Abstract

The Gulf Cooperation Council (GCC) countries face the challenge of balancing their reliance on non-renewable energy with the need for sustainable economic growth. This study investigates the disaggregated impacts of renewable and non-renewable energy sources (coal, oil, natural gas) on GDP in GCC nations from 1995 to 2020, addressing the gap in understanding how different energy types contribute to growth in this region. Using a Cobb-Douglas production function and advanced panel econometric methods, including Feasible Generalized Least Squares (FGLS) and Panel-Corrected Standard Errors (PCSE) models, we account for cross-sectional dependence and heterogeneity. Our results show that non-renewable energy, particularly natural gas, drives long-term GDP growth, but with diminishing returns, while renewable energy shows a significant positive correlation with GDP, indicating its potential for supporting sustainable growth. Causality tests confirm that oil promotes growth, coal and natural gas support conservation, and renewables have a neutral impact. These findings challenge the traditional energy dependency of the GCC and emphasize the need for energy diversification. We recommend increasing investments in renewable energy, improving energy efficiency, and aligning human capital development with sustainability goals. This study provides a region-specific framework for policymakers navigating the energy transition in hydrocarbon-dependent economies.

Similar content being viewed by others

Introduction

Energy plays a pivotal role in the economy, creating a strong interconnection between energy consumption, economic activity, and growth (Amer et al., 2024b). The availability of energy directly influences economic growth, particularly in the industrial sector, where energy is essential for processes such as manufacturing, heating, cooling, and lighting (Payne et al., 2023). However, the utilization of energy, especially fossil fuels, carries significant adverse consequences, including the emission of pollutants (Khalfaoui et al., 2023). Historically, mining and mineral industries have been fundamental in supporting national economies. In response to the growing threat of global warming, researchers and governments have increasingly focused on sustainable mining practices, emphasizing green technology and the recyclability of mineral resources (Shi et al., 2023).

To mitigate emissions, countries may implement policies that promote energy efficiency and prioritize cleaner alternatives, such as renewable energy sources, over traditional fossil fuels like coal, oil, and natural gas (Paramati et al., 2022). While renewable energy is gaining traction—especially in electricity generation and household use—its integration into key economic sectors remains limited (Doğan et al., 2022). The role of energy in a nation’s economic development cannot be overstated (Destek and Sinha, 2020; Emre Caglar, 2020). Frequent fluctuations in energy supply pose significant challenges to economies, as they can slow economic growth and development. Events such as financial crises, global oil crises, or rising oil and related product prices have led to substantial declines in production, further hindering growth. The importance of non-renewable energy resources, particularly oil, has become more pronounced since the recognition of technology’s role in traditional growth theories (Asif et al., 2021). While earlier growth theories mainly focused on factors of production, excluding technology, recent research has emphasized the crucial role of energy in both industrial and agricultural production, underscoring that energy resources are vital components of economic productivity (Akadiri et al., 2019).

Energy-growth dynamics are influenced by external shocks (e.g., asymmetric oil-market spillovers) (Ren et al., 2023), policy interventions (e.g., China’s VAT reform reducing coal intensity by 9%) (Sun et al., 2023), and technological shifts (e.g., ICT’s delayed emission reductions) (Duan et al., 2023). Persistent inefficiencies in both advanced and emerging economies, along with financial disparities (e.g., credit-driven household energy efficiency gains), underscore the need for context-specific frameworks to balance growth with sustainability (Yu et al., 2022; Zhou et al., 2022).

Research has shown that investments and policies can improve energy efficiency. Irfan et al. (2023) found that financial investments positively impacted energy efficiency in both developed and emerging economies. China’s VAT reform significantly reduced energy intensity in firms, particularly in large and energy-intensive industries (Zhou et al., 2022). Household-level efficiency is also influenced by access to credit, with broader access leading to better energy use (Zhou et al., 2023). Furthermore, mineral markets and financial development have contributed to energy transitions in developed countries (Irfan et al., 2023). Integrated environmental regulations in China have reduced both carbon and sulfur emissions (Xu et al., 2022), demonstrating the effectiveness of multi-pollutant regulatory approaches (Xu et al., 2023).

Numerous studies have explored the relationship between energy consumption and economic growth. Scholars agree that these inquiries have become increasingly significant due to growing global concerns about the economic implications of energy consumption and environmental policies (Doğan et al., 2023). However, findings vary based on country-specific factors, economic structure, energy sources, analytical periods, and research methodologies (Amer et al., 2024a). Scholars have yet to reach a consensus on the influence of energy consumption on a country’s economic growth. The central question in current research is whether economic growth drives energy consumption or vice versa (Buhari et al., 2020). Several hypotheses have been proposed to explore this relationship, including the growth, conservation, feedback, and neutrality hypotheses. However, the findings in the literature vary widely. Some studies point to a one-way causal link from energy consumption to economic growth, while others show the opposite. There is also evidence supporting bidirectional causality or no causal relationship at all (Isik et al., 2018). Figure 1 illustrates these theoretical relationships.

Furthermore, understanding the causal relationship between energy consumption and economic growth has significant implications for policy formulation (Isik et al., 2018). According to the conservation hypothesis, capital investments in various economic sectors generate income and employment opportunities, which, in turn, lead to increased energy consumption. This suggests that energy conservation policies may have minimal or no adverse effects on economic growth (Isik et al., 2018; Šikić, 2020). The growth hypothesis posits that increased energy consumption stimulates economic growth. Accordingly, investments in the energy sector can drive economic growth, and a reduction in energy supply may result in decreased income, reduced employment, and an economic downturn. Therefore, it is suggested that nations maintain investments in their energy sectors to strengthen economic performance (Shafiei, 2013; Ohlan, 2016). On the other hand, the feedback hypothesis emphasizes the significant mutual dependence between energy use and economic growth (Isik et al., 2018). In contrast, the neutrality hypothesis proposes that economic growth and energy consumption are not directly linked in a causal way (Khoshnevis Yazdi and Shakouri, 2017; Polat, 2021).

Significantly, while numerous studies have examined economic trends within developed and emerging economies, there has been scant attention to the exploration of developing nations, particularly the GCC countries. The GCC nations have experienced rapid economic growth, as illustrated in Fig. 2, accompanied by a corresponding increase in energy consumption. This escalating energy demand has played a pivotal role in environmental degradation, marked by heightened CO2 emissions, intensified mining, expanded agriculture, increased industrialization, and amplified deforestation (Danish et al., 2019). Moreover, the trajectory of economic growth has fostered urbanization and technological advancements, leading to a greater need for transportation and a subsequent rise in energy consumption. While these advancements are instrumental in propelling economic progress, they simultaneously exacerbate CO2 emissions, as observed in studies by Nathaniel et al. (2021) and Yilanci et al. (2020). This study seeks to address a gap in the literature by exploring the complex relationship between renewable and non-renewable energy consumption and its influence on economic growth, with a focus on the unique context of GCC countries.

This study makes several key contributions to the field of energy economics, particularly in the context of the Gulf Cooperation Council (GCC) countries. First, it offers a novel disaggregated analysis of the relationship between energy consumption and economic growth by distinguishing between renewable and non-renewable energy sources. Unlike previous studies that have examined this relationship in a generalized manner, this research provides deeper insights into how each type of energy consumption uniquely impacts economic growth. By taking this approach, the study enhances understanding of the energy-economic nexus and contributes to the ongoing discourse on sustainable energy transitions.

Second, we address a significant gap in regional specificity by focusing on the GCC countries, a critical yet under-explored region in energy-growth scholarship. By analyzing data from 1995 to 2020, we uncover unique dynamics in hydrocarbon-dependent economies, such as the diminishing returns of non-renewable energy dominance and the latent potential of renewables. These findings not only challenge assumptions about energy reliance in oil-rich economies but also offer empirical foundations for regional decarbonization policies—contributions absent in prior cross-national studies.

Finally, this study advances the methodological rigor of energy-economic research by addressing key econometric challenges often overlooked in previous studies. Traditional analyses frequently assume cross-sectional independence and uniformity in individual slope coefficients, which can lead to biased results. To overcome these limitations, this research employs advanced econometric techniques, including Feasible Generalized Least Squares (FGLS) and Panel-Corrected Standard Errors (PCSE), ensuring more reliable and robust findings. By integrating these methodological improvements, this study not only strengthens the validity of its results but also contributes to the refinement of econometric practices in energy economics.

