Abstract

Finance plays a pivotal role in the regional economic development, making the control of financial risk and its spatial spillover critical to a country’s core competitiveness. Utilizing inter-provincial panel data from China spanning 2007 to 2022, through the entropy weight method, improved economic gravity model, social network analysis, and other methods to analyze the spatial correlation and driving factors of inter-provincial financial risk in China. The findings reveal that financial risk exhibits a wavy distribution pattern, with high levels in the eastern regions that gradually decrease toward the west, while showing no significant variation along the north-south axis. The spatial linkages of inter-provincial financial risks, representing cross-regional risk transmission channels, are densely concentrated in the eastern coastal provinces, such as Shanghai, Jiangsu, Zhejiang, and Guangdong, forming the core of the financial risk network. In contrast, provinces in the northeast and western regions, such as Heilongjiang, Liaoning, Hainan, and Ningxia, occupy periphery positions with sparse network connections. Block model analysis categorizes the network into a net-flow-out block, two two-way-spillover blocks, and an intermediate block that bridges risk spillovers across regions. QAP regression analysis highlights that spatial proximity, economic intensity differences, liquidity ratio disparities, and financial supervision differences jointly shape the structure of China’s inter-provincial financial risk spillover network. These insights underscore the spatial dimensions of financial risk and inform strategies for mitigating cross-regional financial vulnerabilities.

Similar content being viewed by others

Introduction

With the development of global financial market integration, the high degree of cross-market correlation enhances the possibility of systemic financial risk (He and Zhang, 2024). In particular, in recent years, events such as the novel coronavirus, the conflict between Russia and Ukraine, and the bankruptcy of banks in Silicon Valley have further exacerbated the volatility of global financial markets (Zeng et al., 2024). At the same time, as an emerging market country, China has provided the possibility of trans-regional and cross-market transmission of imported international risks, and has had a certain impact on China’s economic operation (Wang et al., 2025). The development of China’s capital market and financial institutions tends to mature, and the businesses of institutions intersect and infiltrate each other. Once there is a risk between provinces or industries, it will lead to the risk through cross-channel transmission to the entire financial market, and then lead to an economic crisis. In December 2021, the People’s Bank Of China further clarified the basis of local financial regulations and superior laws, and further emphasized the importance of China’s strengthening of regional financial risk supervision for the development of financial stability.

Finance is integral to economic growth and constitutes an essential part of the core competitiveness of a region or country. The significance of finance underscores the necessity of managing and mitigating financial risks, which are central to discussions on regional development and planning. This importance has driven extensive scholarly investigations into regional financial risks (Caldara et al., 2016; Giglio et al., 2016). The inherent instability of financial systems arises from economic vulnerability, uncertainty, and information asymmetry (Goldstein and Pauzner, 2004; Brunnermeier and Oehmke, 2013). These dynamics render financial systems highly sensitive to economic cycles, macroeconomic policies, financial regulation, and other systemic factors (Allen and Carletti, 2013; Shin, 2010). During economic upswings, the proliferation of high-risk loans and financial products contributes to the accumulation of systemic risk. Conversely, economic downturns diminish market vitality, further exacerbating financial risks at the regional level (Brown and Piroska, 2022). The expansion of financial risks is further magnified through association networks that facilitate cross-regional spillovers (Greenwood et al., 2015; Yuan et al., 2019; Duarte and Eisenbach., 2021). These interconnected dynamics not only amplify financial risks but also intensify their adverse effects on regional economies and developmental trajectories.

Existing studies on regional financial risks predominantly focus on evaluating the level of risk within specific regions, with limited attention to the spatial correlation and driving factors underlying the spillover of financial risks across regions. To address this gap, this study integrates complex network analysis with classical financial risk assessment techniques to examine the spatiotemporal distribution of regional financial risks and their spillover channels. By employing social network analysis and the Quadratic Assignment Procedure (QAP), this study identifies the significant topological features of the inter-provincial spillover network and the key factors driving its formation. The application of complex network approaches provides valuable insights into the spillover dynamics of inter-provincial financial risks, offering new perspectives for designing policies aimed at preventing and mitigating regional financial risks.

The remainder of this paper is structured as follows: Section 2 provides a review of the relevant literature. Section 3 outlines the research methods and data sources employed in the study. Section 4 presents the research findings and analysis. Section 5 is the limitations and prospects of the article. Finally, Section 6 discusses the theoretical contributions and policy implications of the study.

Literature review

The literature offers a wide range of studies examining the connotation of regional financial risks, identifying transmission mechanisms, and characterizing risk distribution and correlation. Despite significant efforts, there is no unified definition of regional financial risks. However, the existing literature broadly categorizes the concept into two perspectives: the aggregation of micro-financial risks within a region and the regional manifestations of macro-financial risks. The aggregation of micro-financial risks refers to the cumulative risks arising from financial sector activities and individual financial operations within a given region (Chen and Ma, 2013). In contrast, macro-financial risks pertain to risk diffusion driven by external changes in the financial system or shifts in the broader economic environment (Ouyang and Xiong, 2023). Beyond the sources of risk, differences in the interests and objectives of economic agents—including governments, enterprises, banks, and individuals—result in varying impacts of financial risks and divergent attitudes toward risk spillover and control (Basco et al., 2024; Silva et al., 2018). These complexities add challenges to the quantitative measurement of financial risks. To address these difficulties, compound index systems are often developed for evaluating regional financial risks (Song and Yy, 2011; Ding et al.,2019; Lv and Chen, 2014).

In terms of the transmission mechanisms of regional financial risks, these risks tend to accumulate alongside the development of financial markets, and can propagate across regions and markets through channels such as the banking sector, stock market, bond market, and foreign exchange market (Xu and Zhang,2024;Yan et al.,2017). The entire financial industry exhibits significant risk spillovers (Miao et al., 2021; Song and Lv, 2021). Therefore, the factors influencing regional financial risks and their transmission are also highly diverse. Existing studies have explored these factors from multiple perspectives, such as financial innovation (Li and Han, 2023), financial structure (Liu and Sun, 2023), energy structure (Zhang et al., 2024), and digital finance (Ouyang et al., 2024). Some scholars have examined the formation mechanisms of regional financial risks within the framework of central government planning (Zhou and Ji, 2023). They have segmented each province’s economic system into four sectors: the public sector, the financial sector, the enterprise sector, and the residential sector, to analyze the transmission pathways of financial risks across regions and sectors.

