Abstract

This study investigates the evolution and stability of China’s carbon emission trading system, addressing disparities between China’s carbon market development and international practices. By constructing a three-party evolutionary game model involving the government, enterprises, and consumers, this paper identifies key factors influencing system stability and offers policy recommendations. The main contributions include: (1) Developing a dynamic model that incorporates consumer behavior, including the herd effect, to reveal the interplay between demand-side dynamics and market evolution. (2) Demonstrating that government regulatory costs, consumer preferences, and enterprise investment costs significantly impact market stability and green transitions. (3) Highlighting that carbon prices alone have limited influence on enterprise participation, underscoring the importance of comprehensive incentives. This work provides actionable insights to optimize policy design, enhance market efficiency, and promote low-carbon transformation in China.

Similar content being viewed by others

Introduction

Climate change has far-reaching impacts on ecosystems, economies, and public health. The IPCC’s AR6 Synthesis Report1 reveals that atmospheric carbon dioxide has reached its highest concentration in nearly two million years. Since the 1990s, the global carbon market has transitioned through three developmental stages (Fig. 1), evolving from experimental trials to mature systems, marking a shift in climate governance from reactive to proactive strategies. As a market-based mechanism, the Emissions Trading Scheme (ETS) incentivizes carbon reduction by pricing and trading emission rights, promoting cost-effective emissions reductions2. While national ETS systems differ in design and implementation, their common objective is to achieve emissions reduction through market mechanisms3.

China, though a late entrant to the carbon market, has rapidly progressed from regional pilot programs to a unified national system. This system is designed to unlock emission reduction potential, refine market mechanisms, and enhance low-carbon transition efficiency. With increasing participation, the maturation of the MRV (monitoring, reporting, verification) system, and diversification of carbon financial products, China is positioned to become the world’s largest carbon market. The transition from “dual control of energy” to “dual control of carbon emissions” has garnered significant attention from the government, enterprises, and society (Fig. 2), emphasizing the need to understand the evolutionary mechanisms of carbon trading and devise effective emissions reduction strategies.

Despite extensive research on carbon trading mechanisms, significant gaps remain. Most studies have focused on two-party interactions (e.g., government-enterprise or enterprise-consumer) and single influencing factors, often overlooking the dynamic and interdependent relationships among key stakeholders. Additionally, the roles of consumer behavior and feedback mechanisms, such as the herd effect, in shaping carbon market evolution have been underexplored. This study addresses these gaps by constructing a three-party evolutionary game model that integrates government, enterprises, and consumers, providing a comprehensive framework to analyze system stability and identify factors driving green transitions. The literature review in the next section details the gaps in previous research.

The remainder of this paper is structured as follows: Section "Literature review" reviews the relevant literature. Section "Methodology" provides a logical analysis of the behavior of the key actors in the evolutionary game of carbon trading mechanisms. Section "Model construction, stability and numerical analysis" develops the model, examining the trilateral interactions among governments, enterprises, and consumers in a low-carbon context. Section "Conclusions and Policy proposals" concludes with policy recommendations and discusses the study’s limitations.

Literature review

The carbon trading mechanism, as a crucial market-based tool to address climate change, internalizes the cost of carbon emissions through price mechanisms, thereby guiding enterprises, governments, and the public toward low-carbon transitions. However, the effectiveness of carbon trading mechanisms is influenced by various behavioral factors, including policy design, corporate actions, and public participation. Evolutionary game theory provides an effective framework for analyzing these complex dynamics. This study systematically reviews the existing literature on evolutionary game theory in the context of carbon trading mechanisms, identifies its limitations, and highlights the innovations and contributions of this research. (Table 1).

