Abstract

The integration of Fintech is revolutionizing global financial engagement, moving away from traditional payment systems. This study, thus, explores the interaction between communication dynamics, Fintech use, intentions, cashless transactions adoption, financial literacy, personal innovativeness, and socioeconomic development in Pakistan. The study employs a dual methodology, encompassing “PLS-SEM and Probit Model alongside Propensity Score Matching technique.” The survey targeted small business owners and individuals involved in informal sectors, encompassing roles such as fruit and vegetable vendors, small shop owners, taxi drivers, and auto rickshaw operators. A total of 394 responses were analyzed. The findings highlight the facilitating role of individuals’ intentions to use cashless transactions, acting as a mediator through which Fintech use fosters actual behavior. Moreover, the study finds financial literacy and personal innovativeness as critical moderating factors. Adopting cashless transactions emerges as a pathway to enhanced financial inclusion, particularly impactful for small business owners. The achieved financial inclusion has the potential for profound financial inclusion implications, as evidenced by its positive effects on sustainable livelihoods, living conditions, and social development among small business owners and individuals operating within the informal sector.

Similar content being viewed by others

Introduction

The global landscape of economic transactions has been undergoing a significant transformation, driven by the pervasive integration of Financial Technology (Fintech) services and communication strategies. These advancements have progressively redefined traditional modes of financial engagement (Ediagbonya and Tioluwani, 2023), introducing cashless transactions (CLT) as a central facet. In this context, the pivotal role of Fintech use in shaping the adoption of CLT is a noteworthy focal point of investigation.

The present study is situated within the interaction of Fintech’s evolving influence and the growing preference for CLT. Fintech, in this study, denotes “a variety of technology-enabled business models, processes, applications or products for providing financial services effectively (Jagtiani and Lemieux, 2017).” Amidst the dynamic transition from conventional monetary practices to digital financial modes, exploring the underlying mechanisms that facilitate this shift assumes paramount significance (Goswami et al. 2022). A cardinal aspect to be examined is the mediating role of individuals’ intentions to use cashless transactions (IUCT) in connecting the influence of Fintech use to the actual use of cashless transactions (AUCT). The backdrop is enriched by recognizing financial literacy (FL) as a crucial moderating factor that interlaces Fintech use and individuals’ IUCT. The diverse levels of FL among individuals can heighten or diminish the impact of Fintech services on their IUCT. Personal innovativeness (PIN) also emerges as another pertinent moderating factor, elucidating the bridge between individuals’ IUCT and the AUCT. This factor underscores the inherent disposition of individuals to exhibit innovation in their engagement with emerging financial practices (Asif et al. 2023).

The consequentiality of this paradigm shift extends beyond mere transactional convenience. It manifests in the progression toward financial inclusion, with the adoption of CLT functioning as a gateway (Museba et al. 2021). This financial inclusion has the potential to set into motion a broader socioeconomic transformation for small business owners within the Punjab province of Pakistan. As the study condenses the diverse spectrum of small business owners and individuals in informal sectors, it seeks to illuminate the multi-dimensional impact of Fintech, intentions, and adoption of CLT, FL, and PIN on socioeconomic development (SED). The study aims to contribute to a comprehensive understanding of the pathways through which Fintech catalyzes economic transformation and boosts sustainable CLT within the specified context.

The ongoing transformation of economic landscapes, driven by the proliferation of Fintech services, presents a pivotal stage that necessitates thorough investigation. The shift towards sustainable CLT has emerged within this context as a significant paradigm shift, carrying implications for financial inclusivity and SED (Mhlanga, 2022). However, as the adoption of CLT gains momentum, there remains a gap in understanding the dynamics that govern this transition (Niaz, 2022), particularly within the context of small business owners and individuals engaged in informal sectors. Despite the increasing prevalence of Fintech services and the undeniable potential of CLT to reshape the economic landscape, there persists a lack of comprehensive insight into the interaction between Fintech use, intentions, adoption of CLT, FL, PIN, and the subsequent economic growth within these sectors. Moreover, while financial inclusion has been identified as a plausible outcome of the growing use of CLT, there exists a need to scrutinize the precise pathways through which this inclusion translates into tangible SED (Tay et al. 2022) for small business owners in the Punjab province of Pakistan. Thus, a compelling need arises to probe this evolving landscape’s intricacies, assess the mediating role of intentions, the moderating influence of FL and PIN, and the transformative potential of financial inclusion. By addressing these gaps in knowledge, the study seeks to provide a comprehensive understanding of how Fintech’s role in promoting sustainable CLT can yield SED for small business owners within the specific context of the Punjab province of Pakistan.

The selection of small business owners and individuals in the informal sector within the Punjab province of Pakistan is strategically grounded in several compelling justifications. Firstly, small businesses constitute a significant portion of the economic fabric in the Punjab province (Rehman et al. 2023). These businesses encompass various sectors, from fruit and vegetable vending to small shop proprietorship, taxi driving, and auto rickshaw operation. Given their widespread presence and contribution to the local economy, studying the impact of Fintech adoption on this segment holds substantial potential for understanding broader implications for the socioeconomic landscape. Second, a significant portion of the population in the Punjab province depends on the informal sector for their daily survival (Rabbani et al. 2023). Due to their frequent underservicing and financial exclusion, these people are particularly relevant study subjects when examining financial inclusion through CLT. Understanding how Fintech usage translates into financial inclusion for people working in the informal economy might illuminate the best approaches to improve their financial well-being. Thirdly, the distinct socioeconomic and cultural setting of the Punjab province offers a fascinating backdrop for this study. This province includes a wide variety of urban and rural areas and is one of the most populous in Pakistan (Khan et al. 2023). Due to its diversity, Fintech may be examined. Finally, small business owners and individuals in informal sectors often need more access to formal financial services. The strategic selection of this sample provides a rich and contextually relevant dataset to unearth the transformative potential of Fintech in promoting sustainable CLT and driving SED.

The study represents a pioneering endeavor contributing significantly to finance, technology adoption, and SED. This research undertakes a two-stage investigation, each employing distinct methodologies. In stage I, using “Partial Least Squares-Structural Equation Modeling (PLS- SEM),” the study clarifies the complex relationships shaping the adoption of CLT. Identifying Fintech use as a predictor and influencing the AUCLT is a foundational contribution. Furthermore, the delineation of the IUCT as a mediating mechanism in the Fintech-AUCT relationship adds depth to our understanding of the psychological pathways that bridge technological adoption with practical usage. Introducing FL and PIN as moderators further enriches this stage, uncovering the nuanced roles these factors play in shaping individuals’ IUCT. In stage II, through “Propensity Score Matching (PSM) technique,” the study seamlessly transitions into investigating the impact of AUCT on the attainment of financial inclusion. This bridge between actual transactional behavior and inclusion is a significant step forward in understanding the potential of Fintech in extending financial services to the marginalized informal sectors. The subsequent claim that financial inclusion serves as a catalyst for SED among small business owners underscores the broader implications of the study’s findings. Crucially, this research fills a critical gap by examining the Fintech-CLT path, considering individual intentions, adoption, financial inclusion, and SED within the specific context of the Punjab province. The study navigates a nuanced landscape to enhance financial access and uplift economic well-being by encompassing a diverse spectrum of informal sector roles.

