Abstract

This study identifies digitalization as a key determinant of supply chain resilience. Using the quasi-natural experiment provided by China’s supply chain digitalization pilot policies, we find a significant and persistent positive effect on the resilience of firms within supply chain networks. Mechanism analyses indicate that this effect is primarily driven by improvements in firms’ information processing capacity, recovery ability, and inventory turnover efficiency. The results are more pronounced for firms with geographically dispersed supply chains, lower supply chain hierarchies, and higher supply chain transparency. Overall, our findings suggest that digitalization not only strengthens operational and informational linkages but also enables firms to transition from passive disruption management to proactive resilience building in the face of uncertainty.

Similar content being viewed by others

Introduction

We aim to understand how digitalization impacts the resilience of firms within supply chain networks. Over the past decade, digital technologies—such as IoT sensors (Abdel-Basset et al. 2018), blockchain (Cui et al. 2023), cloud computing (Wu et al. 2013), artificial intelligence (Dey et al. 2023), and big data analytics (Boone et al. 2019a)—have become deeply embedded in every stage of the supply chain, from order processing and production scheduling to warehousing, inventory management, logistics, and last-mile delivery. Compared to traditional approaches, these technologies reduce information asymmetry and communication costs, improve access to real-time data and its processing, accelerate decision-making, and enhance forecasting accuracy and responsiveness (Nasiri et al. 2020; An et al. 2024; Liu et al. 2024b). In turn, this leads to greater resilience when confronted with market volatility, sudden supply disruptions, and natural disasters.

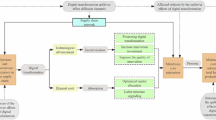

The impact of digitalization on the supply chain is reflected in a dual transformation of content and form: on the one hand, it changes the way supply chain data are presented and used (from paper-based or static information to dynamic, real-time, traceable digital information flows) (Büyüközkan and Göçer 2018); on the other hand, it reshapes the network structure of the supply chain and its coordination mechanism (from a single-point, linear model to a networked, platform-based, collaborative ecosystem) (Feng et al. 2024). We show that adopting digital supply chain technologies enhances firms’ resilience within the supply chain network.

Figure 1 illustrates how digitalization reshapes supply chain resilience by comparing actual order processing and logistics scheduling in a manufacturing firm’s network. In 2010, the company relied primarily on spreadsheets and manual phone calls to coordinate production and could only respond passively to local supply disruptions, often incurring delays and additional costs. By 2019, the company had widely adopted real-time data platforms, intelligent scheduling algorithms and visual analytics systems, and could flexibly adjust supply sources and optimize delivery routes within a working week, which improved order-fulfillment rates and shortened emergency response times.

Our empirical analysis aims to evaluate the dynamic changes in node-level resilience—measured by metrics such as weighted centrality and out-degree—following the introduction of digital infrastructure and data platforms. Two main empirical challenges arise in this investigation: (1) the timing of firms’ adoption may be endogenous to factors such as firm size, financial conditions, and industry status; and (2) the complexity of supply chain networks makes it difficult to separate the impact of digitization from other external factors such as market demand and network structure. To address these challenges, we employ a difference-in-differences (DID) regression model, thereby capturing firm-specific characteristics and time trends. This allows us to focus on how a firm’s time-varying digitalization status relates to changes in supply chain resilience.

We exploit a quasi-natural experiment based on China’s Supply Chain Digital Innovation and Application Pilot to estimate the causal effect of digitalization on resilience. Using a DID estimation strategy, we find that the policy significantly enhances the resilience of firms’ supply chains. This enhancement operates through three primary mechanisms: (1) improved information processing capacity, (2) greater shock absorption and adaptive response, and (3) more efficient inventory turnover. These channels indicate that digital transformation facilitates effective information flows, adaptive operations, and coordinated resource allocation. Furthermore, the effects are more pronounced for firms with geographically dispersed supply chains, flatter supply chain hierarchies, and higher levels of supply chain transparency. This highlights the contingent value of digitalization under structural heterogeneity.

In summary, this study provides empirical evidence, and a mechanism-based explanation for how digital transformation can enhance the resilience of supply chain networks. We argue that digitization lowers the costs associated with acquiring and processing information and enables firms to adopt more agile and responsive strategies in uncertain conditions. This shift helps transform supply chains from reactive systems into proactively managed, resilient networks. While such a transformation requires the gradual accumulation of technological infrastructure and data capabilities, our findings suggest that digitalization ultimately strengthens decision-making flexibility and coordination efficiency. Consequently, both firms and end consumers stand to benefit from more stable, adaptive and sustainable supply systems.

Focusing on the pilot policy’s impact on firms’ node-level resilience, our study contributes new evidence to the literature on digitalization and supply chain management. Unlike prior research that primarily examines production efficiency (Shi et al. 2023), transaction costs (Zhao et al. 2023), or information accessibility (Harju et al. 2023), we analyze how digitalization increases network resilience using firm-level data. Conceptually, we interpret digitalization as enhancing organizations’ information-processing capabilities, thereby extending Organizational Information Processing Theory (OIPT) to dynamic, uncertain, and cross-organizational network settings.

The structure of the remainder of the paper is organized as follows: Section “Related literature and hypothesis development” reviews literature and develops hypothesis; Section “Methodology and data” outlines the empirical research design; Section “Empirical Results” presents the Empirical Results; Section “Conclusion” provides concluding remarks.

Related literature and hypothesis development

Related literature

This study contributes to the literature by leveraging large-scale, objective network data to show how digital technologies enhance firm-level resilience within complex supply-chain systems. Specifically, we show that digital transformation (DT) reshapes the structural foundations of supply-chain resilience (SCR), shedding new light on the mechanisms through which digitalization fosters adaptability and responsiveness in volatile environments. Our research builds upon several key areas of SCR literature while extending prevailing theoretical and methodological assumptions.

A large body of prior research has examined digital technologies as key enablers of resilience, particularly focusing on their capacity to improve visibility (Scholten and Schilder 2015), traceability (Razak et al. 2023) and responsiveness (Kazancoglu et al. 2022). Consistent findings from these studies indicate that technologies such as the Internet of Things (IoT), blockchain, big data analytics and artificial intelligence can significantly enhance a firm’s ability to detect and respond to supply chain disruptions (Qader et al. 2022; Centobelli et al. 2023; Zhao et al. 2023). Much of this research is based on surveys of firms or industries and highlights the importance of information flow and inter-organizational coordination. In the fast-moving consumer goods sector, for instance, Rashid et al. (2025) underscore the institutional role of trust and technological integration in building resilient supply chains that support broader sustainability transitions. However, these studies largely reflect an engineering resilience paradigm, defining resilience as the ability to quickly return to a prior equilibrium following disruption.

A second line of research explores the underlying mechanisms through which DT enhances SCR, focusing particularly on network-level dynamics. Rather than treating resilience as an outcome that cannot be explained, these studies seek to understand how specific digital technologies reshape relationships and configurations between organizations within supply networks (Liao et al. 2023; Choudhary et al. 2021; Rashid et al. 2024a; Zhao et al. 2023; Zamani et al. 2023). For instance, Liao et al. (2023) emphasizes the importance of identifying the pathways through which DT influences green supply chain performance, pointing to a persistent empirical gap. Rashid et al. (2024a) address this gap by providing compelling evidence that externally oriented digital tools play a more transformative role in fostering cross-firm collaboration, agility, and responsiveness than internal IT systems alone. Their findings suggest that digitalization enables fundamental reconfigurations of supply chain structures, including expanded connectivity, greater reach, and enhanced nodal influence across the network, not just incremental efficiency gains. Nevertheless, much of this mechanism-focused research still adopts an engineering-resilience lens, with limited attention to long-term adaptability and systemic transformation.

