Abstract

This study investigates the impact of corporate scale on manufacturing corporate carbon efficiency (MCEE) using empirical analyses and diverse modeling techniques. The research begins with rigorous unit root and cointegration tests, confirming the stationary nature of the data and establishing long-term equilibrium relationships among the variables. Subsequently, benchmark regression analyses employing various models, including system GMM, reveal a robust and significantly positive association between corporate scale and MCEE. The findings emphasize that as corporate scale increases, there is a substantial enhancement in MCEE, attributed to expanded resources, technological advancements, and improved management systems. Robustness tests employing alternative approaches consistently reaffirm this positive correlation, further validating the pivotal role of corporate scale in augmenting MCEE. Furthermore, nonlinear analyses demonstrate varying impacts across different quantile levels of MCEE, highlighting the consistent positive correlation between corporate scale and MCEE. Additionally, the panel threshold model underscores the influence of environmental regulations, R&D investments, and trade openness on this relationship. Notably, stricter environmental regulations intensify the impact of corporate scale on MCEE, emphasizing the importance of corporate expansion in minimizing environmental costs and enhancing resource efficiency. These findings underscore the significance of corporate scale in driving corporate carbon efficiency. They advocate for corporations to not only expand their production capacities but also focus on optimizing management strategies and resource allocation, particularly in contexts influenced by environmental regulations, R&D investments, and trade openness. Overall, this research contributes comprehensive insights into understanding the dynamics governing corporate environmental efficiency and emphasizes the critical role of corporate scale in fostering environmental sustainability.

Similar content being viewed by others

Introduction

Global energy-related carbon dioxide emissions were approximately 37.4 billion tons in 2023, representing a 75.7% increase from the 1990 baseline year of the Kyoto Protocol (IEA, 2023). Emerging economies, driven by continuous economic growth, have significantly increased their energy consumption, becoming major contributors to global carbon emissions (Balsalobre-Lorente et al., 2023). Among these countries, China is particularly noteworthy. As the world’s largest carbon emitter, China resumed production rapidly during the COVID-19 pandemic and took on a number of overseas orders, making it one of the few countries where carbon emissions and fossil energy consumption continued to grow (IEA, 2021).

In response to global climate change, China has acknowledged its responsibility and taken active measures on the international stage (Wang et al., 2024c). At the 75th United Nations General Assembly in 2020, China committed to peaking its carbon dioxide emissions by 2030 and achieving carbon neutrality by 2060. Additionally, China has promoted cooperation with African countries on climate change and green development through multilateral platforms such as the Forum on China-Africa Cooperation. Furthermore, in 2023, China and the United States jointly established a climate change working group aimed at advancing emissions reduction technologies and facilitating climate policy exchanges. In the same year, China initiated the Belt and Road Initiative’s Green Development International Alliance, which supports green infrastructure and sustainable development projects in participating countries, including green energy projects in the China-Pakistan Economic Corridor. These actions not only aid China in its green transition but also encourage other nations to seize opportunities for green transformation, having a profound impact on global carbon emissions.

However, China’s manufacturing sector, as the core of its economic development, presents significant challenges to the green transition due to its rapid growth (Zhai and An, 2020). The sector’s large scale and the high proportion of energy-intensive industries have resulted in persistently high carbon emissions. In 2020, China’s manufacturing industry contributed to 50% of the global carbon emissions while accounting for only 27.7% of the country’s GDP. This disproportion highlights the urgent need to balance economic growth with environmental protection, especially during the transition from a traditional, extensive growth model to a low-carbon, efficiency-driven development model (Bruckner et al., 2022). In this context, carbon emission efficiency (CEE) has become a crucial indicator of the manufacturing sector’s success in transitioning to a low-carbon economy (Jahanger et al., 2023; Peng et al., 2022). This metric not only reflects the environmental impact of industrial activities but also underscores continuous improvements in production processes and technological innovation. Therefore, examining manufacturing carbon emission efficiency (MCEE) of China is vital not only for the country’s green transition but also provides valuable insights and lessons for other nations on balancing economic development with environmental protection.

In the pursuit of understanding MCEE, the role of enterprise size and transformation strategy has received increasing attention (Zhang et al., 2020). China, as the leading global manufacturing hub, has consistently topped global manufacturing outputs, contributing nearly 30% to the world’s manufacturing value added. This immense manufacturing scale not only drives the development of global supply chains but also imposes significant carbon emission pressures. Data from the ‘China Listed Companies Carbon Emission Ranking (2021)’ reveal that emissions from 100 top-listed companies totaled 4.424 billion tons, accounting for about 44.7% of the national emissions. Research indicates that large enterprises typically possess more production equipment and higher production capacities, often resulting in greater energy consumption and carbon emissions (Azar et al., 2021). Yet, the correlation between enterprise scale expansion and carbon emissions is not straightforward. In some cases, expanding firms may decrease emissions per unit of output by adopting advanced technological innovations and upgrading industrial structures (Wen et al., 2021). Therefore, the assumption that enterprise growth invariably increases carbon emissions warrants further investigation. A deeper understanding of how enterprise size impacts MCEE is crucial, not only for identifying emission sources but also for informing more effective emission reduction policies.

In response to the challenges of global climate change, companies not only face intensifying external environmental regulations and stringent ecological requirements from international markets, but also need to increase internal research and development (R&D) investments to facilitate technological transformation. These external pressures and internal motivations drive businesses to expand their scale to meet stricter environmental standards and advance technological transitions, thereby enhancing energy efficiency and reducing carbon emissions. Moreover, in an open economy, the challenges associated with technology and environmental protection increase. Under such circumstances, large enterprises, by virtue of their scale effect and resource advantages, can effectively improve MCEE by increasing their R&D investments and developing new eco-friendly technologies. Consequently, environmental regulation, trade openness, and R&D investments contribute to the relationship between company size and MCEE.

Exploring the factors influencing MCEE is crucial for promoting the green transformation of the manufacturing industry and achieving sustainable economic development. This study focuses on three core issues: first, how enterprise size affects the MCEE of China; second, whether this impact is linear or nonlinear; and third, whether changes in environmental regulation, the degree of openness, and R&D investment produce threshold effects on this impact. To systematically address these questions, this study employs data from 29 sub-sectors of China’s manufacturing industry from 2012 to 2021, utilizing the Generalized Method of Moments (GMM) model, quantile regression methods, and the panel threshold model for empirical analysis. The findings indicate that enterprise size has a significant impact on improving MCEE, with this impact being nonlinear. As environmental regulations strengthen and R&D investment increases, the positive impact of enterprise size on MCEE is enhanced; however, this impact is somewhat weakened in the context of increased openness. Based on these findings, policymakers should encourage firms to expand their size according to their resource endowments and technological capabilities. Additionally, policy efforts should focus on strengthening environmental regulations, increasing R&D investment, and optimizing policies related to openness to ensure the green transformation and sustainable development of the manufacturing industry in a globalized context.

This article contributes to the existing literature in several notable ways. First, in terms of research perspective, this paper integrates enterprise size and MCEE within a unified analytical framework, focusing on the specific economic sector of China’s manufacturing industry. This approach allows for a more detailed understanding and analysis of how enterprise size impacts CEE within a particular industry context. This innovative perspective not only provides a new theoretical angle for comprehending the complex relationship between firm size and carbon emissions, but also offers a basis for formulating relevant policies.

Secondly, in terms of research methodology, this paper introduces a MCEE index construction method based on a non-radial directional distance function. Unlike traditional single-factor methods based on carbon emission intensity and radial Data Envelopment Analysis (DEA) methods, the proposed method not only seeks to maximize economic output but also minimizes resource and environmental impacts. The introduction of this method makes the evaluation of MCEE more comprehensive and accurate, better reflecting the manufacturing sector’s contributions to environmental protection while achieving economic benefits.

Subsequently, using the GMM model, this paper deeply analyzes the impact of enterprise scale on CEE. The use of the quantile regression method, in particular, reveals the heterogeneity in the relationship between enterprise scale and MCEE across different quantiles. This method can demonstrate the specific impacts of enterprise scale on MCEE under different economic conditions, aiding in more precisely identifying and explaining the trends in MCEE at various stages of enterprise development.

