Abstract

This study investigates the complex relationship between geopolitical risks and carbon emissions, highlighting the mediating role of industrial structure upgrading. A threshold effect model combined with bootstrap estimation is applied to panel data from 41 countries. The results indicate that geopolitical risks significantly influence carbon emissions, with divergent impacts observed across different economic contexts. In high-income countries, geopolitical tensions typically lead to increased carbon emissions due to strategic shifts in energy resource allocation. Conversely, in lower-income countries, such risks often result in decreased energy demand and reduced emissions. The study further examines how industrial structure upgrading modulates the interaction between geopolitical risks and carbon emissions. The results indicate that industrial structure upgrading exhibits a double-threshold effect. As the industrial structure value changes, the impact coefficient of geopolitical risk on carbon emissions globally decreases from 0.103 to −0.030, whereas in high-income countries, the coefficient decreases from 0.048 to –0.029. This study offers policy insights for mitigating carbon emissions in the context of geopolitical risks.

Similar content being viewed by others

Introduction

Climate change has become an increasingly pressing global concern, primarily driven by the excessive emissions of greenhouse gases IPCC (2023). In response, numerous countries have pledged to transition towards low-carbon economies and achieve carbon neutrality. However, this transition is not occurring in a vacuum; it is profoundly shaped by complex global dynamics, among which geopolitical factors play a pivotal role. Recent events such as the Russia-Ukraine conflict and the global energy price volatility have underscored how geopolitical tensions can disrupt energy markets, alter national priorities, and indirectly affect environmental outcomes (Kartal and Pata 2023).

Geopolitical risks (GPR), stemming from war, terrorism, and international tensions, further weaken the global economy and pose significant challenges to the control of carbon emissions (Li et al. 2024; Wang et al. 2024b). Resource disputes, particularly over energy resources like oil and gas, are a primary manifestation of these risks. Such competition often leads to an over-reliance on high-carbon emission energy sources, driving up carbon emissions. Despite growing recognition of the geopolitical dimensions of climate action, empirical research examining the nexus between geopolitical risk and carbon emissions remains limited. Most existing studies focus on economic and institutional drivers while overlooking the strategic influence of global political instability. This study addresses this gap by investigating the role of geopolitical risk in shaping carbon emissions, using a comprehensive panel dataset and a novel geopolitical risk index. By doing so, it contributes to a deeper understanding of the external constraints that may hinder global decarbonization efforts.

Industrial structure serves as a critical internal determinant of a country’s economic development and environmental sustainability. The uniqueness of industrial structure lies in its ability to comprehensively consider economic and environmental factors (Yang et al. 2022a; Wang et al. 2025a), providing a more holistic perspective to analyze the relationship between geopolitical risks and carbon emissions. The proportion of industrial value added in Gross Domestic Product (GDP) serves as an indicator for measuring the upgrading of IDS. A lower proportion indicates a declining share of the industrial sector in GDP, reflecting a more advanced and optimized industrial structure. For example, developing countries may focus more on industrialization, while developed countries may focus more on services and high-tech industries. In short, the decrease in the proportion of the industrial sector signifies the success of industrial structure upgrading. There is a direct link between industrial structure upgrading and carbon emissions; different industrial structures have significantly different impacts on energy consumption and production patterns, which directly affect carbon emissions. For instance, heavy industry and manufacturing typically generate more carbon emissions than the service sector. Therefore, as industrial structures change, such as transitioning from heavy industry to services, we can observe changes in carbon emission patterns. This change is a dynamic process that can capture the dynamics of carbon emissions over time, providing policymakers with more flexible decision-making bases. With the adjustment of industrial structures, policymakers can formulate emission reduction strategies for specific industries to achieve a balance between economic development and environmental protection. The development and change of industrial structures also reflect the stages of a country’s economic development; countries at different economic development stages may have different responses and adaptation strategies when facing geopolitical risks. For example, developing countries may prioritize industrialization, while developed countries emphasize services and high-tech industries (Yang et al. 2014; Wang et al. 2024a). This difference means that the same geopolitical risks may have different impacts on different countries, thereby affecting their carbon emission levels. Moreover, the upgrading of industrial structures enables the possibility of cross-country comparisons in research, helping us understand the differences in carbon emissions among different countries when facing geopolitical risks. This comparison not only helps identify which industries are more vulnerable in global supply chains and international trade but also reveals which industries are more effective in adapting to and mitigating geopolitical risks. At the same time, geopolitical risks may have a greater impact on specific industries, especially those that rely on global supply chains and international trade. Such risks can lead to the contraction or expansion of industries, thereby affecting carbon emissions. For example, geopolitical tensions can cause fluctuations in energy prices, affecting the operating costs of energy-intensive industries and, consequently, their carbon emissions. Additionally, geopolitical risks can lead to disruptions in the supply chains of certain industries, forcing companies to seek alternative suppliers or change production locations; these changes can all impact carbon emissions. Therefore, industrial structure not only reveals the direct impact of geopolitical risks on carbon emissions but also reflects the indirect effects of changes in industrial structure on carbon emissions, providing us with a tool to deeply understand and address the relationship between geopolitical risks and carbon emissions. Scholars have employed various research methodologies to explore the direct effects of industrial upgrading on low-carbon emissions (Su and Ang 2015; Yu et al. 2015). Industrial upgrading is typically accompanied by technological advancement and innovation. The application of new technologies can potentially enhance production efficiency and reduce energy consumption, thereby mitigating carbon emissions. Simultaneously, one direction in the upgrading of industrial structure involves the development of green industries, encompassing renewable energy, environmental technologies, and clean energy vehicles, among others (Wang et al. 2025c). These industries generally exhibit lower levels of carbon emissions, contributing to a reduction in overall carbon footprints.

This study aims to address three key questions based on available panel data from 41 countries globally spanning the years 1995 to 2020: (1) Does GPR impact carbon emissions (CO2)? (2) What is the mechanism by which industrial structural upgrading influences the relationship between GPR and CO2 emissions? (3) Is there a difference among countries with different income levels?

The main contributions of this paper are as follows: Firstly, this study aims to fill the gap in the existing literature regarding the impact of geopolitical risks on carbon emissions, an increasingly important issue in the context of climate change and global political-economic dynamics. In the methodology section, we employ a series of econometric models to conduct empirical analysis. Following a set of preliminary tests, we successively utilize the Fully Modified Ordinary Least Squares (FMOLS) model, the Dynamic Ordinary Least Squares (DOLS) model, the panel threshold regression model, and bootstrap methods. The FMOLS and DOLS models serve as baseline regression models to examine the linear relationship between geopolitical risks and carbon emissions, providing a comparative foundation for the more complex models that follow. Meanwhile, the panel threshold regression model captures the nonlinear characteristics embedded in the data. By combining these methods, we enhance the precision and credibility of our research findings. Secondly, we incorporate industrial structure upgrading as a threshold variable in our model, an innovative approach that allows us to further investigate how this key factor influences carbon emissions. Industrial structure upgrading is a significant driver of growth and transformation in the global economy, with profound implications for environmental policies and sustainable development strategies. By analyzing this threshold variable, we reveal how geopolitical risks affect carbon emissions through changes in industrial structure at different stages of economic development and industrial composition, which is crucial for understanding global carbon emission dynamics. Lastly, we group countries worldwide by income level for analysis, a classification method that enables us to explore the differential impact of geopolitical risks on carbon emissions across varying levels of economic development. For policymakers in different income groups, our research provides valuable insights, helping them consider the impact of geopolitical risks when designing flexible environmental policies and promoting sustainable development strategies. This detailed analysis not only enhances the applicability of our research but also offers more precise policy recommendations for global environmental governance.

