Abstract

Governments worldwide are increasingly focused on balancing economic growth and environmental preservation. For developing economies, achieving sustainable growth while reducing their ecological footprint (EF) is more critical than ever. However, despite notable economic progress, many of these nations continue to face significant challenges in mitigating their environmental impact. In light of this, this research examines the relationship between financial development (FD), human capital (HC), renewable energy consumption (REC), industrial structure (IS), and economic growth (GDP) in relation to the EF across 22 Asian nations from 2000 to 2021. To ensure robust and reliable results, the study employs the pooled mean group-autoregressive distributed lag (PMG-ARDL) approach. The results highlight that REC and HC are crucial drivers of reducing the EF in the long-run, with FD playing a supportive role when combined with HC. GDP has mixed effects on the environment: it initially harms the environment but has a positive long-term effect, supporting the environmental kuznets curve (EKC) hypothesis. The IS requires careful management to shift from being a source of ecological stress in the short-run to contributing positively in the long-run. Based on the results, policymakers in developing nations should prioritize integrating FD, renewable energy adoption, and HC investment to effectively reduce the EF and promote sustainable growth.

Similar content being viewed by others

Introduction

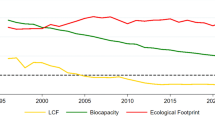

Humanity faces serious risks from climate change, including starvation, extinction of species, and natural disaster (Ma et al., 2022). The rapid pace of economic growth and industrialization has exacerbated these challenges, placing extreme pressure on the planet’s biosphere and atmosphere (Xiong and Sun, 2022). In 2017, the average environmental impact per person was 2.77 hectares, highlighting unsustainable resource consumption (GFN, 2022). To contextualize this, it would require 1.73 Earths to support the human footprint if everyone lived like the average inhabitant of a single country or region (Abou Houran and Mehmood, 2023). This alarming disparity indicates that humanity’s EF has exceeded the planet’s biological carrying capacity. The sustainable development goals (SDGs) are at risk of being undermined unless there is a significant reduction in ecological resource depletion and degradation. However, the Earth’s “maximum ecological carrying capacity” is dynamic, influenced by factors such as economic and financial growth and varying resource utilization patterns across regions (Li et al., 2022; Hailiang et al., 2023). In response to these challenges, and meet the Paris Agreement (COP21) goal of limiting global warming to below 2 °C, countries are formulating strategies to address rising energy consumption and environmental degradation.

Recent research suggests that FD has distinct environmental effects, reflecting two contrasting perspectives on its role in environmental sustainability. A developed financial system, on the one hand, facilitates capital access and investment, stimulating economic activity but often leading to environmental degradation due to increased energy consumption (Adebayo and Ullah, 2023). In contrast, a stable economic system can pave the way for the adoption of energy-efficient manufacturing procedures and advanced technologies that mitigate ecological damage (Adebayo and Ullah, 2023). Furthermore, well-funtioning capital and financial markets can attract global firms to relocation of green technology to host nation while providing essential funding for renewable energy and research and development (R&D) (Zhang et al., 2023).

HC plays a crucial role in mitigating ecological degradation by promoting ecologically conscious behavior and improving resource efficiency. The EKC hypothesis posits that ecological pollution declines after a certain income threshold is reached, but this outcome depends not only on income levels but also on ecologically conscious actions by individuals (Sadiq et al., 2022). HC encompasses multiple aspects that influence ecological quality, such as enhancing production efficiency through the use of skilled labor, reducing resource and energy consumption in manufacturing (Piwowar-Sulej, 2022). The synergy between HC and physical capital is important, as it facilitates the adoption of innovative technologies, leading to energy-efficient manufacturing processes (Hsu et al., 2021). Education, as a crucial component of HC, promotes the acceptance of advanced technologies, contributing to resource conservation and improved ecological outcomes (Latif et al., 2023). It also provides knowledge about environmental challenges and raises awareness about the importance of protecting the environment, fostering sustainable practices (Makhdum et al., 2022).

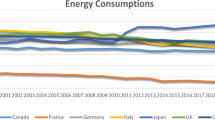

Energy consumption has increased globally due to rapid economic growth, population expansion, and industrialization, particularly in developing countries. In response to growing concerns about climate change, the United Nations Framework Convention on Climate Change (UNFCCC) set a target at COP 26 in 2015 to limit global temperature rise to below 2 °C by 2050 (UNFCCC, 2015). The growing global energy demand drives a corresponding increase in carbon dioxide (CO2) emissions, significantly exacerbating global warming and environmental degradation. The energy sector is responsible for 75% of all greenhouse gas (GHG) emissions (WDI, 2023). Sustainable development is achieved by efforts to reduce GHG emissions by meeting global energy consumption and generation targets (Cai and Le, 2023). Overhauling the current energy system is essential to achieving these goals. Transitioning to renewable energy sources is crucial for guiding countries toward sustainability (Ohajionu et al., 2022). Therefore, it is imperative that policymakers must understand the complex relationships between REC, GDP, nonrenewable energy consumption, and other macroeconomic variables to foster a sustainable environment in Asia.

The most significant transformation in economic development occurs through changes in the IS, particularly the shift from energy-intensive industries to low-carbon sectors and from traditional manufacturing to service-oriented industries. This shift has a major impact on CO2 emissions and the EF (Amin et al., 2022). This study explores the relationship between IS and CO2 emissions by examining changes in the IS over time, specifically through the relative added value of manufacturing and service industries. Therefore, we expect the IS change index in this study to surpass those found in existing literature. Based on this analysis, we have determined that our conclusion will provide valuable policy insights for promoting sustainable industrial development.

This research makes significant contributions to the existing literature in several ways. Firstly, this study investigates the relationship between FD, HC, and EF, while controlling for REC and GDP. Our study is unique in its focus on developing nations, where the relationship between these variables may differ significantly due to varying economic, social, and policy contexts. This study provides valuable insights into the specific challenges and opportunities faced by these nations in achieving sustainable development, considering their distinct structural and institutional dynamics compared to developed economies. To the best of our academic knowledge, no prior research has studied this relationship. Secondly, while many studies examine the impact of FD on CO2 emissions and environmental degradation, few have explored the role of FD on EF. This study innovatively investigates the indirect impact of FD on EF through the moderating role of HC. Analyzing this indirect relationship highlights how FD’s benefits can offset its environmental drawbacks through HC enhancement. Understanding this intricate dynamic of the finance-footprint is crucial for policymakers to design strategies that effectively balance the combined effects of these factors. While FD may have adverse environmental consequences, it also plays a crucial role in fostering HC development, which can mitigate ecological stress. Thirdly, this study employs the pooled mean group autoregressive distributed lag (PMG-ARDL) approach, a cutting-edge econometric method that accounts for critical panel data challenges such as cross-sectional dependence (CD) and slope heterogeneity. This methodological rigor ensures the robustness and generalizability of the findings, providing a solid foundation for further research. Lastly, using Dumitrescu-Hurlin panel causality tests, this study examines the causal relationships among the variables, offering technical insights into the interactions between environmental and economic factors. In summary, this study is innovative in its focus on developing countries, its incorporation of FD and HC, and its use of advanced econometric methods. The findings provide a solid theoretical framework and empirical evidence to guide policymaking focused on promoting environmental sustainability and economic development. Specifically, the main objective of this study is to analyze the impact of FD, HC, REC, and IS on EF across 22 Asian nations, with a focus on understanding their roles in shaping sustainable environmental outcomes.

The paper is organized as follows: It begins with a summary of relevant studies, followed by a detailed explanation of the statistics and methods employed. Next, the results are presented and discussed. Finally, the conclusion and policy recommendations are provided.