A third strand of literature examines the relationship between DT and organizational resilience using the theoretical frameworks of OIPT and dynamic capability theory (DCT) (Tushman and Nadler, 1978; Rashid et al. 2024b; Zhu et al. 2018; Zamani et al. 2023; Quayson et al. 2023; Premkumar et al. 2005). These studies conceptualize DT as a means of enhancing a firm’s ability to sense, interpret and respond to environmental volatility — core tenets of both IPT and DCT — rather than merely as a technological upgrade. For example, Dolgui and Ivanov (2022) claim that DT enhance operational continuity by facilitating real-time detection and rapid response, thereby reducing the time lag between identifying risks and acting. Building on this logic, Zamani et al. (2023) and Quayson et al. (2023) contend that AI and big-data tools cultivate dynamic sensing, coordination, and reconfiguration capabilities, which are especially valuable in turbulent contexts. Rashid et al. (2024b) further show that information alignment and supply-chain digitization enable disruption-oriented capabilities: digital visibility combined with targeted information processing helps firms identify weak signals, coordinate responses, and maintain continuity in the face of “black swan” events. These contributions collectively reinforce the view that resilience is not an inherent trait but a capability that is built and exercised through continuous learning, information integration, and adaptive restructuring. While these studies provide strong conceptual support, they remain primarily focused on the firm level and rarely explore resilience as a structural or emergent property of supply chain networks.

Despite growing evidence that DT promotes resilience, two gaps persist. First, most studies rely on subjective, perception-based data and lack large-scale, objective structural analyses. Second, while network aspects are acknowledged, few studies systematically examine how DT reshapes supply-chain topologies or how features such as centrality and redundancy translate into system-level resilience.

To address these limitations, our study takes a complex network approach to digital resilience, based on an empirical analysis of complex supply chain structures. Using transaction-level data on China’s A-share listed firms, we construct inter-firm supply networks and measure key structural features, such as redundancy, out-degree expansion and node centrality. We then evaluate how DT shifts firms’ embeddedness and strategic positions within the network, thereby strengthening access to resources and the capacity to withstand disruptions. Departing from the conventional emphasis on post-disruption recovery, we define SCR as the capacity of a supply chain to adapt and transform as its structure evolves.

By adopting a structural, system-level perspective on SCR, this study contributes to the literature on digital transformation and resilience. It illustrates how digital technologies can reshape supply-chain configurations under uncertainty and offers practical insights for firms in emerging markets seeking to build more adaptable networks.

Institutional background

In recent years, the rapid advance of DT has fundamentally reshaped the structure and operational dynamics of supply chains, transforming them from traditional frameworks to modern, digitally integrated systems. In October 2017, to cultivate new growth engines within these modernized supply chains and to support supply-side structural reforms, the General Office of the State Council of China issued the Guidance on Actively Promoting Supply Chain Innovation and Application. This Guidance is the central government’s first policy paper on supply chains. It emphasizes the pivotal role of digital technologies in ushering in an era of intelligent supply chains and sets out the goal of building sophisticated, data-driven infrastructure.

Building on this Guidance, the Ministry of Commerce and other agencies launched the Supply Chain Innovation and Application Pilot Program in April 2018. From 1359 applicants, the program designated 266 firms and 55 cities as official pilots. The initiative conferred formal policy status, established performance benchmarks, and set explicit mandates for integrating digital technologies such as real-time data platforms, inter-firm information sharing, and process automation, with the objective of constructing intelligent, interoperable, and collaborative digital supply chains. The pilots constitute a plausibly exogenous treatment determined by a centralized selection process.

This study exploits the 2018 pilot program as a quasi-natural experiment to identify the causal impact of supply-chain digitalization on SCR. Treating the pilot as an exogenous shock to firms’ DT, we estimate its impact within a DID framework. Our approach aligns with recent policy-evaluation studies (e.g., Zhong et al. 2025; Zhu and Zhang 2024) that use government-led digital initiatives as natural experiments to assess corporate outcomes. We extend this literature by directly linking policy-induced digitalization to structural resilience measures derived from inter-firm supply-chain networks, thereby offering a mechanism-oriented perspective.

Theoretical framework

Organization information processing theory

Organizational Information Processing Theory (OIPT) explains how organizations acquire, transmit, and process information to cope with uncertainty and complexity (Galbraith 1973). A core premise is that organizations must align information-processing capacity with information-processing requirements imposed by the environment. As environmental complexity rises, traditional hierarchical channels become bottlenecks; delays and distortions in information flows hinder decision-making (Tushman and Nadler 1978).

OIPT identifies two primary approaches to enhance information processing capabilities: first, by improving information processing technology, such as enhancing cross-departmental collaboration and data integration to boost existing efficiency; and second, by reducing information demand, such as optimizing organizational structures or minimizing unnecessary information dependencies (Daft and Lengel 1986). In recent years, advancements in information technology have expanded the applications of OIPT. Digital technologies now provide organizations with real-time information flow and distributed decision-support tools, enabling them to adapt more efficiently to dynamic environments (Premkumar et al. 2005). Consequently, OIPT has become a central lens for understanding how digitalization bolsters organizational resilience, enabling faster sensing, interpretation, and response under volatility (Wamba et al. 2020).

Research hypotheses

In supply-chain networks, firms operate in environments marked by high uncertainty and tight coupling. External shocks—such as pandemics, geopolitical conflicts, and extreme weather—often propagate across nodes, triggering systemic disruptions and cascading effects (Choudhary et al. 2021; Lavassani et al. 2023). OIPT posits that when the information load confronting a firm exceeds its existing processing capacity, slow responses and judgment errors are likely to occur, thereby eroding the firm’s ability to cope with external disturbances (Galbraith 1973; Tushman and Nadler 1978; Premkumar et al. 2005).

Within a supply-chain network, the main sources of information load include heterogeneous customer-demand changes, fluctuations in upstream supply, incomplete or delayed node information, and opaque chain relationships (Zhao et al. 2023). By contrast, information-processing capacity depends on the technological and institutional arrangements a firm employs to acquire, analyses, integrate, and share information—such as real-time data-collection systems, big-data platforms, and platform-based collaboration tools (Rashid et al. 2024b; Zhu et al. 2018; Boone et al. 2019b; Abdel-Basset et al. 2018).

Digital transformation, especially the deployment of blockchain, cloud platforms, the Internet of Things, and intelligent analytics under supply-chain digitization initiatives—greatly expands firms’ information-processing capacity. These technologies enable efficient alignment of information across nodes, heightened inter-organizational transparency, and synchronized upstream-downstream responses within highly complex network structures (Rashid et al. 2024b; Zamani et al. 2023; Wu et al. 2013). Consequently, they narrow the gap between information load and processing capability and strengthen firms’ ability to react swiftly to sudden events (Nasiri et al. 2020; Wamba et al. 2020).

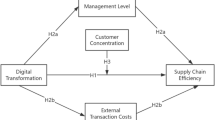

More importantly, digital capabilities are embedded within network structure. A firm’s structural position in the supply-chain networks such as its degree of connectivity, centrality, and structural holes—determines its potential to access information, coordinate resources, and initiate responses (Borgatti and Li 2009; Centobelli et al. 2023). Firms with higher centrality and richer connections possess stronger information-flow and resource-allocation capabilities and are therefore better able to convert digital technologies into organizational adaptability—for instance, by rapidly adjusting inventory policies, redesigning delivery routes, orchestrating alternative supplies (Lin et al. 2023; Wamba et al. 2020; Quayson et al. 2023). From this analysis, we propose hypothesis H1:

H1: The Supply Chain Digitization Pilot improves the resilience of firms in the supply chain network.

According to OIPT, adaptation to environmental uncertainty depends on how effectively an organization processes information. DT increases firms’ capacity to gather, interpret and disseminate information across the supply chain, thereby reducing coordination delays and ambiguity (Premkumar et al. 2005). Enhancements in digital cognition and investments in digital intangible assets are key pathways through which supply-chain digitalization strengthens resilience (Yoo et al. 2010). Based on this analysis, we propose the following hypothesis:

H2a: The Supply Chain Digitization Pilot improves the resilience of firms in the supply chain network by improving their information processing capacity.