Regarding the distribution and correlation of regional financial risks, studies have confirmed the presence of strong spatial correlations and spillover effects. Methods such as the Dagum Gini coefficient, social network analysis, and spatial econometrics have been employed to analyze these dynamics. The findings indicate that regional financial risks are highly interconnected, with regions located at the center of the network exhibiting higher levels of risk. However, the contagion effect of financial risks diminishes as geographical distance increases (Wang and Cao, 2017). Due to these characteristics, regional financial risks exhibit significant spatial disparities. Scholars have observed that provincial-level financial risks in China demonstrate a strong positive spatial correlation, with pronounced local spatial agglomeration. Moreover, the differences in financial risks between regions are more pronounced than those within individual regions (Liu et al., 2022). Moreover, studies have revealed that provincial financial risks in China exhibit a regional pattern characterized by being “high in the east and low in the west”. Additionally, the spatial disparities in regional financial risks are expanding and propagating over time (Wang et al., 2024).

To sum up, although there are abundant studies on the definition, transmission mechanism, distribution and correlation of regional financial risk, the existing achievements still have room for improvement in the systematicness of China’s inter-provincial financial risk assessment system, and are not comprehensive enough in the areas of network characteristics and geospatial visualization of risk transmission, and fail to accurately depict the overall linkage structure and individual micro-connections of regional financial risk.

Therefore, in the construction of the index system, this paper selects the macroeconomic environment, finance, government, households, and enterprises five departments, in order to be able to more accurately measure the level of financial risk in China, and based on this, carry out a quantitative analysis of the spatial correlation structure of financial risk and its driving factors. Compared with the existing literatures, the possible marginal contributions of this paper are as follows: on the one hand, it shows the distribution trend and correlation network characteristics of China’s inter-provincial financial risks in terms of time and space; on the other hand, it effectively combines social network analysis with QAP regression, and conducts the research of “relational data” to reveal the drivers of inter-provincial financial risks and the hidden characteristics of spatial correlation.

In sum, existing studies provide a solid foundation for investigating the spatial correlation and influencing factors of regional financial risks in this paper. Drawing on the literature, we construct a synthetic risk index that integrates macroeconomic performance with the roles of the government, financial sector, household sector, and enterprise sector to quantify regional financial risk levels. Using this risk measure and panel data from China’s provinces spanning 2007 to 2022, we employ an improved gravitational model to analyze the spatial correlation of inter-provincial financial risks. Fitting diagrams and spatial correlation network visualizations are used to comprehensively capture the spillover levels of inter-provincial financial risks and their dynamic spatial evolution. Furthermore, we utilize social network analysis to examine the spatial correlation network characteristics of inter-provincial financial risks in China. Finally, we apply the QAP regression to identify the driving factors behind the spatial correlation network, providing insights into key prevention priorities for managing regional financial risks.

Research methods and data sources

Measurement method of the regional financial risk level

Construction of the regional financial risk level indicator system

The formation and diffusion of regional financial risks is a complex, multidimensional process involving the quality of economic performance across different sectors of the financial market and the external market environment. Risks originating in any segment can propagate throughout the financial system, generating significant impacts. As such, no single economic indicator is sufficient to comprehensively describe the development of financial risks. Accordingly, this study identifies five primary sources of regional financial risks: the macroeconomic environment, the financial sector, the government sector, the household sector, and the enterprise sector.

Building on previous studies (Ouyang and Xiong, 2023; Shen et al., 2017), this study adopts a comprehensive approach to selecting indicators for measuring inter-provincial financial risks in China. For macro-environmental factors, indicators such as industrial structure, foreign trade level, inflation rate (CPI), fixed investment level, and GDP are included. The imbalance of industrial structure will further affect the transmission effect of external shocks on financial risks. The high dependence of foreign trade level will aggravate the impact of external financial risks on domestic financial risks (Fisman and Love, 2007) and have adverse effects on domestic economic growth, employment and export industries, exacerbating the contagion of financial risks. Excessive inflation exacerbates macroeconomic volatility and the decline of monetary purchasing power, thus enhancing the contagion of the financial risks. High-quality investment provides a buffer for the macro economy by improving production capacity, driving employment, and increasing cash flow, thus reducing the vulnerability of the financial system (Laeven and Valencia, 2013). The increase in GDP will enhance the ability of activity main body to resist financial risk. For the financial sector, key dimensions such as real estate, banking, securities, and insurance are assessed through indicators, including the development level of the real estate industry. Among them, the rapid development of the real estate industry is often accompanied by a high leverage ratio and an increase in financing demand. If market price adjustment occurs, it will cause irreversible impact on financial institutions and related enterprises, thus increasing financial risk (He and Zhang, 2024); the loan-to-deposit ratio of banks means that the loan scale is relatively high relative to the deposit scale, increasing liquidity pressure and the possibility of bank run, thus expanding financial risk (Joyce and Nabar, 2009); the rapidly expanding credit expansion rate is often accompanied by capital mismatch and increased lending risk, which impacts the stability of the financial system (Fisman and Love, 2007); the non-performing loan ratio directly reflects the decline in asset quality of banks and other financial institutions, which directly increases the possibility of financial risk (Laeven and Valencia, 2013). Increased stock market activity not only broadens financing channels but also promotes market liquidity and risk diversification, thereby reducing financial risk (He and Zhang, 2024). The continuous development and maturity of the insurance business provide enterprises and residents with a risk diversification mechanism, providing a buffer zone for the contagion of financial risk, thereby reducing the level of financial risk (Cummins and Weiss, 2009). Sales price of commercial housing, loan-to-deposit ratio, credit expansion rate, non-performing loan ratio, stock market activity, insurance depth, insurance density, and insurance compensation. For government, household, and enterprise sectors, indicators include fiscal gap, government debt, unemployment rate, per capita income, per capita expenditure, asset-liability ratio, enterprise loss degree, profit scale, return on equity (ROE), and enterprise development scale. Among them, the larger the government’s fiscal gap, the imbalance between the government’s fiscal revenue and fiscal expenditure (Fisman and Love, 2007); government debt, as an indispensable way for the government to raise funds, is easy to cause fiscal risk, so the increase of both will aggravate the instability of financial risk; the unemployment rate of residents can reflect the overall state of macroeconomic operation, if the unemployment rate of a province exceeds its specified value, it is more likely to generate macroeconomic risk, and further promote the spread of financial risk; per capita income is expressed by residents’ disposable income, households with high income levels have strong household debt repayment ability and consumption stability, effectively reducing the contagion of financial risk (Joyce and Nabar, 2009); per capita expenditure is expressed by residents’ per capita consumption expenditure, which may lead to increased household debt and credit risk, so this indicator is a positive indicator in the financial risk indicator system. Among the indicators on enterprises, listed companies, as the most market-oriented and fully disclosed enterprise groups, their relevant financial indicators can also fully represent the risk exposure of the enterprise sector (La Porta et al., 2002). Therefore, the average value of listed companies in the provinces is selected for calculation. The increase in asset-liability ratio and enterprise losses means that the financial vulnerability of enterprises is enhanced, and financial risk is increased. The increase in profit scale, return on equit,y and development scale indicates that enterprises are operating soundly and can buffer financial risk, so they are negative indicators (Laeven and Valencia, 2013). The final inter-provincial financial risk indicator system for China is presented in Table 1.

