Abstract

This paper provides an in-depth analysis of how management efficiency affects sustainable development in China’s top 10 private energy companies from 2005 to 2021, using the CUP-FM technique. The study finds a notable correlation: a 1% improvement in management efficiency results in a 0.21% reduction in energy expenditure. This highlights the significance of efficient management practices, such as streamlined processes, better resource allocation, and advanced technology use, in optimizing energy consumption and promoting sustainability. Conversely, a 1% increase in the number of employees leads to a 0.49% increase in energy expenditure due to increased operational activities and resource needs. The research also explores the impact of other variables, including earnings per share (EPS), tax payments, and technology spending, on energy expenditure among listed energy companies in China. To foster innovation among employees through improved management efficiency, the paper suggests practical policies such as enhancing sustainable literacy, providing green loans, implementing standardized reporting, and encouraging collaboration and knowledge sharing among energy companies.

Similar content being viewed by others

Introduction

The urgent need for a green transformation in the energy sector stems from the critical requirement to tackle environmental issues and mitigate climate change effects. Reliance on fossil fuels has caused significant harm, including air and water pollution, habitat destruction, and increased greenhouse gas emissions (Squadrito et al. 2023). Previous research, such as that by Du et al. (2023), Zhao and Rasoulinezhad (2023) and Hassan et al. (2024), underscores the importance of transitioning to renewable energy sources—like solar, wind, hydro, and geothermal—to cut carbon emissions and promote sustainability. Additionally, investing in green energy not only drives innovation and job creation but also strengthens energy security by diversifying energy sources (Majeed et al. 2023).

Countries striving for a green transformation in their energy sectors increasingly depend on innovation to address their most pressing environmental challenges. Technological progress is vital for improving the efficiency, cost-effectiveness, and scalability of renewable energy sources (Shobande et al. 2023). Advances in energy storage, smart grid systems, and sustainable transportation are crucial for managing the intermittency and variability of renewable resources, ensuring their reliability and availability (Aydin et al. 2023; Karlilar et al. 2023). Furthermore, innovation in green energy technologies generates new economic opportunities, driving job creation and investment in clean energy infrastructure. By leveraging innovation, countries can expedite the shift to a low-carbon economy while building resilience and adaptability to climate change. Embracing these advancements paves the way for a more sustainable and prosperous future for all (Hille et al. 2020; Song et al. 2024).

Encouraging innovative behavior among employees, particularly within leadership, demands several key requirements. Firstly, fostering a culture that values creativity, risk-taking, and open communication is essential. Leaders should create an environment where employees feel empowered to share ideas freely without fear of criticism. Secondly, providing resources and support for innovation is crucial (Rieger and Klarmann, 2022). This includes allocating time, budget, and tools for experimentation and idea development. Additionally, leaders must lead by example, demonstrating their commitment to innovation through their actions and decisions. They should actively encourage and recognize innovative efforts from employees at all levels of the organization (Euchner, 2022; Mingaleva et al. 2022). Furthermore, establishing clear goals and expectations for innovation ensures alignment with organizational objectives and drives accountability. Lastly, promoting diversity and inclusion within teams fosters a range of perspectives and ideas, enriching the innovation process.

The need for innovation in green transformation is especially urgent for China, given its position as the largest emitter of global greenhouse gases. In 2020, China alone released an astounding 12.3 billion tonnes of CO2 equivalent (GtCO2e), accounting for 27% of global emissions. China’s significant dependence on coal for power generation, representing nearly 60% of global coal consumption, underscores the critical need to shift towards cleaner energy sources. The impact of China’s energy consumption and emissions on global climate change makes innovative solutions essential for mitigating these effects. Without addressing China’s emissions, local environmental issues will worsen, and global reliance on coal, the dirtiest energy source, will continue unabated.

This paper focuses on evaluating the impact of management efficiency, a key element of sustainable development, within China’s top 10 most valuable private energy companies. The study is motivated by the increasing importance of sustainable development in the global energy sector, with China being a major greenhouse gas emitter. By assessing management efficiency, and analyzing the energy expenditure of leading companies such as Jinko Solar, EVE Energy, NIO, Tongwei Co Ltd, Sungrow Power Supply Co Ltd, Formosa Petrochemical Corp, LONGi Green Energy Technology Co., Li Auto, BYD, and CATL—companies identified by Hurun in 2023—this research aims to evaluate the effectiveness of their operational strategies in achieving sustainable outcomes. Understanding the link between management efficiency

