Abstract

The present study estimates a Fiscal Reaction Function (FRF) to assess the sustainability of Egypt’s gross domestic debt from 1990 to 2022. A further focus of the study is to examine the institutional quality’s impact on the relationship between primary balance and debt stock, which is largely believed to significantly influence debt sustainability. Based on the World Development Indicators, World Governance Indicators, the International Monetary Fund, and the Central Bank of Egypt, we used the Autoregressive Distributed Lag (ARDL) and Error Correction (EC) techniques to model non-stationary time-series data. When examining institutional variables, we found that the fiscal deficit is negatively associated with both government effectiveness and regulatory quality. Nevertheless, the primary balance situation remained largely unaffected by indicators such as government corruption, political stability, and VA. To check robustness, we constructed an institutional quality index (IQI) that combines the six institutional indicators using Principal Component Analysis (PCA). The outcomes show that our findings are robust, as they support most of the baseline model results. It is now established that if the institutional quality in Egypt improves over time, fiscal sustainability can be achieved, implying that institutional reforms may mitigate the negative effects of debt rises, which proves that debt sustainability would not be possible without institutional improvements and reforms. Most notably, a negative short-run and a positive long-run interaction effects (DebtxIQI) suggest that debt can promote growth. In other words, austerity worsens the primary balance temporarily in the presence of high IQ; however, debt is paid off sustainably over time, enhancing fiscal health. Nevertheless, the results suggested that, whereas Egypt’s fiscal policy may be sustainable in the long run, there is a considerable challenge in ensuring long-term debt sustainability as evidenced by the slow speed of adjustment, which is depicted by the Error Correction Term “ECT”. To ensure fiscal sustainability, policymakers should focus on key reforms in Government Effectiveness and regulatory quality, while ensuring transparency and accountability through an independent fiscal council with citizen monitoring and legally mandated participatory budgets. Debt rises should also be strictly controlled, kept to less than 80% of GDP, with borrowing specifically directed toward productive projects and worthwhile endeavors.

Similar content being viewed by others

Introduction

Public policy is fundamentally concerned with the sustainability of fiscal policies, especially the sustainability of public debt. The term “debt sustainability” means a country’s capacity to fulfill its financial obligations without requiring external assistance (Marquez, 2000; Ogbeifun and Shobande, 2020). When there is a gap between government revenues and its spending needs (known as fiscal deficit), governments usually manage this gap by borrowing through public debt (Joy and Panda, 2020).

Many studies show that if public debt is effectively managed and directed toward productive public investments, it can help increase the country’s GDP and even reduce the debt-to-GDP ratio. A recent study by De Soyres et al. (2022) confirmed this idea. However, excess accumulation of debt and its improper management can create significant budgetary issues for both current and future generations (Dombi and Dedák, 2019; Ogbeifun and Shobande, 2020). This is why there are many concerns that relying heavily on debt may hurt economic growth and development in the long run.

It is worth noting that the existence of fiscal deficits may be attributed to domestic political problems. Weak institutions and poor governance may allow governments to misuse public resources or make irresponsible budget decisions. Institutional quality refers to the effectiveness and soundness of institutions within a country or a region. Economic growth, social equity, stability, and the improvement of national competitiveness are all directly impacted by the efficacy of national governance, and institutional quality is a crucial indicator of this effectiveness (Duan and Wan, 2025). High institutional quality—presented by strong institutions—can play an important role by improving transparency and holding governments accountable. This can help limit budget deficits and reduce rent-seeking activities. However, most studies that analyze debt sustainability focus only on economic factors and use linear models. They often ignore how the quality of institutions can affect debt sustainability, even though the impact of institutions may change depending on their strength or weakness (Lee et al., 2023).

Developing countries, in particular, face more profound challenges in maintaining debt sustainability, as many of them suffer from higher fiscal deficits and weaker institutions. Egypt is a clear example of this situation. Egypt’s public debt grew massively during the last decades of the 20th century due to large fiscal deficits caused by high government spending. According to the European Union’s standards, the public debt-to-GDP ratio should not exceed 60%, and the public deficit-to-GDP should be less than 3% to maintain fiscal stability and economic growth (Brady and Magazzino, 2019). But in Egypt, the debt-to-GDP ratio increased over time, reaching 87.2% in 2022, and the public deficit-to-GDP ratio reached 6.1% (World Bank, 2021; Central Bank of Egypt, 2023). This can be explained by the adverse debt dynamics, as the real interest rates (RIR) on Egypt’s debt have been higher than the country’s real GDP growth.

In addition, Egypt has been facing challenges with institutional quality. This is evident by the country’s low scores in the WGIs, showing problems in governance, transparency, and accountability, despite efforts by the government to improve these areas. Weak institutions may be one factor behind the rising levels of debt and deficits in Egypt. This, in turn could hurt the country’s long-term development and fiscal sustainability.

Numerous studies have already estimated the Fiscal Reaction Function (FRF) in Egypt to assess its debt sustainability (e.g., Ramadan, 2020; Rashied, 2021; Al Sayed et al., 2021). However, a key limitation of these studies is that they mostly ignore the role of institutional quality in this relationship. This paper tries to fill in this gap by directly integrating institutional quality into the FRF framework. This provides new evidence on how institutions can influence long-term debt sustainability and fiscal behavior.

Moreover, the reasons behind the focus on Egypt are that being an extremely pertinent case for researching the relationship between institutions and fiscal policy, because of its long-standing fiscal deficits, growing public debt, and weak institutional framework. Egypt also could provide valuable policy lessons for other developing countries that struggle to manage debt under inadequate governance frameworks.

In this context, this paper aims to assess debt sustainability in Egypt by estimating an FRF to determine the role of institutional quality in the relationship between the primary budget balance and public debt stock during the period (1990–2022). This is done through the use of unit root and cointegration tests, as well as an Autoregressive Distributed Lag (ARDL) model and Error correction (EC) mechanisms. These methods help to explain that both the short-run dynamics and the long-run relationships between the main variables.

To this end, this paper will be structured as follows. After this introduction, section “Literature Review” reviews previous literature on the definitions and approaches of assessing debt sustainability. Section “Methodology and Data Sources” presents the methodology and data used in this study. Section “Stylized Facts” provides some stylized facts about the main variables of interest. Section “Results and Discussion” presents the empirical results. Finally, section “Conclusion and Policy Implications” concludes and offers policy implications.

Literature review

Different definitions of debt sustainability have been proposed by previous research. For instance, according to IMF, debt sustainability is defined as “a situation in which a borrower is expected to be able to continue servicing its debts without an unrealistically large future correction to the balance of income and expenditure” (IMF, 2002). Additionally, it is described as the case in which the government budget is financed smoothly while maintaining reasonable increases in public debt over time (Blanchard, 1990). It could also be defined as the government’s ability to generate surpluses in the future to repay previous debt rather than the issuance of new debt to finance existing debt and interest payments (Bergman, 2001). Further, it refers to a nation’s ability to manage its current and future debt obligations without resorting to restructuring, debt relief, or issuing a new debt to finance existing liabilities (Gunter, 2011). Despite the diversity of these definitions, all of them share two key concepts that are worth to be clarified, which are: solvency and liquidity. Solvency signifies the debtor’s future capacity to meet its debt obligations without accumulating further debt. Conversely, liquidity refers to the debtor’s ability to secure sufficient funds in each period to cover its financing gap while not resorting to disruptive adjustments (Wyplosz, 2011).

Approaches to debt sustainability evaluation

As for assessing debt sustainability, previous studies highlighted the complexity of this issue and the need for distinctive approaches depending on the country’s context and needs. Consequently, four different approaches can be identified in the literature to evaluate debt sustainability: Debt stabilizing primary balance, Value at risk, IMF approach, and FRF. Each approach is briefly explained in the following part.