The remaining sections of the paper are organized as follows: section “Literature review” reviews the relevant literature. Section “Data description and theoretical model specification” presents the study’s data and theoretical framework. Section “Empirical methodology” details the empirical methodology, while section “Results and discussions” discusses the empirical findings. Finally, section “Conclusion and policy implications” offers conclusions and outlines policy implications.

Literature review

In this domain, we will provide a concise overview of recent research addressing the correlation between energy consumption and its role in fostering economic growth. This includes studies focused on both the GCC countries and the broader global context. We will discuss all studies that used energy consumption, whether as one aggregated variable or disaggregated variables.

The Recent literature extensively explores the interplay between energy consumption, GDP, and environmental sustainability. Azam et al. (2021a, 2021b, 2021c) investigate the impact of natural gas, nuclear energy, and renewable energy on GDP and CO2 in the ten highest CO2-emitting countries, revealing that nuclear and renewable energy positively contribute to GDP and CO2 reduction, while natural gas lacks a similar impact. Another study by Azam et al. (2021b) examines the nexus between renewable electricity generation and GDP in 25 developing countries, finding a positive long-run relationship and bidirectional causality, supporting the feedback hypothesis. Similarly, Shafique et al. (2020) analyze the connection between freight transport, urbanization, energy consumption, and CO2 emissions in Hong Kong, Singapore, and South Korea, highlighting the significant role of GDP and energy consumption in freight transport growth and suggesting policies to control fossil fuel usage for emission reduction. Furthermore, Azam et al. (2021a) assess the effect of renewable electricity consumption on GDP and environmental sustainability in newly industrialized countries, indicating that while renewable electricity consumption contributes to CO2 mitigation, its impact on GDP remains statistically insignificant.

The relationship between energy consumption and economic growth has been widely explored, with varied findings across countries and regions. (Alshehry and Belloumi, 2015), (Long et al., 2015), and (Mirza and Kanwal, 2017) confirm bidirectional causal links, highlighting that in energy-dependent economies, growth both drives and is driven by energy consumption. For example, (Long et al., 2015) focus on China’s dependence on coal, while (Ben Jebli and Ben Youssef, 2017) and (Ameyaw et al., 2017) find similar patterns in Tunisia and Ghana, where energy consumption supports sector-specific development like agriculture. However, (Dey and Tareque, 2019) and (Bikorimana et al., 2020) show more complex dynamics, with the latter finding no causality in Rwanda, suggesting that in some regions, energy may not be a significant driver of growth. Similarly, (Ikhsan et al., 2022) observe no relationship in Indonesia, indicating that energy consumption’s impact on GDP may be contingent on local conditions.

Renewable energy’s role in economic growth is debated. (Ali et al., 2023a) and (Wang et al., 2023b) find that both renewable and non-renewable energy contribute to growth, supporting the feedback hypothesis, particularly in emerging Asian economies. In contrast, (Maji et al., 2019) identify a negative impact of renewable energy on growth in West Africa, possibly due to infrastructure and technological limitations. These differing results underscore the importance of contextual factors in shaping energy-growth dynamics.

Further studies, such as (Ahmed and Azam, 2016) and (Antonakakis et al., 2017), reveal that the energy-growth relationship varies significantly across countries. While some support the feedback hypothesis, others, like (Le and Quah, 2018), demonstrate a long-term relationship between energy consumption and growth in Asia. (Pao and Chen, 2019) and (Wang et al., 2023b) confirm that energy consumption drives economic growth in advanced economies, particularly for non-renewable energy.

In South Asia, studies by (Mughal et al., 2022) and (Majewski et al., 2022) identify bidirectional relationships, while (Eyuboglu and Uzar, 2022) observe neutrality in countries like South Africa and Turkey, suggesting that energy markets or alternative growth drivers might neutralize this link. Additionally, (Iqbal et al., 2022) and (EL-Karimi and El-houjjaji, 2022) highlight the positive impact of renewable energy on growth, particularly in BRICS nations, the U.S., and Canada. However, countries like France, the U.K., Italy, and Japan show no significant relationship, emphasizing the varied effects based on energy policy and infrastructure. (Riti et al., 2022) find similar positive results for renewable energy in Sub-Saharan Africa, reinforcing the region’s growing shift toward sustainable energy.

(Adom, 2011) and (Iyke, 2015) confirmed a growth-led energy hypothesis, showing a strong link between economic growth and electricity consumption in Ghana and Nigeria. Similarly, (Nguyen and Ngoc, 2020) found bidirectional causality between energy consumption and GDP in Vietnam, suggesting that energy use both drives and is driven by growth. However, (Nyasha et al., 2018) and (Bekun et al., 2019) observed one-way causality from growth to energy use in Ethiopia and South Africa, respectively, indicating that economic growth can spur energy demand, but not necessarily the reverse.

Chen et al. (2022) found a significant impact of coal consumption on GDP growth in China, highlighting the role of energy-intensive industries in economic expansion. In a broader context, (Saidi and Hammami, 2016) and (Esso and Keho, 2016) found that economic growth increases energy demand across multiple countries, which in turn may raise CO2 emissions. (Sarwar et al., 2017) expanded this by identifying bidirectional causality between energy consumption and growth in 210 countries. However, the relationship is not always straightforward. (Maji et al., 2019) found that renewable energy use hindered growth in West Africa, suggesting that renewable energy might not always align with short-term economic goals in regions with limited infrastructure.

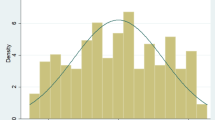

In summary, the literature presents a complex and diverse picture of the energy-growth relationship, with bidirectional causality often observed, but varying by region, energy mix, and development stage. Renewable energy’s impact is similarly variable, with both positive and negative effects depending on contextual factors like infrastructure and technological readiness. This highlights the need for region-specific policies that consider local energy dynamics. Furthermore, 35% of the above discussed studies support growth hypothesis, 17% support conservation hypothesis, 31% support the feedback hypothesis, and 17% support the neutrality hypothesis. See Fig. 3.

Data description and theoretical model specification

This paper’s empirical inquiry is grounded in data pertaining to five GCC nations - specifically, Kuwait, Oman, Qatar, United Arab Emirates, and Saudi Arabia. The study encompasses the period from 1995 to 2020, as data was not available prior to 1995 for most GCC countries. The aim of this study is to examine how the utilization of renewable and disaggregated non-renewable energy sources affects economic growth in GCC countries, with the aim of distinguishing between the two energy sources. Furthermore, since non-renewables continue to be the primary energy sources utilized in economic sectors, the work also examines the effects of natural gas, coal, and oil consumption on economic growth to facilitate comparisons. Econometrically, the dependent variable is economic growth represented in GDP (constant 2015 US$). The independent variables are coal (CC), oil (OC), natural gas (NGC) consumptions measured in (Exajoules). RE represent the consumption of Renewable energy (% of total final energy consumption). K and L are Gross capital formation (% of GDP) and total Labor force. TO is trade openness (the sum of exports and imports as a share of GDP) has been added as controlling variable. Specifically, all the data used in this research were sourced from the World Bank Development Indicators and British Petroleum (2022). In this study, all the variables were log-transformed to interpret their parameter estimates as long-term elasticities of economic growth. An overview of the variables, along with their descriptions and data sources, is presented in Table 1.

This study emphasizes the theoretical and conceptual aspects of the relationship between specific types of energy consumption and economic growth, analyzed through the lens of the Cobb-Douglas production function. The core understanding of economic growth is largely based on Solow’s neoclassical growth model from 1956, which traditionally excludes energy as a production factor, considering the economy as a system where capital and labor inputs alone generate output. However, the role of energy as a crucial production factor has received increasing attention in recent decades. The Cobb-Douglas production function is frequently employed to explore the relationship between various economic factors and output, providing a robust framework for our analysis. Using this theoretical foundation, we constructed our dataset by disaggregating energy consumption into its components (coal, oil, and natural gas) and examining their individual impacts on economic growth.

