Abstract

The digital transformation of education is an inevitable trend, characterized by the deep integration of digital technologies within educational frameworks, making it a crucial driver of educational innovation and reform. Using data from the 2019 China Household Finance Survey, this study empirically examines the effects of digital education on household allocation of risky financial assets, incorporating both mechanistic and heterogeneity analyses. The findings reveal that digital education significantly enhances both the scope and intensity of household engagement with risky financial assets. After addressing endogeneity concerns using instrumental variable techniques and conducting extensive robustness checks, the results consistently validate the initial findings. Furthermore, the impact of digital education on the allocation of risky financial assets varies across different household demographics, with a more pronounced effect observed in households with greater wealth, lower debt ratios, and urban residency. Additionally, the mechanistic analysis clarifies how digital education facilitates the allocation of risky financial assets by broadening access to information, improving financial literacy, and increasing risk tolerance. Overall, this paper underscores the crucial role of digital education in shaping household financial asset allocation.

Similar content being viewed by others

Introduction

With the rapid expansion of global financial markets, the variety of financial products has broadened, complicating the landscape of investment and wealth management. In this evolving landscape, the rise of digital financial technologies, particularly in developing nations, has played a transformative role in enhancing the inclusiveness and innovation of financial systems1. Despite the rapid growth of these markets, many households, especially in China, face significant challenges in effectively managing and allocating their financial assets. As financial literacy improves, optimizing household financial asset allocation and enhancing wealth management capabilities have become focal points for both the global academic community and policymakers2,3,4. In this context, digital education has been increasingly recognized as a crucial tool for improving financial literacy and human capital, thus becoming an essential element in household financial decision-making processes5,6.

In China, the real estate market is characterized by persistently high housing prices and strong demand, resulting in real estate comprising a disproportionately large portion of household assets, approximately 62.4%. Conversely, financial assets account for only 22.7% of total household assets, with a predominant focus on low-risk instruments such as cash, demand deposits, and time deposits. This structural imbalance in asset allocation, relatively uncommon on a global scale, limits Chinese households’ engagement in financial markets and their opportunities to invest in riskier assets7. Since households are the fundamental units of economic activity, their asset allocation decisions are closely tied to financial stability and long-term economic growth8. Therefore, understanding the underlying causes of this phenomenon and developing strategies to increase household participation in financial markets are essential for advancing the maturation of China’s financial sectors and can offer valuable lessons for financial reforms in other developing nations.

In recent years, the rapid advancement of digital education has emerged as a new pathway for enhancing financial literacy and fostering human capital development. Studies suggest that digital education not only enhances individuals’ financial knowledge and decision-making skills but also significantly strengthens households’ ability to participate in financial markets9,10,11. In regions characterized by significant financial exclusion, the widespread adoption of digital financial technologies has enabled broader access to financial services12. Furthermore, digital education goes beyond providing basic financial knowledge; it empowers individuals to make informed decisions amid the complexities of financial instruments13. Despite global initiatives promoting digital education, such as UNESCO’s report “Rethinking Our Common Vision for the Future,” which advocates for education systems to proactively adapt to digital transformation, the specific impact of digital education on household financial behavior in China remains underexplored. Given China’s unique economic structure, the distinct evolution of its financial markets, and the notable imbalance in household financial asset allocation, the influence of digital education on financial decision-making within Chinese households may differ significantly from experiences in other countries. Therefore, investigating the role of digital education in shaping the allocation of financial assets by Chinese households, especially in managing risky financial assets, is of both academic and practical significance.

The main contributions of this paper are threefold. First, it expands the literature on household finance by examining the influence of digital education on the allocation of financial assets. Through rigorous empirical analysis, this study highlights the crucial role of digital education in enhancing financial literacy and promoting engagement with risky financial assets. This not only broadens the research scope within household finance but also contributes to theoretical insights into financial decision-making amid digital transformation. Second, this research explores the impact of digital education as a modern form of human capital on household financial behaviors, particularly emphasizing its role in improving financial knowledge, shaping risk preferences, and enhancing decision-making capabilities. This provides new empirical evidence supporting the integration of behavioral finance and human capital theories. Third, the findings offer practical implications for policymakers, showing that improvements in digital education can effectively increase household participation in financial markets. This establishes a theoretical foundation for formulating more inclusive educational and financial policies, thereby helping to enhance household financial well-being and promote sustainable economic growth.

The structure of the remainder of the paper is as follows: "Literature review" section provides a comprehensive review of the relevant literature. "Theoretical analysis and research hypothesis" section presents a theoretical analysis of the effects of digital education on the allocation of risky financial assets within households and develops the research hypotheses. "Data, variables, and models" section outlines the data sources, criteria for variable selection, and methodology for model construction. "Empirical results analysis" section presents the empirical analysis of the impact of digital education on the allocation of risky financial assets by households. "Conclusion and recommendations" section concludes the paper by discussing the key findings and deriving policy implications based on the research.

Literature review

Research on the impact of digital education on household allocation of financial assets primarily focuses on the following aspects:

Multidimensional determinants of household financial decision-making

Household financial decision-making is influenced by numerous factors, including both internal household characteristics and external elements such as environmental conditions and social networks. Research indicates that factors such as household health status, income levels, marital status, and social networks play crucial roles in shaping household risk preferences and financial asset allocation. Badarinza et al.14 report that households in poorer health tend to adopt more conservative investment strategies, avoiding high-risk investments. Conversely, households with higher incomes are more likely to invest in riskier assets such as stocks and mutual funds, reflecting a higher risk tolerance. Furthermore, Okello et al.15 demonstrate how digital social networks have improved the efficiency of information dissemination, allowing households to participate more actively in financial markets and optimize asset allocation through social interactions and information sharing. Xiao and Tao16 also note that older household heads generally prefer lower-risk asset allocations, a preference closely linked to the household’s life cycle stage and wealth accumulation patterns. While extensive literature explores various factors influencing household financial asset allocation, the specific role of education, particularly digital education, has not been thoroughly examined. In the digital information era, advancements in digital education are crucial for enhancing access to information, improving financial literacy, and reducing barriers to market entry. Therefore, a comprehensive exploration of how digital education influences household allocation of risky financial assets provides not only significant theoretical value but also substantial practical implications.

The role of education in shaping household financial decision-making behavior

Education is essential for enhancing household financial literacy and shaping financial behaviors, particularly in relation to investments in high-risk assets. Sarwar et al.17 argue that education reduces barriers to entry in high-risk asset markets, such as stocks, by improving individuals’ financial knowledge and skills, thereby encouraging households to allocate more resources to riskier investments. Talpsepp et al.18 highlight that education not only improves financial literacy but also increases household income levels and strengthens social networks, thereby indirectly promoting greater household participation in risky assets allocation. Moreover, digital education platforms, particularly those offering online financial education, have become essential for enhancing household financial understanding. This is particularly relevant for younger and lower-income households, as digital education allows them to better understand and engage with financial markets19. Liu and Wang20 note that digital financial education not only enhances household financial decision-making capabilities but also promotes the adoption of financial technology products, thus reshaping household investment behaviors and risk preferences. It has become a critical channel for improving household financial literacy and influencing investment behaviors21. While existing research emphasizes the crucial role of education in strengthening household financial decision-making, the specific mechanisms through which digital education, a growing trend in the digital era, affects household financial asset allocation require further investigation. Furthermore, the role of financial literacy as a potential mediating factor in this process has yet to be confirmed. Therefore, further research into the pathways and mechanisms by which digital education influences household financial asset allocation will not only clarify the underlying dynamics of how the digital economy shapes household financial behavior but also provide new insights into the evolution of household financial decision-making in the digital age.