Recovery ability is a core dimension of resilience, reflecting a firm’s capacity to return to stable operation after disruption (Sheffi and Rice 2005; DuHadway et al. 2019). From an OIPT perspective, improved processing capacity enables earlier detection and faster coordination. Real-time monitoring and predictive analytics support more efficient disturbance management, improving post-shock recovery trajectories (Ivanov et al. 2019; Brandon-Jones et al. 2014). From this analysis, we propose hypothesis H2b:

H2b: The Supply Chain Digitization Pilot improves the resilience of firms in the supply chain network by improving their recovery ability.

Operational efficiency, especially in inventory management, is another crucial aspect of supply chain resilience (Tang 2006). According to OIPT, DT reduce information delays and improve supply-demand coordination, allowing firms to optimize inventory levels under uncertainty (Srinivasan and Swink 2018). By digitizing inventory processes (e.g., ERP, IoT sensing, AI forecasting), firms achieve faster turnover and more adaptive operations, reinforcing resilience during disruptions (Gölgeci and Kuivalainen 2020; Dubey et al. 2019).

H2c: The Supply Chain Digitization Pilot improves the resilience of firms in the supply chain network by improving inventory turnover efficiency.

Methodology and data

Defining supply chain resilience

SCR captures a firm’s robustness within the supply-chain network and reveals properties of the network’s underlying structure. While traditional network analysis frequently relies on centrality measures like Degree, Betweenness, and Closeness to gauge node importance (Choudhary et al. 2021; Choudhary et al. 2023; Borgatti and Li 2009), this study highlights the value of Weighted Degree Centrality and Weighted Out-Degree Centrality.

We build a directed, weighted supply-chain network using both upstream and downstream relationships. “Directed” edges record the flow of trade from suppliers (upstream) to buyers (downstream). Edge weights capture the share of a supplier’s sales going to a given customer. Within this framework:

-

1.

Weighted Degree Centrality measures how well-connected a firm is, taking into account both the number and the strength of its links. It is calculated as: \({{SCR}}_{i}={\sum }_{j\in {N}_{i}}{w}_{{ij}}\), where \({{SCR}}_{i}\) is the weighted degree centrality of firm \(i\), \({N}_{i}\) represents all the neighboring nodes connected to firm \(i\), and \({w}_{{ij}}\) denotes the weight of the connection between firm \(i\) and firm \(j\). A higher weighted degree suggests that a firm maintains more substantial trade relationships, reflecting a higher capacity to absorb shocks.

-

2.

Weighted Out-Degree Centrality focuses specifically on the strength of outbound connections to downstream customers. It captures the extent to which a firm supports certain key customers and is calculated as: \({{Out}}_{i}={\sum }_{j\in {N}_{i}^{{Out}}}{w}_{{ij}}\), where \({{Out}}_{i}\) is the weighted out-degree centrality of firm \(i\), \({N}_{i}^{{Out}}\) represents all the downstream nodes connected to firm \(i\), and \({w}_{{ij}}\) is the weight of the directed edge from firm \(i\) to firm \(j\). A high weighted out-degree indicates that a firm’s resilience is closely tied to a larger number of key partners, potentially increasing its resilience by diversifying trade relationships. The details of data integration, entity matching, and edge-weight construction are provided in Supplementary Appendix B.1.

We prioritize these weighted measures because path-based metrics like betweenness or closeness assume dense connectivity and shortest-path relevance—conditions often violated in real-world supply chains. Many firms are not “bridges,” and sparse or modular structures limit the interpretability of path metrics. By incorporating direction and weight, weighted degree and weighted out-degree yield a more nuanced and practical assessment of firm-level resilience in diverse, partially connected supply-chain networks.

Research design

We exploit the quasi-exogenous shock created by China’s Supply Chain Innovation and Application Pilot Program to identify the causal effect of digital transformation on SCR. As outlined in the Guidance on Actively Promoting Supply Chain Innovation and Application (October 2017), the policy provided a national-level mandate to accelerate digital integration within supply chains. The Ministry of Commerce operationalized this directive in April 2018 by officially designating 55 cities and 266 firms as pilot participants. The selection process was centrally administered and based on predefined criteria, rendering the treatment assignment plausibly exogenous to individual firm outcomes. Accordingly, we implement the following DID model:

In the specification, \(i\) and \(t\) represent the firm and the year, respectively. The dependent variable \({{SCR}}_{i,t}\) and \({{Out}}_{i,t}\) measures firm-level network resilience using Weighted Degree Centrality and Weighted Out-Degree Centrality.

\({{Treat}}_{i}\) equals 1 if the firm is in one of the 55 pilot cities officially approved by the Ministry of Commerce in 2018, and 0 otherwise. The post-policy indicator \({{Post}}_{t}\) takes the value of 1 in 2018 and all subsequent years, and 0 prior to policy launch. Firm fixed effects \({\mu }_{i}\) and year fixed effects \({\delta }_{t}\) are included to control for time-invariant firm characteristics and common macroeconomic shocks, respectively. The idiosyncratic error term is \({\varepsilon }_{i,t}\).

The control vector \({{Control}s}_{i,t}^{k}\) include: (1) Return on Assets (\({ROA}\)), to control the impact of firm profitability; (2) Leverage Ratio (\({Lev}\)), to capture the impact of financial structure on firm performance; (3) \({TobinQ}\), to capture the market’s expectations for the firm’s future growth; (4) Growth Rate (\({Growth}\)), to capture the impact of internal drivers of firm growth; (5) Listing Age (\({ListAge}\)), to capture the impact of different stages of firm development. Additionally, following Lins et al. (2017), we have included control variables that reflect firm governance capabilities: Board size (\({Board}\)), a dummy variable for audit by one of the Big Four accounting firms (\({Big}4\)), and a dummy variable for independent directors is assigned a value of 1 to indicate the presence of independent directors on a board, and a value of 0 to indicate their absence. (\({Indep}\)).

Endogeneity issue

As previously discussed, the selection of pilot cities for supply chain digitalization is non-random, raising concerns of endogeneity in Eq. (1). To address this, we employ an instrumental variable (IV) approach. Specifically, we construct an interaction between a city’s standard deviation of elevation (capturing terrain variation) and a pilot policy dummy (equal to 1 in the year and subsequent years the policy is implemented).

Intuitively, this instrumental variable is highly correlated with the supply chain digitalization pilot and is unlikely to directly affect the dependent variable, thus satisfying the requirements for instrument validity (i.e. relevance and exogeneity).

Relevance

Terrain variation affects infrastructure complexity and the marginal cost of digital rollout, features plausibly considered in central selection, so it should covary with pilot adoption intensity. Prior work shows that topography is a first-order constraint on digital infrastructure deployment (Röller and Waverman 2001; Czernich et al. 2011).

Exogeneity

Elevation variation is a time-invariant geographic characteristic that is plausibly orthogonal to firm-level unobservable directly driving SCR. Conditional on rich fixed effects and controls (e.g., economic development, industry mix), its only channel to SCR should be via the policy exposure. This identification logic follows the geography-as-instrument tradition (Dell et al. 2012).

Sample selection

Firm-level data are drawn from CSMAR. We apply the following filters: (1) firms in the financial sector were excluded; (2) firms with the designations ST, *ST, or PT, indicating abnormal financial conditions during the sample period, had their data for those years excluded; (3) any samples lacking the primary variables under investigation were removed; (4) winsorize all continuous variables at the 1st and 99th percentiles to limit outlier influence.

Table 1 reports descriptive statistics for 7514 firm-year observations. The mean and standard deviation of the primary explanatory variable \({SCR}\) (\({Out}\)) are 0.16 (0.08) and 0.29 (0.21), respectively. The substantial difference between the maximum and minimum values indicates significant fluctuations in \({SCR}\) (\({Out}\)) over the sample period.