The Cobb-Douglas production function is expressed in the following form:

where \({Y}_{{it}}\) is the aggregate output at time t, A is total factor productivity, K is capital, L is labor, and T is the input of technology represented by (energy consumption). β1, β2, and β3 represent the measures of how output changes concerning capital, labor, and technology, respectively. According to recent studies on economic growth, developed nations’ economy growth primarily depends on capital, labor, and energy. As a result, this research focuses on constructing economic growth models based on five elements: output, capital, labor, energy, trade openness, and population. According to the prior studies (Asif et al., 2021; Nguyen et al., 2019; Zhang and Zhang, 2021), this study proposes a mathematical model known as the Cobb-Douglas production function. It incorporates energy as a measure of technology input, alongside the standard inputs of labor and capital, in the form of an equation as follows:

where EC represents the energy consumption and β3 represents the elasticity of output with respect to energy consumption. In Eq. (2), energy consumption (EC) is used as a proxy for technological input (T), reflecting the idea that higher energy use often correlates with the adoption of more advanced technologies. This does not imply a 1:1 substitution between energy consumption and technological input; rather, energy consumption is considered an influencing factor on technological progress. The coefficient β3 remains unchanged as it represents the elasticity of output with respect to technological input, and we assume that energy consumption impacts output similarly to other inputs, such as capital and labor, maintaining the structural integrity of the Cobb-Douglas production function.

According to (Zafar et al., 2019a), (Dogan, 2016), (Shastri et al., 2020), and (Behera and Mishra, 2020), the production process relies on two sorts of energy: renewable and non-renewable. Therefore, the aforementioned function is modified to account for the use of both energy resources. Consequently, the function (2) is adjusted as:

The variables NRE and RE are used to denote non-renewable and renewable energy, respectively. The parameters β3 and β4 describe the responsiveness of output to changes in non-renewable and renewable energy, respectively. To explore the impact of various types of non-renewable sources (such as natural gas, oil, and coal) on economic growth, the NRE term in Equation 6.3 is substituted with CC, OC, and NGC, which respectively refer to natural gas, oil, and coal consumption.

where β3, β4, and β5 represent the responsiveness of output to changes in coal consumption, oil consumption and natural gas consumption, respectively. By incorporating controlling variables and applying natural logarithms to all variables in the previous production function, we transform it into a log-linear form. The resulting equation takes on the following model form:

In the model described above, real gross domestic production (GDP) serves as the dependent variable, while the independent variables include coal consumption (CC), oil consumption (OC), natural gas consumption (NGC), renewable energy (RE), capital (K), labor (L), and trade openness (TO). The economic explanations of β1, β2, β3, β3, β4, β5, β6, and β7 are the elasticities of output with respect to CC, OC, NGC, RE, K, L, and TO, respectively. \({\beta }_{0}\) denotes a constant factor related to specific cross-sections, \({\omega }_{{it}}\) represents the cross-sectional residual components, where i represents the individual countries included in the study (i.e., i = 1,2, …., N), and t signifies the time period (1995–2020).

The relationship between non-renewable energy consumption and economic growth has been widely explored by researchers such as (Asif et al., 2021; Zhang and Zhang, 2021; Dogan, 2016; Khan et al., 2021), who consistently found that energy usage stimulates economic growth. Similarly, (Shafiei, 2013) examined the impact of natural gas, oil, and coal consumption on economic growth, revealing a positive correlation between these energy sources and economic expansion. Therefore, this study anticipates a positive link between the consumption of natural gas, oil, coal, and economic growth. i.e., (\({\beta }_{1}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}{CC}}_{{it}}} \,>\, 0\)), (\({\beta }_{2}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}{OC}}_{{it}}} \,>\, 0\)), and (\({\beta }_{3}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}{NGC}}_{{it}}} \,>\, 0\)). The connection between economic growth and the consumption of renewable energy have been examined by (Ohlan, 2016; Polat, 2021; Shafiei, 2013), and (Zafar et al., 2019b). The research highlights the significant influence of renewable energy consumption on economic growth, showing that an increase in renewable energy use is accompanied by economic expansion. However, studies by (Khoshnevis Yazdi and Shakouri, 2017; Šikić, 2020), and (Behera and Mishra, 2020) suggest that renewable energy consumption may, in some cases, hinder economic growth. Nevertheless, the research generally indicates that there is a positive association whereas a negative relationship is also possible. For this reason, in our study either a positive or a negative connection is expected between economic growth and the consumption of renewable energy. i.e., (\({\beta }_{4}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}{RE}}_{{it}}} \,>\, 0\)) or (\({\beta }_{4}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}{RE}}_{{it}}} \,<\, 0\)). The linking between capital, labor, and economic growth have been studied by (Shastri et al., 2020) and (Behera and Mishra, 2020). These studies proved that capital and labor positively connected with economic growth. On the other hand, the studies of (Dogan, 2016; Šikić, 2020) determine that labor negatively correlated with economic growth. However, in our study a positive nexus is expected between capital and economic growth, as also a positive or a negative relationship is expected between labor and economic growth. i.e., (\({\beta }_{5}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}K}_{{it}}} \,>\, 0\)) and (\({\beta }_{6}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}L}_{{it}}} \,>\, 0\)) or (\({\beta }_{6}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}L}_{{it}}} \,<\, 0\)).

The relationship between trade openness with economic growth have been investigated by (Zafar et al., 2019a; Zhang and Zhang, 2021) and (Khoshnevis Yazdi and Shakouri, 2017). The results conclude that trade openness positively correlated with economic growth. For that, economic growth increases when trade openness increase. On the other hand, the study of (Polat, 2021) determine that trade openness negatively correlated with economic growth. Hence, in this work a positive nexus is expected between trade openness with economic growth. i.e., (\({\beta }_{7}=\frac{{{ln}{GDP}}_{{it}}}{{{ln}{TO}}_{{it}}} \,>\, 0\)).

Empirical methodology

The experimental method followed in this study involves a series of consecutive steps, as shown in Fig. 4, all of which are essential and must be carried out, which begins with descriptive tests, then tests of criteria selecting the model, then tests of panel cross-section dependence, then unit root tests, then long-term cointegration tests between variables, then main model tests, and finally causality tests.

Descriptive statistics

We will begin by performing preliminary statistical tests to understand the key characteristics of the variables used in the model. This analysis will focus on identifying important metrics such as the minimum, maximum, mean values, standard deviations, and the number of observations for each variable individually.

Diagnostic tests

Multicollinearity, in statistical analysis, multicollinearity occurs when two or more predictor variables in a multiple regression model are highly correlated, suggesting that one variable can be reliably predicted by the others. To determine whether this issue affects our model, we will conduct a Variance Inflation Factor (VIF) test to assess the extent of multicollinearity (Ziegel et al., 1999). Heteroskedasticity, when the variance of the error term (u) remains constant across the values of the independent variables, we have a condition known as homoscedasticity, which is favorable for our model. However, if the variance of the error term changes with the predictor variables, this leads to a problematic condition called heteroscedasticity. To address this, we will apply the Breusch-Pagan / Cook-Weisberg (BPCW) test to determine whether heteroscedasticity is present in our statistical model (Breusch and Pagan, 1979; Cook and Weisberg, 1983). Endogenous, endogeneity arises when one or more explanatory variables are correlated with the error term, which can lead to biased estimates. In such cases, the Ordinary Least Squares (OLS) estimator becomes inconsistent. To determine whether endogeneity is a concern in our model, we will apply the Hausman Test (1978) (Hausman Specification Test) (Hausman, 1978). Autocorrelation, Autocorrelation occurs when the error term (u) for one time period is correlated with the error term from a previous period. In simpler terms, the error terms across different time periods should be independent of each other to avoid this issue. To determine if autocorrelation is present in our statistical model, we will apply the Wooldridge test (Drukker, 2003; Wooldridge, 2002).

Panel data cross-section dependence test

In this step, we apply the Lagrange Multiplier (LM) test, as developed by (Breusch and Pagan, 1980), along with (Pesaran, 2014) CD test to evaluate whether CD exists within the panel data. CD arises when countries have interconnections at the global or regional level. It is crucial to examine CD because if left unaccounted for, it can lead to incorrect, biased, and inconsistent outcomes in panel data analysis (Majeed et al., 2021). The H0 hypothesis in these tests posits the absence of common dynamics (CD) among the sampled countries, whereas the H1 hypothesis suggests the presence of common dynamics (CD) among the sampled countries.

Panel data unit root tests

Due to the ineffectiveness of first-generation unit root tests (e.g., IPS, Im, Pesaran, LL) in dealing with issues like cross-sectional dependence (CD) in variables (Dogan et al., 2020), this study employs second-generation unit root tests, specifically the CADF and CIPS tests, as introduced by (Pesaran, 2021). These advanced tests are known for their reliability, even in the presence of heterogeneity and cross-sectional dependence among the analyzed countries (Lv and Xu, 2018) (Amer et al., 2022).

