Abstract

This study, grounded in the Resource-Based View (RBV) theory, investigates the impact of Fintech Adoption (FA) on Financial Performance (FINP) and Environmental Sustainability Performance (ESP) in Chinese banking institutions, with a focus on the mediating roles of Corporate Social Responsibility (CSR) and Green Finance (GF). Using a combination of statistical analysis techniques, including Structural Equation Modeling (SEM) and Necessary Condition Analysis (NCA), this study analyzed data from 257 banking professionals. The empirical findings reveal that FA significantly enhances FINP, ESP, CSR, and GF, with the greatest effect on the effectiveness of GF initiatives. This underscores the critical role of Fintech in both financial growth and environmental sustainability within the banking sector. However, the study also found that the direct impact of CSR on FINP was not significant, highlighting an area for further exploration. The NCA analysis further emphasized that FA and ESP are key drivers for improving financial performance, emphasizing Fintech’s strategic value in maintaining a competitive edge. This study contributes to the understanding of Fintech’s broader impact, offering practical insights for policymakers and industry practitioners on integrating technological innovation with sustainable banking practices. The findings suggest that banking institutions can leverage Fintech to enhance both financial and environmental outcomes, while policymakers should foster regulations that support such integrations for a sustainable future.

Similar content being viewed by others

Introduction

The integration of financial technologies, or Fintech, into the banking industry marks a global paradigm shift towards more efficient, accessible, and sustainable financial services (Sadiq et al., 2024; Zhou and Wang, 2024). This transformation is reshaping banking institutions worldwide, with significant implications for their operational models, competitive dynamics, and strategic orientations towards sustainability and financial performance (Kwamie Dunbar, Sarkis, and Treku, 2024; Liu et al., 2021). At the forefront of this shift is China, a country that has rapidly embraced Fintech innovations to not only revolutionize its banking sector but also align it with broader environmental and social governance (ESG) goals (Liu and You, 2023). The global momentum towards sustainable development, coupled with the urgent need for financial institutions to contribute positively to this agenda, sets a compelling context for examining the intricate interplay between Fintech adoption, environmental sustainability, financial performance, and corporate social responsibility within the banking sector (Guang-Wen and Siddik, 2022b; Siddik, Rahman, and Yong, 2023).

This study intricately examines the roles of Fintech Adoption (FA), Environmental Sustainability Performance (ESP), Financial Performance (FINP), Green Finance (GF), and Corporate Social Responsibility (CSR) within the banking industry. FA encapsulates the deployment of cutting-edge technological solutions aimed at enhancing service efficiency, customer experience, and market competitiveness (Phan et al., 2020). ESP evaluates the extent to which these innovations aid banks in reducing their environmental impact and championing sustainable practices (K. Dunbar, Sarkis, and Treku, 2024). FINP assesses the economic outcomes of integrating Fintech, focusing on profitability, return on investment, and market share (Edwards, 2014). Meanwhile, GF and CSR reflect the banks’ commitments to funding sustainable projects and fulfilling their ethical obligations towards stakeholders, respectively (Dai, Siddik, and Tian, 2022; Guang-Wen and Siddik, 2022).

Recently, various studies have been conducted to examine the role of FA on ESP (Kwamie Dunbar, Sarkis, and Treku, 2024; Siddik, Rahman, and Yong, 2023; Taneja, Bansal, and Kumar, 2023; Vergara, Ferruz Agudo, 2021), FA on GF (Wan, Lee, and Sarma, 2023; Zhou and Wang, 2024), CSR on ESP and FINP (Coelho, Jayantilal, and Ferreira, 2023; Dziri and Jarboui, 2023; Tarabella and Burchi, 2013), GF on ESP (Dai et al., 2022; Guang-Wen and Siddik, 2022), ESP on FINP (Earnhart, 2018; Laguir et al., 2018; Weber, 2017). Despite the burgeoning interest in how Fintech innovations influence sustainability and financial outcomes, the existing literature reveals critical gaps. There is a notable dearth of empirical research on the direct impact of FA on FINP and ESP, particularly from a global perspective that considers varying regulatory, economic, and cultural contexts in a single study within the framework of the Resource-Based View (RBV). The RBV theory can be used to explain how Fintech adoption enhances the environmental and financial performance of banking institutions by positioning Fintech as a valuable, rare, and non-substitutable resource that contributes to competitive advantage. Within this framework, the mediating roles of GF and CSR practices can be seen as key capabilities that help banks leverage Fintech to achieve sustainable growth and superior performance in both financial and environmental dimensions. Moreover, the mediating effects of GF and CSR between FA and both ESP and FINP are insufficiently explored, especially within the unique milieu of the Chinese banking sector, where state policies, market maturity, and consumer behaviors present distinct challenges and opportunities. These gaps underscore the necessity for a comprehensive investigation that not only elucidates these relationships but also contextualizes them within the global shift towards sustainable banking practices.

The primary aim of this study is to examine how Fintech adoption influences the environmental and financial performance of banking institutions in China, with a particular focus on the mediating roles of GF and CSR practices within the framework of RBV theory. The study is guided by the following three research questions: (1) How does Fintech adoption impact the environmental sustainability and financial performance of banking institutions in China? (2) How does Fintech adoption affect green finance and CSR practices within these institutions? (3) Can green finance and CSR practices mediate the relationship between Fintech adoption, environmental sustainability, and financial performance in the Chinese banking sector? Using a combination of statistical techniques, including Structural Equation Modeling (SEM) and Necessary Condition Analysis (NCA), this study analyzed data from 257 banking professionals. The findings show that Fintech adoption significantly enhances FINP, ESP, CSR, and GF, with the greatest impact observed on the effectiveness of GF initiatives. This highlights the crucial role of Fintech in driving both financial growth and environmental sustainability within the banking sector. However, the study also found that CSR had no significant direct impact on financial performance, indicating an area for further research. Additionally, NCA emphasized that Fintech adoption and environmental sustainability performance are essential for improving financial performance, further underscoring Fintech’s strategic value in maintaining a competitive advantage.

This study makes significant contributions to both academic research and practical applications. It advances the understanding of Fintech’s role in promoting sustainable banking practices, particularly within the context of China. By addressing empirical gaps in the literature, it clarifies the direct and mediated pathways through which Fintech adoption influences both environmental sustainability and financial performance in banking institutions. The study integrates the RBV framework with global sustainability trends, offering novel theoretical insights that highlight the strategic importance of Fintech in achieving long-term organizational growth and sustainability. Moreover, it highlights the critical role of Fintech in enhancing green finance and CSR initiatives, thus broadening the scope of Fintech’s impact beyond financial outcomes. For banking executives and policymakers, the research provides actionable, evidence-based strategies for leveraging Fintech to improve both environmental sustainability and financial performance. Additionally, the study introduces an advanced methodological approach, employing a combination of SEM and NCA, to assess Fintech’s impact in the banking sector, offering a more comprehensive understanding of its effects.

After the introduction, the paper includes a literature review establishing the study’s theoretical framework within global Fintech and sustainability discussions. The methodology outlines the research approach and analysis, followed by results. It concludes with theoretical and practical contributions, limitations, and future research directions, exploring Fintech’s impact on banking in China.

Literature review and hypothesis formulation

Research background

The Resource-Based View (RBV) offers a compelling lens through which to examine the strategic advantage of Fintech companies, especially in the realms of green finance and CSR. This theory posits that a firm’s competitive edge is derived from its unique resources and capabilities—particularly those that are valuable, rare, inimitable, and non-substitutable (Paladino, Widing, and Whitwell, 2015). Fintech firms, characterized by their innovative technological capabilities such as advanced data analytics, blockchain, AI, and machine learning, embody the essence of RBV (Seddon, 2014). These technological assets are not only valuable for their contribution to financial services efficiency but are also rare and difficult for competitors to replicate or substitute due to the specialized knowledge and innovation they require (Kero and Bogale, 2023). Fintech’s potential to leverage these technologies for promoting green finance and CSR initiatives presents a unique opportunity to enhance both financial performance and environmental sustainability (K. Dunbar et al., 2024; Phan et al., 2020; Vergara, Ferruz Agudo, 2021; Wang, Xiuping, and Zhang, 2021; Zhou and Wang, 2024b). Green finance encompasses financial products and services that support environmental objectives, such as investments in sustainable energy projects or the issuance of green bonds (Mete Feridun, 2023; Wan et al., 2023). By applying their technological prowess, Fintech companies can develop innovative financial products that appeal to the growing market of environmentally conscious investors, ensuring transparency, efficiency, and alignment with sustainability goals (Mete Feridun, 2023; Xie et al., 2023).