This study addresses several key policy-level issues related to the design and implementation of effective decarbonization strategies. First, by distinguishing the impact of geopolitical risks on CO2 emissions across high-income and non-high-income countries, it helps policymakers understand the heterogeneous vulnerabilities and tailor risk-resilient climate policies accordingly. Second, the findings emphasize the need for robust institutional frameworks that can mitigate the adverse effects of geopolitical tensions on environmental goals. Third, the differentiated results across income levels underscore the importance of international cooperation and targeted climate finance, particularly for developing economies. Hence, the study contributes to the policy discourse by offering evidence-based insights to guide national and multilateral environmental strategies.

The remainder of the paper is structured as follows: The second part presents the literature review. The third part introduces the computational models and data. The fourth part presents the results and discussion. The fifth part summarizes the main findings and policy recommendations.

Literature review

Geopolitical risk and environmental quality

Rising geopolitical risks create major obstacles for global environmental governance, hindering nations’ efforts to tackle climate change and pursue sustainable development. The persistence of such risks not only exerts long-term impacts on global energy supply and prices but also generates negative ripple effects on the smooth operation of key factor markets and end-consumer markets. Against the backdrop of market instability and shrinking demand, rising uncertainty may intensify international trade tensions, thereby disrupting the orderly functioning of global industrial chains (Wang et al. 2021; Riti et al. 2022). This chain reaction could ultimately slow real economic growth, posing a novel economic challenge for nations (Oprea et al. 2024). On the other hand, the exacerbation of geopolitical risks profoundly affects a country’s actions in environmental protection. Concerns over economic development and social welfare may weaken a nation’s motivation to pursue sustainable development, posing a serious threat to the effective implementation of environmental strategies. This not only hampers progress in the low-carbon sector but may also result in the weakening of environmental protection policies and enforcement capabilities (Zhao et al. 2023). Simultaneously, the continuous rise in geopolitical risks has substantial implications for defense and military spending. Increased military expenditures for national security may impede the development and promotion of renewable energy technologies, thereby impacting the sustainability of energy structures (Li et al. 2021). Moreover, the weakening of international cooperation confidence presents new challenges to global environmental governance. The instability of governance systems may lead to a slowdown in transnational cooperation, thereby constraining the ability of countries to collectively address climate change and achieve low-carbon goals (Su et al. 2021).

Caldara and Iacoviello (2022) define geopolitical risk as the threat, realization, and escalation of adverse events related to war, terrorism, and any tensions between states and political actors that affect the peaceful course of international relations. This definition is shaped by both journalistic practices and measurement considerations. In journalistic practice, when it comes to naming indices, the media’s traditional approach is followed, which treats geopolitical risk as an umbrella term to describe the impact of international crises and violence, encompassing both actual events and perceptions of these events. This approach reflects the media’s tendency to simplify various complex geopolitical factors into a concept that is easy to understand and disseminate when reporting on international events. In terms of measurement considerations, the GPR index is primarily based on extensive reading and analysis of news reports on war, terrorism, and international crises over the past 120 years, with the calculation of word frequency related to geopolitical tensions in 11 major international newspapers, providing a reference indicator for the quantification of geopolitical studies. The research finds that in the context of international violence, the stages of threat, realization, and escalation are often intertwined and overlapping. Threats can turn into actual violent acts at any time, and the occurrence of these acts can lead to further escalation of the situation. This complexity requires that when measuring geopolitical risk, one must consider the continuity and dynamic changes of these events, as well as their profound impact on international relations and global peace. Therefore, our definition of geopolitical risk includes not only direct conflicts and violent events but also the underlying tensions and indirect impacts that lead to these events. Such a definition helps to more comprehensively understand and assess the impact of geopolitical risks on global political and economic stability, and how they shape interactions and cooperation between nations. In this way, it is possible to better predict and respond to geopolitical events that may pose a threat to international peace and security. Recognized as a significant source of uncertainty, GPR has the potential to exacerbate business and investment environments, leading to a reduction in economic output. According to Salisu et al. (2022), historical and recent data on GPR suggest that an increase in GPR inhibits investments in risk assets, contributing to a deterioration in financial cycles. Presently, empirical research on geopolitical risk primarily focuses on its impacts on capital markets (Baur and Smales 2020), international trade (Tiwari et al. 2019; Nguyen et al. 2022), political and energy security (Yang et al. 2014), with only a limited body of literature addressing the potential influence of geopolitical risk on a nation’s carbon emissions. The existing research in this domain is characterized by diverse and sometimes conflicting conclusions and its scope is somewhat restricted. From the perspective of the relationship between geopolitical risk and environmental quality, research findings can be broadly categorized into three groups. In early research, scholars tended to use a single indicator to represent geopolitical risks, such as selecting terrorism or military action as proxy variables to explore their interrelationships. Terrorist activities not only have profound impacts on the economic, social, and political spheres, but also cause serious damage to the environment. Therefore, these single indicator research methods have certain limitations in evaluating risk factors such as terrorism, and fail to fully reflect their impact on the environment. In order to overcome the limitations of using a single indicator to represent geopolitical risks, research in recent years has begun to adopt comprehensive indicators to represent geopolitical risks. With the gradual deepening of research, more scholars have incorporated regional differences into their research frameworks, exploring the impact of geopolitical risks on the environment at different periods or quantiles. From a research scope perspective, existing studies have delved into the relationship between geopolitical risk and carbon emissions or environmental development in various contexts. Zhao et al. (2023) have explored OECD countries, while Zhao et al. (2021) focus on the BRICS nations. Husnain et al. (2022) extend their investigation to the E7 countries, encompassing Brazil, China, Indonesia, India, Mexico, Turkey, and Russia. Sweidan (2021) examines geopolitical risk and its connection to carbon emissions in select developed countries, including the United States, Germany, and Japan. Du and Wang (2023) delve into the relationship in the context of developing countries, specifically Saudi Arabia, China, Russia, India, and Indonesia. The collective body of research provides a comprehensive understanding of how geopolitical risk intertwines with carbon emissions and environmental development across diverse geopolitical and economic landscapes. In order to present a clearer overview of the relevant literature, the main literature is summarized below through Table 1.

Industrial structural upgrading and carbon emissions

The relationship between industrial structure and carbon emissions has garnered significant attention from scholars. This research originates from the three effects proposed by (Grossman and Krueger 1995): scale effect, structural effect, and technical effect, with a focus on the structural effect, which examines the impact of industrial structural adjustments on environmental quality. Many scholars have empirically analyzed the influence of industrial structural adjustments on pollutant emissions, yet there are divergent conclusions. Yang et al. (2022b) explored the logical mechanism linking industrial structure upgrading, green total factor productivity (GTFP) improvement, and carbon emission reduction. Their findings indicate that the rationalization of industrial structure significantly suppresses carbon emissions, whereas the upgrading of industrial structure exhibits an inverted “V”-shaped impact-initially accelerating emissions before ultimately reducing them. They further argued that industrial structure upgrading reduces carbon emissions by enhancing GTFP. This conclusion was supported by You et al. (2024), who examined the impact of industrial structure optimization on carbon emissions in the manufacturing sector. Their results revealed that optimizing industrial structure effectively curbs carbon emissions in manufacturing, with the suppressive effect of structural upgrading being more pronounced than that of rationalization. However, Zhang et al. (2023) reached a different conclusion. Investigating the influence of government intervention and industrial structural transformation on carbon emissions, they found a dual effect: while industrial structure rationalization significantly increased emissions, structural upgrading played a mitigating role. In addition, Liu et al. (2025) investigated the impact of digital innovation on regional carbon productivity from the perspective of industrial transformation and upgrading. Their results show that the effect of digital innovation on regional carbon productivity is subject to the heterogeneous threshold effect of industrial upgrading. As industrial transformation and upgrading progress further, the enabling effect of digital innovation can be more effectively realized, thereby enhancing carbon productivity. The development of industrial structure is closely linked to industrial technological progress, and rationalization and upgrading contribute to stimulating green technological innovation and expanding research and development of green products, effectively promoting a country’s low-carbon transformation (Nasir et al. 2021). While existing literature mainly analyzes the impact of advanced industrial structure on the environment, overlooking the impact of rationalization, the coordination of input-output structures among different industries is reflected in the rationalization of industrial structure. It affects emissions by influencing the allocation of energy resources.