Cointegration test

Before estimating the long-term relationship among the variables in the proposed multivariate CO2 model, it is essential to first determine whether structural cointegration exists among these variables. To ensure the robustness of our findings, we conducted several cointegration tests, including those developed by (Kao, 1999), (Pedroni, 2004), and the Durbin-Hausman long-term association test. These tests were chosen to account for cross-dependence and heterogeneity in our econometric analysis, as highlighted by (Westerlund and Edgerton, 2007).

Feasible generalized least squares (FGLS)

In this empirical analysis, we aimed to validate the effectiveness of the ordinary least squares (OLS) method, which requires certain assumptions: specifically, that errors maintain equal variance (no heteroscedasticity) and are independent (absence of serial correlation) (Sell et al., 2021; Yang, 2015). To address these assumptions, we utilized the FGLS model, as proposed by (Kapoor et al., 2007), as our primary analytical approach. FGLS is recognized for its robustness in handling issues such as autocorrelation, heteroscedasticity, and cross-sectional dependence in panel data models (Reed and Ye, 2011; Yuliadi and Yudhi, 2021). This method is especially beneficial when working with panel datasets where the time dimension (T) is equal to or greater than the number of cross-sectional units (N) (Nsanyan Sandow et al., 2021). Given that our dataset encompasses the years 1995 to 2020 and includes information from five different countries, the FGLS method is particularly well-suited for our modeling requirements.

Robustness examination tests (PCSEs and GMM)

To evaluate the robustness of our model’s experimental findings, we utilized the Panel-Corrected Standard Errors (PCSEs) method, initially introduced by (Beck et al., 1995). This approach is particularly valuable in addressing issues such as cross-dependence, autocorrelation, and heteroscedasticity, which can render traditional Ordinary Least Squares (OLS) estimations inefficient and lead to biased standard errors (Adekoya, 2019) (Sundjo and Aziseh, 2018). The PCSEs method preserves the parameter estimates from OLS while substituting them with more reliable standard errors that account for panel data characteristics. (Beck et al., 1995) emphasized the effectiveness of the PCSEs technique in improving the efficiency of standard errors, a finding supported by (Nsanyan Sandow et al., 2021).

To validate the findings from the previous models, we will employ the panel generalized method of moments (GMM) established by (Hansen, 1982). This approach is advantageous due to its consistency in the presence of arbitrary heterogeneity (Baum et al., 2003). The GMM method effectively addresses issues of homogeneity bias and allows for the control of both individual and time effects (Roodman, 2009). Generally, it is advisable to limit the number of instruments relative to the number of countries in the analysis. To achieve this, we will use one or two lags of the explanatory variables as instruments, subsequently consolidating them into smaller groups to minimize the instrument count (Farhadi et al., 2015).

Results and discussions

Descriptive statistics results

Table 2 provides a summary of the descriptive statistics for the variables included in the study model. Considering values based on the statistics which includes the mean, standard deviation, minimum, maximum, and median (Shi et al., 2023). The findings reveal significant variability among the variables in the panel. Among all variables, Labor exhibited the highest mean value of 3,592,074, with a corresponding standard deviation of 3,762,176. In contrast, the variable CC recorded the lowest mean value of 0.0074536, accompanied by a standard deviation of 0.0196445.

Multicollinearity, Heteroskedasticity, Endogenous, and autocorrelation results

Table 3 reveals a variance inflation factor (VIF) of 28.94, suggesting a notable presence of multicollinearity among the variables in this study. Furthermore, Table 4 presents a test result of 16.23, which is statistically significant (p < 0.0001) at the 1% level. This leads us to reject the null hypothesis and accept the alternative hypothesis, confirming the existence of heteroskedasticity in the variables analyzed. Table 5 indicates that the test statistic (908.30) is significant at the 1% level, with a p-value of 0.0000. This allows us to reject the null hypothesis (H0) in favor of the alternative hypothesis (H1), confirming the presence of an endogenous problem within the regression analysis of this study. Similarly, Table 6 reveals a test statistic of 127.288, which is also significant at the 1% level (p-value of 0.0004). This result leads us to reject the null hypothesis and accept the alternative, indicating the existence of autocorrelation among the study’s variables.

Panel cross-section dependence results

Because the GCC countries included in this study share similar geographic and socio-economic backgrounds, it is reasonable to expect that there may be inter-sectoral connections among them. Based on this assumption, the study employed three different approaches (Pesaran CD, Breusch-Pagan LM, and Pesaran scaled LM) to determine whether there is any residual cross-country connectedness within each country’s respective panel. As shown in the Table 7, the research findings indicate that the H0 hypothesis of CD is rejected due to the significant results of the test, revealing the existence of a CD issue among the study’s panels. As previously mentioned, the strong social, economic, and financial ties among GCC nations make cross-sectional dependence somewhat anticipated. The outcome validates that most GCC economies are interdependent in a globalized world, implying that any disruption in one economy affects others. It is commonly disregarded by econometric researchers that a significant reduction in the accuracy of estimation results may occur if the cross-sectional correlations among countries in a panel are substantial (Mensah, 2020; Zmami and Ben-Salha, 2020).

Panel data unit root results

Table 8 presents the findings from the CIPS and CADF tests, which offer valuable and anticipated insights. The CIPS test results show that variables such as GDP, OC, and TO are stationary at the first difference, whereas some variables are stationary at the level. In contrast, the CADF test indicates that OC, RE, K, L, and POPU are stationary at the level, while the other variables display stationarity at the first difference. Overall, these unit root tests confirm that all variables are integrated at either I(0) or I(1).

Cointegration results

Building on the methodologies established in earlier research by (Saud et al., 2019) and (Mensah, 2020), this study employed the Kao, Peroni, and Westerlund cointegration tests. The outcomes, detailed in Table 9, provide strong evidence against the null hypothesis of no cointegration. Both the group and panel statistics, along with their corresponding robust p-values, reached statistical significance. This indicates a considerable likelihood that the variables being examined have long-term relationships, justifying further simulation analyses.

Feasible generalized least squares results

A crucial implication of empirical research involves assessing the long-term parameters associated with the explanatory variables employed (CC, OC, NGC, RE, K, L & TO) once the respective levels of the foretasted variables are confirmed to have a significant long-term connection. This as result aids in measuring the elasticities of the response variable economic growth with respect to the employed predictor variables. virtually all literature studies centering on panel data techniques are focused on OLS, dynamic OLS, and fully-modified OLS estimators; nevertheless, the above estimating methods is contingent on the presuppositions of individual cross-section independences and cannot yield accurate and reliable long-term coefficient estimates. Consequently, due to the presence of CD and proliferation concerns in the panel data as provided in Table 7, the analysis utilized the Feasible Generalized Least Squares estimator, which effectively addresses the issues previously mentioned. The regression results for the entire sample are displayed in Table 10. The findings from this table, derived from the FGLS estimation method, reveal that the Wald Chi-square statistic for the panel GDP model is notably large at 4682.75, with a significance level of 0.0000 (1%). This as a result infers that, the proposed panel GDP model is a good specification and as well valid enough to provide efficient predictive outcome.

Table 10 reveals that the coefficient linked to CC (coal consumption) is negatively inclined but lacks statistical significance. This suggests that the increase in coal consumption has not coincided with economic growth. However, the non-significant p-value in the relationship between GDP and CC indicates that there is no substantial correlation between these two variables. The analysis reveals that coal consumption does not exhibit a reliable influence on economic growth in GCC countries. This finding contrasts with prior studies that suggest a significant relationship between coal consumption and economic performance (H. Chen et al., 2022; Irwandi, 2018; Munir and Nadeem, 2022; Wang and Jia, 2022; Al-mulali and Che Sab, 2018). The discrepancy could be attributed to the GCC’s unique energy mix, which is heavily dominated by oil and natural gas rather than coal.