Moreover, Fintech firms can integrate CSR into their business models through the strategic use of their technological resources (Salah Mahdi, Bouaziz, and Boujelbène Abbes, 2023). This can include leveraging digital platforms to foster engagement with stakeholders on sustainability issues, utilizing AI to optimize operations for energy efficiency, or creating financial instruments that encourage sustainable consumer behaviors. Such initiatives not only help in reducing the environmental impact of financial services but also position Fintech companies as leaders in the transition towards a more sustainable economy. In conclusion, the RBV framework underscores the strategic importance of internal resources and capabilities in gaining a competitive advantage (Paladino et al., 2015; Seddon, 2014). For Fintech companies, this means harnessing their technological innovations not just for economic gain but to contribute meaningfully to green finance and CSR. This approach not only aligns with global sustainability efforts but also meets the increasing demand from consumers and investors for responsible financial practices, marking a significant step towards the future of sustainable finance (Cen and He, 2018). Thus, the RBV theory explains how Fintech adoption can serve as a valuable, rare, and difficult-to-imitate resource that enhances the environmental and financial performance of banking institutions, thereby providing them with a sustained competitive advantage. In this context, Fintech adoption enables banks to develop unique capabilities, such as GF and CSR practices, which play a critical role in driving sustainability and profitability. By focusing on the mediating effects of GF and CSR, the RBV framework helps to illustrate how these practices, when combined with Fintech, contribute to long-term success in both environmental and financial outcomes for banks in China.

Research hypothesis

Fintech and financial performance

From an RBV perspective, Fintech enhances financial performance by providing banking institutions with unique, valuable resources—such as advanced technological capabilities—that enable them to streamline operations, improve customer experiences, and create innovative financial products, thereby gaining a competitive advantage in the market. Recent literature reviews reveal divergent effects of Fintech on financial performance across various studies, indicating a complex and context-dependent relationship. For instance, research within the Indonesian market identified a negative correlation between the proliferation of Fintech firms and bank performance, with subsequent robustness checks affirming this finding (Phan et al., 2020). In contrast, analyses from Saudi Arabia’s financial sector reported a positive influence of Fintech on corporate performance, a conclusion reinforced through additional testing (Al-Matari et al., 2023). Similarly, investigations into the UK banking sector noted a beneficial impact of Fintech on banks’ performance, evidenced by enhanced net interest margins and yields on earning assets (Dasilas & Kara Nović, 2023). Moreover, a study across European banks observed that Fintech investments correlate positively with bank profitability, particularly among larger institutions (Chhaidar, Abdelhedi, and Abdelkafi, 2023). Another study underscored Fintech’s role in bolstering profitability, fostering financial innovation, and enhancing risk management within commercial banks (Wang et al., 2021). Shah, Lai, Tahir, et al. (2024) explore the impact of intellectual capital on financial performance in banks, emphasizing the moderating role of board attributes, particularly board size and independent directors, on return on equity. These varied outcomes underscore that the influence of Fintech on financial performance cannot be pigeonholeed as solely positive or negative; instead, it varies significantly based on regional market characteristics, the regulatory landscape, and individual financial institutions’ strategic approaches. This diversity of impacts suggests that the relationship between Fintech and financial performance in banking is intricate and highly contingent on specific contextual factors. Hence, the following hypothesis is posited for further investigation:

Hypothesis 1: FA exerts a significant influence on FINP.

Fintech and environmental sustainability performance

Drawing from existing scholarly work, there is compelling evidence indicating that Fintech exerts a considerable influence on ESP (Siddik, Rahman, et al., 2023). Defined by its reliance on innovative technological solutions to deliver financial services, Fintech is instrumental in enhancing resource efficiency and fostering the adoption of green finance practices (Dunbar et al., 2024; Liu and You, 2023; Qin et al., 2024; Tao et al., 2022). Pan et al. (2024) investigate how AI and DEA methods can enhance environmental performance in power plants, especially during crises. Zhang et al. (2024) find that Broadband China’s digital transformation, combined with environmental regulations, has a synergistic effect in reducing corporate carbon emissions. Wang et al. (2024) show that governance quality significantly impacts environmental protection, with extreme events moderating this effect. Additionally, Wang et al. (2024) reveal that AI adoption positively influences green innovation efficiency in Chinese energy companies, with long-term strategies enhancing its effectiveness. Furthermore, research has demonstrated that Fintech significantly bolsters green credit development, thereby facilitating carbon emission reductions and improving climate quality (Liu and You, 2023; Qin et al., 2024; Sadiq et al., 2024; Tao et al., 2022). Moreover, it is advocated that governments capitalize on Fintech capabilities to conduct thorough pre-loan assessments for green credit and to create environmental information-sharing platforms, which could enhance the effectiveness of environmental information disclosure policies (Liu and You, 2023; Tao et al., 2022). Fintech factors, including the widespread use of the internet and financial inclusion indexes, are shown to positively influence green economic activities, underscoring Fintech’s role in driving environmentally sustainable economic development (Awais et al., 2023). However, the reliance on natural resources poses challenges to environmental sustainability, prompting recommendations for implementing carbon taxation and environmental performance subsidies as countermeasures to encourage sustainable practices (Kai et al., 2024; Siddik, Rahman, et al., 2023; Wei, Yue, and Khan, 2024). Consequently, the synthesized evidence from these studies underscores Fintech’s critical impact on ESP, particularly through its support for green finance and carbon emission mitigation. Using the RBV theory, the impact of Fintech on environmental sustainability performance can be understood as Fintech providing unique, inimitable resources that enable banks to enhance GF initiatives, streamline environmental processes, and improve their sustainability practices, ultimately contributing to a competitive edge in achieving environmental goals. This leads to the formulation of the following hypothesis:

Hypothesis 2: FA significantly influences ESP.

Fintech and CSR

Based on the extensive literature review, the adoption of Fintech has a significant effect on CSR practices in the financial industry. Scholarly findings demonstrate a positive correlation between an entity’s engagement in Fintech and its CSR initiatives. This association is particularly pronounced in entities characterized by strong political affiliations, reduced agency costs, and superior internal governance mechanisms (Li et al., 2024). Additionally, Fintech is identified as playing a facilitative role in strengthening the bond between CSR and financial stability, enhancing the positive effects of CSR on the latter (Salah Mahdi et al., 2023). Furthermore, technology companies investing heavily in CSR reports experience increases in both revenue and profitability, underscoring the beneficial financial implications of CSR engagement (Okafor, Adusei, and Adeleye, 2021). In the banking sector, Fintech adoption is linked to significant improvements in return on equity and net interest margin profitability (Liu et al., 2021). Nevertheless, while existing research sheds light on the dynamic interplay between Fintech adoption and CSR practices, a gap persists concerning the explicit exploration of this relationship within specific financial contexts, such as China’s. Therefore, despite the insights offered on Fintech’s influence over CSR and financial performance, there remains a need to directly address the effect of Fintech adoption on CSR practices within the financial sector. From an RBV perspective, Fintech enhances CSR practices by providing banking institutions with unique technological capabilities that enable more efficient, transparent, and scalable sustainability initiatives, thereby creating a distinctive competitive advantage in meeting social and environmental goals. Consequently, we propose the following hypothesis:

Hypothesis 3: FA significantly influences CSR practices.

Fintech and green finance

Research highlights a strong link between Fintech and green finance, particularly in regions like Bangladesh (Guang-Wen & Siddik, 2023). Fintech plays a critical role in driving green investment and enhancing the sustainability of financial enterprises (Kwamie Dunbar et al., 2024; Vinaya & Goyal, 2023), especially through improved green credit allocation and reduced information asymmetry (Liu & You, 2023). Its impact on green economic activities underscores the need for policies that promote Fintech adoption to support greener economic growth (Awais et al., 2023). Fintech also aligns with the Sustainable Development Goals (SDGs), fostering initiatives like green bonds and crowdfunding for environmental projects (Taneja et al., 2023). The transformative power of Fintech in green banking is crucial for advancing financial sustainability, especially in supporting clean energy and climate action (Taneja et al., 2023). The COVID-19 pandemic has further demonstrated Fintech’s potential in driving sustainable green businesses (Calle-Nole et al., 2023; Taneja et al., 2023). However, the integration of Fintech in green finance requires careful regulatory oversight and consumer protection (Geetha & Biju, 2024; Vergara & Ferruz Agudo, 2021). Policymakers are encouraged to foster sustainability by promoting Fintech adoption and creating supportive policies for green finance. Thus, the following hypothesis is proposed:

Hypothesis 4: FA exerts a significant influence on green finance.