This paper makes several contributions to the field, primarily focusing on micro-level analysis of sustainable management practices within China’s top private listed energy companies. Firstly, it provides valuable insights into the relationship between management efficiency and energy expenditure, offering a nuanced understanding of how operational strategies influence resource consumption and environmental impact. By identifying factors that contribute to improved management efficiency, such as streamlined processes, innovation, and strategic decision-making, the paper offers actionable recommendations for enhancing sustainability performance within the energy sector. Secondly, the study highlights the importance of sustainable innovation in driving reductions in energy consumption among top private listed energy companies. By examining case studies and empirical data, the paper identifies innovative practices and technologies that have proven effective in optimizing energy usage and minimizing waste. These insights serve as a blueprint for other companies seeking to adopt similar sustainable practices, ultimately leading to a more energy-efficient and environmentally responsible industry. Moreover, the paper contributes to the broader discourse on sustainable development by showcasing the role of private enterprises in driving positive environmental outcomes.

The paper is organized as follows: Section 2 conducts a literature review, examining existing studies on management efficiency, sustainable innovation, and energy consumption in the energy sector. Section 3 provides background information on China’s energy landscape and the role of private listed energy companies. Section 4 outlines the methodology for data collection and model development. In Section 5, empirical analysis results are presented, highlighting the relationship between management efficiency and energy expenditure. Finally, Section 6 offers concluding remarks and policy implications based on the study’s findings.

Literature survey, gaps and research hypothesis

Review of related literature

The shift from fossil fuels to renewable energy sources marks a crucial step towards sustainability and environmental stewardship in the energy sector. Research by Rasoulinezhad (2020), Yoshino et al. (2021), Hou et al. (2022), Jiang et al. (2022), Phung et al. (2023), and Hassan et al. (2024) underscores the urgency of this transition to address climate change and cut greenhouse gas emissions. Handayani et al. (2019) demonstrated the viability of achieving 100% renewable energy globally, highlighting its potential for substantial reductions in carbon emissions and related health benefits. Additionally, Ye and Rasoulinezhad (2023) and Taghizadeh-Hesary et al. (2022) stressed the need for integrated energy strategies that emphasize renewable energy while balancing social, economic, and environmental considerations. The economic advantages of transitioning to renewable energy are also well-documented, with Xu et al. (2023) revealing that investing in renewable technologies not only generates employment and boosts economic growth but also lowers energy costs and strengthens energy security.

Sustainable management practices have emerged as a critical framework for businesses aiming to balance economic prosperity with environmental responsibility and social equity. Extensive literature has emphasized the importance of integrating sustainability principles into organizational strategies and operations. For example, Elkington’s concept of the “triple bottom line” (Greenland et al. 2022) underscores the significance of considering environmental, social, and economic factors in decision-making processes. Additionally, studies such as those by Danish et al. (2019), Ruggerio (2021), and Sarkar et al. (2022) have highlighted the strategic benefits of sustainable management, including enhanced reputation, improved stakeholder relations, and long-term resilience. Furthermore, research by Wqtrobski (2019) has emphasized the role of leadership in driving sustainability initiatives within organizations, stressing the need for visionary leaders who prioritize environmental and social responsibility.

Green innovation has emerged as a cornerstone of efforts to address pressing environmental challenges while fostering economic growth and competitiveness. Extensive literature underscores the transformative potential of green innovation across various sectors. For instance, studies by Melander and Arvidsson (2022), Rasoulinezhad and Taghizadeh-Hesary (2022) and Ogiemwonyi et al. (2023) have highlighted the concept of “eco-innovation,” emphasizing the role of environmental considerations in driving technological advancements and business model innovation. Furthermore, research by Sun has explored the drivers and barriers to green innovation, identifying factors such as regulatory frameworks, market demand, and organizational capabilities. Moreover, studies such as those by Qu and Liu (2022), Niu et al. (2023), and Sun et al. (2023) have underscored the importance of collaborative approaches and stakeholder engagement in fostering green innovation ecosystems.

The sustainability of enterprises in China has become a topic of increasing importance amidst the country’s rapid economic development and environmental challenges. A burgeoning body of literature has addressed various aspects of sustainability within Chinese businesses. For instance, studies by Lu et al. (2020), and Zhou et al. (2023) have examined the environmental management practices of Chinese firms, highlighting the evolution from reactive compliance to proactive sustainability initiatives. Additionally, research by Mitsunami and Nakai (2024) has explored the relationship between corporate sustainability and financial performance in China, demonstrating the potential for sustainable practices to enhance competitiveness and long-term value creation. Moreover, studies such as those by Deng et al. (2023), Yang and Deng (2023), and Lyu et al. (2023) have investigated the role of government policies and regulatory frameworks in shaping corporate sustainability strategies and outcomes.