Empirical results

Regression-based DID

Table 2 presents the results of a DID estimation model analyzing the impact of supply chain digitalization pilots on the resilience and out-degree of nodes in the supply chain network. Columns (1) and (2) indicate that the impact of the supply chain digitalization pilots on the network nodes’ centrality is statistically significant. Specifically, conditioning on controls, the estimated coefficient implies an increase of 0.032 in weighted degree for firms in pilot cities relative to non-pilot cities (column (2)). Given that the average pre-treatment resilience of the supply chain network in pilot cities was 0.16 (based on sample means), the estimated coefficient of 0.032 implies an ~20% relative increase in resilience (0.032/0.16), significant at the 95% confidence level.

Furthermore, results in columns (3) and (4) indicate that this increase is primarily driven by a rise in out-degree, which accounts for over 34% of the total centrality change and is statistically significant at the 99% confidence level. However, due to potential issues of endogenous, the estimates in Table 2 might be biased. We therefore turn to an IV approach in Section “IV method”.

IV method

To correct the estimation bias in the DID model, we adopted the instrumental variable method. The constructed instrumental variable is the interaction term between the standard deviation of city altitudes (\({altitude}\)) and the dummy variable for cities piloting supply chain digitization. The rationality of this instrumental variable has been fully justified in the previous text. Here, its effectiveness is tested. In terms of relevance, columns (1) and (2) of Table 3 report the first-stage regression results of the instrumental variable method. The results show that the instrumental variable is highly positively correlated with the supply chain digitization pilot dummy variable, meeting the relevance requirement (the Kleibergen–Paap rk Lm statistic values provided in Table 3 are all above 10, indicating no weak instrumental variable issue); moreover, the results are consistent with our expectations—that implementing pilot, cities with flatter terrain are more likely to be selected as pilot cities.

Regarding exogeneity, as previously pointed out, the probability that this instrumental variable directly affects the centrality of supply chain network nodes, other than through influencing the supply chain digitization pilot dummy variable, is small, thus satisfying the condition for the exogeneity of the instrumental variable. To verify this, our study follows the method of Dinkelman (2011), constructing a placebo test. We took the period from 2010 to 2017, when supply chain digitization pilots had not yet been implemented, as the sample period and included the interaction term between the standard deviation of city altitudes and the supply chain digitization pilot dummy variable in regression Eq. (1). If this interaction term satisfies the condition of exogeneity, i.e. it only affects the dependent variable by influencing the selection of pilot cities and does not have a direct impact on the dependent variable, then during the years from 2010 to 2017, when pilot had not yet been implemented, it should have no significant effect on the dependent variable. Columns (7) and (8) of Table 3 show that the coefficient of this interaction term is small and statistically insignificant, indicating that the instrumental variable satisfactorily meets the condition of exogeneity.

After ensuring the validity of the instrumental variable, we present the estimation results of the instrumental variable method in Table 3. Consistent with the estimation results of the DID model, the supply chain digitization pilot has a significant positive impact on the centrality of supply chain network nodes, but the absolute value of the impact coefficient is larger. This suggests that the endogeneity problem tends to cause a downward bias in the estimation results. Specifically, after effectively correcting for endogeneity, the supply chain digitization pilot led to a 33.4% increase in the pilot of firms in pilot cities (see column (4) of Table 3) and a 60% increase in out-degree (see column (6) of Table 3). Therefore, the supply chain digitization pilot significantly enhanced the \({SCR}\) of firms in pilot cities, consistent with the original intent of the pilot. At the same time, it also increases the influence of these firms in the supply chain network (see columns (5) and (6) of Table 3). These findings support H1.

Dynamic analysis

The parallel trend assumption is one of the fundamental conditions for applying the DID method. In this study, following the approach of Jacobson et al. (1993), we employ an event study that spans from three years before to three years after the event, using the year prior to the event as the base year. This analysis reinforces the argument that the supply chain digitalization pilot serves as an external shock for the firm, making it unlikely that our results are influenced by reverse causality. We construct the model as follows:

Where, \({{Treat}}_{i}\) is a dummy variable used to classify firms into treatment and control groups; \({T}_{i,u}\) represents a series of time dummy variables. We set the year when the treatment group cities first launched the policy during the sample period as period 0. For each year that is the \(u\) period relative to the treatment cities’ policy launch, \({T}_{i,u}\) takes a value of 1; otherwise, it is 0. The coefficients of interest are \({\beta }_{-3}\), \({\beta }_{-2}\), and \({\beta }_{-1}\). If there were any nonparallel trends between the treatment and control groups, then we would obtain statistically significant estimates of \({\beta }_{-3}\), \({\beta }_{-2}\), and \({\beta }_{-1}\).

We report the dynamic DID results in Table 4. Consistent with the parallel trend assumption, the coefficients of \({\beta }_{-3}\), \({\beta }_{-2}\), and \({\beta }_{-1}\) are not statistically significant in all regressions. This also implies that the positive effect of participation in supply chain digitalization pilots on supply chain resilience is unlikely to result from policymakers selectively including firms based on pre-existing or expected differences in supply chain resilience between treated and control firms. Thus, it helps address the reverse causality concern and further strengthens our previous findings. Moreover, by examining the coefficients associated with post-event time dummies, we find that the positive effect of supply chain digitalization pilots generally begins to materialize in the second year (column (1)) and persists beyond. This is consistent with our hypothesis that improvements in supply chain resilience, driven by digitalization efforts, take time to manifest as firms adapt and integrate digital technologies into their supply chain operations.

Meanwhile, the dynamic coefficients in Table 4 enable us to distinguish between short-term adaptive responses and long-term structural effects. In the first year after the policy was introduced (\({T}_{1}\)), the impact already becomes apparent—especially for the output-based resilience measure (column (2))—indicating that treated firms initiated preliminary adaptive adjustments. Notably, the coefficients continue to rise and reach statistical significance in the second and third years (\({T}_{2}\) and \({T}_{3}\)) for both the SCR and output measures. This growing effect over time suggests that the policy’s influence is far from transitory; instead, it reflects a sustained, structural enhancement of supply-chain resilience, likely driven by the progressive build-up of digital infrastructure and the deepening of inter-organizational coordination mechanisms.

We also provide a graphical illustration of the relative changes in supply chain resilience between the treated and control groups around the initiation of the supply chain digitalization pilot. We plot the coefficients of the interaction terms between the treatment dummy and time dummies estimated from regression Eq. (2).

Figure 2 shows the estimated coefficients and 95% confidence intervals from the dynamic analysis. The results indicate that before the implementation of the policy, the estimated coefficients of the interaction terms remained relatively stable, suggesting no significant statistical differences in \({SCR}\)(\({Out}\)) between the treatment and control groups. After the implementation of the policy, however, the \({SCR}\) (\({Out}\)) of firms in the treatment group exhibited a clear upward trend. Overall, our findings demonstrate that dynamic analysis supports our model.

Heterogeneity analysis

In this subsection, we examine the potential mechanisms through which supply chain digitization enhances resilience. Theoretically, if digitization policies foster greater resilience—by promoting better data integration, advanced monitoring capabilities, and improved adaptability, then their impact should be stronger under conditions that favor the absorption of these benefits. Specifically, we focus on three potential channels: (1) geographical distribution diversity of the supply chain, (2) hierarchy of supply chain, and (3) operations transparency of supply chain. To test these proposed channels, we use the following regression equation:

Where, \({{SCR}}_{i,t}\), \({{Treat}}_{i}\), and \({{Control}s}_{i,t}^{k}\) are the same as in Eq. (1). \({{Post\_H}}_{i,t}\) and \({{Post\_L}}_{i,t}\) are indicator variables equal to 1 if firm \(i\)’s value of the grouping variable is above or below the cross-sectional average prior to the policy, respectively, and 0 otherwise. These group indicators are used in Eq. (3) to examine the heterogeneous effects across high and low groups. These high and low groups are based on the three partition variables: geographical distribution diversity of supply chain, supply chain hierarchy, and operational transparency. By comparing the differences in resilience outcomes between these groups, we aim to identify which conditions amplify or attenuate the positive effects of supply chain digitization.