Measurement methods

The entropy weight method is employed as an objective assignment approach to determine the weight of each indicator within the system, effectively minimizing errors caused by subjective biases (Shen et al., 2025). First, the selected indicator data are standardized to ensure dimensionless comparability. Next, the information entropy of each indicator is calculated to determine its weight within the indicator system. Finally, the weights are multiplied by the standardized data to derive the comprehensive inter-provincial financial risk score index.

Spatial correlation analysis methodology for regional financial risk

Revised gravitational model

The inter-provincial financial risk spatial correlation network represents the aggregation of financial risk correlations across provinces. In this network, nodes correspond to provinces, and paths indicate the spatial associations of financial risks. Compared to the VAR model, the gravitational model offers greater precision in depicting spatial network trends and spillovers (Zhang et al., 2025). Building on this, the revised gravitational model incorporates the influence of economic and geographical distance, aligning more closely with the mechanisms of regional financial risk contagion. Thus, this study employs the revised gravitational model to quantify the connection strength of inter-provincial financial risks.

The formula for the revised gravitational model is as follows:

In the formula, \({r}_{{ij}}\) represents the financial risk correlation strength between province i and province \(i\); \({K}_{{ij}}\) is the gravitational coefficient, which specifically reflects the correlation contribution rate of province\(i\) between province \(i\) and province \(j\); \({R}_{i}\) and \({R}_{j}\) are the financial risk indexes of province \(i\) and j respectively; \({P}_{i}\) and \({P}_{j}\) are the total population of province \(i\) and j at the end of the year; \({G}_{i}\) and \({G}_{j}\) are the regional GDP of provinces \(i\) and \(j\) respectively; \({g}_{i}\) and \({g}_{j}\) represent the per capita GDP of provinces i and j respectively; \({D}_{{ij}}\) is the spherical distance between provincial capital \(i\) and provincial capital \(j\) (measured by the distance between provincial capitals). The financial risk spatial correlation matrix is constructed according to the revised gravity model, and the threshold is set with the average value of each row in the matrix. In the matrix, if the element \({r}_{{ij}}\) is higher than the threshold, it is set to 1, indicating that there is spatial overflow from province \(i\) to province \(j\); otherwise, it is 0, indicating that there is no spatial overflow from province \(i\) to province \(j\).

Social network analysis method

Social network analysis method is a quantitative method used to study the structure and characteristics within social networks. It provides a framework for analyzing both the overall network characteristics and the individual network properties of inter-provincial financial risks in China. The specific formulae for these analyses are presented in Table 2.

In addition, the block model analysis method is employed to cluster the spatial association network of financial risks and to examine its internal structure characteristics. Building on the research of LIU et al.(2015)[41], this paper categorizes the financial risk network into four sectors: “net spillover out”, “net spillover in”, “two-way spillover”, and “intermediate”. This classification clarifies the distinct roles and functions of each province within the financial risk network.

Quadratic assignment procedure model

The formation of financial risk spatial association networks is the result of interactions among various factors. When analyzing the influencing factors of financial network structure using traditional econometric methods, multicollinearity among these factors can lead to biased results. The driving factors of the financial risk network are analyzed using the QAP regression. This method does not require the assumption of variable independence, thereby providing more robust results (Doreian and Cinti, 2012) and effectively mitigating biases caused by multicollinearity. The financial risk correlation network represents a web of associations between the financial risk levels of individual nodes. At its core, this network evolves through a dynamic process where each node interacts by transmitting, attracting, and connecting financial risk ties. The process is shaped by various driving factors, which exert complex and interwoven impacts across temporal and spatial dimensions. Therefore, Difference Matrices such as Spatial Adjacency, Economic Intensity, Financial Size, Current Ratio, Fiscal Regulation, and Household Credit are selected as explanatory variables. Theoretical premises for the selection of indicators for the QAP model are shown in Table 3. The driving factor model is formulated as follows:

In the formula, \({{\rm{F}}}_{{\rm{t}}}\) is the spatial correlation matrix of inter-provincial financial risk in year \({\rm{t}}\); \({\rm{spa}}\) is the spatial adjacency matrix, and \({\rm{pgdp}}\), \({\rm{fin}}\), \({\rm{lp}}\), \({\rm{gov}}\), and \({\rm{loa}}\) are the difference matrix constructed by the absolute difference of driving factors between province \({\rm{n}}\) and province \({\rm{m}}\), respectively (Li et al., 2014).