The optimization effect of digital education on household allocation of financial assets

The rapid evolution of digital technologies has played a key role in enhancing household financial literacy and optimizing asset allocation through digital education. Research indicates that digital education has significantly increased the accessibility of financial knowledge, especially in remote or educationally underserved regions. Digital platforms offer households powerful learning tools, thereby improving their financial literacy22. These platforms not only provide households with extensive financial information, enhancing their understanding of financial markets, but also encourage diversified asset allocations, particularly in high-risk assets such as stocks and mutual funds. Zhang and Liu23 observed that digital education platforms allow households to stay informed about changes in financial markets and adjust their asset allocations accordingly. Yang et al.24 discovered that digital education enhances households’ awareness of financial market risks and returns, enabling more informed decisions in complex financial environments. Wang et al.25 noted that the widespread adoption of digital platforms has expanded access to financial education resources, thereby empowering households to make more informed decisions about wealth management and asset allocation. In particular, digital banking and investment platforms have greatly enhanced households’ financial decision-making capabilities. Chen et al.26 highlighted that the digitalization of social networks has significantly improved the efficiency of information dissemination, providing households with easier access to investment advice and facilitating the sharing of experiences through digital social platforms. Although existing studies demonstrate the positive impact of digital education on household financial literacy and asset allocation optimization, the specific mechanisms through which it facilitates the allocation of risky financial assets, such as expanding access to information, enhancing financial literacy, and increasing risk preferences, still require further validation. Therefore, further exploration of how digital education influences household investment behavior in financial markets, including the specific pathways through which these three factors optimize asset allocation, will not only reveal the underlying dynamics of how digital technology shapes household financial decision-making but also offer new perspectives for advancing financial education and policy development in the digital age.

In summary, while a substantial body of research has examined the factors influencing the allocation of financial assets within households, including individual characteristics and broader economic contexts, the literature has not thoroughly explored the specific impact of education, particularly digital education, on such allocations. Although it is well-established that education plays a crucial role in enhancing financial literacy and improving financial decision-making, its specific influence on the allocation of risky financial assets remains insufficiently addressed. While several studies suggest that education enhances household financial literacy, only a few have explored how digital education, by enhancing financial literacy and reinforcing individual human capital, influences the allocation of risky financial assets in financial markets. This paper aims to fill this gap by systematically examining how digital education can promote the allocation of risky financial assets by households, thereby providing valuable insights into the existing body of literature.

This study contributes to the literature by examining the impact of digital education on household financial behavior, highlighting how digital education enhances financial literacy, increases household participation in financial markets, and ultimately influences asset allocation decisions. By positioning digital education as a key determinant of household financial behavior, this study extends existing theoretical frameworks on household financial decision-making. It not only enriches the research on household financial decisions but also provides empirical evidence and policy recommendations for policymakers. In particular, the findings offer critical policy insights into improving digital education, fostering household participation in risk asset investments, optimizing household financial behavior, and promoting the inclusive development of financial markets.

Theoretical analysis and research hypothesis

Theoretical analysis

Information asymmetry theory

The theory of information asymmetry posits that disparities in access to information among market participants can lead to suboptimal decision-making, thereby diminishing market efficiency. In traditional financial markets, household investors often face significant barriers to accessing high-quality financial information due to limited information channels and inconsistencies in data reliability. Such asymmetries impair their ability to make informed asset allocation decisions, particularly in the context of risky asset investments, where insufficient information may result in investors underestimating or overestimating market risks, ultimately compromising the effectiveness of their investment portfolios.

As a pivotal mechanism for enhancing financial literacy, digital education leverages internet-based and digital technologies to provide household investors with broader, more accurate, and real-time financial information, thereby mitigating the adverse effects of information asymmetry. Moreover, digital education strengthens households’ ability to identify, interpret, and process financial information, enabling them to conduct more comprehensive assessments of investment risks and returns, ultimately facilitating more optimized asset allocation strategies27. In the context of high-risk financial assets, such as stocks and mutual funds, digital education plays a critical role in reducing investment biases stemming from information deficiencies. By equipping household investors with a more comprehensive and systematic understanding of financial markets, digital education fosters more informed, rational, and evidence-based investment decisions28. Consequently, it enhances the efficiency and effectiveness of financial asset allocation, promoting more optimal investment outcomes at the household level.

Human capital theory

Human capital theory posits that knowledge and skills serve as the fundamental drivers of individual economic behavior. Financial literacy, as a crucial component of human capital, directly influences an individual’s performance in financial markets. In the context of household financial decision-making, financial literacy is defined as an individual’s ability to understand, evaluate, and manage financial instruments. It determines whether households can allocate their assets in a rational and efficient manner29. A higher level of financial literacy not only enhances investors’ comprehension of market mechanisms but also improves their ability to assess risks and manage assets, thereby optimizing household investment decisions. As a critical mechanism for improving financial literacy, digital education provides households with flexible, efficient, and diversified learning channels, including online financial courses, financial simulation platforms, AI-driven investment advisory systems, and financial information aggregation platforms. These digital learning tools enable household members to systematically grasp financial market operations and the characteristics of financial products. This digitalized learning approach not only reduces the time costs associated with acquiring financial knowledge but also compensates for the limitations of traditional education in cultivating financial literacy.

Furthermore, enhanced financial literacy strengthens household awareness of financial markets and improves their adaptability to complex market environments. The accumulation of financial knowledge enables household investors to more accurately assess the expected returns and risks of financial products, thereby mitigating the likelihood of investment misjudgments or irrational financial decisions that could lead to asset losses. Consequently, digital education not only enhances financial literacy but also facilitates the optimization of household asset allocation, fostering more informed and strategic investment behavior.

Risk preference theory

Risk preference theory posits that an individual’s attitude toward uncertainty plays a crucial role in asset allocation decisions, particularly in determining the proportion of high-risk financial assets in an investment portfolio. Digital education influences household risk preferences and investment decisions through multiple channels by enhancing financial literacy and strengthening risk management capabilities. First, digital education provides households with systematic training in risk perception and management, enabling them to more rationally assess uncertainties in financial markets. Second, digital education significantly boosts household confidence in investing in high-risk assets. Research suggests that the accumulation of financial knowledge can effectively reduce investors’ fear of market volatility, making them more willing to tolerate short-term fluctuations and pursue higher long-term returns30. Furthermore, digital education leverages data analytics tools, AI-driven robo-advisory systems, and other technological advancements to help households more accurately assess their own risk tolerance, develop more scientifically informed investment portfolios, and enhance the rationality of asset allocation decisions.

As a result, through the influence of digital education, household investors can progressively increase their risk tolerance, strengthen their willingness to engage in high-risk financial assets, and ultimately drive diversification in household financial asset allocation. This, in turn, contributes to greater liquidity and dynamism in financial markets.

