Abstract

In recent years, Chinese cross-border e-commerce (CBEC) firms have experienced rapid growth, playing an increasingly vital role in the global market. However, this expansion is accompanied by persistent challenges, including inefficient marketing, costly cross-border communication, and limited financial support. Despite these issues, the key factors driving CBEC firms’ high-quality development remain insufficiently explored. This study fills this gap by leveraging a fuzzy-set qualitative comparative analysis (fsQCA) to identify the key drivers of high performance and propose actionable strategies for industry practitioners and policymakers. Based on the theoretical framework of high-quality growth and financial data from 95 listed CBEC companies in China, the research reveals that: first, no single factor alone guarantees high- or low-quality development of CBEC firms, but market expansion, employees’ educational background, and government’s financial support are the main core causal conditions for the high-quality development of CBEC companies; second, CBEC enterprises’ high-performance can be achieved through three driving paths: Market expansion driving, Core competence—Policy driving and External conditions driving; third, an analysis of companies experiencing low-quality growth reveals that this condition can be attributed to a lack of market expansion and highly educated employees. This study offers a comprehensive analytical framework to explore the intricate interplay between internal and external factors influencing the trajectory of CBEC firms. Integrating fsQCA with traditional quantitative methods addresses key gaps in CBEC research. In addition, the study highlights the importance of aligning market expansion strategies, workforce development, and government policy support to drive sustainable performance.

Similar content being viewed by others

Introduction

Cross-border e-commerce (CBEC) refers to the online buying and selling of goods and services across borders through digital platforms, encompassing activities such as product sourcing, marketing, logistics, and customer service to promote global commerce (Li et al., 2022; Ma et al., 2021). The emergence of CBEC has revolutionized international trade by reshaping interactions between businesses and global consumers, enabling companies to reach international markets at lower costs and with greater efficiency while meeting diverse consumer demands (Mou et al., 2019; Liu and Li, 2020; Xu et al., 2021; Ma et al., 2021; He et al., 2023). Amidst the burgeoning global CBEC landscape, China plays a leading role in this economic transformation. As one of the largest and fastest-growing CBEC markets, China has leveraged its robust digital infrastructure, expansive manufacturing capabilities, and vast consumer base to drive significant sector growth (Li et al., 2022; Zhong et al., 2022). Supportive policies, including CBEC comprehensive pilot zones, pilot free trade zones, and favorable tax measures (Mi et al., 2021; Yin and Choi, 2023), have enabled Chinese enterprises to expand globally, unlocking opportunities for growth and innovation. However, regulatory compliance, intense competition, and logistical issues hinder sustainable growth (Han et al., 2024; Che et al., 2024). Moreover, rapid technological changes and shifting consumer preferences demand continuous adaptation. Therefore, in the face of these challenges and opportunities, adopting strategic approaches to promote high-quality development is essential for ensuring the long-term sustainability and competitiveness of China’s trade and economic sectors (Song et al., 2019; Shi et al., 2020; Hazarika and Mousavi, 2021).

To promote the high-quality development of CBEC, scholars have conducted extensive research to identify pathways for promoting the high-quality development of CBEC enterprises from different perspectives (Wang et al., 2015; Huang, 2017; Huang and Chang, 2017; Cheng et al., 2019; He et al., 2023). For instance, Wang et al. (2015), from a policy perspective, examined the profound impact of legal regulations and electronic customs clearance mechanisms on CBEC performance. Their findings revealed that a well-developed legal framework can significantly enhance operational efficiency and market competitiveness. By adopting a talent development perspective, Cheng et al. (2019) combined Problem-Based Learning (PBL) with social media tools to design a talent cultivation model tailored explicitly to CBEC. This model aimed to improve students’ practical skills to align with industry demands. From a consumer perspective, Huang and Chang (2017) explored factors influencing consumers’ intentions to shop on foreign websites. They identified key drivers of CBEC competitiveness, including competitive pricing, product uniqueness, and waiting costs.

While these studies offer valuable insights into CBEC development, the existing literature predominantly adopts a single-dimensional approach, lacking a comprehensive integration of internal and external dimensions. In fact, the factors affecting the high-quality development of CBEC enterprises can be categorized into two main types: external and internal factors. External factors include government structures (e.g., policies, laws, transport systems), economic factors (e.g., GDP), and the CBEC trade foundation (e.g., import/export volume), among others (Wang et al., 2015; Huang, 2017). Internal factors encompass aspects such as talent management, consumer understanding, strategic planning, service quality, product differentiation, and so forth (Huang and Chang, 2017; Cheng et al., 2019; He et al., 2023). Previous studies often overlook the interactive effects between internal factors and the external environment, failing to fully explain the complex relationships that influence CBEC enterprise development. This gap highlights the current research shortcomings and undermines the robustness of existing arguments. Therefore, there is an urgent need to introduce new theoretical perspectives to elucidate the pathways for high-quality CBEC development. To address this, we integrate the Competitive Advantage Theory and the Dynamic Capabilities View (DCV) to explore the synergies between external and internal factors in CBEC enterprises. This approach provides systematic insights into the mechanisms driving high-quality development and helps bridge existing research gaps.

Moreover, in terms of research method, previous research primarily uses case analysis (Xu, 2008; Shenglong, 2022) or quantitative methods (Wang et al., 2015; Huang and Chang, 2017; Anthony et al., 2019; Gharizadeh Beiragh et al., 2020; Li et al., 2021). These methods provide reliable statistical results/evidence for uncovering high-quality development in e-commerce enterprises; however, they still possess certain limitations. Quantitative methods like Structural Equation Modeling, Principal Component Analysis, and factor analysis identify general patterns but miss case-specific details and the impact of causal relationships under complex influences. Conversely, qualitative analysis provides depth but lacks external generalizability. Given the complexity of studying CBEC’s high-quality development, we used fsQCA to overcome the limitations of both qualitative and quantitative methods. FsQCA is suitable for both large sample quantitative analysis (over 50 cases) and qualitative analysis of medium (10–50 cases) or small samples (below 10). With a sample size of 95, fsQCA is appropriate. This method bridges the gap between quantitative generalizability and qualitative depth, exploring the interplay of internal and external factors driving CBEC development from a configurational perspective and providing a comprehensive understanding of how they interact.

In summary, with the rapid development of CBEC, increasing research explores factors facilitating its growth. However, few studies have addressed external and internal factors contributing to CBEC firms’ development. Traditional case analysis and quantitative methods often focus on single causal factors, overlooking asymmetric causality and the complexity of CBEC growth. Using data from China’s National Bureau of Statistics, China Stock Market Accounting Research (CSMAR), and annual reports of 95 listed CBEC firms, this paper applies fsQCA based on Competitive Advantage Theory and DCV to identify the driving factors and key configurations of high-quality CBEC growth. This study broadens the research scope on organizational growth, enriches Competitive Advantage Theory and DCV, and offers policy recommendations for government entities and practical suggestions for CBEC enterprises. This study provides a comprehensive view of the complex interactions between factors in CBEC by overcoming methodological limitations.

Literature review and analytical frameworks

Literature review

High-quality development, widely acknowledged by scholars as a multidimensional concept that integrates economic, social, and environmental considerations, goes beyond the mere quantity of economic growth. It emphasizes the quality of this growth, prioritizing factors such as efficiency, innovation, sustainability, inclusivity, digital transformation, and energy-efficient technologies (Penrose, 1959; Wang et al., 2015; Zhang et al., 2022; Fan et al., 2023; Ullah et al., 2023; Zulfiqar et al., 2023). Long-term economic stability relies on continuous technological advancement and management innovation, which are crucial for enterprises and economies to adapt to dynamic market conditions and achieve sustainable growth. In the specific context of CBEC enterprises, high-quality development involves strengthening core competencies to maintain competitiveness in the global marketplace. This process requires leveraging national and industry-level resources to build competitive advantages, enhance product/service quality, stimulate consumer demand, and achieve profitability while pursuing dynamic and sustainable growth (Wang et al., 2015; Huang, 2017; Huang and Chang, 2017; Cheng et al., 2019; Xiao et al., 2022; He et al., 2023; Kapoor et al., 2023; Van, 2024).