Finally, by employing a panel threshold model, this paper further verifies that the impact of enterprise scale on MCEE changes with variations in environmental regulations, R&D investment, and the degree of openness. This aspect of the research not only enriches the dynamic understanding of the relationship between enterprise scale and MCEE but also provides empirical evidence for enterprises to make strategic adjustments under different policy environments.

Researching the relationship between enterprise scale and MCEE plays a crucial role in both emerging economies and developed countries. For emerging economies, understanding this relationship helps to balance the potential conflict between economic growth and environmental sustainability. This can aid these countries in formulating more effective industrial and environmental policies, promoting economic structure optimization, and transitioning to a green, low-carbon economy. Meanwhile, for developed countries, it supports industrial restructuring and innovation, addressing the challenges posed by the information technology revolution and global climate policies.

This article consists of 5 sections: Section 2 provides a literature review; Section 3 introduces the research methods and data; Section 4 presents empirical analysis; and the final section is a conclusion and policy implications.

Literature review

Measurement and influencing factors of manufacturing carbon emissions efficiency

MCEE is assessed using two predominant approaches: the single-factor method and the total-factor method. The single-factor method focuses on metrics like carbon intensity, defined as carbon emissions per unit of GDP, providing a straightforward measure of emission efficiency (Bagchi et al., 2022; Jin et al., 2022; Ye et al., 2020). On the other hand, the total-factor method for MCEE encompasses a comprehensive analysis by integrating input factors, expected outputs, and undesirable outputs. This approach yields more precise and holistic results, offering a thorough reflection of MCEE (Dong et al., 2021). Consequently, this paper adopts the total-factor method to quantify MCEE.

To calculate total-factor MCEE, the predominant methodologies include Stochastic Frontier Analysis (SFA) and Data Envelopment Analysis (DEA). SFA, established as a technique for evaluating single-output efficiency, faces challenges in managing undesirable outputs, which can impose practical limitations on its application (Yeşilyurt et al., 2021). In contrast, DEA assesses the relative efficiency of different units by examining the relationships between their inputs and outputs. This method employs a linear programming model to determine each unit’s efficiency, facilitating a comprehensive efficiency analysis (Zhou et al., 2008). DEA method can effectively address the model specification issues and the normal distribution assumptions on random disturbances present in the SFA method, and it can also consider both desirable and undesirable outputs. Therefore, many existing studies have used the DEA method to measure CEE (Yang et al., 2023a; Zhang et al., 2023). The DEA method has various forms, including the CCR model, the BCC model, the SBM model (Tone, 2001), and so on. Faere et al. (1989) provided a directional distance function that effectively addresses the “inefficient output” problem, but it does not consider the relaxation of input and output variables. Mahlberg and Sahoo (2011), through improvements to the traditional DDF model, introduced the NDDF model. By setting the direction and weight of input and output variations, they overcame the slack bias issue, making it widely applicable. In the realm of MCEE analysis, accurately defining the production technology frontier is imperative. This process was revolutionized by the global DEA method by Oh (2010). Subsequently, Lin and Du (2015) enhanced this approach by introducing the NDDF model, and formulating the global NDDF model. This innovation enables year-over-year comparisons, providing a more dynamic analysis framework. Recent research adopts the global NDDF model to study MCEE. Recent studies employing the NDDF model have shed light on energy and carbon emission efficiencies across China. Guo et al. (2023) investigated the total factor energy efficiency of 30 provinces in China using the NDDF model, uncovering a fluctuating downward trend from 2005 to 2019. Similarly, Liu et al. (2020) applied a global version of the NDDF model to assess the unified total factor efficiency across these provinces. In a distinct study, Guang et al. (2023) employed a meta-frontier global NDDF model, to evaluate CEE from 2005 to 2019. Their findings highlight considerable regional disparities, with the highest efficiencies observed in the eastern provinces and lower efficiencies in the central and western regions. Furthermore, Li and Cheng (2020) explored CEE within 31 manufacturing subsectors in China using the NDDF model, revealing significant heterogeneity among these subsectors. Despite these insights, research on CEE in China’s manufacturing subsectors remains limited. This study leverages the global NDDF model to bridge this gap, focusing on estimating MCEE.

In recent years, scholars have delved deeply into the factors influencing MCEE, considering both internal and external dimensions. Internally, research has focused on the role of R&D investments in enhancing MCEE. For instance, Liu et al. (2022) conducted a decoupling analysis revealing that R&D expenditure is a crucial factor affecting MCEE. Similarly, Hang et al. (2019) found that increased technological investment aids in decoupling carbon emissions from economic growth in China’s manufacturing sector, while corporate size expansion serves as a primary constraint to this decoupling. Externally, the role of environmental regulation has garnered widespread attention. Wang et al. (2018) used FMOLS model to regress 28 Chinese manufacturing sub-industries, finding that environmental regulation can facilitate the reduction of carbon emissions while simultaneously promoting economic benefits. From the perspective of openness to the international market, Li et al. (2023b) discovered that backward integration models positively impact MCEE, whereas forward integration models may have a constraining effect. Moreover, other factors such as corporate energy management practices (Fernando and Hor, 2017), industrial agglomeration (Lin and Guan, 2023), labor and energy allocation efficiency (Zhang et al., 2023), and digitalization (Huang and Zhang, 2023) also play crucial roles in enhancing MCEE. However, existing studies have not fully accounted for the dynamic impacts of factors such as R&D investment, trade openness, and environmental regulation on CEE. Therefore, this paper identifies R&D investment, trade openness, and environmental regulation as key drivers for improving CEE. It explores whether changes in these factors influence the impact of firm size on MCEE.

Corporate scale and manufacturing carbon emissions efficiency

Large corporations possess distinct comparative advantages in areas such as scale effects, financing channels, and corporate strategy, which fundamentally underpin their market dominance. Primarily, according to the theory of economies of scale, large corporates benefit from scale effects, achieving higher production efficiency. Wang et al. (2021) noted that large corporates obtain more output through lower unit costs, directly enhancing production efficiency. Furthermore, an empirical analysis of micro-data from Chinese manufacturing corporates by Wang et al. (2023c) demonstrated that economies of scale significantly improved MCEE. Similarly, Yang et al. (2023b) discovered that the size of a business directly impacts its resource advantages and stability, playing a key role in promoting carbon reduction. Additionally, large corporates typically possess robust financial strength and diversified financing channels. This not only ensures the capital needs for their production and operations but also provides ample financial support for technological innovation. Bollaert et al. (2021) and Feng et al. (2022) stated that ample funding is a crucial factor in enhancing MCEE, especially in technology innovation areas requiring capital-intensive investments. Lastly, large corporates often demonstrate foresight in formulating corporate strategies. Aligning with government policies and market trends, they proactively develop advanced carbon reduction strategies. Pan et al. (2022) highlighted the leading position of large corporations in the development and application of green technologies, which contributes to reducing carbon emissions.

However, the impact of corporate scale on MCEE is a complex and multifaceted issue, with scholars yet to reach a consensus on its effects (Zhao et al., 2021; Wang and Zhang, 2022). Chandler and McEvoy (2000) emphasized that the alignment of corporate size with management efficiency is crucial to realizing economies of scale. A mismatch between management models and scale expansion can impede improvements in production efficiency. Fernandes (2007) pointed out that the complex management structures of large corporations might increase managerial difficulties and add to the organization’s burdens. Such complexities could hinder the effective implementation of carbon reduction policies, thereby diminishing the potential benefits of scale economies. Moreover, Zhang et al. (2023) suggested that excessively large corporate scale might adversely affect the MCEE of China. Similarly, Yu et al. (2023) found that, from 2004 to 2013, industrial corporates in China were more likely to generate increased carbon emissions, suggesting that overly large corporates might face greater challenges in enhancing MCEE. These studies highlight that while scale can offer advantages, it may also pose significant challenges in terms of management complexity and environmental performance, particularly regarding carbon emissions. Therefore, existing literature recognizes that unlimited growth in firm size might negatively impact management, yet few scholars have focused on the nonlinear characteristics of firm size’s impact on CEE.