The role of geographic dispersion of supply chain

de Moura et al. (2021) highlighted that dispersed supply chains rely on the integration of operational technology (OT) and information technology (IT). Digitization enhances transparency and responsiveness through real-time data sharing, converting data from dispersed facilities into valuable information, optimizing logistics, production, and inventory management, and thus mitigating complexity and enhancing supply chain resilience. We use whether a firm has cross-province subsidiaries to measure the geographical dispersion of its supply chain. Based on the cross-province subsidiaries, firms are divided into high and low groups, defined as \({Post\_H}\) and \({Post\_L}\), respectively. We then analyze the changes in firms’ supply chain resilience using Eq. (3), with the results presented in Table 5.

The results show that supply chain digitization policies significantly enhance \({{SCR}}_{i,t}\) and \({{Out}}_{i,t}\) for firms with higher geographical dispersion (\({Post\_H}\)), with positive and significant coefficients for \({Treat}\times P{ost\_}H\) (0.034, p < 0.05 in column (1); 0.033, p < 0.01 in column (2)). In contrast, the coefficients for \({Treat}\times P{ost\_}L\) are small and not significant. The significant differences between the two groups, as shown by \({Treat}\times ({Post\_H}-{Post\_L})\) (0.034, p < 0.1 in column (1); 0.028, p < 0.1 in column (2)), suggest that digitization policies are particularly effective for firms with dispersed supply chains.

The role of hierarchy of supply chain

Following the methodology of Hu et al. (2022), we employ social network analysis techniques to determine each firm’s hierarchical position within the supply chain. Specifically, this approach assigns a metric, referred to as the hierarchical value, to each firm. The hierarchical value reflects a firm’s position in the supply chain network and its susceptibility to demand fluctuations.

Theoretically, firms with lower hierarchical values, those closer to the end consumer, are more likely to directly benefit from the adoption of supply chain digitization technologies. This is because digitization enhances information transparency and real-time responsiveness, enabling downstream firms to manage inventory, address fulfillment pressures, and adapt to market fluctuations more effectively, thereby significantly enhancing supply chain resilience.

To determine the hierarchical value, we first identify the outermost firms in the supply chain network, those without any suppliers of their own. These firms, which are closest to the end consumer, are assigned a hierarchical value of 1. These firms are then removed from the network, and the structure is reevaluated. The firms that emerge as the new outermost layer after this removal are assigned a hierarchical value of 2. This iterative process continues until every firm in the network is assigned a hierarchical value, reflecting its position relative to the ultimate consumer.

Based on hierarchical values, we classify firms into two groups: \({Post\_H}\) and \({Post\_L}\). Firms in the \({Post\_H}\) group have lower hierarchical values, meaning they are closer to the end consumer, while firms in the \({Post\_L}\) group have higher hierarchical values, indicating their position further upstream in the supply chain. This classification allows us to analyze the differentiated impact of digitization policies on firms at varying hierarchical levels within the supply chain. We then analyze the changes in supply chain resilience using Eq. (3), with the results presented in Table 6.

The results indicate that supply chain digitization policies significantly enhance \({{SCR}}_{i,t}\) and \({{Out}}_{i,t}\) for firms closer to the end consumer (\({Post\_H}\)), while having little to no significant impact on firms further upstream (\({Post\_L}\)). The coefficients for \({Treat}\times {Post\_H}\) are positive and highly significant (0.060, p < 0.01 in column (1); 0.046, p < 0.01 in column (2)), suggesting that firms in the \(P{ost\_H}\) group benefit significantly from digitization policies. In contrast, the coefficients for \({Treat}\times P{ost\_}L\) are small and not significant for \({{SCR}}_{i,t}\) (0.010, p > 0.1 in column (1)) and only marginally significant for \({{Out}}_{i,t}\) (0.016, p < 0.1 in column (2)). These findings highlight that supply chain digitization policies have a more pronounced effect on firms positioned closer to the end consumer.

The role of operation transparency of supply chain

Corporate transparency enhances supply chain resilience by facilitating smooth information flow and collaboration among partners (Liu et al. 2024a). High transparency helps in the rapid identification and communication of risks (Wong et al. 2011), reduces uncertainty, and fosters trust through informal collaboration, minimizing reliance on independent risk management practices (Bubicz et al. 2019). This environment of trust and collaboration enables the supply chain to respond more effectively to disruptions and improves its recovery capability (Wieteska 2020).

Following Sodhi and Tang (2019) and Hutton et al. (2009), we measure corporate transparency based on firms’ disclosures related to supply chains (SCT) and financial reporting (Opaque). Specifically, SCT represents the proportion of transaction value with major suppliers and customers whose names are explicitly disclosed in annual reports, relative to the total transaction value of the top five suppliers and customers. Opaque, in line with Hutton et al. (2009), is proxied by the magnitude of earnings management, measured using discretionary accruals estimated from a modified Jones model. Greater discretionary accruals reflect higher financial opacity due to reduced reliability of reported earnings.

Based on the level in the sample, companies are divided into high transparency and low transparency groups, defined as \({Post\_H}\) and \({Post\_L}\), respectively. We then analyze the changes in supply chain resilience using Eq. (3), with the results presented in Table 7.

Columns (1) and (2) present results based on firms’ supply chain transparency. We find that supply chain digitization policies significantly enhance both \({{SCR}}_{i,t}\) and \({{Out}}_{i,t}\) for firms with higher supply chain transparency, with effect sizes of 0.072 and 0.054, respectively (both significant at the 1% level). In contrast, the impact is notably weaker for firms with lower transparency—0.011 (not significant) for \({{SCR}}_{i,t}\) and 0.019 (\(p < 0.1\)) for \({{Out}}_{i,t}\) The difference between high and low transparency groups is statistically significant, as indicated by the interaction term \({Treat}\times (P{ost\_H}-P{ost\_}L\)), with effect sizes of 0.061 (\(p < 0.01\)) and 0.034 (\(p < 0.05\)), respectively.

Columns (3) and (4) report results based on financial reporting transparency. Again, the policy effect is more pronounced among firms with greater transparency in financial disclosures. High-transparency firms exhibit significant improvements in both \({{SCR}}_{i,t}\) (0.032, \(p < 0.05\)) and \({{Out}}_{i,t}\) (0.032, \(p < 0.01\)), whereas the effects for low-transparency firms are negative and statistically insignificant. The interaction term capturing the differential effect, \({Treat}\times (P{ost\_H}-P{ost\_}L\)) shows a significant gap of 0.040 (\(p < 0.1\)) for \({{SCR}}_{i,t}\) and 0.043 (\(p < 0.01\)) for \({{Out}}_{i,t}\)

These findings consistently suggest that transparency serves as an important amplifier of the policy’s effectiveness. Specifically, after the policy implementation, high-transparency firms improved their supply chain resilience more significantly than low-transparency firms, highlighting the amplifying role of transparency in enhancing the effectiveness of supply chain digitization policies.

Mechanism analysis

Next, we further investigate the mechanism through which supply-chain digitalization policies enhance supply-chain resilience. Section “Theoretical framework” has already provided a comprehensive theoretical discussion; therefore, this section concentrates on examining how the digitalization pilot policy affects the key mechanism variables. To that end, we specify the following regression model:

where \({M}_{i,t}\) represents the mechanism variables of supply-chain resilience, including dimensions such as recovery capability and operational efficiency; \({{Treat}}_{i}\times {{Post}}_{t}\) is a dummy variable that equals one for firms covered by the digital-transformation pilot policy. The definitions of the remaining covariates are identical to those in the baseline regression. This model is designed to test whether the pilot program indirectly enhances firms’ supply-chain resilience by improving their information-processing capacity and recovery capability.