Data sources

This paper examines 30 provinces, municipalities directly under the Central Government, and autonomous regions in China from 2007 to 2022, excluding Xizang (Tibet), Hong Kong, Macao, and Taiwan. The data are sourced from the National Bureau of Statistics website, China Statistical Yearbook, China Insurance Yearbook, Wind database, and CSMAR database. The distances between provincial capitals are calculated as spherical distances using ArcGIS software.

Results and analysis

Spatial characteristics of financial risks

Overall, China’s regional financial risk decreased from 0.1537 in 2007 to 0.1429 in 2022, indicating that China’s regional financial risks have been alleviated as a whole, and the ability of each region to prevent financial risks has improved. From the perspective of the four major regions, the eastern region (0.1457) > the northeast region (0.1237) > the western region (0.1176) > the central region (0.1084). The eastern region has the highest financial risk, followed by the northeast, the west, and the central region, showing convergence characteristics in turn. The reason may be that the eastern region is greatly affected by the insurance depth, foreign trade level, commercial housing sales price, and other factors. The financial risk in Northeast China is also at a relatively high level, which has a great relationship with the insurance depth, non-performing loan ratio, profit proportion of listed companies and other factors in Northeast China; the financial market in the central and western regions is relatively stable, mainly because its insurance depth, real estate value, GDP and other development are relatively stable, so the level of financial risk is low. From the perspective of provincial financial risk, the top 5 provinces in terms of financial risk level are Shanghai (0.1802), Tianjin (0.1690), Zhejiang (0.1668), Guangdong (0.1580) and Jiangsu (0.1439), all of which are distributed in the eastern coastal areas; the bottom 5 provinces are Hubei (0.1054), Shaanxi (0.1039), Jiangxi (0.11026), Anhui (0.1009) and Henan (0.0994), primarily situated in the central region.

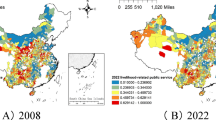

From a spatial perspective, Fig. 1 presents the spatial distribution trend of China’s inter-provincial financial risk levels from 2007 to 2022, fitted using MATLAB. The results reveal a spatial distribution pattern characterized by “elevated in the east, depressed in the center, and slightly elevated in the west”. This indicates a spatial evolution trend where financial risk levels increase from the central region toward both the east and west, with the growth rate in the eastern region exceeding that of the western region. In the east-west dimension, the elevated financial risk levels, particularly in the eastern coastal areas, are closely related to the development of insurance, foreign trade, and real estate in the region. In the north-south dimension, the fitting curve reveals a gradual decline from north to central regions, followed by rapid growth from the central to southern regions. This pattern indicates that financial risk levels in southern China are higher than in the northern regions, highlighting a pronounced north-south disparity.

Correlation analysis of financial risks

The revised gravitational model is used to quantify the linkage strength of China’s inter-provincial financial risk levels. Subsequently, ArcGIS software is utilized to generate financial risk linkage strength diagrams for 2007, 2012, 2017, and 2022 (Fig. 2). These visualizations are used to identify the correlation characteristics of regional financial risks over time.

The analysis reveals that during the study period, the spatial correlation network of inter-provincial financial risks in China has evolved to become increasingly dense, multifaceted, and complex. The spatial connection strength between regions has steadily intensified, with a notable east-to-west gradient in the spatial correlation structure. This pattern highlights the intensified contagion and radiation of financial risks in the eastern coastal areas. As the central region rises and the western region develops, accompanied by economic restructuring, the advancement of green and inclusive finance, and the growth of financial technology, financial markets in the central and western regions have matured, improving their ability to mitigate financial risks. The overall network structure has transitioned from sparse to dense, facilitating the freer flow of financial resources across regions. Over time, the interaction and overlap of contagion channels have enhanced spatial potential energy, further amplifying the spatial correlation effects of financial risks. Additionally, the spatial pattern of decreasing financial risk levels from the southeast coastal areas to the northwest regions suggests that factors such as geographic proximity, economic strength, talent attraction, and infrastructure significantly influence financial risk levels. The spatial correlation effect is particularly pronounced in areas with close spatial proximity, such as the Shanghai-Jiangsu and Shanghai-Zhejiang regions, underscoring the role of regional interconnections in shaping financial risk dynamics. Over time, the spatial correlation of inter-provincial financial risks in China has exhibited distinct evolutionary patterns. Between 2007 and 2012, the spatial correlation network was relatively weak, with risk contagion confined to a small range centered around Shanghai and Jiangsu. During this period, the western and northeastern regions did not form core areas of financial risk activity. By 2017, the spatial spillover effects of inter-provincial financial risks had intensified, giving rise to a more extensive radiation network centered on Shanghai, Jiangsu, Zhejiang, and Guangdong. Guangdong, as a newly emerged core province, demonstrated strong linkages with other regions, including Jiangsu, Shanghai, Anhui, Jiangxi, Hunan, Henan, Hebei, Sichuan, Yunnan, Guangxi, and Guizhou. This highlights the increasing number of transmission channels and the expanded coverage of financial risks, particularly in Guangdong Province. The eastern region, in particular, transitioned from localized contagion to a broader, cross-regional infection pattern. By 2022, spurred by economic restructuring, the integration of financial resources, and enhanced regulatory mechanisms in the central, western, and northeastern regions, the financial risk network evolved into a multi-core spatial correlation pattern. Core provinces such as Shanghai, Jiangsu, Zhejiang, Guangdong, Beijing, and Henan emerged, reflecting a diversified and multi-polar structure in the cross-provincial contagion of financial risks. This progression underscores the increasing complexity and spatial interconnectedness of financial risks across China’s provinces.