(a) Debt stabilizing primary balance

This method is a straightfoward one, where the surplus required to stabilize debt. Is directly calculated. Yet, it necessitates making assumptions about future growth rates and interest rates (Wyplosz, 2005; Ley, 2010). Despite the easiness of implementation of this approach, it has some limitations. This method does not indicate whether or not the debt can be sustained over time; it only provides the surplus (either primary budget or current account) required to stabilize the debt ratio for a given value of its determinants. Furthermore, it fails to take into account the possible dynamic interactions among the important factors that determine debt ratios evolution over time (Akyuz, 2007).

(b) Value at risk

This approach was adopted as a debt sustainability assessment tool for a certain economy during a specific period of time. There are three main methods for this approach: historical simulation, Monte Carlo, and delta-normal. Historical simulation utilizes past market data to construct future scenarios for portfolio gains and losses. Monte Carlo relies on statistical distributions to approximate potential market changes, while delta-normal assumes a multivariate normal distribution for market factors (Wyplosz, 2005). In order to test the impact of shocks on the stock of debt in the baseline scenario, this method necessitates the introduction of stress tests that are applied on certain macroeconomic variables. Wyplosz (2005) outlines a simple three-step estimation process: assume historical correlations remain relevant, consider all possible shock combinations with their probabilities, and test each shock’s impact on debt evolution. While this offers a basic framework, the literature has refined, classified, and applied this approach in diverse ways (Barnhill and Kopits, 2003; Adrogue, 2005; Ferrarini and Ramayandi, 2012). Despite limitations like data dependence and assumptions, its flexibility and continuous development make it a relevant methodology for analyzing and managing debt sustainability in economies facing a dynamic and uncertain future.

(c) IMF Approach

When it comes to debt sustainability analysis, the IMF distinguishes between low-income countries—who primarily rely on concessional support to meet their needs for external financing—and market-access countries, which have substantial access to international capital markets. For the latter, a standardized framework analyzes public and external debt over 5 years, applying stress tests and incorporating governance quality indices. Critics find that this method ignores shock correlations and underestimates the growth potential of borrowing. Meanwhile, the IMF supports low-income countries through broader, flexible initiatives, focusing on capacity building and poverty reduction strategies. While being known for its customization, concerns include overly optimistic projections and prioritizing debt service over development goals.

(d) Fiscal reaction function (FRF)

Lastly, the most widely used empirical test for fiscal sustainability is estimating the FRF. This method looks at how well a nation’s fiscal authorities used primary balance adjustment to stabilize the amount of public debt and business cycle fluctuations. The FRF test models or estimates the government’s FRF based on historical behavior. Since the model determinants are chosen based on their influence and importance on the targeted economy’s primary balance, the estimation of the FRF differs across nations.

In sum, while various approaches exist to assess debt sustainability, this paper focuses on the fiscal reaction approach to analyze the relationship between primary balance and debt stock. Therefore, the next part reviews the results of previous literature on this relationship.

Theoretically, the government’s intertemporal budget constraint can be used to explain debt sustainability (Bohn, 1995, Baharumshah et al., 2017). If a country is included in the no-Ponzi scheme, it is regarded as solvent. Consequently, debt is considered sustainable in this situation because the present value of future revenue could cover the present value of future debt services. This highlights the fact that debt sustainability is a long-term achievement, as the country’s ability to pay off its debts in the short run does not necessarily mean achieving debt sustainability. Consequently, in order to achieve debt sustainability, countries must occasionally run a primary surplus in order to control the mounting debt (Bohn, 1995). In this regard, evidence showing that the primary balance rises as debt levels rise signals that governments are undertaking the required fiscal adjustments to maintain debt sustainability.

According to Blanchard (1993), the equilibrium of fiscal policy is determined by the primary balance, which needs to react negatively to declining output levels and positively to rising output levels. He clarified that lowering the budget deficit has a positive fiscal effect on aggregate demand. Bohn (1998) was the pioneer in the assessment of the sustainability of public debt in the United States (US) during the period (1916–1995). The debt-to-GDP ratio is unstable even though it has a uniform root, according to Bohn (1998), but corrective fiscal policies may cause a reversal. He underlined that the US primary surplus is seen as an increasing function of the debt-to-GDP ratio and that the primary surplus responds positively to changes in debt, indicating that US fiscal policy satisfies the intertemporal budget constraint.

Further, authors continued to empirically estimate the FRF across different countries. For instance, an FRF is estimated by Checherita-Westphal and Zdarek (2017) using a dynamic panel technique for a sample of European countries. It was found that primary surpluses respond positively to higher debt during the reviewed period. Using a comparable sample, Köhler-Töglhofer and Zagler (2007) used data on government debt and government budgets in a sample of 15 European countries, Norway, as well as the United States, during the period (1960–2002). The results indicated that reducing government spending is more crucial for lowering debt rather than rising revenues.

As for the MENA countries, Neaime (2010) investigated public debt sustainability in five MENA countries (Turkey, Egypt, Jordan, Morocco, and Tunisia). The empirical findings indicated the unsustainability of Jordan’s and Turkey’s fiscal and debt policies, while Egypt’s fiscal policies are weakly sustainable, Tunisia’s fiscal policies are strongly sustainable, and Morocco showed mixed results. Similarly, Khalladi (2019) estimated the FRF for a number of MENA nations, including Morocco, Tunisia, Jordan, and Egypt. The findings indicate the presence of fiscal fatigue, which is the inability to control the growth of debt through fiscal adjustments as it rises. Further, Ben Tahar et al. (2022) analyzed fiscal sustainability in 15 MENA countries during the period (1990–2019) and found that these countries generally react responsibly to debt, which was evident from the significant positive response of the primary balance to changes in the lagged debt-to-GDP ratio, adjusting spending to manage debt levels. Notably, oil-exporting countries show stronger responses. Additionally, the study showed that public spending tends to be countercyclical with rising debt and that expenditure-based fiscal adjustment to debt accumulation occurs.

Other authors estimated the FRF for specific countries. For instance, Mello (2008) analyzed Brazil’s fiscal sustainability and found that all levels of government significantly adjust their budgets when debt rises, reflected in increased primary surpluses. Specifically, the study used an advanced model to reveal that expenditure changes are largely offset by long-term revenue increases, suggesting sustainable debt dynamics. Additionally, Burger et al. (2011) examined South Africa’s reaction function and its responses to changes in its debt status. They proved that South Africa has experienced a stable fiscal policy since 1946. This was due to manipulating the primary balance (deficit or surplus) in response to the country’s mounting debt level.

Empirical evidence on the role of institutional quality in debt sustainability

Recently, economists have turned their attention to the role of institutional quality in debt sustainability for long-run economic growth. Although there is no consensus on a single definition for institutional quality, it usually refers to the efficiency, effectiveness and integrity of formal institutions in shaping economic and social outcomes (Duan and Wan, 2025). High institutional quality implies better accountability through enhanced transparency and anti-corruption measures (Persson and Tabellini, 2004). This helps governments to behave responsibly and gives them the credibility to implement stable fiscal policies (Alesina and Tabellini, 1990). While stronger regulatory quality fosters market trust, attracts investment, and supports the sustainability of public debt, strong institutions also enhance administrative capacity to manage taxes and public spending (North, 1990). However, it is worth noting that maintaining strong institutions comes at a price. Governments must allocate resources to combat corruption, implement effective regulations, and maintain competent bureaucracy. Hence, the key challenge here is to find a threshold of institutional quality where the benefits outweigh the costs (Chang, 2011). Therefore, identifying this optimal threshold of institutional quality—the level that achieves debt sustainability—has become a major area of research interest. It is worth noting that there are several measures and indicators of institutional quality, and the literature offers a wide variety of these indices that capture different aspects of this concept. In general, they try to assess the efficiency and soundness of formal institutions in the country. However, these indices differ in scope, methodology and theoretical grounding.