Undoubtedly, the effect of OC is positive and significant at 1%, which indicates that 0.3398% increase in economic growth is related to oil consumption in GCC when all other variables are upheld continuously. A strong demand for oil and related products can drive economic growth through increased investment and employment in the oil sector, which can spill over into other industries. But high oil prices can dampen investment in other sectors, and increase production costs, leading to a slowdown in economic growth (Amer et al., 2024b). Additionally, reliance on oil can also make an economy vulnerable to price shocks, further affecting economic stability and growth. As it is known that the Gulf nations are rich in oil resources and therefore enjoy cheap oil prices, this has led to the role of oil consumption in promoting economic growth. This outcome aligns with the studies (Al-mulali, 2011; A. Ali, Radulescu, et al., 2023a; Awodumi and Adewuyi, 2020; Bashiri Behmiri and Pires Manso, 2013; Luqman et al., 2019), reinforcing the notion that oil consumption remains a key driver of economic expansion in oil-dependent economies such as the GCC.

NGC also seems to derive the economic growth in GCC nations. The coefficient is relatively high and significant at 1% significant level. However, a 1% rise in natural gas consumption will cause economic growth to rise by 0.4013% as disclosed by FGLS. Natural gas is a more efficient and cleaner source of energy compared to oil, which can lead to cost savings and reduce environmental impact, contributing to sustainable economic growth. By consuming natural gas, GCC countries can reduce their dependence on oil and create a more diversified energy mix, making their economies more resilient to fluctuations in oil prices. This result of NGC is in line with the outcomes of many previous studies (Alam et al., 2017; Ali et al., 2019; Galadima and Aminu, 2019, 2020; Ummalla and Samal, 2019; L. Wang et al., 2023a; Xin-gang and Jin, 2022). These studies collectively highlight the positive contributions of natural gas consumption to economic expansion, particularly in energy-rich economies where natural gas serves as a key industrial and household energy source.

More broadly, the analysis confirms that fossil fuel consumption positively and significantly impacts economic growth in GCC countries, reaffirming the region’s heavy reliance on energy resources to sustain economic development. This finding is consistent with prior studies that document a strong link between fossil fuel consumption and GDP growth (Ali et al., 2023b; Baz et al., 2021; Halkos and Gkampoura, 2021; Ilesanmi and Tewari, 2022; Koengkan et al., 2021; Xue et al., 2021). According to FGLS results, it is evident that OC and NGC are among the underlying factors of economic growth. Natural gas emerges as a more significant driver of economic growth than oil among the two fossil fuel sources examined. This finding is unexpected, as we anticipated that oil would play the dominant role in fueling economic expansion, given its status as the most commonly utilized fossil fuel in the GCC countries during the research period. The GCC countries are major producers and consumers of fossil fuels, particularly natural gas and oil. These nations have some of the largest reserves of natural gas and oil in the world, and their economies are heavily dependent on the export of these resources. However, there has been a growing trend towards the reduction of oil and gas consumption in the GCC in recent years. For example, in 2020, the UAE launched its Energy Plan 2050, which aims to rise the country’s use of renewable energy and decrease it using of fossil fuels (UAE Energy Plan 2050, 2020). Similarly, in 2019, Saudi Arabia launched its Vision 2030, which includes a goal to rise the country’s use of renewable energy and decrease its emissions (2030, 2019). Despite this trend, however, the consumption of coal, oil, and natural gas in the GCC remains high. As per to the International Energy Agency (IEA), in 2019, oil accounted for around 70% of the GCC’s total energy mix, while natural gas accounted for around 25%. In contrast, the use of coal in the region remains relatively low, accounting for less than 5% of the region’s energy mix (Agency and Outlook, 2019). See Fig. 5, which illustrates the trend in non-renewable energy consumption in the world and GCC countries.

Regarding renewable energy (RE), the research reveals a significantly and positive link between the utilization of renewable energy and economic growth. As a result, a 1% increase in RE was accompanied by a 0.7589% increase in economic growth. This finding aligns with previous studies (Bao and Xu, 2019; Bhattacharya et al., 2016; Chen et al., 2020; Dogan et al., 2020; Ivanovski et al., 2021; Pearson, 2021; Shahbaz et al., 2020; Wang et al., 2023b; Wang and Wang, 2020), reinforcing the argument that renewable energy can contribute positively to economic expansion. However, it is worth noting that some studies suggest that in certain contexts, renewable energy consumption may have a negative effect on economic growth (Chen et al., 2020; Dogan et al., 2020; Qi and Li, 2017), which could be attributed to high initial costs, inefficiencies, or transitional challenges in renewable energy adoption. The consumption of Renewable energy in the GCC is increasing, driven by a combination of reasons including increasing demand for electricity, a need to decrease emissions, and a desire to promote economic growth (Energy Outlook, 2019). For example, the UAE has set a target to generate 50% of its total electricity from clean energy sources by 2050, and has launched several initiatives to enhance the use of renewable energy, including the launch of the world’s largest concentrated solar power plant and the world’s largest solar park (Energy Outlook, 2019). Similarly, Saudi Arabia has established a goal to produce 9.5 gigawatts of renewable energy by the year 2023, and has launched the Saudi Green Initiative, which aims to develop and promote the use of renewable energy in the country. See Fig. 6, which shows the percentage of renewable energy consumption for each GCC country separately.

The FGLS results further indicate that capital has a significant but negative impact on economic growth, diverging from prior findings in the literature (Halim et al., 2020; Kala et al., 2018; Ngepah et al., 2021; Sani et al., 2018; Shahbaz et al., 2022). In contrast, labor exhibits a significant and positive effect, with a 1% increase in labor contributing to a 0.1621% rise in economic growth. While this result is consistent with some previous studies, it contradicts others (Dogan et al., 2020; Šikić, 2020), indicating that the role of labor in economic expansion may vary across different economic and institutional contexts. The association between capital, labor, and economic growth is a complex one, and the results of studies on this topic can depend on a variety of factors, including the data used, the methodology employed, and the specific countries or regions being analyzed. It is needed to note that the connection between capital and economic growth is likely to be positive, as investments in human capital can lead to increased productivity and output.

In contrast, the association between labor and economic growth is less clear cut, and depends on many factors such as the quality and education level of the labor force, the overall business environment, and the structure of the economy. In some cases, a labor force can be a drag on economic growth if it is not well-educated or if there are inefficiencies in the labor market that prevent workers from finding productive employment (Gupta and Dutta, 2022). One explanation for the negative effect of labor on economic growth is the so-called “labor market rigidities.” This refers to the idea that inefficiencies in the labor market, such as high taxes, minimum wages, and inflexible labor regulations, can lead to a reduction in employment and output, Furthermore, it exerts an adverse influence on economic growth. Another perspective to consider is the “efficiency wage hypothesis,” which posits that companies might offer wages above the market-clearing rate to enhance worker motivation and productivity. If firms do not take into account the impact of these higher wages on employment, this could lead to a negative effect of labor on economic growth (Bhattacharyya and Gupta, 2020).

Finally, trade openness shows a non-significant positive relationship with economic growth. While some studies highlight trade openness as a significant factor driving economic expansion in GCC countries, our results do not provide strong empirical support for this claim (Lee and Shin, 2019, 2021; Mahdawi et al., 2021; Muharromy and Auwalin, 2021). Nevertheless, our findings align with previous studies that report a positive but varying effect of trade openness on economic growth as (Buhari et al., 2020; Bunje et al., 2022; Raghutla, 2020; Sriyana and Afandi, 2020; Udeagha and Ngepah, 2021).

See the Fig. 7, which illustrating the outcomes of the correlation between the independent variables (CC, OC, NGC, RE, K, L, and TO) and the dependent variable (economic growth) across the GCC countries throughout the research period.

Source: Researcher design using the results of FGLS. Note: The colors and arrows in the figure are intended to differentiate between various relationships rather than convey specific meanings themselves. The signs (+/−) inside the arrows indicate the nature of the relationships between the variables and economic growth. CC indicates to carbon consumption, OC indicates to oil consumption, NGC refer to natural gas consumption, RE refer to renewable energy consumption, K is the capital, L is the labor, and TO is the trade openness.

Our empirical analysis identifies the primary contributors to energy consumption and their impact on economic growth in the GCC countries. The ranking of these contributors, from the most to least significant, is as follows: renewable energy consumption ranks first, followed by natural gas consumption in second place, oil consumption in third, labor in fourth, and trade openness in fifth. Notably, our findings indicate that capital does not contribute positively to economic growth; in fact, it appears to have a negative effect. Figure 8 illustrates the hierarchy of these contributors and the extent of each variable’s impact on economic growth in the GCC region.

