Abstract

In the context of increasing natural disasters, volatile geopolitical dynamics, and rising anti-globalization trends—particularly in the post-pandemic era—enhancing economic resilience has become crucial. This study investigates how FDI quality and new quality productivity forces influence economic resilience across 41 cities in China’s Yangtze River Delta (2009–2022). We establish measurement systems for FDI quality, new quality productivity forces, and economic resilience, conducting empirical analyses across temporal and spatial dimensions. Three main findings emerge: First, significant spatial disparities exist, with eastern/northern regions outperforming western/southern areas in all three dimensions. While new quality productivity forces and resilience show upward trends with fluctuations, FDI quality exhibits stagnation and regional imbalances. Second, temporal analysis reveals a U-shaped relationship where FDI quality affects both new quality productivity forces and resilience, with new quality productivity forces demonstrating significant mediation effects. Third, spatial econometric results show an inverted U-shaped spillover effect of FDI quality on neighboring regions’ resilience. These findings provide empirical evidence on the mechanisms through which external investments (FDI) and internal innovation capabilities (new quality productivity forces) jointly shape regional economic resilience, offering valuable insights for policymakers to address development disparities and enhance risk resistance capacities in the new era.

Similar content being viewed by others

Introduction

Amid profound transformations in the global economic order, the interdependence between FDI quality and economic resilience has emerged as a pivotal factor in international strategic competition. The ongoing restructuring of global value chains and technological paradigm shifts have elevated high-quality FDI beyond its conventional function as capital transfer, transforming it into a fundamental catalyst for industrial advancement, technological dissemination, and institutional refinement. In the current era marked by escalating anti-globalization tendencies and heightened systemic vulnerabilities, economic resilience building has shifted from pure risk containment to sustaining growth trajectories within volatile conditions. While advanced economies leverage superior FDI to reinforce their innovation architectures, developing nations increasingly focus on aligning foreign investment with indigenous capacity development to construct more robust economic frameworks. This worldwide phenomenon underscores how FDI quality enhancement serves dual purposes: stimulating immediate economic expansion while simultaneously functioning as a strategic cornerstone for enduring resilience—with its operational dynamics manifesting distinct patterns across nations at varying development phases and with differing industrial configurations.

FDI constitutes a critical external factor influencing economic resilience that demands scholarly attention. China’s mega-sized market, characterized by abundant labor resources, continuous improvements in its business environment, and preferential policies for foreign investors, has emerged as a prime global investment destination. However, the accelerated globalization of capital flows has revealed the dual nature of FDI’s impacts on host economies. While FDI facilitates capital formation, technology transfer, and managerial know-how—thereby promoting economic growth and industrial upgrading in developing countries—it simultaneously introduces external vulnerabilities that may amplify economic volatility and challenge domestic resilience. This paradox underscores the need to systematically examine the FDI quality–resilience nexus, as evidence-based policy formulation in this domain could significantly enhance urban economic resilience against future shocks.

China’s FDI landscape has undergone a strategic transformation from quantity-driven to quality-oriented growth. The earlier development model’s overreliance on capital-intensive, high-energy-consumption FDI became increasingly incompatible with the nation’s high-quality development objectives. The 2023 “Guidelines on Further Optimizing the Foreign Investment Environment” explicitly advocated for a balanced approach prioritizing both quantity and quality in FDI inflows. Although China experienced an 8% year-on-year decline in utilized FDI in 2023, it maintained a substantial inflow of US$161 billion, accounting for 34% of total FDI in developing economies (UNCTAD, 2023). The Yangtze River Delta (YRD) region, serving as a strategic nexus between the Yangtze River Economic Belt and the Belt and Road Initiative, exemplifies China’s FDI quality transition. This economically vibrant region, notable for its openness and innovation capacity, attracts over 50% of China’s total FDI inflows. By examining 41 YRD cities, this study investigates the mechanisms through which high-quality FDI enhances economic resilience, providing valuable policy insights for China and other emerging economies to optimize foreign investment structures and strengthen risk mitigation capabilities.

The enhancement of economic resilience urgently requires endogenous dynamic transformation. Under the current global value chain restructuring, traditional factor-driven productivity models face challenges such as declining total factor productivity (TFP) growth rates and suboptimal capacity utilization, compelling a shift in economic growth drivers. Against this backdrop, the concept of “new quality productive forces” was first proposed by President Xi Jinping during the Symposium on Promoting Comprehensive Revitalization of Northeast China in the New Era held in September 2023. Defined as “a new form of productivity dominated by technological innovation and aligned with high-quality development requirements” (Ren and Dou, 2024), this innovative concept provides a novel theoretical perspective for regional economic resilience building. As a distinct economic growth paradigm and developmental pathway (Ren and Dou, 2024), new quality productive forces exert substantial impacts on regional economic resilience. Notably, high-quality FDI demonstrates significant alignment with the core elements of new quality productive forces through its mechanisms of human capital enhancement, technological innovation facilitation, and industrial upgrading promotion (Alfaro and Charlton, 2007; Thuy and Dung, 2023). Empirical studies further reveal a statistically significant positive correlation between FDI quality and the development of new quality productive forces, with both factors constituting critical mechanisms influencing economic resilience.

A review of existing research reveals relatively comprehensive studies on FDI quality and economic resilience, with abundant literature focusing on the measurement of FDI quality indicators. Current approaches to constructing and evaluating FDI quantity and quality metrics mainly fall into two categories: one employs only the FDI performance index (Zhong and Chen, 2012; Zhang et al. 2023), while the other develops multidimensional comprehensive evaluation indicators encompassing both quantity and quality perspectives (Zhang and Tang, 2022). Some scholars have also built indicator systems based on dimensions such as foreign capital asset contribution rate, average scale, technological level, and profitability (Srivastava, 2003; Sun and Li, 2023; Bai and Lü, 2015). Domestic research on economic resilience remains relatively nascent without a unified definition, yet there is consensus that enhancing economic resilience is crucial for economic development (Li, 2020; Zhao et al. 2023). Compared to China, international scholars began studying economic resilience earlier, with most considering it a prerequisite for urban sustainable development. Reggiani (2002) introduced resilience into spatial economics, Briguglio (2008) defined it as an economy’s capacity to withstand shocks and recover, and Martin (2012) and Simmie (2010) divided it into four dimensions: resistance, recovery, adaptability, and re-innovation—a perspective widely accepted by scholars globally and serving as a reference for this study’s measurement of economic resilience. However, some scholars have used the sensitivity index method to quantify economic resilience (Klimek et al. 2019). Notably, research on new quality productive forces is still in its early stages. Scholars have attempted to interpret its connotation from various angles: the “new” aspect refers to new economic models, emerging formats, and innovative development paradigms under the new technological revolution; the “quality” aspect emphasizes innovation-driven productivity as the core, marking a qualitative leap in productive forces (Sun and Guo, 2024; Xu, 2024). Based on this understanding, some scholars have constructed indicator systems from dimensions such as technological innovation and industrial upgrading (Li et al., 2024; Shao et al., 2024), while others have focused on the constituent elements of traditional productive forces. They argue that accelerating the development of new quality productive forces requires optimizing the trinity of laborers, means of labor, and objects of labor to surpass traditional productive forces (Zhou and Xu, 2023; Wang, 2024). Consequently, many scholars have built new quality productive forces indicator systems based on these three dimensions (Wang and Guo, 2024; Zhu et al. 2024a; Pu and Xiang, 2024; Zhang et al. 2024). This study draws on the indicator construction frameworks of Zhang et al. (2024), Liu and He (2024), and Qin and Chen (2025) to develop its own indicator system.