When facing external complexity and uncertainty, a well-structured industrial layout helps safeguard a country’s industrial and supply chain stability, thereby avoiding “decoupling” in relevant sectors. Simultaneously, a sound industrial structure helps enhance economic growth resilience, drive high-quality economic development, shape new advantages in international cooperation and competition, and strengthen regional low-carbon transformation. When facing the impact of geopolitical risks, countries with a well-planned industrial layout can adjust their production organizational patterns to optimize resource allocation and stimulate factor vitality. On the other hand, countries with industrial structures in need of further upgrading can concentrate high-quality resources to promote industrial structure optimization, reduce the proportion of high-energy-consumption and high-emission industrial sectors, advance productive layout optimization, counteract the adverse effects of global trends such as deglobalization, unilateralism, and protectionism on low-carbon development in trade and finance, and alleviate the pressure on national low-carbon transformation.

As the issue of global climate change becomes increasingly severe, governments and international organizations around the world are seeking effective ways to reduce greenhouse gas emissions. Geopolitical risks, as significant factors shaping national policies and international cooperation, have a notable impact on carbon emissions and should not be overlooked. At the same time, many countries are undergoing industrial structure upgrades and transformations, especially in the transition to a low-carbon economy. Researching how industrial structure upgrading, as a threshold variable, affects carbon emissions can help policymakers better design and implement industrial policies to promote environmentally friendly growth. Additionally, geopolitical risks may lead to fluctuations in energy prices and supply chain disruptions, thereby affecting energy consumption and carbon emissions. Understanding how these risks affect carbon emissions is significant for ensuring energy security and achieving climate goals. Given that climate change is a global issue, international cooperation plays a key role in reducing carbon emissions. This study offers a framework for analyzing how different countries adjust their carbon emission strategies in response to geopolitical risks, offering valuable insights for international coordination on climate change. Finally, our study helps to understand how to balance promoting economic development and reducing environmental pressure, especially in the process of achieving the United Nations Sustainable Development Goals. Therefore, our research not only provides a new perspective for understanding the relationship between geopolitical risks and carbon emissions but also has significant practical implications for formulating effective environmental policies, promoting international cooperation, and achieving global sustainable development goals. A comprehensive review of the literature reveals intricate and dynamic relationships among variables such as geopolitical risk, carbon emissions, and industrial structure upgrading. Results from different research regions and theoretical models often struggle to reach a consensus, with diverse hypotheses persisting in existing studies. Rigorous empirical analysis is imperative to scrutinize the causal relationships among these variables and unveil tailored outcomes for specific research subjects. This paper endeavors to undertake such an examination using advanced econometric techniques.

By amalgamating carbon emissions and economic development indicators, with carbon emissions as the dependent variable, we systematically investigate the linear and nonlinear impacts of GPR on carbon emissions. Expanding our study cohort, we employ panel data regression modeling for 41 countries and conduct differentiated results analysis within two income groups. Additionally, this research introduces industrial structure as a threshold variable, elucidating the mechanism through which geopolitical risk affects carbon emissions under the threshold effects.

Methods and data

The theoretical basis of our model lies in two key strands of literature. First, geopolitical risk (GPR) affects CO2 emissions through multiple channels, including energy market disruptions, decreased foreign direct investment, and reduced economic activity (Feng et al. 2024; Paramati et al. 2025). These channels can lead to either emission increases (due to energy insecurity) or decreases (due to reduced production), depending on a country’s economic and structural characteristics. Second, the relationship between GPR and emissions may not be uniform across all stages of economic development. Industrial upgrading, as a proxy for structural transformation, is a critical factor that can condition how external shocks are absorbed and transmitted into environmental outcomes. According to structural transformation theory, countries at different stages of industrial development exhibit varying emission intensities and adaptive capacities (Liu et al. 2025). Therefore, we first employ the Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) models to estimate the direct impact of Geopolitical Risk (GPR) on carbon emissions. Subsequently, a threshold analysis is employed to explore the potential nonlinear effects of GPR on emissions. By combining linear and nonlinear approaches, this study systematically investigates the dynamic relationship among GPR, industrial structure upgrading, and carbon emissions.

To ensure data stability and the validity of the empirical analysis, this study first conducts a series of preliminary tests, including Variance Inflation Factor (VIF) tests, unit root tests, and cointegration tests. These procedures help confirm the absence of multicollinearity, assess the stationarity of variables, and verify the existence of long-run equilibrium relationships. Given the panel data structure and the presence of cointegration among variables, the Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) models are selected as the primary estimation strategies for the baseline regressions. These models are particularly suitable for addressing issues of endogeneity and serial correlation in long-run estimations.

To further explore potential nonlinearities in the relationship between geopolitical risk (GPR) and carbon emissions, a nonparametric percentile bootstrap method is employed with 300 iterations to identify threshold effects. This approach is advantageous in that it does not impose a priori assumptions about the location of thresholds. Based on the identified threshold values, a panel threshold regression model is then applied to examine how industrial structure upgrading (IDS) may conditionally influence the effect of GPR on carbon emissions. This combination of linear and nonlinear techniques provides a comprehensive framework for understanding the dynamic interplay between GPR, IDS, and carbon emissions. The methodological framework is summarized in Fig. 1.

Threshold regression, a widely applied nonlinear econometric model, constitutes the next analytical step. The fundamental formula for a single-threshold model is expressed in Eq. (1).

\({Y}_{i,t}\) is the explained variable. \({X}_{{it}}\) is the explanatory variable.\(\,{h}_{{it}}\) is the threshold variable. \({{Control}}_{{it}}\) is the control variable. \({\rm{\gamma }}\) is the threshold value. \({\mu }_{i}\) represents an individual effect, meaning it is a constant influencing element over time. \({\varepsilon }_{i,t}\) is the random error term.

The estimation of model parameters is conducted using the Least Squares method proposed by (Hansen 1999), as illustrated in Eq. (2).

The argmin function represents the set of values for \(\omega\) corresponding to the minimum sum of squared residuals.

The construction of the F-statistic is aimed at testing the significance of threshold effects. \({F}_{1}=\frac{{S}_{0}-{S}_{1}\left(\hat{\gamma }\right)}{{\hat{\sigma }}^{2}}\)

Additionally, the likelihood ratio statistic is employed to assess the authenticity of the estimated threshold values. \({LR}(\gamma )=\frac{{S}_{1}(\gamma )-{S}_{1}\left(\hat{\gamma }\right)}{{\hat{\sigma }}^{2}}\)

The fundamental equation for the double threshold model is depicted in Eq. (3).

