Abstract

A successful clean energy transition hinges on overcoming supply chain challenges for critical raw materials, as continued availability is essential for deploying key technologies like wind, solar photovoltaic, and lithium-ion battery. This paper presents a multi-year, optimization-based framework to assess how material supply limitations impact clean energy deployment. Unlike conventional projections ignoring material allocation constraints or estimating demand without resource competition, our framework enables goal-oriented planning and trade-off analysis under varied supply chain scenarios. Applied to the US, it integrates trade data, historical production trends (1985–2020), and geopolitical factors. Results show that, due to bottlenecks in nickel, silicon, and rare-earth elements, the US could fall short by over 730 GW—34% of its cumulative 2050 clean energy capacity goals. While permitting and environmental regulations remain important, findings highlight material scarcity as an immediate physical constraint. Addressing it requires expanding domestic production, diversifying imports, and advancing substitution and recycling.

Similar content being viewed by others

Introduction

Wind, solar photovoltaic (PV), and lithium-ion battery storage systems play a pivotal role in reducing greenhouse gas emissions in the electric power sector and advancing electrification strategies essential for achieving the decarbonization goals outlined in the Paris Agreement1. However, the widespread adoption of these technologies is significantly influenced by the effective management of their supply chains, particularly the critical materials needed for manufacturing. Global supply chain disruptions and material shortages pose significant challenges, hindering the production and deployment of these technologies and, consequently, slowing progress toward regional, national, and global climate targets.

While countries around the world are mobilizing resources to accelerate the clean energy transition—expanding offshore wind farms2, boosting solar energy generation3, and increasing storage capacity4—the rising demand for critical materials is placing increasing pressure on global supply chains. As the need for these materials grows, supply chain constraints have the potential to become a significant bottleneck in the production and deployment of clean energy technologies. This surge in demand has intensified competition for key resources, straining existing supply chains and heightening concerns about material availability5,6,7. These challenges, coupled with geopolitical complexities and the concentrated sourcing of many critical materials, threaten to slow the pace of the transition, despite substantial efforts and financial incentives provided by the US Inflation Reduction Act (IRA)8 and similar global initiatives9,10. While this study focuses on wind, solar PV, and lithium-ion battery technologies as primary pathways for the clean energy transition, we acknowledge the growing policy support for other technologies, including nuclear, as also reflected in the IRA. However, we exclude nuclear from our analysis due to its significantly longer lead times and siting requirements, which limit its relevance to near- and medium-term capacity expansion, and limited capacity additions that can be achieved via re-activation of previously decommissioned nuclear assets. At the same time, US electricity demand is projected to increase due to widespread electrification and the rapid growth of data centers and AI development. However, recent technological breakthroughs, such as more energy-efficient AI models like DeepSeek, suggest that long-term demand trajectories remain highly uncertain. While these developments are not directly included, the framework is designed to remain applicable under evolving conditions, making it well-suited for stress-testing system outcomes across a range of scenarios involving demand growth, technology shifts, and supply chain dynamics.

Although substantial research has been conducted to assess the availability of critical materials for renewable energy transition6,7,11,12,13,14,15, these studies primarily focus on select materials and technologies, and often provide broad predictions rather than such actionable insights as interventions for decision-making. Also, existing analyses assume strongly idealized conditions, such as global or regional cooperation, aggregated material availability, and generic climate targets (e.g., 1.5-degree or 2-degree goals) and do not account for country-specific challenges. As a result, they lack the nuance needed to address potential trade barriers, production capacities, stocks, and phased clean energy goals, which are critical for developing tailored strategies for real-world transitions. In contrast, this paper examines three critical aspects of the US clean energy transition, offering a comprehensive optimization-based framework that incorporates material constraints and tailored national strategies. Optimization is employed to systematically identify bottlenecks, evaluate trade-offs, and propose actionable solutions for achieving clean energy targets under realistic constraints. While we acknowledge the value of extending the analysis to other major economies—given the importance of international trade dynamics and the interconnected global economy—we focus on the US due to its position as one of the largest consumers of critical materials, the ambitious goals codified by the IRA, and its significant influence on global energy markets. Additionally, our framework uses detailed trade data rather than projected global production shares to sidestep the complexity of tracing intermediate processing stages—such as mining, refining, and precursor manufacturing—which often span multiple countries and ownership structures. While we acknowledge the importance of these stages, the final refined materials typically re-enter the US in commodity form through trade, i.e., either without change in condition or after being processed or assembled abroad, as noted by the US Census Bureau16. For instance, the US imports bauxite but lacks domestic aluminum smelting, relying instead on foreign primary aluminum. Similarly, lithium is mined and concentrated globally but primarily refined in China, which dominates precursor production through early investment, supportive policies, and an integrated battery supply chain. These precursors are used domestically or exported to countries like the US, which has limited capacity. By focusing on traded commodities, our model offers a more tractable and realistic estimate of the materials actually accessible to the US. The developed framework is adaptable to other national contexts, and future work will explore its application to additional countries to provide a broader perspective on global clean energy transitions.

First, this paper identifies and quantifies the critical materials for such clean energy technologies as land-based and offshore wind, solar PV, and lithium-ion batteries, which are key for the US clean energy transition. It examines material flows at the component level, detailing how these materials move through supply chains and are transformed into the final products. Second, the paper develops a decision-making framework to simulate clean energy product planning decisions through 2050, in alignment with the US Net-Zero milestones. This framework accounts for the scope and scale of these goals, incorporating constraints such as bilateral material trade, domestic production, and stocks. The analysis helps identify potential bottlenecks, providing insights that can guide strategies for more effectively achieving these goals. Finally, the complexity of the clean energy transition highlights the critical need for international collaboration and trade. Using the framework described above, this paper presents case studies analyzing commodity trade between the US and other nations, explicitly categorizing these countries into stable and other trading partners, with a particular focus on potential non-collaboration scenarios arising from increasing geopolitical tensions17,18. It also examines potential trade disruptions with countries at different levels of democracy19. These analyses explore how global cooperation can accelerate the US clean energy transition while identifying vulnerabilities, emphasizing the importance of strong international partnerships.

Results

Identification and utilization of critical materials

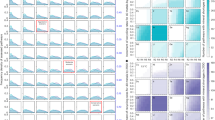

We analyzed both mature and emerging clean energy technologies critical to the energy transition, categorizing them into their key components. Specifically, we selected direct-drive and gearbox-based systems for both onshore and offshore wind power plants20, as well as crystalline silicon (c-Si), cadmium telluride (CdTe), and copper indium gallium selenide (CIGS) solar PV systems21. For battery storage, we include lithium-ion battery systems, which are among the fastest-growing energy storage technologies due to their high-energy density, power output, near 100% efficiency, and low self-discharge rates22. These systems encompass a range of chemistries, including nickel–cobalt–aluminum (NCA), several nickel–manganese–cobalt (NMC) variants—specifically NMC111, NMC811, NMC523, and NMC622—and the increasingly adopted lithium iron phosphate (LFP)23. NMC and NCA chemistries vary in nickel content, influencing material needs and battery performance. For example, NMC111 uses a 1:1:1 ratio of nickel, manganese, and cobalt, while NMC811 increases the nickel proportion to 8:1:1. LFP, by contrast, contains no nickel or cobalt, making it attractive for its material resilience, improved thermal stability, and growing adoption in stationary storage applications. The breakdown of components for each technology is detailed in Table 1. Figure 1a illustrates the component-level material demand, measured in metric tons per megawatt (MW) of installed capacity.

a Component-level material demand in metric tons per MW installed capacity and technology-specific aggregated demand for b land-based wind, c offshore wind, d solar PV and e lithium-ion battery. DD direct drive wind system, GB gearbox wind system, CdTe cadmium telluride panels, cSi c-silicon PV panels, CIGS copper–indium–gallium–selenide panels, NCA nickel–cobalt–aluminum oxide battery, NMC nickel–manganese–cobalt oxide battery, LFP lithium–iron phosphate battery.