Current research on the high-quality development of CBEC enterprises remains limited. Scholars have applied a limited range of frameworks, including the Two Market Theory, Signaling Theory, Technology-Organization-Environment (TOE) framework, and Perceived Risk Theory, to understand CBEC. For instance, Huang and Chang (2017) leveraged the Signaling Theory to highlight product uniqueness, waiting costs, and service quality as key drivers of CBEC competitiveness. Similarly, Xiao et al. (2022) adopted the TOE framework to explore how international cooperation, government support, and innovation during the COVID-19 pandemic can catalyze sustainable growth in global e-commerce. Furthermore, Van (2024), based on Perceived Risk Theory, found that the interaction between individual-level cultural dimensions, perceived risk, and affective risk can enhance customer trust and mitigate risks in CBEC. However, these studies still have some limitations. Theories like Signaling Theory, Two Market Theory, and Perceived Risk Theory overlook external factors such as changing regulatory and market environments, trade barriers, and cultural differences. Although the TOE framework provides a relatively holistic lens to analyze internal and external factors, it struggles with adaptability to rapidly evolving market conditions and often fails to account for the unique nature of internal resources, which are critical for sustaining competitive advantage.

To overcome these theoretical challenges, this study proposes an integrated approach combining Competitive Advantage Theory and the DCV. Competitive Advantage Theory underscores the importance of identifying and optimizing unique resources to establish sustainable competitive advantages (Porter, 1990). In parallel, the DCV highlights the significance of adaptive capabilities, enabling enterprises to respond proactively to changes in the external environment (Rialti et al., 2019; Ciampi et al., 2021). By synthesizing these perspectives, the proposed framework harmonizes the evaluation of internal strengths with the dynamic interaction of external forces. This approach bridges existing theoretical gaps and provides deeper insights into pathways for the sustainable and high-quality development of CBEC enterprises.

Analytical frameworks

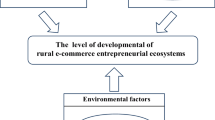

First, this article used the Competitive Advantage Theory as the theoretical foundation of the analytical framework. The Competitive Advantage Theory refers to factors that allow a company or an industry to outperform its market competitors (Porter, 1990). These factors, according to Porter (1990), can be divided into six components: factor conditions, demand conditions, related/supporting industries, as well as firm strategy, structure, and rivalry, chance, and government. Based on this and the characteristics of the CBEC industry, we propose three external secondary indicators: regional import and export trade (demand conditions), tertiary industry’s development (related/supporting industries), government’s support measures (government), and three internal secondary indicators: human resources (factor conditions), ability of opportunity identification (chance), firms’ strategic capability (firm strategy, structure, and rivalry). Based on this, we set up the theoretical, analytical framework of organizational growth factors (as shown in Fig. 1).

Furthermore, this study employed the DCV as a complement for proposing conditional variables. DCV refers to an organization’s dynamic ability to sense and seize new chances, evolve, and reconfigure (Teece et al., 1997; Teece, 2007). Specifically, opportunity sensing ability means the capability of organizations to identify opportunities and threats by scanning the external environment. Opportunity-seizing capability is an organization’s ability to seize opportunities, mobilize resources, and realize value. The ability to evolve and reconfigure requires organizations to continuously innovate and balance internal and external collaborative relationships.

Integrating Competitive Advantage Theory with the DCV offers a more comprehensive analysis of CBEC companies’ growth, combining static elements of competitive advantage with dynamic adjustments necessary for long-term success in a rapidly changing environment. Competitive Advantage Theory provides a static view of how firms leverage specific conditions and strategies to gain market advantages at a particular moment. It focuses on utilizing unique resources and capabilities to establish a strong market position. However, it mainly addresses competition under established market conditions without fully addressing the adaptability and innovation needed over time. In contrast, DCV adds a temporal dimension, focusing on firms’ ability to identify opportunities, allocate resources, and create value amidst ongoing environmental changes. It encompasses capitalizing on current advantages, anticipating future trends, and making strategic adjustments for sustained competitiveness. By integrating these two complementary theories, we propose three external conditional variables: regional cluster of CBEC trade, logistics capacity, government’s financial support, and three internal conditional variables: employees’ educational background, R&D investment, market expansion, and building up the analytical model of growth factors of CBEC company (shown in Table 1).

Next, we will introduce the six variables and the methods used to measure them in detail, explaining how each variable contributes to the overall framework.

Regional cluster of CBEC trade

According to the “demand” conditions in the Competitive Advantage Theory, factors such as the concentration of regional import and export trade, early home demand, market size, and market growth reflect the fundamentals of developing an outward-oriented economy in that area. Zhao (2020) pointed out that the regional cluster of CBEC trade reflects the level of international trade activity of a region, as well as a company’s market penetration and business capabilities in the field of CBEC. Therefore, the regional cluster of CBEC trade can be an essential measurement for the high-quality development of CBEC enterprises. This study reviewed publicly available data from city statistical bureaus, customs websites, and other official sources. Due to the inconsistent reporting of CBEC import and export figures across cities, we focused on broader indicators reliably reflecting CBEC activities, ensuring data availability and completeness. Based on the characteristics of the CBEC industry, we use the ratio of total foreign trade volume to regional GDP, which reflects the level of activity and economic openness of a city, to assess the CBEC trade basis in a city (Che et al., 2024).

Logistics capacity

Based on the “related and supporting industries” condition of the Competitive Advantage Theory, the performance of related and supporting industries can produce critical inputs for innovation and internationalization. An industry can only develop healthily with a related and supporting ecosystem that can provide technology and components. When seeking good deals abroad, one of the consumers’ most significant concerns regarding CBEC purchases involves logistics, e.g., receiving the products on time, which indicates that logistics plays a significant role in developing CBEC business (Giuffrida et al., 2017; Ma and Liang, 2021). Moreover, a well-developed logistics network can ensure that orders are fulfilled promptly, goods are delivered intact, and customers receive support throughout the shipping process, enhancing satisfaction and loyalty. Therefore, the support level of these tertiary industries can be reflected by the support of the logistics industry. Based on data availability, completeness, and variability, we chose the city’s total revenue from the logistics industry to measure the logistics industry level in a region.

Government’s financial support

“Government” can actively promote infrastructure development and talent cultivation by planning and implementing financial policies and legal regulations, which can enhance the development and competitiveness of businesses. For CBEC enterprises, the government’s financial support for the CBEC industry can reflect the government’s attention toward the CBEC industry. It can directly or indirectly impact enterprises’ liquidity and financial health, so it is a crucial variable driving the high-quality development of CBEC firms on the global stage (Che et al., 2024). Consequently, we use local governments’ general public budget expenditure (it can help create a favorable policy environment) to reflect the government’s financial support of CBEC development in a city.

Employees’ educational background

In the knowledge-intensive and technology-driven CBEC industry, a sufficient quantity and high quality of human resources contribute to achieving high-quality labor productivity. Consequently, enterprises in the CBEC industry, both upstream and downstream, need a substantial workforce of highly skilled professionals. These professionals should be capable of providing financial, data, and information services, which are crucial for gaining cost advantages and securing competitive edges. Cheng et al. (2019) and Che et al. (2023) pointed out that the educational background of employees reflects their overall knowledge base and professional competence, providing an effective indicator to measure the quality of talent resources in a company. Based on the characteristics of the CBEC, we use “the number of employees with a bachelor’s degree or higher in a company” to measure the employees’ educational background.