The global landscape of economic transactions is transforming due to the integration of Fintech services and communication strategies, redefining traditional financial engagement and introducing CLT as a central aspect. This study examines how Fintech influences the adoption of CLT, focusing on the mediating role of individuals’ IUCT) and the moderating factors of FL and PIN. Understanding these dynamics is particularly crucial for small business owners and informal sector workers in the Punjab province of Pakistan, where financial inclusion can drive SED. Building on this foundation, the literature review explores the theoretical frameworks, specifically the “Unified Theory of Acceptance and Use of Technology (UTAUT)” model by Venkatesh et al. (2003) and its extended version, UTAUT2 (Venkatesh et al. 2012), to provide a basis for understanding technology adoption and the pathways through which Fintech promotes sustainable CLT. Key factors such as performance expectancy, effort expectancy, facilitating conditions, perceived usefulness, and price value highlight Fintech’s impact on IUCT and subsequent actual use. Introducing FL and PIN as moderators aligns with UTAUT2’s emphasis on individual characteristics influencing technology adoption. The study extends the UTAUT2 model by connecting Fintech-driven AUCT to financial inclusion and SED, underscoring the transformative potential of Fintech adoption. This research enhances the theoretical framework of UTAUT2 and offers empirical support for its relevance in the context of cashless transactions.

The study fills crucial gaps and propels transformative insights. In a swiftly evolving era where technology shapes financial behaviors, understanding Fintech’s influence in steering the AUCT is a central pillar. This insight is pivotal for institutions, businesses, and individuals navigating the transition to digital financial ecosystems. The mediating role of IUCT acts as a crucial bridge between Fintech use and actual adoption. Recognizing this intermediary step enhances our grasp of the psychological dynamics that drive the conversion from intention to action. The study’s exploration of FL and PIN as moderators introduces nuanced dimensions to the Fintech adoption landscape. This comprehension empowers policymakers and stakeholders to design strategies that align with users’ readiness to embrace digital financial practices. At a broader societal level, the study’s emphasis on translating AUCT to financial inclusion holds transformative potential by fostering financial inclusion to empower marginalized individuals in informal sectors. This widening of financial access by fostering financial inclusion through digital avenues, in turn, lays the foundation for SED, specifically benefiting small business owners in the Punjab, Pakistan. Thus, the study’s significance reverberates across academia, policy, financial institutions, and the socioeconomic fabric.

Literature review

Theoretical framework

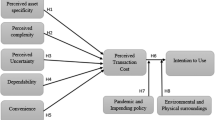

The “Unified Theory of Acceptance and Use of Technology (UTAUT)” model was proposed by Venkatesh et al. (2003) through the amalgamation of eight prominent models and theories about the adoption of information technology. The UTAUT framework has four constructs: “performance expectancy, facilitating conditions, effort expectancy and social influence.” These components have been derived from several theories; “the Theory of Planned Behaviour (TPB), the Social Cognitive Theory (SCT), the Model of PC Utilization (MPCU), the Theory of Reasoned Action (TRA), the Technology Acceptance Model (TAM), combined TAM, TPB (C-TAM-TPB), the Innovation Diffusion Theory (IDT) and the Motivational Model (MM).” Venkatesh et al. (2012) expanded the UTAUT model and introduced the UTAUT2 framework by incorporating three novel constructs: “hedonic motivation, price value, and habit” along with moderating factors (gender, experience and age). The researchers advocated for the model’s refinement and validation across diverse contexts, such as the case of the present study. By incorporating FL and PIN as moderators, this study introduces a novel extension to the UTAUT2 model, emphasizing the influence of individual characteristics in technology adoption. The novel aspect also lies in extending the UTAUT2 framework to connect Fintech-driven AUCT with financial inclusion and SED, showcasing the transformative impact of Fintech adoption. Consequently, in alignment with this premise, we have extended the UTAUT2 model by incorporating additional pivotal constructs, as illustrated in Fig. 1.

Development of hypotheses

Performance expectancy (PE) is frequently invoked within technology acceptance, denoting an individual’s confidence level in a specific technology’s capacity to facilitate the achievement of distinct objectives or enhance their work performance (Venkatesh et al. 2003). Several studies (like Venkatesh et. al., 2012; Khechine et al. 2014; Madan and Yadav 2016; Sharif and Raza, 2017; Chao, 2019; Santosa et al. 2021) evidenced the positive impact of PE on the intention to use Fintech. In the context of CLT, this concept implies that individuals exhibit a propensity to engage in such transactions when they harbor the conviction that doing so will yield advantageous outcomes. Furthermore, Raj et al. (2023) contend that individuals perceiving a high level of PE about CLT are more disposed to adopting such transactional methods. Moreover, a cohort of scholars has demonstrated through their investigations that a favorable correlation exists between PE and the IUCT and their subsequent actual use (Al-Okaily et al. 2022; Sleiman et al. 2022; Saha and Kiran, 2022; Raj et al. 2023).

H1: PE positively influences (a) IUCT and (b) AUCT.

Effort expectancy (EE) is delineated as “the extent of simplicity associated with system utilization” (Venkatesh et al. 2003). The impact of EE on a user’s intention to adopt Fintech is of notable significance (Venkatesh et al. 2003). Several scholars (Jiang et al. 2013; Teo et al. 2015; Bailey et al. 2017; Giovanis et al. 2019; Santosa et al. 2021) found positive influence of EE on the use of Fintech. Substantiated by precedent research in the Fintech acceptance domain, EE has emerged as a pivotal predictor of both intention and practical adoption (Al-Okaily et al. 2022; Raj et al. 2023; Donmez-Turan, 2020). It is foreseeable that individuals’ perceptions regarding the effortlessness of CLT hold substantive influence over the uptake of such systems.

H2: EE positively influences (a) IUCT and (b) AUCT.

Facilitating conditions (FC) are defined as “the degree to which an individual believes that an organizational and technical infrastructure exists and will help him/her to use the system (Venkatesh et al. 2003).” Prior studies (Khechine et al. 2014; Al-Qeisi et al. 2015; Oliveira et al. 2016; Abdullah et al. 2018; Sivathanu, 2019) have found a positive influence of FC on the use of Fintech. The use of CLT typically necessitates specific skills, resources, and requisite technical infrastructure. Consequently, the inclination of customers toward adopting CLT could be heightened when they are furnished with a certain level of support services and resources (Raj et al. 2023). Aligned with outcomes from previous investigations (Al-Okaily et al. 2022; Raj et al. 2023), FC emerges as a pivotal predictor of both intention and actual use of CLT.

H3: FC positively influences (a) IUCT and (b) AUCT.

Perceived usefulness (PU) is the degree to which individuals believe that using a specific Fintech would improve their productivity and effectiveness in achieving specific goals (Venkatesh et al. 2012). It is a critical construct in the UTAUT2 model (Venkatesh et al. 2012) that directly influences individuals’ IUCT. Past research scholars (Liu and Tai, 2016; Hamid et al. 2016; Intarot and Beokhaimook, 2018; Grover et al. 2019) observed a positive relation between PU and CLT. When individuals perceive that using CLT enhances their efficiency, convenience, and overall effectiveness in managing financial transactions, they are more likely to develop positive intentions to embrace and utilize these technologies (Raj et al. 2023; Sleiman et al. 2022), thereby driving increased adoption and usage of CLT.

H4: PU positively influences (a) IUCT and (b) AUCT.

Price value (PV) is characterized as the intellectual deliberation by individuals between the perceived benefits of Fintech and the cost associated with their utilization (Venkatesh et al. 2012). This construct resembles the notion of perceived financial cost as evidenced in contemporary inquiries (e.g., Al-Okaily et al. 2022). Within this context, various investigations have ascertained PV’s role as a consequential predictor of both intention and actual use of CLT. Consequently, individuals tend to accept Fintech services (Singh and Srivastava, 2020; Al-Okaily et al. 2022).

H5: PV positively influences (a) IUCT and (b) AUCT.