A number of studies suggested that effective policy frameworks as well as institutions are required to boost investment, long-term growth, and debt relief. For instance, Avellán et al. (2020) investigated the effect of fiscal stimulus on economic activity in countries with different degrees of institutional quality for a panel of 113 countries during the period (1988–2017). To measure institutional quality International Country Risk Guide (ICRG) dataset was used. It was found that in countries with higher institutional quality, a one percent increase in government consumption results in a significant, long-lasting, and stable increase in economic activity of 0.9%. In contrast, the effect is smaller (0.4%) and more transient for countries with lower institutional quality.

Moreover, Law et al. (2021) provided evidence on the ratio of public debt to GDP threshold value in 71 developing countries during the period (1984– 2015). The findings indicated that stronger institutions typically reduce the detrimental effects of public debt on economic growth. Jammeh et al. (2022) used annual data from the WDI from 2005 to 2018 for a total of 135 low- and middle-income countries to estimate the impact of institutions on debt sustainability. The results showed that in order to achieve debt sustainability, institutions need to take a proactive approach to reducing corruption and enhancing accountability and transparency in the public sector.

Further, Lee et al. (2023) added a new insight by considering countries’ income levels in the relationship between institutional quality and debt sustainability. The study classified a sample of 82 countries into low-income, lower-middle, upper-middle, and high-income, and investigated the threshold effect of institutional quality (measured by the International Country Risk Guide) on debt sustainability. The findings showed that institutional quality has a threshold effect on the fiscal reaction function. Yet, the threshold effect on debt sustainability differs based on the country’s income level. Specifically, debt sustainability in high-income countries weakens when the regime shifts from under threshold to over threshold. Nevertheless, results indicated no significant difference between the lower and upper regimes in upper-middle-income countries. Conversely, lower-middle and lower-income regimes could shift from unsustainable to sustainable debt status if their institutional quality exceeds the threshold value.

Additionally, Nguyen and Luong (2021) examined the impact of fiscal policy and institutional quality - measured by the WGIs—on public debt in a sample of transition countries over the period (2000–2018). Using Ordinary Least Squares, random effects, and two-step GMM methods, findings revealed that after regime changes in those countries, financing to improve the institutional quality in relation to government effectiveness, regulatory quality, and rule of law increases the size of public debt. Similarly, weak governance in controlling corruption leads to a higher accumulation of public debt.

As for the MENA region, Tarek and Ahmed (2017) studied how institutional quality, using the WGIs, affects public debt accumulation in 17 countries of the MENA region. The results showed that three out of the six governance indicators had a significant impact, which are Political Stability (PS) and Absence of Violence, Regulatory Quality, and Rule of Law. This means that institutional quality plays an important role in mitigating the adverse effects of debts.

The same issue was examined by other authors on the country level, especially in developing countries. For instance, Ramzan et al. (2023) investigated the mediating role of institutional quality on the relationship between public debt and economic growth in Pakistan–as a developing country–during the period (1996–2020) using the WGIs to measure institutional quality. According to the findings, public debt in Pakistan is negatively related to economic growth in the long-run. On the contrary, in the short-run, Pakistan’s public debt usually shows crowding to growth, while it interacts with the institutional quality, indicating that Pakistan’s institutional quality is positively associated with economic growth in the short-run.

Debt sustainability in Egypt

In the literature, there is various empirical evidence on Egypt’s debt sustainability. For instance, Alba et al. (2004) evaluated the sustainability of Egypt’s debt by examining the country’s key fiscal trends over a 15-year period while making specific assumptions regarding important macroeconomic variables. The findings of all scenarios indicated that the debt-to-GDP ratio will continue to rise through 2018. At the time, they recommended that fiscal adjustment and economic growth are necessary to achieve sustainability because it was found that debt in Egypt is driven by certain structural flaws, including a weak taxation system as well as high government spending on salaries, subsidies, and interest payments.

In 2005, to assess debt sustainability in Egypt, the World Bank used the debt-stabilizing primary balance method to calculate the primary surplus needed to sustain the current level of debt; even though, it might not be sustainable. The study established a basic scenario that incorporates explicit assumptions for the variables: economic growth rate, nominal exchange rate, inflation rate, imports to GDP, nominal interest rate, and external debt. The results indicated that primary surplus needed was to be above 2.4% (World Bank, 2005).

Further, El-Mahdy and Torayeh (2009) analyzed Egypt’s debt using data from (1981–2006). They found a negative impact of debt on economic growth and concluded that debt was sustainable, but only under specific conditions. They recommended urgent reforms to maintain sustainability, including keeping economic growth higher than interest rates. The same recommendations were proposed by Massoud (2015) who used a Vector Auto-Regressive (VAR) model to evaluate public debt sustainability in Egypt, concluding it was sustainable until 2020. However, the study emphasized the need for government action to control debt accumulation through economic growth policies and fiscal adjustments. It also highlighted the importance of differentiating between domestic and external debt for accurate sustainability assessments.

Al Nashar (2019) used a structural VAR approach and reached the result that the primary deficit ratio and subsequently the valuation effect brought about by exchange rate depreciations are key causes of debt accumulation in Egypt, since applying a one-standard deviation shock to the exchange rate, lead to the rise of both the level of the primary deficit as well as the pace of growth in total government debt. Using the same approach, Hashem and Fahmy (2019) analyzed Egyptian public debt’s sensitivity to economic factors from 2005 to 2015. They found positive correlations with most variables except inflation and revenue. While acknowledging limitations like a short timeframe and missing econometric confirmation, their work suggests real GDP, inflation, exchange rate, and government spending significantly impact debt levels.

Egypt’s debt sustainability was assessed by Ramadan (2020) using the fiscal reaction approach. The findings indicated that Egypt’s debt could be sustainable during the study period, since primary deficit reacts negatively to the increase in debt-to-GDP, which implies that there is a fiscal response by Egypt’s fiscal authorities. Furthermore, Rashied (2021) followed the same objective and approach. The findings demonstrated that the Egyptian authorities have undertaken fiscal consolidation in response to the accumulation of public debt. This was demonstrated by the increase in the primary balance, which reversed the effect of the negative shock. Nevertheless, the speed and magnitude of the response might be insufficient, and the timing of the adjustment is equally important. Although growing primary surpluses in response to increasing public debt suggest that debt to GDP ratio is mean reverting and thus sustainable, Egypt’s slow adjustment rate raises concerns about Egypt’s ability to sustain potential future shocks.

Al Sayed et al. (2021) examined Egypt’s fiscal sustainability (1990–2018) using two models. While the first model, analyzing debt’s impact on deficits, indicated sustainability, the second, focusing on generational accounts, could not be implemented due to data limitations. Interviews revealed various obstacles hindering its application, raising criticism for the study’s reliance on a single model and its failure to fully explore the novel generational approach.

Although the literature assessing debt sustainability in Egypt is abundant, the research on the role of institutional quality in debt sustainability is scant. Allen et al. (2004) employed an alternative approach to assess Egypt’s debt sustainability, through examining the effect of budgetary institutions in Egypt on long-term fiscal sustainability. The results showed a lack of transparency and accountability as budget details are not made public, there is a lack of data released to compare actual and budgeted spending, there are no in-depth analyses offered for developmental goals and how public spending would achieve them, and incomprehensive budget that leaves out important items that are essential to fiscal sustainability. The authors recommended that to ensure fiscal sustainability, Egypt should implement an effective change management plan and consider an institutional reform that enhances accountability and transparency.