R&D investment

Chance, which serves as an auxiliary condition in Competitive Advantage Theory, refers to unpredictable external events, such as technological breakthroughs and shifts in market demand. Companies must enhance their ability to identify and leverage new technologies to thrive in the competitive global market. R&D investment is crucial for recognizing and seizing external opportunities, enabling firms to meet international market demands more effectively (Rialti et al., 2019; Ma et al., 2024). Therefore, this study uses R&D funding as a proxy for firms’ ability to identify opportunities.

Market expansion

Currently, addressing issues such as communication cost, waiting cost, and return cost has become crucial when enterprises plan market strategies to expand into new markets (Huang and Chang, 2017; Zha et al., 2022; Mou and Wang, 2023). Generally, when a company aims to expand its presence in these markets, it is necessary to increase sales expenses to provide multi-language websites, AI-powered customer service, digital exhibitions, or set up overseas warehouses, which can facilitate them to reach more consumers and improve their trust and intention to shop (Lu et al., 2022). Considering the quantifiability of data, this study selects the listed companies’ sales expenses mentioned in their annual report to measure their ability to market expansion.

Research methodology and data processing

Research method

Qualitative comparative analysis (QCA), first proposed by Charles Ragin in 1987, is a case-oriented method in which applying QCA refers to investigating datasets (Ragin and Strand, 2008; Li et al., 2021). The QCA method challenges some core assumptions in mainstream statistical methods and broadens the framework for causal analysis by relaxing certain assumptions. Recently, QCA has gradually become popular, particularly in the field of management, in which it addresses “result-driven” and “configuration” questions (Du et al., 2022). Utilizing Boolean algebra and set theory, QCA explores configurations of conditions that are essential or sufficient for specific outcomes (Schneider, 2018). Unlike conventional statistical methods that focus on symmetrical and linear relationships, QCA can analyze both symmetric and asymmetric, as well as linear and non-linear relationships (Xu et al., 2024). Among methods suitable for comparative research with small case numbers, Ragin’s QCA was appealing due to its effectiveness in addressing complex causal relationships and the role of context in complex interventions (Rao et al., 2019; Hanckel et al., 2021). Moreover, QCA identifies multiple concurrent causalities, emphasizing the diversity and complexity of causality across conditional variables (Cao et al., 2024). Specifically, it includes crisp-set QCA (csQCA), multi-value QCA (mvQCA), and fsQCA. FsQCA, in particular, offers the benefit of preserving truth value assessment while simplifying the handling of partial membership and changes in degree (Tahir et al., 2025). This capability allows researchers to retain information about the cases under study, thereby enhancing the depth and accuracy of the analysis (Li et al., 2021). Therefore, this study chose fsQCA to identify the developmental pathways of CBEC enterprises in detail.

Case selection and data collection

First, this article used Choice software (a subsidiary of East Money Information) to identify 121 companies listed in the A-share market within the CBEC sector as of December 2023. After excluding delisted companies with ‘ST’ (Special Treatment) and ‘*ST’ (Special Treatment with Risk Warning) status, 118 companies remained. These companies cover 34 cities of 17 provincial-level administrative regions in China, displaying significant heterogeneity and meeting the diversity requirements for case selection. Subsequently, we used data from the China Stock Market & Accounting Research (CSMAR) database and applied strict inclusion criteria based on the availability, completeness, and comparability of financial data for CBEC companies. Only companies with publicly available financial statements for the past three fiscal years were considered. Companies were included only if their financial data were comprehensive, without significant omissions or discrepancies. Additionally, selected firms were required to adhere to consistent accounting standards throughout the study period to ensure the validity of the comparative analysis. Based on these criteria, 95 companies were ultimately selected for the study. The selected companies not only reflect the identities of listed CBEC enterprises and their compliance with listing requirements but also ensure the measurability of financial data and meet the homogeneity requirements for sample case selection.

Second, the specific data were collected from the following databases and sources: (1) the data used to evaluate the financial performance of CBEC-listed firms are mainly from CSMAR database; (2) express delivery capacity and other data used to measure the external factors of high-quality growth of CBEC firms are mainly from China Statistical Yearbook, China Logistics Yearbook, etc.; (3) R&D funding and other data used to measure the internal factors are obtained from the annual reports of listed CBEC firms.

Measurement of outcome variables

When evaluating organizational growth performance, two types of indicators are commonly employed: single and composite indicators. Single indicators, such as net profit or revenue growth rates, focus on specific performance aspects. Composite indicators combine multiple dimensions into a comprehensive index, offering a more holistic and widely preferred approach for assessing high-quality development. This study adopts Teece et al.‘s DCV framework (1997) and employs quantitative methods with financial composite indicators. Considering the characteristics of CBEC-listed companies, it uses four sub-variables—profitability, operational capability, growth capability, and debt repayment capability—to measure enterprise development (DEVE). These indicators provide an objective record of financial performance, reflecting core operational characteristics and strategies driving high-quality growth. Detailed metrics are presented in Table 2.

To address comprehensive evaluation issues, scholars combine the entropy weight method with the catastrophe progression method to rank indicator weights in the comprehensive evaluation of enterprises (Chen et al., 2020; Li et al., 2021; Xu and Wang, 2024). This approach integrates catastrophe theory and fuzzy mathematics, beginning with constructing a fuzzy membership function and applying normalization formulas for quantitative calculations. The entropy weight method initially ranks third-level indicator weights by importance and then calculates comprehensive evaluation values through normalization formulas (Karman and Pawłowski, 2022). This integration reduces subjectivity in ranking and enhances evaluation rigor. Detailed steps for assessing CBEC firms’ performance using these methods are outlined below.

Step 1: Standardization processing. The evaluation model’s first three sub-variables (i.e., profitability, operational capability, and growth capability) are positive indicators. The formula for standardizing these positive indicators is shown in Eq. (1).

In this equation, Xij represents the original data of the jth index in the ith enterprise; Pij is the standardized value of Xij; max (Xij) is the maximum value of the jth indicator among all enterprises in the sample; min (Xij) is the minimum value of indicator j among all enterprises in the sample.

Besides, the fourth sub-variable (debt repayment capability) is a moderation indicator, so this study set a moderation index to standardize these indicators. Generally, researchers set the moderate value for the current ratio indicator to 2, the quick ratio indicator to 1, and the debt-to-assets ratio indicator to 0.5. The formula for calculating the moderate indicator is shown as Eq. (2) (Verbeke et al., 2019).

In this equation, Xij represents the original data of ith enterprise’s jth index; Pij represents the indicator data after positive processing of Xij, and A is the target value.

Step 2: Calculating the entropy value Ej (0 ≤ Ej ≤ 1) and the coefficient of variation dj. In the entropy weight method, the entropy value Ej and dj of the jth index are defined as in Eqs. (3) and (4) separately (Dong et al., 2018).

When using the entropy weight method, Pij*ln Pij = 0 is usually set when Pij = 0 to make the calculation convenient.

Step 3: Calculate the weight of third-level indexes. The weight of the jth indicator for the ith enterprise was calculated and denoted as ωj, as shown in Eq. (5).

In the equation, k represents the number of indicators. The larger the dj is, the more significant the impact on the indicator is, and the higher the weight.

After calculating the weights for all third-level indicators, the indicators were ranked (as shown in Table 3).

Step 4: Standardize the financial indicator data. Before calculating the membership function value, the influence of each index dimension (namely dimensionless processing) must be removed by using the normalized formula (as shown in Table 4).

In the equation, x is the state variable; f(x) is the potential function of the state variable; and a, b, and c are the control variables of the state variable. Taking Tongcheng Holdings’s Operational capability index as an example, it belongs to the swallowtail model, so the calculation method is as follows:

Step 5: Calculating second-level indicators involved using SPSS 24.0 to analyze the correlation of third-level indicators. Profitability and debt repayment systems were complementary, while operational and growth capability systems were non-complementary. For complementary systems, averages were used; minimum values were selected for non-complementary ones. For example, Tongcheng Holdings’ operational capability index was calculated as the average of its complementary third-level indicators.