Characteristics of the financial risk network structure

Analysis of the overall network structure characteristics

The overall characteristics of China’s inter-provincial financial risks are assessed through network analysis, measured by the number of correlation relationships, network hierarchy, network efficiency, and network density. As shown in Table 4, the network correlation degree consistently remains at 1, indicating persistent correlations in financial risks among provinces. Since 2007, the number of network relationships has followed an M-shaped trajectory, increasing from 153 to 187, peaking at 173 in 2013 and 2019, and rising to 187 in 2022. Network density has shown a wave-like increase, reaching a high of 0.1989 in 2014, decreasing to 0.1874 in 2020, and then climbing to 0.2149 in 2022. In contrast, the network hierarchy has exhibited an overall downward trend, declining from 0.7587 in 2007 to 0.5865 in 2022, with a temporary peak of 0.7111 in 2014. These trends indicate that the financial risk relationships among provinces in China have strengthened, with more marginal provinces establishing spillover channels to core regions. Meanwhile, network efficiency has fluctuated between 0.712 and 0.6921, with a relatively mild rate of decline. This suggests that the inter-provincial linkages of financial risks have intensified, reflecting an enhanced connectivity effect across regions.

Analysis of individual network structure characteristics

The analysis of the characteristics of the overall network structure provides a macro-level understanding of the inter-provincial financial risk spatial correlation network, but does not define the specific roles of individual provinces within the network. To address this, an in-depth analysis was conducted by calculating degree centrality, proximity centrality, and betweenness centrality, as shown in Table 5.

Degree centrality measures whether a province occupies a central position in the financial risk network. The top five provinces in degree centrality are Shanghai (93.10), Jiangsu (93.10), Zhejiang (79.31), Beijing (72.41), and Guangdong (65.52). Among these, Shanghai and Beijing are the regions with the highest per capita GDP in China, while Guangdong, Jiangsu, and Zhejiang rank 1st, 2nd, and 4th in total GDP, with per capita GDP also ranking within the top seven. This indicates a strong relationship between economic development levels and financial risks, as well as their contagion. Shanghai and Jiangsu exhibit the highest degree of centrality, with financial risks in these provinces having spatial spillovers and exchanges with 27 other provinces. The Yangtze River Delta emerges as the core region for financial risks and contagion. In contrast, Hainan, Tianjin, and Anhui rank lowest in degree centrality, reflecting their relatively peripheral positions in the network.

Proximity centrality measures the extent to which a province’s financial risks are independent of control by other provinces. The top five provinces in proximity centrality align with the top five in degree centrality: Shanghai, Jiangsu, Zhejiang, Beijing, and Guangdong. Additionally, provinces such as Shandong, Fujian, Hubei, and Henan, with proximity centrality values exceeding the average of 61.93, also act as central players in the spatial association network. These provinces efficiently influence and maintain connections with other provinces. In contrast, Hainan, Anhui, and Tianjin rank lowest in proximity centrality, reinforcing their marginal positions in the network.

Betweenness centrality captures the bridging role of provinces within the network, reflecting their influence on the connectivity between other provinces. The top five provinces in betweenness centrality are Shanghai (14.55), Jiangsu (14.55), Beijing (10.46), Zhejiang (10.19), and Guangdong (5.91). Additionally, Shandong, and Fujian also exceed the average value of 2.35, highlighting their roles as bridges within the network. These provinces leverage their economic strength and advanced financial systems to connect with other provinces, amplifying their spatial influence and inter-provincial associations.

It should be noted that Tianjin, Hainan and Anhui ranked very low in the above three indicators. The reason may be that the industrial structure of these provinces is relatively single, dominated by traditional manufacturing or service industries, and failed to form large-scale high-tech industrial clusters. In addition, in the urban agglomerations of the Beijing-Tianjin-Hebei region, the Yangtze River Delta and the Pearl River Delta, these regions are all located in the marginal zone, and the siphon effect of the core provinces is strong, resulting in a continuous concentration of various financial resources to the core regions, reducing their direct links with other nodes, and thus weakening their position in the network.

Clustering feature analysis of the spatial association network

To analyze the subgroup structure and interrelationship in China’s inter-provincial financial risk correlation network, this study applies the CONCOR method in Ucinet software, referencing the work of Liu et al. (2015). Using a maximum segmentation depth of 2 and a convergence standard of 0.2, the 30 provinces (excluding Hong Kong, Macao, Taiwan, and Xizang) are divided into four sectors for 2022. The results are presented in Table 6.

-

Sector 1: This group includes Beijing, Shanghai, Jiangsu, Zhejiang, and Shandong, with most provinces located in the eastern coastal areas. These regions are characterized by strong economic development and significant financial activity.

-

Sector 2: Comprising Fujian, Guangdong, and Hubei, this group, though geographically dispersed, includes provinces with both GDP and per capita GDP among the highest in the country.

-

Sector 3: This group consists of Chongqing, Hebei, Inner Mongolia, Shanxi, Liaoning, Tianjin, and Shanxi, primarily concentrated in North and Southwest China.

-

Sector 4: This group includes 15 provinces—Heilongjiang, Jiangxi, Guangxi, Hainan, Hunan, Jilin, Sichuan, Henan, Guizhou, Yunnan, Anhui, Gansu, Qinghai, Ningxia, and Xinjiang—mainly distributed across the northeastern, central, and western regions.

According to Table 6, the spatial network of regional financial risks, comprising 30 provinces in China, includes a total of 187 correlation relationships, with 21 within-sector relationships and 166 between-sector relationships. This highlights the significant spatial spillover effects and inter-sector network correlations in the financial risk network.

Sector 1: Net spillover sector

Sector 1, which includes 28 spillover relationships, has 14 internal relationships and 14 external spillover relationships, while receiving 100 relationships from outside the sector. The ratio of actual to expected internal relationships is 50.00% and 13.79%, respectively. This indicates that Sector 1 primarily serves as the endpoint for financial risk contagion pathways, receiving spillovers from other sectors while contributing relatively few. As such, Sector 1 is characterized as a “net spillover” sector.

Sector 2: Two-way spillover sector

Sector 2 exhibits both internal and external connections, with 3 internal relationships and a total of 25 spillover relationships. It accepts 33 external relationships and contributes 22 spillover relationships outside the sector. The ratio of actual to expected internal relationships exceeds expectations, reflecting its dual role as both a recipient and transmitter of financial risks. Consequently, Sector 2 is identified as a “two-way spillover” sector.

Sector 3: Net spillover sector

Sector 3 has 39 total spillover relationships, including 4 internal relationships, 7 accepted relationships from other sectors, and 35 spillover relationships to other sectors. The ratio of actual to expected internal relationships is 10.26% and 20.69%, respectively. This sector sends more spillovers than it receives, functioning primarily as a “net spillover” sector.