Information processing capacity

Based on the definition provided in Premkumar et al. (2005), which assesses information processing capacity as “the level of information technology support for various activities in the procurement life cycle,” we use digital information disclosure (\({Digital\_dis}\)) and digital intangible assets (\({Digital\_asset}\)) as proxies. Digital information disclosure through MD&A reflects the cognitive framing and agenda-setting function of top management regarding digital strategies, while digital intangible assets more directly indicate a firm’s operational capacity to manage high volumes of supply chain information efficiently.

First, \({Digital\_dis}\) captures the salience of digital strategies in top management narratives by analyzing the MD&A sections of annual reports issued by publicly listed firms. We identify and count the frequency of digitalization-related terms—such as “digital transformation,” “blockchain,” “cloud computing,” “big data,” “AI,” “platform,” and “smart manufacturing”—and normalize this count by the total word count of the MD&A to account for variation in document length. Second, \({Digital\_asset}\) reflects a firm’s internal investment in digital capabilities. We extract the year-end value of intangible assets from the financial report footnotes that include keywords such as “software,” “network,” “client,” “management system,” “intelligent platform,” or digital-related patents. These components are aggregated and log-transformed to produce a firm-level digitalization indicator. All identified items undergo manual verification to ensure consistency with digital transformation efforts. We then examine the mechanism through which supply-chain digitalization policies influence supply chain resilience by estimating Eq. (4), with the results reported in Table 8.

The results reported in Table 8 provide empirical support for H2a, which suggests that pilot policy enhance firms’ information processing capacity. Specifically, column (1) shows that the coefficient on \({Digital\_dis}\) is statistically significant. (coefficient = 9.875, \(p < 0.01\)), indicating that managers in pilot firms placed greater emphasis on digital transformation in their strategic communications. Column (2) shows that the coefficient on \({Digital\_asset}\) is also statistically significant (coefficient = 3.275, p < 0.01), suggesting greater investment in internal IT infrastructure. Together, these results confirm that the policy intervention bolstered the cognitive and technical dimensions of firms’ information processing capability, thereby validating H2a.

Recovering capability

Based on the conceptual framework established by DuHadway et al. (2019) and Sheffi and Rice (2005), we define recovery ability as a firm’s capacity to return to expected operational performance following a disruption. Specifically, we measure this construction using the natural logarithm of the residual from a firm-level performance regression, where the residual captures deviations from expected outcomes and thus reflects latent recovery capability. We then examine the mechanism through which supply-chain digitalization policies influence supply chain resilience by estimating Eq. (4), with the results reported in Table 9.

Consistent with H2b, the results in Column (1) of Table 9 confirm that pilot policy significantly enhances firm’s recovery ability. The estimated coefficient on the treatment indicator is positive and significant at the 5% level, indicating that pilot firms are better able to respond to and recover from operational disruptions after policy. This supports the argument that digital technologies improve firms’ supply chain resilience by enabling faster recovery capability.

Inventory turnover efficiency

Following operational literature, inventory turnover efficiency reflects a firm’s capacity to align supply with demand and respond swiftly to market fluctuations. It is calculated as the natural logarithm of the inventory turnover ratio, where:

This metric captures how frequently a firm replenishes its inventory over a given period. Higher turnover indicates more efficient inventory utilization, and less capital tied up in stock, which contributes to enhanced operational agility and supply chain resilience. We then examine the mechanism through which supply-chain digitalization policies influence supply chain resilience by estimating Eq. (4), with the results reported in Table 9.

The findings in Column (2) support H2c, showing that pilot policy improves inventory turnover efficiency. The positive significant coefficient suggests that firms in the pilot program manage inventory more effectively post-policy. This lends empirical support to the theoretical expectation that digital infrastructure improves information flow and forecasting accuracy, which in turn facilitates learner and more responsive inventory management practices.

Robust test

Excluding omitted variable bias

To ensure the credibility of our baseline conclusions, we conduct a series of robust tests addressing potential sources of bias. First, to mitigate the influence of unobserved heterogeneity at the regional and sectoral levels, we incorporate fixed effects for cities and industries. This approach controls for time-invariant characteristics that may simultaneously affect a firm’s supply chain centrality and its likelihood of being selected for digital transformation pilots, thus helping isolate the net effect of the policy intervention.

Second, to reduce potential omitted variable bias at the firm level, we include a comprehensive set of control variables informed by prior literature. Specifically, we account for SOE status, given that state-owned enterprises tend to differ in resource access and strategic priorities (Musacchio and Lazzarini 2014); high-tech designation, which reflects innovation capacity and technological adaptability (Kamalahmadi and Parast 2016); and the volume of digital-related patents, a proxy for internal digital capability (Ivanov 2021). Additionally, we control firm age (Tang 2006), CEO gender (Faccio et al. 2016), overseas managerial experience (Nielsen and Nielsen 2013), and academic background (Zhang and Rajagopalan 2004), all of which may influence firms’ risk management behavior and responsiveness to digital initiatives. By accounting for these factors, we strengthen the credibility of our identification strategy and bolster the robustness of our empirical findings.

Across columns (1)–(4) of Table 10, coefficients on the pilot indicator remain positive and statistically significant, and magnitudes are very similar to the baseline, indicating strong robustness.

Excluding selection bias

Second, we also try to use other methods to correct the endogenous selection bias problem to test the reliability of the baseline conclusions. Specifically, this paper adopts the PSM-DID method: firstly, based on the mean data of the matching variables of the sample cities before the pilot implementation (2010–2017), the propensity score is estimated using the Probit model; then, the treated group (sample cities that have implemented the pilot by 2018) and the control group (sample cities that have not implemented the pilot) are matched using the 1-to-1 nearest neighbor matching method; then, based on the panel data of the matched sample counties from 2010 to 2021, the pilot effect is estimated using the DID method.

Supplementary Appendix Table A2 reports pre- vs. post-match t-tests of covariate balance; Supplementary Appendix Fig. A.1 presents covariance-balance plots. Post-matching standardized biases lie well below the 10% threshold and cluster near zero, indicating satisfactory balance. As shown in columns (1)–(4) of Table 11, the PSM–DID estimates remain positive and significant, closely tracking the baseline results and supporting robustness to selection on observables.

Placebo test

To further verify the validity of our baseline estimates, we conduct a placebo test based on the permutation approach proposed by Abadie et al. (2010). Specifically, we randomly reassign the treatment indicator, \({{Treat}}_{i}\times {{Post}}_{t}\), 500 times. After each reshuffle, we re-estimate the DID model, recording the coefficient, its standard error, and the degrees of freedom, while continuing to control for firm characteristics as well as industry, year, and firm fixed effects.

We then plot the empirical distribution of the 500 placebo coefficients alongside the null line (\(\beta =0\)) and the actual DID estimate (dashed line). In Fig. 3 (\({SCR}\) as outcome) and Fig. 4 (Out as outcome), the vast majority of placebo coefficients cluster tightly around zero, with only a small fraction approaching the observed estimate (\(\beta =0.031\) in Fig. 3; \(\beta =0.032\) in Fig. 4). This pattern indicates that the main results are unlikely to be driven by random assignments or model artifacts.

This figure presents the results of 500 placebo simulations where the treatment indicator is randomly reassigned. The scatterplot shows simulated p-values against estimated treatment effects, while the kernel density on the right axis illustrates the distribution of β. The black solid line marks the null hypothesis (β = 0), and the red dashed line indicates the actual estimate from the main regression (β = 0.031). The concentration of simulated estimates around zero, with the actual estimate lying in the far tail, supports the robustness of the policy effect.

This figure presents the results of 500 placebo simulations where the treatment indicator is randomly reassigned. The scatterplot shows simulated p-values against estimated treatment effects, while the kernel density on the right axis illustrates the distribution of β. The black solid line marks the null hypothesis (β = 0), and the red dashed line indicates the actual estimate from the main regression (β = 0.032). The concentration of simulated estimates around zero, with the actual estimate lying in the far tail, supports the robustness of the policy effect.