Literature review and hypothesis development

Theoretical underpinning

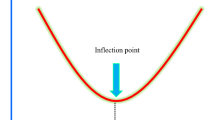

The global decline in ecological quality is attributed to a variety of factors, including economic, social, and environmental dynamics. Among the most prominent theoretical frameworks linking economic activities and environmental outcomes is the EKC hypothesis. The EKC postulates that financial activities tend to be pollution-intensive during the early stages of economic development but eventually become pollution-reducing as economies mature, resulting in an inverted U-shaped relationship between economic growth and environmental degradation (Ameer et al., 2024; Sohail et al., 2023). This hypothesis suggests that during the initial phases of development, countries prioritize growth over environmental protection, with a focus on scale and composition effects, which often exacerbate environmental degradation (Liu et al. 2022). However, as economies reach higher levels of development, structural transformation, technological innovation, and societal awareness contribute to mitigating ecological harm. This shift aligns with the technique effect, where advancements in technology and environmentally conscious policies enable a transition toward cleaner production processes and a reduced ecological footprint (EF) (Chen and Zhao, 2022).

While substantial research has explored the nonlinear EKC framework using GDP as a proxy for economic growth (Ahmad et al., 2022), this approach often overlooks the role of enabling factors such as FD, HC, and IS in shaping environmental outcomes. FD, in particular, is a macroeconomic factor that has complex and dualistic effects on ecological quality. On the one hand, a well-developed financial sector promotes GDP by channeling investments into private and public initiatives, potentially enhancing ecological outcomes when directed toward clean technologies and sustainable projects (Hasan and Du, 2023; Peng et al., 2020). On the other hand, financial resources allocated to pollution-intensive industries can amplify environmental harm. Thus, it is imperative to test the EKC hypothesis within the context of FD to better understand its dual role in promoting both economic growth and environmental sustainability (Baskaya et al., 2022; Wei et al., 2024). In addition to FD, technological advancement and energy consumption patterns are pivotal drivers of environmental change. Modern technologies are designed to enhance resource efficiency, thereby internalizing and mitigating the negative effects of resource consumption on the environment. However, fossil fuel dependence remains a significant challenge for most energy sectors worldwide, contributing to GHG emissions and exacerbating ecological degradation (Nasir et al., 2022; Hailiang et al., 2023; Sohail et al., 2024). Transitioning from fossil fuels to REC is widely regarded as an effective strategy to address these issues. Furthermore, technological progress and REC adoption are interconnected, as advancements in technology facilitate a shift from traditional energy sources to cleaner alternatives, substantially reducing emissions.

Another critical dimension is the role of HC development. HC not only contributes to GDP but also enhances environmental awareness and facilitates the adoption of green practices (Chang et al., 2024). Educated populations are more likely to support and implement environmentally sustainable policies, thereby mediating the harmful effects of resource consumption on ecological quality. This highlights the need to integrate HC development into the broader theoretical framework to fully capture its influence on ecological outcomes (Li et al., 2024). Finally, globalization and industrial structure (IS) also play significant roles. Globalization can either exacerbate or mitigate environmental degradation depending on the nature of trade flows, foreign direct investment inflows, and the transfer of clean or polluting technologies. Similarly, IS transformation from pollution-intensive industries to cleaner and service-oriented sectors, is a key mechanism through which economies can reduce their EF. Therefore, this study builds on the EKC hypothesis and integrates additional theoretical insights from FD, IS, REC, HC development, and economic growth to provide a comprehensive understanding of their collective impact on EF.

Empirical review

Financial development and ecological footprint

The health of a country’s financial sector directly impacts its economic growth and quality of life, making it essential to understand how foreign direct investment influences the environment. There are studies available on the topic of FD effect on environmental quality, but they yield conflicting findings. Measures of FD are often based on indicators such as the ratio of bank credits to GDP, the ratio of liquid liabilities to GDP, and the ratio of domestic lending to the private sector (Zeng et al., 2022). According to the first school of thought, FD greatly increases ecological sustainability by declining the rate of ecological degradation. CO2 emissions in Nigeria were studied by Somoye et al. (2023). By reducing CO2 emissions, they found that FD develops environmental quality. Similarly, Saadaoui (2022) discovered a correlation between FD and ecological decline in the MENA region. With respect to BRI countries, Sheraz et al. (2022) realized that FD had a moderating effect on CO2 emissions. The link between FD and ecological quality was also studied by Baloch et al. (2021), who examined OECD countries. They found that FD improves ecological quality by slowing its deterioration.

The second set of studies demonstrates a causal link between FD and pollution. For instance, Makhdum et al. (2022) found that FD reduced emissions in China. Their findings suggested that despite increasing CO2 emissions, FD really reduced environmental damage. The impact of FD on ecological quality was also studied by Zahoor et al. (2022) in China, and reported that FD has a foremost negative influence on ecological quality. Similarly, Cai and Le (2023) found a favorable consequence of FD on ecological deterioration in Vietnam when they used nonlinear estimation approaches. In a similar manner, Jianguo et al. (2022) found that environmental degradation increases the likelihood of FD in the perspective of OECD economies. The positive correlation between FD and ecological deterioration has been documented by researchers in China (Ren et al., 2020) and BRI countries (Zhuo and Qamruzzaman, 2022). The third body of research concludes that FD has little to no effect on environmental quality. For instance, according to their outcomes, FD has no important impact on ecosystems. Usman et al. (2022a) came to the same conclusion, finding no statistically significant link between FD and environmental quality.

Human capital and ecological footprint

Despite the importance to the environment, there has been insufficient research on the relationship between HC and the EF. To achieve the SDGs, it is crucial to gain a deeper understanding of its impact on the environment. Awwad Al-Shammari et al. (2022) analyzed data on the connection between HC and EF in Saudi Arabia. The findings presented that HC only has a negative effect on EF in the short run, while having no influence at all in the long-run. A similar study was reported by Bletsas et al. (2022) to observe the impact of HC, biocapacity, and economic growth on the EF in 95 countries. According to their findings, HC boosts environmental quality by lowering EF. It was discovered that expanding EF is valuable to economic development and biocapacity. Chandio et al. (2022) looked at how urbanization, HC, and economic expansion influenced EF in China. HC was found to have a deleterious effect on EF, while economic growth and urbanization were found to increase EF and worsen environmental quality.

Furthermore, HC, REC, GDP, and globalization were all studied by Ramzan et al. (2022) to determine their impact on EF in Pakistan. The research displays that economic expansion and globalization have beneficial effects on environmental deterioration, but an increase in HC has a negative impact. The use of REC sources does not degrade ecosystems. Natural resources increase ecological harm, while HC and REC improve ecological quality (Wang and Wang, 2022). Similarly, Ehigiamusoe et al. (2022) found that HC, GDP, and natural resource rents all impact the EF in Africa. According to their findings, HC has a positive but negligible effect on the environment, while the use of fossil fuels and economic growth both contribute to environmental degradation. HC increases environmental degradation, as shown by Usman et al. (2022b), since higher incomes often lead to a more extravagant lifestyle. This is especially true when educational systems fail to emphasize the importance of environmental protection.

Economic growth and ecological footprint

The relationship between economic growth and EF has been a central issue in environmental economics. Traditionally, economic growth, measured by GDP, is associated with increased resource consumption, energy use, and environmental degradation. As economies grow, the demand for goods and services rises, often leading to higher CO2 emissions, deforestation, and resource depletion. However, recent studies challenge the assumption of a linear relationship between GDP and EF. The EKC hypothesis suggests that while economic development initially leads to environmental degradation, beyond a certain income threshold, the relationship may reverse, with wealthier nations investing in cleaner technologies and sustainable practices, thus reducing their EF (Stern, 2004). Nketiah et al. (2024) support this idea, arguing that GDP growth can reduce EF if accompanied by shifts toward energy-efficient, less-polluting industries and greater environmental protection.

However, this perspective is not universally accepted. Critics argue that the EKC fails to account for the broader factors influencing EF, particularly global trade and consumption. Naz et al. (2024) contend that the decoupling of economic growth from environmental harm may not be as effective as the EKC suggests. Despite technological advancements in high-income countries, their EF remains high due to the outsourcing of carbon-intensive production to developing nations. As wealthier countries transition to service-based economies, the demand for manufactured goods like electronics and textiles continues to drive ecological degradation in lower-income countries, contributing to “ecological debt” (Buller, 2022).