Sector 4: Intermediate sector

Sector 4 lacks internal relationships but plays a key role in accepting spillovers from other sectors while also transmitting risks. The ratio of actual to expected internal relationships is 0.00% and 48.28%, respectively. The absence of internal relationships suggests high independence, with Sector 4 acting as both a “recipient” and a “transmitter” within the financial risk network. This sector facilitates the spread of financial risks across regions, making it an “intermediate” sector.

These findings underscore the differentiated roles of each sector within the spatial correlation network, highlighting the complex dynamics of financial risk transmission and spillover across China’s provinces.

To analyze the inter-sector correlations in the financial risk network, a density matrix for each sector was calculated based on the sector divisions outlined in Table 6. The results were further transformed into an image matrix. The network density of regional financial risks in 2022 (0.2149) was used as the threshold. Sectors with a density greater than 0.2149 were assigned a value of 1, while those below the threshold were assigned a value of 0. This transformation converted the multi-value density matrix into a binary image matrix, as shown in Table 7.

According to Table 7, Sector I, while bearing internal financial risks, also absorbs financial risks spilling over from Sectors II, III, and IV. This indicates that the provinces in Sector I, characterized by developed economies and relatively mature financial markets, attract significant financial capital and resources, creating a “siphon effect.” However, Sector I also exhibits a certain degree of spillover to other sectors.

Sector II both accepts financial risk contagion from other sectors and transmits risks outward, functioning as a conduit for risk spillover. Sector III demonstrates internal financial risk correlations and actively spills financial risks to other sectors, further emphasizing its role as a transmitter within the network.

As an “intermediate” sector, Sector IV primarily absorbs risk spillovers from Sector II and subsequently transmits risks to Sectors I and II. The number of spillover relationships from Sector IV significantly exceeds the number of accepted relationships. Geographically, most provinces in Sector IV are located in the central and western regions, as well as the northeast, whereas provinces in Sectors I and II are predominantly situated in the eastern regions. The cross-regional flow of financial resources and the strengthening of financial risk transmission mechanisms highlight the effects of financial integration. These findings underscore the success of China’s regional coordinated development strategy and inclusive finance pilot initiatives. However, they also reveal weaker financial risk management and prevention capabilities in the central and western regions, suggesting the need for targeted strategies to bolster financial stability in these areas.

Analysis of the driving factors of the financial risk spatial correlation network

QAP regression analysis was conducted for the four years of 2007, 2012, 2017, and 2022. Setting a random permutation of 5000 is shown in Table 8, and the adjusted \({R}^{2}\) distribution is [0.3350, 0.4180], all of which pass the 1% significance level. With the change of years, the impact of driving factors on the spatial correlation network of financial risks is also different. Specifically:

-

(1)

The regression coefficient of the spatial adjacency difference matrix on the financial risk spatial correlation network is positive and statistically significant at the 99% level. This finding underscores the critical role of geographical proximity in financial risk contagion, aligning with the conclusions of Wang and Cao (2017). The results indicate that spatial proximity exacerbates the spread of financial risks, with pronounced spatial spillover effects among neighboring provinces. These effects accelerate the formation of interconnected financial risk networks. Examining the underlying mechanisms reveals that spatially adjacent provinces are more likely to experience the “source and remittance effect,” where intensified financial activity in one province propagates financial risk contagion chains to neighboring regions. These interwoven contagion chains collectively contribute to the development of a spatial financial risk network.

-

(2)

The economic strength matrix exhibits a significant negative correlation with the spatial correlation network of financial risk. This finding suggests that provinces with higher economic strength have a greater capacity to mitigate regional financial risk contagion. Further analysis reveals that these provinces benefit from a robust economic foundation, a well-structured economy, and mature financial markets, which enable effective control of financial risks. Consequently, they raise the threshold for spatial spillover of financial risks, thereby weakening the contagion within financial risk networks. These results align with the findings of Zhang and Teng (2021).

-

(3)

The financial scale difference matrix does not exhibit a significant correlation with the spatial correlation network of financial risk. While most regression coefficients are negative, the coefficient for 2022 is positive, suggesting that the influence of financial scale on the spatial correlation network of financial risks is moderate. This indicates that balancing the development of the real economy with the expansion of financial scale plays a crucial role in mitigating the spread of financial risk networks.

-

(4)

The current ratio difference matrix exhibits a significant negative correlation with the spatial correlation network of financial risk. This indicates that enterprises with high liquidity play a critical role in mitigating the spread of financial risk networks. Enterprises with a high liquidity ratio reduce their dependence on credit financing due to their robust internal financing capabilities. Additionally, these enterprises often adhere to the pecking order theory in their financing behavior, prioritizing internal financing over external options. When external financing is required, they typically favor bond financing over equity financing. This strategic approach limits the scale of credit financing, thereby alleviating regional financial risks and reducing the potential for financial contagion within the spatial network.

-

(5)

The difference matrix of fiscal supervision exhibits a significant negative correlation with the formation of the financial risk network. Increased financial supervision expenditures can effectively mitigate regional financial risks. This finding highlights that strong financial oversight and effective supervisory mechanisms are critical for ensuring the stable development of financial systems. Moreover, financial supervision, by promoting the formation of a unified financial market, restricts the unregulated flow of financial risks. This process compels the financial market to reduce the spread of financial risks within the spatial network. In contrast, the household credit difference matrix does not exhibit a significant impact on the spatial correlation network of financial risk. While the correlation coefficient is negative for 2022, it remains positive in other years, suggesting that the effect of household credit differences on the financial risk network is moderate. These differences in household credit may stem from variations in factors such as financial literacy, financial capacity, social relationships, and financial knowledge among households.

Based on the above analysis, efforts should be directed toward actively mitigating the driving factors of financial risk contagion. Reducing the transmission and spread of risks between network nodes is essential. Simultaneously, it is crucial to promote the efficient and reasonable flow of financial resources within the spatial network under the organic regulation of the market. Additionally, macro-level policy guidance should be employed to address shortcomings in financial risk prevention mechanisms. These measures collectively aim to mitigate the contagion effects within the financial risk network and enhance overall stability.

