joule 7, 2054–2073 (2023).

Saager, S., Decker, L., Kopte, T., Scheffel, B. & Zimmermann, B. High-performance anodes made of metallic lithium layers and lithiated silicon layers prepared by vacuum technologies. Batteries 9, 75 (2023).

Hatzell, K. B. et al. Challenges in lithium metal anodes for solid-state batteries. ACS Energy Lett. 5, 922–934 (2020).

Wassiliadis, N. et al. Quantifying the state of the art of electric powertrains in battery electric vehicles: range, efficiency, and lifetime from component to system level of the Volkswagen ID.3. eTransportation 12, 100167 (2022).

Günter, F. J. & Wassiliadis, N. State of the art of lithium-ion pouch cells in automotive applications: cell teardown and characterization. J. Electrochem. Soc. 169, 030515 (2022).

Zhao, Z., Huang, B., Wang, M., Yang, X. & Gu, Y. Facile synthesis of fluorine doped single crystal Ni-rich cathode material for lithium-ion batteries. Solid State Ion. 342, 115065 (2019).

Zhang, H. et al. Single-crystalline Ni-rich LiNixMnyCo1−x−yO2 cathode materials: a perspective. Adv. Energy Mater. 12, 2202022 (2022).

Cheng, E. J. et al. Mechanical and physical properties of LiNi0.33Mn0.33Co0.33O2 (NMC). J. Eur. Ceram. Soc. 37, 3213–3217 (2017).

Li, J., Downie, L. E., Ma, L., Qiu, W. & Dahn, J. R. Study of the failure mechanisms of LiNi0.8Mn0.1Co0.1O2 cathode material for lithium ion batteries. J. Electrochem. Soc. 162, A1401–A1408 (2015).

China Electricity Prices (GlobalPetrolPrices.com, 2024); https://www.globalpetrolprices.com/

Comparison of electricity prices in major North American cities. Hydro Québec https://www.hydroquebec.com/business/customer-space/rates/comparison-electricity-prices.html (2023).

Battery Grade Lithium Metal (Weekly Update) Price, CNY/mt (Shanghai Metals Market, 2024); https://www.metal.com/Lithium/202304250002

Lithium Carbonate (99.5% Battery Grade) Price, CNY/mt (Shanghai Metals Market, 2024); https://www.metal.com/Lithium/201102250059

OECD.stat—Average Annual Wages (Organisation for Economic Co-operation and Development, 2024); https://stats.oecd.org/index.aspx?r=402626

Statistical Data (Republic of Bulgaria National Statistical Institute, 2024); https://www.nsi.bg/en/content/766/statistical-data

China Statistical Yearbook (National Bureau of Statistics of China, 2024); https://www.stats.gov.cn/sj/ndsj/2022/indexeh.htm

Statistical Data (Croatian Bureau of Statistics, 2024); https://podaci.dzs.hr/en/

Salario nominal:nacional. Banco Central De Nicaragua https://www.bcn.gob.ni/sites/default/files/estadisticas/siec/datos/4.5.2.3.htm (2024).

Forta de munca si castiguri salariale-Comunicate de presa; Ocuparea si somajul-Comunicate de presa (Institutul National de Statistica, 2024); http://statistici.insse.ro:8077/tempo-online/#/pages/tables/insse-table

Рынок труда, занятость и заработная плата (Russian Federal State Statistics Service, 2024); https://rosstat.gov.ru/labor_market_employment_salaries

Average Salaries and Wages per Employee (Statistical Office of the Republic of Serbia, 2024) https://www.stat.gov.rs/en-US/

Economy & Prices—Labour (Department of Statistics Singapore, 2024); https://www.singstat.gov.sg/publications/reference/singapore-in-figures/economy

Демографічна та соціальна статистика / Ринок праці / Оплата праці та соціально-трудові відносини (State Statistics Service of Ukraine, 2024); https://www.ukrstat.gov.ua/

OECD Data—Exchange Rates (Organisation for Economic Co-operation and Development, 2024); https://data.oecd.org/conversion/exchange-rates.htm#indicator-chart