To sum up, traditional studies often focus on two-party games and single influencing factors. These studies lack sufficient dynamic analysis of the strategic interactions among governments, enterprises, and consumers, particularly in terms of coordination and negotiation among different stakeholders. Moreover, the analytical framework often overlooks the dynamic policy environment and long-term market effects, such as the potential impacts of policy changes and technological breakthroughs on market stability. Accordingly, this paper focuses on a three-party model and offers the following key contributions:

-

Within the context of China’s carbon market, this study systematically incorporates a broader range of factors influencing the design and development of the carbon trading mechanism, with a focus on diverse stakeholders. A feedback loop emerges in which consumers’ preferences influence enterprises’ strategies, and these strategies, in turn, shape consumer perceptions and behaviors. For instance, growing demand for low-carbon products motivates enterprises to reduce emissions, which further boosts consumer confidence in sustainable goods. Although individual consumers are not direct participants in China’s national carbon market, they play a critical role as demand drivers, indirectly shaping market dynamics and policy decisions. By integrating consumer behavior into the game framework, this study highlights its essential role in linking market demand, enterprise strategies, and government interventions, offering a holistic perspective on carbon trading mechanisms.

-

By integrating the concept that consumer behavior can exert feedback effects on both government and enterprises, this study constructs a dynamic, three-party repeated game model involving government, enterprises, and consumers. The model parameters are set and calibrated using empirical data, with the conclusions verified through simulation analysis.

-

This research incorporates the herd effect in consumer decision-making, applying Social Learning (SL) theory to explore the evolutionary dynamics of low-carbon behavioral preferences. The herd effect, a significant driver of consumer decisions21, highlights how individuals are influenced by the preferences and actions of their social group, shaping collective behavior and accelerating the adoption of low-carbon consumption trends. Ignoring the herd effect risks underestimating the rapid adoption potential of low-carbon products driven by social influence. It also neglects a critical feedback mechanism where consumer behavior influences enterprise strategies and government policies, creating a dynamic interplay that shapes market demand. By integrating the herd effect, this study offers a more comprehensive perspective on the mechanisms underlying carbon trading systems, addressing a previously underexplored area in carbon market research.

Methodology

Evolutionary game-theoretic analysis framework

Evolutionary game theory is a general framework for analyzing how rational participants continuously adjust their behavioral strategies through repeated interactions to achieve optimal responses and stable states22. In the context of carbon emission trading mechanisms, participants modify their strategies based on the actions of others, as well as shifts in market policies and environmental conditions. The core of evolutionary game theory in this setting is to explore how the strategic choices of market participants evolve over time as a result of these interactions.

Following the framework of evolutionary game theory, this study is structured as follows: (1) Key stakeholders in the carbon trading market, along with their strategic space and influencing factors, are identified (Fig. 3). Detailed model settings are described in Section "Main conclusions". (2) In Section "Model construction, stability and numerical analysis", the payoff matrix for each stakeholder is formulated, followed by the derivation of expected payoffs and replicator dynamic equations, which determine the evolution of strategic interactions. (3) The evolutionary stable strategies (ESS) are solved, and the evolutionary paths and stability of the system are analyzed. Equilibrium points are discussed separately, and the effects of various influencing factors on system evolution are assessed in Section "Conclusions and Policy proposals". (4) In Section 6 the optimization paths of the carbon emission trading mechanism are explored, focusing on key factors affecting strategic stability.

All theoretical analyses are further demonstrated through numerical simulations. The numerical results, presented in figures, are generated using Matlab R2022a.

Model assumptions and variables

Assumption 1

(Rational Participants): In this study, the government (policy makers and market regulators), high-emission enterprises (hereafter “enterprises”), and consumers are the primary stakeholders in the game. It is assumed that all parties are boundedly rational and do not have complete information symmetry. Each group seeks to maximize its own interests, and they are modeled as collective entities rather than individuals.

Assumption 2

(Strategy Selection): Under an imperfect carbon trading mechanism, the government can either implement a low-carbon policy or refrain, with probabilities of x and 1-x, respectively. Enterprises choose to reduce emissions with a probability of y, or not with 1-y. Consumers may prefer low-carbon products with a probability of z, or have no preference with 1-z, where x,y,z ∈ [0, 1].