The estimation process for the threshold value is depicted by Eq. (4).

Formulating the F2 statistic is essential for assessing the significance of the dual-threshold model. \({F}_{2}=\frac{{S}_{1}(\hat{{\omega }_{1}})-{S}_{2}^{\omega }\left({\hat{{\omega }_{2}}}^{\omega }\right)}{{\hat{\sigma }}^{2}}\)

Building upon the theoretical analysis in the preceding sections, it is postulated that industrial structure may influence the carbon reduction effects of GPR. This could lead to variations in the impact of GPR on carbon emissions under different industrial structures. Inspired by Hansen (1999), this paper adopts a similar approach and introduces indicator functions into Model (1). This allows for the construction of a panel threshold model to examine the threshold effects of GPR on carbon emissions, with industrial structure serving as the threshold variable. All variables in this paper are transformed using logarithmic transformations.

In the equation: \({\mathrm{ln}{IDS}}_{{it}}\) serves as the threshold variable, representing industrial structure upgrading. The parameter \({\gamma }_{1}\) denotes specific threshold value, and I() represents the indicator function. The indicator function takes a value of 1 when the condition within the parentheses is met, and 0 otherwise. Considering the possibility of multiple threshold values influencing the impact of GPR on carbon emissions under industrial structure upgrading, we further extend the single-threshold model (Eq. 5) to a multiple-threshold model.

In accordance with the availability of data, this research meticulously selects a balanced panel dataset spanning the period from 1995 to 2020, encompassing 41 countries worldwide. These nations, classified into two income groups—High Income (HIC) and Non-High Income (LI), as outlined in Table A1(Appendix) based on World Bank standards, form the basis of our investigation. The key variables under scrutiny are per capita carbon emissions (CO2), geopolitical risk (GPR) and Industrial structure upgrading (IDS). Furthermore, to ensure a comprehensive understanding of the dynamics at play, the model incorporates control variables such as Gross Domestic Product (GDP), trade openness (TRA), and natural resource rents (NA). For the consideration of eliminating heteroskedasticity, this paper treats all variables in logarithmic terms. All the variables selected for this paper are described below.

Explained variable

Carbon dioxide emissions: Selection of metric tonnes of carbon dioxide emissions per capita to measure. Per capita carbon emissions (CO2) serve as a critical metric, reflecting the average carbon output per individual within a given country. Figure 2 presents the carbon emission statistics for 41 countries from 1995 to 2020.

Core explanatory variable

Geopolitical Risk (GPR) : This metric gauges geopolitical risk by quantifying the number of articles related to geopolitical events and comparing it to the total number of articles. Geopolitical risk is a pivotal variable capturing the multifaceted uncertainties arising from geopolitical factors, contributing to a nuanced understanding of its impact on carbon emissions. Specifically, we compile relevant literature and reports covering geopolitical events, threats of war, and aspects of international relations in specific countries or regions. By calculating the proportion of articles related to geopolitical risk within the total body of literature, we derive an index value reflecting the level of geopolitical risk in that country. The utilization of this indicator enhances our comprehensive understanding of the impact of geopolitical risk on a country or region. It also provides a comparable benchmark for conducting cross-national or cross-regional comparative studies (Caldara and Iacoviello 2022). This study utilizes the GPR index as an independent variable. It is important to note that Caldara and Iacoviello (2022) have provided both the current GPR index (denoted as GPR_C) and the historical GPR index (denoted as GPR_H), reporting data for both on a monthly basis. We have filtered these two types of GPR data for the 41 countries and aggregated them into annual data through mean processing. The current GPR index serves as the central independent variable, and this paper illustrates the temporal trends of the GPR index (GPR_C) for the 41 countries over time. The spatial distribution of the GPR index is presented in Fig. 3. Geopolitical risk statistics for 41 countries from 1995 to 2020 are presented in Fig. 4.

Threshold variable

Industrial structure upgrading (IDS). This paper selects the proportion of value added by industrial industry to GDP to measure IDS, High values indicate that a country’s economy is relatively dependent on manufacturing and construction, sectors that typically generate high value added for the country. Lower values indicate a smaller proportion of GDP derived from the industrial sector, suggesting a more advanced industrial structure. In order to effectively characterise the upgrading of industrial structure, this paper inverts the original data, i.e., the larger the value, the better the country’s industrial structure. IDS is an essential aspect, considering its potential influence on carbon reduction efforts.

Control variables

In examining the relationship between geopolitical risk and carbon emissions, it is crucial to account for other factors that could influence carbon emissions independently of geopolitical risk. To address potential endogeneity concerns and provide a more robust analysis, this study includes the following control variables:

Per capita GDP, which reflects the economic development level of a country. As economic development is often linked to both energy consumption and the ability to invest in cleaner technologies, per capita GDP helps control for the economic context within which carbon emissions occur. Higher per capita GDP may be associated with greater industrial activity and higher emissions, but it could also indicate a country’s capacity to invest in sustainable energy solutions and infrastructure. Therefore, including this variable ensures that the study isolates the effect of geopolitical risk on carbon emissions from the broader economic conditions.

Trade openness, which captures the degree to which a country participates in global trade. The relationship between trade openness and carbon emissions is complex: on the one hand, trade can promote the diffusion of green technologies and more efficient production processes (Wang et al. 2025b). On the other hand, increased international trade may also result in higher transportation emissions and more industrial production, potentially increasing carbon emissions (Wang et al. 2025a). By including the ratio of national trade volume to GDP, this study accounts for the potential influence of global trade flows on carbon emissions, controlling for its potential confounding effect on the primary relationship being analyzed.

Natural resource rents represent excess earnings from the extraction of natural resources such as oil, gas, and minerals. Countries with high natural resource rents may have a different environmental trajectory depending on how these resources are managed. For example, reliance on resource extraction could lead to environmental degradation, while resource rents could also provide the financial means to invest in cleaner energy alternatives. To capture this dynamic, the study uses the percentage of natural resource rents to GDP, which reflects the relative importance of natural resource-based industries in the economy and their potential influence on carbon emissions.

By incorporating these variables into the model, this study aims to provide a comprehensive and nuanced analysis of the complex interplay between geopolitical risk, carbon emissions, and associated factors across diverse economies. The detailed variable definitions are provided in Table 2.

Data for all of the above indicators, with the exception of geopolitical risk, were obtained from the World Bank’s World Development Indicators database. The descriptive statistics table plays a crucial role in data analysis, providing key characteristics of the dataset, such as the number of observations, mean, maximum, and minimum values. This allows readers to quickly understand the basic structure of the data. Moreover, the table helps in identifying patterns and trends, serving as a foundation for subsequent statistical analysis and hypothesis testing. It is an essential starting point for comprehending and interpreting the dataset. Descriptive statistics for each variable are presented in Table 3.

To assess the potential issue of multicollinearity in the regression results, we first calculated the correlation coefficient matrices for different groups and performed a multicollinearity diagnostic test. The results of these tests are presented in Tables 4 and 5. The correlation matrices show that all correlation coefficients are below the 0.8 threshold, indicating no significant multicollinearity among the variables. Additionally, the variance inflation factor (VIF) test results reveal that all VIF values are below 5, further confirming the absence of multicollinearity. Together, these findings suggest that multicollinearity does not pose a concern in the subsequent regression analysis.

