Abstract

Carbon trading policy is a major mechanism innovation based on the market to deal with climate change and reduce greenhouse gas emissions. As the scale of China’s carbon trading market gradually expands, the impact of carbon trading policy on the upgrading and optimization of industrial structures has attracted much attention. This paper depicts the upgrading of industrial structure through the advancement of industrial structure, and the optimization of industrial structure through the rationalization of industrial structure. Using panel data from 201 prefecture-level and above cities in China from 2004 to 2018, this study empirically investigates the impact and mechanism of carbon trading policy on the upgrading and optimization of industrial structure based on a double difference and mediation effect model. The research results show that carbon trading policy can generally promote the upgrading and optimization of industrial structures, but there are significant differences between promoting the upgrading and optimization of industrial structures. Mechanism analysis shows that carbon trading policy can promote the upgrading and optimization of industrial structure through technological innovation, and technological innovation has an intermediary effect. Heterogeneity analysis shows that there are significant differences between the eastern region and the central and western regions in carbon trading policy promoting the upgrading and optimization of industrial structure. Carbon trading policy is conducive to the upgrading of industrial structure in the eastern region, while they are conducive to the optimization of industrial structure in the central and western regions. In addition, it was found that there are significant differences in the promotion of the upgrading and optimization of industrial structure by carbon trading policy among cities with different levels of human capital, fiscal expenditure, foreign investment, and infrastructure. These conclusions can provide policy inspiration for high-quality green economic development, environmental policy formulation, industrial policy formulation, and urban resource allocation.

Similar content being viewed by others

Introduction

Carbon trading policy (CTP) refers to carbon emissions trading policy, which is an environmental regulation tool to solve global warming. Specifically, CTP is a policy measure used by the government to regulate the allocation and trading of total carbon emissions and carbon emission quotas (Zhang et al., 2014). China’s CTP includes six aspects: defining the scope of emission control, setting the total amount, allocating quotas, trading systems, reporting and verification mechanisms, and compliance and punishment mechanisms. CTP aims to create a free trading environment, fully leverage the role of the market in factor allocation, and ultimately achieve optimal allocation of carbon resources. The economic activities of human society are bound by the environment and in turn, affect the environment. Before the industrial revolution, the scale and scope of economic activities were small, and the impact of the environment on economic development and economic activities on the environment was inadvertently ignored. After the industrial revolution, the world seems to have found a fast path to economic development, but the problem of environmental pollution has become increasingly prominent.

In recent decades, environmental pollution has become a key factor restricting economic development. In the 1980s, the international community officially raised the issue of climate change for the first time, believing that the production of large amounts of greenhouse gases such as carbon dioxide from fossil fuels is the main cause of global climate change (Anjos et al., 2022; Jang et al., 2024). Only by working together can countries around the world jointly address this challenge. The market mechanism based on carbon emission trading has become a consensus as a new path for cooperation in solving greenhouse gas emissions problems. In 2011, China approved the pilot work of carbon trading in some provinces and cities, aiming to control greenhouse gas emissions by establishing a carbon trading market and conducting market trading based on greenhouse gas emission quotas. At present, the scale of quota trading volume in China’s pilot areas is second only to the European carbon market, and CTP has become an important means for China to promote enterprise emission reduction (Lv and Bai, 2021).

Industrial structure refers to the allocation and interdependence of resources between industries in a country or region during the process of social reproduction (Kuznets, 1957). It is generally believed that changes in industrial structure include two aspects: upgrading of industrial structure (UIS) and optimization of industrial structure (OIS) (Guan et al., 2022; Song et al., 2024). UIS refers to the process of transforming industrial structural systems from lower-level forms to higher-level forms. OIS refers to the coordination between various industries to maintain strong industrial structure transformation ability and good adaptability. Both UIS and OIS reflect the characteristics of changes in industrial structure. The difference lies in that UIS reflects the process of industrial structure evolution from lower to higher levels, such as the sequential transformation of industrial structure from labor-intensive to capital-intensive, and then to knowledge and technology-intensive, or the transformation from low value-added industries to high value-added industries, or the transformation from primary product industries to manufacturing intermediate and final product industries, which also means the continuous upgrading and innovation of traditional industrial production technology or the improvement of product technology content. OIS reflects the proportion balance and coordination degree between industries and reflects the efficiency of resource allocation, coordination, and utilization among industries. Under the constraints of productivity level and resource endowment, it is necessary to allocate production factors reasonably according to specific demand structures, achieve mutual coordination between industries, and maintain strong industrial structure transformation ability and good adaptability.

When the economy reaches a certain stage of development, UIS and OIS are crucial. Since the reform and opening up, relying on the development strategy of heavy industry first, China’s economy has made remarkable achievements in the world (Du et al., 2024). However, this mode of development has obvious characteristics of high pollution and extensive (Yu et al., 2020). High pollution not only aggravates the burden on the environment, but also makes the coupling degree between the input structure and output structure of factors low, resources are not effectively utilized, the transformation ability and adaptability of industrial structure are at a low level, and the economic growth is insufficient. Extensive development has resulted in a smaller share of industries with higher labor productivity, a lower level of industrial structure upgrading, and a lower quality of economic development. UIS and OIS are necessary processes for sustained economic growth and high-quality development in China (Xi and Zhai, 2022).

Can CTP, as an environmental regulatory tool, promote China’s UIS and OIS while reducing carbon emissions? UIS and OIS are obviously related to the environment. The reason why the current industrial structure is not optimized enough and needs to be upgraded is mainly because the industrial structure is highly polluted and extensive in economic development. An earlier study showed that the economic losses caused by environmental pollution accounted for at least 8 to 15% of the average annual GDP (World Bank report, 2007), which shows that there is still much room for improvement in UIS and OIS. CTP is directly aimed at the environment but may ultimately promote UIS and OIS, and UIS and OIS can better ensure the green nature of GDP. Under the incentive of CTP, enterprises can obtain new competitive advantages through the reallocation of resources, while enterprises at a competitive disadvantage may withdraw from the industry. The result of survival of the fittest makes the industry more coordinated to maintain strong industrial structure transformation ability and good adaptability. Some pollution-intensive enterprises may transfer to areas with low environmental standards in order to reduce environmental costs. This transfer not only increases the coordination between industries but also increases the adaptability between industries. CTP can also promote enterprises to develop advanced environmental protection technology through technological innovation to reduce costs, optimize internal production structure through advanced technology, and realize the upgrading of industrial structure. However, there are other possibilities. CTP has increased the product cost on the whole, and the enterprises in the industry are not adapted to the market at all, let alone the enhancement of conversion ability. Enterprises may also not have enough resources to mobilize for technological innovation, and the crowdsourcing transfer of many pollution-intensive enterprises may produce a synthetic fallacy. These circumstances may make CTP unable to promote UIS and OIS.

As the carbon trading market gradually expands, it is urgent to empirically understand the impact of CTP on China’s UIS and OIS. In relevant research fields, existing literature has mostly focused on the mechanism design of carbon trading, the emission reduction effects of CTP, and the impact of CTP on the economy. A small amount of literature has theoretically analyzed the impact of carbon trading environmental regulations on industrial structure, but there is almost no literature that studies the impact of China’s CTP on industrial structure from an empirical perspective and further explores the mechanism of this impact. Therefore, the research in this paper has important theoretical and practical significance.