In summary, existing research has explored the measurement of MCEE, its influencing factors, and the impact of corporate scale on MCEE. However, there are significant gaps in the literature that warrant further investigation. Firstly, although several studies have examined the relationship between firm size, economic growth, and carbon emissions (Wang et al., 2021; Wang et al., 2023c; Pan et al., 2022), they predominantly focus on the isolated impact of firm size on either economic growth or carbon emissions. These studies provide valuable insights, but they are insufficient to reveal how firm size can simultaneously promote economic growth and achieve effective carbon emission reduction, a strategy often referred to as the “dual objective”. There is still a lack of research on how adjusting firm size can optimize CEE while fostering economic growth.

Secondly, in terms of measuring CEE in the manufacturing sector, existing studies primarily rely on single-factor methods based on carbon emission intensity and traditional radial DEA methods (Yang et al., 2023a; Zhang et al., 2023). These methods often emphasize efficiency evaluation based on a single input or output, neglecting the complex interactions between multiple inputs and multiple outputs (including economic output and carbon emissions) in enterprise operations (Tan et al., 2020). This methodological limitation may lead to inaccurate estimates of CEE, failing to comprehensively reflect the true environmental impact of enterprises during production processes.

Lastly, most studies focus on analyzing the direct effects of firm size on carbon emissions, such as the research by Wang and Zhang (2022) and Zhao et al. (2021). While these studies enhance our understanding of the scale effect, they often overlook how the scale effect is influenced by other factors within specific economic contexts, particularly in emerging economies like China’s manufacturing sector. Factors such as environmental policies, R&D investment, and international trade may critically impact firms’ CEE but have not been sufficiently explored in the existing literature.

Methods and data

Measurement of manufacturing carbon emissions efficiency

This study employs the NDDF method to assess MCEE from 2012 to 2021. Unlike the traditional DEA model, the NDDF method offers advanced capabilities by allowing for the specification of change directions and directional weights of variables. Additionally, it addresses the challenges associated with the proportional transformations in the inputs and outputs of the directional distance function. These enhancements confer greater flexibility and applicability to the NDDF method, making it a superior tool for evaluating environmental efficiencies.

Based on Zhou et al. (2012), the NDDF model is constructed as follows:

Among them, \(d\) in \({\vec{D}}^{d}\) represents the production technology type of the NDDF model. According to Oh (2010), production technology is divided into contemporaneous, intertemporal, and global production technology. Specifically, contemporaneous technology can be defined as the production technology of a specific individual \({R}_{h}\) within a specific time t, \({T}_{{R}_{h}}^{C}=\left\{\left({K}^{t},{L}^{t},{E}^{t},{Y}^{t},{C}^{t}\right):\left({K}^{t},{L}^{t},{E}^{t}\right){can\; produce}\left({Y}^{t},{C}^{t}\right)\right\}\). The intertemporal production technique consists of all observations of the group \({R}_{h}\) over the entire period, which is defined as: \({T}_{{R}_{1}}^{I}={T}_{{R}_{1}}^{1}\cup {T}_{{R}_{2}}^{2}\cup \ldots \cup {T}_{{R}_{h}}^{T}\). The global production technique consists of the observations of all groups over the entire period, defined as: \({T}_{{R}_{1}}^{I}={T}_{{R}_{1}}^{I}\cup {T}_{{R}_{2}}^{I}\cup \ldots \cup {T}_{{R}_{h}}^{I}\). To enable comparisons between successive years of carbon efficiency, we employ global production techniques. Input factors include labor force \(L\), capital \(K,\) and energy \(E\). The output elements include expected output and undesired output, among which the expected output is industrial added value \(Y\), and the undesired output is carbon emission \(C\). \(\beta\) represents the scale vector.

According to Eq. (1), we set the direction vector as \(g=\left(-K,-L,-E,Y,-C\right)\). In our analysis, comprehensive consideration is given to the relationships among inputs, desired outputs, and undesired outputs. We posit that these three factors are of equal importance. Consequently, following the methodology proposed by Zha et al. (2023), we have decided to assign an equal weight of one-third to each of these components. Specifically, acknowledging the equal significance of all input variables, we set the weighting vector as \(w=\left(\frac{1}{9},\,\frac{1}{9},\,\frac{1}{9},\,\frac{1}{3},\,\frac{1}{3}\right)\). Therefore, referring to Fan et al. (2022), we define MCEE as:

Econometric model

Firstly, before undertaking the regression analysis, we conduct a comprehensive examination of all variables, encompassing both the unit root test and panel cointegration test. Subsequently, we explore the direct influence of corporate scale on MCEE using the GMM model. Additionally, we delve deeper into heterogeneity in the impact of corporate scale on MCEE across distinct quantiles, employing the MMQR method. Finally, by using environmental regulation, R&D investment, and trade openness as threshold variables, we explore the nonlinear impact of corporate scale on MCEE.

Variable tests

Panel unit root test

In this study, we conduct unit root tests to verify the stability of the selected variables, essential for ensuring the reliability of our econometric analyses. These tests encompass the Levin, Lin, and Chu (LLC) test, the Im, Pesaran, and Shin (IPS) test, the Fisher augmented Dickey-Fuller (ADF) test, and the Fisher Phillips-Perron (PP) test. The rejection of the null hypothesis in these tests implies the absence of unit roots in the variables, indicating their stability.

Among them, the LLC test is formulated as shown in Eq. (3).

Among them, \({c}_{m},\,{I}_{m},\,{E}_{m},\,{T}_{m}\) represent autoregressive coefficients.

Specifically, if cm < 0, it indicates that the variable is stationary, devoid of a unit root.

The IPS test is formalized in Eq. (4).

Equations for the Fisher augmented Dickey-Fuller (ADF) and Fisher Phillips-Perron (PP) tests are presented as Eqs. (5) and (6) respectively.

Among them, \(m\) and \({w}^{-1}\) represent the inverse normal distribution. \({R}_{m}\) represents the P value of the ADF unit root.

Panel cointegration test

To explore the possibility of a long-term relationship among the selected variables, this study utilizes the Kao cointegration test (Kao, 1999). A rejection of the null hypothesis in this test indicates a long-term cointegrating relationship, suggesting that the variables move together over time.

The equation of the Kao cointegration test is shown in formula (7).

Where \({D}_{{bn}}={f}_{b,n-1}+{U}_{{bn}},\,{Z}_{{bn}}={z}_{b,n-1}+{V}_{{bn}},n=1\ldots N{\rm{;}}\,b=1\ldots B.\)

Benchmark model

The primary objective of this paper is to analyze the impact of corporate scale on MCEE. In our analytical framework, corporate scale (CS) is treated as the input variable, while MCEE is considered the output variable. Additionally, energy endowment (EE), product structure (PS), and market competition (MC) are incorporated as control variables to account for their potential confounding effects. The functional relationship among these variables is formally expressed in the following equation:

In this context, MCEE represents the dependent variable, indicating MCEE. The independent variables include CS, representing corporate scale; EE, representing energy endowment; PS, representing product structure; and MC, representing market competition.

This paper constructs and compares three econometric models: Ordinary Least Squares (OLS), Fixed Effects (FE), and GMM. Specifically, the OLS model, illustrated in Eq. (9), is utilized initially:

Here, \(i\) denotes the industry sector; \(t\) denotes the year; \(l{nMCEE}\) is the dependent variable, representing the manufacturing carbon emissions efficiency; \(\mathrm{ln}{CS}\) is the core explanatory variable, representing corporate scale; \({\sum }_{j=1}^{n}{X}_{{jit}}\) is the control variable, including energy endowment; product structure, and marketization level; \({\alpha }_{0},{\alpha }_{1},{\sum }_{j=1}^{n}{\varphi }_{j}\) are coefficients to be estimated; \({\varepsilon }_{{it}}\) represents random error items.

Second, we construct a fixed effect model, as shown in Eq. (10):

Lastly, considering the closely intertwined nature of current and past MCEE, we introduce a lag period into the model and employ the dynamic system GMM for estimation. The dynamic system GMM model presents several key advantages. Firstly, it addresses the issue of endogeneity effectively by using carefully selected instrumental variables, a technique pioneered by Arellano and Bond (1991). Secondly, it alleviates the biases and uncertainties often associated with the first-difference GMM approach (Blundell and Bond, 1998). Consequently, we formulate the system GMM model as depicted in Eq. (11).

Among them, \({\mathrm{ln}{CEE}}_{{it}-1}\) represents the one-period lag of the explained variable.