Results and analysis

Preliminary test

Before conducting the benchmark regression, we performed unit root tests and cointegration tests on the variables across different groups to ensure data stationarity and the reliability of the regression results. Unit root tests are essential because non-stationary data, which exhibit trends or cycles over time, can lead to spurious or misleading results in regression analysis. To address this issue, we employed the CADF (Cross-sectional Augmented Dickey-Fuller) test (Pesaran 2007) and the CIPS (Cross-sectional Imbalance Panel Stationarity) test (Hadri 2000). These tests help determine whether the variables contain unit roots, and thus, whether they are stationary at a certain order. The results of the unit root tests, presented in Table 6, indicate that both tests confirm stationarity at the first-order level, suggesting that the variables are free from unit roots and suitable for reliable inference in regression models.

In addition to the unit root tests, we conducted a cointegration test to examine the existence of long-term relationships among the variables. This is crucial because even if individual time series are non-stationary, they may still move together in a way that maintains a stable, long-term equilibrium. If variables are cointegrated, it implies that they share a common trend, and any regression analysis can yield meaningful results that reflect the true long-term relationship. To test for cointegration, we used the Westerlund cointegration test (Westerlund 2007), which is particularly robust for panel data. The results, presented in Table 7, indicate that the cointegration test successfully identifies a long-term stable relationship among the variables. This suggests that the variables in our model are not only stationary but also share a meaningful, persistent connection, making them suitable for further regression analysis.

By ensuring that the data is stationary and cointegrated, we can avoid issues such as spurious regressions and ensure the validity of the relationships examined in our subsequent benchmark regression analysis. These preliminary tests enhance the robustness of the model and provide a solid foundation for interpreting the regression results. Next, we will use the baseline regression model to further analyze the impact of geopolitical risks on carbon emissions.

Benchmark regression

The primary objective of this study is to investigate how the upgrading of IDS shapes the impact of GPR on carbon emissions. Given the varied geopolitical risks faced globally, influenced by resource endowments and developmental stages, the influence of GPR on global carbon intensity might exhibit heterogeneity at the national level. To explore this, we employ a two-step analytical approach. Initially, a baseline regression is applied to capture linear relationships among variables. Subsequently, a threshold panel regression model is employed to unveil potential nonlinear associations among the variables. Our analysis unfolds from the perspectives of 41 countries and two income groups, allowing for the observation of regional heterogeneity outcomes. Firstly, we conducted a baseline linear regression analysis.

We employed the FMOLS and DOLS models to examine the impact of geopolitical risks on carbon emissions, analyzing countries from different income groups worldwide. One key advantage is their ability to correct for endogeneity, which is crucial given the potential bidirectional relationship between geopolitical risk and carbon emissions. FMOLS achieves this through a nonparametric adjustment, while DOLS explicitly includes lagged and lead differences of explanatory variables to mitigate endogeneity bias. Additionally, both methods effectively handle serial correlation and heteroscedasticity in the error terms, ensuring robust estimation. These features make FMOLS and DOLS particularly suitable for our analysis, allowing us to capture the long-run impact of geopolitical risks on carbon emissions more accurately.

The baseline regression model helps us establish a foundational relationship between geopolitical risks and carbon emissions, which is the cornerstone for understanding more complex models and dynamic changes. It provides a comparative benchmark for subsequent more complex models, aiding in assessing the significance and rationality of model improvements. Moreover, the baseline regression model offers policymakers a clear framework to evaluate the potential impacts of geopolitical risks on carbon emissions and to formulate or adjust environmental policies accordingly. The baseline regression model also has lower data requirements, making it particularly useful when data availability is limited, especially when analyzing countries from different income groups worldwide. Therefore, the baseline regression model provides us with a solid foundation to understand and assess the impact of geopolitical risks on carbon emissions, taking into account the particularities of countries from different income groups globally. This approach not only helps reveal basic causal relationships but also provides valuable information for more in-depth analysis and policy formulation. Drawing upon the constructed baseline model, we scrutinize the quantifiable impact of GPR on carbon emissions across nations, with estimated results presented in Table 8.

Baseline regression results (Table 8) indicate substantial differences in how GPR affects carbon emissions across income groups, emphasizing the complexity of this relationship. Specifically, GPR has a positive effect on carbon emission in both the global sample and high-income countries, while it exhibits a negative effect in non-high-income countries. For the global sample, the FMOLS and DOLS models show that a 1% increase in GPR leads to a 0.0329% (FMOLS) and 0.0504% (DOLS) increase in carbon emission. In high-income countries, the impact is even more pronounced, with GPR increasing carbon emission by 0.0558% (FMOLS) and 0.0884% (DOLS) for each 1% rise in GPR. In contrast, the effect of GPR on carbon emissions in non-high-income countries is negative. Specifically, GPR leads to a 0.0326% decrease in carbon emission (FMOLS), and the effect is near zero in the DOLS model (0.0036%).

The observed heterogeneity in the impact of geopolitical risk (GPR) on carbon emissions across income groups may be rooted in the differential responses of high- and non-high-income countries to external shocks. In high-income countries, heightened geopolitical tensions often trigger strategic shifts in energy policy to ensure energy security. Such shifts may include the temporary reversion to carbon-intensive energy sources like coal and oil, especially when low-carbon alternatives become geopolitically vulnerable. A prominent example is the Russia-Ukraine conflict, which disrupted natural gas supply chains and forced many European countries to scale back their decarbonization efforts and reintroduce fossil-fuel-based power generation (Mikhaylov et al. 2024). These strategic adjustments, while addressing short-term energy security, have the side effect of increasing carbon emissions.

In contrast, non-high-income countries, when exposed to geopolitical risk, are more likely to experience economic downturns due to their limited fiscal and institutional capacities. This leads to suppressed industrial activity and energy consumption, which in turn results in a reduction in carbon emissions. Unlike high-income countries, these nations often lack the resources to implement compensatory energy strategies, making the decline in economic output the dominant channel through which GPR affects emissions. This divergence underscores the importance of national capacity in shaping the environmental consequences of geopolitical shocks.

Although the baseline regression provides us with an initial linear relationship between geopolitical risks and carbon emissions, considering the differences in industrial structure upgrading and economic development stages across countries, the impact of geopolitical risks on carbon emissions may not be linear. Therefore, we introduce the threshold regression model to explore the non-linear relationship between geopolitical risks and carbon emissions, and to verify the varying impacts at different stages.

Threshold effect test

To address this inquiry, the present study employs the Hansen panel threshold model to examine the non-linear impact of GPR on carbon emission intensity. In the process of studying the impact of geopolitical risks on carbon emissions, selecting the threshold model helps to reveal the potential non-linear relationships and structural changes between geopolitical risks and carbon emissions. The threshold model can identify critical turning points, or threshold values, in the data, thereby more accurately capturing changes in the relationships between variables under different conditions. By using energy transition and industrial upgrading as threshold variables, the study can analyze the differences in the impact of geopolitical risks on carbon emissions at various stages of economic development and levels of energy transition. This approach not only reveals the complexity of economic phenomena but also assesses the impact of policies on carbon emissions under different economic conditions, providing a new perspective to understand the interplay between geopolitical risks and carbon emissions.

Prior to conducting the panel threshold analysis, it is essential to determine the number of threshold values in the threshold model, as this defines the specific functional form of the model. To achieve this, the study first examines the existence and number of thresholds in the relationship between GPR and carbon emission intensity using a triple-threshold regression model. The threshold values and corresponding p values are computed using the Bootstrap method with 300 resampling iterations. Table 9 presents the number of thresholds and their significance levels for different groups, while Table 10 provides the specific threshold estimates along with their 95% confidence intervals.