Compared with the existing research, the contributions of this paper include the following three aspects. First, it is the first time to use the panel data of prefecture-level and above cities to study the impact of CTP on UIS and OIS. The sample size of panel data of cities at prefecture-level and above is larger, the data contains more information, and the practical characteristics of the impact of CTP on UIS and OIS can be more carefully captured. Secondly, it reveals the mechanism of the impact of CTP on UIS and OIS. In theory, both the “compliance cost hypothesis” and the “Porter hypothesis” indicate that CTP may promote UIS and OIS by promoting technological innovation, but this mechanism has not been verified empirically (Zhang and Duan, 2020; Porter and Linde, 1995). This study empirically found that CTP can promote UIS and OIS by promoting technological innovation. Thirdly, it expands the scope of research on the heterogeneity of the impact of CTP on UIS and OIS. The usual research on heterogeneity only discusses regional heterogeneity. This study not only studies regional heterogeneity but also studies the heterogeneity of urban characteristics in more detail. Characterized by human capital, financial expenditure, foreign investment, and infrastructure level, this study found that the role of CTP in promoting UIS and OIS is also different if the city characteristics are different.

Literature review

Economic development is faced with environmental constraints. The global climate warming caused by environmental pollution has external diseconomies. In order to achieve the goal of coordinating environmental protection and economic development, it is necessary to regulate economic activities based on environmental regulations. In economic activities, the irrational industrial structure or the low level of industrial operation may cause environmental problems. The government usually uses environmental regulation to regulate economic activities, hoping to promote UIS and OIS through environmental regulation, thus promoting economic growth and alleviating environmental pollution. As far as CTP is concerned, how to design the carbon trading mechanism, whether this mechanism design can reduce the level of carbon emissions, and what impact CTP will have on the economy are all issues worthy of attention. This paper will sort out these relevant documents. This paper aims to study the impact of CTP on UIS and OIS, and the mechanism of this impact. The literature in this area is the focus of this paper. The following is a literature review on these aspects.

The first is the literature on carbon trading mechanisms. The carbon trading mechanism is an environmental regulation based on market means to solve the problem of global climate change, and CTP is the core content (Shobande et al., 2024). The scope of the carbon trading mechanism is broader than that of CTP. Carbon assets were not commodities and had no significant development value. However, in order to address the issue of global climate change, countries jointly signed the Kyoto Protocol in 1997. According to the Kyoto Protocol, by 2010, the amount of six greenhouse gases emitted by all developed countries, including carbon dioxide, methane, etc., will be reduced by 5.2% compared to 1990. However, due to significant differences in energy utilization efficiency, energy structure, and adoption of new energy technologies between developing countries and developed countries, there are significant differences in emission reduction costs, which has led to the emergence of a carbon trading market (Oke et al., 2024). The carbon trading mechanism is a system that regulates the international carbon trading market, which includes mechanisms such as the clean development mechanism (CDM), joint implementation (JI), and emissions trading (ET).

The carbon trading mechanism regards carbon emission rights as a special commodity, and internalizes external costs through market-based means to guide enterprises to achieve emission reduction and promote low-carbon economic development (Chen and Mu, 2023). The key to the carbon trading mechanism is the allocation scheme of carbon emission rights among regions. One is to allocate carbon emission rights based on the current greenhouse gas emissions, the other is to allocate carbon emission rights based on the historical cumulative carbon emissions, and the other is to allocate carbon emission rights based on the carbon capital stock (Peng et al., 2023). However, no matter which allocation scheme is adopted, there may be mismatches. The mismatch of carbon emission rights may lead to adverse selection of enterprises. In order to eliminate the adverse selection of enterprises’ emission reduction from the mechanism design, it is possible to achieve better allocation efficiency by introducing the auction-paid allocation criteria into the carbon trading market (Chen et al., 2023). Zhou et al. (2021) believed that carbon emission quotas should be determined according to the impact of the carbon trading mechanisms on the competitiveness of different industries. Wang et al. (2024) believe that China’s carbon trading market has played a significant role in achieving emission reduction and environmental goals. In the future, we should speed up the improvement of carbon trading-related legislation, develop a multi-level carbon trading market, and pay attention to preventing the risk of quota overrun. In the context of the development of economic integration, the design of a cross-regional carbon emission coordinated governance mechanism has also received attention (Xie et al., 2019). At the micro level, the household carbon emission reduction incentive mechanism (Jia, 2023) and the establishment of an individual carbon trading market (Uusitalo et al., 2022) were included in the research horizon.

The second is the literature on the emission reduction effect of CTP. Generally speaking, the implementation of economic policies is usually affected by various external factors, and the policy effect is often uncertain. How about the emission reduction effect of CTP? At the initial stage of China’s carbon trading market pilot, scholars mostly focused on qualitative research, mainly involving the construction of a CTP performance evaluation index system and the practical problems in the implementation of CTP (Wu et al., 2016). With the continuous development of China’s carbon market, the research on CTP has begun to be quantitative, and this kind of research mainly focuses on the evaluation of the emission reduction effect of CTP. From different macro and micro levels, some scholars have empirically found that CTP has significant emission reduction effects and regional heterogeneity (Tan et al., 2022; Song et al., 2023). Liu et al. (2023) found that CTP can significantly improve the level of industrial carbon productivity, and can produce significant energy structure optimization effects. Fu (2024) believed that although CTP has significantly reduced carbon emissions and carbon intensity and has a significant emission reduction effect, its role in promoting carbon emission reduction is limited, and the market mechanism measured by the carbon price and market liquidity has no significant emission reduction effect. The development of some carbon markets in China is not perfect, the operation and pricing mechanism of the carbon market is not completely reasonable (Lin and Huang, 2022), the instability of carbon prices in the carbon market and the lack of liquidity of carbon trading products (Lyu et al., 2020; Lin and Jia, 2019), and a series of problems may weaken the positive impact of CTP in achieving the minimum social cost reduction. But on the whole, the emission reduction effect of CTP exists.

The third is the literature on the impact of CTP on the economy. CTP is an environmental regulation tool based on the property rights theory of the new institutional economics and taking carbon emissions trading as the core by means of marketization. Therefore, in addition to directly studying the impact of CTP on the economy, scholars have also studied the impact of the carbon emissions trading mechanism and environmental regulation on the economy. Wang et al. (2022) believe that CTP has significantly promoted the high-quality development of the economy, and there are significant regional differences in this promotion. Liu and Liu (2023) found that CTP has significantly promoted the innovative activities of enterprises to explore new knowledge, and the carbon quota allocation method has an important impact on the innovative activities of enterprises. The adoption of the intensity of the carbon quota allocation method is more conducive to the breakthrough innovation of enterprises, while the total carbon quota allocation method is more conducive to the progressive innovation of enterprises. Zhu et al. (2019) believe that CTP can have a positive impact on China’s economy by stimulating investment in low-carbon technology innovation, but this impact is heterogeneous at the micro level. Wang et al. (2024) constructed game models among manufacturers under different carbon trading models and found that when carbon quotas are within a certain range, various CTPs are beneficial to both original manufacturers and remanufacturers. This indicates that CTP has a positive incentive effect on micro-enterprises. Shi et al. (2023) studied the main exogenous shocks that caused China’s economic fluctuations under different carbon quota allocation modes and the mechanisms that affected China’s economic fluctuations and found that the factors that affected China’s economic fluctuations under different carbon quota allocation modes were different. Based on the research from the perspective of environmental regulation, the impact of environmental regulation on economic growth has a threshold effect on technological innovation (Wang, 2023; Chishti et al., 2023). Only when human capital is at a high level can environmental regulation exert its positive economic growth effect (Liu and Pan, 2024). The coordination of environmental regulation policies, on the whole, has significantly promoted high-quality economic development, but there is significant heterogeneity (Kou and Shi, 2024). However, some scholars believe that the economic effect of CTP is weak, and the “strong Poter hypothesis” of CTP on total factor productivity has not been shown (Zhang et al., 2023), and it has not significantly promoted the low-carbon technological innovation of enterprises and the long-term value of enterprises (Wang et al., 2024).