Research hypothesis

Digital education and household allocation of risky financial assets

Digital education, as a key tool for enhancing digital literacy, significantly influences household allocation of risky financial assets, a dynamic that can be examined through various theoretical frameworks. The rapid advancement of digital technologies has significantly reduced barriers to financial participation and expanded the reach of financial inclusion services. The emergence of digital finance allows households to easily access financial information and engage in financial activities through the internet and mobile devices, thereby reducing information asymmetry and improving information transparency31. From an educational standpoint, the integration of digital technologies has broadened both the scope and accessibility of educational content, especially in enhancing digital literacy. Recognized as a crucial component of human capital, digital literacy not only enables individuals to adapt to a digital society but also helps bridge the digital divide, thereby improving households’ ability to effectively use digital tools and financial information32. Through digital education, households gain access to more comprehensive and accurate financial information, empowering them to make more informed and proactive decisions about the allocation of high-risk financial assets. Based on the previous theoretical analysis, this study proposes the following hypothesis:

H1

Digital education enhances households’ capacity to effectively allocate risky financial assets.

Digital education, information channels, and household allocation of risky financial assets

Digital education significantly improves households’ access to financial information by expanding the channels through which it is obtained, thereby increasing the efficiency of information acquisition and indirectly influencing household allocation of risky financial assets. Traditionally, financial information channels have been limited, raising the costs of information search and restricting households’ access to valuable investment insights. However, with advancements in internet and digital technologies, avenues for accessing information have diversified, enabling households to obtain investment information through various digital platforms, such as social media and short-video platforms. This diversification reduces information search costs and improves the quality of decision-making33. The rise of social media and financial platforms has not only transformed information dissemination but also provided households with more opportunities for investment guidance and interactive learning. Through these channels, households can gain investment-related knowledge and share experiences with others, further refining their asset allocation strategies. Building on the theoretical and empirical research discussed above, this study presents the following second hypothesis:

H2

Expanding the information channels available to households is a key mechanism through which digital education influences the allocation of risky financial assets.

Digital education, financial literacy, and household allocation of risky financial assets

The impact of financial literacy on household financial decision-making is well-established. Financial literacy not only enables households to make informed decisions about wealth accumulation and financial planning29 but also encourages their participation in high-risk financial asset investments. As a powerful tool for enhancing financial literacy, digital education provides a variety of flexible and diverse learning methods that help households more effectively acquire investment knowledge and risk management skills. Through online courses, digital libraries, financial apps, and other platforms, households can enhance their financial literacy, overcoming the limitations of time and location34. This improved understanding of financial products and strengthened risk assessment capabilities increase households’ willingness and ability to engage with high-risk assets. Building on the theoretical analysis of how digital education enhances financial literacy, this paper proposes the following third hypothesis:

H3

Enhancing household financial literacy is a critical pathway through which digital education influences the allocation of risky financial assets.

Digital education, risk preference, and household allocation of risky financial assets

Risk preference is a key psychological factor in household financial decision-making, reflecting a household’s tolerance for uncertainty and potential losses. Households with higher risk preferences are generally more likely to allocate a larger portion of their assets to high-risk investments, such as stocks and mutual funds. Digital education not only enhances financial literacy but also indirectly influences households’ risk preferences by expanding their understanding of financial markets and increasing their awareness of investment risks30. By exposing households to a wide range of investment theories and risk management strategies, digital education enables them to better assess potential investment risks and returns35. Moreover, the increased social interaction and information exchange facilitated by digital platforms further boost households’ confidence, encouraging a greater willingness to embrace risks and actively engage in allocating high-risk financial assets. Building on the theoretical insights into how digital education influences risk preferences, this study proposes the following fourth hypothesis:

H4

Strengthening household risk preference is a key mechanism through which digital education impacts the allocation of risky financial assets.

Data, variables, and models

Data source

The data utilized in this study is sourced from the 2019 China Household Finance Survey (CHFS). Conducted annually since 2011, the CHFS provides a comprehensive nationwide survey of household finances and has been extensively employed in research pertaining to household financial behavior, wealth accumulation, and other related areas in China36,37. Covering 29 provinces and 345 counties, including districts and county-level cities, the CHFS offers a highly representative and detailed dataset of household financial information across China, making it an invaluable resource for this analysis.

The selection of the 2019 China Household Finance Survey (CHFS) dataset for this study is justified by several factors: First, its representativeness and scope—the CHFS, with a large sample size of 34,643 valid households across 29 provinces and 345 counties, is one of the most comprehensive sources of household financial data in China, providing detailed insights into household financial decision-making, especially in asset allocation. Second, its reliability and validity are well established. The dataset has been widely used in both domestic and international financial and economic research, and its accuracy and dependability are well recognized in the academic community38. Third, its accessibility and public availability are significant advantages. The CHFS is freely accessible, facilitating academic validation and data replication, which are critical for enhancing research transparency and scientific rigor. Fourth, the dataset’s comprehensive coverage includes multidimensional information on households’ total assets, liabilities, income, consumption, investments, and education levels, providing a robust foundation for analyzing household allocation of risky financial assets. The dataset was meticulously cleaned to exclude households with missing values for key variables or negative income or total assets, resulting in a final sample of 33,436 valid households, ensuring the study’s validity and representativeness.

Variable specification

Explanatory variable: digital education

Digital education is the primary explanatory variable in this study, which investigates how the level of digital education within households influences their allocation of risky financial assets. The impact of digital education on households is assessed through two dimensions “digital education access” and “digital education usage.” The first dimension, “digital education access,” evaluates whether households have the technological infrastructure necessary to engage in digital learning. This includes the availability of essential hardware such as smartphones and computers, as well as access to the internet. Only when these basic conditions are met can households effectively access digital education content. The second dimension, “digital education usage,” assesses the extent to which households actively participate in digital educational activities. This includes utilizing online learning platforms, engaging in remote education courses, and other similar activities19,20. This dimension reflects the actual engagement of households with digital education resources. The comprehensive structure of the digital education indicators is systematically detailed in Table 1.

To rigorously and scientifically assess household digital education levels, we employ two complementary methods to construct a composite digital education variable. Initially, we adopt a direct summation approach, where scores from the dimensions of digital education access and usage are combined to form a composite index. This method is intuitive and provides a straightforward representation of household performance across different dimensions.

However, to address potential biases in dimension weighting that may arise with this approach, we also implement Principal Component Analysis (PCA). PCA is used to extract principal components, facilitating a more nuanced evaluation of household digital education levels. We begin by verifying the suitability of the data for PCA using the Kaiser–Meyer–Olkin (KMO) test. A KMO value greater than 0.5 confirms the appropriateness of the data for factor analysis. Our findings reveal that Bartlett’s test of sphericity is significant (P-value = 0.000), and the KMO measure of sampling adequacy stands at 0.560, indicating the data is suitable for this analysis. Consequently, PCA is employed to provide a robust assessment of household digital education levels, enhancing the reliability and precision of our measurements.

Dependent variable: household allocation of risky financial assets

Following the classification by Wang et al.35, this study differentiates risky financial assets into two categories: narrow and broad. The narrow category includes assets that are tradable in formal financial markets, such as stocks, mutual funds, bonds, financial products, gold, and derivatives. The broad category extends beyond the narrow definition to include assets traded in informal financial markets, such as private lending. It is important to note that the definition of broad risky financial assets is utilized primarily for robustness checks in this analysis.