MMQR method

Although traditional panel quantile models can evaluate the nonlinear influence among variables across different quantiles, they fall short by not accounting for the fixed effects attributable to individual entities within the system, thus exhibiting certain limitations. To address this problem, Machado and Santos Silva (2019) proposed a more cutting-edge moment quantile regression method. The model not only evaluates covariance effects among variables but also captures individual conditional heterogeneity (Yang et al., 2022). Consequently, we employ the MMQR method to rigorously assess the nonlinear characteristics of the impact of corporate scale on MCEE.

Consider the quantile regression \({Q}_{y}(\tau {|X})\) in the position-scale field as shown in the formula (12):

Among them, \(P\left({\delta }_{i}+{Z}_{{it}}^{{\prime} }\theta\, >\, 0\right)=1\). The individual fixed effect is represented by \(i\), that is, \({(a}_{i},{\delta }_{i}),i=1,\ldots ,N\). For \(X\) and its k-vectors, known to be powered by \(Z\), they are differentiable transformations with element \(l\) as follows:

In this model, \({X}_{{it}}\) is the same and independent for any particular individual \(i\) and time \(t\). \({\xi }_{{it}}\) may represent a specific time \(t\) and individual \(i\), and is orthogonal to \({X}_{{it}}\). According to Machado and Santos Silva (2019), formula (14) can be deduced from formula (12):

In this paper, \(X\) represents exogenous variables, including corporate scale, energy endowment, product structure, and market competition. \({Q}_{y}(\tau |{X}_{{it}})\) represents the quantile distribution of the dependent variable \(Y\), which refers to the MCEE. The fixed-effect quantile \(\tau\) of individual \(i\) at time \(t\) is denoted by \({X}_{{it}}^{{\prime} }-{\alpha }_{i}\left(\tau \right)\equiv {\alpha }_{i}+{\delta }_{i}q(\tau )\), where q(τ) represents the τth quantile sample. q(τ)can also be estimated by the optimization results given below:

Among them, \({\rho }_{\tau }=\left(\tau -1\right){BI}\left\{B\le 0\right\}+{TBI}\left\{B\, >\, 0\right\}\) is the verification formula.

Panel threshold model

In this study, we utilize the panel threshold model, as proposed by Hansen (1999), to delve deeper into the nonlinear relationships between variables. The model is defined by the following equations:

Among them, \({q}_{{it}}\) is the threshold variable.

Building on this framework, we formulate the extended panel threshold model as shown in Eq. (18):

In this model, \(I(\cdot )\) denotes the indicator function, which assumes the value of 1 or 0 depending on the condition, which takes the value of 1 or 0; \({q}_{{it}}\) is the threshold variable, which respectively represents environmental regulation, R&D investment, and trade openness; the parameter \(\gamma\) is the threshold; \({\mu }_{i}\) is the individual fixed effect.

Variable

Explained variable—manufacturing carbon emission efficiency (MCEE)

Building on the analysis presented in Section 3.1, we construct the NDDF model to measure MCEE. The specific input and output variables of the model are detailed in Table 1.

-

(1)

Labor input: We employ the average number of workers t as a proxy for labor input. Since the absence of average employment data for 2012 in the “China Industrial Statistical Yearbook”, we supplemented it by interpolation based on the relevant data in 2011 and 2013.

-

(2)

Capital input: This paper adopts the perpetual inventory method to estimate the capital stock. The formula employed is outlined below:

$${K}_{{it}}=\left(1-{\delta }_{{it}}\right){K}_{{it}-1}+{I}_{{it}}$$(19)Among them, \({K}_{{it}}\) represents the capital stock of sector \(i\) in year \(t\), and \({K}_{{it}-1}\) represents the capital stock of sector \(i\) in year \(t-1\). \({I}_{{it}}\) represents the fixed asset investment of sector \(i\) in year \(t\) (expressed at constant prices in 2012), and the deflator is the factory price index of industrial producers. \({\delta }_{{it}}\) represents the capital depreciation rate. Refer to Chen (2011), \({\delta }_{{it}}=\frac{{\gamma }_{{it}-}{\gamma }_{{it}-1}}{{{FI}}_{{it}-1}}\). Among them, \({\gamma }_{{it}}\) and \({\gamma }_{{it}-1}\) represent the accumulated depreciation of sector \(i\) in year \(t\) and year \(t-1\) respectively, and \({\gamma }_{{it}}-{\gamma }_{{it}-1}\) represent the current depreciation of sector \(i\) in year \(t\). \({{FI}}_{{it}-1}\) represents the original price of fixed assets of department \(i\) in year \(t-1\).

-

(3)

Energy input: We use the total energy consumption of various industries to express.

-

(4)

Expected output: we express it by industrial added value. Since the National Bureau of Statistics has only published the growth rate of industrial added value since 2009 (price factors have been deducted), this article calculates the industrial added value based on the industrial added value in 2008 and the growth rates of each subsequent year.

-

(5)

Undesired output: Carbon emissions from the manufacturing sector are calculated using the energy consumption method. This involves the eight primary energy sources in manufacturing—raw coal, coke, crude oil, gasoline, kerosene, diesel, fuel oil, and natural gas (Li et al., 2021). The formula for carbon emissions is:

Among them, \({{CO}}_{2}^{{it}}\) represents the total carbon dioxide emissions by industry \(i\) in year \(t\); \({F}_{j}^{{it}}\) is the consumption of energy \(j\) in industry \(i\) in year \(t\); \({\zeta }_{j}\) is the standard coal conversion coefficient of energy \(j\); \({o}_{j}\) is The average low calorific value of energy \(j\); \({\nu }_{j}\) is the carbon oxidation rate of energy \(j\); \({\mu }_{j}\) is the carbon emission coefficient of energy \(j\). The specific parameters used in these calculations are detailed in Table 2.

Core explanatory variable - corporate scale (CS)

Drawing on the insights of Wang et al. (2023a), corporations capitalize on the scale effect and realize increasing returns to scale, which are conducive to the enhancement of MCEE. Specifically, the expansion of corporate scale facilitates the rational allocation of resources, thereby reducing production costs per unit of output. Furthermore, the expansion of corporate scale enriches human resources, thereby enhancing market competitiveness. Referring to Ouyang et al. (2020), we adopt the ratio of “industrial value-added” to “number of corporate units” as a proxy variable, denoted as CS.

Threshold variables

Based on the above analysis, this paper selects environmental regulation, R&D investment, and trade openness as threshold variables to test the nonlinear impact of corporate size on MCEE.

-

(1)

Environmental regulation (ER). Environmental regulation is recognized as a crucial factor influencing MCEE. The Porter Hypothesis posits that corporations can reduce the costs of environmental regulations and obtain economic benefits through the adoption of environmental technology (Wang et al., 2024a). Therefore, appropriate environmental regulations can incentivize green technological innovations and enhance a firm’s carbon production capacity. Following the methodology of Wang et al. (2023a), this study employs the ratio of “total operating costs for wastewater and gas emissions” to “main operating revenue” as a proxy variable for environmental regulation.

-

(2)

R&D investment (RD). Innovation is an integral aspect of corporate development, with R&D investments serving as the driving force behind innovation (Wang et al., 2023b). Typically, augmenting R&D investments can enhance manufacturing processes, technologies, and efficiency, consequently boosting a firm’s MCEE. Therefore, we refer to Lin and Chen (2020) and adopt the ratio of “R&D funding” to “industrial value-added” as a representation of R&D investment.

-

(3)

Trade openness (OPEN). According to the “Pollution Paradise” hypothesis, developed countries might transfer pollution-intensive industries to developing countries due to industrial restructuring, potentially leading to increased carbon emissions in those developing nations (Gao et al., 2022). Consequently, the expansion of trade openness may have a negative implication on the environmental conditions of developing countries (Wang et al., 2024b). However, the “Pollution Halo” hypothesis suggests that an increase in the degree of trade openness can foster technology spillovers and knowledge diffusion, thereby facilitating the spread of advanced technologies and environmental knowledge, thus positively affecting local MCEE (Gu et al., 2021). Drawing from Wang (2023), this study uses the ratio of “foreign investment” and “investment from Hong Kong, Macau, and Taiwan” to “net fixed assets of industrial corporations” as a measure of the degree of trade openness.