However, current research exploring the relationship among FDI quality, new quality productive forces, and economic resilience remains limited. Most studies focus solely on the impact of FDI quality on economic resilience, or separately examine FDI quality’s effect on new quality productive forces and new quality productive forces’ influence on economic resilience. First, regarding FDI’s direct impact on economic resilience, academic consensus has yet to be reached. Proponents argue that FDI enhances economic resilience (Zhu et al., 2022), while opponents suggest potential negative effects (Qiu et al, 2021; Jin, 2019). The study by Alfaro and Charlton (2007) is particularly significant, challenging the assumption that all FDI has uniform effects on economic growth and proposing that sectoral heterogeneity and technological content are key factors influencing host country growth. Evidently, FDI’s impact on economic resilience varies considerably across regions and time periods. Furthermore, many scholars have moved beyond examining FDI’s direct effects on economic resilience to explore complex mechanisms through which it indirectly influences resilience. Two primary indirect effects have been identified: (1) mediation effects, where most scholars argue that FDI promotes economic growth through mediators, such as economic growth, trade openness, innovation levels, and human capital (Martini, 2020; Branstetter et al. 2021); and (2) moderation effects, where scholars posit that FDI influences economic development through moderating variables such as environmental regulations and information and communication technology (Zhu et al. 2022). Second, concerning the relationship between FDI quality and new quality productive forces, some scholars note that in countries with weak intellectual property protection, foreign firms tend to engage in technology blockade (Kanval et al. 2024), potentially hindering total factor productivity growth (Asif and Lahir, 2021; Branstetter et al. 2021; Bitzer and Kerekes, 2008). Others hold opposing views, arguing that FDI significantly promotes total factor productivity growth (Ahmed and Kialashaki, 2023; Tao, 2021). Research in the Chinese context reflects similar divergences: Li and Wang (2019) found that FDI quality enhances green total factor productivity but with regional variations, while Zhang and Tang (2022) revealed a complex nonlinear relationship between the two. Finally, research on new quality productive forces and economic resilience remains in its infancy. Scholars such as Ren and Dou (2024) and Shi et al. (2024) have theoretically demonstrated the positive role of new quality productive forces in economic resilience. Although empirical studies by Dong and Wang (2024) and Li (2024) have confirmed this positive effect, empirical research in this area remains insufficient. Thus, this study aims to partially address this empirical gap.

Furthermore, scholars both domestically and internationally have long incorporated spatial dimensions into the FDI research framework, generally agreeing that FDI can generate both intra-regional and inter-regional spillover effects (Ye et al. 2023; Xie et al. 2023; Jiang, 2014; Driffield and Love, 2010; Zhu et al. 2022), though research conclusions show certain divergences. The mainstream view holds that FDI exhibits positive spatial spillover effects, yet findings vary across different sample studies (Wen, 2022). Meanwhile, research on the spatial effects of economic resilience has reached relative maturity, with study scales spanning provincial, regional, municipal, and even county levels, covering fields such as digital economy, financial development, and technological innovation (Xia et al. 2024; Tan and Hai, 2024). These studies consistently reveal significant spatial agglomeration characteristics in China’s economic resilience levels. Against the backdrop of FDI development models shifting from “quantity” to “quality,” research on the spatial spillover effects of FDI quality remains virtually nonexistent. Particularly in the specialized area of FDI quality’s spatial spillover effects on economic resilience, studies are even scarcer. Some scholars have confirmed that FDI can not only promote local economic development but also drive growth in neighboring regions (Zhang, 2018), while Pan and Wei’s (2018) research found FDI’s positive spillover effects on economic growth to be less robust. Notably, an increasing number of studies indicate that FDI’s impact on regional economies exhibits nonlinear characteristics (Lu et al. 2017). Zhang et al. (2024) discovered a dual-threshold effect between FDI spillovers and real economic growth based on regional financial strength, and Ke and Lai (2021) further confirmed that FDI’s spillover effects on surrounding areas also demonstrate nonlinear features. These findings provide important insights for this study’s in-depth examination of FDI quality’s spatial spillover effects on economic resilience. A thorough exploration of this issue will not only fill existing research gaps but also provide theoretical support for promoting deeper integration between FDI and high-quality economic development.

Based on the above analysis, this study makes three principal contributions to the literature: First, it addresses the prevalent oversight of municipal-level analysis in existing research on FDI quality, new quality productive forces (NQPF), and economic resilience by conducting a comprehensive assessment across 41 cities in the Yangtze River Delta region, thereby identifying critical development trends and deficiencies at this granular level. Second, building upon policy directives and incorporating insights from established scholars (Zhang et al. 2024; Qin and Chen, 2025), we pioneer a novel tripartite NQPF evaluation framework that systematically examines “high-caliber” labor forces, “next-generation” production tools, and “advanced-material” labor inputs, significantly expanding the methodological approaches to NQPF measurement. Third, through dual temporal and spatial analyses, we not only elucidate FDI quality’s direct and spillover effects on economic resilience but also innovatively establish NQPF’s pivotal mediating role in the “FDI quality → NQPF → economic resilience” transmission mechanism, yielding spatially-sensitive policy recommendations for enhancing regional integration in the Yangtze River Delta.

Mechanism analysis and research hypotheses

Analysis of the impact of FDI quality on economic resilience

The economic development of the Yangtze River Delta region exhibits distinct stage-specific characteristics. During the initial development phase, while low-quality FDI facilitated rapid capital accumulation and economic expansion in the short term, its long-term negative effects gradually emerged. Empirical studies demonstrate that such investments constrained regional development through dual channels: first, by creating market crowding-out effects that compressed domestic firms’ development space and led to industrial structure homogenization (Jin, 2019); second, through concentration in energy-intensive industries, thereby delaying industrial upgrading (Zhu et al. 2024b). More notably, foreign enterprises frequently implemented technology blockade strategies to maintain competitive advantages, stifling the cultivation of indigenous innovation capabilities (Bitze and Kerekes, 2008). Against the backdrop of increasing global economic uncertainty, this development model, reliant on low-end FDI, significantly amplified regional economic vulnerability (Qiu et al. 2021).

In the subsequent high-quality development stage, the structural improvement in FDI quality generated remarkable transformation effects in the Yangtze River Delta. High-quality FDI not only provided substantial capital inputs (Le, 2024) but, more importantly, drove technological upgrading in domestic enterprises through knowledge spillovers and competition effects (Driffield and Love, 2010), facilitating deeper regional integration into global value chains (Lv and Zhao, 2020). This transformational impact manifested in three dimensions: industrial structure advancement, innovation system refinement, and risk resilience enhancement (Martini, 2020). China’s “selective and excellence-oriented” FDI policy provided institutional support for this transition through policy innovation, accelerating the region’s shift toward an innovation-driven development model.

Based on the above analysis, this paper proposes Hypothesis 1: The quality of FDI has a nonlinear impact on economic resilience.

Analysis of the impact mechanism of FDI quality on economic resilience through new quality productivity forces

Prior studies have primarily explored how FDI quality influences economic resilience through new quality productivity forces via three pathways: highly qualified workers, new material quality labor object, and new media of labor materials.

First, the most salient manifestation of high-quality laborers lies in the enhancement of human capital quality. From the human capital enhancement perspective, early-stage FDI addressed China’s capital shortages, improved infrastructure, upgraded industrial structures, and enhanced capital market liquidity, absorbing abundant labor and raising living standards. Concurrently, FDI introduced advanced technologies and managerial expertise, catalyzing technological innovation and industrial upgrading in domestic firms. However, rising labor costs due to improved living standards created a “supply-demand” mismatch between low-quality FDI and high-skilled labor, hindering human capital development. Thus, the technology spillover effects of FDI are contingent on human capital thresholds (Asif and Lahiri, 2021), necessitating alignment between high-quality FDI and skilled labor to sustain economic growth. Human capital also stabilizes domestic demand through consumption capacity during both economic resistance and recovery phases, mitigating external shocks and revitalizing economic systems (Bitzer and Kerekes, 2008). Recent trends show that high-quality FDI, particularly in emerging technologies, attracts and cultivates high-skilled talent (Saha, 2024), driving structural optimization and enhancing recovery capacity and developmental resilience.