Robustness examination results (PCSEs and GMM)

Table 11 presents the findings from the Panels Corrected Standard Errors (PCSEs) model, which serves as a robustness check for this study. These results are consistent with those derived from the primary model, Feasible Generalized Least Squares (FGLS) (Amer et al., 2022; Sundjo and Aziseh, 2018). The data indicate that, in the long term, all examined variables—namely oil consumption, natural gas consumption, renewable energy consumption, trade openness, and labor—exert a positive and statistically significant effect on economic growth. Conversely, labor and coal consumption emerge as the only factors demonstrating a detrimental impact on economic growth.

Table 12 presents the results of the PGMM robustness test, which aligns closely with the findings from the previous models (FGLS and PCSEs). Over the long term, the analysis shows that OC, NGC, RE, TO, and L all have a positive and statistically significant effect on economic growth. On the other hand, K and CC are the only variables found to negatively impact economic growth.

Causality test results

The proof of a long-term connection involving variables shows that at least one path must have causal links. Estimation of the long-run affiliation however, do not unveil the direction of causal relationships between economic growth and other variables. Hence, causal liaisons among economic growth and independent variables are explored using heterogeneous panel system. To make comparisons more apparent, Table 13 and Fig. 9 presents summary of empiric findings which show 8-way causal connections between economic growth and study independent variables. Mixture of results for causal affiliations are obtained between variables. In particular, among the three fossil fuel sources (CC, OC, and NGC), the results indicate a unidirectional relationship from GDP to CC, from OC to GDP, and from GDP to NGC. Surprisingly, no causal links were found between RE, K, TO, and economic growth. Lastly, the analysis reveals a one-way causal connection from L to economic growth.

Source: Researcher design using the results of D-H causality test. Notes: The two-headed arrow (↔) represents the two-way relationship, while the one-headed arrow (→) represents the unidirectional relationship, and finally the arrow devoid of heads (—) represents the absence of a causal relationship between the two variables. CC indicates to carbon consumption, OC indicates to oil consumption, NGC refer to natural gas consumption, RE refer to renewable energy consumption, K is the capital, L is the labor, and TO is the trade openness.

The causality test results confirm the growth hypothesis for the relationship between OC and economic growth, while supporting the conservation hypothesis for both CC and NGC. Additionally, the neutrality hypothesis is validated in the case of RE and its link to economic growth. These findings are consistent with those of numerous prior studies as (Ahmed and Azam, 2016; Baz et al., 2021; EL-Karimi and El-houjjaji, 2022; Fang and Wolski, 2021), and different with some studies as (Ali et al., 2023a; Wang et al., 2023a; Wang et al., 2023b).

Conclusion and policy implications

The preceding centuries have witnessed a heightened consumption of various forms of energy in the pursuit of economic prosperity in the GCC. However, the determinants of economic growth linked to energy utilization in these economies have not been thoroughly explored. Recognizing the significance of this work for decision-makers in these countries, our study objectives delve into a comprehensive examination of the intricate relationship between energy consumption and economic growth in the GCC nations. Utilizing the Cobb-Douglas production function, we meticulously analyze both renewable and disaggregated non-renewable energy sources, namely natural gas, oil, and coal, to discern their diverse impacts on economic growth.

This study distinguishes itself from previous research in energy economics by focusing specifically on the differential impacts of renewable and non-renewable energy consumption on economic growth, offering a nuanced understanding of this relationship. By concentrating on the GCC countries from 1995 to 2020, we fill a significant gap in regional specificity, uncovering unique insights into the energy-growth nexus in this under-explored area. Methodologically, we advance the field by challenging conventional assumptions of independence among cross-sectional residuals and uniformity in slope coefficients, employing state-of-the-art econometric techniques like FGLS and PCSE models to address these issues. Our findings highlight both the benefits of targeted energy policies for economic growth and the need for nuanced, region-specific strategies.

The estimates of long-term coefficients, reveal notable findings. Non-renewable energy sources, especially natural gas, exhibit a substantial and positive connection with economic growth. In details, CC is insignificant negatively inclined with economic growth, suggests that the increase in CC has not coincided with economic growth. Certainly, the effect of OC is positive and significant at 1%, which indicates that 0.3398% increase in economic growth is related to oil consumption. NGC also derive the economic growth. The coefficient is relatively high and significant at 1% significant level. However, a 1% rise in NGC will cause economic growth to rise by 0.4013%. Moreover, RE demonstrates a promising positive correlation with economic growth, a 1% increase in RE accompanied by a 0.7589% increase in GDP. In contrast, capital’s impact on economic growth is both negative and statistically significant, while labor shows a significant positive effect in the region. Of the three fossil fuels (coal, oil, and natural gas), only CC and NGC exhibit a unidirectional relationship, flowing from economic growth to these fuels. OC, however, demonstrates a one-way relationship directed toward economic growth. Notably, RE shows no causal link with economic growth.

The findings indicate that oil consumption (OC) and natural gas consumption (NGC) drive economic growth, but OC supporting the growth hypothesis, whereas CC and NGC shows aligning with the conservation hypothesis, finally, RE supporting the neutrality hypothesis. This suggests a strategic shift towards oil and natural gas could foster economic development. Policymakers should consider incentivizing investments in oil and natural gas sectors while transitioning away from coal to enhance sustainable economic growth. Additionally, the results from alternative models (PCSEs and PGMM), used for robustness testing in this study, align with the outcomes obtained from the primary model (FGLS).

In conclusion, our research yields specific implications for decision-makers in the GCC countries, aligning practical recommendations with the nuanced findings of our study. Firstly, in light of the observed positive correlation between renewable energy and economic growth, policymakers are urged to prioritize investments in sustainable sources like solar and wind power. This strategic move not only diminishes reliance on non-renewable sources but also addresses environmental concerns, fostering economic growth in a sustainable manner. The GCC region is endowed with ample and easily accessible clean energy sources, such as natural gas, wind energy, solar energy, and hydropower. Particularly noteworthy is the region’s significant annual average solar radiation, reaching approximately 2200 kWh (th)/m2, exceedingly even solar-rich areas like Spain by 40% (Amer et al., 2022). Consequently, leverage this abundant solar potential as a primary solution to address the increasing energy demands strongly advised. Unlike previous studies that generally advocate for a global shift to renewables, our recommendations are specifically tailored to the GCC’s unique geographic and climatic advantages, providing a targeted strategy that maximizes regional benefits and supports sustainable economic growth.

Secondly, recognizing the substantial and positive connection between non-renewable energy sources, particularly natural gas, and economic growth, decision-makers should champion energy efficiency measures. Promoting technologies and practices that enhance energy productivity becomes pivotal, optimizing the positive impact of non-renewable sources on economic growth while concurrently curbing overall energy consumption. These economies heavily rely on abundant non-renewable energy sources, such as coal, oil, and gas, which fulfill approximately 80 percent of their energy demands, fueling their pursuit of economic growth (Majeed et al., 2021). In 2017, fossil fuels accounted for 91.51% of the total energy consumption in the UAE, 95.33% in Kuwait, and 98.40% in Bahrain. For the remaining countries, fossil fuel usage approached nearly 100% of their overall energy consumption (Amer et al., 2022). Unlike previous studies that primarily focused on the environmental drawbacks of non-renewable energy consumption, our recommendations emphasize a balanced approach by integrating energy efficiency measures to maximize economic benefits. Furthermore, we advocate for targeted technological advancements in energy productivity, which has not been the central focus in earlier research. This dual strategy not only enhances growth but also mitigates the high dependence on fossil fuels by promoting a more sustainable energy framework.

Furthermore, our findings emphasize the need for economic diversification away from heavy reliance on non-renewable sources, notably oil. To fortify long-term economic growth and resilience, decision-makers should explore alternative avenues for both the energy mix and overall economic activities. Simultaneously, investments in human capital through education and training programs are imperative, aligning with the identified positive correlation between oil consumption and economic growth. Lastly, sustainable economic growth should be a guiding principle for policymakers, ensuring that strategies consider environmental consciousness and foster practices that balance economic prosperity with long-term environmental sustainability.

Limitations and future research directions

The study’s limitations suggest opportunities for future research. This investigation explores the impact of Renewable and Disaggregated Non-renewable Energy Consumption on Economic Growth, utilizing panel data without a specific focus on individual countries. However, a more comprehensive approach in future research, incorporating both country-specific and aggregated panel data, may yield more varied results, enhancing the study’s overall persuasiveness. The study individually examines the influence of each non-renewable energy source on economic growth, while renewable energy is treated as a single variable due to data availability challenges. Therefore, we propose that future studies explore the economic impact of each renewable energy source individually, provided the data is accessible.