To conclude, this section provided empirical evidence on using the fiscal reaction function to assess debt sustainability across different countries. Also, it reviewed the recent empirical evidence on the role of institutional quality on debt sustainability. Although these studies claimed that institutional quality has an effective role in achieving debt sustainability, this impact may vary across countries of different income levels and different characteristics. In other words, institutional quality is not a silver bullet for maintaining debt sustainability. Therefore, policymakers seeking debt sustainability must adopt a comprehensive approach that carefully considers their country’s unique context and needs. As for the case of Egypt, studies that empirically examine the effect of institutional quality on debt sustainability are scant. Thus, this paper tries to fill in this gap by estimating the fiscal reaction function for Egypt during the period (1990–2022) while controlling for the institutional quality level to assess how it affects debt sustainability in Egypt. Institutional quality is measured using the WGIs, as they are commonly used in economic literature, which allow comparability of results, as well as their comprehensiveness, that capture the complex nature of institutional quality

Methodology and data sources

The theoretical discussion in the earlier section established that macroeconomic factors and institutional quality influence the budget position of a country. Hence, the current study examines whether governance, or institutional quality and meaningful macroeconomic variables influence Egypt’s primary balance empirically. The budget equation illustrating the relationship between primary balance and public debt represents our starting point. Bohn (1998) suggests an empirical examination of sustainable fiscal policy as an additional framework to supplement the more intricate sustainability frameworks proposed by Blanchard et al. (1991). Therefore, Bohn (1998) offers the following budget equation as the foundation for analyzing debt sustainability:

Where the debt for the next period (\({B}_{t+1}\)) is calculated by subtracting the current period’s debt (\({B}_{t}\)) from the government’s primary balance (\({p}_{t})\) (the overall budget balance excluding interest payments) times the gross interest factor \((1+\,{R}_{t+1})\). In the context of an expanding tax base and heightened government expenditure, it is illuminating to express this budget equation in ratio format as follows:

where \({b}_{t}\) = \({B}_{t}\)/\({Y}_{t}\) is the domestic debt-to-GDP ratio, \({P}_{t}\) = \({p}_{t}\)/\({Y}_{t}\) is the primary balance-to-GDP ratio, and \({x}_{t+1}=\,\)(1+ \({R}_{t+1}\)) · \({Y}_{t}\)/\({Y}_{t+1}\) ≈ 1+ \({r}_{t+1}\) – \({y}_{t+1}\) is the ratio of the gross yield on government debt to the gross growth rate of GDP (this ratio allows for the measurement of both variables in either real or nominal terms, as inflation cancels out). The variables \({r}_{t+1}\) and \({y}_{t+1}\) denote the RIR and the real growth rate, respectively.

Given that the objective of this study is to investigate whether a consistent relationship exists between the primary balance and the debt-to-GDP ratio (Bohn, 1998), we estimate a FRF indicating the association between the primary balance \({P}_{t}\) and the debt level \({b}_{t}\), as follows:

where θ measures the response of the primary balance to the debt ratio, and \({\tau }_{t}\) comprises additional primary balance determinants (such as economic and institutional) and the error term.

For the sake of sustainability, governments should respond systematically to debt increases. This involves adjusting the primary balance to either increase the surplus or decrease the deficit, net of interest payments. According to Bohn (1998, 2007), an appropriate public debt policy is one in which the primary surplus-to-GDP ratio becomes a positive function of the debt-to-GDP ratio. Economically, it is obvious that the government must increase the primary surplus to pay off past debt in order to sustain public debt (Ogbeifun and Shobande, 2020). However, other studies, like Ghosh et al. (2013), have shown that simply achieving a positive coefficient θ is not enough to ensure fiscal sustainability as supposed by Bohn (2007). This criterion ignores factors such as the country’s initial debt level or the likely limits on primary surpluses that may be sustained due to uncontrollable institutional or political factors. Thus, Bohn’s condition is considered a “weak sustainability condition” (Checherita-Westphal and Žďárek, 2017; Ogbeifun and Shobande, 2020).

Therefore, Ghosh et al. (2013), Fournier and Fall (2015), Ogbeifun and Shobande (2020), Mutuku (2015), Ogiji and Ajayi (2020), Lee et al. (2023) and Arif and Arif (2023) have recently used FRFs to derive benchmarks of primary balances and to estimate the limits and thresholds of public debt sustainability.

Based on these studies’ FRF, the present study adopts the following econometric model that extends the relationship introduced by Bohn (1998):

Where \({P}_{t-1}\) is the one-year lagged value of the primary balance-to-GDP ratio (to account for persistency in fiscal policy), \({b}_{t-1\,}\) is the one-year lagged debt-to-GDP ratio (that is Gross Domestic debt). \({X}_{t}\) is a vector of macroeconomic determinants of the primary balance such as RIR, current account balance, output gap (a proxy for cyclical conditions, as it affects the overall economic performance), and real exchange rate. \({I}_{t}\) measures the institutional quality and \({\varepsilon }_{t}\) represents the error term that consists of random shocks together with measurement errors

According to Eq. (4), debt sustainability is considered to be a dynamic process, depending on institutional features that affect fiscal policy and the policy environment. These factors include PS, the absence of violence, the rule of law, voice and accountability (VA), and corruption control within governmental institutions. An increase in their values indicates a better quality of institutions.

Thus, the detailed dynamic model is specified as follows:

We assess the impact of the six World Governance Indicators on the primary balance-to-GDP ratio separately in six separate models. To check the robustness of our findings, we construct an institutional quality index “IQI” which is a composite measure based on Principal Component Analysis (PCA) that combines the six world governance indicators–Government Effectiveness, Regulatory Quality, Control of Corruption (CC), Rule of Law, VA, and PS–into a single standardized index. The IQI is constructed as follows:

Where wi are the PCA loadings, and all of the institutional variables are standardized. The Principal Component Loadings are presented in Appendix 3. The correlations between the PCA-based IQI and the governance indicators, as shown in Appendix 3, exhibit values closer to 1, indicating that they are highly correlated. The Kaiser–Meyer–Olkin (KMO) test is a further method we use to verify that PCA is appropriate to construct the IQI. Because the overall KMO statistic (0.639) is higher than the 0.6 threshold, PCA usage is justified (Kaiser, 1974). To determine our IQI, we select the first principal component (PC1), which explains the greatest percentage of the overall variation (61%). The selection is supported by the scree plot of PCA eigenvalues for institutional quality indicators, which is shown in Appendix 3. It demonstrates that PC1 dominates since it meets Kaiser’s criterion (eigenvalue > 1) and captures 61% of the total variance (Tabachnick and Fidell, 2001; Piedmont, 2014).

Thus, the detailed dynamic model using the IQI is specified as follows:

It is worth noting that with non-stationary time-series data, our baseline specification follows Bohn’s (1998) linear fiscal reaction function, which remains the standard for cross-country debt sustainability analyses. For the analysis of fiscal reaction functions, several researchers have also used the same methodology, including Ghosh et al. (2013), Fournier and Fall (2015), Ogbeifun and Shobande (2020), Mutuku (2015), Ogiji and Ajayi (2020), Lee et al. (2023), and Arif and Arif (2023). Additionally, due to Egypt’s limited and inadequate fiscal data, our linear model eliminates overfitting and provides a clearer understanding of fiscal adjustment speeds.

Data sources and description of variables

The paper uses an annual time-series dataset from 1990 to 2022. The choice of such a period is driven by the lack of meaningful observations for Egypt until the early 1990s. The long sample periods might also hide unsustainable periods within the dataset (Brady, 2019). Consequently, it is advisable to estimate a FRF for a relatively recent period to assess fiscal policy reactions to increasing debt levels and changing economic circumstances.

The data used in this study were adopted from the World Development Indicators (WDI), the World Governance Indicators (WGIs) made available by the World Bank, the International Monetary Fund (IMF), the Central Bank of Egypt (CBE), and the Ministry of Finance (MOF). The reason behind our use of various sources lies in the fact that some of the variables were not available for years before 2002 in national sources, including the CBE and MOF. To acquire these incomplete variables, international sources such as the IMF and WB were employed. An interpolation method was also adopted to capture the missing values. In Appendix 1, the variables are shown, along with their descriptions and sources.