The last is the literature on the impact of CTP on industrial structure. In essence, the impact of CTP on industrial structure also belongs to the category of economic impact, but considering the purpose of this paper, the literature on the impact of CTP on industrial structure is specially reviewed. An earlier study showed that under the constraints of a low-carbon economy, the extensive economic development model of high pollution is not enough to absorb the impact of emission reduction, and technological progress and structural transformation are crucial to the sustained and stable growth of China’s economy (Zhao et al., 2022). Harris and Sunley (2023) also believe that promoting industrial restructuring is the only way to achieve low-carbon development. The theoretical analysis believes that environmental regulation contributes to the adjustment of industrial structure, and the research on the mechanism of environmental regulation affecting industrial structure has formed three theoretical views. The first is the “compliance cost hypothesis “, which holds that environmental regulation makes enterprises pay extra costs to occupy the production and R & D funds of enterprises, resulting in the reduction of the production efficiency and operating performance of enterprises, and then affects the entry and exit of enterprises through the survival of the fittest, making the industry structure compulsory “cleaning” (Yang et al., 2012; Zhang and Duan, 2020). The second is the “pollution refuge hypothesis”, which holds that pollution-intensive enterprises often transfer to regions with low environmental standards or low intensity of environmental regulations in order to avoid environmental regulations or reduce environmental costs. This transfer will eventually make the industrial structure of a country or region adjust in the direction of rationalization (Millimeter and Roy, 2016; Dou and Han, 2019). The third is the “Porter Hypothesis”, which believes that appropriate environmental regulations can encourage technological innovation of enterprises. Enterprises can optimize their internal production structure by developing advanced technologies that can meet environmental requirements and reduce production costs, resulting in an innovation compensation effect (Porter and Linde, 1995). Du et al. (2021) found empirically that China’s environmental regulation policy can promote the upgrading of industrial structure through the reverse force mechanism, which seems to confirm the “compliance cost hypothesis”. However, some scholars believe that environmental regulation measures have not yet achieved the Potter effect in China, that is, environmental regulation has not achieved UIS and OIS through technological innovation (Nie et al., 2021).

As an environmental regulation tool, CTP has achieved positive results in promoting industrial structure adjustment (Chen et al.,2024). Jia et al. (2024) believe that changes in energy structure have driven the development of China’s industrial system towards the low-carbon direction. Therefore, the establishment of the carbon trading market is conducive to the regional transfer of high energy consumption and high-emission industries, thus increasing the coordination between industries and improving the transformation ability of industrial structure (Tang et al., 2016). Song and Kong (2018) found that carbon emissions trading volume has a significant positive impact on industrial structure changes, indicating that the development of the carbon emissions trading market can promote the optimization of regional economic structure. Liu and Cheng (2022) believe that carbon emissions trading can effectively promote the upgrading of regional industrial structure, but it is not conducive to the rationalization of regional industrial structure. The industrial structure optimization and upgrading effect of carbon emissions trading has obvious regional heterogeneity.

Through the aforementioned literature review, it was found that existing literature has conducted in-depth research on CTP from multiple perspectives, which can provide a reference for this article. However, the existing literature on the impact of CTP on industrial structure is not systematic and in-depth, especially the empirical research needs to be further deepened. For example, Du et al. (2021), Nie et al. (2021) and other studies involved industrial structure, but based on broader environmental regulations, there was no specific CTP, and the research conclusions were quite different. Two more relevant documents are the research of Song and Kong (2018), Liu and Cheng (2022). The former involves industrial structure but mainly focuses on economic structure, while the latter only uses provincial panel data to limit the scope and depth of the research. Based on the panel data of cities at the prefecture level and above, this study has more advantages in feature capture, mechanism recognition, and heterogeneity research.

Model and data

Benchmark model

Based on the literature analysis mentioned above, it can be seen that CTP has a significant impact on industrial structure, but it is not entirely clear whether they have promoted UIS and OIS. The traditional view is that CTP, due to increasing corporate costs, has a negative impact on improving productivity and competitiveness, which may inhibit UIS and OIS (Dai et al., 2018; Zhang and Duan, 2020). The opposite of the Porter hypothesis suggests that CTP can encourage companies to engage in more innovative activities, which will increase productivity and offset the increase in costs caused by environmental protection, thereby enhancing the profitability of companies in the market and promoting UIS and OIS. There may also be another situation where companies pay additional costs to comply with CTP, which squeezes out production and research and development funds, leading to a decrease in production efficiency and operational performance. Such a portion of enterprises have been eliminated, and the industrial structure has been optimized. In addition, from the perspective of industrial transfer, CTP may also encourage pollution-intensive enterprises to transfer to areas with lower environmental standards in order to reduce environmental costs, which may lead to a rationalization of industrial structure.

Carbon trading entities include key emitting enterprises in industries such as electricity, steel, cement, construction, papermaking, and petrochemicals. CTP may achieve UIS and OIS through mechanisms such as cost constraints, innovation incentives, factor substitution, and consumption upgrading. CTP significantly increases the carbon emission cost of high-carbon industries, and low-carbon industries will gradually replace some of their shares due to their cost advantages. This will force high-carbon industries to carry out energy-saving and emission-reduction transformation, thereby promoting overall UIS and OIS. CTP can encourage enterprises to rationally allocate resources in research and development and operation, strengthen the cultivation of technological research and innovation capabilities, increase profits and enhance core competitiveness by selling remaining carbon quotas, and ultimately achieve UIS and OIS (Zhou and Wang, 2022). CTP can also optimize industrial structure through factor substitution. On the one hand, when a company reduces the use of traditional carbon-containing resources, it will inevitably reduce the market’s consumption and demand for such mineral resources, thereby easing the pressure on their mining upstream of the industrial chain; On the other hand, market-oriented carbon prices and quota trading mechanisms change the energy consumption structure of emission control enterprises by influencing their factor inputs, thereby promoting the green transformation of high-emission enterprises. Consumption upgrading may also be a mechanism by which CTP promotes UIS and OIS. Consumption upgrading promotes the flow of funds into energy-saving industries, and under the multiplier effect of funds, the industrial structure develops towards rationalization (Zhao et al., 2022).

In order to examine the impact of CTP on UIS and OIS, and to answer whether CTP can promote UIS and OIS, this paper uses the dual-difference (DID) model for empirical research. The DID model can obtain the net effect of policy implementation through the difference in time trend before and after policy implementation and the difference of policy implementation between the experimental group (pilot area) and the control group (non-pilot area) after effectively removing the unobservable heterogeneity factors. This method is a “quasi-natural experiment” method (Angrist and Pischke, 2018). Specifically, the cities under the jurisdiction of the pilot provinces are taken as the experimental group, and the other cities are taken as the control group. The fixed effects are estimated by setting the interactive dummy variables of whether the policy occurs or not. This design can not only alleviate the bias caused by missing variables to a certain extent but also effectively avoid endogenous problems caused by reverse causality, so as to more accurately estimate the net effect of policy implementation (Lv and Bai, 2021). The benchmark empirical model of this paper is set as follows:

Where i and t represent cities and years, respectively. The variable Upgradei,t represents the level of UIS and OIS. treati is a virtual variable of the city, with a value of 1 or 0. The variable postt is a dummy variable of time. If t is the implementation of the policy in 2011 and later, the value postt is 1, and the value of other years is 0. Xi,t are control variables, which refer to other important factors affecting UIS and OIS besides CTP. ηt is the time-fixed effect, μi is the urban fixed effect that does not change with time, and εi,t is the random error term. The coefficient β of the interaction term treat×post is the focus of the paper. It reflects the net effect of CTP on the optimization and upgrading of the regional industrial structure after the double difference.

Variable selection

Explained variable

Upgrade is the dependent variable, representing the levels of UIS and OIS. UIS is measured by the advancement of industrial structure, and OIS is measured by the rationalization of industrial structure (Lin and Liao, 2023).