In this study, household allocation of risky financial assets is the dependent variable and is divided into two distinct types: breadth and depth. The breadth of household allocation of risky financial assets assesses whether a household possesses at least one type of risky financial asset. If a household owns any risky financial assets, such as stocks or mutual funds, this variable is coded as 1; if not, it is coded as 0. This measure reflects the household’s level of engagement in financial markets. The depth of household allocation of risky financial assets, on the other hand, quantifies the number of different types of risky financial assets a household holds. A greater variety of asset types indicates a higher level of diversification in the household’s financial asset portfolio, suggesting a more sophisticated approach to risk management.

Control variables

In this study’s analytical model, we control for a variety of factors that may influence household allocation of risky financial assets to ensure the accuracy and reliability of our results. Drawing on the frameworks established by Calvet et al.36, Gomes et al.37, and Liu and Fan38, we categorize the control variables into two dimensions: individual household-level factors and macroeconomic factors.

At the individual household level, control variables include the gender, age, marital status, health status, and educational attainment of the household head. These factors are known to directly influence household risk preferences and financial decision-making processes. Additionally, to capture economic standing, variables such as total household income, assets, and liabilities are included as controls in the model, as these elements critically reflect a household’s capacity to engage in risky financial investments37. On the macroeconomic front, control variables include the proportion of regional education spending relative to total fiscal spending, the proportion of regional technology spending relative to total fiscal spending, and regional GDP. These macroeconomic factors are instrumental in shaping the broader economic, educational, and technological landscapes of a region, which can, in turn, affect households’ propensity and preferences for risky financial assets22,33,39. To enhance the robustness of the model, the natural logarithms of total household income, assets, liabilities, and regional GDP are utilized, which helps normalize the data and mitigate the impact of extreme values.

Table 2 displays the descriptive statistics for the key variables in the study. Among the sampled households, about 52.3% hold risky financial assets, with an average of 0.593 types per household. This data suggests that both the likelihood and the extent of participation in risky financial assets are relatively modest in China. Following principal component analysis, the mean value of the digital education variable is 0.00285, indicating that the data are centered around this principal component and suggesting minimal variance from the mean, reflecting a generally low level of digital education adoption among the sampled households, with an average score of 2.613.

In terms of household characteristics, 75.2% of the heads of households are male, with an average age of 56.30 years. Additionally, 84.8% of household heads are married, and the average health status is rated between “fair” and “good.” The average educational attainment of household heads is less than nine years, indicating a generally low level of education. The typical household comprises three members.

An analysis of the variance in household income, assets, and liabilities shows that liabilities exhibit the most significant variation, followed by assets and then income. This variation highlights the differing financial conditions and risk exposures among households. Notably, 90% of households engage in individual business activities, reflecting a high level of entrepreneurship, while only 11% own their homes, indicating a low homeownership rate among the sampled population. This comprehensive data provides a detailed snapshot of the financial behaviors and demographic characteristics of households in China, essential for understanding their financial decision-making processes.

Table 3 provides a correlation matrix detailing the relationship between digital education and the allocation of risky financial assets among the sampled households. The data indicate that regardless of whether digital education is quantified using principal component analysis or the direct summation method, there is a statistically significant correlation with both the ownership of risky financial assets and the diversity of risky asset types held, at the 1% significance level. This evidence underscores a statistically significant link between digital education and the allocation of risky financial assets by households, highlighting the influential role of digital education in shaping financial behaviors.

Model specification

In the empirical analysis assessing the impact of digital education on the allocation of risky financial assets by households, we use a binary dependent variable (0 or 1), which necessitates the use of the Probit model for regression analysis. The Probit model is specifically designed for binary choice problems and is highly effective in scenarios where the dependent variable is dichotomous, taking values of 0 or 1. This model is particularly apt for analyzing the binary decision of whether a household holds risky financial assets, as noted by Smith and Johnson40 and Liu et al.41. The Probit model calculates the cumulative standard normal distribution, which allows us to accurately assess the impact of digital education on the probability that households engage in risky financial asset allocation, offering a clear and interpretable explanation of the probabilities involved.

Moreover, given that household decisions on the allocation of risky financial assets are influenced by a range of factors and exhibit considerable heterogeneity, the Probit model is ideally suited to address these nonlinear relationships, thereby enhancing the precision of the model’s estimates. Therefore, the Probit model is particularly well-suited for this study, providing robust explanatory power and significantly enriching our understanding of how digital education influences household investments in risky financial assets.

The specific model is presented as follows:

whereby \(\mu \sim N(0,{\sigma }^{2})\); \(risky\_1=1\) represent households holding at least one type of risky financial assets, \(risky\_1=0\) denotes households not holding risky financial assets; \(digital\_edu\) represents digital education; \(X\) denotes control variables.

To examine the impact of digital education on the variety of risky financial assets held by households, considering the dependent variable as a discrete numeric value ranging from 1 to 6, we employ a negative binomial model for regression analysis, as shown in the following equation:

wherein \(risky\_2\) represents the count of the types of risky financial assets held by households, ranging from 1 to 6; \(digital\_edu\) represents digital education; \(X\) represents control variables; and \(C\) represents the constant term.

Empirical results analysis

Baseline regression results

Table 4 delineates the impact of digital education on household allocation of risky financial assets, analyzed through two distinct methods: Principal Component Analysis (PCA) and the summation method. The findings are compelling and statistically significant at the 1% level, illustrating the influential role of digital education. Firstly, regarding the breadth of household allocation of risky financial assets, PCA results reveal a coefficient of 0.417 for digital education, indicating that each one-unit increase in digital education enhances the probability of a household holding at least one type of risky financial asset by 41.7%. Similarly, using the summation method, the coefficient is slightly higher at 0.445, suggesting that each one-unit increase in digital education increases this probability by 44.5%.

Secondly, concerning the depth of household allocation of risky financial assets, the PCA-derived coefficient for digital education is 0.256, implying that each one-unit increase in digital education corresponds to a 25.6% increase in the diversity of risky financial assets held by the household. Using the summation method, the coefficient is 0.274, indicating a 27.4% increase, further affirming the positive impact of digital education.

These results clearly demonstrate that digital education not only broadens household participation in financial markets but also enhances the diversification of their risky asset allocations. The findings robustly support Hypothesis H1, underscoring the crucial role of digital education in optimizing household financial decision-making and promoting more nuanced engagement with financial markets.

Robustness checks

Replacing the dependent variable

In this study, we expand the definition of household risky financial assets to include informal loans, given that these channels often provide higher returns at greater risks. We categorize these assets as broad risky financial assets, which encompasses not only traditional risky assets like stocks, mutual funds, and bonds, but also informal financial assets such as high-yield loans. This broader categorization allows for a more holistic examination of household allocation of risky financial assets. Table 5(1)–(4) presents the regression results using broad risky financial assets as the dependent variable. The regression analysis, while controlling for potential omitted variables, shows that the coefficient for digital education is significantly positive at the 1% confidence level. This result underscores that digital education significantly enhances both the breadth and depth of household allocation of broad risky financial assets, thereby affirming the robustness of our model. These findings highlight the pivotal role of digital education in facilitating more comprehensive and risk-diverse financial asset allocation among households.