Second, the fundamental characteristic of new-material objects of labor resides in industrial structure adjustment, namely the establishment of a modern industrial system. From the perspective of building a modern industrial system, neoclassical growth models posit that capital accumulation drives economic growth and industrial transformation. FDI historically addressed China’s “foreign exchange” and “savings gaps,” facilitating factor mobility and enhancing economic resilience. As China transitions to an intensive growth model, high-quality FDI becomes imperative. Technology spillovers elevate productivity in tertiary industries, fostering structural optimization and creating a virtuous cycle. Historically, FDI concentration in manufacturing exacerbated industrial imbalances. However, with emerging technologies, high-quality FDI increasingly flows into high-potential, low-energy-consumption sectors, where foreign firms demonstrate superior productivity (Thuy and Dung, 2023). This forces domestic firms to upgrade (Yin, 2023), accelerating industrial restructuring and modern industrial system development.

Third, the most crucial aspect of new media means of labor is the advancement of innovation capacity. Regarding innovation-driven growth, high-quality FDI targets emerging industries, cultivates talent, and acquires core technologies (Branstetter et al. 2021). While potentially crowding out domestic firms, it also stimulates indigenous innovation, fostering original and disruptive technological breakthroughs (Le, 2024). High-quality FDI attracts capital inflows, enriching China’s “resource pool of production factors” (Bitzer and Kerekes, 2008). Innovation reshapes production modes, with data-driven processes replacing traditional inputs, enhancing efficiency, and reducing costs. This creates a positive feedback loop: high-quality FDI spurs innovation, which in turn attracts more advanced FDI, sustaining economic development and resilience.

In summary, high-quality FDI enhances economic resilience by elevating new quality productivity forces, whereas low-quality FDI suppresses both. The interplay among FDI quality, new quality productivity forces, and economic resilience is illustrated in Fig. 1.

Based on this analysis, we propose Hypothesis 2.

Hypothesis 2: FDI quality can affect the level of economic resilience through new quality productivity as an intermediary between new quality productivity forces.

Spatial spillover effects of FDI quality on economic resilience

The spatial agglomeration of FDI not only influences local factor allocation but also reshapes economic resilience in neighboring regions through cross-regional factor mobility and knowledge spillovers. This process exhibits nonlinear complexity: FDI concentration in one region alters the composition of labor, capital, and other factors in adjacent areas, thereby affecting their productivity and economic resilience. First, FDI generates factor reallocation effects and technology spillover effects. Initial FDI inflows drive capital accumulation and technology transfer (Qiu et al. 2021; Lv and Zhao, 2020), reshaping regional factor allocation. This dynamic is dualistic: (1) FDI may disrupt local industrial ecosystems, prompting domestic firms to relocate to neighboring regions and facilitating industrial spillover; (2) competitive pressures from FDI incentivize local firms to enhance productivity (Ahmed and Kialashaki, 2023), while industrial linkages foster collaborative regional development, creating a synergistic virtuous cycle (Lv and Hu, 2022). Second, FDI’s impacts are stage-dependent. As regional economies develop, FDI’s effects evolve: (1) resource siphon effects emerge, where core regions attract high-quality factors from peripheral areas; (2) the marginal benefits of technology spillovers diminish once local firms’ technological absorptive capacity reaches a threshold (2024).

Based on this analysis, we propose Hypothesis 3.

Hypothesis 3: FDI exerts nonlinear spatial spillover effects on economic resilience.

Metric systems, model building, and data sources

Construction of the indicator system

Explanatory variable

Building on the preceding analysis, this study argues that the foreign capital performance index alone inadequately reflects actual FDI quality. Drawing on the indicator systems and methodologies developed by Bai and Lv (2015), Zhang and Tang (2022), and Liu and Zhan (2024), and incorporating considerations of data rationality and availability at the municipal level, we construct a multidimensional FDI quality measurement framework. This framework evaluates FDI quality across three dimensions: average scale, technological sophistication, and profitability. The specific indicators selected for each dimension are detailed in Table 1.

Mediating variable

Current research lacks a unified framework for measuring new quality productive forces. To ensure multidimensional representation, this study draws on the indicator systems developed by Zhang et al. (2024) and Qin and Chen (2025). Grounded in the conceptual framework of new quality productive forces—which emphasizes the synergistic advancement of labor force, means of labor, and objects of labor—we construct a hierarchical measurement system. This system comprises three secondary indicators: (1) a high-caliber labor force, (2) innovative means of labor, and (3) advanced objects of labor. These are further disaggregated into 10 tertiary indicators (e.g., labor force foundation, worker awareness, labor productivity, economic environment) and 18 quaternary indicators (e.g., educational attainment, human capital structure, employment mindset), supported by quantifiable metrics. The specific measurement indicators are detailed in Table 2.

Explained variable

Prior analyses of economic resilience highlight the objectivity and comprehensiveness of indicator-based measurement systems. Accordingly, this study adopts a scientifically rigorous, theoretically relevant, and data-driven approach to construct an urban economic resilience measurement framework. Building on methodologies from Martin (2012), Wang and Ge (2023), and Hou et al. (2023), we develop a multidimensional indicator system structured around three dimensions: resistance capacity, recovery capacity, and innovation capacity. These dimensions are operationalized through nine tertiary indicators (e.g., industrial diversification, fiscal stability, technological adaptation), with specific metrics detailed in Table 3.

Control variables

Drawing on existing literature and aligned with the research focus, this study selects five control variables: societal employment level (SEL) (Li and Wang, 2019), government support level (GOV) (Hu and Xu, 2020; Li and Wang, 2019), financial development level (FIN) (Li and Wang, 2019), urbanization level (URB) (Wang et al. 2024), and marketization level (MAR) (Wang and Fan, 2019; Xu and Wang, 2024; Xu et al. 2023). The rationale for these variables and their operationalization, including specific indicator definitions and data sources, is comprehensively outlined in the variable table (Table 4).

Model setting

Dynamic relationship testing model construction

Considering data availability and representativeness, this study utilizes panel data from 41 cities in the Yangtze River Delta region spanning 2009–2022 to construct a two-way fixed effects model examining the relationships among FDI quality, new quality productive forces (NQPF), and economic resilience. To investigate potential nonlinear effects of FDI quality on both NQPF and economic resilience, as well as to test the mediating role of NQPF, we incorporate a quadratic term for FDI quality. For mediation analysis, we employ the three-step causal procedure (Wen, 2014) through a nonlinear mediation model specification as follows:

The interpretation of each variable remains the same as previously discussed and will not be repeated here. In the above equation, \({{\rm{\alpha }}}_{1}\) represents the total effect of FDI quality on economic resilience, \({{\rm{\theta }}}_{1}\) represents the direct effect of FDI quality on economic resilience in the context of the mediator variable, \({{\rm{\beta }}}_{1}\), \({{\theta }}_{3}\) represent the mediation effects. The mediation effect is established only when both\(\,{{\rm{\beta }}}_{1}\) and \({{\rm{\theta }}}_{3}\) are significant. When \({{\rm{\alpha }}}_{1}\) is significant, if both \({{\rm{\beta }}}_{1}\,{\rm{and}}\,{{\rm{\theta }}}_{3}\) are significant, it indicates partial mediation; if \({{\rm{\theta }}}_{3}\) is significant but \({{\rm{\beta }}}_{1}\) is not, it suggests full mediation. The mediation effect is further verified using the Sobel test, and the mediation effect value is calculated as the product of \({{\rm{\beta }}}_{1}\) and \({{\rm{\theta }}}_{3}\). The proportion of the mediation effect is then derived by dividing the mediation effect by the total effect.