Conclusion and discussion

This study employs the entropy weight method to measure inter-provincial financial risk levels in China from 2007 to 2022. A revised gravitational model is used to construct the inter-provincial spatial correlation matrix of financial risk, forming the spatial correlation network. The structural characteristics and driving factors of the network are analyzed using social network analysis.

The results reveal significant geographical differences in the spatial distribution of inter-provincial financial risk levels. A wavy distribution pattern is observed along the east-west axis, while the north-south direction demonstrates better balance. Over the investigation period, the strength of inter-provincial financial risk spatial connections has gradually increased, with correlation strength decreasing from east to west. The number of network relationships has grown consistently, and network density has shown a gradual upward trend, reaching its lowest value in 2014. However, both the network level and network efficiency have exhibited a downward trend.

Provinces such as Shanghai, Jiangsu, Zhejiang, Guangdong, and other eastern coastal regions occupy central positions in the spatial correlation network of financial risk, acting as core areas of the network. In contrast, provinces like Heilongjiang, Liaoning, Hainan, and Ningxia are positioned on the periphery of the network, with limited ability to influence other regions. Block model results further show that Beijing, Shanghai, and Jiangsu form “two-way spillover” sectors, while seven provinces, including Chongqing and regions in North China, are classified as “two-way overflow” sectors. Fifteen provinces, primarily in the central and northeastern regions, are identified as “intermediate” sectors, and the remaining three provinces constitute “net spillover” sectors.

The spatial correlation network of inter-provincial financial risk is driven by multiple factors. Spatial proximity exhibits a significant positive correlation with the network, emphasizing the importance of geographical closeness in financial risk contagion. Conversely, economic strength, liquidity ratio, and fiscal supervision exert significant negative correlations, highlighting their mitigating effects on financial risk contagion. In contrast, differences in financial scale and household credit do not significantly impact the financial risk network.

In sum, this work discusses the characteristics and driving factors of inter-provincial financial risk from the perspective of social network, enriching the existing literature on the spatial correlation of inter-provincial financial risk from the perspective of complex network. In the meantime, there are also some limitations in the paper that can be addressed or extended in the future. First, the evaluation of regional financial risk can be refined from the level of prefecture-level cities, and matched with the results of the provincial level of this paper, so as to help more accurately depict the spatial correlation structure and transmission path of financial risk. Secondly, in the measurement of the relationship between financial risks, we can refer to the research methods of econometrics to measure the direction and intensity of regional transmission of financial risks from the perspective of causality.

Data availability

Data is provided within the manuscript or supplementary information files.

References

Acemoglu D, Ozdaglar A, Tahbaz-Salehi A (2015) Systemic risk and stability in financial networks. Am Econ Rev 105(2):564–608

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Allen F, Carletti E (2013) What is systemic risk? J Money Credit Bank 45:121–127

Basco S, Felice G, Merlevede B, Mestieri M (2024) Financial crises and the global supply network: Evidence from multinational enterprises. J Int Econ 152:103983

Bernanke BS, Gertler M (2000) Monetary policy and asset price volatility. Econ Rev–Fed Reserve Bank 85(1):17–51

Brown E, Piroska D (2022) Governing fintech and fintech as governance: The regulatory sandbox, riskwashing, and disruptive social classification. N. Polit Econ 27:19–32

Brunnermeier MK, Oehmke M (2013) Bubbles, financial crises, and systemic risk. Handb Econ Financ 2:1221–1288

Caldara D, Fuentes-Albero C, Gilchrist S, Zakrajšek E (2016) The macroeconomic impact of financial and uncertainty shocks. Eur Econ Rev 88:185–207

Chen YL, Ma Y (2013) Construction of China’s financial imbalance index: Method and its application in macroprudential supervision. J Renmin Univ China 27(1):59–71

Cummins JD, Weiss MA (2009) Convergence of insurance and financial markets: Hybrid and securitized risk-transfer solutions. J Risk Insur 76(3):493–545

Ding SJ, Zhuang XJ, Li WJ (2019) Mechanism and empirical analysis of inter-sectoral contagion of regional financial risks. Econ Lat Long 36:1–8

Doreian P, Conti N (2012) Social context, spatial structure and social network structure. Soc Netw 34:32–46

Duarte F, Eisenbach TM (2021) Fire-sale spillovers and systemic risk. J Financ 76(3):1251–1294

Fisman R, Love I (2007) Financial dependence and growth revisited. J Eur Econ Assoc 5(2–3):470–479

Giglio S, Kelly B, Pruitt S (2016) Systemic risk and the macroeconomy: An empirical evaluation. J Financ Econ 119:457–471

Goldstein I, Pauzner A (2004) Contagion of self-fulfilling financial crises due to diversification of investment portfolios. J Econ Theory 119:151–183

Greenwood R, Landier A, Thesmar D (2015) Vulnerable banks. J Financ Econ 115:471–485

Guo DY, Shi ZY (2023) Interprovincial financial cycle fluctuations in China: Time-varying spillovers and spatial network structure. J Yunnan Univ Financ Econ 39:36–51

He Z, Zhang S (2024) Risk contagion and diversification among sovereign CDS, stock, foreign exchange and commodity markets: Fresh evidence from G7 and BRICS countries. Financ Res Lett 62:105267

Joyce JP, Nabar M (2009) Sudden stops, banking crises and investment collapses in emerging markets. J Dev Econ 90(2):314–322

Kornai J (1986) The soft budget constraint. Kyklos 39(1):3–30

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (2002) Investor protection and corporate valuation. J Financ 57(3):1147–1170

Laeven L, Valencia F (2013) Systemic banking crises database. IMF Econ Rev 61(2):225–270

Li HY, Han JW (2023) Does financial innovation aggravate regional financial risks? Research based on social networks and dynamic panel threshold effects. Secur Mark Her 3:68–79

Li J, Chen S, Wan GH, Fu CM (2014) Spatial correlation and explanation of regional economic growth in China: Based on network analysis. Econ Res 49(11):4–16