Assumption 3

(Government Behavior): In a carbon trading system with imperfect design, the government intervenes to maintain market stability by either enforcing a strict low-carbon policy at a cost of Cg or weak regulation at a lower cost Cw (Cg > Cw). Strict regulation may yield higher or lower returns (θRg) compared to the baseline market returns (Rg) without specific policies, where (θ) reflects the impact of government policies on the market. By leveraging social influence and promoting low-carbon policies, the government enhances social acceptance and gains credibility (M) when consumers benefit from improved welfare. In addition, carbon taxes (T) can offset regulatory costs while encouraging emission reductions, and governments may offer support (S)) through subsidies, tax incentives, or technical assistance to compliant enterprises, while penalizing non-compliant firms (K) for over-emission.

Assumption 4

(Enterprise Behavior): Enterprises, influenced by consumer herd psychology, may pass on the costs of emission reduction through higher prices for low-carbon products, gaining revenue (Rc) compared to the status quo (Rw). An enterprise reducing emissions through low-carbon technologies emits (Q1), while those that do not emit (Q2). Carbon trading involves initial costs (Cd) and potential savings (Cr). Firms may earn revenue from selling surplus allowances or pay for shortfalls (Q3) based on the carbon price (Pc), and those that actively reduce emissions also benefit from intangible ESG gains (U). Investments in abatement technology incur a cost (Ir).

Assumption 5

(Consumer Behavior): There are two reasons for incorporating consumer herd behavior into the analytical framework. First, behavioral psychology demonstrates that individuals are influenced by the preferences and actions of others within their social group. Second, studies show that consumers’ green preferences are significantly correlated with corporate and government policies, indicating that herd behavior can amplify these effects. Consumers following the herd (α) in low-carbon choices derive psychological benefits (g), which reinforce their preference for aligning with group norms and accelerate the adoption of green consumption practices. Increased environmental awareness enhances satisfaction from low-carbon consumption (L1), while unchanged perceptions result in lower satisfaction (L2), directly influencing market demand for sustainable goods. Although individual consumers are not yet direct participants in China’s national carbon market, their behavior indirectly affects market dynamics through demand shifts and their influence on corporate and government strategies. As such, their specific benefits from the trading process are not considered in this analysis.

The relevant parameters and definitions for model formulation are collected in Table 2.

Model construction, stability and numerical analysis

Based on the interactions among the three stakeholders (Fig. 3) and Assumptions 1–5, the corresponding trilateral payoff matrix is presented in Table 3. It is important to note that Table 4 reflects only the individual gains from consumer strategies, without accounting for the herd effect. The impact of the herd effect on consumer behavior will be incorporated into the replication dynamic equation F(z).

Model construction and stability analysis

Following Table 4, the expected payoffs of government choosing participation in carbon market regulation or market-driven (indicated as \({\text{V}}_{\text{x}1}\) and \({\text{V}}_{\text{x}2}\), respectively) are obtained as:

The replicated dynamic equation for government is:

The aggregate expected payoffs and replicated dynamic equation for enterprises can be similarly derived.

Considering the herd effect on consumers, the quantitative equation of herd effect is introduced and the modified expected return is shown in equation as follows:

A mixed strategy equilibrium in an asymmetric game model will not be an evolutionarily stable equilibrium23. Following \(\text{F}\left(\text{x}\right)=\text{F}\left(\text{y}\right)=\text{F}\left(\text{z}\right)=0\), a conclusion concerning the equilibrium points for this dynamic system can be immediately obtained as follows.

Proposition 1.

From F(x)=0, F(y)=0, F(z)=0, there are nine equilibrium points in this model: E1(0,0,0), E2(1,0,0), E3(0,1,0), E4(1,1,0), E5(1,0,1), E6(0,1,1), E7(0,0,1), E8(1,1,1). E9(x*,y*,z*) is the saddle point.