CSR, ESP, and FINP

The nexus between CSR and environmental performance has garnered considerable scholarly attention, particularly concerning how CSR initiatives, especially those focused on the environment, may bolster economic outcomes through the efficient deployment of resources (Tarabella and Burchi, 2013). The “sincere” hypothesis posits a natural alignment between proactive CSR endeavors and environmental stewardship, suggesting that such sincere environmental commitments result in enhanced corporate environmental performance through dedicated investments in environmental safeguarding (Liqi et al., 2023). Conversely, the “concealment” hypothesis argues that firms might leverage CSR as a facade to obscure actual environmental shortcomings, potentially leading to an adverse relationship between CSR engagements and environmental outcomes (Liqi et al., 2023). Furthermore, the role of sustainability committees in enhancing corporate sustainability practices has been widely discussed in recent studies. Shah et al. (2024) investigate the impact of SC on sustainability reporting and firm performance in Malaysian oil and gas companies, revealing that SC positively moderates the relationship between social and environmental SR and financial metrics, such as return on assets and Tobin’s q. Similarly, Hamad et al. (2024) explore the role of SC in enhancing the voluntary disclosure of SDGs in Malaysia, showing that companies with SCs provide more detailed and frequent SDG disclosures, especially regarding social goals. Moreover, Shah et al. (2025) examine the effect of ERM on green growth, finding that ERM practices positively influence GG by addressing ESG risks. Shahzad et al. (2023) discuss the effect of corporate governance on intellectual-capital efficiency, highlighting the impact of governance attributes on the efficiency of intellectual capital.

Moreover, CSR is increasingly recognized as a strategic avenue yielding competitive benefits, with implications suggesting a direct positive influence on financial metrics (Sledge, 2015). Notably, a study of European firms corroborates the enduring positive effect of CSR practices on financial performance (Houda Dziri and Jarboui, 2023). Further research within the Pakistani non-financial sector reinforces the positive financial ramifications of CSR investment, underscoring that firms with robust CSR commitments tend to exhibit superior financial performance (Rasheed et al., 2018). This discourse illuminates the intricate and sometimes contradictory dynamics between CSR and environmental performance, reflecting a spectrum of hypotheses regarding CSR’s environmental impact. Nonetheless, the preponderance of empirical research indicates a favorable influence of CSR practices on financial performance (Indriastuti and Chariri, 2021). Considering these discussions, this study proposes the following hypotheses for examination:

Hypothesis 5: CSR exerts a considerable influence on ESP.

Hypothesis 6: CSR significantly affects FINP.

Green finance, ESP, and FINP

The scholarly discourse on CSR has extensively explored its impact on organizational EP and Financial Performance. Despite this wealth of research, the exploration into the influence of green finance on the banking sector’s EP and FP remains comparatively nascent. Green finance, also known as sustainable or climate finance, emerged as a pivotal element of sustainable banking, especially following its spotlight during the 2016 G20 meeting in China, as highlighted by Akomea-Frimpong et al. (2021). This domain is credited with the potential to drive significant advancements in economic health and market development (Akter et al., 2018; Guang-Wen & Siddik, 2022; Hoque et al., 2019; Zheng G. W. et al., 2021). It adopts a comprehensive approach, aiming to augment the financial system’s role in promoting economic growth, social equity, and environmental sustainability (Zheng et al., 2021). Within the context of this study, green finance is delineated as the investment in eco-friendly initiatives that underpin overall organizational resilience, encapsulating both environmental and financial dimensions. Furthermore, the literature has demonstrated that green finance and technological innovation play critical roles in advancing sustainable development across various regions and sectors. Zhang et al. (2024) highlight that both green finance and high-tech innovation individually contribute positively to sustainable development in the Yangtze River Economic Belt. However, their combined impact is crucial for fostering balanced regional growth. Similarly, Zhang et al. (2024) examine how firms’ ESG performance influences skill premiums in China’s green finance reform pilot zone, demonstrating that improved ESG performance enhances skill premiums, especially in highly urbanized areas. Yu et al. (2022) explore the relationship between green finance and energy efficiency, revealing that financial investments positively impact EE in both developed and emerging economies. Wang et al. (2022) emphasize that green finance plays a significant role in achieving CSR goals in the banking sector, fostering environmental, social, and economic sustainability. Wang et al. (2024) show that governance quality significantly impacts environmental protection, with extreme events moderating this effect.

Moreover, empirical evidence suggests that green finance plays a crucial role in enhancing the EP of banking entities (Zhang et al., 2022), with its components spanning environmental, social, and economic factors, significantly influencing sustainability performance (Zheng et al., 2021). Yilmaz (2021) further substantiates that an organization’s sustainability performance markedly boosts its FP. Recent scholarly contributions have positioned green finance as a key determinant of an organization’s environmental stewardship and sustainability achievements (Chen et al., 2022; Guang-Wen & Siddik, 2022; Zhang et al., 2022). Moreover, Xu et al. (2020) demonstrated green finance’s contribution to enhancing corporate green performance, while Indriastuti & Chariri (2021) underscored its positive impact on firms’ FP and sustainability performance. Regarding the interplay between EP and FP, existing studies generally posit a positive correlation between these facets (Liu, 2020; Nakao et al., 2007; Salama, 2005; Sudha, 2020), albeit Wu et al. (2020) suggested that the relationship is indirect. Conversely, Muhammad et al. (2015) contended that EP does not significantly influence a firm’s FP, indicating a divergence in findings. This variance in empirical results underscores the complexity of the relationships between green finance, EP, and FP, suggesting that the nexus warrants further scholarly scrutiny. The ambiguous outcomes observed in prior studies point to an unresolved discourse, necessitating additional research to disentangle these relationships. Thus, the following hypotheses are proposed:

Hypothesis 7: GF significantly influences ESP.

Hypothesis 8: GF significantly influences FINP.

ESP and FINP

Existing research outlines the relationship between ESP and the FINP of banking institutions, revealing predominantly positive correlations between corporate environmental performance (CEP) and corporate financial performance (CFP) (Khattak, 2021; Laguir et al., 2018; Munjal & Sharma, 2019; Weber, 2017). These studies collectively suggest a mutually reinforcing dynamic, wherein high levels of CFP are associated with superior CEP, hinting at a sophisticated, bidirectional interplay (Laguir et al., 2018). Specifically, investigations within the Chinese banking sector have documented a notable enhancement in environmental and social performance, underpinned by a bidirectional causality between financial and sustainability performance (Weber, 2017). This body of evidence posits a symbiotic relationship between corporate sustainability and financial outcomes, suggesting that strategic investments in sustainability initiatives can strengthen financial prosperity without compromising returns (Weber, 2017). While certain analyses indicate a direct, positive linkage between exemplary environmental performance and financial success (Earnhart, 2018), there are instances where a negative relationship is observed (Earnhart, 2018). Nonetheless, the overarching narrative within the literature leans towards a favorable influence of sound environmental performance on financial achievement (Earnhart, 2018). Consequently, the synthesis of these studies furnishes empirical support for a beneficial association between ESP and FINP among banking entities, underscoring significant implications for policy formulation and corporate strategy. Despite the prevailing consensus, these insights also underscore the necessity for continued inquiry into the dynamics governing the ESP-FINP nexus (Weber, 2017). Considering this, the study posits the following hypothesis for examination:

Hypothesis 9: ESP significantly influences FINP.