The variable SA represents the level of the advancement of industrial structure, defined as the product of the proportion of output in each industrial sector and labor productivity (Liu et al., 2008). The specific formula is as follows:

Where m represents the three major industries, with values ranging from 1 to 3. Y represents total output, LP labor productivity. The larger SA, the higher the UIS level, while the smaller SA, the lower the UIS level. Considering that the labor productivity LP in formula (2) has dimensions and the proportion of output value is a dimensionless index, it needs to be standardized. The formula is as follows:

Where \(L{P}_{i,m,t}^{N}\) represents the standardized labor productivity of the m industry after the completion of industrialization. The meaning of LPi,m,t is the same as before. LPmb is the labor productivity of m industry at the beginning of industrialization, and LPmf is the labor productivity of m industry at the completion of industrialization.

The variable SR represents the level of the rationalization of industrial structure. Under the constraints of productivity level and resource endowment, it is necessary to allocate production factors reasonably according to the specific demand structure to achieve mutual coordination among industries to maintain strong industrial structure transformation ability and good adaptability. Therefore, the coupling degree between the input structure and the output structure is crucial, which reflects the rationalization level of the industrial structure. This coupling degree is usually measured by the structural deviation degree. However, one disadvantage of the structural deviation degree is to treat the importance of each industry in the economy equally, and it may be more common to not consider the unbalanced phenomenon in the economy. For this reason, some researchers introduced the Theil index into the structural deviation degree to measure SR (Gan et al., 2011). This not only considers the coupling relationship between the input structure and the output structure, but also considers the unbalanced phenomenon in the economy. This study follows this approach, and the specific formula is as follows:

Where yi,m,t represents the proportion of the total output of i city m industry in year t to the gross regional product and Li,t represents the proportion of the employees in the total employment of i city in t year. If SR is 0, it indicates that the industrial structure has achieved an equilibrium state. If it is not 0, it indicates that the industrial structure deviates from the equilibrium state. The smaller SR value, the smaller the deviation between the industrial structure and the equilibrium state, and the higher the OIS. SR is an inverse indicator for OIS.

Explanatory variable

The explanatory variable is CTP, represented by treat× post. It is a dummy variable with 2011 as the point of policy impact. If a city is affected by CTP in 2011 or later, then treat×post=1, otherwise it is 0.

Control variable

In the empirical model (1), X represents a series of control variables, and λ is the coefficient of each control variable. The selection and measurement of control variables refer to relevant literature and consider the supply and demand factors that drive UIS and OIS (Lyu et al., 2023; Pan et al., 2023). Six control variables are selected in this study, which are: human (human capital), expressed by the proportion of the number of students in higher education in the total urban population; gov(government expenditure), expressed by the proportion of government public expenditure in urban GDP; pgdp(level of economic development) is expressed by the proportion of urban GDP to the total urban population; urban (urbanization level), expressed as the logarithm of the total urban population divided by the urban area; fdi (foreign investment) is expressed by the proportion of the total amount of FDI actually utilized to the urban GDP; instr(infrastructure) is expressed by dividing the urban road area by the total urban population. Among them, human, gov, fdi, and instr are also used to analyze the heterogeneity of urban characteristics. The details of each variable definition are presented in Table 1.

Intermediary variable

Referring to other relevant studies (Hayes., 2009; Ma et al., 2024), this study uses a mediation effect model to identify the mechanism by which CTP affects UIS and OIS. Patent (technological innovation) is used as a mediator variable, measured by the number of urban patent applications (Liu et al., 2023). The measurements for all variables are presented in Table 1.

Data source and description statistics

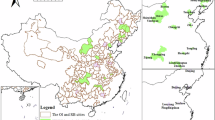

The panel data of 201 prefecture-level and above cities in China (including 33 pilot cities) from 2004 to 2018 were selected as the research samples, with a sample size of 3015. The data were sourced from the China Urban Statistical Yearbook and some prefecture-level city statistical annual reports, and all value variables were processed with 2004 as the base period (Brandt et al., 2012). The descriptive statistics of each variable are shown in Table 1.

Benchmark model estimation results and robustness test

Estimation results of the benchmark model

Table 2 shows the estimated results of model (1). Columns (1)–(3) in Table 2 reflect the estimated results of the impact of CTP on UIS. When no control variables are added, the coefficient of the CTP variable treat×post is 0.178, which is significant at the 1% statistical level; After adding the control variable, the coefficients of treat × post are 0.202 and 0.185, respectively, under the two different conditions of fixed individuals or fixed time, which are significant at the statistical level of 1%, and the coefficient value increases. This shows that CTP has a significant positive impact on UIS, and the overall explanatory power of the model is enhanced after adding control variables. Therefore, CTP can promote UIS.

Columns (4)–(6) in Table 2 reflect the estimated results of the impact of CTP on OIS. It can be seen that the coefficients of treat×post are all negative and consistent with expectations, but the coefficients are not completely statistically significant. When no control variable is added, the coefficient of treat×post is negative 0.003, but it is not significant at the given statistical level; After adding the control variable, the coefficient of treat×post is negative 0.006, which is significant at the statistical level of 5%, and the absolute value of the coefficient increases when the individual and time are fixed at the same time. Although the estimated results are not perfect, the model still has some explanatory power. CTP can promote OIS to a certain extent, and the explanatory power of the model has increased after adding control variables.

From the perspective of the benchmark model estimation results, the coefficients of treat×post are all consistent with expectations. When individuals and time are fixed at the same time, the coefficients of treat×post are at least significant at the statistical level of 5% after adding control variables. Therefore, in general, CTP can promote UIS and OIS, but there is a significant difference between promoting UIS and OIS. CTP is more conducive to promoting UIS, which may also be the practical characteristics of the impact of CTP on UIS and OIS.

What needs further explanation is why the impact of CTP on OIS is weaker than that on UIS. OIS involves the rational allocation of resources and the coordination among industries. China’s carbon trading market has not yet fully developed and matured. The incomplete market mechanism and imperfect legal system make the resource allocation in the pilot area unreasonable (Wang et al., 2024). In addition, there is a lack of awareness of cooperation among enterprises and a low degree of inter-industry correlation (Lin and Jia, 2019). In the process of industrial structure adjustment, the adverse effects of these factors have weakened the role of CTP in promoting OIS, and the offset of adverse effects has led to the weaker role of CTP in promoting OIS than in promoting UIS.

The estimated results of the control variables show that in terms of UIS, the coefficients of human, pgdp, urban and instr are significantly positive, while the coefficients of gov and fdi are significantly negative. In terms of OIS, the coefficients of human and fdi are significantly positive, while the coefficients of gov and pgdp are significantly negative. This also further reflects that there are differences between UIS and OIS.

Dynamic effect test

One prerequisite for using the DID model is that there is no significant difference between the experimental group and the control group before the implementation of the policy, that is, there is a parallel trend between the experimental group and the control group before the occurrence of the policy. Therefore, it is necessary to test the parallel trend of CTP affecting UIS and OIS. In addition, the above-estimated results reflect the average impact of CTP on UIS and OIS in the pilot area. Over time, the impact of the CTP pilot on UIS and OIS may change accordingly. Therefore, it is necessary to further investigate the dynamic effects of CTP to reflect the differences in the effect of the pilot policy in different time periods. Using the methods of Xu and Cui (2020) for reference, the following model (5) is constructed to test the dynamic effects of CTP:

Where, post04 represents a time dummy variable. If it is in 2004, it takes a value of 1, otherwise it takes a value of 0. The remaining 13 times dummy variables, such as post05, are all assigned this value and the values of other variables are the same as those of Eq. (1). The base year is 2010, the year before the implementation of CTP.

The value and test results of coefficient β can be obtained by estimating the model (5). Figure 1 shows the dynamic effect diagram of coefficient β change at 95% confidence. From Fig. 1, it can be seen that the interaction coefficient β is not significant before and after the implementation of CTP, indicating that there is no significant difference between the experimental group and the control group. The parallel trend assumption of double difference is satisfied, and the above estimation of the model (1) is effective. Further, from Fig. 1a of the dynamic effect of CTP to promote UIS, it can be seen that the value of β coefficient began to be significant and gradually increased since 2013, which indicates that the impact of the CPT pilot on the industrial structure in 2011 lagged for two years, and the role of CTP in promoting UIS gradually increased. It can be seen from Fig. 1b of the dynamic effect of OIS that the value of β coefficient gradually becomes negative after 2014, which indicates that the inhibition effect of CTP on the deviation of industrial structure from the equilibrium state begins to appear, and the time lag period of CTP on OIS is longer. In general, the implementation of CTP has a more obvious role in promoting UIS than in OIS.