Li Z, Wang XJ, Liu Q (2021) Spillover effects of house price volatility among Chinese cities: A risk network perspective. J Cent Univ Financ Econ 4:114–128

Liu C, Sun XP (2023) Spatial spillover and regional heterogeneity of financial structure’s impact on financial risks. Stat Res 40:73–87

Liu FG, Liao SJ, Zhang M (2022) Spatial distribution and evolution characteristics of regional financial risks in China. J Yunnan Univ Financ Econ 38:66–84

Liu HJ, Liu CM, Sun YN (2015) Spatial network structural characteristics and effects of energy consumption in China. China Ind Econ (5):83–95

Lv YB, Chen ZY (2014) Spatial effects of inter-sectoral transmission of regional financial risks: 2005–2012. Public Finance Res (8):46–48

Ma J, He XB (2021) Research on financial risk contagion mechanisms: Simulation based on data of Chinese listed banks. J Financ Res (9):12–29

Mian A, Sufi A (2014) What explains the 2007–2009 drop in employment? Econometrica 82(6):2197–2223

Miao ZQ, Zhang T, Dang Y (2021) Research on systemic financial risk contagion in China’s banking system: Big data and machine learning analysis of 24 A-share banks. Financ Rev 13(5):58–74

Modigliani F, Brumberg R (2013) Utility analysis and the consumption function: An interpretation of cross-section data. In: Kurihara KK (ed) Post-Keynesian economics. Routledge, pp 388–436

Ouyang ZS, Xiong JY, Ma WB (2024) How digital finance affects regional financial risks in China: An analysis based on the spatial durbin model. Stat Res 41:24–35

Ouyang ZS, Xiong JY (2023) Research on the spillover effects of regional financial risks in China: Based on social network analysis. J Financ Econ Res 38(3):38–50

Shen D, Hong Y, Ma L (2025) The spatiotemporal evolution and spatial effect of digitalization on urban land intensive use in the Yangtze River Economic Belt. Humanit Soc Sci Commun 12(1):1–17

Shen L, Zhang Y, Li WJ (2019) Research on spatial transmission paths of regional financial risks in China. Contemp Econ Sci 41(5):62–73

Shen Y, Li BY, Zhang JW (2017) Systemic financial risks: Measurement and spatiotemporal pattern evolution analysis. Stat Inf Forum 32:42–51

Shin HS (2010) Risk and liquidity. Oxford University Press, USA

Silva TC, Alexandre MS, Tabak BM (2018) Bank lending and systemic risk: A financial-real sector network approach with feedback. J Financ Stab 38:98–118

Song LF, Ye YG (2011) Research on the transmission of regional financial risks between departments in China. Manage World (9):172–173

Song YC, Lv JR (2021) Evolutionary trends and coping strategies of international financial risk contagion: Evidence from the stock market. Learn Explor (9):130–138

Vazquez F, Federico P (2015) Bank funding structures and risk: Evidence from the global financial crisis. J Bank Financ 61:1–14

Wang XY, Shen Y, Wang XX (2024) Study on the spatial differences of regional financial risks in China. Hum Geogr 39:96–104

Wang B, Bian J, Xu Y, Liu D (2025) The role of internal control on financial fraud: Evidence of pre-fraud and post-punishment from Chinese firms. Emerg Mark Financ Trade 61(5):1446–1459

Wang Y, Cao YQ (2017) Spatial correlation and contagion effects of regional financial risks in China: Based on social network analysis. J Financ Econ Res 32(03):46–55

Wu C, Ren F, Ye X, Liang X, Du Q (2019) Spatiotemporal analysis of multiscale income mobility in China. Appl Geogr 111:102060

Xu SJ, Zhang SH (2024) Dynamic spillover effects of cross-market financial risks in China: Systemic and heterogeneous risks. J Econ 11:193–242

Yan WX, Zhang W, Niu HW (2017) Research on dynamic correlation and heterogeneity of financial risk spillovers. Financ Trade Econ 38:67–81

Yartey CA (2010) The institutional and macroeconomic determinants of stock market development in emerging economies. Appl Financ Econ 20:1615–1625

Yuan H, Zhang T, Feng Y, Liu Y, Ye X (2019) Does financial agglomeration promote the green development in China? A spatial spillover perspective. J Clean Prod 237:117808

Zeng Q, Zhang P, Zhao Z, Meng XX (2024) Stock market volatility and economic policy uncertainty: New insight into a dynamic threshold mixed-frequency model. Financ Res Lett 59:104714

Zhang LG, Teng ZJ (2021) Study on spatial correlation and contagion mechanism of regional financial risks in China: Based on social network analysis and regional data empirical study. Financ Dev Res (11):48–55

Zhang P, Zhang T, Feng Y, Liu Y, Ye X (2025) Spatial correlation networks characteristics and influence mechanisms of the resilience of Beijing–Tianjin–Hebei urban agglomeration: A complex network perspective. Humanit Soc Sci Commun 12(1):1–15

Zhang QJ, Zhao ZS, Meng XX (2024) Energy structure transition and regional financial risks: Mechanism and empirical evidence. J Financ Econ Res 39(3):127–142

Zhou KG, Ji SN (2023) Formation system of regional financial risks under central policy coordination. Financ Trade Econ 44:71–85

Acknowledgements

The work is supported by The Planning Project of Humanities and Social Sciences of the Ministry of Education, China under Grant No. 23YJA790105, and the National Natural Science Foundation of China under Grant no. 72101268.

Author information

Authors and Affiliations

Contributions

Y.Z. and X.Z. provided the main conception and methodology of the study and wrote the main manuscript text, W.X. made the data analysis and create all figures and tables in the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethics approval

This research did not involve studies with human participants or animals, and therefore did not require ethical approval.

Informed consent

This research did not involve human participants; informed consent was therefore not required.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Zhang, Y., Xing, M. & Zhang, X. Spatial correlation network and driving factors of inter-provincial financial risk in China. Humanit Soc Sci Commun 13, 122 (2026). https://doi.org/10.1057/s41599-025-06430-2

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-06430-2