Mediating effect of CSR practices

Numerous studies have established a positive correlation between CSR and financial performance, illustrating that CSR initiatives contribute significantly and continuously to a company’s financial health (Coelho et al., 2023; H. Dziri and Jarboui, 2023; Edwards, 2014). Specifically, the effectiveness of CSR committees and investment in diversity, labor rights, and worker safety are highlighted as beneficial for enhancing firm value (Lin et al., 2019). Although research on the direct impact of Fintech on environmental performance remains scant, existing studies suggest Fintech plays a crucial role in enhancing green credit development by mitigating information asymmetry and improving the efficiency of green credit allocation (Liu and You, 2023). Further, Fintech is recognized for its significant contribution to the environmental sustainability performance of banks (Guang-Wen and Siddik, 2023; Siddik et al., 2023) and Small and Medium Enterprises (SMEs) (Abu Bakkar Siddik et al., 2023; Tian et al., 2023). Despite the absence of direct evidence elucidating CSR’s mediating role between Fintech adoption and environmental/financial performance, the documented positive effects of CSR on financial outcomes, alongside Fintech’s potential to boost environmental performance, imply a possible intermediary function. This gap in the literature indicates a need for further investigation into how CSR might bridge the influence of Fintech on both environmental and financial performance. Drawing on the existing body of research, we hypothesize that CSR could serve as a mediating factor in the dynamics between Fintech adoption, environmental sustainability, and financial performance, leading to the proposal of the following hypotheses for exploration:

Hypothesis 10: CSR acts as a mediator between FA and ESP.

Hypothesis 11: CSR serves as a mediator between FA and FINP.

Mediating effect of green finance

The literature review reveals significant insights into the dynamic interplay among Fintech, green finance, and their collective impact on environmental and financial performance. Fintech has been shown to notably advance green credit development by mitigating information asymmetry and enhancing green credit allocation efficiency (Liu and You, 2023). It also positively impacts the green environmental index through mechanisms such as financial breadth, depth, and digitalization (Qin et al., 2024), directly influencing green finance (Guang-Wen and Siddik, 2023) and ESP (Guang-Wen and Siddik, 2023; Siddik et al., 2023). Fintech’s role extends to reducing carbon emissions and fostering climate quality, with green finance playing a pivotal role in enhancing climate sustainability (Sadiq et al., 2024). Furthermore, Fintech aids in discerning and mitigating greenwashing practices among firms, thereby influencing the provision and access to financial services (Zhou and Wang, 2024).

Moreover, Fintech is identified as a significant deterrent to corporate greenwashing, with financial constraints further amplifying this effect (Xie et al., 2023). Contrarily, some evidence suggests a potential diversion of resources from green finance due to Fintech, hinting at complex implications for financial transparency (Feridun, 2023). Despite these findings, the literature lacks a direct examination of green finance’s mediating role between Fintech and both environmental and financial outcomes. While existing studies shed light on Fintech and green finance’s individual impacts, the potential mediating influence of green finance in bridging Fintech with environmental and financial performance remains unexplored. Hence, to address this gap, we propose the following hypotheses:

Hypothesis 12: GF acts as a mediator between FA and ESP.

Hypothesis 13: GF serves as a mediator between FA and FINP.

Conceptual framework

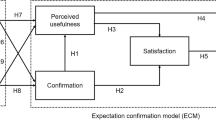

The study’s conceptual framework is designed within the framework of RBV theory, and illustrated in the accompanying Fig. 1, positions FA as the independent variable that influences ESP and FINP, which are the dependent variables. GF and CSR are introduced as mediators within this framework, bridging the relationship between FA and the outcomes of interest, ESP and FINP.

This figure illustrates the hypothesized relationships among Fintech Adoption (FA), CSR Practices (CSR), Green Finance (GF), Financial Performance (FINP), and Environmental Sustainability Performance (ESP). The framework proposes both direct and mediating effects, where CSR and GF mediate the impact of FA on ESP and FINP. Specific hypotheses (H1–H9) denote the direct paths, while H10–H13 capture the mediating pathways through CSR and GF.

Research methodology

Research context

The adoption of Fintech and green finance has markedly influenced the Chinese banking sector (Qian Liu and You, 2023). The evolution of Fintech has notably propelled green finance growth within Chinese banks, enhancing their risk management and operational capabilities (Wan et al., 2023). Furthermore, Fintech has been instrumental in advancing sustainable finance, evidenced by an increase in banking credits, reduced interest obligations, and augmented investments in environmental protection by brown firms (Zhou and Wang, 2024b). Additionally, the digital transformation within banks has been found to positively influence green credit volumes, particularly in banks with advanced management digitization, state-owned entities, and under relaxed monetary policies (Shang and Niu, 2023). Moreover, the integration of Fintech within banking operations has demonstrably benefited bank performance, especially in institutions employing technologically adept managers (Bian, Wang, and Xie, 2023). While the development of Fintech fosters operational efficiency and entrepreneurship, it concurrently introduces challenges, including regulatory ambiguities and potential data misuse (Hua and Huang, 2021). Despite these insights, existing research does not explicitly explore the synergistic impact of Fintech and green finance within the Chinese banking landscape. Nevertheless, cumulative evidence suggests that Fintech positively influences both green finance and bank performance, albeit amidst challenges necessitating strategic addressal to ensure sustainable sectoral growth. Consequently, this study aims to examine the effects of Fintech adoption on environmental and financial performance among Chinese banking institutions, with a particular focus on the mediating roles of green finance and CSR practices.

Data collection

To investigate the influence of FA on ESP and FINP, mediated by GF and CSR, data were gathered from a broad spectrum of banking professionals. This range included individuals from top-level management to entry-level positions within Chinese banking institutions, ensuring a comprehensive perspective. Data collection was accomplished via structured questionnaires disseminated through the WJX platform, spanning from March to May 2023, employing a non-probability convenience sampling method. A non-probability convenience sampling method was employed for data collection, which allowed for quick access to a diverse group of respondents within the banking sector. Convenience sampling was chosen due to its practicality and the accessibility of a broad range of respondents within a constrained timeline (Cao et al., 2024; Qalati, Jiang, Gyedu, et al., 2024). An initial total of 311 responses were collected, of which 54 were subsequently excluded due to incomplete information, resulting in a final sample size of 257. According to the G*Power analysis, this sample size is sufficient to achieve statistical power for the analyses conducted in this study. Prior to the main data collection phase, a pilot study was conducted with 25 participants to rigorously test the questionnaire’s structure and coherence. The instrument’s validity received further reinforcement through evaluations by two field professionals, three bank managers, and an academic scholar, ensuring the questionnaire’s relevance and applicability to our research context. Feedback from both the pilot study and these evaluations informed refinements to the survey items, enhancing the questionnaire’s effectiveness. The detailed demographic and professional characteristics of the respondents, crucial for contextualizing the findings, are delineated in Table 1, providing a solid foundation for analyzing the interplay between FA, ESP, FINP, GF, and CSR in the banking sector.

The study aimed at examining the impact of Fintech on the environmental and financial performance of banking institutions in China through the lens of green finance and CSR practices, featuring a diverse respondent profile. The demographic breakdown reveals a composition of 59.1% male and 40.9% female participants, indicating a relatively balanced gender distribution. The age of respondents is predominantly within the 30–49 years bracket (52.5%), followed closely by those aged 20–29 years (42%), with minimal representation from the 40–49 years (4.7%) and above 50 years (0.8%) groups. This suggests that the study attracted primarily a younger to middle-aged demographic. In terms of educational background, a significant majority of the respondents hold undergraduate degrees (72.4%), while 27.6% have postgraduate qualifications or higher, pointing to a well-educated participant base. Regarding working experience, a majority have over 6 years of experience (54.1%), with others having between 3-5 years (33.9%) and less than 3 years (12.1%). The respondents span across various working positions, with 48.6% being general staff, 26.5% in lower-level, 19.1% in mid-level, and 5.8% in top-level positions. This diverse group, encompassing a range of ages, educational backgrounds, experiences, and job roles, provides a broad spectrum of insights into the integration and impact of Fintech within the banking sector, particularly in relation to green finance and CSR initiatives.