Robustness test

Placebo test

Sampling 1000 times from 201 cities, 33 cities were randomly selected as virtual pilot cities each time, and the remaining 168 cities were used as control cities. By re-estimating model (1), the kernel density distribution Figure of the two explained variables SA and SR can be obtained as shown in Fig. 2. It can be seen from Fig. 2 that t-test values of most of the sampling estimates are between ±2, and most of the P-values are above 0.1, which indicates that CTP has no significant effect in the 1000 random samples, indicating that other unknown factors have a little causal relationship with the impact of CTP on UIS and OIS of the pilot cities.

Propensity score matching-double difference test (PSM-DID)

According to the PSM-DID method, the common support hypothesis is first tested, and the results show that the hypothesis is satisfied, and then the kernel matching method is used for estimation. Figure 3 shows the density function of propensity scores before and after matching. It can be seen from Fig. 3 that after matching, the probability density of the tendency scores of the experimental group and the control group has been relatively close, and the matching effectiveness is good.

Further, columns (1) and (2) of Table 3 present the PSM-DID estimation results. It can be seen from Table 3 that the estimated results of PSM-DID are basically consistent with those of Table 2, indicating that the model’s estimation is robust, which further supports the above empirical conclusion that CTP has promoted UIS and OIS.

Delete the sample value test for the pilot year

Delete the observations from all provinces in 2011 and re-estimate the model. The results are shown in columns (3) and (4) of Table 3. It can be seen from this that the coefficient of interaction terms is still significant at the level of at least 5%, which again shows that the conclusion that CTP promotes UIS and OIS is robust.

Further analysis

Mechanism analysis

This paper empirically finds that CTP can promote UIS and OIS. In order to lead the research to depth, it is necessary to further study the transmission mechanism behind this. This paper will further explore the transmission mechanism of CTP promoting UIS and OIS from the perspective of technological innovation. In theory, the “compliance cost hypothesis” and the “Porter hypothesis” both predict that CTP may promote UIS and OIS by promoting technological innovation. On the one hand, CTP makes enterprises pay extra compliance costs to squeeze out the production and R&D expenditure of enterprises. The lack of expenditure will affect the speed of technological innovation of enterprises. The conversion of competitive advantages and disadvantages may lead to the withdrawal of the enterprise or the entry of other enterprises, and the industrial structure will have to be adjusted compulsorily. On the other hand, CTP can change the industrial structure by encouraging technological innovation of enterprises and generating an innovation compensation effect. In reality, the mechanism design of the carbon trading market allows enterprises to have a certain amount of free emission quota, while allowing free transfer of emission rights on the premise of complying with the provisions of the law. For high-polluting enterprises, after consuming their own emission quotas, they also need to purchase the excess part in the carbon trading market, otherwise they will face economic penalties, which will lead to an increase in the production costs of enterprises. For enterprises with advantages in production technology and technology research and development, after the implementation of the policy, the surplus quota can be sold on the market to obtain profits. High-polluting enterprises under the pressure of cost are forced to make technological innovations to alleviate the pressure of emissions. Enterprises with technological and R & D advantages are encouraged by profits to further carry out production technology R & D to improve the level of technological innovation and obtain more surplus quotas (Cai and Ye, 2022).

In the empirical aspect, the existing research has focused on the impact of CTP on technological innovation and the impact of technological innovation on industrial structure but failed to combine CTP, technological innovation, and industrial structure to examine the mechanism of CTP promoting UIS and OIS. In terms of the impact of CTP on technological innovation, the existing research believes that the establishment of a carbon emission trading pilot has promoted the level of low-carbon technological innovation (Liu et al., 2015), CTP has promoted breakthrough innovation activities of enterprises (Liu and Liu, 2023), CTP has promoted low-carbon technological innovation investment (Zhu et al., 2019), and similar research also includes Jia et al. (2024). In terms of the impact of technological innovation on industrial structure, the existing research believes that UIS and OIS based on technological innovation is an important way of economic growth (You and Zhang, 2022), and technological innovation affects UIS and OIS through three driving forces of technological diffusion, product demand and factor allocation (Zou, 2024). Zhang and Liu (2022) believe that technological innovation has a significant role in promoting UIS and has a positive spatial spillover effect. Today, with the development of digital technology, digital technology integration and innovation will help o UIS and OIS for a long time (Wang et al., 2024).

On the basis of existing research, combining CTP, technological innovation, and industrial structure, empirical research on whether CTP promotes UIS and OIS through technological innovation is not only a test of theory but also a concern for reality. Using the method of Hayes (2009) for reference, build a mediation effect model including three models, and identify the aforementioned transmission mechanism through the overall judgment of the coefficient of the model interaction terms. The specific settings are as follows:

The meaning of each variable in the model is the same as before. The test steps and judgment rules of intermediary effect are as follows: The first step is to test the coefficient α1 which represents the total effect of CTP. If α1 is significant, continue; otherwise, stop testing. The second step is to test the coefficients θ1 and ξ. If both are significant, then the indirect effect is significant, proceed to the fourth step; If at least one coefficient is not significant, proceed to the third step. The third step is to use the Bootstrap method for testing. If significant, the indirect effect is significant. This can proceed to the fourth step, otherwise the test will be stopped. Step four, test the coefficient γ1. If it is not significant, i.e., the direct effect is not significant, then there is only a mediating effect; If significant, that is, the direct effect is significant, proceed to the fifth step. Step five, see the symbols of θ1*ξ and γ1. If the symbols are the same, there is a partial mediating effect; If there is a different symbol, it belongs to the masking effect.

Table 4 reports the estimation and test results of the intermediary effect models (6), (7) and (8). Through these results, we can determine whether the variable Patent has an intermediary effect in CTP to promote UIS and OIS. If there is an intermediary effect, it can be considered that the mechanism of CTP promoting UIS and OIS through technological innovation is established.

First of all, we will examine whether there is an intermediary effect of technological innovation in promoting UIS through CTP. It can be seen from column (1) of Table 4 that the coefficient of the interaction item treat×post is 0.185 and is significant at the statistical level of 1%, indicating that CTP has a significant impact on UIS. It can be seen from column (3) that the coefficient of treat×post is 7.582 and is significant at the statistical level of 1%, indicating that CTP has a significant impact on technological innovation. It can be seen from column (4) that the coefficients of treat×post and the technological innovation variable Patent are 0.088 and 0.013, respectively, and both are significant at the statistical level of 1%, indicating that CTP and technological innovation variables have a significant impact on UIS. According to the judging rules for testing the intermediary effect, technological innovation has an intermediary effect in CTP to promote UIS. CTP can promote UIS by promoting technological innovation.

Then we will examine whether technological innovation has an intermediary effect in promoting OIS through CTP. It can be seen from column (2) of Table 4 that the coefficient of treat×post is negative 0.006 and is significant at the statistical level of 5%, indicating that CTP has a significant impact on OIS. The test results of column (3) show that CTP has a significant impact on technological innovation. It can be seen from column (5) that the coefficient of treat×post is negative 0.006 and significant at the statistical level of 5%, but the coefficient of technological innovation variable Patent is not statistically significant. According to the judging rules of intermediary effect, it can not be determined that there is an intermediary effect in technological innovation, but it can also not be determined that there is no intermediary effect in technological innovation. Therefore, further tests are needed. The bootstrap sampling method is used to test whether there is an intermediary effect. Through 500 bootstrap sampling, the 95% confidence interval is (0.007,0.013), which does not contain 0, and the probability value P of the two-tailed test is 0.000. It can be seen that technological innovation has an intermediary effect in the process of CTP promoting OIS, and CTP can promote OIS by promoting technological innovation.