After the calculation, the catastrophe membership function values of the secondary indicators of each company in 2023 were obtained (some of them are shown in Table 5 as examples).

Step 6: First-level indicators were calculated by integrating secondary indicators using the normalization formula. The potential functions (see Table 4) were computed, and their averages were used to derive the comprehensive growth values. The ranked results for 95 CBEC companies are partially shown in Table 6.

Data calibration

Data calibration, which is an integral aspect of fsQCA, is the process of assigning membership scores to acquired cases. Following previous studies and the data feature of this study (Howell et al., 2022; Jia et al., 2023; Xie et al., 2024), the direct calibration method is used to set the three calibration points: full membership (i.e., more than the 75th percentile), crossover point (median, namely the 50th percentile), and full non-membership (i.e., less than the 25th percentile). The outcome variable “CBEC firms’ development evaluation” and the six conditional variables “regional cluster of CBEC trade, logistics capacity, government’s financial support, employees’ educational background, R&D investment, and market expansion” are calibrated and named DEVE, RCCT, LC, GFS, EEB, RDI, and ME, respectively. The calibration anchor points and descriptive analysis results are shown in Table 7.

After calibration, the cases occurred as partial 0.5 in terms of fuzzy-set membership, which will hinder the classification of cases that are not added to the analysis and result in incorrect results. Therefore, we added 0.001 to the fuzzy-set membership degree of 0.5 after the calibration to solve the problem (Fiss, 2011).

Results and analysis

Necessary condition analysis

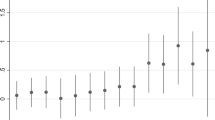

Necessity condition analysis determines the conditions necessary for the outcome (Fiss, 2011). Ragin and Strand (2008) proposed that consistency, which refers to the uniformity of relationships between conditions and outcomes, is an indispensable detection standard for necessary conditions. For a condition to be regarded as necessary for the outcome (or for its negation), its consistency must exceed 0.9 (Schneider, 2018), and it must have non-trivial coverage (the percentage of cases within the sample that share a specific configuration) (Ciampi et al., 2021; Tahir et al., 2024). The necessary condition analysis using fsQCA indicated that the consistency and coverage of the six condition variables were less than 0.9, thus indicating that none of the conditions could fully produce high or low-quality development of CBEC companies. Table 8 presents these results.

The construction of the truth table

In fsQCA, the “truth table solution” assesses which causal combination leads to a specific outcome (Ragin and Strand, 2008). For this study, we set the consistency threshold at 0.8, PRI (proportional reduction in inconsistency) at 0.7, and case frequency at 1 (Ciampi et al., 2021). After analysis, three solutions were obtained: complex, parsimonious, and intermediate. Intermediate solutions incorporating logical remainders are most commonly reported in QCA studies. Therefore, we chose to report the intermediate solutions.

Configurational analysis of high-quality development of CBEC firms

According to the hierarchical relationship between parsimonious and intermediate solutions, this study identified the core and peripheral conditions affecting the development of CBEC enterprises. Then, this study categorized the configurations of high-quality growth into three groups of solutions based on the core conditions of the four configurations, namely, solutions S1, S2a, S2b, and S3. As is shown in Table 9, all the solutions exhibit acceptable consistency (>=0.80), and the overall consistency is 0.8804, indicating all the configurations exceed the consistency threshold. The raw coverage of each configuration is larger than 0, and the overall solution coverage is 0.4231, which means that each configuration can explain some of the high-level growth cases of CBEC enterprises. Collectively, the three configurations provide an acceptable explanation for a portion of these high-level growth cases. In this study, 33 enterprises were identified as exemplars of high-quality development based on the parsimonious solution. From these, we highlight 15 representative firms using the intermediate solution to provide an in-depth exploration of the best practices and success factors that define high-quality development in the CBEC sector. This selection process ensures that the chosen enterprises meet the criteria for high-quality development and serve as illustrative examples within the configurations identified by the solutions S1, S2a, S2b, and S3. Next, according to the characteristics of each type of configuration, this study selected typical cases for further analysis to verify the consistency of the results.

(1) Market expansion driving (S1)

Marketing capabilities empower companies to achieve market expansion and high-level growth. The sample cases covered by this solution are three companies: Global Top (GTE), Hunan Friendship&Apollo Commercial, and Zhejiang Ming Jewelry. These firms’ growth evaluation values are above 0.8 (the Median value), indicating they have achieved high-quality growth. Specifically, in Configuration S1, market expansion is a core condition, and government financial support is a peripheral condition. In contrast, the other two external variables (regional cluster of CBEC trade and logistics capacity) and an internal condition (R&D investment) are absent as the core or peripheral conditions. This means that in less developed trade cities, companies that lack employees’ educational background and R&D investment, with relatively strong government fiscal support, can overcome these deficiencies by increasing marketing expenses to optimize marketing capabilities, enhance customer service level, and improve consumer loyalty. In the digital era, distance is no longer an insurmountable barrier between businesses and customers. Companies benefiting from government support can utilize marketing to gain insights into target markets and identify consumer pain points. They can offer competitive and personalized products by selecting appropriate products and cooperating with reliable suppliers. Moreover, by establishing localized marketing teams and optimizing marketing capabilities, companies can acquire customers more effectively, build brand advantages, and achieve high-quality development. In summary, CBEC, through technological and model innovation, plays a vital role in driving market expansion and enhancing competitiveness. This underscores the critical importance of market expansion as a key factor for achieving high-quality development of CBEC firms in new markets and sustaining long-term growth.

A prominent example of a company that demonstrates the integration of these factors and achieves high-quality development through substantial market expansion is GTE. As a leader in China’s CBEC industry, ranked 29th among 95 firms, GTE is a key example of high-quality development in configuration S1. GTE is an e-commerce platform for cross-border trade that provides a convenient, secure, and reliable trading platform for businesses and consumers worldwide. The company is located in Taiyuan, Shanxi, an inland region in central China with a low regional cluster of CBEC trade and poor transportation infrastructure. However, since its establishment on March 7, 2003, the company has grown rapidly. Currently, it operates leading self-managed apparel and electronics sites and ranks first in sales on the eBay platform, having established a complete end-to-end process for CBEC retail. Its success is primarily attributed to the following two aspects. First, the city in which it is located became a comprehensive pilot zone for CBEC in December 2019. Since then, it has benefited from some financial support from the government. Second, it is good at market expansion (such as supply chain integration and influencer marketing). For example, the company has a professional procurement team that can select high-quality, competitive products from numerous Chinese suppliers. Besides meeting the needs of consumers in different countries and regions, it also provides multilingual customer service and customized marketing promotion plans. In 2022, GTE’s sales expenses were USD 0.061 billion, higher than many CBEC platforms, helping it gain more advantages in this field.

(2) Core competence: policy driving (S2a−S2b)

This configuration is characterized by the synergy between a company’s core competencies and government policy guidance, achieving high-quality development of enterprises. Configuration S2a indicates that when the regional cluster of CBEC trade is absent as a core condition, enterprises can leverage core conditions such as a high proportion of marketing investment, a well-educated workforce, and substantial government financial subsidies, along with peripheral conditions like relatively heavy R&D investment and good logistics support, to drive high-quality development. This solution covers four sample cases: FSPG HI-TECH CO., LTD (FSPG), Zhejiang Orient Financial Holdings Group, etc. All of these firms’ growth evaluation values are above the median value. Configuration S2b illustrates a scenario where enterprises can achieve high-quality development without a robust CBEC trade foundation by leveraging four core conditions: government subsidies, employees’ educational background, R&D investment, and marketing promotion. Government subsidies play a pivotal role by potentially enhancing marketing capabilities, R&D investment, and workforce quality. This integration helps enterprises overcome external challenges such as a low regional cluster of foreign trade and insufficient transportation capabilities. The sample cases covered by this solution are six companies: Anker Innovations, China Tourism Group Duty Free Corporation, etc. The average evaluation value of these firms is 0.844, which is above the median value. Configurations S2b and S2a share similarities in their emphasis on internal core competencies and their reliance on government subsidies, making them suitable for enterprises in regions with low foreign trade concentration but strong local government initiatives to develop an outward-oriented economy. This alignment suggests that enterprises with strong internal driving forces can consolidate their capabilities and expand competitive advantages through the strategic use of government financial subsidies. In summary, enterprises that effectively align their core competencies with government support can overcome external barriers and further enhance their dynamic capabilities. This is crucial for sustainable growth in regions with weaker foreign trade concentration but strong local government initiatives.