Replacing the explanatory variable

To conduct a thorough analysis of the impact of digital education on household allocation of risky financial assets, we divided the study into two distinct dimensions: “digital education access” and “digital education usage.” For digital education access, we employed Principal Component Analysis (PCA) to combine and weight three underlying indicators, effectively addressing multicollinearity issues and boosting the explanatory power of the variables. This method allows for a more accurate assessment of the overall influence of digital education access. For digital education usage, we utilized the logarithmic value of household “total expenditure on online education” as a proxy variable. This approach helps mitigate the influence of extreme values in the data, thereby enhancing the robustness of the regression results. Table 5(5)–(8) presents the regression results for these two substituted dimensions. Both “digital education access” and “digital education usage” show significantly positive coefficients at the 1% confidence level, demonstrating that digital education substantially improves both the breadth and depth of household allocation of risky financial assets. These findings affirm the robustness of the results, highlighting the significant role of digital education in influencing household financial behaviors.

Adding control variables

To address the potential confounding effects of regional factors on household financial decisions, we considered financial accessibility in the household’s province (city or district) as a potentially omitted variable to assess its impact on the regression results. According to Wang and Zhao42, regional financial accessibility significantly influences household participation in financial markets. Following the methodology of Yin et al.43, we utilized the number of securities service centers per ten thousand people in the province (city or district) as a proxy variable. This metric effectively captures the penetration of regional securities markets and the accessibility of financial services for households.

Table 6 presents the regression results after incorporating this variable. The analysis indicates that digital education continues to significantly enhance both the breadth and depth of household allocation of risky financial assets, with the sign and significance of the regression coefficients remaining consistent. This finding suggests that regional financial accessibility does not substantially alter the influence of digital education on household allocation of risky financial assets, thereby further confirming the robustness of our model. These results underscore the enduring effect of digital education in shaping household financial behavior, independent of regional financial service availability.

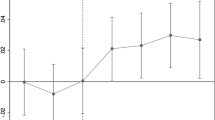

Instrumental variables

In the empirical analysis, a household’s level of digital education may be subject to endogeneity concerns. Specifically, digital education levels are influenced not only by household financial investment behavior but may also interact dynamically with household financial decisions. As households engage in risky financial markets, their exposure to new information and capital accumulation may reshape their perceptions and acceptance of digital education, leading to potential reverse causality that could bias the estimation results.

To mitigate this endogeneity issue, we employ the average level of digital education in the household’s region (province) as an instrumental variable, following the approach of Autor and Handel44. The rationale for selecting this instrument is that the regional level of digital education captures the overall degree of digitalization and the region’s educational development capacity, factors that are exogenous to an individual household’s specific digital education decisions. In other words, while the regional average level of digital education serves as a strong predictor of household digital education levels, it remains uncorrelated with the error term in the regression model, thereby satisfying both the relevance and exogeneity conditions required for a valid instrumental variable.

Table 7 presents the regression results after addressing endogeneity using the two-stage least squares (2SLS) method. In the first stage (see columns 1, 3, 5, and 7 of Table 7), the instrumental variable exhibits a significant positive correlation with the household’s digital education index, confirming the relevance assumption of the instrument. Moreover, the first-stage F-statistic exceeds 10, effectively ruling out concerns related to weak instrument bias.

In the second stage (see columns 2, 4, 6, and 8 of Table 7), after accounting for endogeneity, the regression results remain consistent with the baseline analysis, further validating the robustness of the findings. These results reinforce the conclusion that digital education plays a significant role in shaping household allocation of risky financial assets, while also confirming the reliability of the instrumental variable approach in addressing potential endogeneity concerns.

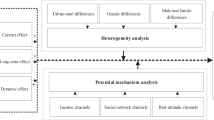

Mechanism analysis

This study examines whether digital education influences household allocation of risky financial assets through three channels: information acquisition, financial literacy, and risk preference. First, concerning information acquisition, this study employs a question from the China Household Finance Survey (CHFS): “How much attention do you usually pay to economic and financial information?” to measure household attention to such information. The responses are coded as follows: “Very attentive” = 5, “Quite attentive” = 4, “Average” = 3, “Rarely attentive” = 2, and “Never attentive” = 1. As shown in columns (1) and (2) of Table 8, digital education significantly increases household attention to financial information, broadening their information sources and thereby promoting household allocation of risky financial assets. The integration of digital technology and education has expanded how households access economic and financial information, enhancing their ability to filter and evaluate it11,33. This enables households to acquire financial investment knowledge more effectively and access relevant information through multiple channels, facilitating more informed financial decisions and improving information retrieval efficiency, thus supporting Hypothesis H2.

Second, regarding financial literacy, this study constructs a financial literacy measurement index based on the definition by Yin et al.45 , using four questions from the China Household Finance Survey (CHFS) related to interest rate calculation, understanding inflation, and investment risk awareness. Each correct answer is assigned a score of 1, while incorrect or “don’t know” responses receive a score of 0. As shown in columns (3) and (4) of Table 8, digital education significantly improves household financial literacy, thereby facilitating household allocation of risky financial assets. Through digital education, households can more conveniently access financial knowledge related to investment and risk management and utilize abundant learning resources and platforms. This, in turn, enhances their financial literacy and risk awareness, thereby supporting Hypothesis H3.

Third, concerning risk preference, this study measures household risk preference using responses to the CHFS questionnaire item: “If you had a sum of money to invest, which type of investment project would you prefer?” Responses indicating “high risk, high return” or “relatively high risk, relatively high return” are coded as 1, while all other responses are coded as 0. As shown in columns (5) and (6) of Table 8, digital education significantly strengthens households’ risk preference, thus facilitating their allocation of risky financial assets. Digital education offers households diverse and convenient learning opportunities, enabling access to high-quality educational resources worldwide. Moreover, it allows households to interact and engage in discussions with investors, experts, and scholars. This interaction improves their understanding and knowledge of the financial sector, enhances their awareness and ability to manage investment risks, and increases their willingness to allocate more risky assets in pursuit of higher returns, thereby supporting Hypothesis H4.

Heterogeneity tests

This paper examines the heterogeneous effects of digital education on household allocation of risky financial assets from three perspectives: assets, liabilities, and urban–rural differences.

Heterogeneity in household assets

Digital education plays a crucial role in promoting household allocation of risky financial assets. However, household wealth levels largely determine household participation in risky asset investment46. To analyze the heterogeneous impacts of digital education on household allocation of risky financial assets across different wealth levels, households are classified into high-asset and low-asset groups based on median total assets. The results in Table 9 indicate that digital education significantly enhances the allocation of risky financial assets for both high-asset and low-asset households. Further analysis of the coefficients reveals that digital education exerts a stronger influence on high-asset households regarding both the breadth and depth of risky financial asset allocation. One possible explanation is that high-asset households generally have a stronger financial foundation and greater risk tolerance37, making them more inclined to invest in risky assets. Additionally, high-asset households tend to possess greater financial literacy and broader financial networks, enabling them to better comprehend and utilize the financial knowledge provided through digital education38. This allows them to adopt a more proactive approach to financial decision-making and apply digital education to more sophisticated asset allocation strategies, thereby deepening their allocation of risky financial assets22,39.