Survey items

The structured questionnaire, designed to investigate the impact of FA on ESP and FINP, with a focus on the mediating roles of GF and CSR, was crafted following an extensive review of existing literature, as shown in Table 2. The survey comprised six sections: respondent demographics, FA, GF, CSR practices, ESP, and FINP. Initial sections gathered basic respondent details such as age, gender, education, work experience, and position. To assess FA, four items were derived from the research of Guang-Wen and Siddik (2023) and Siddik et al. (2023). The measurement of CSR practices incorporated four items based on studies by X. Dai, Siddik, and Tian (2022) and Saiedi, Broström, and Ruiz (2021). Five items evaluating GF were adapted from Dai et al. (2022), while the evaluation of ESP was based on five items from Xiaofei Dai et al. (2022) and Kraus, Rehman, and García (2020). Furthermore, six items measuring FINP were adapted from Bahta et al. (2021) and Saiedi et al. (2021). Data collection employed a 7-point Likert scale, ranging from 1 (strong disagreement) to 7 (strong agreement). The questionnaire was initially drafted in official Chinese and subsequently translated into English by professionals. Adjustments were made to the questionnaire’s language based on feedback from the pilot survey and expert reviews, ensuring the clarity and comprehensibility of the measurement scale.

Common method bias

Prior research underscores Common Method Bias (CMB) as a pivotal concern in studies employing self-reported data, due to its potential to exaggerate correlations between variables (Conway and Lance, 2010; Podsakoff et al., 2003). In this study, the reliance on questionnaire-derived data for both independent and dependent variables introduces the risk of CMB. The application of Harman’s single-factor method indicated that a single factor explained only 30.576% of the variance, thus suggesting CMB does not substantially compromise the data, given that a threshold above 50% typically signals a CMB concern (Podsakoff et al., 2003). However, it’s acknowledged that Harman’s Test may not be fully effective in detecting CMB, potentially offering a misleading reassurance (Aguirre-Urreta and Hu, 2019).

Moreover, this study undertook additional steps to validate sample integrity, including a t-test comparison between early and late respondents to evaluate non-response bias, which revealed no significant discrepancies, thereby affirming the sample’s representativeness. Further scrutiny for CMB through advanced collinearity testing (Kock, 2015) showed all constructs’ variance inflation factor (VIF) scores well below the critical value of 3, corroborating the absence of substantial CMB (Hair et al., 2021). These rigorous assessments of non-response and common method biases enhance the credibility of our findings, underlining the methodological soundness and reliability of the conclusions drawn from our research.

Results and findings

Data analysis techniques

This research employed Partial Least Squares Structural Equation Modeling (PLS-SEM) and Necessary Condition Analysis (NCA) to explore the effects of FA on the ESP and FINP of Chinese banking institutions, considering the mediating roles of GF and CSR. PLS-SEM, widely adopted across disciplines such as economics and business, facilitates a comprehensive evaluation process, including initial assessment, measurement and structural model evaluation, alongside mediation and moderation analyses, utilizing tools like SmartPLS (Cao et al., 2024; Qalati, 2024; Qalati, Siddiqui, and Wu, 2024; Richter et al., 2020). This method rigorously examines model reliability, convergent and discriminant validity—employing the Heterotrait-Monotrait (HTMT) criterion for the latter (Aburumman et al., 2023; Chen, Qalati, and Fan, 2024; Richter et al., 2020). Regarding the questionnaire’s validity and reliability, factor analysis was conducted to ensure construct validity, and Cronbach’s alpha and composite reliability scores were used to assess internal consistency. These measures confirmed the robustness and reliability of the scales used in the study. Additionally, PLS-SEM was preferred over covariance-based SEM (CB-SEM) due to its flexibility in modeling complex relationships with smaller sample sizes and its ability to focus on prediction and exploratory research (Cao et al., 2024; Qalati, Siddiqui, and Magni, 2024). Unlike CB-SEM, which is more suitable for confirmatory analysis with larger samples, PLS-SEM is better suited for this exploratory study, where the relationships between variables were not fully established (Qalati, 2024; Qalati, Siddiqui, and Wu, 2024). This makes PLS-SEM particularly effective in this context, where the goal is to predict key outcomes and explore the complex dynamics between Fintech adoption and performance in Chinese banks.

Moreover, NCA was chosen to complement PLS-SEM by identifying necessary conditions that are essential for achieving specific outcomes (Thiem, 2021). It guides researchers through theoretical underpinnings, data analysis, scatter plots, ceiling line determination, effect size calculation, statistical testing, and bottleneck analysis (Dul, Hauff, and Bouncken, 2023). The synergistic application of PLS-SEM and NCA not only facilitates hypothesis testing under both sufficiency and necessity logics but also broadens the methodological horizon to include theoretical alternatives for established models (Richter et al., 2020). This dual-analytical approach thus lays a robust foundation for discerning critical determinants in the decision-making process, enriching the research landscape with complex insights into the indispensable and contributory factors influencing banking institutions’ performance in China.

PLS-SEM findings

Construct reliability and validity

In this detailed exploration of the study constructs, the reliability and validity of the variables were rigorously evaluated using a variety of statistical techniques. The findings demonstrate that Factor Loadings (FL) exhibit strong correlations with their respective constructs, indicating a high relevance of items and affirming the accuracy of our measures in capturing the intended theoretical concepts (Hair et al., 2021). The internal consistency of these constructs, as indicated by Cronbach’s Alpha (CA) and Composite Reliability (CR) values, mostly surpasses the widely accepted benchmark of 0.7, ensuring a reliable and cohesive item set (Table 2). However, the FA construct showed a CA value slightly under the standard at 0.679, suggesting a slight deviation in internal consistency, yet its CR value exceeded 0.7, maintaining overall reliability (Hair et al., 2021). Average Variance Extracted (AVE) values, approaching but in some cases not reaching the 0.5 threshold—specifically, FINP at 0.478—suggest areas for potential validity enhancement.

While Hair et al. (2021) advocate for AVE values of 0.50 or higher for convergent validity, Fraering and Minor (2006) consider a 0.4 threshold sufficient, and Malhotra, Satyabhusan (2011) argue that AVE’s strictness can be balanced by CR’s demonstration of reliability. With AVE values spanning 0.478 to 0.574 and CR values between 0.806 and 0.849, our study aligns with the convergent validity standards proposed by Fraering and Minor (2006), Malhotra, Satyabhusan (2011), reinforcing the validity of our constructs. Moreover, VIF values indicate no significant multicollinearity concerns, reinforcing the robustness of our study’s constructs. These findings underline the need for interpretation and potential refinement, especially in enhancing the internal consistency of Fintech adoption and bolstering the convergent validity of the financial performance construct to better capture the essence of these complex relationships.

Discriminant validity

Discriminant validity assesses whether concepts or measurements that are supposed to be unrelated are, in fact, distinct from each other (Hair et al., 2021). In the context of the study, discriminant validity was examined using the Heterotrait-Monotrait (HTMT) ratio and the Fornell-Larcker criterion (Fornell and Larcker, 1981; Henseler and Chin, 2010). The HTMT values between constructs such as CSR, ESP, FA, FINP, and GF suggest a satisfactory level of discriminant validity, as the ratios are below the conservative threshold of 0.85, indicating that these constructs are distinct and measure different phenomena, as can be shown in Table 3. For instance, the HTMT ratio between CSR and ESP is 0.633, and between FA and FINP is 0.789, both of which are below the threshold, underscoring their distinctiveness (Henseler and Chin, 2010).

Additionally, the Fornell-Larcker criterion, which compares the square root of the AVE for each construct (diagonal values) with the correlations between constructs (off-diagonal values), further supports discriminant validity (Fornell and Larcker, 1981). Each construct’s AVE square root is larger than its correlations with other constructs, as evidenced by comparisons such as CSR with ESP (0.758 vs. 0.493) and GF with FA (0.714 vs. 0.52). This indicates that each construct shares more variance with its own indicators than with those of other constructs, affirming their discriminant validity within the study’s framework.

Outcomes of research hypotheses

The outcomes of the research hypotheses reveal insightful patterns regarding the influence of FA on ESP, CSR, GF, and FINP, as shown in Table 4. The analysis robustly supports hypotheses H1 through H5 and H7, indicating that FA significantly enhances FINP, ESP, CSR, and GF, with particularly strong effects observed for FA’s impact on GF (H4: β = 0.52, p < 0.000). These results highlight the crucial role of Fintech adoption in driving not only the financial success of organizations but also their commitment to CSR, environmental sustainability, and the integration of green finance practices.