Intention is “an individual’s desire to engage in several distinct behaviors (Fishbein and Ajzen, 1975).” Intentions to use CLT refer “to an individual’s willingness or readiness to adopt and utilize CLT, such as mobile banking (Morgan, 2022)”. This concept is based on the TPB, which suggests that an individual’s attitudes, beliefs and perceptions towards using CLT can significantly impact their actual adoption of CLT (Ajzen, 1991). Past research (Dapp et al. 2014; Chiu 2017; Leong and Sung, 2018) showed positive nexus between PV and CLT. Thus, an individual’s intentions to use CLT can be a crucial predictor of behavior.

H6: Users’ IUCT positively influences their AUCT.

Individuals’ IUCT is a mediating mechanism linking Fintech use variables (PE, EE, FC, PU, PV) and the subsequent AUCT (Venkatesh et al. 2012). The cognitive dimensions encompassed within these Fintech use variables shape individuals’ intentions and beliefs about the feasibility and benefits of using CLT (Rehman et al. 2023). These intentions, in turn, bridge the gap between predispositions and actual behavior. The prior studies claimed that BI is predictive of a subsequent actual behavior (Sripalawat et al. 2011; Harrison et al. 2014; Karjaluoto et al. 2021; Saha and Kiran 2022). Therefore, the interplay between Fintech use variables and IUCT elucidates the underpinning psychological pathways that influence the transition from intention formation to effective engagement, ultimately influencing the actual adoption of CLT (Saha and Kiran, 2022). This mediating role of IUCT captures the complex interdependence between cognitive dispositions and practical behaviors within the context of CLT.

H7: Users’ IUCT mediates the relationship between (a) PE, (b) EE, (c) FC, (d) PU, (e) PV, and their AUCT.

Financial literacy (FL) denotes individuals’ comprehensive grasp and knowledge concerning diverse financial concepts, encompassing aspects such as CLT, facilitating careful decision-making and the adept management of financial resources (Morgan, 2022). Financial literacy’s pivotal role in augmenting CLT acceptance is noteworthy. It is crucial that, though not inherently derived from the UTAUT2 model, financial literacy has been suggested as an additional factor by the information technology literature that might sway users’ inclinations toward embracing novel technology. Within this context, Ameen et al. (2020) have empirically demonstrated that users’ financial literacy significantly influences the adoption of CLT. In parallel, the domain of Fintech systems research has been inclusive of security and privacy concerns within its frameworks (Singh and Srivastava, 2020). However, it is discernible that while security and privacy concerns constitute a substantial impediment to CLT, other factors, such as perceived usefulness, user-interface challenges, and limited awareness, are also cited as noteworthy barriers (Merhi et al. 2021). Despite extensive global investigations into the FL of CLT, the findings exhibit incongruities, with some studies unveiling significant associations while others fail.

H8: FL moderates the relationship between (a) PE, (b) EE, (c) FC, (d) PU, (e) PV and their AUCT.

Personal innovativeness (PIN) is the phenomenon of an individual’s inclination to adopt novel information technology within the Fintech domain (Agarwal and Prasad, 1997). As a moderating factor in the context of UTAUT2, PIN influences the strength of the relationship between individuals’ IUCT and AUCT (Venkatesh et al. 2012). High levels of PIN amplify the positive impact of intentions on actual use, suggesting that individuals who are more open to innovation and novel technologies are more likely to translate their intentions into actual use of CLT effectively (Chauhan et al. 2022; Raj et al. 2023).

H9: PIN moderates the relationship between users’ IUCT and their AUCT.

Demographic characteristics significantly influence the adoption of CLT. Gender disparities may restrict women’s access to technology and financial services (Amari and Anis, 2021). Age can influence familiarity with digital tools (Amari and Anis, 2021). Higher education levels can enhance the understanding and trust in cashless systems (Kandari et al. 2021). Household income affects the affordability of technology (Mouna and Jarboui, 2022). Household size and marital status influence financial decision-making and priorities (Mouna and Jarboui, 2022). Regional disparities in infrastructure and connectivity affect accessibility to Fintech platforms (Kandari et al. 2021). Tailoring financial inclusion initiatives considering these characteristics is crucial to address barriers, increase awareness, and promote the adoption of CLT, thus fostering economic empowerment and growth in the informal sector.

H10: Demographic characteristics (a. gender, b. region, c. marital status, d. education, e. age, f. household size, g. household income) influence the adoption of CLT (financial inclusion).

The adoption of CLT and subsequent financial inclusion yields substantial socioeconomic benefits. It enhances accessibility to a broader range of financial services, such as savings, credit, and insurance, enabling them to manage risks better and invest in their ventures (Lee et al. 2023). Reducing cash reliance improves transparency, reduces corruption and facilitates a conducive business environment (Mhlanga, 2022). Access to digital records and transaction history enables them to build creditworthiness, facilitating access to formal financial institutions. Moreover, the efficiency of CLT saves time and resources, boosting productivity (Ediagbonya and Tioluwani, 2023). Enhanced financial literacy through technology educates and empowers them to make informed decisions (Raj et al. 2023). Thus, adopting CLT uplifts economic activities, fosters growth, and improves livelihoods and socioeconomic development in the informal sector.

H11: The adoption of CLT (financial inclusion) influences (a) sustainable livelihood, (b) growth in living standards, and (c) social development of small business owners and individuals in the informal sector.

The hypotheses about the direct relationships explored in this section were delineated. Subsequently, an analysis of the indirect relationships involving intentions, FL, and PIN was presented. Additionally, the hypotheses corresponding to the influential determinants of CLT adoption (financial inclusion) were formulated, followed by the hypothesis posited for its subsequent impact on socioeconomic development. These interrelated connections are visually depicted in Fig. 1.

Data and methodology

Participants and procedure

A survey methodology employing questionnaires was used to acquire data to evaluate hypotheses. The survey targeted small business owners and individuals involved in informal sectors, encompassing roles such as fruit and vegetable vendors, small shop owners, taxi drivers, and auto rickshaw operators. The rationale for selecting these participants is rooted in the following considerations: (i) The respondents were drawn from diverse socioeconomic and demographic backgrounds, ensuring a comprehensive representation. (ii) The surveyed individuals constitute a substantial segment of the informal economy within the Punjab region, often encountering impediments in accessing formal financial services. By concentrating on this specific population, the study seeks to investigate the role of Fintech use in advancing financial inclusion among those who have conventionally been underserved by traditional banking establishments. The ultimate aim is to foster socioeconomic development.

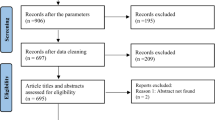

A total of 537 respondents were approached to gauge their interest in participating in the survey. Regrettably, 89 individuals declined to partake, reflecting a refusal rate of 16.57%. Subsequently, the remaining respondents consented to engage in the questionnaire. A total of 448 questionnaires were disseminated through direct distribution, a method chosen to ensure the collection of timely, reliable, and methodologically rigorous data. Rigorous data curation practices were employed, including excluding questionnaires containing incomplete or uniformly identical responses across all variables. As a result of these efforts, a final set of 394 valid responses was attained, yielding a conclusive response rate of 73.37%.

Measures

The refinement of the UTAUT2 model was achieved by adapting established measurement instruments from previous studies (Venkatesh et al. 2012). In the questionnaire development process, specific scales’ components were subject to slight linguistic modifications. All constructs within the model were evaluated using a “5-point Likert scale”. A comprehensive overview of the variables, their respective types, and relevant details are presented in Table 1, including the scale format, item count, and the source of the measurement instrument (more detalied measurements are provided in Appendix A and B). Furthermore, an initial survey was formulated in English to capture respondents’ feedback. It is widely acknowledged that even subtle alterations in the wording of a single element can exert a substantial impact on respondents’ perceptions of the scale. To mitigate this potential, the questionnaire was subsequently translated into Urdu, thereby accounting for linguistic nuances and cultural sensitivities.