In total, Table 1 and Fig. 1a examine 26 critical materials essential for clean energy technologies and relate specific materials needed for each component. Understanding these material demands is critical for making informed decisions on prioritizing products to meet clean energy goals. Aggregated material demands at the technology level are displayed in Fig. 1b–e. Detailed demand schedules for land-based and offshore wind12,24,25,26,27,28,29,30,31,32,33,34,35,36,37, solar PV12,24,25,27,29,38,39,40,41,42,43,44,45, and lithium-ion battery storage systems46,47,48,49 are provided in the Supplementary Information 1.3.1 and 1.3.2.

Aluminum and copper are critical materials for advancing clean energy technologies due to their properties and applications. Aluminum has a high strength-to-weight ratio, thermal and electrical conductivity, and resistance to environmental degradation, which makes it essential for wind turbines and solar PV systems. It is used in turbine blades, nacelles, module frames, and mounting structures, enhancing both efficiency and durability50,51. Similarly, copper has superior electrical and thermal conductivity, durability, and corrosion resistance, which are vital for solar PV systems, where it is extensively used in arrays, cabling, and balance of system (BOS) components, ensuring reliable performance and longevity35,52.

Chromium, nickel, and manganese are essential alloying elements that contribute to the enhanced properties of high-grade steel used in renewable energy. Chromium provides the necessary corrosion resistance, which is critical for offshore wind turbines and solar PV racking systems. Nickel enhances toughness and maintains strength across varying temperatures, making it vital for components such as turbine shafts and nacelles. Manganese increases hardness and wear resistance leveraged for wind turbine blades and other components subjected to mechanical stress26,28,53,54.

Rare-earth elements (REEs), particularly neodymium, dysprosium, praseodymium, and terbium, play a significant role in direct-drive wind systems for both land-based and offshore wind turbines. These elements are fundamental in producing high-strength magnets, which are necessary for generating the strong magnetic fields required for efficient electricity generation. The use of REEs allows for the design of lighter and more compact wind turbine systems, reducing overall weight and enhancing operational reliability34,37,50,54,55.

Certain materials are irreplaceable in clean energy technologies. Silicon is essential in all c-Si PV panels, providing the semiconductor properties needed for efficient solar energy conversion25,39. Tellurium is critical in CdTe panels for creating high-efficiency thin-film PVs. Copper, indium, gallium, and selenium are vital in CIGS panels, contributing to their flexibility and performance42. In lithium-ion batteries, nickel is crucial in both NMC and NCA chemistries for high-energy density and stability, while manganese and cobalt enhance thermal stability and cycle life in NMC batteries46.

Although Fig. 1 does not display steel, iron, and concrete, these materials are nonetheless essential for all renewable energy technologies. Our analysis based on previous studies indicates that a land-based wind power plant typically requires ~394,000 metric tons of concrete, 127,000 metric tons of steel, and 8500 metric tons of iron per gigawatt (GW) of installed capacity. For offshore wind plants, the demand is even greater, with concrete, steel, and iron usage reaching 619,000 metric tons, 263,000 metric tons, and 9000 metric tons per GW, respectively. Solar PV installations necessitate around 38,600 metric tons of concrete, 28,800 metric tons of steel, and 40 metric tons of iron per GW, while battery storage systems consume roughly 9 metric tons of steel per GW for battery casings. In addition, lithium-ion batteries using LFP cathodes require ~220 metric tons of iron per GW, as the cathode material is composed of lithium iron phosphate (LiFePO4)12,24,26,27,48. Despite their substantial usage, steel, iron, and concrete are not considered constrained materials due to their robust production capacities and stable supply networks. The US is a leading global producer, generating 80 million tons of raw steel and 91 million tons of cement in 202356. Additionally, historically stable trade relations with US allies—such as NATO, MNNA, and NAFTA partners, as discussed later in 2.5—help ensure reliable imports of materials used in both civil and strategic applications. These partners collectively contributed over 58% of US steel imports and 75% of cement imports from 2019 to 202256. Decarbonization efforts in these industries, which have the potential to reduce greenhouse gas emissions by over 70% for steel57 and 57% for concrete58, further enhance their sustainability for clean energy applications. Consequently, these materials are excluded from supply chain constraint considerations.

Meeting US clean energy goals

A commodity supercycle refers to a multi-decade period of rising and falling commodity prices, typically lasting 20–30 years, driven by structural shifts in global demand and supply59,60. These cycles are historically associated with major transformations such as industrialization and technological revolutions. The ongoing clean energy transition—characterized by rapidly rising demand for critical materials—may already be triggering a new supercycle, reshaping both price and availability patterns as countries scale up investments in renewable generation and storage technologies61. Building on this context, we project future material availability based on the trends observed during the most recent supercycle (1985–2020), which captures the dynamic interplay of extraction, trade, and innovation relevant to the current transition62,63. The detailed methodology is provided in the “Methods” subsection “Estimation of future availability and price for selected materials”. To facilitate interpretation, we classify the projected availability trends into three categories: (1) near-steady growth with minor fluctuations—graphite, magnesium, manganese, REEs, selenium, tellurium, and titanium; (2) near-steady growth with notable fluctuations—aluminum, chromium, cobalt, copper, nickel, and zinc; and (3) peaking around 2040–2045—balsa, gallium, indium, lithium, molybdenum, silicon, and tin. These categories reflect underlying differences in historical production patterns, trade dynamics, and regional supply characteristics.

Using publicly available mineral commodity trade data for the US and its partners56,64, we estimate the aggregate availability of critical materials through trade, as shown in Fig. 2. These estimates are compared with calculated maximum and minimum material requirements derived from 2050 US clean energy targets, accounting for technology-specific variations in material intensity (e.g., direct-drive vs. gearbox wind turbines). Figure 3 provides a preliminary comparison of projected supply and demand, identifying potential shortfalls for key materials such as nickel, neodymium, silicon, gallium, indium, praseodymium, selenium, tellurium, and terbium—particularly for material-intensive technologies like direct-drive wind, c-Si, CdTe, and CIGS solar panels. While the analysis reflects the least material-intensive configurations, sufficiency is not guaranteed due to additional economic and practical constraints, and it does not yet capture market responses such as price-driven supply adjustments.

a The maximum and b minimum material demands are calculated from the material demands shown in Fig. 1. These demands vary across different types of products, with the maximum demand corresponding to the product that requires the most specific material, and the minimum demand corresponding to the product that requires the least. The annual availability for each material is calculated by aggregating trade and domestic production, as shown in Fig. 2, and averaging across the time period from 2023 to 2050. The short red lines on the bars indicate the annual average availability. A red line above the stacked bars indicates that, on average, the annual availability of the material exceeds the maximum or minimum demand, while a red line within the bar suggests that the availability is, on average, insufficient to meet the clean energy goals.

This assessment offers an initial insight into material risks; however, the complexity of clean energy systems—characterized by diverse technologies with varying material requirements—necessitates a more systematic approach. Optimization is crucial to efficiently allocate resources, address scarcity risks, and quantitatively identify bottlenecks that could impede the achievement of clean energy goals.

Building on previous studies that utilized optimization models to simulate supply chains and product planning decisions65,66, we developed a multi-annual optimization framework to simulate decision-making from the current year to 2050. The model minimizes total costs associated with material procurement, manufacturing, and clean energy deployment, while accounting for material consumption, installation-related soft costs, and evolving government targets (detailed in the “Methods” subsection “Key assumptions”). Unlike single-year capacity analyses, our approach captures the dynamic progression of clean energy transitions by integrating annual material availability, installation capacity limits, and stock accumulation. This framework provides a realistic representation of the gradual, multi-stage process required to achieve clean energy goals, offering a more accurate understanding of resource allocation and capacity installation over time.

The optimization model and constraints, detailed in the “Methods” subsection “Optimization model”, can be summarized as follows. First, annual usage of critical materials are restricted by the maximum quantities obtainable through trading, domestic production, and the accessible stocks. These stocks are estimated based on historical fluctuations, with the peak levels serving as the upper limit for what can be utilized67.