Moran’s index model

Exploratory spatial data analysis (ESDA) measures spatial autocorrelation to examine spatial dependence, heterogeneity, and association patterns of variables within a study area (Hua et al. 2021; Feng et al. 2021). This framework encompasses both global and local autocorrelation analyses. When positive spatial autocorrelation exists, variables exhibit clustered distribution patterns; conversely, variables display random spatial distributions in the absence of spatial autocorrelation. Global autocorrelation analysis quantifies the average spatial correlation and differentiation of a variable across the entire region. The Moran’s I index is calculated as follows:

In the equation,\({\rm{S}}^{2}=\frac{1}{\rm{n}}\mathop{\sum }\nolimits_{\rm{i}=1}^{\rm{n}}{({\rm{X}}_{\rm{i}}-\bar{\rm{X}})}^{2}\), \(\bar{{\rm{X}}}=\frac{1}{\rm{n}}{\sum }_{\rm{i}=1}^{\rm{n}}{\rm{X}}_{\rm{i}}\), n denotes the number of observations, corresponding to the 41 cities in the Yangtze River Delta. \({{\rm{x}}}_{{\rm{i}}}\) and \({{\rm{x}}}_{{\rm{j}}}\) represent the attribute values (FDI quality, economic resilience) of regions ii and jj, respectively. Wij is the spatial weight matrix. In this paper, the economic distance matrix, the geographical distance matrix, and the economic distance nested matrix are selected. Following Lv and Hu (2022), this study employs economic distance matrices and nested geographic-economic distance matrices. The Global Moran’s Index ranges from −1 to 1. A negative index value with a significant Z-value (\({\rm{Z}}=[{\rm{I}}-{\rm{E}}({\rm{I}})/\sqrt{{\rm{VAR}}({\rm{I}})}\)) indicates spatial negative correlation of green finance among provinces, while a positive index value with a significant Z-value indicates spatial positive correlation.

Spatial econometric panel model

Within the framework of spatial economics, this study employs a spatial econometric panel model to identify the spatial spillover effects of FDI quality on economic resilience. The spatial Durbin model (SDM) is initially hypothesized as the optimal specification16, with final model selection contingent on subsequent diagnostic tests (Song et al. 2025). The baseline SDM formulation is expressed as

In the spatial econometric model, let\({{\rm{ER}}}_{{\rm{i}},{\rm{t}}}{,{\rm{QFDI}}}_{{\rm{i}},{\rm{t}}}\) and \({{\rm{ER}}}_{{\rm{i}},{\rm{t}}+1}{,{\rm{QFDI}}}_{{\rm{i}},{\rm{t}}+1}\) respectively represent the FDI quality and economic resilience level of city i during the t and t + 1 periods, and this article introduces the quadratic term of QFDI in Eq. (2), where Control is a series of control variables that affect each variable. The model includes control variables measured as follows: social employment level (SEL), government support (GOV), financial development (FIN), urbanization rate (URB), and marketization level (MAR), with detailed metrics provided in Table 4. σ and ρ, respectively, represent the impact of foreign direct investment quality and the economic resilience level of neighboring cities on the economic resilience level of the city, and ρ is also known as the spatial correlation coefficient. Other as above.

Data sources

Considering the availability, continuity, and comparability of city-level indicators, this study selects 41 cities in the YRD region as the research subjects, using panel data from 2009 to 2022. Primary data were sourced from statistical yearbooks, social development bulletins, various databases, and relevant government documents of the provinces and cities in the YRD. Missing data were addressed through interpolation and trend extrapolation methods.

Analysis of the development level and distribution pattern of FDI quality, new quality productivity forces, and economic resilience

This paper calculates the comprehensive level values of FDI quality, new quality productivity, and economic resilience for each city from 2009 to 2022 based on the entropy weight method. To analyze temporal variations, the sample was stratified by province, and trend charts were created to illustrate changes in these variables across cities in Shanghai, Zhejiang, Jiangsu, and Anhui. These charts demonstrate the cities’ dynamic evolution. Furthermore, ArcGIS10.1 software and the natural breaks method were utilized to categorize each variable into five grades: High, Medium–high, Medium, Medium–low, and Low. Figures 3, 5, and 7 illustrate the spatial distribution pattern of FDI quality, new quality productivity forces, and economic resilience, respectively.

Analysis of FDI quality levels and distribution patterns

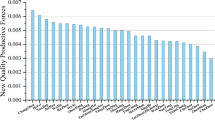

Between 2009 and 2022, the Yangtze River Delta (YRD) region exhibited significant disparities in FDI quality across its cities, revealing pronounced developmental imbalances (Fig. 2). Economically disadvantaged cities experienced persistent declines in FDI attraction capacity, while only select developed cities showed consistent improvement, with most displaying fluctuating patterns that indicated vulnerability to both external shocks and internal weaknesses. Spatially, FDI quality demonstrated clear agglomeration characteristics without significant leapfrogging effects, suggesting structural constraints in quality enhancement, while maintaining a stable geographical hierarchy where eastern cities outperformed western counterparts, northern cities surpassed southern ones, and northeastern areas led southwestern zones, with Shanghai maintaining undisputed leadership (Fig. 3) and Jiangsu Province consistently ranking above Zhejiang and Anhui. These patterns can be attributed to three key factors: the dual concentration effect in core cities (Shanghai, Hangzhou, Suzhou) where advanced industrial ecosystems and favorable business environments attract both high-value FDI and skilled labor; technological absorption constraints in peripheral cities where local firms often lack capacity to effectively assimilate foreign knowledge spillovers; and regulatory fragmentation across provincial boundaries, particularly in FDI access rules and environmental standards, that creates barriers to factor mobility within the “three-province–one-municipality” framework.

Analysis of new quality productivity forces levels and distribution patterns

From 2009 to 2022, the Yangtze River Delta region experienced a significant upward trend in new quality productivity forces (Fig. 4). Leading cities such as Shanghai, Hangzhou, Ningbo, Nanjing, Suzhou, and Hefei stood out, while other cities showed more even, but slower progress. These leading cities, benefiting from substantial capital, advanced technology, and extensive market experience, were at the forefront of new quality productivity forces, with Shanghai, Nanjing, and Hangzhou consistently ranking among the top three. In contrast, other cities, constrained by limited resources and homogeneous industrial structures, exhibited fluctuating increases in new quality productivity forces, without any standout performers. Spatially, the levels of new quality productivity forces in cities across the Yangtze River Delta continued to rise, though with notable regional disparities. Interestingly, in 2009, Anhui Province outperformed Zhejiang and Jiangsu in terms of new quality productivity forces (Fig. 5). However, over the following decade, Jiangsu and Zhejiang gradually surpassed Anhui, leading to a clear spatial agglomeration pattern, with higher levels in the east compared to the west.

Analysis of economic resilience levels and distribution patterns

From a developmental perspective, the economic resilience of cities in the Yangtze River Delta region showed fluctuations but generally increased between 2009 and 2022 (Fig. 6). Significant improvements were observed in cities like Shanghai, Hangzhou, Ningbo, Nanjing, Wuxi, Suzhou, and Hefei. These cities demonstrate high economic resilience, driven by well-developed market conditions, robust economic strength, and effective industrial complementarity policies, which enable them to quickly restore economic stability after shocks. While other cities also exhibited growth in resilience, they still lagged behind the “leading cities.” Spatially, economic resilience varied significantly across the region, with a stepwise decline from east to west. Notably, Anhui lagged behind Zhejiang and Jiangsu due to their siphon effect, limiting its resource attraction and exacerbating its low resilience (Fig. 7). In the context of high-quality economic development, governments must prioritize catch-up strategies for lagging cities and explore leading cities’ potential to drive surrounding area growth, fostering balanced and coordinated regional economic development.

Our analysis reveals systematic linkages between FDI quality, new-quality productive forces, and regional economic resilience in the Yangtze River Delta (2009–2022), characterized by persistent east-west and north–south developmental gradients. Metropolitan centers—particularly Shanghai, Hangzhou, and Nanjing—developed synergistic relationships where high-quality FDI inflows stimulated NQPF advancement, which in turn strengthened economic resilience through technology diffusion and industrial upgrading. In contrast, non-core regions like Anhui Province experienced deteriorating competitiveness as constrained absorptive capacities prevented effective utilization of foreign investment, leading to NQPF stagnation. Two key mechanisms emerged: first, spatial FDI inequalities amplified existing NQPF disparities through differential knowledge spillovers; second, the uneven geography of innovation inputs widened core-periphery resilience gaps. These insights advance theoretical understanding of regional development dynamics and inform subsequent empirical investigations.