This finding carries significant policy implications, suggesting that high-asset households are better positioned to utilize digital education resources, while low-asset households, constrained by limited resources and human capital, may find it challenging to fully benefit from digital education. Furthermore, infrastructure disparities between urban and rural areas may exacerbate this imbalance, particularly in rural regions where households encounter greater difficulties in accessing digital education resources. Therefore, policymakers should prioritize narrowing the digital divide between urban and rural areas, specifically by improving digital education resources and infrastructure in rural regions, to encourage greater participation of rural households in financial markets and enhance overall financial inclusion.

Heterogeneity in household debt

Costa and Farinha47 emphasize that an increase in household debt substantially raises financial vulnerability, thereby influencing household financial decision-making. Households also exhibit significant differences in their allocation of risky financial assets under varying levels of economic pressure. To analyze the heterogeneous impacts of digital education on household allocation of risky financial assets under varying levels of economic pressure, this study classifies households into high-debt and low-debt groups based on median total household debt. The regression results in Table 10 suggest that digital education exerts a significantly positive effect on household allocation of risky financial assets for both high-debt and low-debt households. Further analysis of the coefficients reveals that the effect of digital education is more pronounced for low-debt households in terms of both the breadth and depth of risky asset allocation. One possible explanation is that low-debt households experience less economic pressure and lower financial risk, allowing them to more easily enhance their financial literacy through digital education, which consequently encourages more active allocation of risky financial assets.

This finding carries significant policy implications, suggesting that to encourage broader household participation in financial markets, particularly regarding the allocation of risky financial assets, policies should consider differences in household debt levels and implement targeted strategies to advance digital education. For low-debt households, policies should encourage the full utilization of digital education to enhance financial literacy and optimize asset allocation, thereby strengthening their capacity to participate in financial markets. For high-debt households, additional support should be provided to alleviate financial pressures and improve their financial circumstances, thus creating favorable conditions for more active participation in risky asset allocation.

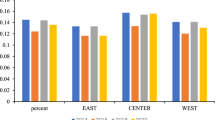

Urban–rural heterogeneity

China’s economy has long been characterized by a distinct urban–rural “dual” structure, marked by persistent disparities in financial development between urban and rural areas48. Rural regions generally face challenges such as inadequate financial service coverage, high financing costs, and low efficiency in capital utilization49,50,51. These challenges limit rural households’ participation in financial markets and influence their investment behavior. These disparities, in turn, affect the role digital education plays in household allocation of risky financial assets.

To analyze the urban–rural differences in the impact of digital education on household allocation of risky financial assets, this study categorizes sample households into urban and rural groups based on their geographic location. The regression results in Table 11 indicate that, regardless of whether households are located in urban or rural areas, digital education has a significantly positive effect on their allocation of risky financial assets. Further analysis of the coefficients reveals that, in both the breadth and depth of risky asset allocation, digital education has a greater impact on urban households. One possible explanation is that urban households have better access to digital education resources, allowing them to acquire financial information more effectively, improve financial literacy, and optimize asset allocation52. In contrast, rural households, hindered by lower digital device penetration and insufficient financial education coverage, face greater barriers to participating in digital education, which limits their ability to improve the allocation of risky financial assets.

This finding has significant policy implications, suggesting that to encourage rural households to actively participate in financial markets, policies should focus on enhancing digital infrastructure in rural areas and improving access to and dissemination of financial education. Specifically, greater investment should be directed toward digital education platforms and financial literacy programs in rural areas to help rural households better utilize digital education resources, enhance their financial decision-making abilities, and optimize their allocation of risky assets.

Conclusion and recommendations

Conclusion

This study empirically examines the impact of digital education on household allocation of risky financial assets using data from the 2019 China Household Finance Survey (CHFS). The findings suggest that digital education significantly enhances both the breadth and depth of household allocation of risky financial assets. After addressing endogeneity concerns using instrumental variable methods and performing multiple robustness checks, the results remain consistent and reliable. Additionally, the effects of digital education exhibit significant heterogeneity across different household wealth levels, debt statuses, and urban–rural classifications. Specifically, the impact of digital education is stronger among households with greater wealth, lower debt levels, and those living in urban areas. A mechanism analysis reveals that digital education significantly boosts household participation in the risky financial asset market by expanding access to information, improving financial literacy, and increasing risk tolerance. These findings provide essential theoretical support for the development of digital education policies and the optimization of household financial decision-making, particularly in fostering household financial participation and enhancing overall financial literacy.

Recommendations

Optimizing the household financial decision-making environment and enhancing financial market accessibility

The government should promote the establishment of a nationally integrated digital financial education platform, providing free, high-quality online financial resources to ensure equitable access to financial information for both urban and rural households, thereby mitigating financial knowledge disparities. Furthermore, digital financial literacy centers could be set up in urban communities in collaboration with banks, securities firms, and other financial institutions to conduct regular investment seminars and advisory sessions. These initiatives would help residents gain a deeper understanding of financial markets and improve their asset allocation capabilities. Additionally, the government should incentivize financial technology (FinTech) firms to develop artificial intelligence (AI)-driven robo-advisory systems that offer personalized investment recommendations tailored to households from diverse economic backgrounds. This would lower entry barriers to financial markets and empower households to allocate risky assets more efficiently. In rural areas, it is essential to establish financial service stations in partnership with local banks and credit cooperatives to provide fundamental financial education, investment consulting, and digital payment training, thereby enhancing farmers’ financial literacy and investment capacity. Moreover, financial information bulletin boards and promotional stations could be set up in rural cooperatives and marketplaces to disseminate basic financial knowledge through illustrated brochures, audio broadcasts, and short videos. These initiatives would facilitate the development of a more intuitive understanding of financial market operations among rural households.

Enhancing the quality of digital education and strengthening household financial literacy

The government should integrate digital financial literacy courses into primary, secondary, and higher education curricula, as well as vocational training programs, to ensure that younger generations acquire essential financial literacy and digital financial skills. Furthermore, a lifelong learning framework should be promoted, leveraging digital platforms such as online courses, smartphone apps, and social media to distribute financial knowledge and increase household awareness of financial products and investment risks. Special emphasis should be placed on financial risk management and consumer protection education, with targeted training programs focusing on preventing investment fraud, financial scams, and cybersecurity threats to enhance households’ awareness of financial risks. In rural areas, “Digital Financial Classrooms” could be established in village schools, offering free mobile financial learning applications to help rural youth develop financial awareness from an early age. Additionally, the government could collaborate with financial technology companies such as Alipay and WeChat Pay to launch low-cost, mobile-based financial education courses, allowing rural households to access clear, easy-to-understand financial education via smartphones and improve their understanding of financial products. Furthermore, university student volunteers and financial professionals could be mobilized to organize rural digital financial literacy workshops, educating residents about common financial products, investment tools, and the use of digital technology in asset management.

Enhancing the mechanism of digital education for financial asset allocation and strengthening household allocation of risky financial assets

The government should encourage banks, securities firms, and technology companies to develop data-driven, personalized investment education tools that help household investors assess their risk preferences and design rational asset allocation strategies. At the same time, integrating financial technology with financial education should be a central priority. The government should support FinTech companies in creating affordable investment simulation software, allowing households to practice investment strategies in a virtual environment and enhance their practical investment capabilities. Furthermore, the government should strengthen the regulation of digital financial platforms to ensure the credibility of online financial education resources, curb the dissemination of misleading investment information, and protect the rights of household investors. In rural areas, the government could introduce a “Rural Financial Experience Program” in collaboration with rural commercial banks and online financial firms to offer small-scale simulated investment experiences. This initiative would provide farmers with the opportunity to acquire investment knowledge in a low-risk environment and enhance their adaptability to financial markets. Additionally, a rural financial advisory volunteer service team could be established, engaging financial professionals from banks and investment institutions to provide one-on-one consulting services to farmers, assisting them in developing rational investment plans. The government should also promote ongoing financial literacy initiatives in rural cooperatives, enabling farmers to understand the practical applications of various financial instruments, such as insurance, mutual funds, loans, and investments, within the context of agricultural production and business operations.