Analysis method

This research endeavor employed a dual methodology, encompassing “PLS-SEM alongside propensity score matching (PSM) technique” through the utilization of the Probit model. This combined approach was employed to validate and substantiate the theoretical framework proposed in this study.

PLS-SEM: stage-I

PLS-SEM is employed across a spectrum of applications. Notably, PLS-SEM possesses the advantage of addressing diverse modeling challenges without necessitating assumptions of scarcity (Hair et al. 2019). Its distinctive attribute lies in the absence of restrictive distribution assumptions, rendering it a straightforward and suitable technique for investigating mediation and moderation effects (Hair et al. 2019). In this study, the predictive attributes of Fintech use are coupled with the anticipated mediating influence of IUCT, leading to AUCT. This AUCT is then translated into financial inclusion.

Probit Model: stage-II

The Probit model estimates the likelihood of embracing CLT (i.e., financail inclusion). The determination to adopt CLT becomes evident when the latent utility surpasses zero. This choice to adopt CLT is contingent upon discernible attributes of respondents, including variables such as age, gender, income, education etc. A method to quantify the influence of CLT adoption involves dividing individuals into two distinct categories: “adopters and non-adopters” (Kikulwe et al. 2014), each possessing shared characteristics. It is essential to recognize that the adoption of CLT is not randomly distributed among individuals, implying that adopters and non-adopters may exhibit systematic dissimilarities.

Modeling CLT adoption

The adoption of CLT is characterized by a voluntary decision-making process rather than being mandated, aligning well with the framework of a choice model that suits the scope of this study. Within the context of a model featuring a binary outcome, denoted as CLTi, it signifies whether an individual embraces CLT (coded as 1) or opts not to adopt it (coded as 0):

Thus,

where \(\varphi i\) denotes CLT’s determinants, \(\alpha\) indicates estimated coefficients, and \({\varepsilon }_{i}\) is the error term.

Hence, to maintain the general applicability of Equation 3, Equation 4 broadens the range of factors to be considered when examining the determinants of CLT adoption.

\({\omega }_{i}\) is a vector of diverse factors that may affect the decision to adopt CLT, \(\delta\) is the vector of parameters to be estimated, and \({\varepsilon }_{i}\) is the error term.

Propensity Score Matching (PSM) of CLT on Socioeconomic Development (SED)

This study investigates the effects of adopting CLT on SED. The research employs the PSM approach. This approach involves comparing the results of individuals who have adopted CLT with those who do not. The method is formally specified as:

Where P(X) represents the conditional probability of undergoing treatment based on pre-existing characteristics denoted by the vector X. The treatment indicator, T = {0,1}, signifies whether an individual becomes an adopter of CLT (1) or refrains from adopting (0). The critical parameter of concern within the PSM model is the “Average Treatment on Treated (ATT).” Mathematically, the expression for ATT is as follows:

Where \(P\left({X}_{i}\right)\) is the propensity score (p-score), \({Y}_{i}^{0}\) and \({Y}_{i}^{1}\) are the outcomes of non-adoption and adoption of CLT, respectively.

Typically, various matching techniques are available to facilitate the comparison of p-scores between adopters and non-adopters, subsequently allowing for the estimation of ATT. This investigation employs radius matching, stratification, and kernel matching techniques. These techniques are selected due to their utilization of all comparable units falling within a predefined radius, contributing to a comprehensive assessment.

Data analysis, results, and discussion

PLS-SEM analysis

Assessment of measurement model (MM)

The MM is evaluated for internal consistency and convergent as well as discriminant validity. First, we look at indicator loadings, as shown in Table 2. The advised loadings must be greater than 0.708, which means that the construct explains more than 50% of the variance in the indicator (Hair et al. 2019). All factor loadings in our models (for both mediation and moderated mediation) are more significant than the required level. The research established the validity of measurement constructs. Table 2 displays the reliability statistics for the variables based on Cronbach’s alpha (α), composite reliability (CR), and rho_A. CR, α, and rho_A test results are acceptable. The results show that the values exceed the suggested cut-off value of 0.708 (Hair et al. 2019). Table 2 also shows that all results obtained from AVE meet the recommended criteria of “AVE ≥ 0.50” for both mediation and moderation analysis. Thus, the convergent validity is present in the data. The Fornell Larcker Criteria are employed to assess discriminant validity (Henseler et al. 2015). According to this criterion, the square roots of AVE (bold diagonal values) shown in Table 3 should be greater than the rest of the values. In our case, all the bold diagonal values are more significant than the off-diagonal values. Thus, the discriminant validity is confirmed. Overall, the measurement items have been found to be both reliable and valid by reliability and validity tests.

Because a single source is used in our case to collect data, prior researchers (Hair et al. 2019) guidance of full collinearity is evaluated to tackle the problem of common method bias (CMB). Moreover, to make the data free from CMB, the VIF scores must be <3.3 (Hair et al. 2019). In our case, all VIF values are <3.3 for both mediation and moderated mediation analysis (as reported in Table 2), implying that the results are free of collinearity and CMB.

Assessment of structural model (SM)

Path analysis is the method of choice for evaluating the formulated hypotheses in stage I. The structural model’s validity is evaluated using the bootstrapping technique, employing 5,000 subsamples. Within this analytical framework, the path coefficients of the latent constructs, along with their corresponding levels of significance, are presented.

Model’s predictive capabilities

The performance of our models in terms of prediction is detailed in Table 4. The study reports “coefficient of determination (R2) and predictive relevance (Q2)” (Hair et al. 2019). The R2 value, indicative of the proportion of variance accounted for, reveals that the comprehensive model elucidates 57.1% (for the mediation model) and 69.2% (for the moderated mediation model) of the variability in AUCT. The R2 values of 0.571 and 0.692 for AUCL are high within the present model. However, in social science context research, the minimum acceptable value for R2 is 0.10 (Falk and Miller, 1992).

Furthermore, the validation of “predictive relevance” mandates Q2 values that exceed zero (Hair et al. 2019). The Q2 values for both mediation and moderation mediation surpass zero, thus affirming the predictive relevance of the model.

Direct paths analysis

The outcomes derived from the analysis of direct paths (as illustrated in Table 5) reveal that the constructs PE, EE, FC, PU and PV exert a positive impact on both IUCT and AUCT. Additionally, IUCT exhibits a positive influence on AUCT. These findings support H1-H6. Detailed results can be found in Table 5 and are visually represented in Fig. 2. The findings underscore a positive and discernible association between the engagement with Fintech services and the intentions and actual use of CLT among individuals. Notably, a range of determinants encompassing PE, EE, FC, PU, and PV collectively exert a psotove influence on individuals’ IUCT and subsequently manifest these intentions through their AUCT. The empirical substantiation of the constructive implications stemming from integrating Fintech within individual financial conduct emphasizes the pivotal role that perceived advantages and operational ease associated with digital fintech adoption play in fostering this transition (Senyo et al. 2022). The ascendancy of Fintech services as vehicles of enhanced performance, user-friendly functionality, and utility (as summarized in PE, EE, and PU dimensions), coupled with their alignment with the requisites for their seamless adoption (as signified by FC), augments individuals’ inclination to endorse the utilization of CLT (Morgan, 2022). Collectively, the findings elucidate the nuances of Fintech’s use in orchestrating the paradigm shift towards CLT. The interaction between user perceptions, operational seamlessness, utility, and economic feasibility finds its expression in the affirming impact of multiple factors on anticipatory intentions and substantive utilization (Guermond, 2022). The growing prominence of CLT necessitates a holistic grasp and adept cultivation of these determinants, pivotal for navigating the route toward pervasive digital financial practices.