Statistical Review of World Energy (2024)—With Major Processing by Our World in Data. Carbon Intensity of Electricity Generation (Ember and Energy Institute, 2024); https://ourworldindata.org/grapher/carbon-intensity-electricity

Pre-publication: Updated Carbon Intensities for Canadian Grid Electricity and Excess Electricity to Grid Processes (Government of Canada, 2024); https://www.canada.ca/en/environment-climate-change/services/managing-pollution/fuel-life-cycle-assessment-model/updated-carbon-intensity-electricity.html

Electric Power Energy-Related Carbon Dioxide Emissions (U.S. Energy Information Administration, 2023); https://www.eia.gov/environment/emissions/state/

Electricity Sales to Ultimate Customers, Total and Residential, Total and per Capita, Ranked by State, 2022 (U.S. Energy Information Administration, 2022).

The Battery Report 2023 Vol. 2023 (Volta Foundation, 2023).

Battery Monitor 2023—The Value Chain between Economy and Ecology (PEM RWTH Aachen University, 2023).

Acknowledgements

This work was supported by the Innovate UK (project number 98841) (M.P.), Nissan Motor Co., Ltd, Japan, Nissan Technical Centre Europe, and by the Faraday Institution (grant numbers FIRG056 and FIRG058) (M.P.). B.J. is grateful for the support of the Clarendon Fund Scholarships.

Author information

Authors and Affiliations

Contributions

M.B., S.N. and M.P. conceived the idea. M.B. performed the techno-economic assessment. S.N., M.J.L. and M.C. reviewed the lithium metal anode production methods. B.J. modelled the lithium utilization. L.F.O. drew the schematic diagrams. S.D. sourced the techno-economic data. M.S. calculated the volumetric energy densities and target coulombic efficiencies. R.A. performed the trial lithium thermal evaporation experiments to yield the deposition rate. R.A. and N.B. provided the machine costings, dimensions, power consumption and utilization rates. T.K. and Y.A. provided expertise relating to the requirements of the automotive industry. M.B. wrote the paper with input from all authors. M.P. supervised the design of the project and provided frequent input on the interpretation of all results.

Corresponding author

Ethics declarations

Competing interests

R.A. and N.B. are employees of Emerson and Renwick, one of the several companies that manufacture evaporation and sputtering equipment. M.S., T.K. and Y.A. are employees of Nissan Motor Co., Ltd, which is exploring implementing solid-state batteries in electric vehicles. The other authors declare no competing interests.

Peer review

Peer review information

Nature Energy thanks Lorenzo Fallarino, Maciej Jastrzebski and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Methods, Tables 1–4 and Figs. 1–11.

Supplementary Software 1

A spreadsheet to calculate production costs when variables are changed.

Supplementary Software 2

A spreadsheet to calculate the coulombic efficiency requirements.

Supplementary Software 3

A spreadsheet calculator to calculate the number of thermal evaporation machines required for a gigafactory.

Supplementary Software 4

A spreadsheet calculator to calculate the power consumption on the thermal evaporators.

Supplementary Data 1

Source data for all supplementary figures.

Supplementary Code 1

Python code to visualize and plot thickness variation from thermal evaporation.

Source data

Source Data Fig. 1

Excel table of source data.

Source Data Fig. 3

Excel table of source data.

Source Data Fig. 4

Excel table of source data.

Source Data Fig. 5

Excel table of source data.

Source Data Fig. 6

Excel table of source data.

Source Data Fig. 7

Excel table of source data.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Burton, M., Narayanan, S., Jagger, B. et al. Techno-economic assessment of thin lithium metal anodes for solid-state batteries. Nat Energy 10, 135–147 (2025). https://doi.org/10.1038/s41560-024-01676-7

Received:

Accepted:

Published:

Version of record:

Issue date:

DOI: https://doi.org/10.1038/s41560-024-01676-7

This article is cited by

-

Mechanically compliant and cost-effective 1.4Li2O-0.75ZrCl4-0.25AlCl3 solid electrolyte for all-solid-state batteries with improved cycling stability

Nature Communications (2026)

-

Purity of lithium metal electrode and its impact on lithium stripping in solid-state batteries

Nature Communications (2025)