Learning from international experiences and promoting global adoption

China’s experience in leveraging digital education to promote financial inclusion offers valuable insights for other developing countries. Governments worldwide can adopt measures such as establishing national digital financial education platforms and offering free, open-access online financial resources to help households in remote areas gain basic financial knowledge. Additionally, countries can collaborate with FinTech companies to develop affordable financial education tools, drawing on China’s experience in utilizing mobile payment platforms to boost financial literacy. Furthermore, strengthening international cooperation is crucial for facilitating global sharing of digital financial education resources. Developing countries, in particular, can benefit from cross-border technological collaboration and financial support to enhance their digital infrastructure, improve access to financial markets, and foster inclusive financial development on a global scale.

Limitations and future research directions

This study provides empirical evidence on the impact of digital education on household allocation of risky financial assets; however, several limitations must be acknowledged. First, data limitations pose a significant challenge to this research. This study relies on the highly representative 2019 China Household Finance Survey (CHFS); however, limitations remain in the selection and measurement of certain variables, particularly in quantifying household digital education levels. Second, while this study offers a preliminary exploration of the heterogeneous effects of digital education, further investigation is warranted. Specifically, the impact of digital education on various household groups may differ depending on factors such as socioeconomic background, educational attainment, and risk tolerance. Therefore, future studies could explore these dimensions in more detail and analyze how different household types modify their behavior in response to digital education. Third, although this study is based on data from China, future research should expand to cross-country comparisons by incorporating data from other countries or regions. This approach would assess the generalizability and variability of digital education’s impact on household financial behavior globally. Such research would not only enhance the external validity of the findings but also offer valuable insights for shaping global digital finance and educational policies.

Data availability

The data supporting the findings of this study are all included in the Supplementary Information file.

References

Narayan, P. K., Sharma, S. S. & Singh, R. J. The rise of digital financial technologies and their impact on financial inclusion: Evidence from developing countries. J. Fin. Technol. 9, 45–62. https://doi.org/10.1016/j.fintech.2020.100204 (2020).

Campbell, J. Y. Household finance. J. Finance 61, 1553–1604. https://doi.org/10.1111/j.1540-6261.2006.00885.x (2006).

Merton, R. C. Financial innovation and the management and regulation of financial institutions. J. Fin. Econ. 44, 3–12. https://doi.org/10.1016/j.jfineco.2014.04.002 (2014).

Guiso, L., Jappelli, T. & Padula, M. Financial literacy and portfolio diversification. Econ. J. 121, 1–28. https://doi.org/10.1111/ecoj.12640 (2021).

Lusardi, A. & Mitchell, O. S. Financial literacy and retirement preparedness: Evidence and implications for financial education. J. Pension Econ. Financ. 13, 309–337. https://doi.org/10.1017/S1474747214000195 (2021).

Grigorescu, A., Tufan, M. & Zaharia, M. Digital literacy and financial participation in emerging economies: Evidence from Central and Eastern Europe. Financ. Innov. 9(1), 15–28. https://doi.org/10.1186/s40854-021-00274-6 (2023).

Ma, Y. & Zhang, L. The structural imbalance in asset allocation: A challenge for Chinese households in financial market participation. J. Chin. Econ. 44, 223–240. https://doi.org/10.1016/j.chieco.2021.03.002 (2021).

Dynan, K. The effect of household asset allocation on economic stability and long-term growth. J. Econ. Perspect. 14, 79–101. https://doi.org/10.1257/jep.14.4.79 (2000).

Means, B. The impact of digital education on financial knowledge and decision-making. Educ. Tech. Res. Dev. 66, 847–869. https://doi.org/10.1007/s11423-018-9556-6 (2018).

Klochkova, I., Kovalenko, S. & Strizhak, P. Digital education and financial literacy: A case study from Russia. Int. J. Educ. Technol. 36, 112–126. https://doi.org/10.1016/j.ijet.2019.04.002 (2018).

Grigorescu, A., Tufan, M. & Zaharia, M. Digital literacy and financial participation in emerging economies: Evidence from central and Eastern Europe. Financ. Innov. 7, 15–28. https://doi.org/10.1186/s40854-021-00274-6 (2021).

Dahlberg, T., Mallat, N. & Olsson, H. Digital financial technologies and financial inclusion: Evidence from low-income households. Inf. Syst. J. 25, 249–273. https://doi.org/10.1111/isj.12059 (2015).

Lusardi, A. & Mitchell, O. S. Financial literacy and retirement preparedness: Evidence and implications for financial education. J. Pension Econ. Finance 13, 309–337. https://doi.org/10.1017/S1474747214000195 (2014).

Badarinza, C., Campbell, J. Y. & Ramadorai, T. M. Household risk tolerance and investment behavior: The impact of health and income. Rev. Fin. Stud. 29, 320–357. https://doi.org/10.1093/rfs/hhv072 (2016).

Okello, D., Mwakalinga, K. & Mugisha, A. Digital social networks and financial decision-making: Implications for asset allocation in Sub-Saharan Africa. Int. J. Fin. Econ. 22, 147–164. https://doi.org/10.1002/ijfe.1554 (2017).

Xiao, J. J. & Tao, R. Age, life cycle, and household financial risk-taking behavior: Evidence from China. J. Family Econ. Issues 42, 301–314. https://doi.org/10.1007/s10834-021-09700-2 (2021).

Sarwar, M., Rahman, M. & Khan, M. Education and financial risk-taking: The impact of financial literacy on high-risk asset allocation. Financ. J. 10, 211–224. https://doi.org/10.1016/j.fina.2020.06.002 (2020).

Talpsepp, K., Kalvet, T. & Kukk, M. The role of education in household financial decision-making: A focus on high-risk asset markets. Financ. Innov. 6, 32–46. https://doi.org/10.1186/s40854-020-00189-3 (2020).

Zhang, Y., Wang, Y. & Li, H. Digital education and its effect on lower-income households’ financial market engagement. Fin. Educ. Rev. 5, 76–92. https://doi.org/10.1007/s41823-022-00029-0 (2022).

Liu, J. & Wang, Z. Digital financial education and its impact on household investment behavior. J. Fin. Technol. 8, 97–111. https://doi.org/10.1016/j.fintech.2021.100211 (2021).

Chen, X., Xu, M. & Zhao, S. The role of digital financial education in shaping household financial behavior. Financ. Innov. 9, 40–53. https://doi.org/10.1186/s40854-023-00458-w (2023).

Song, X., Li, Y. & Zhou, H. The role of digital platforms in enhancing household financial literacy: Evidence from online learning tools. J. Fin. Educ. 18, 56–68. https://doi.org/10.1007/s12163-020-00101-4 (2020).