Control variables

To substantiate the influence of corporate scale on MCEE, we have incorporated a range of factors into our analysis, encompassing energy endowment, product structure, and marketization.

-

(1)

Energy endowment (EE). Research has demonstrated that energy endowment is highly correlated with energy consumption and carbon emissions (Wu et al., 2023). Consequently, energy endowment might exert a considerable impact on MCEE. To address this, we measure energy endowment using the proportion of energy consumption relative to the labor force.

-

(2)

Product structure (PS). Changes in product structure can indeed impact MCEE, and the development of energy-saving products can further influence this efficiency. This is because such new products can produce more income and reduce carbon emissions at a limited input level (Zhang et al., 2012). Drawing from the research by Fan et al. (2021), we employ the ratio of revenue from new product sales to total operating revenue as a measure of product structure.

-

(3)

Market competition (MC). Market competition may have a positive impact on the development of corporates through technological spillover effects. On the other hand, excessive market competition may lead to negative consequences, such as reduced corporate profits (Gouin-Bonenfant, 2022). The overall impact of market competition on MCEE depends on the combined effects of the above positive and negative impacts. Building on the approach by Wang (2023), this study utilizes the proportion of non-state-owned capital to total realized capital within each industry as a measure of market competition.

The definitions of the main variables are shown in Table 3.

Data description

This study analyzes economic and energy data from 29 industries within the Chinese manufacturing sector over the period from 2012 to 2021. According to the “2011 National Economic Industry Classification (GB/T 4754-2011)”, the manufacturing sector comprises 31 industries. However, due to limitations in data availability, the Comprehensive Utilization of Scrap Resources industry, the Machinery and Equipment Repairing industry, and the Metal Products industry were excluded. Thus, the research focuses on the remaining 29 industries. Data were sourced from various editions of the “China Statistical Yearbook”, “China Industrial Statistical Yearbook”, “China Energy Statistical Yearbook”, “China Environmental Statistical Yearbook”, and “China Science and Technology Statistical Yearbook” spanning 2011 to 2022, along with official data from the National Bureau of Statistics. For analytical rigor, all variables were logarithmically transformed. Detailed descriptive statistics for these variables are provided in Table 4, and Table 5 displays the Variance Inflation Factor (VIF) values and correlation coefficients pertinent to this study.

It can be seen that the VIF of each variable is less than 5. Both \(\mathrm{ln}{CS}\) and \(\mathrm{ln}{PS}\) are positively correlated with \(\mathrm{ln}{MCEE}\), while \(\mathrm{ln}{EE}\), \(\mathrm{ln}{MC}\), \(\mathrm{ln}{ER}\), \(\mathrm{ln}{RD}\), and \(\mathrm{ln}{OPEN}\) are negatively correlated with \(\mathrm{ln}{MCEE}\), and there was no severe multicollinearity between variables.

Empirical results and discussion

Unit root test and cointegration test

To avoid spurious regression, we initially perform unit root tests to verify the stationarity of the dataset. The results of these tests are summarized in Table 6. Notably, all variables’ first differences have rejected the null hypothesis. This indicates that the variables used in this study do not possess unit roots, affirming the stationarity of the data.

Subsequently, cointegration tests are employed to verify the existence of long-term equilibrium relationships among the variables. The results of these tests are detailed in Table 7. The data clearly show that all selected variables reject the null hypothesis, indicating robust long-term equilibrium relationships. This meets the prerequisite conditions for conducting regression estimation.

Benchmark regression result analysis

Table 8 presents the regression results regarding the impact of corporate scale on MCEE. In this context, column (1) represents the regression result of the OLS method, and column (2) displays the results of the fixed-effects model. After determining the influence of corporate scale on MCEE and mitigating potential biases due to omitted variables, while considering that the MCEE may also be related to previous factors, this study employs the system GMM method for estimation, as depicted in Eq. (11). The results of this estimation are showcased in column (3).

Upon comparing columns (1)–(3), it can be deduced that the estimation results of the system GMM model are robust. Furthermore, the P value for AR (1) is below 0.1, indicating the presence of first-order autocorrelation in the error term. Conversely, the P value for AR (2) exceeds 0.1, indicating an absence of second-order autocorrelation. The Sargan test, with a value greater than 0.1, corroborates the suitability of the selected instruments in the GMM model.

In column (3), the coefficient for \(\mathrm{ln}{CS}\) is 0.025, which is significantly positive at the 1% level, indicating that for each 1% increase in corporate scale, MCEE increases by 2.5%. This finding underscores that corporate scale significantly enhances MCEE, consistent with the research by Liu and Liu (2023). The possible reasons are: an expansion in corporate scale signifies access to greater labor, capital, and technological resources, as well as improved management information systems, which can reduce energy consumption, improve production efficiency, and ultimately contribute to the improved MCEE.

Robustness tests

To further examine the robustness of the impact of corporate scale on MCEE, the results have been scrutinized through four alternative approaches, summarized in Table 9.

-

(1)

Replacing the estimation model. Employing the difference GMM approach, the regression of corporate scale on MCEE is conducted. The result is displayed in column (1).

-

(2)

Alteration in explained variable measurement. We utilize the Super-SBM model to calculate MCEE and then regress it with corporate scale as the independent variable. The result is depicted in column (2).

-

(3)

Substitution of explanatory variables. Drawing on the study of Li and Li (2022), we replace the explanatory variable with the ratio of the number of manufacturing corporations to the average number of employees and perform the regression anew. The results are exhibited in column (3).

-

(4)

Adjustment of sample time. The sample time is shortened to 2013–2020, and the regression is performed again, and the results are shown in column (4).

It is noteworthy that the estimation results of columns (1)-(4) are consistently aligned with the baseline regression results. Consequently, a robust conclusion can be drawn that corporate scale significantly enhances MCEE.

Nonlinear analysis

Analysis of moment quantile regression results

Table 10 presents the regression results of the MMQR model. The coefficient of the corporate scale is positive and statistically significant for all quantile levels of MCEE. The magnitude of the corporate scale coefficient varies from 0.1592 at the 0.1 quantile to 0.1061 at the 0.9 quantile. This indicates that a 1% increase in corporate scale is associated with an enhancement in MCEE ranging from 10.61% to 15.92%. Furthermore, it can be observed that at all quantile levels, energy endowment and product structure have no effect on MCEE for any quantile. Although market competition is not significant at the 0.1 and 0.2 quantiles, it becomes significantly positive at and beyond the 0.3 quantile, with a rising coefficient trend. This suggests that higher quantiles of MCEE are more susceptible to the impact of market competition.

From the regression results in Table 10, we observe a positive correlation between corporate scale and MCEE across all quantile levels. The expansion of corporate scale implies larger production capacity, the introduction of advanced machinery and equipment, and an increase in both the size and quality of the workforce. When MCEE is at lower quantiles, corporations, under the umbrella of sustainable development, can obtain higher expected output and lower undesirable output through optimizing production structure, thereby yielding a more pronounced positive impact on MCEE.

However, when MCEE is at a high quantile, the input-output structure could be relatively optimized. The dividends of corporate scale on MCEE might have already been realized. Consequently, there may be higher requirements for the corporate scale, not only the expansion of production scale but also the improvement of management hierarchy and awareness, so as to avoid the misallocation and waste of resources.

Analysis of the panel threshold model

To explore deeply the non-linear impact of corporate scale on MCEE, we employ a panel threshold model to examine whether the influence of corporate scale on MCEE differs based on environmental regulation, R&D investment, and trade openness.

Firstly, we test for the presence of threshold effects and determine the number of thresholds. Through 300 bootstrap tests, we obtain specific F-values and P-values. The results are summarized in Tables 11 and 12. The findings indicate that under the influence of environmental regulation, R&D investment, and trade openness, all variables pass the single-threshold test at the 5% significance level. However, the F-statistics for the double threshold are not significant. Based on this, we conclude that a single threshold effect exists between corporate scale and MCEE under the conditions set by environmental regulation, R&D investment, and trade openness.

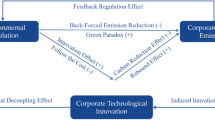

Subsequently, the threshold value test is carried out using the likelihood ratio statistic: LR(α) = −2ln[1-(1-α)1/2], where \(\alpha\) represents the significance level. When α = 5%, LR(α) is approximately 7.35. The image of the likelihood ratio function of the threshold value test is illustrated in Fig. 1. The threshold values for the three variables are all below the dotted line (corresponding to the value 7.35). Therefore, the selection of threshold values for environmental regulation, R&D investment, and trade openness within these three non-linear relationships is deemed appropriate.