Second, the annual installation rates for each clean energy technology—wind, solar PV, and lithium-ion battery storage—are constrained by a combination of factors, including historical installation experience and projected peak installation rates68,69,70, regulatory concerns (for example, offshore wind installation is constrained by the Jones Act, which limits the use of foreign vessels for transport and installation71), and physical supply chain restrictions, such as limitations related to port and vessel availability72,73,74. These factors collectively constrain the rate of annual expansion.

Finally, the model incorporates annual clean energy capacity goals for each technology, which must be met in accordance with the goals outlined in studies69,70,75,76, as detailed in the “Methods” subsection “Key assumptions”. When material availability or installation limits prevent full attainment of these goals, the model endogenously determines the level of unmet capacity via the penalty terms in the objective function. These penalties capture the trade-off between meeting capacity targets and respecting supply constraints. Higher penalties are assigned to offshore wind and solar PV, reflecting their role as generation resources that directly contribute to meeting electricity demand and achieving stepwise deployment targets69,76. In contrast, batteries function as storage, i.e., they shift energy rather than generate it, so their shortfalls are less directly tied to clean energy targets. To further explore potential supply-side responses, we also simulate a feedback mechanism in the “Results” subsection “Sensitivity case: feedback from unmet capacity”, where the persistently present unmet capacity prompts a modeled increase in material availability at a realistic rate, representing accelerated supply-side intervention.

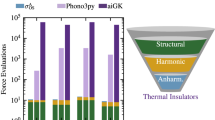

Baseline results under fixed supply chain assumptions

The optimization results in Fig. 4a–e show that, during the early years, the model favors the deployment of gearbox-based wind systems. These systems are less dependent on REEs, a preference driven by the limited annual availability of REEs, although they require higher quantities of other materials such as cobalt and nickel. As the clean energy targets gradually accumulate over time, key materials like nickel are increasingly allocated to solar PV production. At the same time, the accumulation of REE stocks allows the model to transition toward greater adoption of direct-drive offshore wind systems. This shift supports progress toward achieving the offshore wind capacity goals of 30 GW by 2030 and 110 GW by 2050, along with the onshore wind targets for 2050. However, due to persistent material shortages, the model is unable to fully meet these targets.

a Capacity expansion results for all clean energy products across different technologies and b–e individual technology status in achieving clean energy goals. f Shows the critical materials consumption as a proportion of the total availability increment, including trading and self-production. The bars above the reference line in part f indicate extra consumption from stocks. Materials shown in red font indicate a consumption ratio exceeding 75% of their availability increment, signaling potential scarcity.

For solar PV, the model predominantly selects c-Si for nearly all new installations, with minor inclusions of CIGS and CdTe appearing post-2030. On one hand, given the exceptionally high solar PV capacity goal (around 1500 GW of new installations), CIGS and CdTe technologies were expected to supplement c-Si. However, the installation of these alternative technologies is limited by the constrained availability of nickel, which is extensively required for PV panel racking and BOS components. Under such constraints, the model favors the less expensive c-Si technology to maximize production. For lithium-ion batteries, the model consistently selects LFP throughout the period, as its avoidance of nickel provides a key advantage under conditions of nickel scarcity, particularly when nickel is in high scarcity and needed for other technologies.

The observed shortfall, with 34.4% of cumulative goals unmet, is pronounced in land-based wind, offshore wind, and solar PV, with deficits of 308 GW (81.2% of the target), 48.4 GW (44% of the target), and 374.5 GW (25.6% of the target), respectively. This highlights the critical need for strategic resource management and innovative technological solutions, even under optimized material usage.

Sensitivity case: feedback from unmet capacity

While the model endogenously accounts for unmet capacity through optimization penalties, we further investigate how this shortfall could trigger plausible policy responses to ease supply constraints. Specifically, we divide the planning horizon into five-year intervals. At the end of each interval, if the model identifies any unmet capacity, it triggers the following response mechanism: trade-based material availability is increased by 10% through moderate stockpiling, and domestic availability is increased by 25% through incentivized recycling. These response rates are based on conservative estimates from ref. 77, which report demand growth of 8–15% for critical minerals such as nickel and rare earth elements, and suggests that scaling up recycling could reduce the need for new mining supply by 25–40%. Although we do not model market feedback explicitly, this scenario serves as a sensitivity analysis illustrating how targeted interventions could partially alleviate material bottlenecks and improve the likelihood of achieving clean energy deployment targets. Recent studies underscore the growing importance of modeling market dynamics and strategic interventions for critical minerals. Riddle et al. 78 use agent-based modeling to capture firm-level decisions across mining, refining, and magnet production stages in rare earth markets, showing that limited substitutability and dynamic behavior can lead to persistent shortages and price volatility. The study in ref. 79 explores how global critical material markets may evolve toward competition, cooperation, or cartelization, drawing analogies with oil markets and emphasizing the need for international governance. These studies highlight the importance of integrating market behavior and geopolitical strategy into energy system planning. While our sensitivity approach abstracts from these mechanisms, referencing such work clarifies future directions for model development.

The feedback mechanism is first activated after 2028 and remains active throughout the planning horizon due to persistent capacity shortfalls. However, the total unmet capacity decreases from 731.2 GW in the baseline case to 680.8 GW. Specifically, LBW shortfalls are reduced from 308.3 to 296.5 GW, OSW from 48.4 to 37.4 GW, SPV from 374.5 to 346.7 GW. LIB continues to meet its targets in full, benefiting from the model’s exclusive selection of LFP, which avoids dependence on bottleneck materials such as nickel. These results suggest that while moderate stockpiling and incentivized recycling offer measurable improvements, they are not sufficient to fully close the supply-demand gap. Scaling up these strategies will be essential to more effectively support long-term clean energy deployment.

Importance of global collaboration and trade

Given that current material trading and domestic production are insufficient to meet clean energy objectives, robust international cooperation and trade agreements are critical to ensuring a stable supply of critical materials and enhancing domestic production capabilities. However, increasingly strained international relations heighten the need to evaluate dependencies on unstable partners, particularly those with varying political regimes, such as democratic and autocratic states. For instance, the US and many other nations heavily rely on China for critical materials, despite the inherent risks posed by this volatile trading relationship. The following analysis addresses these concerns by examining trade dependencies and potential disruptions stemming from geopolitical tensions.

Figure 5 illustrates the predicted material dependency of the US on various trade partners. We categorize these dependencies into two main distinctions: 1. “Stable–Unstable Distinction,” where trade partners are classified as either stable allies-countries with which the US has established formal agreements such as North Atlantic Treaty Organization (NATO), Major Non-NATO Allies (MNNA), American Nations Energy Alliance (AMNEA), and Mexico under NAFTA (North American Free Trade Agreement)—or as unstable non-allied partners that do not belong to these groups; and 2. “Political Regime Distinction," where trade partners are categorized based on their political regime as either autocratic partners or democratic partners. This classification is based on data from Varieties of Democracy (V-DEM) and Regimes of the World (RoW)80,81,82, which categorize countries into four political regimes: Closed Autocracy, Electoral Autocracy, Electoral Democracy, and Liberal Democracy. For our analysis, autocratic partners include countries classified as Closed Autocracy or Electoral Autocracy, while democratic partners cover those identified as Electoral Democracy or Liberal Democracy. These distinctions are analyzed below to explore the implications of varying degrees of international cooperation challenges.

Regardless of the cooperation type, most materials exhibit consistent trends. Specifically, materials for which the US has a high dependency on unstable partners also show a similar high dependency on “autocratic partners,” such as balsa, REEs, graphite, and magnesium. In Fig. 5, materials marked in red represent those for which imports from unstable partners or autocratic partners constitute more than 50% of the total availability.

There are a few exceptions to this trend of overlapping dependencies. For example, chromium is primarily imported from South Africa, which is classified as both an unstable partner and a democratic partner, and molybdenum is mainly sourced from Peru, which also falls into the categories of an unstable partner and a democratic partner.