Mediation analysis

The methodology prescribed by Hair et al. (2014) has been adhered to meticulously to conduct the mediation analysis. Notably, Table 6 provides a comprehensive display of the statistically significant indirect (mediation) effects. The outcomes underscore that IUCT effectively serves as a mediator in the interrelationship between PE and AUCT (β: 0.199), EE and AUCT (β: 0.198), FC and AUCT (β: 0.221), PU and AUCT (β: 0.283), as well as PV and AUCT (β: 0.244). Moreover, the extent of mediation is gauged through the “variance accounted for (VAF)” score. Following the VAF criteria established by Hair et al. (2014), whereby “VAF index >80%, between 20% and 80%, and <20% indicates full, partial, and no mediation, respectively” it is observed that IUCT serves as a partial mediator between the predictor variables and the outcome. This conclusive finding validates our mediation hypothesis (H7). The comprehensive mediation analysis findings are systematically presented in Table 6, with a graphical representation in Fig. 2.

The study’s findings underscore the pivotal role of IUCT as a mediator within the relationship involving fintech use and AUCT. This mediating function underscores that users’ IUCT serves as a conduit through which the impact of fintech use permeates towards the actual incorporation of these transactions. Empirical evidence highlights that when individuals perceive enhanced performance, user-friendliness, enabling circumstances, utility, and favorable cost attributes within fintech services, these aspects collectively stimulate a favorable disposition toward accepting CLT (Chen and Jiang, 2022). This inclination functions as an intermediary mechanism through which the influence of fintech adoption transmits to the practical execution of CLT. The study elucidates the cognitive process through which the advantageous attributes of Fintech, coupled with their operational convenience, motivate individuals to adopt CLT (Coffie and Hongjiang, 2023). This intention-driven disposition subsequently materializes as actual behavior, specifically in the form of the effective implementation of CLT.

Moderation mediation analysis

In this study, FL and PIN function as moderators. Prior to evaluating the significance of the moderation effect’s structural pathways, the newly introduced constructs (FL and PIN) undergo measurement to ascertain their reliability and convergent validity, as evidenced in Table 2 (moderated mediation analysis). The newly incorporated constructs exhibit satisfactory outer loadings for their respective items, surpassing the established threshold of 0.70. Additionally, indices such as α, rho_A, CR, and AVE consistently exceed their respective thresholds (Hair et al. 2014). Furthermore, the Fornell Larcker Criteria analysis, as depicted in Table 3 (moderated mediation analysis), confirms the existence of discriminant validity. The VIF levels of FL and PIN, as presented in Table 2, remain comfortably below the 3.3 threshold.

Moving forward, Table 7 outlines that FL yields a positive influence on IUCT (β: 0.358). The moderating impact of FL (FL×PE: 0.263; FL×EE: 0.215; FL×FC: 0.116; FL×PU: 0.220; FL×PV: 0.344) on the connection between Fintech use variables and IUCT is significant (R2Δ for IUCT: 0.107). Additionally, Table 7 highlights that PIN significantly affects AUCT (β: 0.131). The moderating influence of PIN (PIN×IUCT) on the relationship between IUCT and AUCT is significant (β: 0.245; R2Δ of AUCT: 0.121). This significant moderating effect facilitates the exploration of indirect effects. Furthermore, employing bootstrapping with 5000 samples reveals that both FL and PIN considerably enhance all indirect relationships between Fintech use variables and AUCT, as depicted in Fig. 3 (coefficients and R2Δ). The explanatory power of these effects amplifies with the rise of the moderators.

The original UTAUT2 model accounted for 57.1% of the variance in AUCT, as illustrated in Fig. 2. The expanded UTAUT2 model, which incorporates FL and PIN as moderators, elevates the explained variance by 12.1% (R2: 69.2% - R2: 57.1%). The R2 values (alongside R2Δ) for both mediation and moderated mediation analyses are presented in Table 4 and Fig. 3. Consequently, H8 and H9 receive empirical support.

Compared to a previous study by Venkatesh et al. (2012), which found that including FL and PIN in the UTAUT2 framework augmented the explained variance by 5%, our study showcases a more substantial increase of 12.1%. Moreover, within the finance domain, Venkatesh et al. (2012) observed that incorporating moderators as supplementary predictors contributed to a variance explanation of financial inclusion ranging from 1 to 10%. In contrast, our study demonstrates a more significant improvement in explained variance (12.1%) beyond the anticipated value. This integration of additional components illuminates intricate aspects that significantly enrich the model’s comprehensiveness, capturing previously unexplored nuances within the interplay between Fintech use and AUCT.

Notably, the empirical evidence underscores the salient role of FL as a potent moderator in defining the nexus between Fintech use and the IUCT. This revelation underscores that the sway exerted by Fintech adoption in shaping individuals’ tendency to embrace CLT is contingent upon their level of FL (Arner et al. 2020). Individuals endowed with higher FL tend to evince an amplified sensitivity to the benefits that Fintech services confer, encompassing high operational convenience, utility, facilitating circumstances, trustworthiness, and perceived value (Moon et al. 2022). This resonance concludes in an amplified IUCT. The PIN is a crucial moderator in shaping the relationship between IUCT and AUCT. This insight underscores the importance of individuals’ innovativeness in navigating their tendency to actualize the adoption of CLT. Individuals characterized by elevated PIN are more apt at effectuating the transformation of intentions into actual behaviors (Banna et al. 2022), thereby elevating the likelihood of AUCT. The findings collectively clarify the complex combination of these moderating variables within the realm of Fintech adoption and the path towards embracing CLT. These outcomes emphasize the indispensability of tailored approaches that factor in individuals’ gradients of FL and PIN. Such strategic alignments can play a contributory role in electrifying both the IUCT and the subsequent AUCT. The perpetual evolution of digital financial services thus contributes to a more comprehensive comprehension of the tricky determinants underpinning the progression toward an increasingly cashless economic paradigm.

Propensity score matching (PSM) analysis

Distribution of CLT adoption

The data presented in Table 8 demonstrates that individuals who have chosen to adopt CLT exhibit an obviously higher degree of socioeconomic development, as indicated by SLD, GLS, and SDT measurements, compared to those who have not adopted CLT. The application of the t-test reveals a significant difference in the levels of SLD, GLS, and SDT between the two groups, adopters and non-adopters. Moreover, these differences are also evident across gender, household income, and education categories, each displaying statistically significant variation at a 1% significance level. However, no statistically significant distinctions are observed concerning the age of respondents, geographical region, marital status, or household size between small business owners who have opted for CLT and those who have not. These findings accentuate the substantial correlation between CLT adoption and elevated socioeconomic development metrics, mainly encompassing SLD, GLS, and holistic SDT.

Factors influencing the adoption of CLT (financial inclusion)

The correlations concerning the adoption of CLT are outlined in Table 9. Among these associations, educational attainment emerges as a significant determinant. Findings demonstrate a positive correlation between higher education levels and the likelihood of CLT adoption, ranging from approximately 18% for secondary education to 37% for graduation. This finding aligns with the expected link between education and financial literacy, as educated households are better positioned to engage with financial products and services, enhancing the propensity for CLT adoption (Peprah et al. 2020). Interestingly, primary education does not yield a significant impact on CLT adoption when compared to individuals with no formal education. This divergence may stem from limited exposure to mobile phone usage at the primary education level. Moreover, the level of education significantly impacts CLT adoption differs from those without formal education, and primary education may not exert substantial influence over CLT adoption and utilization.