Estimation Techniques and Methodology Steps

Literature on fiscal policy sustainability typically involves stationarity and cointegration tests and uses nonstationary time series analysis to investigate fiscal debt sustainability, such as Trehan and Walsh (1991), Wilcox (1989), and Hamilton and Flavin (1986). Therefore, the first step is to conduct stationarity tests for the model’s variables. The Augmented Dickey-Fuller (ADF) testFootnote 1 (1979) is commonly used in this regard. Following this, we perform the cointegration test to assess whether there is a long-run relationship between the variables and to select the most suitable lag order for modeling. While there may exist short-term shocks that affect the movement of the individual series, in the long term, they would be able to converge. If the variables are co-integrated, then we can employ the ARDL and ECM models to estimate the short-run and long-term relationships. However, when there are nonstationary variables that exhibit dynamic interdependencies, without being cointegrated, we can make use of a VAR model. Thus, we conducted the ARDL bound test approach developed by Pesaran and Shin (1999) and Pesaran, Shin, and Smith (2001) to determine the existence of cointegration between the variables. This approach overcomes the limitations of conventional cointegration techniques of Engle and Granger (1987) and Johansen and Juselius (1990). These methods necessitate that all variables in the model are non-stationary at levels and have the same order of integration. The ARDL approach can handle regressors with different orders of integration (I(0) or I(1) or a combination of both) while considering the peculiarities of small samples and the presence of simultaneity bias in the association between variables.

To conduct the bounds test for cointegration, the conditional ARDL (p, qi) model is specified as follows:

Where \({{\rm{\beta }}}_{0}\) represents the intercept, \({{\rm{\alpha }}}_{1}\) to \({{\rm{\alpha }}}_{7}\) are the long-run coefficients, p and q are the number of lags used for dependent and exogenous variables respectively. \({{\rm{\varepsilon }}}_{{\rm{t}}}\) is the error term.

Upon establishing long-run cointegration, the ECM, which derives both short-run dynamics and long-run adjustment parameters, can be specified as follows:

Where \(\Delta\) denotes the first difference operator. \({\delta }_{i}\), \({\theta }_{i}\), \({\mu }_{i}\) and \({\beta }_{1}\) to \({\beta }_{4}\) are the model’s short-run dynamic coefficients. \(\partial\) is the speed of adjustment parameter and \({{ECM}}_{t-1}\) is the error correction term.

Stylized Facts

Since, the main goal of this study is to analyze debt sustainability in Egypt, by estimating a fiscal reaction function using the primary budget balance as a share of GDP as the dependent variable and debt-to-GDP ratio as the independent variable, while controlling for the institutional quality measured by the WGIs. In this part, we will analyze the trend of these main variables of interest in Egypt during the study period.

Figure 1 shows the evolution of the total public debt as a percentage of GDP during the period (1988 – 2022). It is clear from the figure that Egypt’s public debt level shows large fluctuations and is relatively high, although it shows an overall downward trend. By the end of the 1980s and early 1990s, accumulated debt has exacerbated, resulting in a debt crisis. This surge in the public debt and the worsening economic situation pushed the Egyptian government to adopt structural reforms. Egypt embarked on a comprehensive economic reform and structural adjustment program (ERSAP) for the period 1991/92 to 1992/93, to correct the macroeconomic imbalances represented by continued deficits in the budget and the balance of payments, high inflation, and multiple exchange rates. This program was associated with the Paris Club agreement, which reduced the external debt remarkably. Moreover, the associated reforms succeeded in improving the economic situation in Egypt, which was reflected by the continuous declining trend in public debt. In the early 2000s, public debt showed an increasing trend due to the adoption of expansionary fiscal policy, as well as the floating exchange rate regime in 2003. Thus, the government implemented during the period (2006 – 2010) a group of fiscal reform measures such as tax reform procedures and fuel subsidies reduction. As a result, the debt-to-GDP ratio started to decline till 2008, when it started to increase again, exacerbated by the economic slowdown resulting from the political instability witnessed after the 2011 uprising. This increasing trend in the debt-to-GDP ratio was reversed in 2016 with the implementation of the Egyptian government for the structural reform program. Nevertheless, the repercussions of the Covid-19 crisis by end of 2019 resulted in an increase in debt burden till now.

Source: Constructed by the authors relying on data on Public Debt and GDP from the International Monetary Fund, IMF. Webpage: https://data.imf.org/en.

As for the ratio of primary balance to GDP, Egypt has suffered from continued deficits expressed in terms of a negative primary balance-to-GDP ratio. This was only reversed during the implementation of the ERSAP program, which resulted in sound macroeconomic performance, and a surplus in the budget. This surplus continued to exist till the beginning of the 2000s, as the expansionary fiscal policy adopted resulted in increasing the deficit in the budget. With the introduction of the structural macroeconomic reform program in 2016, the deficit in the primary balance started to decline and the budget turned to make surplus starting in 2018 [Fig. 2].

Source: constructed by the authors using data from the Central Bank of Egypt (CBE) on Primary Balance and data from World Development Indicators (WDI) on GDP. Webpage for CBE: https://www.cbe.org.eg/en/economic-research/time-series Webpage for WDI: https://databank.worldbank.org/source/world-development-indicators.

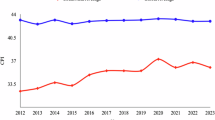

Concerning institutional quality, it could be noted that despite the several efforts exerted by the government to strengthen governance, Egypt either ranks or scores low in institutional quality indicatrs, or it witnesses a deterioration in its performance over time. Analysing Egypt’s performance in WGI, Fig. 3 shows that Egypt scored low on all the WGI, which range from −2.5–2.5, with higher scores indicating better governance. Figure 3 shows that the indicators of rule of law, government effectiveness, and regulatory quality seem to move together during the study period. These indicators, although scoring negative values, had better performance from 1996 till 2011 compared to the period of political instability following 2011 revolution They started to improve gradually, starting in 2013 for government effectiveness and rule of law and starting in 2016 for regulatory quality. As for the indicators of CC and VA, they show different performances with more stable fluctuations during the chosen period. Yet, the indicator of PS/absence of violence started with high performance and then witnessed continuous deterioration, reaching its lowest level in 2013, and then it started to relatively improve, reflecting the PS witnessed during this period and showing the recovery of Egypt from the severe regression it had experienced and indicating the effectiveness of the policies taken by the government to enhance the quality of provided public services. Moreover, this improvement in Egypt’s performance could be attributed to the government's adoption of a set of policies that help to promote the private sector, support small, medium, and micro enterprises, and emphasize the rule of law. This improvement in performance continued until 2020, which witnessed a deterioration in Egypt’s performance in those indicators, except for those of rule of law and regulatory quality. This deterioration coincided with the onset of the adverse impacts of the COVID-19 pandemic around the world, which exacerbated the existing deficiencies in governance mechanisms and posed new challenges at the global level. This highlighted the importance of strengthening the various aspects of governance. In the Middle East and North Africa (MENA) region, Egypt is relatively in an average position comparable to countries like Morocco, Jordan, but it lags behind other countries such as United Arab of Emirates.

Source: Constructed by the authors using data from the Worldwide Governance Indicators issued by the World Bank. Webpage: https://www.worldbank.org/en/publication/worldwide-governance-indicators.

Results and discussion

This section provides the key findings of our study and includes some diagnostic tests to check the goodness of fit and validity of time series models. The ADF test was employed to assess stationarity. The decision criterion is comparing the calculated t values with the Mackinnon critical values to determine whether to reject a hypothesis of a unit root. The test results are shown in Table 1.

Now, we will need to check if primary balance and public debt are co-integrated to assess the sustainability of fiscal policy in Egypt. Nonetheless, the optimal lag length for each variable must be determined before conducting the test. To achieve this, we followed the values of some selected information criteria, such as the Akaike’s information criterion (AIC), the Schwarz’s Bayesian information criterion (SBIC), the Hannan–Quinn information criterion (HQIC), the Final prediction Error (FPE), and Sequential modified LR test statistic. The tabulated results in Table 2 show that all the information criteria provide evidence that the optimal lag length is 2.