This pattern, where the US tends to trade predominantly with politically similar nations, is unsurprising given that, as a highly democratic country, the US has a preference for trading with democratic countries83. Nevertheless, our analysis reveals that the US remains significantly dependent on its trading partners for many critical materials. A substantial number of the materials analyzed in this paper have domestic production ratios below 25% of total availability. Only aluminum, copper, magnesium, molybdenum, silicon, tin, and zinc surpass this threshold. Several materials, including gallium, graphite, indium, manganese, titanium, and REEs, are almost entirely reliant on imports, consistent with findings from United States Geological Survey (USGS) studies56,84,85.

To assess the resilience of the US material supply chain under restrictive international scenarios, we examine two case studies. The first considers trade limited to stable allied partners, reflecting strategic or defense-driven alliances17,18. The second explores scenarios involving extreme economic sanctions or trade restrictions by autocratic states19,86. To facilitate scenario comparison, we summarize key model outcomes in two tables. Table 2 presents the resulting capacity expansion decisions under the Baseline, Case Study 1, and Case Study 2. Table 3 compiles the corresponding material usage risks, highlighting materials at extreme risk (consumption ratio ≥ 75%) and high risk (consumption ratio ≥ 50%). These indicators help identify which resources are currently constrained or may become limiting as clean energy deployment accelerates.

Case study 1: friendshoring trade with stable partners

We examine the capability of the US to achieve its clean energy goals, relying solely on domestic production and stable partners. This analysis is particularly relevant given the increasing trend toward alliance-based trade policy17,18.

As shown in Table 2, the unmet capacity increases in Case Study 1 relative to the Baseline. Deployed land-based wind capacity declines significantly from 71.7 to 29.8 GW, offshore wind from 61.5 to 48.1 GW, and solar PV from 1087.8 to 1070.8 GW. These decreases are largely driven by restricted access to REE imports. Notably, the model shifts toward gearbox-based offshore wind turbines due to constrained REE availability. In contrast, lithium-ion battery storage remains fully deployed across all scenarios, as the use of LFP chemistries avoids key bottleneck materials such as nickel.

Table 3 further illustrates these outcomes, showing that the production of direct-drive wind turbines is substantially reduced due to shortages of REEs, which are predominantly sourced from unstable partners. The exclusion of trade with these partners not only constrains wind turbine manufacturing but also contributes to a decrease in solar PV deployment. This is largely driven by bottleneck materials—such as nickel—that are already in critical shortfall under the baseline scenario. Nickel plays essential roles in arrays, structural components (e.g., wind turbine foundations, solar panel racking, and battery enclosures), and BOS elements. Its reduced availability further limits the deployment potential of both wind and solar PV technologies.

Compared to the Baseline, relying solely on trade with stable partners introduces new challenges in meeting clean energy goals, particularly with regard to REEs, which nearly prohibit the production of direct-drive wind turbines. Additionally, the expansion of c-Si solar PV is restricted, hindering the achievement of the DOE’s capacity goals of 1000 GW by 2035 and 1600 GW by 2050, as specified in the “Methods” subsection “Key assumptions”. Moreover, the usage rates of other materials, such as gallium and indium—critical for CIGS solar PV panels—have increased despite a reduction in overall produced capacity. This occurs because the limitations of material trading with only stable partners force the model to incorporate more substitute products (e.g., CIGS as a substitute for c-Si) to maximize capacity production, regardless of their overall material intensity. On the other hand, the overall increase in unmet capacity compared to the baseline remains relatively modest, due to the US’s pre-existing friendshoring strategy for material imports, which naturally reduces reliance on unstable partners87.

Case study 2: trade disruption with autocratic partners

We examine an extreme scenario where trade interruptions occur due to political regime disagreements, resulting in significant disruptions5,19,88. Using the political regime classifications from V-DEM and RoW80,81,82, as previously described, we simulate the impact of removing trade flows from autocratic partners to assess the effects of potential trade disruptions with countries of varying political regimes.

The capacity expansion results in Table 2 indicate that unmet clean energy goals have increased relative to the Baseline. Compared to Case Study 1, which limited trade to stable partners, the deployment of land-based wind and solar PV has further declined—from 29.8 to 22.2 GW for land-based wind, and from 1070.8 to 1002.8 GW for solar PV. The larger reduction in solar PV deployment is primarily driven by shortages of critical materials, particularly silicon (for c-Si and CdTe) and selenium (for CIGS), as trade with autocratic partners—key suppliers of these materials—has been excluded.

As a result, the model shifts production priorities toward offshore wind, which experiences a smaller shortfall. This shift occurs because nickel, a critical material for solar PV production, becomes available for wind applications as solar PV is first constrained by shortages in other critical materials such as silicon and selenium. Nickel, essential for gearbox-based offshore wind turbines, is redirected to wind turbine production, alleviating some of the material constraints. However, the risk associated with REEs, particularly for direct-drive wind systems, continues to limit offshore wind expansion. Consequently, the model favors more material-intensive gearbox wind turbines for both land-based and offshore applications, as observed in Case Study 1.

Despite optimization efforts, all types of solar PV remain significantly constrained by shortages in critical materials. In particular, shortages of silicon and selenium impose severe limitations on solar PV expansion, making it increasingly difficult to meet cumulative clean energy goals.

Discussion

Our analysis underscores the critical role of materials such as aluminum, copper, chromium, nickel, manganese, silicon, tellurium, and REEs in supporting wind, solar PV, and lithium-ion battery technologies essential for the clean energy transition. Among these, nickel, silicon, and REEs face the most significant shortages, even when resource allocation is optimized. Nickel remains a bottleneck for structural components and BOS elements, while silicon constrains solar PV production, and REEs, such as terbium, neodymium, praseodymium, and dysprosium, limit the manufacturing of direct-drive wind turbines.

Our case studies reveal the US’s heavy reliance on imports from both stable allies and autocratic partners, highlighting the vulnerability of supply chains to geopolitical tensions and economic sanctions. For instance, disruptions in trade with these partners could significantly hinder the expansion of direct-drive wind and solar PV technologies as shown in Tables 2 and 3, high-risk materials, such as manganese (commonly used in alloying) and balsa (used in wind turbine blades), though not previously emphasized, are likely to become emerging constraints as clean energy deployment scales up.

Our baseline results show that material shortages are a primary constraint on clean energy capacity expansion. However, even if materials were unlimited, additional bottlenecks exist. For example, solar PV deployment is constrained by historical peak installation rates, labor availability, and technological experience, with annual growth unlikely to exceed 30 GW before 2025 or 60 GW before 2030. This falls short of the Department of Energy (DOE)’s target of 550 GW by 203089. Offshore wind faces similar challenges, including limited port and vessel capacity, making the 30 GW goal by 2030 highly unattainable.

This paper focuses on the physical availability risks of critical materials, highlighting the substantial volumes required to meet clean energy transition goals. These risks are foundational, as they constrain the supply chain’s capacity to scale technologies such as wind, solar PV, and battery storage. Several additional risks, however, fall beyond the scope of this analysis and are acknowledged as limitations. For example, correlated trade disruptions may amplify shortages—if access to a resource is lost from one trading bloc, aligned partners may also face simultaneous constraints. Additionally, the supply of many critical materials depends on the production of other metals, as they are often byproducts; gallium is derived from bauxite processing, indium from zinc refining, and tellurium from copper anode slimes. Thus, any decline in the production of these host metals can unintentionally constrain the availability of their byproducts. These upstream dependencies not only affect physical supply but also introduce price volatility and market uncertainty. Intermediate components, such as permanent magnets or battery cells sourced from companies with strategic conflicts, further complicate secure supply. While this study offers an initial system-level perspective on physical availability, future research should extend the framework to incorporate inter-material correlations, production linkages, and market responses such as pricing and supply elasticity.

While this analysis primarily addresses physical risks, it acknowledges the significant role of ESG-related challenges, such as permitting delays and regulatory bottlenecks, which are extensively documented in existing literature. These challenges, coupled with grid expansion difficulties and the decentralized nature of the US energy system, further compound supply chain vulnerabilities. Future research should explore the interplay between ESG-related risks and physical constraints, including the feasibility and cost of establishing a national stockpile of critical materials to mitigate both types of risks. Recent studies emphasize the need to tailor stockpiling strategies to national contexts. For example, Zwickl-Bernhard and Oitzinger90 advocate for EU-wide reserves of key materials for solar PV and batteries as a hedge against market volatility and geopolitical shocks, linking stockpile levels to deployment goals and import dependence. Likewise, Zhou et al. 91 propose a risk-based framework for China that prioritizes stockpiling based on import concentration, disruption probability, and material criticality to clean energy systems. These findings suggest that stockpiling is not merely a cost buffer but a vital component of secure and resilient clean energy transitions.