FSPG ranked 33rd among 95 firms, is a leading company in China’s new plastic materials industry, and represents configuration S2a. FSPG is located in Foshan, and it thrives despite Foshan’s weak CBEC trade foundation. Supported by strong R&D and opportunity identification, FSPG received a government subsidy of USD 2.3 million in 2022. With policy support, its R&D investment reached USD 0.02 billion in 2022, growing at an average annual rate of 5.14%. Moreover, FSPG employs a highly educated workforce, with 55.45% of its 1,755 staff holding a bachelor’s degree or higher, surpassing the industry average of 28.11%. Additionally, its investment in the “Guangzhou Nansha Free Trade Zone South China CBEC Park” project aims to reduce CBEC costs and promote high-quality development.

Anker Innovations (ranked 17th among 95 firms), a leading Chinese CBEC brand, exemplifies successful internationalization for solution S2b. Headquartered in inland Changsha, Anker overcame logistical challenges by focusing on R&D and brand building. Transitioning early from “product export” to “brand export,” Anker made substantial R&D investments to better meet consumer needs and enhance brand visibility. It also enhanced marketing and customer service, establishing a globally oriented team to localize its operations. In 2022, Anker’s sales expenses totaled USD 0.54 billion, while R&D investment reached USD 0.20 billion. These two items represent the company’s largest expenditures. Additionally, the company received USD 2.56 billion in government subsidies, exceeding the industry average. These investments and government support helped Anker overcome logistical challenges and become the world’s third-largest digital charging brand by retail sales.

(3) External conditions driving (S3)

This configuration corresponds to solution S3: the sample cases covered by this solution are two companies: XIAMEN ITG GROUP CORP., LTD. (ITG) and Zhejiang China Commodities City Group. The average evaluation value of these firms is 0.842, signaling they have achieved high-quality development. This solution can be expressed with the formula “RCCTfs*LCfs~GFSfs*EEBfs~RDIfs*MEfs,” which can be interpreted as: in regions with a high CBEC trade concentration and high-level logistics, companies can achieve high-quality development when their employees are highly skilled and actively explore new markets. In this situation, government subsidies and corporate R&D investment have a less noticeable impact on the outcome. This solution primarily applies to developed coastal regions and key CBEC export hubs in China. These areas’ strong economic foundations and industrial chains help compensate for enterprises’ limited R&D capabilities. This highlights the importance of leveraging regional trade clusters and logistics infrastructure, which provide crucial external advantages. These factors can reduce firms’ reliance on internal R&D investment, helping them achieve competitive advantages and high-quality development, particularly in regions with strong trade ecosystems.

ITG, ranked 6th among 95 firms, is a leader in China’s transportation and supply chain services and a typical example of configuration S3, specializing in supply chain management for over 40 years. Recently, ITG has expanded its international reach, operating in over 170 countries, with an annual revenue of USD 65.0 billion. A key factor in its success is Xiamen’s favorable business environment, characterized by a robust export-oriented economy, high CBEC trade concentration, and a well-developed logistics network. Moreover, Xiamen’s high salary levels attract a skilled talent pool, which supports ITG’s market expansion. By leveraging its geographical advantages and human resources, ITG provides integrated supply chain solutions, further enhancing service quality and strengthening its competitive position.

Configurational analysis of low-quality development of CBEC firms

Based on the characteristic of causal asymmetry in fsQCA, this study obtained four configurations associated with low-quality growth of CBEC firms (62 companies in total), i.e., NS1, NS2, NS3, and NS4 (as shown in Table 9). Configuration NS1 indicates that when logistics capacity and market expansion are lacking as core conditions, and government subsidies are absent as a peripheral condition, high-quality development is difficult to achieve, even with significant R&D expenditure. Configuration NS2 shows that when the regional cluster of CBEC trade, financial support, and a highly educated workforce are absent as core conditions, and logistics capacity is absent as a peripheral condition, relying solely on a large amount of R&D expenditure is insufficient for high-quality development. Similarly, Configuration NS3 suggests that when employees’ educational background is inadequate as a core condition and market expansion is absent as a peripheral condition, even with significant R&D investment, well-developed transportation infrastructure, and a certain level of CBEC trade cluster, achieving high-quality development remains challenging. By comparing configurations NS2 and NS3, it is found that high-quality development is inseparable from highly educated employees when R&D investment is substantial. Configuration NS4 indicates that high-quality development is hard to achieve if market expansion and logistics capacity are absent as core conditions, even with R&D investment and some CBEC trade aggregation in the firm’s location. The reasons behind this are: Although R&D investment can improve product quality and competitiveness, these good products must first be promoted or introduced to target consumers. Generally, overseas consumers typically go through four stages (namely, the Product cognition stage, Platform emotion stage, Behavior intention stage, and Actual behavior stage) before completing a purchase. Therefore, cultivating high-level CBEC employees, conducting extensive marketing campaigns, and improving product description, product awareness, and platform involvement according to different consumer groups’ cultures and customs are essential to increase consumers’ purchase intentions.

Robustness analysis

Robustness analysis is employed to assess research findings’ resilience (stability and reliability) using alternative discriminant norms. The methods of recalculating results mainly include modifying the anchor point system in data calibration or adjusting the consistency level and case truncation values (Fiss et al., 2013). Based on recalculated results, on the one hand, it is necessary to check if there is a substantial change in the overall configuration and whether there is a change in the subset relationship among the configurations. If there is no notable change in the configurations, it can be considered a robust result. On the other hand, it is necessary to examine if there is a substantial change in the consistency and coverage of the overall solution between the two results. If the results do not differ much, it can be considered a robust result. This research conducted a robustness analysis by adjusting the consistency threshold to 0.85. Based on the result, it was found that the combination of solutions that empower the high-quality development of CBEC enterprises is completely consistent with the previous results, indicating that the conclusions are robust.

Discussions

Based on the Competitive Advantage Theory and the DCV, this study constructed a conceptual framework to investigate the path toward CBEC firms’ high-quality growth and its influencing factors. By evaluating 95 listed companies’ financial performance and exploring the configuration conditions that lead to high-level growth, our research effectively revealed the underlying mechanisms and boundary conditions of how external and internal factors influence the high performance of CBEC companies. Additionally, by integrating external and internal factors as variables, our research extends the Competitive Advantage Theory and the DCV. It offers a more comprehensive understanding of the inter-relationship of external and internal factors and what core conditions can facilitate CBEC firms’ development and thriving in China.

Theoretical implications

Firstly, this study extends the application of the Competitive Advantage Theory and the DCV to the academic context, highlighting the potential for stakeholders in CBEC to view both internal (like marketing capability and employees’ educational background) and external factors (such as government’s financial support and logistics capacity) as core conditions for enterprises’ growth. This perspective challenges the traditional studies that only focus on one dimension: external or internal factors (Koh et al., 2012; Ma et al., 2018) and offers a more in-depth understanding of their roles in promoting the high-quality growth of CBEC firms. The results align with the Competitive Advantage Theory, which suggests that firms gain a competitive edge by leveraging specific conditions and strategies (Porter, 1990). For instance, our findings highlight the critical role of marketing capabilities, government support, and employees’ educational background in achieving competitive advantage, illustrating the importance of both internal resources and external factors. Our results also support the DCV, emphasizing the need for firms to dynamically adjust their resources and capabilities to respond to environmental changes (Teece, 2007). This dynamic capability is crucial in the rapidly evolving CBEC sector, where firms must continuously adapt to shifting market conditions and technological advancements. Moreover, our findings underscore the importance of marketing and employees’ educational background to companies’ growth. While the DCV and the Competitive Advantage Theory highlight the significance of R&D investment and pay less attention to these aspects, our study reveals that the effects of R&D investment on high-level growth may vary in different firms according to their attitude toward marketing investment and employees’ professional ability.