Subsequently, the Jacobian matrix can be obtained by solving the partial derivatives of Eq. F(x), F(y), F(z). According to the Lyapunov discriminant24, when all eigenvalues λ < 0 of the Jacobian matrix, then the corresponding equilibrium is an evolutionarily stable point of the system, and if at least one λ > 0, then the equilibrium is unstable. The conditions for each equilibrium point to be an ESS are summarized in Table 4.

where,

Numerical analysis

This section presents numerical simulations of the triangular evolutionary game model discussed earlier. Initially, the study establishes baseline parameter values, which are then adjusted to analyze the evolutionary paths toward different equilibria. Additionally, a sensitivity analysis is conducted.

Currently, in China’s national carbon market, the government retains control over all carbon allowances, which are distributed free of charge. At the same time, participation in the national carbon trading market is limited to over 2,000 key emission-control enterprises in the power generation sector, whose carbon reduction obligations are mandatory. Moreover, Chinese export enterprises have become more active in the carbon market due to recent constraints from carbon border taxes and stringent carbon reduction requirements in export destinations. In addition, with the introduction of China’s “dual carbon” goals and the implementation and promotion of green strategies in recent years, consumer awareness of green and low-carbon practices has significantly increased. This is evident from the rising production and purchase rates of electric vehicles, demonstrating the driving force of consumer preferences on corporate green production. Given the current status and future expectations of China’s carbon trading mechanism, equilibrium E8 is selected as the benchmark case.

The initial parameter values are categorized into three groups:

-

(1)

Government decisions, scaled and adjusted based on existing literature and reports, for example, Rg, Cg, Cw are numerically determined based on the proportion of regulatory costs to carbon market revenues during the initial phase of China’s pilot carbon markets. According to practical observations, during the early development stages of the carbon markets in Guangdong and Hubei, regulatory costs typically accounted for 10% to 12% of transaction volumes. Considering that the national carbon market is still in its early development phase, the experiences from China’s pilot carbon markets serve as the basis for these setting25. The numerical settings for government subsidies and penalties are based on the proportions used by Qu and Hou26 and Wang et al.27 in their article regarding the implementation of active regulation by the government.。

-

(2)

Enterprise actions, derived from typical real-world scenarios such as carbon prices and the costs of daily operations during emission reductions. Referring to the real-world case of Toyota’s collaboration with steel suppliers to develop low-carbon production processes, the ratio of costs (Cd-Cr + Ir) to revenue (Rw) after investing in green technologies should be approximately 0.828,29 .

-

(3)

Existing studies typically set the value of a between 0.6 and 0.9. Therefore, this paper initially sets it to 0.830,31,32. The parameter values (Array 1) for the benchmark case (E8) are summarized in Table 5.

As outlined in the stability analysis in Section "Main conclusions", the stable evolutionary strategies of the government, enterprises, and consumers are influenced by various factors. To better visualize and assess the evolution of each stakeholder’s strategic choices, simulating the evolution paths of equilibrium points is crucial. Given the unique nature of China’s national carbon market, where emission-control enterprises meeting specific standards are mandated to participate in trading and adhere to local government regulations, the power industry remains the primary market participant. If enterprises opt not to reduce emissions or engage in trading, the carbon market cannot function effectively. Therefore, four equilibrium points where enterprises actively reduce emissions are selected for simulation. The four parameter sets (Table 5) are evolved over 50 iterations from different initial strategy combinations, with the results presented in Fig. 4.

The analysis of these evolution paths demonstrates that in all four equilibrium points (Table 6), enterprises opt to actively invest in emission reduction technologies and participate in carbon trading, suggesting that the carbon trading mechanism effectively promotes emission reduction awareness and drives green transformation in enterprises. The differences arise in the strategic behaviors of governments and consumers. Further sensitivity analysis of key parameters will provide theoretical support for developing targeted intervention mechanisms based on the benchmark case.

Sensitivity analysis for governments decision

(1) Costs of Setting a Low-Carbon Policy (Cg ): To assess the sensitivity of governments to regulatory costs, Cg is set to 20, 40, 60, 80, and 100, respectively. Figure 5(a) shows that higher supervision costs reduce the incentive for governments to implement low-carbon policies, with strategy evolving from strict regulation to a free market. This shift occurs as governments may face deficits from the regulatory burden and opt for deregulation to balance economic and social considerations. Governments can mitigate these costs by encouraging businesses and consumers to adopt green practices, expanding carbon-inclusive finance, and increasing revenue from carbon trading.