Building on the Baseline results, we explored the implications of allowing additional material imports by relaxing the trading quantity constraints for materials identified as scarce in both the baseline and case studies—namely nickel, silicon, REEs, selenium, and tellurium—permitting an increase of up to 500% above the projected trade levels to meet the US clean energy goals under economically feasible conditions. Nevertheless, the outlook remains challenging. As shown in Table 4, by 2050, achieving these goals will still require substantial additional imports, including ~7724 metric tons of neodymium (a 68.7% increase above projections), 1,336,994 metric tons of nickel (104.8% increase), 939,860 metric tons of silicon (33.0% increase), and 2787 metric tons of tellurium (321% increase). The feasibility of securing these imports, however, is uncertain. For example, despite being the world’s largest nickel producer, Indonesia has implemented an export ban on nickel92, driven by its national interests, making increased US imports unlikely. Similarly, China, which controls over 70% of global production for silicon, tellurium, and neodymium56, has initiated strategic production controls and stockpiling, further constraining global supply. In addition to domestic production dominance, China also maintains substantial control over critical mineral resources outside its own borders. For example, while countries such as Australia and Chile are considered stable and democratic partners of the US, many lithium and cobalt mines in these regions are owned or operated by Chinese companies. This reduces the effective access of the US to these resources, even when the producing countries are geopolitically aligned. Consequently, national ownership, rather than just the geographic location of production, plays a crucial role in determining the security of material imports.

To address these challenges, several strategic recommendations are proposed. Insights from our Sensitivity Case suggest that enhancing domestic production and recycling capabilities can reduce reliance on imports and ease critical material bottlenecks. This includes advancing mining, improving recycling technologies, and strengthening secondary supply chains. Recent studies have begun to quantify recycling potential within energy transition models, e.g., Lee et al. 93 shows that end-of-life recovery from US wind and solar could significantly offset primary demand for materials like neodymium and silver, while Safarzynska94 reviews methods for embedding recycling, substitution, and feedback into climate-economic frameworks. Despite these advances, dynamically linking recycling to deployment trajectories and global material flows are incomplete, underscoring the need for further integration of circularity into energy system planning.

Promoting technological innovation is essential for identifying alternatives to scarce materials and improving material efficiency in clean energy technologies, especially those that do not depend on bottleneck materials such as nickel. The model’s consistent selection of LFP batteries across all scenarios demonstrates that avoiding nickel not only allows battery deployment targets to be fully met, but also enables more flexible allocation of limited materials to other technologies. Additional research and development efforts should explore the use of composite materials to replace balsa wood in wind turbine blades, alternatives to permanent magnets, advancements in photovoltaic technologies such as perovskite solar cells95, and increasing the substitution rate of synthetic graphite with natural graphite. Government funding for research and development, along with public–private partnerships, can accelerate innovation and bring new solutions to market. Although this study does not incorporate all emerging technologies due to the limited availability of material demand data—particularly for those that are still in early development or not yet commercialized—the model framework is structured to accommodate these technologies in future extensions.

International collaboration remains vital to ensuring a stable supply of critical materials. The US should engage in strategic partnerships and trade agreements with both stable and unstable trading partners to secure long-term access to essential resources. Trade policies should prioritize stable and diversified supply chains, and bilateral and multilateral agreements that ensure the free flow of critical materials and technology can mitigate the risks of geopolitical disruptions. Collaborative efforts in technology sharing and capacity building can enhance global supply chain resilience. Additional exemptions might be considered, such as allowing vessels from EU countries to participate in offshore wind installations in the US to improve supply chain efficiency.

Looking ahead, uncertainty in electricity demand and technology development presents new challenges for clean energy planning. Electrification across sectors, along with the rapid growth of data centers and AI applications, is expected to increase demand, though advances in energy-efficient computing, such as models like DeepSeek, may offset some of this growth. Nuclear energy may also play a larger role over longer horizons, but its long lead times require early consideration. These dynamics highlight the value of planning tools that can flexibly accommodate evolving conditions rather than rely on fixed forecasts. An optimization framework is essential for developing adaptive supply chain strategies to mitigate disruptions. Such a framework enables efficient diversification of supply sources, strategic stockpiling, and robust risk management, ensuring timely access to critical materials during shortages. Coordinating these efforts with industry stakeholders will enhance resilience and improve resource allocation across the supply chain.

Methods

Selection of technologies, critical materials of interest

Using the Princeton Net-Zero America’s analysis on potential pathways, infrastructure, and impacts 89 and scenario planning from the NREL Annual Technology Baseline (ATB) 96, we selected four technologies to support the achievement of clean energy transition in the future: land-based wind, offshore wind, solar PV, and utility-scale lithium-ion batteries. We acknowledge the existence of emerging technologies, such as solid-state batteries, perovskite solar cells, and advanced wind turbine designs. However, these technologies are not yet mature enough for large-scale commercialization, making it difficult to estimate their future impacts and material requirements. Exploring these technologies and their potential roles in future clean energy pathways represents an important area for future research.

For land-based and offshore wind, we assumed that wind farms consist of two types of turbines: those with asynchronous gearbox (gearbox) motors and those with permanent magnet generators (direct-drive). We categorized conventional solar PV into two types: c-Si and thin-film solar technologies, including CIGS and CdTe. For lithium-ion batteries, we identified three major chemistries: NCA, NMC, and LFP. We further differentiated NMC batteries into subcategories based on cathode compositions—specifically NMC 111, 811, 523, and 622—which indicate varying ratios of nickel, manganese, and cobalt.

We referenced the critical material list from the USGS97 and a series of studies conducted in response to Executive Order 14017 on America’s Supply Chains by the DOE98,99,100,101, the detailed lists are in Supplementary Information 1.1.1 and 1.1.2. Ultimately, we selected 26 critical materials for our analysis: aluminum, balsa, chromium, cobalt, concrete, copper, dysprosium, gallium, graphite, indium, iron, lithium, magnesium, manganese, molybdenum, neodymium, nickel, praseodymium, selenium, silicon, steel, tellurium, terbium, tin, titanium, and zinc. This list is not exhaustive of all materials used in the four technologies selected above, but it provides a representative assessment of the materials required that are likely to experience supply difficulties.

Notably, certain materials initially considered were excluded from our analysis. For example, cadmium (used in CdTe PV), boron (used in wind turbine blades and battery coatings), and phosphorus (used in LFP cathodes) were omitted due to stable domestic production and limited contributions to overall clean energy demand (see Supplementary Information 1.7). In particular, phosphorus is primarily used in agriculture, with only a small fraction utilized in batteries; over 85% of the US supply is domestically produced, and most imports originate from stable trade partners such as Peru97. These materials also do not appear on major critical materials lists (see Supplementary Information 1.2)97,98, indicating minimal supply risks under the criticality thresholds applied in this study.

Estimation and calculation of demand schedule

The estimation of the material demand is customized for each renewable technology studied.

For both land-based and offshore wind turbines, we use data from NREL’s Renewable Energy Materials Properties Database (REMPD), developed by the International Energy Agency (IEA) Wind Task 37, as the base reference. For land-based wind, the REMPD model assumes a 3.4 MW gearbox turbine102, while for offshore wind, it uses a 15 MW direct-drive turbine103. We assume that common components such as arrays, foundations, and substations are consistent across both technologies. For direct-drive land-based wind, we supplement REMPD data with estimates from various studies12,25,26,27,28,29,30,31,32,33,34,35,36,37, using the average material estimates as our basis. Where the REMPD’s estimates differ significantly from these studies, we cross-validate against existing original equipment manufacturer data. For offshore wind, we use a similar approach, estimating material demand with data from REMPD while referencing the same external studies to ensure consistency.