Gaps and research hypothesis

In the existing literature on sustainable management practices within China’s energy sector, there remains a notable gap in understanding the specific mechanisms through which management efficiency impacts sustainable innovation and ultimately leads to reduced energy consumption among top private listed energy companies. While previous studies have explored the broader concepts of management efficiency, sustainable innovation, and energy consumption individually, there is a lack of comprehensive analysis that integrates these factors within the context of China’s energy industry. Therefore, the research hypothesis of this paper posits that higher levels of management efficiency among top private listed energy companies in China will positively influence their capacity for sustainable innovation, subsequently leading to decreased energy consumption.

Background and channels of impacts

China has embarked on a sustained journey towards sustainability, marked by significant achievements and ongoing efforts spanning nearly five decades. Since officially initiating ecological and environmental protection endeavors in 1972, China has been a pioneer in embracing the concept of sustainable development. Over the years, the country has demonstrated its commitment through substantial investments in poverty reduction and renewable energy initiatives. Between 2012 and 2020, China allocated approximately 1.6 trillion Chinese yuan ($219 billion) to poverty reduction efforts, aligning with Sustainable Development Goal 1. Furthermore, China’s energy landscape has witnessed a notable transformation, with wind and solar energy poised to surpass coal in electricity production capacity for the first time in 2024, accounting for 40% of total installed capacity. In 2021, the country derived 7.727% of its energy from hydroelectric sources, 2.32% from nuclear power, and 7.141% from other renewables. Despite these advancements, fossil fuels, primarily coal, still dominate China’s electricity generation, comprising around 70% of the total output. Nevertheless, China’s renewable energy sector has experienced substantial growth, with installed capacity exceeding 1.45 billion kilowatts by 2023, underscoring the nation’s steadfast commitment to sustainable energy development.

In the journey towards sustainability, the micro-level status of enterprises plays a pivotal role in driving meaningful change. Specifically, focusing on management efficiency with a sustainability lens becomes crucial for achieving this goal. Management efficiency, when directed towards sustainability objectives, holds the potential to catalyze a cascade of positive outcomes within enterprises. Firstly, focusing on management efficiency with a sustainability perspective can cultivate a culture of innovation within enterprises. By prioritizing sustainability goals, companies are prompted to reassess traditional practices and explore alternative approaches that minimize environmental impact while maximizing resource efficiency. This emphasis on sustainability as a core value encourages employees to think creatively and proactively seek out innovative solutions to complex challenges. Moreover, it fosters a sense of responsibility and ownership among employees, empowering them to contribute their ideas and expertise towards the development and adoption of sustainable practices and technologies. Secondly, improving management efficiency enhances overall enterprise efficacy, streamlining operations and resource allocation towards sustainable endeavors. This, in turn, contributes to enhanced profitability and competitiveness in the market. Moreover, a focus on sustainability-driven management efficiency leads to reduced energy consumption, aligning with environmental conservation goals and promoting resource efficiency. Lastly, heightened emphasis on sustainability can attract increased Environmental, Social, and Governance (ESG) investments, further bolstering enterprises’ capacity to drive positive social and environmental impacts. Therefore, prioritizing management efficiency with a sustainability focus emerges as a multifaceted strategy with far-reaching implications for enterprises’ sustainability journey and their broader contributions to societal and environmental well-being.

Research method and data of variables

This paper delves into the evaluation of management efficiency’s impacts, serving as the bedrock for sustainable development, within China’s top 10 most valuable private energy companies spanning from 2005 to 2021. These companies include Jinko Solar, EVE Energy, NIO, Tongwei Co Ltd, Sungrow Power Supply Co Ltd, Formosa Petrochemical Corp, LONGi Green Energy Technology Co., Li Auto, BYD, and CATL. Management efficiency is computed and incorporated as the explanatory variable, while energy expenditure stands as the dependent variable. Controlling for factors such as the number of employees, EPS (Earnings Per Share), technology expenditure, and tax payments in our empirical model, data for these variables were primarily sourced from the BANK OF CHINA GLOBAL WEBSITE, China Stock Market & Accounting Research (CSMAR), and the China Financial Futures Exchange (CFFEX) dataset. Detailed information on these variables is outlined in Table 1.