Technological innovation and policy frameworks play a crucial role in decoupling growth from EF. Atasoy et al. (2022) argue that advancements such as renewable energy adoption and energy-efficient technologies can reduce the EF of economic growth. Nations that invest in clean energy and sustainable infrastructure can foster economic growth while minimizing environmental harm, as seen in Germany’s Energiewende policy (Pata et al., 2024). Moreover, the concept of “green growth” promotes environmentally sustainable economic development by enhancing resource efficiency and encouraging sustainable consumption. Green growth policies can achieve both economic development and EF reduction, as demonstrated by Sweden’s policies supporting renewable energy and carbon pricing (Saidi and Omri, 2020). Despite these strategies, challenges remain, such as the rise in global population and consumption, particularly in emerging economies like China and India, which may offset the benefits of decoupling efforts (Wang et al., 2018).

Renewable energy consumption and ecological footprint

The global use of REC has been increasing, yet their potential to significantly reduce the global EF remains limited due to continued reliance on fossil fuels. In 2018, renewable energy accounted for about 26.2% of global electricity generation (Kurbatova and Perederii, 2020). Despite this progress, fossil fuels still dominate the global energy mix, making it difficult to achieve substantial reductions in EF. Renné (2022) argue that achieving net-zero emissions by 2050 will require a rapid and widespread transition to renewable energy, alongside energy efficiency measures and innovations in carbon capture and storage.

Several studies have examined the impact of REC on EF. Jacobson and Delucchi (2009) emphasize that a global shift from fossil fuels to renewable energy is essential for reducing CO2 emissions and the global carbon footprint. They suggest that such a transition could prevent up to 8 gigatons of CO2 emissions annually. Goldstein et al. (2020) also highlight that renewable energy adoption could reduce CO2 emissions by ~80%. While renewable energy sources like solar and wind are crucial for reducing carbon footprints, land use and efficiency concerns also affect their ecological impact. Biomass, in particular, requires a significant land area, raising concerns about competition with agriculture and natural ecosystems. However, studies show that, when properly managed, renewable energy systems can offer a net reduction in EF compared to fossil fuel-based systems. Dhar et al. (2020) note that while wind and solar farms require land, they still have a smaller EF than fossil fuel extraction, such as coal mining, which causes substantial environmental damage. Gao et al. (2021) emphasize that although renewable energy technologies have material and manufacturing-related environmental costs, these are outweighed by the long-term benefits of clean energy production. Aneja et al. (2024) highlight that clean energy, including renewables, can play a key role in reducing the EF, especially through the promotion of green innovation and technological advancements. Song et al. (2022) also report that integrating renewable energy into the European Union’s energy mix has led to a noticeable reduction in the region’s EF, underscoring the role of technological advancements in minimizing the ecological cost of renewable energy. The reduction of EF due to REC varies regionally, depending on local energy policies, resources, and infrastructure. In developed countries like Germany, the Energiewende policy, which prioritizes renewable energy transition, has significantly reduced carbon emissions and EF (Chen, 2024). However, developing countries face challenges in adopting renewable energy, primarily due to high initial costs and limited infrastructure. Jacal (2022) indicates that, despite these hurdles, sub-Saharan African nations are increasingly investing in solar power to reduce fossil fuel reliance and their EF.

Industrial structure and ecological footprint

The structure of an economy significantly influences its EF, with industrial operations playing a major role in shaping environmental outcomes. As economies transition from agrarian to industrialized systems, the demand for energy, raw materials, and industrial emissions typically leads to an increase in EF. Arogundade et al. (2022) highlight that the IS, particularly heavy manufacturing and resource extraction industries, has a disproportionate impact on EF. Industries such as steel, cement, and chemicals are known for their high energy consumption and CO2 emissions, causing significant environmental degradation, including deforestation, air pollution, and GHG emissions (Kumar et al., 2022). The expansion of these industries in emerging economies often leads to an increased EF, as these sectors rely heavily on fossil fuels and natural resources, further exacerbating environmental stress.

In contrast, service-oriented economies generally exhibit a smaller EF due to lower energy consumption and reduced environmental impact. Lee et al. (2021) found that countries with a larger proportion of economic growth derived from the service sector tend to have lower EF than those with a strong manufacturing base. As many developed countries shift towards a service-based economy, this transition has been accompanied by a reduction in resource consumption. Services, which typically require less raw material input and energy for production, contribute less to the overall ecological impact when compared to industrial goods.

The IS also plays a crucial role in shaping the potential for technological advancements to reduce EF. The adoption of cleaner technologies and the shift towards circular economies in industries like manufacturing can significantly mitigate environmental impacts. Vangeri et al. (2024) suggest that sustainable industrial practices, such as the implementation of resource-efficient technologies and the recycling of waste materials, can significantly lower EF. Furthermore, shifting towards renewable energy in industrial processes can reduce both CO2 emissions and energy consumption, contributing to a smaller EF. However, global trade dynamics also influence the overall IS in a country. Yadav et al. (2024) emphasize that medium- and high-tech industries, with their focus on technological innovation, can help mitigate industrial emissions and reduce the EF by incorporating cleaner technologies into industrial processes. However, global trade dynamics also influence the overall IS in a country. Economies heavily reliant on resource-intensive exports like oil, coal, and minerals often face inflated EF due to the environmental degradation caused by extraction and export activities (Zhao et al. 2023). Conversely, countries with diversified industrial sectors that emphasize sustainable practices and technological innovation can decouple economic growth from environmental degradation, as seen in Sweden, where industrial growth has been decoupled from CO2 emissions (Adanma et al. 2024).

Literature gaps

The discussed literature reveals several gaps. In the literature, many studies have reported mixed results regarding the impact of FD on EF, due to variations in sample and methodologies (Baloch et al., 2019; Destek, 2021; Yasin et al., 2020). Few studies examined the inverted U-shaped relationship between FD and EF (Balsalobre-Lorente et al., 2023; Sun et al., 2023). To the best of our knowledge, the role of FD on EF in Asian countries remains largely unexplored. Furthermore, no previous studies have examined the combined impact of FD, HC, and REC on EF. Moreover, we have employed a novel PMG-ARDL empirical method for the selected Asian countries to analyze the impact of FD and HC on EF. This research seeks to address these knowledge gaps by applying cutting-edge information and econometric techniques to the challenge of helping the Asian countries to achieve the SDGs by 2030.

Data and methodology

Data explanation

This study aims to assess the impact of financial development (FD), human capital (HC), renewable energy consumption (REC), industrial structure (IS), and economic growth (GDP) on the EF in 22 Asian nations over the period from 2000 to 2021. To achieve this, panel data comprising a range of economic and social indicators was compiled to facilitate a comprehensive analysis of the relationship between these variables and their influence on environmental sustainability.

In the current analysis, EF serves as the dependent variable, provides a comprehensive measure of environmental impact. EF quantifies the demand for natural resources and the environmental pressures of human activities, offering a broader perspective than individual indicators like CO2 emissions. It measures the biologically productive land and water required to support consumption and waste assimilation. As an essential tool for understanding the sustainability of resource use, EF helps in evaluating the environmental consequences of economic activities. The data on EF, measured in global hectares per capita and was sourced from the Global Footprint Network (GFN, 2022). Jacobson and Delucchi (2009) and Goldstein et al. (2020) emphasize the need for a reduction in EF, particularly through renewable energy adoption, which is crucial in mitigating environmental pressures.