After determining the optimal lag for the entire model and each variable, a cointegration test is necessary to establish the long-term relationship between the variables. According to the results in Table 3, the bounds test has provided strong evidence of a long-term relationship between the primary balance-to-GDP ratio and its determinantsFootnote 2. As a result, we estimated both long-term and short-term models using the ARDL and ECM approaches instead of a VAR model, which can lead to biased and inconsistent estimates if cointegration exists.

Estimation of the ARDL and the EC models

The ARDL and the ECM baseline results presented in Table 4 exhibit both the short-term dynamics and long-term relationships between the public debt-to-GDP ratio and fiscal policy in Egypt. According to these findings, there exists an inverse relationship between the lagged primary balance to GDP ratio and the primary balance to GDP ratio. This observation implies that the previous primary balance serves as a significant factor in determining the subsequent fiscal policy. Specifically, an upsurge in the previous primary balance, leading to a surplus, results in a reduction of the existing primary balance, thereby resulting in a deficit. Also, the long-run coefficient of the public debt-to-GDP ratio displays a positive sign and is statistically significant in all specifications. As indicated, a 1% change in the debt-to-GDP ratio is on average associated with an increase in the primary balance by 0.5%–0.9% at the statistical significance level of 5% and 1% respectively. Therefore, one might deduce that the Egyptian government was able to tackle the long-run debt levels using some effective fiscal measures, such as increasing the primary balance surplus or decreasing its deficit, providing great evidence of its capability of ensuring fiscal stability in the long run. This result aligns with Bohn (1998), Checherita-Westphal and Zdarek (2017), Ramadan (2020), and Ben Tahar et al. (2022) findings. However, small long-term coefficients suggest slow reactivity and weak remedial mechanisms, which is in line with Egypt’s substantial debt burden.

The short-term coefficient of the public debt-to-GDP ratio is negative and statistically significant, indicating that the government cannot react to fluctuations in its debt levels in the short run. This can further deteriorate the overall primary balance and thus increase the budget deficit. This result might be due to macroeconomic imbalances in the Egyptian economy, especially with the prevailing destabilizing economic shocks and political instabilities, such as the financial crisis of 2008 and the Egyptian revolution of 2011.

Based on results in Table 4, it has also been found that the coefficient of the output gap is positive and statistically significant at the 1% level. It can be concluded from the results that a 1% rise in the output gap translates into a 96% increase in the primary balance on average in the short run. The long-run coefficient is also highly significant and has the same sign with a high magnitude. Therefore, it can be inferred that any improvements in national output would positively impact the fiscal sustainability position in Egypt. Conversely, in the event of a destabilizing shock leading to a negative output gap, it would adversely affect macroeconomic stability. In such a scenario, the fiscal policy would have to increase public spending to stabilize the economy, which would imply an automatic stabilization effect.

This study further intends to test the mediating effect of the quality of institutions on debt sustainability. According to the results shown in Table 4the Government Effectiveness’s (GE) positive impact across specifications suggests that it directly improves the implementation of policies, through institutional and operational reforms, such as improving bureaucracy efficiency and capacity along with the digital tax systems, leading to quick fiscal gains. Therefore, funding civil service efficiency projects, such as e-governance initiatives, could lead to greater fiscal gains, improving the investment environment, resulting in profits and tax revenues increases due to high-performance production. Therefore, better institutional quality is favorable to better debt sustainability, as envisaged and uncovered by Tarek and Ahmed (2017), Law et al. (2021), Nguyen and Luong (2021), and Lee et al. (2023).

Additionally, the tested relationship between the primary balance and regulatory quality was positive and significant in the short run. This positive association would be seen as an improvement in government regulations, causing an increase in government revenues and primary surplus. However, while the RQ’s short-term benefits show the potential of regulatory reforms, the lack of long-run significance raises concerns about these reforms’ resilience. This highlights the systemic problems within Egypt’s centralized fiscal governance system, which could impede sustained progress. Thus, the risk of institutional retreat may occur in the absence of a persistent and dedicated commitment to reform, making any progress temporary and leaving the system susceptible to reverting to earlier inefficiencies and challenges. This shows how important it is to have a strong framework that not only supports the initial improvements made but also guarantees their long-term efficacy in this governance environment.

Moreover, a 1% change in the Rule of Law results in a 0.6% reduction in the primary balance in the long run at a 1% statistical significance level, consistent with the Ramzan et al. (2023) study. This negative impact reflects judicial inefficiencies that enable tax evasion by some concentrated interest groups and some insider actors, thus negatively affecting the quick gains obtained by the operational reforms. Thus, to increase the institutional reforms efficiency, it is essential to implement legal reforms and eliminate protective measures that serve elites.

Concerning the remaining institutional quality indicators, namely the VA, PS, and CC, they are all found to be insignificant factors. The insignificant result for PS is consistent with data showing that budgetary allocations are protected by regime stability even during protests. Moreover, the insignificance of the VA indicates that Egypt’s fiscal policies are not significantly influenced by public participation mechanisms such as elections and legislative monitoring. The researchers proposed that this could be due to factors like limited citizen participation and lack of transparency, and accountability in the government. While accountability (VA) has been reduced as a threat, efficient bureaucracy (GE) is accepted because it supports regime stability. Therefore, policymakers should be aware that Egypt’s fiscal sustainability necessitates both trying institutional democratization to improve the VA and working inside the executive-dominated system through training bureaucrats. The insignificance of CC might be a reflection of systemic informality; in Egypt, corruption frequently occurs through networks that are not captured by aggregate indices. In sum, the short-term effects of institutional reforms suggest that ongoing interventions, like yearly civil service audits, rather than one-time measures, are necessary for Egypt’s fiscal sustainability.

It is worth noting that the WGIs might not fully represent Egypt’s informal institutional reality and the informal networks that shape its fiscal policy. Therefore, future research could benefit from incorporating enterprise surveys or more disaggregated fiscal data.

As shown in model 2 (Table 4), the RIR has a positive and significant impact in the short run. This means that when the lending rate increases, exceeding the inflation rate and thus increasing the RIR, there is a higher interest on debt service. This consumes a significant amount of the overall budget deficit, thus leading to a surplus in the primary balance. It therefore follows that an increase of 1% of RIR translates into about a 0.15–0.2% increase in the primary balance (surplus) of the government. Conversely, if the inflation rate exceeds the nominal lending rate, thus decreasing the RIR, the government is prompted to borrow more in view of the fact that the real cost of borrowing goes down with a high rate of inflation. Consequently, public spending increases, which decreases the primary surplus or increases the budget deficit. Nevertheless, the RIR had no significant impact on the primary balance in the long run.

It is also found that there is a long-run negative relationship between the ratio of current account balance to GDP (CA ratio) and the primary balance. Precisely, a rise of 1% in the CA ratio decreases the primary balance ratio by 1.2–1.4 percentage points, on average. This relationship is statistically significant, as evidenced, and suggests that a CA balance surplus incites the government to spend more due to funds availability and thereby register a budget deficit. Conversely, in the event of a CA deficit, the government registers a budget surplus. With respect to the relationship between fiscal policy and the exchange rate, both the short- and long-run specifications present insignificant results for all specifications.

Finally, the results from the ECM in Table 4 indicate that the error correction coefficient (ECT), which refers to the speed at which the primary balance-to-GDP disequilibrium is adjusted from its initial level to a long-term equilibrium path, is approximately −0.3. This is negative and highly significant at 1%. This implies that the disequilibrium resulting from a shock in the previous year would be corrected by 30% in the following year to reach the equilibrium level in the long run. In other words, any errors or deviations from long-run equilibrium that occurred in the previous year are rectified in the current year at a convergence speed of 30%. The negative and highly significant ECT indicates the efforts made by the government to adjust deviations from the equilibrium level. Nevertheless, its speed of adjustment is relatively slow at 30%, a result that is consistent with El Mahdy and Torayeh (2009) and Rashied (2021). Egypt’s 30% rate of adjustment indicates that there are persistent fiscal rigidities, making it a risk for Egypt to serve and sustain its debt in the future at this slow rate of adjustment (Kim et al., 2007) and emphasizes the necessity of proactive reforms to prevent costly measures.