Zhang, L. & Liu, Y. Digital education and asset allocation: The impact of digital learning on household investment behavior. J. Fin. Technol. 11, 75–89. https://doi.org/10.1016/j.fintech.2022.100241 (2022).

Yang, T., Wu, F. & Zhang, S. Enhancing risk awareness through digital education: Households’ financial decision-making in complex markets. J. Econ. Psychol. 78, 168–182. https://doi.org/10.1016/j.joep.2023.101794 (2023).

Wang, J., Chen, X. & Luo, L. Digital platforms and financial decision-making: How digital resources are shaping household asset allocation. Financ. Innov. 9, 47–60. https://doi.org/10.1186/s40854-023-00430-8 (2023).

Chen, Q., Zhao, L. & Li, R. The impact of digital social networks on financial decision-making: Improving the efficiency of information dissemination. J. Fin. Technol. 12, 90–102. https://doi.org/10.1016/j.fintech.2024.100313 (2024).

Georgarakos, D. & Pasini, G. Financial literacy and household asset allocation: Evidence from a survey. J. Bank. Fin. 35, 610–624. https://doi.org/10.1016/j.jbankfin.2010.08.006 (2011).

Becker, G. S. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education (University of Chicago Press, 1964). https://doi.org/10.7208/chicago/9780226041223.001.0001.

Lusardi, A. & Mitchell, O. S. Financial literacy and retirement planning: New evidence from the United States. J. Pension Econ. Finance 10, 497–508. https://doi.org/10.1017/S147474721100045X (2011).

Keller, C. & Siegrist, M. Risk attitude and risk perception: Evidence from Switzerland. Risk Anal. 26, 55–63. https://doi.org/10.1111/j.1539-6924.2006.00762.x (2006).

Barefoot, K., Liu, H. & Thompson, S. Digital finance: Empowering households through improved information access. J. Fin. Technol. 9, 123–134. https://doi.org/10.1016/j.fintech.2018.06.003 (2018).

Haleem, A., Muneer, S. & Moin, M. Digital literacy and human capital: bridging the digital divide and enhancing household financial decision-making. Technol. Forecast. Soc. Change 174, 1214–1225. https://doi.org/10.1016/j.techfore.2021.121454 (2022).

Sarker, S., Alam, M. & Hossain, M. The impact of digital platforms on information search costs and household investment decisions. Inf. Syst. J. 29, 347–366. https://doi.org/10.1111/isj.12164 (2019).

Bado, B., Hasan, M., Tahir, T. & Hasbiah, S. How do financial literacy, financial management learning, financial attitudes and financial education in families affect personal financial management in generation Z?. J. Int. J. Prof. Bus. Rev. 8, 1–29 (2023).

Wang, X., Li, J. & Zhang, Q. Defining and classifying risk financial assets: A comprehensive approach. Financ. Innov. 9, 45–60. https://doi.org/10.1186/s40854-023-00420-8 (2023).

Calvet, L. E., Campbell, J. Y. & Sodini, P. Downward nominal wage rigidity and household portfolio choice. J. Fin. 69, 233–273. https://doi.org/10.1111/jofi.12137 (2014).

Gomes, F., Gomes, M. & Villanueva, R. The role of macroeconomic factors in household asset allocation: Evidence from emerging economies. J. Econ. Dyn. Control 130, 103729. https://doi.org/10.1016/j.jedc.2021.103729 (2021).

Liu, X. & Fan, Y. The CHFS dataset: Reliability, validity, and its application in financial and economic research. J. Fin. Econ. 52, 112–128. https://doi.org/10.1016/j.jfineco.2024.01.003 (2024).

Khan, M., Ali, Z. & Shah, M. Technological development, education, and household financial behavior: Evidence from emerging economies. Financ. Innov. 8, 15–29. https://doi.org/10.1186/s40854-022-00299-w (2022).

Smith, A. & Johnson, B. Modeling household investment behavior: The decision to hold risk financial assets. J. Fin. Econ. 42, 320–335. https://doi.org/10.1016/j.jfineco.2017.10.005 (2018).

Liu, X., Wang, Y. & Zhang, S. Household portfolio choices and risk asset ownership: Evidence from a survey. Rev. Econ. Dyn. 26, 207–220. https://doi.org/10.1016/j.red.2018.10.003 (2019).

Wang, X. & Zhao, Y. Regional financial accessibility and household participation in financial markets: Evidence from China. Financ. Innov. 8, 43–56. https://doi.org/10.1186/s40854-022-00315-5 (2022).

Yin, Z., Li, H. & Zhang, T. Regional financial development and household investment behavior: A case study from China. J. Fin. Econ. 54, 285–298. https://doi.org/10.1016/j.jfineco.2015.03.001 (2022).

Autor, D. H. & Handel, M. J. Putting tasks to tasks: Human capital, job tasks, and wages. J. Labor Econ. 31, S59–S116. https://doi.org/10.1086/669160 (2013).

Yin, Z., Chen, L. & Li, X. Financial literacy and household financial behavior: Evidence from China. J. Econ. Surv. 28, 527–546. https://doi.org/10.1111/joes.12038 (2014).

Paya, I. & Wang, J. Household wealth and participation in risk asset investment: A study of Chinese households. Financ. Innov. 2, 31–46. https://doi.org/10.1186/s40854-016-0044-7 (2016).

Costa, A. & Farinha, L. The impact of household debt on financial vulnerability and household financial decisions. Rev. Econ. Financ. 2, 45–58. https://doi.org/10.1016/j.refe.2012.02.003 (2012).

Chen, Y., Huang, R., Zeng, Y. & Huang, Q. Research on the impact of digital inclusive finance on the performance of rural returnee entrepreneurs in China. Sci. Rep. 14, 22077. https://doi.org/10.1038/s41598-024-72691-7 (2024).

Liu, Y., Chen, X. & Wang, Z. Financial challenges in rural areas: An empirical study from China. J. Rural Econ. 34, 112–125. https://doi.org/10.1016/j.jre.2013.01.004 (2013).

Chan, S. & Wei, X. Financial inclusion and economic development in rural China. Financ. Stud. 28, 249–264. https://doi.org/10.1016/j.fss.2021.03.005 (2021).

Dihai, Z. The role of financial accessibility in rural economic development. Econ. Dev. Q. 37, 42–57. https://doi.org/10.1016/j.edq.2023.01.009 (2023).

Chen, Y., Huang, R., Zhang, Y. & Shuai, Q. The impact of digital transformation of commercial banks on household income: Evidence from China. PLoS ONE 19, e0310277. https://doi.org/10.1371/journal.pone.0310277 (2024).

Acknowledgements

The authors are grateful to the editors and the anonymous reviewers for their insightful comments and suggestions.

Institutional review board

This research was conducted in accordance with recognized ethical standards. Ethical review and approval were not required, as the study relied exclusively on secondary data from the China Household Finance Survey (CHFS), a publicly available dataset that contains no identifiable personal or sensitive information. Access to the CHFS data is available upon registration and application through the official website: [https://chfs.swufe.edu.cn/].

Author information

Authors and Affiliations

Contributions

Writing and editing, Ruoxuan Huang. And Yuran Chen.; Conception and design, Qinghong Shuai. And Qiaoyun Zhang.; Data analysis and original draft preparation, Yuying Zhang.; All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Informed consent