To sum up, CTP can promote UIS and OIS. In terms of the promotion mechanism, CTP can promote the development of UIS and OIS by promoting technological innovation. Technological innovation has an intermediary effect.

Heterogeneity analysis

Heterogeneity means that some things are different in some characteristics. When studying the impact of one variable on another variable, further investigation of the heterogeneity of the impact after clarifying the impact relationship will help to understand the impact more deeply and carefully. This study found that CTP can generally promote UIS and OIS. However, due to significant differences in economic development level, resource endowment, industrial structure, and other aspects among different regions, these differences may lead to heterogeneity in CTP when promoting UIS and OIS. Capturing this heterogeneity through relevant data is not only the need of empirical research but also helpful to put forward targeted differentiation policy recommendations. The heterogeneity analysis based on regional and urban characteristics in this paper is a further deepening of the research on the impact of CTP on UIS and OIS.

Analysis of regional heterogeneity

Based on Jin and Xu (2024), this paper divides China into the Eastern region and the Central and Western regions. Therefore, the regional heterogeneity analysis model of the impact of CTP on UIS and OIS is constructed as follows:

Where Did is the interaction term treat in model (1). locationk is a location level variable with a value of 1 or 0. k represents the city type, with a value of 1 or 2, where 1 represents the eastern city and 2 represents the central and western cities. The interaction coefficient β reflects the regional heterogeneity of the impact of CTP on UIS and OIS. The estimated results are reported in Table 5.

From the coefficient of interaction item Did×location in Table 5, it can be seen that CTP has significantly promoted UIS of the eastern developed cities (as shown in columns (1) and (2)), both with and without control variables. However, in central and western cities, the impact of CTP on UIS is not significant (as shown in columns (3) and (4)). The eastern developed cities have a high level of industrialization. After the implementation of CTP, the location advantages of technology and capital promote enterprises to further innovate technology, improve labor productivity, and then promote the industrial structure of the eastern developed cities to develop in an advanced direction. The proportion of industries with high energy consumption and high pollution in the central and western regions is still large. The implementation of CTP has put forward higher requirements for the level of pollution control technology in the central and western regions. The high cost of pollution control may have a restraining effect on the advanced development of the industrial structure.

It can also be seen from Table 5 that CTP has not significantly promoted OIS of the eastern developed cities (as shown in columns (5) and (6)). However, for central and western cities, the implementation of CTP can promote OIS (as shown in (7) and (8)). The reason for this situation may be that the industrial structure of developed cities in the eastern region is already relatively reasonable, and the effect of CTP on further rationalizing their industrial structure is relatively weak. However, for the central and western regions, due to the large space for further improvement in OIS, when there are new situations where dominant industries or new technology industries strengthen the degree of correlation between industries, CTP more clearly promotes OIS in the region.

Heterogeneity analysis on urban characteristics

After discussing regional heterogeneity, this paper further explores the urban characteristic heterogeneity of CTP to promote UIS and OIS. The analysis of urban characteristics heterogeneity is the refinement of regional heterogeneity analysis and is more detailed in perspective. Referring to Shi et al. (2018), the four variables of human, gov, fdi, and instr are used to describe the urban characteristics. Cities are divided into low-level and high-level categories according to the value of each variable. The classification rules are as follows: first, they are sorted according to the value of each variable from small to large, then they are divided into first-class groups, second-class groups, and third-class groups according to the value of each variable from small to large, and finally, the first-class groups are classified as low-level categories, and the second-class and third-class groups are classified as high-level categories. For example, according to the classification of human capital, cities will be divided into low human capital cities and high human capital cities; If classified by fiscal expenditure, cities will be divided into two categories: low fiscal expenditure cities and high fiscal expenditure cities, and the rest are the same. Group regression based on model (1) is conducted, and the results are shown in Tables 6 and 7.

First, by comparing the coefficient of interaction item treat×post in the two columns of human variable in Tables 6 and 7, it can be seen that in cities with high human capital, CTP has a more significant role in promoting UIS and OIS (the interaction coefficient is 0.225 and −0.012, respectively), which shows that human capital plays an important role in promoting UIS and OIS by CTP. UIS and OIS depend on advanced technology, and the development and acquisition of advanced technology have a certain threshold. Workers with higher education levels find it relatively easy to learn these technologies, while workers with lower education levels find it relatively difficult to master and use technologies in a short time.

Secondly, by comparing the coefficient of interaction item treat×post in the two columns of gov variable in Table 6 and Table 7, it can be found that in cities with high fiscal expenditure, CTP has promoted UIS (interaction coefficient is 0.326), and in cities with low fiscal expenditure, CTP has promoted OIS (interaction coefficient is −0.008), This reflects that there are significant differences between fiscal expenditure policies and CTP in promoting UIS and OIS.

Third, by comparing the coefficient of interaction item treat×post in the two columns of fdi variable in Table 6 and Table 7, it can be seen that compared with the cities with low foreign investment, CTP in the cities with high foreign investment has a smaller effect on promoting UIS and OIS (interaction coefficient: 0.146 is less than 0.225, and the absolute value of −0.008 is less than the absolute value of −0.011). The reason for this phenomenon may be the balance between the long-term and short-term benefits of foreign capital. Foreign capital is unwilling to invest in emissions reduction which will take a long time. Therefore, in cities with high levels of foreign investment, the effect of CTP to promote UIS and OIS has not been fully played. It may also be the quality problem of introducing foreign capital. Only by introducing high-quality and cost-effective foreign capital can it drive UIS and OIS under the guidance of CTP.

Fourth, by comparing the coefficient of treat×post in the two columns of instr variable in Table 6 and Table 7, it can be found that compared with low-infrastructure cities, CTP in high-infrastructure cities has a greater effect on promoting UIS and OIS (interaction coefficient: 0.214 is greater than 0.176, and the absolute value of −0.006 is greater than the absolute value of −0.001). A city with better infrastructure is more conducive to the flow of capital, labor, and other factors of production, and the city’s scientific and technological strength may also be stronger. So, UIS and OIS are more likely to be realized under the guidance of CTP.

To sum up, in the process of CTP promoting UIS and OIS, there are significant differences in the size of the boosting effect due to differences in urban characteristics, which shows obvious heterogeneity based on urban characteristics.

Conclusions and policy implications

Conclusions

Under the realistic background that China’s economy has entered a high-quality, green, and low-carbon development, this paper uses the panel data of 201 prefecture-level and above cities in China from 2004 to 2018 and empirically studies the impact of CTP on UIS and OIS based on the DID model and the intermediary effect model. The purpose is to empirically test the boosting effect and mechanism of CTP on industrial structure and to examine the heterogeneity of the boosting effect.

On the whole, CTP can promote UIS and OIS. But compared with promoting OIS, CTP is more helpful to promote UIS. After a variety of robustness tests, the conclusion is still valid. The mechanism analysis found that CTP can promote UIS and OIS by promoting technological innovation, and technological innovation has an intermediary effect in CTP promoting UIS and OIS. In the new context, technological innovation has become the key path of CTP promoting UIS and OIS.

Further, the heterogeneity analysis found that there are regional heterogeneity and urban characteristics heterogeneity in CTP to promote UIS and OIS. In terms of regional heterogeneity, it is found that CTP has promoted UIS in the eastern region, but the impact on UIS in the central and western regions is not significant. CTP has no significant impact on OIS in the eastern region but has boosted OIS in the central and western regions. In terms of the heterogeneity of urban characteristics, it is found that in cities with high human capital, CTP plays a more significant role in promoting UIS and OIS. CTP in cities with high fiscal expenditure can promote UIS, and CTP in cities with low fiscal expenditure can promote OIS. In cities with high foreign investment, CTP has less effect on promoting UIS and OIS. In high-infrastructure cities, CTP has a greater effect on promoting UIS and OIS.