The PCA-based IQI and the interaction effects between debt-to-GDP and IQI were used to confirm the robustness of our baseline findings, particularly the rate of adjustment for deviations from the long-term equilibrium level. The results are shown in Table 5. All models exhibit a noteworthy rate of convergence to long-term equilibrium, which is roughly -0.3. This suggests that Egypt’s fiscal policy returns the budget to long-term equilibrium by correcting about 30% of the primary balance’s disequilibrium from the previous year. These results are consistent with our baseline model, indicating that our findings are robust. The third and fourth models, where the IQI moderates the fiscal responses to debt, show a slower rate of adjustment, as indicated by the ECT (21.8%), demonstrating that Egypt’s weak institutions might slow down the correction process.

By combining strong, significant variables (GE, RQ) with weak, insignificant ones (VA, CC, PS), the adoption of the IQI obscures the conditional effects of debt, causing the debt-to-GDP ratio to lose statistical significance. By assigning weights to weak predictors, the PCA creates noise and increases the standard errors of the debt variable over the examined period. However, in the short term, the public debt-to-GDP ratio shows significant negative effects in all models, indicating that short-term debt rises deteriorate the primary balance. Nonetheless, the positive impact of its lagged variable suggests a partial recovery in the following periods. These outcomes support our prior findings.

The institutional quality index (IQI) has an insignificant long-term impact in all models. This could be explained by the fact that informal institutions, like military fiscal domination, which eventually affect official regulations, are not included in IQI, because the informal fiscal practices are not captured by the World Bank indicators. Thus, if there are strong institutions, their institutional impact could be diluted with other weak and informal institutions in the long run. In the short term, though, it has a significant beneficial impact, suggesting that institutional reforms result in immediate fiscal improvements, demonstrating the quick benefits of reforms. This also aligns with the earlier positive short-run coefficient of the Government Effectiveness, indicating that the GE indicator had the strongest effect, which outweighs the effect of the IQI. As mentioned earlier, digital tax systems are one example of a formal reform that has quickly increased efficiency.

Further analysis using the interaction effects shows that when Debt and IQI interact, a paradox is revealed. Although debt-to-GDP ratios exhibit no long-term effects, their interaction with the IQI is both positive and significant in the long run, according to model 4. At high IQI levels, as indicated in Table 5 (model 4), a 1% increase in debt-to-GDP might eventually result in a 0.2% improvement in the primary balance to GDP. This implies that the debt’s detrimental effects on primary balance and fiscal sustainability can be mitigated over time by stronger and better institutions. This could be attributed to the fact that existing strong institutions (high IQI) guarantee that borrowed funds are effectively allocated, for example, in infrastructure and human capital, which eventually fosters growth and improves the primary balance. The development of the Suez Canal is an ideal example of how debt can occasionally finance growth, but only when institutions are resilient. This result has only been demonstrated in the fourth model, and its impact and importance are likewise minimal, implying that this is an anomaly rather than a norm in Egypt, considering its numerous institutional challenges and obstacles. Nonetheless, if tackled, these improvements allow for the productive use of debt, enhancing sustainability over the long term through growth and credibility.

On the other hand, even with a high IQI, a 1% rise in debt could cause the primary balance to deteriorate by 0.1% in the short run, since in all models shown in Table 5, the coefficient for the short-run interaction term is negative and significant. Put it another way, the short-term financial burdens brought on by growing debt levels are marginally increased by how strong institutions are. One explanation is that because high debt levels often result in austerity measures, which involve cutting government spending and subsidies, strong institutions, represented by the strong government effectiveness and higher regulatory quality in the Egyptian context, effectively impose these costly short-term measures. Although the primary balance is supposed to be immediately improved by austerity measures like tax increases and spending cuts, they have short-run adverse effects. These restrictive measures lower consumer and business incomes, which in turn discourage investment and consumption and cause the economy to collapse. By reducing the tax base, this economic contraction neutralizes any revenue gains from higher tax rates. As a result, tax revenue and short-term GDP tend to fall higher than spending cuts can regulate. Fiscal lags are another factor to take into account. Spending cuts, like removing subsidies, have an immediate impact, but revenue increases from policies like increased value-added tax (VAT) compliance can’t be seen for years. By reducing short-run demand and due to fiscal lags, such measures might temporarily decrease the primary balance. The government must sufficiently warn citizens and businesses of the immediate repercussions of austerity measures in order to prevent them from getting involved in austerity traps. To optimize the short-term benefits of institutional improvements, policy must additionally foster credibility by restricting debt to 80% of GDP. Improvements in IQI should also incorporate informal fiscal governance, like military spending, for long-term effects.

Both the short-term (Model 2) and long-term (Model 1) effects of the output gap are positive and significant, supporting the implementation of a pro-cyclical fiscal policy and the RIR had mixed effects, positive in Model 1, and insignificant elsewhere. Lastly, in all models, the current account was insignificant; this could be explained by the possibility that fiscal adjustments and external balances are only loosely related.

In conclusion, the current study explored the use of the ARDL and ECM techniques to test the relationship between Egypt’s primary balance-to-GDP and debt-to-GDP ratios, taking into account the impact of institutional quality. All specifications results suggested that fiscal policy is sustainable in Egypt in the long run; however, the speed of adjustment is slow, which suggests that the current fiscal policy needs some sort of review. Concerning the institutional quality impact, the initially presented findings found that government effectiveness and regulatory quality might have a positive effect on primary balance and debt sustainability. However, PS, CC and VA do not have a significant influence on the above-mentioned variables. When combined into a single index, results show that short-term primary balance improves, but there is no long-term impact. Beyond these observations, the most striking result is when debt increases with increasing institutional strength, austerity worsens the primary balance temporarily; however, debt is paid off sustainably over time, enhancing fiscal health. This indicates that long-term sustainability requires sacrificing short-term stability. This could be a positive sign as these short-term primary balance cuts with high debt levels can enhance credibility and increase investor confidence.

Yet, there is an urgent need to review Egypt’s current fiscal policy to ensure both short- and long-term economic well-being, as the contrasting results from the long-run and short-term analyses, along with the slow speed of adjustment, reveal the complexities of Egypt’s fiscal policy system. Although implementing sustainable fiscal measures may be effective for the Egyptian government in the long run, the short-term challenges reflected by the low responsiveness to debt fluctuations may raise doubts about the durability of these policies. Instead, it is necessary to tackle these problems, considering both the macroeconomic imbalances and the specific shocks affecting the Egyptian economy, to ensure efficient debt management and long-term fiscal stability in Egypt. Hence, it becomes crucial for policymakers to take appropriate actions to have a stable fiscal reaction function for debt sustainability in Egypt.

Furthermore, we have performed diagnostic tests to check the reliability of our results. These diagnostic tests carried out in Appendix 2 indicate that the residuals are independent and identically distributed (iid). In addition, the Normality test shows that the residuals are normally distributed. We also found that the model is free from serial correlation problems and is considered homoscedastic. To ensure the stability of long-term parameters, we applied the CUSUM and CUSUMSQ tests developed by Brown et al. (1975), providing further evidence of the stability of our model, according to the plots in Appendix 2.

Conclusion and policy implications

Bohn (1998), Uctum and Wickens (2000), and Brady and Magazzino (2019) contended in their studies on debt sustainability that current public liabilities must be mitigated by future primary budget surpluses to maintain fiscal sustainability. Based on both the ARDL and ECM approaches, our results support this argument by showing that, in the long run, a higher debt-to-GDP ratio is associated with a higher primary balance, as expected, due to some productive public projects conducted using public debt. This also suggests that the government’s response to increasing debt would be in the form of primary surplus accumulation or deficit reduction. However, the negative short-term effect of the debt-to-GDP ratio on the primary budget balance reveals that in the short run, increases in debt levels may produce decreases in the primary budget balance, due to both the imposed austerity measures and some notable institutional challenges. This short-term effect probably reflects the difficulties of controlling the level of debt while maintaining fiscal sustainability.