Based on the data presented in Tables 9, 10, the threshold estimation and test results reveal significant single and double threshold effects at the global level when industrial structure upgrading is used as the threshold variable, with significance levels of 1% and 10%, respectively. This indicates the presence of a dual-threshold effect of industrial structure on the relationship between GPR and carbon emissions, with the first and second threshold values estimated at 3.0941 and 3.2494, respectively. For the high-income group, a single threshold effect is significant at the 1% level, with the threshold value of industrial structure estimated at 3.0947. In contrast, no threshold effect is detected for the non-high-income group. These findings suggest that a dual-threshold model is appropriate for the 41 countries globally, whereas a single-threshold model is more suitable for high-income countries.

Panel threshold regression analysis

This study explores the non-linear effects of GPR on carbon emissions from the perspective of IDS. Additionally, control variables including GDP, natural resource rent, and trade openness have been incorporated into the model. Based on the threshold value estimates with IDS as threshold variable, the regression results of the model (threshold variable: IDS) are presented in Table 11.

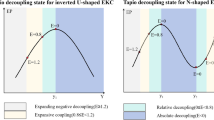

In the threshold model analysis of all countries, we found that IDS is a key factor affecting the impact of geopolitical risks on carbon emissions, dividing this impact into three distinct stages, with two critical threshold estimates at 3.0941 and 3.2494. In the first stage, where the level of industrial structure upgrading is below 3.0941, the impact coefficient of geopolitical risks on carbon emissions is 0.103, and it is highly significant at the 1% level, indicating that at a lower level of industrial structure upgrading, an increase in geopolitical risks will significantly promote an increase in carbon emissions. As the level of industrial structure upgrading increases, entering the second stage between 3.0941 and 3.2494, the impact coefficient decreases to 0.017, showing a weakening positive impact of geopolitical risks on carbon emissions. In the third stage, where the level of industrial structure upgrading is above 3.2494, the impact coefficient becomes −0.030, indicating that at a higher level of industrial structure upgrading, an increase in geopolitical risks actually helps to reduce carbon emissions, that is, for every 1% increase in geopolitical risks, carbon emissions will decrease by 0.030%. For high-income groups, the IDS exhibits a single threshold. Although the regression coefficients are not significant, the GPR coefficients for carbon emissions gradually decrease under the influence of the threshold effect, and the direction undergoes a structural transformation (from positive to negative), which is consistent with the global regression results. Before and after the threshold (3.0947), the coefficients for the two stages under the single threshold effect are 0.0476 and −0.0290, respectively. Under the influence of IDS, the impact coefficient is first positive and then negative, showing an inverted U-shaped pattern. The specific threshold regression schematic diagram is shown in Fig. 5.

The figure shows the threshold effect of industrial structure upgrading. It illustrates how the impact of geopolitical risks on carbon emissions changes as industrial structure upgrading improves. The model shows that as the industrial structure improves, the impact of geopolitical risks on carbon emissions shifts from a significant positive impact to a negative impact.

This trend indicates that as industrial structure continues to upgrade, the impact of geopolitical risks on carbon emissions gradually decreases, and the impact coefficient changes from positive to negative, showing that industrial structure upgrading plays an important role in mitigating the negative impact of geopolitical risks on carbon emissions. This finding aligns with the work of (Adams et al. 2020), who argue that geopolitical risk can act as a catalyst for environmental reform. In response to geopolitical disruptions, some governments may accelerate the implementation of domestic renewable energy projects and diversify energy portfolios to reduce external dependence. Upgraded industrial structures are generally more energy-efficient and less carbon-intensive, thereby enhancing resilience to external shocks.

From a policy perspective, this suggests that promoting industrial upgrading is not only conducive to economic transformation but also instrumental in enhancing environmental resilience under geopolitical stress. Policymakers should therefore adopt integrated strategies that simultaneously support structural transformation and environmental governance, aiming to achieve energy security and emissions reduction in a coordinated manner.

As for the control variables, for all income-level countries, GDP has a significant positive impact on carbon emissions, indicating a close relationship between economic growth and increased energy demand. However, for high-income countries, the impact of GDP on carbon emissions is weaker, likely due to their more advanced economic structure and higher energy efficiency, which mitigates the growth of carbon emissions. Additionally, trade openness has a significant suppressive effect on carbon emissions in all income-level countries, which aligns with the pollution haven hypothesis. In contrast, the impact of trade openness in high-income countries is more ambiguous, possibly due to their economic structure being less dependent on external resources. Regarding natural resource rents, they have a significant promoting effect on carbon emissions in all income-level countries, but the regression coefficient for high-income countries is not significant.

Conclusion and policy implications

Conclusion

This research endeavors to explore the intricate and multifaceted relationship between GPR, IDS, and their collective impact on carbon emissions across a diverse spectrum of countries categorized into high-income and non-high-income groups. The study employs a rigorous multi-step analytical methodology, encompassing both linear regression and threshold panel regression models, to unveil the intricate and nuanced dynamics inherent in this complex relationship.

The baseline regression analysis provides initial insights, revealing distinct patterns in the influence of geopolitical risk on carbon emissions across income groups. Notably, high-income countries exhibit a positive correlation between heightened geopolitical tensions and increased carbon intensity, often attributed to strategic reconfigurations in energy resource utilization amidst instability. Conversely, non-high-income nations experience a reduction in energy demand during times of elevated geopolitical risks, consequently leading to a decrease in carbon emissions.

The subsequent exploration using threshold panel regression models illuminates compelling non-linear effects. Industrial structure upgrading demonstrates a dual-threshold effect on a global scale, highlighting nuanced shifts in the relationship between geopolitical risk and carbon emissions across different phases of economic development. This non-linearity underscores the crucial role economic structures play in shaping responses to geopolitical upheavals, thereby influencing carbon emission patterns.

Furthermore, the examination of control variables elucidates varied impacts on carbon emissions across different income groups. Variables such as GDP, population aging, trade openness, and natural resource rents differently affect carbon emissions, underscoring the interplay of economic, demographic, and resource factors.

This study offers valuable insights into the nexus of geopolitical risks, industrial structure, and carbon emissions, advancing the academic discussion on climate change and global development. These findings offer a deeper understanding of the complexities inherent in this relationship, emphasizing the necessity for tailored and context-specific strategies to effectively address the challenges of carbon emission mitigation on a global scale. The implications extend beyond academic discourse to inform policymakers and stakeholders, emphasizing the imperative of nuanced approaches in crafting sustainable environmental policies and interventions across diverse economic landscapes.

Policy implications

Geopolitical risk and carbon emissions

Our findings reveal that geopolitical risk significantly impacts carbon emissions, and this effect varies depending on the level of industrial structure upgrading. Therefore, differentiated policy frameworks are essential. For high-risk countries, particularly those reliant on fossil energy imports, it is critical to strengthen energy security by diversifying import sources and enhancing domestic renewable energy capacity. Governments should develop strategic reserves and promote international partnerships to mitigate supply disruptions caused by geopolitical tensions.

High-income countries, owing to their technological and financial advantages, should continue to lead in carbon pricing mechanisms, such as carbon taxes and emissions trading systems, while also supporting lower-income countries through climate finance and technology transfer. These measures not only internalize carbon externalities but also help stabilize carbon-reduction paths amid geopolitical instability.

Non-high-income countries facing escalating geopolitical risks should prioritize reducing reliance on energy-intensive and emission-heavy industries. Instead, they should foster the growth of strategic emerging sectors, such as green manufacturing and digital services, which are less sensitive to geopolitical shocks. Targeted trade and industrial diversification strategies can serve to cushion the vulnerability of low-carbon transitions to geopolitical fluctuations.