Anticipated impact explanations on energy expenditure are as follows.

Improved management efficiency often leads to better resource allocation, streamlined processes, and optimized operations. Companies with higher management efficiency are more likely to implement energy-saving practices, invest in renewable energy sources, and adopt efficient technologies. Consequently, this leads to a reduction in overall energy expenditure as resources are utilized more effectively and wastage is minimized. Moreover, the number of employees can impact energy expenditure in various ways. While a larger workforce may result in increased energy usage due to higher operational activity and facility occupancy, companies with efficient management can mitigate this by optimizing labor efficiency and reducing energy-intensive processes. Additionally, a smaller but highly skilled workforce may lead to increased innovation in energy-saving technologies, further reducing energy expenditure. Earnings per share reflect a company’s profitability, which can influence its ability to invest in energy-saving measures. Higher EPS may indicate greater financial capacity to implement energy-efficient technologies and practices, leading to a decrease in energy expenditure. However, companies solely focused on maximizing short-term profits may prioritize cost-cutting measures that could inadvertently increase energy usage. Thus, the impact of EPS on energy expenditure depends on the company’s strategic priorities and long-term sustainability goals. Furthermore, increased investment in technology often results in the adoption of energy-efficient equipment, automation, and smart systems, leading to reduced energy consumption and expenditure. Companies with efficient management are more likely to allocate resources towards research and development of sustainable technologies, thereby driving down energy costs over time through innovation and optimization of energy usage. Tax payments can influence energy expenditure through various channels. On one hand, higher tax payments may limit the financial resources available for investment in energy-saving initiatives, potentially leading to increased energy expenditure in the short term. Additionally, tax incentives geared towards promoting sustainable practices and investment in renewable energy sources can serve as powerful catalysts for companies to prioritize energy efficiency. By offering tax breaks, credits, or subsidies for initiatives such as installing solar panels, implementing energy-efficient machinery, or transitioning to greener production processes, governments can incentivize businesses to adopt more sustainable practices. These incentives not only lower the financial barriers to implementing energy-saving technologies but also provide long-term cost savings through reduced energy expenditure. Consequently, the impact of tax payments on energy expenditure is intricately linked to the broader regulatory landscape and the strategic decisions made by companies in response to such policies. Businesses that strategically leverage tax incentives to invest in energy efficiency measures are likely to experience significant reductions in energy expenditure over time, contributing to both their bottom line and environmental sustainability efforts.

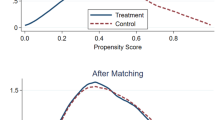

The empirical section of this study utilizes the panel co-integration approach as its primary methodology, renowned for its effectiveness and relevance when analyzing variables that demonstrate long-term co-integration. To comprehensively evaluate the impact of independent variables, a detailed panel data econometric analysis is undertaken, involving several diagnostic steps. Initially, the method proposed by Pesaran and Yamagata (2008) is employed to meticulously examine the consistency of slopes across the panel, ensuring the validity of the model assumptions. Subsequently, it becomes imperative to address the evaluation of cross-sectional dependency, which is accomplished through the utilization of statistical techniques such as Pesaran’s (2021) method. The following step entails scrutinizing the stationarity status of the series, utilizing the CADF and CIPS approach introduced by Pesaran (2007). The investigation then proceeds to explore long-term relationships between variables using Westerlund’s (2007) methodology. Additionally, the analysis is augmented through the application of the Continuously Updated Fully Modified (CUP-FC) approach.

The CUP-FC (Continuously Updated Fully Modified) estimator offers several notable advantages for econometric analysis. By continuously updating the correction factors, CUP-FC enhances the precision of estimates in the presence of panel data with potential cross-sectional dependence and heterogeneity. This approach addresses both finite sample bias and the inconsistency of traditional estimators in such contexts.

Interpretations of the results

In this paper, the empirical section primarily focuses on assessing the influence of management efficiency on energy consumption within a selection of listed energy companies in China spanning from 2005 to 2021. The empirical results are elucidated through a structured presentation of sequential tests along with their corresponding outcomes.