An avenue worth exploring further is the analysis of how different energy consumption sources affect various economic sectors. Such insights could prove valuable for policymakers striving to foster sustainable development and environmental preservation. Given the frequent developments in energy and environmental policy reforms, including those occurring after the sample period, revisiting trends as new data emerges becomes intriguing. The incorporation of more end-use and sub-sectoral data in decomposition analysis might enhance the accuracy of estimations. These aspects remain open for potential investigation in future research.

Data availability

The datasets analyzed during the current study are available in (http://www.bp.com/statisticalreview) and (https://data.worldbank.org).

References

2030, S. V. (2019) Saudi Vision 2030. https://vision2030.gov.sa/en

Adekoya AF (2019) Income inequality and violent crime in Nigeria: a panel corrected standard error approach. Ib J Peace Dev 9(2):1–10

Adom PK (2011) Electricity Consumption-Economic Growth Nexus: The Ghanaian Case. Int J Energy Econ Policy 1(1):18–31. https://www.econjournals.com/index.php/ijeep/article/view/20

Agency IE, Outlook WE (2019) World Energy Outlook 2019. The World in Figures

Ahmed M, Azam M (2016) Causal nexus between energy consumption and economic growth for high, middle and low income countries using frequency domain analysis. Renew Sustain Energy Rev 60:653–678. https://doi.org/10.1016/j.rser.2015.12.174

Akadiri AC, Akadiri SS, Taheri E, Bekun FV (2019) Carbon emissions, energy consumption and economic growth: a causality evidence. Int J Energy Technol Policy 15(2–3):320. https://doi.org/10.1504/ijetp.2019.10019648

Alam MS, Paramati SR, Shahbaz M, Bhattacharya M (2017) Natural gas, trade and sustainable growth: empirical evidence from the top gas consumers of the developing world. Appl Econ 49(7):635–649. https://doi.org/10.1080/00036846.2016.1203064

Ali F, Khan KA, Raza A (2019) Determining the relationship between energy consumption and economic growth in Pakistan. Ukrainian J Ecol 9(3):322–328. https://doi.org/10.15421/2019_98

Ali A, Radulescu M, Balsalobre-Lorente D (2023a) A dynamic relationship between renewable energy consumption, nonrenewable energy consumption, economic growth, and carbon dioxide emissions: evidence from Asian emerging economies. Energy Environ. https://doi.org/10.1177/0958305X231151684

Ali, A, Xinagyu, G, & Radulescu, M (2023b) Nonlinear effects of urbanization routes (proportion of small cities, and proportion of large cities) on environmental degradation, evidence from China, India, Indonesia, the United States, and Brazil. Energy Environ. https://doi.org/10.1177/0958305X231186843

Al-mulali U (2011) Oil consumption, CO2 emission and economic growth in MENA countries. Energy 36(10):6165–6171. https://doi.org/10.1016/j.energy.2011.07.048

Al-mulali U, Che Sab CNB (2018) The impact of coal consumption and CO2emission on economic growth. Energy Sources Part B Econ, Plan Policy 13(4):218–223. https://doi.org/10.1080/15567249.2012.661027

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sustain Energy Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Amer EAAA, Meyad EMA, Meyad AM, Mohsin AKM (2024a) The impact of natural resources on environmental degradation: a review of ecological footprint and CO2 emissions as indicators. Front Environ Sci 12(March):1–14. https://doi.org/10.3389/fenvs.2024.1368125

Amer EAAA, Xiuwu Z, Meyad EMA, Meyad AM, Mohsin AKM, Rahman A (2024b) The long-term relationship between oil price changes and economic growth from the perspective of the resource curse: an empirical study from Yemen. PLoS ONE 19(11 November):1–23. https://doi.org/10.1371/journal.pone.0313206

Amer EAAA, Meyad EMA, Gao Y, Niu X, Chen N, Xu H, Zhang D (2022) Exploring the link between natural resources, urbanization, human capital, and ecological footprint: a case of GCC countries. Ecol Indic 144(October):109556. https://doi.org/10.1016/j.ecolind.2022.109556

Ameyaw B, Oppong A, Abruquah LA, Ashalley E (2017) Causality nexus of electricity consumption and economic growth: an empirical evidence from Ghana. Open J Bus Manag 05(01):1–10. https://doi.org/10.4236/ojbm.2017.51001

Antonakakis N, Chatziantoniou I, Filis G (2017) Energy consumption, CO2 emissions, and economic growth: an ethical dilemma. Renew Sustain Energy Rev 68:808–824. https://doi.org/10.1016/J.RSER.2016.09.105

Asif M, Bashir S, Khan S (2021) Impact of non-renewable and renewable energy consumption on economic growth: evidence from income and regional groups of countries. Environ Sci Pollut Res 28(29):38764–38773. https://doi.org/10.1007/s11356-021-13448-x

Awodumi OB, Adewuyi AO (2020) The role of non-renewable energy consumption in economic growth and carbon emission: Evidence from oil producing economies in Africa. Energy Strategy Rev 27:100434. https://doi.org/10.1016/j.esr.2019.100434

Azam A, Rafiq M, Shafique M, Ateeq M, Yuan J (2021a) Investigating the impact of renewable electricity consumption on sustainable economic development: a panel ARDL approach. Int J Green Energy 18(11). https://doi.org/10.1080/15435075.2021.1897825

Azam A, Rafiq M, Shafique M, Yuan J (2021b) Renewable electricity generation and economic growth nexus in developing countries: An ARDL approach. Econ Res-Ekonom Istrazivanja, 34(1). https://doi.org/10.1080/1331677X.2020.1865180

Azam A, Rafiq M, Shafique M, Zhang H, Yuan J (2021c) Analyzing the effect of natural gas, nuclear energy and renewable energy on GDP and carbon emissions: a multi-variate panel data analysis. Energy 219. https://doi.org/10.1016/j.energy.2020.119592

Bao C, Xu M (2019) Cause and effect of renewable energy consumption on urbanization and economic growth in China’s provinces and regions. J Clean Prod 231:483–493. https://doi.org/10.1016/j.jclepro.2019.05.191

Bashiri Behmiri N, Pires Manso JR (2013) How crude oil consumption impacts on economic growth of Sub-Saharan Africa? Energy 54:74–83. https://doi.org/10.1016/j.energy.2013.02.052

Baum CF, Schaffer ME, Stillman S (2003) Instrumental variables and GMM: estimation and testing. Stata J Promot Commun Stat Stata 3(1):1–31. https://doi.org/10.1177/1536867x0300300101

Baz K, Cheng J, Xu D, Abbas K, Ali I, Ali H, Fang C (2021) Asymmetric impact of fossil fuel and renewable energy consumption on economic growth: a nonlinear technique. Energy 226:120357. https://doi.org/10.1016/j.energy.2021.120357

Beck N, Katz JN, American T, Science P (1995) What to do (and not to do) with Time-Series Cross-Section Data. Am Polit Sci Rev 89(3):634–647

Behera J, Mishra AK (2020) Renewable and non-renewable energy consumption and economic growth in G7 countries: evidence from panel autoregressive distributed lag (P-ARDL) model. Int Econ Econ Policy 17(1):241–258. https://doi.org/10.1007/s10368-019-00446-1

Bekun FV, Emir F, Sarkodie SA (2019) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765. https://doi.org/10.1016/j.scitotenv.2018.11.271

Ben Jebli M, Ben Youssef S (2017) Renewable energy consumption and agriculture: evidence for cointegration and Granger causality for Tunisian economy. Int J Sustain Dev World Ecol 24(2):149–158. https://doi.org/10.1080/13504509.2016.1196467

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy 162:733–741. https://doi.org/10.1016/j.apenergy.2015.10.104

Bhattacharyya, C, & Gupta, MR (2020) Union, efficiency of labour and endogenous growth. Hitotsubashi J Econ 61(2). https://doi.org/10.15057/hje.2020008

Bikorimana G, Rutikanga C, Mwizerwa D (2020) Linking energy consumption with economic growth: Rwanda as a case study. Econ Policy Energy Environ 2:181–200. https://doi.org/10.3280/EFE2020-002008

Breusch TS, Pagan AR (1979) A simple test for heteroscedasticity and random coefficient variation. Econometrica 47(5):1287. https://doi.org/10.2307/1911963