For solar PV systems, we similarly refer to the data listed in the IEA Photovoltaic Power Systems Program Task 12104 for c-Si, CdTe, and CIGS as the basis. We assume that cabling, inverters, racking, BOS, and transformers are common components, as their material demand has shown little variation in previous studies. For data not detailed or listed by the IEA, we refer to previous studies for estimation.

For lithium-ion battery storage, we assume that battery cases, collectors, electrolyte, and anode are common. We use ref. 48 as the base reference for different types of cathodes and adjust our estimates using data from refs. 47,49. The initial demand schedule was summarized in tons per GWh, reflecting the material requirements for energy capacity. To ensure consistency in the final results, we utilized NREL’s study70, which provides projections for different battery durations. We converted the projected energy capacity from GWh to GW by using the weighted average duration time for each type of battery. The final results are therefore summarized in tons per GW, ensuring the estimates reflect the material requirements across different battery duration scenarios.

The detailed estimation data, including the demand schedule at the component level and the contributions of each component to the final product, are provided in Supplementary Information 1.3.1 and 1.3.2. The literature sources used for these estimates, including publication names and years, are listed in Supplementary Information 1.3.3.

Estimation of future availability and price for selected materials

To project future material availability, we consider three sources: imports from trading partners, domestic mining production, and stocks.

For trade-driven import data, we utilized the United Nations Commodity Trade Statistics Database (UN Comtrade, https://comtrade.un.org), a widely recognized source for commodity trade data. We examined various classifications, including the Harmonized System (HS) and Standard International Trade Classification (SITC), and finalized the code list as detailed in Supplementary Information 1.4 to obtain historical trade data. To ensure accuracy, these data were cross-verified with the overall import quantities of each material reported by the USGS. The dataset includes both the quantity and trade value, recorded as cost, insurance, and freight (CIF).

However, we acknowledge several limitations associated with using international trade codes to track critical materials. Many of these classification systems—such as the HS and the SITC—are designed around broad commodity categories and often fail to isolate individual elements or compounds. For example, SITC code 5259 refers to “rare-earth metal compounds or mixtures of yttrium or scandium” without distinguishing between specific rare earth elements such as neodymium or dysprosium. Furthermore, these trade codes typically capture only declared products and do not reflect embedded materials within imported components or finished goods, which poses additional challenges for material-specific modeling. While the integration of multiple trade classification datasets can partially improve resolution, limited granularity remains a common constraint in supply chain research.

To mitigate the limitations in trade code granularity, we cross-validate reported import quantities with data from the USGS and clearly document the classification coverage used for each material. In cases where specific elements are not separately reported—such as dysprosium, neodymium, praseodymium, and terbium, which are aggregated under broader REE categories—we rely on supplementary sources to estimate their availability. Specifically, we draw on the work of Fernández et al. 105, which provides detailed compositional data for rare-earth oxides extracted from various source minerals. Using the average elemental proportions reported in that study, we disaggregate the total REE category to approximate the availability of individual elements in our model.

For self-production data, we refer to USGS annual reports56,84,85, which detail the self-production of most materials each year. Notably, some materials, such as Balsa, Gallium, and REEs, do not have recorded self-production, indicating that the US has no or only negligible production of these materials.

For stocks data, we rely on USGS Data Series 140106, which provides historical statistics for mineral and material commodities in US. We utilize historical stock data for each material dating back to 2000. The most recent available data for each material serves as the initial stock input in our optimization model. Additionally, the maximum historical stock change rate for each material is used to determine the maximum annual usable stock proportion. This assumption is further elaborated in subsequent sections. Detailed stocks and historical data are provided in Supplementary Information 1.5.1.

After establishing the “Base” data, we estimate future quantities and prices by projecting them according to the supercycle pattern, as follows:

We use World Mining Data107 to obtain historical mining production by continent from 1985 to 2020, a period selected to align with the most recent global commodity supercycle. According to Erten and Ocampo59, commodity prices have historically followed multi-decade supercycles, with the most recent cycle beginning in the late 1990s and peaking around 2008, followed by a prolonged downturn through the 2010s. Similarly, Baffes and Kabundi60 identify four major commodity supercycles since 1900, with the most recent one spanning approximately from the mid-1980s to the late 2010s. This period captures key structural shifts in global demand, including China’s industrialization and global infrastructure expansion, making it representative for analyzing long-term material availability trends. We calculate average annual mining production growth rates for each continent over this period and average them over 5-year intervals to construct a stabilized Supercycle trend. Each trading partner in the UN Comtrade and USGS datasets is mapped to its respective continent (e.g., the US is classified under North America). By applying these growth rates to 2022 base-year import and production data, we estimate material availability through 2050. Projected trends—categorized as steady growth, peak in 2040, or peak in 2050—are presented in Fig. 2 and detailed in Supplementary Information 1.5.2.

For price estimation, we use the Global Price of Metal Index as recorded by the International Monetary Fund108 during the production supercycle years referenced in this paper. We assume that global mineral commodity prices fluctuate simultaneously, with no regional price differences, as price variation is not the primary focus of this paper. Detailed price index are provided in Supplementary Information 1.5.3.

Optimization model

To account for the various factors affecting the product planning process in renewable energy capacity expansion, we developed a multi-annual optimization model. This model captures the complexities of supply chain dynamics over multiple years, providing a more accurate representation of the overall process. The details of the model’s sets, variables, and parameters are summarized in Tables 5–7.

The objective function, as shown in Eq. (1), seeks to minimize the discounted total cost over all time periods within the set \({{\mathcal{T}}}\). This total cost includes expenses related to the forecasted prices of materials—whether acquired through trade, self-produced, or drawn from stocks—as well as the costs associated with manufacturing and installing clean energy technologies.

Constraint (2) ensures that the total utilization of each material m at time t must meet or exceed the demand arising from the production of all components.

Constraint (3) ensures that the production of each component c at time t satisfies or exceeds the demand from the production of all products.

Constraint (4) ensures that the total utilization of each material m at time t does not surpass the total purchased materials, self-produced materials, and stocks.

The material acquisition constraints in Eqs. (5) and (6) restrict the quantity of each material m acquired, whether purchased or self-produced, from each origin o at time t, based on the available total commodity Yo,m,t.

Constraint (7) defines the stock level of each material m at time t, which is determined by the stock level from the previous period, plus the net amount of purchased, self-produced, and utilized materials during the prior period t−1.

Constraint (8) specifies the consumption from the stock of each material m at time t, which is determined by the difference between the stock levels at time t and time t + 1. The stock consumption is constrained to be non-negative, as further enforced by the non-negativity constraint in Eq. (11).

Constraint (9) set limits on the production of each product category, ensuring that annual production stays above lower limits but does not exceed upper limits.

Constraint (10) ensures that the cumulative production for each product category reaches or exceeds set goals by the designated projection years for each category (e.g., land-based and offshore wind, solar PV, lithium-ion batteries).

Finally, constraints in Eq. (11) enforce that all variables remain non-negative.

Key assumptions

This paper adopts a discount rate of 3%, in alignment with recent trends in energy price indices and discount factors for life-cycle cost analysis 109.

We use the latest NREL ATB data as a reference for the costs incurred during installation. Specifically, we adopt the “Default” option from the ATB data because it provides a balanced and representative estimate of installation costs, reflecting typical market conditions without being overly optimistic or conservative. Detailed data and explanations can be found in Supplementary Information 1.6.

To model the use of materials, we introduce two rates in the optimization model. The proportion of the total available material m at time t allocated for clean energy installation is represented by \({R}_{m,t}^{{ {d}}}\), while \({R}_{m,t}^{{ {s}}}\) denotes the proportion stocked for future use. Both quantities are unitless. In this paper, we assume that 30% of each material can be utilized for the construction of renewable energy products. This assumption is informed by multiple factors.

First, accurately determining the exact proportion of materials directly and indirectly flowing into clean energy-related sectors remains challenging due to the complexity and cross-sectoral nature of material flows. Critical materials are often shared across various industries, making it difficult to isolate their specific contribution to clean energy manufacturing. To address this, we estimated the proportion of material use in clean energy by leveraging a bottom-up approach.