The independent variable in this study include FD, HC, IS, REC, and GDP. Specifically, FD refers to the expansion of financial systems that support environmentally sustainable activities. It represents the integration of green initiatives into financial markets and the role of financial institutions in supporting renewable energy and sustainable practices, helping to assess the effectiveness of financial tools in mitigating environmental challenges (Jiakui et al., 2023). The data on FD, measured in domestic credit to private sector. Previous studies, including Somoye et al. (2023) and Saadaoui (2022), found that FD can reduce ecological degradation by supporting green initiatives, whereas others like Jianguo et al. (2022) and Zahoor et al. (2022), observed that FD may exacerbate environmental damage by fostering industrialization without sufficient environmental safeguards. Data on FD was sourced from the IMF (2023). HC reflects the skills, education, and knowledge of a population, which are crucial for driving technological innovation and promoting sustainability. A well-educated and skilled population can drive the adoption of green technologies, improve energy efficiency, and support sustainable development policies. However, the data on HC was sourced from the Penn World Table (PWT) (2023). Studies suggest that educated populations are more likely to adopt green technologies and implement sustainable policies (Awwad Al-Shammari et al., 2022; Bletsas et al., 2022). However, Chandio et al. (2022) indicate that increased HC can have negative consequences, as higher incomes and consumption patterns associated with better education may contribute to a higher EF. IS refers to the composition of an economy’s sectors (such as agriculture, industry, and services) and their contributions to GDP. As economies transition from agrarian to industrialized systems, their EF typically increases due to higher energy consumption, resource extraction, and industrial emissions. Arogundade et al. (2022) and Kumar et al. (2022) highlight that heavy industries, such as steel, cement, and chemicals, contribute disproportionately to EF due to their high energy demands and environmental degradation. On the other hand, service-oriented economies tend to exhibit a smaller EF, as they require less raw material input and energy for production (Lee et al., 2021). The transition towards cleaner industrial practices and renewable energy adoption within industries can reduce their EF significantly (Adanma et al., 2024). Data on IS was sourced from the WDI (2023). REC reflects the use of sustainable energy sources, such as wind, solar, and hydropower, to replace fossil fuels, thereby reducing CO2 emissions and mitigating environmental degradation. Data on REC, expressed in billions of kilowatt-hours (kWh) per capita and was obtained from the WDI (2023). Jacobson and Delucchi (2009) and Goldstein et al. (2020) emphasize that a shift towards renewable energy could substantially reduce CO2 emissions and the overall EF. However, concerns related to land use and material requirements for technologies such as biomass, solar, and wind energy have been highlighted in studies by Gao et al. (2021) and Dhar et al. (2020), which suggest that careful management is necessary to optimize the ecological benefits of renewable energy. The selected variables are interconnected, offering a comprehensive view of how economic, social, and environmental factors collectively shape sustainability outcomes.

This study included the following 22 countries: “Malaysia, Bahrain, Indonesia, Myanmar, Bangladesh, Iran, Nepal, Brunei, Israel, Pakistan, China, Jordan, Philippines, India, Kuwait, UAE, Turkey, Singapore, Qatar, Saudi Arabia, Sri Lanka, and Thailand.” The focus on these countries captures Asia’s significant economic growth, rapid industrialization, and evolving environmental challenges. The selected timeframe allows for examining long-term trends and the effects of FD, HC, and IS on EF. Asia’s diversity in economic development and industrial activities provides a comprehensive basis for understanding the relationship between these factors and environmental sustainability. The selection ensures relevance and robustness in addressing the study’s objectives. Figure 1 presents the conceptual framework of the study. It integrates the impact of FD, HC, IS, REC, GDP, and their interactions with EF. This framework captures the dynamic and complex relationships among these variables, offering valuable insights into their influence on environmental sustainability.

Model specification

The model specification is based on the EKC hypothesis and integrates additional determinants of EF, such as FD, HC, REC, IS, and GDP. The EKC hypothesis provides the theoretical underpinning to explore the nonlinear relationship between economic growth and environmental outcomes (Grossman and Krueger, 1991). The inclusion of FD, HC, and REC aligns with recent literature emphasizing their roles in environmental sustainability (Zeng et al., 2022; Jacobson and Delucchi, 2009; Kumar et al., 2022). This study aims to assess the impact of FD, HC, REC, IS, and GDP on the EF. This is accomplished by presenting the empirical econometric function in its panel form, as shown below:

Total EF, FD, HC, REC, IS, economic growth (GDP), and square of GDP (GDP2), are all presented in Eq. (1), while i and t denote the 22 Asian economies and the available time periods from 2000 to 2021. The natural logarithm is applied to the study’s variables. Following, Manning (1998), checking for normality issues in the variables are checked prior to logarithmic transformation. The following model is used to investigate the connection between EF and other factors: The rationality of the EKC hypothesis is tested by including GDP squared (GDP2) in the analysis. The expanded version of the EKC hypothesis is as follows:

The purpose of this study is to demonstrate that FD and HC may have a moderating effect on the EF of 22 Asian economies, in addition to their direct impacts. To address this issue, the study seeks to investigate the moderating influences of FD on EF. The robustness of the results is evaluated by employing alternative model parameters as a part of sensitivity analysis. Specifically, Model 1 is modified by (a) adding an interaction term between FD and HC, and (b) using a linear model measurement by without the squared term of GDP (GDP2), respectively, to test the moderation effect of FD and the robustness of the outcomes through alternative model stipulations. The new model specifications are presented in Eq. (3).

Where \({\beta }_{0}={\mathrm{ln}\text{A}}_{0}\) shows the intercept term, depicts the stochastic error term and \({\beta }_{1}\to {\beta }_{7}\) denotes the elasticity of candidate variables.

In addition, we calculate both models using data from Asian countries to facilitate direct comparisons between them. Shocks to the independent variables have shown distinct impacts across panels of countries from different regions (Dong et al., 2019). Despite all the nations in this study being emerging economies, there are significant differences in their average GDP per capita. In 2016, the average GDP per person in these Asian nations was ~$16,160 (World Bank, 2020). However, these economies are at different stages of development, which may contribute to heterogeneity in the results. Similarly, the average EF per capita varies significantly across the region. World Bank (2020) estimates that in 2016, the average EF of the selected Asian nations was 2.92 global hectares per person. Consequently, it is evident that these Asian nations represent a mix of the most developed and the most polluted among the selected developing countries. Other critical factors in our analysis show a similar degree of variability, suggesting that macroeconomic determinants of EFs may differ across various geographical sub-samples.

Methodology

Cross-sectional dependency test

Many techniques for investigating CD in panel data are widely discussed in the literature. In this study, we employ four well-known and frequently used tests: (a) the B-P LM test (Breusch and Pagan, 1980), (b) scaled LM test (Pesaran 2004), (c) the bias-corrected scaled LM test (Baltagi et al., 2012), and (d) CD test (Pesaran 2004). All of these tests operate under the assumption that the variables are not cross-sectionally dependent, with the null hypothesis (H0) being that there is no CD.

Panel unit root tests

To ensure the credibility of the empirical estimation, we first examined the normality, SLH, and CD of the indicators, followed by an assessment of the likelihood of a unit root. The absence of a unit root in the panel data comprising both time series and cross-sectional data is crucial for the credibility of the empirical estimation. To test for stationarity, we employ the second-generation cross-sectional augmented Pesaran and Shin (CIPS) test introduced by Pesaran (2007). The CIPS test assumes a nonstationary series under the null hypothesis and stationarity under the alternative hypothesis. The formula for the CIPS test is derived from the cross-sectionally augmented Dickey–Fuller (CADF) model and is described in Eqs. (4) and (5).

Panel cointegration test

Using the cointegration technique proposed by Westerlund (2007), we examine the long-run relationships between FD, HC, REC, IS, GDP, GDP2, and EF. Given the panel’s focus on SLH and CD, we base our analysis on the error correction model introduced by Westerlund (2007). This test provides estimates for both panel-level statistics and group means, offering robust insights into the dynamics of the variables under study.

The panel cointegration method proposed by Westerlund and Edgerton (2008) provides an alternative approach to assess the existence of cointegration among variables. This method accounts for CD to address potential structural disruptions across cross-sectional units. Two test statistics are generated in this process, with the null hypothesis stating that there is no cointegration between the variables.

where Sit represented the degree of pollution in country i at time t. In addition, the coefficients of the vector of explanatory variables are displayed in Xit, where scalars denote individual values and β denotes the K*1 coefficient vector. The speed of adjustment of the linked parameter is shown by Pesaran et al. (1999) as:

where term represents the rate of change, which must be statistically significant and negative, with a value between −2 and 2. The primary advantage of this method is that it does not enforce any boundaries on the order of integration between the variables, allowing it to handle mixed integration order for the first difference, but not the second. In addition, this estimator provides both short-term and long-term results, which distinguishes it from the more commonly used approaches in the literature.