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239. https://doi.org/10.2307/2297111

Bunje MY, Abendin S, Wang Y (2022) The effects of trade openness on economic growth in Africa. Open J Bus Manag 10(02):614–642. https://doi.org/10.4236/ojbm.2022.102035

Chen C, Pinar M, Stengos T (2020) Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy 139:111295. https://doi.org/10.1016/j.enpol.2020.111295

Chen H, Liu K, Shi T, Wang L (2022) Coal consumption and economic growth: a Chinese city-level study. Energy Econ 109:105940. https://doi.org/10.1016/j.eneco.2022.105940

Cook RD, Weisberg S (1983) Diagnostics for heteroscedasticity in regression. Biometrika 70(1):1–10. https://doi.org/10.1093/biomet/70.1.1

Damilola Ilesanmi K, Tewari DD (2022) Increased fossil fuel consumption and its impact on energy efficiency and economic growth. Acad J Interdiscip Stud 11(1):188. https://doi.org/10.36941/ajis-2022-0017

Danish, Hassan ST, Baloch MA, Mahmood N, Zhang J (2019) Linking economic growth and ecological footprint through human capital and biocapacity. Sustain Cities Soc 47(January):101516. https://doi.org/10.1016/j.scs.2019.101516

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic Co-operation and development countries. J Clean Prod 242:118537. https://doi.org/10.1016/j.jclepro.2019.118537

Dey SR, Tareque M (2019) Electricity consumption and GDP nexus in Bangladesh: a time series investigation. J Asian Bus Econ Stud 27(1):35–48. https://doi.org/10.1108/jabes-04-2019-0029

Dogan E (2016) Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renew Energy 99:1126–1136. https://doi.org/10.1016/j.renene.2016.07.078

Dogan E, Altinoz B, Madaleno M, Taskin D (2020) The impact of renewable energy consumption to economic growth: a replication and extension of Inglesi-Lotz (2016). Energy Econ 90:104866. https://doi.org/10.1016/j.eneco.2020.104866

Doğan B, Balsalobre-Lorente D, Nasir MA (2020) European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. J Environ Manag 273:111146. https://doi.org/10.1016/j.jenvman.2020.111146

Doğan B, Chu LK, Ghosh S, Diep Truong HH, Balsalobre-Lorente D (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renew Energy 187:645–656. https://doi.org/10.1016/j.renene.2022.01.077

Doğan B, Shahbaz M, Bashir MF, Abbas S, Ghosh S (2023) Formulating energy security strategies for a sustainable environment: evidence from the newly industrialized economies. Renew Sustain Energy Rev 184:113551. https://doi.org/10.1016/j.rser.2023.113551

Drukker DM (2003) Testing for serial correlation in linear panel-data models. Stata J Promot Commun Stat Stata 3(2):168–177. https://doi.org/10.1177/1536867x0300300206

Duan K, Ren X, Wen F, Chen J (2023) Evolution of the information transmission between Chinese and international oil markets: a quantile-based framework. J Commod Mark 29:100304. https://doi.org/10.1016/j.jcomm.2022.100304

EL-Karimi M, El-houjjaji H (2022) Economic growth and renewable energy consumption nexus in G7 countries: symmetric and asymmetric causality analysis in frequency domain. J Clean Prod 342:130618. https://doi.org/10.1016/j.jclepro.2022.130618

Emre Caglar A (2020) The importance of renewable energy consumption and FDI inflows in reducing environmental degradation: Bootstrap ARDL bound test in selected 9 countries. J Clean Prod 264:121663. https://doi.org/10.1016/j.jclepro.2020.121663

Esfahani HS (2014) J Appl Econ 29(2012):1–21. https://doi.org/10.1002/jae

Esso LJ, Keho Y (2016) Energy consumption, economic growth and carbon emissions: cointegration and causality evidence from selected African countries. Energy 114:492–497. https://doi.org/10.1016/j.energy.2016.08.010

Everts E (2003) Econometric analysis of cross section and panel data. Booksgooglecom 16(2). https://doi.org/10.1515/humr.2003.021

Eyuboglu K, Uzar U (2022) Asymmetric causality between renewable energy consumption and economic growth: fresh evidence from some emerging countries. Environ Sci Pollut Res 29(15):21899–21911. https://doi.org/10.1007/s11356-021-17472-9

Fang Z, Wolski M (2021) Human capital, energy and economic growth in China: evidence from multivariate nonlinear Granger causality tests. Empir Econ 60(2):607–632. https://doi.org/10.1007/s00181-019-01781-7

Farhadi M, Islam MR, Moslehi S (2015) Economic freedom and productivity growth in resource-rich economies. World Dev 72:109–126. https://doi.org/10.1016/j.worlddev.2015.02.014

Galadima MD, Aminu AW (2019) Positive and negative impacts of natural gas consumption on economic growth in Nigeria: a nonlinear ARDL approach. Afr J Econ Sustain Dev 7(2):138. https://doi.org/10.1504/ajesd.2019.10025216

Galadima MD, Aminu AW (2020) Nonlinear unit root and nonlinear causality in natural gas— economic growth nexus: evidence from Nigeria. Energy 190:116415. https://doi.org/10.1016/j.energy.2019.116415

Gupta MR, Dutta PB (2022) Taxation, capital accumulation, environment and unemployment in an efficiency wage model. J Econ/Z Fur Nationalokonomie 135(2):151–198. https://doi.org/10.1007/s00712-021-00754-8

Halim HA, Harun NH, Shaari MS, Abidin NZ (2020) The effects of capital, labor and electricity consumption on economic growth in Malaysia. Int J Energy Econ Policy 10(6):305–309. https://doi.org/10.32479/ijeep.10034

Halkos GE, Gkampoura EC (2021) Examining the linkages among carbon dioxide emissions, electricity production and economic growth in different income levels. Energies 14(6):1682. https://doi.org/10.3390/en14061682

Hansen LP (1982) Large sample properties of generalized method of moments estimators author(s): Lars Peter Hansen Source. Econometrica 50(4):1029–1054

Hausman JA (1978) Specification tests in econometrics. Econometrica 46(6):1251

Ikhsan I, Fachrurrozi K, Nasir M, Elfiana E, Nurjannah N (2022) Energy-growth nexus in Indonesia: fresh evidence from asymmetric causality test. Int J Energy Econ Policy 12(1):396–400. https://doi.org/10.32479/ijeep.11837

Iqbal A, Tang X, Rasool SF (2022) Investigating the nexus between CO2 emissions, renewable energy consumption, FDI, exports and economic growth: evidence from BRICS countries. Environ Dev Sustain 25:2234–2263. https://doi.org/10.1007/s10668-022-02128-6

Irfan M, Rehman MA, Razzaq A, Hao Y (2023) What derives renewable energy transition in G-7 and E-7 countries? The role of financial development and mineral markets. Energy Econ 121:106661. https://doi.org/10.1016/j.eneco.2023.106661

Irwandi I (2018) The relationship between coal consumption and economic growth in Indonesia. Eur J Eng Form Sci 2(1):13. https://doi.org/10.26417/ejef.v2i1.p13-20

Isik C, Dogru T, Turk ES (2018) A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: theory and evidence. Int J Tour Res 20(1):38–49. https://doi.org/10.1002/jtr.2151

Ivanovski K, Hailemariam A, Smyth R (2021) The effect of renewable and non-renewable energy consumption on economic growth: non-parametric evidence. J Clean Prod 286:124956. https://doi.org/10.1016/j.jclepro.2020.124956

Iyke BN (2015) Electricity consumption and economic growth in Nigeria: a revisit of the energy-growth debate. Energy Econ 51:166–176. https://doi.org/10.1016/j.eneco.2015.05.024

Kala G, Masbar R, Syahnur S (2018) The effect of exchange rate, inflation, capital and labor force on economic growth in Indonesia. J Ekon Dan Kebijakan Publik Indones 5(1):12–27

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90(1):1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Kapoor M, Kelejian HH, Prucha IR (2007) Panel data models with spatially correlated error components. J Econ 140(1):97–130. https://doi.org/10.1016/j.jeconom.2006.09.004

Khalfaoui R, Arminen H, Doğan B, Ghosh S (2023) Environment-growth nexus and corruption in the MENA region: novel evidence based on method of moments quantile estimations. J Environ Manag 342:118146. https://doi.org/10.1016/j.jenvman.2023.118146