Empirical study on the dynamic relationship between FDI quality, new quality productivity forces, and economic resilience

Analysis of the impact of FDI quality on economic resilience

Based on the preceding mechanism analysis, we first examine the impact of FDI quality on economic resilience. Regression is conducted using linear and nonlinear two-way fixed-effects panel models, with the results presented in Table 5. Model (1) displays the linear panel regression results, showing that FDI quality has a significant negative impact on economic resilience. Model (2) presents the nonlinear fixed-effects panel regression results after incorporating a quadratic term. In Model (2), the coefficient of FDI quality is significantly negative, while the quadratic term is significantly positive, indicating a significant U-shaped relationship between FDI and economic resilience. A possible explanation is that, with China’s economic development, the indiscriminate influx of low-quality FDI fails to align with the demands of high-quality economic growth, while also crowding out domestic firms’ market share. On one hand, this compresses innovation space for enterprises in the Yangtze River Delta region and threatens the survival of SMEs (Ye and Fan, 2023), forcing some local firms to exit the market, thereby hindering improvements in local labor productivity and New Quality Productivity Forces, while reducing industrial diversity. On the other hand, the resource competition effect manifests in talent drain (due to higher wages offered by foreign firms) and preferential land policies (Saha, 2024). However, with the introduction of policies optimizing FDI and China’s economic transformation, FDI has gradually shifted from low to high quality. High-quality FDI facilitates technology spillovers, enabling domestic firms to absorb advanced know-how through talent circulation (Jin et al. 2019). Additionally, institutional demonstration effects drive reforms in the business environment. For instance, after adopting international certification standards introduced via FDI, firms in the Yangtze River Delta improved compliance efficiency by 37%. These changes enhance economic stability and, consequently, economic resilience.

To further validate the U-shaped relationship, a U-test was conducted. The results show a T-value of 3.61 and a P-value of 0.0002, significant at the 1% level. The inflection point is 0.2957, located on the left side of the value range [0.0254, 0.6504], indicating that FDI quality has already passed the turning point and will promote economic resilience in the future. This confirms a significant U-shaped (or non-linear) relationship between FDI quality and economic resilience. Further slope analysis reveals a negative left slope (−0.2357) and a positive right slope (0.3093), reinforcing the U-shaped trend—where FDI quality initially suppresses and later enhances economic resilience. Based on this, the nonlinear model is selected, supporting Hypothesis 1.

Regarding control variables, most align with expectations. In Model (4), the employment level coefficient is positive at the 10% significance level, suggesting that higher employment improves economic resilience. Government intervention shows a significantly negative coefficient, implying excessive involvement hinders resilience. Financial development, urbanization, and marketization levels are all significantly positive, indicating that a robust financial sector, urban growth, and market vitality enhance urban economic resilience.

Analysis of the impact of new quality productivity forces on economic resilience

Before conducting the mediation effect test, it is necessary to examine the impact of FDI quality on new quality productivity forces and the effect of new quality productivity forces on economic resilience. Regression analyses were performed using linear and nonlinear two-way fixed-effects panel models sequentially, with results presented in Table 6. Model (3) displays linear panel regression outcomes, indicating a positive yet statistically insignificant effect of FDI quality on New Quality Productivity Forces. Model (4) incorporates quadratic terms in the nonlinear fixed-effects specification; the significantly negative coefficient of FDI quality and significantly positive coefficient of its quadratic term, combined with the U-test results from the previous section, confirm a U-shaped relationship between FDI and New Quality Productivity Forces.

Subsequent empirical analysis focuses on the impact of new quality productivity forces on economic resilience. Both linear and nonlinear two-way fixed-effects models were employed, with regression outcomes shown in Models (5) and (6) of Table 9. Model (5) exhibits excellent explanatory power, revealing a significant positive linear relationship: a one-unit increase in New Quality Productivity Forces enhances economic resilience by 0.424 units. Model (6) demonstrates an insignificant positive coefficient for the linear term of New Quality Productivity Forces but a significantly positive quadratic term. This violates the prerequisite of opposite signs for U-shaped relationships, confirming the primary linear effect. The underlying mechanism lies in the new quality productivity forces’ role as fundamental drivers of social development, encompassing advanced labor forces, innovative production materials, and optimized labor processes that permeate all phases of economic resilience (resistance, recovery, adaptation, and transformation). Specifically, high-skilled workers exhibit strong knowledge accumulation and executive capabilities to adapt to rapid economic changes; novel production materials stimulate new growth momentum (Shi and Xu, 2024); and optimized labor processes enable swift crisis responses and effective economic restoration strategies (Xu et al. 2025).

Regarding the control variables in Model (5), the impacts of government support level, financial development level, and urbanization level on economic resilience are generally consistent with those in Model (4). Specifically, government support shows a significantly negative effect on economic resilience, while both financial development and urbanization demonstrate positive effects, with urbanization exhibiting a more pronounced promoting effect. Employment rate and marketization level display insignificant and significant negative impacts, respectively, potentially due to threshold effects in the Yangtze River Delta region, where current market development has not reached the level required to enhance economic resilience. However, future improvements in marketization driven by New Quality Productivity Forces may eventually positively influence economic resilience.

Based on the benchmark regression analysis, the results indicate that FDI quality has a significant U-shaped impact on both new quality productivity forces and economic resilience, while new quality productivity forces positively influence economic resilience. This suggests that new quality productivity forces may act as a mediating variable in the relationship between FDI quality and economic resilience. To further investigate this pathway, the analysis incorporates new quality productivity forces and FDI quality into the model for testing the mediation effect in a nonlinear context. The mediation effect test results are presented in Table 7. Model (9) shows the results after introducing the mediating variable. The coefficient of the linear term of FDI quality is significantly negative, indicating that the total effect of FDI quality on economic resilience is significantly negative, with a coefficient of −0.258. Specifically, a one-unit increase in FDI quality leads to a 0.258-unit decrease in economic resilience at the 1% significance level. The coefficient of the quadratic term is significantly positive, confirming a U-shaped relationship between FDI quality and economic resilience. The coefficient of FDI quality on new quality productivity forces is −0.088 (significant at the 5% level), suggesting a negative impact of FDI quality on new quality productivity forces. The quadratic term of FDI quality is also significantly positive, further confirming the U-shaped relationship between FDI quality and new quality productivity forces. Notably, the absolute value of the linear term’s coefficient in Model (9) is significantly smaller than in Model (7), but it remains negative, indicating that the direct effect is still negative, albeit weaker. The coefficient of new quality productivity forces is 0.530 (significant at the 1% level), showing a significant positive effect on economic resilience. This suggests that FDI quality can promote urban economic resilience through new quality productivity forces, with the mediation effect quantified at −0.088*0.530 = −0.046, accounting for 17.99% of the total effect. To verify the stability and reliability of this mediation effect, the Sobel test was conducted for the mediating variable. The results of the Sobel test show that Z = 2.464 and P = 0.014, which is significant at the 5% level. Since the statistic is greater than the critical value, the mediation effect is robust, confirming that FDI quality promotes economic resilience through new quality productivity forces. Thus, Hypothesis 2 is supported.

Robustness test and endogeneity test

Endogeneity test

Existing studies suggest that regions with higher economic resilience are more likely to attract FDI, necessitating endogeneity testing. Terrain ruggedness influences FDI, as areas with higher ruggedness typically have lower transportation density and higher development costs, discouraging FDI inflows. Thus, terrain ruggedness, an inherent geographical feature, exhibits a strong correlation with FDI. As it remains largely unchanged over time and does not directly affect productivity through other channels, it satisfies the exogeneity assumption for instrumental variables (IVs). Therefore, this study selects terrain ruggedness as one IV. Given the inclusion of both QFDI and QFDI2 as independent variables, the distance to the nearest port is chosen as another IV. Ports, as key hubs for international trade and investment, enhance transportation efficiency, reduce costs, and improve market accessibility, attracting more FDI. The distance to the nearest port, a historically determined geographical variable, is unrelated to economic resilience, ensuring its exogeneity. Since both IVs are time-invariant, they are interacted with year-fixed effects before being incorporated into the model. The results (Table 8) show that the core explanatory variables remain robust after IV inclusion, addressing endogeneity concerns for Hypotheses 1 and 3.