Pool mean group-autoregressive distributive lag (PMG-ARDL)

The PMG-ARDL was chosen for this study due to its ability to address complex econometric challenges inherent in panel data analysis. Unlike traditional methods, PMG-ARDL effectively handles variables with mixed orders of integration, such as I(0) and I(1), without requiring data transformations or differencing. This is particularly advantageous in examining datasets where variables such as EC, FD, and IS exhibit varying levels of stationarity. Traditional models like Fixed Effects or Random Effects often fail in such cases as they assume uniform integration orders, which limits their applicability in dynamic economic and environmental analyses (Pesaran et al., 1999).

A distinct advantage of PMG-ARDL is its capacity to simultaneously estimate both long-run equilibrium relationships and short-run dynamics within a unified framework. This dual focus is critical in understanding how structural factors such as FD, HC, and IS impact EC over time. For instance, while long-term effects might be driven by stable institutional and economic policies, short-term variations could reflect transient policy changes or economic shocks. Unlike methods like Generalized Method of Moments, which predominantly emphasize short-term effects, PMG-ARDL allows researchers to disentangle and analyze both dimensions effectively (Dogan and Seker, 2016; Shahbaz et al., 2013).

PMG-ARDL also accounts for cross-sectional heterogeneity, enabling short-run dynamics to vary across different cross-sectional units while maintaining homogeneity in long-run coefficients. This is particularly relevant in cross-country studies where nations differ significantly in their economic structures, policy frameworks, and environmental practices but may share common long-term trends. Models such as Dynamic Fixed Effects impose uniformity across all dimensions, potentially obscuring valuable insights arising from these differences. By allowing heterogeneity in short-run adjustments, PMG-ARDL better captures the nuances of country-specific economic-environmental dynamics (Lopez et al., 2011).

Another key feature of the PMG-ARDL methodology is its incorporation of lagged dependent and independent variables, which effectively addresses potential endogeneity issues and captures temporal dependencies in panel datasets. This is essential when analyzing variables such as FD and EF, which are often influenced by their historical values and other dynamic interactions. By explicitly modeling these lag structures, PMG-ARDL reduces biases arising from omitted variable issues and improves the robustness of the estimated relationships (Blundell and Bond, 1998). Moreover, the choice of PMG-ARDL is further reinforced by its proven effectiveness in recent empirical literature. For example, Akinlo and Olayiwola (2021) employed the model to explore the nexus between dividend policy and corporate performance, highlighting its strength in capturing both short-term and long-term effects. These studies illustrate the applicability and reliability of PMG-ARDL in addressing complex relationships involving economic, environmental, and policy variables.

Dumitrescu–Hurlin panel causality test

Dumitrescu-Hurlin (2012) introduced an advanced method for determining the direction of causation between explanatory variables, building on Granger’s (1969) non-causality framework. This method employs a linear model to analyze and establish a causal connection between the variables under investigation:

where i stands a constant individual influence, K denotes the time lag, and the model accounts for cross-sectional heterogeneity. The two t-statistics derived by Dumitrescu and Hurlin are the Wbar statistic and the Zbar statistic. These are derived by averaging the Wald statistics across all cross-sectional units, as follows:

In this case, H0 = no homogeneous causality in the panel is shown by the Wald statistics Wi, t. Because (a) it accounts for CD, (b) it can be used with even relatively small cross-sections, and (c) it produces consistent results even when applied to unbalanced panels, the DH test is highly effective, as stated by Aydin (2019). Therefore, the “Dumitrescu–Hurlin panel causality test” is used in this investigation. Figure 2 illustrates the empirical analysis flowchart.

Results and discussion

Descriptive statistics

The descriptive statistics for selected Asian countries are presented in Table 1. The descriptive statistics for the variables under study have mean values of 1.962713 for EF, FD, HC, REC, IS, GDP, and GDP2. These values are followed by standard deviations of 0.637523 for EF; 0.787025 for FD; 0.233879 for HC; 0.086449 for REC; 1.929206 for IS; 0.169632 for GDP; and 11.98839 for GDP2. However, the standard deviations are standard deviations for EF, FD, HC, REC, IS, GDP, and GDP2 are 0.6285, 1.1603,1.0172, 0.2855, 0.2122, 0.7037, and 0.2639, respectively.

Results of cross-sectional dependence tests

The CD prospects of the models (1 and 2) are statistically significant, as shown in Table 2. This highlights the slope parameter unpredictability and the presence of CD in both techniques. The assumption of homogeneity across cross-sections is disproven, as the three approaches exhibit distinct cross-sectional characteristics. Despite this heterogeneity, changes in one parameter may influence others. In the CD test, all variables such as FD, HC, REC, IS, and GDP are statistically significant (p < 0.05), leading to the rejection of the null hypothesis of no CD. This finding underscores the interconnectedness of the variables across cross-sections. The findings reveal that CD exists due to interconnected spillover effects, both within and across countries. Most countries are now connected, which has led to increased cross-border reliance. As a result, the effects of a change in even a single element in one country ripple out to affect the others. The issue of cross-sectional reliance is exacerbated by the growing interdependence of businesses and by natural disasters on a national and international scale. Demand shocks, the Asian economic crisis, and natural calamities on a global scale are all examples. These results highlight the critical role of cross-border interdependence, where changes in one country can significantly influence others through economic, environmental, and resource-based linkages. Collaborative strategies are essential to address shared challenges effectively, ensuring resilience against global disruptions like financial crises and natural disasters while promoting sustainable development.

Results of panel unit-root tests

The results of the panel unit root testing are shown in Table 3. The correlation between cross-sectional units due to social, economic, and political issues presents a CD estimation challenge in panel data. Scaled versions of the Pesaran LM and Pesaran CD were employed in the research. All variables have CD problems, as the alternative hypothesis of CD is widely accepted. Furthermore, both CIPS and CADF panel unit root tests confirmed the stationary nature of the variables. Both second-generation unit root tests indicate that all variables are stationary at the first difference because they are not integrated at the level. The presence of CD and the stationarity of variables at the first difference validate the robustness of the analysis. These findings highlight the interconnected nature of the sampled countries and support the use of advanced econometric methods to ensure reliable long-run estimations.

Results of panel cointegration test

The cointegration test was developed by Westerlund (2007) to verify the robust stability links between model variables. Instead of taking the first two options, which do not take CD into consideration, this method can be used to anticipate cointegration characteristics. Panel cointegration test results for the baseline model are shown in Table 4. The overall sample distribution of Asian nations is connected to ecological assets, FD, and HC over the long-run. Predicted parameter estimates (Gt, Pt) are statistically valid at the 0.01, 0.05, and 0.1% levels of predictive significance, hence, there is no reason to reject the stationarity hypothesis. Westerlund cointegration tests, as well as the expected parametric test for both targeted and complete panels of Asian economies, find emperically significant long-term associations between the variables reported in Table 6. FD, HC, REC, SI, GDP, and GDP2 all have an equal influence on the growth of Asia’s economic systems, as shown in Model 2. The main conclusion of this theory is that both technological progress and an abundance of natural resources are advantageous to a country’s actual economy. This claim is supported by the positive value of the coefficient in the interaction term, which is statistically significant at the 1% level. Thus, education spending has a direct impact on GDP in Asia and helps mitigate the negative consequences of resource extraction for developing nations. This is an important realization for strategic purposes. Table 6 shows how Asia’s mineral riches can either help or hurt the region’s economy. Thus, results highlight the interconnectedness of economic and ecological factors in Asian nations, demonstrating long-term associations among FD, HC, REC, and IS. The findings highlight the dual role of natural resources and technological progress in driving economic growth, where effective resource management and investment in education can mitigate negative environmental impacts. These insights emphasize the importance of balanced strategies to leverage natural resource wealth for sustainable economic development.