(2) Impact Factor of Low-Carbon Policies on Revenue (θ): By varying θ from 0.8 to 1.6, the evolutionary results (Fig. 5(b)) indicate that as the impact factor increases, governments are more likely to implement low-carbon policies. However, governments will only regulate carbon trading mechanisms if they derive additional benefits from the carbon market.

(3) Government Support (S): Setting S at 3, 10, 25, 40, and 50 reveals that governments tend to support enterprises’ low-carbon transitions when subsidies are low (Fig. 5(c)). As subsidies increase, there is a threshold beyond which governments opt to reduce or eliminate them. Notably, when subsidies are between 40 and 50, governments initially adopt low-carbon policies but eventually revert to a free market approach.

(4) Government Penalty (K): Varying K from 10 to 50 (Fig. 5(d)) shows that penalties prompt governments to adopt low-carbon policies and take active supervision. However, penalties do not significantly influence the speed of the government’s decision-making, and increasing penalties does not affect the rate of policy adoption.

Proposition 2.

Governments will implement low-carbon policies if the cost of setting such policies is lower than not doing so, if the enhancement factor for low-carbon revenue is substantial, and if increased support accelerates the transition to a free carbon market. However, the imposition of penalties does not affect the speed of government decision-making.

Sensitivity analysis for enterprises action

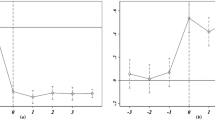

(1) Investment costs of abatement technologies for enterprises (Ir) and Surplus/Shortfall allowances or CCERs (Q3). To assess the sensitivity of enterprises to the costs of abatement technologies and allowances, Ir is adjusted from 25 to 65, while Q3 moves inversely, from 10.5 to 2.5. Figure 6(a) shows that as the cost of low-carbon investments increases without a corresponding rise in surplus allowances or a reduction in shortfall allowances, enterprises are less incentivized to reduce emissions and participate in carbon trading. Thus, enterprises must consider the ratio of low-carbon investment to benefits when making decisions.

(2) Carbon price (Pc). Increasing the carbon price from 2 to 10 with a step of 2, the results shown in Fig. 6(b). The impact of carbon price changes on enterprises’ behavior is limited, indicating that other key factors should be leveraged to influence corporate decisions.

Proposition 3.

Enterprises are more likely to actively reduce emissions if the ratio of low-carbon investment to benefits is favorable. However, carbon price alone has a limited effect on their decision-making. An increase in carbon price will not necessarily enhance corporate willingness to reduce emissions unless accompanied by factors such as the availability of tradable carbon allowances.

Sensitivity analysis for consumer behavior

(1) The impact factor for low-carbon policies on the revenue (θ). Increasing θ from 0.8 to 1.6 shows that consumer preferences remain largely unchanged as θ rises (Fig. 6(c)). In the context of China’s carbon market, where consumers are not yet direct participants, they remain insensitive to carbon market benefits. The government should focus on translating carbon market gains into social welfare to increase consumer acceptance, thereby influencing their low-carbon choices.

(2) Intensity of herd effect (α). To examine the sensitivity of the herd effect, α is set at 0.8, 0.7, 0.6, 0.5, and 0.4 (Fig. 6(d)). The results indicate that consumers consistently choose low-carbon preferences if the herd effect exists. However, as the intensity of the herd effect increases, the transition from original preferences to low-carbon preferences slows.

Proposition 4.

Consumers will adopt low-carbon preferences if they benefit from the carbon market or if a moderate herd effect exists. In practice, consumer choices in favor of low-carbon products will influence firms’ green production decisions due to market dynamics. Additionally, if consumers can participate in carbon trading, their behavior will be further shaped by the herd effect.