Industrial structure upgrading and carbon emissions

Our results identify a threshold effect in the moderating role of industrial structure upgrading, implying that only after surpassing a certain level of structural sophistication does it effectively weaken the emission-enhancing effect of geopolitical risk. Therefore, countries near or below this threshold should adopt targeted support policies to accelerate industrial upgrading. These may include subsidies for clean technology R&D, tax incentives for green investment, and dedicated funding for the transformation of high-emission sectors.

For high-income countries and those already above the threshold, the focus should shift to consolidating low-carbon advantages through innovation-driven industrial policies. Promoting circular economy models, enhancing the application of artificial intelligence in energy management, and establishing carbon-neutral industrial parks are examples of such advanced measures.

Globally, enhanced cooperation is needed to facilitate knowledge sharing and joint initiatives in low-carbon industrial development. International agreements should also recognize the differentiated capacities of countries in crossing the industrial upgrading threshold and offer flexible, supportive frameworks accordingly.

Data availability

The datasets publicly available should be through https://dataverse.harvard.edu/dataset.xhtml?persistentId=doi:10.7910/DVN/NQMLBS.

References

Adams S, Adedoyin F, Olaniran E et al. (2020) Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ Anal Policy 68:179–190. https://doi.org/10.1016/j.eap.2020.09.012

Ahmed Z, Ahmad M, Murshed M et al. (2022) The trade-off between energy consumption, economic growth, militarization, and CO2 emissions: does the treadmill of destruction exist in the modern world? Environ Sci Pollut Res 29(12):18063–18076. https://doi.org/10.1007/s11356-021-17068-3

Anser MK, Syed QR, Apergis N (2021a) Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environ Sci Pollut Res 28(35):48011–48021. https://doi.org/10.1007/s11356-021-14032-z

Anser MK, Syed QR, Lean HH et al. (2021b) Do Economic Policy Uncertainty and Geopolitical Risk Lead to Environmental Degradation? Evidence from Emerging Economies. Sustainability 13(11).https://doi.org/10.3390/su13115866

Baur DG, Smales LA (2020) Hedging geopolitical risk with precious metals. J Bank Financ 117:105823. https://doi.org/10.1016/j.jbankfin.2020.105823

Borozan D (2024) Do geopolitical and energy security risks influence carbon dioxide emissions? Empirical evidence from European Union countries. J Clean Prod 439:140834. https://doi.org/10.1016/j.jclepro.2024.140834

Cai Y, Wu Y (2021) Time-varying interactions between geopolitical risks and renewable energy consumption. Int Rev Econ Financ 74:116–137. https://doi.org/10.1016/j.iref.2021.02.006

Caldara D, Iacoviello M (2022) Measuring geopolitical risk. Am Econ Rev 112(4):1194–1225. https://doi.org/10.1257/aer.20191823

Chen L, Gozgor G, Lau CKM et al. (2024) The impact of geopolitical risk on CO2 emissions inequality: Evidence from 38 developed and developing economies. J Environ Manag 349:119345. https://doi.org/10.1016/j.jenvman.2023.119345

Ding T, Li H, Tan R et al. (2023) How does geopolitical risk affect carbon emissions?: An empirical study from the perspective of mineral resources extraction in OECD countries. Resour Policy 85:103983. https://doi.org/10.1016/j.resourpol.2023.103983

Du Y, Wang W (2023) The role of green financing, agriculture development, geopolitical risk, and natural resource on environmental pollution in China. Resour Policy 82:103440. https://doi.org/10.1016/j.resourpol.2023.103440

Feng Y, Pan Y, Lu S et al. (2024) Identifying the multiple nexus between geopolitical risk, energy resilience, and carbon emissions: Evidence from global data. Technol Forecast Soc Change 208:123661. https://doi.org/10.1016/j.techfore.2024.123661

Grossman GM, Krueger AB (1995) Economic Growth and the Environment. Q J Econ 110(2):353–377. https://doi.org/10.2307/2118443

Hadri K (2000) Testing for stationarity in heterogeneous panel data. Econ J 3(2):148–161. https://doi.org/10.1111/1368-423X.00043

Hansen BE (1999) Threshold effects in non-dynamic panels: Estimation, testing, and inference. J Econ 93(2):345–368. https://doi.org/10.1016/s0304-4076(99)00025-1

He Z-W, Lee C-C, Sharma SS (2025) The impact of geopolitical risks on the renewable energy transition. Energy Econ 143:108278. https://doi.org/10.1016/j.eneco.2025.108278

Hoang DP, Chu LK, To TT et al. (2025) The interaction of energy diversification policy and geopolitical uncertainty in sustaining the environment: International evidence. Energy Policy 200:114560. https://doi.org/10.1016/j.enpol.2025.114560

Hunjra AI, Azam M, Verhoeven P et al. (2024) The impact of geopolitical risk, institutional governance and green finance on attaining net-zero carbon emission. J Environ Manag 359:120927. https://doi.org/10.1016/j.jenvman.2024.120927

Husnain MIU, Syed QR, Bashir A et al. (2022) Do geopolitical risk and energy consumption contribute to environmental degradation? Evidence from E7 countries. Environ Sci Pollut Res Int 29(27):41640–41652. https://doi.org/10.1007/s11356-021-17606-z

IPCC (2023) Climate Change 2023: Synthesis Report. https://www.ipcc.ch/report/ar6/syr/

Kartal MT, Pata UK (2023) The function of geopolitical risk on carbon neutrality under the shadow of Russia-Ukraine Conflict: Evidence from Russia’s sectoral CO2 emissions by high-frequency data and quantile-based methods. J Sustain Dev Issues 1(1):1–12. https://doi.org/10.62433/josdi.v1i1.7

Li R, Wang Q, Guo J (2024) Revisiting the Environmental Kuznets Curve (EKC) hypothesis of carbon emissions: Exploring the impact of geopolitical risks, natural resource rents, corrupt governance, and energy intensity. J Environ Manag 351:119663. https://doi.org/10.1016/j.jenvman.2023.119663

Li R, Wang Q, Liu Y et al. (2021) Per-capita carbon emissions in 147 countries: The effect of economic, energy, social, and trade structural changes. Sustain Prod Consum 27:1149–1164. https://doi.org/10.1016/j.spc.2021.02.031

Liu Z, Li L, Jian H et al. (2025) Does digital innovation improve carbon productivity? A new perspective based on industrial upgrading. Applied Economics: 1-19.https://doi.org/10.1080/00036846.2025.2455593

Ma W, Nasriddinov F, Haseeb M et al. (2022) Revisiting the impact of energy consumption, foreign direct investment, and geopolitical risk on CO2 emissions: Comparing developed and developing countries. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.985384

Mikhaylov A, Bhatti IM, Dincer H et al. (2024) Integrated decision recommendation system using iteration-enhanced collaborative filtering, golden cut bipolar for analyzing the risk-based oil market spillovers. Comput Econ 63(1):305–338. https://doi.org/10.1007/s10614-022-10341-8

Nasir MA, Canh NP, Lan Le TN (2021) Environmental degradation & role of financialisation, economic development, industrialisation and trade liberalisation. J Environ Manag 277:111471. https://doi.org/10.1016/j.jenvman.2020.111471

Nguyen DT, Le TH, Do DD et al. (2023) Does geopolitical risk hinder sustainable development goals? Evidence from a panel analysis. J Environ Manag 347:119204. https://doi.org/10.1016/j.jenvman.2023.119204