PMG-ARDL model results

The results from the PMG-ARDL analysis presented in Table 5 offer valuable insights into the long- and short-run relationships between various economic and environmental variables for developing countries across Asia. In Model 1, the long-run coefficient for FD shows a positive and significant relationship with the EF, with a 1% increase in FD associated with a 0.0041% increase in EF at the 10% significance level. This finding suggests that FD in developing Asian countries tends to exacerbate environmental degradation. As financial systems improve, there may be an increase in investments in industries that are heavily reliant on fossil fuels or environmentally harmful technologies, contributing to a higher EF. This is consistent with findings from Hsu et al. (2021), which indicate a surge in fossil fuel demand in major Asian countries like China, exacerbating environmental quality. Furthermore, the rise in financial capital could lead to greater industrial expansion without necessarily considering sustainable practices, reinforcing the reliance on polluting resources such as coal and oil (Irfan et al., 2022). In Model 2, the interaction term (LnFD*LnHC) becomes significant, suggesting that the negative impact of FD on EF can be mitigated by a skilled workforce. This supports the idea that countries with higher HC may be better positioned to adopt green technologies, thereby reducing the environmental consequences of EF. Also, the coefficient for HC in both models is negative and highly significant, indicating that higher levels of HC are associated with reduced environmental impact. In Model 1, a 1% increase in HC is linked to a 0.1543% decrease in EF. This result highlights the importance of HC in driving environmentally sustainable practices. A more educated and skilled workforce can promote innovation in clean technologies and improve resource efficiency, which leads to better EF. This finding aligns with the studies of Ehigiamusoe et al. (2022), which highlight the positive role of HC in reducing environmental degradation in densely populated regions like Asia. It further emphasizes that investments in education and training are crucial for achieving SDGs in the region. In addition, the long-run elasticity for REC is negative and significant in both models, suggesting that increasing REC helps reduce the EF. Specifically, a 1% increase in REC leads to a 0.3395% decrease in EF. This finding supports the notion that renewable energy sources, such as solar, wind, and hydropower, are crucial in mitigating environmental damage associated with conventional energy consumption (Wang and Dong, 2022). As countries in South Asia and other parts of Asia shift towards renewables, they can decouple economic growth from environmental degradation, achieving sustainable development. This is consistent with Oyebanji and Kirikkaleli (2022), who observed a similar relationship in Western European countries, reinforcing the importance of transitioning to green energy sources. Furthermore, the relationship between IS and EF is insignificant in Model 1, but in Model 2, a significant negative relationship is found, with a 1% increase in IS leading to a 1.8048% reduction in EF. This suggests that the composition of the industrial sector plays a crucial role in determining environmental outcomes. A shift towards less polluting industries or cleaner production processes could reduce the overall EF, particularly in rapidly industrializing economies in Asia. This aligns with the findings of Shahbaz et al. (2022), which emphasize the importance of structural changes in industries to promote sustainability.

Moreover, the U-shaped relationship between GDP growth and EF observed in Model 1 suggests that in the early stages of economic development, increased production and industrial activity lead to higher pollution levels. This is evidenced by the negative coefficient for GDP and the positive coefficient for GDP2, which indicates that as GDP grows, EF initially rises. However, as economies mature and cleaner technologies are adopted, the environmental impact begins to decline, which is reflected in the turning point indicated by GDP2. In Model 2, although EF increases with GDP, the absence of the squared term limits the ability to confirm a U-shaped relationship fully.

In the short run, the elasticity of FD in Model 1 is not significant, and in Model 2, it shows a negative but insignificant relationship with EF. This suggests that while FD might have long-term implications for environmental quality, its short-term effects are less pronounced. This could be due to the time lag required for financial capital to flow into industries and for its impacts on environmental quality to materialize. Also, the coefficient for HC is insignificant in both models. This implies that while HC plays a crucial role in driving long-term sustainability, its short-term effects on the EF are less observable. The accumulation of HC may require more time to influence industries and technology adoption, suggesting a delayed impact on environmental outcomes. In addition, in Model 2, the interaction term (LnFD∗LnHC) indicating that it is statistically insignificant. This suggests that the combined effect of FD and HC does not have an immediate moderating impact on the EF. In the short run, financial resources might still be directed toward high-polluting industries, and HC improvements may not have had sufficient time to foster a transition toward cleaner production and sustainable technologies. This finding is consistent with previous studies (e.g., Shahbaz et al., 2022), which argue that short-term environmental gains from FD and HC interaction are often constrained by institutional inertia, delayed policy impacts, and industrial dependencies on nonrenewable resources. Moreover, REC show a negative but insignificant relationship with EF in both models. This suggests that while the long-term benefits of renewable energy adoption are clear, the short-run impact might be constrained by factors such as the availability of renewable infrastructure, policy implementation, and the gradual transition from fossil fuels. Furthermore, in Model 2, the short-run coefficient for IS is significant and positive, suggesting that IS may have an immediate positive effect on the EF in the short-term. This could reflect the rapid industrial expansion in certain sectors, which may not yet be optimized for environmental sustainability. The immediate effects of industrialization might thus increase the EF before long-term adjustments occur.

Moreover, the short-run results for GDP and GDP² are insignificant. This suggests that while economic growth may have a significant role in determining long-term environmental outcomes, its immediate impact on the EF remains unclear. The insignificance of these variables could reflect the complexity of economic development, where short-term growth does not necessarily lead to immediate environmental improvements, as the effects of GDP growth on EF may take time to materialize.

The PMG-ARDL analysis provides critical understanding of the relationship between GDP, FD, HC, and REC in influencing EC across Asian nations. The findings highlight that rapid economic progress in the region negatively affects ecological health, as FD often supports environmentally harmful activities due to underdeveloped regulatory frameworks. This trend is compounded by heavy reliance on fossil fuels, which dominates the energy landscape in many Asian economies, driving significant increases in the EF. However, the study also identifies mitigating factors, such as HC and REC, which exhibit negative elasticities with EF. These results emphasize that investing in education and innovation can foster sustainable practices and that transitioning to renewable energy sources is essential to counteract the environmental impact of industrial and economic activities. Moreover, the positive relationship between natural resource consumption and EF underscores the urgent need for improved resource management, especially in resource-intensive economies like China and India. Particularly, the U-shaped relationship between GDP and EF challenges the applicability of the EKC hypothesis in the Asian context, suggesting that economic growth in the region has yet to lead to significant environmental improvements. Instead, economic expansion often comes at the cost of resource depletion and ecological degradation, reflecting a trade-off between development and sustainability. The long-term benefits of renewable energy and green innovation, as evidenced by their ability to reduce CO2 emissions, highlight the transformative potential of these technologies.

Robustness check

The results of testing the robustness of the PMG-ARDL model’s estimated coefficients are shown in Table 6. Corresponding coefficients on explanatory variables support the results from the PMG-ARDL model. CO2 emissions are negatively influenced by HC and REC, yet there is a negative association between FD and GDP. Thus, the robustness tests confirm the reliability of the PMG-ARDL model, showing that HC and REC reduce EF, while FD negatively associates with GDP. These findings highlight the need for policies that align financial growth with sustainability through investment in education and renewable energy.

Dumitrescu–Hurlin panel causality

The outcomes of a panel causality test proposed by Dumitrescu and Hurlin (2012) are presented in Table 7. This test in heterogeneous panel dataset suggests that Granger non-causality from the explanatery variables to the explained variable requires the application of the panel causality technique. The results demonstrates that while there is a one-way causation between the other variables (FD, HC, REC, IS, and GDP), there is a two-way causality between GDP and EF. Thus, the panel causality test confirms the influence of FD, HC, REC, and IS on EF and reveals a two-way causality between GDP and EF, highlighting the interdependence of economic growth and environmental quality, necessitating sustainable growth strategies. The symbols ⇨ shows unidirectional and ⟺ symbolize show bidirectional causality association among variables.