Secondly, this study advances the Competitive Advantage Theory and the DCV by integrating them and proposing new aspects of CBEC. Because CBEC is a new and fast-evolving field of study, current theories may not solely provide a comprehensive and accurate theoretical foundation and understanding of it. On the one hand, the Competitive Advantage Theory, which has been widely used in many related research studies about companies’ growth (Bilgihan et al., 2011; He et al., 2023), is used as the foundation to provide a general analytical framework of CBEC growth factors. On the other hand, DCV emphasizes the ability of enterprises to acquire, integrate, reconfigure, and release resources in a dynamic environment to cope with changes in the external environment and seize new opportunities. This is consistent with the rapidly changing international market environment in which CBEC enterprises operate. Therefore, DCV complements the Competitive Advantage Theory and proposes specific variables that may lead to the outcome. By combining these theories, new frameworks have been constructed to more comprehensively explore the influencing factors of CBEC enterprises and evaluate their performance, enriching the research perspective on high-quality development and broadening the applicability of the Competitive Advantage Theory and DCV framework in a globalized context. Furthermore, integrating these two theories and exploring CBEC from different angles (e.g., market expansion investment and employees’ educational background) can also provide other scholars with implications for creating theories that can better explain CBEC development in the fast-changing era.

Finally, this research contributes to the theoretical understanding of the inter-relationship of external and internal factors in influencing a company’s growth among different regions in China. On the one hand, our findings resonate with those of Huang and Chang (2017), highlighting the significance of a company’s marketing ability in enhancing foreign consumers’ intention to shop. A good marketing team can reduce consumers’ distrust by improving their website design quality, communication efficiency, and brand recognition (Huang and Chang, 2017; Cheng et al., 2019). On the other hand, however, few previous studies have explored the inter-relationships among external and internal factors. Based on the research results, this study finds a complementary and mutually reinforcing relationship between external and internal factors. For instance, a firm can increase its R&D and marketing investment with the help of the government’s fiscal support, which can help it gain competitiveness in the market and develop better in the future. In summary, concerning the research results, this study, based on an overall configuration perspective, explores the diverse configurations of high-level development from the dimensions of external and internal factors, to some extent opening the “black box” of the inter-relationship of external and internal factors and how internal core competencies influence high-quality development by adapting to the external environment.

Practical implications

The research findings offer two implications for government entities and CBEC companies.

Firstly, from the perspective of CBEC enterprise managers, there are multiple approaches to achieving high-quality development in the sector. Managers can leverage their companies’ existing strengths and resources while also considering the interplay and adjustments between internal capabilities and the external environment holistically rather than focusing solely on the impact of a single factor (Huang, 2017; Cheng et al., 2019). By adopting a configuration coordination mindset, managers can make strategic decisions that foster the high-quality growth of their enterprises. For example, when the CBEC trade foundation is weak, companies can implement a market expansion strategy (configuration S1), increase marketing investment, and adjust marketing plans to target cultural characteristics, such as multilingual websites, AI customer service, virtual fitting, digital exhibitions, and local payment methods, to build a global brand and increase consumer purchasing intent. In contrast, in regions where the government supports the CBEC industry, firms with strong core capabilities can adopt the Core Competence—Policy Driving Strategy (configurations S2a–S2b), leverage subsidies, and develop products tailored to local preferences. To support this, companies should provide ongoing training in CBEC skills and cross-cultural awareness while offering incentives like equity and bonuses to attract top talent. Additionally, in areas with a good export-oriented economic foundation, enterprises can adopt the External conditions driving strategy (S3), leverage the favorable economic and transportation conditions for overseas market expansion, and overcome the shortcomings of weak R&D capabilities.

Secondly, from the perspective of government departments, they must provide comprehensive CBEC policy support and guide CBEC enterprises in strengthening their core competencies. In achieving high-quality development through four distinct paths, policy support becomes a core condition variable in two key configurations (S2a and S2b). Therefore, relevant government departments must design tailored policies to support the high-quality development of CBEC enterprises. For example, the government should introduce targeted fiscal subsidy programs, such as developing specialized industrial parks and constructing overseas warehouses, to create a comprehensive support framework that enhances operational efficiency and drives international expansion. Besides providing financial subsidies, government departments should assist local universities in establishing CBEC programs and collaborate closely with enterprises to cultivate urgently needed marketing talent.

Limitations and future directions

This paper has the following limitations: First, only 95 Chinese A-share listed CBEC companies in 2023 were selected as the research objects. This study did not include CBEC companies listed outside mainland China (such as Alibaba, SheIn, Pinduoduo, and other leading companies). Future research can select all Chinese CBEC-listed companies globally as research objects to more comprehensively explore the paths toward improving the high-quality development of Chinese CBEC companies. Second, fsQCA is used to discuss the configuration for high-quality development from two dimensions of internal and external factors, but the universality of the conclusions is limited. Future research can conduct a comprehensive and in-depth analysis of more factors based on large sample data. Third, the study of high-quality development of CBEC firms is still in its early stages, and there are few measurement methods for the outcome variable. The existing measurement methods may have certain biases. Future research can further develop mature measurement scales to comprehensively evaluate the level of CBEC enterprise development.

Conclusions

This paper, based on an analytical framework combining the Competitive Advantage Theory and the DCV, uses fsQCA to explore the configuration strategies for the high-quality development of enterprises from the perspectives of external and internal factors. The study sample consists of 95 CBEC-listed companies in China, and the main research findings are as follows: First, there is no necessary condition for the outcome. No conditional variable can independently influence the development of CBEC firms. However, market expansion, employees’ educational background, and government financial support play a significant role in the process of generating high innovation performance. Second, there are three configurations: market expansion driving, Core competence—Policy driving, and External conditions driving. The development of CBEC companies is influenced not only by the firm’s marketing investments but also by various internal and external factors, including employees’ professional capabilities, government subsidy intensity, foreign trade development foundations, and R&D efforts. Third, without the involvement of employees’ educational background and market expansion, even with substantial investment in product R&D, it is difficult for enterprises to achieve high-quality development. These results help academia build new frameworks to analyze growth factors and evaluate CBEC company’s development, which sheds light on the interplay between external and internal factors and what factors can achieve firms’ high-quality growth, thereby enriching existing literature. In addition, the discoveries provide fresh ideas and strategies (such as enhancing their marketing capabilities, innovating marketing concepts and strategies) for CBEC firms and the government to achieve high-level development. Looking ahead, future research should expand the sample to include global CBEC companies and develop more refined measurement tools to better assess CBEC development. Such steps will deepen the understanding of CBEC dynamics and provide stronger theoretical and practical insights.