Conclusions and Policy proposals

Main conclusions

This study focuses on understanding the dynamic interactions among government policies, enterprise strategies, and consumer preferences in China’s carbon trading mechanism. By incorporating consumer behavior, particularly the herd effect, into the analytical framework, it highlights the critical role of demand-side dynamics in shaping market evolution and policy design. The main conclusions are as follows:

-

(1)

Dynamic Interactions and Feedback Mechanism: The interactions among government policies, enterprise strategies, and consumer preferences form a dynamic feedback loop that significantly influences the evolution of the carbon trading system. For example, increasing consumer demand for low-carbon products incentivizes enterprises to adopt green transformations, which in turn strengthens government regulation and policy implementation.

-

(2)

Role of Government Regulation and Costs: Active government regulation, supported by effective policies such as subsidies and penalties, is essential for maintaining market stability. However, high regulatory costs can deter government intervention, highlighting the need for innovative mechanisms like market stability reserves (MSR) to optimize regulatory efficiency.

-

(3)

Limited Impact of Carbon Prices on Enterprises: While carbon prices influence enterprise behavior, their impact is less significant compared to factors like investment costs for emission reduction technologies and the availability of carbon allowances. Enterprises are more likely to participate in carbon trading if the ratio of low-carbon investment to benefits is favorable.

-

(4)

Significance of Consumer Behavior: Consumers play a critical role as demand drivers in the carbon trading mechanism. Their low-carbon preferences and herd behavior amplify market dynamics, motivating enterprises to adopt green production practices. Although consumers are not yet direct participants in China’s national carbon market, their behavior indirectly shapes policy decisions and market evolution.

-

(5)

Herd Effect as a Key Driver: The herd effect significantly accelerates the adoption of low-carbon consumption, as individuals tend to align their behavior with group norms. Ignoring this effect could lead to underestimating the rapid adoption potential of low-carbon products and the broader implications for market stability.

Building on these findings, future research should focus on three key areas. First, it should explore how consumer participation in carbon trading, such as through individual carbon credits, can further enhance market efficiency. Second, it should investigate the long-term effects of integrating digital tools, such as blockchain and artificial intelligence, into the regulation and transparency of carbon markets. Third, it should examine cross-regional and international coordination mechanisms to improve the scalability and stability of carbon trading systems.

Policy proposals

Based on the conclusions above and the current state of China’s national carbon market, the following optimization paths for carbon emission trading mechanisms are proposed from the perspectives of government, enterprises, and consumers:

-

(1)

Government Policy and Guidance: Government engagement in carbon trading directly affects market development and efficiency. The government should establish clear policy objectives and development plans to encourage carbon reduction and low-carbon technology innovation. Policies should prioritize high-emission industries such as steel and cement. For example, Guangdong Province implemented a differentiated quota allocation strategy in the power sector, effectively reducing emissions while balancing economic growth. Similar tailored strategies should address industry-specific challenges and regional disparities.

-

(2)

Regulatory Costs: The government should implement an efficient monitoring, reporting, and verification (MRV) system. Provinces and municipalities should adhere to standardized carbon accounting practices to ensure data accuracy and transparency. Integrating automation and AI technologies, as trialed in Hubei Province, has significantly reduced regulatory costs while improving data accuracy. Additionally, establishing a market stability reserve (MSR) can help balance market supply–demand fluctuations and reduce oversight burdens.

-

(3)

Enterprise Low-Carbon Investment and Benefit Ratio: Enterprises, as the main actors in the carbon market, must consider the costs and benefits of emission reduction. To support participation, the government should provide R&D funding and tax breaks. For example, Zhejiang Province has piloted carbon finance initiatives, providing risk-sharing mechanisms to reduce enterprises’ upfront costs for low-carbon investments. Policies should also promote carbon capture and storage (CCS) in industries like cement and chemicals, which face higher emission reduction costs.