Conclusion

In the digital era, the ability to acquire, process, and coordinate information has become a core determinant of supply-chain resilience. Using a causal identification strategy, this study shows that China’s supply-chain digitalization pilot program significantly strengthens the resilience of firms embedded in supply-chain networks, primarily through structural changes such as greater connectivity and centrality. Anchored in OIPT, we argue that this effect operates through three interrelated mechanisms: enhanced information processing capacity enabled by digital asset investment, improved recovery ability in response to disruptions, and greater inventory turnover efficiency that facilitate operational flexibility across the supply chain.

While our findings highlight the positive impact of digitalization on enhancing supply chain resilience, it is important to acknowledge the emerging risks associated with digital transformation. As firms increasingly rely on digital infrastructure, they also become more vulnerable to cyberattacks, data breaches, and algorithmic failures, which may compromise operational stability and introduce new forms of systemic risk (Ivanov and Dolgui 2020). These risks are particularly salient in highly interconnected supply chain networks, where disruptions can propagate rapidly through digital channels. Although we do not explicitly model digital risks, the observed resilience gains should be interpreted alongside the need for robust digital governance, cybersecurity protocols, and adaptive risk-management frameworks. Future research should more systematically examine trade-offs between digital integration and digital vulnerabilities to support evidence-based policymaking.

Several limitations nevertheless merit acknowledgement. First, the observed policy effects may reflect a certain degree of temporal lag. As supply chain digitalization often requires time for infrastructure deployment, capability building, and organizational adaptation, the short-term impact may appear muted while medium- to long-term effects become more pronounced. Our data covers a relatively limited post-treatment period; thus, future research could revisit this question with extended panel data to better capture the full trajectory of policy impact over time. Second, we focus on structural indicators of resilience and do not directly measure response speed, cost efficiency, or recovery time—dimensions future research could capture using firm-level operational data. Third, our sample is restricted to A-share listed companies in China, which may limit the generalizability of our findings to small firms, informal suppliers, or regions with different institutional settings. Four, although our analysis is grounded in OIPT, a deeper exploration of how digital tools reshape internal routines and decision heuristics remains an important theoretical avenue. Finally, our study uses an exogenous policy shock to identify the effect of digitalization on supply chain resilience. We acknowledge that future research focusing on firm-level digital adoption may face reverse causality concerns, which more resilient firms might be more likely to invest in digital technologies. Although policy assignments in our setting mitigate this risk, future studies should further address this potential endogeneity.

Data availability

Data will be made available on request.

References

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s tobacco control program. J Am Stat Assoc 105(490):493–505

Abdel-Basset M, Manogaran G, Mohamed M (2018) Internet of Things (IoT) and its impact on supply chain: a framework for building smart, secure and efficient systems. Future Gener Comput Syst 86(9):614–628

An S, Gu Y, Pan L, Yu Y (2024) Supply chain digitalization and firms’ green innovation: evidence from a pilot program. Econ Anal Policy 84:828–846

Boone CA, Skipper JB, Hazen BT (2019a) A framework for investigating the role of big data in service parts management. J Bus Logist 40(4):348–359

Boone T, Ganeshan R, Jain A, Sanders NR (2019b) Forecasting sales in the supply chain: consumer analytics in the big data era. Int J Forecast 35(1):170–180

Borgatti SP, Li X (2009) On social network analysis in a supply chain context. J Supply Chain Manag 45(2):5–22

Brandon-Jones E, Squire B, Autry CW, Petersen KJ (2014) A contingent resource‐based perspective of supply chain resilience and robustness. J Supply Chain Manag 50(3):55–73

Bubicz ME, Barbosa-Póvoa APFD, Carvalho A (2019) Incorporating social aspects in sustainable supply chains: trends and future directions. J Clean Prod 237:117500

Büyüközkan G, Göçer F (2018) Digital supply chain: literature review and a proposed framework for future research. Comput Ind 97:157–177

Centobelli P, Cerchione R, Maglietta A, Oropallo E (2023) Sailing through a digital and resilient shipbuilding supply chain: an empirical investigation. J Bus Res 158:113686

Choudhary NA, Ramkumar M, Schoenherr T, Rana NP (2021) Assessing supply chain resilience during the pandemic using network analysis. IEEE Trans Eng Manag 71:12297–12310

Choudhary NA, Ramkumar M, Schoenherr T, Rana NP, Dwivedi YK (2023) Does reshoring affect the resilience and sustainability of supply chain networks? The cases of Apple and Jaguar Land Rover. Br J Manag 34(3):1138–1156

Cui Y, Gaur V, Liu J (2023) Supply chain transparency and blockchain design Manag Sci 70(5):3245–3263

Czernich N, Falck O, Kretschmer T, Woessmann L (2011) Broadband infrastructure and economic growth. Econ J 121(552):505–532

Daft RL, Lengel RH (1986) Organizational information requirements, media richness and structural design. Manag Sci 32(5):554–571

Dell M, Jones BF, Olken BA (2012) Temperature shocks and economic growth: evidence from the last half century. Am Econ J Macroecon 4(3):66–95

de Moura RL, Gonzalez A, Franqueira VNL, Neto ALM, Pessin G (2021) Geographically Dispersed Supply Chains: A Strategy to Manage Cybersecurity in Industrial Networks Integration. In: Daimi K, Peoples C (eds) Advances in Cybersecurity Management. Springer, Cham

Dey PK, Chowdhury S, Abadie A, Vann Yaroson E, Sarkar S (2023) Artificial intelligence-driven supply chain resilience in Vietnamese manufacturing small-and medium-sized enterprises. Int J Prod Res 62:5417–5456

Dubey R, Gunasekaran A, Childe SJ, Blome C, Papadopoulos T (2019) Big data and predictive analytics and manufacturing performance: integrating institutional theory, resource‐based view and big data culture. Br J Manag 30(2):341–361

DuHadway S, Carnovale S, Hazen B (2019) Understanding risk management for intentional supply chain disruptions: risk detection, risk mitigation, and risk recovery. Ann Oper Res 283:179–198

Dinkelman T (2011) The effects of rural electrification on employment: new evidence from South Africa. Am Econ Rev 101(7):3078–3108

Dolgui A, Ivanov D (2022) 5G in digital supply chain and operations management: fostering flexibility, end-to-end connectivity and real-time visibility through internet-of-everything. Int J Prod Res 60(2):442–451

Faccio M, Marchica MT, Mura R (2016) CEO gender, corporate risk-taking, and the efficiency of capital allocation. J Corp Financ 39:193–209

Feng B, Zheng M, Shen Y (2024) The effect of relational embeddedness on transparency in supply chain networks: the moderating role of digitalization. Int J Oper Prod Manag 44:1621–1648

Galbraith JR (1973) Designing Complex Organizations. Addison-Wesley, Reading, MA

Gölgeci I, Kuivalainen O (2020) Does social capital matter for supply chain resilience? The role of absorptive capacity and marketing-supply chain management alignment. Ind Mark Manag 84:63–74

Harju A, Hallikas J, Immonen M, Lintukangas K (2023) The impact of procurement digitalization on supply chain resilience: empirical evidence from Finland. Supply Chain Manag Int J 28(7):62–76

Hu N, Liang P, Liu L, Zhu L (2022) The bullwhip effect and credit default swap market: a study based on firm-specific bullwhip effect measure. Int Rev Financial Anal 84:102386

Hutton AP, Marcus AJ, Tehranian H (2009) Opaque financial reports, R2, and crash risk. J Financial Econ 94(1):67–86

Ivanov D, Dolgui A (2020) Viability of intertwined supply networks: extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. Int J Prod Res 58(10):2904–2915