Data availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Anthony P, Behnoee B, Hassanpour M, Pamucar D (2019) Financial performance evaluation of seven Indian chemical companies. Decis Mak Appl Manag Eng 2(2):81–99. https://doi.org/10.31181/dmame1902021a

Arnold VI, Wassermann GS, Thomas RK (1986) Catastrophe theory (vol. 3). Springer, Berlin

Bilgihan A, Okumus F, “Khal” Nusair K, Joon‐Wuk Kwun D (2011) Information technology applications and competitive advantage in hotel companies. J Hospit Tour Technol 2(2):139–153. https://doi.org/10.1108/17579881111154245

Cao D, Tahir SH, Rizvi SMR, Khan KB (2024) Exploring the influence of women’s leadership and corporate governance on operational liquidity: the glass cliff effect. PLoS ONE 19(5):e0302210. https://doi.org/10.1371/journal.pone.0302210

Che J, Liu W, Wang J, Xie Z (2023) The construction of the competency model and its application in talent cultivation. Int J Wirel Mob Comput 25(3):250–257. https://doi.org/10.1504/IJWMC.2023.134673

Che Y, Yuan M, Zhang Y, Zhao L (2024) Cross‐border e‐commerce and China’s exports during the COVID‐19 Pandemic. China World Econ 32(3):215–242. https://doi.org/10.1111/cwe.12537

Chen L, Gao X, Gong S, Li Z (2020) Regionalization of green building development in China: a comprehensive evaluation model based on the catastrophe progression method. Sustainability 12(15):5988. https://doi.org/10.3390/su12155988

Cheng X, Su L, Zarifis A (2019) Designing a talents training model for cross-border e-commerce: a mixed approach of problem-based learning with social media. Electron Commer Res 19(4):801–822. https://doi.org/10.1007/s10660-019-09341-y

Ciampi F, Demi S, Magrini A, Marzi G, Papa A (2021) Exploring the impact of big data analytics capabilities on business model innovation: the mediating role of entrepreneurial orientation. J Bus Res 123:1–13. https://doi.org/10.1016/j.jbusres.2020.09.023

Dong G, Shen J, Jia Y, Sun F (2018) A comprehensive evaluation of water resource security: a case study from Luoyang City, China. Water 10(8):1106. https://doi.org/10.3390/w10081106

Du H, Teng Y, Ma Z, Guo X (2022) Value creation in platform enterprises: a fuzzy-set qualitative comparative ysis. Sustainability 14(9):5. https://doi.org/10.3390/su14095331

Fan B, Zhao H, Waqas Kamran H, Husain Tahir S (2023). Environmental sustainability targets: the role of green investment, ICT development, and economic growth. Econo Res 36(3). https://doi.org/10.1080/1331677X.2022.2151490

Fiss PC (2011) Building better causal theories: a fuzzy set approach to typologies in organization research. Acad Manag J 54(2):393–420. https://doi.org/10.5465/amj.2011.60263120

Fiss PC, Sharapov D, Cronqvist L (2013) Opposites attract? Opportunities and challenges for integrating large-N QCA and econometric analysis. Polit Res Q 191–198. https://doi.org/10.1177/1065912912468269e

Gharizadeh Beiragh R, Alizadeh R, Shafiei Kaleibari S, Cavallaro F, Zolfani SH, Bausys R, Mardani A (2020) An integrated multi-criteria decision making model for sustainability performance assessment for insurance companies. Sustainability 12(3):789. https://doi.org/10.3390/su12030789

Giuffrida M, Mangiaracina R, Perego A, Tumino A (2017) Cross-border B2C e-commerce to Greater China and the role of logistics: a literature review. Int J Phys Distrib Logist Manag 47(9):772–795. https://doi.org/10.1108/IJPDLM-08-2016-0241

Guastello SJ, Correro II AN, Marra DE (2019) Cusp catastrophe models for cognitive workload and fatigue in teams. Appl Ergon 79:152–168. https://doi.org/10.1016/j.apergo.2018.08.019

Han Z, Wood S, Coe NM, Alexander A (2024) Conceptualising the co-evolution of China’s industrial and institutional environment for cross-border e-commerce. Geoforum 153:104034. https://doi.org/10.1016/j.geoforum.2024.104034

Hanckel B, Petticrew M, Thomas J, Green J (2021) Qualitative comparative analysis (QCA) is used to address causality in complex systems: a systematic review of research on public health interventions. BMC Public Health 21(1):877. https://doi.org/10.1186/s12889-021-10926-2

Hazarika BB, Mousavi R (2021) Review of cross-border e-commerce and directions for future research. J Glob Inf Manag 30(2):1–18. https://doi.org/10.4018/JGIM.20220301.oa1

He X, Ye T, Yu D (2023) Exploring the academic development trace and theme evolution in Cross-Border Electronic Commerce. Electron Mark 33(1):53. https://doi.org/10.1007/s12525-023-00676-x

Howell T, Bingham C, Hendricks B (2022) Going alone or together? A configurational analysis of solo founding vs. cofounding. Organ Sci 33(6):2421–2450. https://doi.org/10.1287/orsc.2021.1548

Huang J (2017) Comparison of e-commerce regulations in Chinese and American ftas: Converging approaches, diverging contents, and polycentric directions? Neth Int Law Rev 64(2):309–337. https://doi.org/10.1007/s40802-017-0094-1

Huang SL, Chang YC (2017). Factors that impact consumers’ intention to shop on foreign online stores. http://hdl.handle.net/10125/41641

Jia J, Yuan S, Wei LQ, Tang G (2023) When firms adopt sustainable human resource management: a fuzzy‐set analysis. Hum Resour Manag 62(3):283–305. https://doi.org/10.1002/hrm.22164

Kapoor A, Sindwani R, Goel M (2023) Exploring quick commerce service experience: a moderated mediated investigation using SEM and fsQCA. Total Qual Manag Bus Excell 34(13-14):1896–1919. https://doi.org/10.1080/14783363.2023.2213653

Karman A, Pawłowski M (2022) Circular economy competitiveness evaluation model based on the catastrophe progression method. J Environ Manag 303:114223. https://doi.org/10.1016/j.jenvman.2021.114223

Koh TK, Fichman M, Kraut RE (2012) Trust across borders: buyer-supplier trust in global business-to-business e-commerce. J Assoc Inf Syst 13(11):886–922. https://doi.org/10.17705/1jais.00316

Li C, Lin CL, Chin T (2022) How does the paradoxical leadership of cross-border e-commerce (CBEC) gig workers influence Chinese company performance: the role of psychological well-being. Sustainability 14(19):12307. https://doi.org/10.3390/su141912307

Li J, Lee SC, Hong SL (2021) Study on influencing factors of port logistics development based on configuration analysis QCA. J Korea Trade 25(5):58–73. https://doi.org/10.35611/jkt.2021.25.5.58

Liu Z, Li Z (2020) A blockchain-based framework of cross-border e-commerce supply chain. Int J Inf Manag 52:102059. https://doi.org/10.1016/j.ijinfomgt.2019.102059

Lu X, Xie Y, Zhang B, Li K (2022) Supply–demand docking joint decision of cross-border e-commerce under the influence of internet celebrity. J Glob Inf Technol Manag 25(1):54–82. https://doi.org/10.1080/1097198X.2021.2020515

Ma S, Liang Q (2021) Industry competition, life cycle and export performance of China’s cross-border e-commerce enterprises. Int J Technol Manag 87(2-4):171–204. https://doi.org/10.1504/IJTM.2021.120926

Ma S, Chai Y, Zhang H (2018) Rise of cross‐border e‐commerce exports in China. China World Econ 26(3):63–87. https://doi.org/10.1111/cwe.12243

Ma S, Guo X, Zhang H (2021) New driving force for China’s import growth: assessing the role of cross-border e-commerce. World Econ 44:3674–3706. https://doi.org/10.1111/twec.13168

Ma S, Huang S, Wu P (2024) Intelligent manufacturing and cross-border e-commerce export diversification. Int Rev Econ Financ 94:103369. https://doi.org/10.1016/j.iref.2024.05.048

Mi C, Wang Y, Xiao L (2021) Prediction on transaction amounts of China’s CBEC with improved GM (1, 1) models based on the principle of new information priority. Electron Commer Res 21:125–146. https://doi.org/10.1007/s10660-020-09434-z

Mou J, Wang S (2023) Value‐added service for fashion product supply chain with overseas warehouse logistics outsourcing. Math Probl Eng 2023(1):8798358. https://doi.org/10.1155/2023/8798358