Specifically, we estimated the 2023 global capacity increment for wind energy, solar PV, and battery storage systems based on data from the IEA110,111. Using typical market shares—50% direct-drive and 50% gearbox wind systems, 95% c-Si, 4% CdTe, and 1% CIGS solar PV systems, and an average composition for lithium-ion batteries—we applied our demand schedule to calculate the total material demand for clean energy product manufacturing. This material demand was then compared against the total global production of each material to determine the proportion used in clean energy manufacturing. The detailed numerical results of this analysis are provided in Supplementary Information 1.7.

From our estimates, we observed that for most of the critical materials, the proportion of usage in clean energy products ranged from above 5% to under 30% of total global production. This aligns with the findings from USGS reports56,84,85, which indicate that 20–35% of certain common metals, such as aluminum and copper, are used in construction. Given the US’s aggressive clean energy transition goals and the accompanying demand for renewable energy technologies, we adopt 30% as a reasonable and conservative estimate for the proportion of materials flowing into clean energy product manufacturing. This conservative assumption ensures that our optimization framework reflects realistic constraints while accounting for potential variability in material usage across sectors.

For \({R}_{m,t}^{{\rm {s}}}\), we assume that this rate is the historical maximum change in stock levels since 2020 for each material. We use the maximum observed positive and negative stock changes as the maximum annual usable stock fractions 67, as detailed in Supplementary Information 1.5.1.

We acknowledge that domestic manufacturing capacity plays a critical role in determining the realizability of clean energy transitions. For instance, although the US assembles wind turbines, it currently lacks the capability to produce the rare earth magnets essential for direct-drive systems. In the solar sector, domestic manufacturing remains limited relative to China’s dominance in the production of photovoltaic cells and modules. A similar pattern is observed in the lithium-ion battery supply chain, where China maintains a lead across nearly all processing and assembly stages. To more accurately capture these constraints in our analysis, we draw upon detailed assumptions from existing studies and national capacity expansion plans69,70,75,76. The specific assumptions are outlined below.

For land-based wind, we refer to the E+ and RE− scenarios from the Net-Zero America study75. These scenarios also emphasize that wind capacity expansion is not only shaped by material availability but also by domestic supply chain limitations, such as constrained manufacturing and installation capabilities. Reflecting both the projected demand and these practical constraints, we assume that the annual installation of land-based wind ranges from 7 to 15 GW/year over the simulation period, consistent with historical peak deployment levels.

For offshore wind, this paper adheres to the White House’s offshore wind goal of 30 GW by 2030 and 110 GW by 205076. For annual capacity expansion, the US is currently challenged by its limited capacity in marshaling port infrastructure, crucial for offshore wind projects. As of 2023, the US marshaling port capacity stands at 0.9 GW73, a stark contrast to the more extensive facilities found in Europe. This shortfall stems from both concentrated development along the East Coast and environmental permitting challenges. In response to the growing demands for offshore wind energy, a significant expansion of port capacity is essential. Given the cumulative capacity of state-derived demand from 2020 to 2024 (6 GW)73 and port capacity construction parameters, we project a linear increase for port capacity from 0.9 GW in 2022 to 3.1 GW in 2024, and a continued increase to 5.3 GW in 2025, sufficient to meet the 2030 (30 GW) and 2050 (110 GW) demand. We do not specify a minimum annual expansion.

For solar PV, we refer to the DOE’s study69, establishing 5-year capacity expansion goals of 1000 GW by 2035 and 1600 GW by 2050. To define annual capacity expansion limits, we adopt the maximum annual expansion rate from the Net-Zero America study’s E+ scenario75, as this scenario’s overall capacity expansion roadmap to 2050 (1320 GW) closely aligns with the DOE’s target. To further reflect DOE planning assumptions, we impose minimum annual capacity additions of 30 GW/year through 2025, increasing to 60 GW/year from 2026 to 2050, recognizing the increasing pace needed to meet national clean energy goals under existing domestic manufacturing and deployment capabilities.

For lithium-ion battery storage, we refer to NREL’s study70, setting biennial capacity goals starting from 2030 until 189.8 GW by 2050. We also adopt the annual capacity expansion settings from this paper, with a maximum of 30 GW/year, and minimum annual expansions of 1 GW until 2030 and 7 GW thereafter.

Detailed data for the clean energy goals used in this paper can be found in Supplementary Information 1.8.

Data availability

The data supporting this study are provided in the Supplementary Information and are also available from the corresponding authors upon reasonable request.

Code availability

The code used in this study is available from the corresponding authors upon reasonable request.

References

Agreement, P. Paris agreement. In Report of the Conference of the Parties to the United Nations Framework Convention on Climate Change (21st Session, 2015: Paris). Retrieved December, Vol. 4, 2 (HeinOnline, 2015).

Musial, W. et al. Offshore Wind Market Report: 2023 edn. Technical Report (National Renewable Energy Laboratory (NREL), Golden, CO, USA, 2023).

Tabassum, S. et al. Solar energy in the united states: development, challenges and future prospects. Energies 14, 8142 (2021).

Denholm, P., Nunemaker, J., Gagnon, P. & Cole, W. The potential for battery energy storage to provide peaking capacity in the United States. Renew. Energy 151, 1269–1277 (2020).

Sovacool, B. K. et al. Sustainable minerals and metals for a low-carbon future. Science 367, 30–33 (2020).

Moreau, V., Dos Reis, P. C. & Vuille, F. Enough metals? Resource constraints to supply a fully renewable energy system. Resources 8, 29 (2019).

Wang, S. et al. Future demand for electricity generation materials under different climate mitigation scenarios. Joule 7, 309–332 (2023).

Min, Y., Brinkerink, M., Jenkins, J. & Mayfield, E. Effects of renewable energy provisions of the inflation reduction act on technology costs, materials demand, and labor. Working Paper (BlueGreen Alliance, 2023).

Xu, M., Xie, P. & Xie, B.-C. Study of China’s optimal solar photovoltaic power development path to 2050. Resour. Policy 65, 101541 (2020).

Golombek, R., Lind, A., Ringkjøb, H.-K. & Seljom, P. The role of transmission and energy storage in European decarbonization towards 2050. Energy 239, 122159 (2022).

Imholte, D. et al. An assessment of us rare earth availability for supporting us wind energy growth targets. Energy Policy 113, 294–305 (2018).

Carrara, S., Alves Dias, P., Plazzotta, B. & Pavel, C. Raw Materials Demand for Wind and Solar PV Technologies in the Transition Towards a Decarbonised Energy System (Publications Office of the European Union, 2020).

Mancini, L. et al. Responsible and Sustainable Sourcing of Battery Raw Materials (Publications Office of the European Union, 2020).

Kim, T.-Y. et al. The Role of Critical Minerals in Clean Energy Transitions 70–71 (International Energy Agency, 2021).

Klimenko, V., Ratner, S. & Tereshin, A. Constraints imposed by key-material resources on renewable energy development. Renew. Sustain. Energy Rev. 144, 111011 (2021).

U.S. Census Bureau. Foreign Trade: A Guide to U.S. Trade Data (U.S. Census Bureau, 2024).

Rooney, B., Johnson, G., Sytsma, T. & Priebe, M. Does the U.S. Economy Benefit from U.S. Alliances and Forward Military Presence? (RAND Corporation, Santa Monica, CA, 2022).

Chivvis, C. S. & Kapstein, E. US Strategy and Economic Statecraft: Understanding the tradeoffs (Carnegie Endowment for International Peace, 2022).

Aidt, T. S. & Gassebner, M. Do autocratic states trade less? World Bank Econ. Rev. 24, 38–76 (2010).

Polinder, H., Van der Pijl, F. F., De Vilder, G.-J. & Tavner, P. J. Comparison of direct-drive and geared generator concepts for wind turbines. IEEE Trans. Energy Convers. 21, 725–733 (2006).