Furthermore, a distinct urban-rural divide is evident in CLT adoption rates. Urban locales offer greater access to technological infrastructure, including internet connectivity and financial services. This favorable environment heightens the likelihood of CLT adoption among urban small business owners, leading to a discernible difference in adoption rates between urban and rural settings (Kara et al. 2021). Evidence underscores a significant correlation between respondents’ age and the adoption of CLT. This pattern implies that younger individuals are more inclined towards CLT usage, potentially stemming from their high familiarity and ease with digital technology. Conversely, older individuals may manifest reduced adoption rates due to potential challenges related to technology adaptation (Tay et al. 2022).

Besides, an extensive inquiry into the potential impacts of gender, marital status, household size, and household income on the adoption of CLT reveals that these variables do not yield statistically significant effects. This outcome suggests that, within the contextual confines of this research, attributes such as gender, marital status, household size, and household income may not exert substantial influence over the adoption dynamics of CLT within the cohort of small business owners subject to examination (Mpofu, 2022). The findings are summarized in Fig. 4. Thus, H10 is partially acknowledged.

Impact of CLT’s adoption (financial inclusion) on socioeconomic development

Table 10 presents the outcomes of the average treatment effect of CLT adoption on small business owners’ SED. The findings indicate that using any of the PSM techniques leads to a notable increase in the SLD of small business owners, ranging between 39.7% and 52.1%, with statistical significance at the 1% level. Furthermore, the adoption of CLT is associated with a significant increase in the GLS, ranging from 59.3% to 74.4%. Similarly, the adoption of CLT is shown to positively influence the SDT of small business owners, yielding gains between 42.5% and 47.6%, although at varying levels of statistical significance. Hence, H11 is supported. Moreover, the summary of the findings is visually presented in Fig. 4.

These results provide valuable insights into the adoption of CLT and the economic well-being of small business owners within the specific context of Punjab, Pakistan. This study uses CLT to emphasize the importance of including small business owners in financial activities. The results show a noticeable improvement in SLD from 39.7% to 52.1%. Using digital financial methods can benefit businesses in Punjab by giving them access to formal financial systems and enhancing their overall sustainability. This change can be attributed to relying less on physical money, gaining better financial access, and managing cash flow more effectively, all of which contribute to better well-being for small business owners (Niaz, 2022). The study also looks at how adopting CLT affects the GLS. The substantial increase, ranging from 59.3% to 74.4%, highlights a strong and meaningful connection between using CLT and improving the living conditions of small business owners. This growth can be linked to various factors, including earning more income, better financial planning, and spending more money (Mhlanga, 2022). The findings suggest that using CLT simplifies business operations and directly impacts the quality of life for these business owners. Furthermore, the study also examines the impact of using CLT on SDT. The reported increase (42.5% - 47.6%) underscores the potential of digital financial inclusion to bring about comprehensive improvements among small businesses in Punjab. It includes progress in the economy, empowerment in society, and awareness about the environment. Although differences in the strength of these connections might explain the varying levels of statistical significance, the overall trend indicates that adopting CLT has significant potential to lead to long-term improvements across different aspects (Lee et al. 2023).

Considering the specific context of Punjab, Pakistan, it is essential to acknowledge how this can influence the results. The study does not just present statistical patterns but also highlights how technology advancements can change local businesses. However, challenges like technology limitations, accessibility issues, and the need for targeted training should be addressed to ensure that the benefits of CLT reach all small business owners relatively. This study strongly advocates for the widespread use of CLT among small businesses in Punjab, Pakistan. The documented improvements in SLD, GLS, and SDT clearly show how digital financial inclusion can bring about positive changes in the socioeconomic landscape. Policymakers and stakeholders should consider the unique context of Punjab to maximize the advantages and promote inclusive economic growth for all small business owners in the region.

Conclusion and implications

Conclusion

This study highlights the potential of Fintech services and communication strategies to promote sustainable CLT practices, advancing the economic landscape. By integrating Fintech, global financial engagement is shifting away from traditional payment systems. This research enhances the understanding of modern financial ecosystems, emphasizing CLT’s critical role in replacing conventional financial practices during this transformative phase. The study explores the mechanisms driving the transition from traditional to digital financial systems, highlighting how individuals’ IUCT serves as a key channel through which Fintech use promotes AUCT. The study scrutinizes the psychological processes that bridge the gap between intention and action, with a specific focus on the influence of cognitive factors on tangible behavioral outcomes. Moreover, the research highlights the significance of FL as a critical moderating variable interacting with Fintech use and individuals’ IUCT. The varying levels of FL shape the effectiveness of Fintech services in influencing their intentions to embrace CLT. Similarly, PIN emerges as a moderating factor, elucidating the connection between individuals’ intentions and their subsequent AUCT. This dimension taps into the innate human inclination to adopt novel financial practices in their interactions. Beyond its immediate transactional convenience, this paradigm shift holds profound implications for financial inclusion. The adoption of CLT emerges as a pathway to enhanced financial inclusion, particularly impactful for small business owners in Punjab, Pakistan. The achieved financial inclusion has the potential for profound financial inclusion implications, as evidenced by its positive effects on sustainable livelihoods, living conditions, and social development among small business owners and individuals operating within the informal sector. Conclusively, this study elucidates the interplay between Fintech use, intentions, CLT adoption, FL, PIN, and SED. It contributes to the debate on Fintech’s role in shaping economic landscapes, highlighting the complex dynamics driving the transition to sustainable CLT and its broad implications for socioeconomic development.

Theoretical contribution

The study is firmly based on the UTAUT2 model, offering a comprehensive framework to understand technology adoption. It examines Fintech adoption, intentions, FL, PIN, and SED. By investigating Fintech’s impact on IUCT and AUCT, the study empirically supports the UTAUT2 model, highlighting the roles of PE, EE, FC, PU, and PV. Introducing FL and PIN as moderators enriches the model, emphasizing individual characteristics in technology adoption. The study extends UTAUT2 by linking Fintech-driven AUCT to financial inclusion and SED, underscoring Fintech’s transformative potential and advancing the theoretical understanding of technology adoption and its broader socioeconomic implications.

Policy implications

The study’s findings offer valuable insights for policymakers, financial institutions, small business owners, and individuals in the informal sector, highlighting the role of Fintech in promoting sustainable CLT and driving SED. The positive impact of Fintech on IUCT and AUCT underscores the need for user-friendly interfaces that enhance performance, ease of use, facilitating conditions, perceived usefulness, and attractive pricing. Financial institutions and Fintech providers should prioritize these aspects to foster positive perceptions and motivations, encouraging the adoption and use of CLT.

The mediating role of IUCT emphasize the importance of targeted interventions to shape users’ attitudes and beliefs. Policymakers and financial educators can design awareness campaigns and training programs that emphasize the benefits of CLT, addressing practical advantages and contributions to financial well-being. This can stimulate greater CLT adoption and support the digital economy’s growth. The moderating roles of FL and PIN highlight the need for tailored approaches: financial institutions should offer educational resources to enhance FL, and managers should promote a culture of openness to technological innovations to encourage innovative thinking in financial practices.