Policy implications

First, in the high-quality and green development of the economy, China must fully leverage the decisive role of market mechanisms. the high-quality development of the economy requires the industrial structure to develop from low to high, and the industrial structure is more optimized and reasonable. How to optimize and upgrade without increasing the environmental burden is the key to the green development of the economy. In the past, the carbon emissions of various regions and industries were generally controlled and constrained by administrative means. The implementation of CTP introduced the market mechanism into the field of environmental protection and optimized the allocation of carbon emissions of enterprises by market means. The research results of this paper provide empirical evidence for the feasibility of high-quality green development of China’s economy and also provide empirical interpretation for the rationality of the direction of carbon trading marketization reform.

Second, in formulating environmental regulatory policies, the government should pay special attention to their guiding role in enterprise technological innovation. The inducement factors of enterprise technological innovation are diverse, and CTP is one of many factors. This study found that CTP promotes UIS and OIS by guiding the technological innovation of enterprises, and technological innovation plays an intermediary role. With the establishment of the carbon trading market, the green and low-carbon energy consumption of high-emission industries has an endogenous power, and the carbon market has given enterprises continuous innovation incentives. Therefore, when formulating environmental regulation policies, the government should firmly grasp the key of technological innovation and take whether the environmental regulation policies can guide enterprises to actively carry out technological innovation as an important consideration.

Third, when formulating industrial policies, the government should fully consider the regional heterogeneity of the impact of CTP on industrial structure. The regional heterogeneity of the impact of CTP on industrial structure requires the government to take full account of the different impacts of CTP on enterprises in different industries in the eastern central and western regions when formulating industrial policies. The government must formulate customized strategies for UIS and OIS and corresponding policies and measures according to the actual industrial development status and comparative advantages of different regions, and respect the differences of different regions in UIS and OIS.

Fourth, In the allocation of urban resources, the government must fully consider the heterogeneity of urban characteristics in the impact of CTP on industrial structure. In order to maximize the boosting effect of CTP on UIS and OIS, it is necessary to reasonably allocate various resources from the perspective of carbon. For example, the government can increase the financial expenditure to ensure low-carbon technology breakthroughs in cities with low and medium economic development, and then improve the energy conservation and emission reduction technology of cities; The government can encourage and attract high-quality green and low-carbon foreign investment, and then drive the development of green technology in cities.

Research prospect

Terms such as climate change, low-carbon living, low-carbon economy, and green development have only gradually appeared in people’s lives in recent decades, but when people feel it, climate problems have become very serious. CTP, as an environmental regulatory tool to address climate change, promote green development, and promote harmonious coexistence between humans and nature, will inevitably have an impact on industries in economic development. This article empirically studies the impact and mechanism of carbon trading policies on industrial structure. However, due to various circumstances, this study inevitably has limitations. Future research can be conducted from the following three aspects.

Firstly, measure the industrial structure using other methods and examine the impact of CTP on the industrial structure. At present, the measurement of UIS and OIS are based on the traditional division of three industries, and this study is no exception. The theoretical basis of this division fundamentally stems from the evolution law of industrial structure described by the early Petty-Clark law. However, with the rapid development of high-tech such as information technology, the scale and methods of human industrial activities have undergone tremendous changes. The use of industrial structure measurement methods that take into account these changes in future research will be an extension of this study.

Secondly, in mechanism analysis, more factors can be considered than just technological innovation, although technological innovation may be a key factor. This article mainly examines the mechanism of the impact of carbon trading policies on industrial structure from the perspective of technological innovation and does not involve other possible mechanism factors. Therefore, further research is needed to examine whether other factors have a mediating effect in promoting UIS and OIS through CTP.

Finally, this paper is only based on data from China, and in the future, a comparative study of the impact of CTP between countries on industrial structure can be conducted based on data from more countries. Climate issues are a global issue, and carbon trading involves global markets. Research based on a global perspective will make the research more comprehensive and also be a natural extension of this study.

Data availability

All data used in the study have been provided in the supplementary materials.

References

Angrist JD, Pischke JS (2018) Mostly harmless econometrics: an empiricist’s companion. Princeton University Press, Princeton

Anjos MF, Feijoo F, Sankaranarayanan S (2022) A multinational carbon-credit market integrating distinct national carbon allowance strategies. Appl Energy 319(1)):119181. https://doi.org/10.1016/j.apenergy.2022.119181

Brandt L, Johannes VB, Zhang YF (2012) Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J Dev Econ 97(2):339–351. https://doi.org/10.1016/j.jdeveco.2011.02.002

Cai WG, Ye PY (2022) Does carbon emission trading improve low-carbon technical efficiency? Evidence from China. Sustain Prod Consum 29:46–56. https://doi.org/10.1016/j.spc.2021.09.024

Chen WQ, Liu YH, Liu Y (2024) Exploring the spatial spillover effects of climate mitigation policies on the upgrading of industrial structure: Evidence from 31 provinces of China. Environ Chall 16:100963. https://doi.org/10.1016/j.envc.2024.100963

Chen XQ, Ma CQ, Ren YS, Lei YT (2023) Carbon allowance auction design of China’s ETS: A comprehensive hierarchical system based on blockchain. Int Rev Econ Financ 88:1003–1019. https://doi.org/10.1016/j.iref.2023.07.053

Chen Y, Mu HZ (2023) Natural resources, carbon trading policies and total factor carbon efficiency: A new direction for China’s economy. Resour Policy 86:104183. https://doi.org/10.1016/j.resourpol.2023.104183

Chishti MZ, Nadia A, Calvin WH (2023) Exploring the time-varying asymmetric effects of environmental regulation policies and human capital on sustainable development efficiency: a province level evidence from China. Energy Econ 126:106922. https://doi.org/10.1016/j.eneco.2023.106922

Dai Y, Li N, Gu RR, Zhu XD (2018) Can China’s carbon emissions trading rights mechanism transform its manufacturing industry? Based on the perspective of enterprise behavior. Sustainability 10(7):2421. https://doi.org/10.3390/su10072421

Dou JM, Han X (2019) How does the industry mobility affect pollution industry transfer in China: Empirical test on Pollution Haven Hypothesis and Porter Hypothesis. J Clean Prod 217:105–115. https://doi.org/10.1016/j.jclepro.2019.01.147

Du KR, Cheng YY, Yao X (2021) Environmental regulation, green technology innovation, and industrial structure upgrading: the road to the green transformation of Chinese cities. Energy Econ 98:105247. https://doi.org/10.1016/j.eneco.2021.105247

Du WH, Wei Y, Naeem MA (2024) Solid mineral development and Chinese economic growth: role of technological advancement. Resour Policy 95:105139. https://doi.org/10.1016/j.resourpol.2024.105139

Fu XS (2024) Impacts of the pilot policy for carbon emissions trading on pollution reduction in China. J Clean Prod 6(12):142878. https://doi.org/10.1016/j.jclepro.2024.142878

Gan CH, Zheng RG, Yu XF (2011) An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ Res J 46(05):4–16. http://qikan.cqvip.com/Qikan/Article/Detail?id=37714817

Guan S, Liu JQ, Liu YF, Du MZ (2022) The Nonlinear influence of environmental regulation on the transformation and upgrading of industrial structure. Int J Environ Res Public Health 19(14):8378. https://doi.org/10.3390/ijerph19148378

Harris JL, Sunley P (2023) Multi-system dynamics in regional path upgrading: The intra- and inter-path dynamics of green industrial transitions in the Solent marine and maritime pathway. Prog Econ Geogr 1(2):100005. https://doi.org/10.1016/j.peg.2023.100005

Hayes AF (2009) Beyond Baron and Kenny: statistical mediation analysis in the New Millennium. Commun Monogr 76(4):408–420. https://doi.org/10.1080/03637750903310360