Conclusion and policy implications

This study investigates the impact of FD, HC, REC, IS, and GDP on EF across 22 Asian nations over the period from 2000 to 2021. Rather than using a standard proxy (i.e., CO2), it analyzes the EF as a more comprehensive measure of environmental sustainablity. The study utilizes the PMG-ARDL technique to provide reliable results by testing for stationarity, CD, and cointegration. In addition, the Dumitrescu-Hurlin panel causality test is applied to examine causal relationships, while the Wasterlund cointegration test assesses the long-run connections among the variables. The findings exhibit CD and variability in the slope. The unit root test establishes a standard sequence for combining variables. The cointegration analysis demonstrates a long-run relationship between the EF and key factors such as FD, HC, REC, IS, and GDP. The findings of the PMG-ARDL method indicate that, in the long run, FD, when interacted with HC, has a positive but limited direct effect on reducing the EF. In contrast, HC significantly reduces EF, underscoring the critical role of education and skills in promoting environmental sustainability. The combination of FD and HC further amplifies this reduction, highlighting their synergistic impact. In the short run, however, the effects of FD, HC, and their interaction on EF are insignificant, suggesting that their environmental benefits unfold over a longer period. Furthermore, in the long run, REC is a major driver of ecological sustainability, showing a significant negative effect on EF. However, in the short run, REC does not show an immediate impact on EF, likely due to delays in the adoption of renewable technologies. Moreover, in the long run, IS has mixed results, with its direct impact being insignificant in the first model but significant in the second model, indicating that sustainable industrialization strategies become more effective over time. In the short run, IS adds to environmental pressures, but this effect is expected to shift towards sustainability in the long run. Lastly, GDP initially leads to environmental deterioration in the long run, but beyond a certain threshold, it starts improving environmental outcomes, thus supporting the EKC hypothesis. Both GDP and its squared term are also insignificant in the short run, emphasizing that the EKC relationship primarily emerges in the long run. The analysis of causality demonstrates the interconnectedness of development and economic growth strategies.

After informing policymakers on the current state of affairs, we recommend targeted solutions to maintain ecological balance in Asian economies. Specifically, the scale effect in Central and Eastern Asian economies can be mitigated through (a) promoting renewable energy sources tailored to local resources, such as solar power in South Asia and wind energy in Central Asia; (b) expanding financial capitalization services to fund green technologies and ecological efficiency projects, with incentives for industries to adopt cleaner practices; (c) supporting technical innovation by subsidizing research and development in eco-friendly technologies; (d) enforcing strict ecological compliance laws with region-specific benchmarks and penalties for nonadherence; and (e) empowering regulatory authorities with resources to implement proactive and adaptive regulations based on real-time ecological data. Moreover, while this study provides a regional analysis, future research should include country-specific estimates to reflect local economic, social, and environmental contexts. For instance, identifying nation-specific links between economic growth, energy consumption, and environmental degradation can offer more granular insights. Expanding the scope to consider other proxies for ecological deterioration, such as CO2 and NO2 emissions, would provide a broader understanding of environmental challenges. Finally, future studies could examine the role of globalization and international trade in shaping the ecological trajectory of Asian economies, exploring how trade policies and global partnerships can contribute to sustainable development.

Taking into account the extensive empirical findings of this study, we propose the following policy actions: Banks are unwilling to provide finance for green capital projects, so government intervention is also required. The governments of Asian countries may do this by avoiding the passage of laws and instead enforcing guidelines requiring banks to allocate a certain percentage of their lending capacity to green projects. Governments in Asia may more keenly engage with REC across the entire economic spectrum by doing things like investing in green FD tools used in industry and making green finance inexpensive and available to families and companies. One strategy for doing so is to shift subsidies away from nonrenewable energy and toward REC. Furthermore, the government should investigate whether or not the financial sector is prepared to back natural gas projects over those that rely on fossil fuels. Our findings somewhat support this view, as HC has a detrimental impact on EF. However, there are a number of elements that must be in place before economic growth may occur. When a nation hits a tipping point on the EKC, it opens the door to rapid economic, social, and institutional growth. Europe’s economies benefit greatly from their widespread use of renewable energy sources. Europe may become more resilient in the face of fluctuating oil and gas prices if it embraces alternative energy sources. Expanding reliance on fossil fuels boosts GDP more than switching to renewable energy. The potential for green energy in these countries may be among the worst in the world. This investigation also uncovered a unidirectional connection between REC and EF. Investment in renewable energy sources is necessary to reduce the environmental impact and overall energy consumption. In addition to lowering negative effects on the environment, increasing energy security, and enhancing regional stability, the promotion of REC sources is a central tenet of the Paris Agreement.

The limitations of this study are rather evident and have been discussed. First, a wider variety of countries can be researched and compared in order to better comprehend the minuscule role that FD, GDP, and REC have in contributing to ecological pollution. Second, additional factors, such as the strictness of environmental rules, monetary and fiscal policies, research and development, human development, and green finance and investment, can be identified as contributors to CO2 emissions. Last but not least, nonlinear models can be used to combine uneven connections between variables.

Data availability

Data will be made available on request.

References

Abou Houran M, Mehmood U (2023) How institutional quality and renewable energy interact with ecological footprints: do the human capital and economic complexity matter in the Next Eleven nations? Environ Sci Pollut Res 1:1–13. https://doi.org/10.1007/S11356-023-26744-5/TABLES/7

Adanma UM, Ogunbiyi EO (2024) A comparative review of global environmental policies for promoting sustainable development and economic growth. Int J Appl Res Soc Sci 6(5):954–977

Adebayo TS, Ullah S (2023) Formulating sustainable development policies for China within the framework of socioeconomic conditions and government stability. Environ Pollut 328:121673. https://doi.org/10.1016/J.ENVPOL.2023.121673

Ahmad M, Ahmed Z, Bai Y, Qiao G, Popp J, Oláh J (2022) Financial inclusion, technological innovations, and environmental quality: analyzing the role of green openness. Front Environ Sci 10:851263. https://doi.org/10.3389/fenvs.2022.851263

Akinlo AE, Olayiwola AF (2021) Dividend policy and corporate performance in Nigeria: evidence from PMG-ARDL. Financ Res Lett 41(5):1–10

Ameer W, Ali MSE, Farooq F, Ayub B, Waqas M (2024) Renewable energy electricity, environmental taxes, and sustainable development: empirical evidence from E7 economies. Environ Sci Pollut Res 31(34):46178–46193. https://doi.org/10.1007/S11356-023-26930-5/METRICS

Amin A, Ameer W, Yousaf H, Akbar M (2022) Financial development, institutional quality, and the influence of various environmental factors on carbon dioxide emissions: exploring the nexus in China. Front Environ Sci 9:838714

Aneja R, Yadav M, Gupta S (2024) The dynamic impact assessment of clean energy and green innovation in realizing environmental sustainability of G‐20. Sustain Dev 32(3):2454–2473

Arogundade S, Mduduzi B, Hassan AS (2022) Spatial impact of foreign direct investment on ecological footprint in Africa. Environ Sci Pollut Res 29(34):51589–51608

Atasoy FG, Atasoy M, Raihan A, Ridwan M, Tanchangya T, Rahman J, Al Jubayed A (2022) Factors affecting the ecological footprint in the United States: the influences of natural resources, economic conditions, renewable energy sources, and advancements in technology. J Environ Energy Econ 1(1):35–52

Awwad Al-Shammari AS, Alshammrei S, Nawaz N, Tayyab M (2022) Green human resource management and sustainable performance with the mediating role of green innovation: a perspective of new technological era. Front Environ Sci 10:581

Aydin M (2019) Renewable and non-renewable electricity consumption–economic growth nexus: evidence from OECD countries. Renew energy 136:599–606

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26:6199–6208

Baloch MA, Ozturk I, Bekun FV, Khan D (2021) Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: does globalization matter? Bus Strateg Environ 30:176–184. https://doi.org/10.1002/BSE.2615

Balsalobre-Lorente D, Topaloglu EE, Nur T, Evcimen C (2023) Exploring the linkage between financial development and ecological footprint in APEC countries: a novel view under corruption perception and environmental policy stringency. J Clean Prod 414:137686

Baltagi BH, Feng Q, Kao C (2012) A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. J Econ 170(1):164–177