The findings also point towards regional disparities, education levels, and age influencing the likelihood of CLT adoption. Policymakers can utilize this information to design targeted initiatives for regions with lower adoption rates and implement educational programs that cater to different educational backgrounds and age groups. These efforts can contribute to more inclusive and equitable adoption of CLT. The study’s revelation of CLT adoption’s potential to improve SED holds substantial implications for small business owners and individuals in the informal sector. Policymakers can foster financial inclusion by ensuring that digital financial services are accessible to individuals in remote areas and informal sectors. It can stimulate economic growth, enhance living standards, and contribute to social development in marginalized communities.

The study’s findings also have profound societal implications. The foremost societal implication of this study revolves around the potential for enhanced financial inclusion. The positive Fintech-IUCT-AUCT relationship highlights the importance of fostering an environment conducive to adopting digital financial services. The shift towards CLT promises to dismantle historical barriers that have excluded certain individuals from formal financial systems, ultimately leading to increased economic empowerment and livelihoods. Moreover, the study highlights the significant roles of FL and PIN in driving societal change. Policymakers can bridge the knowledge gap in Fintech services by addressing discrepancies in FL levels and promoting financial education, facilitating a more informed adoption of CLT, and narrowing the digital divide. Recognizing individual innovativeness as a moderating factor emphasizes the need to cultivate an environment that encourages innovation and embraces technological advancements, fostering inventive approaches that benefit personal financial well-being and societal progress. The study’s findings also shed light on the potential positive outcomes of embracing CLT concerning SED, indicating the possibility of broader societal transformations. The adoption of CLT among individuals and small business owners in the informal sector can enhance financial inclusion, leading to sustainable livelihoods, better living conditions, and community-level social development. This Fintech-driven financial inclusion can contribute to regional growth and positively impact the broader socioeconomic landscape.

Limitations and future recommendations

The study’s primary focus on the Punjab region of Pakistan limits the generalizability of its findings to other regions with different socioeconomic contexts. Future research should broaden its geographical scope to provide a more comprehensive understanding of CLT adoption and its implications for SED. Additionally, the study’s emphasis on small business owners and individuals in informal sectors may introduce sampling biases, as their motivations and challenges might differ from those in formal sectors. Future research should include a more diverse range of economic sectors to validate and expand the findings. Moreover, exploring cultural, sociological, and psychological factors influencing Fintech and CLT adoption through qualitative methods like interviews or focus groups could provide deeper insights into individuals’ perspectives, motivations, and barriers. Besides, other moderating mechanism, such as financial empowerment and perceived Fintech quality, could be examined.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

References

Abdullah EME, Rahman AA, Rahim RA (2018) Adoption of financial technology (Fintech) in mutual fund/unit trust investment among Malaysians: Unified Theory of Acceptance and Use of Technology (UTAUT). Int J Eng Technol 7(2.29):110

Agarwal R, Prasad J (1997) The role of innovation characteristics and perceived voluntariness in the acceptance of information technologies. Decis Sci 28(3):557–582

Ajzen I (1991) The theory of planned behavior. Organ Behav Hum Decis Process 50(2):179–211

Al-Okaily M, Alqudah H, Al-Qudah AA, Al-Qadi NS, Elrehail H, Al-Okaily A (2022) Does financial awareness increase the acceptance rate for financial inclusion? An empirical examination in the era of digital transformation. Kybernetes. Available at: https://doi.org/10.1108/K-08-2021-0710

Al-Qeisi K, Dennis C, Hegazy A, Abbad M (2015) How viable is the UTAUT model in a non-Western context? Int Bus Res 8(2):204–219

Al-Somali SA, Gholami R, Clegg B (2009) An investigation into the acceptance of online banking in Saudi Arabia. Technovation 29(2):130–141

Amari M, Anis J (2021) Exploring the impact of socio-demographic characteristics on financial inclusion: empirical evidence from Tunisia. Int J Soc Econ 48(9):1331–1346

Ameen N, Tarhini A, Shah MH, Madichie NO (2020) Employees’ behavioural intention to smartphone security: A gender-based, cross-national study. Computers Hum Behav 104:106184

Arner DW, Buckley RP, Zetzsche DA, Veidt R (2020) Sustainability, FinTech and financial inclusion. Eur Bus Organ Law Rev 21:7–35

Asif M, Khan MN, Tiwari S, Wani SK, Alam F (2023) The impact of fintech and digital financial services on financial inclusion in india. J Risk Financial Manag 16(2):122

Bailey AA, Pentina I, Mishra AS, Ben Mimoun MS (2017) Mobile payments adoption by US consumers: an extended TAM. Int J Retail Distrib Manag 45(6):626–640

Banna H, Mia MA, Nourani M, Yarovaya L (2022) Fintech-based financial inclusion and risk-taking of microfinance institutions (MFIs): Evidence from Sub-Saharan Africa. Financ Res Lett 45:102149

Chao CM (2019) Factors determining the behavioral intention to use mobile learning: An application and extension of the UTAUT model. Front Psychol 10:446627

Chauhan V, Yadav R, Choudhary V (2022) Adoption of electronic banking services in India: An extension of UTAUT2 model. J Financial Serv Mark 27:27–40

Chen F, Jiang G (2022) The roles of fintech with perceived mediators in consumer financial satisfaction with cashless payments. Mathematics 10(19):3531

Chiu IH (2017) A new era in fintech payment innovations? A perspective from the institutions and regulation of payment systems. Law, Innov Technol 9(2):190–234

Coffie CPK, Hongjiang Z (2023) FinTech market development and financial inclusion in Ghana: The role of heterogeneous actors. Technol Forecast Soc Change 186:122127

Dapp T, Slomka L, AG DB, Hoffmann R (2014) Fintech–The digital (r) evolution in the financial sector. Dtsch Bank Res 11:1–39

Donmez-Turan A (2020) Does unified theory of acceptance and use of technology (UTAUT) reduce resistance and anxiety of individuals towards a new system? Kybernetes 49(5):1381–1405

Ediagbonya V, Tioluwani C (2023) The role of fintech in driving financial inclusion in developing and emerging markets: issues, challenges and prospects. Technol Sustainability 2(1):100–119

Falk RF, Miller NB (1992) A Primer for Soft Modeling. University of Akron Press, Akron, OH

Fishbein M, Ajzen I (1975) Belief, Attitude, Intention and Behavior: An Introduction to Theory and Research. Addison-Wesley, Reading, Massachusetts

Giovanis A, Assimakopoulos C, Sarmaniotis C (2019) Adoption of mobile self-service retail banking technologies: The role of technology, social, channel and personal factors. Int J Retail Distrib Manag 47(9):894–914

Goswami S, Sharma RB, Chouhan V (2022) Impact of financial technology (Fintech) on financial inclusion (FI) in Rural India. Univers J Account Financ 10(2):483–497

Grover P, Kar AK, Janssen M, Ilavarasan PV (2019) Perceived usefulness, ease of use and user acceptance of blockchain technology for digital transactions–insights from user-generated content on Twitter. Enterp Inf Syst 13(6):771–800

Guermond V (2022) Whose money? Digital remittances, mobile money and fintech in Ghana. J Cultural Econ 15(4):436–451

Hair Jr JF, Sarstedt M, Hopkins L, Kuppelwieser VG (2014) Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. Eur Bus Rev 26(2):106–121

Hair JF, Risher JJ, Sarstedt M, Ringle CM (2019) When to use and how to report the results of PLS-SEM. Eur Bus Rev 31(1):2–24

Hamid AA, Razak FZA, Bakar AA, Abdullah WSW (2016) The effects of perceived usefulness and perceived ease of use on continuance intention to use e-government. Procedia Econ Financ 35:644–649

Harrison ST, Onyia OP, Tagg SK (2014) Towards a universal model of internet banking adoption: Initial conceptualization. Int J Bank Mark 32(7):647–687