Mou J, Ren G, Qin C, Kurcz K (2019) Understanding the topics of export cross-border e-commerce consumers feedback: an LDA approach. Electron Commer Res 19:749–777. https://doi.org/10.1007/s10660-019-09338-7

Penrose ET (1959) The theory of the growth of the firm, 2nd edn., Basil Blackwell, London

Porter M (1990) The competitive advantage of nations. Free Press, New York. https://doi.org/10.1002/smj.4250120706

Ragin CC, Strand SI (2008) Using qualitative comparative analysis to study causal order: comment on Caren and Panofsky (2005). Sociol Methods Res 36(4):431–441. https://doi.org/10.1177/0049124107313903

Rao N, Mishra A, Prakash A et al. (2019) A qualitative comparative analysis of women’s agency and adaptive capacity in climate change hotspots in Asia and Africa. Nat Clim Chang 9:964–971. https://doi.org/10.1038/s41558-019-0638-y

Rialti R, Marzi G, Ciappei C, Busso D (2019) Big data and dynamic capabilities: a bibliometric analysis and systematic literature review. Manag Decis 57(8):2052–2068. https://doi.org/10.1108/MD-07-2018-0821

Schneider CQ (2018) Realists and ldealists in QCA. Political Anal 26(2):246–254. https://doi.org/10.1017/pan.2017.45

Shenglong C (2022) Operating in international markets through cross-border e-commerce: a practitioners’ perspective. Вестник Санкт-Петербургского университета Менеджмент 21(4):548–574. https://doi.org/10.21638/11701/spbu08.2022.403

Shi Y, Wang T, Alwan LC (2020) Analytics for cross-border e-commerce: inventory risk management of an online fashion retailer. Decis Sci 51(6):1–30. https://doi.org/10.1111/deci.12429

Song B, Yan W, Zhang T (2019) Cross-border e-commerce commodity risk assessment using text mining and fuzzy rule-based reasoning. Adv Eng Inform 40(January):69–80. https://doi.org/10.1016/j.aei.2019.03.002

Tahir SH, Ghafoor S, Zulfiqar M, Sajid MA, Illyas H (2024) Navigating board dynamics: Configuration analysis of corporate governance’s factors and their impact on bank performance. PLoS ONE 19(5):e0300283. https://doi.org/10.1371/journal.pone.0300283

Tahir SH, Wang X, Zulfiqar M, Ullah MR, Sajid MA (2025) The synergistic impact of digital technology and financial systems on sustainable environment. In: Natural Resources Forum. Blackwell Publishing Ltd, Oxford, UK

Teece DJ (2007) Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strateg Manag J 28:1319–1350. https://doi.org/10.1002/smj.640

Teece DJ, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strateg Manag J 18:509–533

Teirlinck P (2017) Configurations of strategic R&D decisions and financial performance in small-sized and medium-sized firms. J Bus Res 74:55–65. https://doi.org/10.1016/j.jbusres.2017.01.008

Ullah MR, Tahir SH, Shahzadi H, Kamran HW (2023) Digital pathways to success: the transformative power of digitalization and digital capabilities on SMEs’ financial performance. Iras J Econ 5(2):465–485. https://doi.org/10.52131/joe.2023.0502.0140

Van Anh PT (2024) Investigating cultural differences, risks, and purchase intention in cross-border e-commerce: a mixed-method analysis. https://doi.org/10.1111/ijcs.13067

Verbeke A, Ciravegna L, Lopez LE, Kundu SK (2019) Five configurations of opportunism in international market entry. J Manag Stud 56(7):1287–1313. https://doi.org/10.1111/joms.12355

Wang L, Yang J, Yin S (2015) Electronic commerce international logistics performance influence factor analysis. Int J Mob Commun 13(5):498–509. https://doi.org/10.1504/IJMC.2015.070965

Xiao L, Cheng X, Mou J (2022) Understanding global e-commerce development during the COVID-19 pandemic: technology-organization-environment perspective. J Glob Inf Technol Manag 25(1):1–6. https://doi.org/10.1080/1097198X.2022.2026658

Xie X, Han Y, Tan H (2024) Greening China’s digital economy: exploring the contribution of the East–West Computing Resources Transmission Project to CO2 reduction. Humanit Soc Sci Commun 11(1):1–15. https://doi.org/10.1057/s41599-024-02963-0

Xu X (2008) Effects of two national environmental factors on e-commerce functionality adoption: a cross-country case study of a global bank. Enterp Inf Syst 2(3):325–339. https://doi.org/10.1080/17517570802132938

Xu XY, Tayyab SMU, Chang FK, Zhao K (2021) Hierarchical value-attainment paths of CBEC consumers: a means-end-chain perspective. Internet Res 31(2):699–736. https://doi.org/10.1108/INTR-10-2019-0397

Xu L, Wang Y (2024) Resilience evaluation model of photovoltaic industry chain based on grey-entropy-catastrophe progression method: a case study of Jiangsu province. Grey Syst Theory Appl. https://doi.org/10.1108/GS-09-2023-0085

Xu X, Tahir SH, Khan KB, Sajid MA, Safdar MA (2024) Beyond regression: unpacking research of human complex systems with qualitative comparative analysis. Heliyon 10(10). https://doi.org/10.1016/j.heliyon.2024.e31457

Yin ZH, Choi CH (2023) The effects of China’s cross-border e-commerce on its exports: a comparative analysis of goods and services trade. Electron Commer Res 23(1):443–474. https://doi.org/10.1007/s10660-021-09483-y

Zha X, Zhang X, Liu Y, Dan B (2022) Bonded-warehouse or direct-mail? Logistics mode choice in a cross-border e-commerce supply chain with platform information sharing. Electron Commer Res Appl 54:101181. https://doi.org/10.1016/j.elerap.2022.101181

Zhang X, Guo W, Bashir MB (2022) Inclusive green growth and development of the high-quality tourism industry in China: the dependence on imports. Sustain Prod Consum 29:57–78. https://doi.org/10.1016/j.spc.2021.09.023

Zhao Y (2020) Influencing factors of cross-border e-commerce trade between China and “Belt and Road” coastal and inland countries. J Coast Res 103(SI):70–73. https://doi.org/10.2112/SI103-015.1

Zhong M, Wang Z, Ge X (2022) Does cross-border e-commerce promote economic growth? empirical research on China’s Pilot Zones. Sustainability 14(17):11032. https://doi.org/10.3390/su141711032

Zulfiqar M, Tahir SH, Ullah MR, Ghafoor S (2023) Digitalized world and carbon footprints: does digitalization really matter for sustainable environment? Environ Sci Pollut Res 30(38):88789–88802. https://doi.org/10.1007/s11356-023-28332-z

Acknowledgements

This research was supported by the Project on Enhancement of Basic Research Ability of Young and Middle-aged Teachers in Guangxi Higher Education Institutions (No. 2024KY0701), Project on Enhancement of Basic Research Ability of Young and Middle-aged Teachers in Guangxi Higher Education Institutions (No. 2023KY0712), A Collaborative Education Project between Industry and Academia, Ministry of Education of China (No. 220602206280702), A Research Project of the Education Department of Guangxi Zhuang Autonomous Region, China. (No. 2025JGB409), and A Research Project of the Education Department of Guangxi Zhuang Autonomous Region, China. (No. GXGZJG2023B200).

Author information

Authors and Affiliations

Contributions

Conceptualization: SHL; Methodology: SHL and CSL; Validation: GXC and JQZ; Formal analysis: CSL; Investigation: CSL; Resources: SHL; Writing—original draft: SHL; Data curation: JDJ; Writing—review and editing: CSL and QPX. Funding acquisition: SHL. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Ethical approval was not required as the study does not involve human participants.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, S., Chen, G., Zhu, J. et al. Empowering China’s cross-border e-commerce: high-quality development explored through fsQCA. Humanit Soc Sci Commun 12, 1183 (2025). https://doi.org/10.1057/s41599-025-05551-y

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05551-y