-

(4)

Carbon Price Stability and Predictability: The stability and predictability of carbon prices are critical for market confidence and long-term investment. While carbon price changes have a limited impact on evolutionary outcomes, the government can stabilize market expectations by implementing price corridors, minimum and maximum price limits, and other measures. Establishing a carbon futures market, as seen in Shanghai’s carbon exchange, can mitigate price volatility and enhance market confidence. Integrating quota banking and borrowing systems, along with carbon funds, can further stabilize the market during periods of price shocks.

-

(5)

Consumer Preference for Low-Carbon Products: Consumer demand for low-carbon products drives corporate emission reductions. The government should increase public awareness of climate change through education and provide transparent product carbon footprints via carbon labeling. For example, Guangdong’s green consumption subsidy program incentivized low-carbon product adoption, leveraging consumer behavior to amplify market demand. Expanding such initiatives and enhancing social incentives, such as eco-product certifications, can further promote green consumption.

Data availability

The datasets used and/or analysed during the current study available from the corresponding author on reasonable request.

Change history

21 January 2026

The original online version of this Article was revised: In this article the statement in the Funding information section was incorrectly given as “This research is supported by the National Social Science Fund Major Project (Grant No.23TJA00092) and Liaoning Province Social Science Planning Fund General Project (Grant No.L23BGL013).” and should have read “This research is supported by the National Social Science Fund Key Project (Grant No. 23ATJ006).”

References

IPCC: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, IPCC, Geneva, Switzerland, 35-115 (2023)

European Commission. The European Union Emissions Trading System (EU ETS): insights into its operation and effectiveness. https://ec.europa.eu/clima/policies/ets_en (2020)

Ellerman, A. D. "The EU emission trading scheme: A prototype global system?." Post-Kyoto international climate policy: Implementing architectures for agreement 88–118 (2010)

Jiao, J. L. et al. A study of local governments’ and enterprises’ action in the carbon emission mechanism of subsidy or punishment based on the evolutionary game. Chin. J. Manage. Sci. 25(10), 140–150 (2017).

Zhang, S., Wang, C. & Yu, C. The evolutionary game analysis and simulation with system dynamics of manufacturer’s emissions abatement behavior under cap-and-trade regulation. Appl. Math. Comput. 355, 343–355 (2019).

Chen, W. & Hu, Z. H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod.. 201, 123–141 (2018).

Fang, G. C., He, Y. & Tian, L. X. Evolutionary game analysis of government and enterprises carbon-reduction under the driven of carbon trading. Chin. J. Manage. Sci. 32(05), 196–206 (2024).

Gao, Y. et al. Design of ecological carbon sink compensation mechanism for national parks based on carbon trading. J. Nat. Resour. 39(10), 2294–2309 (2024).

Dong, Y. et al. Research on the governance effect and emission reduction mechanism of the carbon emission trading system. Sci. Res. Manage. 45(10), 160–171 (2024).

Guo, D. Y., Chen, H. & Long, R. Y. The allocation strategy of government for initial carbon allowance in downstream carbon trading market. China Popul. Resour. Environ. 28(4), 43–54 (2018).

Wang, W. L. & Cheng, T. Y. Evolutionary game analysis of supply chain operations decision under the background of carbon trading. Syst. Eng.-Theor. Pract. 41(05), 1272–1281 (2021).

Ma, T. & Wang, Y. Globalization and environment: Effects of international trade on emission intensity reduction of pollutants causing global and local concerns. J. Environ. Manage. 297, 113249 (2021).

Liu, P. D., Li, X. N. & Li, J. L. Low carbon technology diffusion of competitive firms under cap and trade mechanism—Evolutionary game analysis based on complex network. Syst. Eng. Theory Pract. 44(2), 684–699 (2024).

Li, Y. M. et al. Stochastic evolutionary game between governments and enterprises in renewable energy investment in view of dynamic carbon price perspective. China Environ. Sci. 44(1), 567–580 (2024).

Li, B., Xia, X. Q. & Li, Q. Y. Research on the influence of carbon trading on carbon emission reduction effect and coordination mechanism under carbon quotas. Chin. J. Manage. Sci. 32(08), 250–261 (2024).