Ivanov D, Dolgui A, Sokolov B (2019) The impact of digital technology and Industry 4.0 on the ripple effect and supply chain risk analytics. Int J Prod Res 57(3):829–846

Ivanov D (2021) Digital supply chain management and technology to enhance resilience by building and using end-to-end visibility during the COVID-19 pandemic. IEEE Trans Eng Manag 71:10485–10495

Jacobson LS, LaLonde RJ, Sullivan DG (1993) Earnings losses of displaced workers. Am Econ Rev 83(4):685–709

Kamalahmadi M, Parast MM (2016) A review of the literature on the principles of enterprise and supply chain resilience: major findings and directions for future research. Int J Prod Econ 171:116–133

Kazancoglu I, Ozbiltekin-Pala M, Mangla SK, Kazancoglu Y, Jabeen F (2022) Role of flexibility, agility and responsiveness for sustainable supply chain resilience during COVID-19. J Clean Prod 362:132431

Lavassani KM, Boyd ZM, Movahedi B, Vasquez J (2023) Ten-tier and multi-scale supply chain network analysis of medical equipment: random failure and intelligent attack analysis. Int J Prod Res 61(24):8468–8492

Liao F, Hu Y, Chen M, Xu S (2023) Digital transformation and corporate green supply chain efficiency: evidence from China. Econ Anal Policy 81:195–207

Lin J, Lin S, Benitez J, Luo XR, Ajamieh A (2023) How to build supply chain resilience: the role of fit mechanisms between digitally-driven business capability and supply chain governance. Inf Manag 60(2):103747

Lins KV, Servaes H, Tamayo A (2017) Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis. J Financ 72(4):1785–1824

Liu Y, Du J, Kang T, Kang M (2024a) Establishing supply chain transparency and its impact on supply chain risk management and resilience. Oper Manag Res 17:1157–1171

Liu Y, Hu S, Wang C (2024b) The green innovation spillover effect of enterprise digital transformation: based on supply chain perspective. Econ Anal Policy 84:1381–1393

Musacchio A, Lazzarini SG (2014) Reinventing state capitalism: Leviathan in business, Brazil and beyond. Harvard University Press, Boston, MA

Nasiri M, Ukko J, Saunila M, Rantala T (2020) Managing the digital supply chain: the role of smart technologies. Technovation 96:102121

Nielsen BB, Nielsen S (2013) Top management team nationality diversity and firm performance: a multilevel study. Strat Manag J 34(3):373–382

Premkumar G, Ramamurthy K, Saunders CS (2005) Information processing view of organizations: An exploratory examination of fit in the context of interorganizational relationships. J Manag Inf Syst 22(1):257–294

Qader G, Junaid M, Abbas Q, Mubarik MS (2022) Industry 4.0 enables supply chain resilience and supply chain performance. Technol Forecast Soc Change 185:122026

Quayson M, Bai C, Sun L, Sarkis J (2023) Building blockchain-driven dynamic capabilities for developing circular supply chain: Rethinking the role of sensing, seizing, and reconfiguring. Bus Strat Environ 32(7):4821–4840

Rashid A, Rasheed R, Ngah AH, Amirah NA (2024) Unleashing the power of cloud adoption and artificial intelligence in optimizing resilience and sustainable manufacturing supply chain in the USA. J Manuf Technol Manag 35(7):1329–1353

Rashid A, Rasheed R, Ngah AH, Pradeepa Jayaratne MDR, Rahi S, Tunio MN (2024b) Role of information processing and digital supply chain in supply chain resilience through supply chain risk management. J Glob Oper Strat Sourc 17(2):429–447

Rashid A, Rasheed R, Rahi S, Amirah NA (2025) Impact of supplier trust and integrated technology on supply chain resilience for sustainable supply chain in FMCG sector. J Sci Technol Policy Manag

Razak GM, Hendry LC, Stevenson M (2023) Supply chain traceability: a review of the benefits and its relationship with supply chain resilience. Prod Plan Control 34(11):1114–1134

Röller LH, Waverman L (2001) Telecommunications infrastructure and economic development: a simultaneous approach. Am Econ Rev 91(4):909–923

Scholten K, Schilder S (2015) The role of collaboration in supply chain resilience. Supply Chain Manag Int J 20(4):471–484

Sheffi Y, Rice Jr JB (2005) A supply chain view of the resilient enterprise. MIT Sloan Management Review

Shi Y, Zheng X, Venkatesh VG, Humdan EA, Paul SK (2023) The impact of digitalization on supply chain resilience: an empirical study of the Chinese manufacturing industry. J Bus Ind Mark 38(1):1–11

Sodhi MS, Tang CS (2019) Research opportunities in supply chain transparency. Prod Oper Manag 28(12):2946–2959

Srinivasan R, Swink M (2018) An investigation of visibility and flexibility as complements to supply chain analytics: an organizational information processing theory perspective. Prod Oper Manag 27(10):1849–1867

Tang CS (2006) Perspectives in supply chain risk management. Int J Prod Econ 103(2):451–488

Tushman ML, Nadler DA (1978) Information processing as an integrating concept in organizational design. Acad Manag Rev 3(3):613–624

Wamba SF, Dubey R, Gunasekaran A, Akter S (2020) The performance effects of big data analytics and supply chain ambidexterity: the moderating effect of environmental dynamism. Int J Prod Econ 222:107498

Wieteska G (2020) The impact of supplier involvement in product development on supply chain risks and supply chain resilience. Oper Supply Chain Manag Int J 13(4):359–374

Wong CY, Boon-Itt S, Wong CW (2011) The contingency effects of environmental uncertainty on the relationship between supply chain integration and operational performance. J Oper Manag 29(6):604–615

Wu YUN, Cegielski CG, Hazen BT, Hall DJ (2013) Cloud computing in support of supply chain information system infrastructure: understanding when to go to the cloud. J Supply Chain Manag 49(3):25–41

Yoo Y, Henfridsson O, Lyytinen K (2010) Research commentary—the new organizing logic of digital innovation: an agenda for information systems research. Inf Syst Res 21(4):724–735

Zamani ED, Smyth C, Gupta S, Dennehy D (2023) Artificial intelligence and big data analytics for supply chain resilience: a systematic literature review. Ann Oper Res 327(2):605–632

Zhang Y, Rajagopalan N (2004) When the known devil is better than an unknown god: an empirical study of the antecedents and consequences of relay CEO successions. Acad Manag J 47(4):483–500

Zhao N, Hong J, Lau KH (2023) Impact of supply chain digitalization on supply chain resilience and performance: a multi-mediation model. Int J Prod Econ 259:108817

Zhong T, Duan Y, Du D, Wu D (2025) How does digital supply chain innovation affect corporate ESG performance?—Empirical Evidence Based on Supply Chain Innovation and Application Pilot in China. Emerg Mark Finance Trade 1–30

Zhu S, Song J, Hazen BT, Lee K, Cegielski C (2018) How supply chain analytics enables operational supply chain transparency: an organizational information processing theory perspective. Int J Phys Distrib Logist Manag 48(1):47–68

Zhu Y, Zhang Z (2024) Supply chain digitalization and corporate ESG performance: evidence from supply chain innovation and application pilot policy. Financ Res Lett 67:105818

Acknowledgements

This study was supported by the Key Project of Philosophy and Social Sciences under the “Outstanding Young Teachers Basic Research Support Plan” of Heilongjiang Province (Project No. YQJH2023057).

Author information

Authors and Affiliations

Contributions

Tianye: Writing - Original Draft, Investigation, Methodology, Data curation. Cuilei: Conceptualization, Writing- Reviewing and Editing, Validation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This study did not involve human participants or the use of personally identifiable data.

Informed consent

This study did not involve human participants or personal data.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Tian, Y., Cui, L. Supply chain resilience and digital transformation: perspectives from a supply chain network. Humanit Soc Sci Commun 12, 1738 (2025). https://doi.org/10.1057/s41599-025-06011-3

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-06011-3