Nguyen TTT, Pham BT, Sala H (2022) Being an emerging economy: To what extent do geopolitical risks hamper technology and FDI inflows? Econ Anal Policy 74:728–746. https://doi.org/10.1016/j.eap.2022.04.005

Oprea S-V, Georgescu IA, Bâra A (2024) Charting the BRIC countries’ connection of political stability, economic growth, demographics, renewables and CO2 emissions. Econ Change Restructuring 57(5).https://doi.org/10.1007/s10644-024-09746-2

Paramati SR, Safiullah M, Soytas U (2025) Does geopolitical risk increase carbon emissions and public health risk? Energy Econ 143:108235. https://doi.org/10.1016/j.eneco.2025.108235

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312. https://doi.org/10.1002/jae.951

Riti JS, Shu Y, Riti M-KJ (2022) Geopolitical risk and environmental degradation in BRICS: Aggregation bias and policy inference. Energy Policy 166:1130. 10.10.1016/j.enpol.2022.113010

Saharti M, Chaudhry SM, Pekar V et al. (2024) Environmental, social and governance (ESG) performance of firms in the era of geopolitical conflicts. J Environ Manag 351:119744. https://doi.org/10.1016/j.jenvman.2023.119744

Salisu AA, Omoke PC, Sikiru AA (2022) Geopolitical risk and global financial cycle: Some forecasting experiments. J Forecast 42(1):3–16. https://doi.org/10.1002/for.2904

Su B, Ang BW (2015) Multiplicative decomposition of aggregate carbon intensity change using input–output analysis. Appl Energy 154:13–20. https://doi.org/10.1016/j.apenergy.2015.04.101

Su C-W, Khan K, Umar M et al. (2021) Does renewable energy redefine geopolitical risks? Energy Policy 158:112566. https://doi.org/10.1016/j.enpol.2021.112566

Sweidan OD (2021) The geopolitical risk effect on the US renewable energy deployment. J Cleaner Prod 293.https://doi.org/10.1016/j.jclepro.2021.126189

Sweidan OD (2023) The effect of geopolitical risk on environmental stress: evidence from a panel analysis. Environ Sci Pollut Res Int 30(10):25712–25727. https://doi.org/10.1007/s11356-022-23909-6

Syed QR, Bhowmik R, Adedoyin FF et al. (2022) Do economic policy uncertainty and geopolitical risk surge CO(2) emissions? New insights from panel quantile regression approach. Environ Sci Pollut Res Int 29(19):27845–27861. https://doi.org/10.1007/s11356-021-17707-9

Tiwari AK, Das D, Dutta A (2019) Geopolitical risk, economic policy uncertainty and tourist arrivals: Evidence from a developing country. Tour Manag 75:323–327. https://doi.org/10.1016/j.tourman.2019.06.002

Wang K-H, Kan J-M, Jiang C-F et al. (2022) Is geopolitical risk powerful enough to affect carbon dioxide emissions? Evidence from China. Sustainability 14(13).https://doi.org/10.3390/su14137867

Wang Q, Li Y, Li R (2024a) Ecological footprints, carbon emissions, and energy transitions: the impact of artificial intelligence (AI). Humanities & Social Sciences Communications 11(1).https://doi.org/10.1057/s41599-024-03520-5

Wang Q, Li Y, Li R (2025a) Integrating artificial intelligence in energy transition: A comprehensive review. Energy Strategy Rev 57:101600. https://doi.org/10.1016/j.esr.2024.101600

Wang Q, Sun T, Li R (2025b) Does Artificial Intelligence (AI) enhance green economy efficiency? The role of green finance, trade openness, and R&D investment. Humanities Soc Sci Commun 12(1):12. https://doi.org/10.1057/s41599-024-04319-0

Wang Q, Zhang F, Li R (2025c) Artificial intelligence and sustainable development during urbanization: Perspectives on AI R&D innovation, AI infrastructure, and AI market advantage. Sustain Dev 33(1):1136–1156. https://doi.org/10.1002/sd.3150

Wang Q, Zhang F, Li R et al. (2024b) Does artificial intelligence promote energy transition and curb carbon emissions? The role of trade openness. J Clean Prod 447:141298. https://doi.org/10.1016/j.jclepro.2024.141298

Wang Y, Liao M, Wang Y et al. (2021) The impact of foreign direct investment on China’s carbon emissions through energy intensity and emissions trading system. Energy Econ 97:105212. https://doi.org/10.1016/j.eneco.2021.105212

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Yang Y, Li J, Sun X et al. (2014) Measuring external oil supply risk: A modified diversification index with country risk and potential oil exports. Energy 68:930–938. https://doi.org/10.1016/j.energy.2014.02.091

Yang Y, Wang H, Löschel A et al. (2022a) Energy transition toward carbon-neutrality in China: Pathways, implications and uncertainties. Front Eng Manag 9(3):358–372. https://doi.org/10.1007/s42524-022-0202-8

Yang YZ, Wei XJ, Wei J et al. (2022b) Industrial Structure Upgrading, Green Total Factor Productivity and Carbon Emissions. Sustainability 14(2).https://doi.org/10.3390/su14021009

You JM, Zhang W, Lin WW et al. (2024) The impact of technological progress and industrial structure optimization on manufacturing carbon emissions: a new perspective based on interaction. Environ Dev Sustainability. https://doi.org/10.1007/s10668-024-04531-7

Yu S, Zhang J, Zheng S et al. (2015) Provincial carbon intensity abatement potential estimation in China: A PSO–GA-optimized multi-factor environmental learning curve method. Energy Policy 77:46–55. https://doi.org/10.1016/j.enpol.2014.11.035

Zhang SH, Li J, Jiang B et al. (2023) Government Intervention, Structural Transformation, and Carbon Emissions: Evidence from China. Int J Environ Res Public Health 20(2).https://doi.org/10.3390/ijerph20021343

Zhao W, Zhong R, Sohail S et al. (2021) Geopolitical risks, energy consumption, and CO(2) emissions in BRICS: an asymmetric analysis. Environ Sci Pollut Res Int 28(29):39668–39679. https://doi.org/10.1007/s11356-021-13505-5

Zhao Z, Gozgor G, Lau MCK et al. (2023) The impact of geopolitical risks on renewable energy demand in OECD countries. Energy Econ 122:106700. https://doi.org/10.1016/j.eneco.2023.106700

Zhu Z, Hunjra AI, Alharbi SS et al. (2025) Global energy transition under geopolitical risks: An empirical investigation. Energy Econ 145:108495. https://doi.org/10.1016/j.eneco.2025.108495

Acknowledgements

This work is supported by the National Natural Science Foundation of China – Science and Technology Management Special Project (No. J2424015), and the “Youth Innovation Team Project” of the Higher Education Institutions under the Shandong Provincial Department of Education, China (No. 2023RW015).

Author information

Authors and Affiliations

Contributions

RL: Methodology, Data curation, Investigation Writing—Original draft, Writing- Reviewing. QW: Conceptualization, Methodology, Software, Data curation, Writing—Original draft preparation, Supervision, Writing—Reviewing and Editing. XL: Methodology, Software, Data curation, Investigation Writing—Original draft, Writing—Reviewing and Editing.

Corresponding author

Ethics declarations

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Li, R., Wang, Q. & Li, X. Geopolitical risks and carbon emissions: the mediating effect of industrial structure upgrading. Humanit Soc Sci Commun 12, 790 (2025). https://doi.org/10.1057/s41599-025-05172-5

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05172-5