Ramanujam, J. et al. Flexible CIGS, CdTe and a-Si: H based thin film solar cells: a review. Prog. Mater. Sci. 110, 100619 (2020).

Center for Sustainable Systems, U. O. M. U.S. Energy Storage Factsheet. Publication No. CSS15-17 https://css.umich.edu/factsheets/us-energy-storage-factsheet (2024).

Yudhistira, R., Khatiwada, D. & Sanchez, F. A comparative life cycle assessment of lithium-ion and lead-acid batteries for grid energy storage. J. Clean. Prod. 358, 131999 (2022).

NREL (National Renewable Energy Laboratory). Renewable Energy Materials Properties Database https://apps.openei.org/REMPD/ (2023).

Watari, T. et al. Total material requirement for the global energy transition to 2050: a focus on transport and electricity. Resour. Conserv. Recycl. 148, 91–103 (2019).

Valero, A., Valero, A., Calvo, G. & Ortego, A. Material bottlenecks in the future development of green technologies. Renew. Sustain. Energy Rev. 93, 178–200 (2018).

Beylot, A., Guyonnet, D., Muller, S., Vaxelaire, S. & Villeneuve, J. Mineral raw material requirements and associated climate-change impacts of the French energy transition by 2050. J. Clean. Prod. 208, 1198–1205 (2019).

McLellan, B. C. et al. Critical minerals and energy—impacts and limitations of moving to unconventional resources. Resources 5, 19 (2016).

Tokimatsu, K. et al. Energy modeling approach to the global energy-mineral nexus: a first look at metal requirements and the 2 c target. Appl. Energy 207, 494–509 (2017).

Fishman, T. & Graedel, T. Impact of the establishment of us offshore wind power on neodymium flows. Nat. Sustain. 2, 332–338 (2019).

Elshkaki, A. & Shen, L. Energy-material nexus: The impacts of national and international energy scenarios on critical metals use in China up to 2050 and their global implications. Energy 180, 903–917 (2019).

Deetman, S., Pauliuk, S., Van Vuuren, D. P., Van Der Voet, E. & Tukker, A. Scenarios for demand growth of metals in electricity generation technologies, cars, and electronic appliances. Environ. Sci. Technol. 52, 4950–4959 (2018).

Habib, K. & Wenzel, H. Reviewing resource criticality assessment from a dynamic and technology specific perspective—using the case of direct-drive wind turbines. J. Clean. Prod. 112, 3852–3863 (2016).

Cao, Z. et al. Resourcing the fairytale country with wind power: a dynamic material flow analysis. Environ. Sci. Technol. 53, 11313–11322 (2019).

Månberger, A. & Stenqvist, B. Global metal flows in the renewable energy transition: exploring the effects of substitutes, technological mix and development. Energy Policy 119, 226–241 (2018).

Nassar, N. T., Wilburn, D. R. & Goonan, T. G. Byproduct metal requirements for US wind and solar photovoltaic electricity generation up to the year 2040 under various clean power plan scenarios. Appl. Energy 183, 1209–1226 (2016).

Farina, A. & Anctil, A. Material consumption and environmental impact of wind turbines in the USA and globally. Resour. Conserv. Recycl. 176, 105938 (2022).

Fizaine, F. & Court, V. Renewable electricity producing technologies and metal depletion: a sensitivity analysis using the EROI. Ecol. Econ. 110, 106–118 (2015).

Kavlak, G., McNerney, J., Jaffe, R. L. & Trancik, J. E. Metal production requirements for rapid photovoltaics deployment. Energy Environ. Sci. 8, 1651–1659 (2015).

Moss, R., Tzimas, E., Kara, H., Willis, P. & Kooroshy, J. Critical Metals in Strategic Energy Technologies. Assessing Rare Metals as Supply-chain Bottlenecks in Low-carbon Energy Technologies. Technical Report (Institute for Energy and Transport IET, 2011).

Moss, R. L., Tzimas, E., Kara, H., Willis, P. & Kooroshy, J. The potential risks from metals bottlenecks to the deployment of strategic energy technologies. Energy Policy 55, 556–564 (2013).

Gervais, E., Shammugam, S., Friedrich, L. & Schlegl, T. Raw material needs for the large-scale deployment of photovoltaics—effects of innovation-driven roadmaps on material constraints until 2050. Renew. Sustain. Energy Rev. 137, 110589 (2021).

Duan, H., Wang, J., Liu, L., Huang, Q. & Li, J. Rethinking China’s strategic mineral policy on indium: implication for the flat screens and photovoltaic industries. Prog. Photovoltaics: Res. Appl. 24, 83–93 (2016).

Stamp, A., Wäger, P. A. & Hellweg, S. Linking energy scenarios with metal demand modeling—the case of indium in CIGS solar cells. Resour., Conserv. Recycl. 93, 156–167 (2014).

Zhou, Y. et al. Dynamic criticality of by-products used in thin-film photovoltaic technologies by 2050. J. Clean. Prod. 263, 121599 (2020).

Shafique, M., Rafiq, M., Azam, A. & Luo, X. Material flow analysis for end-of-life lithium-ion batteries from battery electric vehicles in the USA and China. Resour. Conserv. Recycl. 178, 106061 (2022).

Xu, C. et al. Future material demand for automotive lithium-based batteries. Commun. Mater. 1, 99 (2020).

Bongartz, L., Shammugam, S., Gervais, E. & Schlegl, T. Multidimensional criticality assessment of metal requirements for lithium-ion batteries in electric vehicles and stationary storage applications in Germany by 2050. J. Clean. Prod. 292, 126056 (2021).

Song, J. et al. Material flow analysis on critical raw materials of lithium-ion batteries in China. J. Clean. Prod. 215, 570–581 (2019).

Sutherland, H. J. A summary of the fatigue properties of wind turbine materials. Wind Energy: Int. J. Prog. Appl. Wind Power Convers. Technol. 3, 1–34 (2000).

Lennon, A., Lunardi, M., Hallam, B. & Dias, P. R. The aluminium demand risk of terawatt photovoltaics for net zero emissions by 2050. Nat. Sustain. 5, 357–363 (2022).

Haas, J. et al. Copper mining: 100% solar electricity by 2030? Appl. Energy 262, 114506 (2020).

Pehlken, A. & Zimmermann, T. Material life cycles in wind energy plants. In Proc. of the International Conference on Mechanical Engineering and Mechatronics, Toronto, ON, Canada, Vol. 221, 1–8 (International ASET Inc., 2012).

Grandell, L. et al. Role of critical metals in the future markets of clean energy technologies. Renew. Energy 95, 53–62 (2016).

Elshkaki, A. & Graedel, T. Dysprosium, the balance problem, and wind power technology. Appl. Energy 136, 548–559 (2014).

Survey, U. G. Mineral Commodity Summaries 2024. Technical Report, U.S. Geological Survey 212 https://doi.org/10.3133/mcs2024 (2024).

Ryan, N. A., Miller, S. A., Skerlos, S. J. & Cooper, D. R. Reducing CO2 emissions from US steel consumption by 70% by 2050. Environ. Sci. Technol. 54, 14598–14608 (2020).

Gregory, J. et al. The role of concrete in life cycle greenhouse gas emissions of US buildings and pavements. Proc. Natl Acad. Sci. USA 118, e2021936118 (2021).

Erten, B. & Ocampo, J. A. Super cycles of commodity prices since the mid-nineteenth century. World Dev. 44, 14–30 (2013).

Baffes, J. & Kabundi, A. Do supercycles dominate commodity price movements? Econ. Lett. 237, 111646 (2024).

Americo, A., Johal, J. & Upper, C. The energy transition and its macroeconomic effects. Econ. Voice 21, 249–274 (2024).

Fernández, A., Schmitt-Grohé, S. & Uribe, M. Does the Commodity Super Cycle Matter? Technical Report (National Bureau of Economic Research, 2020).

Woetzel, J., Sellschop, R. & Chui, M. Beyond the Supercycle: How Technology is Reshaping Resources. Technical Report (McKinsey Global Institute, 2017).

Comtrade, U. The United Nations Commodity Trade Statistics Database http://comtrade.un.org/ (2023).