Ding C, Cao X L. Study on the impact of EU carbon border adjustment mechanism on China’s trade: GTAP-E model simulation analysis based on dynamic recursion.World Economy Studies, 2024(02): 18–33+135. https://doi.org/10.13516/j.cnki.wes.2024.02.009.

Yin, J. Y. & Li, D. W. Study on the impact of the carbon border adjustment mechanism (CBAM) on China’s goods exports to the European union. Macroecon. Res. 11, 93–108 (2024).

Li, L. X., Wu, S. & Tian, Y. Carbon emission trading and corporate green technology innovation. J. Stat. Inform.. 39(6), 89–99 (2024).

Liu, Y., Lu, Y. Q. & Chen, Y. Impact of carbon emission trading on quantity increase and quality improvement of urban green technology innovation. Resour. Sci. 46(6), 1198–1212 (2024).

Xu, J. W. & Liu, Z. H. Carbon trading pilot policies, energy consumption, and regional low-carbon economic transformation. Stat. Decis. 40(20), 172–177 (2024).

Zheng, R., Shou, B. & Yang, J. Supply disruption management under consumer panic buying and social learning effects. Omega. 101, 102238 (2021).

Smith, J. M. & Price, G. R. The logic of animal conflict. Nature 246, 15–18 (1973).

Aradhana Narang & A. J. Shaiju, 2019. "Evolutionary Stability of Polymorphic Profiles in Asymmetric Games," Dynamic Games and Applications, Springer, 9(4), 1126–1142, December. https://doi.org/10.1007/s13235-019-00302-6

Lyapunov, A. M. The general problem of the stability of motion. Int. J. Control 55(3), 531–534 (1992).

Guangdong Provincial Development and Reform Commission. Summary Report on the Pilot of Carbon Emissions Trading Rights. Internal document of the Guangdong Provincial Development and Reform Commission (2016)

Qu, X. C. & Hou, G. S. Governance of platform information security based on tripartire evolutionary game. J. Mod. Inform. 40(07), 114–125 (2020).

Zhang, J., Wang, K. Q. & Zhang, Y. Carbon emission abatement performance of carbon emissions trading scheme—Based on the intermediary effect of low-carbon technology innovation. Soft Sci. 36(05), 102–108 (2022).

Liu, Z. et al. Government regulation to promote coordinated emission reduction among enterprises in the green supply chain based on evolutionary game analysis. Resour. Conserv. Recycl. 182, 106290 (2022).

Xu H J, Ye C M, L F. Evolutionary Game Analysis of Carbon Emission Reduction in Supply Chain Enterprises under Government Regulation.[J/OL].Soft Science,1–11[2025–01–13]. http://kns.cnki.net/kcms/detail/51.1268.G3.20241225.1524.006.html.

Xia, L. J. et al. Differential game analysis of carbon emissions reduction and promotion in a sustainable supply chain considering social preferences. Ann. Oper. Res.. 310(1), 257–292 (2022).

He, L. F. et al. Differential game theoretic analysis of the dynamic emission abatement in low-carbon supply chains. Ann. Oper. Res. 324(1–2), 355–393 (2023).

Zhang D L, Li F, Liang L, et al. Carbon emission reduction decision considering dynamic consumer green perception under the cap-and-trade policy.[J/OL]. Chinese Journal of Management Science,1–23[2025–01–13].https://doi.org/10.16381/j.cnki.issn1003-207x.2023.0867.

Funding

This research is supported by the National Social Science Fund Key Project (Grant No. 23ATJ006).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Conceptualization, methodology and formal analysis were performed by Nanyu Chen, Hongyu He, Yanzhi Zhao. The first draft of the manuscript was written by Nanyu Chen. Article revised by The funding acquisition from Yanzhi Zhao and Hongyu He. All authors have read and approved the final manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Chen, N., Zhao, Y., He, H. et al. Stability analysis of carbon emission trading mechanism in China based on a tripartite evolutionary game. Sci Rep 15, 7304 (2025). https://doi.org/10.1038/s41598-025-91373-6

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41598-025-91373-6