However, the investigation also sheds light on the complex nature of these relationships, particularly through the examination of mediating effects and the direct impact of CSR on FINP. Notably, hypothesis H6 (CSR → FINP) was rejected (β = 0.021, p = 0.732), indicating a lack of direct influence of CSR initiatives on financial performance. This suggests that the pathway through which CSR contributes to FINP may be more indirect and potentially mediated by other factors not captured in this model, such as operational efficiency, customer loyalty, or brand reputation. These results imply that CSR initiatives alone may not immediately translate into financial gains, and further research is needed to explore the complex interactions and additional mediating variables that might strengthen the link between CSR and financial performance. Additionally, while CSR and GF were shown to mediate the relationship between FA and ESP successfully, the mediating role of CSR in the FA-FINP link (H11) was not supported (β = 0.01, p = 0.743), further emphasizing the potentially indirect benefits of CSR on FINP.

Despite these rejections, the acceptance of hypotheses, especially those involving the mediating roles of CSR and GF (H10, H12, H13), albeit H13 at a 10% significance level, illustrates the vital pathways through which Fintech adoption can foster sustainability and financial gains. The results underline the importance of integrating Fintech with green finance and CSR strategies to achieve comprehensive organizational growth and sustainability. The rejected hypotheses, particularly regarding the direct impact of CSR on FINP, call for a deeper exploration into the mechanisms and conditions under which CSR initiatives can translate into tangible financial benefits. It is possible that CSR’s impact on financial performance is indirect, influenced by other mediating factors such as customer perception, employee engagement, or market positioning. This highlights an area ripe for future research, where further investigation could uncover how different organizational or environmental contexts may shape the relationship between CSR and financial performance, providing valuable insights into optimizing CSR strategies for greater financial outcomes.

NCA analysis

To augment the insights derived from PLS-SEM, a supplementary post-hoc NCA was conducted to investigate the indispensable effects of FA, CSR, GF, and ESP on FINP, following the methodology outlined by Dul, Hauff, and Bouncken (2023). Utilizing the latent variable scores obtained via the PLS algorithm as inputs, the analysis was executed in SmartPLS 4.0, adhering to Dul, Hauff, and Bouncken's (2023) recommendation for a substantial random sample size of 10,000 to ascertain the statistical significance of the effect sizes (d) of these latent variables. The interrelations among the constructs were scrutinized through the application of the ceiling envelopment-free disposal hull (CE-FDH) approach, delineated by Richter et al. (2020) as a nondecreasing stepwise linear progression that delineates the requisite level of independent variable X to attain a given outcome in dependent variable Y, as can be shown in Fig. 2. The exhaustive outcomes of this NCA are delineated in Table 5, which underscored that ESP and FA constitute a significant and necessary condition for enhancing financial performance, with effect sizes surpassing 0.189 and 0.298 respectively, and achieving statistical significance (p < 0.001). Conversely, CSR and GF are shown to have comparatively less significant effect sizes, indicating a more subdued direct influence on financial performance relative to FA and ESP.

NCA Ceiling Line Charts for Necessary Conditions of FINP. These NCA (Necessary Condition Analysis) ceiling line charts illustrate the necessary relationships between individual predictors and Financial Performance (FINP): a CSR Practices (CSR) and FINP—The CE-FDH line indicates a threshold level of CSR is necessary to achieve higher financial performance. b Fintech Adoption (FA) and FINP—The chart demonstrates that higher levels of FA are a necessary condition for improved FINP, with a clear step-function pattern in the CE-FDH curve. c Green Finance (GF) and FINP—A near-horizontal ceiling line suggests minimal variation in GF is required once a threshold is met for higher financial outcomes. d Environmental Sustainability Performance (ESP) and FINP—The relationship shows that ESP acts as a necessary precursor for achieving higher financial returns, highlighting its strategic importance. Each chart includes the CR-FDH (gray area) and CE-FDH (yellow line) estimations, with blue dots representing observed values.

For further clarification, a bottleneck analysis was undertaken, with its findings detailed in Table 6, and the associated scatter plots for all pertinent correlations are illustrated in Fig. 2a–d. Moreover, the bottleneck analysis provides deeper insights into the thresholds at which these variables exert significant constraints on FINP. Notably, FA emerges as a consistent influencer of financial performance across various thresholds, beginning to exhibit a bottleneck effect at a mere 10% threshold. Conversely, the influence of CSR on FINP manifests significantly only beyond a 50% threshold, escalating markedly to reach a 92.22% threshold, which suggests a critical mass effect where CSR’s impact becomes profoundly significant. This comprehensive examination delineates the intricate and differential roles that CSR, ESP, FA, and GF play in sculpting the financial landscape of banking institutions. It underscores the instrumental role of FA and ESP as primary drivers of financial success, while positioning CSR and green finance within a more complex framework of influence on FINP, thereby enriching the discourse on strategic priorities within the banking sector.

Discussion and implications

Discussion

The findings of this study explore the impact of FA on the ESP and FINP of banking institutions in China through the mediating effects of CSR and GF, offer substantive theoretical contributions to the RBV theory. The SEM outcomes underscore the significant enhancement of FINP, ESP, CSR, and GF attributable to FA, with a notably profound impact on GF, explaining Fintech’s pivotal role not just in financial optimization but as an essential catalyst for sustainable banking practices (Coelho et al., 2023; Dai et al., 2022; Dziri and Jarboui, 2023; M. Feridun, 2023; Guang-Wen and Siddik, 2023; Liu and You, 2023; Xie et al., 2023).

However, the SEM analysis also highlights the intricate nature of these influences, particularly the indirect effects of CSR on financial outcomes, a revelation that challenges and expands the RBV theory by suggesting that the strategic value of CSR and GF, while not directly impactful on financial performance, may manifest through complex mediating pathways (Coelho et al., 2023; Kero and Bogale, 2023; Seddon, 2014). The finding that CSR does not have a significant direct impact on FINP may be explained by contextual factors such as the regulatory environment and stakeholder perceptions. In some cases, weak enforcement of CSR-related regulations or limited stakeholder pressure may reduce the financial incentives for firms to engage in CSR activities. This suggests that the financial benefits of CSR might emerge more indirectly—through channels like FA and GF.

The NCA further enriches this discourse by identifying FA and ESP as critical and non-substitutable conditions for financial performance improvement, reinforcing the indispensable role of Fintech in driving sustainable financial success. The differential impact levels observed for CSR and GF, along with the bottleneck effects, suggest a complex strategic landscape where FA directly and consistently influences financial performance, whereas CSR’s impact becomes significantly perceptible only beyond certain thresholds. This critical mass effect for CSR’s impact introduces a layer to the RBV theory, emphasizing the conditional nature of strategic resources’ contribution to organizational performance.

Together, these findings offer an extension to the RBV theory, suggesting that the strategic management of resources like FA, CSR, GF, and ESP within banking institutions is not merely a linear path to enhanced financial and environmental performance but a complex interplay of direct and mediated influences. This study calls for a broader perspective on resource-based strategies, advocating for the integration of Fintech innovations with sustainable banking practices as a comprehensive approach to achieving organizational growth and sustainability. Thus, the study not only contributes to the theoretical advancement of the RBV in the context of Fintech and sustainable banking but also highlights the imperative for banking institutions to strategically align their resource configurations to leverage the full spectrum of benefits offered by Fintech adoption, CSR, and green finance initiatives.

Practical contributions

This study further makes significant practical and policy contributions by clarifying the impact of FA on the ESP, FINP, CSR, and GF within the banking sector in China, offering a complex understanding that can guide strategic decision-making and policy formulation. Firstly, this study highlights the critical need for banking institutions to strategically incorporate Fintech innovations into their operations to improve both financial outcomes and sustainability practices. By prioritizing Fintech investment, banks can unlock their full potential in enhancing corporate social responsibility and green finance initiatives (Guang-Wen and Siddik, 2023). Secondly, the research underscores the importance of leveraging Fintech to bolster CSR and green finance practices (Dai et al., 2022). Banks are advised to utilize Fintech as a tool for improving the efficiency of green investments and CSR activities, thus fostering a symbiotic relationship between technological advancements and sustainable banking practices (M. Feridun, 2023; Liu and You, 2023; Siddik et al., 2023; Weber, 2017). Thirdly, the positive influence of Fintech adoption on environmental sustainability performance suggests that banks should embrace technology to meet their sustainability goals (Guang-Wen and Siddik, 2023; Siddik et al., 2023). Fintech can be a catalyst in enhancing environmental risk assessments, monitoring sustainability metrics, and offering green financial products that resonate with eco-conscious stakeholders.