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43:115–135

Intarot P, Beokhaimook C (2018) Influencing factor in e-wallet acceptant and use. Int J Bus Adm Stud 4(4):167

Jagtiani J, Lemieux C (2017) Fintech lending: Financial inclusion, risk pricing, and alternative information. Risk Pricing, and Alternative Information. https://doi.org/10.2139/ssrn.3096098

Jiang LA, Yang Z, Jun M (2013) Measuring consumer perceptions of online shopping convenience. J Serv Manag 24(2):191–214

Kandari P, Bahuguna U, Salgotra AK (2021) Socio-economic and demographic determinants of financial inclusion in underdeveloped regions: a case study in India. J Asian Financ, Econ Bus 8(3):1045–1052

Kara A, Zhou H, Zhou Y (2021) Achieving the United Nations’ sustainable development goals through financial inclusion: A systematic literature review of access to finance across the globe. Int Rev Financ Anal 77:101833

Karjaluoto H, Glavee-Geo R, Ramdhony D, Shaikh AA, Hurpaul A (2021) Consumption values and mobile banking services: understanding the urban–rural dichotomy in a developing economy. Int J Bank Mark 39(2):272–293

Khan MS, Siddique M, Ali K (2023) Business education and entrepreneurial participation in punjab: mediating role of financial literacy. J Dev Soc Sci 4(2):768–778

Khechine H, Lakhal S, Pascot D, Bytha A (2014) UTAUT model for blended learning: The role of gender and age in the intention to use webinars. Interdiscip J E-Learn Learn objects 10(1):33–52

Kikulwe EM, Fischer E, Qaim M (2014) Mobile money, smallholder farmers, and household welfare in Kenya. PloS one 9(10):e109804

Lee CC, Lou R, Wang F (2023) Digital financial inclusion and poverty alleviation: Evidence from the sustainable development of China. Econ Anal Policy 77:418–434

Leong K, Sung A (2018) FinTech (Financial Technology): what is it and how to use technologies to create business value in fintech way? Int J Innov Manag Technol 9(2):74–78

Liu GS, Tai PT (2016) A study of factors affecting the intention to use mobile payment services in Vietnam. Econ World 4(6):249–273

Madan K, Yadav R (2016) Behavioural intention to adopt mobile wallet: a developing country perspective. J Indian Bus Res 8(3):227–244

Merhi M, Hone K, Tarhini A, Ameen N (2021) An empirical examination of the moderating role of age and gender in consumer mobile banking use: a cross-national, quantitative study. J Enterp Inf Manag 34(4):1144–1168

Mhlanga D (2022) The role of financial inclusion and FinTech in addressing climate-related challenges in the industry 4.0: Lessons for sustainable development goals. Front Clim 4:949178

Moon IT, Shamsuzzaman M, Mridha MMR, Rahaman ASMM (2022) Towards the advancement of cashless transaction: A security analysis of electronic payment systems. J Comput Commun 10(07):103–129

Morgan PJ (2022) Fintech and financial inclusion in Southeast Asia and India. Asian Econ Policy Rev 17(2):183–208

Mouna A, Jarboui A (2022) Understanding the link between government cashless policy, digital financial services and socio-demographic characteristics in the MENA countries. Int J Sociol Soc Policy 42(5/6):416–433

Mpofu FY (2022) Industry 4.0 in financial services: mobile money taxes, revenue mobilisation, financial inclusion, and the realisation of Sustainable Development Goals (SDGs) in Africa. Sustainability 14(14):8667

Museba TJ, Ranganai E, Gianfrate G (2021) Customer perception of adoption and use of digital financial services and mobile money services in Uganda. J Enterp Commun: People Places Glob Econ 15(2):177–203

Niaz MU (2022) Socio-Economic development and sustainable development goals: a roadmap from vulnerability to sustainability through financial inclusion. Econ Res -Ekon istraživanja 35(1):3243–3275

Oliveira T, Thomas M, Baptista G, Campos F (2016) Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput Hum Behav 61:404–414

Peprah JA, Oteng C, Sebu J (2020) Mobile money, output and welfare among smallholder farmers in Ghana. Sage Open 10(2):2158244020931114

Rabbani MTAW, Idrees U, Akram M (2023) Role of media in economic growth through the promotion of cottage industries in Pakistan. J ISOSS 9(2):555–572

Raj LV, Amilan S, Aparna K, Swaminathan K (2023) Factors influencing the adoption of cashless transactions during COVID-19: an extension of enhanced UTAUT with pandemic precautionary measures. J Financ Servi Mark, 1–20. Available at: https://doi.org/10.1057/s41264-023-00218-8

Rehman SU, Khalid W, Rasheed A (2023) Impact of financial technology, banking access on financial inclusion with mediating role of Financial Literacy. J Dev Soc Sci 4(2):779–792

Saha P, Kiran KB (2022) What insisted baby boomers adopt unified payment interface as a payment mechanism?: an exploration of drivers of behavioral intention. J Adv Manag Res 19(5):792–809

Santosa AD, Taufik N, Prabowo FHE, Rahmawati M (2021) Continuance intention of baby boomer and X generation as new users of digital payment during COVID-19 pandemic using UTAUT2. J Financ Serv Mark 26(4):259–273

Senyo PK, Karanasios S, Gozman D, Baba M (2022) FinTech ecosystem practices shaping financial inclusion: the case of mobile money in Ghana. Eur J Inf Syst 31(1):112–127

Sharif A, Raza SA (2017) The influence of hedonic motivation, self-efficacy, trust and habit on adoption of internet banking: a case of developing country. Int J Electron Cust Relatsh Manag 11(1):1–22

Singh S, Srivastava RK (2020) Understanding the intention to use mobile banking by existing online banking customers: an empirical study. J Financ Serv Mark 25(3-4):86–96

Sivathanu B (2019) Adoption of digital payment systems in the era of demonetization in India: An empirical study. J Sci Technol Policy Manag 10(1):143–171

Sleiman KAA, Jin W, Juanli L, Lei HZ, Cheng J, Ouyang Y, Rong W (2022) The factors of continuance intention to use mobile payments in Sudan. Sage Open 12(3):21582440221114333

Sripalawat J, Thongmak M, Ngramyarn A (2011) M-banking in metropolitan Bangkok and a comparison with other countries. J Comput Inf Syst 51(3):67–76

Tay LY, Tai HT, Tan GS (2022) Digital financial inclusion: A gateway to sustainable development. Heliyon 8:e09766

Teo AC, Tan GWH, Ooi KB, Hew TS, Yew KT (2015) The effects of convenience and speed in m-payment. Ind Manag Data Syst 115(2):311–331

Venkatesh V, Thong JY, Xu X (2012) Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Q 36(1):157–178

Venkatesh V, Morris MG, Davis GB, Davis FD (2003) User acceptance of information technology: Toward a unified view. MIS Q 27(3):425–478

Acknowledgements

This study is supported by “辽宁省 ‘兴辽英才计划’项 目资助” (英 文: Supported by LiaoNing Revitalization Talents Program) 项 目编号 XLYC2002116 项目负责人霍伟东.

Author information

Authors and Affiliations

Contributions

WH Made significant contributions in conceiving and designing the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper. XW Made significant contributions to Performed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data. MZ Made significant contributions to Conceived and designed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper. AM Made significant contributions to Performed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data. MZ Made significant contributions to Conceived and designed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Huo, W., Xiohui, W., Zulfiqar, M. et al. Communication dynamics: Fintech’s role in promoting sustainable cashless transactions. Humanit Soc Sci Commun 11, 1368 (2024). https://doi.org/10.1057/s41599-024-03729-4

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03729-4