Table 2 presents the descriptive statistics for key variables, revealing notable variability across the sample. Management Efficiency has a mean of 13.243 and a high standard deviation of 8.769, indicating significant differences in management practices among companies, with values ranging from 2.494 to 23.546. Energy Expenditure averages 13,244.035 with a standard deviation of 435.45, suggesting moderate consistency despite a broad range of expenditure from 7,449.39 to 23,659.49. The Number of Employees averages 56,004, but with a high standard deviation of 1,657, the range from 43,646 to 119,543 shows considerable variation in company sizes. Earnings per Share (EPS) has a mean of 5.362 and a large standard deviation of 8.193, indicating diverse profitability levels, with EPS ranging from −3.657 to 7.90. Technology Expenditure averages 9,853.12 with a standard deviation of 1,504.64, reflecting moderate variability in investment levels, ranging from 1,650.40 to 21,354.59. Lastly, Tax Payment has a mean of 453,635.46 and a standard deviation of 17,088.49, with values ranging from 130,434.22 to 985,343.50, highlighting differences in company size and financial performance.

Next, as delineated in Table 3, centers on the assessment of slope homogeneity. Since all p-values are found to be statistically significant at the 5% significance level, it can be inferred that the panel displays uniformity in slopes.

The following analysis focuses on evaluating cross-sectional dependency by employing Pesaran’s (2021) and Breusch-Pagan (1980) metrics, which measure the correlation among the cross-sectional units within the panel. The results of this evaluation are summarized in Table 4, confirming the rejection of the null hypothesis, as evidenced by the statistically significant p-values at the 5% significance level.

Subsequently, the Cross-sectional IPS and ADF approaches are employed to ascertain the degree of integration within the series. The outcomes of these analyses are elaborated upon in Table 5, revealing that the series exhibits stationarity at the first level of difference.

The outcomes of the subsequent analysis, utilizing the Westerlund (2007) technique to investigate the long-term relationship among the variables, are presented in Table 6. Examination of the p-values derived from the four statistics leads to the determination that, within our panel data, the variables exhibit long-term cointegration.

The findings of the coefficient estimation, derived from the panel cointegration estimator CUP-FM, utilized to address cross-sectional dependency, are delineated and deliberated upon in Table 7.

The observed correlation, where a 1% increase in management efficiency results in a 0.21% decrease in energy expenditure among selected energy companies in China, highlights several key factors. Enhanced management efficiency typically involves streamlined processes, improved resource allocation, and better technology utilization. Companies with efficient management practices can more effectively identify and address operational inefficiencies, leading to optimized energy use and reduced waste. Moreover, such efficiency fosters a culture of innovation and sustainability, promoting the adoption of energy-saving technologies and practices. Investments in renewable energy, upgraded equipment for improved efficiency, and conservation measures are common outcomes. Additionally, efficient management allows companies to swiftly adapt to market changes, regulatory demands, and technological advances, ensuring they remain proactive in implementing energy-saving strategies.

The observed association indicating that a 1% increase in the number of employees corresponds to a 0.49% rise in energy expenditure among selected enterprises in China can be attributed to several key factors. Firstly, an expanding workforce typically entails higher operational activity and increased facility occupancy, leading to greater energy usage for lighting, heating, cooling, and other operational needs. As the number of employees grows, so does the demand for resources, including energy, to support their activities within the company premises. Additionally, a larger workforce may necessitate the operation of additional machinery and equipment to accommodate higher production levels, further contributing to overall energy consumption. Moreover, managing a larger workforce often requires additional administrative and support services, which can increase energy usage in areas such as office spaces, computing systems, and employee amenities. Furthermore, the indirect impacts of a larger workforce, such as increased transportation needs for commuting employees and expanded supply chain operations, can also drive up energy expenditure across various facets of the business.

The estimated positive coefficients for earnings per share (EPS) and tax payment, alongside the negative coefficient for technology expenditure, regarding their impacts on energy expenditure among listed energy companies in China, reflect distinct dynamics within these variables. Firstly, the positive association between EPS and energy expenditure suggests that companies with higher profitability may be inclined to invest more in energy-intensive operations or expansion strategies, thereby increasing overall energy consumption. Additionally, higher EPS could signify financial stability and growth, enabling companies to afford increased energy usage to support their business activities. Similarly, the positive coefficient for tax payment implies that companies with higher tax obligations may have greater financial resources at their disposal, which they may allocate towards expanding operations or investing in energy-intensive processes, consequently driving up energy expenditure. Conversely, the negative coefficient for technology expenditure indicates that investments in technology aimed at enhancing energy efficiency and reducing consumption have a mitigating effect on energy expenditure. Companies that prioritize technological advancements geared towards energy conservation can achieve cost savings by optimizing energy usage and reducing waste.