Policy recommendations

To foster technological innovation that enhances both environmental sustainability and financial performance in banking institutions, policymakers should take several targeted actions based on the study’s findings. First, regulatory bodies should introduce incentive-based policies that promote the integration of Fintech with sustainability initiatives. This can include tax incentives or government subsidies for banks that adopt green Fintech solutions, such as blockchain-based platforms for transparent environmental finance, or AI tools for monitoring and managing environmental risks. In addition, policymakers could develop clear regulatory frameworks and classification systems for green Fintech products, ensuring they meet defined ESG criteria. This would not only provide clarity and standardization but also accelerate responsible Fintech innovation in the financial sector.

Second, enhancing transparency and accountability in banking practices is critical for aligning financial institutions with sustainability goals. To this end, the implementation of mandatory ESG disclosure requirements should be prioritized. Banks should be required to publicly report the environmental and social impacts of their Fintech investments, CSR initiatives, and green finance activities. Such disclosures would empower stakeholders—including investors, regulators, and consumers—to assess banks’ commitments to sustainability, improve market discipline, and encourage responsible competition across the sector. Third, to directly support environmental outcomes through financial innovation, Fintech-driven carbon credit trading schemes should be encouraged. Governments can support the development of digital platforms that use blockchain and AI to facilitate real-time, transparent trading of verified carbon credits. Such platforms would increase accessibility, reduce transaction costs, and enhance trust in carbon markets—ultimately helping banks and their clients offset emissions more effectively and contribute to national sustainability targets.

Finally, recognizing the interconnectedness between FA, GF, and CSR, the study advocates for cross-sector collaboration as a key driver of innovation. Policymakers should facilitate partnerships between banking institutions, Fintech companies, environmental NGOs, and government bodies to create an ecosystem that supports sustainable finance. These collaborations could involve joint research initiatives, sharing of best practices, or the co-development of new Fintech solutions that address specific environmental challenges, such as carbon emissions reduction or resource optimization. By establishing a collaborative framework, policymakers can accelerate the development and adoption of Fintech solutions that drive both financial success and environmental sustainability, creating a more resilient and responsible banking sector. This approach aligns with theories such as stakeholder theory and institutional theory, which emphasize the importance of collaboration and the role of external pressures in driving corporate responsibility.

Conclusion

This study examined the transformative impact of FA on the banking sector’s ESP and FINP in China, focusing on the mediating roles of CSR and GF. Using SEM and NCA, the study identified the direct positive effects of FA on ESP, CSR, GF, and FINP, and revealed the complex mediating roles of CSR and GF in strengthening the FA-ESP relationship. The findings showed FA’s critical role in driving both sustainability and financial gains, despite the complexity of its interaction with CSR and GF practices. The rejection of hypotheses on CSR’s direct impact on FINP suggests that further research is needed to explore the indirect pathways through which CSR contributes to financial performance. NCA findings emphasized FA and ESP as necessary conditions for improving financial performance, offering insights into the thresholds at which these factors influence outcomes. Rooted in the RBV theory, this study highlighted Fintech’s strategic importance in sustainable banking, serving as a catalyst for organizational growth and sustainability. The multi-method approach enriched the understanding of Fintech’s impact and opens avenues for future research into enhancing CSR and GF’s role in financial and environmental performance, ultimately guiding banking institutions in integrating Fintech with sustainability initiatives for long-term success.

Study limitations and directions for future research

This study, while providing significant insights into the impacts of FA on ESP and FINP via the mediating link of CSR and GF within the banking sector in China, is subject to certain limitations that pave the way for future research directions. Firstly, the study’s scope is limited to Chinese banks, which may reduce the applicability of the findings to other regulatory and economic environments. Replicating this study in different global contexts would help understand how varying regulatory frameworks and economic conditions influence the integration of Fintech, CSR, and sustainability in banking. Besides, the sample size, limited to 277 respondents, restricts the generalizability of the findings across broader contexts and geographies, suggesting a need for replication studies with larger and more diverse samples to validate and extend these results. The unexpected findings, such as the non-significant impact of CSR on FINP and the mediating role of CSR in the relationship between FA and FINP, underscore the need for refining or expanding existing theoretical frameworks to better capture the complex dynamics at play. These rejected hypotheses suggest that the impact of CSR on financial performance may not be as direct as previously assumed, and that its role could be more complex, potentially influenced by other mediating or moderating factors. Future research should explore these pathways further, considering the interplay between CSR, Fintech, and sustainability initiatives. Furthermore, the integration of Fintech into sustainability practices should be explored in greater depth, particularly in light of regulatory and cultural differences that may influence how these innovations are adopted and implemented across diverse regions. Understanding how regulatory environments and cultural factors shape Fintech adoption and its intersection with sustainability can provide valuable insights for more effective policy formulation and practical applications in the banking sector. Moreover, our study employed PLS-SEM and NCA for data examination. Future studies might be used by exploring the non-linear relationships that could exist among the variables using advanced machine learning approaches such as Artificial Neural Networks (ANN) or applying fuzzy set Qualitative Comparative Analysis (fsQCA) in conjunction with PLS-SEM and NCA (Dul, Hauff, and Bouncken, 2023). Such methodologies could uncover deeper insights and potentially reveal complex causal patterns not captured by linear models. Addressing these limitations and employing these suggested methodologies would not only enhance the robustness of the findings but also contribute to a deeper and more complex understanding of the interplay between technology, sustainability, and performance in the banking industry, thereby offering a more comprehensive picture of the strategic implications of Fintech adoption.

Data availability

The data that support the findings of this study are attached as a supplementary data file and are available from the corresponding authors upon reasonable request.

References

Aburumman OJ, Omar K, Al Shbail M, Aldoghan M (2023) How to deal with the results of PLS-SEM? In: Alareeni B, Hamdan, A. (eds) Explore business, technology opportunities and challenges after the Covid-19 pandemic. ICBT 2022. Lecture Notes in Networks and Systems, vol 495. Springer, Cham

Aguirre-Urreta MI, Hu J (2019) Detecting common method bias: performance of the Harman’s single-factor test. Data Base Adv Inf Syst 50(2):45–70. https://doi.org/10.1145/3330472.3330477

Akomea-Frimpong I, Adeabah D, Ofosu D, Tenakwah EJ (2021) A review of studies on green finance of banks, research gaps and future directions. J Sustain Finance Invest 1–24. https://doi.org/10.1080/20430795.2020.1870202

Akter N, Siddik AB, Mondal MSA (2018) Sustainability Reporting on Green Financing : A Study of Listed Private Sustainability Reporting on Green Financing : A Study of Listed Private Commercial Banks in Bangladesh. J Bus Technol (Dhaka) XII(July):14–27

Al-Matari EM, Mgammal MH, Senan NAM, Kamardin H, Alruwaili TF (2023) Fintech and financial sector performance in saudi arabia: an empirical study. J Gov Regul 12(2):43–65. https://doi.org/10.22495/jgrv12i2art5

Al-Matari EM, Mgammal MH, Senan NAM, Kamardin H, Alruwaili TF(2023). Fintech and financial sectorperformance in saudi arabia: an empirical study. J Gov Regul 12(2):43–65

Awais M, Afzal A, Firdousi S, Hasnaoui A (2023) Is Fintech the New Path to Sustainable Resource Utilisation and Economic Development? Resources Policy 81. https://doi.org/10.1016/j.resourpol.2023.103309

Bahta D, Yun J, Islam R, Bikanyi KJ (2021) How does CSR enhance the financial performance of SMEs ? The mediating role of firm reputation How does CSR enhance the financial performance. Economic Res.-Ekonomska Istraživanja 34(1):1428–1451. https://doi.org/10.1080/1331677X.2020.1828130

Bian W, Wang S, Xie X (2023) How valuable is FinTech adoption for traditional banks? Eur Financ Manag https://doi.org/10.1111/eufm.12424

Calle-Nole M, Alvarez-Risco A, Contreras-Taica A, de las Mercedes Anderson-Seminario M, Del-Aguila-Arcentales S (2023) FinTech: An Innovative Green Entrepreneurship Model. Environmental Footprints and Eco-Design of Productsand Processes 245–257. https://doi.org/10.1007/978-981-19-8895-0_11