Baskaya MM, Samour A, Tursoy T (2022) THE FINANCIAL INCLUSION, RENEWABLE ENERGY AND CO2 EMISSIONS NEXUS IN THE BRICS NATIONS: NEW EVIDENCE BASED ON THE METHOD OF MOMENTS QUANTILE REGRESSION. Appl Ecol Environ Res, 20(3):2577–2595

Bletsas K, Oikonomou G, Panagiotidis M, Spyromitros E(2022) Carbon dioxide and greenhouse gas emissions: the role of monetary policy, fiscal policy, and institutional quality. Energies 15:4733. https://doi.org/10.3390/EN15134733 4733 15

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Breusch TS, Pagan AR (1980) The Lagrange Multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239. https://doi.org/10.2307/2297111

Buller A (2022) Time travellers: escaping ecological debt. In: The value of a whale. Manchester University Press, p 183–226

Cai L Le TT (2023) Natural resources and financial development: role of corporate social responsibility on green economic growth in Vietnam. Res Policy 81. https://doi.org/10.1016/j.resourpol.2022.103279

Chandio AA, Jiang Y, Abbas Q, Amin A, Mohsin M (2022) Does financial development enhance agricultural production in the long‐run? Evidence from China. J Public Aff 22(2):e2342. https://doi.org/10.1002/pa.2342

Chang Q, Wu M, Zhang L (2024) Endogenous growth and human capital accumulation in a data economy. Struct Change Econ Dyn 69:298–312

Chen CC (2024) Comparative impacts of energy sources on environmental quality: a five-decade analysis of Germany’s Energiewende. Energy Rep. 11:3550–3561

Chen H, Zhao X (2022) Green financial risk management based on intelligence service. J Clean Prod 364. https://doi.org/10.1016/j.jclepro.2022.132617

Destek MA (2021) Deindustrialization, reindustrialization and environmental degradation: evidence from ecological footprint of Turkey. J Clean Prod 296:126612

Dhar A, Naeth MA, Jennings PD, Gamal El-Din M (2020) Geothermal energy resources: potential environmental impact and land reclamation. Environ Rev 28(4):415–427

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, and oil prices on carbon emissions in the USA: Evidence from the ARDL bounds testing approach. Renew Sustain Energy Rev 54:1093–1100

Dong XY, Ran Q, Hao Y (2019) On the nonlinear relationship between energy consumption and economic development in China: new evidence from panel data threshold estimations. Qual Quant 53:1837–1857

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Ehigiamusoe KU, Lean HH, Babalola SJ, Poon WC (2022) The roles of financial development and urbanization in degrading environment in Africa: Unravelling non-linear and moderating impacts. Energy Rep. 8:1665–1677. https://doi.org/10.1016/j.egyr.2021.12.048

Gao C, Zhu S, An N, Na H, You H, Gao C (2021) Comprehensive comparison of multiple renewable power generation methods: a combination analysis of life cycle assessment and ecological footprint. Renew Sustain Energy Rev 147:111255

GFN (2022) Global Footprint Network. https://www.footprintnetwork.org/

Goldstein B, Gounaridis D, Newell JP (2020) The carbon footprint of household energy use in the United States. Proceedings of the National Academy of Sciences, 117(32):19122–19130

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement

Hailiang Z, Chau KY, Waqas M (2023) Does green finance and renewable energy promote tourism for sustainable development: empirical evidence from China. Renew Energy 207:660–671. https://doi.org/10.1016/j.renene.2023.03.032

Hasan MM, Du F (2023) Nexus between green financial development, green technological innovation and environmental regulation in China. Renew Energy 204:218–228. https://doi.org/10.1016/J.RENENE.2022.12.095

Hsu CC, Quang-Thanh N, Chien F, Li L, Mohsin M (2021) Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ Sci Pollut Res 28(40):57386–57397. https://doi.org/10.1007/S11356-021-14499-W/TABLES/5

IMF (2023) Financial Development (FD)-dataset by imf | data.world. https://data.world/imf/financial-development-fd

Irfan M, Razzaq A, Sharif A, Yang X (2022) Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol Forecast Soc Change 182. https://doi.org/10.1016/j.techfore.2022.121882

Jacal S, Straubinger FB, Benjamin EO, Buchenrieder G (2022) Economic costs and environmental impacts of fossil fuel dependency in sub-Saharan Africa: a Nigerian dilemma. Energy Sustain Dev 70:45–53

Jacobson MZ, Delucchi MA (2009) A path to sustainable energy by 2030. Scientific American, 301(5):58–65. http://www.jstor.org/stable/26001592

Jiakui C, Abbas J, Najam H et al. (2023) Green technological innovation, green finance, and financial development and their role in green total factor productivity: empirical insights from China. J Clean Prod 382:135131. https://doi.org/10.1016/J.JCLEPRO.2022.135131

Jianguo D, Ali K, Alnori F, Ullah S(2022) The nexus of financial development, technological innovation, institutional quality, and environmental quality: evidence from OECD economies. Environ Sci Pollut Res 29:58179–58200

Kumar R, Kumar A, Saikia P (2022) Deforestation and forests degradation impacts on the environment. In: Environmental degradation: challenges and strategies for mitigation. Springer International Publishing, Cham, p 19–46

Kurbatova T, Perederii T (2020) Global trends in renewable energy development. In 2020 IEEE KhPI Week on Advanced Technology. KhPIWeek pp. 260–263. IEEE. https://doi.org/10.1109/KhPIWeek51551.2020.9250098

Latif Y, Shunqi G, Fareed Z, Ali S, Bashir MA (2023) Do financial development and energy efficiency ensure green environment? Evidence from RCEP economies. Econ Res 36(1):51–72. https://doi.org/10.1080/1331677X.2022.2066555

Lee CC, Chen MP (2021) Ecological footprint, tourism development, and country risk: international evidence. J Clean Prod 279:123671

Li M, Yao-Ping Peng M, Nazar R et al. (2022) How does energy efficiency mitigate carbon emissions without reducing economic growth in post COVID-19 era. Front Energy Res 10:1–14. https://doi.org/10.3389/fenrg.2022.832189

Li Y, Zhao X, Wang B (2024) Public education expenditure and corporate human capital: evidence from China. Financ Res Lett 60:104926

Liu Z, Vu TL, Phan TTH, Ngo TQ, Anh NHV, Putra ARS (2022) Financial inclusion and green economic performance for energy efficiency finance. Econ Change Restruct 55(4):2359–2389. https://doi.org/10.1007/s10644-022-09393-5

Lopez R, Galinato GI, Islam A (2011) Fiscal spending and the environment: theory and empirics. Environ Dev Econ 22(1):37–66

Ma Q, Tariq M, Mahmood H, Khan Z (2022) The nexus between digital economy and carbon dioxide emissions in China: the moderating role of investments in research and development. Technol Soc 68:101910. https://doi.org/10.1016/J.TECHSOC.2022.101910

Makhdum MSA, Usman M, Kousar R, Cifuentes-Faura J, Radulescu M, Balsalobre-Lorente D (2022) How do institutional quality, natural resources, renewable energy, and financial development reduce ecological footprint without hindering economic growth trajectory? Evidence from China. Sustainability 14(21):13910. https://doi.org/10.3390/SU142113910

Manning WG (1998) The logged dependent variable, heteroscedasticity, and the retransformation problem. J health Econ 17(3):283–295

Nasir MH, Wen J, Nassani AA et al. (2022) Energy security and energy poverty in emerging economies: a step towards sustainable energy efficiency. Front Energy Res 10:1–12. https://doi.org/10.3389/fenrg.2022.834614

Naz F, Tanveer A, Karim S, Dowling M (2024) The decoupling dilemma: examining economic growth and carbon emissions in emerging economic blocs. Energy Econ 138:107848

Nketiah E, Song H, Adjei M, Obuobi B, Adu-Gyamfi G (2024) Assessing the influence of research and development, environmental policies, and green technology on ecological footprint for achieving environmental sustainability. Renew Sustain Energy Rev 199:114508