Finally, based on the obtained threshold values, this study constructs single-threshold models, and the regression results are presented in Table 13. While holding other variables constant, the influence of corporate scale on MCEE varies as environmental regulation, R&D investment, and trade openness are in different threshold ranges. To be specific:

In column (1), we examine the regression results with environmental regulation as the threshold variable. When environmental regulation is below the threshold value, a 1% increase in corporate scale leads to a 11.86% growth in MCEE. On the other hand, when environmental regulation surpasses the threshold value, a 1% increase in corporate scale results in a 22.68% increase in MCEE. It is evident that as environmental regulation strengthens, the influence of corporate scale on MCEE becomes more pronounced. With stricter environmental regulations, governments intensify their efforts to combat environmental pollution. In response, for the purpose of minimizing environmental governance costs and increasing public trust, corporations tend to expand their scale to possess more resources and capabilities for environmental responsibility (Li et al., 2023a). This allows them to reduce energy consumption, enhance resource efficiency, and subsequently elevate MCEE.

In column (2), we present the regression results with R&D investment as the threshold variable. When R&D investment falls within the interval \(\left(-{{\infty }}\right.,\, \left.0.7827\right]\), a 1% increase in corporate scale leads to a 7.21% enhancement in MCEE. Conversely, when R&D investment lies within the interval \(\left[0.7827,\, +\infty\right)\), a 1% increase in corporate scale results in a 13.86% growth in MCEE. It is evident that with the expansion of R&D investment, the promotion effect of corporate scale on MCEE is gradually enhanced. R&D investment plays a pivotal role in driving the implementation of green technologies, which in turn improves the efficiency of eco-friendly equipment. This mechanism propels the relationship between corporate scale and MCEE.

In column (3), we display the regression results with trade openness as the threshold variable. When trade openness falls within the first threshold interval, the regression coefficient for the corporate scale is 0.2374. When the degree of trade openness lies within the second threshold interval, the regression coefficient for corporate scale is 0.114. It is evident that as the degree of trade openness deepens, the promoting effect of corporate scale on MCEE is weakened. This may stem from the continued intensification of foreign capital inflows as trade openness increases. This influx could lead to the relocation of more pollution-intensive industries to China, directly or indirectly promoting the development of energy-intensive and pollution-intensive industries. Consequently, this trend might dampen the positive role of corporate scale in enhancing MCEE.

Conclusions and policy implications

Conclusion

This paper examines the relationship between enterprise size and MCEE in China from 2012 to 2021, using the GMM model, MMQR method, and panel threshold model. Initially, unit root tests confirmed the stationarity of the variables, ensuring the robustness of subsequent analyses. The empirical results indicate the following: (1) Enterprise size has a significant positive impact on MCEE. This conclusion holds even after robustness checks. (2) The nonlinear analysis conducted using the MMQR model delves deeper into the varying impacts of firm size at different quantile levels of MCEE. There is a positive correlation between firm size and MCEE across all quantiles. However, the magnitude of these effects varies, with the positive impact of firm size being more pronounced at lower levels of MCEE. (3) Firm size’s impact on MCEE exhibits significant threshold effects depending on environmental regulation, R&D investment, and trade openness. The positive effect of firm size on MCEE strengthens with increased R&D investment and stricter environmental regulations. Conversely, with greater trade openness, the positive impact of firm size on MCEE diminishes. This study not only offers a new perspective for understanding sustainable development in emerging economies but also deepens the understanding of the internal synergistic relationship between firm size and MCEE. The findings provide crucial insights for policymakers and businesses in formulating corporate strategies.

Drawing on the successful experiences of developed countries in manufacturing transformation (Fort, 2023; Egerer et al., 2024), emerging economies with latecomer advantages should leverage economies of scale to revamp traditional industries and develop emerging sectors. In this process, emerging economies can capitalize on their lower labor and production costs, combined with their rapid capacity for technology absorption and application, to accelerate the optimization and upgrading of industrial structures. These strategies and findings provide valuable theoretical references for policymakers in formulating effective manufacturing development strategies. They also offer empirical evidence for developed countries considering industrial relocation and global layout strategies.

Policy implications

Based on the above research findings, in order to enhance MCEE and promote the high-quality development of manufacturing enterprises, we propose the following recommendations:

-

(1)

Given that this study has confirmed the positive effect of corporate scale on MCEE, expanding corporate scale is beneficial for enterprises to fully utilize various resources and harness the intrinsic drive for energy-saving and emission reduction. Therefore, governments should continue to encourage companies to expand their scale, leveraging the scale effect to guide the transition towards greener practices. Additionally, governments at all levels should persist in refining policies related to corporate taxation and finance. They should further improve relevant laws and regulatory frameworks in alignment with the overall development direction of enterprises, thereby providing a stable legal environment for corporate growth.

-

(2)

Based on the regression results obtained through the MMQR method, manufacturing sectors should expand corporate scale according to their resource endowments and technological capabilities. Indeed, enterprises should not blindly pursue scale expansion, but should adopt scientific management practices. For instance, small and medium-sized enterprises should shift away from simple replication and imitation during the expansion process. Meanwhile, they should focus on continuous learning and innovation to grow their scale. The key to expanding corporate scale lies not just in transitioning from small to large, but in evolving from weak to strong.

-

(3)

Considering the results from the panel threshold model regression, the positive impact of corporate scale on MCEE is contingent upon environmental regulations, R&D investment, and trade openness. Consequently, the government should prioritize actions related to these three factors. Firstly, the government should formulate environmental regulations policies for various sectors within the manufacturing industry based on their current developmental status, and implement appropriate incentive and penalty measures. Under appropriate circumstances, the government can also provide consultancy services to give full play to the positive role of enterprises in promoting environmentally sustainable development. Secondly, the government should encourage R&D investment while improving the efficiency of R&D fund utilization. This would result in a higher success rate for green patents and projects. Such incentives can come in the form of subsidies for green technology R&D. Lastly, the government should offer tax reductions, subsidies, and other incentives to attract foreign investment in clean energy sectors. This would help facilitate the green transformation of the manufacturing industry.

This paper conducts a fundamental examination of the role of firm size in improving CEE in the manufacturing sector. However, there remains additional work to be done. The primary focus of this study is on China; future research could extend to the manufacturing industries of other emerging economies to gain a more comprehensive understanding of the impact of firm size on CEE. Furthermore, while this study investigates the nonlinear effects of environmental regulation, R&D investment, and openness to foreign trade on the relationship between firm size and CEE, it does not consider other potential influences such as resource misallocation and ownership structure. These are important areas for future research to address.

Data availability

The datasets publicly available should be through https://doi.org/10.7910/DVN/50CPSK.

References

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297. https://doi.org/10.2307/2297968

Azar J, Duro M, Kadach I, Ormazabal G (2021) The big three and corporate carbon emissions around the world. J Financ Econ 142(2):674–696. https://doi.org/10.1016/j.jfineco.2021.05.007

Bagchi P, Sahu SK, Kumar A, Tan KH (2022) Analysis of carbon productivity for firms in the manufacturing sector of India. Technol Forecast Soc Change 178:121606. https://doi.org/10.1016/j.techfore.2022.121606

Balsalobre-Lorente D, Shahbaz M, Murshed M, Nuta FM (2023) Environmental impact of globalization: the case of central and Eastern European emerging economies. J Environ Manag 341:118018. https://doi.org/10.1016/j.jenvman.2023.118018

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Bollaert, H, Lopez-de-Silanes, F, Schwienbacher, A (2021) Fintech and access to finance. J Corp Finace 68, 101941

Bruckner B, Hubacek K, Shan Y, Zhong H, Feng K (2022) Impacts of poverty alleviation on national and global carbon emissions. Nat Sustain 5(4):311–320. https://doi.org/10.1038/s41893-021-00842-z

Chandler GN, McEvoy GM (2000) Human resource management, TQM, and firm performance in small and medium-size enterprises. Entrep Theor Pract 25(1):43–58. https://doi.org/10.1177/104225870002500105