Robustness test

Exclusion of special samples

To verify result robustness, we excluded Shanghai (a municipality directly under the central government) and re-ran the nonlinear mediation tests. As Table 9 shows, with sample size reduced from 574 to 560, the coefficients of FDI quality (linear/quadratic terms) and new-quality productive forces remained stable, maintaining significant mediation effects at the 10% level.

Lagged effect

To address potential lag effects of FDI quality on economic resilience, we conducted lagged-period regressions (N = 533 vs. original 574). Table 9 shows all core explanatory and mediating variables remain significant at 1% level with robust mediation effects, further confirming our findings’ reliability.

Heterogeneity analysis

Regional heterogeneity analysis

Considering the economic diversity across cities, variations in FDI quality, new quality productivity forces, and economic resilience inevitably lead to diverse impacts on economic resilience. To address this, regression analyses categorized the sample by provincial jurisdictions. The results (Table 10) indicate a U-shaped relationship between FDI quality and economic resilience in Zhejiang and Jiangsu, with an initial inhibitory followed by a promotional effect. In contrast, Anhui shows a potential inverted U-shaped effect. Mediation tests reveal full mediation through new quality productivity forces in Zhejiang and Jiangsu, with insignificant direct but significant negative indirect effects. In Anhui, both direct and indirect effects are significantly positive, suggesting partial mediation.

China intensified its opening-up efforts in 2018, further regulating foreign capital inflows and introducing the “Six Stabilizations” policy to stabilize key economic areas, posing new productivity requirements. Samples were divided into 2009–2017 and 2018–2022 periods. Due to temporal linearity, quadratic terms were excluded. Table 11 shows the significant negative impact of FDI quality on economic resilience in 2009–2017 and a significant positive impact in 2018–2022, confirming a U-shaped relationship. Notably, mediation effects via new quality productivity forces increased significantly from 2018 to 2022.

Analysis of spatial spillover effects

Spatial autocorrelation test

We conducted global Moran’s I index measurements for the core explanatory variable (FDI quality) and the dependent variable (economic resilience level) from 2009 to 2022. The results (Table 12) demonstrate that FDI quality showed statistically significant positive spatial autocorrelation in all years except 2015. Similarly, economic resilience levels exhibited significant positive Moran’s I coefficients throughout the entire 2009–2022 period. These findings indicate the existence of pronounced positive spatial dependence for both FDI quality and economic resilience across years, with clearly observable spatial correlation patterns. This spatial interdependence establishes a solid foundation for subsequent spatial effect analysis.

Model selection

The aforementioned tests confirm significant spatial correlations among variables. Prior to examining the spatial effects of FDI quality on economic resilience in the Yangtze River Delta region, we conducted LM, LR, and Hausman tests to determine the appropriate spatial model. The LM-lag and Robust-LM-lag tests assess spatial lag dependence (null hypothesis: no spatial lag effects), while LM-error and Robust-LM-error tests examine spatial error correlation (null hypothesis: no spatial error effects). As shown in Table 13, all four tests (LM-error, LM-lag, R-LM-lag, and R-LM-error) yield statistically significant positive results, indicating the suitability of the spatial Durbin model (SDM). Furthermore, the LR-SAR and LR-SEM tests show significance at the 1% level, confirming that the SDM neither reduces to SAR nor SEM. Consequently, we selected the SDM for analysis. The Hausman test, significant at the 1% level, rejects the null hypothesis, justifying the use of fixed effects for estimation.

Spatial spillover effects analysis

The spatial Durbin model (Table 14) reveals significant spatial lag effects (ρ), indicating neighboring regions’ economic resilience influences local resilience. Under the economic distance matrix, the FDI quality’s linear term shows a significantly negative coefficient, while the quadratic term is positive, confirming a U-shaped impact on economic resilience. Notably, the spatial lag term exhibits an inverted U-shaped relationship (significant at conventional levels), supporting Hypothesis 3. Initially, improved FDI quality drives technological spillovers and industrial linkages, optimizing resource allocation in adjacent areas (Qin et al. 2022). Beyond a threshold, core cities’ “siphon effect” dominates, causing excessive outflow of high-end talent and capital due to neighboring cities’ “magnetic field effect” (Chen et al. 2022). Concurrently, widening technological gaps marginalize local firms in regional competition (Wang et al. 2017), potentially leading to “industrial lock-in risks” and over-reliance on external technologies (Zhao et al. 2024). These dynamics highlight the nonlinear spatial impacts of FDI quality on economic resilience.

At the same time, in view of the fact that the difference in the weight matrix may lead to the change of regression, this paper adjusts the spatial weight matrix and replaces the economic distance matrix with the geographic distance matrix and the economic distance nested matrix, and the results show that the coincidence and significance of the explanatory variables after the transformation of the matrix are roughly consistent with the previous analysis, which further proves the robustness of the results.

Discussion

Key Finding

This study investigates the impact of FDI quality on economic resilience in China’s Yangtze River Delta (2009–2022) through temporal and spatial dimensions, alongside the mediating role of new quality productive forces. Key conclusions are: (1) FDI quality, new quality productive forces, and economic resilience exhibit significant spatial clustering across cities. FDI quality shows no clear upward trend and displays intercity/regional disparities, while new quality productive forces and economic resilience demonstrate fluctuating growth. Six cities—Shanghai, Hangzhou, Ningbo, Nanjing, Suzhou, and Hefei—outperform others, with relatively balanced development in remaining cities. (2) A U-shaped relationship exists: FDI quality initially suppresses then enhances new quality productive forces and economic resilience. New quality productive forces positively mediate the FDI quality–economic resilience linkage. Regional analysis shows complete mediation of FDI quality on economic resilience through new-quality productive forces in Zhejiang and Jiangsu, while Anhui exhibits partial mediation with an inverted U-shaped relationship. Temporally, FDI quality negatively impacted resilience during 2009–2017 but positively during 2018-2022, with stronger mediation through new-quality productive forces in the latter period. (3) Nonlinear spatial spillover effects emerge: neighboring regions gain positive spillovers when local technological absorptive capacity is weak. However, widening technological gaps, diminishing marginal returns of knowledge spillovers, and enhanced factor mobility (e.g., improved infrastructure) shift dominance to siphoning effects over spillovers. This creates an inverted U-shaped impact of local FDI quality on neighboring regions’ economic resilience.

Theoretical implications

This study makes three substantive contributions to the literature on regional economic development. First, it identifies and empirically validates complex nonlinear interdependencies between FDI quality, new quality productive forces, and regional economic resilience, thereby extending conventional understandings of FDI spillover mechanisms. The analysis demonstrates that these relationships follow distinct U-shaped and inverted U-shaped spatial patterns across different development phases. Second, the research establishes a robust mediation framework that elucidates how new quality productive forces serve as the critical transmission channel linking FDI quality to enhanced economic resilience, providing new empirical evidence for resilience formation theories. Third, through integrated spatiotemporal analysis, the study advances theoretical interpretations of technological disparity and siphon effects, offering fresh insights into the persistent development imbalances observed in the Yangtze River Delta region.

Practical implications

The research yields significant policy implications for regional development governance in the Yangtze River Delta. First, the empirical findings substantiate the need for spatially differentiated foreign investment policies, particularly highlighting how targeted investment strategies in less-developed subregions (e.g., Anhui Province) could effectively address persistent development gaps. Second, the demonstrated mediation mechanism of new quality productive forces provides concrete policy levers for local authorities to foster innovation ecosystems through enhanced industry–academia-research collaboration. The study further contributes to regional policy frameworks by proposing an integrated coordination mechanism that combines institutional alignment with optimized resource allocation, offering a viable approach to achieve both balanced regional development and quality economic growth simultaneously. These insights provide actionable guidance for policymakers seeking to enhance the region’s overall competitiveness while reducing intra-regional disparities.