Continuing the analysis, a thorough investigation was undertaken utilizing the Fully Modified OLS method to reassess the signs of the coefficients. The outcomes, presented in Table 8, indicate a negative impact of management efficiency on energy expenditure among enterprises in China. This suggests that as management efficiency improves, there is a corresponding decrease in energy expenditure, ultimately fostering greater sustainability within these enterprises.

Conclusion and practical implications

This paper offers an in-depth examination of how management efficiency impacts sustainable development among China’s top 10 private energy companies from 2005 to 2021. The analysis reveals a notable correlation where a 1% increase in management efficiency results in a 0.21% decrease in energy expenditure. This finding highlights the crucial role of effective management practices, such as optimizing processes, improving resource allocation, and leveraging technology, in reducing energy use and promoting sustainability. Conversely, the study also shows that a 1% increase in the number of employees correlates with a 0.49% increase in energy expenditure, reflecting the added operational demands and resource needs of a larger workforce. Moreover, the paper explores the influences of other variables like earnings per share (EPS), tax payments, and technology expenditure on energy expenditure, emphasizing the complex interplay of factors affecting energy consumption. These results stress the importance of strategic management in enhancing energy efficiency and advancing sustainability in the energy sector.

To enhance employees’ innovation behavior through management efficiency in energy listed companies in China, several practical policies can be implemented:

-

i.

Increasing Sustainable Literacy of Managers and Employees:

Introduce training programs and workshops to boost the sustainable literacy of managers and employees in energy companies. These initiatives should emphasize sustainable practices, energy-saving methods, and the role of innovation in advancing sustainability efforts. By raising awareness and deepening understanding of sustainability challenges, these programs will enable managers and employees to effectively incorporate sustainable practices into their everyday activities and nurture a culture of innovation.

-

ii.

Increasing Green Loans to Enterprises:

Introduce policies to incentivize financial institutions to offer green loans with favorable terms to energy listed companies that demonstrate a commitment to sustainability and innovation. These loans can be earmarked for investments in energy-efficient technologies, renewable energy projects, and research and development initiatives aimed at improving energy management and reducing environmental impact. By providing access to affordable financing, companies will be encouraged to undertake innovative sustainability projects that drive energy efficiency and reduce carbon emissions.

-

iii.

Standardization of Sustainable Reporting:

Establish standardized guidelines and reporting frameworks for sustainable practices and environmental performance for energy listed companies. This will ensure consistency and transparency in reporting sustainability metrics such as energy consumption, carbon emissions, and environmental impact. By standardizing sustainable reporting, companies will be better able to benchmark their performance, track progress over time, and demonstrate their commitment to sustainability to investors, stakeholders, and the public. Additionally, transparent reporting can incentivize companies to prioritize sustainability and innovation as part of their corporate strategy.

-

iv.

Promoting Collaboration and Knowledge Sharing:

Facilitate collaboration and knowledge sharing among energy listed companies, industry associations, research institutions, and government agencies to foster innovation and best practices in sustainable energy management. Establish platforms for sharing case studies, success stories, and lessons learned from sustainability initiatives. Encourage cross-sectoral partnerships and collaborative research projects to develop innovative solutions to common sustainability challenges. By promoting collaboration and knowledge sharing, companies can leverage collective expertise and resources to drive continuous improvement in energy efficiency and sustainability performance.

For future research endeavors, there remains ample opportunity to delve deeper into sustainable corporate management requirements within Chinese enterprises. This avenue of study could entail a comprehensive examination of the regulatory frameworks, industry standards, and corporate governance practices that shape sustainability initiatives and management practices within Chinese companies. Additionally, conducting surveys to gauge the perception of sustainable innovation among employees and managers within enterprises could provide valuable insights into the factors influencing engagement with sustainability initiatives, barriers to adoption, and opportunities for improvement.

Data availability

For inquiries regarding access to the datasets generated or analyzed in the current study, please do not hesitate to reach out to the corresponding author.

References

Aydin M, Degirmenci T, Gurdal T, Yavuz H (2023) The role of green innovation in achieving environmental sustainability in European Union countries: Testing the environmental Kuznets curve hypothesis. Gondwana Res. 118:105–116

Breusch TS, Pagan AR (1980) The lagrange multiplier test and its application to model specifications in econometrics. Rev. Econ. Stud. 47:239–253

Danish M, Seniyu T, Funabashia T, Ahmadi M, Ibrahimi A, Ohta R, Howlader H, Zaheb H, Sabory N, Sediqi M (2019) A sustainable microgrid: A sustainability and management-oriented approach. Energy Procedia 159:160–167