Chen S (2011) Reconstruction of sub-industrial Statistical Data in China (1980—2008). China Econ Qu 10(03):735–776. https://doi.org/10.13821/j.cnki.ceq.2011.03.012

Dong F, Li Y, Zhang X, Zhu J, Zheng L (2021) How does industrial convergence affect the energy efficiency of manufacturing in newly industrialized countries? Fresh evidence from China. J Clean Prod 316:128316. https://doi.org/10.1016/j.jclepro.2021.128316

Egerer J, Farhang-Damghani N, Grimm V, Runge P (2024) The industry transformation from fossil fuels to hydrogen will reorganize value chains: Big picture and case studies for Germany. Appl Energy 358:122485. https://doi.org/10.1016/j.apenergy.2023.122485

Faere, R, Grosskopf, S, Lovell, CAK, Pasurka, C (1989) Multilateral productivity comparisons when some outputs are undesirable: a nonparametric approach. Rev Econ Stat 71:90–98

Fan L-W, You J, zhang W, Zhou P (2021) How does technological progress promote carbon productivity? Evidence from Chinese manufacturing industries. J Environ Manag 277:111325. https://doi.org/10.1016/j.jenvman.2020.111325

Fan M, Li M, Liu J, Shao S (2022) Is high natural resource dependence doomed to low carbon emission efficiency? Evidence from 283 cities in China. Energy Econ 115:106328. https://doi.org/10.1016/j.eneco.2022.106328

Feng S, Zhang R, Li G (2022) Environmental decentralization, digital finance and green technology innovation. Struct Change Econ Dyn 61:70–83. https://doi.org/10.1016/j.strueco.2022.02.008

Fernandes AM (2007) Trade policy, trade volumes and plant-level productivity in Colombian manufacturing industries. J Int Econ 71(1):52–71. https://doi.org/10.1016/j.jinteco.2006.03.003

Fernando Y, Hor WL (2017) Impacts of energy management practices on energy efficiency and carbon emissions reduction: a survey of malaysian manufacturing firms. Resour Conserv Recycl 126:62–73. https://doi.org/10.1016/j.resconrec.2017.07.023

Fort TC (2023) The changing firm and country boundaries of US manufacturers in global value chains. J Econ Perspect 37(3):31–58. https://doi.org/10.1257/jep.37.3.31

Gao D, Li G, Li Y, Gao K (2022) Does FDI improve green total factor energy efficiency under heterogeneous environmental regulation? Evidence from China. Environ Sci Pollut Res 29(17):25665–25678. https://doi.org/10.1007/s11356-021-17771-1

Gouin-Bonenfant É (2022) Productivity dispersion, between-firm competition, and the labor share. Econometrica 90(6):2755–2793. https://doi.org/10.3982/ECTA18612

Gu K, Dong F, Sun H, Zhou Y (2021) How economic policy uncertainty processes impact on inclusive green growth in emerging industrialized countries: a case study of China. J Clean Prod 322:128963. https://doi.org/10.1016/j.jclepro.2021.128963

Guang F, Deng Y, Wen L, Sharp B, Hong S (2023) Impact of regional energy allocation distortion on carbon emission efficiency: evidence from China. J Environ Manag 342:118241. https://doi.org/10.1016/j.jenvman.2023.118241

Guo Q-T, Dong Y, Feng B, Zhang H (2023) Can green finance development promote total-factor energy efficiency? Empirical evidence from China based on a spatial Durbin model. Energy Policy 177:113523. https://doi.org/10.1016/j.enpol.2023.113523

Hang Y, Wang Q, Zhou D, Zhang L (2019) Factors influencing the progress in decoupling economic growth from carbon dioxide emissions in China’s manufacturing industry. Resour Conserv Recycl 146:77–88. https://doi.org/10.1016/j.resconrec.2019.03.034

Hansen MT (1999) The search-transfer problem: the role of weak ties in sharing knowledge across organization subunits. Admin Sci Q 44(1):82–111

Huang Y, Zhang Y (2023) Digitalization, positioning in global value chain and carbon emissions embodied in exports: evidence from global manufacturing production-based emissions. Ecol Econ 205:107674. https://doi.org/10.1016/j.ecolecon.2022.107674

IEA (2021) Global Energy Review 2021, IEA, Paris. https://www.iea.org/reports/global-energy-review-2021

IEA (2023) World Energy Outlook 2023, IEA, Paris. https://www.iea.org/reports/world-energy-outlook-2023

Jahanger A, Ozturk I, Chukwuma Onwe J, Joseph TE, Razib Hossain M (2023) Do technology and renewable energy contribute to energy efficiency and carbon neutrality? Evidence from top ten manufacturing countries. Sustain Energy Technol Assess 56:103084. https://doi.org/10.1016/j.seta.2023.103084

Jin Z, Li Z, Yang M (2022) Producer services development and manufacturing carbon intensity: evidence from an international perspective. Energy Policy 170:113253. https://doi.org/10.1016/j.enpol.2022.113253

Kao, CJJOE (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1), 1–44

Li J, Cheng Z (2020) Study on total-factor carbon emission efficiency of China’s manufacturing industry when considering technology heterogeneity. J Clean Prod 260:121021. https://doi.org/10.1016/j.jclepro.2020.121021

Li R, Wang Q, Li L, Hu S (2023a) Do natural resource rent and corruption governance reshape the environmental Kuznets curve for ecological footprint? Evidence from 158 countries. Resour Policy 85:103890. https://doi.org/10.1016/j.resourpol.2023.103890

Li R, Wang Q, Liu Y, Jiang R (2021) Per-capita carbon emissions in 147 countries: the effect of economic, energy, social, and trade structural changes. Sustain Prod Consum 27:1149–1164. https://doi.org/10.1016/j.spc.2021.02.031

Li X, Li H (2022) Do foreign investment and technological progress bias affect the carbon emission of China’s Manufacturing Industry?——Based on the empirical research of manufacturing sector segmentation. Data. China Soft Sci Mag 01:159–170

Li Y, Wang Y, Li J, Huang Q (2023b) Global value chain embedding mode and carbon emission efficiency: evidence from China’s manufacturing industry. Technol Forecast Soc Change 194:122661. https://doi.org/10.1016/j.techfore.2023.122661

Lin B, Chen Y (2020) Will land transport infrastructure affect the energy and carbon dioxide emissions performance of China’s manufacturing industry? Appl Energy 260:114266. https://doi.org/10.1016/j.apenergy.2019.114266

Lin B, Du K (2015) Energy and CO2 emissions performance in China’s regional economies: do market-oriented reforms matter? Energy Policy 78:113–124. https://doi.org/10.1016/j.enpol.2014.12.025

Lin B, Guan C (2023) Evaluation and determinants of total unified efficiency of China’s manufacturing sector under the carbon neutrality target. Energy Econ 119:106539. https://doi.org/10.1016/j.eneco.2023.106539

Liu J, Liu X (2023) Effects of carbon emission trading schemes on green technological innovation by industrial enterprises: evidence from a quasi-natural experiment in China. J Innov Knowledge 8(3):100410. https://doi.org/10.1016/j.jik.2023.100410

Liu J, Yang Q, Ou S, Liu J (2022) Factor decomposition and the decoupling effect of carbon emissions in China’s manufacturing high-emission subsectors. Energy 248:123568. https://doi.org/10.1016/j.energy.2022.123568

Liu K, Lu S, Zhang G (2020) Regional difference in global unified efficiency of China—Evidence from city-level data. Sci Total Environ 713:136355. https://doi.org/10.1016/j.scitotenv.2019.136355

Machado JAF, Santos Silva JMC (2019) Quantiles via moments. J Econom 213(1):145–173. https://doi.org/10.1016/j.jeconom.2019.04.009

Mahlberg B, Sahoo BK (2011) Radial and non-radial decompositions of Luenberger productivity indicator with an illustrative application. Int J Prod Econ 131(2):721–726. https://doi.org/10.1016/j.ijpe.2011.02.021

Oh D-H (2010) A metafrontier approach for measuring an environmentally sensitive productivity growth index. Energy Econ 32(1):146–157. https://doi.org/10.1016/j.eneco.2009.07.006

Ouyang X, Li Q, Du K (2020) How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139:111310. https://doi.org/10.1016/j.enpol.2020.111310