Policy recommendations

Based on the above conclusions, this study proposes four policy recommendations: (1) Promote high-level opening-up and facilitate the“stable growth and quality improvement“of foreign investment. Governments should expand market access for foreign capital in an orderly manner, leverage technology spillover effects, and prioritize guiding foreign investment into advanced manufacturing and modern services. Less-developed regions like Anhui should adopt tailored policies to deepen integration between foreign capital and local industries, achieving mutually beneficial and sustainable development. (2) Strengthen innovation-driven development strategies to further unleash the potential of new, quality, productive forces. Cultivating new, quality, productive forces hinges on enhancing enterprises’ independent innovation capabilities, while introducing high-quality foreign capital can accelerate technology transfer and productivity growth. Governments should increase policy support, establish industry–university-research collaborative innovation systems, build resource-sharing platforms, and channel innovation factors toward new quality productive forces. Meanwhile, an innovation ecosystem with government guidance, market dominance, and enterprise leadership should be fostered to sustain industrial transformation. (3) Adopt diversified strategies to innovate resilient economic development pathways. This involves improving industrial policy systems to provide institutional safeguards, innovating talent policies with increased education investment and industry-education integration to align talent cultivation with market demands, and refining regional coordination mechanisms in the Yangtze River Delta to enhance factor mobility, leveraging the radiating role of core cities like Shanghai and Nanjing. (4) Align policies with urban characteristics to advance regional integration in the Yangtze River Delta. Central cities like Nanjing should strengthen their leading role through metropolitan area development, while less-developed regions should proactively utilize policy dividends. Inter-city collaboration should be deepened to integrate innovation, industrial, and capital chains for complementary advantages and resource sharing.

Limitations and future directions

This study examines the relationship between FDI quality, new-quality productive forces, and economic resilience in the Yangtze River Delta region, but it has certain limitations. Future research could further explore the following aspects: First, the concept and measurement system of new-quality productive forces are still evolving, and the current study has certain imperfections in indicator construction, particularly in adequately capturing emerging sectors. Future research could incorporate a more comprehensive indicator system, such as introducing enterprise innovation patent data and AI development levels, to more accurately measure the development of new-quality productive forces. Second, the data sources primarily rely on traditional statistical data, failing to fully utilize big data from the internet, which may affect the timeliness and dynamic analysis capabilities of the study. Future research could integrate diverse data sources, such as web crawler technology and enterprise databases, to enhance real-time analysis and precision. Third, the research scale is relatively singular, focusing only on the Yangtze River Delta region without comparative analysis with other domestic economic regions (e.g., Beijing–Tianjin–Hebei, Pearl River Delta) or national/provincial levels, potentially limiting the generalizability of the findings. Future studies could expand to other domestic economic regions or even compare with similar international regions to strengthen the applicability and reference value of the conclusions. Fourth, the time span of the data in this study is limited, and the impact of FDI on the economy may vary across development stages, policy adjustments, or external shocks (e.g., trade conflicts, global pandemics). This study has not fully examined the long-term evolutionary patterns. Future research could employ longer-term panel data to explore the differential mechanisms of FDI quality and economic resilience across periods.

Data availability

Data used in this study are available from the corresponding author at reasonable request.

References

Ahmed EM, Kialashaki R (2023) FDI inflows spillover effect implications on the Asian–Pacific labour productivity. Int J Financ Econ 28(1):575–588

Alfaro L, Charlton A (2007) International financial integration and entrepreneurial firm activity. Kauffman Foundation Large Research Projects Report. Kauffman Foundation

Asif Z, Lahiri R (2021) Dimensions of human capital and technological diffusion. Empir Econ 60(2):941–967

Bai JH, Lyu XH (2015) FDI quality and environmental pollution improvement in China. J Intl Trade 41:72–83

Bitzer J, Kerekes M (2008) Does foreign direct investment transfer technology across borders? New evidence. Econ Lett 100(3):355–358

Branstetter L, Li G, Veloso F (2021) FDI and domestic innovation: the mediating role of human capital upgrading. Res Policy 50(7):104301

Briguglio L, Cordina G, Farrugia N, Vella S (2008) Economic vulnerability and resilience: concepts and measurements. Oxf Dev Stud 37(3):229–247

Chen Y, Jiang H, Liang Y, Pan S (2022) The impact of foreign direct investment on innovation: evidence from patent filings and citations in China. J Comp Econ 50(4):917–945

Dong WW, Wang HL (2024) Research on the impact of new quality productive forces on regional economic resilience. J Ind Technol Econ 43(11):22–30+161

Driffield NL, Love JH (2010) Foreign direct investment, technology sourcing and reverse spillovers. Manch Sch 71(6):659–672

Feng J, Zhang Y, Tsou JY, Xue T, Li Y (2021) Comparative study of factors contributing to land surface temperature in high-density built environments in megacities using satellite imagery. Sustainability 13(24):13706

Hou S, Zhang Y, Song L (2023) Digital finance and regional economic resilience: evidence from 283 cities in China. Heliyon 9(10):e21086

Hu XP, Xu P (2020) The impact of FDI quality characteristics on China’s high-quality economic development. J Int Trade 10:31–50

Hua XY, Lv HP, Jin X (2021) Research on high-quality development efficiency and total factor productivity of regional economies in China. Sustainability 13(15):8287

Jiang Y (2014) Openness, economic growth and regional disparities: The case of China. Springer, Berlin, Heidelberg

Jin B, García F, Salomon R (2019) Inward foreign direct investment and local firm innovation: the moderating role of technological capabilities. J Int Bus Stud 50(5):847–855

Kanval N, Ihsan H, Irum S, Ambreen I (2024) Human capital formation, foreign direct investment inflows, and economic growth: a way forward to achieve sustainable development. J Manag Pract Humanit Soc Sci Commun 8(3):48–61

Ke S, Lai M (2021) Spatial spillovers of FDI in China. China Econ Rev 68:101636

Klimek P, Poledna S, Thurner S (2019) Quantifying economic resilience from input–output susceptibility to improve predictions of economic growth and recovery. Nat Commun 10(1):1677

Le HTP, Pham H, Do NTT, Duong KD (2024) Foreign direct investment, total factor productivity, and economic growth: evidence in middle-income countries. Humanit Soc Sci Commun 11:1388

Li HY (2024) New quality productive forces, industrial co-agglomeration and urban economic resilience. Manag Mod 44(6):35–43

Li MJ, Wang J (2019) Quality of foreign direct investment and growth of China’s green total factor productivity. Soft Sci 33(9):13–20

Li Y, Chen H, Tian M (2024) Statistical measurement and spatiotemporal evolution characteristics of new quality productivity levels. Stat Decis 40(9):11–17

Li Q (2020) Economic development and response under COVID-19: analysis based on resilience economic theory. Financ Econ (4), 70–79

Liu Y, He Z (2024) Synergistic industrial agglomeration, new quality productive forces and high-quality development of the manufacturing industry. Int Rev Econ Financ 94:103373

Liu Y, Zhan SN (2024) Did the environmental protection fee-to-tax reform improve the quality of foreign direct investment? Tax Res 40(11):112–120

Lu Y, Tao Z, Zhu L (2017) Identifying FDI spillovers. J Int Econ 107:168–182

Lv YQ, Zhao B (2020) Foreign direct investment, regional innovation and industrial structure transformation. East China Econ Manag 34(7):44–51

Lv Z, Hu CP (2022) The spatial nonlinear effects of FDI on labor productivity: Empirical evidence from multinational panel data. Int Bus 36(1):87–102

Martin R (2012) Regional economic resilience, hysteresis and recessionary shocks. J Econ Geogr 12(1):1–32

Martini B (2020) Resilience, resistance and recoverability, regional economic structure and human capital in Italy. Are they related. Appl Econ Int Dev 20(1):47–62

Pan HF, Wei HJ (2018) Identification of spatial effects of financial development, FDI and economic growth. Stat Decis 34(22):154–157

Pu QP, Xiang W (2024) Connotative characteristics, internal logic and realization paths of new quality productive forces: new momentum for promoting Chinese modernization. J Xinjiang Norm Univ (Philos Soc Sci Ed) 45(1):77–85

Qin B, Gai Y, Ge L, Sun P, Yu Y, Zheng Y (2022) FDI, technology spillovers, and green innovation: theoretical analysis and evidence from China. Energies 15(20):7497

Qin D, Chen T (2025) New quality productive forces empowering agricultural and rural modernization: theory and empirical evidence. Stat Decis 41(6):11–16