Deng Z, Song S, Jiang N, Pang R (2023) Sustainable development in China? A nonparametric decomposition of economic growth. China Econ. Rev. 81:102041. https://doi.org/10.1016/j.chieco.2023.102041

Du J, Shen Z, Song M, Vardanyan M (2023) The role of green financing in facilitating renewable energy transition in China: Perspectives from energy governance, environmental regulation, and market reforms. Energy Econ. 120:106595. https://doi.org/10.1016/j.eneco.2023.106595

Euchner J (2022) Innovation and Culture. Res.- Technol. Manag. 65(2):9–10

Greenland S, Saleem M, Misra R, Mason J (2022) Sustainable management education and an empirical five-pillar model of sustainability. Int. J. Manag. Educ. 20(3):100658. https://doi.org/10.1016/j.ijme.2022.100658

Hassan Q, Viktor P, Al-Musawi T, Ali B, Algburi S, Alzoubi H, Al-Jiboory A, Sameen A, Salman H, Jaszczur M (2024) The renewable energy role in the global energy Transformations. Renew. Energy Focus 48:100545. https://doi.org/10.1016/j.ref.2024.100545

Hille E, Althammer W, Diederich H (2020) Environmental regulation and innovation in renewable energy technologies: Does the policy instrument matter? Technol. Forecast. Soc. Change 153:119921. https://doi.org/10.1016/j.techfore.2020.119921

Hou H, Lu W, Liu B, Hassanein Z, Mahmood H, Khalid S (2022) Exploring the role of fossil fuels and renewable energy in determining environmental sustainability: evidence from OECD countries. Sustainability 15(3):2048. https://doi.org/10.3390/su15032048

Jiang Z, Mahmud A, Maneengam A, Nassani A, Haffar M, Cong P (2022) Non linear effect of Biomass, fossil fuels and renewable energy usage on the economic Growth: Managing sustainable development through energy sector. Fuel 326:124943. https://doi.org/10.1016/j.fuel.2022.124943

Karlilar S, Balcilar M, Emir F (2023) Environmental sustainability in the OECD: The power of digitalization, green innovation, renewable energy and financial development. Telecommun. Policy 47(6):102568. https://doi.org/10.1016/j.telpol.2023.102568

Lu J, Li B, Li H, Zhang Y (2020) Sustainability of enterprise export expansion from the perspective of environmental information disclosure. J. Clean. Prod. 252:119839. https://doi.org/10.1016/j.jclepro.2019.119839

Lyu W, Wang T, Hou R, Liu J (2023) Going green and profitable: The impact of smart manufacturing on Chinese enterprises. Computers Ind. Eng. 181:109324. https://doi.org/10.1016/j.cie.2023.109324

Majeed Y, Khan M, Waseem M, Zahid U, Mahmood F, Majeed F, Sultan M, Raza A (2023) Renewable energy as an alternative source for energy management in agriculture. Energy Rep. 10:344–359

Melander L, Arvidsson A (2022) Green innovation networks: A research agenda. J. Clean. Prod. 357:131926. https://doi.org/10.1016/j.jclepro.2022.131926

Mingaleva Z, Shironina E, Lobova E, Olenev V, Plyusnina L, Oborina A (2022) Organizational culture management as an element of innovative and sustainable development of enterprises. Sustainability 14(10):6289. https://doi.org/10.3390/su14106289

Mitsunami K, Nakai M (2024) Are sustainable firms more innovative? The case of China. Jpn. World Econ. 69:101238. https://doi.org/10.1016/j.japwor.2024.101238

Niu P, Yang Y, Sun L (2023) High quality imports and green innovation. Innov. Green. Dev. 2(2):100049. https://doi.org/10.1016/j.igd.2023.100049

Ogiemwonyi O, Alam M, Hago I, Azizan N, Hashim F, Hossain S (2023) Green innovation behaviour: Impact of industry 4.0 and open innovation. Heliyon 9(6):e16524. https://doi.org/10.1016/j.heliyon.2023.e16524

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 22(2):265–312

Pesaran MH (2021) General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 60(1):13–50

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J. Econ. 142(1):50–93

Phung T, Rasoulinezhad E, Thu H (2023) How are FDI and green recovery related in Southeast Asian economies? Economic Change Restruct. 56:3735–3755

Qu K, Liu Z (2022) Green innovations, supply chain integration and green information system: A model of moderation. J. Clean. Prod. 339:130557. https://doi.org/10.1016/j.jclepro.2022.130557