Furthermore, based on our analysis, it appears that the primary balance-to-GDP ratio is positively and significantly associated with the output gap and RIR in all specifications. However, our findings indicate that the exchange rate does not have a significant impact on debt sustainability in Egypt.

Upon examining institutional variables separately, our findings indicate a negative association between the fiscal deficit and both government effectiveness and regulatory quality. In other words, higher institutional quality leads to a reduction in the budget deficit. However, our analysis does not reveal any significant influence on the primary balance situation for government corruption, VA, and PS. This conclusion underlines the necessity to improve bureaucratic quality, democratic accountability, and the rule of law as steps toward reducing the budget deficit and achieving debt sustainability. When combined into a single standardized index (IQI), the results confirm the above-mentioned reasoning.

Additionally, some models’ significant interaction term (DebtxIQI) indicates that fiscal reactions to debt are moderated by institutional strength, indicating that fiscal adjustments are contingent upon the levels of institutional quality. The positive long-term interaction effect suggests that institutional quality ultimately reduces debt risks, most likely due to productive investment and increased fiscal credibility. However, the negative short-term coefficient indicates that immediate costs precede long-term benefits, suggesting short-term sacrifices. Therefore, since institutional strength guarantees long-term debt sustainability, policymakers must accept short-term budgetary deterioration under austerity reforms.

For the speed of adjustment, presented by the ECT, findings revealed that it is very slow, hence portending complexities in maintaining long-term sustainability in debt. Therefore, this slow speed of adjustment, along with the government’s difficulties in adjusting fiscal policy in the short run as well as the existence of critical institutional challenges, provides strong evidence of a potential risk to Egypt’s ability to sustain its debt levels in the future. Therefore, this slow speed of adjustment and the low responsiveness of the fiscal policy to debt fluctuations are fundamental issues that need to be addressed to ensure long-term fiscal stability and sustainability in Egypt.

Hence, Egypt can undertake several measures, including maintaining levels of economic growth higher than the RIR, reducing the level of wasteful government expenditures, and strengthening the tax revenue base, following a progressive tax system. Further, policymakers should focus on key reforms in Government Effectiveness, such as expanding the digital tax collection system, and in Regulatory Quality by simplifying business licensing procedures, as these reforms have substantial immediate benefits. Equally important, higher degrees of institutional quality should be emphasized by strengthening the rule of law, improving governance structures, and enhancing transparency and accountability. This could be established by establishing an independent fiscal council with citizen monitoring and legally mandated participatory budgets. On top of that, fiscal authorities should take proactive measures to carefully manage debt increases and keep it below 80% of GDP, with borrowing specifically directed toward productive projects in order to avoid the costly short-run austerity measures. Thus, the Egyptian government should effectively allocate resources towards more productive investments in key development sectors, such as education, health, innovation, and infrastructure, aligning with the development goals of Egypt. Besides, Egypt should make well-informed investment decisions to increase credibility and achieve economic growth and long-term sustainability.

Although the major objective of our analysis was to estimate the overall linear association between Egypt’s primary balance and debt dynamics, nonlinear dynamics may provide useful extensions. Thus, future research might employ threshold ARDL models to examine nonlinear institutional impacts, such as whether fiscal reactions become more intense during currency crises or when debt exceeds 90% of GDP. Additionally, an in-depth analysis of the short-run relationships between the primary balance and debt fluctuations, as well as the speed of adjustment, can be accomplished by extending the time period and incorporating more recent data. Future research can also consider including more control variables, such as indicators of the business environment’s status and ease of doing business. This comprehensive approach could provide insight into the potential impact of these factors on Egypt’s fiscal policy decision-making process. The association between the debt-to-GDP ratio and economic development can also be examined in more detail, accounting for the primary budget balance as a mediator in the aforementioned relationship. The purpose of this analysis is to assess the extent to which Egypt has met development goals set by the government.

Data availability

Data are provided within supplementary information files.

Notes

The null hypothesis of the Augmented Dickey-Fuller (ADF) test asserts that the time series exhibits non-stationarity. If the p-value derived from the test is lower than a selected significance level (e.g., 0.05), the null hypothesis is rejected, suggesting that the time series is stationary.

The F-statistic in the model is greater than both critical values at the lower and upper bounds.

References

Adrogué R (2005) IV fiscal sustainability: a value-at-risk approach. Central America: Global Integration and Regional Cooperation, 59

Akyüz Y (2007) Debt sustainability in emerging markets: a critical appraisal. DESA Working Paper. No. 61

Alba P, Shawarby S, and Iqbal F (2004) Fiscal and public debt sustainability in Egypt. World Bank, Middle East and North Africa, the Office of the Chief Economist

Allen R, Banerji A, Nabil M (2004) An assessment of Egypt’s budgetary institutions. Egyptian Center for Economic Studies

Al Nashar S (2019) Egypt’s government debt: perpetual deficits and exchange rate depreciations. The World Bank

Al Sayed O, Samir A, Anwar HH (2021) Assessing fiscal sustainability in Egypt: a comparative study. Rev Econ Political Sci 6(4):292–310

Alesina A, Tabellini G (1990) A positive theory of fiscal deficits and government debt. Rev Econ Stud 57(3):403–414

Arif A, Arif U (2023) Institutional approach to the budget deficit: an empirical analysis. Sage Open, 1–9

Avellán L, Galindo Andrade AJ, León-Díaz J (2020) The role of institutional quality on the effects of fiscal stimulus (No. IDB-WP-01113). IDB Working Paper Series

Baharumshah AZ, Soon SV, Lau E (2017) Fiscal sustainability in an emerging market economy: when does public debt turn bad?. J Policy Model 39(1):99–113

Barnhill T, Kopits G (2003) Assessing fiscal sustainability under uncertainty. IMF Working Paper. WP/03/79

Ben Tahar M, Ben Slimane S, AlMarzoqi R (2022). Fiscal policy response to public debt: evidence for the MENA Region. Econ Res Forum

Bergman M (2001) Testing government solvency and the No Ponzi Game condition. Appl Econ Lett 8(1):27–29

Blanchard OJ (1990) Suggestions for a new set of fiscal indicators

Blanchard OJ, Chouraqui JC, Hagemann R, Sartor N (1991) The sustainability of fiscal policy: new answers to an old question. NBER Working Paper (R1547)

Blanchard O (1993) Consumption and the Recession of 1990–1991. Am Econ Rev 83(2):270–274

Bohn H (1995) The sustainability of budget deficits in a stochastic economy. J Money, Credit Bank 27(1):257–271

Bohn H (1998) The behavior of US public debt and deficits. Q J Econ 113(3):949–963

Bohn H (2007) Are stationarity and cointegration restrictions really necessary for the intertemporal budget constraint?. J Monet Econ 54(7):1837–1847

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Series B Stat Methodol 37(2):149−163

Brady GL, Magazzino C (2019) The sustainability of Italian fiscal policy: myth or reality?. Econ Res 32(1):772–796

Burger P et al. (2011) Fiscal sustainability and the fiscal reaction function for South Africa. IMF Working Paper Series. WP11/69

Central Bank of Egypt (2023) Monthly statistical bulletin No. 318. Econ Rep

Checherita-Westphal C, Žďárek V (2017) Fiscal reaction function and fiscal fatigue: evidence for the euro area (No. 2036). ECB Working Paper

Chang HJ (2011) Institutions and economic development: theory, policy and history. J Instit Eco 7(4):473-498

De Mello L (2008) Estimating a fiscal reaction function: the case of debt sustainability in Brazil. Appl Econ 40(3):271–284

De Soyres C, Kawai R, Wang M (2022) Public Debt and Real GDP: revisiting the impact. International Monetary Fund working papers

Dombi A, Dedák I (2019) Public debt and economic growth: what do neoclassical growth models teach us?. Appl Econ 51(29):3104–3121