Cao S, Xu P, Qalati SA, Wu K (2024) Impact of employee environmental concerns on sustainable practices: investigating organizational commitment and job satisfaction. Sustainability 16(13). https://doi.org/10.3390/su16135823

Cen T, He R (2018) Fintech, green finance and sustainable development. Adv Soc Sci Educ Hum Res 291:222–225

Chen L, Qalati SA, Fan M (2024) Effects of sustainable innovation on stakeholder engagement and societal impacts: the mediating role of stakeholder engagement and the moderating role of anticipatory governance. Sustain Dev. https://doi.org/10.1002/sd.3247

Chen J, Siddik AB, Zheng G-W, Masukujjaman M, Bekhzod S (2022) The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies, 15(4). https://doi.org/10.3390/en15041292

Chhaidar A, Abdelhedi M, Abdelkafi I (2023) The Effect of Financial Technology Investment Level on European Banks’ Profitability. J Knowl Econ 14(3):2959–81. https://doi.org/10.1007/s13132-022-00992-1

Coelho R, Jayantilal S, Ferreira JJ (2023) The impact of social responsibility on corporate financial performance: a systematic literature review. Corp Soc Responsib Environ Manag 30(4):1535–1560. https://doi.org/10.1002/csr.2446

Conway JM, Lance CE (2010) What reviewers should expect from authors regarding common method bias in organizational research. J Bus Psychol 25(3):325–334. https://doi.org/10.1007/s10869-010-9181-6

Dai X, Siddik AB, Tian H (2022) Corporate social responsibility, green finance and environmental performance: does green innovation matter? Sustainability 14(20). https://doi.org/10.3390/su142013607

Dasilas A, G Karanović (2023) The Impact of FinTech Firms on Bank Performance: Evidence from the UK. Eur Med J Bus https://doi.org/10.1108/EMJB-04-2023-0099

Dul J, Hauff S, Bouncken RB (2023) Necessary condition analysis (NCA): review of research topics and guidelines for good practice. Rev Manag Sci 17(2):683–714. https://doi.org/10.1007/s11846-023-00628-x

Dunbar K, Sarkis J, Treku DN (2024) Fintech for environmental sustainability: promises and pitfalls. One Earth 7(1):23–30. https://doi.org/10.1016/j.oneear.2023.12.012

Dziri H, Jarboui A (2023) The moderating effect of the CSR committee on the relationship between CSR performance and financial performance: empirical evidence from European firms. Int Stud Manag Organ. https://doi.org/10.1080/00208825.2023.2284467

Earnhart D (2018) The effect of corporate environmental performance on corporate financial performance. Annu Rev Resour Econ 10:425–444. https://doi.org/10.1146/annurev-resource-100517-023007

Edwards D (2014) The link between company environmental and financial performance (Routledge Revivals). Routledge

Feridun M (2023) Green finance: do innovation, fintech and financial transparency play a role? Appl Econ Lett. https://doi.org/10.1080/13504851.2023.2244227

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res 18(1):39–50. https://doi.org/10.1177/002224378101800104

Fraering M, Minor SM (2006) The virtcomm scale: a virtual community measurement tool. In: American Marketing Association Summer Educators Conference Proceedings. Chicago, IL

Guang-Wen Z, Siddik AB (2023) The effect of Fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: the role of green innovation. Environ Sci Pollut Res 30(10):25959–25971. https://doi.org/10.1007/s11356-022-23956-z

Guang-Wen Z, Siddik AB (2022) Do corporate social responsibility practices and green finance dimensions determine environmental performance? An empirical study on Bangladeshi banking institutions. Front Environ Sci 10. https://doi.org/10.3389/fenvs.2022.890096

Hair Jr JF, Hult GTM, Ringle CM, Sarstedt M (2021) A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications

Hamad S, Lai FW, Shad MK, Shah SQA, Jan AA, Ali SEA (2024) A reflection on the voluntary disclosure of sustainable development goals: the role of sustainability committee. Bus Strateg Dev 7(3). https://doi.org/10.1002/bsd2.398

Henseler J, Chin WW (2010) A comparison of approaches for the analysis of interaction effects between latent variables using partial least squares path modeling. Struct Equ Modeling Multidiscip J 17(1):82–109. https://doi.org/10.1080/10705510903439003

Hoque N, Mowla MdM, Uddin MS, Mamun A, Uddin MR (2019) Green Banking Practices in Bangladesh: A Critical Investigation. Int J Econ Financ 11(3):58. https://doi.org/10.5539/ijef.v11n3p58

Hua X, Huang Y (2021) Understanding China’s fintech sector: development, impacts and risks. European. J Financ 27(4–5):321–333. https://doi.org/10.1080/1351847X.2020.1811131

Indriastuti M, Chariri A (2021) social responsibility investment on sustainable The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus Manag 8(1). https://doi.org/10.1080/23311975.2021.1960120

Kai ZM, Sharaf SY, Wei AA, Shraah LT, Le DA, Bedekar A, Bani Ahmad AYA (2024) Exploring the Asymmetric Relationship between Natural Resources, Fintech, Remittance and Environmental Pollution for BRICS Nations: New Insights from MMQR Approach. Resources Policy 90: https://doi.org/10.1016/j.resourpol.2024.104693

Kero CA, Bogale AT (2023) A systematic review of resource-based view and dynamic capabilities of firms and future research avenues. Int J Sustain Dev Plan 18(10):3137–3154. https://doi.org/10.18280/ijsdp.181016

Khattak MA (2021) Corporate Sustainability and Financial Performance of Banks in Muslim Economies: The Role of Institutions. J Public Aff 21(1). https://doi.org/10.1002/pa.2156

Kock N (2015) Common method bias in PLS-SEM: a full collinearity assessment approach. Int J E-Collab 11:1

Laguir I, Marais M, El Baz J, Stekelorum R (2018) Reversing the business rationale for environmental commitment in banking: does financial performance lead to higher environmental performance? Manag Decis 56(2):358–375. https://doi.org/10.1108/MD-12-2016-0890

Li B, Guo F, Xu L, Meng, S (2024) Fintech Business and Corporate Social Responsibility Practices. Emerg Mark Rev 59: https://doi.org/10.1016/j.ememar.2023.101105

Lin L, Hung PH, Chou DW, Lai CW (2019) Financial Performance and Corporate Social Responsibility: Empirical Evidence from Taiwan. Asia Pacific. Manag Rev 24(1):61–71. https://doi.org/10.1016/j.apmrv.2018.07.001

Liqi Yi, Tao Li, Erli D, Ting Z (2023) Corporate Social Responsibility and Environmental Performance: ‘Sincerity’ or ‘Concealment’?; [企业社会责任与环境绩效:‘ 真心’ 还是‘ 掩饰’ ?].” J Ind Eng Eng Manag 37(2). https://doi.org/10.13587/j.cnki.jieem.2023.02.001

Liu Y, Saleem S, Shabbir R, Shabbir MS, Irshad A, Khan S (2021) The relationship between corporate social responsibility and financial performance: a moderate role of Fintech technology. Environ Sci Pollut Res 28(16):20174–20187. https://doi.org/10.1007/s11356-020-11822-9

Liu Z (2020) Unraveling the complex relationship between environmental and financial performance ─── A multilevel longitudinal analysis. Int J Prod Econ 219:328–340. https://doi.org/10.1016/j.ijpe.2019.07.005

Liu Q, You Y (2023) Fintech and green credit development—evidence from China. Sustainability 15(7). https://doi.org/10.3390/su15075903

Malhotra NK, Satyabhusan D (2011) Marketing research an applied orientation (Paperback). Pearson Publishing, London

Muhammad N, Scrimgeour F, Reddy K, Abidin S (2015) The relationship between environmental performance and financial performance in periods of growth and contraction: evidence from Australian publicly listed companies. J Clean Prod 102:324–332. https://doi.org/10.1016/j.jclepro.2015.04.039

Munjal P, Sharma D (2019) Environmental performance reporting in commercial banks of India: Exploring association with financial performance. Int. J. Innovative Technol Explor Eng 8(12):4390–4395. https://doi.org/10.35940/ijitee.L3906.1081219

Nakao Y, Amano A, Matsumura K, Genba K, Nakano M (2007) Relationship between environmental performance and financial performance: an empirical analysis of japanese corporations. Bus Strategy Environ 16(2):106–118. https://doi.org/10.1002/bse.476