Rasoulinezhad E (2020) Environmental Impact Assessment Analysis in the Kahak’s Wind Farm. J. Environ. Assess. Policy Manag. 22(01):2250006. https://doi.org/10.1142/S1464333222500065

Rasoulinezhad, E, and Taghizadeh-Hesary, F (2022) Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency, 15 (14), https://doi.org/10.1007/s12053-022-10021-4

Rieger V, Klarmann M (2022) The effect of cooperative team culture on innovation. J. Bus. Res. 144:1256–1271

Ruggerio C (2021) Sustainability and sustainable development: A review of principles and definitions. Sci. Total Environ. 786:147481. https://doi.org/10.1016/j.scitotenv.2021.147481

Sarkar B, Dissanayake P, Bolan N, Dar J, Kumar M, Haque N, Mukhopadhyay R, Ramanayaka S, Biswas J, Tsang D, Rinklebe J, Ok Y (2022) Challenges and opportunities in sustainable management of microplastics and nanoplastics in the environment. Environ. Res. 207:112179. https://doi.org/10.1016/j.envres.2021.112179

Shobande O, Ogbeifun L, Tiwari A (2023) Re-evaluating the impacts of green innovations and renewable energy on carbon neutrality: Does social inclusiveness really matters? J. Environ. Manag. 336:117670. https://doi.org/10.1016/j.jenvman.2023.117670

Song A, Rasool Z, Nazar R, Anser M (2024) Towards a greener future: How green technology innovation and energy efficiency are transforming sustainability. Energy 290:129891. https://doi.org/10.1016/j.energy.2023.129891

Sun Y, Gao P, Tian W, Guan W (2023) Green innovation for resource efficiency and sustainability: Empirical analysis and policy. Resour. Policy 81:103369. https://doi.org/10.1016/j.resourpol.2023.103369

Squadrito G, Maggio G, Nicita A (2023) The green hydrogen revolution. Renew. Energy 216:119041. https://doi.org/10.1016/j.renene.2023.119041

Taghizadeh-Hesary F, Phoumin H, Rasoulinezhad E (2022) COVID-19 and regional solutions for mitigating the risk of SME finance in selected ASEAN member states. Economic Anal. Policy 74:506–525

Westerlund J (2007) Testing for error correction in panel data. Oxf. Bull. Econ. Stat. 69(6):709–748

Wqtrobski J (2019) Towards knowledge handling in sustainable management domain. Procedia Computer Sci. 159:1591–1601

Xu J, Zhao J, Liu W (2023) A comparative study of renewable and fossil fuels energy impacts on green development in Asian countries with divergent income inequality. Resour. Policy 85(Part A):104035. https://doi.org/10.1016/j.resourpol.2023.104035

Yang G, Deng F (2023) Can digitalization improve enterprise sustainability?–Evidence from the resilience perspective of Chinese firms. Heliyon 9(3):e14607. https://doi.org/10.1016/j.heliyon.2023.e14607

Ye X, Rasoulinezhad E (2023) Assessment of impacts of green bonds on renewable energy utilization efficiency. Renew. Energy 202:626–633

Yoshino N, Rasoulinezhad E, Taghizadeh-Hesary F (2021) Economic impacts of carbon tax in a general equilibrium framework: empirical study of Japan. J. Environ. Assess. Policy Manag. 23(01):2250014. https://doi.org/10.1142/S1464333222500144

Zhao L, Rasoulinezhad E (2023) Role of natural resources utilization efficiency in achieving green economic recovery: evidence from BRICS countries. Resour. Policy 80:103164. https://doi.org/10.1016/j.resourpol.2022.103164

Zhou M, Jiang K, Zhang J (2023) Environmental benefits of enterprise digitalization in China. Resour., Conserv. Recycling 197:107082. https://doi.org/10.1016/j.resconrec.2023.107082

Acknowledgements

The authors would also like to express our sincere thanks to Professor HT Park for his valuable insights and thoughtful comments, which have greatly contributed to the refinement of this manuscript. This research did not receive any funding.

Author information

Authors and Affiliations

Contributions

Ting Su: Conceptualization, supervision, resources, writing review and editing; Xiaokang Wang:Data curation, writing original draft preparation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not encompass studies involving human participants conducted by any of the authors.

Informed consent

This article does not include any studies involving human participants conducted by the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Su, T., Wang, X. The impact of leadership on employees’ innovation behavior: evidence from China’s energy listed companies. Humanit Soc Sci Commun 11, 1515 (2024). https://doi.org/10.1057/s41599-024-03915-4

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03915-4