Pan X, Pu C, Yuan S, Xu H (2022) Effect of Chinese pilots carbon emission trading scheme on enterprises’ total factor productivity: The moderating role of government participation and carbon trading market efficiency. J Environ Manag 316:115228. https://doi.org/10.1016/j.jenvman.2022.115228

Peng H, Lu Y, Gupta S, Wang Q (2022) Dynamic and heterogeneity assessment of carbon efficiency in the manufacturing industry in China: Implications for formulating carbon policies. Environ Impact Assess Rev 97:106885. https://doi.org/10.1016/j.eiar.2022.106885

Tan X, Choi Y, Wang B, Huang X (2020) Does China’s carbon regulatory policy improve total factor carbon efficiency? A fixed-effect panel stochastic frontier analysis. Technol Forecast Soc Change 160:120222. https://doi.org/10.1016/j.techfore.2020.120222

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Operat Res 130(3):498–509. https://doi.org/10.1016/S0377-2217(99)00407-5

Wang F, Wu M, Du X (2023a) Does industrial upgrading improve eco-efficiency? Evidence from China’s industrial sector. Energy Econ 124:106774. https://doi.org/10.1016/j.eneco.2023.106774

Wang ML (2023) Effects of the green finance policy on the green innovation efficiency of the manufacturing industry: a difference-in-difference model. Technol Forecast Soc Change 189:122333. https://doi.org/10.1016/j.techfore.2023.122333

Wang Q, Hu S, Li R (2024a) Could information and communication technology (ICT) reduce carbon emissions? The role of trade openness and financial development. Telecommun Policy 48(3):102699. https://doi.org/10.1016/j.telpol.2023.102699

Wang Q, Ren F, Li R (2024b) Exploring the impact of geopolitics on the environmental Kuznets curve research. Sustain Dev 32(3):1700–1722. https://doi.org/10.1002/sd.2743

Wang, Q, Sun, T, Li, R (2023b) Does artificial intelligence promote green innovation? An assessment based on direct, indirect, spillover, and heterogeneity effects. Energy Environ. https://doi.org/10.1177/0958305X231220520

Wang Q, Zhang F, Li R, Sun J (2024c) Does artificial intelligence promote energy transition and curb carbon emissions? The role of trade openness. J Clean Prod 447:141298. https://doi.org/10.1016/j.jclepro.2024.141298

Wang W, Zhang Y-J (2022) Does China’s carbon emissions trading scheme affect the market power of high-carbon enterprises? Energy Econ 108:105906. https://doi.org/10.1016/j.eneco.2022.105906

Wang X, Wang S, Zhang X (2023c) Heterogeneity and influence factors of carbon productivity: evidence from Chinese manufacturing enterprises. J Clean Prod 404:136938. https://doi.org/10.1016/j.jclepro.2023.136938

Wang Y, Xiuping S, Zhang Q (2021) Can fintech improve the efficiency of commercial banks? —An analysis based on big data. Res Int Bus Finance 55:101338. https://doi.org/10.1016/j.ribaf.2020.101338

Wang Y, Yan W, Ma D, Zhang C (2018) Carbon emissions and optimal scale of China’s manufacturing agglomeration under heterogeneous environmental regulation. J Clean Prod 176:140–150. https://doi.org/10.1016/j.jclepro.2017.12.118

Wen H, Lee C-C, Song Z (2021) Digitalization and environment: how does ICT affect enterprise environmental performance? Environ Sci Pollut Res 28(39):54826–54841. https://doi.org/10.1007/s11356-021-14474-5

Wu G, Cui S, Wang Z (2023) The role of renewable energy investment and energy resource endowment in the evolution of carbon emission efficiency: spatial effect and the mediating effect. Environ Sci Pollut Res 30(35):84563–84582. https://doi.org/10.1007/s11356-023-28390-3

Yang H, Zhang X, Liu B, Huang Y (2023a) Evaluation of green low-carbon innovation development efficiency: An improved two-stage non-cooperative DEA model. J Clean Prod 400:136662. https://doi.org/10.1016/j.jclepro.2023.136662

Yang Q, Huo J, Saqib N, Mahmood H (2022) Modelling the effect of renewable energy and public-private partnership in testing EKC hypothesis: evidence from methods moment of quantile regression. Renew Energy 192:485–494. https://doi.org/10.1016/j.renene.2022.03.123

Yang S, Jahanger A, Hossain MR (2023b) How effective has the low-carbon city pilot policy been as an environmental intervention in curbing pollution? Evidence from Chinese industrial enterprises. Energy Econ 118:106523. https://doi.org/10.1016/j.eneco.2023.106523

Ye C, Ye Q, Shi X, Sun Y (2020) Technology gap, global value chain and carbon intensity: evidence from global manufacturing industries. Energy Policy 137:111094. https://doi.org/10.1016/j.enpol.2019.111094

Yeşilyurt ME, Şahin E, Elbi MD, Kızılkaya A, Koyuncuoğlu MU, Akbaş-Yeşilyurt F (2021) A novel method for computing single output for DEA with application in hospital efficiency. Socio-Econ Planning Sci 76:100995. https://doi.org/10.1016/j.seps.2020.100995

Yu L, Liu Y, Niu Y, Xiao Z (2023) Greener together: the impact of China’s mixed-ownership reform on firm carbon emissions. Energy Policy 180:113689. https://doi.org/10.1016/j.enpol.2023.113689

Zha Q, Liu Z, Wang J (2023) Spatial pattern and driving factors of synergistic governance efficiency in pollution reduction and carbon reduction in Chinese cities. Ecol Indicat 156:111198. https://doi.org/10.1016/j.ecolind.2023.111198

Zhai X, An Y (2020) Analyzing influencing factors of green transformation in China’s manufacturing industry under environmental regulation: a structural equation model. J Clean Prod251:119760. https://doi.org/10.1016/j.jclepro.2019.119760

Zhang S, Yu R, Wen Z, Xu J, Liu P, Zhou Y et al. (2023) Impact of labor and energy allocation imbalance on carbon emission efficiency in China’s industrial sectors. Renew Sustain Energy Rev 184:113586. https://doi.org/10.1016/j.rser.2023.113586

Zhang XF, Zhang SY, Hu ZY, Yu G, Pei CH, Sa RN (2012) Identification of connection units with high GHG emissions for low-carbon product structure design. J Clean Prod 27:118–125. https://doi.org/10.1016/j.jclepro.2012.01.011

Zhang, Y-J, Shi, W, Jiang, L (2020) Does China’s carbon emissions trading policy improve the technology innovation of relevant enterprises? 29(3), 872–885. https://doi.org/10.1002/bse.2404

Zhao M, Sun T, Feng Q (2021) Capital allocation efficiency, technological innovation and vehicle carbon emissions: evidence from a panel threshold model of Chinese new energy vehicles enterprises. Sci Total Environ 784:147104. https://doi.org/10.1016/j.scitotenv.2021.147104

Zhou P, Ang BW, Poh KL (2008) A survey of data envelopment analysis in energy and environmental studies. Eur J Operat Res 189(1):1–18. https://doi.org/10.1016/j.ejor.2007.04.042

Zhou P, Ang BW, Wang H (2012) Energy and CO2 emission performance in electricity generation: a non-radial directional distance function approach. Eur J Operat Res 221(3):625–635. https://doi.org/10.1016/j.ejor.2012.04.022

Acknowledgements

This work is supported by the “Youth Innovation Team Project” of the Higher Education Institutions under the Shandong Provincial Department of Education (No. 2023RW015), and the National Natural Science Foundation of China (No. 71874203).

Author information

Authors and Affiliations

Contributions

QW: Conceptualization, Methodology, Software, Data curation, Writing- Original draft preparation, Supervision, Writing- Reviewing and Editing. TS: Methodology, Software, Data curation, Investigation Writing- Original draft, Writing- Reviewing and Editing. RL: Conceptualization, Methodology, Data curation, Investigation Writing- Original draft, Writing- Reviewing.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wang, Q., Sun, T. & Li, R. Does larger scale enhance carbon efficiency? Assessing the impact of corporate size on manufacturing carbon emission efficiency. Humanit Soc Sci Commun 11, 993 (2024). https://doi.org/10.1057/s41599-024-03474-8

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03474-8