Jang MC, Yoon S, Jung S, Min B (2024) Simulating and assessing carbon markets: application to the Korean and the EUETSs. Renew Sustain Energy Rev 195:114346. https://doi.org/10.1016/j.rser.2024.114346

Jia LJ, Zhang X, Wang XN, Chen XL, Xu XF, Song ML (2024) Impact of carbon emission trading system on green technology innovation of energy enterprises in China. J Environ Manag 360:121229. https://doi.org/10.1016/j.jenvman.2024.121229

Jia SB, Zhu XW, Gao X, Yang XT (2024) The influence of carbon emission trading on the optimization of regional energy structure. Heliyon 10(11):e31706. https://doi.org/10.1016/j.heliyon.2024.e31706

Jia ZJ (2023) What kind of enterprises and residents bear more responsibilities in carbon trading? A step-by-step analysis based on the CGE model. Environ Impact Assess Rev 98:106950. https://doi.org/10.1016/j.eiar.2022.106950

Jin YS, Xu YS (2024) Carbon reduction of urban form strategies: regional heterogeneity in Yangtze River Delta, China. Land Use Policy 141:107154. https://doi.org/10.1016/j.landusepol.2024.107154

Kou P, Shi JH (2024) Dynamic evolution of China’s government environmental regulation capability and its impact on the coupling coordinated development of the economy-environment. Socio-Econ Plan Sci 91:101785. https://doi.org/10.1016/j.seps.2023.101785

Kuznets S (1957) Quantitative aspects of the economic growth of nations: II. Industrial distribution of national product and labor force. Econ Dev Cult Change 5(4):1–111

Lin BQ, Huang CC (2022) Analysis of emission reduction effects of carbon trading: market mechanism or government intervention? Sustain Prod Consum 33:28–37. https://doi.org/10.1016/j.spc.2022.06.016

Lin BQ, Jia ZJ (2019) What are the main factors affecting carbon price in emission trading scheme? A case study in China. Sci Total Environ 654(1):525–534. https://doi.org/10.1016/j.scitotenv.2018.11.106

Lin ZQ, Liao XC (2023) Synergistic effect of energy and industrial structures on carbon emissions in China. J Environ Manag 345:118831. https://doi.org/10.1016/j.jenvman.2023.118831

Liu BL, Ding CJ, Hu J, Su YQ, Qin C (2023) Carbon trading and regional carbon productivity. J Clean Prod 420:138395. https://doi.org/10.1016/j.jclepro.2023.138395

Liu HY, Pan HY (2024) Reducing carbon emissions at the expense of firm physical capital investments and growing financialization? Impacts of carbon trading policy from a regression discontinuity design. J Environ Manag 356:120577. https://doi.org/10.1016/j.jenvman.2024.120577

Liu JY, Liu X (2023) Effects of carbon emission trading schemes on green technological innovation by industrial enterprises: evidence from a quasi-natural experiment in China. J Innov Knowl 8(3):100410. https://doi.org/10.1016/j.jik.2023.100410

Liu LW, Chen CX, Zhao YF, Zhao ED (2015) China׳s carbon-emissions trading: Overview, challenges and future. Renew Sustain Energy Rev 49:254–266. https://doi.org/10.1016/j.rser.2015.04.076

Liu MF, Cheng SJ (2022) Does the carbon emission trading scheme promote the optimization and upgrading of regional industrial structure? Manag Rev 34(07):33–46. https://qikan.cqvip.com/Qikan/Article/Detail?id=7107978289&from=Qikan_Search_Index

Liu W, Zhang H, Huang ZH (2008) Investigation on the height of China’s industrial structure and the industrialization process and regional differences. Econ Perspect 11:4–8. https://qikan.cqvip.com/Qikan/Article/Detail?id=28726309&from=Qikan_Search_Index

Liu YB, Lu F, Xian CF, Ouyang ZY (2023) Urban development and resource endowments shape natural resource utilization efficiency in Chinese cities. J Environ Sci 126:806–816. https://doi.org/10.1016/j.jes.2022.03.025

Lv MC, Bai MY (2021) Evaluation of China’s carbon emission trading policy from corporate innovation. Financ Res Lett 39:101565. https://doi.org/10.1016/j.frl.2020.101565

Lyu JY, Cao M, Wu K, Li HF, Ghulam M (2020) Price volatility in the carbon market in China. J Clean Prod 255:120171. https://doi.org/10.1016/j.jclepro.2020.120171

Lyu YW, Wu Y, Zhang JN (2023) How industrial structure distortion affects energy poverty? Evidence from China. Energy 278:127754. https://doi.org/10.1016/j.energy.2023.127754

Ma LD, Xu WX, Zhang WY, Ma YA (2024) Effect and mechanism of environmental regulation improving the urban land use eco-efficiency: evidence from China. Ecol Indic 159:111602. https://doi.org/10.1016/j.ecolind.2024.111602

Millimet DL, Roy J (2016) Empirical tests of the Pollution Haven Hypothesis when environmental regulation is endogenous. J Appl Econ 31(4):652–677. https://doi.org/10.1002/jae.2451

Nie X, Wu JX, Chen ZP, Zhang AL, Wang H (2021) Can environmental regulation stimulate the regional Porter effect? Double test from quasi-experiment and dynamic panel data models. J Clean Prod 314:128027. https://doi.org/10.1016/j.jclepro.2021.128027

Oke AE, Oyediran AO, Koriko G, Tang LM (2024) Carbon trading practices adoption for sustainable construction: a study of the barriers in a developing country. Sustain Dev 32(1):1120–1136. https://doi.org/10.1002/sd.2719

Pan XF, Wang MY, Li MN (2023) Low-carbon policy and industrial structure upgrading: based on the perspective of strategic interaction among local governments. Energy Policy 183:113794. https://doi.org/10.1016/j.enpol.2023.113794

Peng W, Xin BG, Xie L (2023) Optimal strategies for production plan and carbon emission reduction in a hydrogen supply chain under cap-and-trade policy. Renew Energy 215:118960. https://doi.org/10.1016/j.renene.2023.118960

Porter ME, Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118. https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.9.4.97

Shi DQ, Ding H, Wei P, Liu JJ (2018) Can smart city construction reduce environmental pollution. China Ind Econ 6:117–135. http://qikan.cqvip.com/Qikan/Article/Detail?id=7000675382

Shi W, Li W, Qiao FW, Wang WJ, An Y, Zhang GW (2023) An inter-provincial carbon quota study in China based on the contribution of clean energy to carbon reduction. Energy Policy 182:113770. https://doi.org/10.1016/j.enpol

Shobande OA, Ogbeifun L, Tiwari AK (2024) Extricating the impacts of emissions trading system and energy transition on carbon intensity. Appl Energy 357:122461. https://doi.org/10.1016/j.apenergy.2023.122461

Song JR, Hu SG, Frazier AE, Wu S, Wang M (2024) Will industrial structure changes promote or reduce non-grain production? Evidence from the Yangtze River Economic Belt. J Clean Prod 446:142902. https://doi.org/10.1016/j.jclepro.2024.142902

Song ML, Zheng HY, Shen ZY (2023) Whether the carbon emissions trading system improves energy efficiency–Empirical testing based on China’s provincial panel data. Energy 275:127465. https://doi.org/10.1016/j.energy.2023.127465

Song XL, Kong CM (2018) Empirical analysis of the impact of China’s carbon trading market on regional economic structure. Macroeconomics 9:98–108. https://qikan.cqvip.com/Qikan/Article/Detail?id=676533224&from=Qikan_Search_Index

Tan XJ, Liu YS, Dong HM, Zhang Z (2022) The effect of carbon emission trading scheme on energy efficiency: Evidence from China. Econ Anal Policy 75:506–517. https://doi.org/10.1016/j.eap.2022.06.012