Qiu S, Wang Z, Geng S (2021) How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J Environ Manag 287:112282

Reggiani A, De Graaff T, Nijkamp P (2002) Resilience: an evolutionary approach to spatial economic systems. Netw Spat Econ 2(3):211–229

Ren B, Dou Y (2024) New quality productive forces: a literature review and research prospects. Econ Manag Rev 40(3):5–16

Saha SK (2024) Does the impact of the foreign direct investment on labor productivity change depending on productive capacity? J Knowl Econ 15:8588–8620

Shao C, Dong H, Gao Y (2024) New quality productivity and industrial structure in China: the moderating effect of environmental regulation. Sustainability 16(16):6796

Shi JX, Xu L (2024) The strategic significance and pathways to accelerate the formation of new quality productive forces. Res Financ Econ Issues 46(1):3–12

Simmie J, Martin R (2010) The economic resilience of regions: towards an evolutionary approach. Camb J Reg Econ Soc 3(1):27–43

Song X, Qin X, Wang W (2025) Exploring the spatial spillovers of digital finance on urban innovation and its synergy with traditional finance. Emerg Sci J 9(2):45–62

Srivastava S (2003) Globalization and the quality of foreign direct investment. J Southeast Asian Econ 20(2):234–250

Sun L, Guo J (2024) Construction and empirical measurement of an evaluation index system for new quality productive forces. Stat Decis 40(9):5–11

Sun P, Li DJ (2023) Service trade, business environment and FDI quality: a quasi-natural experiment based on service trade innovation development pilot. Int Bus (J Univ Int Bus Econ) 5:60–77

Tan YZ, Hai X (2024) Can financial agglomeration effectively enhance county economic resilience? Spatial effect analysis based on 88 counties (cities) in Hunan Province. J Soc Sci Hunan Norm Univ 53(2):88–103

Tao M, Chen XX (2021) FDI, technological progress, and green total factor energy productivity: evidence from 281 prefecture cities in China. Environ Dev Sustain 24(9):11058–11088

Thuy BTD, VN Dung (2023) Does foreign direct investment stimulate the output growth of the formal economic sector in Vietnam: a subnational-level analysis. Int J Emerg Mark 18(11):5523–5541

United Nations Conference on Trade and Development (2023) Trade: unlocking sustainable strategies for people, planet and prosperity (UNCTAD/OSG/2024/1). https://unctad.org/publication/annual-report-2023

Wang F, Ning L, Zhang J (2017) FDI pace, rhythm and host region technological upgrading: Intra- and interregional evidence from Chinese cities. China Econ Rev 46(Suppl):S65–S76

Wang H, Ge Q (2023) Spatial association network of economic resilience and its influencing factors: evidence from 31 Chinese provinces. Humanit Soc Sci Commun 10:290

Wang H, Peng G, Du H (2024) Digital economy development boosts urban resilience: evidence from China. Sci Rep. 14:2925

Wang K, Guo XX (2024) The level of China’s new quality productive forces, regional differences and spatio-temporal evolution characteristics. Stat Decis 40(9):30–36

Wang CK (2024) From productive forces to new quality productive forces: an investigation based on the history of economic thought. Shanghai J Econ 43(3):14–30

Wang XL, Fan G, Hu LP (2019) China’s provincial marketization index report. Social Sciences Academic Press, p. 236

Wen Y (2022) Foreign direct investment and the innovation performance of local enterprises. Humanit Soc Sci Commun 9:252

Wen ZL, Ye BJ (2014) Mediation effect analysis: methodology and model development. Adv Psychol Sci 22(5):731–745

Xia T, Zhou JH, Sun JW (2024) Digital economy development, government intervention and urban economic resilience. China Soft Sci (5), 111–121

Xie KJ, Chen XY, Gong ZZ (2023) The impact of foreign direct investment on China’s green development performance and its spatial differences. Forum World Econ Polit 43(5):152–172

Xu CY, Feng DZ, Zhang WG (2025) The impact of new quality productive forces on regional economic resilience. Enterprise Econ 44(4):119–128

Xu HB (2024) New quality productive forces: scientific connotation, strategic considerations and theoretical contributions J Soc Sci 35:1–9

Xu Y, Wang ZQ (2024) Digital economy and export resilience: empirical evidence from panel data of 281 prefecture-level cities World Survey Res 37:15–26

Xu YP, Pan YT, Shi YM (2023) Digital inclusive finance, marketization level and high-quality economic development: evidence from 217 prefecture-level cities in China. J Financ Dev Res 42(1):47–56

Ye AZ, Fan KJ (2023) How does foreign direct investment affect resource allocation in the Yangtze River Delta? An empirical study based on semi-parametric spatial econometric model. Modern Manag Sci 42(4):3–12

Yin Y, Su XY, Xie XQ (2023) Spatial effects of industrial structure upgrading on urban economic resilience. Econ Geogr 43(8):86–92+112

Zhang AD (2018) Interprovincial FDI, financial market development and economic growth in China: a re-examination based on spatial panel Durbin model. Res Financ Educ 31(4):64–73

Zhang XF, Tang HY (2022) Quantity and quality of foreign direct investment and urban green total factor productivity: from the perspective of innovation capability. J Henan Inst Sci Technol 42(7):1–8

Zhang XF, Hu BB, Chen W, Zhang SJ (2023) FDI quantity, quality and innovation performance of national high-tech zones. Sci Res Manag 44(5):54–61

Zhang Z, Li JG, Tangnu’er H (2024) Measurement and spatio-temporal evolution of China’s new quality productive forces development level. Stat Decis 40(9):18–23

Zhao JJ, Zhang XX, Wang YH, Miao CH (2023) Spatio-temporal pattern characteristics and influencing factors of regional economic resilience in China. Econ Geogr 43(8):1–11

Zhao M, Chen Q, Dai D, Fan Y, Xie J (2024) The spillover effect of foreign direct investment on China’s high-tech industry based on interprovincial panel data. Sustainability 16(4):1660

Zhao S (2024) Foreign business presence and local entrepreneurship development: evidence from China. Humanit Soc Sci Commun 11:1224

Zhong X, Chen XS (2012) Regional differences and influencing factors of foreign direct investment: a comparative study. Stat Res 29(3):54–60

Zhou W, Xu LY (2023) On new quality productive forces: connotative characteristics and key focal points. Reform 36(10):1–13

Zhu FX, Li RX, Xu XL, Sun JC (2024a) Index construction and spatio-temporal evolution of China’s new quality productive forces. J Ind Technol Econ 43(3):44–53

Zhu S, Li X, Zhang Y (2022) Can foreign direct investment harness green innovation? Evidence from Chinese cities. Energy Econ 110:106000

Zhu ZY, Yang FM, Li WL (2024b) Three-dimensional innovation ecosystem and level measurement analysis of new quality productive forces. J Yunnan Univ Finance Econ 40(6):1–14

Acknowledgements

This work is supported by the Zhejiang Provincial Soft Science Research Program Key Project (No. 2024C25043), as well as by Zhejiang Provincial Philosophy and Social Sciences Planning Project (No. 23NDJC226YB), and the Ministry of Education Humanities and Social Sciences Research Planning Youth Fund Project (No. 24YJC790063).

Author information

Authors and Affiliations

Contributions

Haiping Lv: Drafted the outline of the paper, drafting the initial manuscript, Polishing the language and performing critical reviews; Yi Lian: Responsible for data collection and organization, empirical analysis, drafting the initial manuscript, and revisions; Xiangyu Hua: Is corresponding author for this article, jointly supervised this work, Drafted the outline of the paper, refining the manuscript and Polishing the language. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Ethical approval was not required as the study did not involve human participants.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Lv, H., Lian, Y. & Hua, X. The relationship between FDI quality, new quality productivity forces, and economic resilience in China’s Yangtze River Delta region: insights from an empirical spatial Durbin model. Humanit Soc Sci Commun 12, 1083 (2025). https://doi.org/10.1057/s41599-025-05436-0

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05436-0

This article is cited by

-

Resilience and recovery in CEE economies: examining sectoral adaptations and the role of FDI post-pandemic

Review of Managerial Science (2026)